- Is Opteck safe or a scam?

- Trading Platform

- Accounts

- Spread

- Leverage

- Deposits and Withdrawals conditions with a minimum deposit and withdrawal fee

- Conclusion

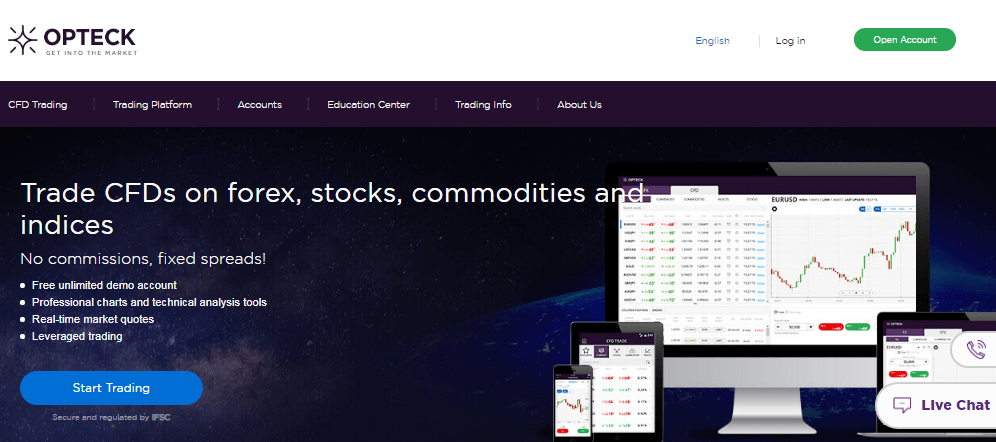

What is Opteck?

Opteck is the brokerage service company that strives to provide a simple, yet unique environment for seamless trading. Thus, technological innovation with advanced platforms, analytical chart, smart portfolio reports, and news are available and developed until a very high level.

Opteck was found in 2011 while headquarters located in Cyprus, however in order to serve customers whenever they require it the company maintains offices around the globe.

10 Points Summary

| 🏢 Headquarters | Cyprus |

| 🗺️ Regulation | CySEC |

| 🖥 Platforms | Opteck WebTrader |

| 📉 Instruments | CFDs on forex, stocks, commodities, and indices through a fixed spread basis with no commissions |

| 💰 EUR/USD Spread | 0.3 pips |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | 250 USD |

| 💰 Base currencies | EUR, USD, AUD |

| 📚 Education | Video courses, eBooks, webinars, daily market reviews |

| ☎ Customer Support | 24/5 |

Instruments

The market offering includes trading CFDs on forex, stocks, commodities, and indices through a fixed spread basis with no commissions and real-time market quotes. Howsoever, since the broker simplifies the process they do not offer thousands or all available market but has chosen the most appropriate ones.

Markets are available through the proprietary trading platform that features an intuitive yet powerful capability with simple and straightforward trading.

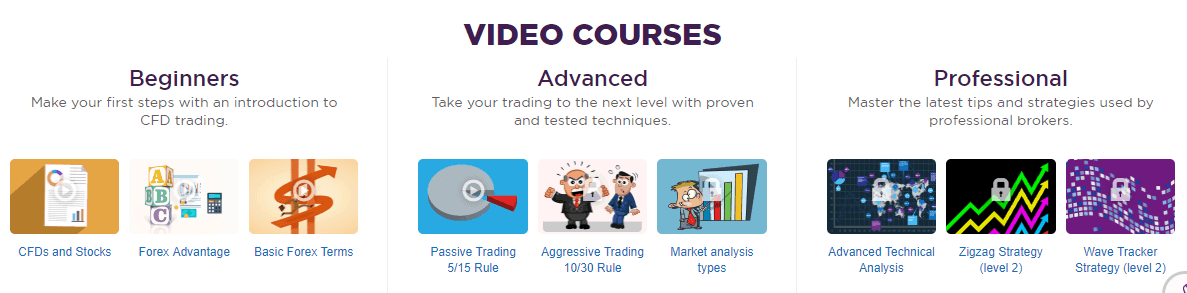

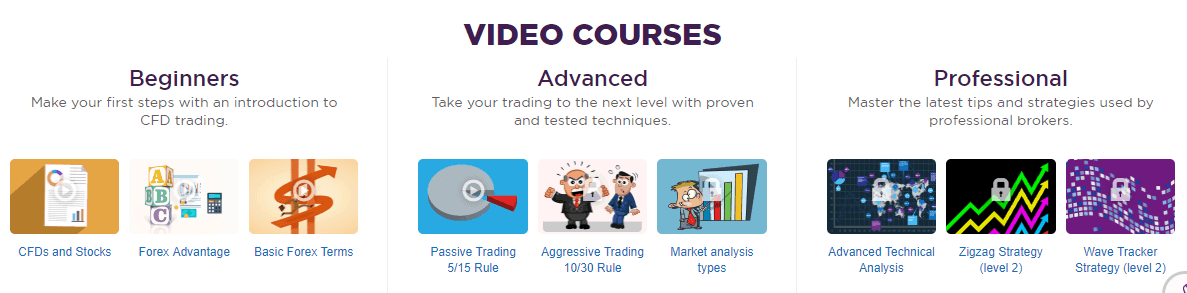

Education

And of course, to become a successful trader it is essential to develop skills by education and trading, hence the Opteck support their client in these regards by free access to the collection of Video courses, eBooks, webinars, daily market reviews and more.

The broker truly believes that the client is fully entitled to full control over the portfolio so the company role is to support you in that. Furthermore, dedicated support experts are available at all times to assist their clients with every request in multiple languages.

Is Opteck safe or a scam?

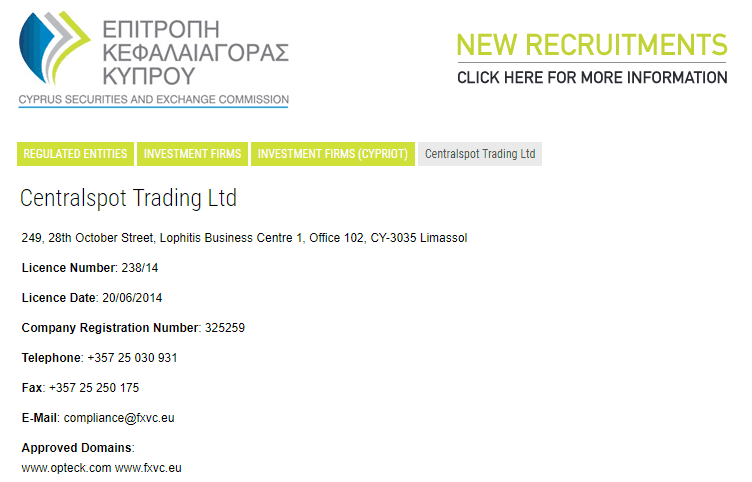

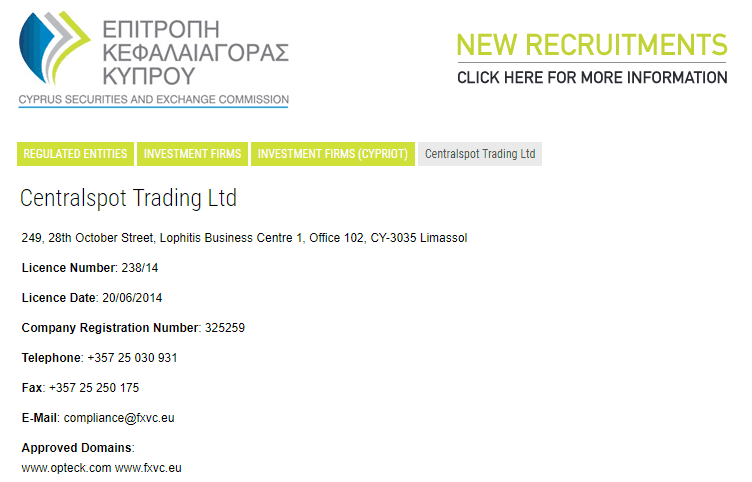

Opteck complies with the strictest regulatory guidelines that bring a safe trading environment and ensures a regulated experience while you, as a trader, treated in accordance with international laws. Opteck is a trading name of Centralspot Trading (Cyprus) Ltd. that is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

An additional entity of Opteck is located in offshore zone BVI, which is not recommended to trade with, in case this is the only authority licensing the broker. Since Opteck holding an additional license from the European regulator, it is considered as a safe portfolio, while the company clearly distinguishes client funds from their own by keeping them in segregated accounts.

The broker also uses the security measures while handling the account details or funds, all information is SSL encrypted and securely stored.

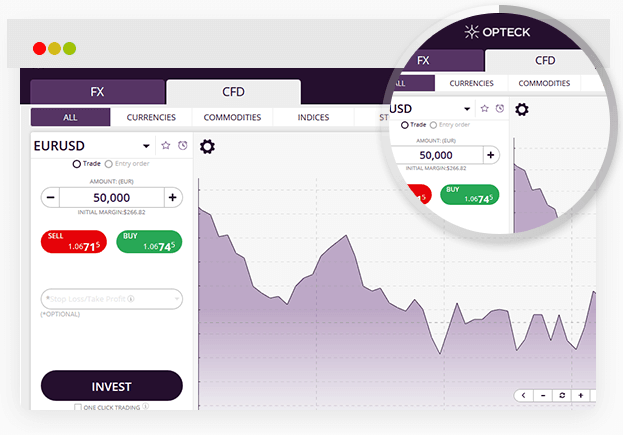

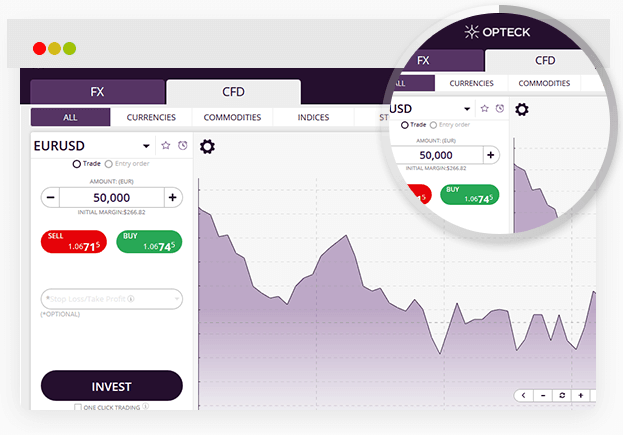

Trading Platforms

The most crucial factor when trading the markets is timing, thus Opteck carefully crafted an advanced system to quote up to date market prices with zero delays. The broker provides its own tradable prices which are derived from independent price providers.

Opteck trading platform is a developed proprietary technology with endless possibilities available for desktop, mobile and tablets. The platform opens the markets with top trading tools, live data and allows to perform trading through fast execution along with numerous instruments and available features.

The platform features a user-friendly interface that is intuitive and simple to use. Multiple graphs, integrated marker news and professional trading signals are inserted into the platform.

The Opteck platform actually has won multiple awards for its functionality and response, 100% of customization allows to trade CFDs and markets through cutting-edge features with instant market access.

In addition, Opteck brings an advanced App to seize market opportunities as they happen, to manage accounts and portfolio along with news with ease and comfort directly from your phone.

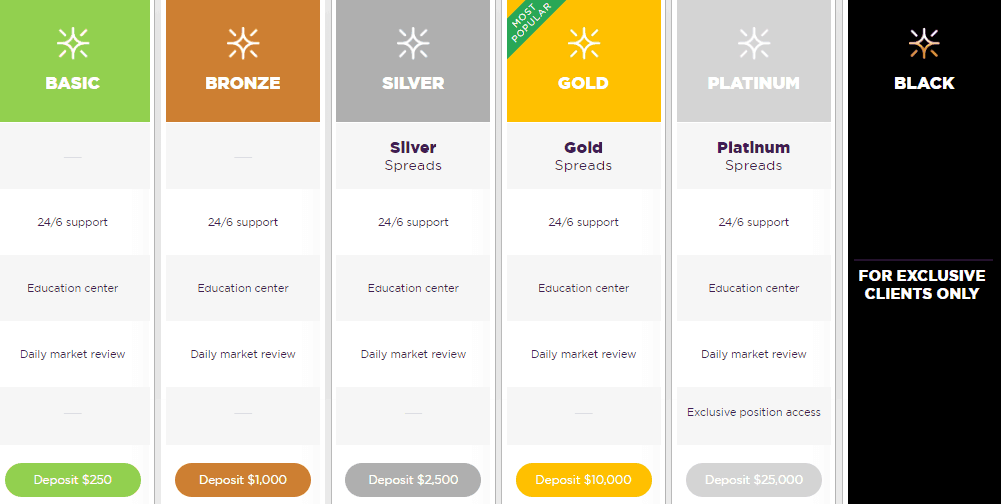

Account types

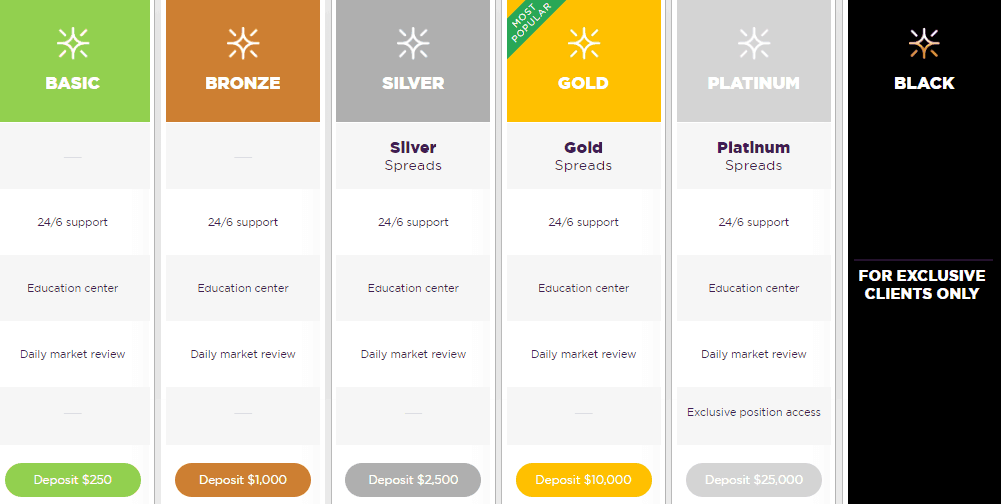

Opteck designed 6 account types that are packed with tools to fit trading needs and of course level of expertise. The range includes Basic, Bronze, Silver, Gold, Platinum and Black Accounts that diverse by the deposit requirements and offered conditions to trade, which means with a bigger size of account the client get a better fixed spread offering.

The Black Account designed for exclusive clients only, which is an absolutely tailor-made account with unique features that are discussed between the client and company.

In addition, Opteck created a unique account to enable worldwide traders to trade while keeping the Sharia rules. That means an Islamic account includes no interest, no swap (check forex swap-free), no rollover commissions, and no overnight positions.

Fees

Opteck spreads as mentioned designed as much the higher account size the better spread offering is included, as an example averaged spread offering for EUR/USD is 0.03, also see most popular pairs below.

Also, always consider rollover or overnight fee as a cost, which is about -0.00987 for short positions on Eur/Usd and -0.00125 on long ones, which are held longer than a day. As well you may compare fees to another popular broker HotForex.

| Asset/ Pair |

Opteck Spread |

| EUR/USD |

0.3 |

| Crude Oil WTI |

5.5 |

| Gold |

75 cents |

Opteck Leverage

While trading with Opteck you are able to operate with powerful tool leverage, which may increase your potential gains timely through its possibility to multiple initial accounts. Yet, learn how to use leverage correctly, as leverage may increase your potential loses as well.

Opteck leverage offering is determined by various measures and firstly set according to the regulatory requirements in the region or another.

So trading with global Opteck entity you are able to use high leverage levels like 1:400, 1:500 or even higher by confirming your professional status.

- However, in case you are a resident of Europe or trading with European entity of Opteck automatically, you will comply to ESMA regulation, which lowered leverage to the maximum ratio of 1:30 on Forex instruments, 1:10 for Commodities, etc.

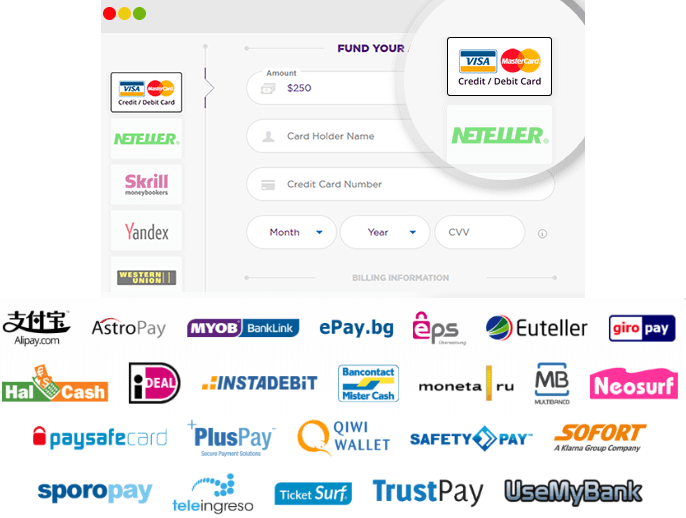

Deposits and Withdrawals

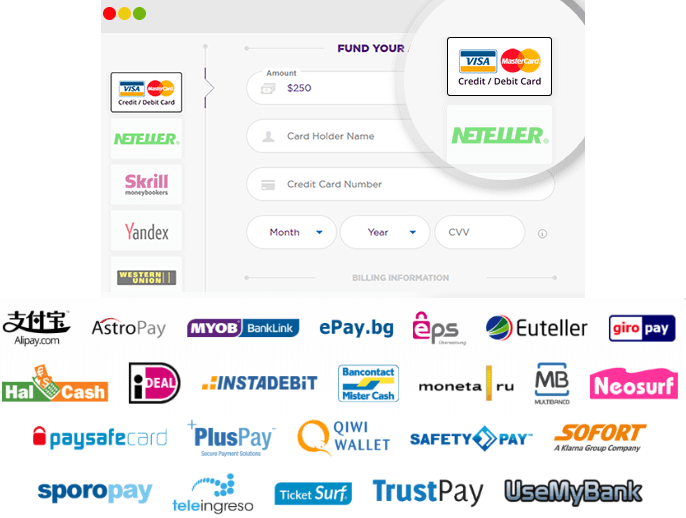

Opteck gathered various payment methods that allow to fund or withdraw profits through the convenient method and truly covering the majority of payment methods from all around the world. This simple and secure option include Credit or Debit Cards, Bank Wire Transfers, and a vast range of e-payments, see snap below.

Minimum deposit

The minimum deposit amount is depending on the trading account you choose with Opteck, thus the first grade type – Basic, demands only 250$ as a start, which is good benefit for beginning traders. While further and higher grade account types minimum varies from 1k$, 2.5k$ and even 25k$ for Platinum benefit.

Withdrawal

As for the deposit or withdrawal service fee, Platinum and Black account holders are granted their first withdrawal is free of charge, while 3.5% is charged on all other withdrawals.

Conclusion on Opteck

After Opteck review the conclusion comes to the simplicity in the overall process, which the company delivers and chose as the main path. Nowadays, trading is a quite confusing investment due to numerous offerings, tools, and markets.

Yet, Opteck brings a simple choice of proprietary platform, powerful markets to trade along with good education and support from the company.

Traders of any size can join the company since the deposit requirements are not high to start, as well the trading pricing based on a fixed spread with a competitive figure among the market. Generally speaking, the company does not bring sophisticated tools or features to “impress” but stick more into the simple and true process of trading.

And of course, please let us know your opinion about Opteck, share your experience with pros or cons, or ask us for some additional information.

Opteck Updates

Opteck trading name is no longer active and available for traders on both domains it operated previously. However, Centralspot Trading (Cyprus) Ltd. remain active and operates new trading name fxcv.com/eu

We recommend to do your own research before signing with any proposals from OPTECK or its registered company.

Share this article [addtoany url="https://55brokers.com/opteck-review/" title="Opteck"]