- What is Gildencrest Capital?

- Gildencrest Capital Pros and Cons

- Regulation and Security Measures

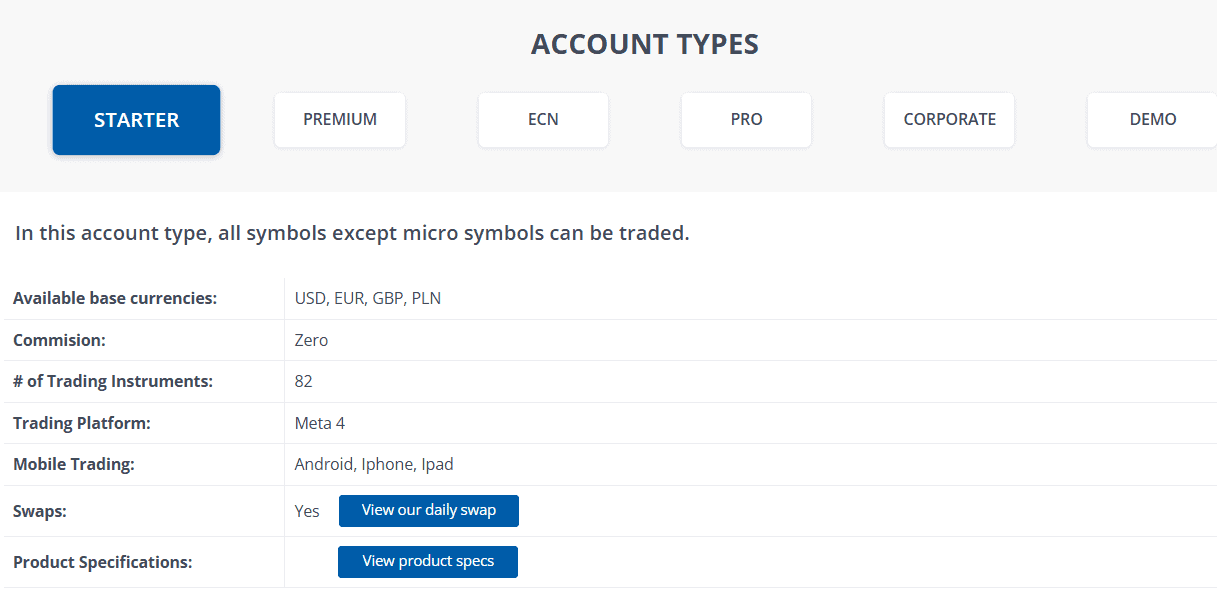

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Gildencrest Capital Compared to Other Brokers

- Full Review of Broker Gildencrest Capital

Overall Rating 4.2

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is Gildencrest Capital ex TeraFX?

Gildencrest is an online Forex trading broker specializing in Forex and CFDs on indices, commodities, and precious metals through a fully regulated trading environment accompanied by robust technology. The broker was previously named TeraFX and has recently been rebranded as Gildencrest Capital. Despite the change of the name and website, the broker has retained its FCA license.

The broker is based in London, UK, and is authorized and regulated by the top-tier Financial Conduct Authority (FCA). We found that Gildencrest follows a No Dealing Desk (NDD) execution model, which means that the trading orders are directly transferred to the market through multiple liquidity providers.

Overall, the broker offers competitive Forex and CFD trading services via the advanced MetaTrader trading platforms, which are highly regarded in the industry for their extensive features and user-friendly interface.

Gildencrest Capital Pros and Cons

According to our research, Gildencrest is a trustworthy brokerage due to its strong regulatory framework, smooth account opening process, diverse funding options, and wide selection of account types. Traders can also take advantage of the popular MT4 and MT5 platforms for their trading needs.

For the cons, the broker lacks extensive educational resources and research materials to assist traders in their decision-making. Moreover, there is no 24/7 customer support, which may be a limitation for traders who require immediate assistance outside regular business hours.

| Advantages | Disadvantages |

|---|

| Top-tier license | No 24/7 customer support |

| FCA regulation and oversight | Limited educational and research materials |

| MT4 and MT5 trading platforms | |

| STP/NDD execution model | |

| Retail and professional trading | |

| Competitive spreads | |

| Low minimum deposit | |

| Available for UK traders | |

Gildencrest Capital Features

Gildencrest Capital is a well-regulated broker with offerings that will suit traders of different experience levels. With its competitive costs, advanced retail platforms, and wide range of instruments, Gildencrest can become an appealing offer for beginners and professional traders. See the main aspects of trading with the broker below:

Gildencrest Capital Features in 10 Points

| 🗺️ Regulation and License | FCA |

| 🗺️ Account Types | Starter, Premium, ECN, Pro, Corporate |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex and CFDs on Indices, Commodities and Precious Metals |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | $20 per round lot for the spread-based account |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | USD, EUR, GBP, PLN |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Gildencrest Capital For?

Based on our findings and financial expert opinions, Gildencrest Capital stands out for its favorable services tailored to meet different needs and trading expectations. Here are the main aspects the broker is good for:

- Traders from the UK

- Traders who prefer the MT4 and MT5 trading platforms

- CFD and currency trading

- Beginners

- Professional trading

- STP/NDD execution

- Competitive spreads

- EA/Auto trading

- Good trading tools

Gildencrest Capital Summary

Gildencrest Capital is an esteemed broker that provides traders with a secure and reliable trading environment. Regulated by the respected FCA, the broker meets stringent regulatory requirements. Traders can enjoy competitive pricing, access to popular markets, and advanced MetaTrader trading platforms. Nevertheless, the broker’s educational and research materials are limited, and customer support is not available 24/7.

Although we found that Gildencrest Capital offers competitive trading conditions, we still advise conducting thorough research and evaluating whether the broker’s services and offerings align with your specific trading requirements.

55Brokers Professional Insights

Our research revealed that TeraFX has been rebranded to Gildencrest Capital. Although the name has been changed, based on our research, most trading conditions and services are the same. The broker continues to serve the trading accounts that were opened under TeraFX.

Moving forward, the broker has a favorable rating due to its top-tier license from the FCA, popular trading products, advanced platforms, and competitive spreads. The broker serves different clients, from beginners to professionals; thus, it has tailored multiple trading accounts to meet various needs and expectations. The MT4 and MT5 platforms are available via various operating systems, enabling flexibility and ease of reach. Traders also have access to a good range of trading products across multiple financial assets, gaining exposure to the market.

Although the education section is not very rich, there are still a few materials that can be useful for beginner traders who need to polish their knowledge and skills. The available demo account is a great way to practice before emerging into live trading. All in all, Gildencrest Capital is a broker that created a reliable and favorable setting for a successful trading experience.

Consider Trading with Gildencrest Capital If:

| Gildencrest Capital is an excellent Broker for: | - Beginner and intermediate traders

- Professionals and high-frequency traders

- Clients who prefer the MT4 and MT5 platforms

- Traders looking for extensive trading tools

- Forex and CFD traders

- EA and Algorithmic traders

- Clients who prefer variable spreads |

Avoid Trading with Gildencrest Capital If:

| Gildencrest Capital is not the best for: | - Clients looking for high leverage opportunities

- Traders who prefer very low spreads

- Cryptocurrency traders

- Clients looking for a wide range of instruments

- Traditional investors

- Beginner traders looking for extensive educational materials and 24/7 customer support |

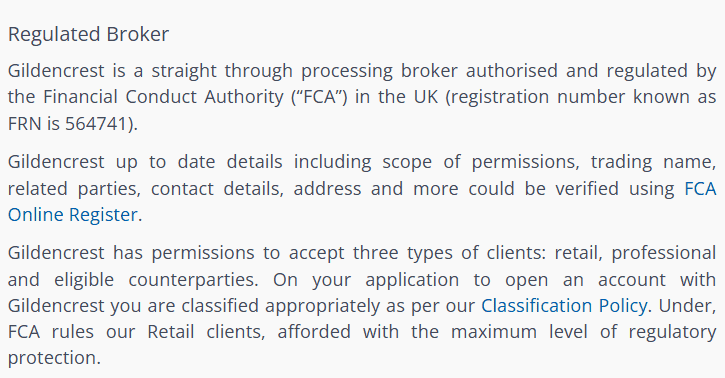

Regulation and Security Measures

Score – 4.5/5

Gildencrest Capital Regulatory Overview

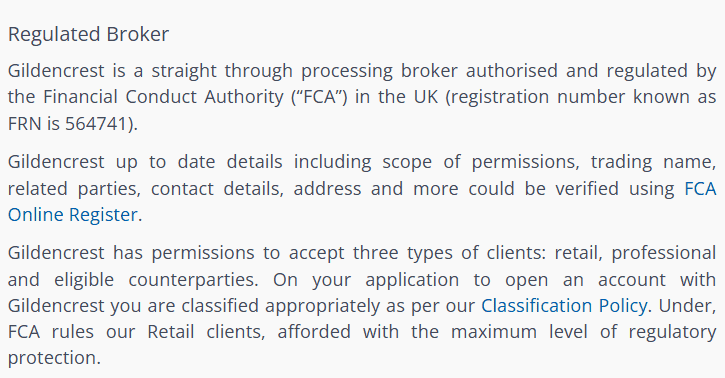

Gildencrest Capital is regarded as a reliable and trustworthy broker, as it is regulated by a top-tier FCA (UK). The FCA implements strict regulations and guidelines to ensure the broker operates at high standards. Also, the broker places significant importance on adhering to regulatory obligations and is closely monitored to ensure compliance. This focus on regulatory compliance enhances the safety of traders and instills a sense of confidence in the company.

- Our research on the broker showed that for many years, Gildencrest Capital had been successfully operating as TeraFX. Although the broker has been rebranded into Gildencrest Capital, the FCA regulation and license have been retained, and the broker continues to provide a secure trading environment and high-standard services on par with the market requirement.

How Safe is Trading with Gildencrest Capital?

The broker’s regulation by the FCA is highly significant, indicating its adherence to strong operational standards, financial backing, and robust safety protocols.

- Additionally, we found that the FCA maintains consistent monitoring and conducts audits of all trades carried out by Gildencrest Capital. To ensure the protection of the client’s funds, the broker keeps them separate from its funds and holds them in trusted Tier-1 banks. This additional measure offers clients an added level of security and peace of mind.

Consistency and Clarity

Gildencrest Capital started its operations in 2011; back then, it was still known as TeraFX. To estimate the broker’s consistency and the clarity of its services, we have considered its offerings over the years. Also, we compared the available conditions before and after the rebranding. Overall, the broker has been consistent in its growth and development over the years, and rebranding was perhaps the next step in its thriving. All the trading opportunities included with TeraFX have been retained, including the FCA license and the security it entails.

We have also considered Gildencrest Capital customer feedback and found mixed reviews: many clients are satisfied with the provided services, pointing out advanced platforms, a wide choice of trading accounts, and competitive costs. Others indicate that the broker needs improvements in its deposits and withdrawals. Also, some clients complain that the MT4 and MT5 platforms are a little outdated. All in all, Gildencrest Capital seems to provide reliable services that will suit different clients. We recommend considering various aspects of trading with the broker and only then making a final decision.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Gildencrest Capital?

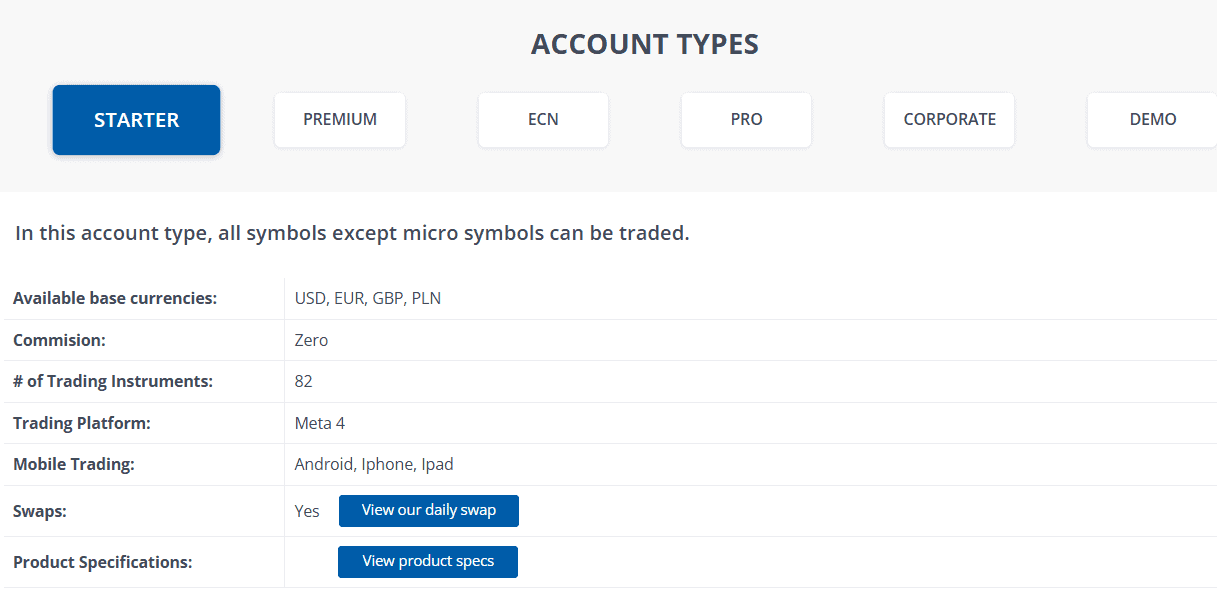

Per our research, Gildencrest Capital has designed 5 account types tailored for CFD trading, each catering to specific needs. Moreover, new traders are allowed to open a demo account free of charge.

The available account types are Starter, Premium, ECN, Pro, and Corporate. Each account type offers different trading conditions, meets certain trading needs, and is tailored for various levels of expertise. Starter, ECN, and Premium accounts are spread-based, with no commissions and variable spreads. Only the Pro account applies commissions, which are on demand and are not indicated on the website. The leverage available is up to 1:30 and depends on the traded instrument.

- The Starter account, as the name indicates, is tailored for beginners. With 82 available tradable products, clients can access Forex pairs, commodities, indices, and precious metals. The minimum deposit is $100.

- The premium account is another spread-based account with variable spreads and access to over 147 tradable products.

- The ECN account does not apply commissions, and all the costs are based on spreads. The leverage is up to 1:30, and clients have access to about 82 instruments, including popular precious metals, forex pairs, and indices.

- Commissions for the Pro account are applied upon request, combined with variable spreads. The account gives access to more tools and features, enabling better opportunities.

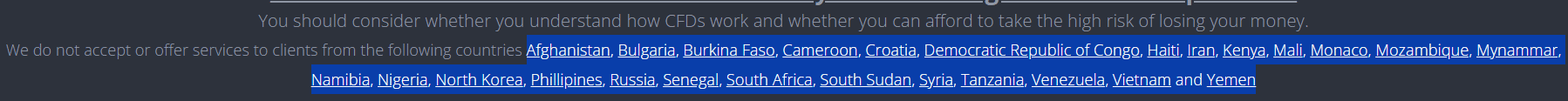

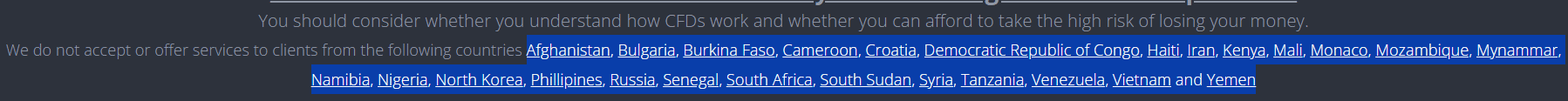

Regions Where Gildencrest Capital is Restricted

As Gildencrest Capital is regulated only by the FCA and does not include an offshore entity, based on regulatory restrictions, the broker might not accept clients from certain regions and countries. See the list of the countries we were able to reveal as restricted countries by Gildencrest Capital:

- Afghanistan

- Bulgaria

- Burkina Faso

- Cameroon

- Croatia

- Democratic Republic of Congo

- Haiti

- Iran

- Kenya

- Mali

- Monaco

- Mozambique

- Mynammar

- Namibia

- Nigeria

- North Korea

- Phillipines

- Russia

- Senegal

- South Africa

- South Sudan

- Syria

- Tanzania

- Venezuela

- Vietnam

- Yemen

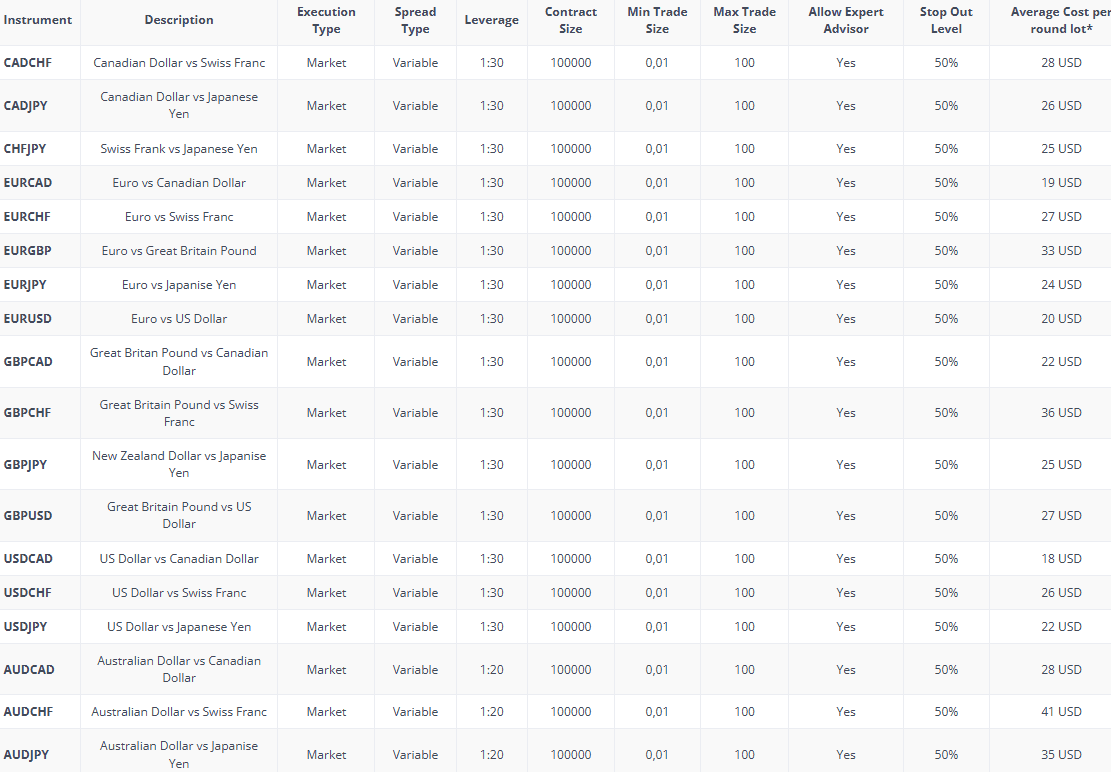

Cost Structure and Fees

Score – 4.3/5

Gildencrest Capital Brokerage Fees

Reviewing the broker’s fee structure, we discovered that the broker provides competitive pricing for trading instruments. However, additional fees, such as swap or rollover, as well as inactivity fees, may be incurred during trading activities. We found that Gildencrest Capital mostly offers spread-based accounts, and only the Pro account offers spreads combined with negotiable commissions.

- Gildencrest Capital Spreads

Gildencrest Capital offers five trading accounts, of which three are spread-based. The Starter, Premium, and ECN accounts have variable spreads. On the broker’s website, traders can find detailed information about the overall costs for each instrument traded. The broker reveals charges for each instrument per round lot. The spreads are not represented in pips, instead, the broker gives the overall price for each instrument. For instance, for the Starter commission-free account, the average charges based on spreads for the EUR/USD pair are calculated at $20. As we have found, the average fee for gold is $33.

- Gildencrest Capital Commissions

The broker charges commissions only for its Pro account, which is tailored specifically for professional traders. The commission amount is not revealed, as it is charged upon demand and can vary based on many factors, from the trade size to the instrument traded.

- Gildencrest Capital Rollover / Swap Fees

Gildencrest Capital also charges swap fees for the positions held overnight. We reviewed long and short positions for the popular EUR/USD pair: for the long positions, the broker charges -$8.09, and for the short positions, $4.45.

How Competitive Are Gildencrest Capital Fees?

We have reviewed Gildencrest Capital’s fees to see how competitive and transparent they are. The broker’s costs depend on the account choice. Gildencrest Capital offers three spread-based accounts. For each account, it gives detailed information on each instrument. The spreads are variable, but instead of mentioning spreads, the broker mentions the average trading cost per lot. The Pro account, on the other hand, is based on commissions. However, the commission amount is not specified. As we have found, commissions are charged upon request and depend on multiple factors. The broker also mentions swap fees for each instrument. As swaps change constantly, traders have access to the updated swap information.

Overall, the broker is mostly clear and transparent about its fees, which makes the broker’s offering favorable for traders who are looking for efficient and fair solutions.

| Asset/ Pair | Gildencrest Capital Spread | Sucden Financial Spread | Varianse Spread |

|---|

| EUR USD Spread | $20 | 1 pip | 1 pips |

| Crude Oil WTI Spread | $70 | 3 | 0.05 |

| Gold Spread | $33 | 1 | 0.22 |

Gildencrest Capital Additional Fees

Based on our findings, there are a few non-trading fees, such as an inactivity fee and a currency conversion fee. The broker charges a $25 inactivity fee for accounts that have been dormant for 12 or more months. Besides, when the transactions are different from the account-based currencies, there are currency conversion fees. Another essential point is that the broker does not mention deposit or withdrawal charges. However, we recommend being careful and considering the fees that the service provider might charge.

Score – 4.3/5

For CFD trading, clients can access the widely recognized and popular MetaTrader 4 trading platform, which is available in desktop, web, and mobile versions. More professional clients can access MetaTrader 5. These platforms offer diverse features and enable traders to employ various strategies.

| Platforms | Gildencrest Capital Platforms | Sucden Financial Platforms | Noor Capital UK Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | No | Yes |

| cTrader | No | No | No |

| Own Platform | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

Gildencrest Capital Web Platform

The web platform is a perfect solution for those traders who need quick access to their accounts. The MT4 and MT5 web platforms do not require downloads or installations, making them a flexible solution. Clients can access a good range of trading tools and features, including multiple charts and graphs and other analysis tools, to get the most out of their trading experience. Traders can access a wide range of Forex pairs and CFDs, getting exposure to the market.

Gildencrest Capital Desktop MetaTrader 4 Platform

Per our analysis, Gildencrest Capital provides traders with a variety of trading tools, such as advanced charting features with multiple chart types, various timeframes, trading signals, an economic calendar, over 40 technical indicators, and multilingual support. Moreover, traders have the option to utilize Expert Advisors (EAs) to automate their trades, helping to identify market movements and enhance their market entry and stop-loss strategies. The platform is easily installed and is available via desktop, web platforms, and a mobile app.

Gildencrest Capital Desktop MetaTrader 5 Platform

The MetaTrader 5 is an enhanced variant of the market-popular MT4 platform. Gildencrest Capital offers the MT5 platform to its more professional and corporate clients. Clients get good exposure to the market, with access to multiple financial assets. Besides, the available trading and analysis tools enable in-depth research and insight into the market. Clients can use a good range of technical indicators, custom charts, and graphs, and make use of stop, limit, take profit, and trailing stop orders. The platform also enables backtesting, instant trade execution, and the placing of advanced orders to be managed later by the platform.

Main Insights from Testing

Gildencrest Capital offers its clients to conduct trades through its advanced MT4 and MT5 platforms. The MT4 platform is ideal for retail clients, while the MT5 is ideal for professional and institutional clients. Both platforms support a good range of tradable products, supplemented by robust tools and features. The platforms are available on desktop, web, and mobile, making them easily accessible for different users.

Gildencrest Capital MobileTrader App

Clients can also trade through the broker’s MT4 and MT5 mobile apps, accessible through iOS and Android devices. Traders have the freedom to access the platforms from anywhere in the world just by downloading the mobile app. Most of the robust tools and features available through the desktop platform are also accessible via the apps, including charts and graphs, technical indicators, automated trading opportunities, etc. Besides, both MT4 and MT5 mobile platforms have an intuitive and simple interface that is easy to navigate.

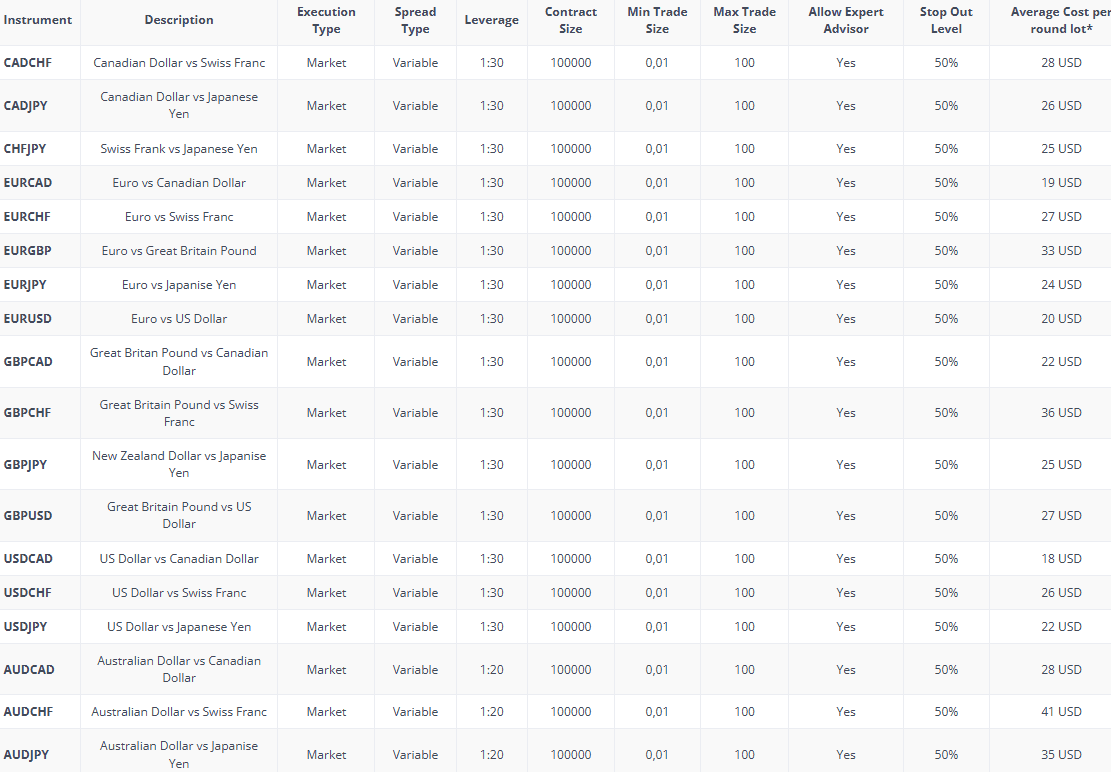

Trading Instruments

Score – 4.4/5

What Can You Trade on the Gildencrest Capital Platform?

Gildencrest Capital offers a selection of popular markets for traders to engage in, including Forex as well as CFDs on Indices, Commodities, and Precious Metals. The broker offers over 60 major, minor, and exotic Forex pairs with reasonable trading costs via an advanced platform. Clients also have access to the most popular precious metals, including Gold and silver, with low margin requirements. In addition, clients can access 9 global indices with low spreads and favorable market conditions.

Main Insights from Exploring Gildencrest Capital Tradable Assets

Based on our research, the broker offers access to Forex and CFDs on multiple financial assets. The number of available instruments mostly depends on the account type. The Starter and ECN accounts allow access to over 82 trading instruments through the MT4 platform. On the other hand, the Premium account offers 147 tradable products. For the Pro and Corporate accounts, the instrument availability might be wider.

Overall, Gildencrest Capital offers trading in a safe environment via popular trading platforms, advanced tools, and competitive costs. The only disadvantage is that the number of instruments is limited to the most popular and in-demand products, restricting chances for those who want to explore the market further. Besides, the lack of stocks and ETFs excludes long-term trading chances and share ownership prospects.

Leverage Options at Gildencrest Capital

Leverage is a well-known instrument that multiplies the initial capital you trade with and can magnify your potential gains. However, high leverage can work in reverse, too.

Gildencrest Capital’s leverage is offered according to FCA regulations:

- UK traders can use low leverage up to 1:30 for major currency pairs and 1:10 for commodities.

- Professional clients have access to up to a 1:500 leverage ratio.

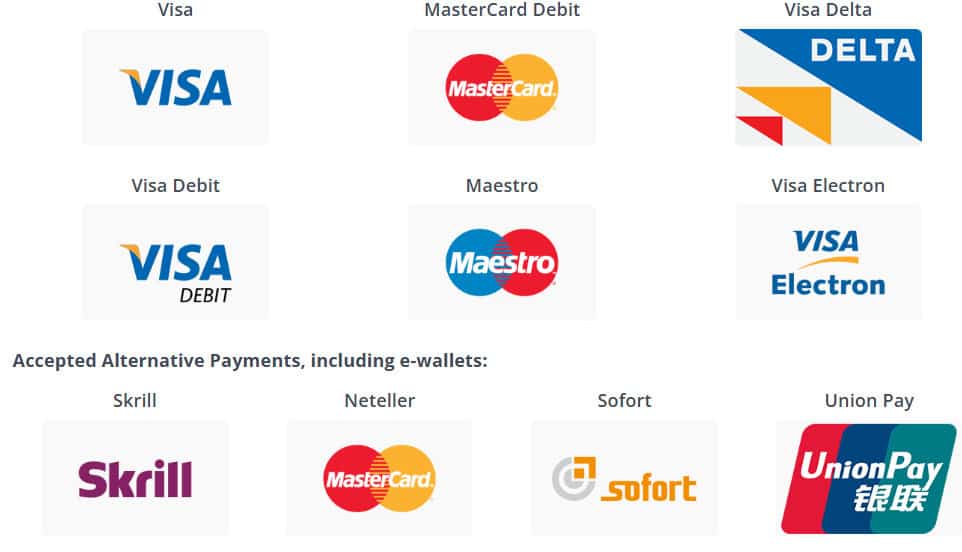

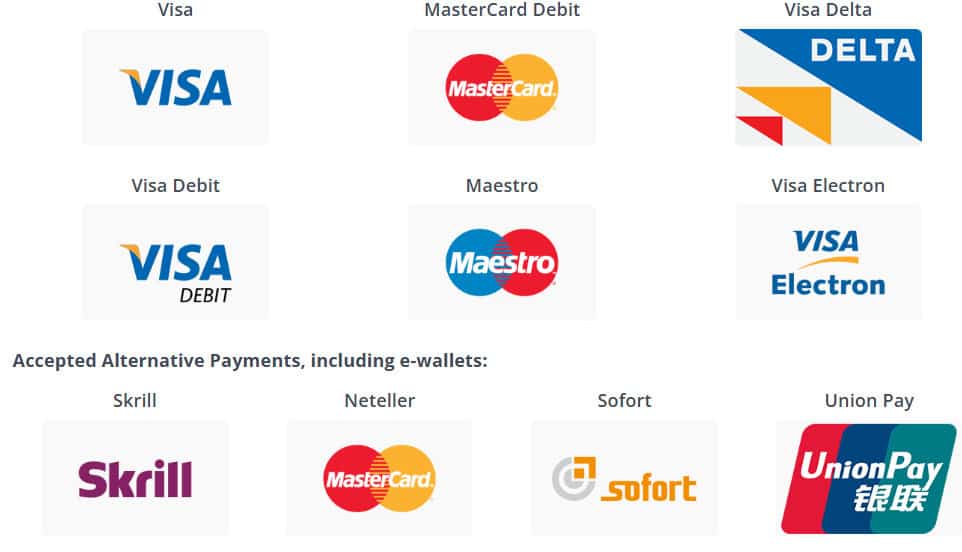

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at Gildencrest Capital

There are a variety of payment methods for brokers’ clients to deposit funds into trading accounts, including bank wire, credit/debit cards, and e-wallets such as Skrill and Neteller. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved. The broker does not impose any deposit fees; yet, there might be certain fees from the side of the payment provider.

Minimum Deposit

The minimum deposit for Gildencrest Capital is $100. Various account types demand different amounts at the opening stage. Besides, for e-wallets, there is a certain limit for deposits up to $5,000.

Withdrawal Options at Gildencrest Capital

We found that the broker charges a $0 fee for deposits and withdrawals. Withdrawal options are similar to deposits, but traders should always check with the payment provider in case it charges any transaction fees. For bank transfers, the approximate processing time is 1 to 5 business days; for credit cards, 2 to 5 days; and for e-wallets, 1 to 3 business days.

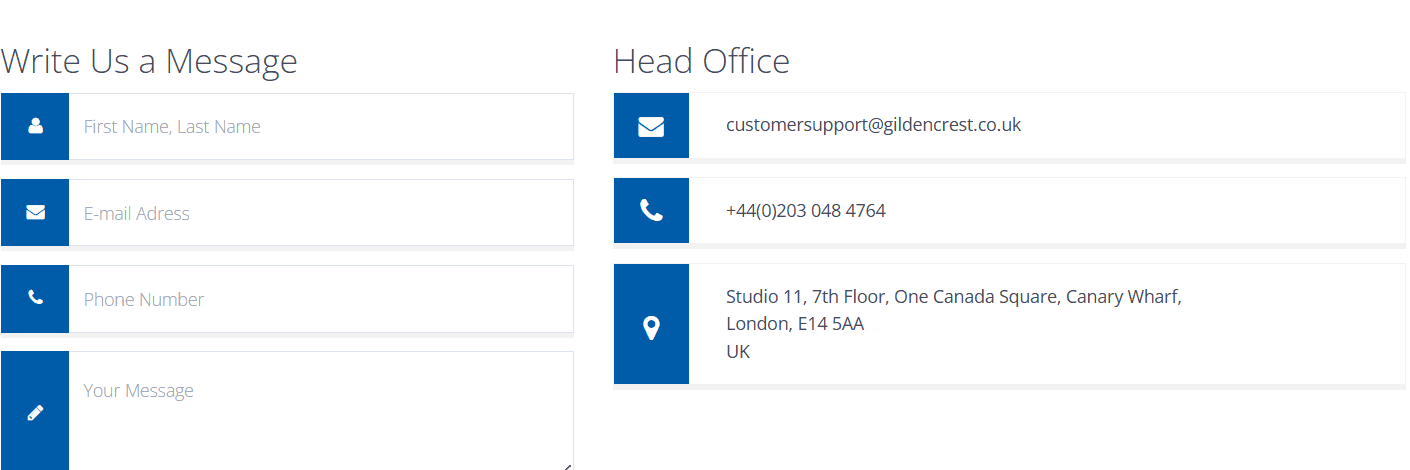

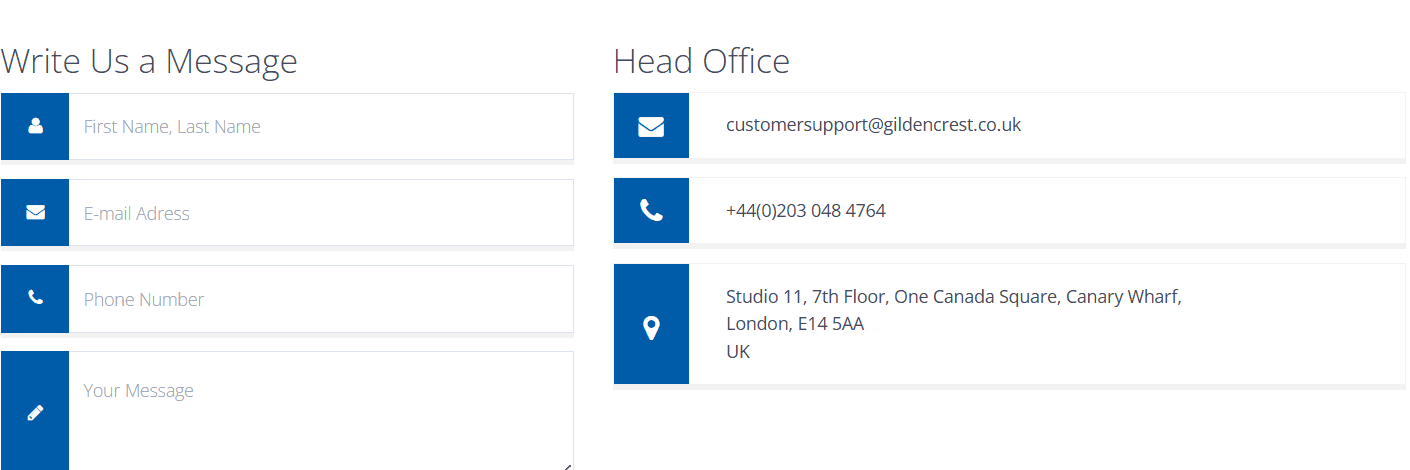

Customer Support and Responsiveness

Score – 4.6/5

Testing Gildencrest Capital Customer Support

Broker’s customer support is available 24/5 through Email, Phone, and Live chat. Also, the support team includes trading specialists who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- Gildencrest Capital also has an FAQ section, although it is not very informative and includes only a few guidelines and answers.

Contacts Gildencrest Capital

We have tested the broker’s customer support to see how responsive the broker is and if the support team delivers helpful services.

- Retail clients can send their questions straight from the broker’s support page (Write us a message section) by providing their names, email addresses, and the main request or question.

- The quickest way to get in contact with the Gildencrest Capital support team is to connect through the live chat. Based on our testing, the answers are quick and detailed.

- Another option the broker provides for connection is through a phone line. Clients who prefer direct contact with a support agent can use the provided number: +44(0)203 048 4764.

- At last, clients can send their requests, questions, or concerns to the provided email address: customersupport@gildencrest.co.uk.

Research and Education

Score – 4.2/5

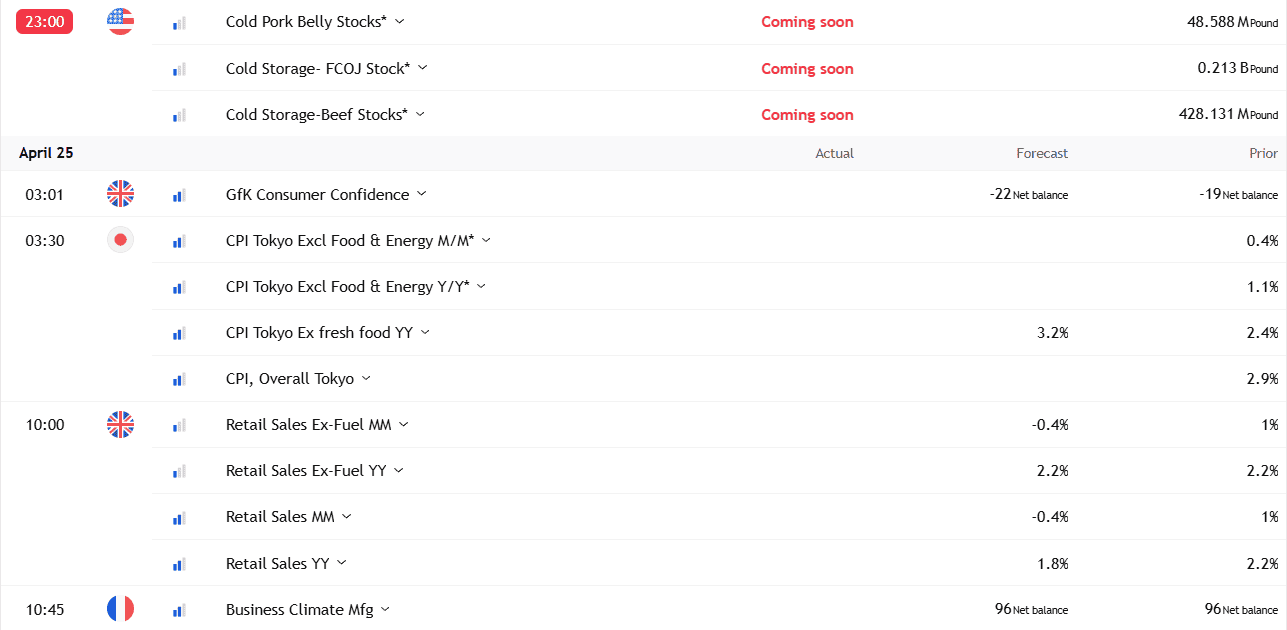

Research Tools Gildencrest Capital

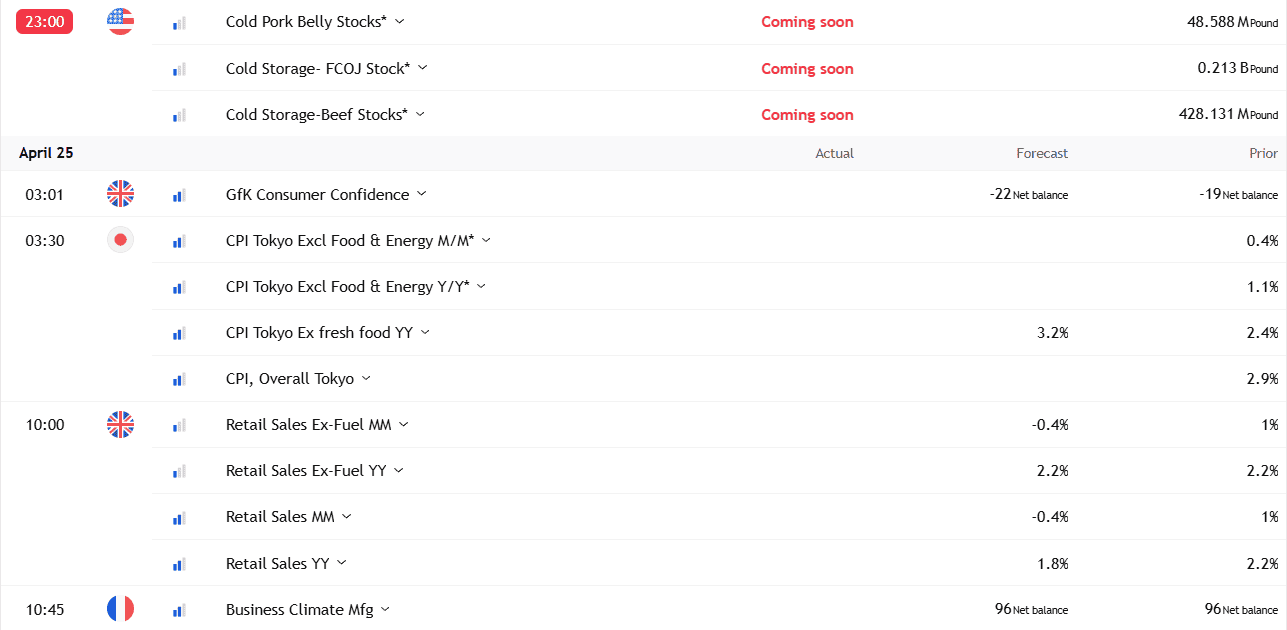

We found that the broker has limited research tools available for traders. Most of the features are already included in the broker’s platforms, ensuring in-depth analysis. However, Gildencrest Capital still includes a few tools that could enhance the users’ trading experience and add more insight into the market:

- Gildencrest Capital provides an economic calendar that can be useful for traders, informing them about upcoming market changes. Being in the know in advance might help traders develop strategies and make certain trading decisions that will help them profit from the impending changes.

- Besides, the broker also provides a trading calculator that calculates pips, margins, and currency. This is another helpful tool for clients to calculate the possible charges and positions before placing a trade.

Education

Based on our research, the educational resources provided by Gildencrest Capital may not offer a comprehensive educational experience for those seeking in-depth knowledge. However, the broker offers a demo account option, enabling traders to practice their strategies without risking real money.

- The broker also includes a trading glossary to help clients understand market terms better and be able to trade with greater confidence and understanding.

Is Gildencrest Capital a Good Broker for Beginners?

Gildencrest Capital is a broker with favorable conditions, safety measures, and great opportunities, tailored to meet different trading expectations. With competitive pricing, various account types, and advanced MT4 and MT5 platforms, Gildencrest Capital gives access to the most popular instruments in the market. The initial deposit is $100, enabling clients to engage without substantial investments. While the broker is a good choice for beginners, especially with its Starter account, there are no comprehensive educational materials, which can be a downside for clients who need serious guidance and access to comprehensive educational resources.

Portfolio and Investment Opportunities

Score – 3.5 /5

Investment Options Gildencrest Capital

Gildencrest Capital offers about 150 trading instruments, mainly based on CFDs. However, this range does not give many possibilities for diversification and portfolio expansion. Besides, the fact that the products are CFD-based limits long-term investment opportunities.

- We have also reviewed alternative options for investment, such as MAM or PAMM accounts or copy trading. As of now, the broker does not give public information about the provision of the mentioned services.

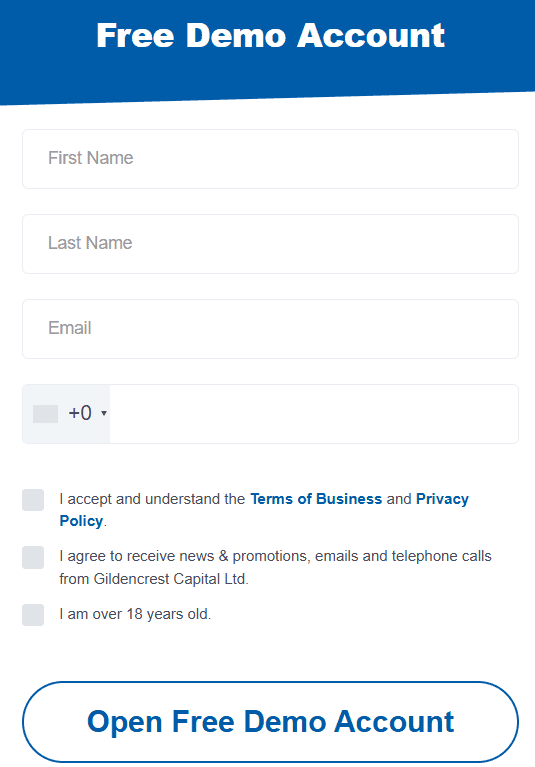

Account Opening

Score – 4.6/5

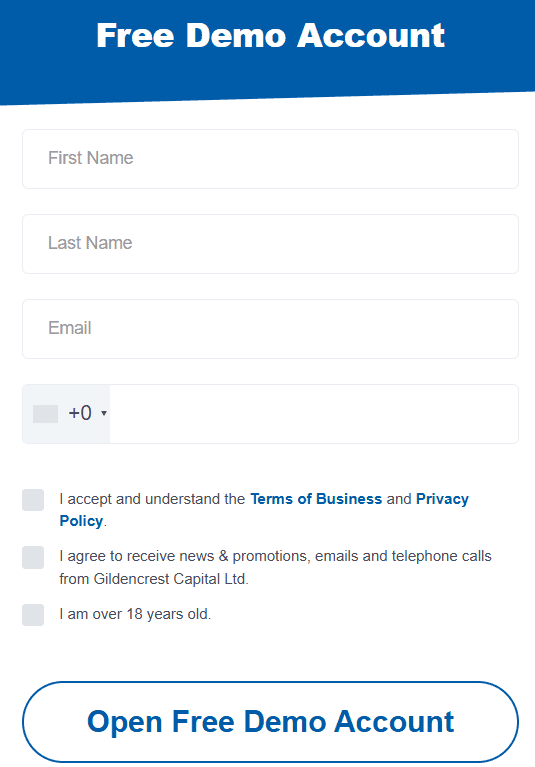

How to Open a Gildencrest Capital Demo Account?

The availability of a demo account is a great opportunity for beginner traders who want to enhance their trading skills and even for professionals who want to try and practice new strategies. Opening a demo account with the broker is easy, with the following steps:

- Visit the official website.

- Click on the “Free demo account” button.

- Fill out the registration form by providing your name, email, and phone number.

- Also choose the platform, account type, currency, and leverage.

- Submit the form and verify by receiving a confirmation email.

- Use the demo credentials to enter your account.

- Start practicing.

How to Open a Gildencrest Capital Live Account?

Opening a live account with the broker is easy, as you can log in and register with Gildencrest Capital within minutes. Just follow the opening account or sign-in page and proceed with the guided steps.

- Select and click on the “Open Live Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.5/5

Based on our research, there are no additional tools and features available on the broker’s website. All the essential tools traders can access through the MT4 and MT5 platforms. Other than that, the broker also offers an economic calendar and calculators, which we have already discussed in the research and education section. Thus, clients who are looking for extensive and additional research tools might be disappointed.

Gildencrest Capital Compared to Other Brokers

At last, after careful consideration of each trading aspect of Gildencrest Capital, we have compared it to other brokers and their offerings. As to regulation, Gildencrest Capital holds a license from the well-respected FCA, ensuring its reliability and adherence to stringent regulatory rules. Based on our comparison, HFM is another broker with an FCA license. Yet it holds licenses from other respected authorities, adding an additional layer of safety.

As to the offered instrument range, Gildencrest Capital includes a modest selection of tradable products (about 150). This is a limited amount when compared to IC Markets with its 1,000+ instruments and AIMS with over 2,000 products. The trading costs, on the other hand, are competitive, enabling even low-cost clients to trade with small initial investments and with comfort. The broker offers several spread-based accounts, breaking down the average overall trading cost for each instrument on its website. However, Deriv, with its low spreads starting at 0.5 pips with low commissions, is another great opportunity in regard to cost-efficient trades.

Our comparison of brokers’ trading platforms showed that most offer MT4 or MT5 platforms. However, Deriv and AIMS offer several advanced alternatives, including cTrader, TradingView, and proprietary platforms. Gildencrest Capital lacks a comprehensive educational section, while traders can find useful learning materials with FP Markets.

| Parameter |

Gildencrest Capital |

Deriv |

FXTM |

HFM |

FP Markets |

IC Markets |

AIMS |

| Spread Based Account |

$20 overall costs per round lot |

Average 0.5 pips |

Average 1.5 pips |

Average 1 pip |

From 1 pip |

From 1 pip |

Average 1.5 pips |

| Commission Based Account |

Commissions on demand |

0.0 pips + $0.05 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.50 |

No commissions |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, MT5 |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5 |

MT4, MT5, HFM App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

| Asset Variety |

150+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

10,000+ instruments |

1,000+ instruments |

2000+ instruments |

| Regulation |

FCA |

MFSA, Labuan FSA, BVI FSC, VFSC |

FCA, FSC, CMA |

FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, LFSA |

| Customer Support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Limited |

Good |

Good |

Good |

Excellent |

Good |

Basic |

| Minimum Deposit |

$100 |

$5 |

$200 |

$0 |

$100 |

$200 |

$50 |

Full Review of Broker Gildencrest Capital

We have conducted thorough research on the broker and revealed different aspects of its offerings. We noticed that the broker has operated for over a decade as TeraFX, and only a while ago, the company was rebranded to Gildencrest Capital. However, it seems that the rebranding has not caused many alterations to the broker’s overall proposal. Besides, it continues to operate under the FCA license and follows stringent regulatory rules.

With Gildencrest Capital, traders can benefit from competitive pricing, access popular markets, and advanced MT4 and MT5 trading platforms via desktop, web, or mobile apps. The broker provides several trading accounts with different fee structures and trading conditions, making it possible for traders of various levels to invest and trade with ease. Gildencrest Capital also offers a demo account for clients who need to practice and gain trading skills before switching to trade live. However, the broker’s limited educational resources might be a drawback for beginners who need to enhance their trading knowledge.

Overall, Gildencrest Capital offers competitive trading conditions that will appeal to different users. Our advice to traders is to consider the broker’s offerings carefully and see how they meet their trading goals.

Share this article [addtoany url="https://55brokers.com/terafx-review/" title="Gildencrest Capital"]

Well, I am highly convinced with the article read, but will Terafx accept international applicant?