- What is Magic Compass?

- Magic Compass Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Magic Compass Compared to Other Brokers

- Full Review of Broker Magic Compass

Overall Rating 4.2

| Regulation and Security | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4 /5 |

| Account opening | 4.5 / 5 |

| Additional Tools and Features | 3.5 / 5 |

What is Magic Compass?

Magic Compass is a Cyprus-based Forex and CFD trading provider with a focus on delivering excellent trading opportunities through the popular MT4 platform. As a regulated broker, Magic Compass adheres to the high standards set by the CySEC financial authority.

Among other offerings, Magic Compass provides low variable spreads and charges low commissions, enabling traders to access over 90 instruments across various markets, including Forex, Metals, Energy, and Spot Indices.

- Magic Compass also offers trading services specifically tailored for professional traders. When a professional trader requests such services in written form, the broker promptly reviews the request and establishes contact with the trader, catering to their specific requirements.

Magic Compass Pros and Cons

After thorough research, we found that Magic Compass ensures a level of trust and compliance with financial authority standards. The broker provides a range of trading opportunities through the popular MT4 platform, catering to traders of various experience levels. The competitive low variable spreads and low commissions offered by Magic Compass make trading cost-effective.

For the Cons, the broker does not hold a license from any Tier 1 regulator, which may raise concerns for some traders. Additionally, the broker doesn’t provide educational materials, and there have been reports of customer complaints regarding customer support response times and a lack of communication in certain cases. Also, there is no 24/7 support.

| Advantages | DIsadvantages |

|---|

| Cyprus-based | limited number of market instruments

|

| Regulated by CySEC | No comprehensive education |

| Negative Balance Protection and Compensation Scheme | No Top-tier license |

| Low Spreads | |

| MT4 broker | |

| Decade of Operation | |

Magic Compass Features

Based on our analysis, Magic Compass provides reliable trading solutions, average pricing, and attractive opportunities for different traders. Moreover, the broker offers access to an advanced MT4 platform that allows users to trade well-known financial products. Here, we have compiled the main aspects of trading with Magic Compass for a quick look.

Magic Compass Features in 10 Points

| 🗺️ Regulation | CySEC, SFC |

| 🗺️ Account Types | Silver, Raw Spread, Gold |

| 🖥 Trading Platforms | MT4, MCtrader |

| 📉 Trading Instruments | 90+ instruments across Forex and CFDs on Spot Indices, Energy, and Metals |

| 💳 Minimum deposit | $100 |

| 💰 EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | GBP, USD, EUR |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/5 |

Who is Magic Compass For?

Magic Compass is a secure trading option with appealing trading services and diverse features. Based on our financial experts’ opinion, the broker is especially suitable for the following:

- CFD and currency trading

- Traders who prefer the MT4 platform

- Professional traders

- Scalping/Hedging strategies

- Copy Trading

- Competitive spreads

- Trading with EAs

- Good trading tools

Magic Compass Summary

In conclusion, Magic Compass is a Cyprus-based Forex and CFD trading provider that offers trading opportunities through the popular MT4 platform. The broker is regulated by the CySEC, ensuring a level of trust and adherence to financial authority standards. Magic Compass offers competitive low variable spreads and a wide range of trading instruments, including Forex, Metals, Spot Indices, and Energies. It caters to both beginner and professional traders. On the other hand, the broker lacks comprehensive education and doesn’t have an Islamic account.

Overall, Magic Compass is known for its trustworthiness and reliability, with diverse trading opportunities.

55Brokers Professional Insights

Overall, Magic Compass is a broker suitable for many traders, from beginners to larger size traders, trading from Europe and those who looking for a range of trading opportunities through its popular MT4 platform. Trades can also be conducted via the broker’s MCtrader app, favorable for mobile traders.

With a choice of three account types, each tailored for different trading needs, which offers good flexibility for you prefered trading style. For beginner traders, a Silver account might be a suitable choice, as the initial deposit requirement is low. In contrast, Raw Spread or Gold accounts can offer more attractive services for professional clients, with commissions that are on the lower side, according to our tests.

Yet, the number of trading products is limited to 90 instruments, which might be not enough for clients looking for diversity and large instrument selection.

As for the research and education sections, the broker includes an Economic Calendar and live quotes. Yet, clients do not have access to any educational resources, thus a lack of learning materials is a disadvantage for beginner traders who seek knowledge and guidance, so either opt to another broker or sign for education elsewhere.

Consider Trading with Magic Compass If:

| Magic Compass is an excellent Broker for: | - Clients who prioritize the CySEC regulation

- Those who favor low costs

- The users of the MT4 platform

- CFD and Forex traders

- Beginner and professional clients |

Avoid Trading with Magic Compass If:

| Magic Compass is not the best for: | - Those who value top-tier regulations

- Clients who prefer trading on MT4, cTrader, pr other advanced platforms

- Are looking for extensive educational resources

- Long-term traders or traditional investors

- Clients looking for diversity of financial products |

Regulation and Security Measures

Score – 4.3/5

Magic Compass Regulatory Overview

Magic Compass is a legitimate and trustworthy broker, ensuring a low-risk trading environment. The broker is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

This regulatory oversight ensures that the broker adheres to strict financial standards and practices, providing an added layer of security and transparency for traders.

- We also found that Magic Compass is additionally regulated by the SFC (Securities and Futures Commission) in Hong Kong.

- Furthermore, CySEC is a member of ESMA (European Securities and Markets Authority). As a member of ESMA, CySEC collaborates with other national regulatory authorities in the EU to develop common regulatory standards and ensure consistent application of EU financial regulations. CySEC is also responsible for implementing and enforcing the MiFID regulations within its jurisdiction.

How Safe is Trading with Magic Compass?

Magic Compass protects traders through various measures. They ensure fund security by keeping traders’ funds in segregated accounts and offer negative balance protection to prevent losses beyond deposited funds. As a regulated broker under the CySEC, Magic Compass adheres to regulatory standards, providing a safe trading environment. Additionally, the broker has a privacy policy in place to safeguard traders’ personal information, further enhancing their protection.

Consistency and Clarity

Since its establishment in 2016, Magic Compass has delivered consistent and reliable services to please its clients. The broker holds a CySEC license and is a favorable choice for European clients.

Its transparent trading conditions with low fees, an advanced platform, and popular instruments make the broker a trustworthy choice. Real clients share mostly positive experiences, indicating competitive fees, helpful customer support, and an advanced platform.

However, we noticed that the broker warns about scam companies operating under the same name, using the broker’s regulation information, and other aspects. Thus, it is essential to pay attention and not become a victim of fraud.

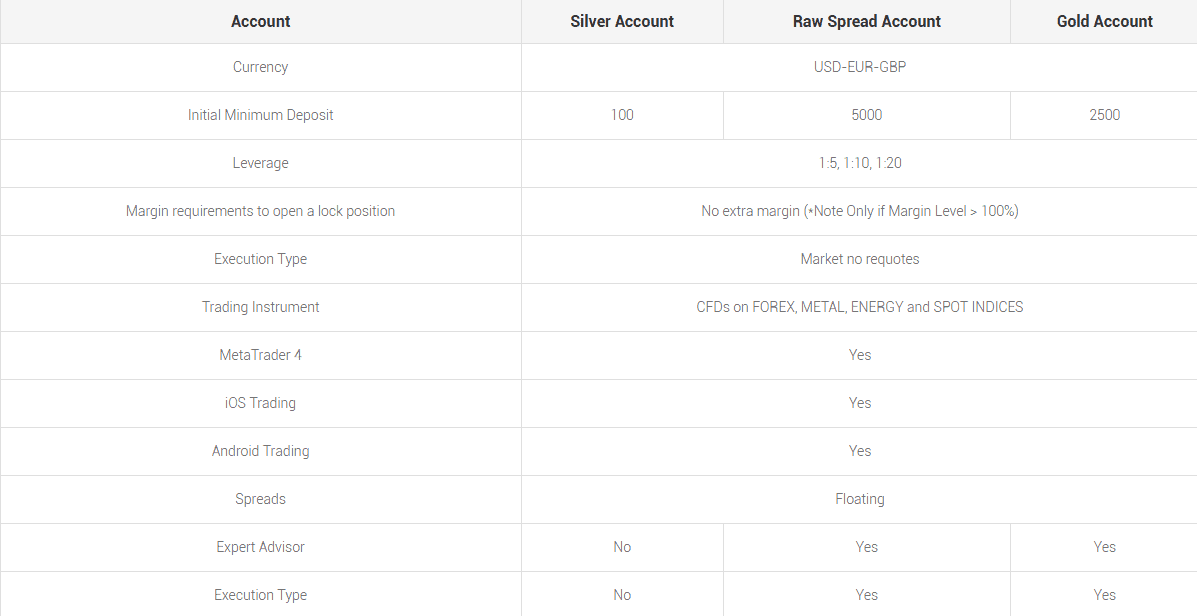

Account Types and Benefits

Score – 4.4/5

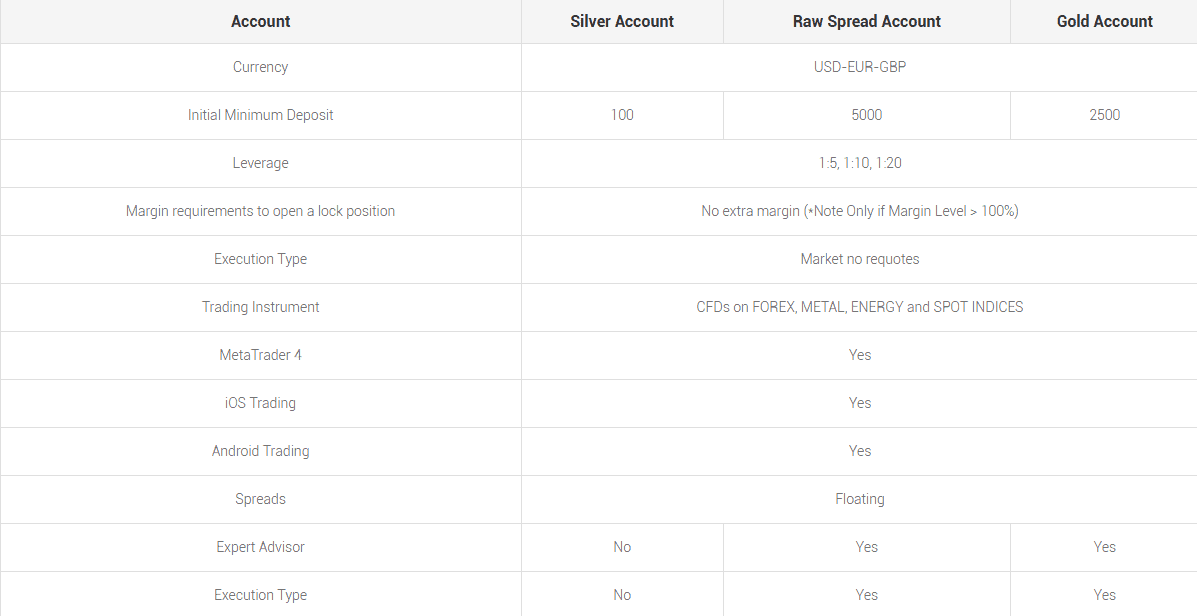

Which Account Types Are Available with Magic Compass?

Based on our research, Magic Compass offers three account types designed to cater to different traders’ needs and specific requirements.

- The Silver Account is designed for new traders, offering a platform for trading with a lower deposit requirement of $100. The Silver account is spread-based and offers an average spread of 1.2 pips for the popular EUR/USD.

- The Raw Spread Account is intended for professional traders, providing the lowest spreads available in the market, starting from 0.1 pips. It requires a higher minimum deposit ($5000), tailored for experienced traders.

- The Gold Account is suitable for more experienced traders, offering even lower spreads than the Silver Account, with no commissions. It supports automated trading through Expert Advisors, enabling efficient and automated execution of trading strategies.

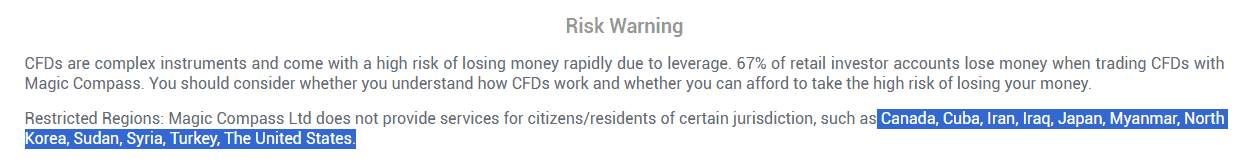

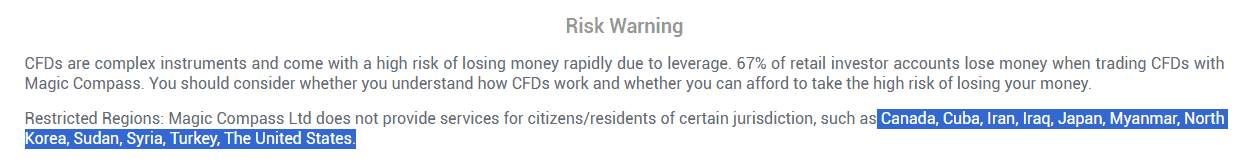

Regions Where Magic Compass is Restricted

Due to its CySEC regulation, Magic Compass offers its services mainly to European clients. Due to restrictions, the broker is not able to serve clients from different regions. Below, you can see the list of countries where Magic Compass is available:

- Austria

- Bulgaria

- Croatia

- Czech

- Denmark

- Estonia

- Finland

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovenia

- Spain

- Sweden

- UK

Cost Structure and Fees

Score – 4.4/5

Magic Compass Brokerage Fees

Magic Compass fees may vary depending on various factors, including the type of account, trading instruments, and trading conditions. It is advisable to consult the broker’s official website or contact their customer support for the most up-to-date and accurate information regarding their fee schedule.

Based on our research, Magic Compass offers both spread-based and commission-based structures. Additional costs, including inactivity fees and funding fees, should be considered for complete pricing and fee structure.

Magic Compass offers competitive floating spreads starting from as low as 0.1 pips. However, it’s important to note that spread values can vary depending on market conditions, liquidity, and the specific trading instrument. Spreads also depend on the account type. For the Silver account, the average spread is 1.2 pips, with no additional commissions. The Gold account offers even lower spreads, starting from 0.9 pips. The Raw Spread account offers very low spreads from 0.1 pips, combined with fixed commissions.

- Magic Compass Commissions

The Magic Compass applies commissions only for its Raw Spread account. For this account, the spreads start from 0.1 pips, combined with commissions, which the broker does not elaborate on its website.

How Competitive Are Magic Compass Fees?

Based on our findings, Magic Compass offers competitive fees, mostly integrated into spreads. For the Raw Spreads account, spreads start as low as 0.1 pips, combined with fixed commissions. Overall, the average spread offered by the broker is around 1.2 pips.

However, Magic Compass does not publicly disclose its commissions, and professional clients must contact the support team to obtain the full picture of the applicable fees. Additionally, traders should also consider potential additional charges, such as inactivity fees, withdrawal transaction commissions, and swaps.

| Spreads | Magic Compass Spreads | KCM Trade Spread | XTrend Spread |

|---|

| EUR/USD Spread | 1.2 pips | 1.6 pips | 0.2 pips |

| Crude Oil WTI Spread | 0.12 | 5 | 0.024 |

| Gold Spread | 1 | 3.5 | 0.07 |

Magic Compass Additional Fees

As we have found, the broker does not impose deposit fees; however, clients will pay withdrawal fees, depending on the funding method used.

- The broker does charge an inactivity fee for accounts dormant for over three consecutive months. The monthly inactivity fee is $15.

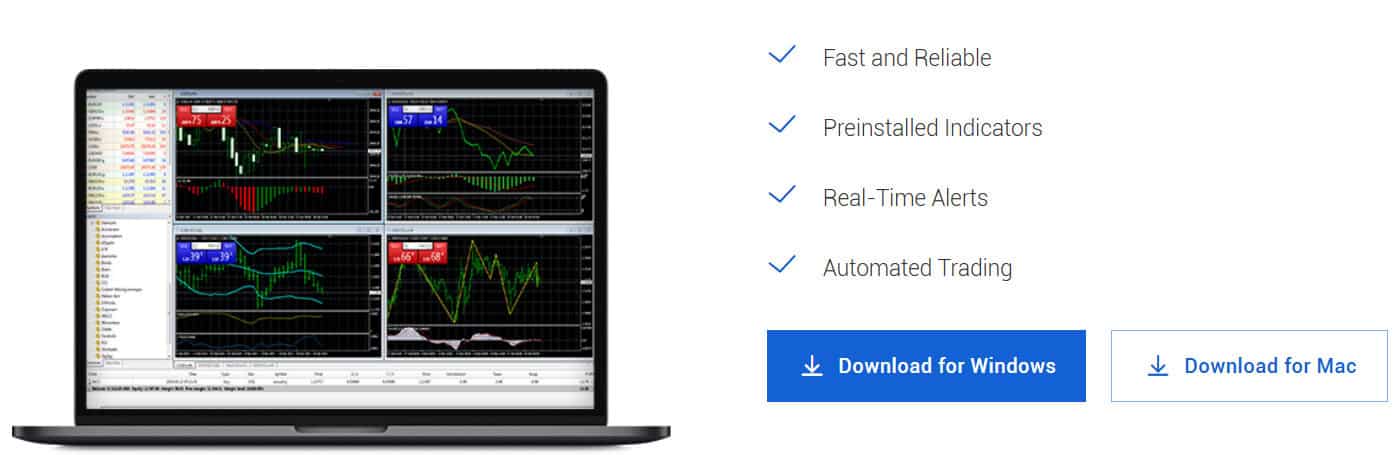

Score – 4.2/5

Magic Compass traders are given access to the MT4 platform, known for its stability, reliability, and comprehensive functionality. Mobile traders can also enjoy the broker’s proprietary mobile App, MCtrader.

Trading Platform Comparison to Other Brokers:

| Platform | Magic Compass Platform | KCM Trade Platforms | XTrend Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Proprietary Platform | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Magic Compass Web Platform

Based on our research, Magic Compass offers web-based trading platforms, including MetaTrader 4 WebTrader and MCtrader Web. MetaTrader 4 WebTrader allows traders to access their accounts and trade directly through a web browser with real-time market quotes, advanced charting tools, and order execution capabilities.

The web platform ensures excellent flexibility and functionality, retaining all the essential tools and features available through the desktop platform.

Magic Compass Desktop MetaTrader 4 Platform

The MT4 platform provided by Magic Compass is a favorable option for both traders who favor simplicity and ease of use and more professional users, looking for advanced opportunities. The platform allows traders to analyze the markets, execute trades, and manage their positions effectively.

Additionally, the broker offers a social trading functionality that enables users to replicate trades from fellow traders or distribute their own trading signals within the community. The MT4 platform also facilitates automated trading through Expert Advisors (EAs).

Magic Compass Desktop MetaTrader 5 Platform

Based on our research, Magic Compass does not provide any additional platform access, besides the popular MT4 and its own MCtrader. Thus, the MT5 platform enthusiasts might find the broker’s proposal limiting, and the available platform features insufficient to their trading needs and expectations.

Magic Compass MobileTrader App

Magic Compass provides mobile trading apps for traders who prefer to trade on the go. These mobile apps are designed to be compatible with smartphones and tablets running on popular operating systems such as iOS (iPhone and iPad) and Android. The broker’s MCtrader mobile app includes all the functionalities to ensure efficient trades just from the mobile.

Main Insights from Testing

Like many other brokers, Magic Compass offers the popular retail MT4 platform for easy navigation and profitable outcomes. Traders can use the platform through web, desktop, and mobile apps, ensuring flexibility and versatility. Besides, mobile traders can benefit from the broker’s MCtrader app, accessing their accounts from the palm of their hands. All the platforms are easily downloadable and provide basic charting and analysis opportunities. However, the broker does not offer MT5, cTrader, or TradingView platforms that are better equipped with innovative features.

AI Trading

As we have found, Magic Compass does not offer any AI-powered functionalities. It only supports EAs, allowing automation of trades. However, clients looking for comprehensive AI tools should look for another broker option, as Magic Compass does not include such opportunities.

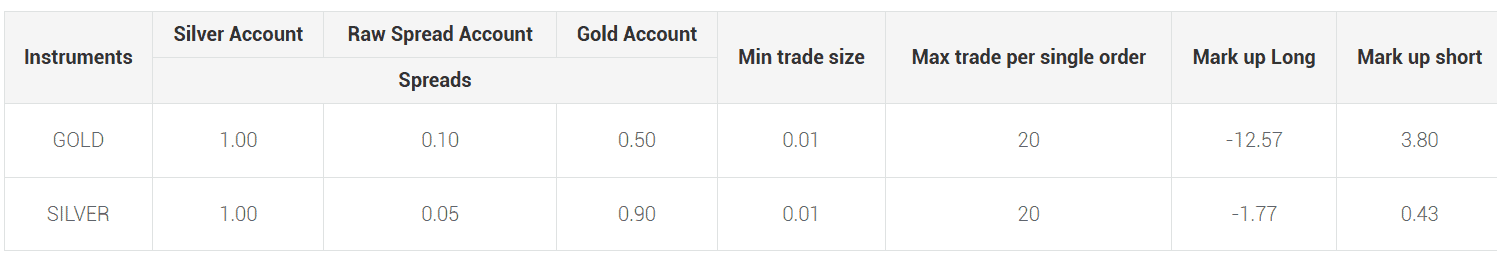

Trading Instruments

Score – 4.4/5

What Can You Trade on the Magic Compass Platform?

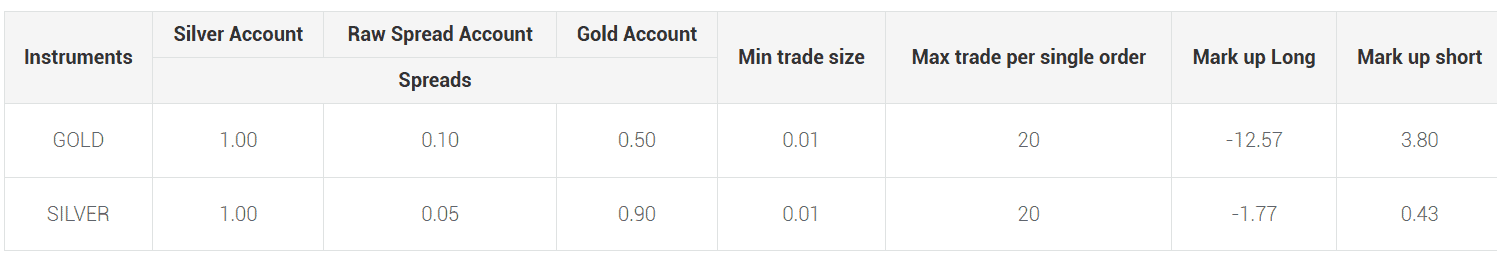

Magic Compass offers a diverse range of trading instruments, including major, minor, and exotic currency pairs in the Forex market. Traders can also access trading opportunities in precious metals like gold and silver, speculate on the performance of popular stock market indices through spot indices, and participate in energy markets by trading oil and natural gas.

- However, the number of instruments is limited to 90, limiting chances for those looking for better diversification and exposure to the market. Long-term investors and traditional traders will also find the offering unfavorable.

Main Insights from Exploring Eurotrader Tradable Assets

With Magic Compass, traders can access over 90 tradable products across Forex, metals, energy, and spot indices. The broker is a favorable choice for CFD and currency pair traders, with access to 20+ Forex pairs.

However, clients can trade only the most popular metals, such as gold and silver, and also access energies, such as oil and gas. The fees for all the instruments are low or average, allowing cost-conscious traders to benefit from the proposal.

However, the broker offers only the most popular products, and compared to many of its competitors in the market, the offering is very modest.

Leverage Options at Magic Compass

Magic Compass Leverage Levels vary depending on the regulatory requirements, account type, and the traded instrument. CySEC has imposed restrictions on high leverage use for retail clients trading with CySEC-regulated brokers. Under the implemented regulations by MIFID II, the maximum leverage available for traders is 1:30

- As for Magic Compass, the maximum leverage level for trading Forex is 1:20 within the framework of CySEC regulation.

- Hong Kong traders are allowed to use a maximum leverage of 1:20

Leverage is a financial tool that allows traders to amplify their exposure to the market by using borrowed funds. While leverage can potentially enhance profits, it also increases the potential for losses. Traders need to have a thorough understanding of leverage and its associated risks before engaging in leveraged trading.

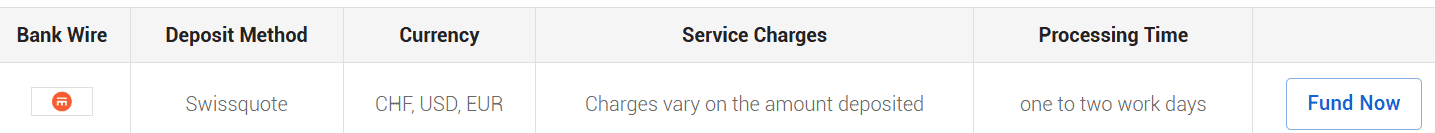

Deposit and Withdrawal Options

Score – 4.5/5

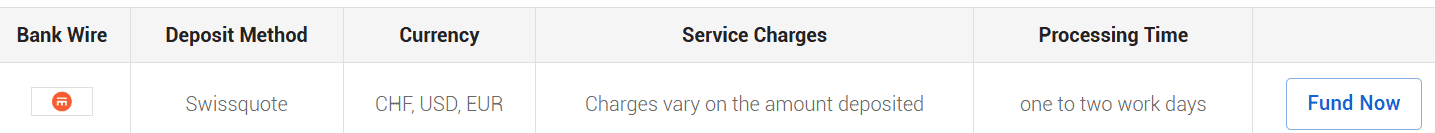

Deposit Options at Magic Compass

Magic Compass provides a range of deposit and withdrawal methods to facilitate transactions for its clients. While the specific methods may vary depending on your location and other factors, some commonly available options include:

Minimum Deposit

Magic Compass sets a minimum deposit requirement of $100. This means that traders are required to deposit at least $100 in their trading account to start trading with the broker. For its Raw Spread and Gold accounts, the deposit requirement is much higher.

Withdrawal Options at Magic Compass

Making withdrawals from the account is easy and safe. Clients can withdraw funds to their bank account or e-wallet.

The broker charges withdrawal fees, depending on the funding method used.

Customer Support and Responsiveness

Score – 4.5/5

Testing Magic Compass Customer Support

Magic Compass provides customer support services to assist traders with their inquiries and concerns. Customer support is available 24/5, meaning it operates 24 hours a day from Monday to Friday. However, it’s important to note that customer support is offered exclusively in English.

- The broker also offers an FAQ section, offering answers to the most common questions.

Contacts Magic Compass

Magic Compass provides dedicated customer support via multiple channels. The broker’s clients are free to choose the most comfortable communication option:

- Questions and suggestions can be sent through a form available on the broker’s website.

- Clients who choose to direct their questions via email can use the following address: info@magiccompass.com. The broker also provides separate email addresses for specific requests.

- Additionally, traders can contact the support agent directly by phone at +357 25023880.

- However, Live chat support is not available with Magic Compass.

Research and Education

Score – 4/5

Research Tools Magic Compass

As we found, Magic Compass provides real-time quotes and an economic calendar to support and enhance its clients’ decisions. However, all the other research and analysis tools are the ones included on the broker’s MT4 and MCtrader platforms. There are no additional features traders can benefit from.

- The Economic Calendar is one of the most sought-after tools for learning about upcoming market events, changes, and movements. It assists clients in informed decision-making, based on the current market situation.

Education

Another aspect in which Magic Compass falls short is the lack of comprehensive Forex trading educational resources, making it a significant drawback for beginners. The broker’s offerings are limited to an economic calendar, which solely assists investors in monitoring market-moving events.

Is Magic Compass a Good Broker for Beginners?

Our research showed that Magic Compass has many aspects that make it a favorable choice for beginner and inexperienced traders. The broker offers simple and easy-to-use platforms, suitable for novice traders to navigate. The fee structure is diverse, and the applicable fees are in line with the market average. Besides, the availability of a demo account allows beginners to practice trading without risking real investments.

The only drawback for beginners is the lack of proper educational and research features. Other than that, Magic Compass is a reliable and favorable broker for many European traders.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options Magic Compass

Based on our research of the broker’s available assets and trading opportunities, it becomes evident that the broker offers a limited range of instruments (only 90), including only the most popular products. The lack of diversity does not allow traders to expand their portfolios and explore the market further. Besides, Magic Compass does not provide long-term trading and traditional investment opportunities.

Yet, clients can benefit from an alternative investment option.

- Through the Copy Trading feature, clients can copy profitable trades of professional clients and gain profits.

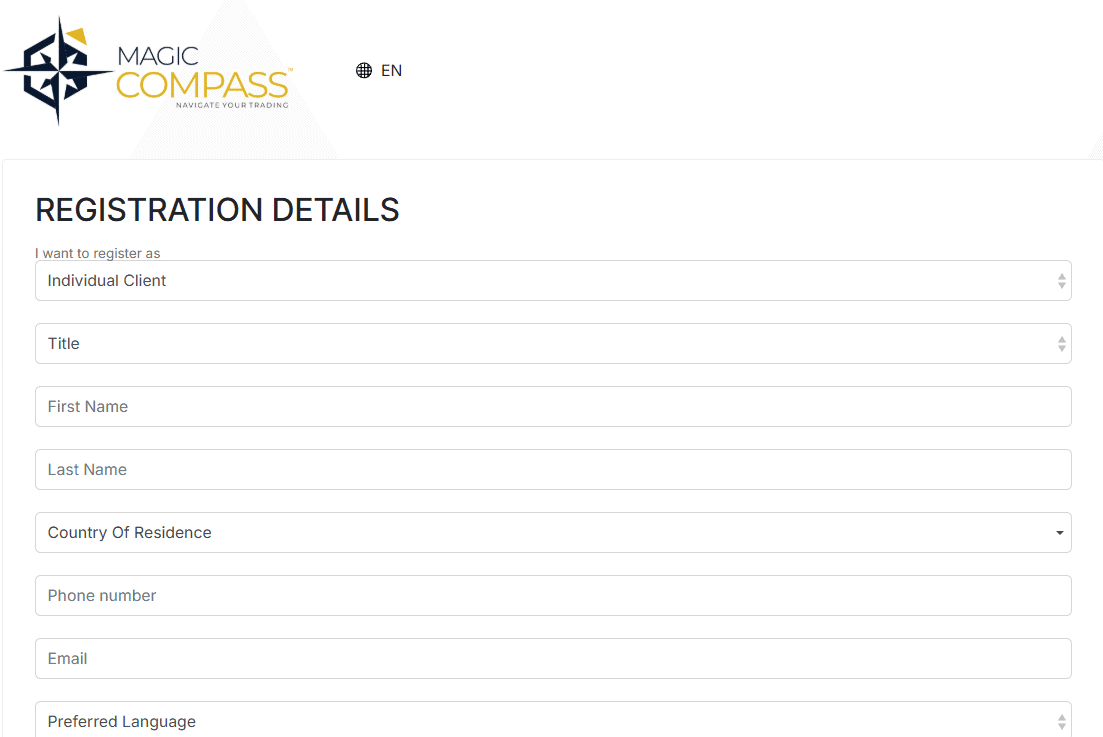

Account Opening

Score – 4.5/5

How to Open a Magic Compass Demo Account?

We also found that Magic Compass provides a demo account that benefits both beginner and professional traders. This account serves as a tool for enhancing trading skills and allows professional traders to test new strategies. The demo account comes preloaded with $100,000 in virtual money, enabling traders to practice in a risk-free environment. It’s important to note that the demo account has a time limitation and is available for a period of 30 days.

Here are the steps to open a demo account:

- Go to the broker’s website and click on the “Demo account” button.

- Fill out the registration form with personal information.

- Verify your email.

- Receive the account credentials.

- Start practicing with virtual funds.

How to Open a Magic Compass Live Account?

To open a live account with Magic Compass, follow these general steps:

- Visit the official website of Magic Compass.

- Look for the “Register” button on the homepage and click on it.

- You will be directed to a registration page where you need to provide personal information such as your name, email address, country of residence, and phone number. Follow the instructions and fill in the required details accurately.

- Read and accept the terms and conditions and any other legal agreements presented by the broker.

- Choose the type of account you wish to open, such as Silver, Gold, or Raw Spread, based on your trading preferences and experience level.

- Submit your application for a live account.

- Depending on the broker’s procedures, you may be required to provide additional documentation to verify your identity, such as a passport or ID, proof of address (e.g., utility bill or bank statement), and possibly a financial questionnaire.

- Once your application and verification process are complete, you will receive your live account credentials, including login details and instructions on how to fund your account.

Score – 3.5/5

We have researched the broker’s proposal for additional tools and features and found only the basic features that are already included on the broker’s platforms. There are no additional tools clients can benefit from, besides the economic calendar and real-quotes already discussed in the research section.

Magic Compass Compared to Other Brokers

We have compared Magic Compass to other brokers to see where it stands and how its proposal aligns with the market standards. As we have found, Magic Compass holds a license from the CySEC, ensuring its credibility and adherence to strict regulations. Likewise, Forex.com, Admirals, XS, and OneRoyal hold a license from CySEC. However, they also hold licenses from other respected regulators, adding more credibility to their offering.

Then we compared Magic Compass’s trading charges and found that they are mostly average and in line with Forex.com’s 1.3 pips and XS’s 1.1 pips.

Almost all the brokers we reviewed offer trading through the MT4 or MT5 platforms. Magic Compass offers the MT4 platform and its MCtrader mobile app. However, there are brokers with additional platforms offering, such as Forex.com with its Web Trader and TradingView.

As to the instrument offering, the competitors offer better diversity than Magic Compass, with its 90 instruments. One of the most extensive offerings is Admirals’ (over 8,000 instruments).

Magic Compass also lacks an education section. On the other hand, Admirals and Forex.com stand out for their comprehensive resources.

| Parameter |

Magic Compass |

Admirals |

Forex.com |

XS |

OneRoyal |

Xtrade |

Tradeview |

| Spread-Based Account |

Average 1.2 pip |

From 0.6 pips |

Average 1.3 pips |

Average 1.1 pips |

Average 1 pip |

Average 2 pips |

Average 0.3 pips |

| Commission-Based Account |

0.1 pips + commissions based on the trading volume |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $5 |

0.1 pips +$3 |

0.0 pips + $3.50 |

No commissions, based on fixed spreads |

0.0 pips + $2.5 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Average |

Average |

Average |

Low/ Average |

| Trading Platforms |

MT4, MCtrader |

MT4, MT5, Admiral Markets app |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5 |

MT4, MT5 |

Xtrade WebTrader |

MT4, MT5, cTrader |

| Asset Variety |

90+ instruments |

8000+ instruments |

6000+ instruments |

1000+ instruments |

2,000+ instruments |

1,000+ instruments |

200+ instruments |

| Regulation |

CySEC |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, FSA, LFSA |

ASIC, CySEC, VFSC, FSA, CMA |

FSC, FSCA |

MFSA, CIMA, FSC, FS |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Excellent |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$100 |

$1 |

$100 |

$0 |

$50 |

$250 |

$1000 |

Full Review of Broker Magic Compass

After carefully considering the services and opportunities Magic Compass delivers, we can conclude that the broker is a reliable and trustworthy choice, especially favorable for European clients. Magic Compass holds a CySEC license and complies with the MiFID II laws and guidelines.

Magic Compass offers competitive fees, affordable for even cost-conscious traders. It offers three account types, each with a different fee structure, deposit amount requirement, and overall varying conditions. As we found, clients can access only the most popular products across Forex, Metals, energy, and spot indices. The demo account availability is another advantage that enables clients to learn how to trade the platform or practice new strategies.

However, we found that Magic Compass does not provide any educational materials, which can be a negative point for beginners who need guidance in trading.

The customer support is available 24/5 through multiple channels. Yet, live chat is not supported by the broker.

We recommend that clients check the broker’s conditions and proposal to see if it is a good match and whether it meets their trading expectations.

Share this article [addtoany url="https://55brokers.com/magic-compass-review/" title="Magic Compass"]

My husband is doing trade with magic compass but when he tried to withdraw money they said you have to deposit 10% of the total amount first for security,like seriously why would one withdraw money in the first place if he/she have already enough to deposit more. Well by taking loan he arranged that amount and deposited it then he tired they said it’s weekend and you have to wait for 48 hours. Ok after 48 hours when he tried again they said you have made two different accounts now that’s why you have to deposit 8k USD more. While all these silly rules weren’t told when he was investing in the start.i am sure it’s a scam