- What is M1 Finance?

- M1 Finance Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- M1 Finance Compared to Other Brokers

- Full Review of Broker M1 Finance

Overall Rating 4.6

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

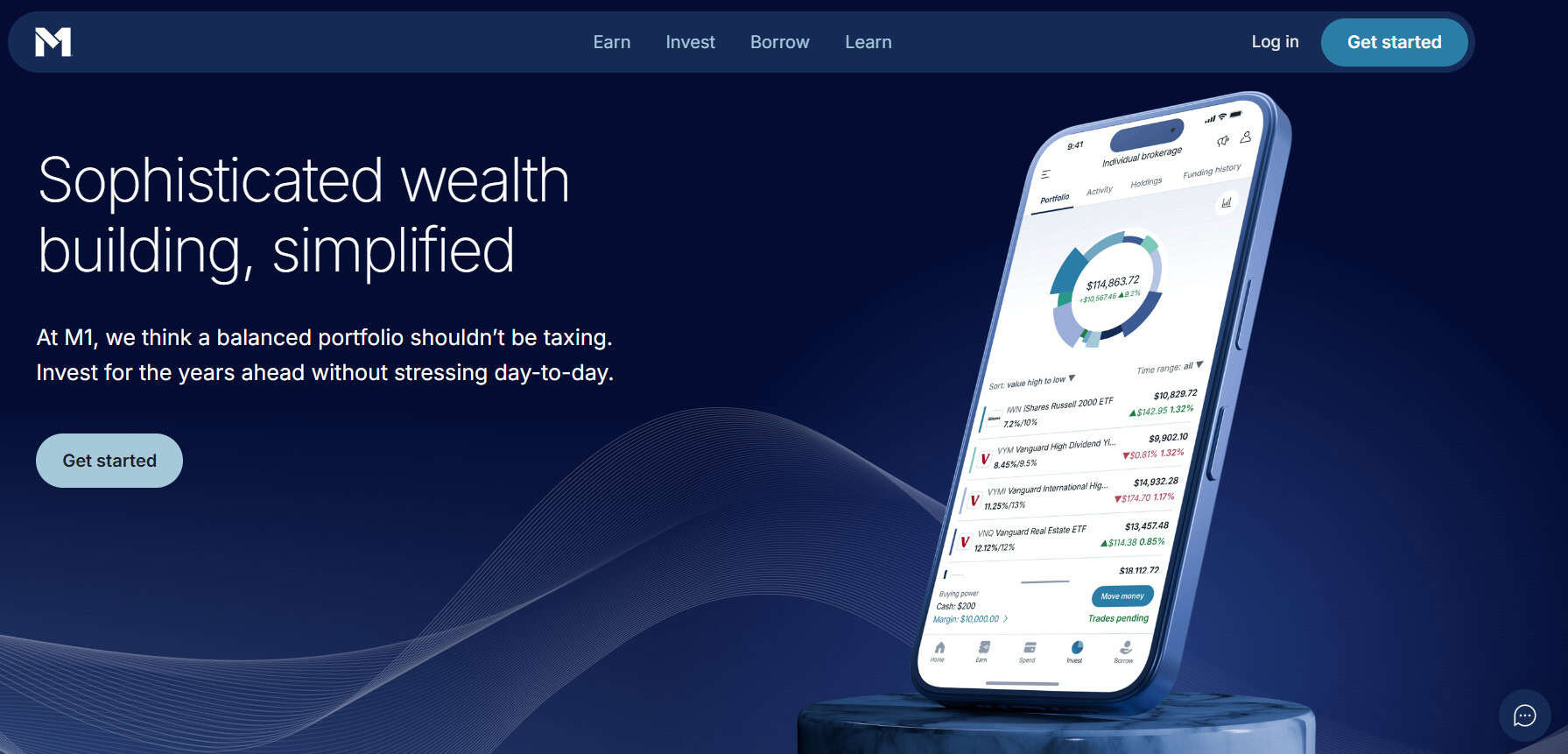

What is M1 Finance?

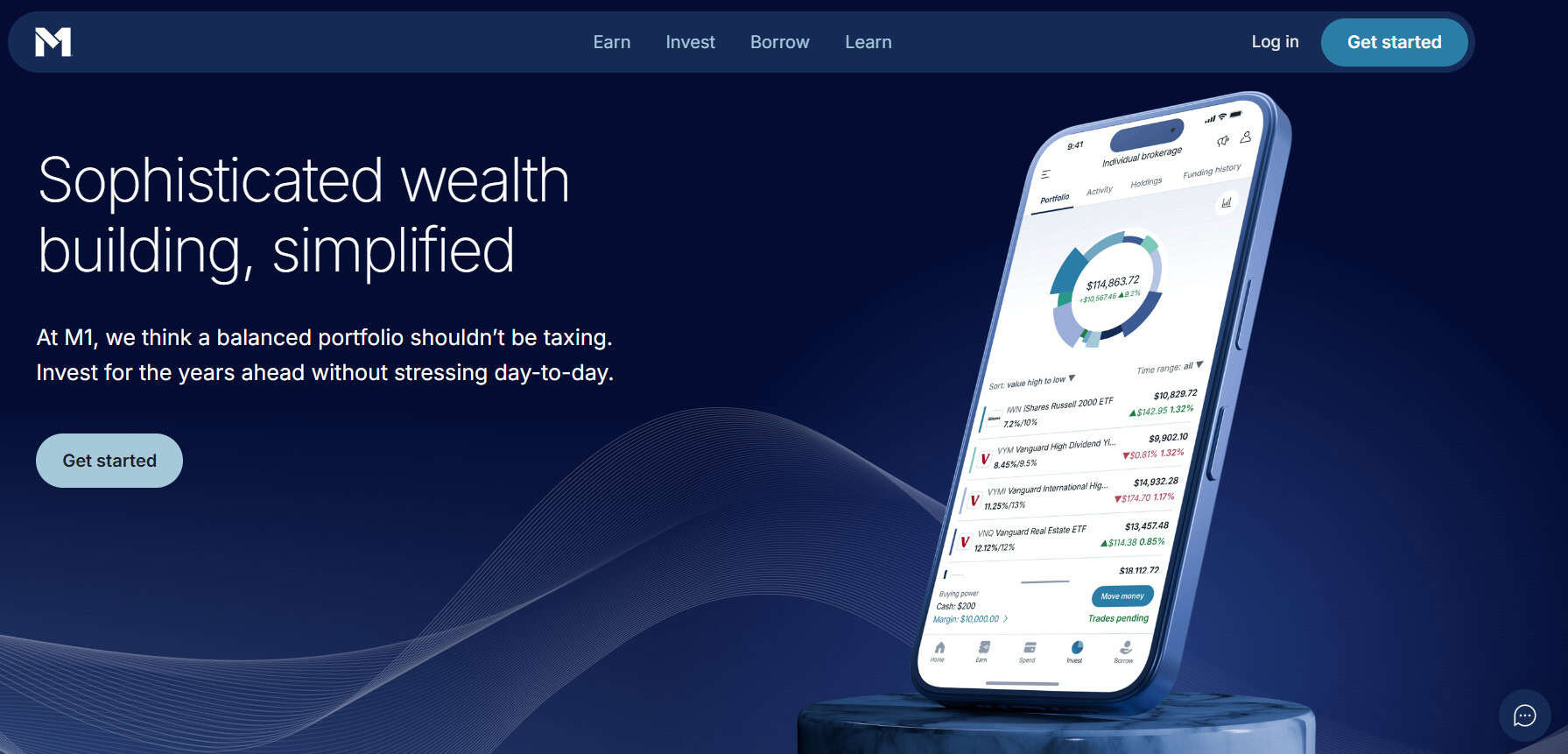

M1 Finance is a Stock trading and Investing company that provides a combination of self-directed investing and robo-advisory services, allowing traders to buy and sell a variety of products, including Stocks, Shares, ETFs, Cryptocurrencies, Fractional Shares, and Securities.

The firm adheres to strict regulatory oversight by the US SEC, FINRA, and SIPC to ensure compliance with securities laws and provide transparent information.

Overall, the firm is known for its user-friendly interface and aims to simplify the investment process for both beginners and experienced investors.

Is M1 Finance Stock Broker?

Yes, M1 Finance is a Stock Trading brokerage platform that combines self-directed investing with robo-advisory services. It allows users to create and manage diversified portfolios by selecting individual stocks and ETFs and offers features like fractional share investing and automatic rebalancing.

M1 Finance Pros and Cons

The firm has gained popularity for its innovative approach to investing, offering several advantages. One notable strength is its Pie investing feature, allowing users to easily create and manage diversified portfolios with fractional shares. The platform’s automatic rebalancing, no-commission trading, and the option to borrow against one’s portfolio through M1 Borrow are additional benefits.

For the cons, M1 Finance has fewer research tools and educational resources compared to traditional brokerage platforms, which could be a drawback for investors who rely heavily on in-depth market analysis and research.

While the firm offers a wide range of Stocks and ETFs, it does not provide access to certain investment products such as mutual funds and options. This limitation could restrict investment choices for some users.

| Advantages | Disadvantages |

|---|

| SEC, FINRA, and SIPC regulation and oversee | No 24/7 customer support |

| US traders and investors | Limited investment products |

| Competitive trading conditions | No paper trading or demo account |

| Self-directed investing | Limited education and research materials |

| Robo-advisor technology | |

| User-friendly interface | |

| Secure investing environment | |

| Commission-free trading for Stocks and ETFs | |

M1 Finance Features

With its automated investment approach and comprehensive solutions, M1 Finance holds a competitive position in the financial market. A summary of its key features is as follows:

M1 Finance Features in 10 Points

| 🏢 Regulation | SEC, FINRA, SIPC |

| 🗺️ Account Types | Individual, Joint, Custodial, Individual Retirement, Cash, Crypto, Trust Accounts |

| 🖥 Trading Platforms | M1 Proprietary Trading Platform, Mobile Apps |

| 📉 Trading Instruments | Stocks, Shares, ETFs, Cryptocurrencies, Fractional Shares, Securities |

| 💳 Minimum Deposit | $100 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Articles, FAQs, Knowledge Bank |

| ☎ Customer Support | 24/5 |

Who is M1 Finance For?

M1 Finance is designed for investors who want a flexible, automated approach to building wealth, combining the simplicity of robo-advising with the control of self-directed investing. Based on our findings, M1 Finance is Good for:

- Traders from the US

- Investing

- Self-Directed Investing

- Fractional Shares

- Stock trading

- Advanced traders

- Professional trading

- Low fees

- Competitive conditions

- Supportive customer service

M1 Finance Summary

In conclusion, M1 Finance offers comprehensive investment opportunities and stands out for its commitment to providing a commission-free and user-friendly experience.

While it lacks extensive educational resources and some advanced features, the broker’s transparent fee structure and emphasis on cost-effective trading make it an appealing choice for those seeking a straightforward approach to investment.

Overall, we found that the platform provides a reliable environment; however, we advise conducting your research and evaluating whether the firm’s offerings suit your specific requirements.

55Brokers Professional Insights

M1 Finance stands out as a modern investment platform that blends automation with personalization, offering investors a unique mix of robo-advisor convenience and self-directed control. It is very well organized for invest and stock trade purposes, with classic fit and proposals great for vast investors, despite level of expereicne or account size.

Its signature “pie-based” investing system allows users to easily build and customize diversified portfolios, while automated rebalancing ensures that allocations stay aligned with long-term goals. What makes M1 Finance particularly appealing is its commission-free structure and the integration of investing, borrowing, and spending within a single ecosystem, creating a seamless financial management experience.

There are strong and well-designed mobile and web platforms, intuitive design, and a focus on long-term wealth building rather than short-term trading, the firm has positioned itself as an innovative solution for investors seeking both efficiency and flexibility. Yet, if you look for AI driven trading methods or some innovations in trading might be better check other proposals since M1 is great for classic invest, yet with robust tools inlcuded.

Consider Trading with M1 Finance If:

| M1 Finance is an excellent Broker for: | - Need a well-regulated broker.

- Secure trading environment.

- Offering popular financial products.

- US investors.

- Competitive trading conditions.

- Commission-free trading.

- Stock Trading and Investment.

- Long-term investing.

- Traders who need automated trading features.

- Looking for broker with a long history of operation and strong establishment.

- Looking for broker with Top-Tier licenses.

- Providing diverse account options.

- Professional trading.

- Looking for Reputable Firm.

|

Avoid Trading with M1 Finance If:

| M1 Finance might not be the best for: | - Futures and Options traders.

- Need a broker with trading services worldwide.

- Looking for broker with 24/7 customer support.

- Investors who prefer robust learning resources.

|

Regulation and Security Measures

Score – 4.7/5

M1 Finance Regulatory Overview

M1 Finance is a reliable Stock trading firm that follows the strict rules and guidelines established by the SEC, FINRA, and SIPC. These Top-Tier regulations safeguard client assets and provide low-risk investing.

How Safe is Trading with M1 Finance?

M1 Finance is a legitimate and regulated investing platform. It is authorized by reliable US financial authorities and has a good reputation in the financial market.

The company prioritizes the security and protection of its clients’ investments by adhering to regulatory standards and industry best practices. This commitment includes implementing measures to prevent fraud, unauthorized account access, and stringent identity verification processes.

Moreover, as a member of the Securities Investor Protection Corporation (SIPC), the firm protects its customers up to $500,000 (including $250,000 in cash), providing an additional layer of security. However, investors should remain cautious, regularly monitor their investments, and practice safe online habits to enhance their trading protection further.

Consistency and Clarity

M1 Finance has built a solid reputation in the financial services industry, recognized for its innovative approach to investing and banking. The broker consistently earns high scores from industry experts while also receiving mixed but generally positive feedback from traders, who appreciate its automated investing features and fee transparency, though some note limitations in advanced tools.

Established with a strong operational foundation, M1 Finance has gained credibility through its steady growth and user-friendly platform. Over the years, it has also been acknowledged with various awards for its fintech innovation and customer-centric services.

Beyond financial performance, the company maintains an active presence in social and community initiatives, reflecting its commitment not only to investors but also to broader societal engagement.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with M1 Finance?

M1 Finance offers a diverse range of account types to suit different financial needs, including Individual, Joint, Custodial, Individual Retirement Accounts (Traditional, Roth, and SEP IRAs), as well as Cash, Crypto, and Trust Accounts.

This flexibility allows investors to manage both long-term wealth building and short-term financial goals within one platform. However, the firm does not provide a demo account option, meaning users need to commit real funds to start investing.

Individual Account

An Individual Account with M1 Finance is a standard brokerage account designed for personal investing, offering access to stocks, ETFs, crypto, and cash management features all in one place.

It is ideal for those looking to build and manage their own portfolio with the help of automated tools and flexible investment options. To open an Individual Account, M1 Finance requires a minimum deposit of $100, making it accessible for most beginner and intermediate investors.

Regions Where M1 Finance is Restricted

M1 Finance is currently restricted to U.S. residents and is not available for investors outside the United States. This limitation means international users cannot access its investing, cash management, or crypto services.

Cost Structure and Fees

Score – 4.7/5

M1 Finance Brokerage Fees

The platform is known for its fee transparency and does not charge commissions on trades, allowing users to buy and sell stocks and ETFs without incurring transaction fees.

Additionally, there are no account management fees. The firm also offers a low-cost borrowing option through M1 Borrow, where users can access a portfolio line of credit at competitive interest rates.

M1 Finance is recognized for its commission-free trading approach, enabling traders to engage in stock and ETF transactions without incurring traditional commission fees. This model contributes to the platform’s appeal for cost-conscious investors seeking a budget-friendly experience.

However, commissions and fees can change over time and may vary based on the specific investments and market conditions. Therefore, traders should review the platform’s fee details for a comprehensive understanding of the costs associated with their investments.

M1 Finance does not charge commissions on trades, but like all U.S. brokers, it passes on standard exchange and regulatory fees set by agencies such as the SEC and FINRA.

These fees are minimal and apply to all market participants, typically only a few cents per transaction, and M1 Finance does not mark them up. This ensures transparency while keeping overall costs low for investors.

- M1 Finance Rollover / Swaps

M1 Finance does not operate like a traditional Forex or CFD broker, so it does not charge rollover or swap fees on overnight positions. Instead, the platform focuses on long-term investing in stocks, ETFs, and crypto, where such fees are not applicable.

- M1 Finance Additional Fees

While M1 Finance is known for commission-free investing, there are some additional fees that users should be aware of. These include charges for services such as outgoing account transfers, paper statements, and account inactivity in certain cases.

Premium features under the M1 Plus membership also come with an annual subscription fee, offering added benefits like lower borrowing rates and enhanced cash management tools.

How Competitive Are M1 Finance Fees?

M1 Finance’s fees are highly competitive compared to traditional brokerage firms, making it an attractive option for cost-conscious investors.

Its commission-free model allows users to buy and sell stocks, ETFs, and crypto without paying per-trade fees, which is a significant advantage over many competitors. Additionally, account management and platform usage are largely free, with costs primarily limited to optional premium services or regulatory charges.

Overall, M1 Finance keeps its fee structure relatively transparent and competitive, but investors should review the details to avoid unexpected costs.

| Asset/ Pair | M1 Finance Commission | AJ Bell Commission | Questrade Commission |

|---|

| Stocks Fees | From $0 | From £3,50 | From $0 |

| Fractional Shares | Yes | No | No |

| Options Fees | - | - | From $0.99 |

| ETFs Fees | From $0 | From £5 | From $0 |

| Free Stocks | Yes | No | Yes |

Trading Platforms and Tools

Score – 4.5/5

M1 Finance provides a comprehensive and user-friendly trading experience through its proprietary platform, which users can access via the web.

In addition to the web-based platform, the broker offers mobile apps for both iOS and Android devices, empowering investors to manage their portfolios, make trades, and monitor market activity on the go.

Trading Platform Comparison to Other Brokers:

| Platforms | M1 Finance Platforms | AJ Bell Platforms | E-Trade Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

M1 Finance Web Platform

M1 Finance’s web platform offers a clean, intuitive interface that allows investors to manage their portfolios, track performance, and execute trades seamlessly from any browser.

The web version provides access to all core features, including automated investing, portfolio customization, and account management tools, making it convenient for users who prefer desktop trading. Its user-friendly design ensures both beginners and experienced investors can navigate the platform efficiently.

M1 Finance Desktop MetaTrader 4 Platform

M1 Finance does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support CFD trading, which is typically associated with MT4.

M1 Finance Desktop MetaTrader 5 Platform

M1 Finance does not support MetaTrader 5 either. The firm does not provide access to advanced platforms like MT5, maintaining its focus on its proprietary platforms.

M1 Finance MobileTrader App

According to our findings, the broker offers a robust mobile app, compatible with both iOS and Android devices. The app provides users with a streamlined and user-friendly interface, enabling them to efficiently manage their investments, execute trades, and stay informed about market developments while on the move.

With features like dynamic trading, fractional share investing, and automated portfolio rebalancing, the M1 Finance mobile app offers a versatile and comprehensive tool for investors seeking convenience and flexibility in their financial management.

Main Insights from Testing

M1 Finance’s mobile platform delivers a smooth and user-friendly experience, mirroring much of the functionality available on the web version.

Through testing, it proves convenient for monitoring portfolios, placing trades, and managing cash and crypto accounts on the go. The app is praised for its intuitive navigation, real-time updates, and responsive performance, making it a practical choice for investors who prefer managing their finances from a smartphone or tablet.

AI Trading

M1 Finance does not offer traditional AI-driven trading or algorithmic tools like some other brokers, but it provides automated portfolio management through its “Pie” investing system.

This system uses technology to help investors create diversified portfolios, automatically rebalance them, and manage contributions according to user-defined targets. While not fully AI-powered in the predictive or trading sense, these tools simplify investment decisions and provide a semi-automated approach that leverages smart automation for long-term portfolio growth.

Trading Instruments

Score – 4.6/5

What Can You Trade on M1 Finance’s Platform?

The broker offers a range of investment products designed to cater to diverse investor preferences, including Stocks, Shares, ETFs, Cryptocurrencies, Fractional Shares, and Securities.

This variety of trading products empowers investors to create comprehensive portfolios that align with their financial objectives and risk preferences.

Main Insights from Exploring M1 Finance’s Tradable Assets

Exploring M1 Finance’s tradable assets reveals a platform focused on simplicity and long-term growth, with a range of options designed to suit different investment strategies.

The assets are well-integrated into its automated portfolio tools, making it easy for users to diversify and manage risk without complex navigation.

Margin Trading at M1 Finance

M1 Finance offers margin trading through its M1 Borrow feature, allowing eligible account holders to borrow against their portfolio at competitive interest rates.

This provides additional flexibility for investors looking to multiply their holdings for larger investments or short-term financial needs. However, margin trading carries inherent risks, including the potential for losses exceeding the borrowed amount, so it is best suited for experienced investors who understand leverage and risk management.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at M1 Finance

The platform supports a few funding methods to deposit money into user accounts. Users can fund their accounts through electronic bank transfers (ACH transfers) and wire transfers from linked bank accounts.

These funding options provide flexibility for investors to fund their accounts conveniently.

M1 Finance Minimum Deposit

For M1 Individual Brokerage, Joint Brokerage, Custodial, and Crypto Accounts, the minimum required deposit is $100. However, for M1 Traditional IRA, Roth IRA, and SEP IRA accounts, a minimum deposit of $500 is needed to open an account.

Withdrawal Options at M1 Finance

The platform allows users to initiate withdrawals from their accounts through ACH transfers. Traders can transfer funds from their M1 Finance accounts to their linked bank accounts.

Customer Support and Responsiveness

Score – 4.6/5

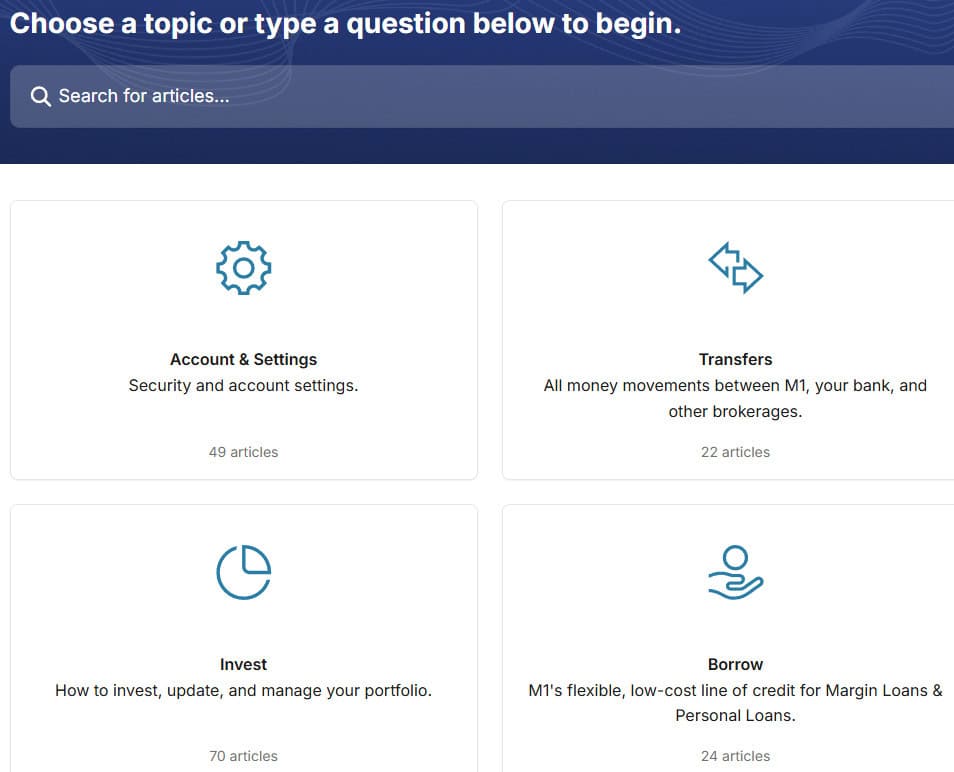

Testing M1 Finance’s Customer Support

The company offers 24/5 customer support through live chat, email, phone, and FAQs. The platform aims to offer responsive assistance to address user concerns, ensuring a positive and supportive experience for its investors.

Contacts M1 Finance

For general inquiries or support, M1 Finance can be reached via email at help@m1.com. For urgent requests, you can give them a call at 312-600-2883 to receive immediate assistance from their support team.

Research and Education

Score – 4.5/5

Research Tools M1 Finance

M1 Finance provides a variety of research tools across its web and mobile platforms to help investors make informed decisions.

- Users can access detailed company and ETF information, performance charts, analyst ratings, and historical data to evaluate potential investments.

- The platform’s automated “Pie” system also assists with portfolio analysis and diversification insights, while customizable watchlists and real-time updates make it easy to monitor market trends. These tools combine to offer a streamlined research experience for both new and experienced investors.

Education

The platform lacks comprehensive educational and research materials, as well as seminars and webinars, providing only financial education articles and guides.

This limitation may be considered a drawback, as robust educational resources play a crucial role in enhancing investors’ skills and knowledge.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options M1 Finance

M1 Finance offers a range of investment solutions focused on long-term wealth building, including stocks, ETFs, and crypto assets. Through its automated “Pie” investing system, users can create diversified portfolios tailored to their financial goals and risk tolerance.

The platform also supports retirement accounts and cash management, providing a holistic approach to managing and growing investments within a single ecosystem.

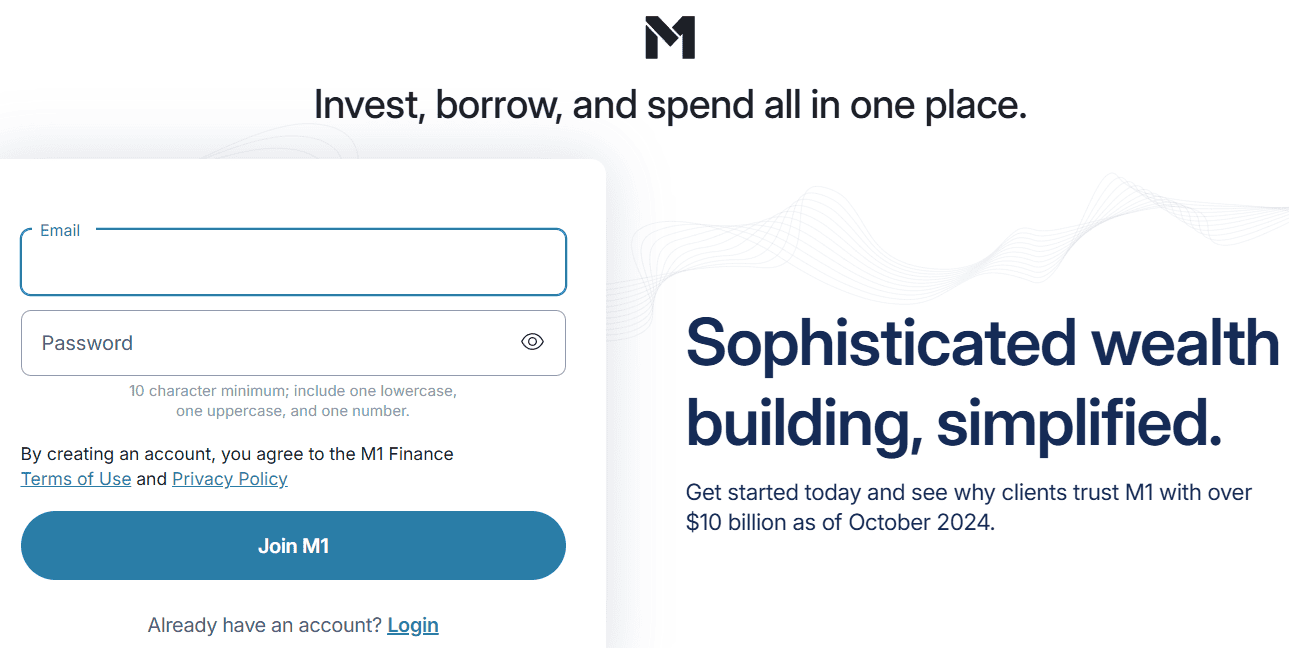

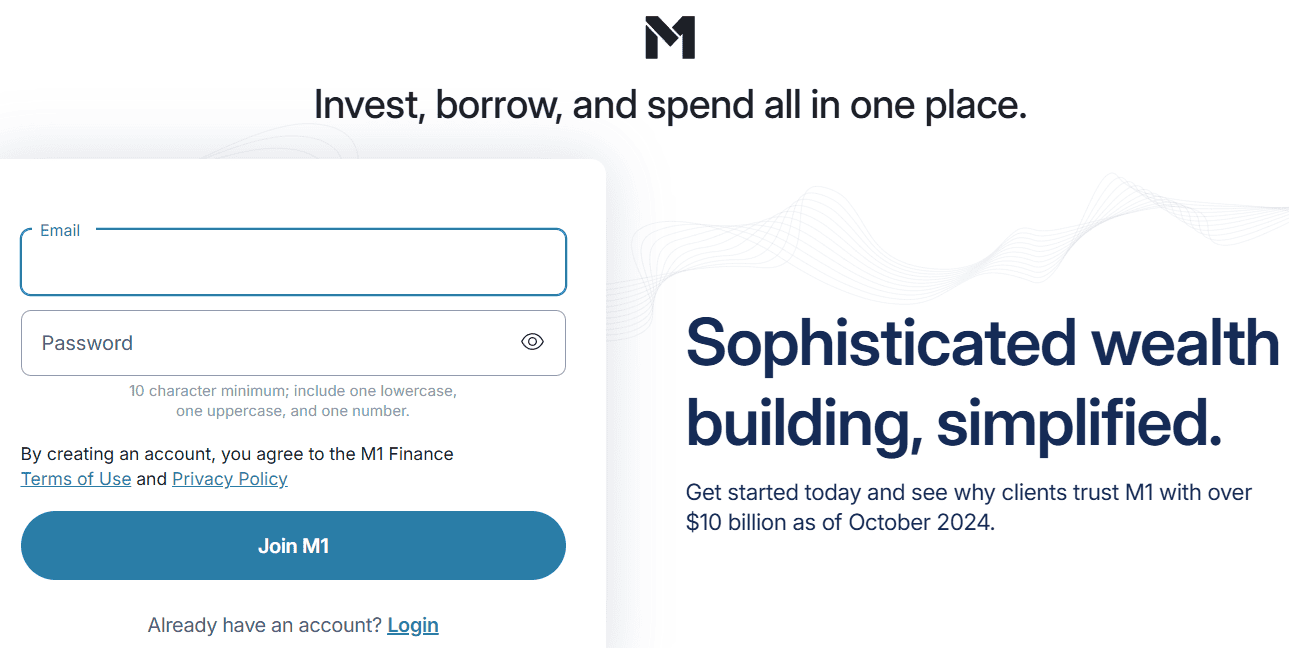

Account Opening

Score – 4.5/5

How to Open M1 Finance Demo Account?

M1 Finance does not offer a demo account, so users need to open a live account with real funds to start investing on the platform.

How to Open M1 Finance Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or M1 Finance login page and proceed with the guided steps:

- Select and click on the “Get Started” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

Beyond its research tools, M1 Finance offers additional features designed to enhance the investing experience.

- These include automated portfolio rebalancing, recurring deposits, tax-efficient investment options, and access to M1 Spend for integrated cash management.

- Premium members can also benefit from lower borrowing rates and a debit card with rewards. Together, these tools provide users with greater control, convenience, and flexibility in managing their financial goals.

M1 Finance Compared to Other Brokers

M1 Finance stands out among its competitors for its low-cost structure, commission-free trading, and user-friendly proprietary platform, making it particularly attractive for long-term investors and those starting.

While it does not offer futures trading like some full-service brokers, it provides a wide range of assets, including stocks, ETFs, crypto, and fractional shares, along with automated portfolio management tools that simplify investing.

Compared to other brokers, M1 Finance’s research and educational resources are moderate, and its customer support is reliable during standard trading hours. Overall, it competes strongly on accessibility, platform simplicity, and cost efficiency, though more advanced traders may prefer brokers with broader asset types, advanced tools, or 24/7 support.

| Parameter |

M1 Finance |

Trade Republic |

AJ Bell |

TD Ameritrade |

Freetrade |

Questrade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

Futures contracts not available / Stock Commission from €1 |

Futures contracts not available / Stock Commission from £3,50 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$Futures contracts not available / Stock Commission from $0 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low/Average |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

M1 Proprietary Trading Platform, Mobile Apps |

Trade Republic Mobile App |

AJ Bell Trading Platform |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Shares, ETFs, Cryptocurrencies, Fractional Shares, Securities |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, Warrants |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, SIPC |

BaFin, Bundesbank |

FCA |

SEC, FINRA, SIPC, MAS |

FCA |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Limited |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$100 |

€0 |

$0 |

$0 |

$0 |

$1,000 |

$0 |

Full Review of Broker M1 Finance

M1 Finance is a versatile investment platform known for its commission-free trading and automated portfolio management system. It caters to a range of investors, offering accounts for individuals, retirement, custodial, cash, crypto, and trusts.

The platform emphasizes long-term wealth building through diversified portfolios, while additional features like recurring deposits, automated rebalancing, and integrated cash management enhance convenience.

M1 Finance also maintains a strong reputation for transparency, low fees, and user-friendly web and mobile platforms, making it a solid choice for both new and experienced investors.

Share this article [addtoany url="https://55brokers.com/m1-finance-review/" title="M1 Finance"]