- What is PRCBroker?

- EXT Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- PRCBroker Compared to Other Brokers

- Full Review of Broker PRCBroker

Overall Rating 4.2

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.1 / 5 |

| Deposit and Withdrawal Options | 4.2 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 3.6 / 5 |

| Portfolio and Investment Opportunities | 3.8 / 5 |

| Account opening | 4.4 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is PRCBroker?

PRCBroker is a Forex trading broker that enables corporate and business clients to trade various financial products, including Forex, CFDs, metals, oil, and stocks.

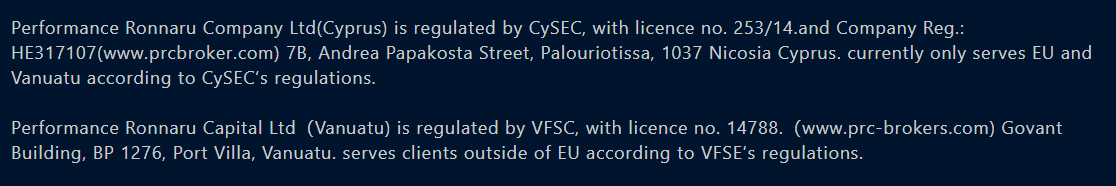

The company was founded in 2014 in Cyprus and operates under the Cyprus Securities and Exchange Commission (CySEC) regulation. Moreover, the company holds an additional license issued by the Vanuatu Financial Services Commission (VFSC).

Overall, PRCBroker provides reliable services and competitive trading options mainly to institutional clients and professional traders, utilizing the popular MetaTrader platforms and various trading systems.

PRCBroker Pros and Cons

After conducting an analysis, we have identified several advantages and disadvantages to consider when selecting PRCBroker as your Forex trading broker. For the pros, the broker offers widely recognized and efficient MT4 and MT5 trading platforms, facilitating effective trade execution. The company also provides fast and secure trading conditions, offering competitive rates and spreads suitable for business clients.

For the cons, the trading conditions offered by PRCBroker may vary depending on the specific entity involved. Besides, the proposal is mainly tailored for institutional clients and professionals; thus, it might be limited for retail traders. Moreover, the company does not offer 24/7 customer support, which may be inconvenient for some traders. Another drawback is the absence of an education section on the website.

| Advantages | Disadvantages |

|---|

| CySEC regulation and oversight | Trading conditions might vary based on the entity |

| Tailored proposal for Institutional trading | Mainly suitable for institutions not retail trading |

| MT4 and MT5 platforms | High first deposit |

| Available for European traders | Limited number of trading instruments and educational materials |

| Competitive pricing | Not suitable for Beginning Traders |

| Negative balance protection | |

PRCBroker Features

PRCBroker offers safe and competitive trading services with favorable fees and spreads for various financial trading products. The broker is a suitable choice for both corporate clients and experienced traders. For a better understanding of what the broker offers, we have compiled a list of the main aspects of trading with PRCBroker.

PRCBroker Features in 10 Points

| 🗺️ Regulation | CySEC, VFSC |

| 🗺️ Account Types | Premium, VIP accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | Forex, CFDs, Metals, Oil, and Stock |

| 💳 Minimum deposit | $10,000 |

| 💰 Average EUR/USD Spread | 2 pips |

| 🎮 Demo Account | Not available |

| 💰 Account Base currencies | USD, EUR, GBP |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is PRCBroker For?

Based on our findings and financial expert opinions, PRCBroker offers competitive trading conditions and a secure trading environment. However, the broker’s proposal might be a better match for certain traders and trading needs, including:

- Traders from Europe

- International trading

- CFD and currency trading

- Traders who prefer the MT4 and MT5 platforms

- Institutional trading

- Professional traders

- STP/NDD execution

- Competitive pricing

- EA/Auto trading

- Good trading tools

PRCBroker Summary

PRCBroker is a good Forex trading company that provides access to a range of financial products for corporate and business clients. With its establishment in Cyprus and regulation by CySEC, as well as an additional license from VFSC, the broker offers a reliable trading environment and international access.

PRCBroker provides clients with popular and widely used MetaTrader 4 and MetaTrader 5 trading platforms, ensuring accessibility and convenience across various devices. However, it is important to note that the broker’s minimum deposit is high and also lacks a dedicated section for educational materials, seminars, and webinars. This means that the broker is not suitable for beginner traders.

Overall, the broker offers a secure trading platform and competitive trading conditions. However, every trader has unique needs, so it is crucial to evaluate whether PRCBroker aligns with their specific trading goals and preferences.

55Brokers Professional Insights

PRCBroker is a choice for either global traders or those reside in EU, since Broker provides services through various entities. We think, PRCBroker’s proposal is more suitable for institutional and professional clients, as minimum capital to start is quite high, making it not the best for beginners, also accounts tailored with different trading conditions and fee structures.

The rest of trading conditions are good and on necessary level, with software offered via MT4 or MT5 platforms, packed with necessary capabilities and features for large volume trading. Yet, the range of trading products is modest across Forex, metals, oil, and stocks so consider this while selecting. The broker also does not offer a demo account or an education section, again marking its proposal as favorable for professionals only.

We also recommend considering the differences between the entities, as the trading conditions, account types available, and other aspects may vary.

Consider Trading with PRCBroker If:

| PRCBroker is an excellent Broker for: | - Professional and Institutional clients

- Traders from Europe

- International traders

- MT4 and MT5 enthusiasts

- CFD and currency traders

- MAM managers

|

Avoid Trading with PRCBroker If:

| PRCBroker is not the best for: | -Beginner traders

- Traders looking for comprehensive education

- Clients who want access to 24/7 support

- Traders looking for platforms other than MT4/MT5

- Clients looking for an extensive range of instruments |

Regulation and Security Measures

Score – 4.4/5

PRCBroker Regulatory Overview

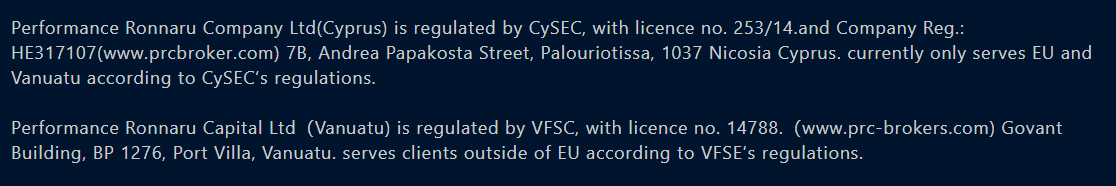

PRCBroker is a reliable and secure company that follows the strict rules and guidelines established by CySEC, the European regulatory authority that oversees its operations. Compliance with the regulatory requirements set by CySEC enhances the safety and confidence of traders who choose to trade with PRCBroker.

- PRCBroker is also regulated by the Vanuatu Financial Services Commission (VFSC). Although this is an offshore entity, the CySEC license of the broker ensures the security and reliability of operations. Besides, due to the offshore jurisdiction, the broker’s services are available to international clients.

How Safe is Trading with PRCBroker?

PRCBroker prioritizes the safety and security of its clients’ funds by segregating them from the firm’s accounts and not using them for operational purposes. Also, the broker provides different protective measures, such as negative balance protection, which is great during times of market volatility to ensure that traders’ accounts do not go below zero.

Consistency and Clarity

Since its establishment in 2014, PRCBroker has offered safe and strictly overseen services to professionals and institutional clients. Based on our research, the broker has been consistent in its development to meet different trading needs and offer attractive services to its European and international clients.

We have reviewed customers’ feedback to see what real experiences traders share. The experiences are different, but most clients have pointed out dedicated customer service and an overall favorable trading environment. Some traders express doubts about the broker’s regulation, as well as indicate issues with the platforms. Yet, the overall reviews of the broker are mostly positive. From our side, we recommend traders pay attention to the broker’s proposal and how it meets their specific expectations. Also, do not ignore concerns and negative experiences shared by fellow traders, and make informed and well-thought-out decisions based on them.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with PRCBroker?

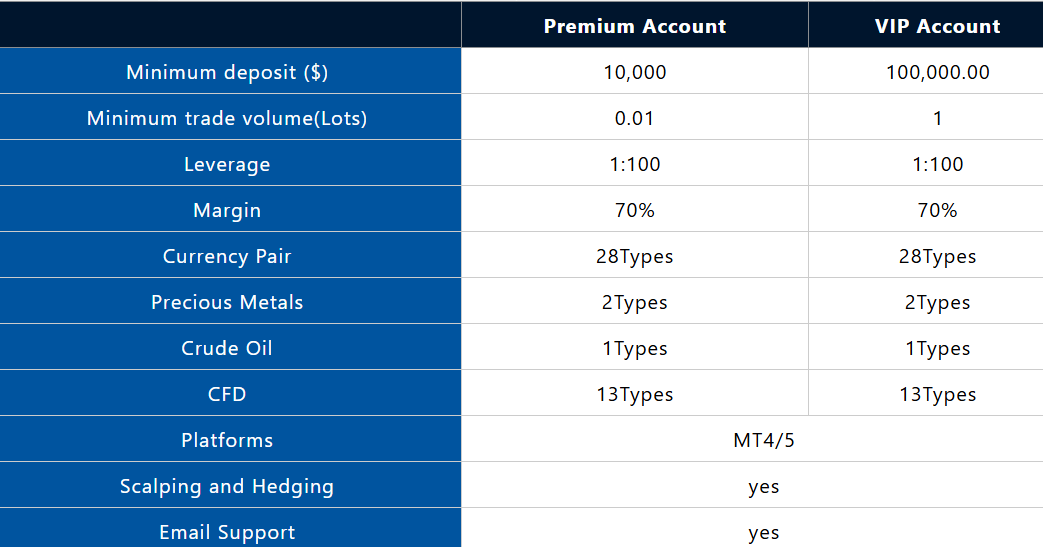

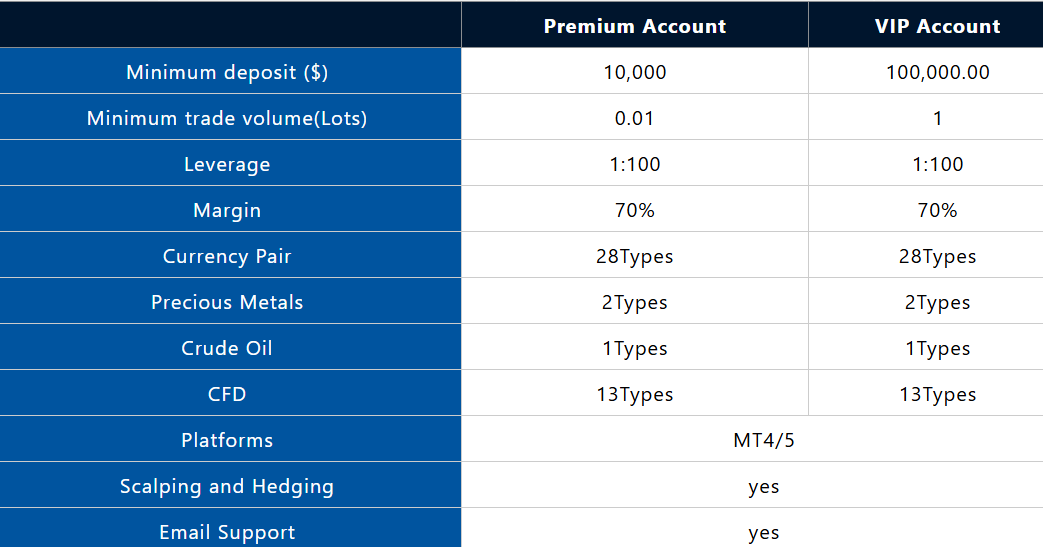

Based on our findings on PRCBroker, through the European entity, traders can select between Premium and VIP account types, while fund managers can opt for the King Mam account. However, international traders should conduct comprehensive research to gather information about the available account types.

Each account is designed for different trading needs, offering fast execution and favorable conditions. The two accounts, Premium and VIP, have common features, including the leverage ratio of up to 1:100. Trades are conducted on the MT4/MT5 platforms. The range of the available instruments is the same for both accounts. Also, traders can use hedging and scalping strategies.

- The Premium account is tailored for average traders and ensures safe and reliable transactions. The minimum deposit requirement for this account is $10,000.

- The VIP account is for professional clients, ensuring ultra-fast execution and tailored services. The minimum deposit is $100,000.00.

- The King MAM account is created for fund managers. It provides real-time monitoring of multiple accounts and all the positions in one interface. MAM fund managers can access historical data, use Expert Advisors, and other favorable features for a better experience.

Regions Where PRCBroker is Restricted

PRCBroker operates under an international entity, making its proposal available globally. However, there are regional restrictions based on regulation and jurisdiction. Here is the list of regions the broker does not accept clients from:

- The USA

- Canada

- Mauritus

- Haiti

- Suriname

- Nort Kores

- Puerto Rico

- Hong Kong

Cost Structure and Fees

Score – 4.3/5

PRCBroker Brokerage Fees

We found that the broker offers competitive pricing for trading instruments. However, trading fees generally vary based on the account type, trading instrument, and specific entity, so thorough research is recommended to determine the available options and costs. In addition to spreads and commissions, non-trading charges might be included in overall costs.

Based on our test trade, PRCBroker spreads are floating, with an average spread of 2 pips for the widely-traded EUR/USD currency pair in the Forex market, which is slightly higher than average. The broker provides competitive spreads for all major currency pairs and other popular trading instruments. However, the trading conditions can differ depending on the entity, thus, traders need to do their research to understand the specific conditions in place.

PRCBroker does not publicly disclose its commissions. Overall, the broker operates in a spread-based fee system. As we have found, the broker’s commissions are not applied to individual trades but are rather applied to partnership and affiliate programs. The commissions are tailored and determined based on the clients and their specific trading needs.

How Competitive Are PRCBroker Fees?

From what we have found, PRCBroker offers competitive fees and pricing for all the major trading products. The fees are in line with the market average, or, for certain instruments, a little on the higher side.

The trading costs depend on the account type, instrument, and, of course, the entity. Based on the jurisdiction, trading costs and overall conditions can vary. Our advice is to conduct thorough research and see how the broker’s offering aligns with their special trading needs. Besides, the broker does not publicly disclose all its applicable fees. To some charges, traders can access only after opening an account with the broker. This lack of transparency can be discouraging for many clients.

| Asset/ Pair | PRCBroker Spread | EXT Spread | VIBHS Spread |

|---|

| EUR USD Spread | 2 pips | 0.3 pips | 1.6 pips |

| Crude Oil WTI Spread | 3 | 3 | 2 pips |

| Gold Spread | 1 | 0.005% | 0.5 pips |

PRCBroker Additional Fees

Based on our findings, PRCBroker does not charge an inactivity fee. However, as the broker does not disclose all its applicable costs, we encourage traders to contact the customer support team. Besides, the terms and conditions also depend on the jurisdiction and might be different.

- In addition, there might be deposit and withdrawal fees depending on the funding methods.

Score – 4.4/5

Both European and global entity traders can trade using the highly popular MetaTrader 4 and MetaTrader 5 trading platforms provided by PRCBroker. These platforms are widely recognized and can be accessed through desktop, web, and mobile devices, ensuring traders can stay connected to the markets and execute trades conveniently from anywhere.

| Platforms | PRCBroker Platforms | EXT Platforms | VIBHS Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | No |

| cTrader | No | No | No |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

PRCBroker Web Platform

PRCBroker’s web platform is known for its user-friendly interface, extensive features, and ability to automate trading strategies. The MetaTrader web platform inspires trust in traders and enables them to trade at their desired pace. The web platform does not require downloads or installations, enabling traders to access their accounts through a browser. The good thing about it is that the web option retains all the essential features and conditions of the desktop platform, including good charting and graphic tools, trading indicators, real-time icon display, analytical objects, and more.

PRCBroker Desktop MetaTrader 4 Platform

Per our analysis, PRCBroker offers a range of trading tools that include advanced charting features with multiple chart types, various timeframes, an economic calendar, and technical indicators.Moreover, the MT4 platform facilitates automated trading through Expert Advisors (EAs) and algorithmic trading. Traders can also access updated market data, news, quote analysis, and daily reports. The platform is easy to use, it is dynamic, and integrates simplicity with flexibility and functionality.

PRCBroker Desktop MetaTrader 5 Platform

The MT5 is a more advanced version of the MT4 platform, including enhanced features and capabilities. The platform meets the needs of professional traders, enabling them to explore the market with a set of functional and innovative tools. Via the MT5 platform, traders can access all asset classes, use over 24 analytical objects, and more than 30 technical indicators, monitor real-time orders, and access trading history. The platform also enables real-time synchronization of browsers and mobile terminals, access to full transaction reports, and more.

PRCBroker MobileTrader App

One of the best opportunities in trading is the availability of a mobile platform for traders. PRCBroker enables its clients access via MT4 and MT5 mobile apps. The mobile platforms integrate all the fundamental tools and features, enhancing clients’ opportunities to explore the market from the palm of the hand with advanced capabilities. The mobile apps include, but are not limited to, an extensive range of analytical objects and technical indicators. Besides, users can set pending, stop loss, and take profit orders.

The mobile app is available via iOS and Android devices, ensuring accessibility and easy reach of the app.

Main Insights from Testing

Based on our research and experience with the broker, its trading platforms integrate advanced tools and features to accommodate a positive trading experience. The MT4 platform has a simple interface, combined with advanced capabilities, ensuring a great trading experience. The MT5 platform is more enhanced, with an extensive range of analytical tools, charts, and trading indicators. Also, the web and mobile platforms ensure greater flexibility and the ability to manage accounts from anywhere with internet access.

Trading Instruments

Score – 4.1/5

What Can You Trade on the PRCBroker Platform?

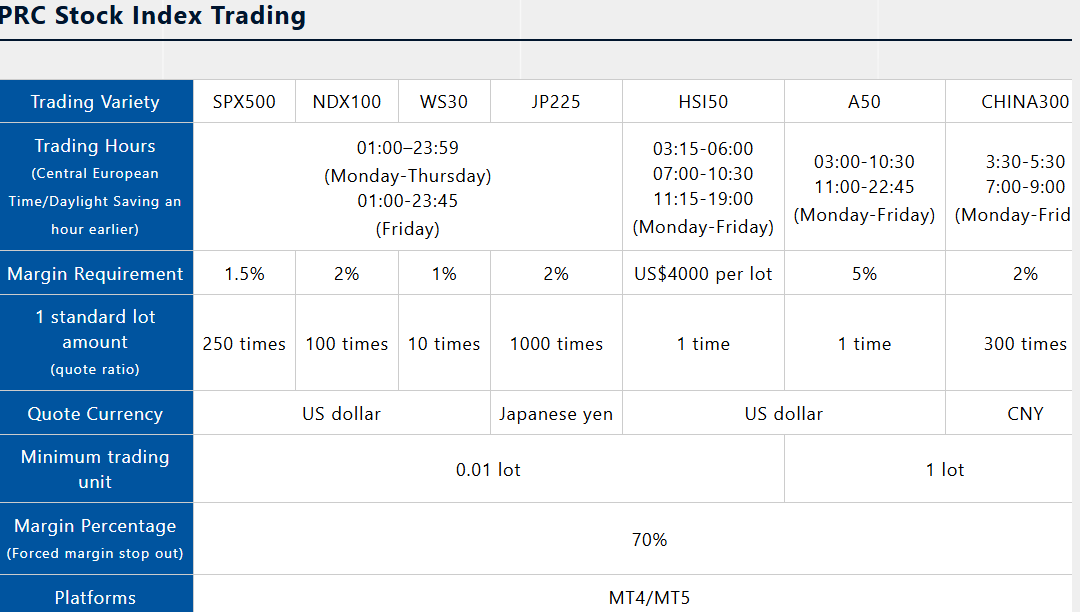

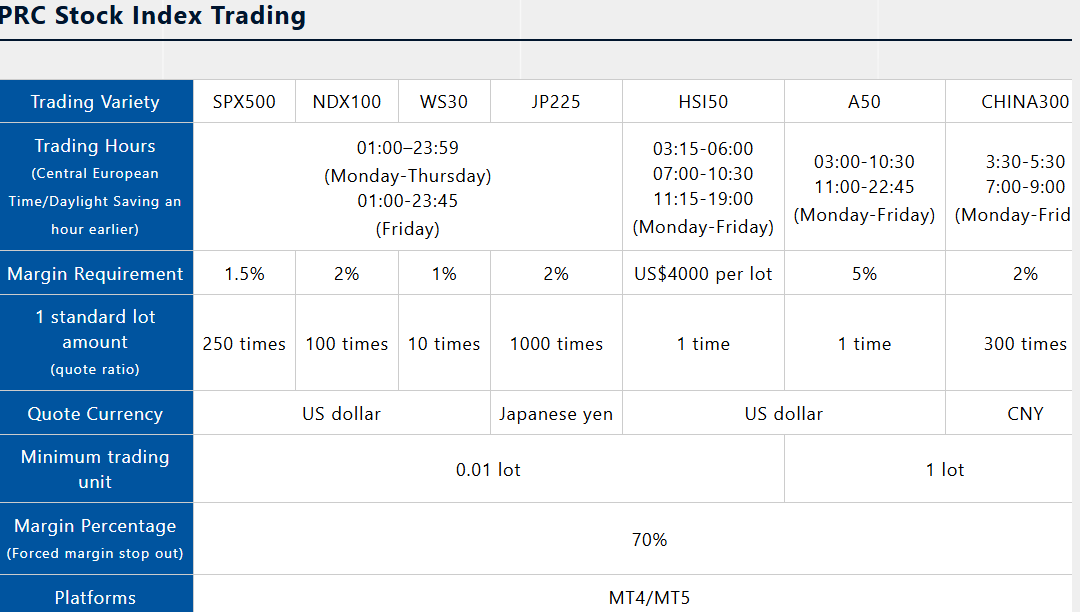

PRCBroker offers clients the opportunity to trade Forex, Precious Metals, Crude Oil, and CFDs on Commodities. Forex trading is particularly notable among these markets due to its widespread recognition, high liquidity, and competitive spreads. However, it is important to note that the availability of trading instruments may differ based on the specific entity, so it is advisable to conduct comprehensive research to ascertain the range of options available.

Overall, traders have access to the following tradable products:

- 30 currency pairs

- Gold and silver

- Crude oil

- Stocks

Main Insights from Exploring PRCBroker Tradable Assets

Our research revealed a modest offering of tradable products. The broker offers only the most popular Forex pairs, commodities, precious metals, and stocks on CFDs. PRCBroker offers 28 currency pairs through its EU entity, and 30 pairs through the global entity. Traders can also trade the most popular precious metals, gold and silver. Also, the broker offers stock trading, offering thirteen of the most popular indicators: the Nasdaq index, the UK FTSE 100, DAX30, China A50, etc.

Overall, the range of tradable products is modest. Stocks are available through the global entity. We advise traders to be careful about the instrument availability, costs, and overall conditions based on the jurisdiction.

Leverage Options at PRCBroker

Leverage is a valuable tool that allows Forex traders to enter the market with limited capital. However, you should understand that it can result in substantial gains or losses. Therefore, understand how leverage operates and its potential consequences before engaging in any trading activities involving leverage.

PRCBroker leverage is offered according to the CySEC and VFSC regulations:

- European traders can use a maximum of up to 1:30 for major currency pairs.

- For international traders, the maximum leverage is 1:100.

Deposit and Withdrawal Options

Score – 4.2/5

Deposit Options at PRCBroker

PRCBroker provides a few funding methods to its clients to deposit funds into trading accounts, including bank wire transfers, credit/debit cards, and online payment systems like Skrill and Neteller. However, it is important to note that specific requirements and limitations for each funding method may vary depending on the financial institution and the country of residence.

Minimum Deposit

To open a live trading account with PRCBroker, traders are required to deposit a minimum amount of $10,000 for a Premium account. This initial deposit amount is relatively high and may not be suitable for beginners. For Vip accounts, the minimum deposit amount is set at $100,000.

Withdrawal Options at PRCBroker

As we found, traders can expect an easy and quick withdrawal process with PRCBroker, enabling them to access their funds efficiently. However, conditions usually vary by the payment provider and might take several days to appear in your account.

- Besides, depending on the funding method, there might be deposit and withdrawal fees.

Customer Support and Responsiveness

Score – 4.6/5

Testing PRCBroker Customer Support

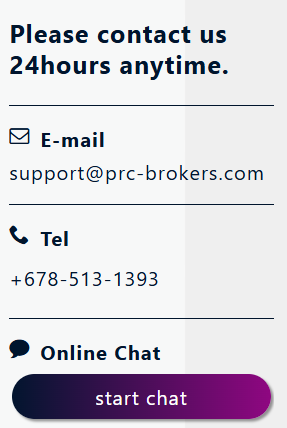

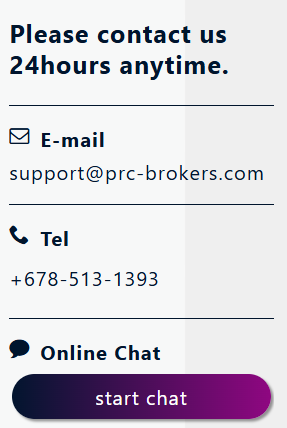

We found that PRCBroker customer support is available 24/5 through email, phone, and live chat. The broker has a team of experienced trading specialists who are available to help clients with various issues. These include technical problems, general inquiries, and operational concerns.

- The broker is not socially active and does not provide updates on its operations through any social platform.

Contacts PRCBroker

PRCBroker provides dedicated multilingual customer support 24/7. Clients can contact the broker’s team via one of these options:

- Phone assistance allows traders to reach out directly to the support team for prompt answers and solutions to their concerns. For phone communication, clients can use the provided phone number: +678-513-1393.

- Clients can also send their inquiries, questions, or suggestions to the broker via the available email address: support@prc-brokers.com.

- At last, the live chat is available 24/5, providing prompt, quick, and detailed answers. It is the fastest way to reach the broker and get professional support.

Research and Education

Score – 3.6/5

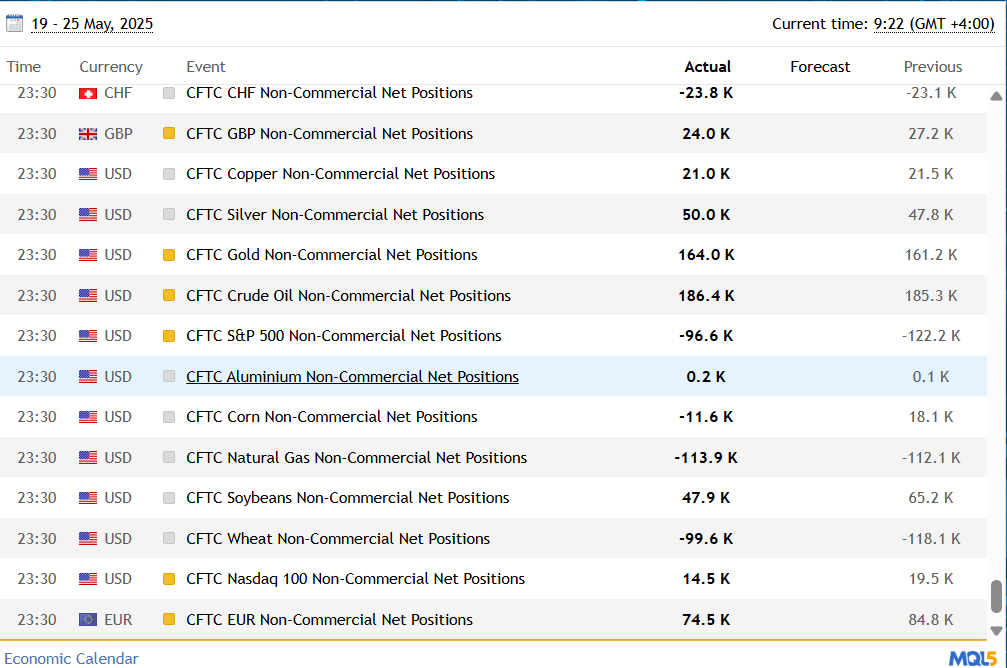

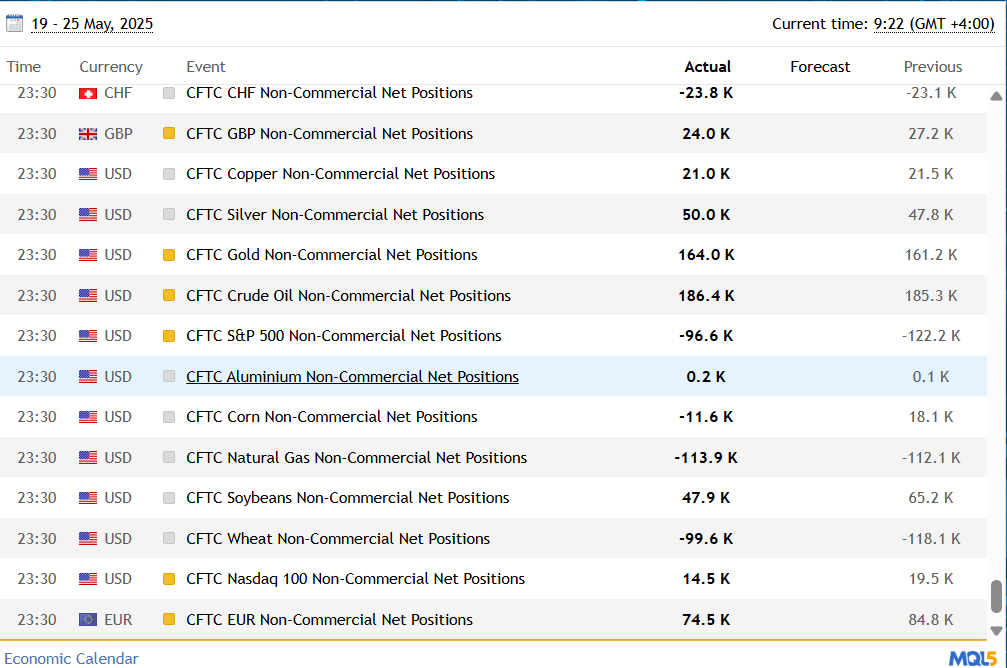

Research Tools PRCBroker

As we have found, all the essential tools and features, along with research capabilities, are included on the broker’s platforms. The platforms are advanced and well-equipped with analytical tools, indicators, and charts. Through the official website, the broker provides only one other research opportunity – the Economic calendar and Forex news, which may not be sufficient for those seeking a variety of solutions.

Education

We noticed that the broker lacks a dedicated section on its website for educational materials, seminars, and webinars. This absence can be considered a drawback since educational resources play a crucial role in the development and improvement of traders’ skills.

- However, since the broker focuses mainly on institutional trading, educational materials for beginner or intermediate traders are not a priority.

Is PRCBroker a Good Broker for Beginners?

Our research of PRCBroker showed that the broker primarily directs its services to professional and institutional clients. The minimum deposit requirement is very high, which already makes the broker an unattractive option for beginners and cost-conscious clients. Besides, the broker does not include a research or educational section, which makes it an unfavorable option for traders looking for guidance and basic trading knowledge. Another factor that confirms the broker’s insufficiency for novice traders is the absence of a demo account. In short, beginner traders should look for more suitable brokers, including materials and proposals for inexperienced clients.

Portfolio and Investment Opportunities

Score – 3.8 /5

Investment Options PRCBroker

Our research revealed a limited number of trading instruments. The tradable products are across Forex, commodities, indices, and stocks. However, the proposal is mainly CFD-based, restricting any chances of long-term investments.

This said, the broker still offers an alternative option for expanding portfolios and exploring more opportunities.

- The MAM accounts are a great opportunity for fund managers to manage several accounts and positions all at once from a single interface.

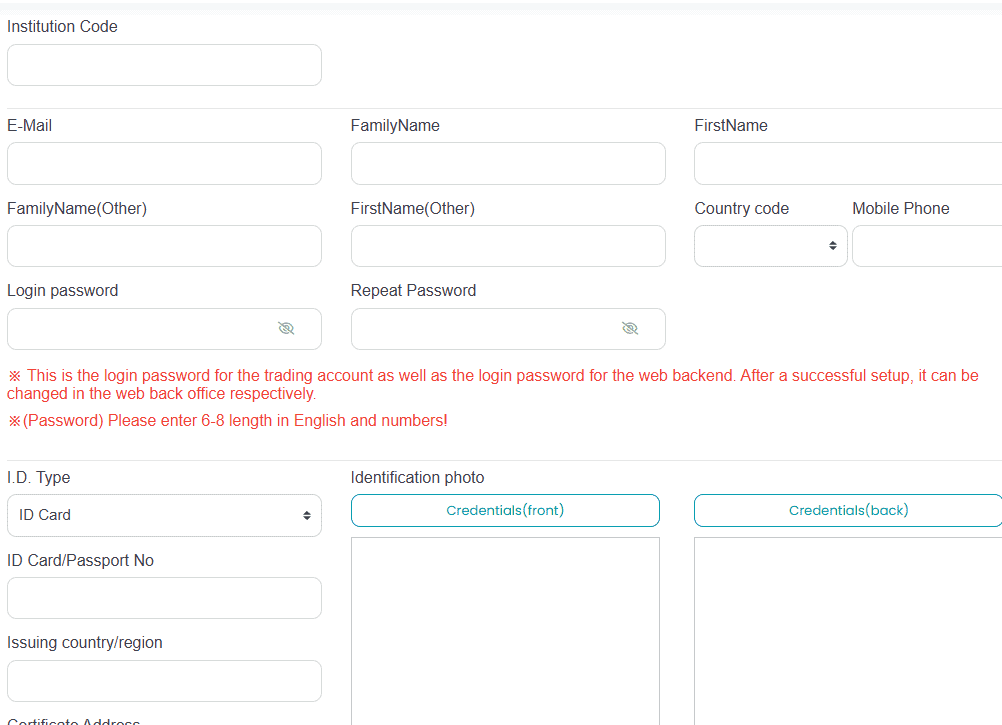

Account Opening

Score – 4.4/5

How to Open a PRCBroker Demo Account?

We have found that PRCBroker does not offer a demo account. This is perhaps connected with the fact that the broker’s proposal is for advanced traders who are already experienced in the market and do not need to gain skills and footing in trading.

How to Open a PRCBroker Live Account?

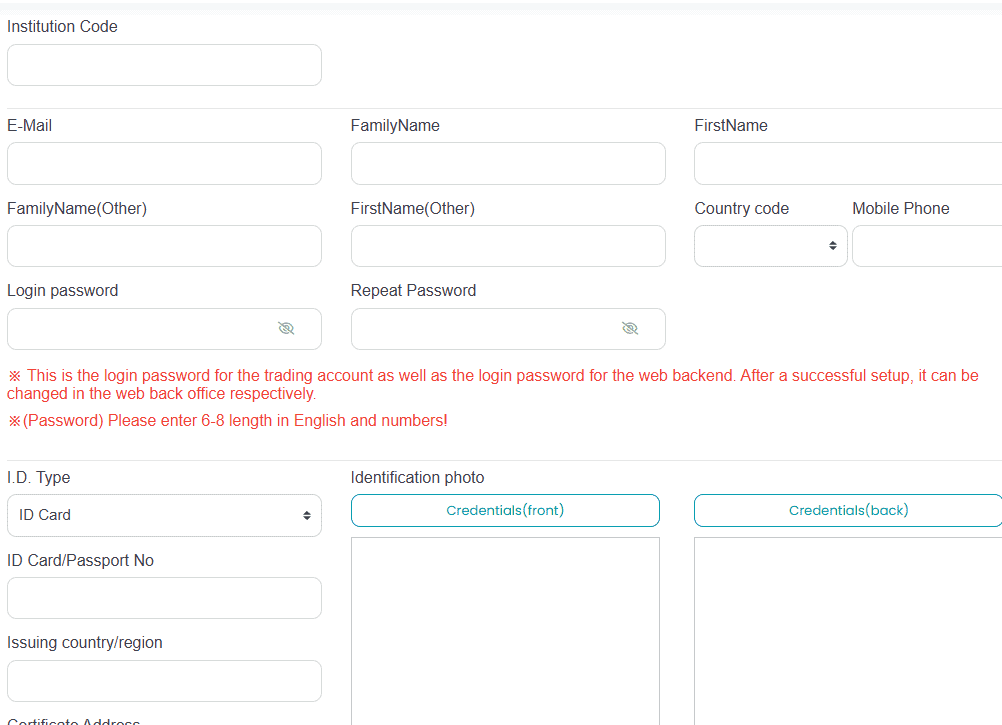

Opening an account with a broker is quite easy. The process will likely take several minutes, yet the offering is mainly for corporate trading and institutional clients. Clients should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Register Account” page.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your personal data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.7/5

As we have already mentioned, PRCBroker integrates all the trading tools and features into its platforms. Those traders who are looking for additional tools on the broker’s website will probably not find satisfactory ones. The only additional feature is a financial calendar that provides essential information on the coming market events and changes. Through the broker’s financial calendar, clients can earn insights into each financial asset.

PRCBroker Compared to Other Brokers

We have also compared PRCBroker with other respected brokers in the market to see where it stands. In our broker comparison, we start with the regulatory status. Based on our findings, PRCBroker holds a license from CySEC, which ensures the safety of trades and adherence to strict rules. The broker also operates under an international entity, attracting clients from all over the world. Similar regulatory oversight has FXGT.com, being regulated by CySEC, FSCA, FSA, and VFSC.

The broker offers the most popular MT4 and MT5 platforms through web, desktop, and mobile apps. Most of the brokers we reviewed offer the MT4/MT5 platforms, although CFI and BlackBull Markets provide other platforms as well, for better diversity. When it comes to the trading instruments, from all the brokers we reviewed here, PRCBroker has the smallest range of 70+ instruments. RoboForex, for instance, has one of the most extensive amounts of 12,000+, and BlackBull Markets has an even more attractive offering of 26,000+ tradable products.

Another point we reviewed is the availability of educational materials. PRCBroker does not have an educational section, which makes the broker unfit for beginner traders. Besides, it does not offer a demo account, and the initial funding requirement is very high. On the contrary, FBS is a great option for beginners, as it offers excellent educational resources and a demo account, while the initial deposit requirement is $5.

| Parameter |

PRCBroker |

CFI |

RoboForex |

FBS |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread-Based Account |

From 2 pip |

From 0.4 pip |

Average 1.3 pip |

Average 0.7 pip |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission-Based Account |

0.0 pips + commission based on the trading volume |

0.0 pips + commission based on the trading volume |

0.0 pips + $4 |

0.0 pips+$3 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Average |

Low |

Average |

Low |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader, TradingView, CFI Multi-Asset |

MT4, MT5, R StocksTrader |

MT4, MT5, FBS App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

70+ instruments |

15.000+ instruments |

12,000+ instruments |

550+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

CySEC, VFSC |

FCA, CySEC, DFSA, FSC, VFSC, FSA, JSC, BDL |

FSC |

ASIC, CySEC, FSC |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Not available |

Good |

Good |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$10.000 |

No minimum deposit |

$10 |

$5 |

$0 |

$100 |

$5 |

Full Review of Broker PRCBroker

In conclusion, PRCBroker offers professional services to corporate and business clients. The broker is established in Cyprus and holds a license from CySEC. The regulatory oversight ensures adherence to stringent laws and a reliable trading environment. It also operates under an additional international entity under VFSC.

Traders can choose to conduct trades between the popular MetaTrader 4 and MetaTrader 5. Both platforms stand out for the excellent range of advanced tools. Besides, clients can conduct trades through the web, desktop, and mobile apps. PRCBroker offers two account types with different conditions and opportunities. However, the minimum deposit is very high for both accounts, making the proposal unfavorable for beginner and cost-conscious clients. Other factors that make the broker unfit for novice traders are the lack of a demo account and the non-existent educational materials.

Overall, the broker offers a secure trading platform and competitive trading conditions. However, every trader has unique needs, so it is crucial to evaluate whether PRCBroker aligns with their specific trading goals and preferences. Another important notice is the differences between jurisdictions. We have noticed differences in the account types, tradable product availability, and other trading aspects.

Share this article [addtoany url="https://55brokers.com/prcbroker-review/" title="PRCBroker"]