- What is Trade360?

- Tade360 Bank Pros and Cons

- Is Trade360 safe or a scam?

- Leverage

- Accounts

- Fees

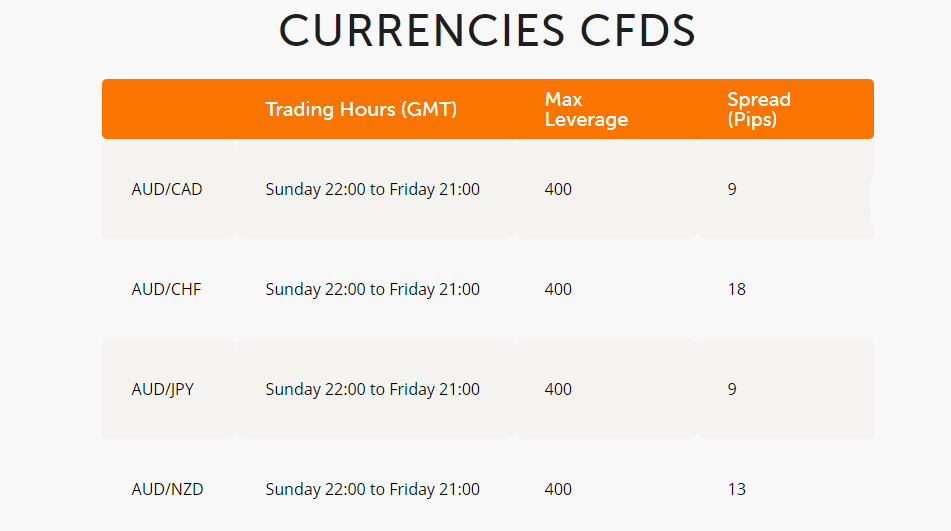

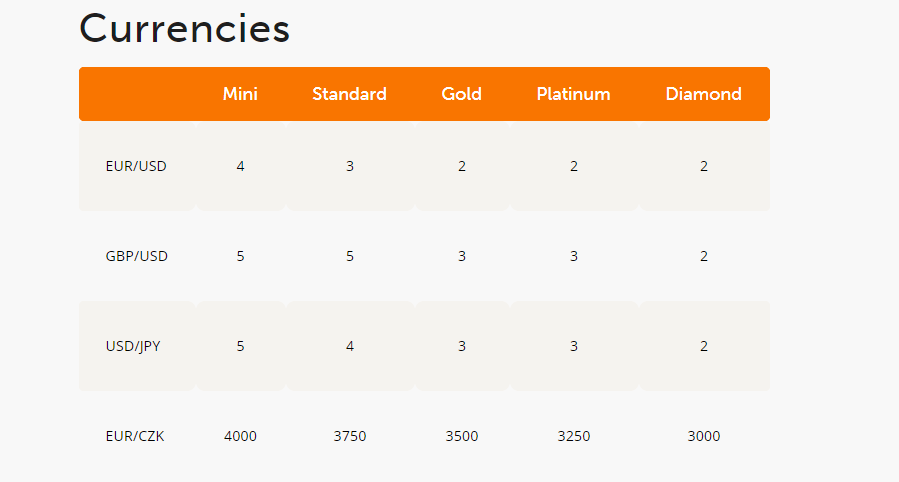

- Spreads

- Market Instruments

- Deposits and Withdrawals

- Trading Platform

- Customer Support

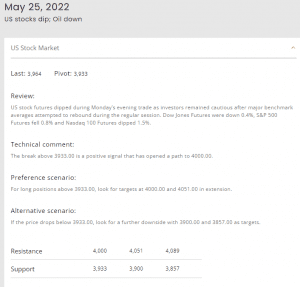

- Education

- Conclusion

What is Trade360?

Trade360 is an international brokerage firm that was previously established in the offshore island only, Marshall Islands, while further since trading word become more popular and traders looking for regulated entities established its branches in Cyprus and Australia.

Trade360 was founded in 2013 by a group of trading entrepreneurs and technology experts that wanted to democratize the trading environment and offer trading access to the world.

Eventually, the step which Trade360 made by acquiring previously established financial brokers in entities like Cyprus and Australia, made it possible for European and Australian traders (Best Forex Trading Platform Australia) to engage in safe trading activity since those entities are regulated and overseen by the local authorities. Therefore are considered safe investment opportunities.

For more of the trading details we will look further in our Trade360 Reviews, but be sure you learn all the details deeply as we would advise trading with only entities under serious regulations.

- There are some finds based on our expert research and financial trading opinion, be sure to read the Trade360 Updates below

Trade360 Pros and Cons

Trade360 provides quality trading conditions via its Australia and Cyprus entities (read more about Australia headquartered broker FP Markets), with good costs and trading options like social trading. Account opening is easy and smooth.

On the negative side, there are also some negative responses about the broker that happened with the international entity.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation and License | CySEC |

| 🖥 Platforms | MT4 and CrowdTrader |

| 📉 Instruments | CFDs on Currency Pairs, Commodities, Stocks and Indices |

| 💰 Costs | EUR USD 3 pips |

| 🎮 Demo Account | Offered |

| 💳 Minimum deposit | 100$ |

| 💰 Base currencies | Several Currencies |

| 📚 Education | Not provided |

| ☎ Customer Support | 24/5 |

Is Trade360 safe or a scam

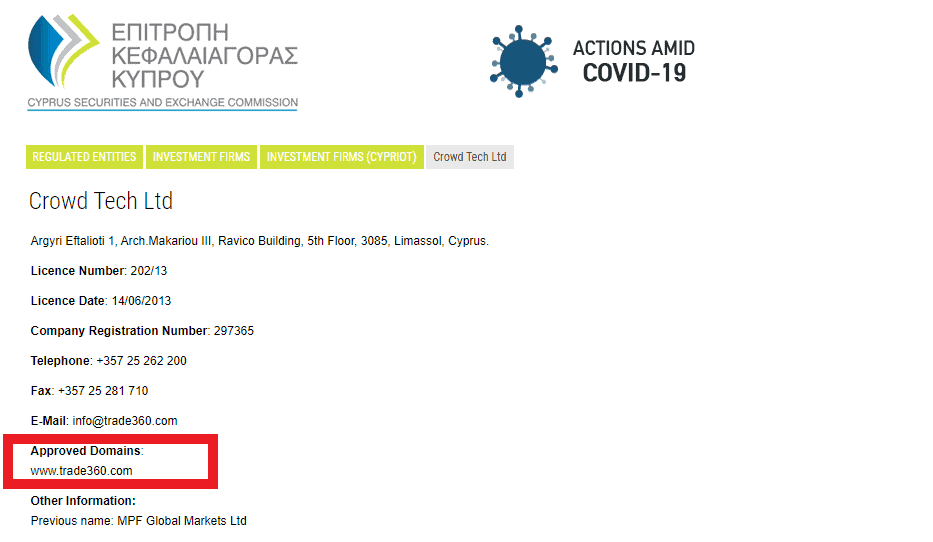

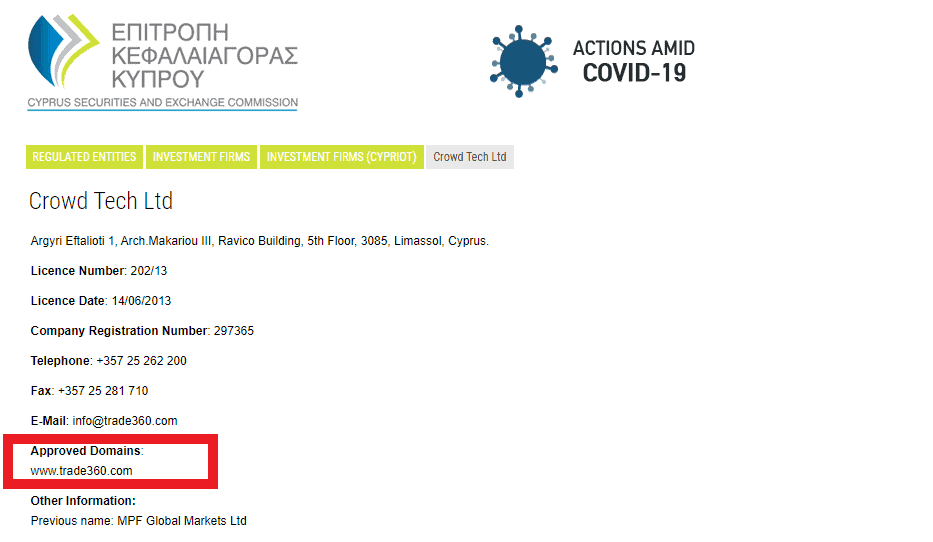

Trade360 is not a scam, it has a quite long history of operation while previously it was solely an offshore firm now it has regulated CySEC (See CySEC regulated TriumphFX’s review) and ASIC licenses with lower Forex risks.

Is Trade360 legit?

Concerning the most important question, we now found that Trade36 operates through three entities, while one is still based in the offshore Marshall Islands where requirements and audit from the authorities are rather basic.

While another entity is now again located in Cyprus since Trade360 operates through Crowd tech company established under necessary laws and particular obligation to ESMA rules and customer protection. In addition, there is an Australian entity that is also regulated and registered with ASIC, the authority that oversees Forex and the trading industry.

So overall we would again mention that you better open account under-regulated entities of Trade360 where conditions are aligned to customer protection rules so you get layers of safety.

Leverage

Obviously leverage levels depend on the entity and regulatory obligations that are set by the authority in particular jurisdictions. Alike, European traders will use lower leverage due to restrictions, while Australian traders can still access high leverage ratios available even for retail traders and professionals.

The international proposal also allows high leverage, but beware of how you use leverage and better learn how to apply it correctly as your losses may multiply the same as potential gains.

- 1:500 which is mainly offered for professionals,

- Retail traders through the Cyprus entity may access ratios like 1:30

- Australian traders entities for a maximum of 1:500

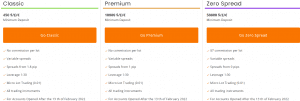

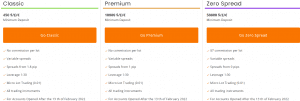

Account types

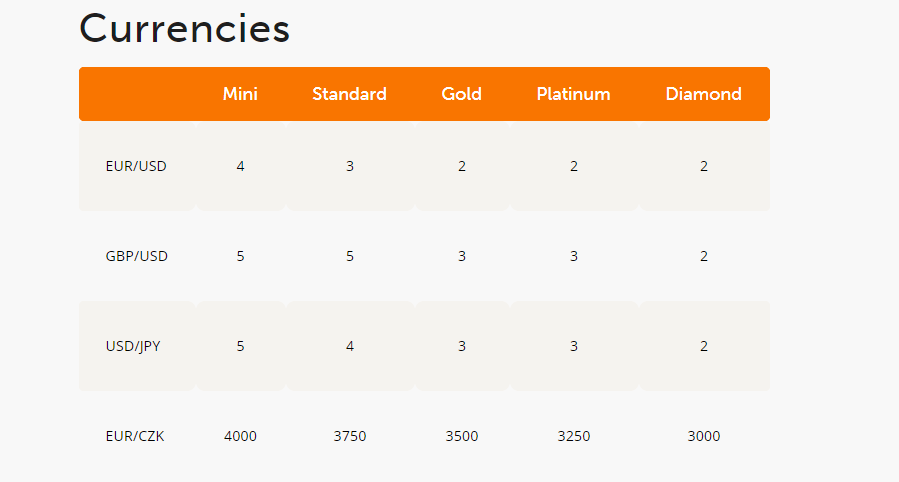

There are 5 account types defined by the first deposit starting from 250$ and up to 50,000$ for the Diamond account, plus the Islamic account available upon request, but demanding a minimum of 10k$.

Mini account though does not support the MT5 platform for trading, while further on the client can choose the platform and will get push notifications and personal exclusive market updates as a benefit from the broker.

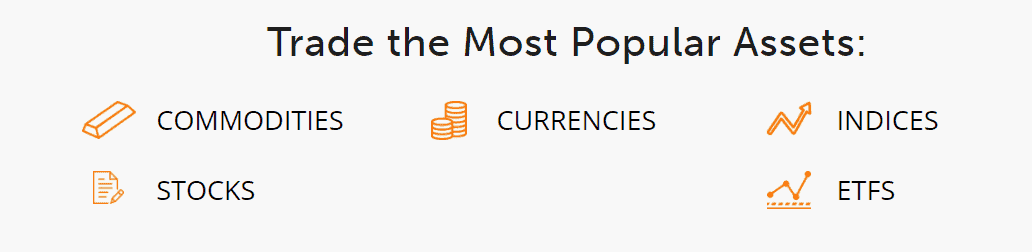

Trading Instruments

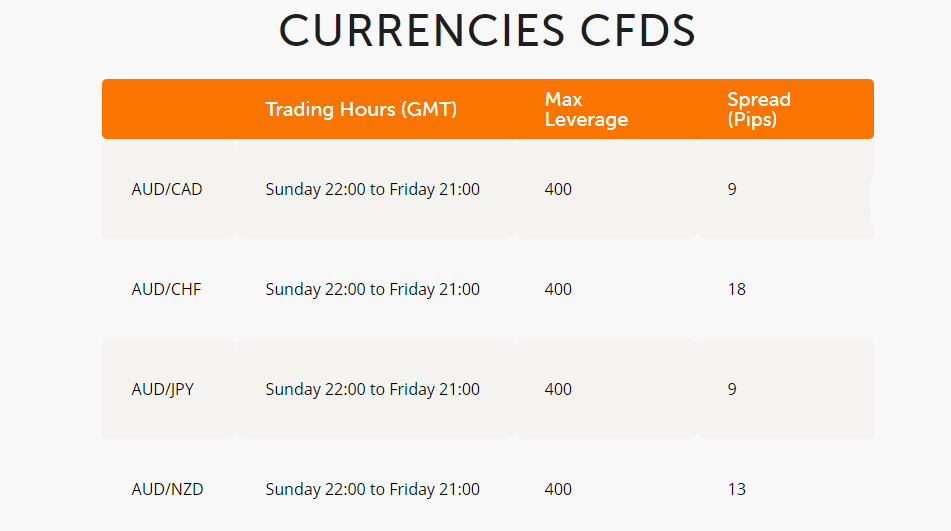

Trade360 as based on technology solutions offering trading CFDs on Currency Pairs, Commodities, Stocks and Indices. Even though CFD trading is a rather simplified version of asset trading, be sure to learn more about how this instrument works especially while using leverage.

Fees

Trade350 fee terms and what exactly the costs are which you will need to pay for trading service mainly built into a variable spread available for all account types. Higher grade accounts get lower spreads also there is an option to get a tailored solution for your trading need. In addition, consider other fees like funding or inactivity, see the Trade360 fee table below.

| Fees | Trade360 Fees | JP Markets Fees | FXTM Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | High | Average | Average |

Spreads

Trade360 Spreads are variable and based on market conditions, while spreads get lower as long as the account type is a higher grade. Nevertheless, we realize that Trade360 spreads are rather high if to compare it to the industry competitors. Even the highest grade account type offers spreads higher than the Standard account of competitors.

However, there is no clear information about spread conditions provided through the website, you can see an example of spread defined by account type below. Yet, we couldn’t see clear statistics on its spread, better to check out conditions through the Demo account through.

Also, compare fees to another popular broker BlackBull Markets.

| Asset/ Pair | Trade360 Spread | JP Markets Spread | FXTM Spread |

|---|

| EUR USD Spread | 3 pips | 1.7 pips | 1.5 pips |

| Crude Oil WTI Spread | 7 pips | 5 pips | 9 pips |

| Gold Spread | 195 | 26 | 9 |

Snapshot of Spreads

Deposits and Withdrawals

The last point within Trade360 Review is funding methods that will allow you to send money into your trading account.

Deposit Options

There are various deposit options available for deposits, where the most common methods are supported. Yet be sure to verify conditions and laws in the particular jurisdiction, as methods, as well as minimum deposits may vary according to entity rules.

- Bank wire transfers

- Credit and Debit Cards

- Skrill and ewallets

Minimum deposit

Trade360 Minimum deposits demand 100$ for a Standard account, and the international offering demands a minimum of 250$ for Mini account, meaning conditions vary. Also, each account type has a specified minimum line, where the account size is defined.

Trade360 minimum deposit vs other brokers

|

Trade360 |

Most Other Brokers |

| Minimum Deposit |

$100 |

$500 |

Withdrawals

Trade360 does not mention charges for deposits or withdrawals, however, your bank or payment provider may waive some fees due to international policies, so you better check with the provider for its fees. Withdrawal options include bank transfers, e-wallets, and cards.

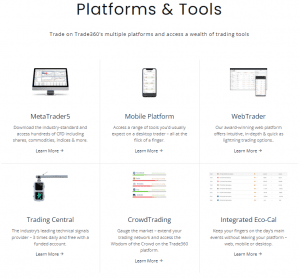

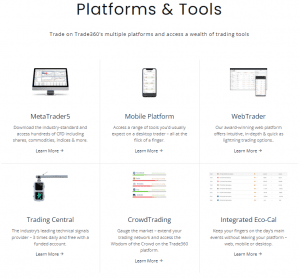

Trading Platforms

| Pros | Cons |

|---|

| CrowdTrader and MT5 | None |

| Customer friendly design | |

| Good range of tools | |

| Mobile App | |

| Clear look | |

Web Trading

Trade360 since based on a fintech company also developed an intuitive interface platform based solely on online CrowdTrader. There are numerous assets available for trading also with good customization tools so the software indeed is remarked.

Nevertheless, if traders wish to use the popular version MetaTrader5 they are still able to do so, apart from the traders using Mini accounts since it does not support MT5.

Mobile Platform

To remain updated on the go Trade360 developed its Trade360 app suitable for iPhone, iPad ad Android which is a super comfortable software allowing you to take control over your trading at any time.

Desktop Platform

So besides trading markets in a manual or automatic way, you may also engage in Social Trading with Copy Trader or Copy Master accounts accessible via Desktop Platform. This means that you may copy master accounts and profit from trading without any knowledge or interruption just by a simple copy of orders. Mainly MT5 platform offers a trading experience with innovative trading features also with virtual servers and professional level analysis available for traders.

Customer Support

In terms of the Customer Support Trade360 establish customer support service available in each region it operates with the purpose to provide traders with relative answers and quality answers. You can contact the team within working hours through Live Chat, Emails, or phone lines.

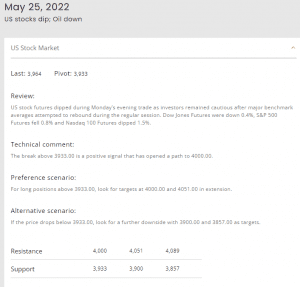

Education

Actually, Trade360 does not provide education or courses that are essential for beginners. There are no online trading courses or Webinars with education materials. The only material available to traders is research tools included in the platforms, as well as the Daily Market report that you can find online. Yet, there is a social trading option where trading ideas are available.

Conclusion

Trade360 Review brought us an understanding that brokers’ trading conditions are suitable for traders who prefer trading CFD instruments, and also engage in social trading through the proprietary platform or popular MT5. There there are options either to trade manually or to copy trades from the Copy Accounts, making investment opportunities better, yet if you need education you better look for another regulated broker.

Nevertheless, there are also some negative responses and experiences with the broker as well, particularly happened with the international entity. So we would strongly advise investors to do their comprehensive checking before opening an account with Trade360 and better sign in only with regulated entities of Trade360 either in Cyprus or Australia.

Trade360 Update

Based on our research, we found that Crowd Tech Ltd for now has suspended the opening of new trading accounts. Nevertheless, the existing account holders will continue to be serviced, we advise existing clients though to close accounts too, since is not clear weather the broker will operate longer or just temporary.

- As of the 2025 Review of Trade360 – the website directs to another website address since Broker mentioned its been rebranded, however the site does not open either but warns about a phishing website.

- With our experience in Trading and over 10 year of expertise, money safety stands first, it is much better to choose a reliable broker with top-tier regulations and good conditions like FXTM, HFM or FP Markets.

Share this article [addtoany url="https://55brokers.com/trade360-review/" title="Trade360"]

A Scam to Avoid

I had a terrible experience with Trade360. After investing my money, they refused to let me withdraw my funds, constantly giving excuses. It became clear that they had no intention of allowing me access to what was rightfully mine. It wasn’t until I spoke out online that I finally got help. Thankfully, another company (revo recov com) stepped in and helped me get back most of my funds. I strongly advise anyone to stay away from Trade360 – they are not to be trusted.

Scam scam scam. I couldn’t get my money back, they also said they owed me $20000 worth of bitcoin when in fact they stole my $1000 worth of bitcoin. This company Trade 360 is a scam

I started trading a while ago and I have to say the service that Trade360 has provided me has been pretty useful. It’s useful does not matter who strategies of trading you employ – whether it be day trading, swing trading or simply buy and hold. Another good thing about trade360 is that it offers international trading, it means that I can trade in different financial markets etc. From London to Tokyo to New York. The minimum deposits starts at 250 which is pretty convenient for someone who is new to trading. The crowdfeed option is pretty interesting – I mean I have not seen any other brokerage forms with this function. Trade360 also allowed me to dive into the world of forex and commodities. The mobile app is solid, not the best in the world but it can get a pass. Additionally the 0% commission has been pretty convenient although sometimes I question the purpose of this (its a brokerage site after all so it’s a bit unusual). The website also offers lots of good articles on the trading so I have learned a lot as well from the education that trade360 has provided – the information provided were pretty straight forward. Overall I give it a 7.5/10. I recommend it to people who have just started trading or people who are interesting in trading with all kinds of stuff whether it be forex or commodities or common stocks etc. I wouldn’t change it for any other brokerage platform.

i love the company

I have had a great experience using trade360, it’s a good and reputable company.

I was with them recently and it was excellent. I was able to make money and was treated respectfully.

I have had a pleasant experience with trade360, it is an incredible company.

I was with them recently and it was favourable. They treated me very well and I was able to make a profit.

I really appreciate Trade360 since it has a lot of useful and easy-to-understand educational content for people like me who are just getting started. Everything is well-made and has the correct look and feel. I find it to be pretty simple to use, and the support staff appears to be extremely concerned, which is a very significant feature for me. There are several excellent trading tools available, and I find them to be quite useful and simple to use. Right now, I’m considerably more confident in my trading abilities. And I’m not sure I’d be able to develop as a trader in any other environment. Overall, the website is excellent, and I intend to use it as my primary trading platform.

My view of trade360 is becoming more and more positive every day. Looking at it from the point of view of a person who constantly handles financial markets, what it offers is really very interesting. Recently I have been struck by the way it can encourage novice investors to trade in an environment that is quite reliable and easy to handle. It is worth noting that the technology used today is above others which makes it easier to play when trading, especially considering the strength it provides when using it.

Simply in my opinion, trading with trade360 is easier and safer in the trading environment, especially because they have an indicator with a very impressive success. Maybe they could improve a little on some points, but there is nothing negative when trading.

I have been with trade360 brokerage since 2019. I was recommended to create an account with them by a friend, so this has been my first broker. So far I have not had any incidences with the service, conditions have improved since then. First, I used to manage a premium account, but now I am using a low Spread account and spreads are very very competitive. Not to mention that the customer service is one of the best that I have ever had for my training company so I think that that a top of everything really just sells this program.

First of all, let me say that Trade 360 is the best trading platform you’ve come across in my entire life! With a service that goes from London to Riyadh, Tokyo,I have the convenience of working from anywhere in the world. I have been using it for a few years and it has only brought good luck and happiness to my life. I would definitely recommend this website and its services to anyone new to the trading business!

There are also a good amount of features on the platform! You can, of course, work manually and make your own trades! They have most of the common assets available for trading on the site, such as stocks, commodities, currencies and ETFs. MT4 is not your only option when it comes to platforms.

I see a lot of people are a bit confused here, but that’s quite normal with most brokers. It took them an average of 48 hours to complete my withdrawal and no withdrawal fees were charged.

They also have a mobile app that allows you to trade on the go, and the app’s interface is sleek and feels very smooth.

They have a customer service that really responds to emails and calls, as well as a live chat feature that is not available 24/7, but the opening hours are reasonable. They also have multilingual customer service representatives, but this isn’t a feature I personally need to be British, but it could be of some value to those of you who don’t speak English as your first or second language!

Trade360 is also fully licensed and regulated by CySEC and Australia. They also offer a fund separation for your protection! In summary, Trade360 is definitely worth a look and in my opinion you will not be disappointed, I have been using it for several years and already see that my investments have really paid off so far!

The website looks so nice making it a joy to play around with. From my experience, it is the best one in this industry and that there are no real competitors that even come close to what you get from Trade360. It also has a beginner trading option which is very practical for beginners to do before using their actual money and to get the feel of the market before actually getting involved. They teach you advanced techniques to master this market. They always get back to you quickly with an answer to your question or query or even a solution to your problem (however rare problems are). The addition of zero commissions is also vital for the overall experience as it helps make you feel that what you do isn’t being taken advantage of. I believe Trade 360 will become to most popular trading site in the world. I am so happy I have been able to be part of this site now. I highly recommend you just check the site out and read about all the features like I did.

Well first off let me start by saying Trade 360 is the best trading platform u have came across in my entire lifetime! With service ranging From London to Riyadh, Tokyo to New York it gives me the comfort of working from anywhere in the world. I’ve been using it for a few years and it has brought nothing but good luck and fortune to my life. I would definitely and positively recommend this website and their services to anyone wanting to start fresh in the trading business!

There’s a good amount of features on the platform too!You can of course go manual and make your own trades! They have most of the common assets available to trade on the site such as stocks, commodities, currencies and ETF’s. MT4 is not your only option when it comes to platforms.

I see many people get bit confused here but that’s quite norm among most brokers around. They on average took 48 hrs to complete my withdrawal and charged no withdrawal fees.

They’ve also got a mobile app that you can utilise giving you trading on the go and the UI of the app is sleek and feels very smooth.

They have customer service which is really responsive to emails and calls alongside a live chat feature, however this isn’t 24/7 but the opening times are sensible. They also have multilingual customer services reps but this isn’t a feature I personally need being British, but it might be of some value to those of you who don’t speak english as your 1st or 2nd language!

Trade360 is also fully licensed and regulated by CySEC and Australia, they also provide funds segregation for your protection! In summary Trade360 is definitely worth a look in and in my opinion you won’t be disappointed, I’ve been using it for a few years and already I’m really seeng a return on my investments walking away with a profit so far!

In summary, YOU ABSOLUTELY NEEED THIS PROGRAM IN YOUR LIFE!

Trade360 Is an absolutely amazing trading platform! Right off the bat they have a wide variety of account options to choose from (5 in total!) with options starting from $250 – $50,000 minimum deposits! Also speaking of deposits there’s various types of different deposit methods on the site.

There’s a good amount of features on the platform too, but one of the favourites (well my favourites) is the ‘copy trading’ just sit back relax and let someone else do the work! You can of course go manual and make your own trades if you wish too. They have most of the common assets available to trade on the site such as stocks, commodities, currencies and ETF’s.

They’ve also got a mobile app that you can utilise giving you trading on the go and the UI of the app is sleek and feels very smooth.

They have customer service which is really responsive to emails and calls alongside a live chat feature, however this isn’t 24/7 but the opening times are sensible. They also have multilingual customer services reps but this isn’t a feature I personally need being British, but it might be of some value to those of you who don’t speak english as your 1st or 2nd language!

Trade360 is also fully licensed and regulated by CySEC and Australia, they also provide funds segregation for your protection! In summary Trade360 is definitely worth a look in and in my opinion you won’t be disappointed, I’ve been using it for a few months and already I’m really seeng a return on my investments walking away with a profit so far!

I loved it, it is very user-friendly, MT4 is not your only option when it comes to platforms, the minimum deposit is not bad, the truth of payment processors when withdrawing is a good insent, but very especially the spreed basses make it a very attractive option for all of us who are passionate about scalping. It does not force us to sacrifice our RATES, it is a very viable alternative for those who are interested not only in investing but in short-term recurring income

I was recommended to this site by my friend who has had much success trading on it. I am new to trading but Trade360 made it so easy with so much information and features to help. It keeps me updated on how my stocks are doing which is perfect because as a newbie I like to check up on them every day to make sure I am doing it right. Their customer support is second to none with a chat function and have also been there immediately whenever I have had technical issues. Trade 360 also have an app for IOS and android so you can keep up to date on the go which is great for me as I am not in the house much. Minimum deposit is $100 so not too much like other companies and this is quite a common amount for trade sites to use. My confidence trading has grown since being on this platform. I have been on here for a few months now and their training seminars along with useful tips have made me go from someone with no knowledge whatsoever to a successful trader. If you aren’t confident at first you can have a demo account to become familiar on the site and practise trades without using real money I used this for a week to find my feet before taking the plunge with my money, which is still the best decision I have made so far! Keep up the good work trade360!

Trade360 is a well known forex trading platform of 2021. From their website you can learn about trading, or you can just trade by opening a new account. Their website is well described and very user-friendly. You can browse their website by 13 major languages. Trade360 is licensed by CySEC, ASIC and Global. By thinking of their clients, there are so many options for new account opening. There are 6 types of accounts you can choose from. Those are,(1) Mini

250 USD

Minimum Deposit

1 000 USD

Minimum Line

(2) Standard

1 000 USD

Minimum Deposit

10 000 USD

Minimum Line

(3) Gold

5 000 USD

Minimum Deposit

50 000 USD

Minimum Line

(4) Platinum

10 000 USD

Minimum Deposit

100 000 USD

Minimum Line

(5) Diamond

50 000 USD

Minimum Deposit

500 000 USD

Minimum Line

(6) VIP

100 000 USD

Minimum Deposit

1 000 000 USD

Minimum Line

I am very much satisfied by their prompt customer service. All the online support stuffs are very professional and highly qualified. They can solve the problem very easily and rapidly. I am also satisfied by their withdrawal system. It does not take so long to deliver the money. I highly recommend Trade360.

I really feel that Trade 360 is the best trading site I’ve ever used. It has no commissions which is one of the things I love about it the most in my opinion. I also really trust that they are giving me the correct and up to date quotes on my stocks. This is important to me because I check my stock daily and need to know the exact price of them evrytime. I never have to worry about that when I am using Trade 360 though. Their simple and secure website makes it easy for anyone to use, even if they have never traded a single stock before. I told my friend about the site and he switched over from his old trading site straight to this one. He tells me all the time how much he loves the features and will never go back to the old site. I also enjoy the CrowdFeed feature. It lets me stay up to date on my stocks with live information. My old site didn’t have anything close to this kind of feature. I can’t believe I didn’t find out about this site earlier because I could have saved so much money on my stocks! I’ve been an investor for a lot time and now I feel I am doing everything right because of Trade 360. If you haven’t signed up by now, you really need to! Don’t wait because you will regret it once you find out how much money and time you’ll be saving using this site over your old one. I believe Trade 360 will become to most popular trading site in the world. I am so happy I have been able to be part of this site now. I highly recommend you just check the site out and read about all the features like I did.

This website is great Investing in Trade360 had been one of the best things that had happened to me 2021,I started investing beginning of 2021and .I must say there are one of the best trading sites ever!

I am a trader who has invested in a variety of currencies, including bitcoin, ethereum, and the ASX200, and I can honestly say that Trade360 is the best forum for trading. I would recommend it to anybody, even a complete beginner who has never traded before, because it is so quick and easy to use. Despite the fact that the minimum deposit is $100, I would recommend this platform because it is extremely user-friendly.Even though the minimum deposit is $100, I would recommend using this platform because it is very user friendly and available on Android, iOS, and the web. I’ve been trading with them for a few months and have had no issues. I would highly recommend them to everyone!! This platform was recommended to me by a friend, and it has proven to be the best recommendation because it is so easy to use.

Investing in Trade360 had been one of the best things that had happened to me 2020,I started investing beginning of this year and now I recover my losses I made last year from other companies,they provided all tools needed to become a successful trader.I most say there are one of the best

Thank You! Very easy to use. Trade360 has got everything I need, I would be lost without Trade360. it’s exactly what I was lacking. Keep up the excellent work. Not able to tell you how happy I am with Trade360. Best. Product. Ever! Man, this thing is getting better and better as I learn more about it. I use Trade360 often. The service is excellent. I have no regrets! Thank you for making it painless, pleasant and most of all hassle free! It really saves me time and effort. Trade360 is exactly what our business has been lacking. Really good. Buy this now. I STRONGLY recommend Trade360 to EVERYONE interested in running a successful online business! I couldn’t have asked for more than this.

I joined Trade360 in 2017. I have been trading markets for a decade and seen all the bigger rooms. Guy and his team are next level and provide education at an institutional level while also having a great time. I retired from corporate work to be a full time trader thanks to these guys.

I am a trader myself and have invested in many currencies like bitcoin, ethereum and the asx200 and I can confidently say that Trade360 is the best platform to trade on. It is so simple and easy to use I would recommend it to anyone even a basic beginner who has never traded before. Even though the minimum deposit is $100 I would definitely suggest using this platform as it is very user friendly and they have there platform on both android, ios and on website. I have been traded with for couple of months and have had no problems would definetly recommend to anyone!! My friend recommend this platform to me and it has be the best suggestion because it is so easy to use. 10/10 give it a shot.

Trade360 is a awesome take on the Forex Trading platforms that have been popping up the last few decades, the amount of tools available is amazing and allows for full flexibility when you’re just starting out, the $100 minimum deposit may seem daunting but they also offer a demo account if you’re just looking to wet your feet, using the interface is simple as the design is extremely customer friendly, even on their mobile app on both Android and ios which also has a clear look.

Overall though an amazing platform that I fully recommend, I’ve been trading with them for around a year now so I feel I have enough experience to write this, hope this makes you feel more sure about Trade360.

Definitely worth checking out guys!

Trader360 is a great approach to Forex trading, to use big data which is very simple and easy to access and share it with everyday traders. Not only helps everyone make successful trades and their accounts profitable and makes the whole experience of trading much more enjoyable. The crowd trading feature that I’ve mentioned is something which drew myself to trader360 and has helped me grow my knowledge and strengthen my position in the stock market.

Trader360 also doesn’t charge any commission, so I know any money I deposit which is safe and secure can go 100% into stocks of my choosing. The page is also really easy to use, so I often check on the progress of my stocks several times a day! I’ve signed up a few of my friends, and we use the websites features to copy our stock moves and make profits together while giving us extra fuel for the group chat discussions with everyone trying to find the new hot stock.

I’ve only had a few issues with the site which were fixed almost immediately by the great customer service team. It turned out I was just looking in the wrong area for my information, but the service team were very patient and quick to respond. Could not recommend this site enough, it has made the entire experience of trading much more enjoyable and knowledgable. The old site I used had hidden fees, and I was never really comfortable or knowledgable on what I was doing. Trader360 helps change that and put you in the driving seat.

Trader360 took a whole new approach to Forex trading. The concept is to use big data, and share that information with their traders. They call it Crowd Trading, which is very different from Copy Trading or Mirror Trading. Crowd Trading puts indicators on all currency pairs, so that you have the real time market sentiment of actual Forex traders.

The trading platform is web based, and they also offer mobile apps for Android & iOS. Recently, this broker released the MetaTrader 5 platform, for more experienced traders. The website is available in the following languages: English, Spanish, Italian, German, Turkish, Polish, Arabic and Dutch.

Leverage on many assets is as high as 30:1, unless you are a professional trader, you can apply for 400:1 margin. The list of assets available at Trade360 is simply to long to list. They have every currency pair a trader could ask for! They also have plenty of market indices, commodities, stocks and more.

Finally I can say I have had a pleasant experience with trade360

I recommend this broker since from my beginnings in trading they recommended it to me and so far I have been doing great with them, they are brokers who are aware of their investments, they do not leave you alone, they always offer you help and materials to learn how to Every day, many and many things offer you every day so that you develop more on this path, I hope that they continue like this or that you improve every day. I recommend them

Trade 360 is the best trading site I’ve ever used. It has 0% commissions which is one of the things I love about it the most! I trade a lot of stocks so this saves me so much money in the long run. I also really trust that they are giving me the correct and up to date quotes on my stocks. This is important to me because I check my stock daily and need to know the exact price of them. I never have to worry about that using Trade 360! Their simple and secure website makes it easy for anyone to use, even if they have never traded a stock before. I told my friend about the site and he switched over from his old trading site. He tells me all the time how much he loves the features and will never go back to the old site. I also love the CrowdFeed feature. It lets me stay up to date on my stocks with live information. My old site didn’t have anything close to this kind of feature. I can’t believe I didn’t find out about this site earlier because I could have saved so much money on my stocks! I’ve been an investor for a lot time and now I feel I am doing everything right because of Trade 360. If you haven’t signed up by now, you really need to! Don’t wait because you will regret it once you find out how much money and time you’ll be saving using this site over your old one. I believe Trade 360 will become to most popular trading site in the world. I am so happy I have been able to be part of this site now. I highly recommend you just check the site out and read about all the features like I did.

I think Trade 360 is a fabulous financial broker and forex trader. You will understand why I like them so much. I have even recommended to three of my friends. The best I have ever used. Crowd trader is very useful as you can see what others are buying or selling and get an instant insight on how the market is going and adapting at current time. A great online trading websites that offers zero commission on stock. Trade 360 offers many tools that make trading so much easier! They will quickly reply to your queries and they are very courteous too. I was very glad I registered with them. I have been take out all my money from the other platforms I used to trade with. Please sign up and start reaping rewards for yourself.And You will understand why I like them so much. I have even recommended to three of my friends.

And they have not regretted it sînce I introduce them. You can întroduce your friends or keep it as your own secret way of making money.They have helpful and easy to follow and information alongside tools that help me trade- I don’t have tons of experience, yet it was easy to follow and put money into. I would recommend using this platform to help grow your personal wealth in one easy step!

Using trade 360 has been an amazing experience for trading. The ease of use and the interface are exceptional. Without trade 360 I wouldn’t have known where to start, it is an extremely positive experience as a whole. I definitely recommend everyone to use this to use this service. I recommended it to my friend and he absolutely hasn’t looked back. It’s a one of a kind service. Trade 360 is clear, precise and right on the point, just what you need for getting a start with the trading policies. By no means is it exclusively for beginners but it maintains the professionalism for experts and also simplicity for beginners to freely handle their trading policy.

It is a one of a kind trading service that no one will regret. Not only is it easy to use but the fees are shown to you upfront unlike some other sites with hidden fees. Trade 360 offers many tools that make trading easier and modern Fast execution of deals, and there is no re-quotes or rejection of orders. They have excellent technical support around the clock and are always ready to answer any question or solve any problem. I recommend it to everyone. I find it quite easy to use and the assistance seems to care a lot, which is a very important factor for me. There are a lot of great tools that can help you trade and I find them very useful and not at all difficult to use. I feel much more confident in trading right now. And I’m not sure I could grow to such an extent as a trader anywhere else.

Trade 360 is the best site out there for trading. I dont know I have been trading before without them. Not only is it easy to use but the fees are shown to you upfront unlike some other sites with hidden fees. It can be used by beginners and even advance or experience traders. If you have never traded before. You will be shown how and if you have traded before, you have come to the right place. It is the best site I have used. I cannot overemphasise that. Give it a try and you wont be disappointed. And a final note is their customer service is top notch. They will quickly reply to your queries and they are very courteous too. I was very glad I registered with them. I have been take out all my money from the other platforms I used to trade with. Please sign up and start reaping rewards for yourself.And You will understand why I like them so much. I have even recommended to three of my friends.

And they have not regretted it sînce I introduce them. You can întroduce your friends or keep it as your own secret way of making money.

A close friend told me about trade360, he said he had a cool experience with trade360 and it turned out to be so, its a good company. He told me how they treated him very well and how he was able to make cool cash. He referred me and I take the bold step with them. They are legit

My experience with Trade360 has been amazing. I have used trade360 for a very long time now and would recommend it for anyone who is interested in financial markets. I have learned so much about stocks, CFDs, and growing a market.Trade 360 is the best financial broker I dealt with the best part for me is the ease and speed of withdrawal and deposit, in addition to the availability of the social trading feature, which saves a lot of time instead of analyzes and following the news Trade 360 offers many tools that make trading easier and modern Fast execution of deals, and there is no requotes or rejection of orders They have excellent technical support around the clock and are always ready to answer any question or solve any problem. I recommend it to everyone Good luck.

I used this platform, and it really pays, but logically you have to have knowledge of trading to be profitable, something that some people do not know, that’s why they enter and lose money and begin to say that it is a scam, for I really like it

I have tried most trading platforms in US and over the last few years and they are so basic. I was recommended to try Trade360 and have heard good thing. I’ve tried the Trade360 for several months and am very impressed with them.

Their platforms are the best i have ever used, it’s give so much opportunities to trade,I appreciate how their fees and commissions are upfront with no hidden costs to tuck you up.

Excellent responsive customer support for all urgent needs and cutting edge web platform. They answered imminently when enter the customer support-chat.

I like Trade360 very much, there are a lot of useful and easy to follow educational materials for someone just starting out, like me. Everything is done professionally and looks and feels right. I find it quite easy to use and the assistance seems to care a lot, which is a very important factor for me. There are a lot of great tools that can help you trade and I find them very useful and not at all difficult to use. I feel much more confident in trading right now. And I’m not sure I could grow to such an extent as a trader anywhere else. Overall, the site is great and I think I will use it as my main trading platform. I would recommend it to beginners, but I am confident that experienced users would appreciate the platform even more. And one small thing I love is the night mode, it’s not something that should be essential, but it’s still a big bonus.

Trade 360 is a fabulous financial broker and forex trader. The best I have ever used. Crowd trader is very useful as you can see what others are buying or selling and get an instant insight on how the market is going and adapting at current time. A great online trading websites that offers zero commission on stock. Trade 360 offers many tools that make trading so much easier! Also the fact that you can all of this online, makes it standard out as a modern technology focused company. The helpful information provided on the website makes the process easy to understand and to great detailed information for first time stock purchasers. This platform is perfect and has been designed just for beginners as well as experts with helpful hints and tips. A great platform that can be used with outstanding educational sources for many people that are just starting out trading. Trade Forex gives users an insight into what to buy and what knowledge they will need to be successful traders and make the best investment decisions. Also the fact that they have developed an app makes this company stand out even more. You can now not only use Trade 360 in an online forum but you can also access the app while on the go to make sure you maximise your profits if anything changes with the trends of the market. Variety of different options available to make deposits, and with a low deposit minimum makes the risks low when you’re depositing for the first time. Trade 360 raises the bar and makes trading and investments easy.

I like Trade360 a lot, there are a lot of helpful and easy to follow educational material for someone who is just starting, like me. Everything is professionally made and looks and feels just right. I find it quite easy to use and support seems to care a lot, which is a very important factor for me. There are a lot of great tools that can help with trading and I find them very helpful and not hard at all to use. I feel much more confident in trading right now. And I am not sure I’d be able to grow to such extent as a trader anywhere else. Overall the website is great and I think I’ll be using it as my main trading platform. I would recommend it to beginners but I am confident that experienced users would appreciate the platform even more. And one small thing that I love is the Night Mode, it is not something that should essential but is a great bonus nonetheless.

A great place where everything is precisely explained and everything you need to know about.

customer need to be shown everything before they choose product or service. this is the web site where you can see everything and choose your service or product. good job guys. excellent work.

The platform is very friendly, practical. It’s easy to get lost with so much information for those of us who are just starting out. Technical analysis may be better. It is difficult on a smartphone but on PCs it is a delight. Keep in that way. I will recommend this platform

Well, I have had a staggering commitment in trade360, it is a dumbfounding affiliation. Not only that, but I’m glad to the point that I decided to utilize Trade360 when I began. Not only that, but I’ve been utilizing Trade360 for a long time now. I was another merchant and was searching for a decent transporter and when I did some examination and evaluation I connected with Trade360 I was another vendor and was searching for a decent agent and when I did some examination and assessment I interfaced with Trade360. Their foundation gives such a huge load of chance to exchange. It is extraordinarily simple to screen the market. Additionally, as enlightening for the young people. You’ll appraisal With top-notch signals from Trading Central. I truly like anyway there accuses are essentially simple of no hidden costs or anything. Just after I at first began, I used to be amazingly not used to mercantilism and Trade360 made ME such an extent. Their half on mentoring is moreover accordingly very. Exceptionally obliging. They need on-line classifications to chase after. Trade360 furthermore incorporates an adaptable application for every humanoid and IOS, so you can utilize it in an extreme surge. The apparatus offers a gathering of an enormous extent of vernaculars, they’re composed and just have generally a couple of qualifications with the target that they are true blue, and a broad selection of items and cash records EFTs. Besides, I need to regard their client care. It’s truly astonishing how vivacious they react and help you out with whatever you need. Unequivocally propose utilizing this affiliation. Thank you so much.

I was a new trader and was looking around for a good broker and when I did some research and analysis I came in contact with Trade360 I was a new trader and was looking around for a good broker and when I did some research and analysis I came in contact with Trade360I have had a pleasant experience with trade360, it is an incredible company. I’m so happy that I chose to use Trade360 when I started. I’ve been using Trade360 for a couple months now. Their platform gives so much opportunity to trade. It is very easy to monitor the market. As well as very informative for the beginners. You can analysis With world-class signals from Trading Central. I really like how their fees are just straight forward with no hidden fees or anything. When I first started, I was very new to trading and Trade360 helped me so much. Their section on education is also so very. very helpful. They have online seminars to sign up for. Trade360 also has a mobile app for both Android and IOS, so you can use it on the go. The app offers a variety of all kinds of languages, they are regulated and only have few awards so that they are legitimate, and a broad choices of commodities and currency indices EFTs. Also I have to appreciate their customer service. It’s really amazing how quick they respond and help you out with whatever you need. Highly recommend using this company. Great work

I looked through the profile and I enjoyed seeing what their business was about; it is nice to see many people are trying to break through and become part of the larger trading world. They have helpful and easy to follow and information alongside tools that help me trade- I don’t have tons of experience, yet it was easy to follow and put money into. I would recommend using this platform to help grow your personal wealth in one easy step!

I looked through the profile and I enjoyed seeing what their business was about; it is nice to see many people are trying to break through and become part of the larger trading world. They have helpful and easy to follow and information alongside tools that help me trade- I don’t have tons of experience, yet it was easy to follow and put money into. I would recommend using this platform to help grow your personal wealth in one easy step!

I like Trade360 a lot, there are a lot of helpful and easy to follow information. There are a lot of great tools that can help with trading. Trade360 is great, especially when I don’t have much experience but once I applied myself I gained more experience much appreciated. I would recommend to those to give Trade360 a go, you will learn and also grow.

My friend recommended Trade360 to me which was wonderful.

I don’t have that big experience with trading, their education section is also very helpful with online seminars to sign to. whenever I need a question they’re there helpful and prompt. Also, Trade360 offers a wide variety of deposit and withdrawal methods which include credit and debit cards, bank wire transfer etc which are looks very good to me.

at the last, I will say that they are the best.

Great Trading service ever I have seen! It is very easy to monitor the market.As well as very informative for the beginners.You can analysis With world-class signals from Trading Central. You can also use this service from your Android or iphone by installing their official apps. Over 500 CFDs are also available at Trade360.

The platform is very friendly, practical. It’s easy to get lost with so much information for those of us who are just starting out. Technical analysis may be better. It is difficult on a smartphone but on PCs it is a delight. Keep in that way. I will recommend this platform

This broker has used me a lot, since I started in this world of trading it has been with you, and truly the best experience I have had, everyone I know changes to this broker, it is not to exaggerate but they are very good, always They have updated material and their platform is excellent. I hope they continue like this

I like Trade360 a lot, there are a lot of helpful and easy to follow educational material for someone who is just starting, like me. Everything is professionally made and looks and feels just right. I find it quite easy to use and support seems to care a lot, which is a very important factor for me. There are a lot of great tools that can help with trading and I find them very helpful and not hard at all to use. I feel much more confident in trading right now. And I am not sure I’d be able to grow to such extent as a trader anywhere else. Overall the website is great and I think I’ll be using it as my main trading platform. I would recommend it to beginners but I am confident that experienced users would appreciate the platform even more. And one small thing that I love is the Night Mode, it is not something that should essential but is a great bonus nonetheless.

A great place where everything is precisely explained and everything you need to know about.

customer need to be shown everything before they choose product or service. this is the web site where you can see everything and choose your service or product. good job guys. excellent work.

From the start I said the design is amazing, I straight away saw from who they are certified which gave me some confidence to sign up. Apart of all everything go in hand, whatever I need I have in front of me. A pure professional look and services, good job guys. Thanks for such an amazing experience and services!

A great platform! Extensive tutorial video suite. I liked the graphics and charts tool applications very much. Customer service inquiries were responded to quickly and displayed well developed subject knowledge.

I love this broker, it has worked wonderfully for me, recommended, they are always available in customer service, easy to deposit and withdraw, working with trade360 has been the best experience in this new venture that I have had

Trade 360 is a very good investment tool for anyone who is new to online investment. They have an easy to understand trading platforms that are easily comprehended by the lamest of people in the world of trading. Their on-net support is equally a beneficial tool that gives customers satisfaction. My profits from trade 360 has almost always been on the rise

The platform is very friendly, practical. It’s easy to get lost with so much information for those of us who are just starting out. Technical analysis may be better. It is difficult on a smartphone but on PCs it is a delight. Keep in that way. I will recommend this platform

first off, id say it a very recommended site for people who are new to investing, As a new trader, this could be a great platform for you, for one Trade360 is user-friendly for beginner traders and the fully functional mobile app makes trading on-the-go easy. Less efforts in making withdrawals is also a big plus, Trade360 offers a wide variety of deposit and withdrawal methods which include credit and debit cards, bank wire transfer and collect ewallets. It is a perfect BuY.

The best trader page I have ever known, since I started in this world it has been very difficult for me to understand and get a page that will really help me, I started with you since you recommended them and they were one of my first projects, which I I really liked the experience obtained, they are the best on the subject, now I am the one who recommend them. Trade360.com have been the best, I have grown a lot and you have been my support, continue like this or improve even more

This platform is truly a really good one with crowd trading which gives me a good understanding to other traders emotions and vision, it helps me do better decisions for sure, I would say it is pretty simple to understand too, as I don’t have that big experience with trading, their education section is also very helpful with online seminars to sign to, also supporting app trading on both ios and android with different languages,they are regulated and have few awards as well to insure their legitimacy, and a broad choices of currency indices EFTs and commodities, also gotta praise their customer service, whenever I need a question they’re there helpful and prompt.

In conclusion I highly recommend them.

As a new trader, this could be a great platform for you. Because it is really very easy and friendly to use for beginner traders. The best part is they will offer you a big variety of withdrawal. Smart web trading platform is the best ever thing of theirs. Truly speaking I was not so much aware and professional about trade marketing but as I can have a personalized homepage view, I had get to know a lot of things from Trade 360. I feel secured trading with them due to the fact that they have a trading portfolio and they know what is best for you and will really help you gain profit. . Even It is much better than traditional platforms such as mt4 and mt5 because it is fast and provides more professional trading tools. I am fully satisfied with their services. You will also find a help center on their pages where you will get a lot of FAQ pages.

So…at the last, I will say that you can trust Trade 360 blindly and they are the best. I recommend them highly.

Trade360 offers a wide variety of deposit and withdrawal methods which include credit and debit cards, bank wire transfer, and a variety of e-wallets such as Neteller, Trustly, Skrill, PaySafeCard, Rapid, and Sofort, and with all of these different methods, it makes this by far one of the best services that you should be taking advantage of. All in all, I think it is the best in the market and one that I highly recommend.

In the era of economic turbulence, it was not easy to achieve no loss of principal, and it was even harder to make a profit on this basis. By chance, my friend recommended Trade360 to me, which was really beyond my imagination, and it was really wonderful. One month brought me 25% profit, gold, crude oil… Sometimes I wonder why I didn’t know Trade360 earlier. This may be fate, I think, in the near future, I will certainly make up all the losses in the past, and make a good profit on this basis. At one time Thanks to Trade360, I jumped out of the swamp, I really love it

Trade360 is user-friendly for beginner traders and the fully functional mobile app makes trading on-the-go easy. The crowd trading statistics section is also a relatively unique attribute that many clients may benefit from. Other benefits include APIs, safe CySEC-licensing, positive customer testimonials on forums, and the esteemed MT5 platform.

The website also hosts a Help Centre with many in-depth FAQ pages where account support queries such as how to delete an account or make a complaint can be answered.

Trade360 accepts traders from Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, and most other countries. totally it’s a biggest platform in the world.

Finally, I can say Trade360 is a good company and you can make your profit with them, using their services is worth it.

In my opinion, they deserve ⭐ ⭐ ⭐ ⭐ ⭐

Trade 360 is the best financial broker I dealt with, and what distinguishes it for me is the ease and speed of withdrawal and deposit, in addition to the availability of the social trading feature, which saves a lot of time instead of analyzes and following the news

Trade 360 offers many tools that make trading easier and modern

Fast execution of deals, and there is no requotes or rejection of orders

They have excellent technical support around the clock and are always ready to answer any question or solve any problem if you encounter me

Several withdrawal and deposit methods are available here

The best thing is the smart web trading platform. It is much better than traditional platforms such as mt4 and mt5 because it is fast and provides more professional trading tools.

They have a mobile app that is also easy and simple to use

And it is the first financial intermediary from which I collected real profits in a short time

In short, I recommend it to everyone

Good luck

Really good trading site that was highly recommended by a close friend.I highly recommend trading with Trade 360 because they are a great company that has been in business for a long time instead of all these new companies popping up without any credentials.

The one thing I love was the great customer service I received and how easy it is to navigate their website. Trade 360 has helped me more than I can explain with a review. I am now recommending them to my brother just like my friend did for me.

Really good trading site that was highly recommended by a close friend.I highly recommend trading with Trade 360 because they are a great company that has been in business for a long time instead of all these new companies popping up without any credentials.

Trade360 is a good company and you can make your profit with them, using their services is worth it. Their platform is good compared to other companies offering the same service and will recommend Trade360 if asked for a good company to trade.

There are a lot of trading sites on the web Therefore it can seem hard nowadays to find a trustworthy site that has good customer care and is most importantly beginner friendly. I started my journey with Trade360.com and I am a lot richer now. I Would recommend Trade360.com to any person looking to invest in forex trading.

Best trading site. So much reliable,trustworthy and best payouts. Trade360 provides you with your own, personalised feed into the wisdom of the masses.With world-class signals from Trading Central. As a new trader I have great experience with Trade360.

I want trade here again and again.

A great, no, fantastic company with a wide range of choices and options to fulfil all my trading (and other) needs. It has helped me a lot during the last few months and I am so grateful for the customer service and the easy to use website. It has so many different pages, all giving you a new a unique tool. I love how transparent they are about what they do and from the emails I’ve exchanged, every one is very friendly. They always get back to you quickly with an answer to your question or query or even a solution to your problem (however rare problems are). The addition of zero commissions is also vital for the overall experience as it helps make you feel that what you do isn’t being taken advantage of. It’s shocking how many other sites that a large commission, it displays how much they care about the customer. It’s so cool how you can pick from big brands like Netflix or Nvidia. The website looks so nice making it a joy to play around with. From my experience, it is the best one in this industry and that there are no real competitors that even come close to what you get from Trade360. I would recommend it to anyone who wants to get into trading or stocks in general because, simply put, you won’t get a better job anywhere else. I have never had any problems and I don’t think that you will either, as it is just such a good brand.

I did used this site to use trading and their service was mind blowing. They have a very secure transaction process and it’s strongly recommended. I feel secured trading with them due to the fact that they have a trading portfolio and they know what the best is. I also did never forgot investing them. But I did face no problem with their trading after a long time when I visited. Remember if a company has to try to convince you to join them and go through all that process just to get you to deposit money with them (the point of the 1hr call is solely to get you to deposit money) then are they that great of a platform to use for trading? You’d be better off going with a professional broker who couldn’t care less if you deposited or not, and doesn’t ring you 5 times a day trying to convince you to see their platform (being shown the platform is the deposit pitch)

When I started this role we were all made to create fake names to use, and the view was that our clients were idiots who have no idea what to do with their money, so it’s better off in our pockets as commissions. It is a clean site with a flawless look, and someone without any technical background would definitely appreciate it. The layout makes anyone feel comfortable because it is so well done and clean looking. You feel as if you are in good hands and you know that you will be able to find. Finally, this is the best site ever I made trading.

I’m a newbie when it comes to trading and I appreciate how they provide information on their website. It helps me more understand about trading. I never regret I invested on them and so far, I haven’t encounter any problems I had an easy time opening an account, I feel secured trading with them due to the fact that they have a trading portfolio and they know what is best for you and will really help you gain profit. . I highly satisfied and also recommend this trading platform.

This site definitely appeals to the average person because the layout

is so simple but very VERY effective. It is a clean site with a

flawless look, and someone without any technical background would

definitely appreciate it. The layout makes anyone feel comfortable

because it is so well done and clean looking. You feel as if you are

in good hands and you know that you will be able to find anything you

need on this site.

Trade360 are very Helpful and responsive to enquiries I personally found this company a great way to fill in the work gaps and will use them again. Jonestown Builders & maintenance Liverpool extensions Thanks Trade360.

Simply put, the best trading platform for equities traders. I’ve used Trade360 for a few years and whether you’re a day trader, swingtrader or investor, there is no real downside. Granted, the wire in/out is a bit costly, but considering the safety of the and the withdrawal/deposit speed, it’s worth every penny. Also the platform itself is really good,Their support team have been very helpful and they respond in a matter of minutes. I have not experienced any issues with them so far and my trading process has always been smooth.They really work hard to give their users a unique trading experience.

Love the company. I have made this my primary trading platform for over 3 years! Overall I love the layout of the website and the user experience of it all. If I had to refer this platform to a fried I sure would. As well I feel that my odds are best on this site compared to others

Absolutely the best platform to use when trading. i got into trading a few months ago and came across trade360. the platform is easy to use especially for beginners and the amount experience i have gained has really allowed me to double my income and now i feel right at home when it comes to trading. this is the best service if you really want to get into trading . it has changed the way i look at trading exponentially and i hope to this company grow.

I was a new trader and was looking around for a good broker and when I did some research and analysis I came in contact with Trade360 and was surprised to get a call from them and be assigned to one of the customer support member who gave me all the regulation details and provided several details on the company it was really good and after I gained some experience I still feel Trade360 market is the best to use.

Very efficient and straightforward FX platform. Low spread, quick execution and reliable platform.

Funding and withdrawal made very easy.

Thank you Trade360

Well, am a forex trader and I think trade 360 is a n excellent cryptocurrency platform that will help a lot of people from different parts of the world. Since it gives trading ideas and research tools, I believe newbies in the business will also find it great and make good success from the crypto world through this wonderful medium.

As one of the workers said, the idea was to get as many people to deposit vast sums of money. The more you deposit the more the agent would receive in commissions. Which is the only objective for this company and the job role.

After you deposit and place a trade you would be passed onto a PTS (personal training specialist) who can’t be called a personal trading specialist as they have no personal trading experience themselves whatsoever, but will talk jargon to novices to convince them they’re experts, and have them deposit even more funds (again increasing those commissions). They’re just another sales agent who has likely been in the company 6 months longer than the other phone agents.

Usually the calls will be based around trying to show you the trading platform (I suggest you outright reject these offers as the platform is very basic, remember the idea at the end is for you to deposit a lot of money). They’ll try to show you an opportunity with oil, gold, silver or a currency pair. Then they’ll show you some old chart information and make you feel like you missed so many opportunities to make profits. They’ll then do some calculations using the professional level multipliers (levarage) which you won’t have access to anyway to show potentially how much you could have made. Which is all irrelevant as you won’t have access to that level of levarage with your personal accounts, this part is solely designed to make you greedy and make you feel like you could have made these profits yourself. Then with that fresh in the mind it’s off to the deposit centre..

Throughout the call they might mention 3rd party analysts, as the company itself has no analysts (this should be a red flag). Who they refer to as 3rd party analysts are bloomberg or reuters, they are news channels that are playing in the office. You could also just put these news channels on your own TV’s at home and you have access to trade 360s analysts..

The tools they offer are the personal deposit agent (PTS), which we have covered.

For experienced traders I’ve seen spreads on trending markets be at 128 pips!

Crowd trading (which every brokerage has but might be called something different, even unregulated brokers have crowd trading) is where you can see what other traders are buying or selling. This is not new or something only one brokerage has, they all have it. Usually one main brokerage will have upto 7 different trading brands, and you will be able to see what all traders are trading with on their platforms. You have to remember 90% of new traders lose all their investments, so why would you follow other peoples mistakes?

Best advise is to learn to trade yourself through materials online, baby pips is a good place to start.

If you choose to learn through a broker like this then you will have to pay thousands for information that is available online freely or worst case scenario you won’t learn anything and just be given bad investment advice.

Remember if a company has to try to convince you to join them and go through all that process just to get you to deposit money with them (the point of the 1hr call is solely to get you to deposit money) then are they that great of a platform to use for trading? You’d be better off going with a professional broker who couldn’t care less if you deposited or not, and doesn’t ring you 5 times a day trying to convince you to see their platform (being shown the platform is the deposit pitch)

When I started this role we were all made to create fake names to use, and the view was that our clients were idiots who have no idea what to do with their money, so it’s better off in our pockets as commissions.

In summary, I would avoid trade 360 as its essentially a gambling site rather than a professional brokerage. Remember even gambling sites have to be regulated in Europe, so this isn’t something that should be used as a reason to deposit your money with them. If they surgest to you to deposit with them because they’re regulated in Europe I would just laugh at them.

Great Trading service ever I have seen! It is very easy to monitor the market.As well as very informative for the beginners.You can analysis With world-class signals from Trading Central. You can also use this service from your Android or iphone by installing their official apps. Over 500 CFDs are also available at Trade360.

I have tried most trading platforms in US and over the last few years and they are so basic. I was recommended to try Trade360 and have heard good thing. I’ve tried the Trade360 for several months and am very impressed with them.

Their platforms are the best i have ever used, it’s give so much opportunities to trade,I appreciate how their fees and commissions are upfront with no hidden costs to tuck you up.

Excellent responsive customer support for all urgent needs and cutting edge web platform. They answered imminently when enter the customer support-chat. No ques or having to wait for emails. I wish other companies would learn from these guys about how to take care of clients/customers.

Trade360 is a refreshing take on the Forex Trading platforms that have been popping up the last few years, the amount of tools available is astounding and allows for full flexibility when you’re just starting out, the $100 minimum deposit may seem daunting but they also offer a demo account if you’re just looking to wet your feet, using the interface is simple as the design is extremely customer friendly, even on their mobile app on both Android and ios which also has a clear look.

The best part of Trade360 is the Crowd Trading feature, it will allow you to fully diversify your investments giving you the real experience of a day trader without having to leverage as much, if you’re still not sold by my testimonial then rest assured because Trade360 is fully licensed by a range of auditing bodies including ST Services, Crowd Tech and Sirius Financial Markets, combined with the large variety of pairs they offer you’re definitely going to find something you’re interested in trading, personally I use Crypto but anything you can think of is on offer, I have also moved all of my assets onto Trade360 as I feel it’s the safest option available currently although their spreads are pretty high, that’s the only drawback.

Overall though an amazing platform that I fully reccomend, I’ve been trading with them for around a year now so I feel I have enough experience to write this, hope this makes you feel more sure about Trade360.

trade360 is a cool platform with crowd trading which gives me a good understanding to other traders emotions and vision, helps me do better decisions for sure, it’s pretty simple to understand too, as I don’t have that big experience with trading, their education section is also very helpful with online seminars to sign to, also supporting app trading on both ios and android with different languages,they are regulated and have few awards as well to insure their legitimacy, and a broad choices of currency indices EFTs and commodities, also gotta praise their customer service, whenever I need a question they’re there helpful and prompt.

I’m a new user and had some questions and needed help with trying their trading software for PC and also to get my account fully registered and working. I thought that me being a Swede complicated things. Got helped very friendly and answered all my questions quick and well. They answered to me immediately when i entered the customer support-chat. No ques or having to wait for emails and I’m very happy with that.

The best site in Trade 360 You can also buy Bitcoin, Atrium and Lightcoin currencies. The company operates using crowd funding and crowd funding technology.

It also has a beginner trading option which is very practical for beginners to do before using their actual money and to get the feel of the market before actually getting involved.They teach you advanced techniques to master this market, they play both Long/Short they also trade Options. The swap rates apply to night jobs, as mentioned on the site.

Finally I’m very satisfied with them and highly recommend them.

Trader360 took a whole new approach to Forex trading. The concept is to use big data, and share that information with their traders. They call it Crowd Trading, which is very different from Copy Trading or Mirror Trading. Crowd Trading puts indicators on all currency pairs, so that you have the real time market sentiment of actual Forex traders.

The trading platform is web based, and they also offer mobile apps for Android & iOS. Recently, this broker released the MetaTrader 5 platform, for more experienced traders. The website is available in the following languages: English, Spanish, Italian, German, Turkish, Polish, Arabic and Dutch.

Leverage on many assets is as high as 30:1, unless you are a professional trader, you can apply for 400:1 margin. The list of assets available at Trade360 is simply to long to list. They have every currency pair a trader could ask for! They also have plenty of market indices, commodities, stocks and more.

Finally I can say I have had a pleasant experience with trade360

I have had a pleasant experience with trade360, it is an incredible company.

I was with them recently and it was favorable. They treated me very well and I was able to make a profit.

A close friend told me about trade360, he said he had a cool experience with trade360 and it is an incredible company. He told me how they treated him very well and how he was able to make cool cash. He referred me and I’m willing to take the bold step with them

Terrible company… Trend24 is a scary site that invests money by tricking people into lying, please don’t fall into this trap

Too late for my family member. They stole thousands from him or should I say, he fell for it

Sad

TRADE 360 are Crooks and operate illegally therefore prosecutable which I’m going to do and some of the Directors and CEO etcetera will go to jail.

Don’t go anywhere near TRADE 360.

I worked for this company and ultimately the idea was to get as many people to deposit vast sums of money. The more you deposit the more the agent would receive in commissions. Which is the only objective for this company and the job role.

After you deposit and place a trade you would be passed onto a PTS (personal training specialist) who can’t be called a personal trading specialist as they have no personal trading experience themselves whatsoever, but will talk jargon to novices to convince them they’re experts, and have them deposit even more funds (again increasing those commissions). They’re just another sales agent who has likely been in the company 6 months longer than the other phone agents.

Usually the calls will be based around trying to show you the trading platform (I suggest you outright reject these offers as the platform is very basic, remember the idea at the end is for you to deposit a lot of money). They’ll try to show you an opportunity with oil, gold, silver or a currency pair. Then they’ll show you some old chart information and make you feel like you missed so many opportunities to make profits. They’ll then do some calculations using the professional level multipliers (levarage) which you won’t have access to anyway to show potentially how much you could have made. Which is all irrelevant as you won’t have access to that level of levarage with your personal accounts, this part is solely designed to make you greedy and make you feel like you could have made these profits yourself. Then with that fresh in the mind it’s off to the deposit centre..

Throughout the call they might mention 3rd party analysts, as the company itself has no analysts (this should be a red flag). Who they refer to as 3rd party analysts are bloomberg or reuters, they are news channels that are playing in the office. You could also just put these news channels on your own TV’s at home and you have access to trade 360s analysts..

The tools they offer are the personal deposit agent (PTS), which we have covered.

For experienced traders I’ve seen spreads on trending markets be at 128 pips!

Crowd trading (which every brokerage has but might be called something different, even unregulated brokers have crowd trading) is where you can see what other traders are buying or selling. This is not new or something only one brokerage has, they all have it. Usually one main brokerage will have upto 7 different trading brands, and you will be able to see what all traders are trading with on their platforms. You have to remember 90% of new traders lose all their investments, so why would you follow other peoples mistakes?

Best advise is to learn to trade yourself through materials online, baby pips is a good place to start.

If you choose to learn through a broker like this then you will have to pay thousands for information that is available online freely or worst case scenario you won’t learn anything and just be given bad investment advice.