- What is Nutmeg?

- Nutmeg Pros and Cons

- Regulation and Security Measures

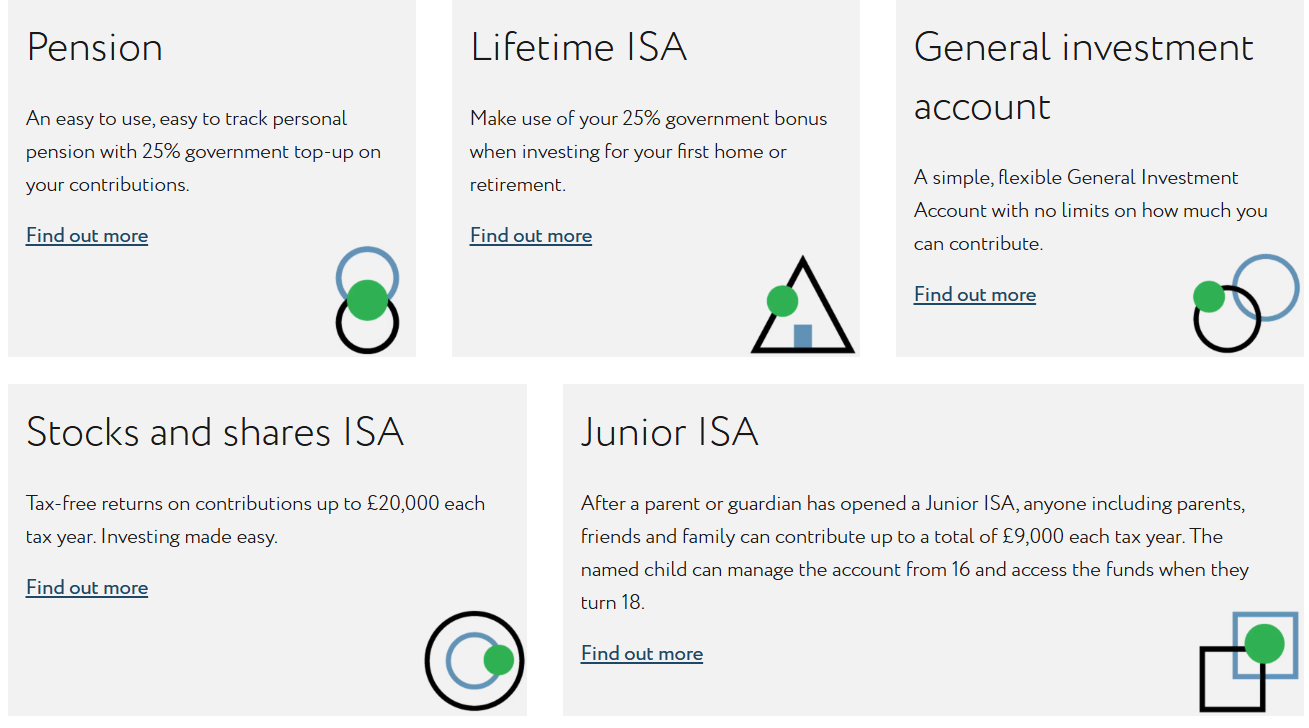

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Nutmeg Compared to Other Brokers

- Full Review of Broker Nutmeg

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Nutmeg?

Nutmeg is a UK-based investment management firm that offers a range of products exclusively through exchange-traded funds (ETFs), including global stocks through equity ETFs, bond ETFs, thematic ETFs, and more.

The company operates under the regulatory oversight of the Top-Tier Financial Conduct Authority (FCA), ensuring strict adherence to regulation.

Overall, the company focuses on innovative solutions to make investing more accessible, transparent, and cost-effective, offering a trading model that facilitates the management of diversified portfolios.

Is Nutmeg Stock Broker?

Yes, Nutmeg is a Stock Broker and a digital investment management platform. It functions as a robo-advisor, utilizing algorithms to automate investment decisions. With a commitment to transparency and cost-effectiveness, the platform provides traders with a streamlined and accessible approach to managing investment portfolios.

Nutmeg Pros and Cons

The firm offers several benefits and drawbacks for potential investors. Its automated technology simplifies the investment process, particularly appealing to those who prefer a more hands-off approach. The platform also provides competitive costs and user-friendly interfaces. Additionally, the top-tier regulatory oversight from FCA enhances the overall security of the investment experience.

For the cons, smaller portfolios may face relatively higher fees, and there is exposure to market volatility. The absence of direct human interaction for personalized advice and potential minimum investment requirements are also factors to consider.

Additionally, the firm offers limited availability of learning materials, and the absence of 24/7 customer support adds another layer of disadvantage, potentially impacting accessibility and assistance for users at any time.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | No paper trading or demo account |

| Competitive investment conditions | No 24/7 customer support |

| User-friendly interface | Limited education and research materials |

| Robo-advisor technology | |

| Trading products through exchange-traded funds | |

| Secure investing environment | |

| UK traders | |

Nutmeg Features

Nutmeg offers a range of investment features to suit all levels of investors, combining fully managed portfolios, automated rebalancing, and transparent fee structures through a user-friendly digital platform. Below is a comprehensive list of its key features:

Nutmeg Features in 10 Points

| 🏢 Regulation | FCA |

| 🗺️ Account Types | Stocks and Shares ISAs, Personal Pension, Lifetime ISAs, Junior ISAs, General Investment Account |

| 🖥 Trading Platforms | Nutmeg Investment Platform, Mobile App |

| 📉 Trading Instruments | Global Stocks through Equity ETFs, Bond ETFs, Thematic ETFs |

| 💳 Minimum Deposit | £500 |

| 💰 Average Stock Commission | 0.75% on the first £100,000 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | GBP, EUR, USD |

| 📚 Trading Education | Guides, Insights |

| ☎ Customer Support | 24/5 |

Who is Nutmeg For?

Nutmeg is ideal for individuals looking for a hands-off, professionally managed investment solution with clear pricing and low entry barriers. It is well-suited for investors who prefer digital wealth management over self-directed trading. Based on our findings and Financial Expert Opinions, Nutmeg is Good for:

- UK traders

- Investing

- Fractional Shares

- Competitive conditions

- Low fees

- ETF trading

- Portfolio Management

- Advanced traders

- Professional trading

- Good trading tools

Nutmeg Summary

In conclusion, Nutmeg is a user-friendly investment platform that caters to both new and seasoned investors. With a transparent fee structure and diverse investment options, the firm strives to provide a complete investment experience.

While individual experiences may vary, the overall benefits of Nutmeg, including automation and accessibility, make it a good choice for those seeking a streamlined and informed investment experience.

Overall, we found that Nutmeg provides a trustworthy environment for investment and managing investment portfolios. However, we advise conducting your research and evaluating whether the firm’s offerings suit your specific requirements.

55Brokers Professional Insights

Nutmeg stands out as one of the UK’s leading digital wealth managers by combining professional investment expertise with innovative technology.

Unlike traditional brokers or investment platforms, the firm offers fully managed, risk-adjusted portfolios built by a team of investment professionals who actively monitor and rebalance them based on market conditions.

The platform uses ETFs to provide broad global diversification while maintaining low costs. Nutmeg also offers features like socially responsible investing, goal-based planning tools, and tax-efficient account options such as ISAs and pensions, making it a compelling choice for modern investors seeking convenience, control, and professional-grade portfolio management.

Consider Trading with Nutmeg If:

| Nutmeg is an excellent Broker for: | - Investors looking for professionally managed portfolios.

- UK traders.

- Long-term investing.

- Looking for Reputable Firm.

- Need a well-regulated broker.

- Competitive trading conditions.

- Looking for broker with a long history of operation and strong establishment.

- Secure trading environment.

- Professional trading.

- Pension planners.

- Beginner and professional investors.

- Looking for a broker with a Top-Tier license.

|

Avoid Trading with Nutmeg If:

| Nutmeg might not be the best for: | - Looking for broker with 24/7 customer support.

- Investors outside the UK.

- High-frequency traders.

- Investors who want access to margin trading.

- DMA access to popular investment products. |

Regulation and Security Measures

Score – 4.6/5

Nutmeg Regulatory Overview

Nutmeg is a legitimate and regulated investing firm. It is regulated by the respected UK Financial Conduct Authority (FCA) and has a good reputation and integrity in the financial industry.

Additionally, the company does not offer services in offshore zones, emphasizing its commitment to operating within regulated jurisdictions and providing transparency to investors.

How Safe is Trading with Nutmeg?

The company prioritizes the protection of clients’ investments by adhering to regulatory standards and implementing industry-leading practices. This includes robust measures against fraud and unauthorized account access, enforced through strict identity verification processes.

Additionally, as a member of the UK Financial Services Compensation Scheme, assets held with Nutmeg UK can be protected up to £85,000. However, investors are advised to be cautious, regularly monitor their investments, and adopt secure online practices to further enhance their protection.

Consistency and Clarity

Nutmeg has built a strong reputation in the UK investment environment for offering transparent, goal-based investing with a digital-first approach.

Its track record of reliability is reflected in consistently positive ratings from independent platforms such as Trustpilot, where many users praise its ease of use, clear communication, and portfolio performance.

However, some reviews also mention drawbacks like limited customization and a lack of advanced features. Regulated by the FCA, Nutmeg ensures a secure investing environment, and its acquisition by the J. P. Morgan group in 2021 has further strengthened its credibility and resources.

Although it does not provide the extensive features of traditional brokers for selecting individual stocks or trading complex instruments like derivatives, Nutmeg stands out for its long-term investment focus, professional portfolio management, and clear fee structure.

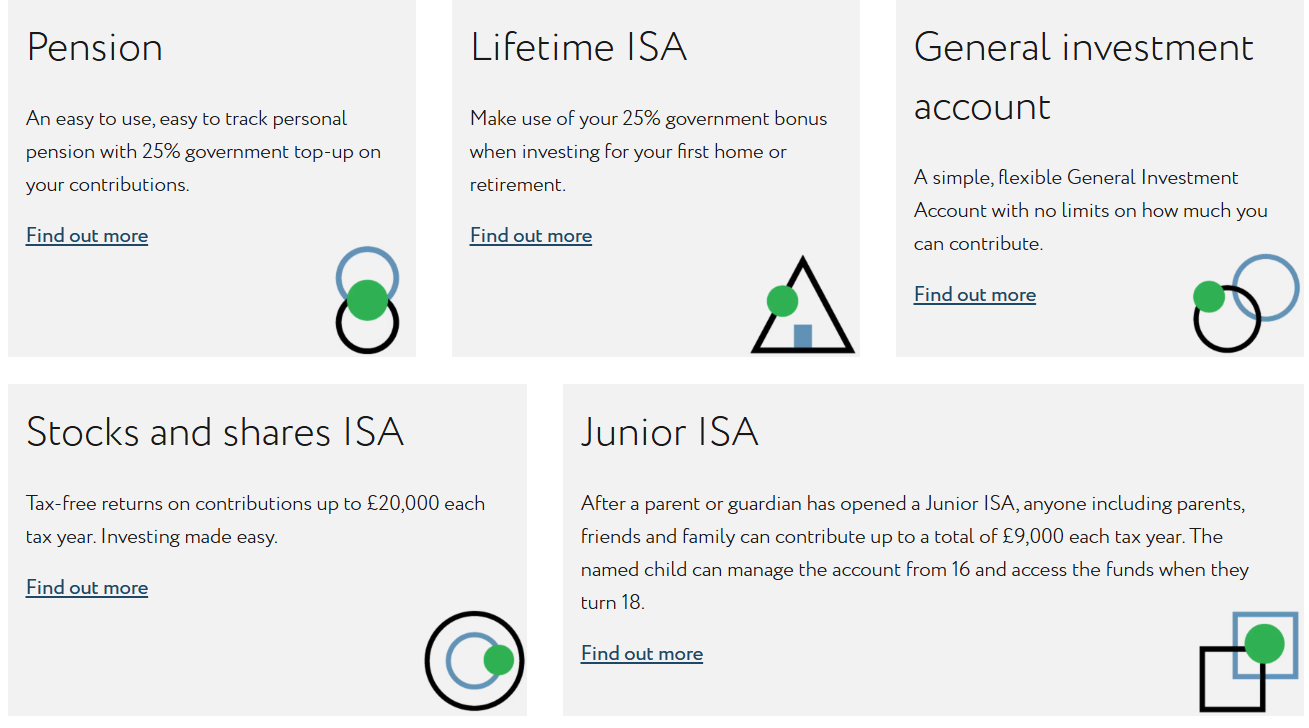

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Nutmeg?

The firm offers different account types to cater to varying investor needs. These include Stocks and Shares ISAs, Personal Pension, Lifetime ISAs, Junior ISAs, and General Investment Account. Nutmeg ISAs provide tax-efficient savings, GIAs offer a standard investment account, and Pension accounts are designed for retirement savings.

Each account type may have its unique features and benefits, allowing investors to choose the one that aligns best with their financial goals and circumstances. However, we recommend reviewing the platform’s current offerings or contacting customer support for the latest information on available account types and their specific features.

Stocks and Shares ISA

The Stocks and Shares ISA offered by Nutmeg is a tax-efficient investment account that allows individuals to invest in a diversified portfolio without paying UK capital gains or income tax on returns.

It is designed for long-term investors looking to grow their wealth through exposure to global markets. With Nutmeg, the minimum deposit to open a Stocks and Shares ISA is £500.

This account type provides access to fully managed, fixed allocation, or socially responsible portfolios, with transparent fees and regular rebalancing, a suitable choice for both beginners and experienced investors seeking a hands-off approach.

Regions Where Nutmeg is Restricted

Nutmeg is primarily available to UK residents, with certain restrictions applying to users based outside the UK depending on their residency status and documentation:

- Austria

- Belarus

- Canada

- Cuba

- Germany

- Italy

- Iran

- Japan

- Luxembourg

- Myanmar

- New Zealand

- North Korea

- Russia

- South Africa

- Spain

- Sudan

- Switzerland

- Syria

- The Crimea, Donetsk People’s Republic, and Luhansk People’s Republic regions of Ukraine

- United States

- Venezuela

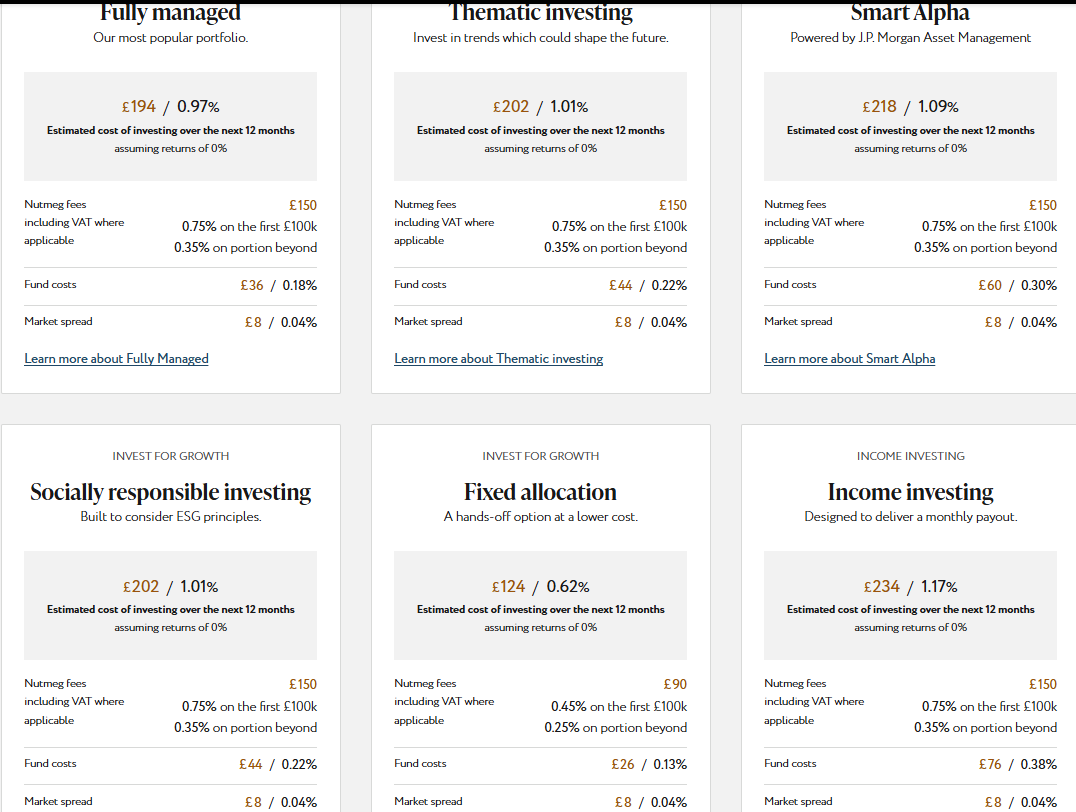

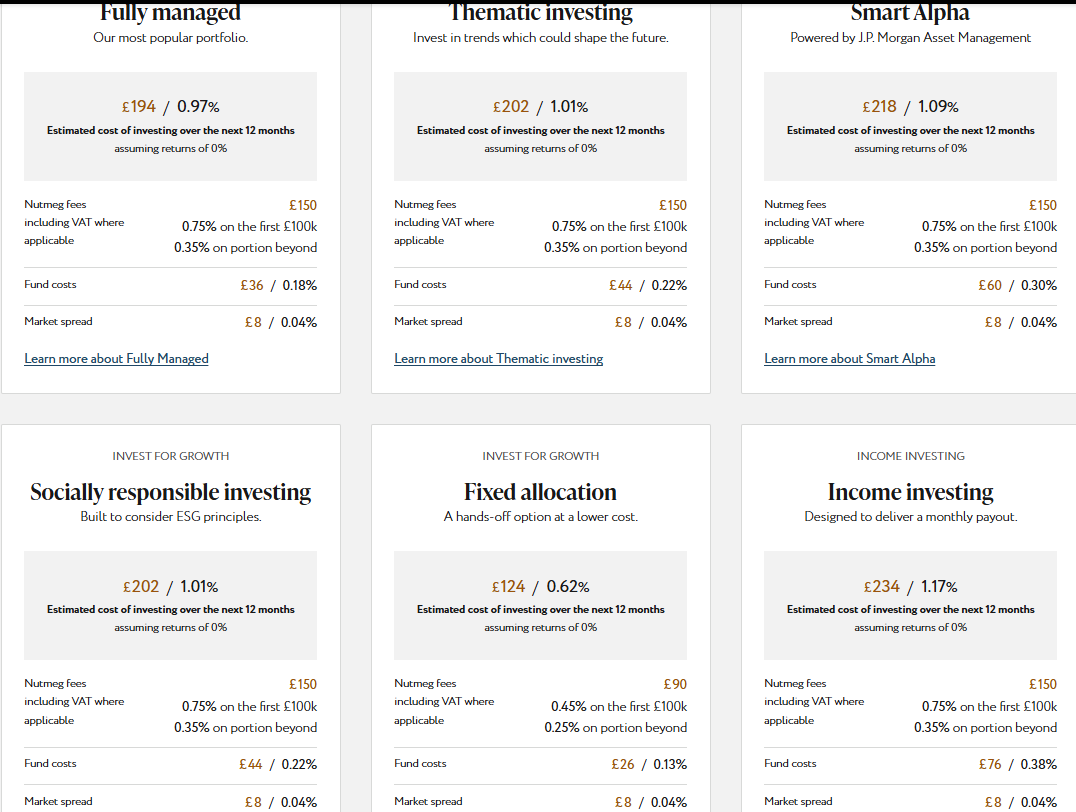

Cost Structure and Fees

Score – 4.6/5

Nutmeg Brokerage Fees

The firm employs a transparent fee structure, charging investors based on the assets they place under the platform’s management.

The fees typically include an annual management fee, which is a percentage of the total investment, and underlying fund costs. The exact percentage may vary depending on the investment amount.

However, investors should carefully review Nutmeg’s fee schedule to understand the cost implications associated with their investment, ensuring transparency and clarity in their financial decisions.

Nutmeg, as a robo-advisor investment platform, typically operates on a fee-based model rather than charging traditional commissions. Investors are usually subject to an annual management fee, calculated as a percentage of their total assets under management, along with underlying fund costs.

Nutmeg charges 0.75% per annum on the first £100,000 of your investment for its Fully Managed, Smart Alpha, Socially Responsible, Thematic, and Income portfolios, with a reduced rate of 0.35% applied to amounts above £100,000.

However, fees can change over time and may vary based on the type of account, the specific investments, and market conditions. Therefore, investors should review the platform’s fee details for a comprehensive understanding of the costs associated with their investments.

Nutmeg does not charge a separate exchange fee for ETF transactions; instead, its only execution-related cost is the market spread.

The firm minimizes this spread by trading over-the-counter for most orders, benchmarking against exchange prices to optimize execution quality.

Nutmeg does not offer Forex or leveraged products, so it does not charge any rollover or swap fees. These fees are typical in foreign exchange markets where positions are carried overnight with interest charges, but the firm’s investment model is built entirely around ETF-based portfolios, without derivatives or margin trading.

How Competitive Are Nutmeg Fees?

Nutmeg’s fees are generally competitive for a managed investment platform, especially considering its ease of use, diversified ETF portfolios, and automated rebalancing.

With management fees starting at 0.75% per year on the first £100,000 and lower rates for higher balances or fixed allocation portfolios, the pricing suits hands-off investors seeking cost-effective long-term growth.

However, for active traders, the flat annual fee may be less attractive compared to commission-free brokers.

| Asset/ Pair | Nutmeg Commission | Public Commission | Charles Schwab Commission |

|---|

| Stocks Fees | Management fee of 0.75% per annum on the first £100,00 | From $0 | From $0 |

| Fractional Shares | Yes | $5 | $5 |

| Options Fees | - | From $0 | From $0 |

| ETFs Fees | 0.17% - 0.32% per year | $0 | From $0 |

| Free Stocks | No | Yes | Yes |

Nutmeg Additional Fees

Nutmeg maintains a transparent fee structure with no hidden costs such as setup, exit, or withdrawal fees. However, some additional charges may apply, such as a £20 fee per stock line for in-specie transfers and optional financial advice packages starting from £450.

There are no inactivity fees, making Nutmeg cost-effective for long-term investors seeking simplicity.

Trading Platforms and Tools

Score – 4.5/5

Nutmeg platform serves as a user-friendly and secure space for investors to manage their portfolios. Offering a streamlined experience, it empowers users to easily monitor, adjust, and execute transactions according to their investment preferences.

Moreover, investors have the option to use the platform’s mobile application, enhancing flexibility in managing their investments across different devices.

Trading Platform Comparison to Other Brokers:

| Platforms | Nutmeg Platforms | Degiro Platforms | MEXEM Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Nutmeg Web Platform

Nutmeg web platform is user-friendly, intuitive, and designed to make investing accessible for everyone, from beginners to experienced investors. Through a clean dashboard, users can easily open and manage different types of accounts, monitor investment performance, adjust contributions, and access a range of planning tools.

The platform also provides educational content, portfolio breakdowns, and insights to help users make informed decisions.

Nutmeg Desktop MetaTrader 4 Platform

Nutmeg does not offer the MetaTrader 4 platform. It relies exclusively on its custom web and mobile platforms.

Nutmeg Desktop MetaTrader 5 Platform

The firm does not support the MetaTrader 5 platform either. Users cannot use MT5’s advanced charting, Expert Advisors, or algorithmic tools; only Nutmeg’s proprietary platform is available.

Nutmeg MobileTrader App

Nutmeg app offers investors the flexibility to manage their investments on the go. With a user-friendly interface, the app allows users to monitor portfolios, make adjustments, and execute transactions conveniently from their smartphones or tablets.

This mobile extension of the Nutmeg platform provides a seamless and accessible experience for investors to stay connected with their financial portfolios wherever they are.

Main Insights from Testing

Nutmeg’s mobile app delivers a smooth and intuitive experience, ideal for users who prefer managing their investments on the go. The app provides access to all key features, portfolio tracking, contributions, goal planning, and performance monitoring, within a clean and user-friendly interface.

AI Trading

Nutmeg does not offer a dedicated AI trading platform like those found with some algorithmic brokers. However, it incorporates advanced algorithmic intelligence into its Smart Alpha portfolios, which are co-designed with J.P. Morgan Asset Management.

These portfolios use proprietary models to optimize asset allocation dynamically, adapting to changing market conditions and clients’ risk profiles.

Trading Instruments

Score – 4.6/5

What Can You Trade on Nutmeg’s Platform?

Nutmeg’s platform enables clients to invest exclusively via ETFs, giving them access to targeted exposure in major asset classes such as global equities, global stocks through equity ETFs, developed and emerging market government and corporate bonds, and commodities, all built into diversified portfolios tailored to users’ risk profiles.

Main Insights from Exploring Nutmeg’s Tradable Assets

Exploring Nutmeg’s tradable assets reveals a focus on simplicity and long-term investment. Rather than offering a wide range of individual securities, Nutmeg builds diversified portfolios using pre-selected instruments aligned with various risk levels and investment goals.

While advanced traders may find the choices limited, the firm’s asset offering supports a user-friendly path to building wealth over time.

Margin Trading at Nutmeg

Nutmeg, as a robo-advisor investment platform, does not offer margin accounts. It primarily focuses on providing automated investment services without the option for margin trading.

However, for the most accurate and current information about the firm’s offerings, including leverage or margin trading, we recommend checking the official website or contacting its customer support directly.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Nutmeg

The platform offers a few payment methods to facilitate the funding of investor accounts, including bank transfers and direct debits. Investors can initiate transactions through these channels to deposit funds into their accounts, allowing for seamless and secure financial transactions.

However, the availability of funding methods may be subject to specific terms and conditions outlined by the firm. Therefore, investors should check the platform’s official documentation or contact customer support for the most accurate and up-to-date information on payment options.

Nutmeg Minimum Deposit

Investors have the flexibility to initiate their investment journey with Nutmeg with a minimum of £100 for a Lifetime ISA and Junior ISA or £500 for a General Investment Account and ISA. For Nutmeg pension accounts, the minimum investment requirement is £500. This approach ensures accessibility for a diverse range of investors with varying financial capacities.

Withdrawal Options at Nutmeg

Investors can request withdrawals through the platform, and the proceeds are typically returned to the linked bank account. You should consider any potential tax implications and be aware that withdrawals typically take 3-7 business days, with the exact timeline varying based on factors such as market conditions and the specific withdrawal request.

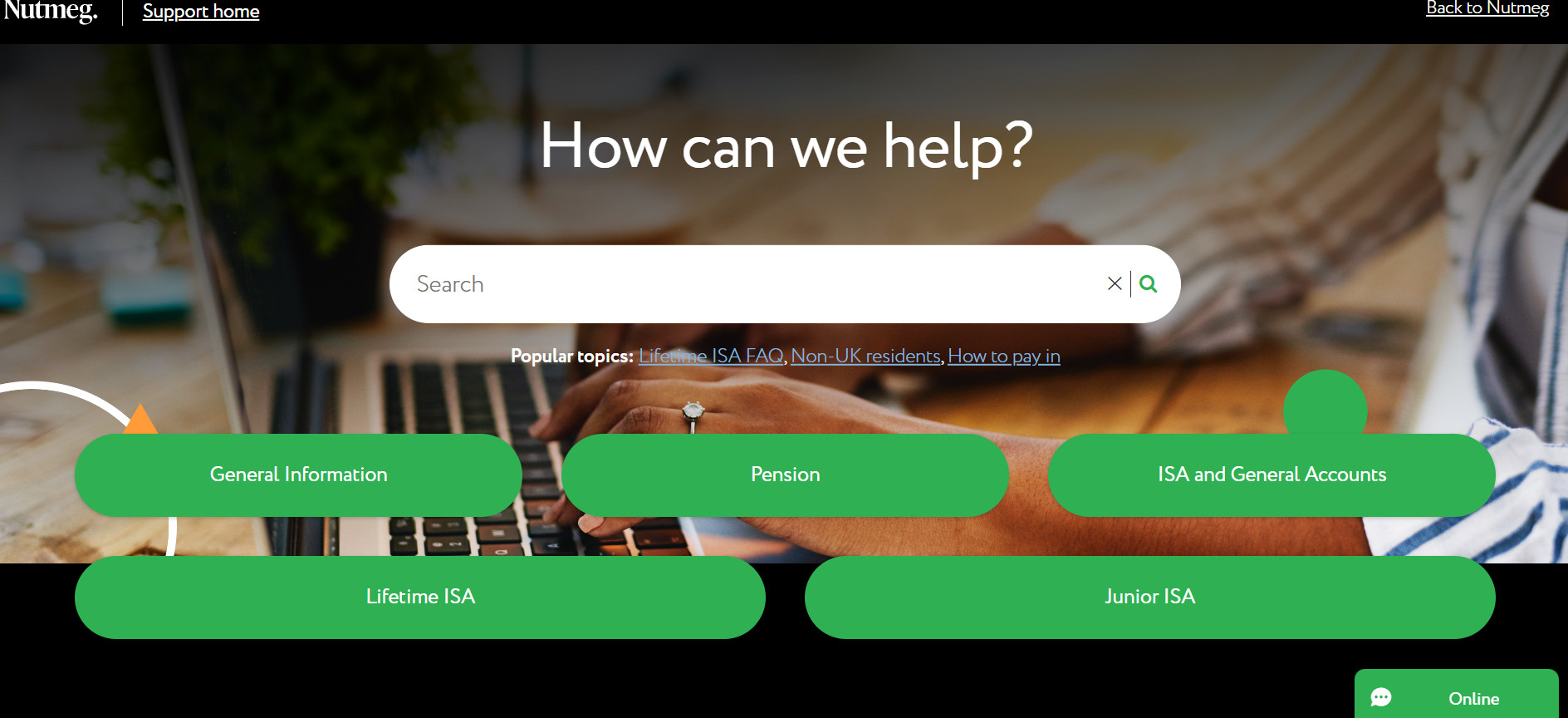

Customer Support and Responsiveness

Score – 4.6/5

Testing Nutmeg’s Customer Support

The firm’s customer support is available 24/5 through live chat, email, phone, FAQs, and Support Center. The platform aims to offer responsive assistance to address user concerns, ensuring a positive and supportive experience for its investors.

Contacts Nutmeg

You can contact Nutmeg via phone at +44 20 3598 1515 for general support or email them at support@nutmeg.com if you are an existing client. New clients can reach out to newclient@nutmeg.com.

Research and Education

Score – 4.5/5

Research Tools Nutmeg

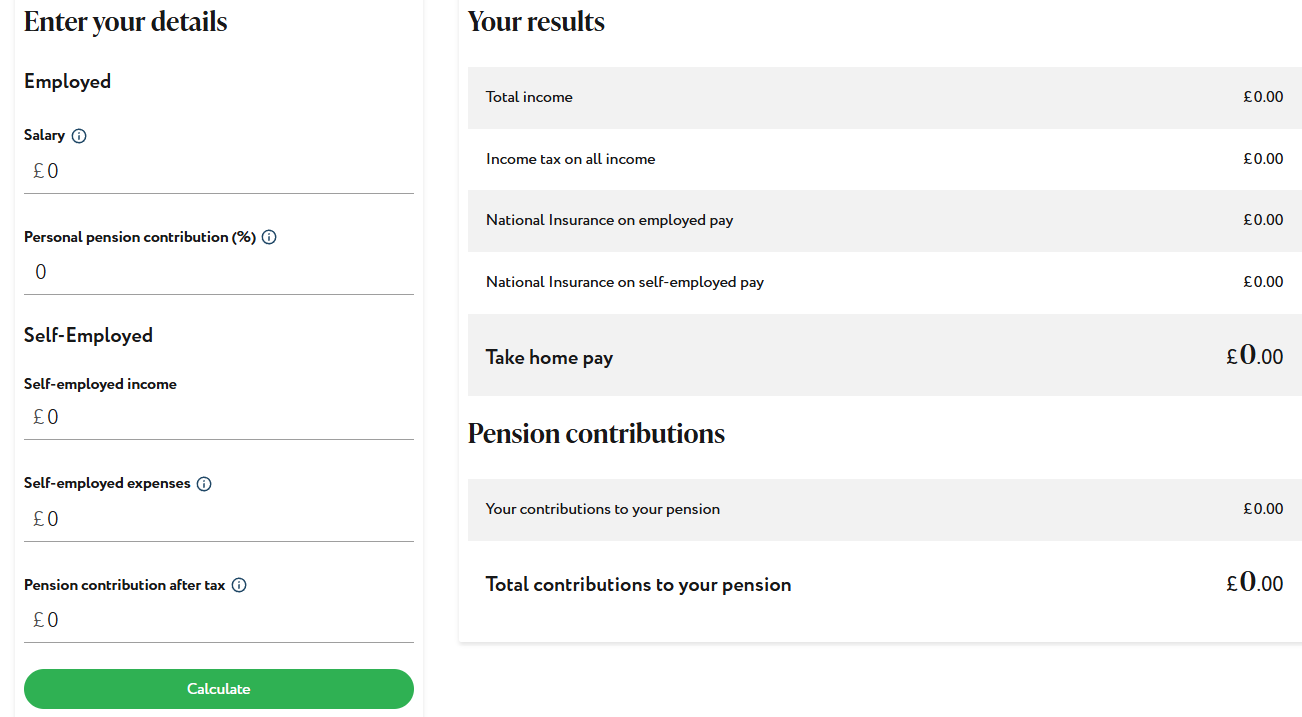

Nutmeg offers a variety of research and planning tools available both on its website and within the investment platform.

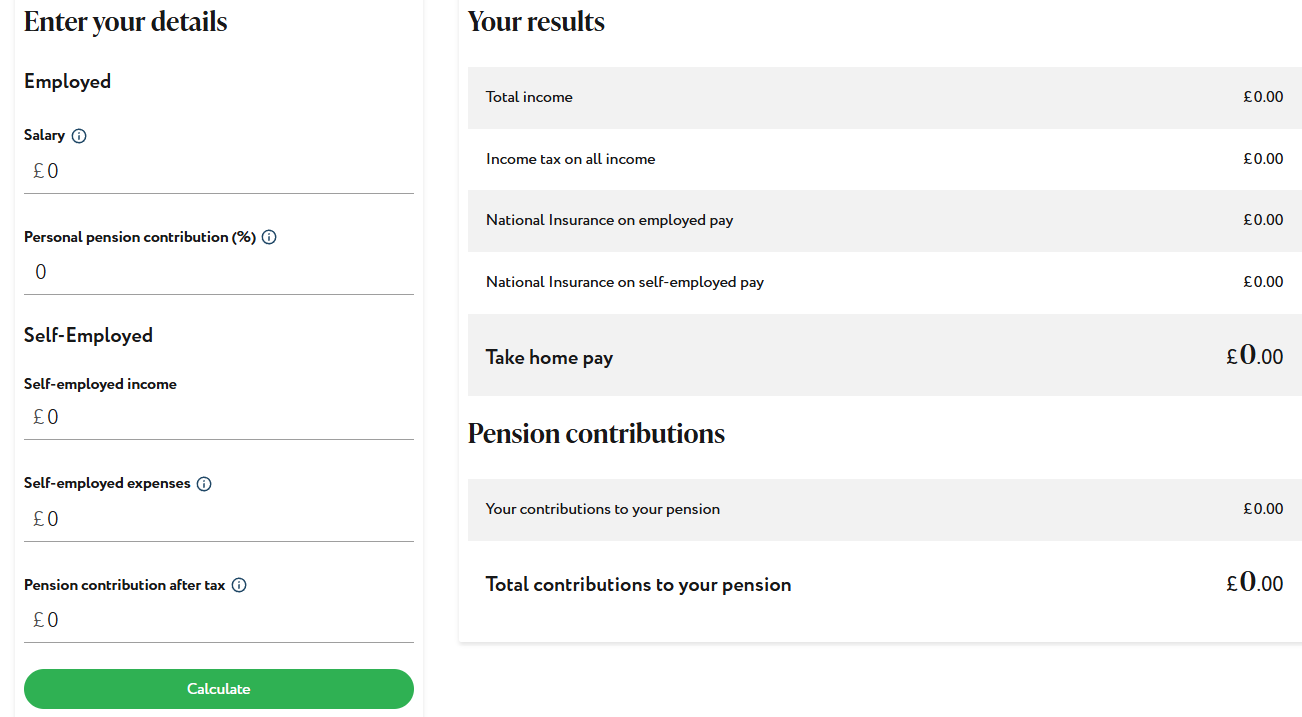

- On the website, users can access practical calculators such as the Compound Returns Calculator, ISA Calculator, Pension Calculator, Capital Gains Tax Calculator, and Self-Employed Tax Calculator to help plan and visualize their financial goals.

- Meanwhile, the platform itself provides interactive tools like risk assessments, performance projections, portfolio breakdowns, and goal-setting features to support informed, long-term investing decisions. This combination ensures users have comprehensive resources for both planning and ongoing portfolio management.

Education

The firm’s educational resources include articles, guides, and other informative content aimed at enhancing users’ understanding of the investment environment.

However, the learning materials may not be as comprehensive as some other platforms, but as the platform primarily targets investors and professional traders, we do not see this as a major drawback, considering that the firm provides a wider range of advanced products.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options Nutmeg

Nutmeg offers a variety of investment portfolios tailored to different financial goals and risk preferences. Clients can choose from options such as Fully Managed, Smart Alpha, Thematic, Fixed Allocation, Socially Responsible Investing, and Income portfolios.

These portfolios are primarily composed of diversified ETFs, providing broad exposure across asset classes, sectors, and regions. This range of investment opportunities is designed to suit both growth-oriented investors and those looking for income or ethical investment approaches.

Account Opening

Score – 4.4/5

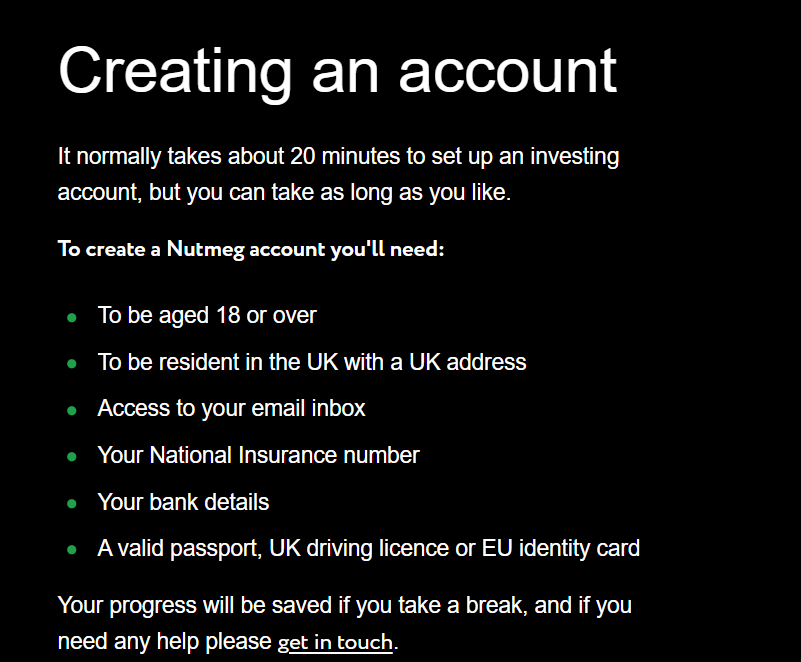

How to Open Nutmeg Demo Account?

Nutmeg does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Nutmeg Live Account?

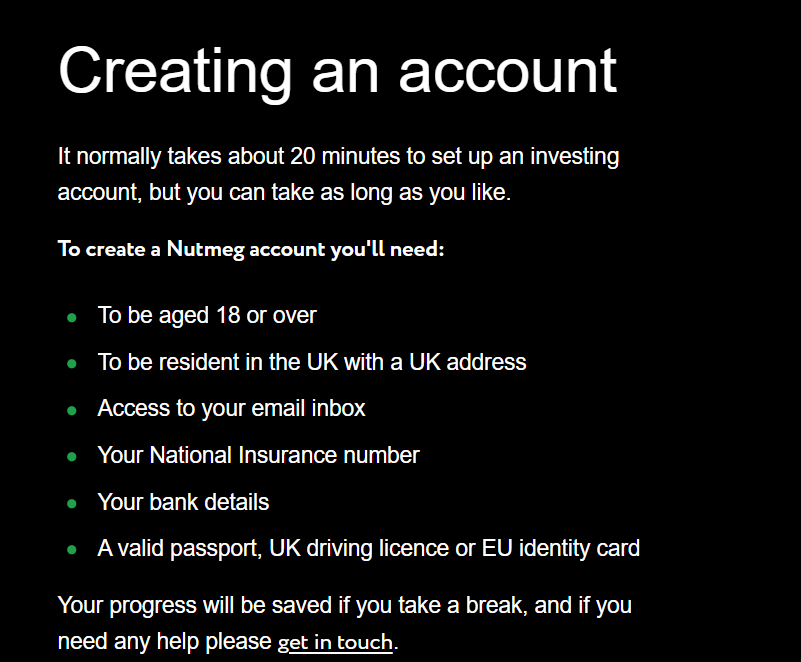

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Nutmeg login page and proceed with the guided steps:

- Select and click on the “Sign Up” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core offerings, Nutmeg provides several helpful features to support investors in managing their portfolios effectively.

- These include automatic portfolio rebalancing, goal-setting tools, and socially responsible investment options for those seeking ethical alignment with their investments.

- The platform also delivers visual performance tracking and clear reporting to enhance transparency.

All features are seamlessly integrated into Nutmeg’s web and mobile platforms, making it easier for users to monitor and adjust their investments in line with their financial goals.

Nutmeg Compared to Other Brokers

Compared to its competitors, Nutmeg stands out primarily as a digital wealth management platform with a strong focus on simplicity, long-term investing, and automated portfolio management.

While it may not offer the broad asset variety or advanced tools found on platforms like Interactive Brokers, MEXEM, or TD Ameritrade, Nutmeg appeals to investors looking for hands-off, goal-oriented investment solutions.

Its platform and mobile app are designed for ease of use, though it lacks the depth of educational resources and complex order types offered by traditional brokerage firms.

Nutmeg’s fee structure is transparent and competitive for its managed portfolios, but it may not be the best fit for active traders seeking a wide range of tradable instruments and advanced functionalities. Overall, the firm caters well to passive investors focused on long-term portfolio growth rather than frequent trading.

| Parameter |

Nutmeg |

MEXEM |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / 0.75% per annum on the first £100,000 |

$0.85 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Nutmeg Investment Platform, Mobile App

|

Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Global Stocks through Equity ETFs, Bond ETFs, Thematic ETFs |

Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

FCA |

CySEC, FCA, AFM, FSMA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Good |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

£500 |

€0.1 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Nutmeg

Nutmeg is a UK-based digital investment platform offering fully managed portfolios tailored to individual risk preferences and financial goals.

The firm provides access to globally diversified investments through ETFs, with options including Fixed Allocation, Fully Managed, Socially Responsible, and Smart Alpha portfolios. The platform emphasizes transparency, offering clear fee structures and regular performance updates.

Nutmeg also integrates automated features like rebalancing and tax-efficient investment accounts such as ISAs and pensions. With its intuitive mobile and web platforms, the firm is designed for investors seeking a digital approach to wealth building, supported by regulated oversight and robust security standards.

Share this article [addtoany url="https://55brokers.com/nutmeg-review/" title="Nutmeg"]