- What is Trade Nation?

- Trade Nation Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

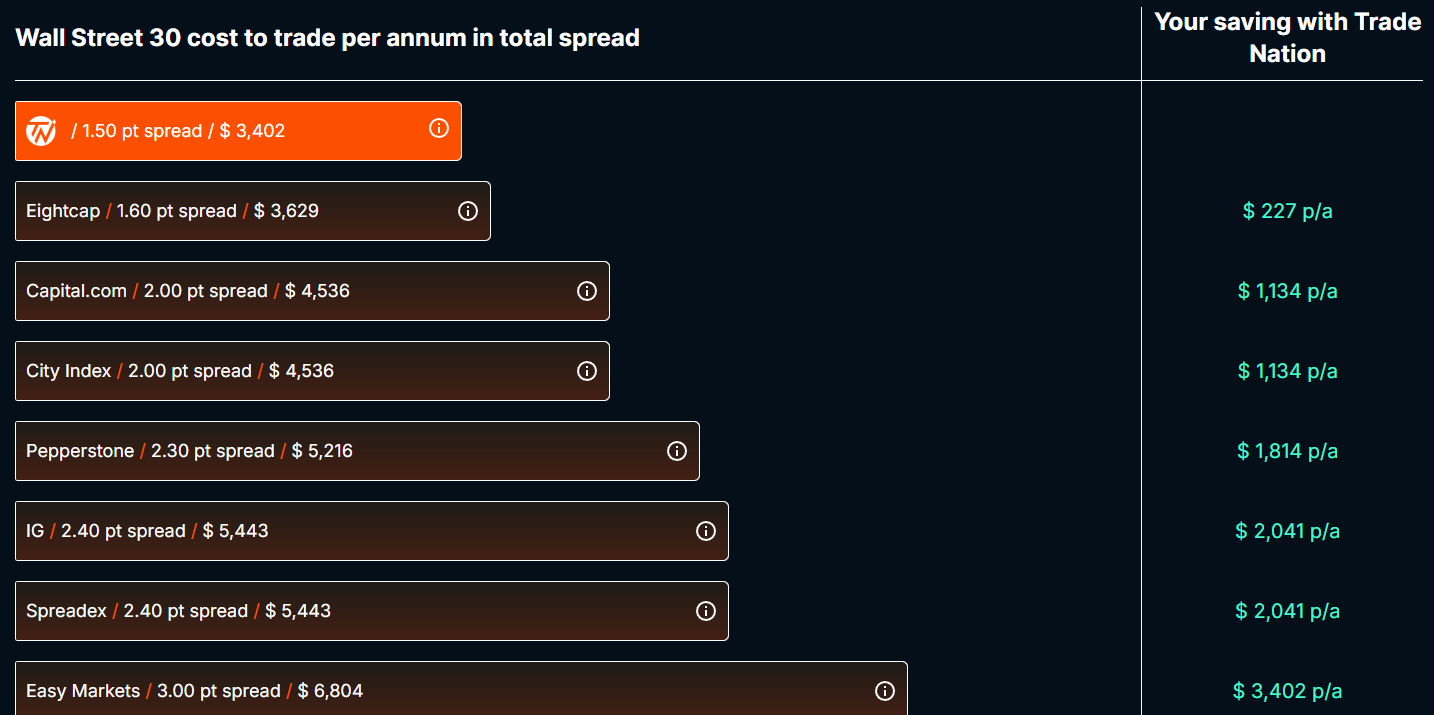

- Cost Structure and Fees

- Trading Platforms and Tools

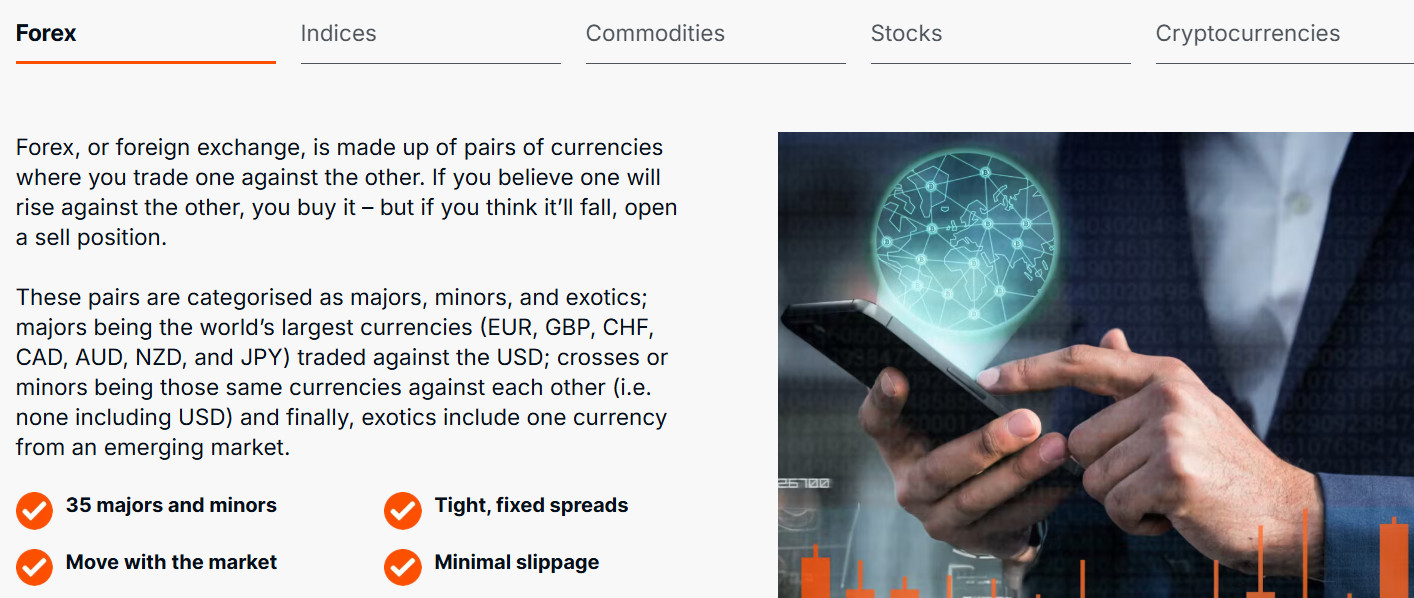

- Trading Instruments

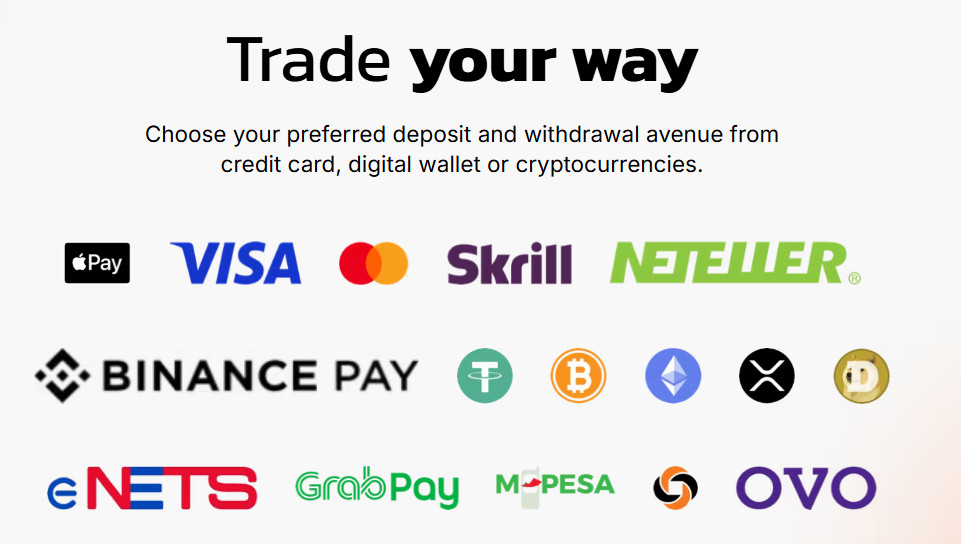

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Trade Nation Compared to Other Brokers

- Full Review of Broker Trade Nation

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Trade Nation?

Trade Nation is a Forex and CFD trading broker that was established in 2014 under the brand name Core Spreads. This was eventually changed to Trade Nation in 2019 as a trading provider with products such as Forex, CFDs, indices, commodities, metals, stocks, bonds, and more.

Based on our findings, the broker offers its services globally and carries out local entities to support traders in the UK, Australia, South Africa, the Bahamas, and other international destinations.

In general, Trade Nation is a competitive and reputable brokerage firm that provides comprehensive financial solutions to a wide range of clients globally.

Trade Nation Pros and Cons

From our point of view, Trade Nation has both advantages and disadvantages necessary to evaluate. The broker offers a range of trading instruments across various financial products, along with competitive trading costs. Traders have the flexibility to choose from advanced trading platforms like MT4 and proprietary TN Trader.

Additionally, the broker’s regulatory compliance with multiple authorities, including the Top-tier FCA and ASIC licenses, brings a sense of trust and security.

For the pros, trading conditions may vary based on the entity, and clients should be aware that market fluctuations can affect investment returns while trading via an international entity since regulations are not so tight there. Also, the broker lacks 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Fully regulated broker

| Trading proposal and conditions vary according to regulation |

| FCA and ASIC licenses and oversee | No 24/7 support |

| Free deposit and withdrawal | Offshore entities |

| Fixed spreads | |

| MT4 trading platform | |

| No minimum deposit | |

Trade Nation Features

Trade Nation is a globally regulated broker known for its transparent pricing, fixed low spreads, and user-friendly trading platforms. Below is a comprehensive list of its key features:

Trade Nation Features in 10 Points

| 🏢 Regulation | FCA, ASIC, FSCA, SCB, FSA |

| 🗺️ Account Types | TN Trader, MetaTrader, Professional Accounts |

| 🖥 Trading Platforms | MT4, TN Trader, TradingView, TradeCopier |

| 📉 Trading Instruments | Forex, CFDs, Indices, Stock, Commodities, Cryptocurrencies |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, GDP, EUR |

| 📚 Trading Education | Knowledge Base, Market Insights, Glossary |

| ☎ Customer Support | 24/5 |

Who is Trade Nation For?

Trade Nation is designed for traders of all experience levels looking for simple and transparent platforms, competitive spreads, and advanced tools. The broker caters to those who value stability and straightforward trading conditions. Based on our findings and financial expert opinions, Trade Nation is good for:

- Traders from the UK

- Traders from Australia

- Traders who prefer the MT4 trading platform

- International traders

- CFD and currency trading

- Beginners

- Institutional trading

- Competitive spreads

- Good trading tools

- EA/Auto trading

Trade Nation Summary

In summary, Trade Nation is a reliable Forex trading broker that offers a competitive trading environment, a range of popular trading products, and low trading fees for both retail and institutional clients. The broker provides the well-known MT4 trading platform, which is equipped with advanced features and tools offering suitable for various levels of traders. Another plus is no minimum requirement for deposit and a variety of funding methods.

However, there may be variations in trading conditions depending on the specific entity. The broker has entities in offshore zones, so mainly international clients are served by these entities, which indeed offer lower security levels compared to its UK or Australian entity. Moreover, the absence of 24/7 customer support is another drawback to consider.

Overall, Trade Nation is a comprehensive platform for traders seeking confidence in navigating the financial markets. Yet, we recommend conducting thorough research to ensure that the broker aligns with your individual trading needs, considering possible differences in conditions across different entities.

55Brokers Professional Insights

Trade Nation stands out due to its commitment to transparency, fixed-spread pricing, and a user-friendly trading experience. Unlike many competitors that operate with variable spreads, Trade Nation offers fixed spreads, ensuring traders benefit from stable costs regardless of market volatility. This pricing model is particularly advantageous for scalpers and day traders who require cost consistency.

Additionally, the broker is regulated across multiple jurisdictions, including the FCA and ASIC, reinforcing its credibility and security. Another good point is its proprietary trading platform, designed for both beginners and experienced traders, featuring a clean interface, advanced charting tools, and integrated market insights.

Consider Trading with Trade Nation If:

| Trade Nation is an excellent Broker for: | - Need a well-regulated trading provider.

- UK and Australian traders.

- Secure trading environment.

- Access to popular trading instruments.

- Providing a proprietary trading platform.

- Looking for MT4 platform.

- Need broker with no minimum deposit requirement.

- Providing competitive trading conditions.

- Offering services worldwide.

- Need broker with Copy Trading.

- Providing fixed spreads.

|

Avoid Trading with Trade Nation If:

| Trade Nation might not be the best for: | - Who prefer 24/7 customer service.

- Need broker with access to VPS Hosting.

|

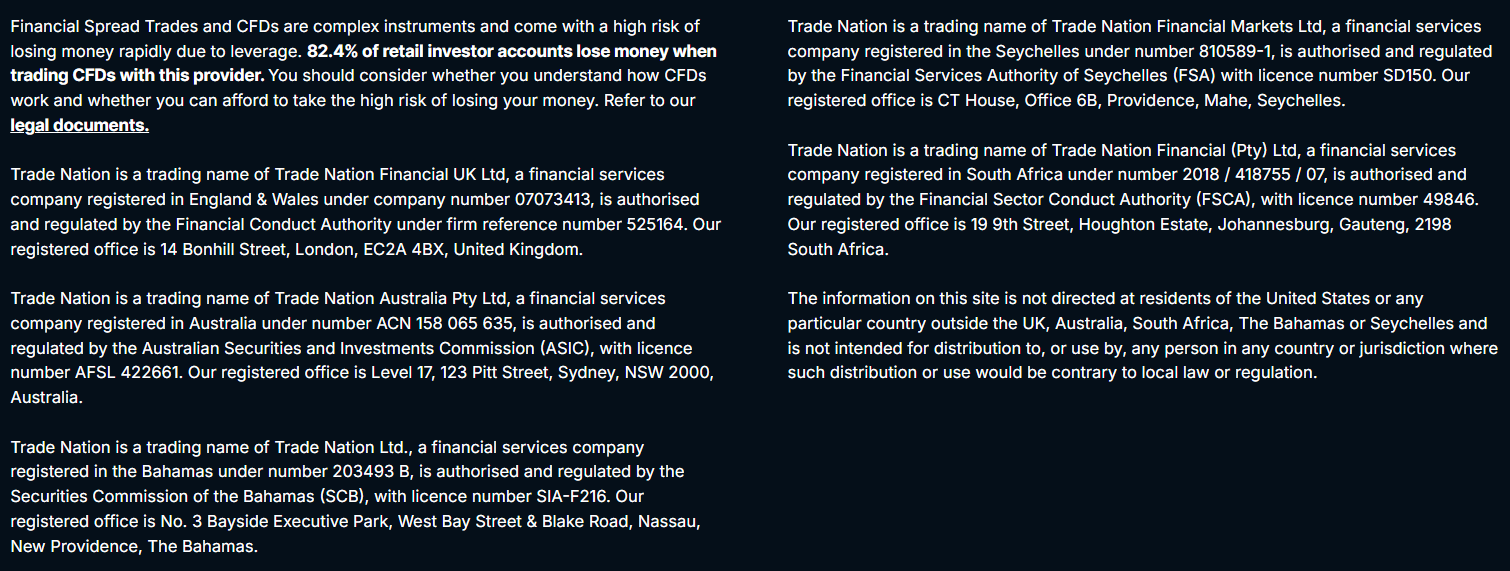

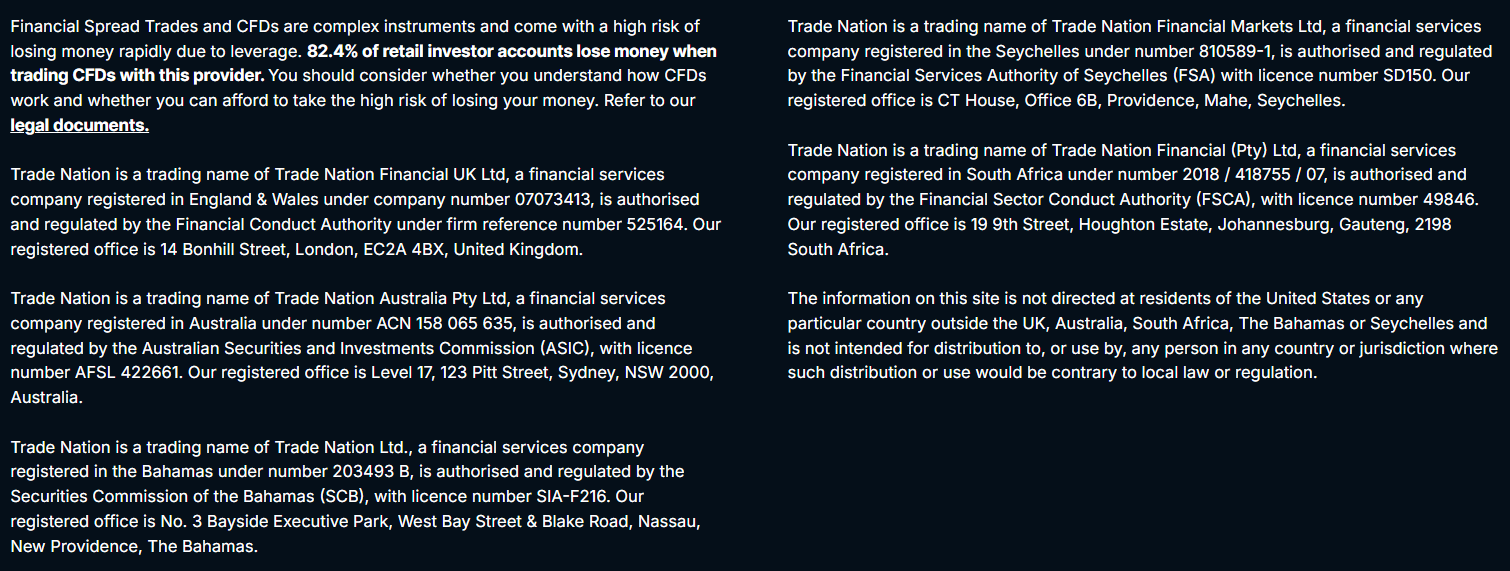

Regulation and Security Measures

Score – 4.7/5

Trade Nation Regulatory Overview

Trade Nation operates under a strong regulatory framework, ensuring that its clients are protected while enjoying a secure and transparent trading environment. The broker is regulated by the UK’s FCA, Australian ASIC, and South African FSCA, offering traders a high level of confidence. These reputable regulatory bodies are known for their strict oversight and investor protection measures, ensuring that the broker adheres to rigorous standards of conduct.

Trade Nation is also regulated by the Securities Commission of The Bahamas and FSA in Seychelles, allowing it to offer competitive leverage and services on an international scale. While offshore regulations may offer higher leverage and flexible conditions, traders should be aware of the reduced investor protections compared to stricter jurisdictions.

How Safe is Trading with Trade Nation?

Trade Nation is heavily regulated in 5 jurisdictions, including ASIC and FCA. This regulatory status means the broker is required to always treat customers fairly, in accordance with the strict requirements of each regulator.

Moreover, the broker is also regularly audited and keeps all clients’ funds in segregated trust accounts along with compensation schemes in case of insolvency, to ensure that money is protected. All funds are held with top-tier banks, such as Barclay’s in the UK and Westpac in Australia. The broker also offers negative balance protection to all retail client trading accounts.

Consistency and Clarity

Trade Nation has established itself as a reliable and transparent broker, earning a solid reputation in the trading community. The broker is highly regarded for its fixed spreads, competitive pricing, and consistent execution, which contribute to a smooth trading experience for its users.

Many traders appreciate the straightforward nature of Trade Nation’s offerings. While some traders may find offshore regulations offer more flexibility, Trade Nation remains well-respected for its adherence to high regulatory standards. With positive reviews, industry recognition, and a focus on customer support, the broker continues to solidify its position as a trusted player in the brokerage space.

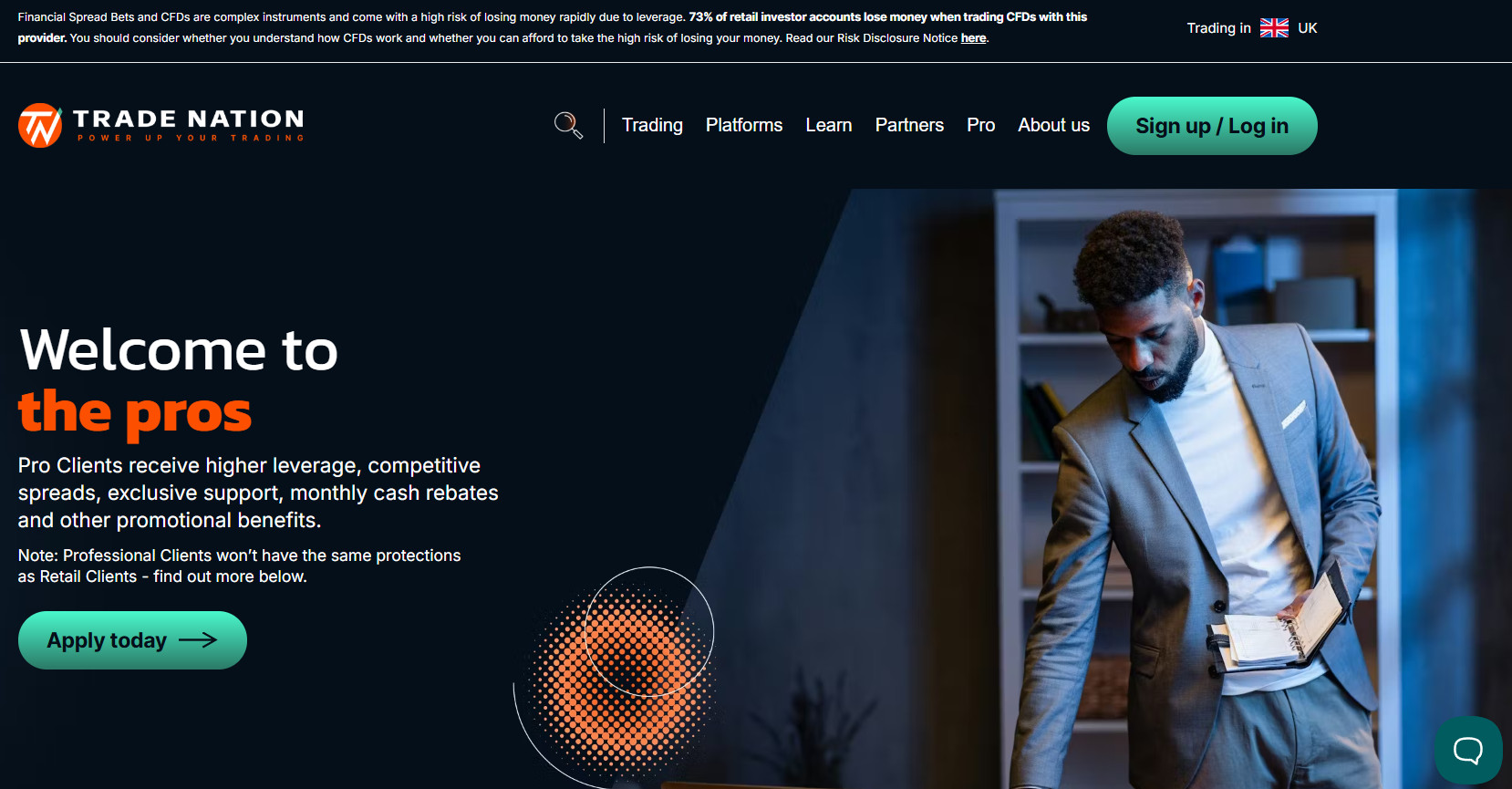

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Trade Nation?

Trade Nation offers several account types designed to meet the needs of traders. The broker provides access to three primary account types: TN Trader Account, MetaTrader Account, and Professional Account. Each account is tailored to suit different levels of experience and trading preferences, with varying conditions for deposit, spreads, and leverage.

Additionally, Islamic accounts are available for traders who require swap-free trading conditions. The broker also offers a demo account to allow new traders to practice with virtual funds before committing real capital.

TN Trader Account

The TN Trader Account is the perfect option for beginner and intermediate traders who prefer a user-friendly interface. This account offers fixed spreads with no commission charges and requires no minimum deposit to open an account.

Traders can access leverage up to 1:500 under the international entities, offering them greater flexibility to execute different trading strategies. The TN Trader Account provides access to a variety of markets, making it an ideal choice for traders who are just starting or looking for a straightforward trading experience.

MetaTrader Account

The MetaTrader Account is designed for traders who prefer the widely used MetaTrader 4. This account type allows for automated trading, comprehensive charting tools, and advanced technical analysis, making it ideal for more experienced traders.

The account features tight spreads starting from 0.0 pips. It is best suited for traders who want a more customizable trading environment with the robust features provided by the MetaTrader platform.

Professional Account

The Professional Account is designed for high-volume and institutional traders who require premium trading conditions. With a higher minimum deposit of $10,000, this account provides tight spreads starting from 0.0 pips and a reduced commission fee per lot, ensuring competitive pricing for large traders.

The maximum leverage available for this account is 1:200, striking a balance between high trading power and responsible risk management. The Professional Account is best suited for experienced traders seeking high liquidity, fast execution speeds, and a premium trading environment.

Regions Where Trade Nation is Restricted

Trade Nation operates globally but is subject to regulatory restrictions in certain regions. Due to legal and compliance reasons, the broker may not offer its services in the following countries:

- USA

- Cnada

- Japan

- Iran

- North Korea

- Syria

Cost Structure and Fees

Score – 4.6/5

Trade Nation Brokerage Fees

Trade Nation offers its clients a transparent and competitive fee structure, ensuring that traders are fully aware of the costs involved in their trading activities. The broker charges various fees, including spreads, commissions, and overnight fees, depending on the account type, instruments traded, and trading volume.

Additionally, Trade Nation does not charge fees for deposits and withdrawals, although fees may be associated with transferring funds to and from your trading account.

Per our test trade, Trade Nation offers low fixed spreads with an average of EUR/USD 0.6 pips. Unlike variable spreads that could potentially be much wider by the time you exit your position, fixed spreads stay the same from start to finish.

Trade Nation applies commission fees on its Professional Account, which is designed for more experienced traders. The charges start from $3 per lot per side, depending on the instrument being traded and the volume.

- Trade Nation Rollover / Swaps

The broker applies rollover fees for positions that are held overnight. These fees reflect the interest rate differential between the two currencies in a currency pair. Traders should be aware that rollover rates can either be positive or negative, depending on the direction of their position.

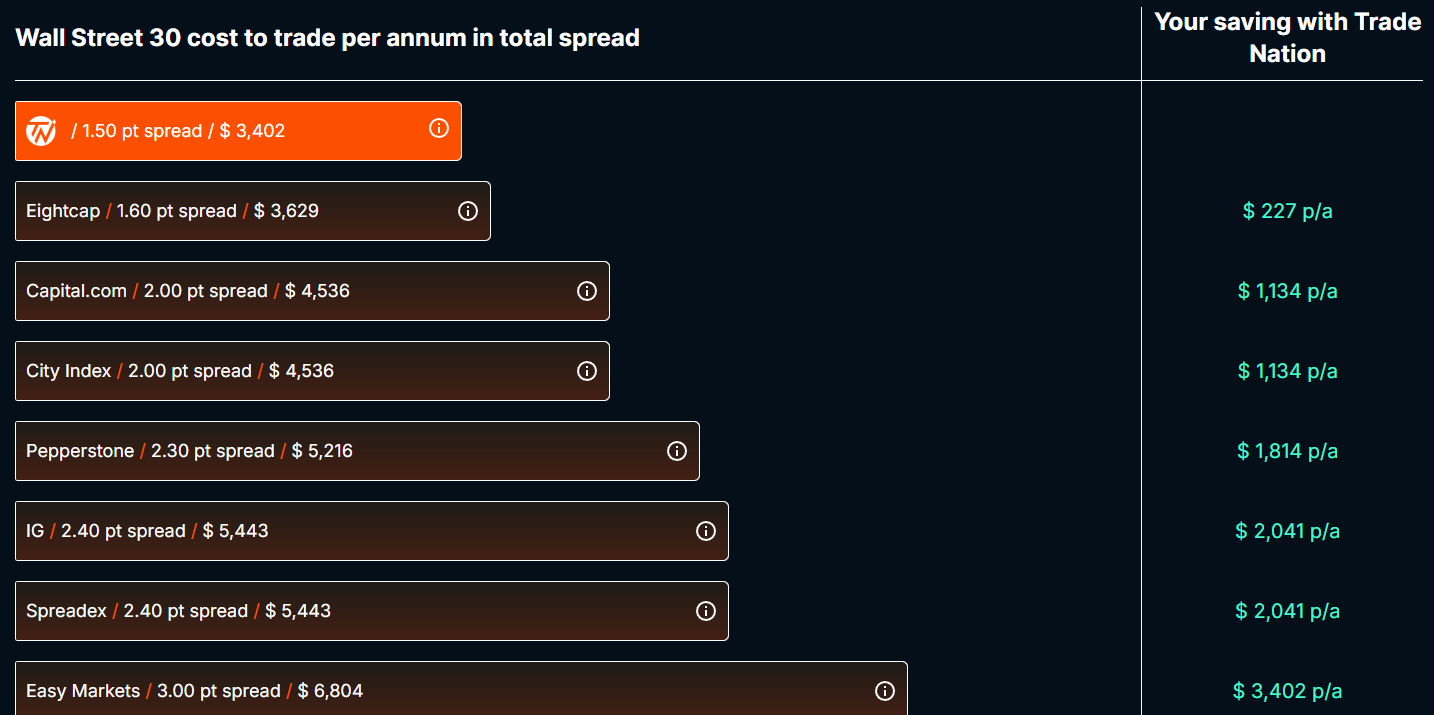

How Competitive Are Trade Nation Fees?

Trade Nation’s fees are generally considered competitive in the industry, offering clear and consistent pricing structures. The broker’s approach to transparent fee disclosures helps traders manage their costs effectively and avoid any unpleasant surprises.

The fee structure is designed to cater to a variety of traders, from casual retail traders to professional clients, ensuring that the conditions are flexible enough to meet the needs of diverse trading strategies. Overall, Trade Nation maintains a strong focus on providing value through competitive fees and transparent pricing, contributing to a positive trading experience for its clients.

| Asset/ Pair | Trade Nation Spread | ACY Securities Spread | Velocity Trade Spead |

|---|

| EUR USD Spread | 0.6 pips | 1.1 pips | 1 pip |

| Crude Oil WTI Spread | 0.04 pips | $0.034 | 4 |

| Gold Spread | 0.25 pips | 3 | 40 |

| BTC USD Spread | 1.5% | 23.7 | - |

Trade Nation Additional Fees

In addition to spreads and commissions, Trade Nation may impose other fees, depending on the specific conditions of a trade. These include fees for withdrawing funds via certain payment methods, though the broker offers a range of payment options to accommodate traders’ preferences.

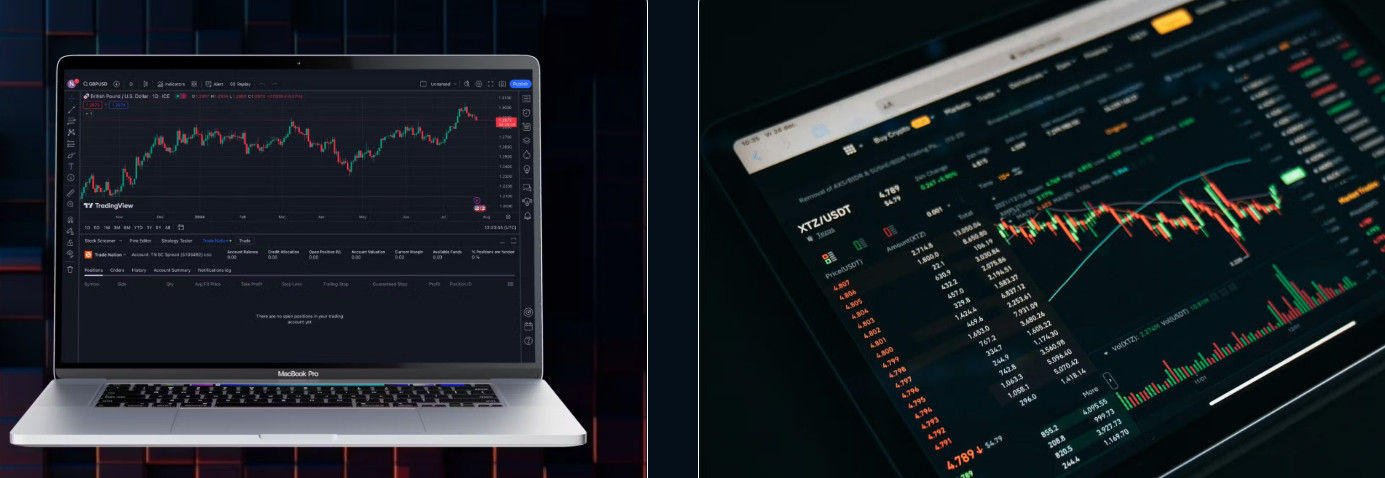

Trading Platforms and Tools

Score – 4.5/5

Traders have access to the proprietary TN Trader, as well as the industry-leader MetaTrader4 platform, which is accessible through desktop, web, and mobile. The platform features leading indicators, oscillators, EA strategies, and automated desktop stations that, all in all, bring numerous options for smart investment and trading processes.

Of course, all platforms feature mobile trading apps, so you can use Mobile devices that are bringing absolute freedom to trade.

Trading Platform Comparison to Other Brokers:

| PLatforms | Trade Nation Platforms | ACY Securities Platforms | Velocity Trade Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Trade Nation Web Platform

Trade Nation offers the MT4 Web Platform for traders who prefer accessing their accounts directly from a web browser without the need for downloading software. The MT4 web platform provides essential features such as real-time market data, advanced charting tools, and seamless trading functionality.

Traders can easily manage their trades and access their accounts from any device with an internet connection. The web platform offers flexibility and convenience, allowing for a smooth trading experience without the need to install additional software.

Trade Nation Desktop MetaTrader 4 Platform

The desktop MT4 is a powerful tool designed for both beginner and professional traders. MT4 is known for its intuitive interface and comprehensive features, including multiple timeframes, customizable charts, and more than 30 built-in technical indicators.

Additionally, over 20 analytical objects are available to enhance technical analysis. With MT4, traders can analyze market trends, implement various trading strategies, and execute trades with precision. It also supports automated trading via Expert Advisors, allowing traders to set up algorithmic trading systems to manage trades even when they are not actively monitoring the market.

Trade Nation Desktop MetaTrader 5 Platform

Currently, Trade Nation does not offer an MT5 platform. MT5 is an advanced version of MT4, offering additional features such as more timeframes, more order types, and enhanced charting options.

Trade Nation TN Trader

Trade Nation’s TN Trader desktop platform is designed to cater to the specific needs of both novice and experienced traders. The platform features an intuitive and easy-to-navigate interface with access to a wide array of trading tools and features.

TN Trader includes advanced charting capabilities, real-time market updates, and various order types to facilitate seamless trading experiences. Its customizable layout allows traders to tailor their workspace according to their preferences, improving overall efficiency and productivity. With robust performance, fast execution, and access to a range of instruments, TN Trader offers a solid platform for active traders seeking flexibility and reliability.

Main Insights from Testing

The TN Trader platform offers a user-friendly and streamlined trading experience. The platform’s customization options allow traders to personalize their workspace, improving efficiency and ease of navigation. With a focus on speed and reliability, TN Trader ensures seamless access to a wide range of financial instruments and trading tools, making it a solid choice for those looking for a flexible trading platform.

Trade Nation MobileTrader App

Trade Nation ensures traders can stay connected with the market on the go through the mobile apps. Both the MT4 and TN Trader platforms are available on mobile devices, offering the same comprehensive set of features that users can access from their desktops.

Traders can manage their accounts, execute trades, and analyze the market from their smartphones or tablets. Additionally, TradeCopier, a mobile app, is available for users who wish to copy the best strategies in real time. This copy trading app connects traders with a community of global experts, allowing them to mimic the trades of successful professionals and learn trading strategies.

Trading Instruments

Score – 4.4/5

What Can You Trade on Trade Nation’s Platform?

Trade Nation provides access to over 1,000 markets, allowing traders to diversify their portfolios across multiple asset classes. The platform offers a wide range of Forex pairs, including major, minor, and exotic currencies, as well as CFDs on various financial instruments.

Traders can also engage in indices trading, stocks, and commodities, enabling traders to invest in popular shares and key resources such as gold, silver, crude oil, and natural gas.

For those interested in digital assets, the platform also includes cryptocurrency trading, offering access to Bitcoin, Ethereum, and other major digital currencies.

Main Insights from Exploring Trade Nation’s Tradable Assets

Trade Nation stands out for its diverse selection of tradable assets, catering to traders with different strategies and risk appetites. The platform offers competitive pricing, transparent spreads, and flexible leverage, making it accessible to both beginners and experienced traders.

One key highlight is the availability of both traditional and emerging markets, allowing users to explore opportunities across various asset classes. Additionally, Trade Nation prioritizes a user-friendly trading experience, ensuring seamless execution and efficient risk management tools to enhance market participation.

Leverage Options at Trade Nation

Another great feature while trading Forex is an allowance to use the multiplier, which may potentially increase your gains. However, in order to minimize risks as well, which work in both directions, it is necessary to learn how to use leverage smartly.

Trade Nation leverage is offered according to FCA, ASIC, FSCA, SCB, and FSA regulations:

- UK and Australian traders are eligible to use low leverage up to 1:30 for major currency pairs.

- International traders may use higher leverage, up to 1:500.

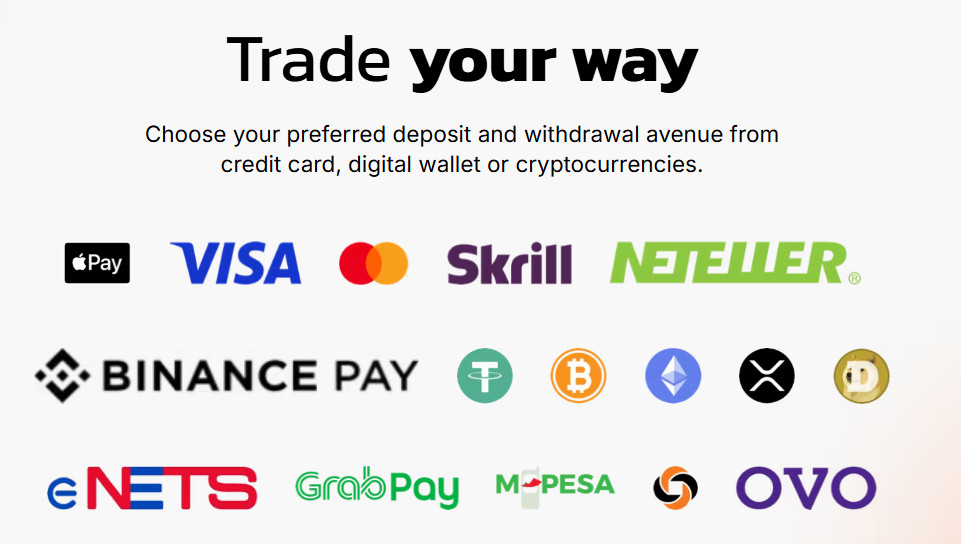

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at Trade Nation

In terms of funding methods, Trade Nation offers a few payment methods to conveniently and securely fund your account:

Trade Nation Minimum Deposit

There is no minimum deposit for the new Trade Nation investors. Traders only need enough funds to cover the margin requirements of their trade.

Withdrawal Options at Trade Nation

Trade Nation does not charge any fees for either deposits or withdrawals. The broker’s minimum withdrawal amount is 50 units of the account base currency.

Customer Support and Responsiveness

Score – 4.4/5

Testing Trade Nation’s Customer Support

Another good point in its client-oriented philosophy is competent customer service which is available through various methods including Online Live Chat, Phone, emails, etc.

The broker’s team is available 24/5 and supports international languages accessible via Live Chat, email, and phone lines in Australia, the UK, and internationally as well.

Contacts Trade Nation

Trade Nation provides multiple channels for customer support, ensuring traders can easily get assistance when needed. Clients can reach out via phone at +44 020 3180 5952 for UK-based inquiries or +1 844 907 8776 for international support.

For more specialized assistance, email support is available at fcamatters@tradenation.com, addressing regulatory and compliance-related queries.

Research and Education

Score – 4.3/5

Research Tools Trade Nation

Trade Nation provides a range of research tools to help traders make informed decisions.

- On its website, traders can access market insights, trading guides, and news updates, offering valuable perspectives on financial markets.

- The website also includes an economic calendar, helping users track important events that may impact asset prices.

- Within the trading platform, traders benefit from real-time charting tools, technical indicators, sentiment analysis, and risk management features.

- Additionally, the TN Trader platform offers a news feed and market analysis, keeping traders updated with the latest trends. These tools cater to both beginners and experienced traders, enhancing their trading experience with actionable insights.

Education

Trade Nation offers an education section that includes a Knowledge Base, Market Insights, and a Glossary to help traders understand key financial concepts and market movements.

The Knowledge Base provides fundamental trading guides, while Market Insights offers analysis on economic trends and trading opportunities. The Glossary serves as a reference for trading terminology.

However, the broker’s educational resources are not as comprehensive as those provided by some other brokers, as it lacks webinars, video tutorials, and interactive learning sessions. While the available materials are useful, traders seeking in-depth education may need to supplement their learning from external sources.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options Trade Nation

Trade Nation primarily offers Forex and CFD trading, allowing traders to access a wide range of markets, including currencies, indices, stocks, commodities, and cryptocurrencies.

While the broker does not provide traditional investment options such as stocks or ETFs for direct ownership, it offers copy trading through the TradeCopier mobile app. This feature enables traders to mirror the strategies of experienced professionals in real time, making it a useful investment tool for those who prefer a hands-off approach or want to learn from expert traders.

Account Opening

Score – 4.4/5

How to Open Trade Nation Demo Account?

Opening a Trade Nation demo account is a straightforward process that allows traders to practice their strategies in a risk-free environment. To get started, visit the Trade Nation website and navigate to the “Try a Free Demo” section.

You will be required to fill in basic details, such as your name, email, and phone number, before selecting your preferred trading platform. Once registered, you will receive login credentials to access the demo account, which comes with virtual funds to simulate real-market conditions. This allows traders to explore Trade Nation’s platform, test strategies, and familiarize themselves with trading tools before committing real capital.

How to Open Trade Nation Live Account?

Opening an account with a broker is an easy process, as you can log in and register with Trade Nation within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Sign up” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

Trade Nation offers additional tools and features that enhance the trading experience beyond standard research tools.

- One standout feature is its integration with TradingView, allowing traders to access advanced charting tools, custom indicators, and a vast community of traders for insights and strategy-sharing.

- The broker also provides TradeCopier, a copy trading tool that enables users to replicate successful strategies from experienced traders in real time. These extra tools provide traders with deeper market insights and more flexibility in refining their trading strategies.

Trade Nation Compared to Other Brokers

Trade Nation stands out among its competitors for its user-friendly trading environment, low-cost fee structure, and access to multiple trading platforms, including MT4, TN Trader, and TradingView.

While it provides a solid range of over 1,000 instruments, it falls behind brokers like Saxo Bank and City Index, which offer significantly more asset variety. Trade Nation’s regulation across multiple jurisdictions enhances its credibility, but some competitors hold a broader range of top-tier licenses.

In terms of educational resources, Trade Nation lags behind industry leaders, offering only basic materials without in-depth webinars or advanced training programs. However, its integration with copy trading tools like TradeCopier gives it an edge for traders interested in automated strategies, something not all brokers provide.

Overall, Trade Nation offers a well-rounded trading experience, though some competitors excel in specific areas such as asset variety, advanced platforms, and educational content.

| Parameter |

Trade Nation |

Z.com Forex |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.6 pips |

Average 1 pip |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $3 |

Not Available |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, TN Trader, TradingView, TradeCopier |

Z.com Trader |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

1000+ instruments |

50+ currency pairs |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FCA, ASIC, FSCA, SCB, FSA |

JFSA, SFC |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Excellent |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker Trade Nation

Trade Nation is a regulated broker offering a range of trading tools and platforms, including MT4, TN Trader, and TradingView, catering to both beginner and experienced traders.

With over 1,000 instruments available, including Forex, CFDs, indices, stocks, commodities, and cryptocurrencies, it provides a diverse range of assets for traders to access. The broker’s low spreads and competitive commission structure make it an attractive option for cost-conscious traders.

While the educational resources are limited, with a basic knowledge base and market insights, it offers a copy-trading feature for those looking to follow experienced traders. The user-friendly interface, integration with popular platforms, and solid regulatory oversight from bodies like the FCA, ASIC, and FSCA provide a secure and flexible trading environment.

However, more advanced educational tools and webinars could enhance the learning experience for traders seeking in-depth knowledge.

Share this article [addtoany url="https://55brokers.com/trade-nation-review/" title="Trade Nation"]

Trade Nation is undoubtedly the best broker for forex. I have made good money through it. But for the last few months, I have been facing issues with withdrawal. Tried calling customer support many times but didn’t get any satisfactory answer. Distressed with the services, I searched for another Forex broker and found InvestFW. The broker was regulated, I quickly created an account and started trading. After using the platform for over 1 month, here’s my review – The platform is perfect, leverage is good, spreads are lowest and most importantly, the withdrawals are quick. It took only a few hours for withdrawals to credit to my bank account.

I am happy Trade Nation services but deposit option is not so easy like depositing 4000 dollars take too much time and efforts. So, I changed my broker and choosed InvestFW. The services of InvestFW is beyond my expectations. I have been trading on it happily for over 10 months.

I have been working with Trade Nation for several months straight and didn’t really notice some terrible flaws. However, the recent policy changes of Trade Nation have negative impacted my trading. I’m unable to withdraw my funds. But I have found a good trading platform – TradeEU. The trading conditions are the best and its lowest fees is probably the biggest reason why I love this platform.

I have been working with Trade Nation for several months straight and didn’t really notice some terrible flaws. However, the recent policy changes of Trade Nation have negative impacted my trading. I’m unable to withdraw my funds. But I have found a good trading platform – TradeEU. The trading conditions are the best and its lowest fees is probably the biggest reason why I love this platform.

i traded with trade nation and i payed the withdraw fee only to find out the file was corrupted and asking for another withdraw fee twice i have to pay withdraw fee and its heaps