- What is Trade Nation?

- Is Trade Nation Safe or a Scam?

- Leverage

- Accounts

- Fees

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, regulations and licenses, fees, spreads, platforms, customer service, and placed traders to see trading conditions and give expert opinions about Trade Nation.

What is Trade Nation?

Trade Nation is a Forex and CFD trading broker that was established in 2014 under the brand name Core Spreads. This was eventually has been changed to Trade Nation in 2019 as a trading provider with products such as Forex, CFDs, indices, commodities, metals, stocks, bonds, and more.

Based on our findings, the broker offers its services globally and carries out local entities with the purpose to support traders in the UK, Australia, South Africa, the Bahamas, and other international destinations.

In general, Trade Nation is a competitive and reputable brokerage firm that provides comprehensive financial solutions to a wide range of clients globally.

Trade Nation Pros and Cons

From our point of view, Trade Nation has both advantages and disadvantages necessary to evaluate. The broker offers a range of trading instruments across various financial products, along with competitive trading costs. Traders have the flexibility to choose from advanced trading platforms like MT4 and proprietary TN Trader. Additionally, the broker’s regulatory compliance with multiple authorities, including the Top-tier FCA and ASIC licenses brings a sense of trust and security.

For the pros, trading conditions may vary based on the entity, and clients should be aware that market fluctuations can affect investment returns while trading via an international entity since regulations are not so tight there. Also, the broker lacks 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Fully regulated broker

| Trading proposal and conditions vary according to regulation |

| FCA and ASIC licenses and oversee | No 24/7 support |

| Free deposit and withdrawal | Offshore entities |

| Fixed spreads | |

| MT4 trading platform | |

| No minimum deposit | |

Trade Nation Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, ASIC, FSCA, SCB, FSA |

| 🖥 Platforms | MT4, TN Trader |

| 📉 Instruments | Forex, CFDs, indices, commodities, metals, stocks, bonds |

| 💰 EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $0 |

| 💰 Base currencies | USD, GDP, EUR |

| 📚 Education | Provided |

| ☎ Customer Support | 24/5 |

Overall Trade Nation Ranking

According to our analysis, Trade Nation holds a reputable position in the brokerage industry. With its diverse range of financial solutions, competitive trading costs, and a vast selection of trading instruments, the broker offers a compelling package to clients. Moreover, the top-tier FCA and ASIC licenses add an extra layer of credibility and trust.

- Trade Nation Overall Ranking is 8.5 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Trade Nation | SquaredFinancial | Goldwell Capital |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Fees | Trading Instruments | Trading Conditions |

Trade Nation Alternative Brokers

Even though, spreads, platforms, and trading conditions are really good at Trade Nation, we have conducted a comprehensive analysis and compiled a list of possible broker alternatives to the firm.

Is Trade Nation Safe or Scam?

No, Trade Nation is not a scam. The broker is trustworthy and secure as it is regulated by the Top-tier FCA (UK) and ASIC (Australia), as well as also holds additional licenses in various jurisdictions allowing global expansion. The authorities are known for enforcing stringent rules and regulations to maintain the highest standards in the financial industry. These regulatory oversights add extra confidence in the broker’s operations, guaranteeing their adherence to regulatory requirements.

Is Trade Nation Legit?

Yes, Trade Nation is a legit and regulated brokerage firm that holds the necessary licenses and follows regulations for offering Forex trading services. The broker’s compliance with industry standards is assured by its regulation under top-tier authorities, which ensures compliance with established financial regulations and industry standards.

However, the broker also holds offshore licenses. Therefore, before engaging in trading activities you should carefully consider and understand the differences while trading in different jurisdictions even using the same Broker.

Read our conclusion on Trade Nation reliability:

- Our ranked Trade Nation Trust Score is 8.5 out of 10 demonstrating that it is committed to following the necessary regulations and providing its clients with safe trading solutions. Yet, assess your trading needs, and preferences to determine whether the broker is a suitable fit for your specific requirements.

| Trade Nation Strong Points | Trade Nation Weak Points |

|---|

| FCA and ASIC regulated international broker | International proposal runs through offshore entity |

| Global coverage and years of operation | |

| Negative balance protection | |

Client Trading Protection

Trade Nation is heavily regulated in 5 jurisdictions, including ASIC and FCA. This regulatory status means Trade Nation is required to always treat customers fairly, in accordance with the strict requirements of each regulator.

Moreover, the broker is also regularly audited and keeps all clients’ funds in segregated trust accounts along with compensation schemes in case of insolvency to ensure money is protected. All funds are held with top-tier banks, such as Barclay’s in the UK and Westpac in Australia. The broker also offers negative balance protection to all retail client trading accounts.

Trade Nation Leverage

Another great feature while trading Forex is an allowance to use leverage, which may potentially increase your gains. However, in order to minimize risks as well, which work in both directions, it is necessary to learn how to use leverage smartly.

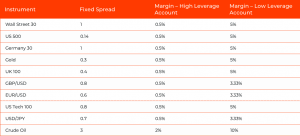

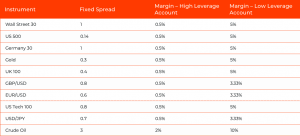

Trade Nation leverage is offered according to FCA, ASIC, FSCA, SCB, and FSA regulations:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs.

- The Australian clients that hold with ASIC-regulated Trade Nation accounts are entitled to up to 1:30.

- International traders may use higher leverage up to 1:500.

Account Types

Per our findings, traders can choose among Individual, Professional, and Corporate account types.

Additionally, the broker provides a Demo account without any charges, allowing traders to practice trading and test different strategies through simulated trades.

| Pros | Cons |

|---|

| Fast digital account opening | Conditions vary depending on the account type |

| Demo Account | |

| No minimum deposit | |

Opening Trade Nation Trading Account

Opening an account with a broker is an easy process, as you can log in and register with Trade Nation within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Trade Now” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

Trade Nation trading Instrument range is offered through FX and CFD models offering FX pairs, indices, commodities, metals, stocks, bonds, and more.

- Trade Nation Market Range ranked 7.9 out of 10 for its extensive array of Forex and CFD instruments. However, users should be aware that there may be some variation in offers between different entities.

Trade Nation Fees

Reviewing the broker’s fee structure we found that the broker offers competitive pricing for a majority of its trading services with low commissions. Additionally, Trade Nation does not charge fees for deposits and withdrawals, although there may be fees associated with transferring funds to and from your trading account.

- Trade Nation Fees are ranked low with an overall rating of 8.5 out of 10 based on our testing and compared to over 500 other brokers. Fees and commissions vary based on entity offering, see our findings of fees and pricing in the table below.

| Fees | Trade Nation Fees | SquaredFinancial Fees | Goldwell Capital Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | No | Yes | Yes |

| Fee ranking | Low | Low | Average |

Spreads

Per our test trade, Trade Nation offers low fixed spreads with an average of EUR/USD 0.6 pips. Unlike variable spreads that could potentially be much wider by the time you exit your position, fixed spreads stay exactly the same from start to finish.

- Trade Nation Spreads are ranked low or average with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spread lower than the industry average and spreads for other instruments are competitive too.

| Asset/ Pair | Trade Nation Spread | SquaredFinancial Spread | Goldwell Capital Spread |

|---|

| EUR USD Spread | 0.6 pips | 1.1 pips | 1.8 pips |

| Crude Oil WTI Spread | 3 | 3 | 4 |

| Gold Spread | 1 | 34 | 50 cents |

Deposits and Withdrawals

The broker provides its clients with the option to deposit funds into their trading accounts using debit cards, credit cards, and bank transfers. It can receive deposits via Skrill as well. Payment with credit/debit cards is instant, while bank transfers may take several days to be processed.

- Trade Nation Funding Methods we ranked good with an overall rating of 8 out of 10. Fees are low, and also you can benefit from various account-based currencies.

Here are some good and negative points for Trade Nation funding methods found:

| Advantage | Disadvantage |

|---|

| No deposit fees | Conditions may vary according to regulations |

| No deposit and withdrawal fees | |

| Fast digital deposits | |

Trade Nation Minimum Deposit

There is no minimum deposit for the new Trade Nation investors. Traders only need enough funds to cover the margin requirements of their trade.

Trade Nation minimum deposit vs other brokers

|

Trade Nation |

Most Other Brokers |

| Minimum Deposit |

$0 |

$500 |

Trade Nation Withdrawals

Trade Nation does not charge any fees for both deposits or withdrawals. The broker’s minimum withdrawal amount is 50 units of the account base currency.

Withdraw Money from Trade Nation Step by Step:

To initiate a withdrawal fund from your trading account, the brokerage firm provides a set of typical steps that can be followed:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with the requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

Traders have access to the proprietary TN Trader, as well as the industry-leader MetaTrader4 platform, which is accessible through desktop, web, and mobile. The platform features leading indicators, oscillators, EA strategies, and automated desktop stations that all in all bring numerous options for smart investment and trading processes.

Of course, all platforms feature mobile trading apps, so you can use Mobile devices that are bringing absolute freedom to trade.

- Trade Nation Platforms are ranked good with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers the widely popular MT4 trading platform, which is suitable for various trading strategies.

| PLatforms | Trade Nation Platforms | SquaredFinancial Platforms | Goldwell Capital Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Trading Tools

We found that Trade Nation offers a diverse range of trading tools to assist traders in making informed decisions and optimizing their trading strategies, which include powerful charting capabilities, advanced order types, and execution, strategy automation, and many other advanced features. Moreover, traders have access to real-time data feeds, risk management tools, economic calendars, and other valuable resources aimed at enhancing the trading experience and improving overall trading performance.

Customer Support

Another good point in its client-oriented philosophy is competent customer service which is available through various methods including Online Live Chat, Phone, emails, etc. Broker’s team is available 24/5 and supports international languages accessible via Live Chat, email, and phone lines in Australia, the UK, and internationally as well.

- Customer Support in Trade Nation is ranked good with an overall rating of 7.9 out of 10 based on our testing. We got fast and knowledgeable responses, the only point is that it is not available on weekends.

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quality customer support with live chat | No 24/7 customer support |

| Relevant answers | |

| Quick responses | |

Trade Nation Education

In the end, the broker’s website does not offer extensive educational and research materials, seminars, or webinars, only providing technical and fundamental analysis and insights. This lack of comprehensive educational resources can be seen as a disadvantage since such resources are essential for traders to enhance their skills and knowledge.

- Trade Nation Education ranked with an overall rating of 6.9 out of 10 based on our research. We recommend considering alternative brokers that provide a broader selection of educational resources since CapTrader lacks comprehensive learning materials, which may not be ideal for beginner traders.

Trade Nation Review Conclusion

In summary, Trade Nation is a reliable Forex trading broker that offers a competitive trading environment, a range of popular trading products, and low trading fees for both retail and institutional clients. The broker provides the well-known MT4 trading platform, which is equipped with advanced features and tools offering suitable for various levels of traders. Another plus is no minimum requirement of deposit and a variety of funding methods.

However, there may be variations in trading conditions depending on the specific entity, alike Broker has entities in offshore zones, so mainly International clients are served by these entities which indeed offer lower security levels compared to its UK or Australian entity. Moreover, the absence of 24/7 customer support is another drawback to consider.

Overall, Trade Nation is a comprehensive platform for traders seeking confidence in navigating the financial markets. Yet, we recommend conducting thorough research to ensure that the broker aligns with your individual trading needs, considering possible differences in conditions across different entities.

Based on Our findings and Financial Expert Opinions Trade Nation is Good for:

- Traders from the UK

- Traders from Australia

- Traders who prefer the MT4 trading platform

- International traders

- CFD and currency trading

- Beginners

- Institutional trading

- Competitive spreads

- Good trading tools

- EA/Auto trading

Share this article [addtoany url="https://55brokers.com/trade-nation-review/" title="Trade Nation"]

Trade Nation is undoubtedly the best broker for forex. I have made good money through it. But for the last few months, I have been facing issues with withdrawal. Tried calling customer support many times but didn’t get any satisfactory answer. Distressed with the services, I searched for another Forex broker and found InvestFW. The broker was regulated, I quickly created an account and started trading. After using the platform for over 1 month, here’s my review – The platform is perfect, leverage is good, spreads are lowest and most importantly, the withdrawals are quick. It took only a few hours for withdrawals to credit to my bank account.

I am happy Trade Nation services but deposit option is not so easy like depositing 4000 dollars take too much time and efforts. So, I changed my broker and choosed InvestFW. The services of InvestFW is beyond my expectations. I have been trading on it happily for over 10 months.

I have been working with Trade Nation for several months straight and didn’t really notice some terrible flaws. However, the recent policy changes of Trade Nation have negative impacted my trading. I’m unable to withdraw my funds. But I have found a good trading platform – TradeEU. The trading conditions are the best and its lowest fees is probably the biggest reason why I love this platform.

I have been working with Trade Nation for several months straight and didn’t really notice some terrible flaws. However, the recent policy changes of Trade Nation have negative impacted my trading. I’m unable to withdraw my funds. But I have found a good trading platform – TradeEU. The trading conditions are the best and its lowest fees is probably the biggest reason why I love this platform.

i traded with trade nation and i payed the withdraw fee only to find out the file was corrupted and asking for another withdraw fee twice i have to pay withdraw fee and its heaps