- What is Trade245?

- Trade245 Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Trade245 Compared to Other Brokers

- Full Review of Broker Trade245

Overall Rating 4.1

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.2 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3.8 / 5 |

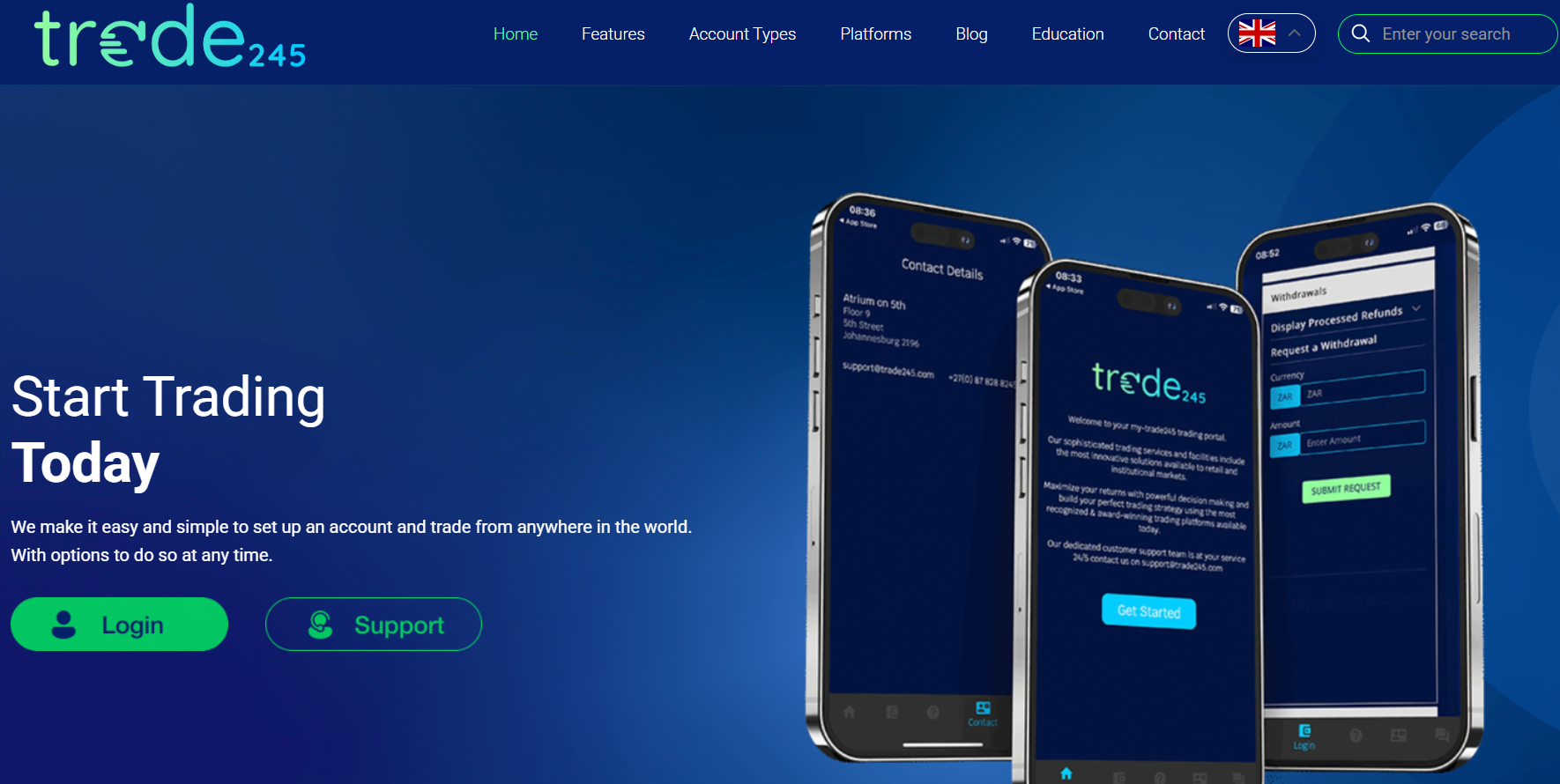

What is Trade245?

Trade245 is a brokerage company that was established in 2020 in Johannesburg, South Africa. It offers a range of online trading services, including Forex, Indices, Stocks, Commodities CFDs, and Cryptocurrencies.

The company is authorized and regulated by the reputable Financial Sector Conduct Authority (FSCA) in South Africa. Additionally, the broker holds a license from the Financial Services Authority (FSA) in Seychelles, allowing the firm to operate internationally.

Overall, Trade245 appears to be a reliable broker in the Forex trading industry. It provides secure trading conditions and efficient execution of trades through the widely used MetaTrader trading platforms.

Trade245 Pros and Cons

Per our findings, the company offers several advantages and disadvantages for traders to consider. On the positive side, Trade245 provides a range of popular financial instruments for trading, competitive trading solutions, an allowance to start with a very small amount of funding and access to well-known MT4 and MT5 trading platforms. Also, being a South African broker, the proposal makes it suitable for traders from the African region, including Namibia, Zambia Trading, etc.

For the cons, the broker has a restricted variety of trading instruments and markets for traders. Research and educational resources are also limited, and there may be fees for withdrawals and deposits. Also, we revealed many negative reviews from traders, and its overall rating is not very high. At last, the broker lacks 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Fast execution | Conditions might vary based on the entity |

| FSCA regulation and oversight | Limited trading products |

| Access to MT4 and MT5 | No 24/7 customer support |

| Multiple trading currencies | Not comprehensive education and research |

| Competitive pricing | |

| Variety of funding methods | |

Trade245 Features

Trade245 is a relatively new broker, yet it has managed to establish itself in the market and gain loyalty from clients. With tight regulatory oversight from FSCA, Trade245 ensures a safe and transparent trading environment. We have also reviewed different aspects of trading with the broker to see how competitive its offerings are and where it stands in the market. Below is a brief introduction to the main conditions of trading with Trade245:

Trade245 Features in 10 Points

| 🗺️ Regulation | FSCA, FSA |

| 🗺️ Account Types | Bonus 100, No Bonus, Swap Free, Zero Spread, Bonus 245, Bonus Rescue, Micro |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, Indices, Stocks, Commodities CFDs, Cryptocurrencies |

| 💳 Minimum deposit | $5 |

| 💰 Average EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | ZAR, USD, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Trade245 For?

Based on Our findings and Financial Expert Opinions Trade245 offers good trading conditions and opportunities, simultaneously ensuring a safe environment for investments. The broker’s services meet the needs of different traders being especially favorable for the following:

- Clients from South Africa and the African Region

- International traders

- Those who prefer the MT4 and MT5 trading platform

- Currency trading

- Beginners

- Islamic clients

- STP execution

- Competitive spreads and fees

- Good trading tools

Trade245 Summary

Overall, Trade245 is a good-standing Forex trading broker with a wide presence in the African region and internationally. The broker offers competitive trading solutions, efficient execution, and access to popular trading platforms across different devices. Trade245 ensures the safety of clients’ funds and provides various payment methods. However, trading conditions may vary depending on the specific entity, and there is limited availability of certain trading instruments. Additionally, the lack of 24/7 customer support and live chat on the website can be seen as a drawback. So we advise you to conduct thorough research and evaluate your trading needs to determine if Trade245 aligns with your requirements.

55Brokers Professional Insights

Trade245 is a relatively new broker that has been operating in the market for only a few years, however, Broker manage to provide services seem to be good, with access to popular and advanced platforms (MT4/MT5), a really very large variety of accounts with floating spreads, basic educational resources, and access to Future Indices, and other CFDs. The license from the FSCA is another good point that enables clients to trade with peace of mind that their investments are not at risk.

However, certain concerns and complaints from clients should be addressed, alike the broker’s reliability and trustworthiness, as overall, it has a low rating compared to other Brokers and as rated by real traders. We recommend clients be careful and sign under the FSCA entity only, as trading with the offshore entity can still be risky.

Consider Trading with Trade245 If:

| Trade245 is an excellent Broker for: | - Traders who prefer the MT4 and MT5 trading platform

- Currency traders

- Novice traders

- For STP execution

- Those who prioritize competitive spreads and fees

- Traders from the South African region

|

Avoid Trading with Trade245 If:

| Trade245 is not the best for: | - Those who prefer strong regulatory oversight

- Long-term investments

- Traders who are looking for a wide range of trading instruments

- Traders who look for comprehensive education |

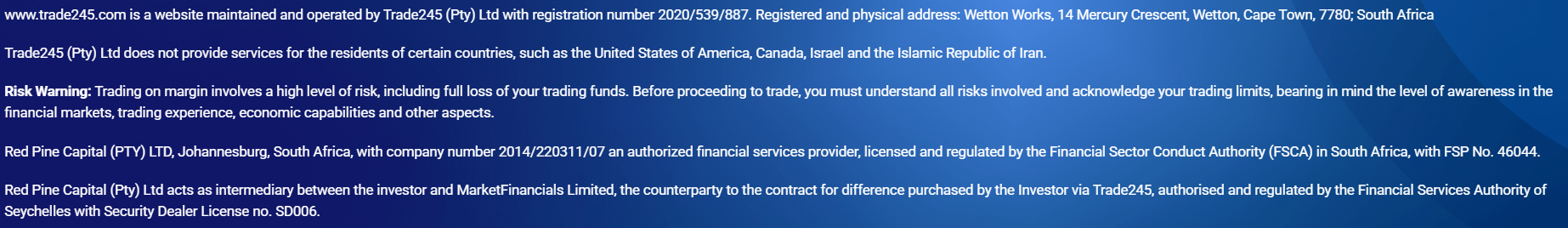

Regulation and Security Measures

Score – 4.2/5

Trade245 Regulatory Overview

Trade245 is a regulated brokerage company authorized by the reputable FSCA in South Africa, which suggests a level of credibility and adherence to certain industry standards. However, as we found the broker also operates internationally through the offshore zone provided by FSA in Seychelles.

- The broker is registered and regulated in each region in which it operates and is authorized as the main entity in South Africa. While the broker offers the advantage of international trading, it is provided via an offshore entity, which raises potential concerns regarding regulatory oversight and investor protection compared to brokers in more established financial jurisdictions. Therefore, it is preferable to verify conditions fully.

How Safe is Trading with Trade245?

According to our research, the FSCA plays a crucial role in enforcing regulatory compliance within the financial services industry. As part of its oversight, the regulatory body ensures the security of clients’ funds by requiring the segregation of funds from company accounts. This practice prevents the use of client funds for operational purposes, adding an extra layer of protection for clients. However, these conditions are different for the other entity of the broker, which does not provide enough security.

Consistency and Clarity

For the consistency and transparency of Trade245, we find that there is a large gap between what is officially claimed on the broker’s website about its reliability and tight regulatory status, and what clients report about the broker.

Despite the fact that Trade245 is a listed broker with the FSCA, there are still a great number of customer reviews that report the broker’s lack of consistency and clarity in several key areas, including withdrawal issues, with delays and withdrawal denials, lack of transparency and hidden and unexpected fees, also, complaints on the platform performance and reports about inconsistent customer support.

All of this combined is a good ground for concerns. Thus, we recommend clients be careful and consider all of the mentioned before making a decision to register with the broker.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with Trade245?

Trading245 offers a really wide range of trading accounts that can be seen both as a positive feature, but also as a little confusing. The account types are Bonus 100, No Bonus, Swap Free, Zero Spread, Bonus 245, Bonus Rescue, and Micro. There are many common conditions among the accounts, like the highest available leverage level being 1:500. Also, spreads offered by the broker are floating for all account types and generally start from 1 pip, except for the Zero Spread account, which the name of the account already implies, has spreads from 0 pips.

- Bonus 100, No Bonus, Swap Free, Zero Spread, Bonus 245, Bonus Rescue account types allow access to the MT4 platform.

- Micro account allows to conduct trades on both MT4 and MT5 platforms.

- Bonus 100, Bonus 245, and Bonus Rescue accounts include bonuses when opening an account.

Clients should explore the peculiarities of each account further before making a final choice of an account type. This is why the large variety of choices can be confusing for traders.

Regions Where Trade245 is Restricted

Based on the information from the broker’s official website, we found that there are certain regions the Trade245 does not accept clients from. Here are the main countries the broker mentions:

Cost Structure and Fees

Score – 4.2/5

Trade245 Brokerage Fees

After examining the broker’s fee offering, we found that Trade245 provides competitive pricing for the majority of trading services. On specific account types, the broker applies commissions. The broker offers floating spreads, that are mostly in line with the market average. However, according to certain reports on the broker, there might be hidden fees, too, which clients find about later in trading.

According to our test trade, Trade245 offers tight and variable spreads, with an average spread of 1 pip for the EUR/USD currency pair in the Forex market for most of its accounts. For its Zero Spread account spreads start from 0 pips. However, trading conditions, including spreads, may differ depending on the specific entity. Therefore, gain a clear understanding of the spread conditions offered by the brokerage.

As to the broker’s commissions, we found that commissions are charged on certain account types at $10 per lot. However, this offering is higher than the market average.

Moreover, be aware that additional fees, such as swap or rollover fees, may be applicable during trading activities. So, carefully review the broker’s fee structure and terms and conditions to gain a comprehensive understanding of the associated charges and their potential impact on trading operations.

How Competitive Are Trade245 Fees?

Generally, we find the broker’s offering moderate and in line with the market. Although the commissions offered are higher than the average in the market. We also noticed, that on the broker’s website, you cannot find detailed contract specifications, detailed for each instrument.

Besides, based on numerous comments and reports from customers, there might be hidden fees while trading with Trade245, which raises certain concerns. We recommend traders be careful and view all the applicable fees before opening an account with the broker.

| Asset/ Pair | Trade245 Spread | Fortrade Spread | LiteForex Spread |

|---|

| EUR USD Spread | 1 pip | 2 pips | 1 pips |

| Crude Oil WTI Spread | 3 | 0.04$ | 9 pips |

| Gold Spread | 1 | 0.45$ | 4 pips |

Trade245 Additional Fees

Also, the broker may incur certain additional fees, like charges for deposits and withdrawals, depending on the selected funding method. Besides, if the Client Account is inactive for a year or longer, the Company reserves the right to charge an inactivity fee to maintain the account.

Score – 4.2/5

Trade245 clients have access to the popular MetaTrader 4 and MetaTrader 5 trading platforms. These platforms are widely recognized in the industry for their robust features, user-friendly interfaces, advanced charting tools, and comprehensive trading capabilities.

| Platforms | Trade245 Platforms | Fortrade Platforms | Plus500 Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Trade245 Web Platform

The Trade245 MT4 WebTrader enables customers to access their accounts directly in a web browser without installation. The platform assures real-time market data, advanced charting, and easy navigation on the platform. The MT4 WebTrader is easily accessible through various operating systems and devices ensuring flexibility.

Trade245 Desktop MetaTrader 4 Platform

The MT4 platform allows access to Future, Indices, Commodities, and other CFD transactions. The MetaTrader4 platform is favorable for clients of any level of experience. It is well known for its simplicity and intuitiveness, technical analysis, charts, good functionality, and the availability of automated trading. Through the MT4 platform clients can access the Bonus, No Bonus, Swap Free, and Zero Spread accounts.

Trade245 Desktop MetaTrader 5 Platform

The Trade245 MT5 platform is an advanced version of the MT4 platform and offers a range of advanced charting tools, diverse timeframes, trading signals, technical indicators, and other features. Additionally, this platform provides automated trading functionality, enabling traders to identify market movements and enhance their market entry and stop-loss strategies. We also found that desktop applications for Windows and Mac systems are available for installation. The MT5 platform is available for traders who choose the Micro account type.

Trade 245 MobileTrader App

Mobile trading apps are available for iOS and Android, enabling clients to manage their accounts through their mobile phones. It supports both MT4 and MT5 and thus, the users can choose between them according to their preference and trading strategy. With it, mobile traders enjoy real-time market data, advanced charting, and smooth order execution.

Main Insights from Testing

Our main conclusion from the Trade245 mobile apps is positive. We found the apps to be user-friendly so that both beginners and professionals alike can use them with ease. With mobile compatibility, Trade245 allows traders to connect with the markets at any time and from any location. The apps mostly maintain the functionality and features of the desktop platform, at the same time enabling flexibility and ease of access.

Trading Instruments

Score – 4.3/5

What Can You Trade on the Trade245 Platform?

Trade245 provides access to popular trading instruments, such as Forex, Indices, Stocks, Commodities CFDs, Cryptocurrencies, and more. However, the availability of these instruments may vary depending on the specific entity, so we advise researching to determine the range of options available. The availability of over 25 currency pairs, global stock indices, and commodities like gold and oil gives Trade245 clients opportunities to explore different markets.

Main Insights from Exploring Trade245 Tradable Assets

We have conducted a thorough research of the available tradable products offered by Trade245, to come to the conclusion that the broker’s offering is considerably limited, especially when comparing it to other similar brokers in the market. The currency trading is limited to around 25 forex pairs, which is considered a modest number. Some brokers offer more than 60 forex pairs.

Besides, Trade245’s instruments are CFD-based, which limits the opportunities for portfolio diversification for those who are interested in long-term investments, stock ownership, or any other investment alternative. Thus, for those clients who are eager to explore the market further, the broker might not be a good fit.

Leverage Options at Trade245

Using leverage in trading can be advantageous as it allows clients to access the market with a smaller capital investment. However, it carries the potential for significant gains and losses as well. Therefore, traders should have a thorough understanding of how leverage works and the potential consequences it can bring before engaging in leveraged trading.

Trade245 leverage is offered according to the FSCA, and FSA regulations:

- Residents from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:500.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Trade245

Per our research, Trade245 offers a few options for clients to instant deposit funds into their trading accounts including Visa/Mastercard, M-PESA, Skrill, Ozow, and more. However, certain funding methods may have specific requirements or restrictions based on the client’s bank or other financial institutions involved.

Minimum Deposit

We found that the broker presents attractive options requiring a $5 low minimum deposit requirement for opening an account. However, the broker recommends its clients to deposit at least $100 for more opportunities. Deposits via the Client Portal are instant.

Withdrawal Options at Trade245

As we found the broker offers several withdrawal options to its clients. These typically include bank wire transfers, credit/debit card withdrawals, and electronic payment systems. However, certain withdrawal methods may have associated fees or processing times.

- As we found there are no limitations on withdrawal amounts.

- After the approval, withdrawals are processed within minutes and are commonly reflected on the trader’s account within 24 hours.

Customer Support and Responsiveness

Score – 4.2/5

Testing Trade245 Customer Support

The broker provides 24/5 customer support, staffed by trading experts who can assist with technical support, recommendations, general inquiries, and operational issues.

- The broker also provides a FAQ section, where traders can find answers to the most common questions related to trading with Trade245.

Contacts Trade245

In general, the support options Trade245 provides are limited. The broker does not offer Live chat, and as it is, the main means of communication is through email and phone.

- To direct questions to the brokers clients can use the provided email address: support@trade245.com.

- Clients can also find information and updates on the broker through the broker’s IG and FB social pages.

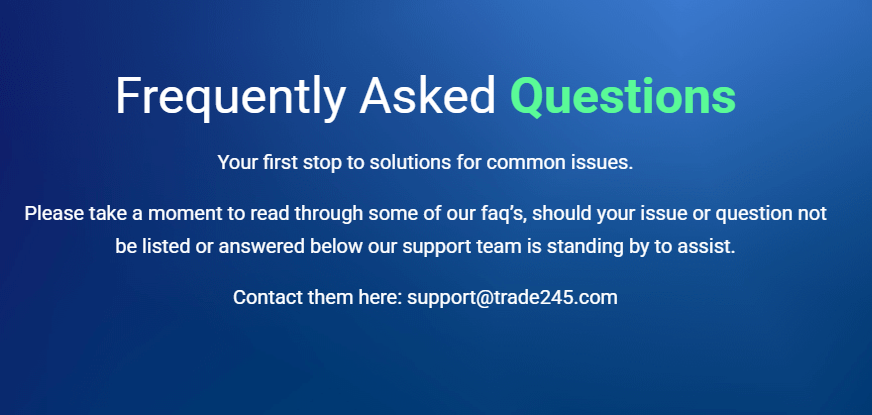

Research and Education

Score – 4.3/5

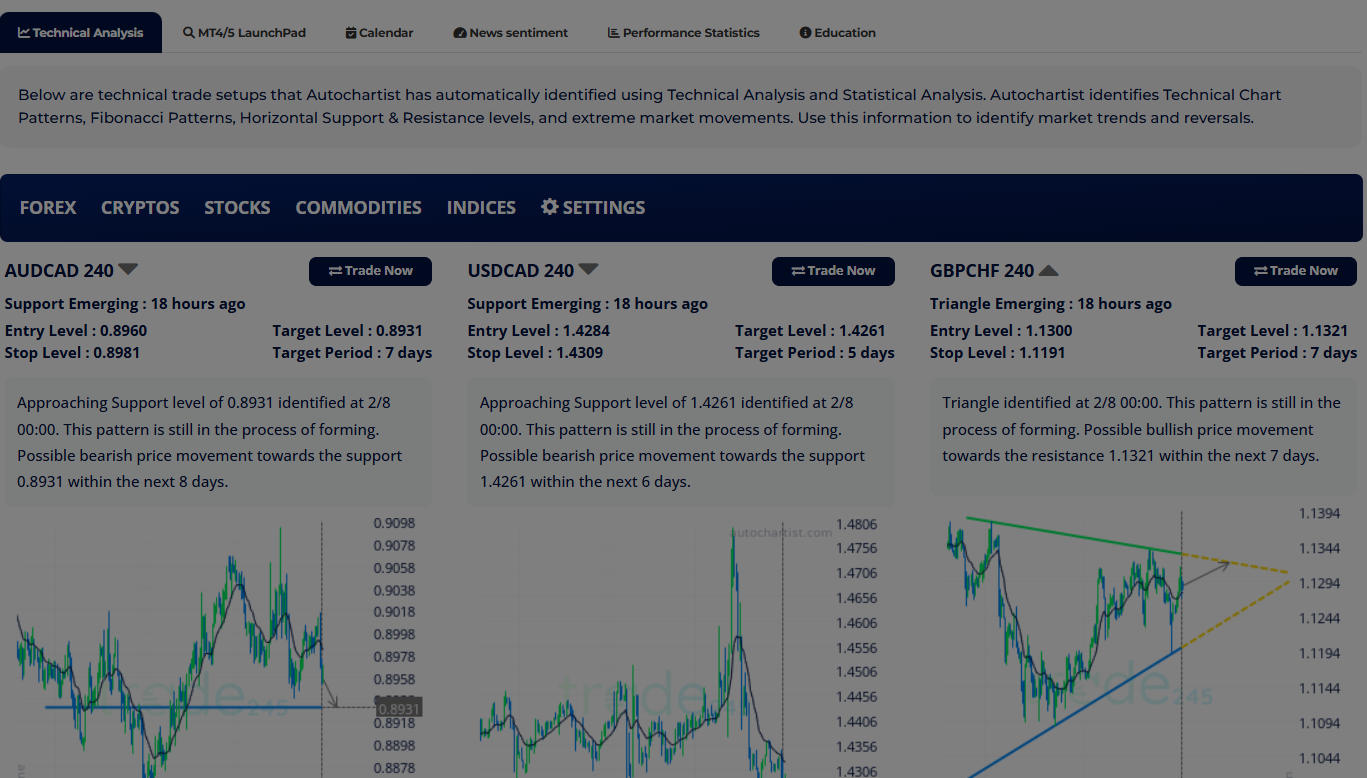

Research Tools Trade245

Based on our research, most of the broker’s research tools are integrated into its MT4 and MT5 platforms. Although not many additional resources are provided, the platforms enable good research and insight into the market.

- However, we found that the broker provides a Research Portal to its clients, which is very helpful and includes news sentiment, performance statistics, Calendar, and Technical Analysis. Yet, it is possible to enter the portal only after registration.

Education

In the end, it is hard to say that the broker’s website offers comprehensive educational materials, yet, there are still available resources, a blog, glossary, and available webinars, that enable traders of different levels to gain certain skills and knowledge on different aspects of trading. The broker’s FAQ section is also helpful, concentrating mainly on the questions connected with the broker’s services.

Here are the additional educational resources clients can access:

- The Glossary section includes quite an impressive amount of financial and forex terms that will enable traders to understand the trading process better.

- The Blog includes detailed articles on the market and various trading-related topics, that would keep traders informed.

- Besides, the platform provides tutorials that would guide clients during the trading process.

Is Trade245 a Good Broker for Beginners?

Generally, Trade245 can be a favorable broker for beginner traders for multiple reasons. The broker requires only a $5 initial deposit, it offers a demo account, quite competitive fees for tradable products, and the popular MT4 and MT5 platforms that also offer a simple interface and easy navigation. Although the education and research sections are not entirely comprehensive, there are still useful features and materials included, that can be helpful for beginners. Thus, Trade245 can be suitable for beginner traders, of course, if its services meet their trading expectations and needs.

Portfolio and Investment Opportunities

Score – 3.5 /5

Investment Options Trade245

Trade245’s investment opportunities are limited due to the fact that the broker’s tradable products are mainly based on CFDs. Thus, traditional investments in stocks and shares are not supported.

- Besides, those who are looking for alternative options for investment may not find Trade245’s offerings favorable, as the MAM and PAMM accounts are not available. Thus, those interested in managed account services may need to consider alternative brokers that offer PAMM accounts.

- Trade245 offers a Copy Trading Account, which enables traders to copy trades of selected professionals, who are called Master Traders. This allows users to participate in the financial markets without active management and much effort.

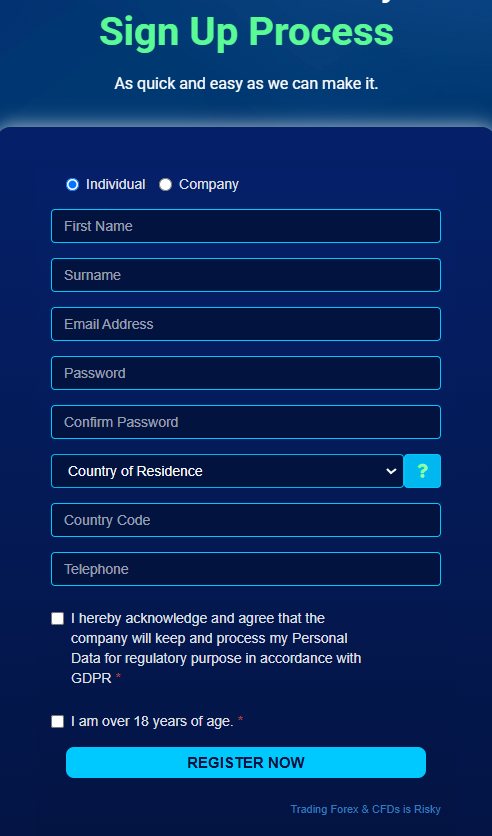

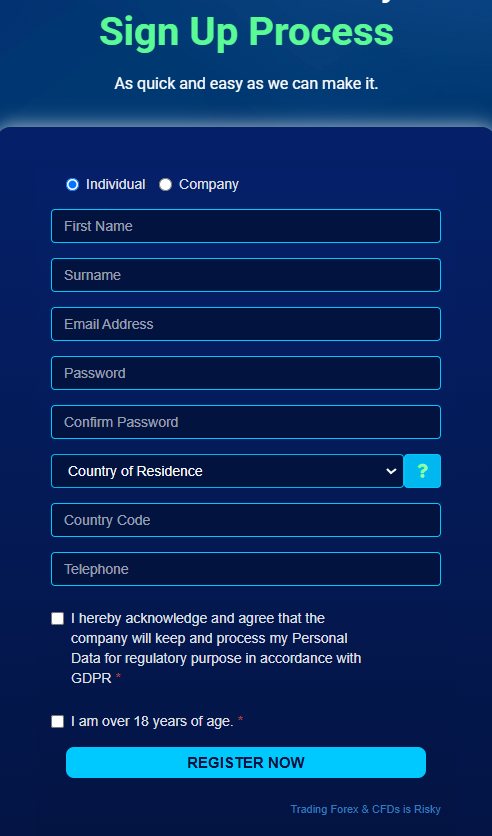

Account Opening

Score – 4.6/5

How to Open a Trade245 Demo Account?

The Demo account option is a great opportunity to practice trading and gain skills before engaging in real trading. Besides, opening a Demo account is easy and simple, with only a few quick steps to take:

- Go to the broker’s website and click on the “Sign Up” or “Register” button

- Fill out the registration form by providing your name, email, residency, age, etc.

- Create a secure password

- Configure your demo account settings, such as choosing the desired leverage, platform, account type, etc.

- Download the MT4 or MT5 trading platform

- Use the demo account credentials provided via an email to log in to the platform

How to Open a Trade245 Live Account?

Opening a Trade245 Live account is quite an easy process, as you can register within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open an Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit

Score – 3.8/5

We have already discussed the main tools and features available with Trade245. In fact, the main tools are already inserted into the platforms, enabling advanced trading experience. Here we want to mention the broker’s bonus program.

- As we have revealed during our research, Trade245 offers a few bonus programs to enhance traders’ experience and give them additional trading advantages. These bonuses are associated with specific account types, each for different trading preferences. Clients can access bonuses by signing in with one of the bonus accounts: Bonus 100, Bonus 245, and Bonus Rescue. Clients can get a 100% deposit bonus, effectively doubling their initial deposit. For the Bonus 245 account, clients receive a 245% bonus on their deposit, significantly increasing their trading capital.

Trade245 Compared to Other Brokers

After researching Trade245’s different aspects of trading, we have also conducted a comparison of the broker to other brokerage firms in the market that have similar services. In terms of regulation, we have compared Trede245 to several other brokers, to find that it holds a license from FSCA and offshore FSA regulatory authorities. While the FSCA provides tight regulatory oversight, making the broker a safer choice compared to RoboForex which holds only an offshore license, it still lacks the same rigorous oversight as brokers like FP Markets and FBS provide.

Afterward, we compared the broker’s applicable fees to other brokers. While the offered spreads are in line with the market average, commissions are on the higher side, thus being a more costly offering than JustMarkets or FXGT.com, which have a better fee structure, with tight spreads and lower fixed commissions.

In regard to the available platforms, we find Trade245’s offering rather basic, with its MT4 and MT5 platforms, which most of the brokers provide, including FSGT.com, RoboForex, and BlackBull Markets. Moving to the available instruments, Trade245 offers about 12.000 tradable products, which is still behind the BlackBull Markets’ offering (26.000+).

Finally, although the education section is not very comprehensive, it still includes some essential and useful materials and resources, like articles, glossaries, and webinars. However, those traders who are looking for better guidance and more educational materials, had better check brokers, such as FP Markets, FBS, and XM.

| Parameter |

Trade245 |

FP Markets |

RoboForex |

FBS |

BlackBull Markets |

JustMarkets |

FXGT.com |

| Spread Based Account |

From 1 pip |

From 1 pip |

Average 1.3 pip |

Average 0.7 pip |

From 0.8 Pips |

From 0.3 pip |

Average 1.2 pip |

| Commission Based Account |

0.0 pips + $5 |

0.0 pips + $3 |

0.0 pips + $4 |

0.0 pips+$3 |

0.1 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low |

Low |

Low |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, R StocksTrader |

MT4, MT5, FBS App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, JustMarkets App |

MT4, MT5 |

| Asset Variety |

12.000+ instruments |

10,000+ instruments |

12,000+ instruments |

550+ instruments |

26000+ instruments |

260+ instruments |

1000+ instruments |

| Regulation |

FSCA, FSA |

ASIC, CySEC, FSCA, CMA |

FSC |

ASIC, CySEC, FSC |

FMA, FSA |

FSCA, CySEC, FSA, FSC |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Basic |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$5 |

$100 |

$10 |

$5 |

$0 |

$10 |

$5 |

Full Review of Broker Trade245

Trade245 is a good Forex and CFD broker, especially for traders in South Africa and throughout the African continent. The broker gives access to MT4 and MT5 platforms, two of the most popular platforms, a very large selection of account types with flexible trading conditions, and various financial instruments, including Forex, indices, and commodities. FSCA regulation of the broker adds to its credibility and hence provides a level of security for traders registering under this entity. Also, the very low minimum deposit, competitive spreads, and STP execution model make Trade245 an attractive offer both for beginner traders and more experienced ones.

On the other hand, the broker has received very mixed reviews from the clients and has a relatively low rating on some review platforms. Some traders might view limitations to some trading instruments available to them, a lack of 24/7 customer support, and an absence of live chat as certain drawbacks. Clients should also be cautious signing up under the Trade245 offshore entity since the regulatory protections are not as tight as what they would experience under the FSCA oversight.

Share this article [addtoany url="https://55brokers.com/trade245-review/" title="Trade245"]