- What is LMAX Exchange?

- LMAX Exchange Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- LMAX Exchange Compared to Other Brokers

- Full Review of Broker LMAX Exchange

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

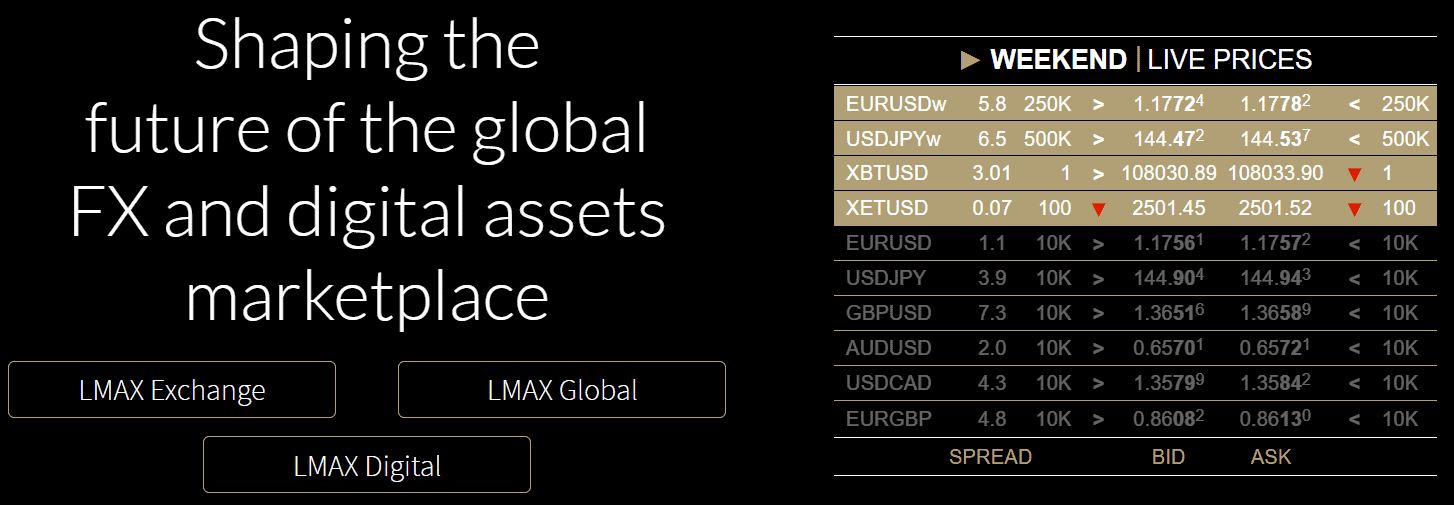

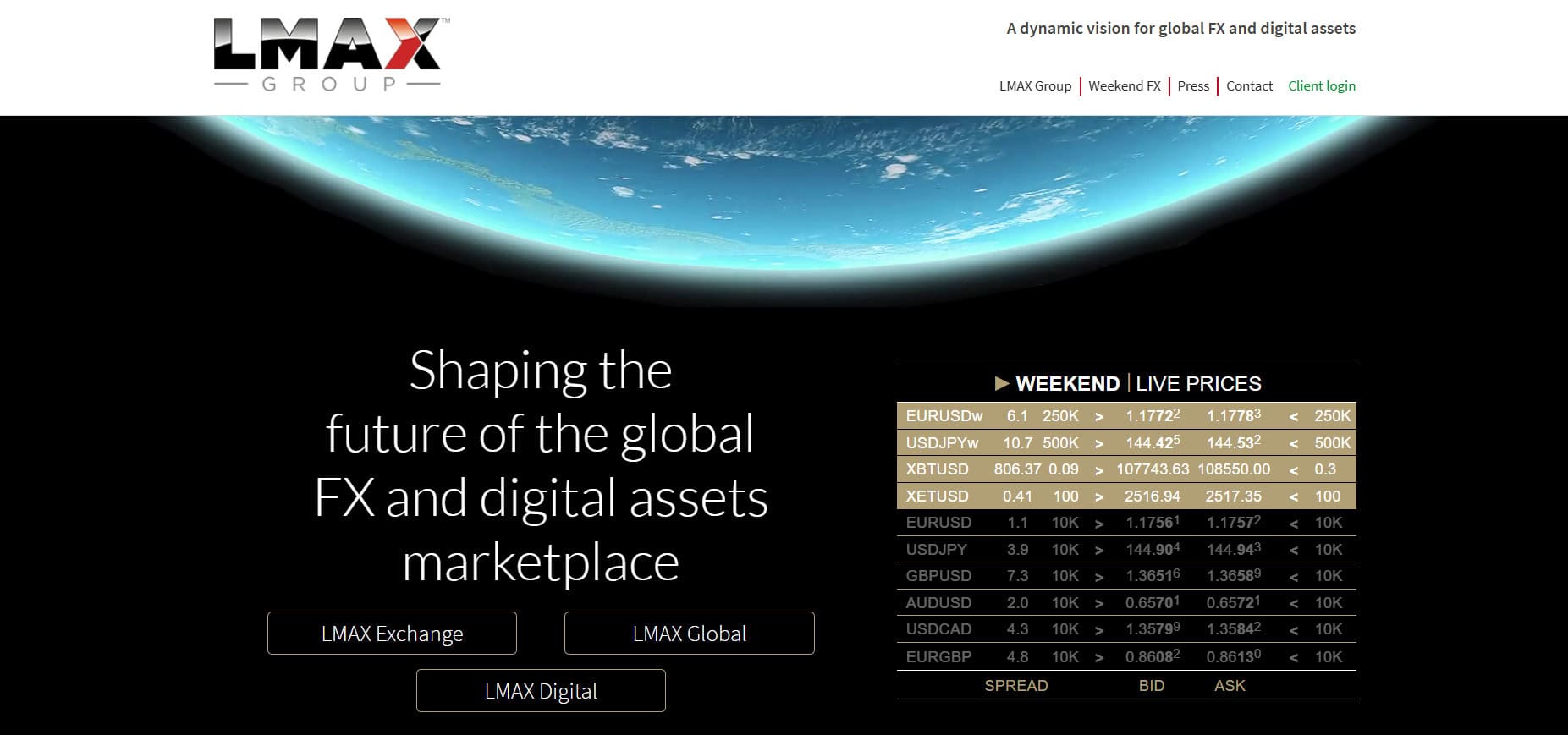

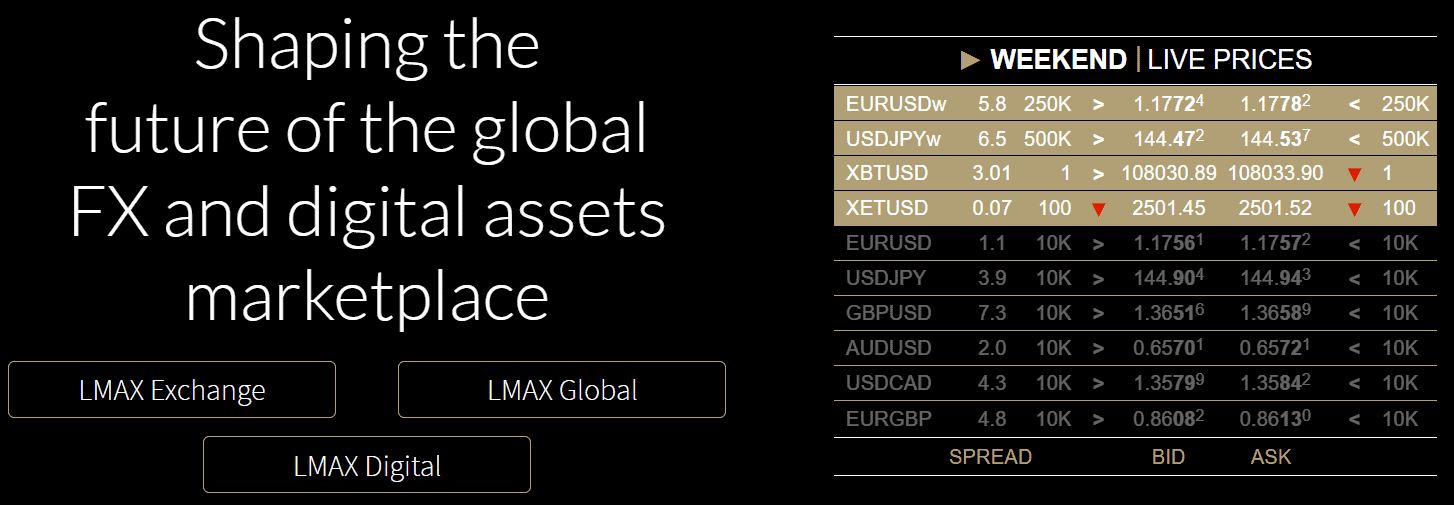

What is LMAX?

LMAX is a brokerage firm that provides traders worldwide with access to a range of trading instruments, including Forex, metals, commodities, crypto CFDs, and Equity-index CFDs.

LMAX Group, the parent company of LMAX Exchange, LMAX Global, and LMAX Digital, is a financial technology firm incorporated in London, UK.

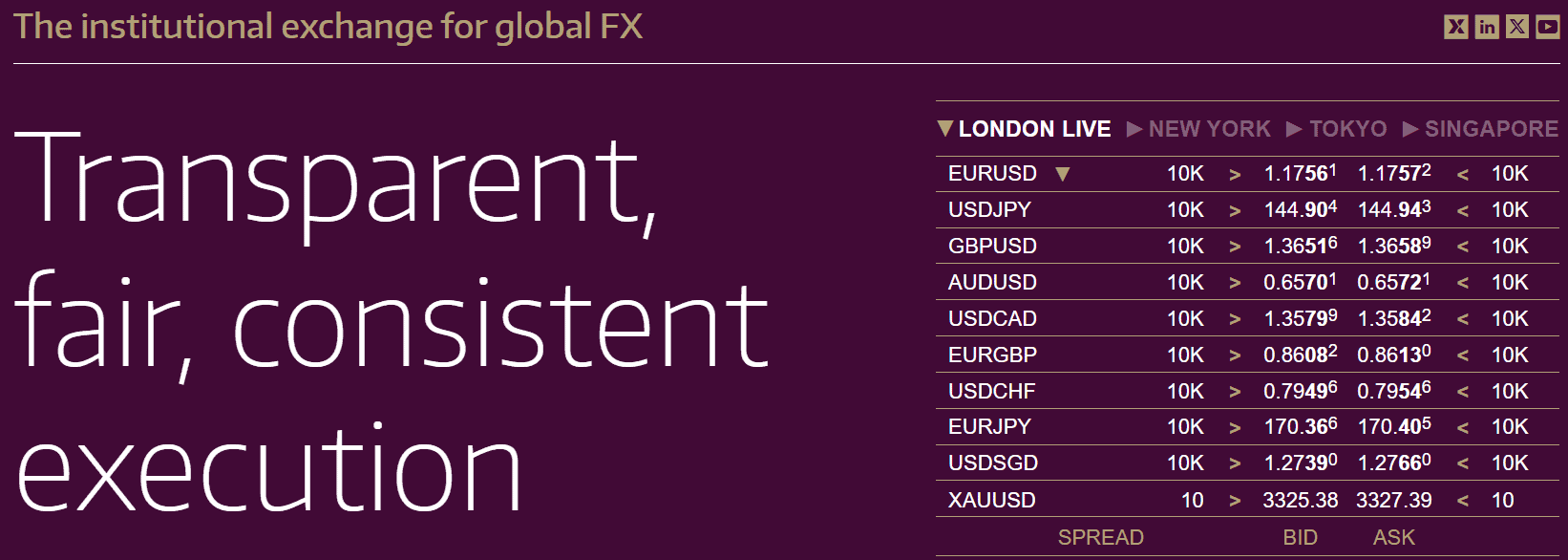

Based on our research, LMAX Group has a global presence, with offices in nine countries and clients around the world. Located in London, New York, Tokyo, and Singapore, the company has developed its exchange infrastructure with a focus on high performance and ultra-low latency.

LMAX Pros and Cons

LMAX Exchange is a reputable broker that offers competitive and transparent conditions, along with advanced platforms and tools, and 24/7 customer support. The broker is regulated by the top-tier FCA in the UK, which provides a strong level of security.

For the Cons, the minimum deposit amount is above average and the conditions might vary based on the entity.

| Advantages | Disadvantages |

|---|

| FCA license and overseeing | Conditions might vary based on the entity |

| Regulated broker with competitive trading conditions | The initial deposit amount is above average |

| Popular trading Instruments | |

| International trading | |

| Access to MT4/MT5 trading platforms | |

| Professional trading | |

| 24/7 customer support | |

LMAX Exchange Features

LMAX is a well-regulated broker that offers traders competitive trading conditions. The company provides various opportunities with low spreads and fees, which can be attractive to traders of all levels.

The key features are summarized in 10 points, covering aspects like Platforms, Account Types, available Instruments, and more.

LMAX Exchange Features in 10 Points

| 🏢 Regulation | FCA, CySEC, FSP, MAS, FSC |

| 🗺️ Account Types | Standard Account |

| 🖥 Trading Platforms | LMAX Exchange Proprietary Platform, MT4/MT5 bridges |

| 📉 Trading Instruments | Forex, metals, commodities, crypto CFDs, Equity-index CFDs |

| 💳 Minimum Deposit | $10,000 |

| 💰 Average EUR/USD Spread | 0.4 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR, GBP, AUD |

| 📚 Trading Education | LMAX Exchange Rulebook, Market Data, Economic Calendar, Blog |

| ☎ Customer Support | 24/7 |

Who is LMAX Exchange For?

LMAX Exchange is primarily for institutional clients, including banks, hedge funds, and professional traders looking for low-latency, high-transparency execution. Based on our findings and Financial Expert Opinions, LMAX Exchange is Good for:

- Traders from the UK

- European traders

- Traders from New Zealand

- International traders

- Professional traders

- Investors

- Institutional trading

- CFD and currency trading

- Competitive spreads and fees

- Good customer support

LMAX Exchange Summary

Overall, the review of LMAX Exchange shows that the company provides advanced solutions for experienced traders and institutions. While the broker may not be suitable for beginners due to its technology and high financial requirements, its offerings are competitive and robust.

The overall proposal of the broker is comprehensive and can be customized to meet specific needs. However, we recommend doing your research before choosing to sign up with LMAX to ensure it is the right choice for you.

55Brokers Professional Insights

LMAX Exchange stands out for its commitment to transparency and performance. The broker is primarily built for institutional clients who require consistent, high-performance execution in the Forex and CFD markets.

What sets it apart is its centralized limit order book model; unlike most over-the-counter venues, it operates without a “last look,” meaning all trades are executed on a strict price and time priority basis.

Additionally, the platform’s technology is built for high-frequency and API-based trading, offering ultra-low latency execution and co-location services in major financial centers. This infrastructure supports rapid order routing and data access, which is essential for institutions running latency-sensitive strategies.

Consider Trading with LMAX Exchange If:

| LMAX Exchange is an excellent Broker for: | - Need a well-regulated broker.

- Offering a range of popular instruments.

- Secure environment.

- Institutional and high-frequency traders.

- Looking for broker with access to MT4 and MT5 platforms.

- Who prefer higher leverage up to 1:200.

- International trading.

- API trading.

- Providing competitive fees and spreads.

- European and UK traders.

- Currency trading.

- Professional trading.

- Need a broker with 24/7 customer support. |

Avoid Trading with LMAX Exchange If:

| LMAX Exchange might not be the best for: | - Need broker with access to VPS Hosting.

- Prefer MAM/PAMM trading.

- Need broker with low minimum deposit amount.

- Providing Copy Trading. |

Regulation and Security Measures

Score – 4.5/5

LMAX Exchange Regulatory Overview

LMAX Exchange operates under a strong multi-jurisdictional regulatory framework designed to meet the needs of institutional clients worldwide.

LMAX Exchange is a Multilateral Trading Facility regulated by the UK FCA. This regulatory status ensures that the broker adheres to strict standards of transparency.

In addition, the LMAX Group includes entities regulated by several well-known authorities, such as CySEC for European clients, FSP New Zealand, and MAS Singapore for the Asia-Pacific region.

The Group is also licensed by the Financial Services Commission of Mauritius, further extending its global regulatory reach.

How Safe is Trading with LMAX Exchange?

Due to its regulations and compliance requirements, LMAX Exchange provides the utmost level of security to its investors and clients, along with full compliance with applicable laws and best protective strategies.

Moreover, the funds are protected by segregated, separate accounts within top-tier banks. This means the company can never use the client’s money for its good, besides the money is always protected and covered by the UK’s Financial Services Compensation Scheme (FSCS).

However, trading through its FSC entity carries higher risk due to weaker regulatory oversight. Traders should be aware that the offshore entity generally has fewer investor protections compared to FCA-regulated accounts.

Consistency and Clarity

LMAX Exchange is known for its consistent execution quality, transparent business model, and regulated operations. Trusted by professional traders and financial institutions globally, it scores highly in areas such as price integrity and low-latency execution.

Reviews from traders often highlight its reliable infrastructure, though some note its services are primarily for institutions rather than retail users. The broker has also received multiple industry awards, including recognition for Best Execution Venue and Best Cryptocurrency Exchange.

Additionally, LMAX Group is also active in corporate social responsibility, participating in charitable initiatives.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with LMAX Exchange?

LMAX Exchange offers only one Standard account type, which is based on the investor’s profile. Institutional or Professional clients with a strong financial background are the ones who can benefit from the superior technology provided by LMAX Exchange. The reason for this is that LMAX Exchange caters to larger traders who require advanced technology, and as a result, the account opening balance is set at a relatively high level of $10,000.

Additionally, new traders can sign up for a free demo account to practice trading with trial trades.

Standard Account

The broker’s Standard Account is tailored for professional traders and institutions, offering access to a range of instruments including Forex, equity index CFDs, and commodities.

The account typically requires a minimum deposit starting from $10,000, reflecting its institutional focus. Traders can operate through LMAX’s proprietary web-based platform, as well as via FIX API, MT4, and MT5 bridges, depending on the setup.

Regions Where LMAX Exchange is Restricted

LMAX Exchange imposes restrictions on account openings and product offerings in certain jurisdictions due to regulatory and legal considerations. The broker does not provide trading services in countries including:

- USA

- North Korea

- Iran

- Syria

- Cuba, etc.

Cost Structure and Fees

Score – 4.5/5

LMAX Exchange Brokerage Fees

LMAX Exchange offers a competitive fee model based on commissions and spreads. The broker does not charge any deposit fees or withdrawal fees.

Another cost, that you should take into consideration, is an overnight fee or swap rate, which is paid in case the position is held longer than a day.

LMAX offers variable spreads, with an average spread of 0.4 pips for the EUR/USD, and a competitive commission rate structure depending on the level of activity.

- LMAX Exchange Commissions

LMAX Exchange charges transparent, volume-based commissions starting from $25 per million traded for spot FX. The exact rate depends on the client’s trading volume and asset class.

These commissions are charged in addition to the raw institutional spreads, which remain tight due to the central limit order book model.

- LMAX Exchange Rollover / Swaps

LMAX Exchange applies swap charges on positions held overnight, reflecting the interest rate differential between the two currencies in a pair or the cost of carrying a position in CFDs.

These fees are calculated based on institutional market rates and are transparently passed through to the client without markups.

- LMAX Exchange Additional Fees

LMAX Exchange maintains a competitive fee structure with minimal additional costs beyond commissions and spreads. There are typically no deposit or withdrawal fees charged by LMAX itself, though clients should be aware of potential fees from banks or payment providers.

The broker charges an inactivity fee of $10 per month on accounts that have not been active for a month. Additionally, traders may incur market data fees for access to real-time price feeds and advanced market information, which vary depending on the level of data and venue subscription.

How Competitive Are LMAX Exchange Fees?

LMAX Exchange fees are considered rather competitive within the institutional environment. Its commission-based pricing, combined with raw spreads from a centralized limit order book, appeals to professional traders who prioritize cost efficiency. While the minimum deposit and fee structure reflects its focus on larger-scale clients.

| Asset/ Pair | LMAX Exchange Spread | Taurex Spread | FXTrading Spread |

|---|

| EUR USD Spread | 0.4 pips | 1.7 pips | 1 pip |

| Crude Oil WTI Spread | 4 | 0.054 | 22 |

| Gold Spread | 14 | 0.34 | 8 |

| BTC USD Spread | 20 | 41.92 | 323 |

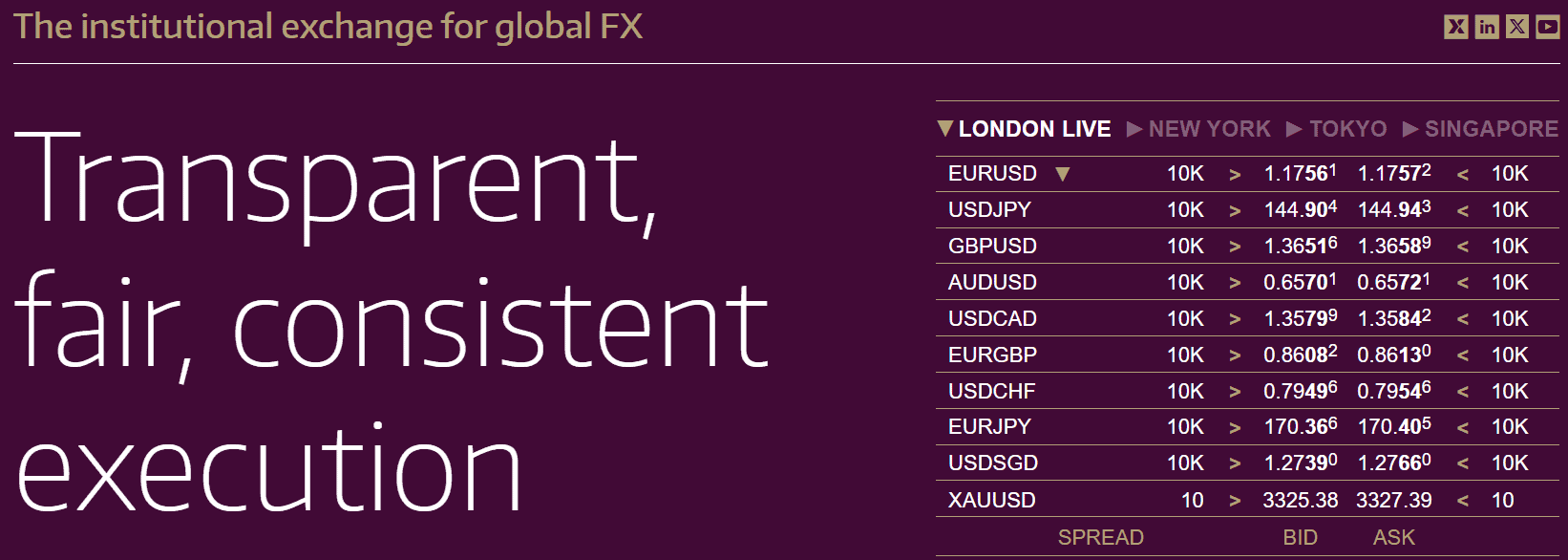

Trading Platforms and Tools

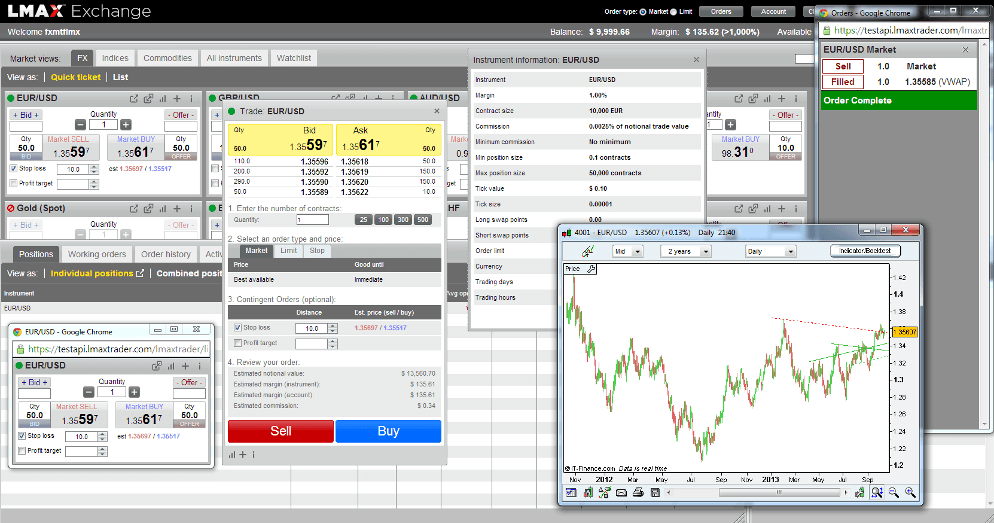

Score – 4.6/5

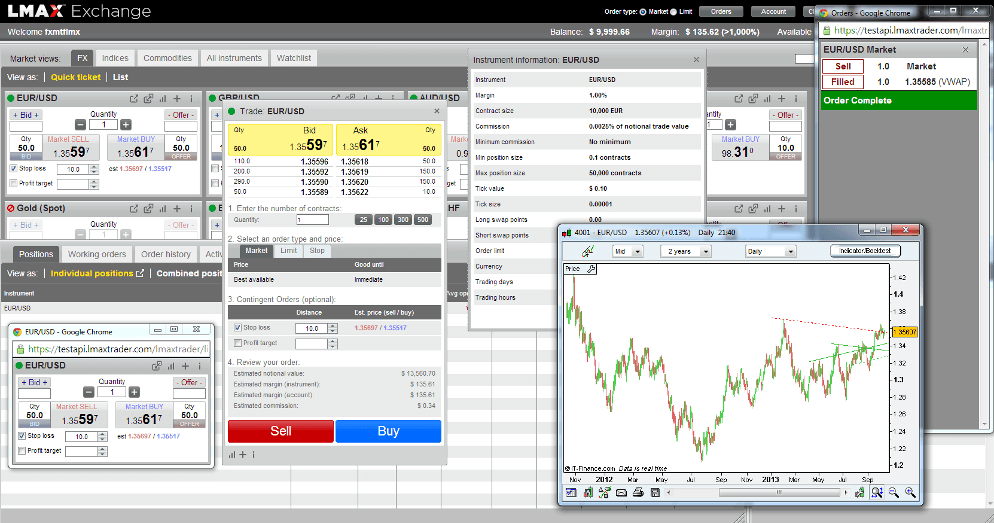

LMAX Exchange offers a range of professional platforms and tools for institutional and high-volume traders. Its proprietary web-based platform delivers real-time access to the central limit order book with full market depth and transparent pricing.

For more advanced users, LMAX supports FIX 4.4 API for low-latency, algorithmic trading, as well as connectivity through MT4 and MT5 bridges via LMAX Global. The platform suite includes detailed reporting tools, execution analytics, and market data feeds, allowing traders to monitor performance and maintain compliance.

Trading Platform Comparison to Other Brokers:

| Patforms | LMAX Exchange Platforms | Taurex Platforms | FXTrading Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

LMAX Exchange Web Platform

The LMAX Exchange proprietary web platform is a professional-grade trading interface built specifically for institutional and high-frequency traders. It provides direct access to the central limit order book, offering full market depth, real-time pricing, and transparent trade execution with average speeds of around 3 milliseconds.

The platform is designed for speed and reliability, with ultra-low latency execution and intuitive navigation for managing multi-asset portfolios. Traders can view live order flow, access detailed trade history, and use integrated reporting tools for post-trade analysis.

Main Insights from Testing

Testing the broker’s web platform reveals a stable and responsive environment optimized for professional use. Order execution is fast and consistent, with minimal delays even during volatile market conditions.

The platform layout is straightforward, with customizable watchlists and clear order management features, allowing efficient trade placement and monitoring.

LMAX Exchange Desktop MetaTrader 4 Platform

Through LMAX Global, clients can access the MetaTrader 4 desktop platform, widely recognized for its user-friendly interface and robust charting tools. It supports automated trading via Expert Advisors and offers real-time pricing from LMAX’s institutional liquidity pool.

MT4 users benefit from stable execution and thousands of custom indicators and strategies, making it a preferred choice for algorithmic traders.

LMAX Exchange Desktop MetaTrader 5 Platform

LMAX Global also provides access to the MT5 desktop platform, offering enhanced features such as improved order management, more timeframes, and an economic calendar.

MT5 supports multi-asset trading and faster processing capabilities, ideal for users who require deeper analytical tools and higher performance.

LMAX Exchange MobileTrader App

The LMAX Exchange’s Mobile app offers a responsive trading experience for professional users on the go. Available for both iOS and Android devices, the app provides real-time access to live pricing, full order management, and account monitoring.

While more simplified than desktop or web platforms, it maintains essential functionality, including placing and modifying trades, viewing market depth, and tracking portfolio performance.

AI Trading

LMAX Exchange does not currently offer dedicated AI tools; however, it supports algorithmic and API trading.

With access to ultra-low latency execution, FIX API connectivity, and transparent market data from a centralized limit order book, the broker provides a reliable environment for AI and machine learning models.

Trading Instruments

Score – 4.4/5

What Can You Trade on LMAX Exchange’s Platform?

LMAX provides access to trade over 100 instruments in popular asset classes, including Forex, metals, commodities, crypto CFDs, and Equity-index CFDs.

Moreover, Cryptocurrency institutional trading is enabled through a separate brand within the group LMAX Digital that enables trading of Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple among institutions admitted to trading. The technology is based on the proprietary LMAX Exchange and is a custodian solution on a tiered system with increased security.

Main Insights from Exploring LMAX Exchange’s Tradable Assets

Exploring LMAX’s tradable assets reveals a strong focus on institutional-grade liquidity across all markets it offers. Asset coverage is structured to meet the needs of professional traders, with tight spreads, competitive commissions, and deep liquidity available 24/7.

Leverage Options at LMAX Exchange

LMAX provides traders with the option to use leverage, which is a borrowed amount from the broker that can amplify potential profits, but it should be used cautiously as it also increases the possibility of risks. LMAX Exchange’s multiplier is offered according to the broker’s regulations:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs.

- European traders can use a maximum of up to 1:30 for major currency pairs.

- International traders are eligible to use a maximum of up to 1:200.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at LMAX Exchange

In terms of funding methods, LMAX offers the following payment methods:

- Bank Wire

- Credit/Debit cards

- Neteller

- Skrill, etc.

LMAX Exchange Minimum Deposit

LMAX minimum deposit is $10,000 or an establishment amount, which will allow you to engage in trading with LMAX.

Withdrawal Options at LMAX Exchange

LMAX Exchange does not impose fees for deposit or withdrawal transactions, and traders can choose from Bank Wire and Credit Card options. However, traders should confirm with the payment provider or bank if any fees apply.

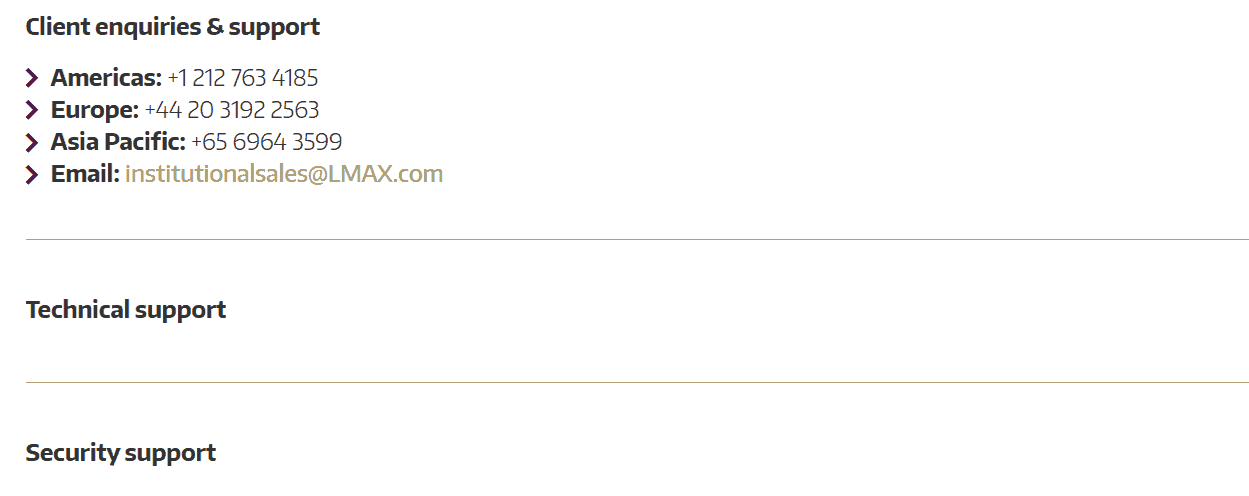

Customer Support and Responsiveness

Score – 4.6/5

Testing LMAX Exchange’s Customer Support

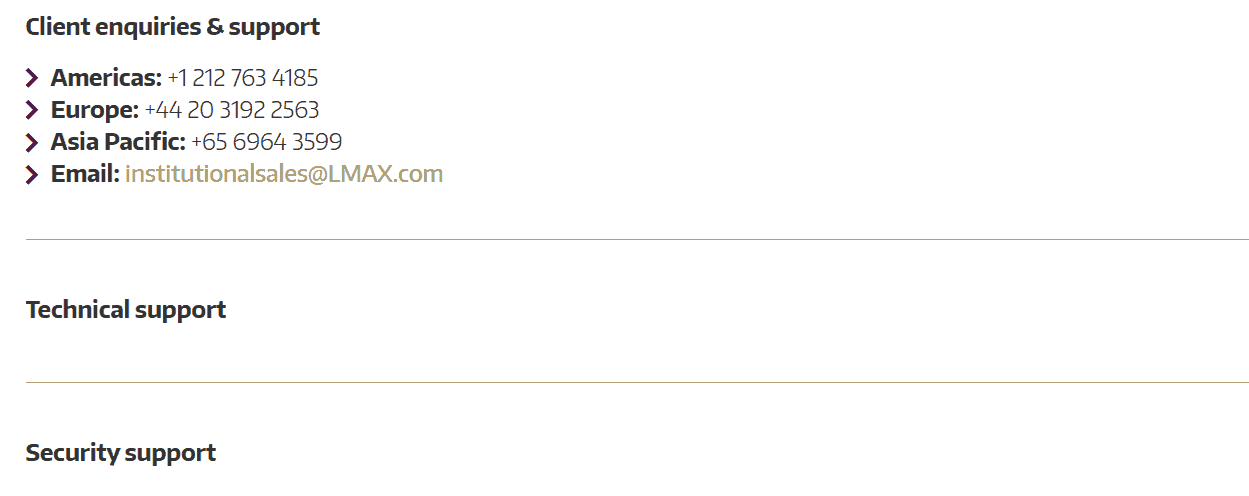

LMAX Exchange provides 24/7 customer support through Phone Lines and Email. The support team at the broker is composed of experts who are able to assist traders with a variety of matters such as technical support, analysis advice, general inquiries, and operational issues.

Contacts LMAX Exchange

To get in touch with LMAX Exchange, clients can reach out via regional contact numbers: +1 212 763 4185 for the Americas, +44 20 3192 2563 for Europe, and +65 6964 3599 for the Asia Pacific region.

For general inquiries or sales-related questions, clients can also contact the firm by email at institutionalsales@LMAX.com.

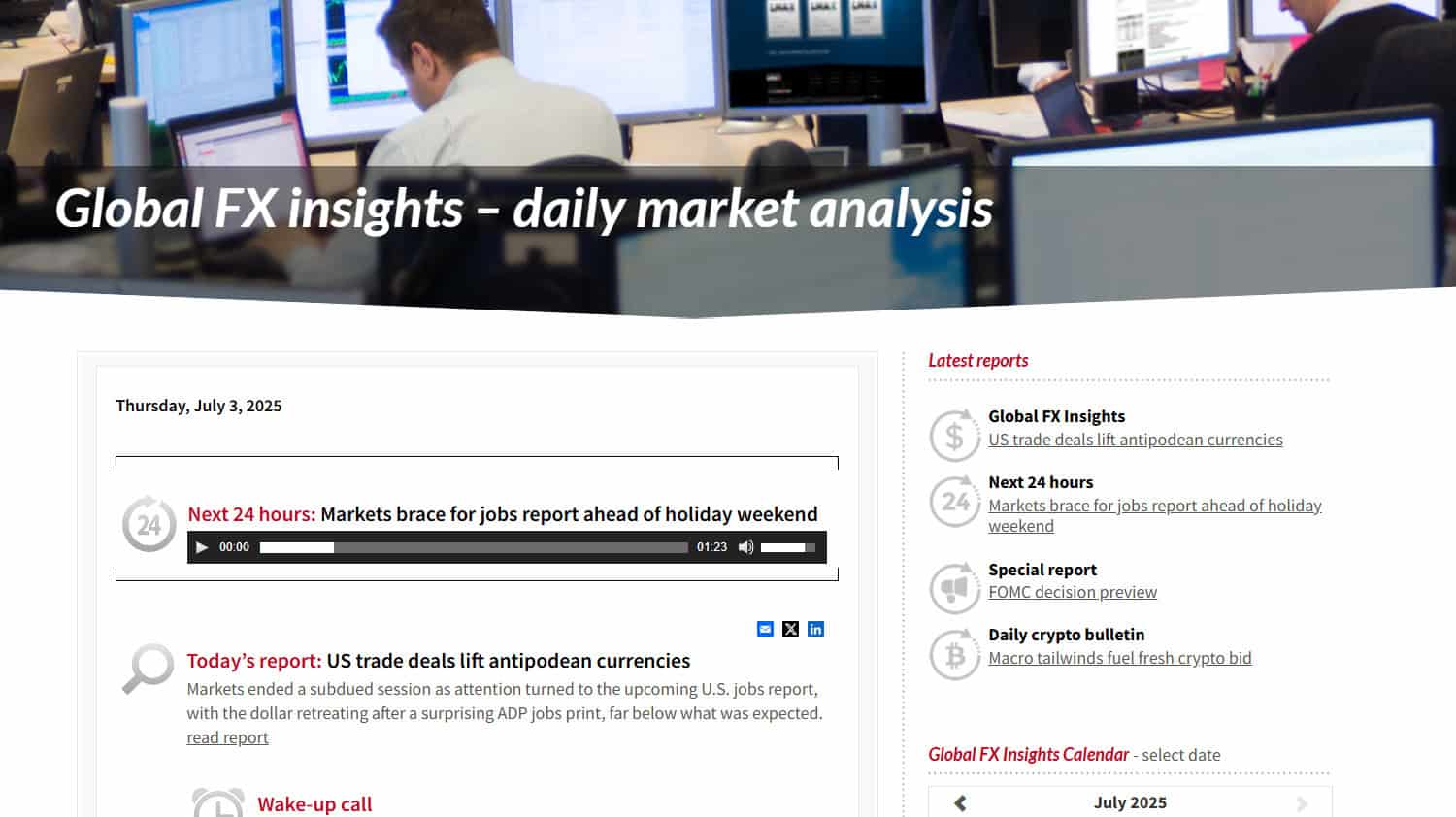

Research and Education

Score – 4.5/5

Research Tools LMAX Exchange

LMAX Exchange provides a range of research and analytical tools to support professional trading decisions.

- On the platforms, users can access real-time market depth, trade history, and execution analytics to monitor performance and strategy effectiveness.

- The proprietary platform also includes detailed reporting features for post-trade analysis.

- On the website, traders can find additional resources such as daily and historical spread data, institutional market insights, product fact sheets, and trading specifications.

Education

LMAX provides an economic calendar, market data access, LMAX Exchange Rulebook, and a blog; however, the broker does not offer any educational resources, such as webinars, seminars, or learning materials, which may be useful for novice traders.

Portfolio and Investment Opportunities

Score – 3.5/5

Investment Options LMAX Exchange

LMAX Exchange does not offer traditional investment solutions like managed portfolios, PAMM/MAM accounts, or copy-trading services.

Instead, it provides a pure execution venue focused on providing high-efficiency access to its centralized limit order book across Forex, indices, and commodities. This setup is made for professional traders and institutions to execute their strategies, rather than investing through LMAX’s own or third-party funds.

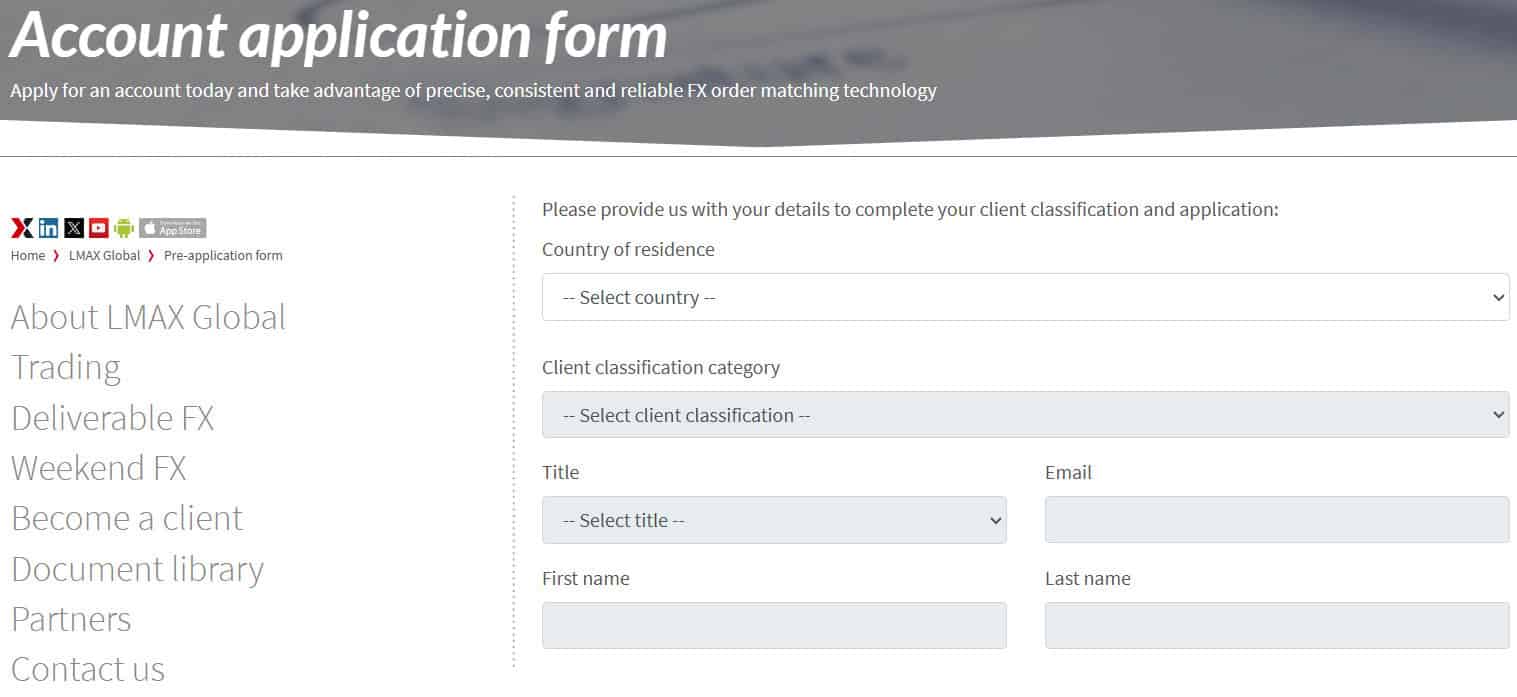

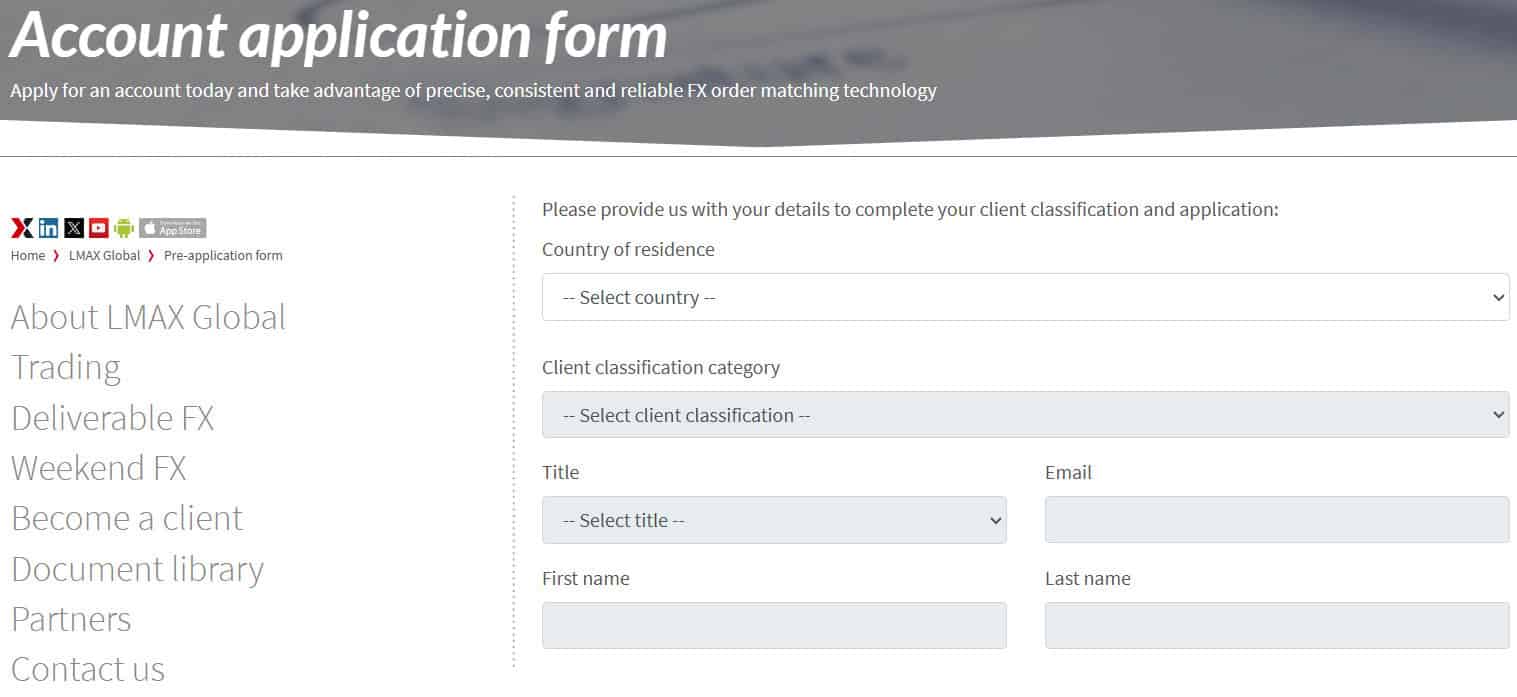

Account Opening

Score – 4.4/5

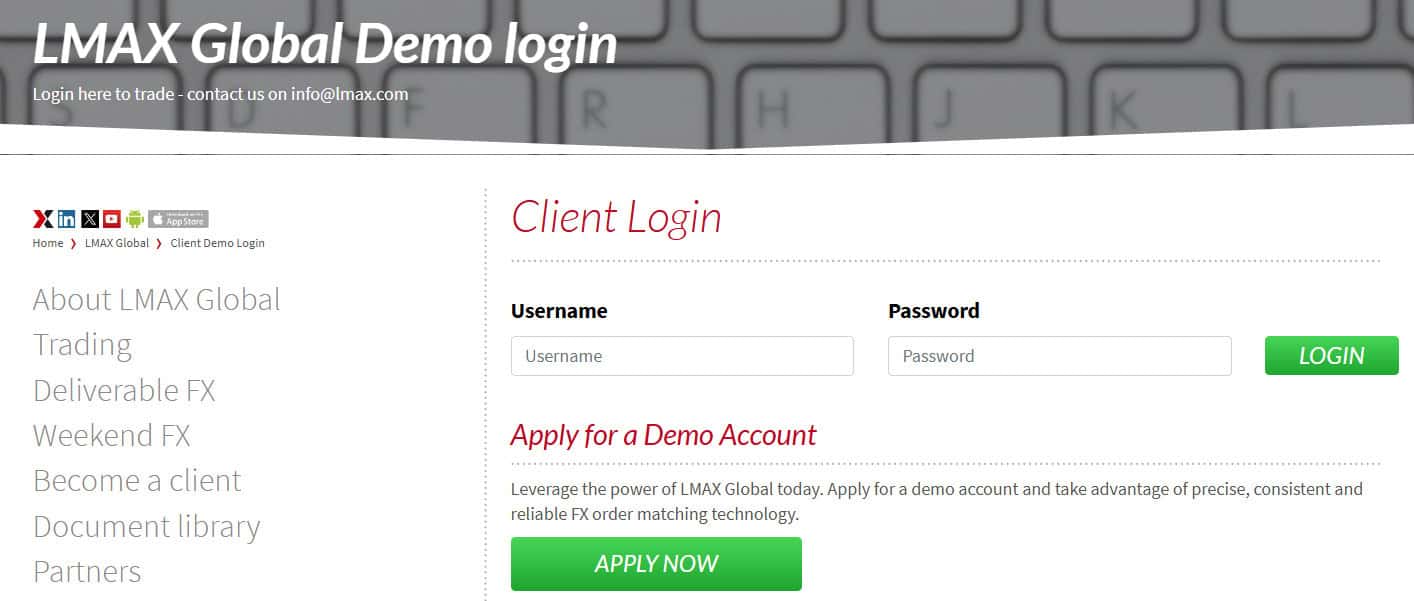

How to Open LMAX Exchange Demo Account?

Opening a demo account with LMAX is an easy process and ideal for professional practice. Users can apply directly via the LMAX Global site, where the demo allows you to test the institutional-grade CLOB technology in a risk-free environment.

The online form requires basic details, such as your name, email, and intended account use, and once submitted, you will receive login credentials for practice trading.

The demo provides full platform access, including live market depth, execution analytics, and tools, enabling you to explore LMAX Exchange’s order matching and reporting functionality before committing real capital.

How to Open LMAX Exchange Live Account?

Opening an account with LMAX is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Start Application” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.5/5

In addition to its main research and analytics tools, LMAX Exchange offers several advanced features that enhance the experience for institutional and professional users.

- Through MetaTrader 4 and 5, traders can benefit from automated strategies using Expert Advisors, supporting both backtesting and live algorithmic execution.

- For high-frequency traders, FIX API connectivity enables seamless integration with in-house systems, while co-location services in major financial data centers ensure ultra-fast execution. These additional tools cater to traders seeking automation and customization.

LMAX Exchange Compared to Other Brokers

Compared to its competitors, LMAX Exchange stands out as a broker built specifically for institutional and professional traders, focusing on transparent execution, low-latency infrastructure, and regulatory strength.

While other brokers like FXTrading, Tickmill, and ActivTrades cater more to retail clients with lower entry requirements and broader educational support, LMAX Exchange targets experienced traders with a high-performance environment and commission-based pricing for high-volume trading.

The broker does not provide the same asset variety as multi-asset brokers like Colmex Pro or CMC Markets; however, it compensates with its limit order book model, tight spreads, and consistent pricing.

For traders who value execution quality and regulatory credibility, LMAX Exchange presents a compelling and institution-grade alternative.

| Parameter |

LMAX Exchange |

FXTrading |

Tickmill |

Colmex Pro |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.4 pips |

Average 1 pip |

Average 0.1 pips |

Average 4 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

$25 per million traded for spot FX |

0.0 pips + $2 per side |

0.0 pips + $3 |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

LMAX Exchange Proprietary Platform, MT4/MT5 bridges |

MT4, MT5 |

MT4, MT5, Tickmill Trader |

Colmex Pro 2.0, MT4 |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

100+ instruments |

1,000+ instruments |

180+ instruments |

28,000+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, CySEC, FSP, MAS, FSC |

ASIC, VFSC |

FCA, CySEC, FSCA, FSA |

CySEC, FSCA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$10,000 |

$50 |

$100 |

$500 |

$50 |

$0 |

$0 |

Full Review of Broker LMAX Exchange

LMAX Exchange is a multi-regulated institutional firm known for its transparent and professional-grade environment. Designed for high-volume traders, it offers deep liquidity across Forex, equity index CFDs, and commodities, with ultra-low latency and reliable pricing.

The broker supports advanced trading via its proprietary platform, FIX API, and MT4/MT5 bridges via LMAX Global, catering to algorithmic and API-based strategies.

With a strong global regulatory coverage and a reputation for fast execution integrity, LMAX Exchange delivers a robust and efficient environment for institutional and professional trading.

Share this article [addtoany url="https://55brokers.com/lmax-exchange-review/" title="LMAX Exchange"]