- Is LCG Safe or a Scam?

- LCG Pros and Cons

- Leverage

- Accounts

- Trading Fees

- Spread

- Deposits and Withdrawals

- Platforms

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about LCG.

What is LCG?

London Capital Group known as LCG is a CFD provider offering its clients over 7000 trading instruments across 9 asset classes including Forex, indices, shares, commodities, bonds, ETFs, cryptocurrencies, and more.

The broker operates for over two decades in online trading providing competitive prices, advanced technology, and professional service for all types of traders.

LCG celebrates 20 years of world-class trading, with over $1 billion in deposits and over $20 trillion in executed volume.

LCG Pros and Cons

LCG is a reliable broker since it is listed in Stock and authorized by a top-tier authority FCA. The account opening is fully digital, there are numerous funding methods, ECN accounts, and an advanced range of instruments.

For the Cons, there is no proper learning and research section, spreads might be high for some instruments, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| FCA license and overseeing | No 24/7 customer support |

| Competitive trading costs and spreads | |

| MT4 trading platform | |

| Quality customer support | |

LCG Review Summary in 10 Points

| 🏢 Headquarters | UK |

| 🗺️ Regulation | FCA, CySEC, SCB |

| 🖥 Platforms | LCG Trader, MT4 |

| 📉 Instruments | ETFs CFDs and spread betting (for UK residents only). Shares, Bonds and Interest Rates, Indices, Commodities, Spot Metals, Forex, Vanilla Options |

| 💰 EUR/USD Spread | 1.45 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $0 |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | News, economic calendar, technical analysis, trading videos |

| ☎ Customer Support | 24/5 |

Overall LCG Ranking

LCG is considered a good broker with safe and favorable trading conditions with transparency. The broker offers a range of trading services designed for all level traders with no initial deposit amount. LCG is available in many countries, so traders can sign in also with the lowest spreads.

- LCG Overall Ranking is 8.5 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | LCG | Capital Index | ICM Capital |

|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Platforms | Trading Conditions | High Liquidity |

LCG Alternative Brokers

LCG offers good trading conditions, a range of trading instruments, also competitive trading spreads and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to LCG:

Awards

LCG implements innovations and fresh solutions to all trading processes, which is confirmed by a number of their clients or partners, as well as various international awards that have recognized their strives.

Is LCG Safe or Scam?

No, LCG is not a scam. London Capital Group Holdings plc (LCG Group) is a company registered in England and Wales, as well as a member of the NEX Exchange with low-risk Forex trading. LCG as a UK-based company is authorized and regulated by FCA, UK.

Is LCG Legit?

Yes, LCG is a legit and regulated broker in various jurisdictions.

Moreover, the Cyprus entity was conducted as a London Capital Group (CYPRUS) Limited (LCG CY) that respectively operates under the supervision of Cyprus Authorities and the Cyprus Securities and Exchange Commission (CySEC).

See our conclusion on LCG Reliability:

- Our Ranked LCG Trust Score is 8.9 out of 10 for good reputation and service over the years, also for a reliable top-tier license. The only point is that regulatory standards and protection vary based on the entity, and one of the regulations is in the offshore zone.

| LCG Strong Points | LCG Weak Points |

|---|

| Regulated broker with FCA license | Regulatory standards and protection vary based on the entity |

| Negative balance protection | |

| Compensation scheme | |

How Are You Protected?

As a regulated brokering services provider, with 20 years of experience, the broker is committed to strict rules of operation, while dealing with clients and their funds transparently, as well shows performance efficiency. The confidence in secure funds storing is provided by the tailor-regulated rules, which include holding of client’s funds in a Tier 1 bank, full segregation of accounts, and participation in the scheme or compensation funds in case things go wrong with the Broker.

Moreover, LCG provides its clients with negative balance protection to guarantee that they will never lose more than they have in their accounts.

Leverage

Being a UK and Cyprus-based regulated broker LCG follows strict guidelines set by the regulatory authorities. Leverage levels fall under a particular set of rules, alike UK and European regulators set a limitation towards maximum offered leverage levels, as ESMA recognizes a potential risk in case very high leverage is used.

- UK and European traders are eligible to use low leverage up to 1:30 for major Forex currency pairs, 1:20 for minor ones, and 1:10 for Commodities, etc.

Account Types

LCG offers three account types to its clients: CFD trading, ECN, and Islamic accounts (following the Muslim faith).

Of course, in the beginning, any trader can open a risk-free demo account with LCG.

| Pros | Cons |

|---|

| Fast account opening | Methods and fees vary in each entity |

| No minimum deposit amount requirement | |

| Demo and Islamic accounts available | |

| Account base currencies GBP, EUR, USD | |

How to Open LCG Live Account?

Opening an account with LCG is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Instruments

LCG offers 7000+ trading markets across 9 asset classes including CFDs, Forex, indices, shares, commodities, bonds and interest rates, vanilla options, ETFs, and cryptocurrencies.

- LCG Markets Range Score is 8.9 out of 10 for wide trading instrument selection among Forex, shares, indices, and more.

LCG Fees

LCG fees are built into a tight spread and low commission for ECN accounts. There is an option to trade share CFD with good margin requirements, also additional monthly cash rebates including ETFs, available via CFD and spread betting (for UK residents only).

The overnight financing is charged at a 0.04% admin fee per day and will be charged for each position open at 22:00 (UK time) each day. Three days of financing will be charged for positions held after 22:00 (UK time) on Fridays.

- LCG Fees are ranked average with an overall rating of 8.5 out of 10 based on our testing and compared to over 500 other brokers.

| Fees | LCG Fees | Capital Index Fees | Tickmill Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | No |

| Fee ranking | Average | Low, Average | Low |

Spreads

LCG trading costs or spreads offer different spread conditions that vary according to the traded instrument and average 1.45 pips for EUR/USD, however, spreads may be slightly different at two of the platforms which LCG uses.

ECN spreads start from 0 pips with no requotes for those who maintain a $10,000 balance along with a commission of $45 per $1,000,000 traded.

- LCG Spreads are ranked low or average with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found Forex spreads average, and spreads for other instruments are very attractive too.

| Asset/ Pair | LCG Spread | Capital Index Spread | Tickmill Spread |

|---|

| EUR USD Spread | 1.45 pips | 1.1 pips | 0.3 pips |

| Crude Oil WTI Spread | 3 pips | 7 | 4 |

| Gold Spread | 3 | 0.5 | 20 |

| BTC USD Spread | 1% | - | 12 |

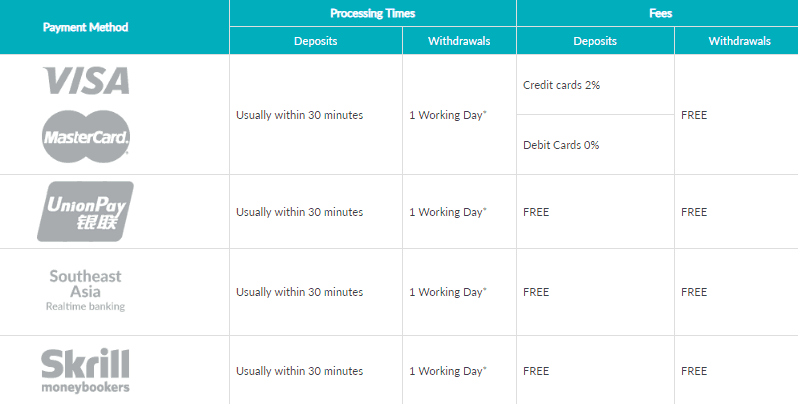

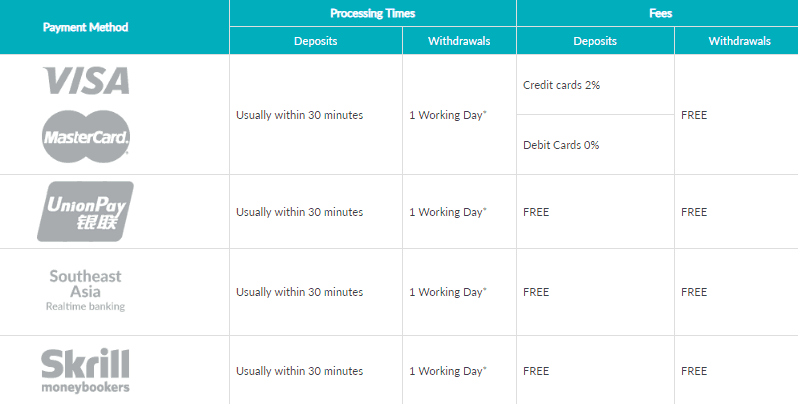

Deposits and Withdrawals

LCG typically processes payment in a short time within 1 working day, while offering several payment methods at the trader’s convenience. Yet, traders should be aware of differences between the methods according to the account they open with.

- LCG Funding Methods we ranked good with an overall rating of 8.5 out of 10. Fees are either none or very small also allowing to benefit from various account-based currencies, yet deposit options vary on each entity.

Here are some good and negative points for LCG funding methods found:

| LCG Advantage | LCG Disadvantage |

|---|

| $0 is a first deposit amount | Methods and fees vary in each entity |

| No internal fees for withdrawals | |

| Fast digital deposits, including Credit/Debit Cards | |

| Multiple Account Base Currencies | |

Deposit Options

In terms of funding methods, LCG offers a few payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

- UnionPay

LCG Minimum Deposit

LCG does not have a minimum deposit requirement for the opening of a trading account. The client deposits should have enough funds to cover the margin costs for the markets you are trading, which is definitely a great advantage for beginning traders or even seasoned ones too.

LCG minimum deposit vs other brokers

|

LCG |

Most Other Brokers |

| Minimum Deposit |

$0 |

$500 |

LCG Withdrawals

LCG withdrawals are smooth offering Bank Transfers and Card Payments. The clients regulated under CySec are able to use either bank transfers or Visa/MasterCards, which as well will include an additional 2% commission for credit card deposits. The clients under FCA may use bank transfers and cards as well, with additional options of Skrill and Neteller, which apply a $0 fee for transactions.

How Withdraw Money from LCG Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Trading Platforms

LCG offers traders MetaTrader4, available for desktop, mobile, and tablet, and its proprietary trading platform LCG Trader, available for mobile and browser trading.

- LCG Platform is ranked good with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers a popular MT4 professional trading platform.

Trading Platform Comparison to Other Brokers:

| Platforms | LCG Platforms | Capital Index Platforms | Tickmill Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Customer Support

LCG provides 24/5 customer support to its clients. Phone lines, Live chat, and Email are also available here.

- Customer Support in LCG is ranked good with an overall rating of 8.5 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of Live chat, phone lines, and email | |

LCG Education

LCG provides an economic calendar, breaking news, technical analysis, trading videos, and more.

- LCG Education ranked with an overall rating of 8 out of 10 based on our research. The broker provides good quality education and analysis, and also cooperates with market-leading providers of data. However, there is no proper research and seminars section provided.

LCG Review Conclusion

For final thoughts, LCG’s performance and reliability bring a safe trading environment and convenient conditions. General offering through the diverse range of trading products, the choice between the proprietary platform and the comfortable MT4 covers the demands of any trader with a different experience.

In addition, there is an option to trade through an ECN account, however, the minimum account balance required for an ECN account is quite high which is good for traders of bigger size only.

Based on Our findings and Financial Expert Opinions LCG is Good for:

- Beginners

- Advanced traders

- Professional trading

- Investing

- Traders from Europe and UK

- International traders

- Currency and CFD trading

- ECN trading

- STP/OTC execution

- Competitive trading fees and spread

- Tight spreads

- Supportive customer support

Share this article [addtoany url="https://55brokers.com/lcg-london-capital-group-review/" title="LCG"]

It’s nice

Really ?

Is https://www.lcg.fit/ genuine website ?

LCG Broker & Forex went factual broke 2018. It has been taken down from the stock exchange.

A complex restructuring has been established, The LCG broker has been taken away by Henri Charles Sabet for his own interest. He stepped down from the LCG Group, which is seeking capital ventures in new projects under its new structure.

Interesting to know that Sabet must have lost about 30 million Pounds since 2014, when he tookover LCG and tried to reestablisch the broker. He failed.

LCG is a forex and CFD agent without any capital or assets. So be carefull.

Follow up to my message.

I have just find this https://www.financemagnates.com/institutional-forex/regulation/frp-advisory-trading-limited-appointed-as-liquidator-of-lcg-holdings/

which confirms what I wrote last year. Now the previous ‘mother company’ and after the separation with LCG Broker & Forex, the new project, has now been taken out of business bu the London Courts. At the time of separation the LCG Broker & Forex

was responsable for a majority of debts, though Mr Sabet, bought it back in a swap deal (I guess against his shares in the holding through his vehicle GIO, or debts elimination) So that makes that LCG Broker & CFD is basically reverted to a Cyprus company (where Mr Sabet lives ?), without any stock exchange quotation. When I last asked for their annual return, I was answered, that such is no longer available; this makes sense, as smaller entities, not quoted, can be exempt of publishing their accounts. Basically a CFD & Forex broker provider, cannot or should never go broke, unless they pay their staff too much and make too many promotional cost.

Thanks for the info. Was never attractive with such high spreads, now its a on the avoid list for sure..

I want to open a account with you guys

How much spread?