- What is Opofinance?

- Opofinance Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Opofinance Compared to Other Brokers

- Full Review of Broker Opofinance

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 3.8 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Opofinance?

Opofinance is an online Forex and CFD broker with over 200k active traders, renowned for its trader-oriented approach.

Opofinance is regulated by the well-regarded FSCA in South Africa and the top-tier ASIC. The broker also operates under an international entity, with a license from the Financial Services Authority (FSA) in Seychelles. However, it first started as an offshore company and was listed on an unregulated list of brokers. Many still speculate about the trustworthiness of the Opofinance.

Still, Opofinance offers attractive trading conditions. It provides multiple trading platforms (MT4, MT5, cTrader, and OpoTrade) with numerous platform-based accounts. The accounts offer different fee structures, both spread-based and commission-based. The leverage is based on the entity, account type, and the instrument, and can be as high as 1:2000.

Opofinance also offers over 1100 tradable products across Forex, commodities, metals, indices, stocks, and cryptocurrencies.

The broker’s customer support team provides quality assistance through multiple channels.

Opofinance Pros and Cons

Per our findings, the broker presents both pros and cons that are essential to consider. On the positive side, Opofinance offers competitive trading conditions and access to the popular MT4, MT5, and cTrader trading platforms. The broker also provides its proprietary app for an advanced trading experience. Additionally, the firm supports social trading, AI tools, and more. The instrument range is also impressive, with over 1100 tradable products across multiple financial markets, ensuring sufficient diversity.

For the cons, there is no 24/7 customer support available. Also, Opofinance provides services under various entities. Thus, trading conditions and safety measures may vary from one jurisdiction to another.

| Advantages | Disadvantages |

|---|

| ASIC Regulation | No 24/7 customer support |

| Presence in the South Africa | International offering available through FSA entity |

| Good trading conditions | No educational resources |

| Competitive pricing | |

| Various account types | |

| Professional and Retail trading options | |

| Forex and CFD trading | |

| Social trading availability | |

| AI Tools | |

| High Leverage | |

Opofinance Features

According to our research, Opofinance ensures a trustworthy environment with competitive pricing, advanced platforms, and multiple account types. Moreover, the broker allows users to trade well-known financial products across various markets. Here are the main aspects of trading with Opofinance to see how the broker meets different expectations.

Opofinance Features in 10 Points

| 🗺️ Regulation | ASIC, FSCA, FSA |

| 🗺️ Account Types | MT4/MT5 Standard, ECN, ECN Pro, Social Trade, Prop, Black, cTrader ECN, cTrader ECN Plus, cTrader Copy, OpoTrade Standard, OpoTrade ECN, OpoTrade Pro |

| 🖥 Trading Platforms | MT4, MT5, cTrader, OpoTrade |

| 📉 Trading Instruments | Forex, commodities, metals, indices, stocks, and cryptocurrencies |

| 💳 Minimum deposit | $100 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | Various currencies available |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is Opofinance For?

Opofinance is a secure trading option, offering favorable and diverse trading services, with advanced features and tools. Based on our research and a financial expert’s opinion, the broker is suitable for the following:

- International traders

- Traders from the South African region

- Traders prioritizing top-tier licenses

- CFD and Currency trading

- Professional traders

- Social/Copy trading

- AI-powered trading

- Swap-Free accounts

- Beginners

- cTrader enthusiasts

- Competitive spreads and fees

- EA/Auto trading

Opofinance Summary

Opofinance is a trustworthy Forex trading broker with licenses from ASIC, FSCA, and FSA for international clients. The broker offers competitive conditions, fast execution, and reasonable fees and solutions. The broker stands out for a good range of platforms and numerous platform-based account types. Traders have access to a wide range of instruments and a good diversification of trades across various assets.

All in all, the firm ensures an adequate trading environment and many opportunities. However, there are drawbacks as well, such as trading within offshore zones and the absence of 24/7 customer support. Besides, the broker’s operations at the beginning of its journey were a subject of regulatory concerns. Thus, it is essential to consider this substantial fact, too.

55Brokers Professional Insights

Our research on Opofinance revealed a favorable opportunity for traders of various experience levels. The broker is under the strict oversight of the top-tier ASIC and FSCA. Additionally, it holds a license from the FSA in Seychelles to ensure its global presence.

An important reminder for our readers is that we previously listed Opofinance in the unregulated broker section, as there were no substantial facts about the broker’s regulatory status. However, the broker is officially regulated by the ASIC and has recently obtained an FSCA license, further reinforcing its credibility and regulatory framework.

As we found, Opofinance offers an impressive number of account types with different fee structures and conditions to meet the various needs of clients. The accounts are based on platforms (MT4/MT5, cTrader, and the broker’s proprietary OpoTrade). Opofinance’s advanced and popular platforms are packed with innovative capabilities and features. The broker also supports social trading and AI-powered solutions.

The education and research sections are limited, which is a drawback for beginner clients looking for guidance. However, the broker offers a demo account for practice. The customer support is available 24/5 through multiple channels.

All in all, trading with Eurotrader will ensure a safe and positive trading experience, enabling traders to expand their portfolios in a favorable environment.

Consider Trading with Opofinance If:

| Opofinance is an excellent Broker for: | - Beginner and professional traders

- International traders

- MT4, MT5, and cTrader platforms enthusiasts

- Cost-conscious traders

- Social/Copy traders

- Clients looking for an access to a wide range of assets

- Traders looking for various account types

- Secure trading environment |

Avoid Trading with Opofinance If:

| Opofinance is not the best for: | - For clients looking for oversight from the FCA

- Traditional investors

-Traders looking for PAMM/MAM accounts

- Clients prioritizing 24/7 customer support |

Regulation and Security Measures

Score – 4.4/5

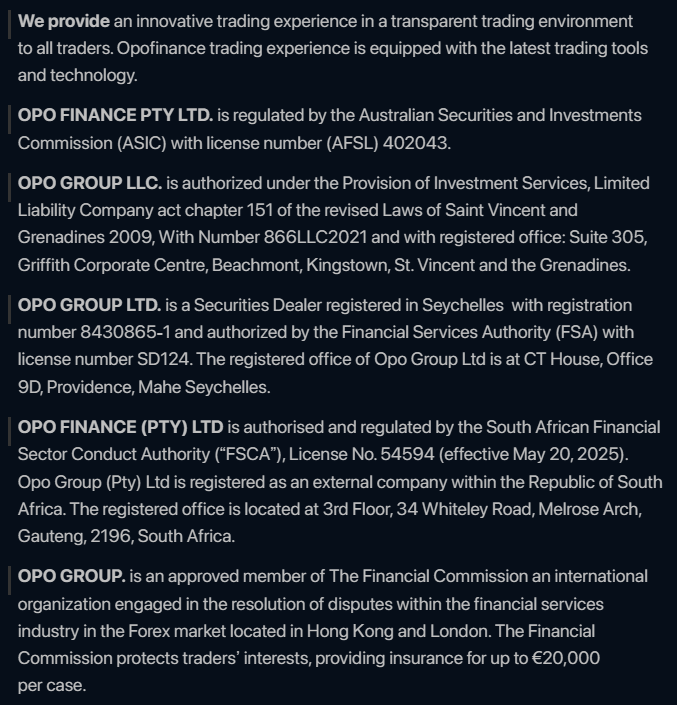

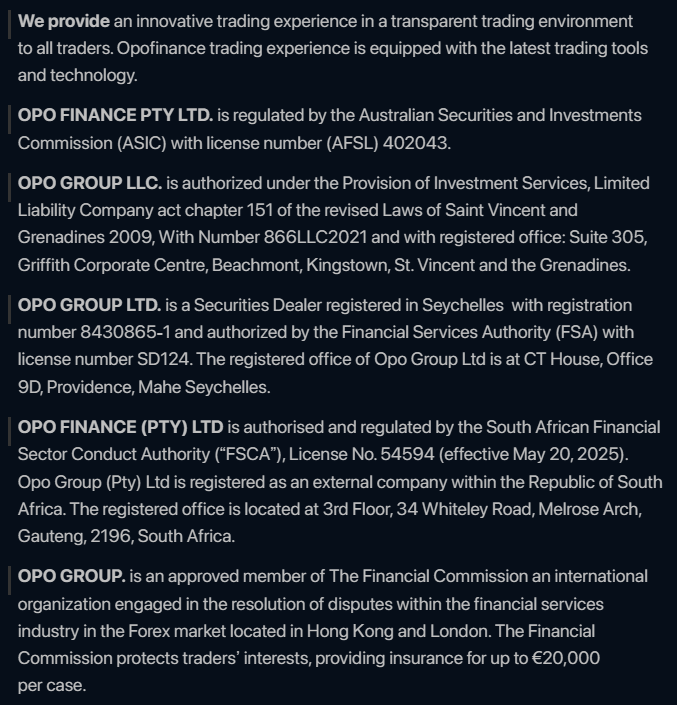

Opofinance Regulatory Overview

Opofinance is a trustworthy broker ensuring a low-risk trading environment. It is authorized and regulated by the top-tier Australian Securities and Investments Commission (ASIC) and the well-regarded FSCA in South Africa.

Thus, Opofinance is a legitimate and tightly overseen brokerage that holds essential licenses and adheres to strict laws for offering Forex trading services.

- However, the broker is also regulated in offshore zones to ensure global availability. Opofinance holds a license from the Financial Services Authority (FSA) in Seychelles. Thus, traders should conduct their research, read user reviews, and consider other essential aspects to assess the broker’s reputation and legitimacy.

- And a last essential note for potential clients of the broker: Opofinance has been operating as an offshore broker for a while, with no stringent oversight, and has been flagged as an unregulated and unreliable choice.

How Safe is Trading with Opofinance?

According to our findings, Opofinance follows stringent industry standards and requirements under its ASIC and FSCA regulations. Based on these stringent oversight, Opofiance ensures the following safety measures:

- Client fund protection and segregation from company funds.

- Negative balance protection ensures that clients do not incur losses exceeding their account balance.

- Opofinance is a member of The Financial Commission, a body dedicated to safeguarding the interests of traders to some extent, offering insurance coverage of up to EUR 20,000 per case.

However, for safety purposes, we recommend that traders conduct thorough research and carefully examine the broker’s documentation, legal agreements, and policies to have a comprehensive understanding of the specific protection measures the broker ensures.

Consistency and Clarity

It is fundamental to research the broker in terms of consistency and transparency of practices. Based on our findings, the broker started its operations as an offshore brokerage firm, regulated in Seychelles. It also received warnings from well-regarded financial authorities. Clients also shared their concerns and negative experiences.

However, the broker has reinforced its regulatory framework and now operates under the oversight of the South African FSCA and Australian ASIC. The regulations oblige the broker to follow rigorous rules and undertake essential protection measures. The current customer feedback also shows a substantial change, with numerous positive reviews on Trustpilot and other respected networks.

The broker’s proposal and range of services have also improved, offering a more extensive range of instruments and platforms.

We strongly advise traders to consider the essential sides of trading with Opofinance before making a final decision.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Opofinance?

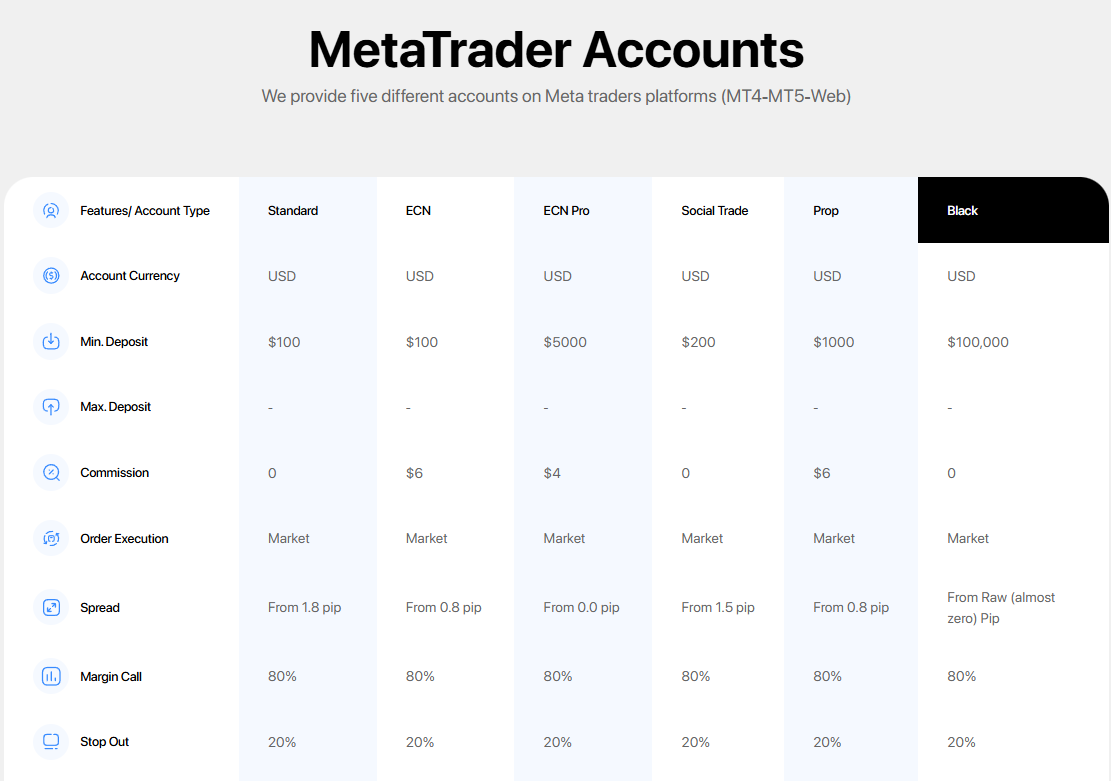

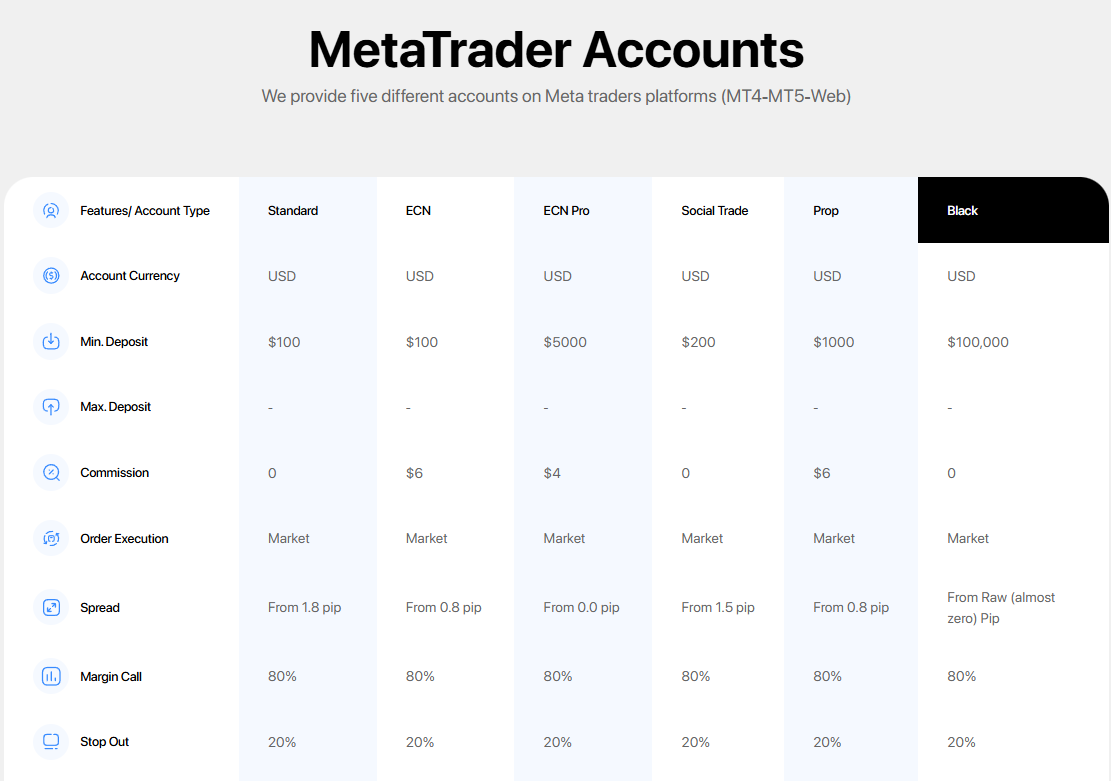

Opofinance offers a wide range of account types with different conditions and opportunities. The broker’s account types are platform-based – MT4/MT5, cTrader, and OpoTrade.

- The MetaTrader-based accounts are Standard, ECN, ECN Pro, Social Trade, Pro, and Black. Each account type offers different fee structures, either spread-based or commission-based. The Standard, Social Trade, and Black accounts are spread-based with no additional commissions. ECN and Prop accounts offer spreads from 0.8 pips, combined with fixed transaction fees of $6. The ECN Pro account offers lower commissions of $4. The Standard and ECN accounts have a low initial deposit requirement of $100, while the other accounts require higher funding.

- The cTrader-based accounts are cTrader ECN, cTrader ECN Plus, and cTrader Copy. The cTrader ECN account is a commission-based account with spreads from 1 pip, combined with a $6 fixed transaction fee. On the other hand, the cTrader ECN Plus account has commissions of $4, with very low spreads from 0.0 pips. At last, the cTrader Copy account has higher spreads of 2.2 pips, with no commissions.

- The OpoTrade-based accounts are Standard, ECN, and ECN Pro. Their trading conditions are similar to MetaTrader-based Standard, ECN, and ECN Pro accounts’ conditions and proposals.

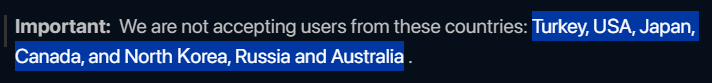

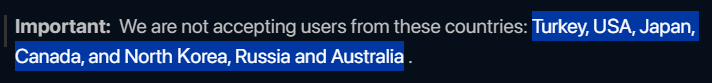

Regions Where Opofinance is Restricted

Due to its numerous regulations in South Africa, Australia, and internationally, Opofinance offers its services to a wide list of countries.

However, due to regulatory restrictions, the broker cannot accept clients from certain countries, as well as countries on sanction lists.

Here are the prohibited countries:

- Turkey

- The USA

- Japan

- Canada

- North Korea

- Russia

- Australia

Cost Structure and Fees

Score – 4.5/5

Opofinance Brokerage Fees

After a careful examination of the broker’s trading charges, we found that Opofinance offers competitive fees, which are favorable for both cost-conscious beginners and skilled traders. The broker has numerous accounts. The fee structure varies depending on the account, offering either spread-based or commission-based structures. Those clients who prefer low spreads combined with fixed commissions for each trade can choose the commission-based accounts on their preferred platform.

Based on our test trade, the broker provides competitive spreads, on average 1.8 pips for the EUR/USD for the Standard account. Other accounts offer lower spreads. The Social Trade account offers 1.5 pips on average, with no commissions. The Black account offers raw spreads from 0 pips, with no additional transaction fees.

It is essential to carefully consider the proposal based on the account type and the instrument traded. Each account offers different conditions and spreads, so it is advisable to consult the broker’s website or contact customer support for detailed information on the spreads they offer for specific instruments and account types.

Opofinace offers several account types with a commission-based fee structure. The MetaTrader-based ECN, ECN Pro, and Prop accounts are commission-based. The ECN and Prop accounts offer spreads starting at 0.8 pips, combined with a fixed $6 transaction fee. The ECN Pro account offers spreads of 0 pips with $4 commissions for each trade.

How Competitive Are Opofinance Fees?

Based on the test trade, Opofinance’s fees are competitive for most of the tradable products it offers. They depend on several factors, including the type of account, the traded instrument, and the jurisdiction.

As we found, Opofinance offers both spread and commission-based accounts. The account types available are various, and each comes with its own conditions and trading charges. For the MetaTrader Standard account, spreads are slightly higher, with a 1.8 pips for the EUR/USD pair. On the other hand, the commissions are on the lower side. There are several commission-based accounts, and the conditions are different. On average, the broker offers $3 commission fee per side per lot.

All in all, the broker has a transparent fee structure and publicly discloses almost all the charges for each account type and instrument. As far as our research has provided, there are no hidden fees. Traders should also confirm the applicable charges for the specific entity.

| Asset/ Pair | Opofinance Spreads | XTrend Spread | Evest Spreads |

|---|

| EUR USD Spread | 1.8 pips | 0.2 pips | 2 pips |

| Crude Oil WTI Spread | 10 | 0.024 | 1.1 |

| Gold Spread | 20 | 0.07 | 3.7 |

Opofinance Additional Fees

When trading with Opofinance, clients will not face many additional fees. The offering is clear, and all the costs are included in spreads and commissions, depending on the account type. Here are the extra charges to consider:

- As we found, the broker does not charge an inactivity fee. However, if the account remains inactive for three months or more and has a zero balance, it will be closed.

- Opofinance does not charge deposit or withdrawal fees.

- Opofinance applies swap fees for the positions held overnight.

Score – 4.5/5

At Opofinance, clients can conduct trades through the advanced MT4, MT5, cTrader, and OpoTrade trading platforms. The platforms stand out for their extensive features, a simple interface, advanced and in-depth analysis, and extensive trading capabilities.

The platforms are available on desktop, web, and mobile devices, allowing users to choose the option that suits their trading preferences and strategies.

| Platforms | Opofinance Platforms | XTrend Platforms | Evest Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | No | No |

| cTrader | Yes | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Opofinance Web Platform

Opofinance provides its clients with a web platform, compatible with MT4/MT5, available through the web terminals. The WebTrader does not require downloads or installations, and accessibility is quick and without complications. The platform contains all the essential features for a successful trading experience. Users can access the same extensive analytical tools available through the desktop platform. The web platform not only ensures a good range of analytical tools and fast execution, but also adds extra functionality and flexibility.

Opofinance Desktop MetaTrader 4 Platform

Through its popular MT4 platform, Opofinance provides extensive charting tools, analytical tools, robots, EAs, trading signals, over 50 technical indicators, and multiple order types. The platform is user-friendly, with high-edge analytical tools and enhanced technology.

Due to the ease of use, the platform is suitable even for inexperienced traders. The MT4 platform can be accessed via web, desktop, and mobile apps, ensuring better accessibility.

Opofinance Desktop MetaTrader 5 Platform

The broker’s MT5 platform is the more improved and advanced version of the already advanced MT4 platform. It includes additional innovative features and provides access to more charts and graphical objects. As we found, the MT5 platform is downloadable through Google Play, App Store, macOS, and Windows.

The MT5 platform includes charting and analytical capabilities, more than 80 built-in indicators, 21 timeframes, algorithmic trading, automation, and EAs. The platform also ensures high protection through encryption.

Opofinance cTrader Platform

Opofinance’s cTrader is a user-friendly, yet advanced and sophisticated platform, especially suitable for professional clients and different trading styles.

Available on desktop, web, and mobile, cTrader provides built-in copy trading strategies, innovative risk-management tools, detachable charts, and technical indicators.

cTrader also supports in-depth analysis and promotes decision-making. The high-speed execution ensures better trade potential.

OpoFinance MobileTrader App

The Opofianace’s proprietary app enables its clients to conduct trades on the go with maximum flexibility and functionality. This mobility permits traders to access their accounts from anywhere in the world.

The Opofinance app can be downloaded through the App Store or Google Play. With advanced tools and features, traders will benefit from trading to the fullest.

All in all, those who prefer mobile trading will value the easy-to-use interface, one-click trading, enhanced charting and indicators, and other capabilities the platform includes.

Main Insights from Testing

Like many other brokers, Opofinance provides the popular retail MT4 and MT5 platforms. Traders can enter their accounts through web, desktop, and mobile apps, ensuring flexibility and versatility. Besides, cTrader enthusiasts can enjoy an advanced trading experience with features tailored for more advanced clients. Opofinance also offers its proprietary desktop platform and the Opofinance app.

All the platforms are easily downloadable and include great capabilities.

AI Trading

Opofinance offers AI trading, empowering clients to make informed decisions relying on AI solutions.

- Pulse AI by Opofinance uses advanced AI features to analyze real-time forex news. It also offers actionable insights for wiser trading decisions.

- The Chartist AI analyzes 80 indicators and creates a coherent market report, recognizing patterns that are imperceptible to humans.

Trading Instruments

Score – 4.5/5

What Can You Trade on the Opofinance Platform?

OpoFinance offers over 1100 trading instruments across Forex, commodities, metals, indices, stocks, and cryptocurrencies. The number of tradable products allows clients to diversify their portfolios and engage in various markets. The instruments come with competitive charges and conditions.

- Traders gain access to an extensive number of major, minor, and exotic currency pairs. Traders can also speculate on market changes of the popular CFD-based stocks, trade global indices, and popular cryptocurrencies.

Main Insights from Exploring Opofinance Tradable Assets

Our experience revealed that Opofinance supports its clients in diversifying their trades by accessing over 1100 products. Although the number of instruments is extensive, the products are still on CFDs. Thus, longer-term traders and traditional investors who prefer real stock trading will not benefit from this proposal.

All in all, the broker offers major, minor, and exotic Forex pairs. Stocks are based on CFDs, enabling clients to speculate on the price movements of popular stocks, including Apple Inc., Amazon, Tesla, Inc., and others.

Clients can also access popular stablecoins and altcoins. Opofinance clients can also access gold, silver, oil, and Natural Gas.

- Finally, as the broker operates under various entities, we advise them to carefully consider the conditions and instrument availability.

Leverage Options at Opofinance

Leverage is a useful tool for traders who enter the market with a smaller initial investment. Leverage can multiply the earnings; however, it also holds risk. Thus, before engaging in leverage trading, it is essential to understand the associated risks.

Opofinance leverage is provided according to ASIC, FSCA, and FSA regulations:

- Under ASIC, traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International traders can access higher leverage of up to 1:2000.

- Under the FSCA entity, traders are eligible up to 1:30 leverage for major currency pairs.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Opofinance

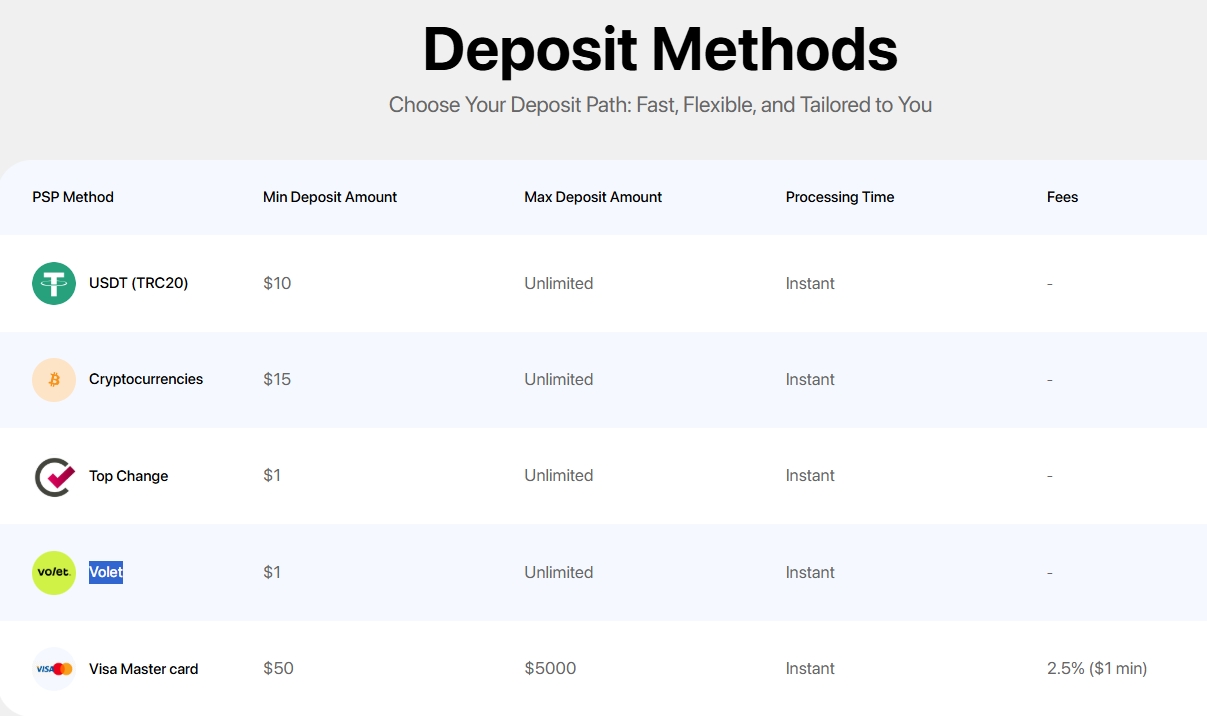

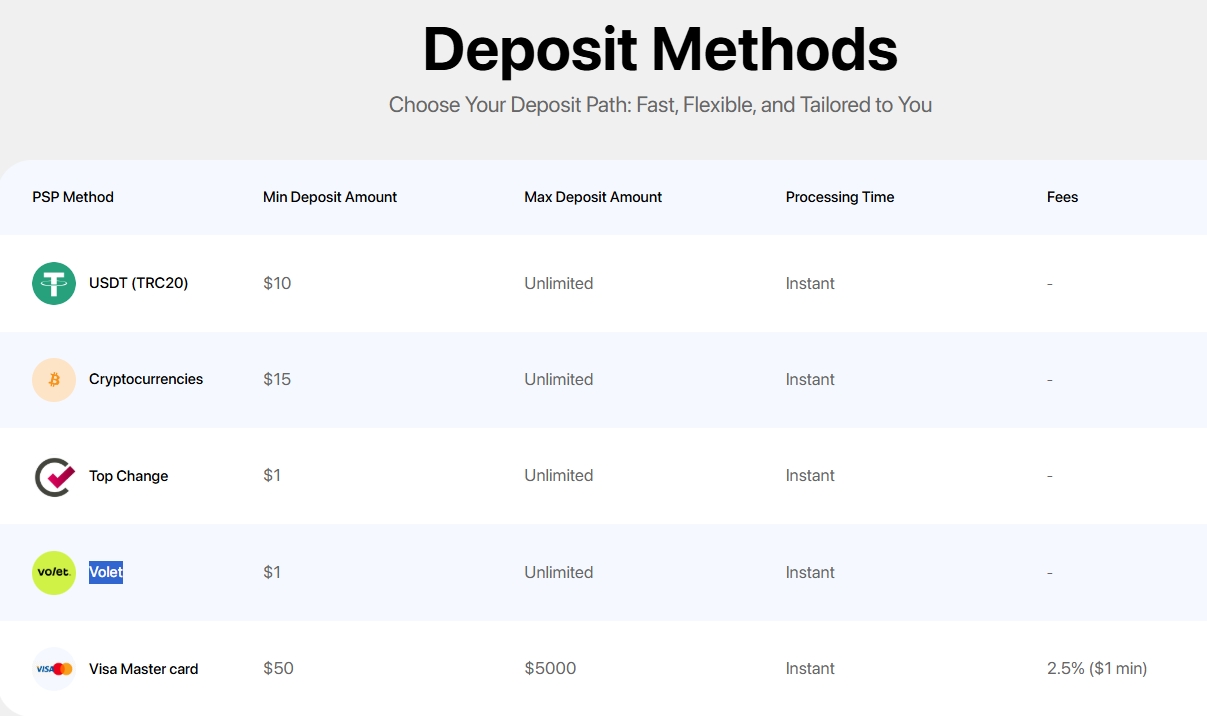

Based on our research of the broker’s funding methods, we found that Opofiance provides a few fast and efficient methods for safe deposits. Funding through Tether and cryptocurrencies is the most popular option the broker offers. Traders can also use Topchange, ADVCASH, Perfect Money, Volet, and Credit cards. The deposit processing time is instant for most methods, and there are no transaction fees.

Minimum Deposit

To open an account with Opofinance, clients need to make the first deposit. For the Standard account, the minimum deposit is $100. More professional accounts require much higher initial funding.

- However, for further deposits, clients can make a minimum deposit of $15 for cryptocurrencies, and even less for some other methods.

Withdrawal Options at Opofinance

For withdrawals with Opofinance, traders should use the same methods used for deposits. The broker does not have any daily limitations on withdrawals.

- Withdrawals generally take up to 24 hours to process.

Customer Support and Responsiveness

Score – 4.6/5

Testing Opofinance Customer Support

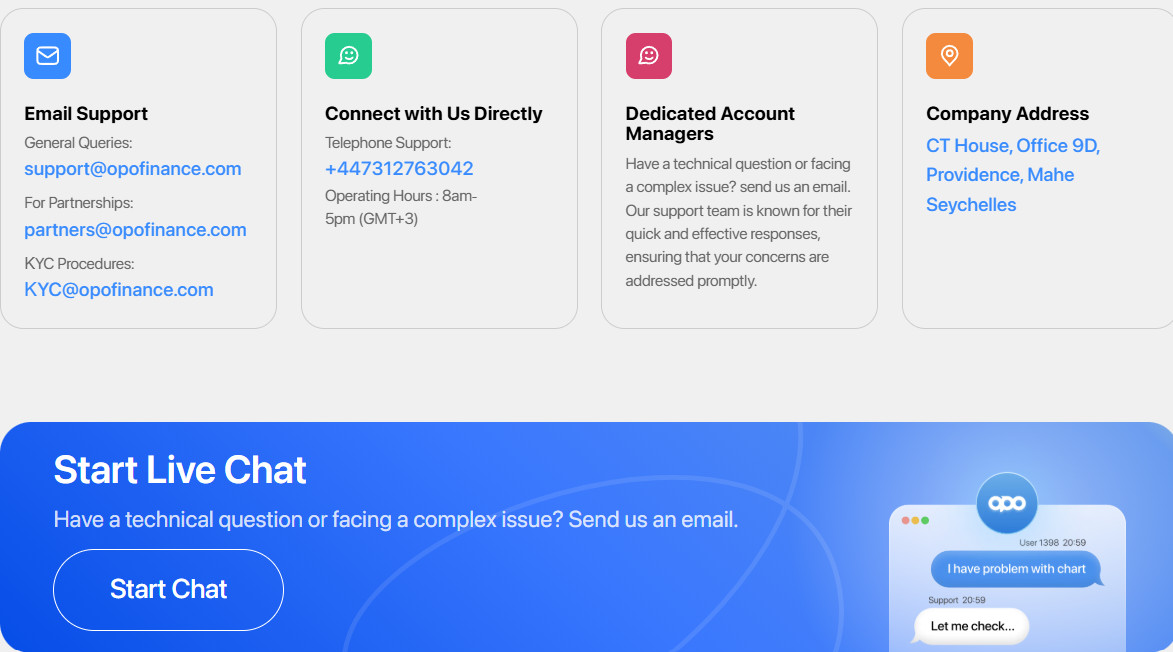

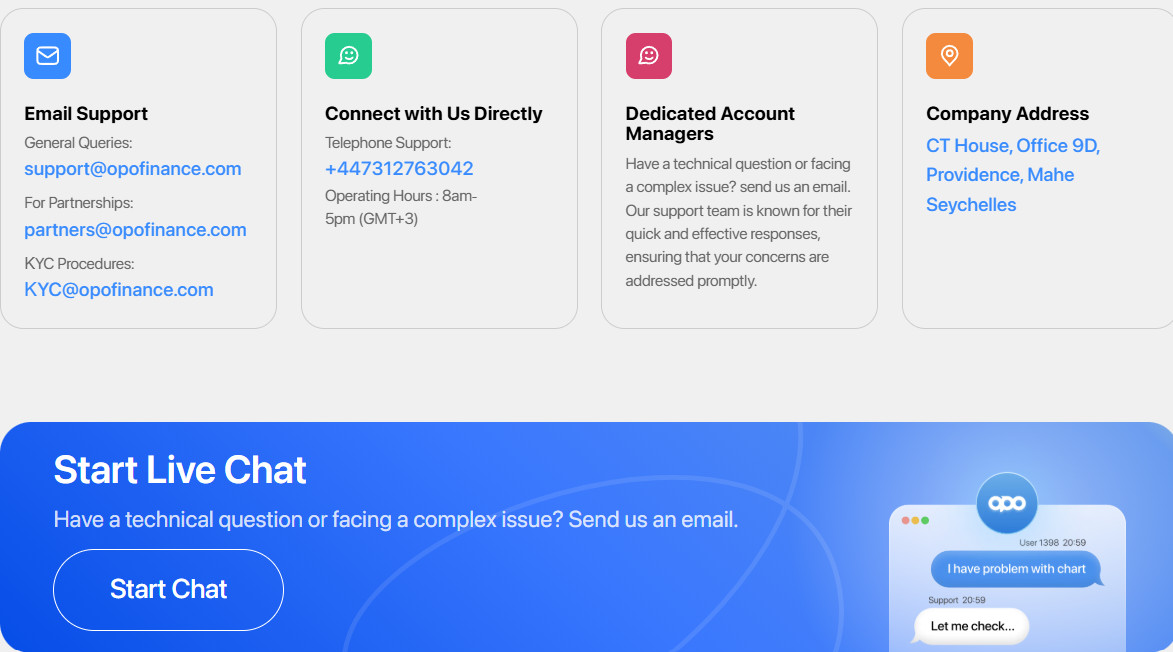

Opofinance offers 24/5 customer support via live chat, email, phone line, and a contact form.

- The broker also has an FAQ section, where clients will find the most common answers and guides to trading with Opofianance.

- As we found, the broker is present on social platforms, providing updates and news about its activities. Opofinance is active on Facebook, LinkedIn, X, Instagram, and Telegram.

Contacts Opofinance

Our experience with the broker’s support team was positive. Opofinance provides reliable and helpful customer support via various channels.

- Live chat is one of the fastest options for contacting the support team and obtaining answers and solutions.

- Traders can also use the Contact form to send their questions, suggestions, or concerns right from the broker’s website.

- Clients who prefer to direct their questions, issues, and suggestions via email can use support@opofinance.com for general queries.

- At last, those clients who prefer direct communications with the support agent can use the provided phone number: +447312763042.

Research and Education

Score – 3.8/5

Research Tools Opofinance

Opofinance provides extensive platforms that include comprehensive tools for in-depth analysis and research. All the platforms available (MT4/MT5, cTrader, OpoTrader, and the Opofinance app) offer innovative features and capabilities.

- We also found that on the broker’s website, traders can access the Economic Calendar. The latter provides clients with information about upcoming market events that is powerful enough to make an impact.

Education

As we found, there are no educational materials available with Opofinance. Traders can only access the broker’s blog, which includes informative articles on various trading-related topics.

- The unavailability of educational resources is a drawback for many beginner traders who prioritize access to the learning resources, including webinars, video courses, eBooks, and more.

Is Opofinance a Good Broker for Beginners?

Regarding different aspects of trading with Opofinance, the broker can be a good choice for clients of different skill levels. With the availability of numerous account types, with varying fee structures and platform accessibility, traders are free to choose the most favorable option to accommodate their trading experience and style.

The initial deposit for its Standard accounts is $100, which is an average requirement for cost-conscious traders. Another positive aspect for beginners is the broker’s demo account. The account imitates a real-time trading environment, enabling novice traders to practice with no risks.

The only major drawback we noticed is the lack of educational materials.

Portfolio and Investment Opportunities

Score – 4.2 /5

Investment Options Opofinance

Opofinance concentrates on Forex and CFD trading and provides access to over 1100 products. The number ensures an above-average exposure to the market. Yet, the broker will not appeal to long-term investors.

- For more opportunities, Opofinance also offers social/copy trading. Clients can copy the trades of professionals of their choice and gain profits.

- With Opofiance, clients can also engage in Prop trading: another opportunity for exposure to the market and new opportunities.

Account Opening

Score – 4.5/5

How to Open an Opofinance Demo Account?

The demo account is beneficial for novice traders to practice and try new strategies. By choosing the demo account, traders learn to navigate the broker’s platforms and then switch to live trading.

Here are the main steps to open a demo account with Opofinance:

- Choose the ‘Demo account’ option on the Opofinance website.

- Fill out the registration form with personal information.

- Provide the required information (name, email address, country of residence, and password).

- Receive an email with the account credentials to access the demo account.

- Choose account specification (platform, account type, etc.)

- Get the virtual funds and start practicing.

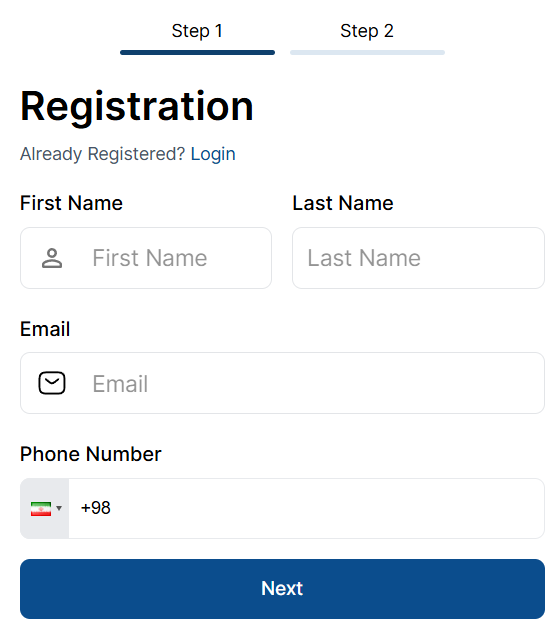

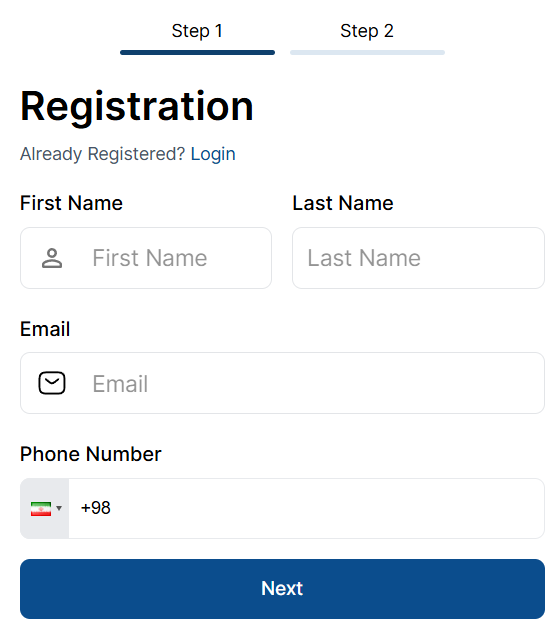

How to Open an Opofinance Live Account?

Opofinance clients can open a live account in a matter of minutes. The process is quick and efficient.

Here are the steps to follow:

- Visit the broker’s official website and click on the “Create account” button.

- Fill out the online registration form with personal data (name, email, phone number, etc.)

- Verify your email and receive the account credentials.

- Choose the account type and platform.

- Upload a valid ID and Proof of address.

- Log in to the client dashboard.

- Fund your account and start trading.

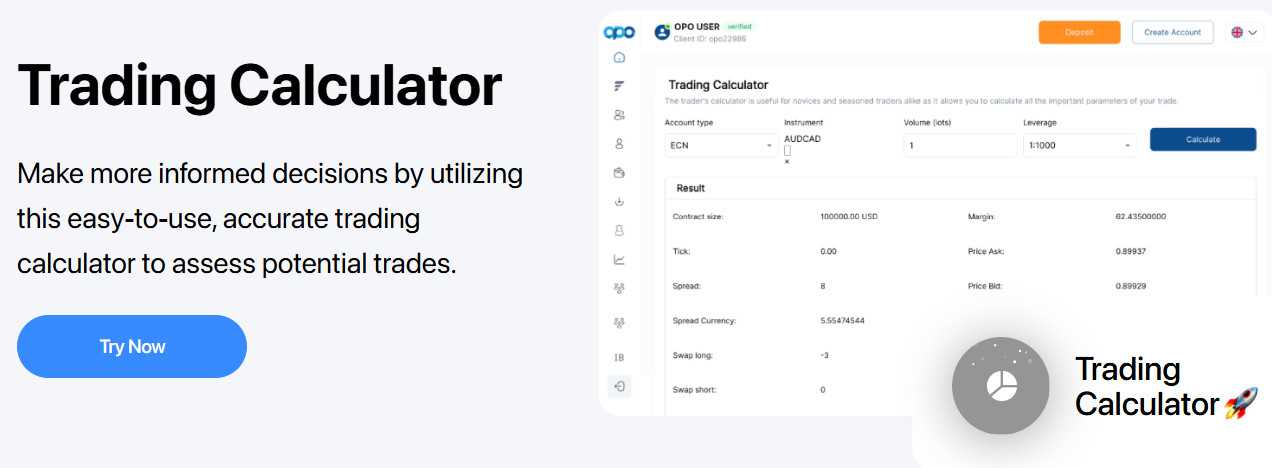

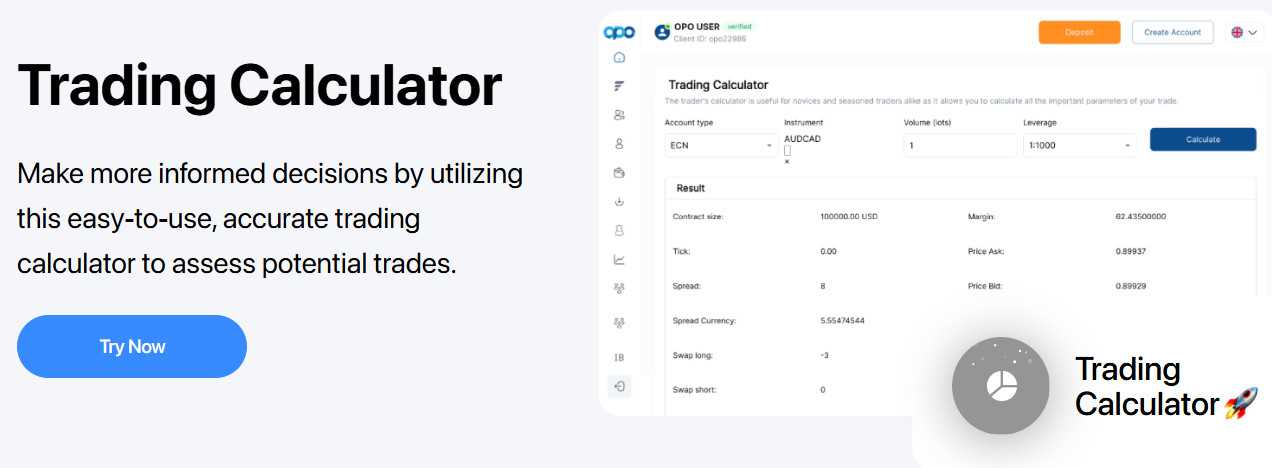

Score – 4.3/5

Opofinance also offers a few additional features to enhance the overall experience and trading outcome.

- The broker provides an easy-to-use calculator that estimates potential risks and profits.

- The Pulse AI delivers immediate access to market news and data, and offers concise assessments that help traders make faster and informed decisions.

- Chartist AI is another tool that analyzes the market from different angles and provides a valuable summary.

Opofinance Compared to Other Brokers

As a final step in our review, we have compared Opofinance to other competitor brokers to see how its proposal stands out. Opofinance holds licenses from ASIC and the well-regarded FSCA, ensuring compliance with stringent rules. It is additionally licensed by the FSA, ensuring the broker’s global exposure. Brokers of good standing, like Pepperstone, Admirals, and Eightcap, also hold licenses from ASIC.

Opofinance offers various accounts with different pricing solutions. An average spread is 1.8 pips for its Standard account, which is higher than what Exness (from 0.2 pips) or CapTrader (0.1 pips) offer. The commissions of Opofinance are on the lower side.

As to the trading platforms, Opofinance offers advanced solutions, including MT4, MT5, cTrader, OpoTrade, and the Opofinance App. Many brokers in the market limit their platform choice to MT4 or MT5 platforms. The minimum deposit requirement is average, starting from $100. Admirals, for instance, requires a $1 initial deposit, which is certainly a more appealing option.

At last, Opofinance does not offer a comprehensive education section, whereas Evest, Pepperstone, and Admirals stand out for extensive learning resources, including webinars, courses, eBooks, and more.

| Parameter |

Opofinance |

Pepperstone |

Admirals |

Exness |

CapTrader |

Evest |

Eightcap |

| Spread-Based Account |

From 1.8 pips |

From 1 pip |

From 0.6 pips (0.02 commissions for Share and ETF CFDs) |

From 0.2 pips |

From 0.1 pip |

Average 2 pip |

Average 1 pip |

| Commission-Based Account |

0.0 pips +$3 |

0.0 pips + $3.5 |

0.0 pips + from $0.02 to $3.0 |

0.0 pips + $3.5 |

0.1 pips + from $1 to $8 based on the instrument |

Commissions only for real stock trading |

0.0 pips + $3.5 |

| Fees Ranking |

Low/Average |

Low/Average |

Low/Average |

Low |

Low/ Average |

Average |

Average |

| Trading Platforms |

MT4, MT5, cTrader, OpoTrade, Opofinance App |

MT4, MT5, cTrader, TradingView |

MT4, MT5, Admiral Markets app |

MT4, MT5 |

Trader Workstation TWS, TradingView, AgenaTrader, Mobile App |

Proprietary WebTrader, Mobile app |

MT4, MT5, TradingView |

| Asset Variety |

1100+ instruments |

Over 1,200 instruments |

8000+ instruments |

200+ instruments |

12 million instruments |

400+ instruments |

800+ instruments |

| Regulation |

ASIC, FSCA, FSA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

BaFin |

FSCA, VFSC, MISA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

| Educational Resources |

Limited |

Excellent education and research |

Excellent |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$100 |

$0 |

$1 |

$10 |

$2000 |

€250 |

$100 |

Full Review of Broker Opofinance

After carefully reviewing the overall proposal and regulatory compliance, we have formed an assessment of the broker.

Opofinance once held only an offshore license. At present, the broker is regulated by the Australian ASIC and the South African FSCA. The strengthened oversight ensures secure trading and an additional level of safety.

Opofinance offers platform-based account types. The accounts are spread or commission-based, with overall competitive charges. The broker does not charge deposit or withdrawal fees or an inactivity fee, which is also a plus. The initial funding requirement for the Standard account is $100. Besides, clients can practice through the demo account before opening a live account and gain practical skills.

One of the broker’s drawbacks is the lack of proper education. However, via its diverse platforms, Opofinace ensures deep research and analysis. Clients can also engage in social trading and prop trading. The broker also supports AI features.

All in all, Opofinance is a favorable choice for clients all over the world. However, potential clients need to check the specific conditions for each entity.

Share this article [addtoany url="https://55brokers.com/opofinance-review/" title="Opofinance"]