- What is Swissquote?

- Swissquote Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Swissquote Compared to Other Brokers

- Full Review of Broker Swissquote

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Swissquote?

Swissquote is a leading provider of online financial and trading services, offering access to over 400 Forex and CFD instruments, 30 cryptocurrencies, stocks, ETFs, funds, bonds, options, futures, and more.

The company started back in 1990 with the set-up of Marvel Communications SA, a business specializing in financial software and web applications. Further on, the business model became Swissquote through the launch of the first financial platform in 1996, which offered free access to private investors’ real-time prices for all securities traded on the Swiss stock exchange and with the mission to democratize banking.

Swissquote Group Holding Ltd is listed on the SIX Swiss Exchange and has its headquarters in Gland (VD) with offices in Zürich, Bern, Dubai, Malta, Hong Kong, and London.

Swissquote Pros and Cons

Swissquote is a multiply regulated broker with global recognition and audit providing quality conditions. There is a range of top platforms offered by Swissquote including MT4 and MT5 with no restrictions on strategies, costs are low and learning materials are great for beginning traders. Funding methods are widely offered, and traders can benefit from online banking via Swissquote Bank.

For the Cons, conditions are different in each jurisdiction, also spreads might be higher for some instruments like Currency pairs.

| Advantages | Disadvantages |

|---|

| Heavily regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| Globally recognized and awarded broker | |

| MT4, MT5, and proprietary Swiss DOTS trading platforms | |

| Worldwide coverage | |

| Popular trading products | |

| Competitive trading conditions | |

| Good quality educational materials, and excellent research | |

| Quality customer support | |

Swissquote Features

Swissquote is a leading Swiss online bank, offering a range of financial services, including Currency and CFD trading, stock investments, cryptocurrencies, and robo-advisory solutions. It is regulated by top-tier authorities like FINMA, ensuring a high level of security and transparency. Below is a comprehensive list of key features Swissquote provides:

Swissquote Features in 10 Points

| 🏢 Regulation | FINMA, FCA, CySEC, MFSA, DFSA, SFC |

| 🗺️ Account Types | Standard, Premium, Prime, Professional |

| 🖥 Trading Platforms | MT4, MT5, Swiss DOTS, TradingView |

| 📉 Trading Instruments | Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Forex, Commodities, Bonds and Cryptocurrencies |

| 💳 Minimum Deposit | $1,000 |

| 💰 Average EUR/USD Spread | 1.7 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP |

| 📚 Trading Education | YouTube Channel, Blog, Podcasts, Courses, Webinars |

| ☎ Customer Support | 24/5 |

Who is Swissquote For?

Swissquote is ideal for traders looking for a secure and versatile environment. With a broad range of financial services, it caters to diverse financial goals. Its user-friendly platforms and educational resources make it accessible for novices, while advanced tools, competitive spreads, and professional account options appeal to seasoned traders and institutional investors. Based on our findings and Financial Expert opinions Swissquote is Good for:

- Experienced traders

- Traders who prefer the MT4 and MT5 platforms

- Currency and CFD trading

- Variety of strategies

- Algorithmic and automated trading

- Supportive customer support

- Excellent educational and research materials

Swissquote Summary

Overall, we admit a company with a strong establishment according to Switzerland’s strict financial laws, all necessary licenses, and sharp regulations in each global jurisdiction.

The traders who require a multi-asset solution the Swissquote bank is a good option, through access across a vast array of exchange-traded sides. The technical solution from the company is quite impressive too.

In addition, any trader can benefit from the leading online bank solutions, educational materials, worldwide supporting offices, and trustworthy offers.

55Brokers Professional Insights

Swissquote stands out as a broker due to its strong regulatory framework, being licensed by FINMA in Switzerland and other top-tier authorities globally, which ensures a high level of trust and security for traders, in fact only very few Brokers operate under this license as its very hard to get.

Besides, the conditions are quite good too, as one of its key strengths is the comprehensive range of instruments Broker offers, all accessible through advanced platforms like MetaTrader 4/5 and its proprietary Swissquote platform. What truly differentiates Swissquote is its integration of traditional banking services with cutting-edge solutions, allowing clients to manage both investments and banking needs in one place, making it good choice for either investors or traders. Also, traders of larger size is one of greatest options for many financial optimization reasons covered.

Additionally, the broker provides in-depth market research, real-time data, and robust educational resources, making it a preferred choice for professional traders seeking a well-rounded and secure trading environment.

Consider Trading with Swissquote If:

| Swissquote is an excellent Broker for: | - Need a well-regulated broker.

- UK and European traders.

- Quality educational and research materials.

- Secure environment.

- Offering popular instruments.

- Providing competitive conditions.

- Offering services worldwide.

- Professional traders and institutions.

- Who prefer higher leverage up to 1:400.

- Providing robust platforms.

- Access to Robo-Advisor.

- Offering Copy Trading.

- Access to PAMM, LAMM and MAM systems.

- Providing diverse strategies.

- Access to third-party VPS providers.

|

Avoid Trading with Swissquote If:

| Swissquote might not be the best for: | - Beginner traders.

- Looking for cTrader platform.

- Who prefer 24/7 customer service.

|

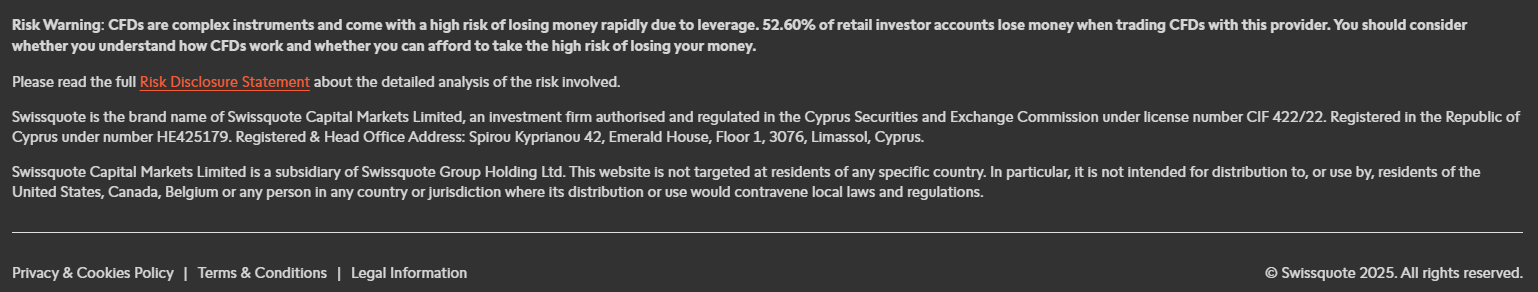

Regulation and Security Measures

Score – 4.7/5

Swissquote Regulatory Overview

Swissquote operates under a robust regulatory framework, ensuring high trust and security for its clients. The broker is primarily regulated by the Swiss FINMA, reflecting its strong Swiss banking roots and commitment to stringent financial standards.

In addition to FINMA, Swissquote is authorized by several other top-tier regulatory bodies, including the FCA in the UK, the Cyprus CySEC, and the Malta MFSA, which provide oversight for its European operations.

The broker also holds licenses from the Dubai Financial Services Authority (DFSA), catering to clients in the Middle East, and the SFC in Hong Kong, ensuring compliance in Asia. This extensive global regulation highlights Swissquote’s dedication to transparency, client protection, and adherence to international financial standards, making it a trusted choice for traders worldwide.

How Safe is Trading with Swissquote?

Trading with Swissquote is considered highly safe due to its strong regulatory backing and commitment to transparency. As a licensed Swiss bank, it enforces strict financial standards and client protection measures.

Additionally, Swissquote is overseen by other reputable authorities, ensuring global compliance and security. Client funds are held in segregated accounts, separate from the company’s operational funds, providing an added layer of protection.

The broker also offers deposit protection up to CHF 100,000 under Swiss banking laws. Combined with its transparent fee structure, advanced encryption technology, and strong financial stability, Swissquote provides a secure and reliable environment for both individual and institutional investors.

Consistency and Clarity

Swissquote has built a strong reputation in the financial industry as a reliable and transparent broker, reflected in consistently high ratings and positive reviews from both professional analysts and traders. The broker is praised for its robust regulatory framework, diverse range of instruments, and user-friendly platforms.

Many traders highlight Swissquote’s excellent research tools, strong customer support, and seamless integration of banking and trading services as key advantages. However, some users note that its spreads can be higher compared to other brokers, and the absence of certain features like proprietary VPS services may be a drawback for advanced traders.

Established in 1996, Swissquote has grown into a globally recognized brand, earning numerous awards for innovation and excellence in online banking and trading. The broker is also actively involved in social and sponsorship activities, including partnerships with prestigious sports teams like Manchester United and events in the fintech space, further solidifying its positive image within the global financial community.

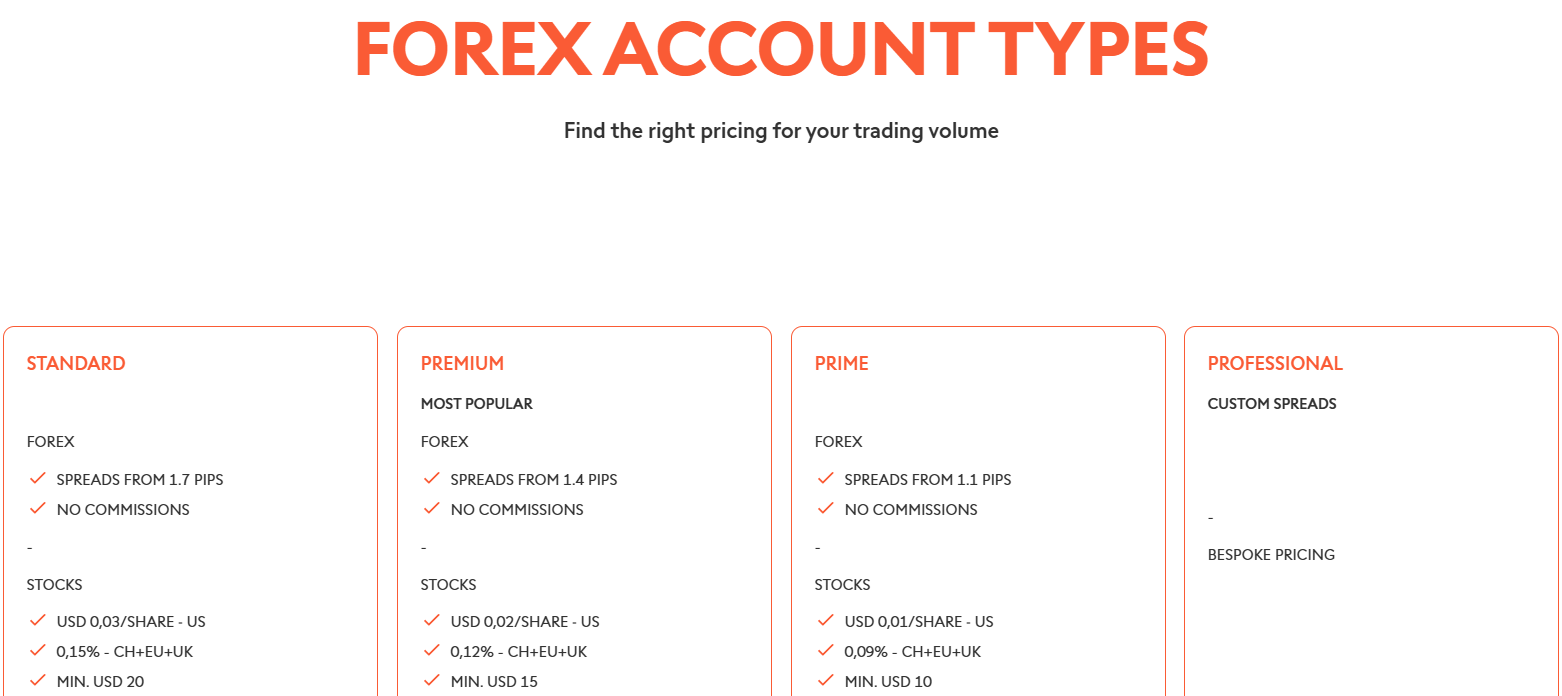

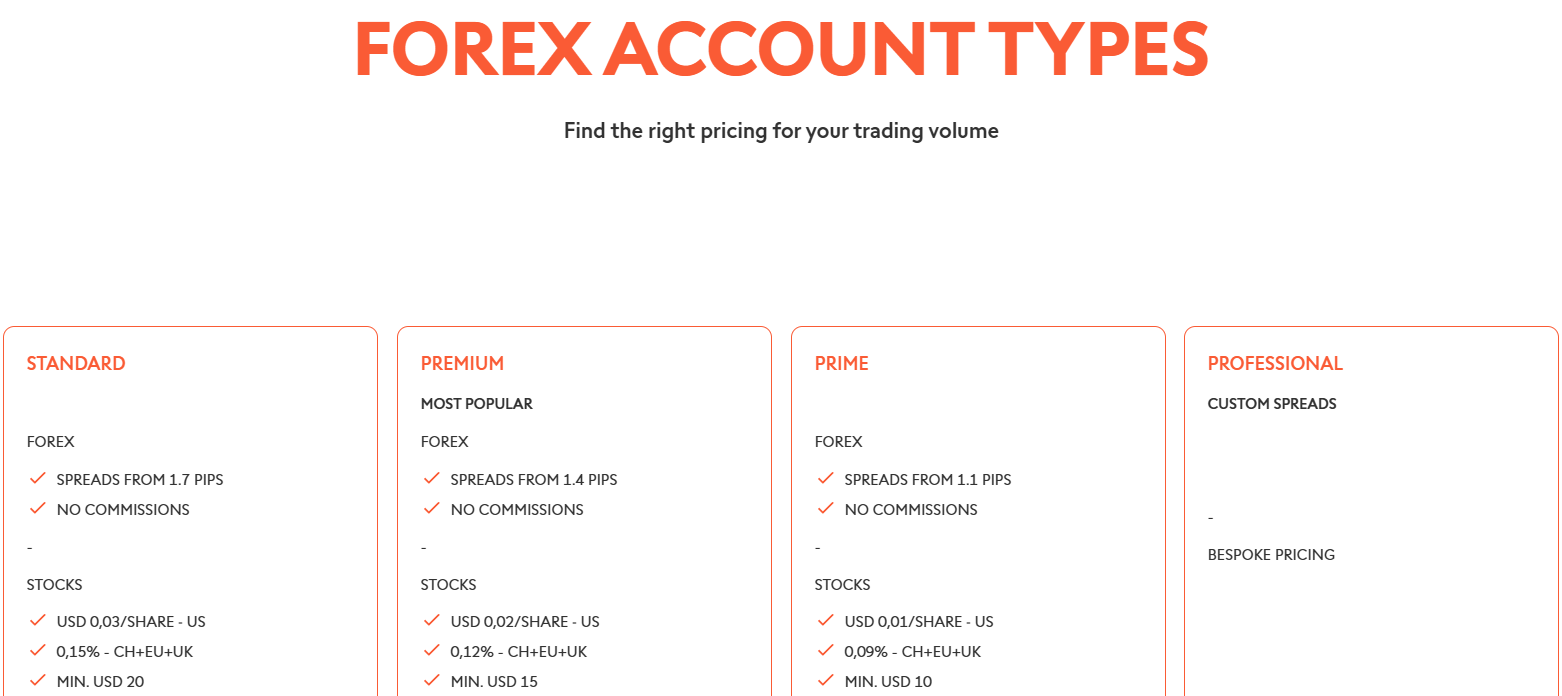

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Swissquote?

Swissquote offers a variety of account types to cater to traders of all experience levels and preferences, including Standard, Premium, Prime, and Professional accounts. These diverse account options, combined with access to industry-known platforms like MetaTrader 4/5 and Swissquote’s proprietary platform, ensure a comprehensive and flexible experience for all types of traders.

The broker also accommodates traders following Islamic principles with Swap-Free Accounts, which eliminate overnight interest charges in compliance with Sharia law. For those looking to practice financial strategies without financial risk, Demo Accounts are available, offering a simulated environment with real-time market data.

Standard Account

The Standard Account is designed for beginner traders, offering a straightforward and accessible entry into the world of trading. While the minimum deposit of $1,000 is not considered low, it provides access to Swissquote’s advanced platforms, along with educational resources and customer support to help new traders grow their skills.

The account offers access to a wide range of markets, with spreads starting from 1.7 pips.

Premium Account

The Premium Account is designed for more experienced traders who seek tighter spreads and greater flexibility. With spreads starting from 1.4 pips, this account type offers better conditions compared to the Standard Account.

It requires a minimum deposit of $10,000, which helps ensure access to professional-grade features, including higher leverage and advanced research tools. Premium Account holders also benefit from exclusive customer support and enhanced capabilities across Swissquote’s platforms, making it a great option for active traders looking for more competitive conditions.

Prime Account

The Prime Account is suited for high-volume traders and those who demand the best possible conditions. With spreads starting from 1.1 pips and a minimum deposit requirement of $50,000, this account type offers even more favorable terms.

It is designed for clients who engage in frequent, larger trades, providing them with low-cost entry and exit points. Prime Account holders also enjoy access to Swissquote’s proprietary platform and MetaTrader 4/5, along with additional features like premium customer support, real-time market data, and comprehensive risk management tools.

Professional Account

The Professional Account is tailored for institutional clients and seasoned traders who require raw spreads starting from 0 pips, with a commission of €2.50 per lot under the European entity. This account type is ideal for large-scale operations or those who need highly flexible and customizable conditions.

With a Professional Account, traders can access advanced features such as commission-based pricing and tighter spreads, ideal for high-frequency or algorithmic strategies. Swissquote’s Professional Account also comes with personalized customer support, advanced reporting, and access to additional premium tools, ensuring a seamless experience for professionals.

Regions Where Swissquote is Restricted

Swissquote is a globally recognized broker, however, its services are restricted in certain regions due to regulatory and compliance requirements. The broker does not provide services to residents of the following countries:

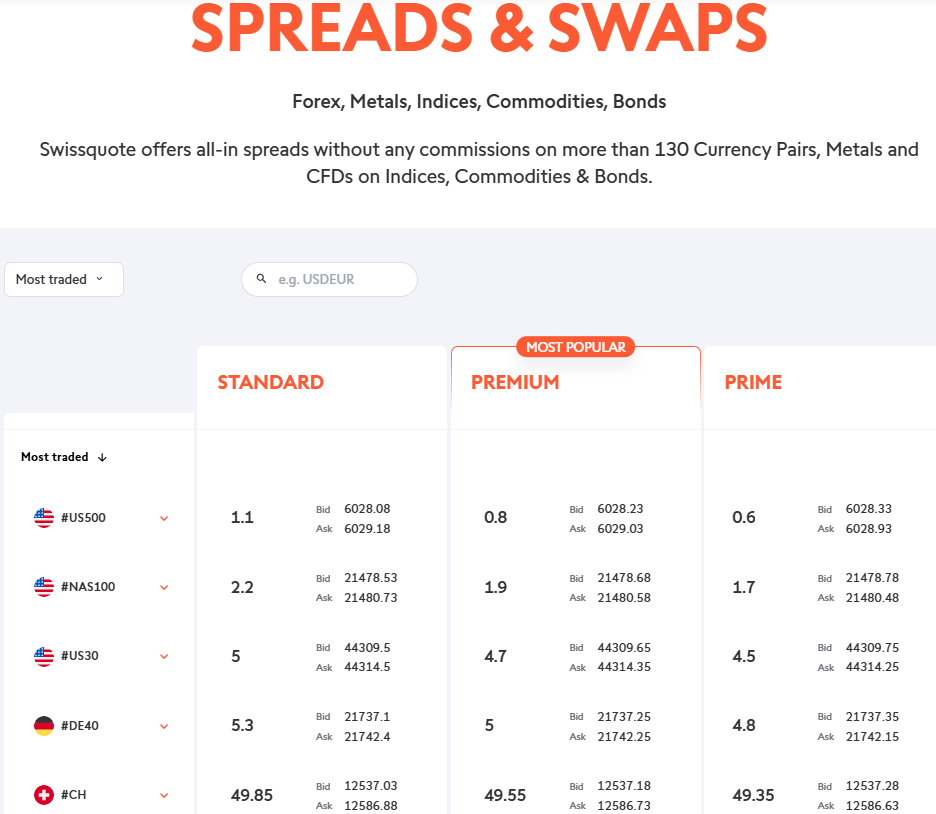

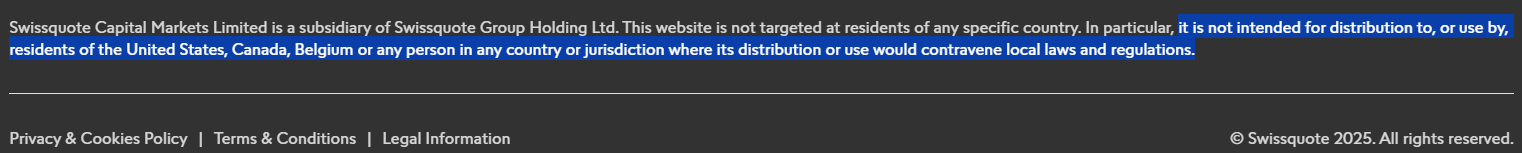

Cost Structure and Fees

Score – 4.4/5

Swissquote Brokerage Fees

Swissquote cost for all instruments is diverse according to the trading size and trader’s activity, while generally considered to be on a low spread level. Additional fees may apply for inactive accounts, currency conversions, or using premium services like VPS hosting.

In addition, the company does not charge fees for deposits, while for withdrawals third-party fees may apply up to $10. While Swissquote’s fees are transparent and aligned with industry standards, traders should review the fee structure for their specific account and trading needs.

Swissquote offers competitive spreads across its range of account types and instruments. For Forex, the average EUR/USD spread is 1.7 pips on the Standard Account, making it suitable for traders looking for reliable pricing with no hidden costs.

More experienced traders can benefit from tighter spreads with the Premium Account starting at 1.4 pips and the Prime Account offering spreads from 1.1 pips.

For professional and institutional traders, the Professional Account provides raw spreads starting from 0 pips. These flexible spread options make Swissquote a versatile choice for both beginner and advanced traders seeking cost-effective conditions.

Swissquote’s commission structure varies based on the account type and instruments. For Standard, Premium, and Prime Accounts, forex trading is commission-free, with costs incorporated into the spreads.

However, for Professional Accounts, traders benefit from raw spreads with a commission of €2.50 per lot under the European entity, catering to high-volume and institutional traders seeking transparent pricing.

For stocks, ETFs, and other securities, Swissquote charges a commission per transaction, typically starting at 0.10% of the trade value with minimum fees depending on the market. This flexible commission model ensures that traders can select an account that aligns with their trading style and cost preferences.

- Swissquote Rollover / Swaps

Swissquote applies rollover fees or swaps for positions held overnight in Forex and CFD trading. These fees are calculated based on the interest rate differential between the two currencies in a currency pair and can either be positive or negative, depending on the direction of the trade and market conditions.

The specific swap rates vary depending on the instrument and are updated regularly to reflect current market rates. Traders can view the applicable swap rates directly on the Swissquote platforms, such as MetaTrader 4/5. For clients seeking swap-free options, Swissquote offers Islamic Accounts that comply with Sharia law, eliminating interest-based fees while maintaining access to the same conditions.

- Swissquote Additional Fees

In addition to spreads, commissions, and rollover fees, Swissquote charges several additional fees that traders should be aware of. An inactivity fee of $10 per month is applied to accounts that remain dormant for over 6 months.

Currency conversion fees are charged at 0.95% when instruments in a currency different from the account’s base currency. Traders using advanced tools like VPS hosting for algorithmic trading may incur extra charges, with fees varying based on the provider and package selected.

Additionally, withdrawal fees apply, typically $10 per transaction for international wire transfers.

How Competitive Are Swissquote Fees?

Swissquote’s fees are generally competitive within the industry, particularly when considering the broker’s reputation, regulatory framework, and comprehensive range of services. While its spreads and commissions may not be the lowest compared to some discount brokers, they are justified by the high level of security, advanced platforms, and access to a broad range of markets.

The broker’s transparent fee structure, combined with its strong regulatory backing and banking license, ensures that traders receive value through reliability and quality service. For professional and institutional traders, Swissquote offers attractive pricing with raw spreads and low commissions, making it a strong choice for those prioritizing both cost and security.

| Asset/ Pair | Swissquote Spread | ICM Capital Spread | Dukascopy Spread |

|---|

| EUR USD Spread | 1.7 pips | 1.3 pips | 0.28 pips |

| Crude Oil WTI Spread | 5 | 4 | 4.41 |

| Gold Spread | 28.6 | $0.35 | 52.60 |

| BTC USD Spread | 101 | 20 Cents | 77.73 |

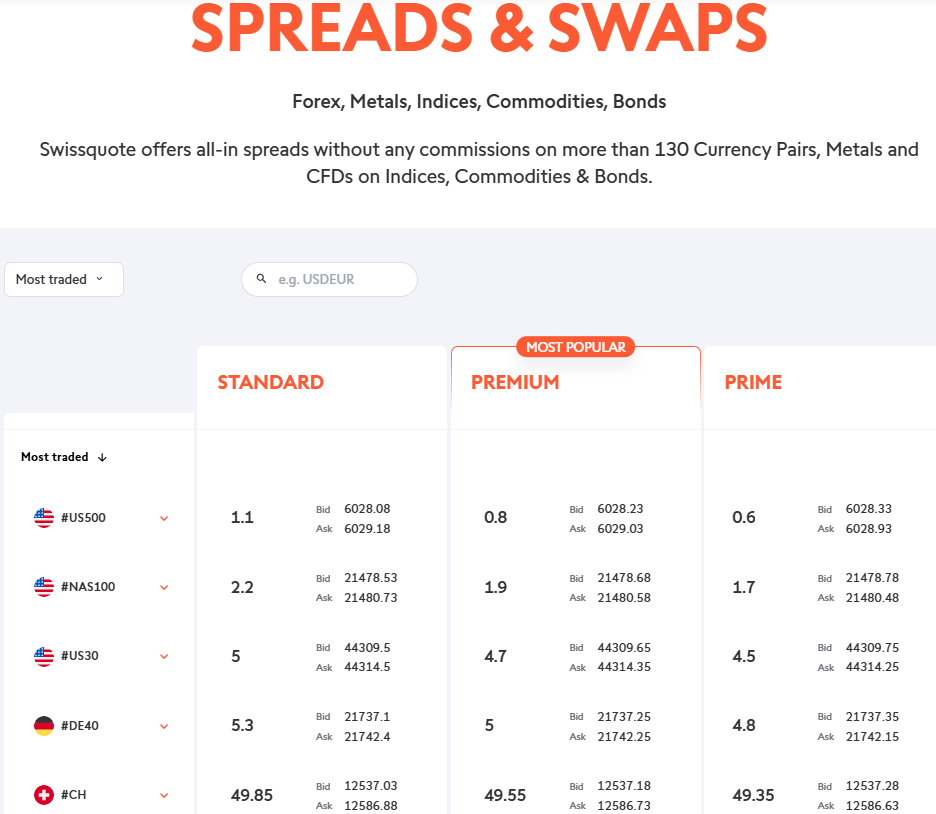

Trading Platforms and Tools

Score – 4.6/5

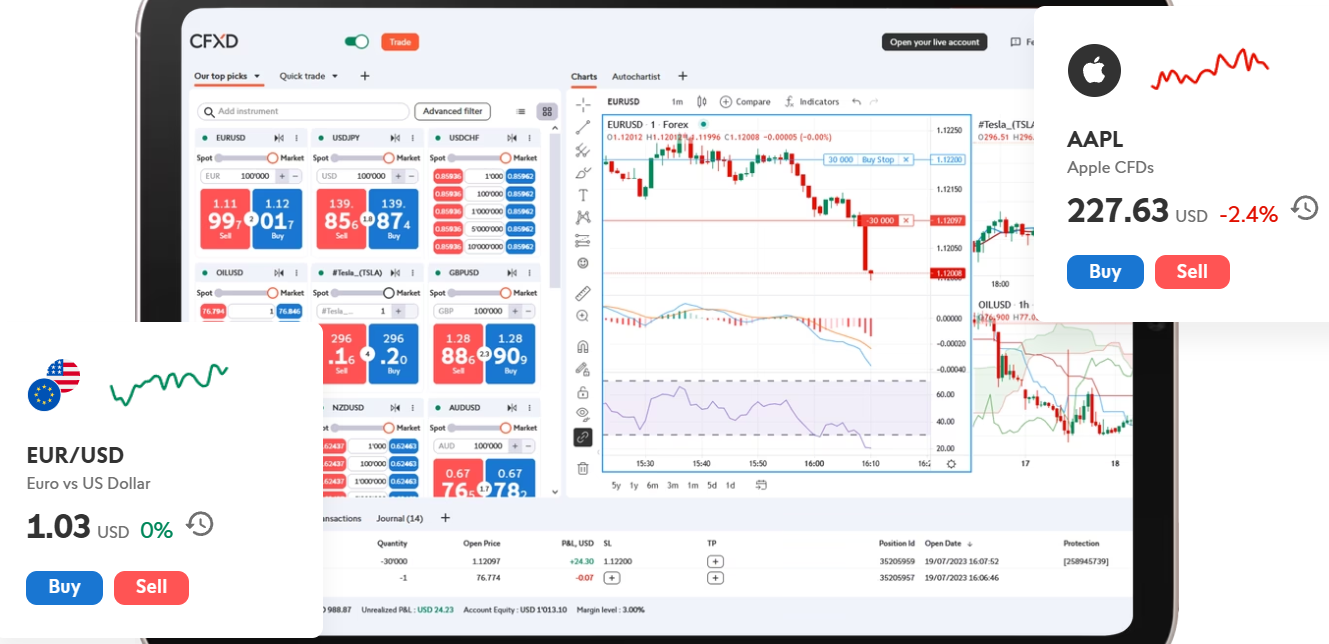

Swissquote offers a robust selection of platforms and tools designed to meet the needs of traders at all levels. Clients can access the popular MetaTrader 4 and MetaTrader 5 platforms, known for their advanced charting tools, automated trading capabilities, and customizable indicators.

In addition to these industry-standard platforms, Swissquote provides its proprietary Swiss DOTS platform, offering direct access to over 90,000 derivative products, including leveraged products and structured products.

For traders seeking a more social and visual financial experience, Swissquote integrates with TradingView, allowing users to leverage its powerful charting tools and community-driven insights. This diverse range of platforms ensures that traders have access to cutting-edge tools tailored to their specific trading styles and strategies, with an average execution speed of 9 ms combined with a 98% fill ratio.

Trading Platform Comparison to Other Brokers:

| Platforms | Swissquote Platforms | ICM Capital Platforms | Dukascopy Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Swissquote Web Platform

The Swiss DOTS platform is Swissquote’s powerful web-based solution, offering direct access to a wide range of financial instruments, including over 90,000 derivative products. It is designed to cater to traders who seek real-time pricing, fast execution, and advanced tools in an intuitive online environment.

Swiss DOTS allows users to trade equities, CFDs, options, futures, and structured products seamlessly, with a focus on providing a high level of flexibility and control. Additionally, the platform offers features like customizable watchlists, advanced charting tools, and integrated order types, empowering traders to make informed decisions on the go.

Main Insights from Testing

Testing Swiss DOTS reveals a user-friendly interface with a strong focus on speed and reliability. The platform offers smooth navigation and quick execution, making it suitable for traders who need real-time data and fast decision-making tools.

Its customizable layout enhances the experience, allowing users to tailor the workspace to their preferences. Additionally, Swiss DOTS provides a seamless integration of diverse instruments, ensuring flexibility for various strategies. Overall, the platform delivers a solid performance with an emphasis on efficient trade execution and ease of use.

Swissquote Desktop MetaTrader 4 Platform

The MT4 platform offers a highly customizable experience, allowing you to choose from 30 built-in indicators, as well as access to over 2,000 free custom indicators and more than 700 paid ones.

The platform also includes 24 analytical objects, such as lines, channels, Gann and Fibonacci tools, shapes, and arrows, which allow for precise technical analysis. Traders can customize charts with 9 different timeframes and easily combine indicators and graphical objects on various periods of a single symbol, providing a flexible environment to develop and execute trading strategies.

Swissquote Desktop MetaTrader 5 Platform

The MT5 platform offers a comprehensive suite of tools for advanced traders seeking flexibility and precision. It allows users to create custom indicators or choose from 80 built-in indicators, with thousands more available from the Market and Code Base.

The platform provides 44 analytical objects, including Gann, Fibonacci, and Elliott tools, geometric shapes, various channels, and more, giving traders extensive options for market analysis. With 21 timeframes and highly customizable charts, traders can fine-tune the calculation parameters and appearance of indicators and graphical objects to suit their strategies.

Swissquote MobileTrader App

Moreover, the free applications are designed for any device, including iPhone, Android, Smartwatch, and even Apple TV, offering sophisticated technological solutions. Various tools can be connected to the platform, exclusively available to Swiss clients, allowing them to trade with a virtual reality headset or through MacOS screensavers, TV, and more.

Trading Instruments

Score – 4.5/5

What Can You Trade on Swissquote’s Platform?

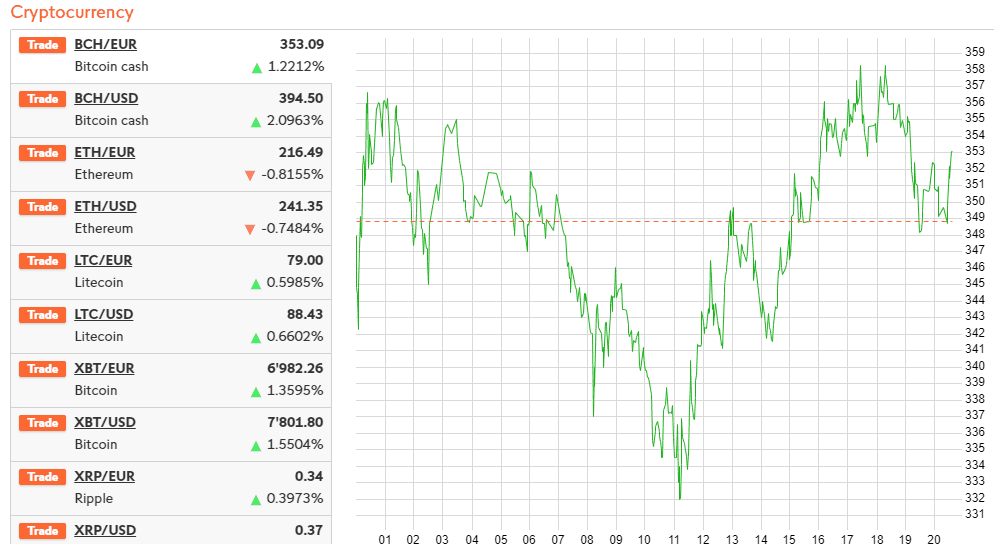

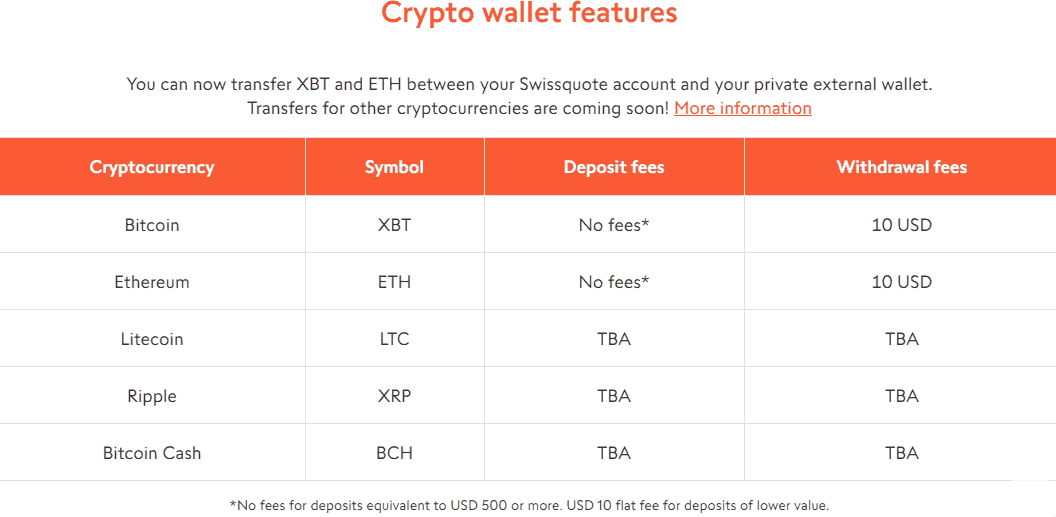

Swissquote offers access to over 400 Forex and CFDs, 30 Cryptocurrencies, Shares, Warrants and Derivatives, Options and Futures, Funds, ETFs, Indices, Commodities, Bonds, and more.

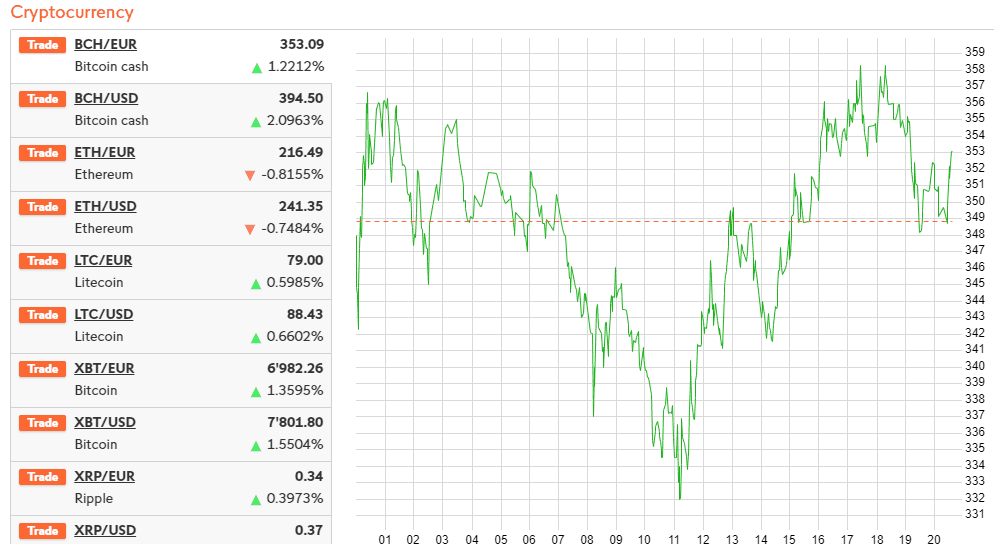

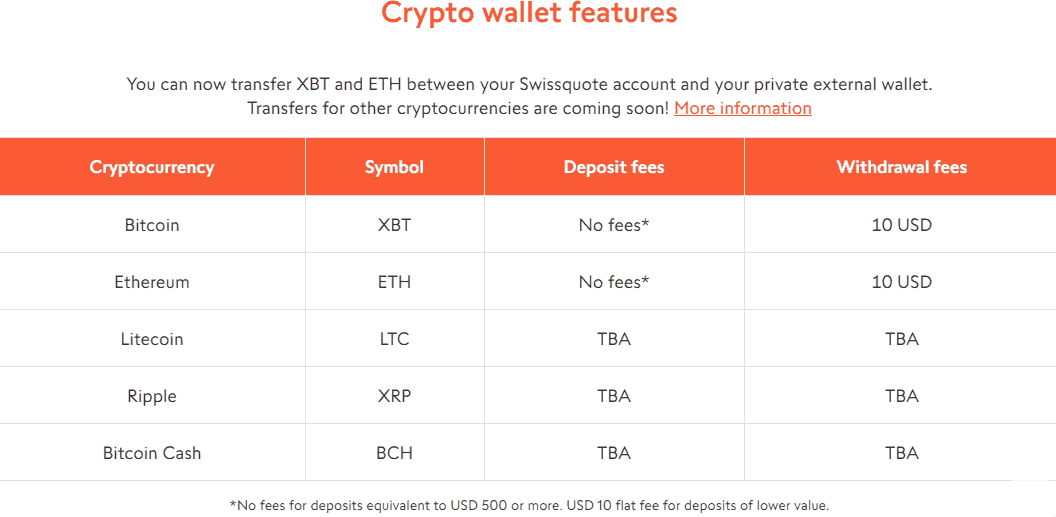

The attractive rates presented for Funds, ETFs, and Swiss DOTS start from 9 pips, Options, and Futures from 1.5 CHF. While, the cryptocurrency trade has quickly established itself as a leader that brings an infinite opportunity to trade through 5 available instruments Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash.

Main Insights from Exploring Swissquote’s Tradable Assets

Exploring Swissquote’s instruments reveals a diverse and comprehensive selection that caters to a range of strategies. One key advantage is the broker’s access to both traditional and alternative asset classes, including over 90,000 derivative products.

However, some niche instruments may come with higher spreads or limited liquidity, which could be a consideration for traders focused on specific markets. Overall, Swissquote offers a well-rounded range of assets that suit both beginners and seasoned traders.

Leverage Options at Swissquote

Swissquote’s Standard Leverage level is 1:100. Based on our research, the regulation particular entity falls under specific requirements, therefore the rates may change, as well as the level of trader professional or retail always affects the rate too.

- European and UK clients are entitled to use a maximum of 1:30 for major currency pairs and even lower for other instruments.

- Entities in Dubai and Hong Kong may be entitled to a higher 1:400.

Nevertheless, every trader should learn how to use the multiplier smartly, as high rates increase risk levels too, which may cause a loss of money.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at Swissquote

In terms of funding methods, Swissquote offers two payment methods to conveniently and securely fund your account:

Swissquote Minimum Deposit

Swissquote minimum deposit is $1,000 for a Standard Forex account and goes higher according to the trader’s size, or the account you may use.

Withdrawal Options at Swissquote

Swissquote withdrawals are processed through unique Swissquote eBanking services that allow traders to add or withdraw funds and manage accounts simply and conveniently. Being a Swiss bank you can issue your very own Swissquote Card with all the benefits to pay and withdraw right from the cash machine.

However, withdrawal fees may apply, with wire transfers typically incurring a fee of around $10 per transaction. Additionally, fees may vary depending on the withdrawal method, such as using the Swissquote Card or third-party payment systems. Always check the specific terms for the most accurate fee structure.

Customer Support and Responsiveness

Score – 4.5/5

Testing Swissquote’s Customer Support

Another good point in our Swissquote review goes to qualified customer support available 24/5 through Live chat, Phone lines, and Emails. Customer service is defined by the region with available hours and hotlines as well, which is a quite well-organized structure allowing traders to stay always in touch.

Contacts Swissquote

Swissquote offers a variety of contact options for customers seeking assistance. The Customer Care Center can be reached at +41 44 825 88 88 for general inquiries. Private clients and partners can contact the dedicated team at +41 44 825 87 77 or via email at fx@swissquote.com for support tailored to their needs.

For matters related to currency trading, the Forex Dealing Desk is available at +41 22 999 94 76. These contact options ensure that Swissquote clients can quickly and easily get the help they need.

Research and Education

Score – 4.7/5

Research Tools Swissquote

Swissquote offers a comprehensive suite of research tools to help traders make informed decisions.

- On the website, clients have access to market analysis, economic calendars, news updates, and market reports that provide insights into global financial markets.

- Additionally, the broker integrates advanced tools on its platforms, including the FIX API for seamless integration with third-party applications, offering high-speed data transmission and order execution for professional traders.

- Autochartist is another powerful tool available, providing automated technical analysis with pattern recognition and volatility analysis.

- For those looking for more tailored guidance, Robo-Advisor helps traders create and manage portfolios based on their risk preferences and goals.

These tools, combined with advanced charting options on platforms like MetaTrader 4/5 and Swiss DOTS, make Swissquote a versatile choice for traders seeking comprehensive research and analytical support.

Education

Swissquote offers a wealth of educational resources to support traders at all levels.

- The YouTube channel provides a variety of video content, including tutorials, market analysis, and expert insights.

- The Swissquote blog features articles on market trends, strategies, and financial news, ensuring traders stay updated.

- Additionally, Swissquote offers podcasts where traders can listen to interviews and discussions on key financial topics.

- For those seeking more structured learning, the broker provides courses that cover fundamental and technical analysis, as well as webinars hosted by industry experts, offering real-time learning opportunities.

- Traders can also access a range of e-books that delve into various aspects of trading, from beginner basics to advanced strategies.

These resources make Swissquote an excellent choice for traders seeking to expand their knowledge and improve their skills.

Portfolio and Investment Opportunities

Score – 4.4/5

Investment Options Swissquote

While Swissquote is primarily focused on Currency trading, it also offers a range of investment options to meet the needs of various traders and investors.

Beyond Forex, clients can invest in stocks, ETFs, commodities, cryptocurrencies, and bonds, providing a diversified range of assets to build a balanced portfolio. For those looking for more hands-off investment strategies, Swissquote offers copy trading, allowing traders to replicate the strategies of successful investors.

Additionally, the broker provides MAM/PAMM accounts, which allow investors to combine their funds and benefit from professional money management.

Account Opening

Score – 4.5/5

How to Open Swissquote Demo Account?

Opening a Swissquote demo account is a simple process. To get started, visit the Swissquote website and navigate to the account registration section. Once there, select the demo account option, where you will be asked to provide basic personal information, such as your name, email, and country of residence.

After submitting the details, you will receive login credentials, which grant you access to the demo platform. This account allows you to practice trading with virtual funds, allowing you to explore the environment, test strategies, and get familiar with the broker’s platforms, including MetaTrader 4/5 or Swiss DOTS, without any financial risk. The demo account is a great way to gain hands-on experience before opening a live account.

How to Open Swissquote Live Account?

Opening an account with Swissquote is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit

Additional Tools and Features

Score – 4.4/5

Swissquote offers several other valuable resources to enhance the experience.

- One of the standout features is the integration with TradingView, a powerful charting platform that provides advanced charting tools, real-time market data, and social trading features. Traders can analyze markets with various chart styles and timeframes, as well as collaborate with other traders through the platform’s social network.

- Trading Central is another essential tool available to Swissquote clients, offering in-depth market research, technical analysis, and trade ideas. With Trading Central, traders can access detailed reports and actionable insights to guide their financial decisions.

These additional tools, combined with the broker’s core offerings, make Swissquote a comprehensive platform for traders seeking advanced analysis and a more dynamic financial experience.

Swissquote Compared to Other Brokers

Swissquote stands out in several key aspects when compared to its competitors in the online brokerage industry. While it may not have the lowest spreads or minimum deposit requirement, Swissquote offers a robust and diverse range of platforms, including MT4, MT5, Swiss DOTS, and TradingView, catering to different trader preferences.

The broker’s comprehensive asset variety and global regulatory compliance through entities like FINMA, FCA, and CySEC enhance its reputation for trust and security. Compared to some competitors, Swissquote’s educational resources are highly regarded, providing traders with an excellent foundation.

Although competitors like CMC Markets and Dukascopy may offer lower spreads or lower minimum deposit requirements, Swissquote’s combination of features and extensive regulatory oversight makes it a strong contender in the industry, particularly for those seeking a more structured and secure environment.

| Parameter |

Swissquote |

Spreadex |

ICM Capital |

Dukascopy |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.7 pips |

Average 0.6 pips |

Average 1.3 pips |

Average 0.28 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + €2.50 |

For Stock CFDs Only (Commission of 0.15%, Maximum of 3.5 points) |

0.0 pips + $7 |

$5 per $1 million traded in MT4/MT5 Accounts |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, Swiss DOTS, TradingView |

Spreadex Web Platform, TradingView |

MT4, MT5, cTrader |

JForex, MT4, MT5, Binary Trader |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

400+ Forex and CFDs instruments |

10,000+ instruments |

1,000+ instruments |

1200+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA |

FCA, FSCA, FSC, FSA, ARIF, SCAB, QFC |

FINMA, FCMC, JFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Good |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$1,000 |

$0 |

$200 |

$100 |

$50 |

$0 |

$0 |

Full Review of Broker Swissquote

Swissquote is a reputable Swiss-based broker known for its strong regulatory compliance and a range of instruments, including Forex, stocks, ETFs, commodities, and cryptocurrencies. The broker offers a variety of account types, catering to both beginner and professional traders, with access to advanced platforms like MT4, MT5, and Swiss DOTS.

Traders benefit from competitive conditions and a range of research tools, such as TradingView, Autochartist, Robo-Advisor, and Trading Central. Swissquote also provides educational resources like webinars, e-books, and a YouTube channel to help traders enhance their skills.

With robust customer support and secure payment options, Swissquote is a solid choice for those looking for a reliable, well-regulated environment.

Share this article [addtoany url="https://55brokers.com/swissquote-review/" title="Swissquote"]

I had an account at SwissQuote and they blocked all my funds without any notice. I cant invest or withdraw my money now. Support just answered later said they forwarded it to the department and havent received any answer since then. They already cost me profits because I could not invest. The company is a scam. Do not trade here!