- What is MEXEM?

- MEXEM Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

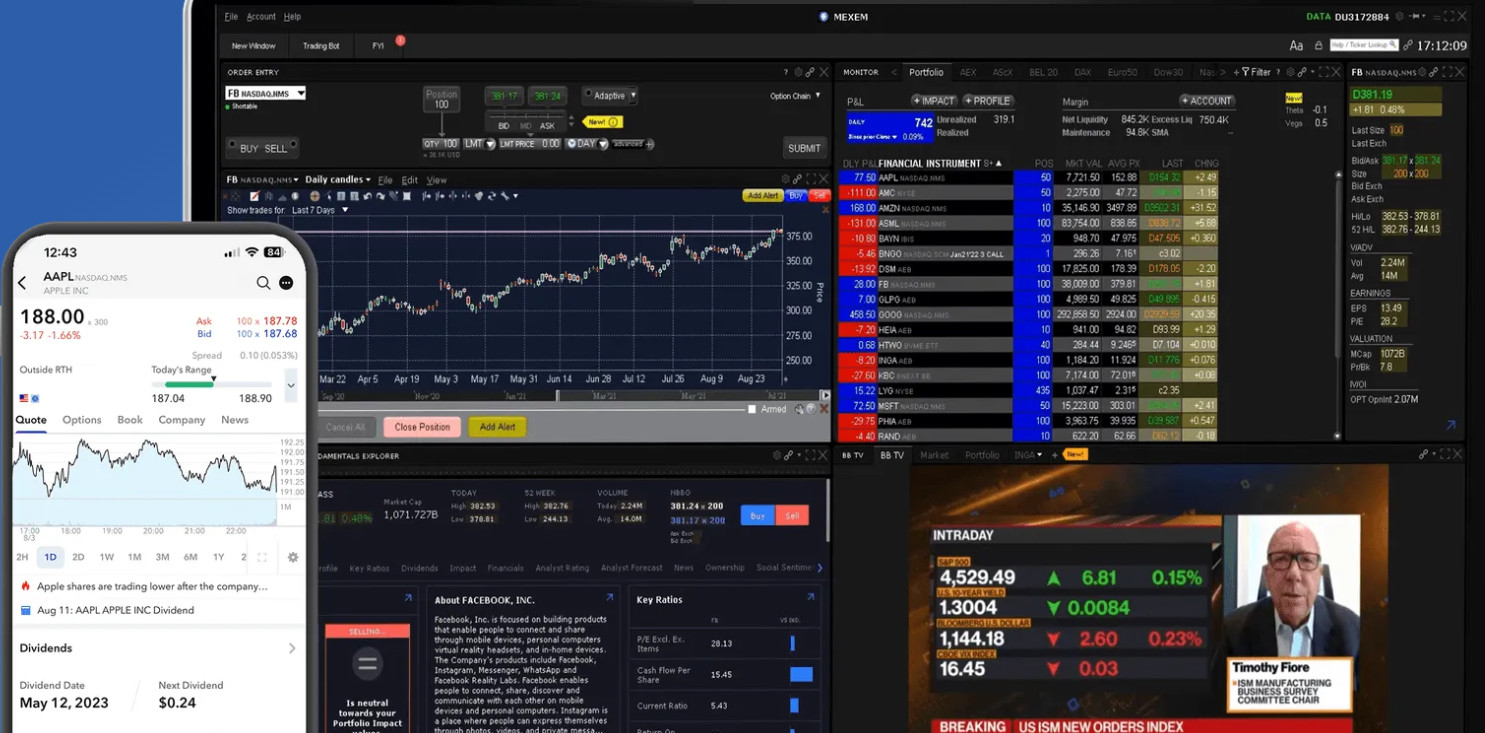

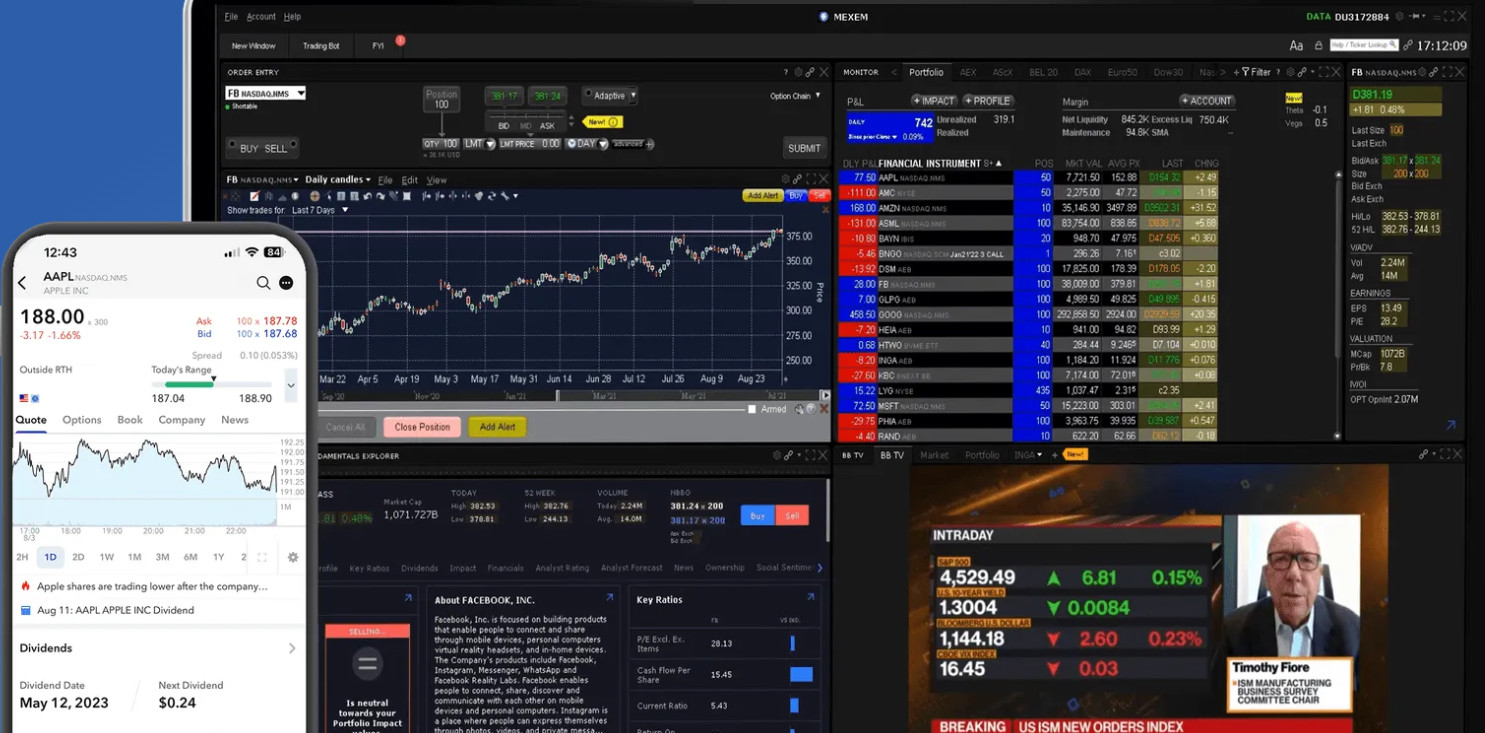

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- MEXEM Compared to Other Brokers

- Full Review of Broker MEXEM

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.8 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is MEXEM?

MEXEM is a European Stock Trading firm founded in 2018 that serves as an Introducing Broker for Interactive Brokers, offering access to global financial markets, including stocks, ETFs, futures, options, and bonds.

MEXEM is regulated by Cyprus’s Securities and Exchange Commission (CySEC) and is also registered with the Financial Conduct Authority (FCA) in the UK, the Financial Markets Authority (AFM) in the Netherlands, and with the Financial Services and Markets Authority (FSMA) in Belgium.

The firm is known for its low commissions and minimal deposit requirements, making it attractive to active traders and investors targeting European markets.

Is MEXEM Stock Broker?

Yes, MEXEM is a Stock Trading Broker that provides direct access to global markets through its partnership with Interactive Brokers. Regulated by CySEC and registered with other major UK and European financial authorities, the broker offers trading in a wide range of instruments.

MEXEM Pros and Cons

MEXEM offers several advantages, including access to a wide range of global markets, competitive trading conditions, and professional trading platforms such as Trader Workstation (TWS).

The broker is well-regulated, with oversight from CySEC and FCA, and registrations with financial authorities in countries like the Netherlands and Belgium, providing an added layer of trust and security. Additionally, client funds are held in segregated accounts at Interactive Brokers, ensuring transparency and protection.

For the Cons, MEXEM may not be ideal for beginners due to its technology and limited educational resources. Also, customer support is not available 24/7.

| Advantages | Disadvantages |

|---|

| Stock Trading and Investment | No 24/7 customer support |

| CySEC and FCA regulation and oversee | Limited educational materials |

| Competitive fees and commissions | |

| Suitable for active traders and professionals | |

| Advanced trading platforms | |

| Good trading tools and research | |

| Suitable for long-term investing | |

| Access to Real Futures | |

MEXEM Features

MEXEM offers a wide range of features, including direct market access to popular global markets, competitive commission rates, and advanced trading platforms. Below is a comprehensive list of its key features:

MEXEM Features in 10 Points

| 🏢 Regulation | CySEC, FCA, AFM, FSMA |

| 🗺️ Account Types | Individual, Institutional Accounts |

| 🖥 Trading Platforms | Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

| 📉 Trading Instruments | Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

| 💳 Minimum Deposit | €0.1 |

| 💰 E-mini and Standard Contract | $0.85 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, CHF, GBP |

| 📚 Trading Education | Educational Portal |

| ☎ Customer Support | 24/5 |

Who is MEXEM For?

MEXEM is best suited for active traders, experienced investors, and institutions looking for direct access to global financial markets and low-cost trading. Its robust tools, flexible order types, and advanced trading platforms make it ideal for those who prioritize execution quality and market reach. In our opinion, MEXEM is Good for:

- Investing

- European traders

- UK traders

- Direct Market Access trading

- Real Stock Trading

- Competitive trading fees

- Great trading tools

- Advanced traders

- Professional trading

- Real Futures trading

- Long-term investors

MEXEM Summary

Overall, MEXEM is a competitive Stock trading brokerage that combines global market access with localized European support. Through its affiliation with Interactive Brokers, it provides a reliable trading infrastructure supported by robust regulatory compliance across multiple jurisdictions.

The broker also offers tailored account services, transparent pricing, and support for a broad range of asset classes. Its user experience is more focused toward self-directed traders who value control, flexibility, and access to professional tools, rather than simplified or beginner-focused platforms.

55Brokers Professional Insights

MEXEM stands out by offering a professional-grade trading environment backed by the infrastructure of Interactive Brokers. Standing on a strong background and highly efficient environment of IB we consider the proposal very competitive for various size or level traders, investors. What sets it apart is its combination of institutional-level market access with personalized, multilingual support tailored to European clients.

You may benefit from direct market access, low-latency execution, and the powerful TWS platform, which includes advanced charting, customizable algorithms, and risk management tools. So all type of strategies are well accommodated, the only thing is to get used with TWS platform, which might be slightly overwhelming for beginning traders, yet it is highly practical and packed with great tools.

The broker also supports a range of financial instruments, including stocks, ETFs, options, futures, bonds, and more. Its competitive commission model, lowest minimum deposit, and regulatory coverage across multiple EU countries make it especially appealing to investors seeking both cost efficiency and comprehensive market coverage.

Consider Trading with MEXEM If:

| MEXEM is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Suitable for professional traders and investors.

- Low fees and commissions.

- Stock Trading and Investment.

- Access to robust trading platforms.

- Excellent trading tools and trading technology.

- European investors.

- Offering popular financial products.

- Providing diverse trading tools, and trading strategies.

- Secure trading environment.

|

Avoid Trading with MEXEM If:

| MEXEM might not be the best for: | - Who need comprehensive educational resources.

- Looking for broker with 24/7 customer support.

- International investors. |

Regulation and Security Measures

Score – 4.6/5

MEXEM Regulatory Overview

MEXEM operates under strong regulatory oversight, ensuring a secure and transparent trading environment for its clients. The firm is primarily regulated by the Cyprus Securities and Exchange Commission under license number 325/17, which allows it to offer investment services across the European Economic Area.

In addition to CySEC, MEXEM is also registered with the Top-Tier FCA in the UK, the AFM in the Netherlands, and the FSMA in Belgium. This multi-jurisdictional regulatory framework enhances client protection and promotes compliance with EU financial standards.

How Safe is Trading with MEXEM?

Trading with MEXEM is considered safe due to its partnership with Interactive Brokers, which provides institutional-grade custody and infrastructure.

Client funds and assets are held in segregated accounts, ensuring they are protected from the broker’s financial obligations. Additionally, clients benefit from investor protection schemes such as the Investor Compensation Fund in Europe and SIPC coverage through Interactive Brokers, offering an added layer of financial security.

Consistency and Clarity

MEXEM has built a solid reputation in the trading community for its reliability, competitive pricing, and access to a wide range of global markets. It has received industry recognition, including awards such as the Best Broker of 2021 by Beleggers Belangen.

Traders’ reviews are generally positive, often highlighting MEXEM’s low fees, responsive customer service, and good trading tools, though some traders have reported delays in account transfers and occasional support issues.

Overall, MEXEM is a trustworthy and well-established investment firm that combines institutional-grade infrastructure with localized support, earning respect within the trading community while continuing to expand its presence in the financial trading environment.

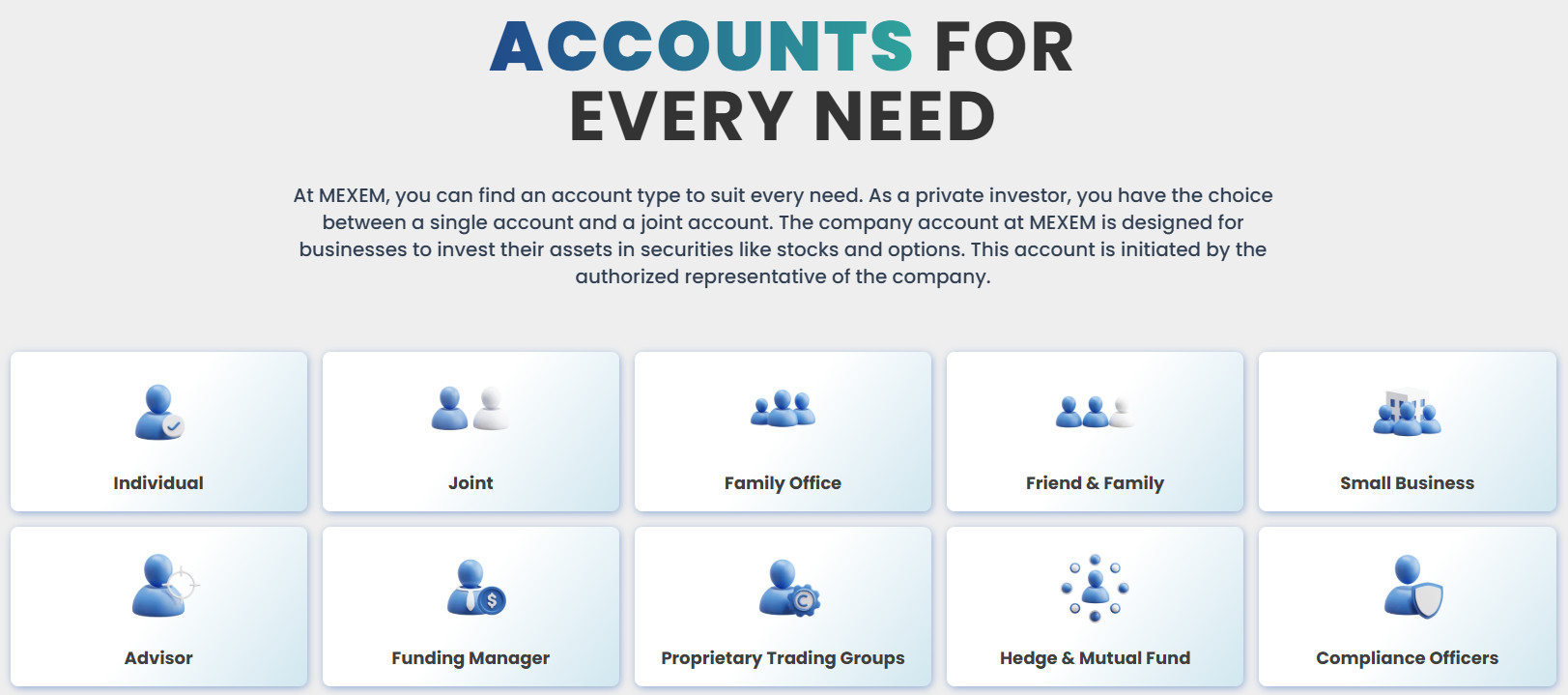

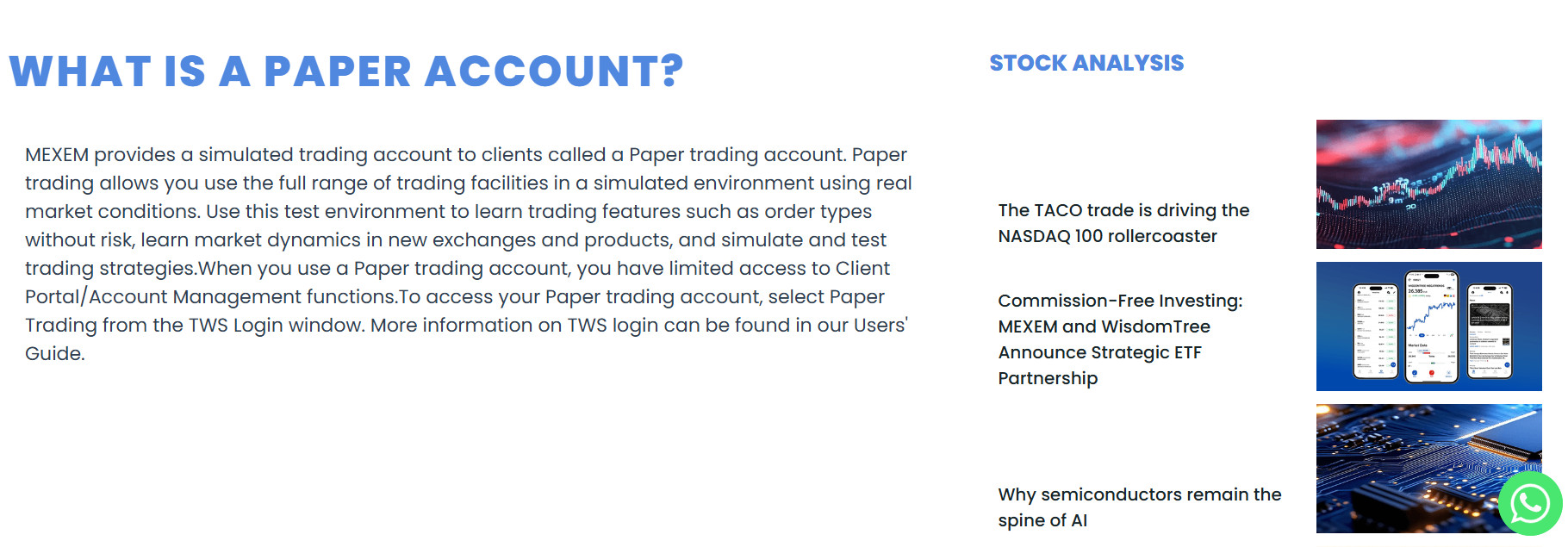

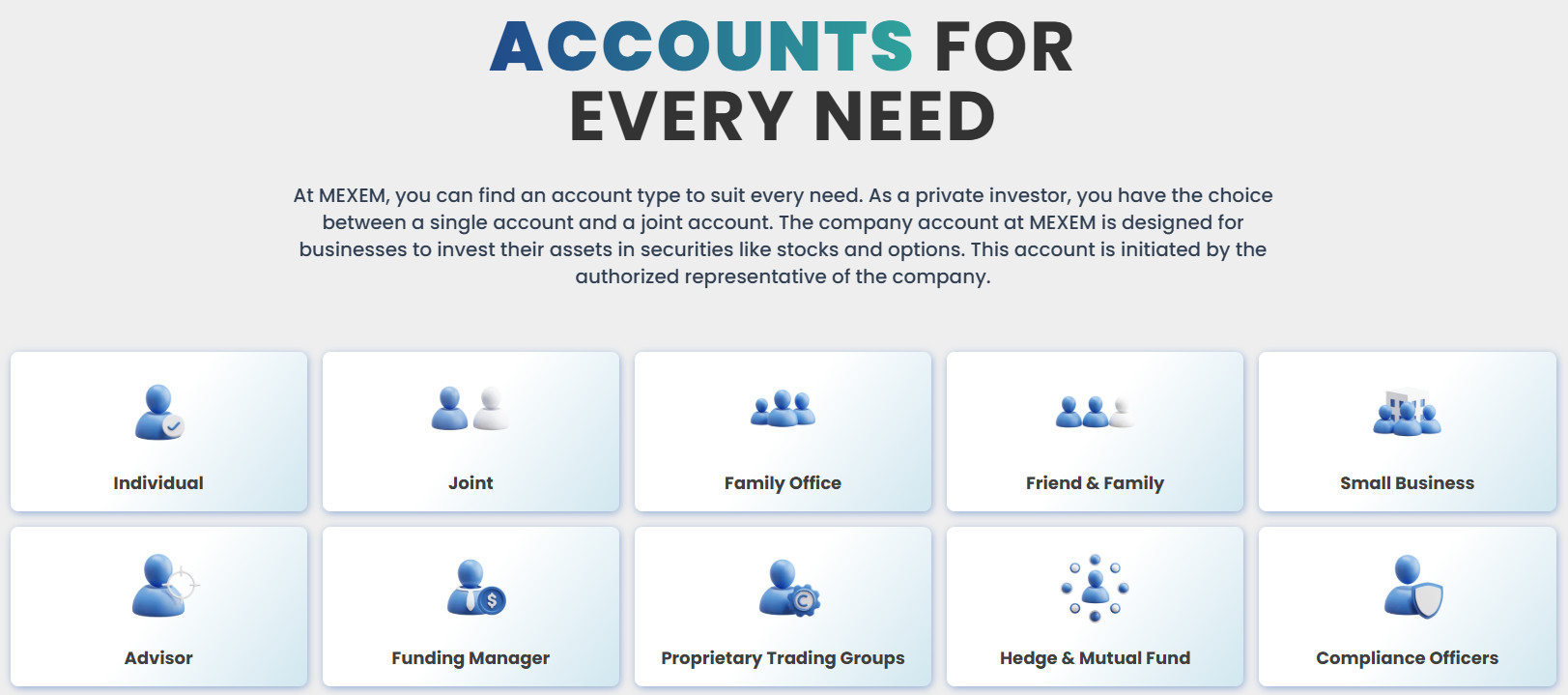

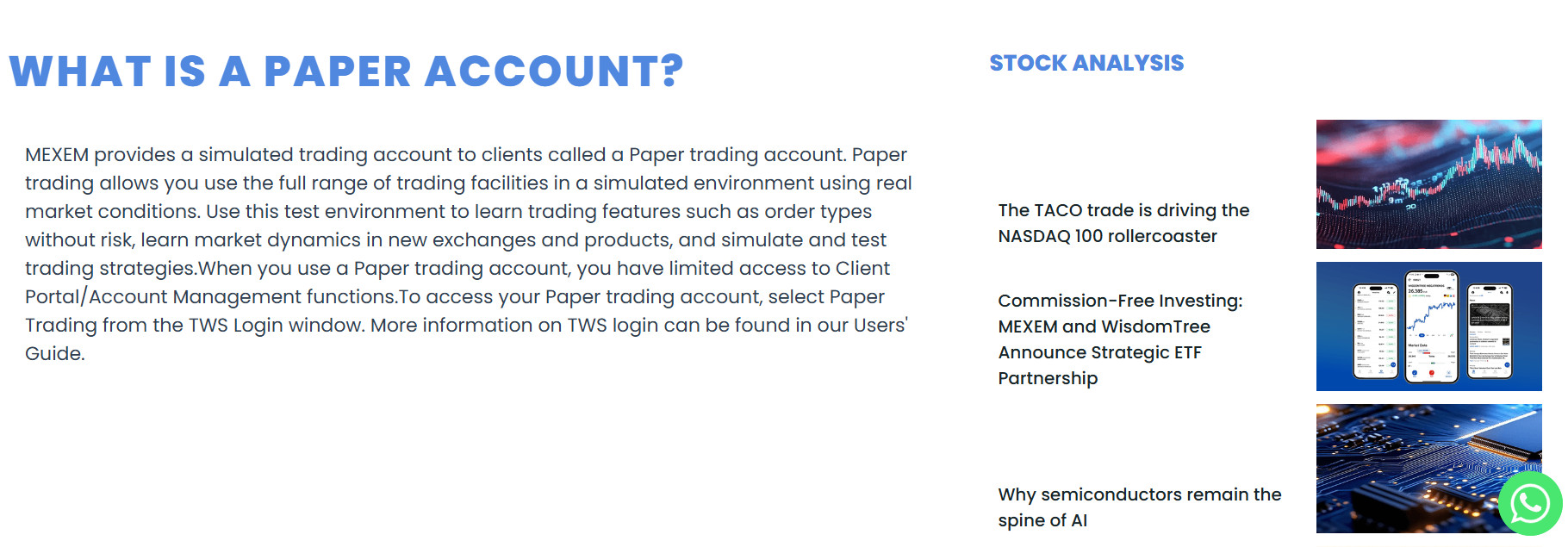

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with MEXEM?

MEXEM offers both individual and institutional accounts for a wide range of traders and investors. The individual category includes several options such as Individual, Joint, Friend & Family, and more.

On the institutional side, the broker supports advisors, family offices, hedge funds, proprietary trading groups, and more accounts. Additionally, the broker provides a paper trading account, allowing users to test strategies in live market conditions without financial risk.

Individual Accounts

MEXEM’s Individual Accounts come with almost no minimum deposit requirement. You can open and maintain an account even with a balance as low as €0.1.

Clients can choose from Cash, Reg T, or Portfolio Margin options depending on their trading style and risk profile. Account setup is digital, typically completed in about one business day after identity verification.

Additionally, users can open a paper trading account to practice strategies under live market conditions without risking real capital

Regions Where MEXEM is Restricted

MEXEM accepts clients from many countries; however, its services are restricted in certain regions and countries due to regulatory limitations, local laws, or political factors:

- USA

- North Korea

- Iran

- Syria, etc.

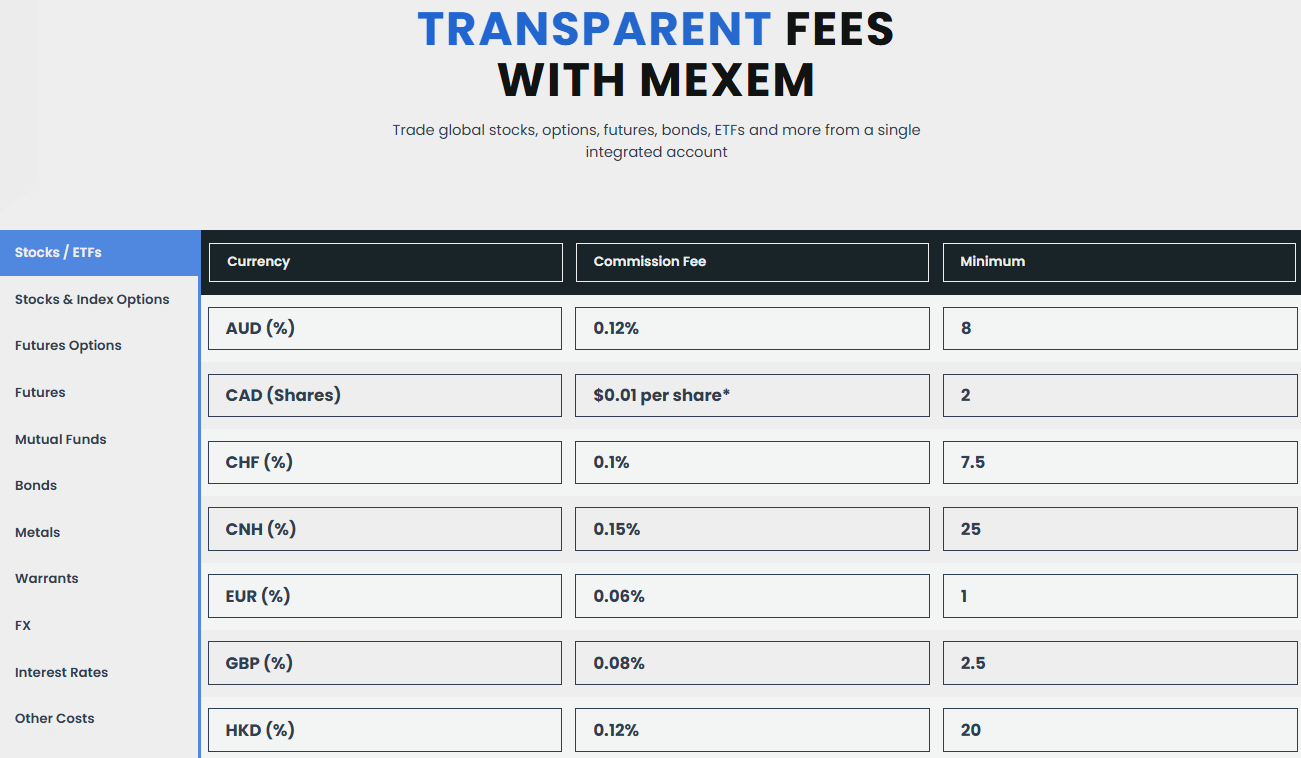

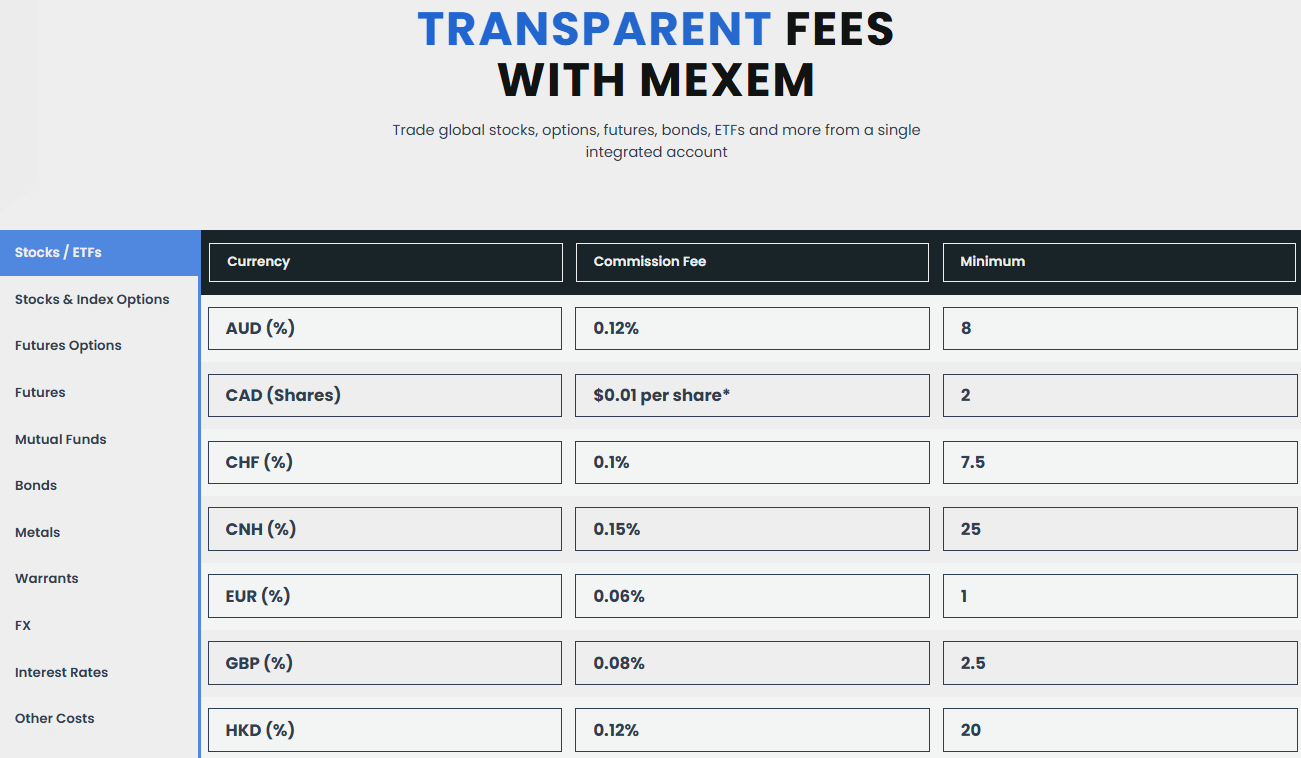

Cost Structure and Fees

Score – 4.6/5

MEXEM Brokerage Fees

MEXEM offers a competitive and transparent fee structure. Stock and ETF trades start from just $0.005 per share in the US, with minimums around $1, while European equity fees begin at 0.06% of the trade value.

Futures are priced from $0.85 per contract in the US, and mutual funds carry fixed or tiered fees depending on the region. Bond trading fees are generally 0.15% of the trade value.

Additionally, the broker does not charge inactivity, deposit, or maintenance fees, and the first withdrawal each month is free of charge.

MEXEM charges a flat commission of $0.85 per contract for standard US futures, plus applicable exchange, clearing, and regulatory fees. For E‑mini contracts, MEXEM also applies the same base rate of $ 0.85 per contract.

For Micro products commission starts at approximately $0.25 per contract per side, with potential tiered discounts based on monthly trading volume.

Besides the main commissions, traders are also charged exchange, clearing, and regulatory fees, which vary by market and contract type. These external costs depend on the specific exchange, such as Euronext, Eurex, ICE, or MEFF, and can differ significantly across regions.

For example, trading European futures on Euronext or Eurex may involve fees per contract starting from approximately €0.30 to €2.50, depending on the instrument.

While MEXEM does not offer traditional Forex or CFD trading, and therefore does not charge standard swap fees, traders may still face financing-related costs.

These typically come in the form of margin interest for leveraged positions or rollover charges associated with futures contracts. Such costs reflect the underlying interest rate differentials, funding rates, or the cost of carry, depending on the instrument and holding duration.

MEXEM charges several additional fees beyond trading commissions. Clients are entitled to one free withdrawal per month, after which a fee applies depending on the currency and method used.

Currency conversions incur a commission of approximately 0.05% of the trade value, with a small minimum charge. While standard account services like custody and dividend processing are typically free, specific actions such as DRS transfers or certain international withdrawals may involve extra charges.

How Competitive Are MEXEM Fees?

MEXEM offers a competitive pricing structure that appeals to active and cost-conscious traders. Its transparent, low-cost commission model is particularly attractive for those trading large volumes across multiple asset classes.

The broker also stands out by not inflating spreads or embedding hidden costs, which helps traders maintain better control over their total trading expenses.

| Fees | MEXEM Fees | Webull Fees | AMP Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $0.85 | $0.70 | $1.25 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | No | No | Yes |

| Fee ranking | Low/Average | Low | Low |

Trading Platforms and Tools

Score – 4.7/5

MEXEM provides a robust range of trading platforms, including its core Trader Workstation (TWS), a comprehensive desktop platform offering advanced charting, over 100 order types and algorithms, and integrated tools like Risk Navigator and OptionTrader.

TWS is available for Windows, macOS, and Linux, and includes a mobile app for iOS and Android devices, ensuring seamless trading on the go. Also, MEXEM Lite offers an intuitive interface with essential order types and enhanced security, ideal for beginners or traders on the go.

Additionally, Watch TWS allows users to receive trading notifications and monitor key account metrics directly from their Apple Watch, providing convenient access without needing a phone.

For those who need a streamlined experience, the Client Portal offers a user-friendly web interface for managing accounts, placing trades, and accessing reports.

The broker also supports algorithmic trading through its FIX API and Excel API, catering to institutional clients and developers seeking to automate strategies and integrate with third-party systems.

Trading Platform Comparison to Other Brokers:

| Platforms | MEXEM Platforms | TradeZero Platforms | Freetrade Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

MEXEM Desktop Platform

MEXEM’s desktop platform is built on the full version of Trader Workstation, with the intuitive Mosaic layout serving as the default workspace. Mosaic offers a flexible interface where you can view live quotes, charts, watchlists, portfolio data, and order windows, all within a single customizable dashboard.

The platform supports over 100 order types and advanced algorithms such as bracket, stop-limit, one-cancels-other, and pair-hedging orders accessible directly from the orders panel.

It also includes real-time streaming news, premium analyst research, and integrated tools like Risk Navigator, Option Analytics, and Model Navigator for sophisticated trade and risk management.

Main Insights from Testing

During testing, MEXEM’s desktop platform proved to be robust and feature-rich, built for active and professional traders. The platform offers extensive functionality, including advanced charting, real-time data, customizable layouts, and powerful analytical tools.

It also supports a wide range of asset classes and complex order types, enabling users to implement advanced trading strategies.

MEXEM Desktop MetaTrader 4 Platform

MEXEM does not offer the MT4 platform. Traders looking to use MT4’s interface or automated trading features should consider alternative brokers that support it.

MEXEM Desktop MetaTrader 5 Platform

MEXEM does not offer access to the MetaTrader 5 platform. Traders looking for MT5 functionality will need to consider other brokers, as the broker primarily relies on Interactive Brokers’s proprietary platforms for executing trades and managing portfolios.

MEXEM MobileTrader App

MEXEM provides several mobile trading options, including the MEXEM App, MEXEM Lite, and the TWS Mobile platform. These apps are available on iOS and Android, offering access to global markets, real-time data, and secure account management.

While MEXEM Lite suits beginners, TWS Mobile is tailored for active traders needing advanced tools on the go.

AI Trading

MEXEM offers AI-powered tools like IBot, which lets users interact with their account using natural language to place trades or get market data, and AI Stock Analytics, known as Desha, which provides auto-generated research reports on thousands of companies.

These tools aim to simplify research and improve decision-making without requiring coding or complex setups.

Trading Instruments

Score – 4.8/5

What Can You Trade on MEXEM’s Platform?

MEXEM provides access to over 30,000 financial instruments across 150 global markets, including Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, and Metals.

This extensive product range caters to both retail and institutional investors looking for diverse multi-asset trading.

Main Insights from Exploring MEXEM’s Tradable Assets

Exploring MEXEM’s tradable assets reveals a platform well-suited for diverse trading strategies and investor profiles. The wide selection allows users to build varied portfolios, from equity-focused investments to complex derivatives and fixed income products.

Overall, the broker’s asset offering supports both active traders looking for flexibility and long-term investors with the aim of broad diversification.

Margin Trading at MEXEM

MEXEM provides leverage to traders through margin accounts, allowing them to multiply their trading positions. To qualify for a margin account, a minimum liquidity of $2,000 is required.

The specific leverage available depends on factors such as the asset class, market conditions, and the trader’s portfolio risk profile. However, leverage can magnify both gains and losses, so traders should be cautious and ensure they fully understand the implications of leveraged trading.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at MEXEM

In terms of funding methods, MEXEM accepts deposits only via bank transfers from accounts held in the same name as the user’s MEXEM account. Credit and debit cards, as well as e-wallets, are not supported.

MEXEM Minimum Deposit

MEXEM requires a minimum deposit of €0.1 to maintain an active account status. While there is no strict minimum deposit to open an account, however, keeping the balance above €0.1 ensures your account remains active and in good standing.

Withdrawal Options at MEXEM

MEXEM allows withdrawals mainly via SEPA and wire transfers in EUR, USD, and GBP. Users get one free withdrawal per month; additional withdrawals incur fees ranging from €1 to €10, depending on the currency and method.

Withdrawals are managed through the Client Portal, with limits based on account security settings.

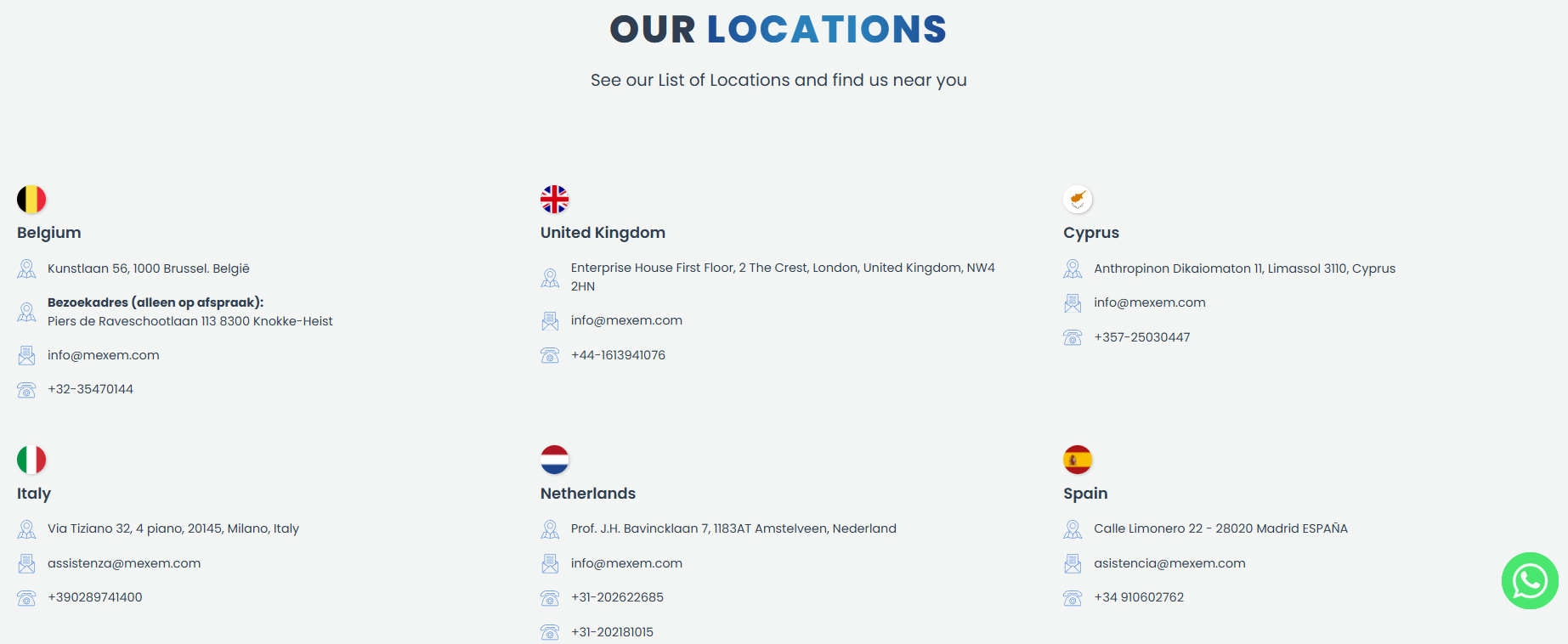

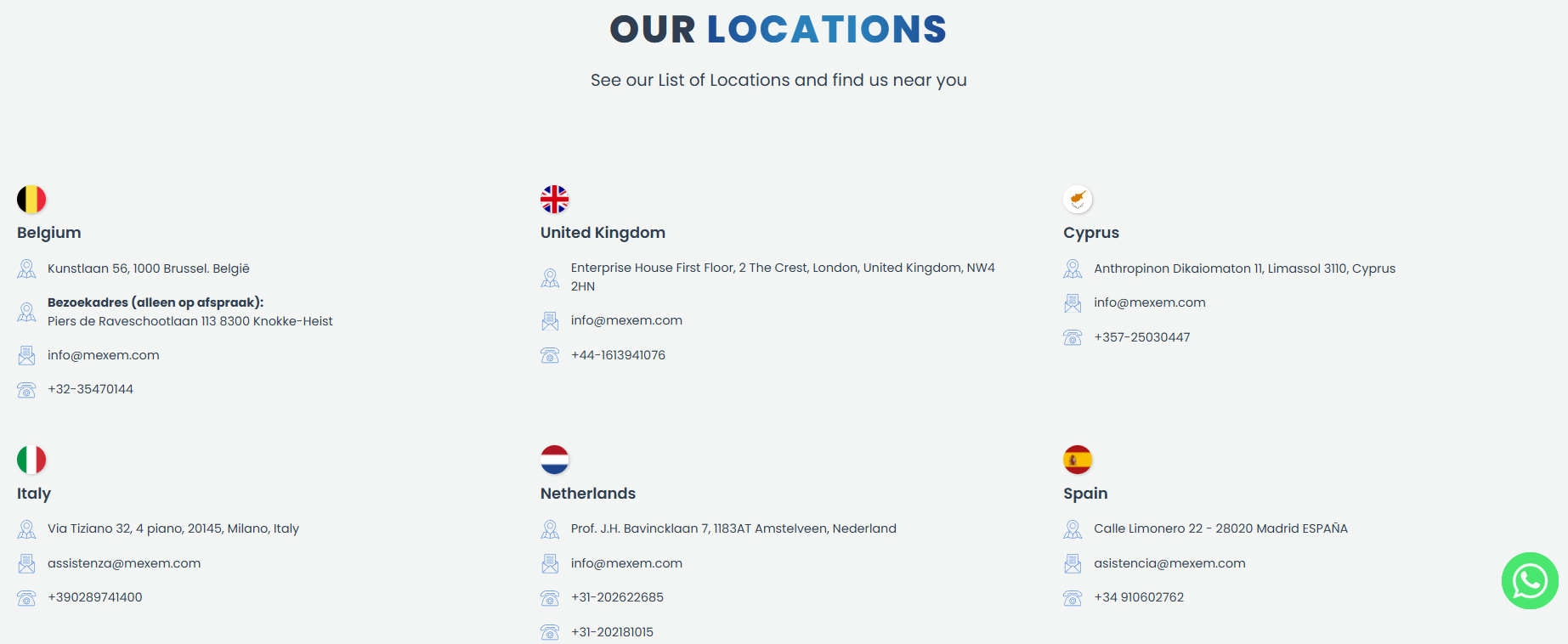

Customer Support and Responsiveness

Score – 4.5/5

Testing MEXEM’s Customer Support

The broker provides 24/5 customer support via phone, email, WhatsApp, and a support center. While live chat is not available, the multiple communication channels ensure that most queries are addressed efficiently during weekdays.

Contacts MEXEM

To get in touch with MEXEM, clients can reach out via email at info@mexem.com. The broker offers regional phone support, including +357-25030447 for Cyprus and +44-1613941076 for the UK.

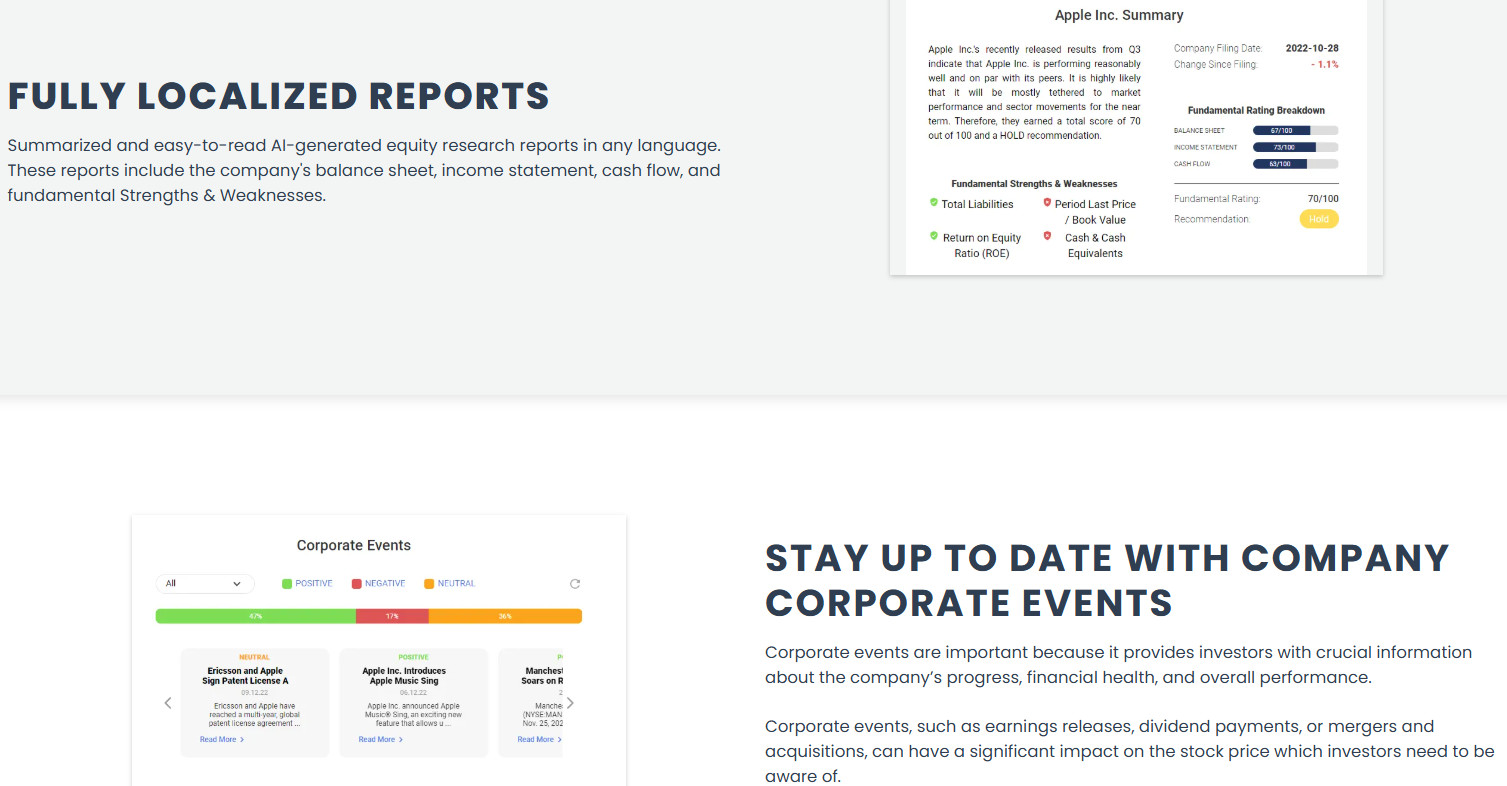

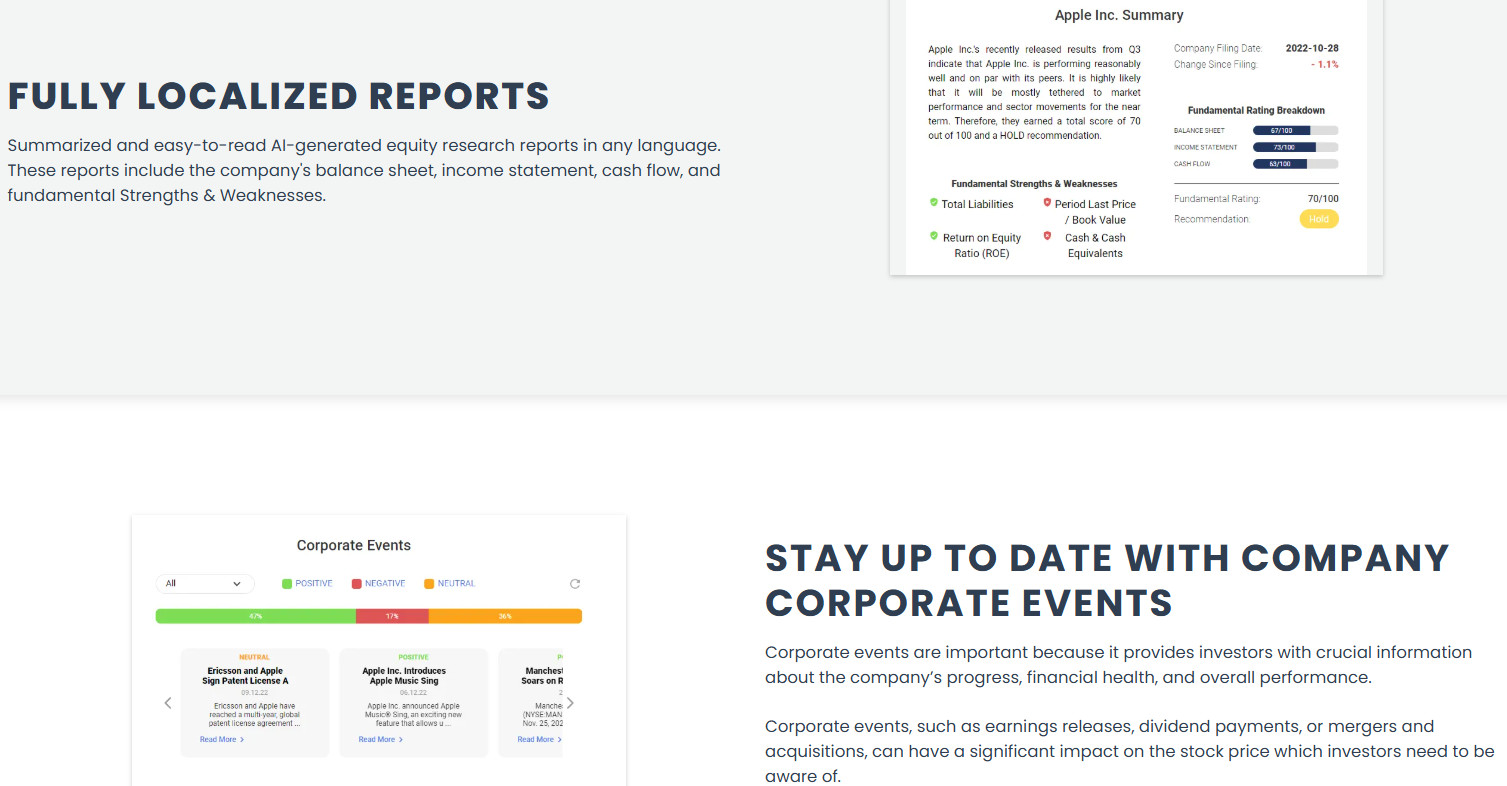

Research and Education

Score – 4.7/5

Research Tools MEXEM

MEXEM provides a wide range of research and trading tools available both on its website and platforms.

- On the website, traders can use the AI-powered IBot to request quotes, charts, and even place trades using plain language.

- Traders can also explore the AI Stock Analytics tool, known as Desha, market screeners, earnings calendars, and fundamental data.

- Within the TWS platform and MobileTrader app, users can access powerful in-platform tools such as BookTrader, ChartTrader, Risk Navigator, OptionTrader, BasketTrader, ScaleTrader, Integrated Stock Window, and Probability Lab, all designed to support advanced trading strategies.

- Additionally, MEXEM offers API connectivity for custom trading solutions and Smart Routing technology to ensure optimal order execution across global markets.

Education

MEXEM provides an Educational Portal with a range of self-paced courses covering various asset classes and trading strategies. However, the broker does not currently offer live webinars, seminars, or other educational events.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options MEXEM

MEXEM offers a range of investment solutions, including access to professionally managed portfolios through partnerships with FRAME AM and Aleph Finance.

Additionally, the broker’s Savings Plan supports recurring, low-cost investments to build diversified portfolios over time. Moreover, investors can trade over 70 commission-free WisdomTree ETFs/ETPs, gaining exposure to various asset classes.

Account Opening

Score – 4.5/5

How to Open MEXEM Demo Account?

MEXEM offers a paper trading account that lets users explore the platform and practice trading without risking real money. This demo account replicates real-time market conditions and provides access to many of the platform’s features, including charting tools, order types, and various financial instruments.

All new MEXEM accounts automatically include a paper trading account. If your account was opened earlier and does not yet include one, you can manually create it via the Client Portal. Simply log in, go to settings, then account settings, and then click the icon next to Paper Trading Account in the configuration section.

Set your User ID and password, then click continue to submit the request. If submitted before 4:00 PM EST on a business day, the account is usually ready by the next business day. You will be notified by email once it is ready to use.

How to Open MEXEM Live Account?

Opening a live trading account with MEXEM is quite a seamless process. The broker offers multiple account types and a fully digital onboarding experience. Here is how to get started:

- Visit the official MEXEM website.

- Click on “Open Account” in the top right corner.

- Choose your account type.

- Complete the online application form with personal and financial details.

- Upload the required identification and verification documents.

- Review and agree to the terms and conditions.

- Submit your application for approval.

- Once approved, fund your account to start trading.

Additional Tools and Features

Score – 4.4/5

In addition to its primary trading and research features, MEXEM offers a variety of advanced tools to support smarter investing.

- These include the Rebalance Portfolio tool to efficiently adjust holdings to target allocations.

- The Mutual Fund/ETF Replicator for finding lower-cost fund alternatives.

- The Strategy Builder for developing and testing custom trading strategies, and the Market Scanner, which helps identify trading opportunities based on real-time data and personalized filters.

These tools empower users with deeper customization and decision-making capabilities across markets.

MEXEM Compared to Other Brokers

MEXEM offers competitive conditions compared to other brokers, combining a wide range of trading instruments with advanced trading platforms like TWS and MEXEM Lite.

While some brokers focus mainly on stock or ETF trading, MEXEM also provides access to futures, Forex, metals, and more, suitable for both active and professional traders. Its platform and tool selection are on par with industry leaders, offering a robust trading experience.

Although some competitors provide 24/7 support or more extensive education, MEXEM provides solid overall experience with strong global market access, low-cost trading, and reliable service.

| Parameter |

MEXEM |

Vanguard |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$0.85 |

Futures contracts not available / Stock Commission from $0 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

No |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite

|

Proprietary trading platform, Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

Stocks, Options, CDs, ETFs, Bonds, Mutual Funds |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

CySEC, FCA, AFM, FSMA |

SEC, FINRA, SIPC, FCA, ASIC, Central Bank of Ireland |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Limited |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

€0.1 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker MEXEM

MEXEM is a well-regulated Stock Trading Broker offering access to 150 global markets through a range of powerful platforms, including TWS, Client Portal, MEXEM Lite, and mobile apps.

Regulated across multiple jurisdictions, the broker supports trading in stocks, options, futures, bonds, and more. MEXEM stands out with its low-cost structure, professional-grade tools, and customizable trading experience.

With features like API access, advanced order types, and risk management tools, the broker is well-suited for active traders and institutions. It also provides educational materials and responsive support, making it a reliable choice for those looking for comprehensive market access and technology-driven trading solutions.

Share this article [addtoany url="https://55brokers.com/mexem-review/" title="MEXEM"]

Im interested in online trading. Can you give me more information on online trading with your company