- What is MultiBank Group?

- MultiBank Group Pros and Cons

- Regulation and Security Measures

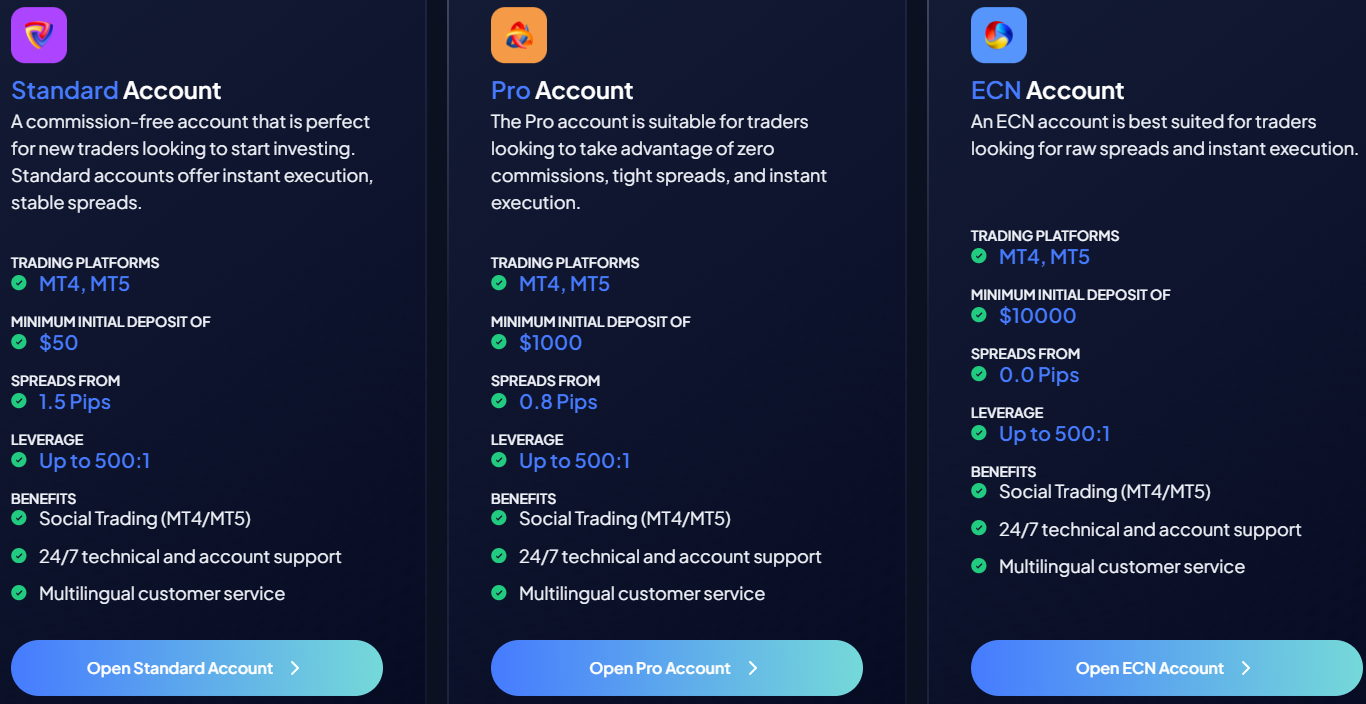

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

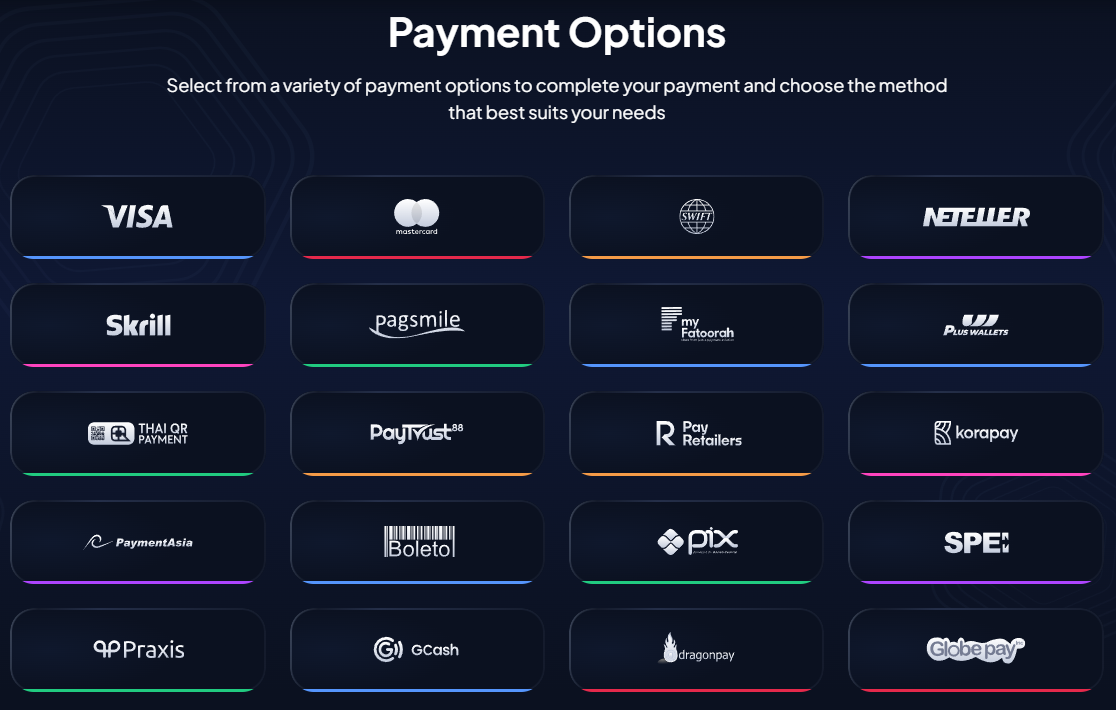

- Deposit and Withdrawal Options

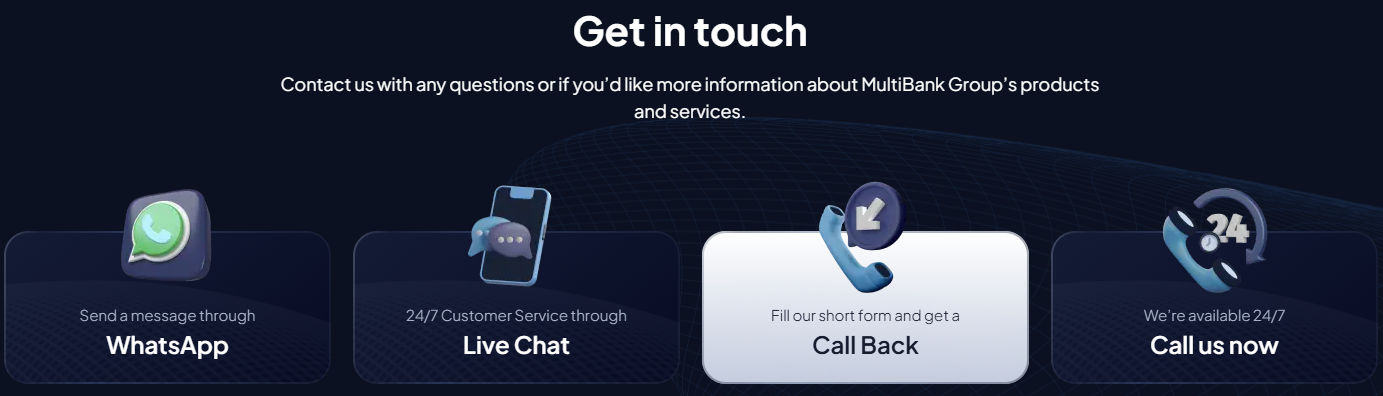

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- MultiBank Group Compared to Other Brokers

- Full Review of Broker MultiBank Group

Overall Rating 4.5

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is MultiBank Group?

MultiBank is one of the world-leading Forex Brokers, established in California in 2005 and since then became a large financial world institution that offers its customers direct access to banks and exchanges through advanced platforms.

The MultiBank Group service delivered to over 280,000 retail and institutional customers through over 90 countries, while MultiBank has offices in Sydney, Los Angeles, Vienna, Frankfurt, Madrid, Cyprus and UAE.

- Also, the group serves various branches where each maintains its defined task and role, alike MEXFintech located in Hong Kong, while MEX Group Worldwide maintains offices in Hong Kong, MEX Asset Management (Austria) GmbH, Beijing, Tianjin, Hangzhou and Ho Chi Minh City.

MultiBank Group Pros and Cons

Based on our expert opinion, MultiBank Group Globally is well recognized as a financial institution with sharp adherence to regulation, providing a wide range of Forex and CFDs trading with great capabilities, industry-standard platforms, and No commission deposits and withdrawal options. The broker is also known for providing some institutional features to retail traders.

For negative points, proposals vary according to the entity, the market is based only on FX and CFDs, and also it lacks good educational resources and the range of research tools is limited as well.

| Advantages | Disadvantages |

|---|

| Globally recognized financial institution | Proposals vary according to the entity |

| Sharp adherence to regulation | |

| Forex and CFDs trading | |

| Great Forex trading capabilities with range of platforms | |

| Fast account opening | |

| No commission deposits and withdrawal options | |

| 24/7 Support | |

MultiBank Features

MultiBank Group is a globally recognized financial broker offering a wide range of products, including Forex, commodities, indices, and cryptocurrencies. With a strong regulatory presence across multiple jurisdictions, the company provides traders with competitive spreads and advanced platforms. Here is a comprehensive list of its key features:

MultiBank Group Features in 10 Points

| 🏢 Regulation | ASIC, BaFin, CySEC, FMA, SCA, CIM |

| 🗺️ Account Types | Standard, Pro, ECN Accounts |

| 🖥 Trading Platforms | MT4, MT5, MultiBank-Plus Trading Platforms |

| 📉 Trading Instruments | Forex, CFDs on Metals, Indices, Shares, Commodities, Cryptocurrenices |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, GBP, EUR, CHF, AUD, NZD, CAD |

| 📚 Trading Education | Learning Courses, eBooks, Videos |

| ☎ Customer Support | 24/7 |

Who is MultiBank For?

MultiBank Group is designed for a wide range of traders, from beginners to experienced professionals and institutional investors. With its diverse account types and solutions, the broker caters to individual traders, fund managers, and businesses looking for advanced conditions.

- Beginning Traders

- Professional Traders

- Traders who prefer MT4 and MT5 platforms

- Currency and CFD Trading

- DMA access to Markets

- Running various Strategies

- API Traders

- EAs trading

- MAM/PAMM Trading

- Free VPS Trading

MultiBank Summary

Overall, the MultiBank Group review presents a company with a diverse range of established offices and enlarged portfolios through numerous countries, regulations, and offerings. In general, MultiBank broker is a reliable option for almost any trader from almost anywhere due to their global coverage comprehensive proposal, and the great support they offer.

The choice between the accounts is suitable for beginning traders or seasoned investors, as well as the competitive conditions through the STP processing of orders.

55Brokers Professional Insights

MultiBank Group stands out as a globally regulated broker with a strong presence in multiple jurisdictions, offering traders a high level of security and transparency. One of its key advantages is its diverse range of instruments, combined with competitive spreads and leverage up to 1:500.

The broker also provides MAM/PAMM Managers for asset managers, free Forex VPS, various tools, and account types to suit different trading styles. Additionally, MultiBank offers advanced platforms like MetaTrader 4 and MetaTrader 5, catering to both retail and institutional traders.

However, some drawbacks include relatively high spreads on Standard accounts compared to industry competitors and limited educational resources for beginners. While MultiBank’s regulatory strength and conditions make it a solid choice, traders should carefully assess their specific needs before committing.

Consider Trading with MultiBank If:

| MultiBank Group is an excellent Broker for: | - Looking for broker with a Top-Tier license.

- Get access to MT4 and MT5 platforms.

- Beginners and professional traders.

- Secure environment.

- Who prefer higher leverage up to 1:500.

- Providing services worldwide.

- Offering popular instruments.

- Broker with a variety of strategies.

- Offering MAM/PAMM trading.

- Access to free Forex VPS.

- Providing Social trading.

- Offering competitive conditions.

- Looking for broker with low minimum deposit requirement.

- 24/7 customer support.

- ECN trading.

|

Avoid Trading with MultiBank If:

| MultiBank Group might not be the best for: | - Who prefer to trade with cTrader.

- Limited educational materials.

|

Regulation and Security Measures

Score – 4.7/5

MultiBank Regulatory Overview

MultiBank Group is one of the recognized and regarded financial institutions that adhere to best practices and is fully regulated and registered in each jurisdiction it operates. MultiBank licenses include top-tier ASIC, BaFin, and CySEC, hence is considered low-risk currency and CFD trading.

However, the broker’s international trading is conducted under offshore regulators. While these licenses offer a level of credibility, clients should be aware that trading under offshore jurisdictions may involve different levels of investor protection compared to stricter regulatory environments.

How Safe is Trading with MultiBank?

Trading with MultiBank is generally considered safe due to its strong regulatory framework and global presence. The broker also claims to offer negative balance protection, segregated client funds, and advanced security measures to safeguard traders’ capital.

However, while regulatory oversight adds credibility, some traders may find the broker’s offshore entities less reassuring compared to top-tier regulators like the ASIC or CySEC. Additionally, the lack of investor compensation schemes in certain jurisdictions could be a consideration for risk-averse traders.

Overall, MultiBank’s strong regulatory background and security measures make it a reliable choice, but traders should always review the specific entity under which they register to ensure the highest level of protection.

Consistency and Clarity

MultiBank has built a solid reputation in the financial industry, earning numerous awards that recognize its commitment to regulatory compliance, innovation, and service excellence. These accolades reflect the broker’s efforts to provide a secure and competitive environment for its clients.

However, while MultiBank Group holds multiple regulatory licenses, some traders may find its offshore entities less reassuring compared to top-tier financial regulators. Additionally, certain regions may have varying levels of investor protection, making it essential for traders to carefully review the entity under which they register. Overall, MultiBank’s strong regulatory background, industry recognition, and security measures position it as a reliable choice for traders seeking a well-regulated broker.

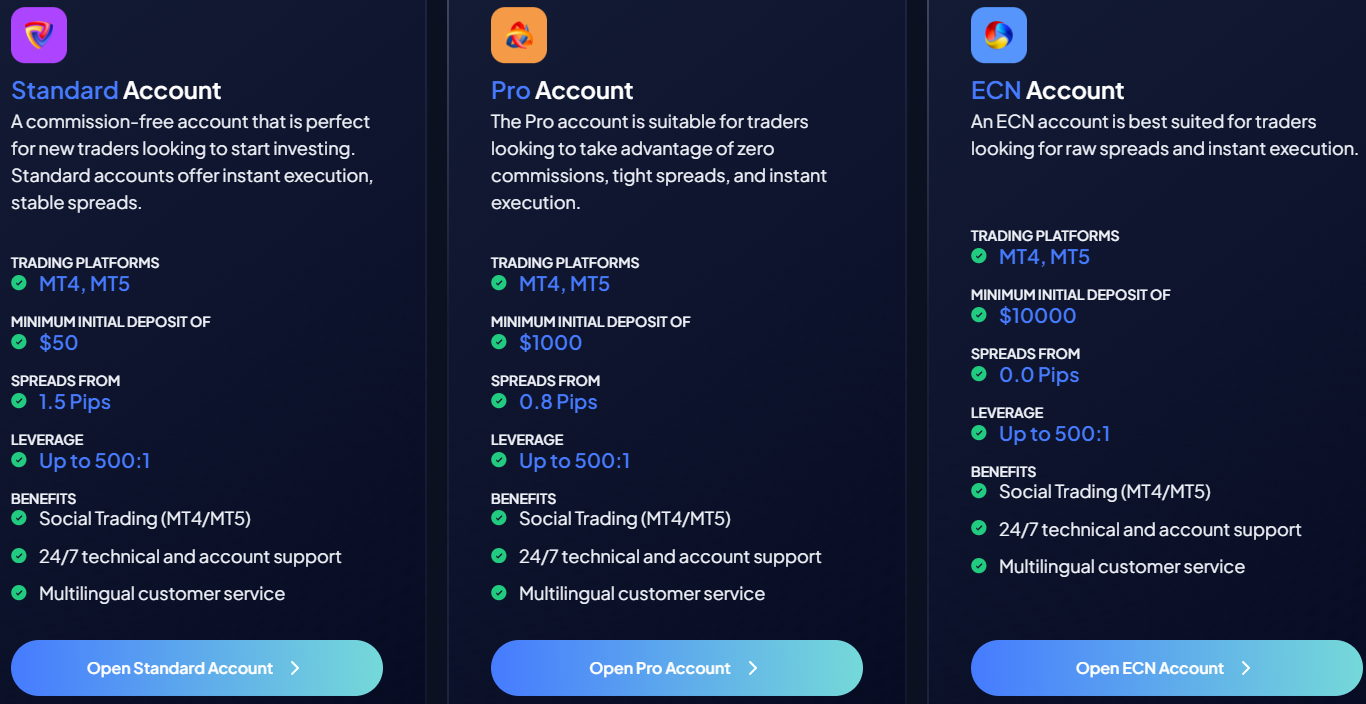

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with MultiBank?

MultiBank offers 3 types of accounts comprising Standard, Pro, and ECN accounts that suit every needs. Standard account offers commission-free trading with an initial deposit of $50 and instant execution while spreads start from 1.5 pips.

Pro account offers much smaller spreads with a higher initial deposit, and lastly, there’s an ECN account which uses an electronic communication network perfect for raw spread trading.

The broker also offers a demo account for beginners to test trade their skills and gain more knowledge without risking their money. You can also sign up for an Islamic Account which does not swap or rollover interest on overnight positions, thus, operating in compliance with Sharia.

Standard Account

The Standard Account is for new traders who are just starting their investment journey. The account allows traders to access all platforms, offering powerful tools for analysis and trading. With a minimum initial deposit of just $50, it is an affordable way for beginners to enter the world of trading.

In addition, the Standard Account offers spreads starting from 1.5 pips and leverage up to 1:500, which can help traders maximize their positions while managing risk. The account also provides 24/7 technical and account support and multilingual customer service, ensuring traders have assistance whenever needed. For those looking to engage in Social Trading, this account type supports both MT4 and MT5 platforms, offering a collaborative environment where traders can learn from and copy successful strategies.

Pro Account

The Pro Account is designed for traders who seek low spreads, and fast execution. With spreads starting from 0.8 pips, this account provides competitive pricing for active traders who want to maximize efficiency and reduce costs. The account offers advanced tools, custom indicators, and expert advisors for a professional experience.

The account requires a minimum initial deposit of $1,000, making it more suitable for traders who are ready to commit more capital. The Pro Account offers leverage up to 1:500, allowing traders to scale their positions and maximize their potential returns.

ECN Account

The ECN Account is perfect for professional traders or institutional investors who need raw spreads, direct market access, and ultra-fast execution. Offering spreads starting from 0.0 pips, this account provides the most competitive pricing with no dealing desk intervention, making it the preferred choice for scalpers and high-frequency traders.

The account requires a minimum initial deposit of $10,000, positioning it as a more premium option for those who require the best possible conditions.

Regions Where MultiBank is Restricted

MultiBank operates globally, but there are certain regions where its services are restricted due to regulatory and legal constraints. The regions where MultiBank Group’s services are limited include:

- USA

- Japan

- Canada

- Iran

- North Korea

- Syria

Cost Structure and Fees

Score – 4.5/5

MultiBank Brokerage Fees

As for the costs, MultiBank Group mainstays on costs built into the spread-only strategy available for Standard and Pro accounts.

ECN Account, as a professional account with a maintained balance of $5,000 offers spreads from 0.1 pips and a commission of $3 per lot with the traded amount of $20,000, while further the commission is discounted to $2 per lot. Indeed a quite competitive and good trading option.

Overall, MultiBank Exchange Group costs range as low-cost trading compared to industry competition.

MultiBank conditions will vary according to the account or platform you will use at MultiBank, thus if you are trading through Standard Account the spread averages 1.5 pips for Forex EUR/USD pairs. MultiBank Pro Account is designed mainly for traders with experience and bigger size, since requires a $1,000 initial deposit it also brings lower costs typically 0.8 pips.

MultiBank Group offers competitive commission structures across its ECN Account. For an ECN Account with a maintained balance of $5,000, traders can benefit from spreads starting from 0.1 pips, with a commission of $3 per lot for a traded amount of $20,000.

As traders increase their trading volume, the commission is further discounted to $2 per lot, providing an incentive for higher trade activity.

- MultiBank Rollover / Swaps

MultiBank offers rollover or swap rates on overnight positions, which are the fees applied when holding a position beyond the trading day. These rates are determined by the interest rate differential between the two currencies being traded and can vary depending on market conditions, the currency pair, and the direction of the trade.

Typically, long positions may incur a positive or negative swap, while short positions are also subject to swap charges based on the interest rates of the respective currencies.

- MultiBank Additional Fees

In addition to standard costs, MultiBank charges certain additional fees under specific conditions. One of the key additional charges is the monthly maintenance fee, which is $60 per month for accounts with low or inactive balances.

Traders should be mindful of these potential fees and ensure their accounts remain active or sufficiently funded to avoid unnecessary charges.

How Competitive Are MultiBank Fees?

MultiBank Group offers competitive fees compared to other brokers in the industry. The ECN Account offers raw spreads from 0.0 pips, along with a commission-based structure, ensuring that traders with higher volumes can benefit from more cost-effective pricing.

Overall, MultiBank’s fee structure is designed to accommodate a wide range of traders, from beginners to professionals, with flexible options that cater to different strategies and preferences.

| Asset/ Pair | MultiBank Spread | KAB Spread | Rakuten Spread |

|---|

| EUR USD Spread | 1.5 pips | 0.1 pips | 0.5 pips |

| Crude Oil WTI Spread | 0.03 | 0.5 | 6.10 |

| Gold Spread | 0.25 | 0.05 | 1.5 |

| BTC USD Spread | 58 | - | - |

Trading Platforms and Tools

Score – 4.6/5

MultiBank platform offers technology based on MetaTrader’s proven powerful capabilities, installed to MT4 and MT5 platforms that enable partial fill with bridge technology, without any requotes rejections or slippage. Using the MT4 engine these platforms run ECN connection with customized capabilities of opportunities allowing sophisticated, yet customer-friendly suit to any strategy.

Additionally, MultiBank provides its proprietary MultiBank-Plus Web and Mobile App, offering flexibility and access to trading on the go.

Trading Platform Comparison to Other Brokers:

| Platforms | MultiBank Platforms | KAB Platforms | Rakuten Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

MultiBank Web Platform

The MultiBank-Plus platform delivers a next-gen experience with a simple and easy-to-use interface. Offering advanced features for efficient market analysis and trade execution, this platform provides access to a wide range of financial instruments with real-time data and customizable charts.

The user-friendly layout ensures that traders can easily manage their accounts, place trades, and monitor market movements. Accessible via web and mobile, the platform is optimized for smooth performance, providing traders with the flexibility to trade anytime and anywhere while enjoying a seamless and efficient experience.

MultiBank Desktop MetaTrader 4 Platform

The desktop MetaTrader 4 platform offers a comprehensive experience with features designed to meet the needs of all levels of traders. With a Stop Out Level of 50%, it provides a clear risk management framework, ensuring that positions are automatically closed when margin requirements are not met.

The platform supports One-Click Trading, allowing traders to execute trades instantly with a single click. VPS Hosting is also available for uninterrupted trading, ensuring that automated strategies and Expert Advisors run smoothly without any downtime.

The platform offers full EA functionality, enabling the use of automated systems for enhanced efficiency. In addition, traders benefit from superior fundamental analysis, including financial news and an economic calendar to stay updated on market-moving events. The platform also includes Social Trading functionality, allowing traders to follow and copy successful strategies from others, further enhancing their opportunities.

Main Insights from Testing

Testing of MT4 platforms reveals a strong emphasis on execution speed, user-friendly interfaces, and a wide range of tools that cater to various strategies. Traders have found the platforms to be stable, with minimal downtime and fast order execution.

The integration of advanced charting and analysis tools ensures a comprehensive experience, while the ability to access accounts and trade via multiple devices adds significant flexibility.

MultiBank Desktop MetaTrader 5 Platform

The MT5 platform offers a powerful and versatile environment with enhanced features designed for professional traders. It provides advanced charting tools, multiple timeframes, and an expanded range of technical indicators to support in-depth market analysis.

The platform supports multi-asset trading, giving traders the flexibility to diversify their portfolios. With full Expert Advisor functionality, traders can automate their strategies for greater efficiency. Additionally, the platform offers superior order execution, advanced order types, and access to an economic calendar for keeping track of key market events.

MultiBank MobileTrader App

The broker provides traders with the flexibility to trade on the go, offering both MT4/MT5 and the MultiBank-Plus mobile apps. These mobile platforms deliver all the essential features needed for efficient trading, including real-time market data, advanced charting tools, and the ability to execute trades swiftly from anywhere.

The MT4/MT5 mobile apps mirror the functionality of their desktop counterparts, enabling traders to manage positions, access technical indicators, and utilize automated systems directly from their mobile devices. Meanwhile, the MultiBank-Plus mobile app offers a user-friendly interface with a focus on simplified trading and real-time updates, making it an ideal choice for traders looking for an intuitive mobile trading experience.

Trading Instruments

Score – 4.8/5

What Can You Trade on MultiBank’s Platform?

On MultiBank’s platform, traders have access to an extensive selection of over 20,000 instruments, offering a diverse range of opportunities. This includes Forex pairs, allowing traders to access the global currency markets, as well as CFDs on Metals, such as gold and silver, for those looking to trade precious commodities.

Additionally, MultiBank provides CFDs on Indices, allowing exposure to major stock market indices, as well as Shares in leading companies for equity trading. Traders can also take positions in a wide variety of Commodities, including oil and agricultural products, and Cryptocurrencies, providing access to the rapidly growing digital asset market.

Main Insights from Exploring MultiBank’s Tradable Assets

Exploring MultiBank’s tradable assets reveals a comprehensive offering that caters to a wide range of trader preferences. The platform stands out for its diverse range of assets, allowing traders to access not only traditional instruments like Forex and commodities but also cutting-edge markets like cryptocurrencies.

Popular crypto pairs such as Bitcoin/USD, Ethereum/USD, and Ripple/USD are available for traders looking to capitalize on the volatility in the digital currency space. MultiBank’s extensive asset variety provides ample opportunities for diversification, making it an appealing choice for traders who wish to explore multiple markets with ease.

Leverage Options at MultiBank

Depending on the particular entity of the MultiBank Group and its applicable regulatory obligation, you will be offered to use a multiplier with the possibility to magnify your outcome from the trading. High leverage ratios make it possible to amplify your gains with a small initial capital through borrowed funds, however, it may magnify losses as well.

- Australian clients may use up to 1:30.

- European clients are entitled to use a maximum of 1:30 for major currency pairs and even lower for other instruments.

- Leverage of 1:500 is available through international entities.

However, we highly recommend you thoroughly examine how to use leverage smartly so as not to fall under unnecessary risks while trading.

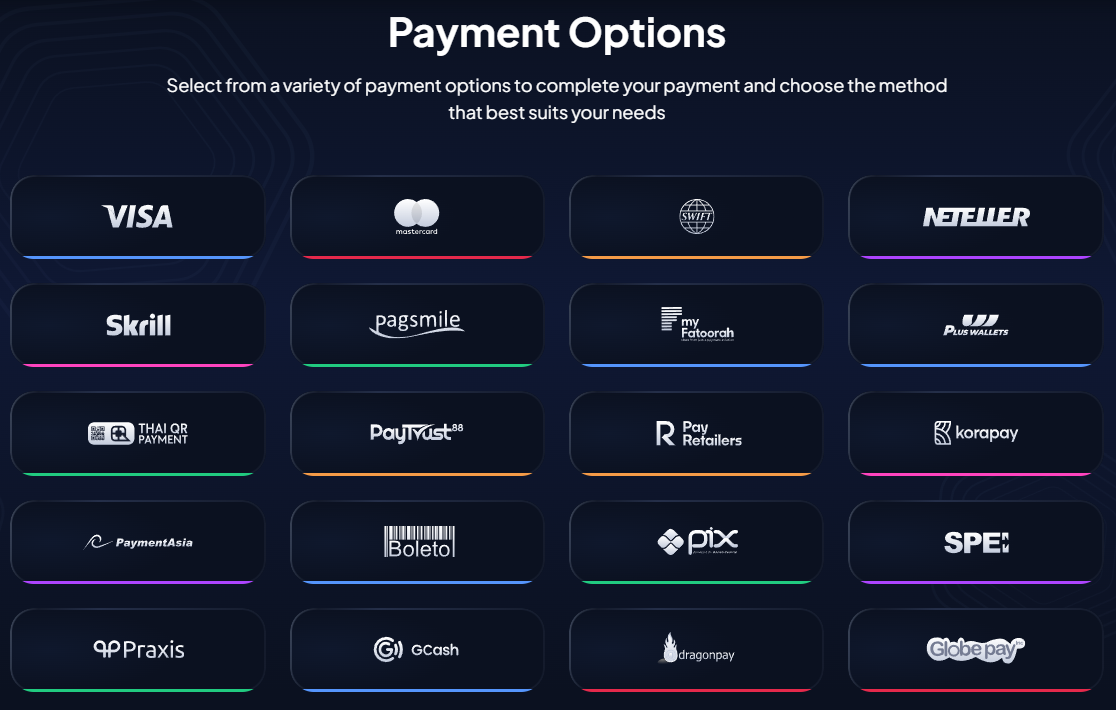

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at MultiBank

One of the great things is that you can choose your account-based currency so that you will avoid unessential conversion charges. The supported currencies include USD, GBP, EUR, JPY, CHF, AUD, NZD, and CAD, while general funding options include the following ones. Again, make sure the method is available in your country of origin.

- Bank Wire Transfers

- Credit Card

- Neteller, Skrill, fasapay, and online-payments

MultiBank Minimum Deposit

The multiBank minimum deposit for the Standard account is $50, which is a great opportunity for traders despite its size or strategy. However, make sure to check applicable margins for the instrument you are willing to trade, so you cover particular conditions, as well as various technology platforms, that may require higher deposits.

Withdrawal Options at MultiBank

Generally, MultiBank does not charge a commission for deposits or withdrawals from its side, however, in various jurisdictions, its legal conditions of payment providers and international rules may add on some charges. So you should always verify in case of any fees with the payment provider himself, as well as the customer service of the broker.

To withdraw the funds from the account you should submit the request online, further the money will be transferred by the selected method. Typically broker confirms your withdrawal request within 1-2 business days, yet this may vary according to entity conditions.

Customer Support and Responsiveness

Score – 4.6/5

Testing MultiBank’s Customer Support

What we found also fascinating about this broker is the diversity of the companies provides their customers with multiple support in any case and questioning. The 24/7 customer service is available in 10+ languages with the service desk, onboarding, configuration, and cash management facilities.

Also, Customer Service is reachable easily and provides quality answers while available through Live Chat, email, the contact form, and supporting an impressive number of international phone lines, truly covering the globe.

Contacts MultiBank

For any inquiries, MultiBank provides multiple contact options to ensure efficient customer support. The company’s headquarters is located in Dubai, UAE, serving as the central hub for its global operations. Traders can reach out to MultiBank’s support team via phone at +971 800203040 for immediate assistance.

Additionally, the broker offers multilingual customer support to cater to its international client base. For email inquiries, clients can contact the support team at cs@multibankfx.com, ensuring a direct and professional response to any questions related to trading, accounts, or platform issues.

Research and Education

Score – 4.4/5

Research Tools MultiBank

MultiBank provides a variety of research tools on both its website and platforms, ensuring traders have access to essential resources for informed decision-making.

- On the website, traders can find an economic calendar for tracking major financial events, market news, and analysis to enhance their knowledge. MultiBank also offers insights on different strategies and regular updates on market trends.

- On the platforms, traders can utilize Free VPS hosting for uninterrupted automated trading, Expert Advisors for algorithmic trading, and MAM/PAMM accounts for professional fund management.

- Additionally, the broker provides FIX API for direct market access and advanced charting tools to support technical analysis.

Education

MultiBank Group provides a selection of educational resources to help traders improve their market knowledge and skills. The broker offers learning courses, eBooks, and video tutorials, covering fundamental and technical analysis, strategies, and platform guides.

While these materials offer valuable insights, the broker’s educational offering is not as comprehensive as some other brokers, as it lacks live webinars, interactive sessions, and in-depth mentorship programs. Traders who prefer a more structured learning experience with real-time guidance may find the available resources somewhat limited.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options MultiBank

While MultiBank primarily focuses on currency and CFD trading, it also provides investment options for traders looking to diversify their strategies. The broker offers MAM and PAMM accounts, allowing experienced traders and money managers to handle multiple client funds efficiently.

Additionally, social trading features on MT4 and MT5 enable investors to follow and copy the strategies of professional traders, making it easier for beginners or passive investors to participate in the markets. These investment tools give traders flexibility beyond traditional self-directed trading, offering opportunities to engage in automated or managed solutions.

Account Opening

Score – 4.4/5

How to Open MultiBank Demo Account?

Opening a MultiBank demo account is a simple and quick process, allowing traders to practice risk-free before committing real funds. To get started, visit the MultiBank Group website and navigate to the demo account registration page.

Fill out the required details, including your name, email, phone number, and preferred platform. Once registered, you will receive login credentials via email, granting access to a simulated environment with virtual funds. The demo account provides real-time market conditions, enabling traders to test strategies, explore platform features, and gain confidence before transitioning to a live account.

How to Open MultiBank Live Account?

Here is our guide on how to open a digital account which is a quite simple process. You should submit the necessary information and documentation for your identity and walk through the next steps.

- Follow the Open Account link.

- Provide personal data and experience to confirm your Live account.

- Verify your account through the link on your email and get access to your account area.

- Make the first deposit.

- Access trading and markets.

Additional Tools and Features

Score – 4.3/5

MultiBank provides additional tools and features designed to enhance the experience.

- One of its standout offerings is Social Trading, allowing users to follow and copy expert traders’ strategies directly from the MT4 and MT5 platforms.

- The broker also supports Auto Trading, enabling algorithmic strategies and automated solutions for more efficient execution.

- With multi-account management tools and a dedicated client portal, MultiBank caters to both retail and institutional traders, offering a well-rounded environment.

MultiBank Compared to Other Brokers

MultiBank stands out among its competitors with a diverse range of over 20,000 instruments, making it more competitive in asset variety than most brokers except for a few like Saxo Bank. It offers both spread-based and commission-based accounts with relatively low fees, though some brokers provide even tighter spreads.

In terms of platforms, MultiBank provides MT4, MT5, and its proprietary MultiBank-Plus, giving traders multiple options, while others offer exclusive platforms like SaxoTraderGO or CMC Markets’ Next Generation platform. MultiBank also holds multiple global regulatory licenses, ensuring a secure environment, though some competitors like Saxo Bank and Swissquote have a stronger presence in top-tier regulatory jurisdictions.

Customer support is a strong point, with 24/7 availability, whereas most competitors only offer support 24/5. However, its educational resources are not as extensive as brokers like Saxo Bank or City Index, which provide more in-depth learning materials. While MultiBank requires a low minimum deposit, making it accessible for new traders, some competitors offer a $0 deposit option, providing even greater flexibility for beginners.

| Parameter |

MultiBank Group |

KAB |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.5 pips |

Average 0.1 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.1 pips + $3 |

For Share CFDs (Commission of 0.10%) |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, MultiBank-Plus Trading Platforms |

MT5 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

20,000+ instruments |

300+

instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC, BaFin, CySEC, FMA, SCA, CIMA, FSC, MAS, TFG, VFSC |

KCCI |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$50 |

$100 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker MultiBank

MultiBank Group is a well-established broker offering a wide range of financial instruments across Forex, CFDs, indices, commodities, and cryptocurrencies. It provides competitive spreads starting from 1.5 pips on standard accounts and low commissions on its commission-based accounts.

Traders can access popular platforms like MT4 and MT5, along with its proprietary MultiBank-Plus platform, ensuring flexibility for various strategies. With a robust regulatory presence in multiple regions and a solid reputation, MultiBank offers security and trust to its clients. The broker’s customer support operates 24/7, ensuring timely assistance, while social trading and MAM/PAMM features enhance opportunities. Overall, MultiBank offers a solid trading experience for both beginners and experienced traders, with competitive fees and a wide selection of assets.

Share this article [addtoany url="https://55brokers.com/multibank-exchange-group-review/" title="MultiBank Group"]

do you have nasdaq