- What is TD365?

- TD365 Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- TD365 Compared to Other Brokers

- Full Review of Broker TD365

Overall Rating 4.3

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 3.8 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 3.5 / 5 |

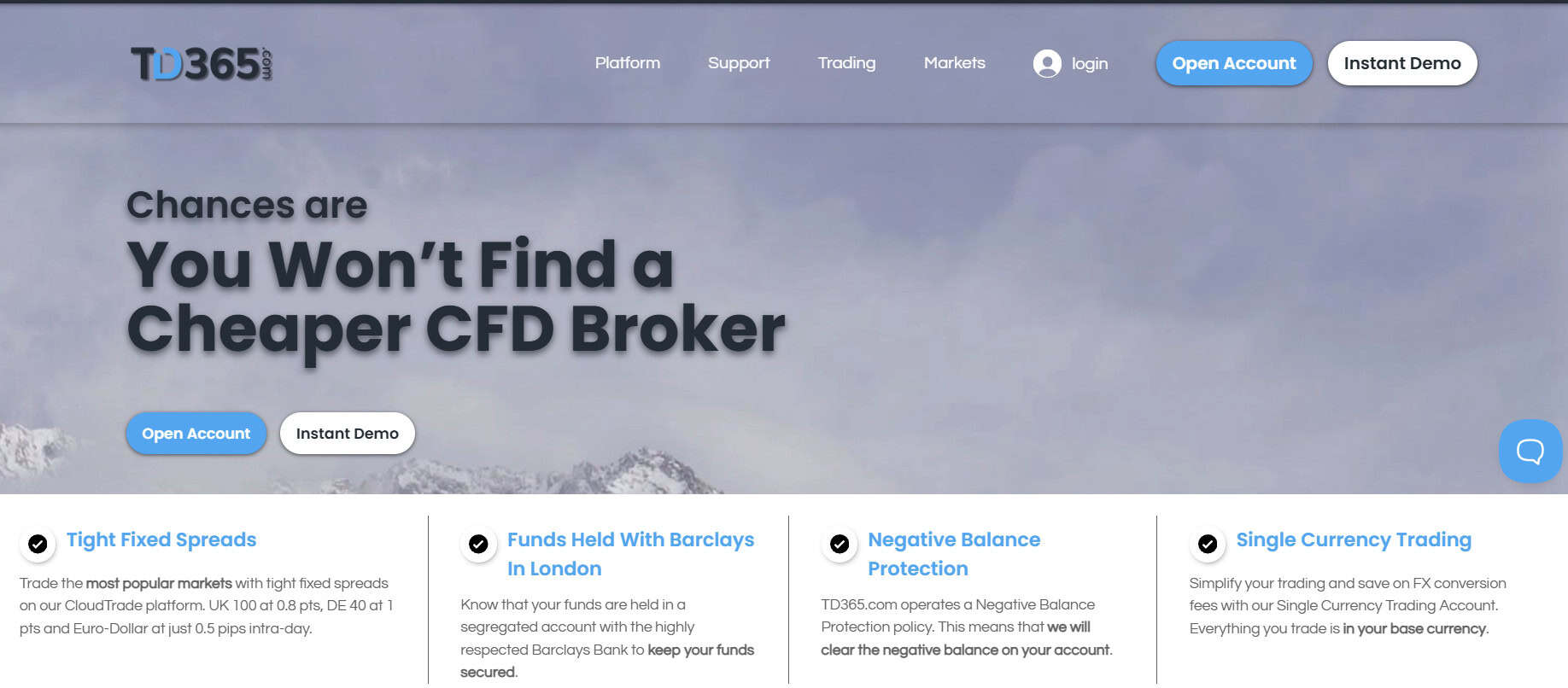

What is TD365?

TD365 is a brand name that operates under the Trade Nation group. The broker provides access to CFD trading and Spread Betting across Forex, Indices, Commodities, Cryptocurrency, and Stocks. Trades are conducted through the CloudTrade web or the popular MT4 platforms.

The broker holds licenses from the top-tier FCA and the Securities Commission of the Bahamas. The FCA regulation ensures adherence to tight laws and stringent rules, while the SCB license ensures the broker’s global availability.

On the other hand, Trade365 does not include educational resources to support beginner traders, and the customer support is not available 24/7.

TD365 Pros and Cons

TD365 is a trustworthy broker that offers a secure trading environment, advanced technology, competitive trading fees, and access to a wide range of assets and instruments. The broker also offers spread betting with competitive and favorable conditions. For quick and smooth deposits and withdrawals, the broker offers a range of funding methods.

From the negative points, there are no advanced learning materials essential for beginners, which can complicate the learning path for novice traders. Besides, there are no 24/7 support centers. Another point for consideration is the broker’s operation under two different entities, which means different trading conditions and safety levels.

| Advantages | Disadvantages |

|---|

| FCA license | No educational resources |

| Fully regulated broker | No 24/7 customer support |

| Advanced platforms | International trading through an offshore entity |

| CFD and Spread Betting Trading | |

| Competitive pricing | |

TD365 Features

TD365 is a well-established Forex and CFD broker with advanced features to meet the needs of different experience levels. The broker provides the safety of trades due to its strong establishment. Below, we have compiled the main aspects of TD365 in 10 points to help traders assess the broker’s offerings at a glance:

TD365 Features in 10 Points

| 🗺️ Regulation | FCA, SCB |

| 🗺️ Account Types | CloudTrade and MT4 accounts |

| 🖥 Trading Platforms | CloudTrade, MT4 |

| 📉 Trading Instruments | Forex, Indices, Commodities, Cryptocurrency, Stock |

| 💳 Minimum deposit | $1 |

| 💰 Average EUR/USD Spread | 0.5 points |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | A single currency |

| 📚 Trading Education | Not provided |

| ☎ Customer Support | 24/5 |

Who is TD365 For?

Our research shows that TD365 is suitable for traders interested in CFD and Forex trading. The broker stands out for its advanced platforms and innovative features. Besides, the broker is a good choice for those who prioritize top-tier regulation and safety. Based on our findings, TD365 is good for:

- Forex Traders

- Spread Betting

- Traders who prefer the MT4 platform

- EAs running

- Copy trading

- Tight fixed spreads

- Competitive fees

- Traders with a Variety of Trading Strategies

- International availability

TD365 Summary

TD365 enables its clients to trade the most popular markets with low spreads on its CloudTrade and MT4 platforms. In addition, TD365 offers traders high leverage of 200:1, a single currency Trading Account, and other benefits.

TD365 is licensed by the Securities Commission of the Bahamas, which in itself is an offshore zone. However, the broker is a part of the Trade Nation group, with a license from the UK FCA. The broker also provides security measures, such as negative balance protection.

However, the broker’s website lacks sufficient educational resources. Traders may need to take the initiative to explore alternative information sources to acquire the necessary skills and knowledge. The sole form of assistance the broker provides is the availability of a demo account and a video guide to the platform.

55Brokers Professional Insights

Our research of TD365 revealed a broker with quite attractive features and opportunities, as now TD365 holds a top-tier license from the respected FCA it is considered safe too. We previously reviewed the broker and listed it as an unregulated broker to avoid, as back then, the broker did not follow stringent rules and laws and was only operating as an offshore broker therefore we blacklist it. Yet, since Broker improved its regulatory status, it shows clearly the good development of the Broker and its proposal alike.

Analysing different aspects of trading with TD365, we found that the broker offers two platform-based accounts, the CloudTrade account and the MT4 account, where each account has specific conditions and proposals that might suit different types of traders and is a big plus. The platforms are advanced and allow for efficiency and fast execution, so most of the strategies are running well on the platform. Besides, traders can engage in copy trading and expand investment chances by following numerous master accounts to select from.

Although TD365 offers all the popular products and a single currency trading opportunity, the number of instruments is limited to 78, which is a modest number, especially for those clients who are looking for diversity. So if you look for wide instrument selection, better opt to another Broker. Yet, the trading fees are favorable, with spreads starting from 0.5 pips on average, which is lower than the market average.

Another limitation we found about TD365 is the lack of research and education sections. This absence of learning materials will hinder novice traders who rely on guidance and assistance from the broker.

Consider Trading with TD365 If:

| TD365 is an excellent Broker for: | - Looking for access to industry-leading platforms like the Meta Trader 4

- CFD and Forex traders

- Cryptocurrency traders

- Copy trading

- Clients looking for transparency in prices and fixed spreads

- Spread betting

- Cost-conscious traders

- Clients looking for top-tier regulations

|

Avoid Trading with TD365 If:

| TD365 is not the best for: | - Traders who prefer ECN/STP execution

- Clients who prefer floating spreads

- Traders looking for a wide range of instruments

- MT5 platform enthusiasts

- Look for 24/7 support

- Beginner traders prioritizing comprehensive educational resources

- Long-term investors |

Regulation and Security Measures

Score – 4.6/5

TD365 Regulatory Overview

TD365 holds a license from the Securities Commission of the Bahamas, which in itself is an offshore zone. The regulation does not provide a sufficient level of security and strict supervision. International traders can open an account under this entity. Of course, it is not recommended to trade solely with offshore brokers; yet, as TD365 holds a reputable license, it means the broker is regulated in terms of its operation.

- TD365 is a trading name of Trade Nation Financial UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Besides, it is backed by Trade Nation Australia Pty Ltd, with oversight from the ASIC.

How Safe is Trading with TD365?

The regulation under the FCA authority ensures a safe environment. This tight regulation ensures rigorous safety measures.

- TD365 offers Negative Balance Protection, ensuring that traders do not lose more funds than they have invested. The protection is typically for retail traders and does not apply to wholesale traders

- The broker also provides Segregation of clients’ accounts from the company’s funds.

Consistency and Clarity

As we have found, TD365 provides a strong level of consistency and transparency. The broker’s pricing model is clear, providing clients with fixed spreads and a simple structure.

The broker has undergone a path of development, as it has strengthened its offering and safety measures over the years.

The clients’ feedback is also positive, with clients pointing out the effective fee structure, advanced platforms, and overall transparency of the offering. A common drawback many clients note is the absence of education.

From our side, we urge traders to pay attention to the broker’s previous journey and regulatory inconsistencies, and for now, consider the differences between the entities.

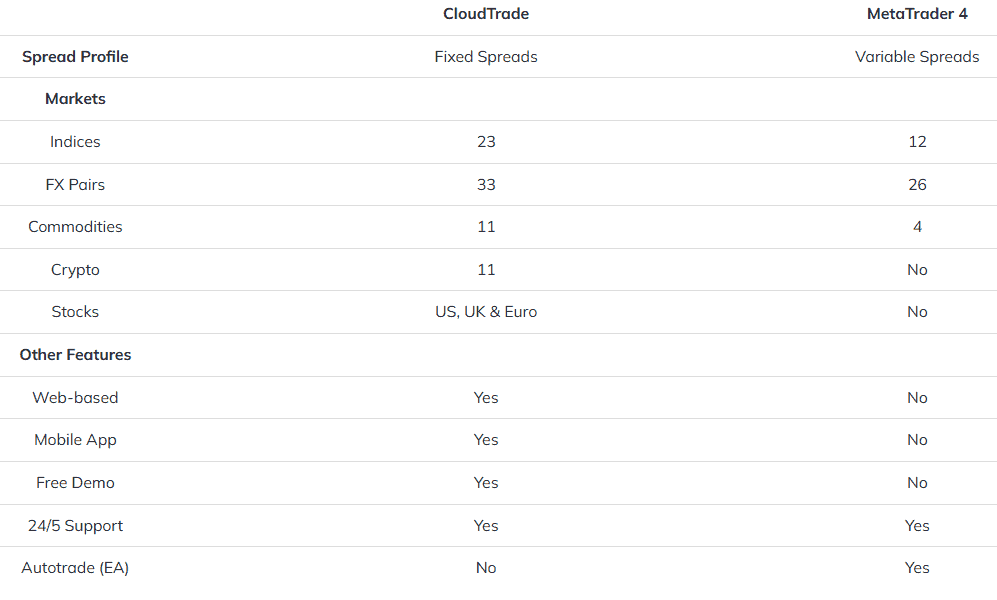

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with TD365?

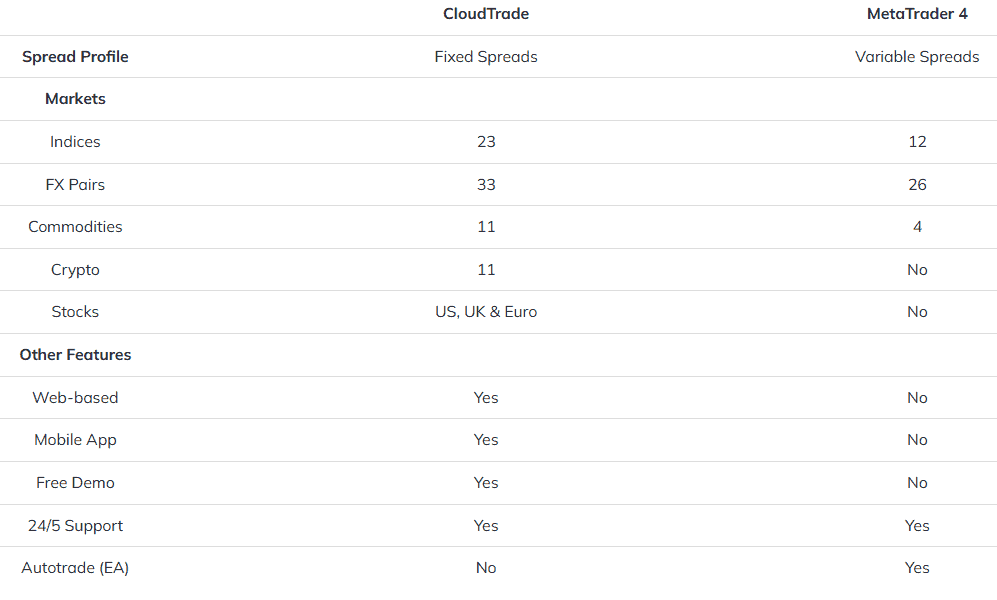

The broker offers two distinct account types, CloudTrade and MT4. The accounts are platform-based, with varying opportunities.

Each account has its distinctions and meets different trading needs and expectations.

The leverage is up to 1:200 for both accounts. The minimum deposit requirement is also the same for both accounts and starts from $1.

- With the CloudeTrade account, trades are conducted on the broker’s proprietary web platform. For this account, the spreads are fixed, with no commissions. Traders have access to over 78 instruments across different markets. One of the advantages is the single-currency trading, which simplifies account management and eliminates currency conversion costs.

- The MT4 live account is available on the industry-standard MT4 platform. The account offers floating spreads that fluctuate depending on the market volatility. The number of instruments traders can access is limited to 42.

- The broker also offers a Demo account available for CloudTrade only. The account allows traders to practice in a simulated environment with virtual funds.

Regions Where TD365 is Restricted

Based on the information we found about the available regions and countries, TD365 does not accept clients from the following countries due to regulatory and legal requirements:

- Afgnanistan

- Australia

- Belgium

- Canada

- Korea

- Haiti

- Iran

- Iraq

- Israel

- Lebanon

- Libya

- Mali

- Myanmar

- Russia

- Somalia

- Spain

- The UK

- The USA

- Virgin Islands

- Yemen

Cost Structure and Fees

Score – 4.4/5

TD365 Brokerage Fees

As we have found, TD365’s fee structure depends on the account type, trading platform, and the asset class traded. Below is the breakdown of the broker’s cost structure, focusing on spreads, commissions, overnight fees, and more.

TD365 offers both fixed and floating spreads, based on the account type and the platform. Fixed spreads are available through the CloudTrade account. The spreads stay fixed even in the most volatile markets. On the other hand, the MT4 live account offers floating spreads for those who favor variable spreads over the fixed ones. The spreads also depend on the instrument traded.

Based on our research, TD365 does not charge any commissions, and all the charges are included in spreads. Thus, the broker offers a no-commission structure, which might be unfavorable for more professional clients who prefer fixed fees for each trade.

How Competitive Are TD365 Fees?

As a result of our testing, TD365 fees are on the lower side. The Forex spread is low, starting at 0.5 pips, which is considered lower compared to 500 other Brokers. The broker does not offer a commission-based account, and all the charges are integrated into either fixed or floating spreads.

As we found, the fixed spreads are offered for the CloudTrade account, while the floating spreads are available on the MT4 account.

To conclude, the broker has a transparent fee structure and discloses all the applicable charges for each instrument.

| Asset/ Pair | TD365 Spreads | SmartFX Spreads | Opofinance Spreads |

|---|

| EUR USD Spread | 0.5 pips | 1.2 pips | 1.8 pips |

| Crude Oil WTI Spread | 3 points | 0.03 | 10 |

| Gold Spread | 0.4 points | 0.28 | 20 |

TD365 Additional Fees

We found that TD365 charges overnight fees for positions held overnight. The fee depends on the instrument traded. Other than that, the broker does not charge any inactivity, deposit, or withdrawal fees.

Score – 4.4/5

With TD365, clients will have access to the popular MetaTrader 4 and the broker’s proprietary CloudTrade web-based platform. The platforms are equipped with a broad range of features and tools.

| Platforms | TD365 Platforms | SmartFX Platforms | Opofinance Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | Yes | No | Yes |

| Mobile Platform | Yes | Yes | Yes |

TD365 Web Platform

CloudTrade is TD365’s popular web-based platform, equipped with advanced and innovative features. The platform offers fixed spreads even in the most volatile markets. It allows traders access to low-latency live pricing, benefits from various advanced charts, order types, trade history, and more.

The execution is instant, and clients can trade with a single currency. As our testing showed, CloudTrade is a reliable and fast platform, available for web trading, ensuring flexibility and high functionality.

TD365 Desktop MetaTrader 4 Platform

Many traders still prefer to trade on the popular MT4 platform; thus, the broker offers access to the MT4 platform with advanced features and a simple interface. It can be easily downloaded and is an excellent option for desktop trading. Traders can access over 42 instruments across Indices, Forex, and Commodities. The platform has a range of sophisticated trading tools and allows the use of plug-in expert advisors.

The platform offers a comprehensive range of charts, technical indicators, analytical objects, and additional features. Spreads on this platform are variable.

Main Insights from Testing

TD365 platforms stand out for their easy-to-use interfaces, efficiency, and advanced analysis tools. The platforms are suitable for all strategy types and experience levels. The broker’s accounts are platform-based. Each platform offers different trading conditions. The number of instruments, spread type, and other conditions depend on the platform.

TD365 MobileTrader App

The broker offers a mobile app with real-time data, charting capabilities, price alerts, and more. Both the CloudTrade and MT4 platforms enable mobile trading, allowing access to the main features and tools. All in all, the broker’s mobile apps are user-friendly options for all types of users who want to monitor their trades on the go.

AI Trading

Based on our findings, TD365 does not offer AI-based trading, including AI signals or full automation of trades. Traders interested in AI-powered tools will need to explore alternative broker options.

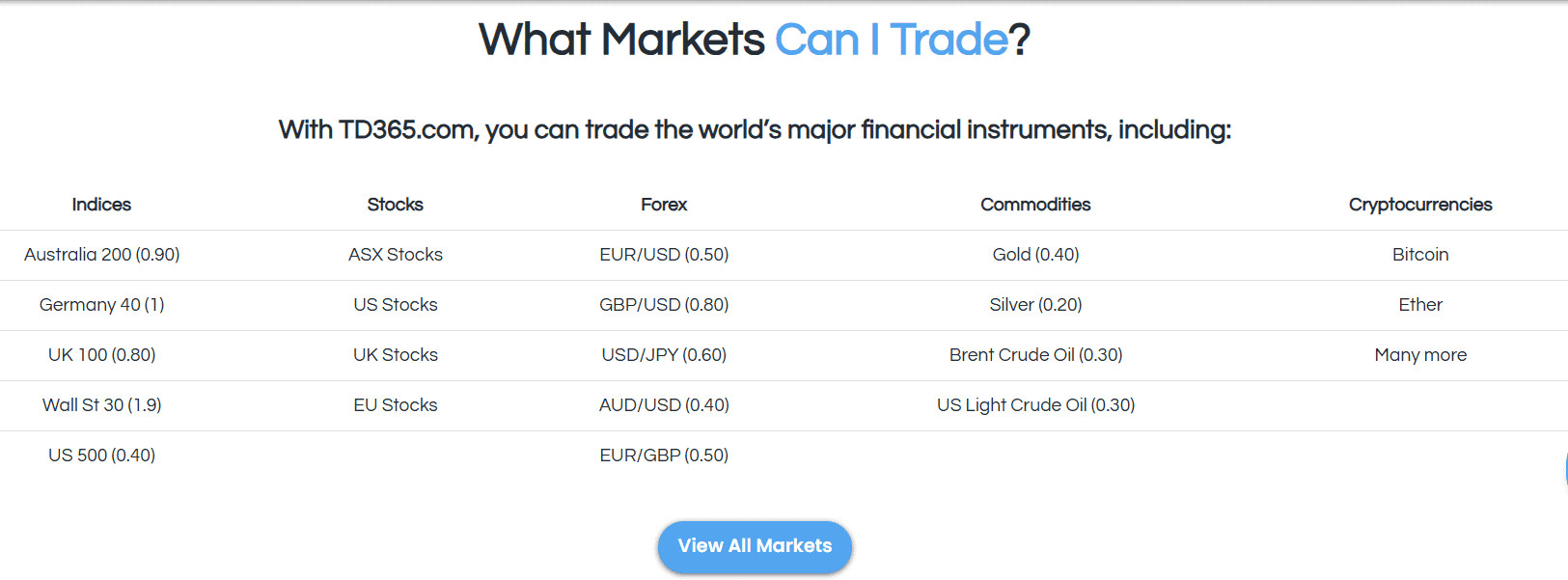

Trading Instruments

Score – 4.2/5

What Can You Trade on the TD365 Platform?

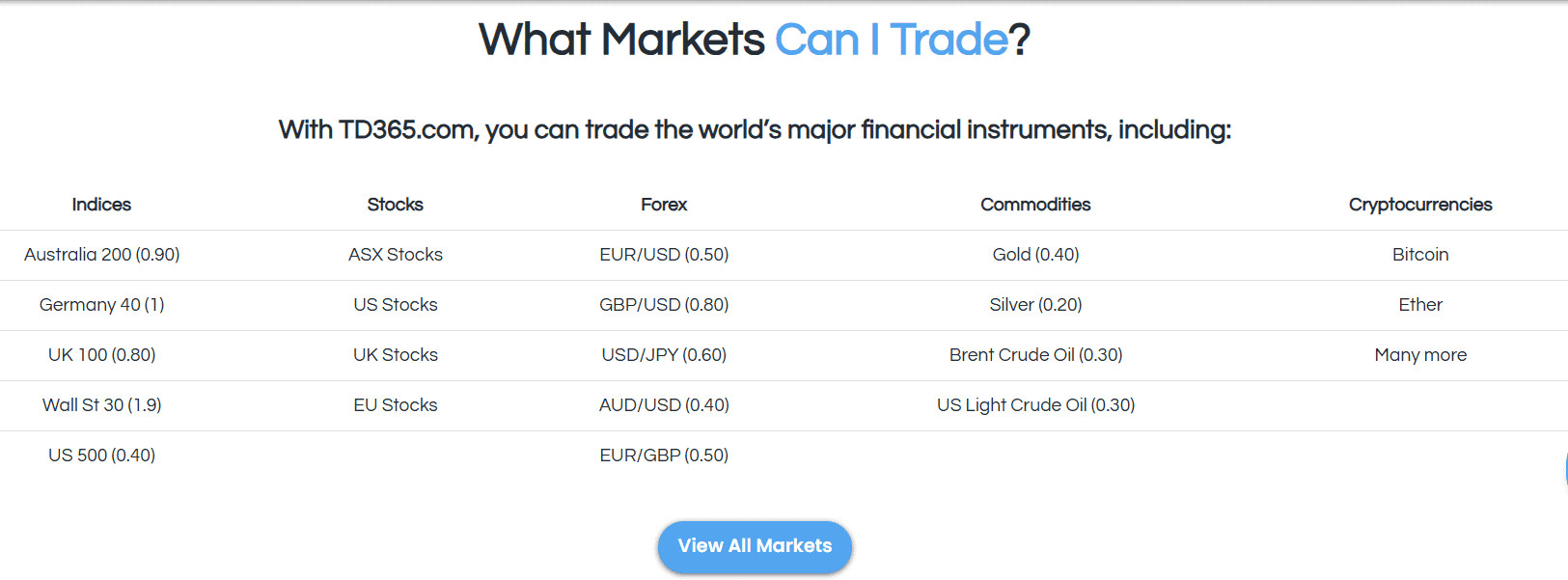

TD365 offers all the popular instruments, allowing traders access to products across a range of financial assets. The availability of the instruments depends on the platforms. The broker’s proprietary platform permits access to over 78 instruments in total, while clients using the MT4 platform will have access to fewer products. Among the offered markets, Forex is the most traded, offering excellent liquidity and very low fixed spreads.

Here are the main assets clients can access with TD365:

Main Insights from Exploring TD365 Tradable Assets

Overall, we found that TD365 offers its clients access to a variety of financial assets. The availability of only 78 instruments does not allow good diversification. Still, clients have access to the most popular products with tight spreads and overall favorable conditions.

With TD365, clients can trade the most popular currency pairs, cryptocurrencies (Bitcoin, Ethereum, and Ripple), as well as commodities (gold, silver, and oil). Also, traders can access the popular global indices and stocks.

Leverage Options at TD365

One of the great features of Forex trading is the ability to use leverage. Traders can benefit from leverage by expanding their possible gains; yet, leverage can also work against them. The maximum leverage available with TD365 can go up to 1:200.

The leverage offered by TD365 depends on the entity and the instrument traded.

- Traders registered under the FCA entity are entitled to leverage of up to 1:30.

- International traders may access high leverage up to 1:200.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at TD365

To fund the account and start live trading with TD365, traders can choose between bank wire transfers, credit card payments, crypto deposit options, or e-wallet payment options. The availability of funding methods also depends on the entity.

Minimum Deposit

Based on our research, TD365 has a very low initial deposit requirement for both of its account types. Clients can open an account with $1 deposit.

Withdrawal Options at TD365

Withdrawals with TD365 are processed through the same funding methods used for deposits. It usually takes up to 1 business day to process withdrawals.

- However, the time can depend on the method used and the bank, and might sometimes take up to 3 days.

- Faster payments are available for UK-based traders.

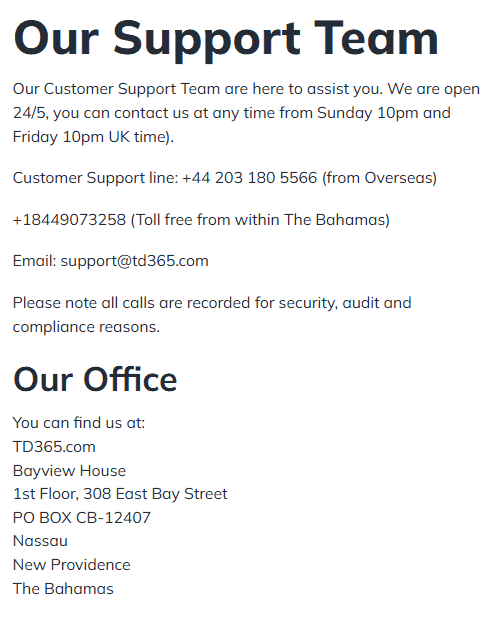

Customer Support and Responsiveness

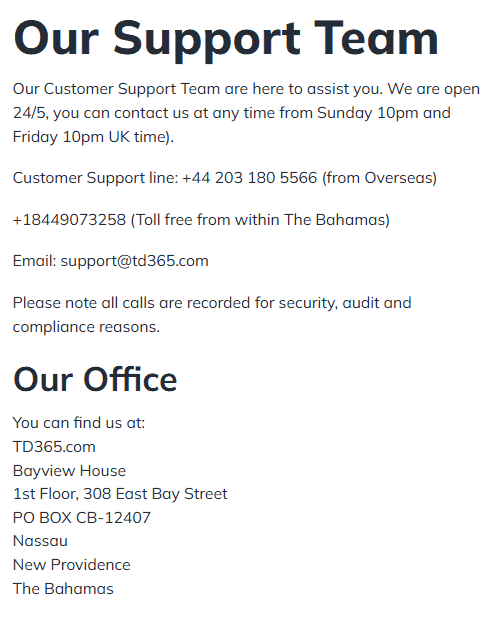

Score – 4.5/5

Testing TD365’s Customer Support

We have also tested TD365’s customer support to find out how dedicated its team is. All in all, TD365 has a dedicated support team that assists traders through phone, email, and live chat.

- In addition, the broker offers an FAQ section, where it provides answers to the most common trading-related questions.

Contacts TD365

Our research on the broker’s customer support revealed a dedicated and helpful team that tries to solve clients’ problems 24/5 through the following methods:

- Clients can use the provided phone number: +18449073258.

- TD365 also provides an email address for different types of inquiries: support@td365.com.

- The live chat is one of the fastest methods to solve the trading-related issues. We found that the answers and solutions are quick and on point.

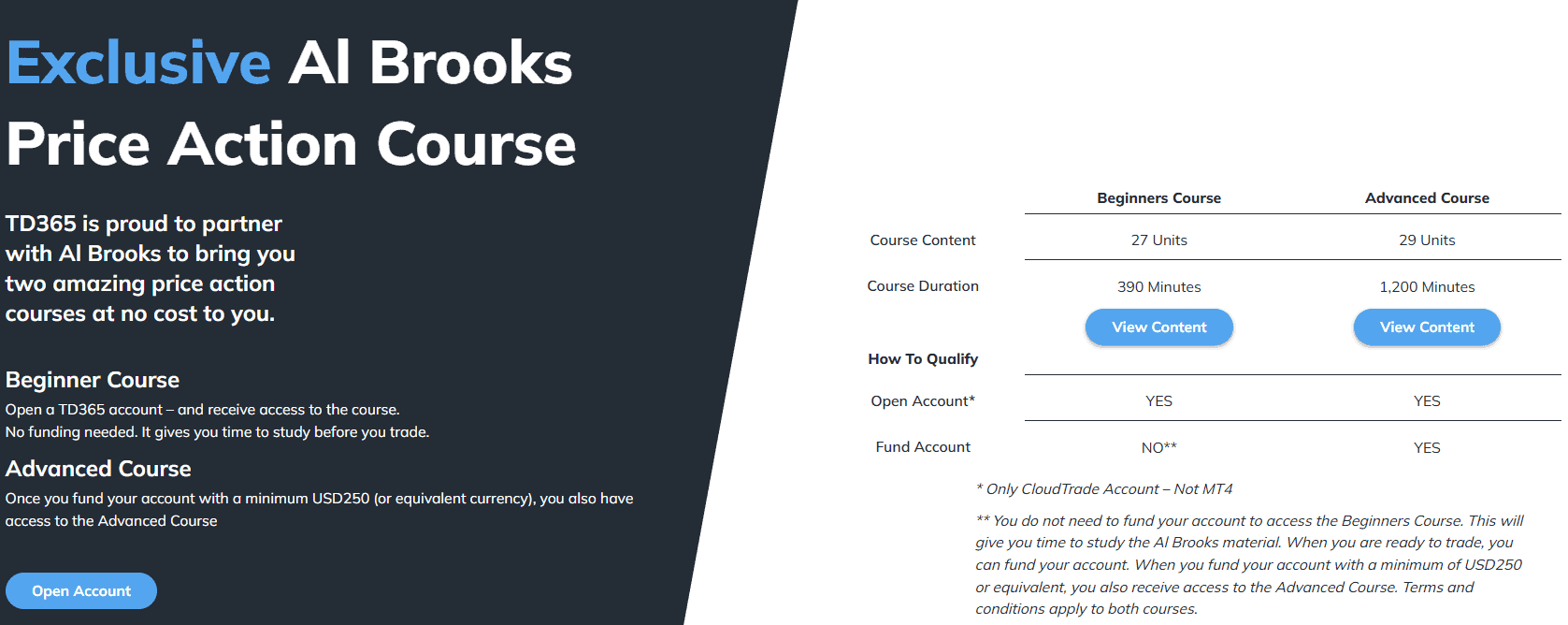

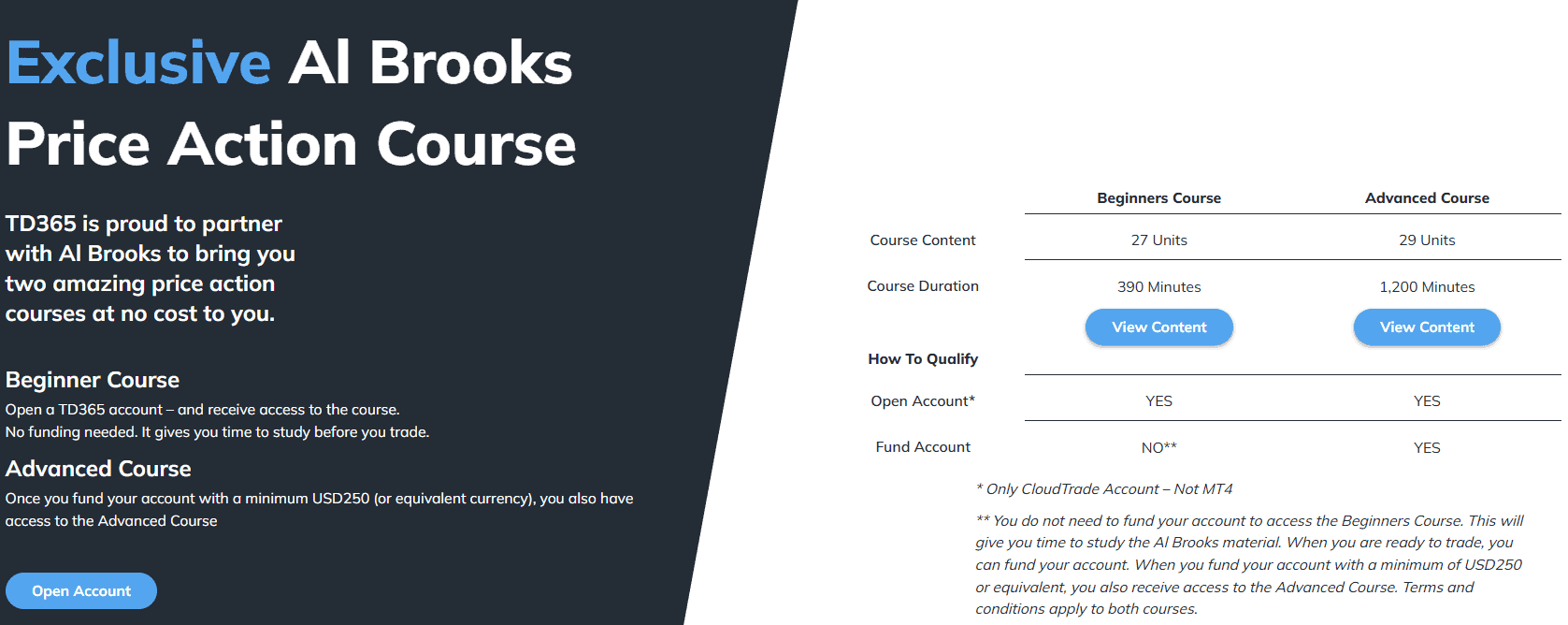

Research and Education

Score – 3.8 /5

Research Tools TD365

TD365 provides advanced platforms with extensive tools and features to conduct in-depth analysis. Both the MT4 and the CloudTrade platforms include good charting and technical analysis capabilities that support the clients in decision-making. However, other than one or two small opportunities, there are no additional research tools on the broker’s website.

Education

We have also checked if the broker provides educational resources on its website. As a result, we revealed that TD365 does not offer extensive educational resources that beginner traders might look for, such as webinars, eBooks, a glossary, and more.

However, we could find the following limited opportunities:

- The AI Brooks Price action course provides traders with two price action courses for free. The course is tailored for beginner and advanced clients, offering 27 units.

- The broker also introduces short videos, instructing its clients how to use the CloudTrade platform.

Is TD365 a Good Broker for Beginners?

TD365 is a favorable broker for clients of different skill levels. It offers two advanced platforms and account types based on the platforms. Another positive aspect is the demo account that imitates a real-time trading environment, enabling novice traders to practice in a risk-free environment.

TD365 also offers both floating and fixed spreads, mostly in line with the market average or lower. The initial deposit is $1, an attractive offering for traders who want to start with the smallest investments.

The only significant disadvantage is the absence of comprehensive learning materials.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options TD365

Investment opportunities with TD365 are limited to CFD-based products and only 78 instruments. This number is small, especially if compared to other brokers with an extensive range of trading products. Besides, it does not provide any traditional investment opportunities, such as buying physical assets, like stocks, bonds, or mutual funds.

- As an alternative option for investments, TD365 offers copy trading. Clients can replicate the trades of professional and advanced traders and gain profits.

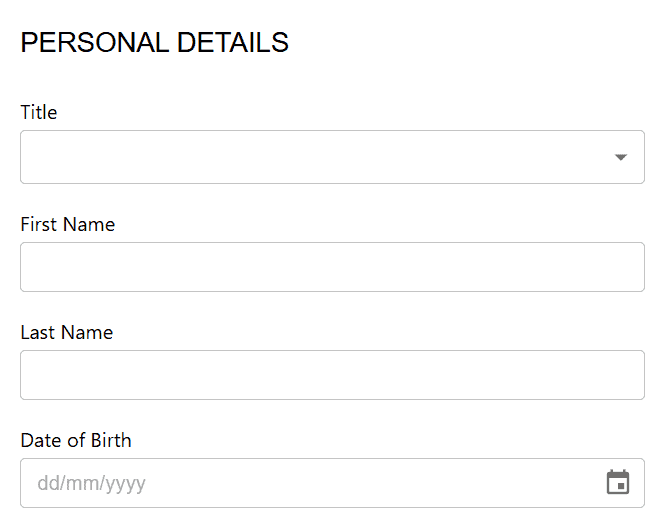

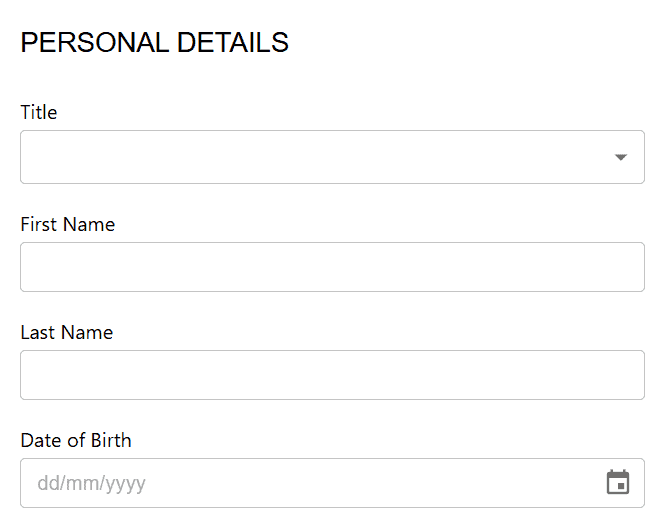

Account Opening

Score – 4.5/5

How to Open a TD365 Demo Account?

Practicing through a demo account is a great opportunity to enhance your trading skills and gain a solid understanding of how it works.

Here are the main steps of how to open a demo account with TD365:

- Go to the broker’s website and click on the “Instant Demo” button.

- Fill out the registration form with the required information.

- Choose one of the broker’s available platforms.

- Submit the form and receive the login details via email.

- Log in to the platform with the provided credentials and start practicing.

How to Open a TD365 Live Account?

Opening a live account with TD365 is a simple process that can be completed within minutes. Clients can follow the following steps for a smooth and quick account opening:

- Go to the TD365 website and choose the “Open Account” button.

- Fill out the registration form with personal, login, and contact details.

- Provide information about the financial and trading experience.

- Choose the preferred platform.

- Provide additional documents, including a valid ID and proof of address.

- Submit the application form and wait for approval.

- Once approved, fund your account, access your preferred platform, and start trading.

Score – 3.5/5

We have carefully considered TD365’s additional offerings, features, and tools to see how the broker accommodates and enhances its clients’ experience. Our research revealed that all the main features are included on the broker’s trading platforms.

- Clients looking for various additional opportunities, such as Fixed API, free VPS, bonuses, promotions, and other capabilities, will not find them with TD365.

TD365 Compared to Other Brokers

We compared TD365 with well-regarded brokers in the market to see how it stands out and what aspects need improvement. Based on this comparison, we revealed essential insights.

First, we compared the broker’s regulation: TD365 is regulated by the FCA and holds an international license from the SCB. When we compared it to HFM, we found that the broker holds additional licenses from top-tier authorities, ensuring an extra level of safety.

As for the fees, TD365 offers fixed and floating spreads from 0.5 pips with no commissions. On the contrary, FXPrimus offers two commission-based accounts with different spreads and commission amounts, ensuring a variety of choices to traders.

As for trading platforms, TD365 supports the MT4 and its web-based CloudTrade platform. With the advanced features and tools, the platforms can satisfy the trading needs of most types of traders. As we found, Deriv and IC Markets offer cTrader as an additional platform for diversification.

At last, in terms of education, we found that XM is ahead in terms of learning resources, not only from TD365 but from most other brokers in the industry.

| Parameter |

TD365 |

Deriv |

XM |

HFM |

FXPrimus |

IC Markets |

FXTM |

| Spread-Based Account |

Average 0.5 pips |

Average 0.5 pips |

1.6 pips |

Average 1 pip |

From 1.5 pip |

From 1 pip |

Average 1.5 pips |

| Commission-Based Account |

No commission |

0.0 pips + $0.05 |

Only on Shares Account |

0.0 pips + $3 |

0.0 pips + $2.5 |

0.0 pips + $3.50 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, CloudTrade |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5, XM WebTrader |

MT4, MT5, HFM App |

MT4, MT5, WebTrader |

MT4, MT5, cTrader |

MT4, MT5 |

| Asset Variety |

78+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

200+ instruments |

1,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, SCB |

MFSA, Labuan FSA, BVI FSC, VFSC |

ASIC, CySEC, FSC, DFSA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

CySEC, VFSC |

ASIC, CySEC |

FCA, FSC, CMA |

| Customer Support |

24/5 |

24/7 |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

| Educational Resources |

Basic |

Good |

Excellent |

Good |

Basic |

Good |

Good |

| Minimum Deposit |

$1 |

$5 |

$5 |

$0 |

$15 |

$200 |

$200 |

Full Review of Broker TD365

TD365 is a good-standing broker with a top-tier license from the FCA. The broker is a part of the well-regarded Trade Nation Group, ensuring adherence to strong rules and guidelines. TD365 is also regulated in the Bahamas, serving its international clients under this entity. It was also once solely regulated by the SCB, which made TD365 an offshore broker with lax practices.

As we have found, TD365 has an appealing proposal that includes the CloudTrade and the MT4 platforms. The platforms are well-equipped with innovative analytical features. Trade365 account types are platform-based. Each platform has different conditions and offers different trading solutions. The CloudeTrade offers low fixed spreads for over 78 popular instruments. For the MT4 platform users, spreads are floating, and the number of products is only 42.

One of the broker’s disadvantages is the lack of proper education and research features. Despite this, TD365 can serve as a good choice for clients looking for stability, security, and favorable market opportunities.

Share this article [addtoany url="https://55brokers.com/td365-review/" title="TD365"]