- What is Swissquote?

- Swissquote Pros and Cons

- Awards

- Is Swissquote Safe or a Scam?

- Leverage

- Accounts

- Trading Instruments

- Fees

- Spreads

- Deposits and Withdrawals

- Trading Platform

- Customer Support

- Education

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about Swissquote.

What is Swissquote?

Swissquote is a leading provider of online financial and trading services, offering access to over 400 Forex and CFD instruments, 30 cryptocurrencies, stocks, ETFs, funds, bonds, options, futures, and more.

The beginning of company started back in 1990 with the set-up of Marvel Communications SA, a business specializing in financial software and web applications. Further on, the business model became Swissquote through the launch of the first financial platform in 1996, which offered free access to private investors’ real-time prices for all securities traded on the Swiss stock exchange and with the mission to democratize banking.

Swissquote Group Holding Ltd is listed on the SIX Swiss Exchange and has its headquarters in Gland (VD) with offices in Zürich, Bern, Dubai, Malta, Hong Kong, and London.

Swissquote Pros and Cons

Swissquote is a multiply regulated broker with global recognition and audit providing quality trading conditions. There is a range of top trading platforms offered by Swissquote including MT4 and MT5 with no restrictions on strategies, costs are low and learning materials are great for beginning traders. Funding methods are widely offered, and traders can benefit from online banking via Swissquote Bank.

For the Cons, conditions are different in each jurisdiction, also spreads might be higher for some instruments like Currency pairs.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| Globally recognized and awarded broker | |

| MT4, MT5, and proprietary Swiss DOTS trading platforms | |

| Good quality educational materials, and excellent research | |

| Quality customer support | |

Swissquote Review Summary in 10 Points

| 🏢 Headquarters | Switzerland |

| 🗺️ Regulation | FINMA, FCA, MFSA, SFC, DFSA |

| 🖥 Platforms | MT4, MT5, eTrader, Swiss DOTS |

| 📉 Instruments | Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Forex, Commodities, Bonds and Cryptocurrencies |

| 💰 EUR/USD Spread | 1.7 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $1,000 |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Provided with research tools |

| ☎ Customer Support | 24/5 |

Overall Swissquote Ranking

Swissquote holds a strong establishment and good reputation offering safe and very favorable trading conditions. The company provides a range of online trading services, yet the user-friendly platforms also offer solutions for eForex, ePrivate Banking, eMortgage, and flexible saving accounts. In addition to a low-cost service for private clients, Swissquote also developed specialized services for independent asset managers and corporate clients.

- Swissquote Overall Ranking is 9.2 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | Swissquote | Dukascopy | FxPro |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Trading Platforms | Trading Conditions | Deep Liquidity |

Swissquote Alternative Brokers

Swissquote offers a range of trading instruments, good trading conditions, spreads, and fees. However, there are a number of other brokers or banks that offer similar services. Here are some of the best alternatives to Swissquote:

- Dukascopy – Regulated Swiss Bank with an excellent reputation

- FP Markets – Powerful trading technology and ECN environment

- XM – Wide Range of Trading Opportunities

Awards

There are many industry awards that recognized the strive and achievements of Swissquote. In addition, the firm takes an active part in social contribution and support.

- We found that Swissquote is in a global partnership with Manchester United, one of the most popular football teams in the world.

- New partnership between Swissquote and Luzerner Kantonalbank (LUKB) for mortgages are signed in 2022.

- Swissquote becomes an issuer of structured products under the “Yield Booster” brand in cooperation with Leonteq in 2022.

Is Swissquote Safe or Scam?

No, Swissquote is not a scam. It is considered a safe broker regulated by a top-tier authority in the UK by FCA. Therefore, it is secure and low-risk to trade Forex and other trading instruments with Swissquote.

Is Swissquote Legit?

First of all, Swissquote Bank Ltd holds a banking license issued by its supervisory authority FINMA, and is a member of the Swiss Bankers Association.

- Furthermore, world-established branches are the subsidiaries of the Swissquote Bank and respectively authorized by the relevant country regulators.

Thus the reputable regulation from Switzerland along with other authorities brings a clear state of transparent and trustful operation Swissquote performs.

See our conclusion on Swissquote Reliability:

- Our Ranked Swissquote Trust Score is 9.2 out of 10 for good reputation and service over the years, also reliable top-tier license, and serving regulated entities in each region it operates. The only point is that regulatory standards and protection vary based on the entity.

| Swissquote Strong Points | Swissquote Weak Points |

|---|

| Regulated broker with Switzerland banking license | Regulatory standards and protection vary based on the entity

Regulated by top-tier authorities |

| Heavy regulation and obligation to audit | |

| Additional licenses from FCA, SFC, DFSA, and MFSA | |

| Negative balance protection | |

| Global expand | |

How Are You Protected?

In general words, the sharp regulation of the broker means that every transaction and action it does is overseen and reported strictly. In addition, the broker and bank at the same time do not only act fairly towards the clients, since authorities may fine entity in case of a breach but also compensate and cover clients’ risks by various means.

And actually, this is the main reason why every trader should consider only well-regulated brokers and not fall under offshore trading, which lacks any guidelines.

Leverage

Swissquote Standard Leverage level is 1:100. Based on our research, the regulation particular entity falls under specific requirements, therefore the rates may change, as well as the level of trader professional or retail always affects the rate too.

- Therefore, European clients are entitled to use a maximum of 1:30 for major currency pairs and even lower for other instruments.

- Entities in Dubai and Hong Kong may be entitled to a higher 1:200.

Nevertheless, every trader should learn how to use leverage smartly, as high rates increase risk levels too, which may cause a loss of money.

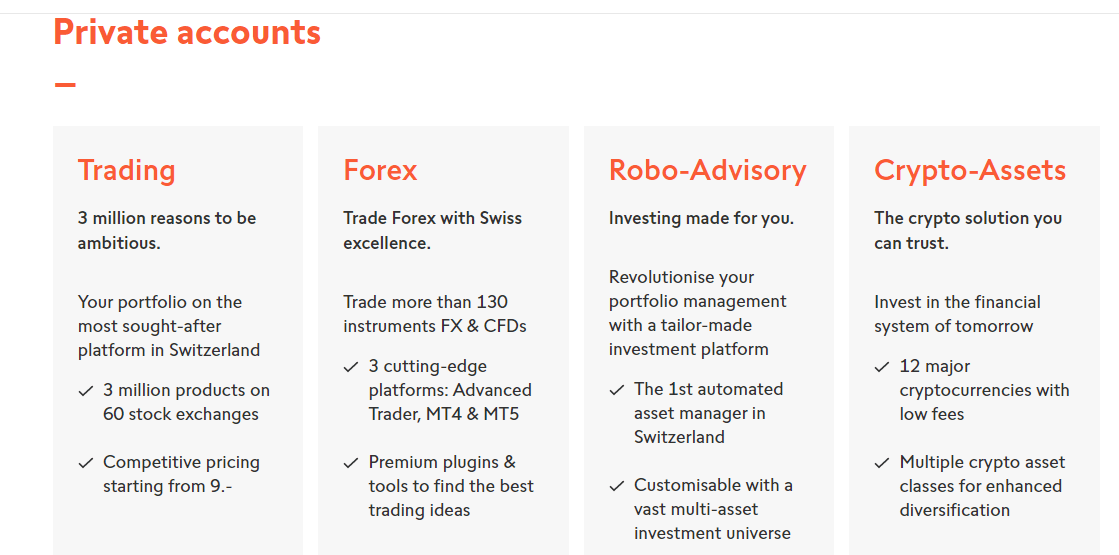

Account Types

According to our research, Swissquote offers different trading accounts (such as swap-free account) optimized according to the trader type and can be either private or B2B accounts. The private accounts are the following: Trading, Forex, Robo-Advisory, and Crypto-Assets accounts. In addition,

- Forex account brings a choice of multi-asset platforms including MT4, MT5, and advanced traders with availability to trade FX and CFDs.

- The Trading account brings an option to optimize a portfolio via Stocks trading with over 3 million products and 60 exchanges.

- Robo-Advisors account is an investment account with revolutionary portfolio management that Swissquote is quite known for.

- The crypto-Assets account is a solution to trade 12 major cryptos with quite low fees. Of course, all the above-mentioned accounts are available in the demo version too, to practice and get familiar with the systems.

While business accounts offer these two options: Asset Managers, and Companies.

| Pros | Cons |

|---|

| Fast account opening | Account conditions may vary according to regulation |

| Private and business accounts | |

| Suitable for new and experienced traders | |

| Easy switch between Demo and Live Accounts | |

| Various account base currencies | |

| Separate accounts for Stock trading, Forex, Robo Advisory and Crypto assets | |

How to Open Swissquote Live Account?

Opening an account with Swissquote is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open an Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit

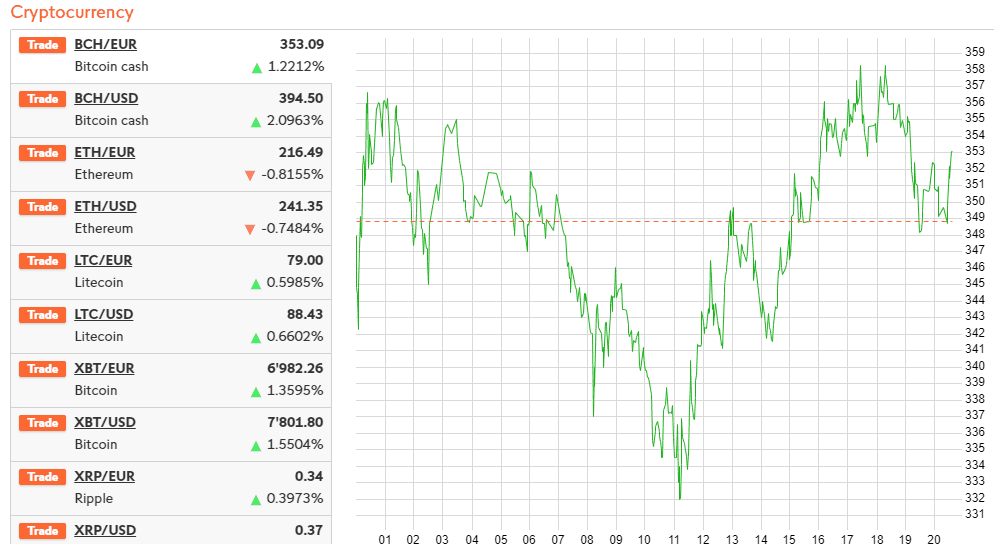

Trading Instruments

Swissquote offers access to Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Forex, Commodities, Bonds, Cryptocurrencies, and more

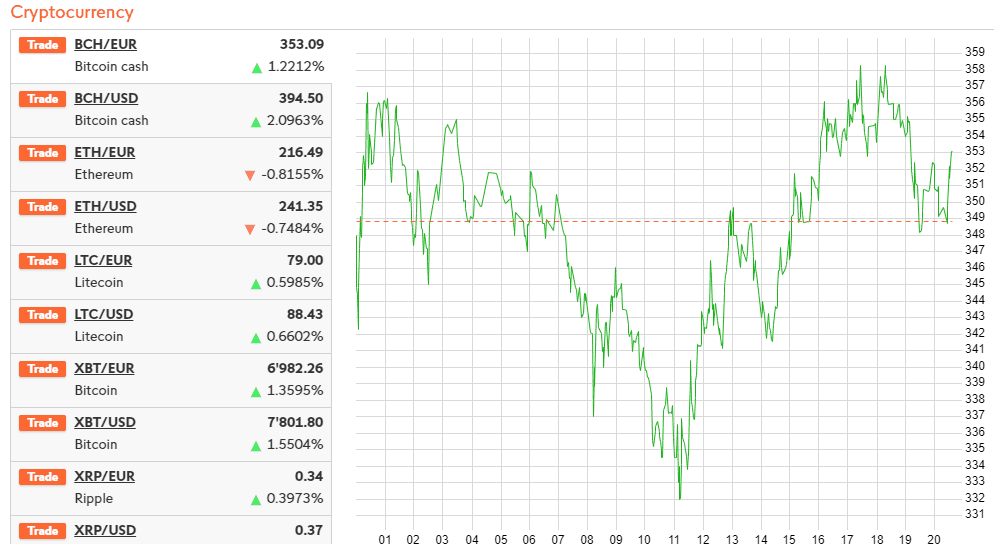

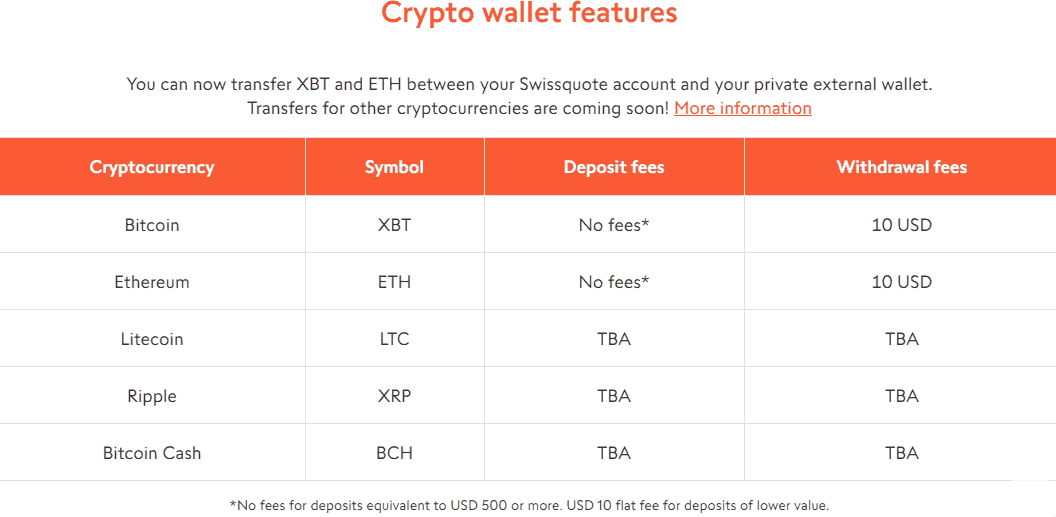

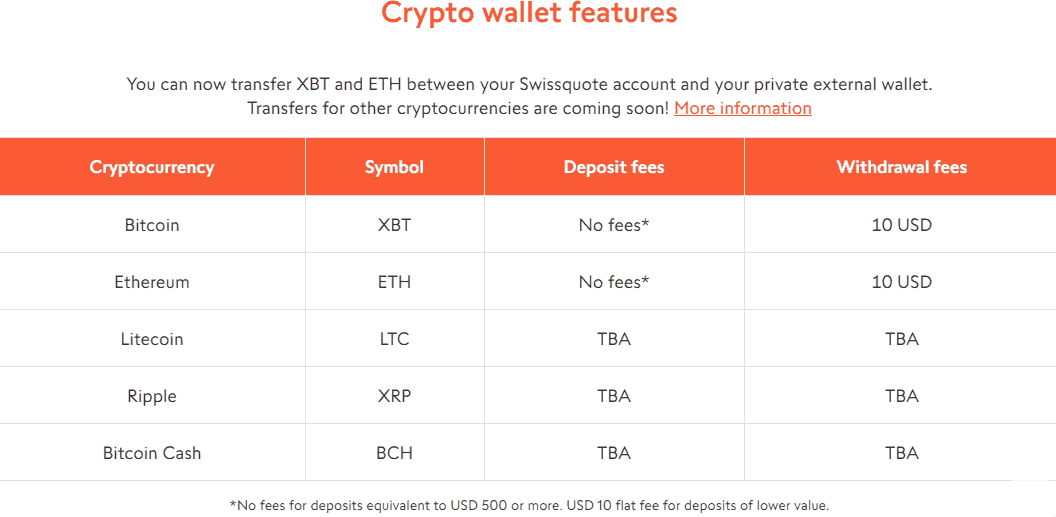

The attractive rates presented for Funds, ETFs, and Swiss DOTS start from 9 pips, Options, and Futures from 1.5 CHF. While, the cryptocurrency trade has quickly established itself as a leader that brings an infinite opportunity to trade through 5 available instruments Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash.

- Swissquote Markets Range Score is 8.9 out of 10 for wide trading instrument selection among Forex, Futures, Indices, Cryptos, and more.

Swissquote Fees

Swissquote trading cost for all instruments is diverse according to the trading size and trader’s activity, while generally considered to be on a low spread level. Total Swissquote fees are based on spread plus funding fees, inactivity fees, and swap fees.

- The inactivity fee will be charged if you have no open positions and have not been trading on your accounts for a period of 6 months or more. It amounts to a maximum of 10 units of your base currency or to the equivalent of your remaining balance.

In addition, the company does not charge fees for deposits, while for withdrawals third-party fees may apply up to $10.

- Swissquote Fees are ranked average with an overall rating of 8.9 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity offering, see our findings of fees and pricing in the table below, however, Swissquote overall fees are considered good.

| Fees | Swissquote Fees | Dukascopy Fees | FxPro Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | Yes | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Low, Average | Low | Low, Average |

Spreads

Swissquote spreads are different from each account features its own fee structure, while costs can be inbuilt into a spread-only basis like with Forex trading or with a commission for Stocks or investments.

E.g., while trading Cryptocurrencies for amounts equivalent to 5 – 10,000 CHF 1% fees will be charged, as long as the size goes above it can reach 0.75% fees or even 0,5% only.

- Swissquote Spreads are ranked low with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spread much lower than the industry average, and spreads for other instruments are very attractive too.

| Asset/ Pair | Swissquote Spread | FxPro Spread | Dukascopy Spread |

|---|

| EUR USD Spread | 1.7 pips | 0.9 pips | 0.2 pips |

| Crude Oil WTI Spread | 5 | 88 | 5 |

| Gold Spread | 28.6 | 1619 | 30 pips |

| BTC USD Spread | 1% | 20155 | 60 |

Deposits and Withdrawals

Transaction of funds is an easy and quick process at Swissquote, offering two funding options to its clients: Wire Transfer and Credit Card Deposits.

- Swissquote Funding Methods we ranked good with an overall rating of 8.2 out of 10. However, the minimum deposit is above the average in the industry, yet fees are either none or very small also allowing to benefit from various account-based currencies, and also deposit options may vary on each entity.

Here are some good and negative points for Swissquote funding methods found:

| Swissquote Advantage | Swissquote Disadvantage |

|---|

| Fast digital deposits | Conditions may be different according to your residency |

| Bank services through Swissquote bank account | |

| No internal fees for deposits | |

| Multiple account base currencies | |

| Withdrawal requests confirmed within 1 working day | |

Deposit Options

In terms of funding methods, Swissquote offers two payment methods to conveniently and securely fund your account:

- Bank Wire Transfer

- Credit card deposits

Swissquote Minimum Deposit

Swissquote minimum deposit is $1,000 for a Standard Forex account and goes higher according to the trader’s size, or the account you may use.

Swissquote minimum deposit vs other brokers

|

Swissquote |

Most Other Brokers |

| Minimum Deposit |

$1000 |

$500 |

Swissquote Withdrawals

Swissquote withdrawals are processed through unique Swissquote eBanking services that allow traders to add or withdraw funds and manage accounts simply and conveniently. Being a Swiss bank you can issue your very own Swissquote Card with all the benefits to pay and withdraw right from the cash machine.

How Withdraw Money from Swissquote Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

Swissquote has direct access to the markets provided by the highly secured and powerful platforms that the company chose to offer: MetaTrader 4, Meta Trader 5, proprietary eTrader, and Swiss DOTS.

- Swissquote Platform is ranked Excellent with an overall rating of 9.2 out of 10 compared to over 500 other brokers. We mark it as excellent being one of the best proposals we saw in the industry, and a great range including MT4 and MT5 suitable for professional trading. Also, all are provided with good research and excellent tools.

Trading Platform Comparison to Other Brokers:

| Platforms | Swissquote Platforms | Dukascopy Platforms | FxPro Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Web Trading Platform

With the choice of eTrading platform, Swiss DOTS, Themes Trading, and Mobile applications are able to choose and cover your particular need. Actually, the proposal is truly impressive so see below do general info and choose the best for you.

- eTrader is a multi-asset platform suitable for all traders, that enables them to achieve objectives in a simple and intuitive way. Widgets on eTrading platform bring account overviews, ratings, and analysis along with daily analysis through Trend Radar.

- Swiss DOTS a platform for derivatives with more than 90,000 OTC products offers competitive conditions with a range of extensive too.

Desktop Platform

From the download center, you can select the platform you need according to your device settings as well. In addition, Forex and CFDs trading is available via the MT4 and MT5 platforms as well, so if you prefer its popular technology Swissquote got you covered.

Mobile Trading

Moreover, free applications are designed for any device iPhone, Android, Smartwatch, and even Apple TV, offering sophisticated technological solutions. Various tools can be connected to the platform, exclusively to swiss clients’ availability to trade with a virtual reality headset, or through MacOS screensaver or TV and more.

Robo Trading

Another great Swissquote feature is autonomous investing which requires a separate look. Without an emotional impact developed and brought by robots that deliver precise results, increase performance, and save time.

The Robo-Advisor is an electronic asset manager that creates a portfolio and monitors around the clock. The Robo-Advisors work with the same algorithm applied to the Swissquote Quant Fund.

Customer Support

Another good point in our Swissquote review goes to qualified customer support available 24/5 through Live chat, Phone lines, and Emails. Customer service is defined by the region with available hours and hotlines as well, which is a quite well-organized structure allowing traders to stay always in touch.

- Customer Support in Swissquote is ranked good with an overall rating of 8.5 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and Ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of live chat, and phone lines | |

Swissquote Education

Our Expert findings show that Swissquote provides detailed and professionally prepared education materials with key elements, analysis, courses, webinars, and e-books. In addition, the Demo account is at your disposal together with powerful analytical, and technical analysis inbuilt into the platforms, together with news fed and price alerts.

- Swissquote Education ranked with an overall rating of 9 out of 10 based on our research. The company provides very good quality educational materials, and excellent research also cooperates with market-leading providers of data.

Swissquote Review Conclusion

Concluding the Swissquote review, we admit a company with strong establishment according to Switzerland’s strict financial laws, all necessary licenses, and sharp regulations in each global jurisdiction.

The traders who require a multi-asset solution the Swissquote bank is a good option, through access across a vast array of exchange-traded sides. The technical solution from the company is quite impressive too. In addition, any trader can benefit from the leading online-bank solutions, educational materials, worldwide supporting offices, and trustworthy offers.

Based on Our findings and Financial Expert Opinions Swissquote is Good for:

- Experienced traders

- Traders who prefer the MT4 and MT5 trading platforms

- Currency and CFD trading

- Variety of trading strategies

- Algorithmic and automated trading

- Supportive customer support

- Excellent educational and research materials

Share this article [addtoany url="https://55brokers.com/swissquote-review/" title="Swissquote"]

I had an account at SwissQuote and they blocked all my funds without any notice. I cant invest or withdraw my money now. Support just answered later said they forwarded it to the department and havent received any answer since then. They already cost me profits because I could not invest. The company is a scam. Do not trade here!