- What is StarTrader?

- StarTrader Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

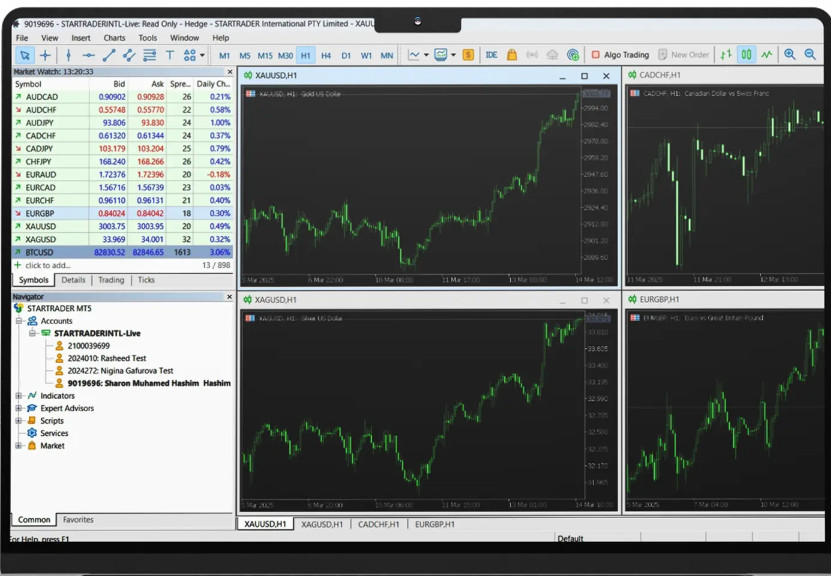

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- StarTrader Compared to Other Brokers

- Full Review of Broker StarTrader

Overall Rating 4.3

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is StarTrader?

StarTrader is a Forex company, offering access to a range of popular instruments such as Forex, CFDs, commodities, indices, shares, and metals.

Based on our research, the broker is currently under the authorization and regulation of the top-tier FCA in the UK, the Financial Sector Conduct Authority (FSCA) in South Africa, the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA), and the Financial Services Authority (FSA) in Seychelles.

In general, StarTrader is a good Forex broker providing competitive opportunities and popular market assets through the widely used MetaTrader platforms. The broker also offers Copy trading, PAMM accounts, and other features and opportunities for profitable trading.

StarTrader Pros and Cons

Per our findings, StarTrader has many advantages and some disadvantages important to consider. On the positive side, StarTrader offers competitive solutions, a low minimum deposit requirement, and access to the popular MT4 and MT5 trading platforms. The firm also provides a variety of funding methods and good trading tools. Also, StarTrader offers over 1,000 tradable products across a good range of financial assets.

For the cons, there is no 24/7 customer support available. Additionally, StarTrader is regulated under several entities, and the conditions can vary based on the jurisdiction.

| Advantages | Disadvantages |

|---|

| Competitive spreads and fees | No 24/7 customer support |

| MT4 and MT5 | Limited trading instruments |

| Good trading conditions | Offshore licenses |

| Low minimum deposit | |

| Professional trading | |

| Funding methods | |

StarTrader Features

StarTrader is a broker with good standing, with tight regulations and adherence to strict rules and laws. The broker offers access to a good range of instruments through the popular MT4 and MT5 platforms. Overall, StarTrader has a favorable offering, and we have researched different aspects of trading with the broker and come up with a list of the main points for a quick look.

StarTrader Features in 10 Points

| 🗺️ Regulation | FCA, SVG FSA, FSA |

| 🗺️ Account Types | Standard and ECN accounts |

| 🖥 Trading Platforms | MT4, MT5, Web Trader, App |

| 📉 Trading Instruments | Forex, CFDs, Commodities, Indices, Shares, Metals, ETFs |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/6 |

Who is StarTrader For?

StarTrader comes up with a good proposal package to meet the different expectations and needs of its clients. The broker aspires to develop and enhance its offering constantly, and is good for the following:

- International traders

- Traders who prefer MT4 and MT5 platforms

- Currency trading

- Beginners

- Advanced traders

- STP/NDD execution

- Competitive fees and spreads

- EA/Auto trading

- Good trading tools

StarTrader Summary

StarTrader is a regulated brokerage firm that offers competitive trading conditions, access to a range of financial instruments, and advanced trading platforms. The broker provides favorable pricing, along with tight spreads for various trading activities. Another plus is the low minimum deposit requirement and the availability of different payment methods.

All in all, StarTrader provides a reliable trading environment suitable for traders at different skill levels. However, we advise traders to conduct their own research and evaluate whether the broker’s offerings suit their specific trading requirements. Besides, clients should consider the regulatory environment and potential variations across jurisdictions.

55Brokers Professional Insights

StarTrader is a good choice for international trades, since broker operating through multiple entities, and since there is a top-tier license from the FCA, the proposal reliable and safe. For the trading conditions, there are well-tailored account types, spread and commission-based fee structures, and popular and advanced platforms make StarTrader making them favorable for different clients. The availability of over 1,000 instruments across various financial assets great for portfolio diversification, while fees are trading executtion been steady and stable on our tests. We think Broker is good for scalpers and pattern traders alike, algo traders too due to ECN account.

Besides, the broker has a good educational section, with webinars, a Forex glossary, and a knowledge center. StarTradera also offers 24/6 multilingual support, providing quality assistance in more than 20 languages.

Consider Trading with StarTrader If:

| StarTrader is an excellent Broker for: | - Global traders

- Currency and CFD traders

- MetaTrader platform enthusiasts

- Cost conscious traders

- Clients preferring to trade via web platform

- Traders looking for high leverage opportunities

- Copy traders

- Beginner traders

- Advanced traders

- EA traders

- Clients who prioritize tight regulations and safety

|

Avoid Trading with StarTrader If:

| StarTrader is not the best for: | - Long-term investments

- Traders looking for platforms other than MT4/MT5

- Clients looking for 24/7 support

- Real Stock traders |

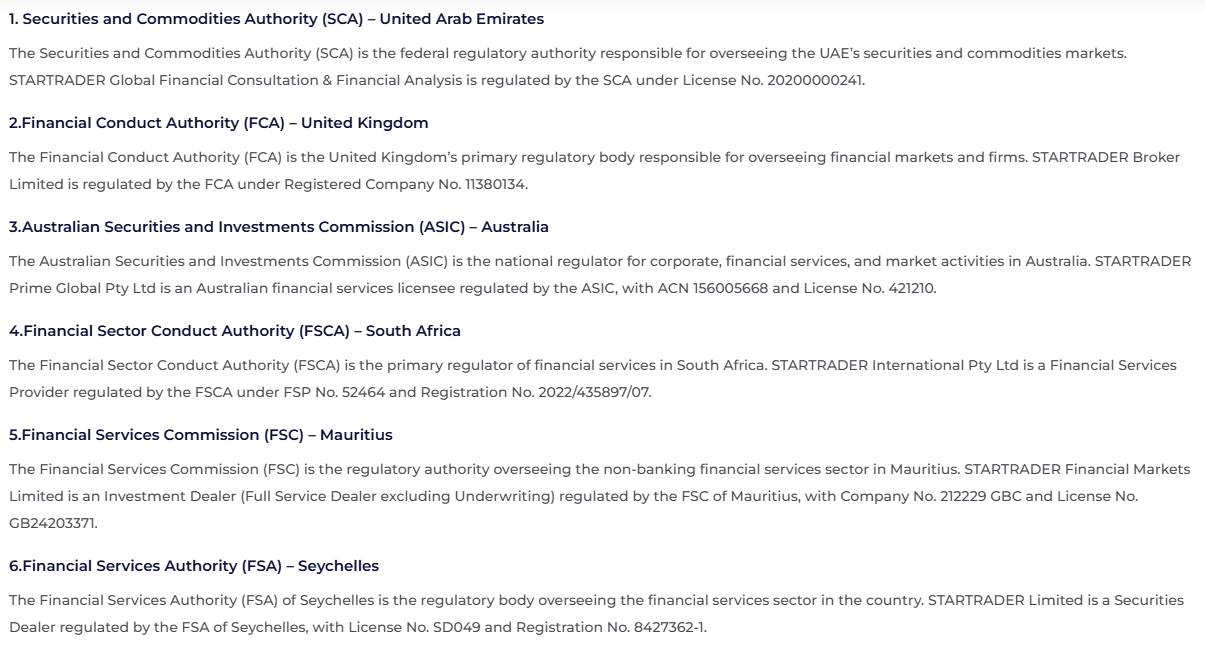

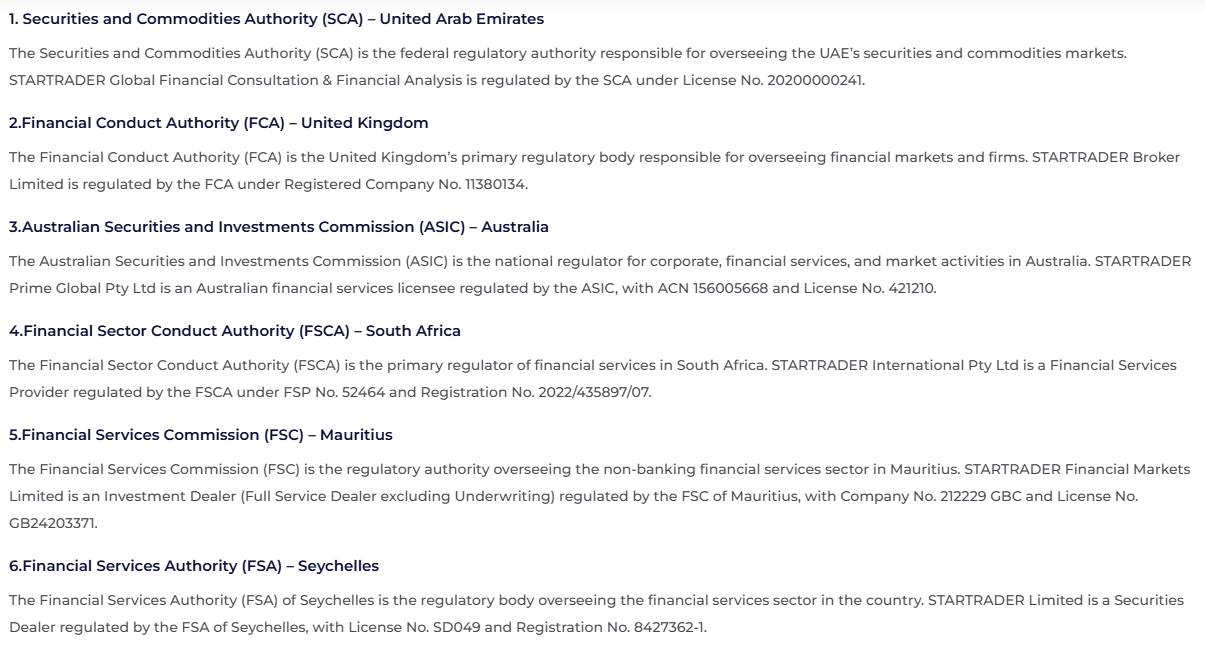

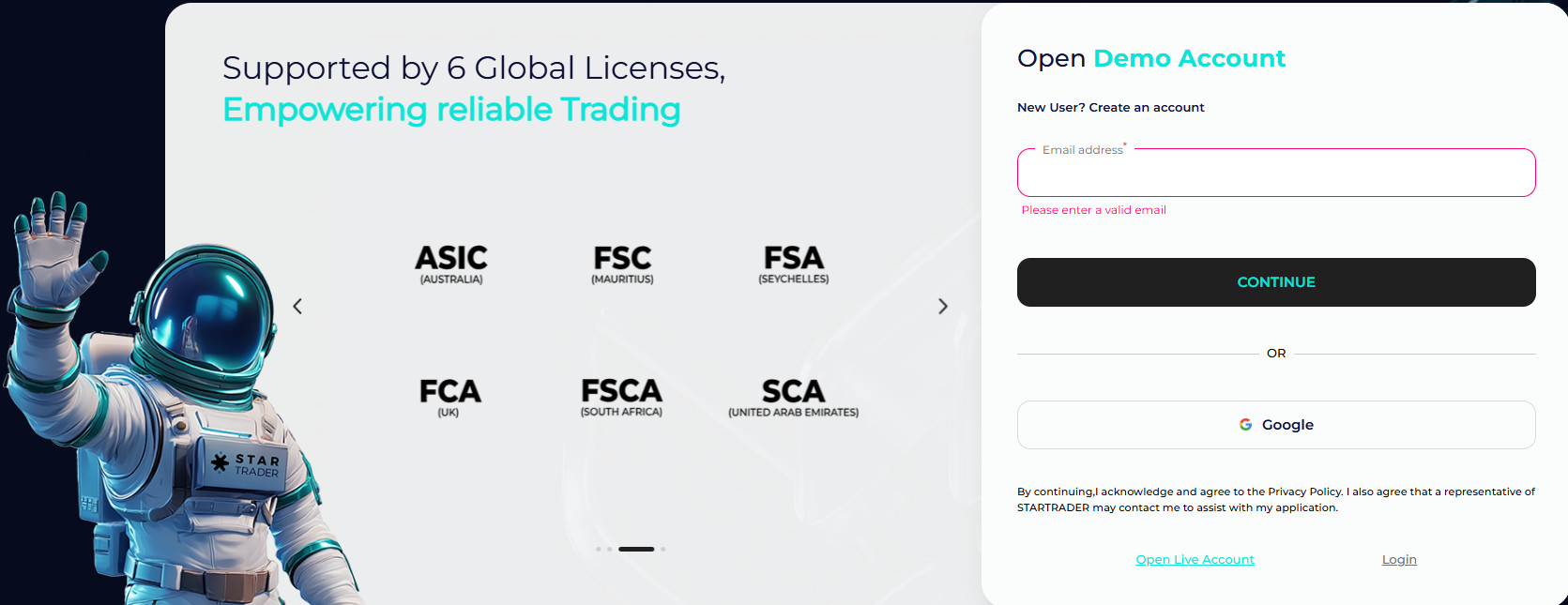

Regulation and Security Measures

Score – 4.6/5

StarTrader Regulatory Overview

StarTrader is a regulated brokerage that ensures a low-risk trading environment. The broker is tightly regulated by the top-tier FCA in the UK and ASIC in Australia. The licenses from these two reputable authorities ensure compliance with strict laws and rules and provide safety measures to clients and their funds.

- StarTrader is also authorized and regulated by SVG FSA in Saint Vincent and the Grenadines and the FSA in Seychelles, enabling global presence. However, we recommend considering the variations that can arise when trading in different jurisdictions before engaging in trading activities.

- The broker also holds a license from a reputable FSCA in South Africa, providing its services to African clients.

How Safe is Trading with StarTrader?

We found that StarTrader adheres to strict industry standards and compliance requirements, which include client fund protection and segregation from company funds. Additionally, the broker offers additional protections, such as negative balance protection, which ensures that clients do not incur losses exceeding their account balance.

However, we recommend carefully reviewing the broker’s documentation, legal agreements, and policies to fully understand the specific trading protections offered by StarTrader before engaging in trading activities.

Consistency and Clarity

StarTrader has been actively operating since 2013. It has since earned multiple reputable licenses, including FCA, ASIC, and FSCA, thus establishing itself as a reliable broker with strict adherence to stringent rules. The broker has always been consistent in its services, providing the best opportunities to its clients. It has constantly developed its proposal, expanding the instrument amount, tools, features, and overall trading conditions. As proof of its transparent and consistent practices, StarTrader has earned over 20 industry awards, being recognized for its excellent services in different aspects of trading.

We have also considered StarTrader’s customer feedback from clients sharing their own experiences. From positive reviews, traders point out the broker’s efficient and advanced platforms, its copy trading features, and dedicated customer service. From the negative feedback, traders indicate issues with accounts, customer support issues, and differences in regulation between the entities.

Overall, StarTrader stands out for its transparency, consistent growth, and recognition in the market.

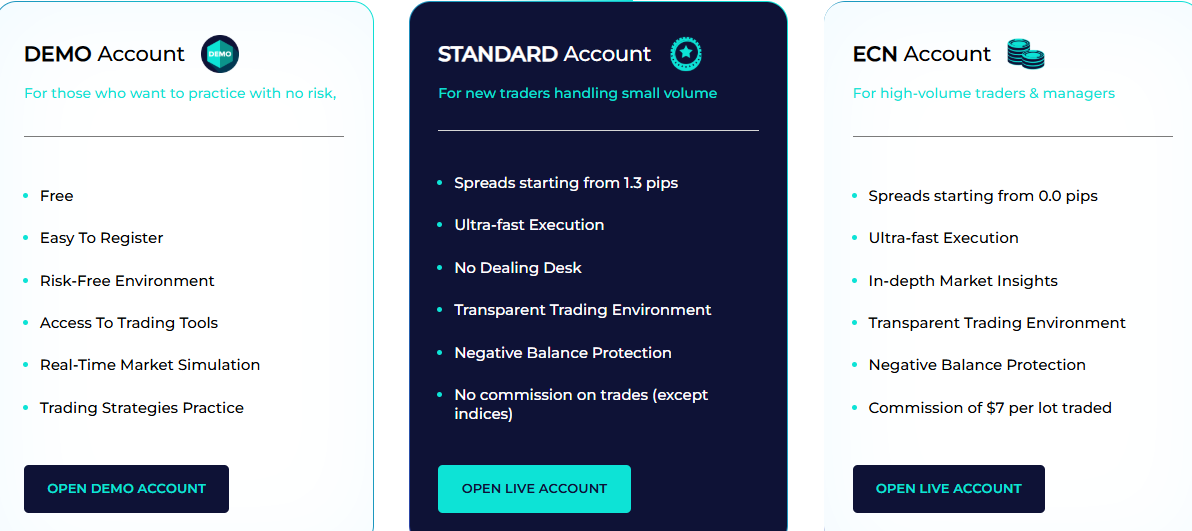

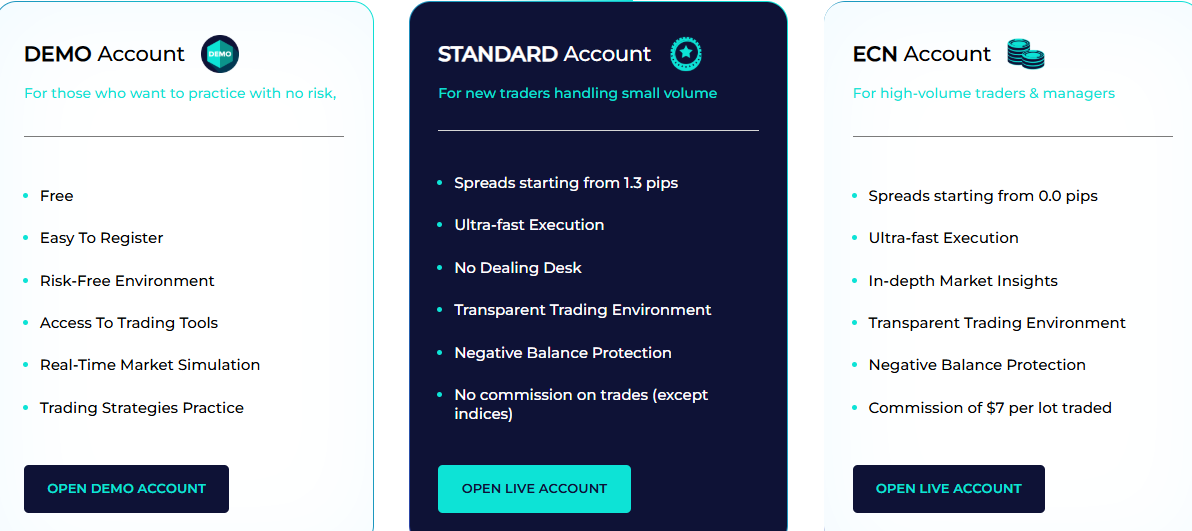

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with StarTrader?

Per our research, the broker offers Standard and ECN accounts that might suit the needs of different traders. The initial deposit required for all account types is $50. Both accounts provide access to a wide range of instruments, including over 50 currency pairs, 700+ stocks, over 10 commodities, and 20+ indices. The trades are conducted through the MT4/MT5 platforms, web trader, and mobile app. The account base currencies for both Standard and ECN accounts are AUD, CAD, EUR, GBP, USD, and NZD. The main difference between the account types is their fee structure – spread or commission-based, meeting the different needs of traders.

- The Standard account has a spread-based structure, with spreads starting from 1.3 pips. The account is tailored for beginners and small trading volumes.

- The ECN account is suitable for professionals, high-volume traders, and managers. The account is commission-based, with spreads starting from 0.0 pips.

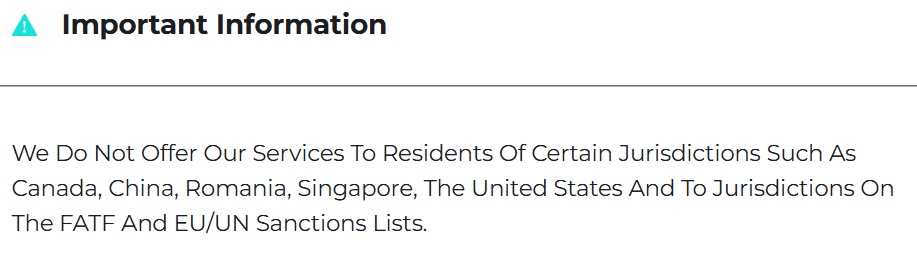

Regions Where StarTrader is Restricted

Based on our research, StarTrader offers its services globally. However, due to regulatory restrictions, the broker does not accept clients from a few countries. In addition to the list below, the broker does not accept clients from FATF blacklisted countries.

- Canada

- China

- The United States

- Romani

- Singapore

Cost Structure and Fees

Score – 4.4/5

StarTrader Brokerage Fees

According to our analysis, StarTrader offers favorable conditions, including competitive spreads and pricing for popular financial products. Spreads and commissions depend on the account type chosen and the instrument traded. Besides, as StarTrader operates under several jurisdictions, the trading conditions and charges may differ based on the entity. Thus, we recommend carefully reviewing the broker’s fee structure, terms, and conditions to understand the associated charges and their potential impact on trading operations.

StarTrader provides competitive and tight spreads, with an average spread of 1.3 pips for the EUR/USD currency pair in the Forex market. For its Standard account, the trading is spread-based, and all the charges are calculated as spreads. The only exception is indices that may be subject to commissions even for the Standard account.

Spreads can also vary based on market conditions, volatility, and liquidity, so consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

StarTrader applies commissions for its ECN account. The account is commission-based, with tight spreads from 0.0 pips and fixed commissions of $7 per lot traded. Commissions are also applied to indices for the Standard account.

How Competitive Are StarTrader Fees?

StarTrader offers competitive spreads and commissions, in line with the market average. The broker mostly discloses its spreads, commissions, and other applicable fees, but for specifications on each instrument, traders need to either contact the customer support team or sign in to enter the specification section. The charges also depend on the entity with which traders open an account. Thus, it is essential to consider all the applicable fees and trading conditions according to the jurisdiction.

Overall, StarTrader is transparent in its practices and has a cost-efficient offering that will be suitable even for the most cost-conscious traders. Also, clients should consider non-trading fees, which are common in trading and are added to the overall fees.

| Asset/ Pair | StarTrader Spread | Doo Prime Spread | XGLOBAL Markets Spread |

|---|

| EUR USD Spread | 1.3 pips | 1.1 pips | 1 pips |

| Crude Oil WTI Spread | 1 | 3 | 0.035 |

| Gold Spread | 1 | 1 | 0.20 |

StarTrader Additional Fees

In addition to the common spreads and commission, there are also a few additional fees traders should be aware of. While the broker does not charge for deposits and withdrawals, additional fees may be applicable during trading activities. Besides, there might be International Telegraphic Transfer fees, which are calculated at $20. There are also inactivity fees charged to the accounts that have been dormant for 90 days.

- Also, StarTrader charges swap fees for the positions held overnight. For specifications, traders should contact the broker’s customer support.

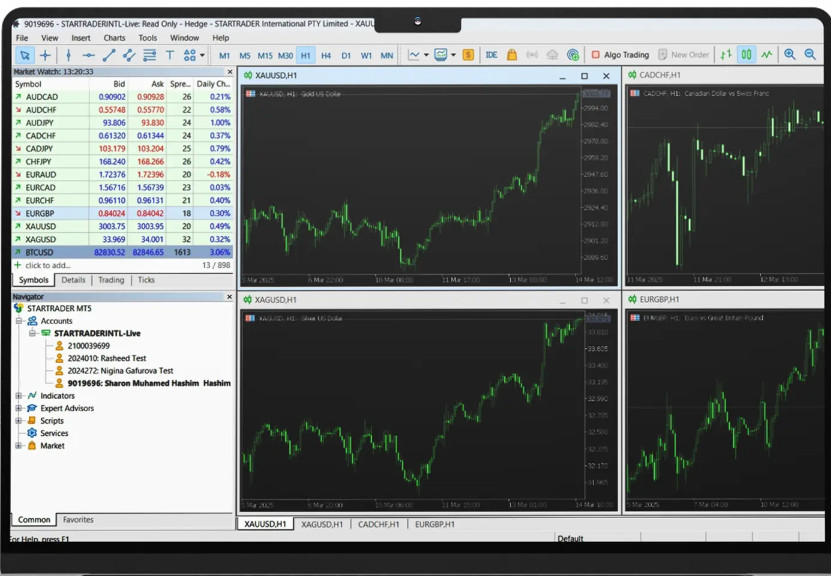

Score – 4.4/5

StarTrader provides traders with access to highly recognized and popular MetaTrader 4 and MetaTrader 5 platforms. The platforms offer a wide range of features, including technical indicators, trading analysis tools, intuitive interfaces, multiple execution options, and various order types, which are suitable for different trading strategies.

| Platforms | StarTrader Platforms | Doo Prime Platforms | XGLOBAL Markets Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

StarTrader Web Platform

We found that the StarTrader’s Web Trader simplifies the trading experience, allowing traders to buy and sell assets effortlessly. With a user-friendly interface and real-time market data, this online platform enables quick decision-making. Web Trader also seamlessly integrates with MT4 and MT5, providing an accessible trading experience directly from the web browser. StarTrader’s web platform includes over 30 indicators, 9 timeframes, charts and graphical objects, one-click trading, real-time quotes, and trading history. All in all, the web platform combines flexibility and advanced features, enabling traders to get the most out of trading.

StarTrader Desktop MetaTrader 4 Platform

The StarTrader’s MT4 platform is an advanced solution for all types of traders. It is easily downloadable and is available for Windows and Mac. The MT4 platform enables access to over 1000 tradable products, providing the best features and tools for profitable trading. The platform ensures in-depth analysis, easy navigation, and a simple but powerful interface. Clients can use over 50 pre-installed trading indicators, 24 analytical tools, numerous charts and graphs, 9 timeframes, and trading signals. Traders can also use Expert Advisors to automate their trades.

StarTrader Desktop MetaTrader 5 Platform

Along with the common features and conditions the MT4 platform includes, StarTrader’s MT5 platform integrates better opportunities and more innovative features to assist its clients in trading. With the MT5 platform, users can access more than 44 analytical charting tools, 21 time-frames, 38 built-in indicators, customizable charts, and trading history. The MT5 platform is a great choice for different clients, and it can meet both beginners’ expectations and satisfy professional clients’ needs.

Traders can also use the MQL5 language to create trading systems and enhance their trading opportunities.

StarTrader MobileTrader App

StarTrader offers clients a perfect opportunity to access the market through a mobile app and trade with ease and utmost flexibility. In addition to the mobile versions of the MT4 and MT5 platforms, StarTrader also offers its mobile app, thus offering a trusted platform to conduct trades from anywhere in the world. Traders can access their accounts through a user-friendly interface, access real-time data, use risk-management tools, and build a watchlist. The app is available via iOS and Android devices, making it accessible for everyone.

Main Insights from Testing

Our testing of the StarTrader platforms revealed that the broker offers advanced and innovative MT4 and MT5 platforms, WebTrader, and a mobile app. The availability of different platform options enables traders to access the market in the most suitable way, accessing the market by using robust trading tools and features. Although StarTrader does not offer alternative platforms, such as cTrader or TradingView, its proposal still meets the needs of different traders and ensures a flexible and profitable trading experience.

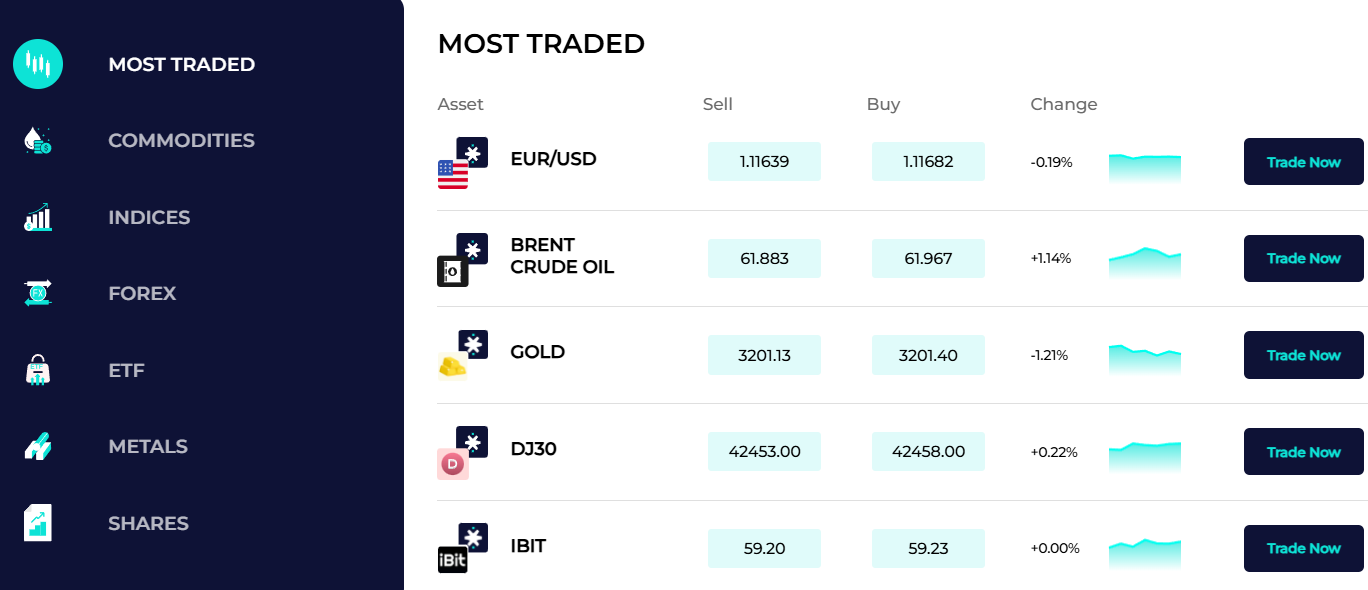

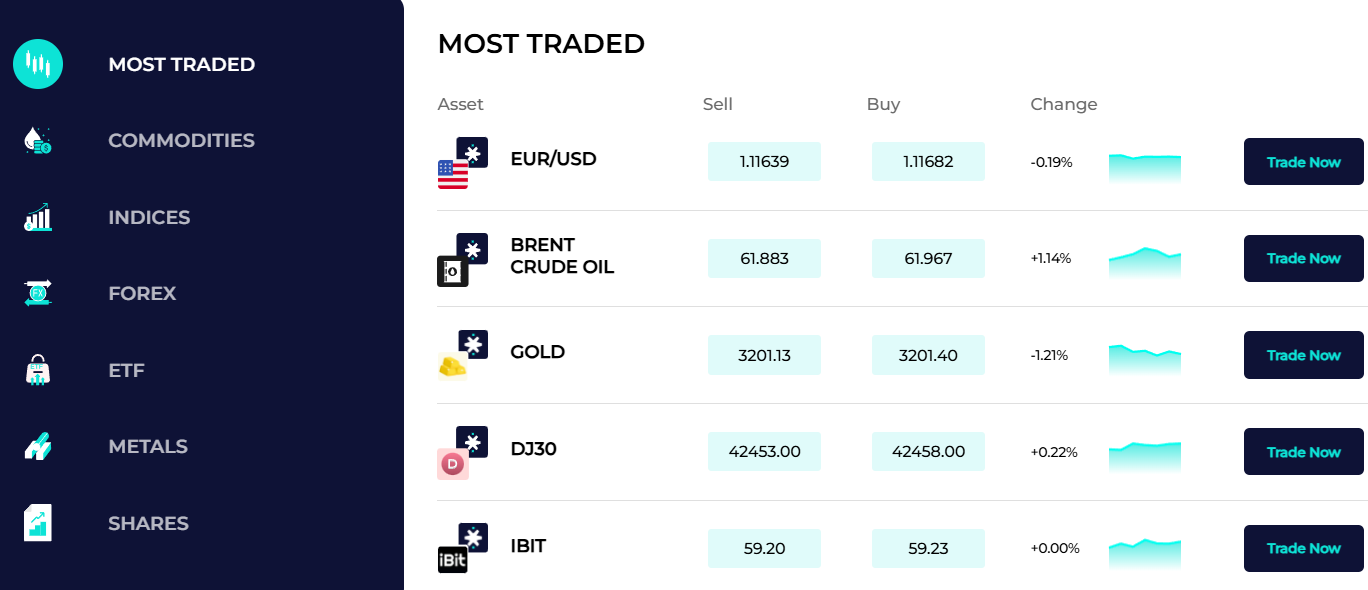

Trading Instruments

Score – 4.5/5

What Can You Trade on the StarTrader Platform?

StarTrader provides access to popular instruments, such as Forex, CFDs, Commodities, Indices, Shares, and Metals. The broker offers over 80 currency pairs – major, minor, and exotic, with tight spreads and favorable conditions. Clients can also access the most popular precious metals, including gold, silver, platinum, palladium, and copper.

- However, the availability of specific trading instruments may vary depending on the entity, so we advise conducting thorough research to determine the range of options available.

Main Insights from Exploring StarTrader’s Tradable Assets

We have explored the broker’s trading instrument offering to see how clients can diversify their trading with StarTrader. The broker offers over 1,000 tradable products across a range of financial assets, enabling solid exposure to the market. In addition to Forex pairs, precious metals, StarTrader offers a list of agricultural products, such as coffee, sugar, wheat, corn, soybeans, cocoa, cotton, etc.

Traders can also access the world’s leading indices (S&P 500, NASDAQ, and Dow Jones), shares from famous companies (Tesla, Nvidia, Apple, Pfizer, etc), and ETFs.

Overall, the broker has an extensive trading instrument offering, however, the fact that the products are CFD-based restricts the opportunities for long-term traders and traditional investors.

Leverage Options at StarTrader

Leverage enables its users to enter the market with a smaller initial investment. However, traders should understand the associated risks before participating in leveraged trading.

StarTrader leverage is offered according to its various jurisdictions:

- International traders may use higher leverage of up to 1:1000.

- UK traders can use low leverage up to 1:30 for major currency pairs.

- Those trading under the South African jurisdiction can access up to 1:500 leverage.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at StarTrader

StarTrader offers numerous payment methods to deposit funds into trading accounts, including Bank Wire, Credit/Debit cards, Skrill, and Neteller. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

- The availability of certain payment methods also depends on the entity, so we recommend considering the possibility that some funding methods might be unavailable in different regions.

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $50 as an initial deposit amount for all trading accounts.

Withdrawal Options at StarTrader

Based on our analysis, the StarTrader’s withdrawal process is convenient and swift. The broker does not charge fees for the withdrawal of funds in most countries. To withdraw funds, traders need to log in to the MyAccount and proceed with the withdrawal.

- The withdrawals via bank wire transfer usually reach traders’ accounts in 3 business days.

Customer Support and Responsiveness

Score – 4.6/5

Testing StarTrader Customer Support

The broker offers 24/6 customer support via live chat, email, and social media channels. Also, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- Clients can also find answers to the common trading-related questions on the broker’s Help Center. The section includes answers on account opening, trading platforms, fund management, and more.

Contacts StarTrader

We have tested StarTrader’s customer support to see how responsive and dedicated the broker’s support team is. Overall, our experience was positive, as we received detailed and quick answers to our inquiries. Here are the main channels to contact the broker:

- Clients can contact the customer team via the provided email address: info@startrader.com. Note, that based on the entity, the email address might be different.

- Clients can find the quickest support through the live chat. The answers come almost instantly and are mostly detailed and satisfying.

- Traders can also send a quick message right from the ‘Contact us’ section, through the inquiry form, by filling out the name, email address, country, and typing out the question.

- StarTrader is also active on social media and provides updates on the market and company operations constantly. Traders can find StarTrader on Facebook, Instagram, LinkedIn, X, YouTube, and TikTok.

Research and Education

Score – 4.2/5

Research Tools StarTrader

Our research of StarTrader’s research section has revealed great analytical tools and features to promote the traders’ experience. The broker’s platforms include extensive trading indicators, great charting, and market depth to support its clients in decision-making. In addition, StarTrader also provides a few extra features:

- The Economic Calendar is an essential tool in Forex trading, informing traders about the upcoming market events and possible changes that are substantial enough to impact the market.

- The News Room is another great opportunity to learn and be updated about the market, receive professional analysis, and read detailed reviews on the ongoing market situation.

Education

The broker includes a great educational section, including learning materials and educational videos catering to beginner and intermediate traders. StarTrader also provides a Forex glossary, informative articles, and webinars.

- The Knowledge Center includes detailed and informative articles for beginner and intermediate traders. The section also includes educational videos on different topics, explaining the most essential aspects of trading.

- The Glossary section includes trading terms and concepts, turning the complex professional terms into easily comprehensible language.

- StarTrader offers webinars, primarily for beginner traders, to gain knowledge and skills from professionals.

Is StarTrader a Good Broker for Beginners?

StarTrader is a reliable international broker, providing well-tailored services to traders of every level. With account types designed for beginners and professionals, advanced yet easy-to-use trading platforms, extensive analytical tools, and competitive fees, StarTrader can meet different trading needs. The broker provides a demo account and a very good education section with an emphasis on materials for beginner and intermediate traders. Novice traders can find educational videos and articles on different aspects of trading and also access webinars from professionals in the market. The trading glossary is also helpful for clients who are not acquainted with complex trading language. The low minimum deposit requirement is another advantage that will attract cost-conscious traders.

Portfolio and Investment Opportunities

Score – 4/5

Investment Options StarTrader

We have reviewed StarTrader’s offering to see how it accommodates traders to expand their portfolios and experience better opportunities. Although the broker offers a good range of instruments across multiple financial markets, StarTrader’s tradable products are mainly based on CFDs. This means limitations in investment options, such as long-term trading and traditional investments.

However, StarTrader includes a few alternative investment options clients can benefit from:

- Copy trading is a great way for an alternative investment, as clients can copy the trades of professionals and make profits without much effort and time. The copy trading feature is suitable for both beginner traders and professionals, who can register with StarTrader as a provider and earn profit from the followers.

- StarTrader is recognized as a PAMM broker, giving opportunities to traders to connect with experienced money managers and expand their investments across various financial assets.

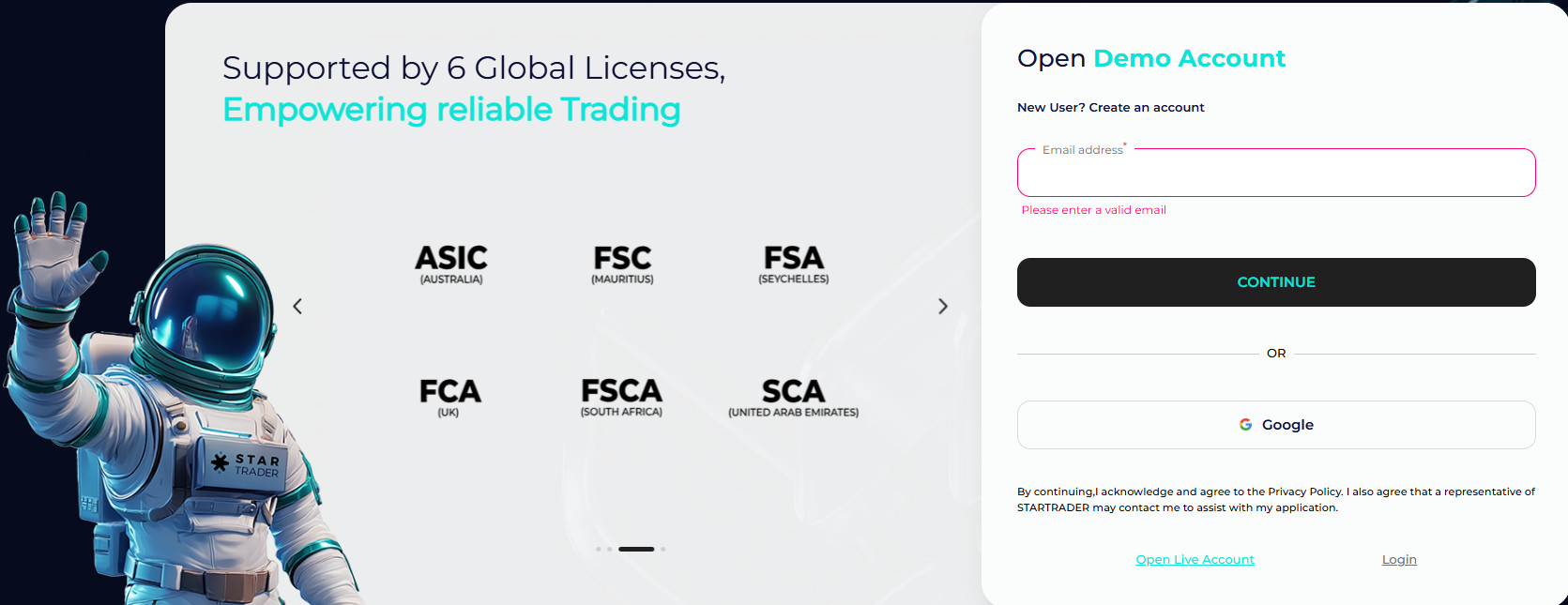

Account Opening

Score – 4.6/5

How to Open a StarTrader Demo Account?

With StarTrader, both new and existing clients can open a demo account and practice trading and new strategies. New clients should follow the steps listed below to open a demo account:

- Go to the broker’s official website and choose the practice account option.

- Fill out the registration form.

- Choose the preferred settings (account type, platform, account currency, leverage, and virtual fund amount).

- Click the “Create the account” button.

- Receive the account credentials via email.

- Start practicing.

How to Open a StarTrader Live Account?

Opening a live account with the broker is straightforward, as it takes only a few minutes to register and start trading. Clients just need to follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open a Live Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 4.1/5

In addition to the already advanced tools and features, StarTrader offers a good range of extra tools and opportunities to enhance traders’ experience and ensure a profitable and effective trading experience.

- The VPS is a powerful transaction server that provides ultra-fast execution and connection stability and keeps EAs running 24/7. However, StarTrader’s VPS is not free, and it offers $20 and $30 plans.

- The broker provides a 50% deposit bonus for the first deposit and a $20 bonus for subsequent deposits.

StarTrader Compared to Other Brokers

As a last part of our review, we have compared StarTrader to brokers with similar offerings to see where StarTrader stands and how it stands out.

First, we reviewed the broker’s regulatory compliance and compared it to others. StarTrader is regulated by the top-tier FCA and holds additional licenses from SVG FSA, FSA, and FSCA, ensuring compliance with strict laws and rules. AvaTrade, DooPrime, and XM also stand out for their reliability and adherence to stringent rules, providing an extra layer of protection.

The trading instruments provided by StarTrader are over 1,000, ensuring great diversity. Exness, on the other hand, offers only 200 tradable products, which is considered a modest proposal, while DooPrime enables access to 10,000 products across a range of assets. As to the trading platforms, StarTrader’s clients can conduct the trades via MT4, MT5 platforms, WebTrader, and the StarTrader App. While the offering is good, AvaTrade offers more variety, including MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, and Capitalise.ai.

The trading costs charged by StarTrader are average, with spreads of 1.3 pips for the popular EUR/USD pairs. For the commission-based accounts, StarTrader charges a $3.5 transaction fee per side. Exness offers spreads starting from 0.2 pips, which is much lower when compared to other brokers.

At last, StarTrader’s education section includes great educational materials suitable for beginners and intermediate traders. On the contrary, Exness and DooPrime have limited educational materials.

| Parameter |

StarTrader |

AvaTrade |

RoboForex |

Exness |

XM |

Doo Prime |

Eightcap |

| Spread-Based Account |

Average 1.3 pips |

From 0.9 pips |

Average 1.3 pip |

From 0.2 pips |

Average 1.6 pips |

Average 1 pips |

Average 1 pip |

| Commission-Based Account |

0.0 pips + $3,5 |

For Professional Accounts only |

0.0 pips + $4 |

0.0 pips + $3.5 |

Only on the Shares Account |

0.0 pips + $3-$7 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Low |

Average |

Low |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, WebTrader, App |

MT4, MT5, WebTrader, AvaTrade App, AvaOptions, DupliTrade, ZuluTrade, AvaSocial, Capitalise.ai |

MT4, MT5, R StocksTrader |

MT4, MT5 |

MT4, MT5, XM WebTrader |

MT4, MT5, Doo Prime InTrade, TradingView, FIX API 4.4 |

MT4, MT5, TradingView |

| Asset Variety |

1.000+ instruments |

250+ Instruments |

12,000+ instruments |

200+ instruments |

1,000+ Instruments instruments |

10.000+ instruments |

800+ instruments |

| Regulation |

FCA, SVG FSA, FSA, FSCA |

Bank of Ireland, ASIC, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

FSC |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSC, DFSA |

FSC, SEC, FINRA, FCA, ASIC, FSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/6 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Good |

Excellent |

Good |

Fair |

Excellent |

Fair |

Good |

| Minimum Deposit |

$50 |

$100 |

$10 |

$10 |

$5 |

$0 |

$100 |

Full Review of Broker StarTrader

To summarize our review of StarTrader, we found the broker reliable, adhering to strict laws and rules. The broker holds licenses from the FCA and FSCA, SVG FSA, and FSA, serving global traders.

Startrader’s proposal meets different trading needs, providing favorable conditions to beginner and professional traders equally. The fee structure is based on spreads and commissions, meeting the market’s average. The spread for the popular EUR/USD pair is 1.3 pips. Traders of Startrader can conduct their trades via the MT4/MT5 platforms, WebTrader, and mobile app, gaining access to multiple markets with an average number of 1,000 tradable products.

Clients can also engage in copy trading and invest by copying professional providers. Also, professional clients can register as providers and gain profits. StarTrader is also popular for its PAMM account.

The broker has a $50 requirement as the initial deposit. It also offers a 50% deposit bonus for the first deposit and 20% for the subsequent deposits, but check those based on entiyt rules also current availability. All in all, StarTrader is a safe international broker with favorable conditions. However, before engaging with the broker, traders should consider the variations in the offering based on the jurisdiction.

Share this article [addtoany url="https://55brokers.com/startrader-review/" title="StarTrader"]