- What is Public?

- Public Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

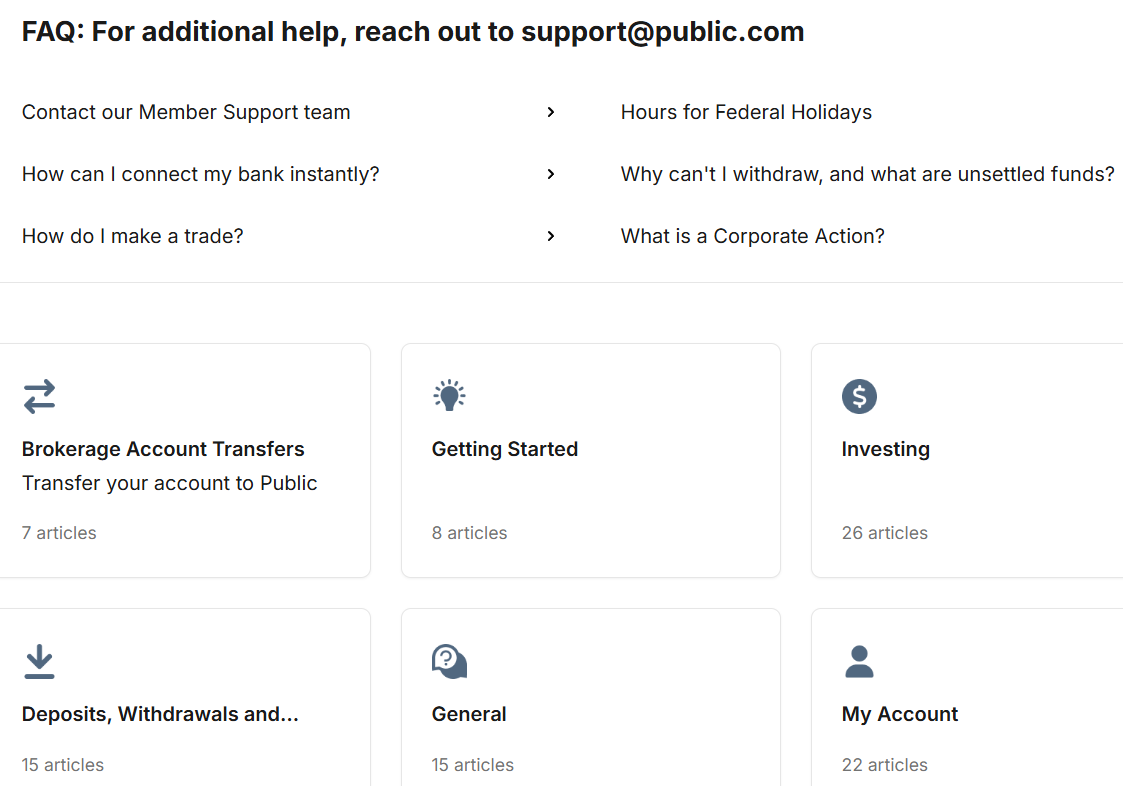

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Public Compared to Other Brokers

- Full Review of Broker Public

Overall Rating 4.7

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Public Investment?

Public is a well-known US Investment firm that enables traders to invest in a diverse range of assets, including stocks, ETFs, treasuries, crypto, bonds, collectibles, and more. The company provides a user-friendly platform that imposes no commission fees on stock market transactions.

Functioning as a registered broker-dealer under the US Securities and Exchange Commission (SEC), Public also maintains memberships with regulatory bodies such as FINRA and SIPC in the USA.

Overall, the company provides innovative approaches to ensure that investing becomes more accessible and transparent.

Is Public Stock Broker?

Yes, Public operates as a stock brokerage platform. It allows users to invest in stocks, ETFs, and other investment assets through its user-friendly web and mobile app.

While it provides a platform for investing stocks, Public.com is not a traditional stockbroker in the sense of offering a full range of financial services; rather, it focuses on making investing more accessible and social for a broad audience.

Public Pros and Cons

The firm has several pros and cons that investors should consider. Public offers several advantages, including commission-free investment, which makes it cost-effective for users. Another advantage is the availability of investing fractional shares, allowing individuals to invest with smaller amounts of capital, thereby improving accessibility.

For the cons, potential disadvantages may include a more limited range of investment options compared to some traditional brokers. Additionally, the web and mobile platforms may be a limitation for those who prefer desktop trading. Therefore, traders need to consider these factors based on their preferences and investment needs.

| Advantages | Disadvantages |

|---|

| SEC, FINRA, and SIPC regulation and oversee | No 24/7 customer support |

| Fractional Share investing | Limited investment products |

| Low trading fees | No paper trading or demo account |

| Commission-free trading for Stocks and ETFs | Limited trading platforms |

| $0 minimum deposit | |

| Direct Market Access | |

| Competitive investment conditions | |

| US traders | |

Public Features

Public is known for its innovative approach to investing and its commission-free model. The firm generally appeals to investors seeking a combination of accessibility, transparency, and a collaborative investment experience. Below is a comprehensive list of its key features:

Public Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC |

| 🗺️ Account Types | Brokerage, Retirement Accounts |

| 🖥 Trading Platforms | Public Web, Mobile Apps |

| 📉 Trading Instruments | Stocks, ETFs, Treasuries, Crypto, Bonds, Fine Art, Collectibles, etc. |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Investing Insights and Essentials, Video Tutorials |

| ☎ Customer Support | 24/5 |

Who is Public For?

Public is designed for investors who want a streamlined and transparent trading experience. It is ideal for beginners and intermediate users looking to invest in popular assets, without being overwhelmed by complex tools. Based on our findings and Financial Expert Opinions, Public is Good for:

- Investors from the USA

- Fractional Shares

- Free Stocks

- Investment

- Advanced traders

- Professionals

- Direct market access

- Commission-based trading

- Good learning materials

- Supportive customer service

Public Summary

To sum up, Public is a reputable and user-friendly investment platform, with a focus on accessibility and developing collaboration for well-informed investment decisions.

Additionally, the company is authorized and regulated by leading financial authorities in both the US and the UK. With its commitment to commission-free trading and fractional shares, Public makes investing accessible to everyone.

Overall, the firm offers a transparent and reliable investment environment. However, we recommend conducting thorough research to assess whether Public’s offerings align with your specific needs.

55Brokers Professional Insights

Public stands out by combining accessibility, innovation, and transparency in a single platform, and is marked by us as one of shortlisted brokers for real stock trading as best. Unlike traditional brokers, Public has expanded far beyond just stocks and ETFs; it offers access to alternative assets like fine art, collectibles, and private credit, positioning itself as a modern wealth-building firm, so most of investors or traders will find a good match of instruments..

The platform’s use AI-powered tools, packed with real-time insights, earnings recaps, and customizable thematic investing through Generated Assets, which we ultimately enjoy for trading analysis, that makes advanced market research more accessible, even to newcomers.

With an intuitive interface and support for fractional investing, the broker is also a good match for trades or different size and portfolios, allowing to empower long-term investors who want diversified exposure, along with educational content, and a simplified trading experience.

Consider Trading with Public If:

| Public is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Low fees and commissions.

- Professional trading.

- US investors.

- Beginner and intermediate investors.

- Secure trading environment.

- Stock Trading and Investment.

- Looking for broker with Top-Tier licenses.

- Offering popular financial products.

- Looking for broker with a long history of operation and strong establishment.

- Providing diverse trading tools, and trading strategies. |

Avoid Trading with Public If:

| Public might not be the best for: | - Looking for broker with 24/7 customer support.

- Investors who prefer robust educational resources.

- International investors outside the US. |

Regulation and Security Measures

Score – 4.7/5

Public Regulatory Overview

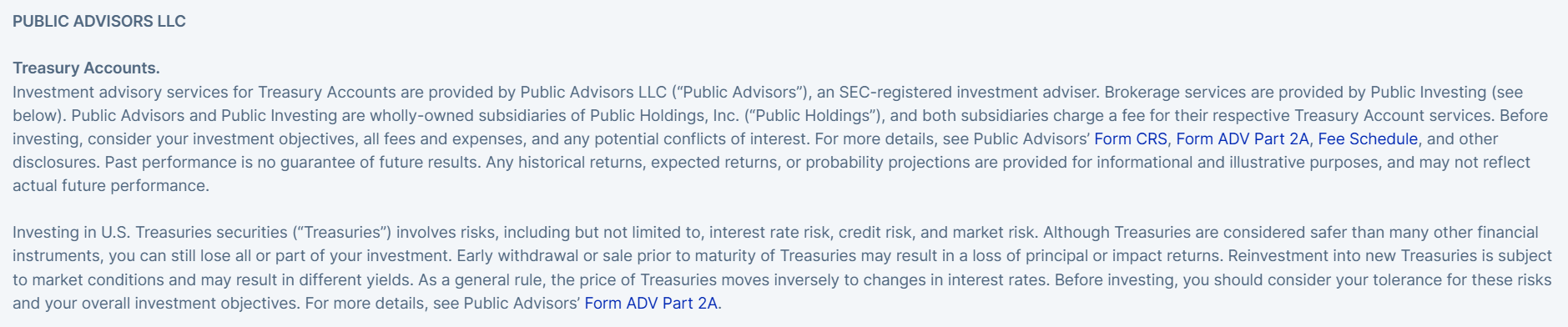

Public is a reputable Investing broker that follows the strict rules and guidelines established by the SEC, FINRA, and SIPC. These Top-Tier regulations safeguard investors’ assets and provide low-risk investing markets.

How Safe is Trading with Public?

Public is a legitimate and regulated investing platform. It operates as a registered broker-dealer under the U.S. Securities and Exchange Commission (SEC). Additionally, the firm holds memberships with regulatory bodies such as the Financial Industry Regulatory Authority (FINRA) and Securities Investor Protection Corporation (SIPC) in the United States.

These regulatory affiliations help ensure that the platform adheres to industry standards and provides a secure environment for investors.

The company also places a strong emphasis on protecting clients’ investments through compliance with regulatory standards and industry-leading practices. This involves safeguards against fraud, unauthorized account access, and robust coding for online transactions, with strict identity verification processes.

Additionally, as a member of FINRA and SIPC, securities in your account are protected up to $500,000. However, investors are advised to be cautious, regularly monitor their investments, and adopt secure online practices to further enhance their trading protection.

Consistency and Clarity

Public has built a solid reputation as a transparent brokerage, particularly appealing to the new generation of investors. Founded in 2019, the broker has grown steadily, earning trust through its clear business model that avoids payment for order flow, setting it apart from many competitors.

Trader reviews often praise the platform’s clean interface, ease of use, and access to fractional shares and alternative assets. However, some users note limitations in advanced charting tools, lack of futures trading, and absence of a demo account.

Despite these drawbacks, Public maintains high ratings across independent review platforms and app stores. The broker has also received positive mentions in media outlets for its innovation and transparency.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Public?

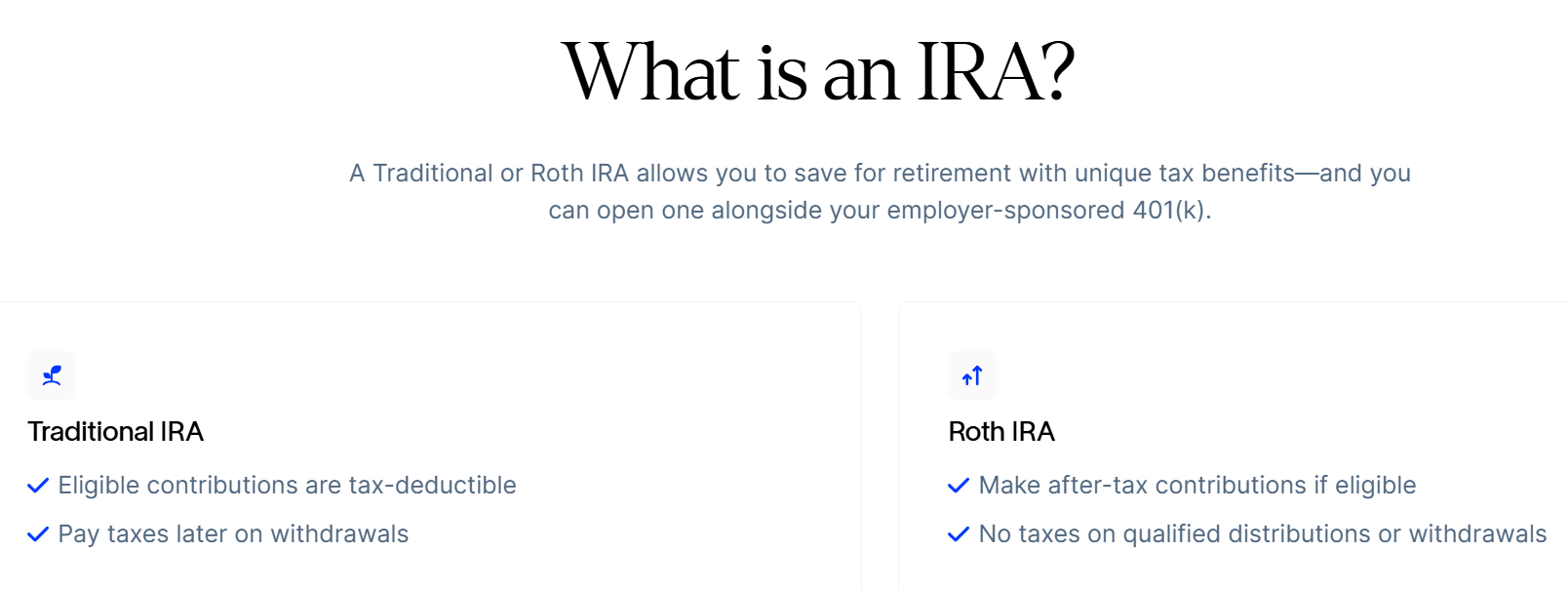

Public.com offers two main account types: Individual Taxable Brokerage accounts and Retirement accounts, including Traditional and Roth IRAs.

The brokerage account supports both cash and margin trading, giving users access to a wide range of assets like stocks, ETFs, crypto, bonds, and alternative investments. However, a demo account is not available, so users must trade with real funds from the start.

Brokerage Accounts

Public.com offers a standard individual taxable brokerage account available as either a cash account or an optional margin account. There is no minimum deposit required to open an account, meaning you can start with $0, though Public recommends beginning with around $100 for convenience and usability.

Debit card, bank, and check funding methods require a minimum of $20. Once funded, you can start investing with as little as $5 per trade via fractional share purchases.

Regions Where Public is Restricted

Public is currently restricted to US residents only and is not accessible to users in most other countries. Below is a list of regions where the broker is either restricted or entirely unavailable:

- UK

- Canada

- Europe

- Australia

- Japan, and more

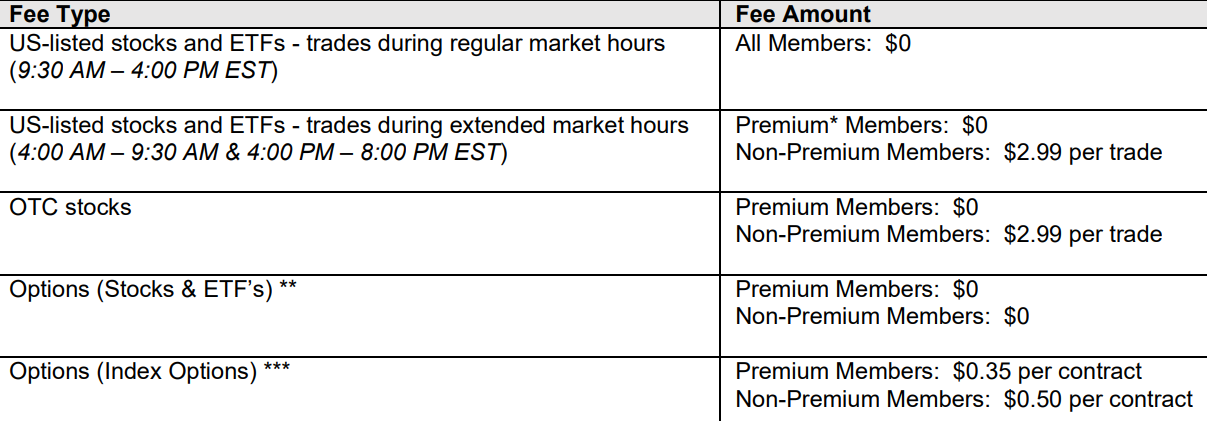

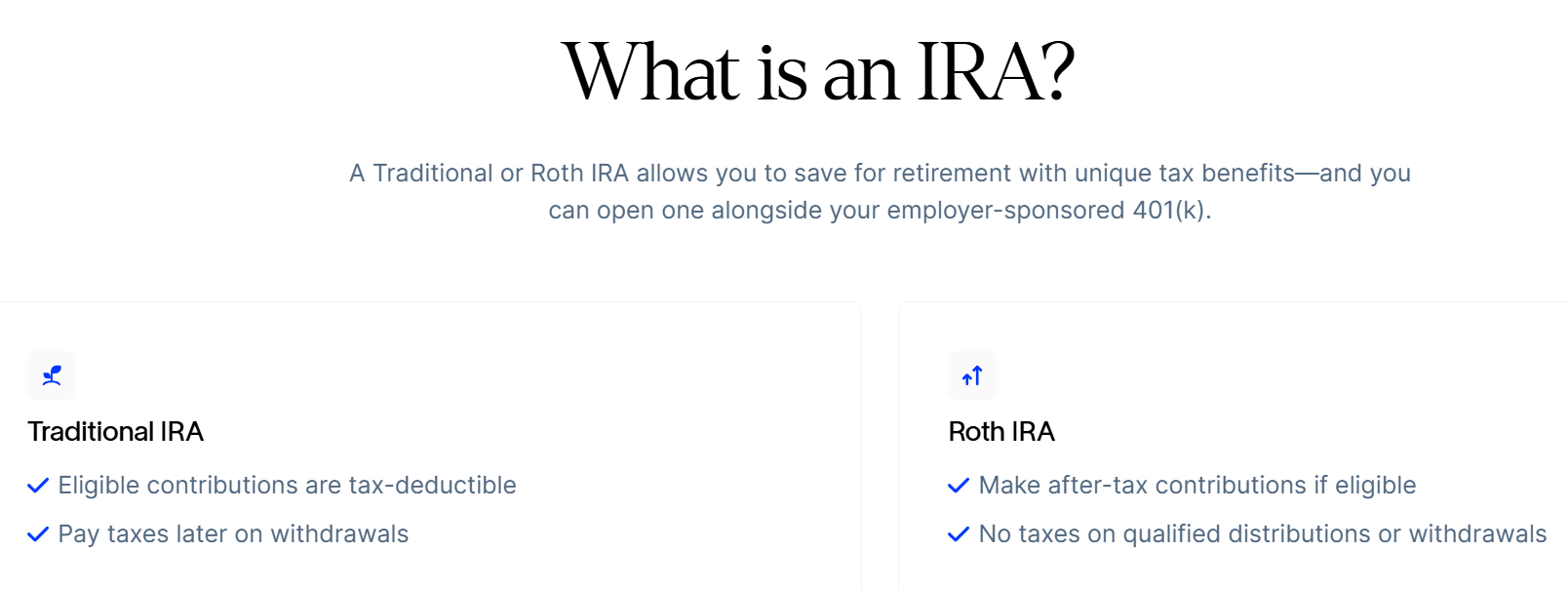

Cost Structure and Fees

Score – 4.6/5

Public Brokerage Fees

In terms of fees, the firm operates with a no-commission trading model, meaning users can invest in stocks without incurring traditional brokerage fees.

However, while investing itself is commission-free, there might be other fees associated with certain activities or services on the platform, like inactivity fees, transfer Public agent fees, Public service commission, etc. Therefore, investors should review Public’s current fee schedule and terms, as they can change over time.

The firm offers commission-free trading for Stocks and ETFs. However, trading commissions and fees can change over time and may vary based on the type of account, the specific Public policy for investment, and market conditions. For example, the company charges a foreign exchange fee when investors make a deposit or withdraw cash.

Public applies certain exchange and regulatory fees depending on the asset type and venue of execution. These exchange fees may vary based on the exchange used, such as NYSE or NASDAQ, and typically apply to options or advanced order types.

Additionally, standard regulatory fees, like those set by the SEC and FINRA, are charged per trade, though they are usually small.

The broker does not offer rollover swaps or swap-based trading. Instead, it provides a 1% match on IRA rollovers and transfers, which must remain in the account for at least five years to avoid an early removal fee. This match applies to eligible contributions and rollovers, enhancing your retirement savings without the complexities of swap transactions.

Public keeps most services free but charges fees for certain features. There are no general account maintenance fees, but an inactivity fee of up to $3.99 per month applies if your account balance is under $70 and you have no activity for 6 months.

Investment Plans carry small per-trade fees unless you are a Premium member, crypto trades incur variable fees based on order size, and alternative assets include transaction and management fees. Additional charges may apply for wire transfers, paper statements, and broker-assisted trades.

How Competitive Are Public Fees?

Public’s fee structure is generally competitive for casual and long-term investors. While some specialized fees apply, the broker avoids hidden charges common at other brokers.

Its pricing model favors simplicity, making it attractive for investors who prioritize clarity and predictable expenses over low fees directed toward high-frequency trading.

| Asset/ Pair | Public Commission | Charles Schwab Commission | Fidelity Commission |

|---|

| Stocks Fees | From $0 | From $0 | From $0 |

| Fractional Shares | $5 | $5 | $1 |

| Options Fees | From $0 | From $0 | From $0 |

| ETFs Fees | $0 | From $0 | $0 |

| Free Stocks | Yes | Yes | Yes |

Trading Platforms and Tools

Score – 4.4/5

Public operates primarily as web and mobile trading platforms, offering users a user-friendly and accessible experience. The platform stands out for its commission-free stock trading model, fractional shares, and social investing features.

While it does not provide a desktop version, the web and mobile apps are designed to cater to both new and experienced investors.

Trading Platform Comparison to Other Brokers:

| Platforms | Public Platforms | Charles Schwab Platforms | MEXEM Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Public Web Platform

Public’s web platform offers a clean, user-friendly interface designed for both beginners and experienced investors. It features intuitive navigation, real-time data, and interactive charts. The platform emphasizes transparency, providing community insights, company fundamentals, and analyst ratings alongside each asset.

Main Insights from Testing

Testing the web platform reveals a smooth and responsive experience with fast load times and minimal lag during market hours. The layout is logically organized, allowing users to quickly execute trades, view watchlists, and access educational content.

While advanced charting tools are somewhat limited, essential features like order placement, portfolio tracking, and news integration work efficiently, making it suitable for everyday investing rather than in-depth technical analysis.

Public Desktop MetaTrader 4 Platform

Public does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

Public Desktop MetaTrader 5 Platform

Public does not support MetaTrader 5 either. The broker does not provide access to advanced trading platforms like MT5, maintaining its focus on its trading platform.

Public MobileTrader App

Public’s mobile app serves as the central hub for users to engage in commission-free stock trading. The app allows investors to buy and sell stocks, explore fractional shares, and participate in a community-driven investing experience.

The mobile app is easily accessible, making it a convenient tool for both novice and seasoned investors to manage their portfolios and stay connected with market trends.

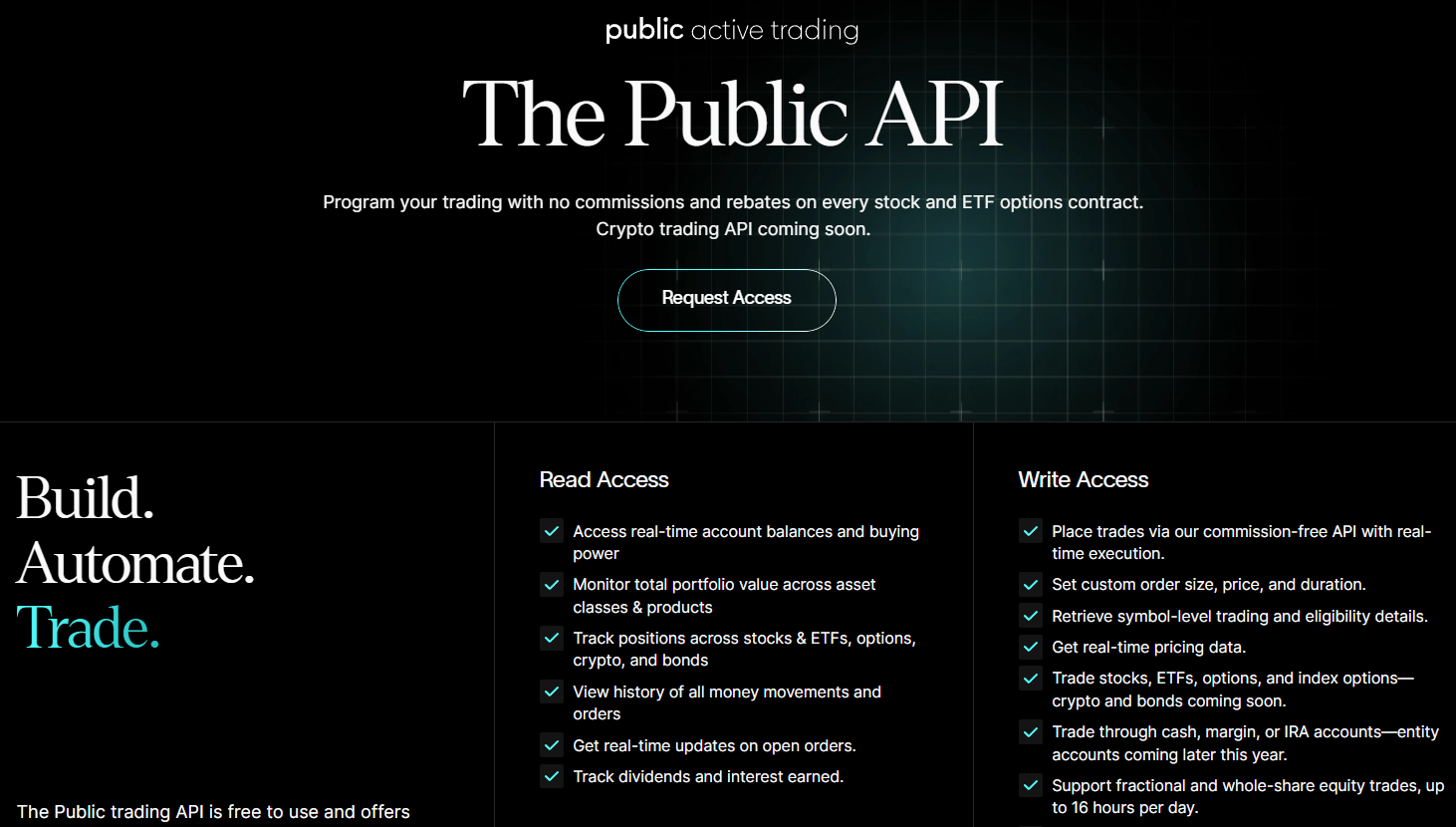

AI Trading

Public enhances its platform with AI-powered tools like Alpha and Generated Assets. Alpha offers real-time insights, earnings summaries, and chart explanations through a chat interface.

Users can ask questions and receive actionable market intelligence. Meanwhile, Generated Assets lets investors turn custom themes into investable indices, using AI to select stocks, backtest performance, and provide live tracking. These features make research and thematic investing more accessible and personalized.

Trading Instruments

Score – 4.6/5

What Can You Trade on Public’s Platform?

Public offers a range of investment products designed to cater to diverse investor preferences, which include stocks, ETFs, bonds, treasuries, Public gold trading, cryptos, art, collectibles, and more.

However, the broker does not support futures, forex, commodities, or indices trading. The platform is designed for accessible exposure across equities, fixed income, crypto, and unique alternative investments.

Main Insights from Exploring Public’s Tradable Assets

Public’s platform provides investors with access to a popular selection of assets, suitable for those looking to build a diversified portfolio. From traditional securities to newer asset classes, the platform simplifies investing through a user-friendly interface.

Margin Trading at Public

Public provides margin trading to qualified users with at least $2,000 in margin-eligible assets. Interest rates are tiered, starting at 9.50% and decreasing with higher borrowing amounts.

The platform ensures users understand potential risks with built-in risk alerts and educational content. The multiplier is currently available only for brokerage accounts and is not supported for retirement accounts. While useful for experienced traders, borrowing on margin involves higher risks and requires careful management.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Public

The platform offers investors a few funding methods to deposit money into their accounts for trading, including:

Public Minimum Deposit

The firm offers great options with no minimum deposit requirement for opening an account.

Withdrawal Options at Public

Public withdrawals can typically be initiated through the platform, and the funds are transferred back to the linked bank account.

Customer Support and Responsiveness

Score – 4.4/5

Testing Public’s Customer Support

The broker offers 24/5 customer support to assist users with inquiries and resolve issues related to their investment activities. Investors can typically reach customer support through various channels, such as email, live chat, and the FAQ section.

Contacts Public

Public provides customer support primarily through email and in-app chat. You can reach their support team by emailing support@public.com or press@public.com. Currently, the broker does not offer phone support, focusing instead on digital communication channels to assist users.

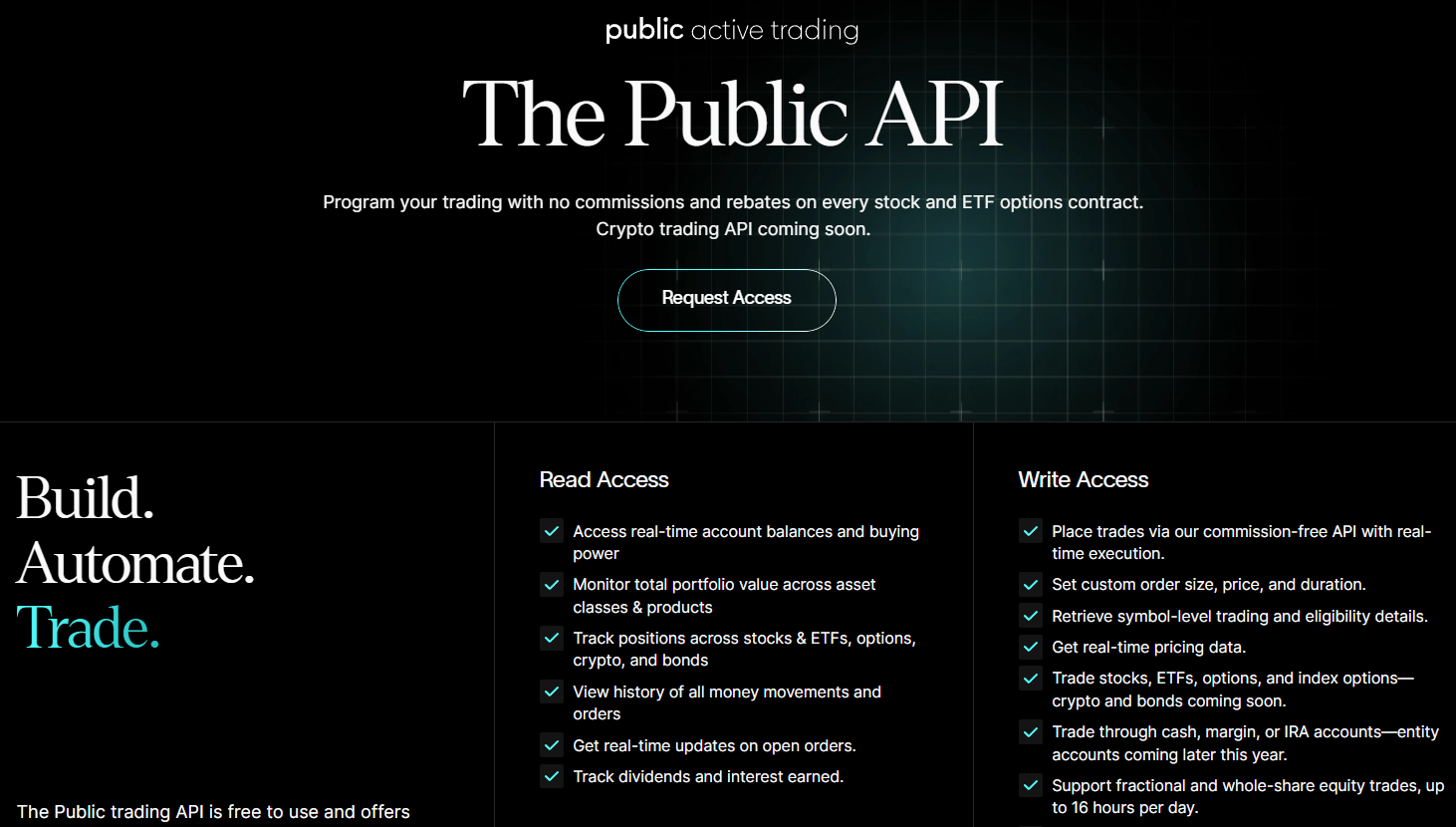

Research and Education

Score – 4.6/5

Research Tools Public

Public offers a range of research tools available on both its web and mobile platforms.

- The standout feature is Alpha, an AI-powered assistant that helps users understand earnings, market trends, and asset movements in real time.

- Investors can also access fundamental data like P/E ratios, market cap, and dividend yield, along with advanced charting tools for Premium users on the web.

- Additional features include personalized watchlists, price alerts, and access to a free trading API for users looking to automate their strategies.

Education

Public provides users with informative content to enhance their understanding of the stock market and investment strategies. The platform offers educational resources such as articles, video tutorials, and other materials to empower users with the knowledge needed to make informed investment decisions.

Additionally, the firm keeps users informed about market trends, stock updates, and relevant financial news through its news features.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options Public

Public offers a variety of investment solutions, including investing in stocks, ETFs, bonds, and more. Additionally, the broker features Generated Assets, which allow users to build AI-generated thematic portfolios based on their interests and market trends.

Investors can also access Treasury bills, alternative assets like fine art and collectibles, and even participate in IPO offerings. For those focused on long-term financial goals, retirement accounts such as Roth and Traditional IRAs are available, making Public a flexible platform for long-term financial planning.

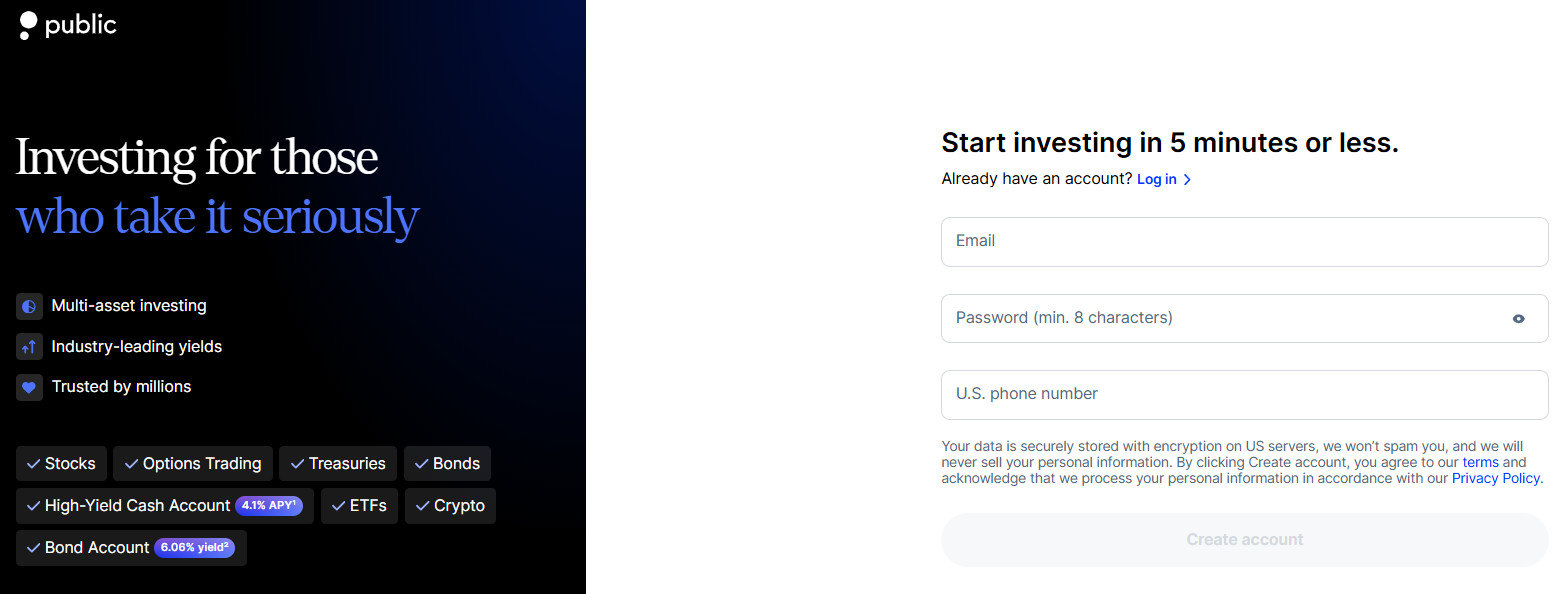

Account Opening

Score – 4.4/5

How to Open Public Demo Account?

Public does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Public Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register with the broker within minutes. Just follow the opening account or Public login page and proceed with the guided steps:

- Select and click on the “Get Started” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and verified, follow up with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core research functions, Public provides several helpful trading tools, including earnings calendars, market sentiment indicators, and analyst ratings to assist in evaluating potential investments.

Users can also access company financials, SEC filings, and automated recurring investments.

Public Compared to Other Brokers

Public stands out as a modern, beginner-friendly brokerage focused on simplicity and transparency, though it lacks access to futures trading and more complex financial instruments offered by full-service brokers like Interactive Brokers or TD Ameritrade.

While its platform design is intuitive and well-suited for mobile-first investors, advanced traders may find its tools and research capabilities more limited compared to platforms like Thinkorswim or TWS.

Unlike some brokers that provide a broader global reach and asset diversity, Public caters more to long-term investors interested in stocks, ETFs, and unique alternatives like collectibles and fine art.

In terms of regulation and support, Public maintains strong US regulatory backing and offers reliable customer service, though not 24/7 like some competitors.

| Parameter |

Public |

MEXEM |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

$0.85 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Public Web, Mobile Apps |

Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, ETFs, Treasuries, Crypto, Bonds, Fine Art, Collectibles |

Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, SIPC |

CySEC, FCA, AFM, FSMA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

€0.1 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Public

Public is a US-based investment platform designed to simplify investing for both beginners and casual investors. It offers access to a wide range of assets, including stocks, ETFs, treasuries, crypto, bonds, and more.

One of its standout features is the AI-powered Generated Assets, which allow users to build thematic portfolios tailored to their interests. The platform is accessible via web and mobile apps and includes useful trading tools like customizable watchlists, price alerts, and real-time market data.

With no account minimums and commission-free trading on stocks and ETFs, Public provides an accessible and transparent investing experience backed by strong US regulatory oversight.

Share this article [addtoany url="https://55brokers.com/public-review/" title="Public"]