- What is SimpleFX?

- SimpleFX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- SimpleFX Compared to Other Brokers

- Full Review of Broker SimpleFX

Overall Rating 4.2

| Regulation and Security | 4.2 / 5 |

| Account Types and Benefits | 4.2 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4 / 5 |

What is SimpleFX?

SimpleFX is a crypto and CFD trading platform that offers its services globally and has been in the market since 2014. The broker offers a good range of instruments across Forex, crypto, indices, commodities, metals, and equities. The trades are conducted through the broker’s proprietary platform via desktop, web, and mobile versions. The broker supports different funding methods, including crypto deposits, bank transfers, credit/debit cards, and e-wallets.

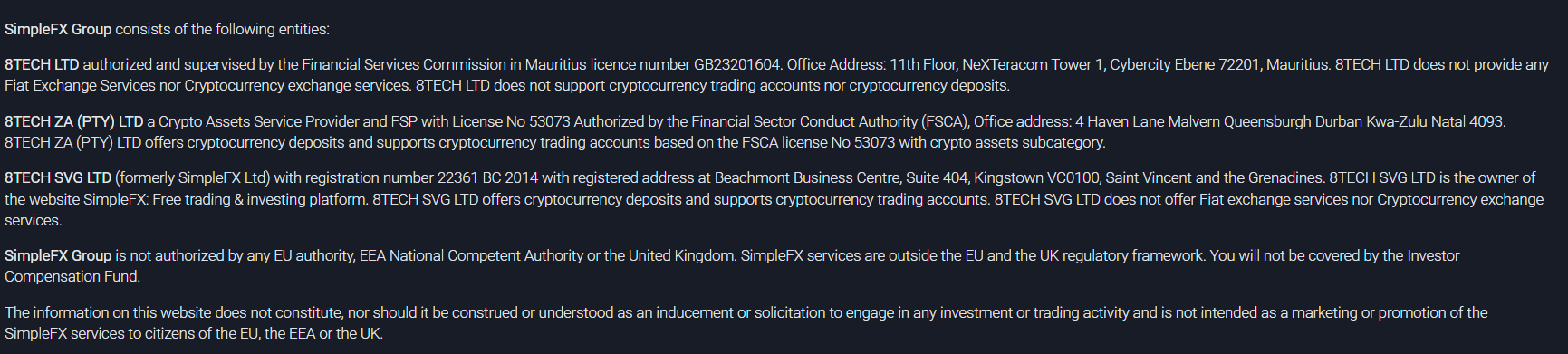

The broker is regulated by the Financial Sector Conduct Authority in South Africa, providing good protection of clients’ funds and negative balance protection. The broker also holds licenses from the FSC of Mauritius and is registered in the SVG. In the past, SimpleFX held a license from only the FSC and solely an offshore broker with insufficient regulatory oversight; therefore not recommended for trading. Yet, with its present regulatory status, SimpleFX is considered a safe and reliable choice.

SimpleFX Pros and Cons

SimpleFX has various advantages for traders seeking flexibility and ease of use. SimpleFX offers its own advanced and intuitive platform available via desktop, web, and mobile. Traders have access to over 1000 tradable products across a range of financial assets based on CFDs. We also found that the broker offers multiple funding methods for safe and fast deposits and withdrawals. The education section is also quite helpful with a forex glossary, detailed articles, and a blog.

Among the aspects to be enhanced are the limitations of trading platforms, with no access to the popular MT4/MT5, or the more advanced cTrader and TradingView. The absence of 24/7 support can also be a disadvantage for many. At last, clients prioritizing top-tier regulations will not find the security measures adequate.

| Advantages | Disadvantages |

|---|

| FSCA regulation | No 24/7 customer support |

| Availability in the South African region | Regulatory issues in the past |

| Advanced platform | Offering based on CFDs only |

| No minimum deposit requirement | |

| Competitive fees | |

SimpleFX Features

Our analysis revealed reliable trading solutions with competitive fees and favorable conditions for all levels of traders. The broker’s advanced platform can become a good solution for many. We have reviewed all the aspects of trading with the broker and made a list for a quick look:

SimpleFX Features in 10 Points

| 🗺️ Regulation | FSCA, FSC |

| 🗺️ Account Types | A single account |

| 🖥 Trading Platforms | Own platform |

| 📉 Trading Instruments | Forex, crypto, indices, commodities, metals, and equities |

| 💳 Minimum deposit | No minimum deposit |

| 💰 Average EUR/USD Spread | 0.9 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Various currencies available |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is SimpleFX For?

Our findings on the broker and the opinions of financial experts indicate that SimpleFX can be a profitable choice for different clients with numerous trading needs. The broker can be especially fitting for the following:

- Traders from South Africa and the African Region

- Currency traders

- Beginners

- Advanced traders

- International trading

- Competitive fees

- STP execution

- Good trading tools

- Web traders

SimpleFX Summary

After carefully reviewing the broker’s proposal, we recognize SimpleFX as a trustworthy broker with competitive solutions, an advanced platform, low fees and spreads, and access to over 1000 instruments across multiple markets. Another advantage is the minimum deposit requirement and the availability of different payment methods.

While the broker provides a favorable environment and secure practices, we recommend carefully reviewing the available offerings, terms, and conditions. It is also essential to consider that SimpleFX operates under different entities, which might result in differences in conditions and terms.

55Brokers Professional Insights

Based on our research, we identified multiple advantages of the broker that make it attractive to different traders and might be suitable for various strategies. Although the broker offers a single account based on its proprietary platform, the account comes with multiple advantages and favorable conditions. First, there is no minimum deposit requirement, making the offering accessible to any trader and beginners, too. Besides, very high leverage ratios of up to 1:1000 are available under the international entity, while the FSCA-regulated entity offers lower leverage.

Although SimpleFX offers access to only 200 tradable products, the selection includes all the main instruments with quite low spreads and conditions that are suitable for either long or day trading strategies. However, large diversification and access to real stocks and long-term investments are not supported, so in case it is your choice might be good to check other proposals. Those traders who prioritize only top-tier regulations might not find SimpleFX’s regulatory measures strict enough either; nevertheless, the broker is regulated by the South African FSCA, which ensures safety and reliability of trades.

Moving forward, it is essential to mention the past regulatory issues of the broker and the operation under an offshore license. This resulted in a negative image of the broker, listing it as an unregulated and untrustworthy broker. Additionally, we found negative feedback from clients, pointing out multiple inconsistencies. However, the present regulation and oversight make SimpleFX a reliable choice.

Consider Trading with SimpleFX If:

| SimpleFX is an excellent Broker for: | - Beginner traders

- Professional traders

- African traders

- Global traders

- Cost conscious clients

- Currency and CFD traders

- Cryptocurrency traders |

Avoid Trading with SimpleFX If:

| SimpleFX is not the best for: | - Traders prioritizing top-tier regulations

- MT4/MT5 platform enthusiasts

- Clients looking for a wide range of instruments

- Beginner traders who need comprehensive educational resources

- Long-term investors

|

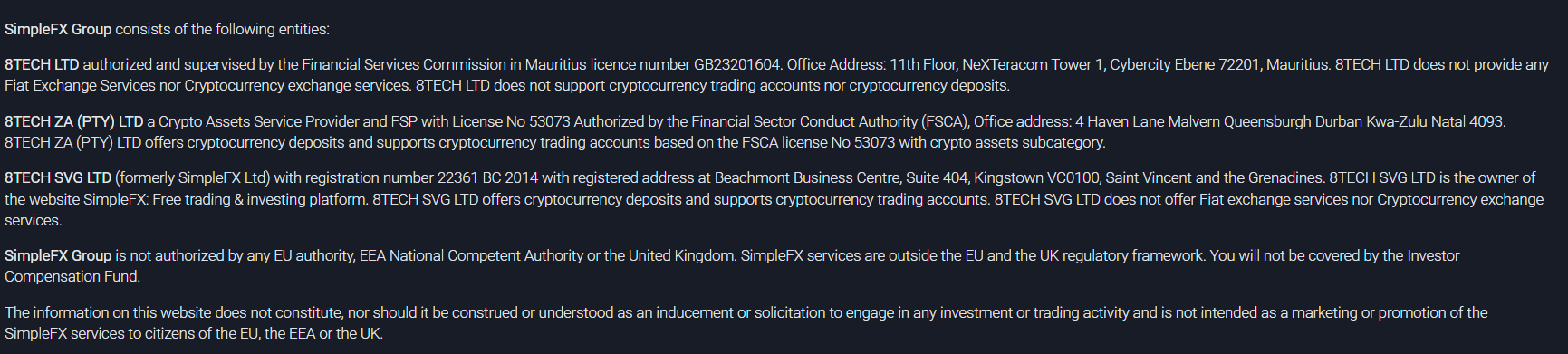

Regulation and Security Measures

Score – 4.2/5

SimpleFX Regulatory Overview

SimpleFX operates as a legitimate and regulated broker, following all the rules for offering Forex trading services. The oversight by the FSCA, a respected regulatory body in the financial industry, enhances the safety and confidence of clients who choose SimpleFX as their broker. This regulatory authorization ensures that the company operates within a serious legal framework, following predefined industry standards.

- However, the broker also holds an offshore license from the Financial Services Commission of Mauritius (FSC), an offshore zone with more lax practices. Thus, before engaging in trading activities, traders should carefully consider and understand the differences when trading in different jurisdictions.

- The broker also has a registered entity in the Saint Vincent and the Grenadines without a formal regulation.

How Safe is Trading with SimpleFX?

We have researched how companies under the FSCA regulation protect their clients. As we have found, the FSCA has a substantial weight in the industry, and as an essential part of its oversight, it ensures that brokers keep clients’ funds separate from their accounts, protecting them.

Consistency and Clarity

We also researched the broker regarding its consistency and clarity of the proposal. At present, SimpleFX follows strict laws and guidelines, ensuring transparency of operations. However, when SimpleFX started in 2014, it operated as an offshore broker under the Financial Services Commission (Mauritius) with no serious license and adequate oversight. This led to serious regulatory issues, linking the broker to questionable conduct. The broker also received numerous negative feedback from clients regarding safety and withdrawal issues. Based on the mentioned facts, we marked SimpleFX as unregulated and warned our readers against the broker.

The present FSCA license ensures transparent and consistent practices. The customer’s satisfaction level has also improved, reflected by the growing number of satisfied reviews. From our side, we recommend considering the broker’s past operations and the present positive status, and only then make an informed decision to trade with SimpleFX.

Account Types and Benefits

Score – 4.2/5

Which Account Types Are Available with SimpleFX?

We found that SimpleFX provides a single account based on the broker’s proprietary platform. The account is tailored to meet the needs of various clients, from beginners to professionals. The account does not have a minimum deposit requirement.

The SimpleFX account enables access to over 1000 instruments across various financial assets. The spreads offered are floating and in line with the market average. Many clients will find the no-commission fee structure favorable, with costs embedded in spreads. The leverage depends on the jurisdiction. For the international entity, clients are allowed to use up to 1:1000 leverage.

- The broker also strongly encourages new traders to practice and educate themselves by using a demo account.

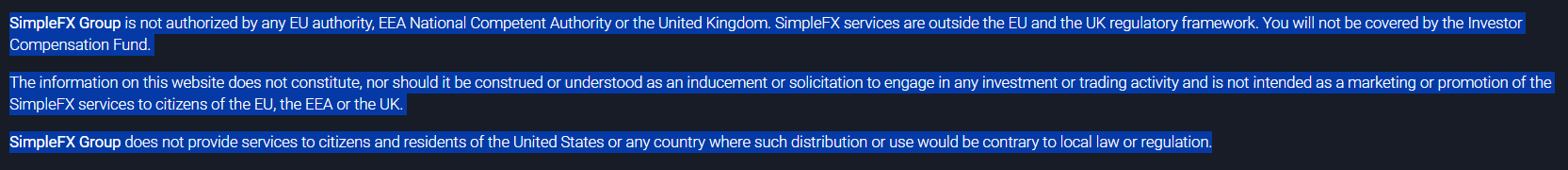

Regions Where SimpleFX is Restricted

According to the information we found on SimpleFX’s website, the broker does not accept clients from a list of countries due to regulatory and legal requirements. Be careful, as the restrictions may also depend on the entity:

- The USA

- The UK

- EU countries

- Canada

- Cuba

- Ukraine

- Ecuador

- Iraq

- Japan

- Germany

- North Korea

- Romania

- Sudan

- Syria

Cost Structure and Fees

Score – 4.2/5

SimpleFX Brokerage Fees

SimpleFX offers a spread-based structure, which limits flexibility for traders prioritizing various structures and diversity. We found the broker’s spreads competitive with no hidden fees. There are no commissions on trades, with all the charges integrated into average spreads. Below is detailed information on SimpleFX’s applicable costs.

SimpleFX’s spreads are defined based on the instrument traded. The broker offers tight floating spreads starting from 0.9 pips for the popular EUR/USD pair. The offering aligns with the market standards, with no additional commissions added.

Spreads can also vary across the broker’s entities, so it is an essential point to consider.

One of the advantages SimpleFX offers is the absence of commissions, as the broker’s trading charges are built into spreads. The commission-free structure can be especially beneficial for beginner or intermediate traders, while professional traders usually prefer very low spreads combined with fixed transaction fees. The broker also doesn’t apply any additional hidden charges, making the offering transparent.

How Competitive Are SimpleFX Fees?

Based on our testing, SimpleFX’s fees are competitive. SimpleFX ensures a friendly environment with floating spreads as low as 0.9 pips. There are no commissions applied, which results in favorable costs. However, many advanced traders prefer commission-based accounts, and in this case, SimpleFX will not be the best option for them.

Besides, we found a few additional fees and no hidden costs, which enables traders to calculate all the charges in advance. Another point worth awareness is the broker’s operation under different entities, causing differences in trading conditions.

| Asset/ Pair | SimpleFX Spreads | Aurum Markets Spreads | EC Markets Spread |

|---|

| EUR USD Spread | 0.9 pips | 1.8 pips | 1.1 pips |

| Crude Oil WTI Spread | 30 pips | 1 | 0.45 |

| Gold Spread | 42 pips | 1 | 2.8 |

SimpleFX Additional Fees

SimpleFX charges a few additional fees, which are considered standard in the market. The costs are added to the overall trading charges.

- The inactivity fee is applied to accounts that have been dormant for 90 days. The broker charges $25 each month until there is activity on the account, such as funding the account or placing a trade.

- SimpleFX does not charge fees for deposits. However, third-party providers may impose transaction fees.

Score – 4.2/5

As our research revealed, SimpleFX offers its proprietary platform available through desktop, web, and mobile versions. The desktop and mobile platforms are easy to download and accessible through Windows, Linux, and macOS for desktop and Android and iOS for the mobile app.

| Platforms | SimpleFX Platforms | Aurum Markets Platforms | EC Markets Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Platform | Yes | Yes | Yes |

SimpleFx Web Platform

The broker’s web platform is accessible right from the broker’s official website. Traders need to enter their account details and start trading. The easy access to the market ensures flexibility for traders, with no need for installations and downloads. Besides, the web platform includes the same range of advanced tools and features, allowing high functionality. It is also worth mentioning that the broker’s web platform was recognized as the best trading platform at the Cryptocurrency World Expo.

The platform includes innovative charting, technical indicators, market notifications, and more. Trade execution is fast, ensuring efficiency.

SimpleFX Desktop MetaTrader 4/5 Platforms

Our testing revealed that the popular MT4 and MT5 platforms are unavailable with SimpleFX. For many, the absence of the MT4/MT5 platforms is a disadvantage, as the majority of traders are used to the advanced features they offer. However, the broker’s own platform is also quite functional and easy to use, attracting traders after they try it.

SimpleFX Proprietary Platform

It is easy to download the SimpleFX desktop platform through any operating system and trade in a safe environment. The desktop platform ensures that traders enjoy the full functionality and tools available directly from their computers. The platform allows traders to view several charts at the same time. Clients can access different strategies, including day trading, margin trading, Bitcoin leverage trading, CFD trading, intraday trading, or scalping. The take profit and stop loss features enable clients to manage their trades better and avoid losses.

The interface is simple, suitable for any trader, even for beginners with no experience.

SimpleFX MobileTrader App

SimpleFX offers the mobile version of its proprietary platform. The app is equipped with the essential features for efficiency and functionality, ensuring that traders experience a high level of trading on the go without limitations. So, mobile traders can easily access a range of financial assets with competitive fees and advanced tools, charts, indicators, one-click trading, and more.

Main Insights from Testing

Our testing of the broker’s platform went smoothly, revealing a flexible and easy-to-use interface and simple solutions, yet advanced tools and features. Although the broker does not offer the popular MT4 or MT5 platforms, or more advanced cTrader and TradingView, the broker’s platform is a great option for different clients, whether novice traders or professionals. The platform is accessible in web, desktop, and mobile versions, ensuring easy access and versatility.

AI Trading

We found no built-in AI or AI bots available with SimpleFX. This means that clients who favor the innovative AI solutions will have to look for the feature elsewhere.

Trading Instruments

Score – 4.3/5

What Can You Trade on the SimpleFX Platform?

At SimpleFX, clients can trade Contracts for Difference on various assets, ensuring exposure to the market. SimpleFX provides a wide range of instruments, over 1000 symbols. The broker also allows cryptocurrency trading with low spreads and favorable conditions.

Below, see the main trading products you can access with SimpleFX:

Main Insights from Exploring SimpleFX Tradable Assets

Our research of SimpleFX’s products revealed a good number of instruments across various financial assets. Traders can access a good number of major, minor, and exotic currency pairs, commodities, including energy and agricultural products, worldwide indices, and more. The range also includes equities of American, Asian, and European companies.

All in all, trading instruments offered by SimpleFX are impressive and allow traders adequate diversity. However, all products are based on CFDs, allowing traders to speculate on the price movements and earn profits. Long-term and traditional investments are not supported.

Leverage Options at SimpleFX

Leverage is an essential tool that enables traders to enter the market with limited capital and gain substantial profits. However, traders should understand the usage of leverage, as it can also lead to financial loss.

SimpleFX leverage is offered according to the FSCA and FSC regulations:

- Trades from South Africa are eligible to use leverage up to 1:30 for major currency pairs.

- International traders may use higher leverage up to 1:1000.

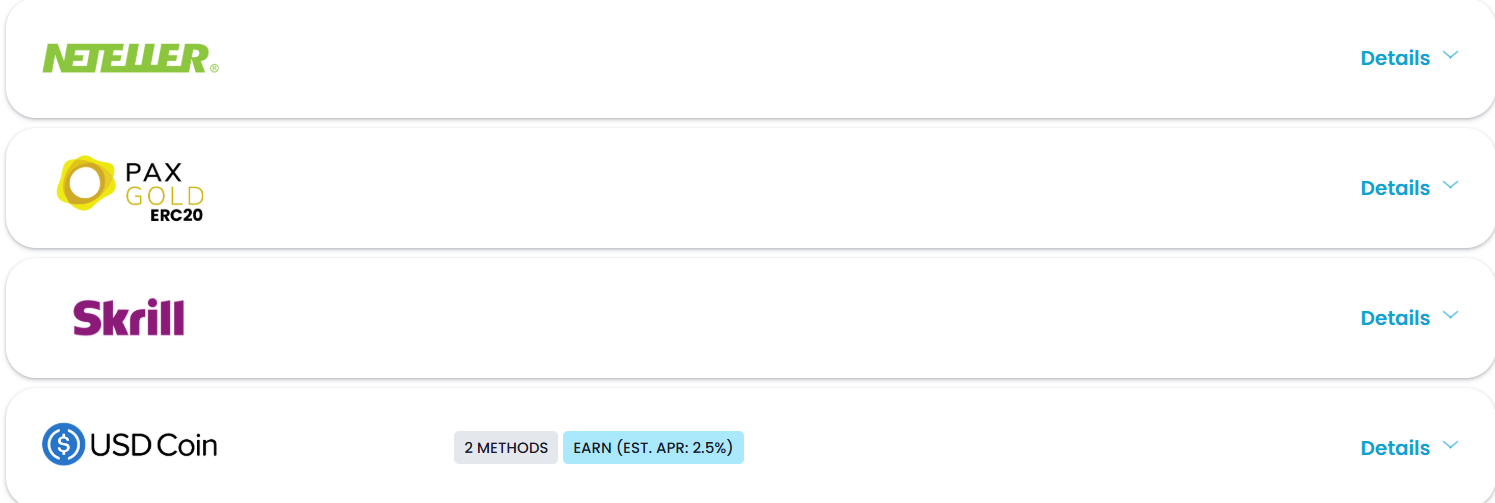

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at SimpleFX

SimpleFX offers an impressive range of funding methods (98 in total). The availability of the methods is based on the entity. The broker elaborates in the deposit and withdrawal section on each method’s availability under each entity and country.

- Overall, traders can fund their accounts via credit/debit cards, wire transfers, Skrill, Neteller, Tether, Bitcoin Cash, Fasapay, USD Coin, and more. There is no deposit fee for the funding methods from the side of the broker; however, there might still be transaction fees applied by the payment providers.

Minimum Deposit

As we found, the broker offers a single account with no minimum deposit requirement. So traders can open an account with the smallest investments. It makes the broker more accessible for cost-conscious clients.

However, even though it is possible to open an account with minimum funding, traders will still need sufficient funds to meet the margin requirements and place trades.

Withdrawal Options at SimpleFX

- SimpleFX requires clients to make withdrawals with the same funding methods used for deposits.

The broker applies a small withdrawal fee based on the funding method. Traders can find the exact amount of the transaction fee on the broker’s website.

Customer Support and Responsiveness

Score – 4.6/5

Testing SimpleFX Customer Support

SimpleFX has a helpful support team that assists its clients through various channels. The broker enables its clients to start a conversation through an online chat or compose an email indicating the issue.

- The broker also offers an FAQ section, including answers to the most trading-relevant questions.

Contacts SimpleFX

We found that SimpleFX delivers dedicated customer support. Our testing left us satisfied with the answers and solutions the support agent offered.

- The live chat provides prompt and detailed answers 24/5.

- The broker also provides an email address (support@simplefx.com) for directing different questions and issues.

- SimpleFX is also active on social media, providing updated information on its operations and market development through LinkedIn, Facebook, Instagram, YouTube, TikTok, and Telegram.

Research and Education

Score – 4.2/5

Research Tools SimpleFX

SimpleFX offers an advanced platform with extensive research tools and features. The platform primarily supports technical analysis and short-term trading.

Based on our research, the broker’s website does not offer additional research tools; however, the platform provides built-in features such as an economic calendar, watchlists, alerts, and market news.

Education

The education section of SimpleFX offers detailed and informative articles, popular tutorials, a Forex glossary, and a blog. Although there are no webinars, e-books, or extensive courses, the section can still be helpful for beginner and intermediate traders.

- The tutorials educate clients on how to open an account with the broker, how to trade, how to close an order, and many other essential trading-related topics.

- The forex glossary explains complicated market terms, translating them into comprehensible language.

Is SimpleFX a Good Broker for Beginners?

We have considered whether SimpleFX is a favorable choice for beginners. All in all, the broker’s platform has an interactive interface that is easy to navigate. The single account offers favorable conditions that can attract traders of any level of experience. The no minimum deposit requirement allows clients to start small, with minimum investments.

SimpleFX beginner clients can also access a demo account and trade in a risk-free environment, which is another advantage. So, to the question of whether SimpleFX is suitable for novice traders, the answer is positive.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options SimpleFX

Although SimpleFX offers a wide selection of financial assets, it does not provide long-term and traditional investments. The alternative investment options are also limited with SimpleFX.

- Long-term investors, copy or social traders, or traders favoring other investment options will have to look for other brokers and opportunities.

Account Opening

Score – 4.5/5

How to Open a SimpleFX Demo Account?

We revealed that SimpleFX clients can access a demo account after registering with the broker. To register, clients need to provide an email or a Google or Facebook login and set a password. After, the broker will send a verification link through the provided email. Within the platform, clients can choose between the demo and live accounts.

How to Open a SimpleFX Live Account?

To open a SimpleFX live account, traders should complete a few simple steps:

- Visit the broker’s website, provide their email, and create a password.

- Complete the verification process (government-issued ID, proof of address).

- After the verification, access the broker’s platform and choose a live account.

- Choose the account specification.

- Fund your account and start trading.

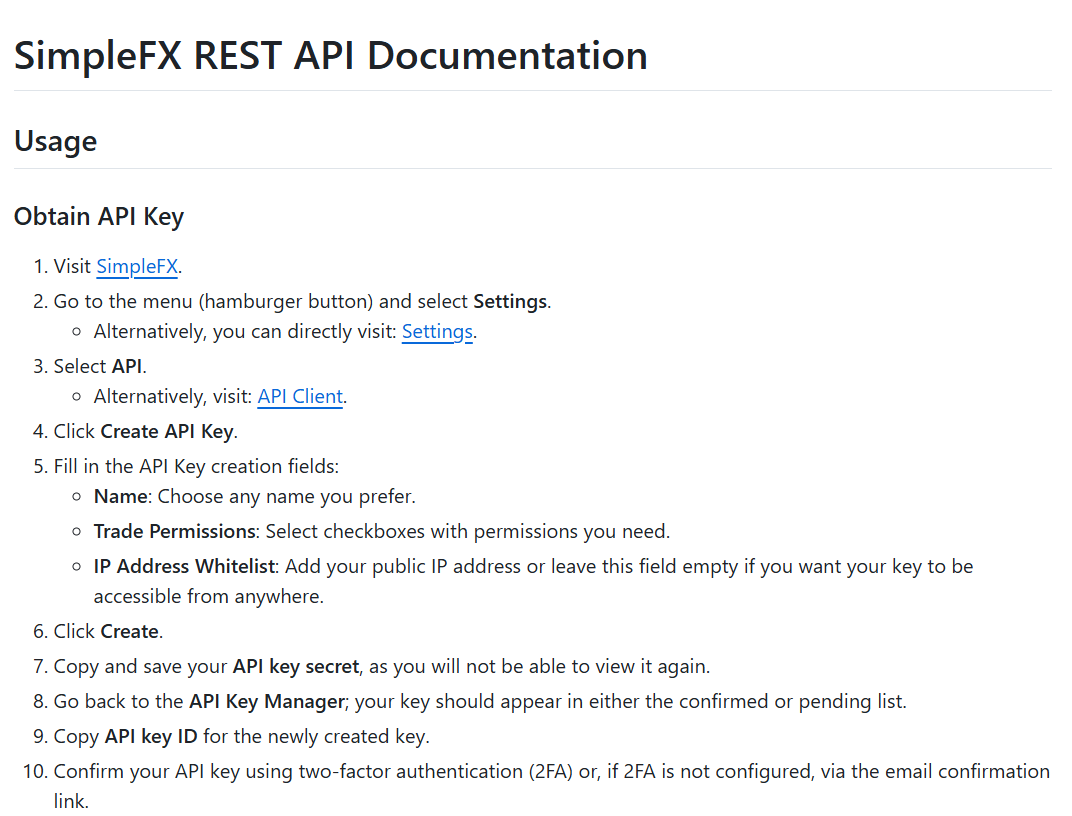

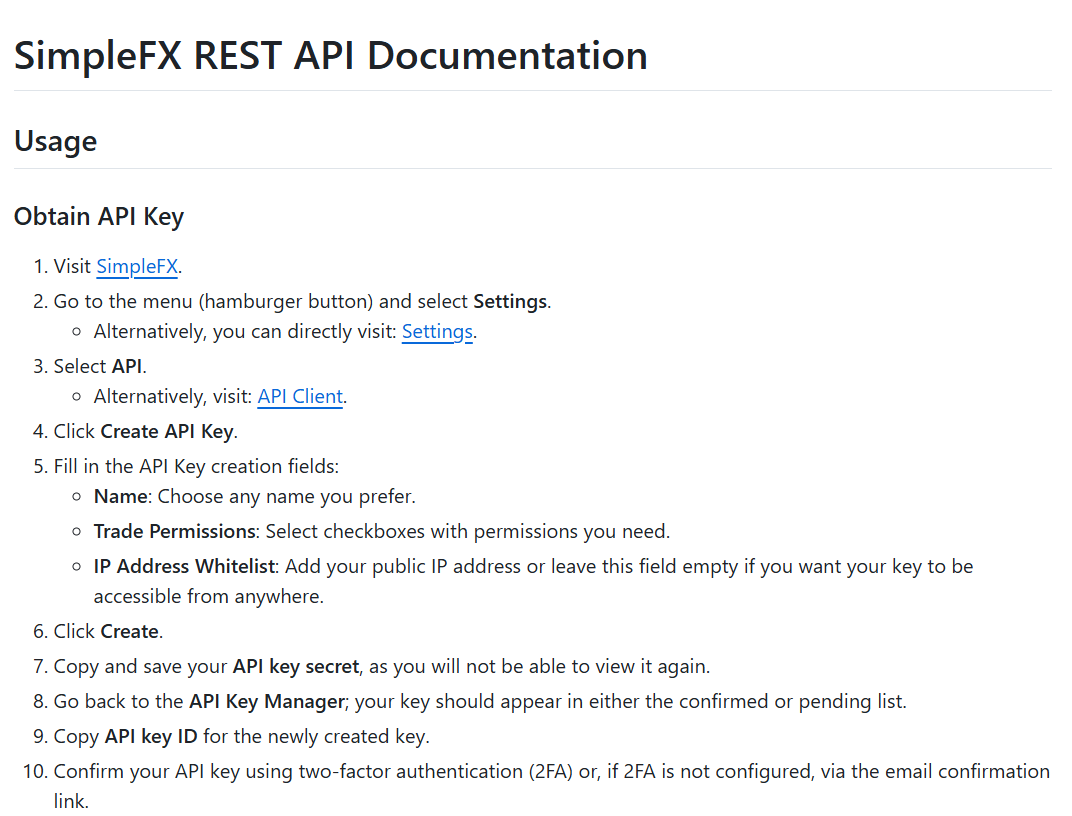

Score – 4/5

The research and close consideration of SimpleFX’s additional features reveal that most of the essential tools of the broker are already included in SimpleFX’s proprietary platform.

- Clients can also benefit from the broker’s comprehensive API platform tailored for advanced clients. It allows users to automate strategies and access real-time data. The API will be ideal for developers and algo traders.

SimpleFX Compared to Other Brokers

We have also compared SimpleFX with other brokers to assess how it meets overall market norms. We started our comparison with the regulatory standards. SimpleFX is a broker regulated by the South African FSCA, ensuring the safety and transparency of trades.

The costs applied by the broker are average, with floating spreads starting at 0.9 pips, with no commissions. Capital.com also offers a spread-based structure with lower spreads of 0.6 pips.

As to the available platforms, many brokers we reviewed, including Eightcap and Pepperstone, offer the popular MT4 and MT5 platforms. However, SimpleFX provides its proprietary platform with no other options.

The number of available instruments is 1,000, which is considered an attractive opportunity for diversification of trades. Although the offering is good, there are many brokers, such as RoboForex, with a larger number of tradable products (12,000+).

The education section is quite good, allowing access to helpful educational resources. Traders who need more extensive learning materials can check Pepperstone and Capital.com.

| Parameter |

SimpleFX |

Capital.com |

RoboForex |

Pepperstone |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread-Based Account |

Average 0.9 pip |

From 0.6 pip |

Average 1.3 pip |

Average 0.7 |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission-Based Account |

Not available |

Not available |

0.0 pips + $4 |

0.0 pips + $3.50 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Average |

Low |

Average |

Average |

Low |

Average |

Average |

| Trading Platforms |

SimpleFX Proprietary Platform |

Capital.com CFD platform, MT4, TradingView |

MT4, MT5, R StocksTrader |

MT4, MT5,cTrader, TradingView |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

1000+ instruments |

3000+ instruments |

12,000+ instruments |

1,200+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

FSCA, FSC |

CySEC, FCA, ASIC, FSA |

FSC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Excellent |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

No minimum deposit |

$20 |

$10 |

$0 |

$0 |

$100 |

$5 |

Full Review of Broker SimpleFX

We have carefully reviewed SimpleFX’s proposal to find that the broker is a safe option for trading with oversight from the FSCA in South Africa. SimpleFX also holds an offshore license from the FSC. Yet, during our research, we found that the broker had previous regulatory issues for operating under an offshore entity only. It also received complaints from clients for insufficient practices, a lack of an appropriate withdrawal process, and other issues. However, as we see, SimpleFX now complies with regulatory rules and guidelines and follows the stringent laws set by the FSCA.

The broker offers its proprietary platform available in desktop, web, and mobile versions. The instrument availability is attractive, with over 1,000 products across various financial assets.

The costs for most instruments are expressed in average spreads. There are no commissions applied, as the broker offers a single spread-based account. The education section is moderate, providing articles, a forex glossary, and video tutorials. The customer support is available through live chat and email 24/5.

All in all, SimpleFX is a favorable platform that meets different trading needs. Beginner traders can also benefit from the broker’s proposal, although the education section is limited when compared to many other brokers.

Share this article [addtoany url="https://55brokers.com/simplefx-review/" title="SimpleFX"]

https://dirtyscam.com/report/richard-williams-fx/

Be careful

Even if it is simple fx saying in these comments that they are ‘not controlled by Wall Street’, if that is a good thing and beneficial, and it is factually true, does that not still mean it is a good thing and beneficial. I do not understand the criticism.

All this comments sounds like someone being paid to say so. Thats to good to be true. No one says not controlled by wallstreet and be happy. Its just the saying of a paid advertiser to justify the beings of the company being a market maker, not and stp broker as they claim.

Great trading app with cryptocurrency accounts. I’ve been looking for a reliable app where I can easily move my BTC or ETH when I see a trading opportunity on stocks. SimpleFX is simply great. Love it. Spreads are at times bit high, but this is what you’d expect.

Great app. A standard CFD service (free, but you pay with spread), but they:

have a great app (mobile and web) which they update every week

will list anything you ask for, just post your suggestion at community.simplefx.com

support Binance Smart Chain, and probably will introduce Lightning Network soon.

allow you to stake ETH 2.0 and reinvest the frozen funds. I literally shorted crypto this week with my frozen ETH, how awesome is that?

They’ve been around since 2014, while Binance has just turned 4…

App is very simple to use. You can invest your cryptocurrencies and multiply money. SimpleFX is independent and not controlled by Wall Street and I like it.

Easy to navigate through the app. The easiest way to trade, even for beginner in Forex. Never got any problems.

Great and simple to understand app. I’ll never think of money the same way! Fantastic way to realize how poorly your understanding of the markets actually is.

I think SimpleFX is definitely no.1 lowest spreads that are consistent, super fast withdrawals, platform always 100% up with no delays, best execution I have seen. They are just super reliable consistent and the cost is the lowest.

Hard to find good platform – for me most important is: Competitve offer. Multilingual support. I choose Simple FX. I needed to learn strategy cause 74.39% of CFD accounts lose money.

Is this the company that trades in the west midlands area of the uk?

Managing director is Richard Williams?