- What is LCG?

- LCG Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

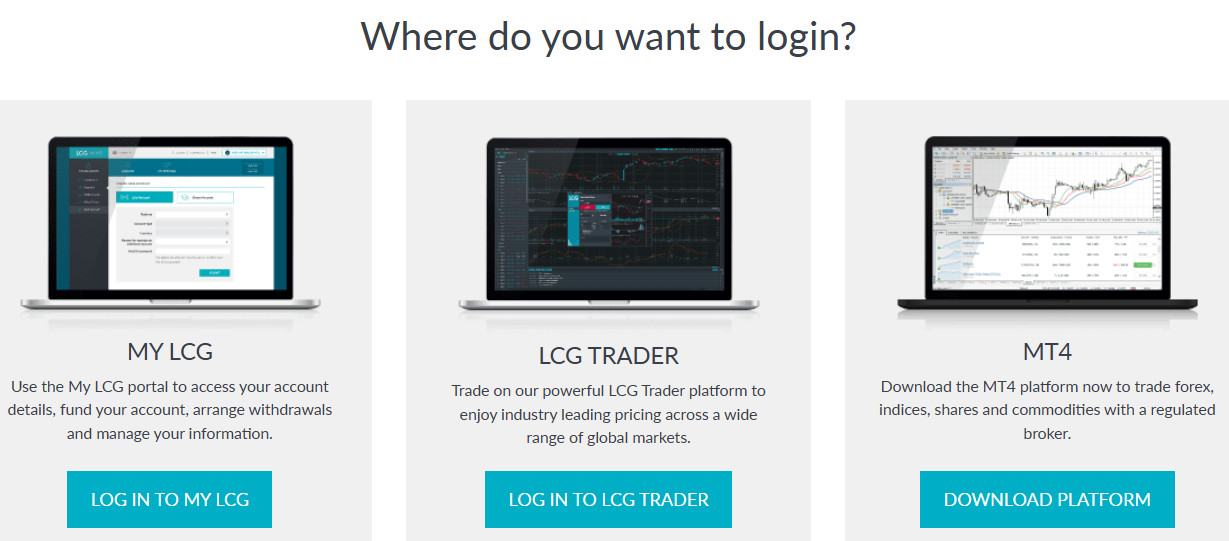

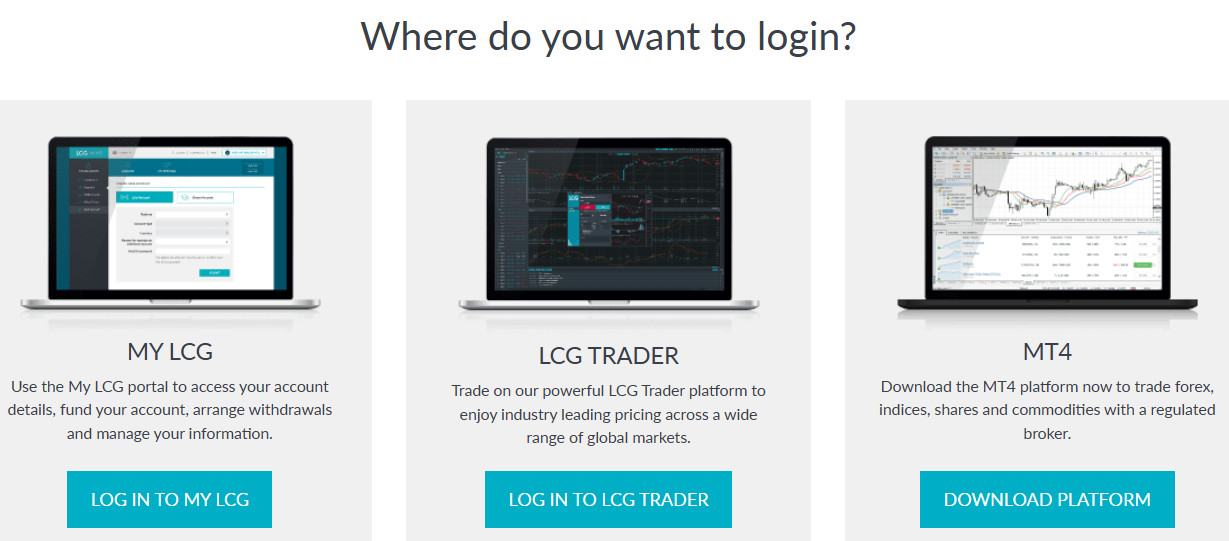

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- LCG Compared to Other Brokers

- Full Review of Broker LCG

Overall Rating 4.3

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4 / 5 |

What is LCG?

London Capital Group known as LCG is a CFD provider offering its clients over 7000 instruments across 9 asset classes including Forex, indices, shares, commodities, bonds, ETFs, and more.

The broker operates for about three decades in online trading providing competitive prices, advanced technology, and professional service for all types of traders.

LCG Pros and Cons

LCG is a reliable broker since it is listed in Stock and authorized by a top-tier authority FCA. There are numerous funding methods, ECN accounts, and an advanced range of instruments.

For the Cons, there is no proper learning and research section, spreads might be high for some instruments, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Regulated broker with a strong establishment | Conditions may vary according to regulation and entity |

| FCA license and overseeing | No 24/7 customer support |

| Competitive trading costs and spreads | |

| MT4 trading platform | |

| Forex and CFDs trading | |

| Suitable for beginners and professionals | |

| Quality customer support | |

LCG Features

LCG is a multi-asset broker offering a range of instruments, competitive spreads, and advanced platforms. With a focus on transparency, reliable execution, and professional conditions, LCG caters to all experience levels of traders.

LCG Features in 10 Points

| 🏢 Regulation | FCA, SCB |

| 🗺️ Account Types | Standard, ECN Accounts |

| 🖥 Trading Platforms | LCG Trader, MT4 |

| 📉 Trading Instruments | Forex, CFDs, Spread Betting (for UK residents only), ETFs, Shares, Bonds and Interest Rates, Indices, Commodities, Spot Metals, Vanilla Options |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | GBP, USD, EUR |

| 📚 Trading Education | Video Materials |

| ☎ Customer Support | 24/5 |

Who is LCG For?

LCG is designed for traders of all levels, from beginners looking for user-friendly platforms and popular instruments to advanced traders seeking tight spreads, ECN accounts, and professional tools. Based on our findings and financial expert opinions LCG is Good for:

- Beginners

- Advanced traders

- Professional trading

- Investing

- Traders from the UK

- International traders

- Currency and CFD trading

- ECN trading

- STP/OTC execution

- Competitive fees and spread

- Tight spreads

- Supportive customer support

LCG Summary

For final thoughts, LCG’s performance and reliability bring a safe environment and convenient conditions. General offering through the diverse range of products, the choice between the proprietary platform and the comfortable MT4 covers the demands of any trader with a different experience.

In addition, there is an option to trade through an ECN account, however, the minimum account balance required for an ECN account is quite high which is good for traders of bigger size only.

55Brokers Professional Insights

LCG stands out as a well-established and FCA-regulated broker, offering a diverse range of instruments suitbale for traders looking for good asset variety, good costs and seamless execution. One of its key advantages is the availability of both standard and ECN accounts, catering to different styles with competitive spreads starting from 0.0 pips on ECN accounts and commission charge for those strategy best suit this fee model.

LCG also provides access to industry-known platforms like MT4 and its proprietary web-based platform, so the choice is yours, along with good execution and advanced charting tools as per our tests done. Additionally, its commitment to transparency and security makes it a trusted choice for traders.

However, the broker has some limitations, such as the lack of extensive educational resources and research section compared to some competitors. Despite these drawbacks, LCG remains a good option for traders looking for a regulated and professional environment.

Consider Trading with LCG If:

| LCG is an excellent Broker for: | - Need a well-regulated broker.

- UK and international traders.

- Spread betting trading.

- Offering low leverage up to 1:30.

- Providing competitive fees and spreads.

- Quality educational video materials.

- Offering popular instruments.

- Secure environment.

- Providing proprietary platform.

- Offering MAM/PAMM trading. |

Avoid Trading with LCG If:

| LCG might not be the best for: | - Who prefer 24/7 customer service.

- Limited educational and research materials.

- Need broker with access to VPS Hosting and Copy Trading. |

Regulation and Security Measures

Score – 4.4/5

LCG Regulatory Overview

London Capital Group operates under strong regulatory oversight, ensuring a secure environment for its clients. The broker is primarily regulated by the FCA in the UK, one of the most respected financial regulators globally, which enforces strict compliance, client fund protection, and transparency standards.

In addition to its FCA regulation, LCG also holds a license from the Securities Commission of The Bahamas (SCB), which provides an offshore trading option with potentially more flexible conditions. While the SCB regulation allows for broader market access and higher leverage, traders should be aware that offshore entities generally have fewer investor protections compared to FCA-regulated accounts.

How Safe is Trading with LCG?

As a regulated brokering services provider, with about 30 years of experience, the broker is committed to strict rules of operation, while dealing with clients and their funds transparently, as well shows performance efficiency.

The confidence in secure funds storing is provided by the tailor-regulated rules, which include holding of client’s funds in a Tier 1 bank, full segregation of accounts, and participation in the scheme or compensation funds in case things go wrong with the Broker.

Moreover, LCG provides its clients with negative balance protection to guarantee that they will never lose more than they have in their accounts.

Consistency and Clarity

LCG has historically been recognized as a reputable broker, regulated by esteemed authorities. However, in recent years, LCG’s reputation has been marred by serious allegations and operational challenges. Clients have reported unauthorized position closures, platform malfunctions, and substantial financial losses. Consequently, in 2024, LCG was blacklisted by the crypto community due to its involvement in these scandals.

These developments have significantly tarnished LCG’s standing in the financial industry, overshadowing its previous accolades and contributions. Despite the controversies surrounding LCG in recent years, the broker has historically been recognized for its strong regulatory oversight, ensuring a degree of transparency and client fund protection.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with LCG?

LCG offers Standard and ECN Accounts to cater to different styles. The Standard Account is ideal for beginners, offering competitive spreads and conditions, while the ECN Account is designed for advanced traders seeking tighter spreads and direct market access with a commission-based structure.

LCG also provides swap-free accounts for traders who require Islamic-compliant conditions. Additionally, a demo account is available, allowing users to practice trading with virtual funds before committing to real capital.

Standard Account

The Standard Account at London Capital Group is designed for beginner and intermediate traders who prefer a simple, commission-free traexperience. This account offers competitive spreads, starting from around 0.8 pips on major Currency pairs. The minimum deposit amount to open the account is $100.

Traders with a Standard Account also have access to LCG’s MT4 platform and web-based platform, both providing a seamless experience with advanced charting tools. Additionally, LCG offers a swap-free version of the Standard Account, allowing traders to engage in trading without any overnight financing charges, which is particularly useful for Islamic traders.

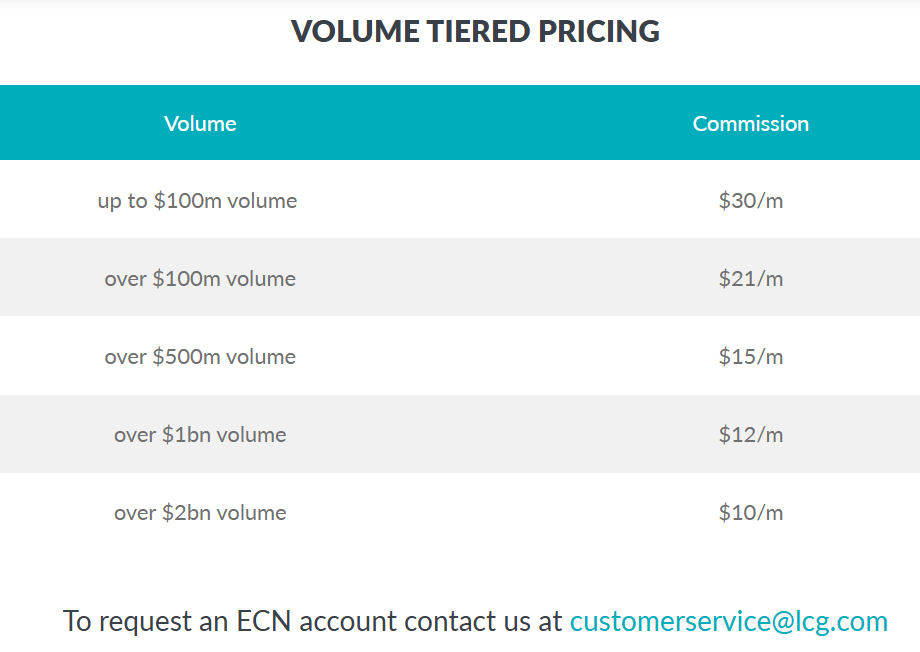

ECN Account

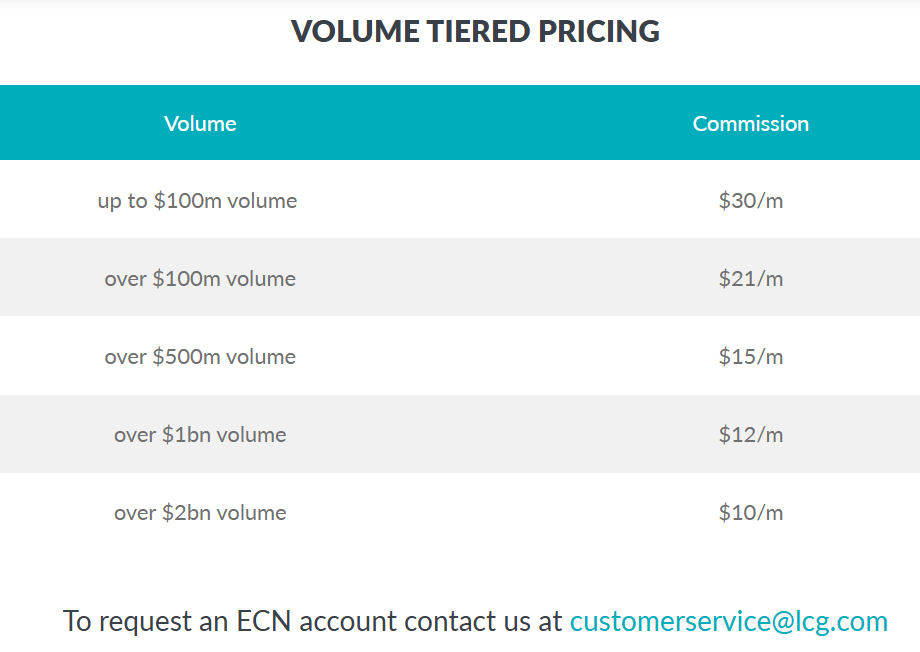

The ECN Account is for active traders who require direct market access, offering spreads starting from 0.0 pips on major Forex pairs. This account is perfect for traders who engage in high-frequency trading, scalping or require tight spreads to optimize their strategies.

The commission-based structure charges $30 per million traded, up to a volume of $100 million, ensuring competitive pricing and transparency in costs. To qualify for the ECN Account, traders must maintain a $10,000 account balance.

Regions Where LCG is Restricted

LCG’s services are restricted in certain regions due to regulatory and compliance requirements. The broker does not provide financial services in countries including:

- USA

- Australia

- Belgium

- Canada

- New Zealand

- Singapore

Cost Structure and Fees

Score – 4.4/5

LCG Brokerage Fees

LCG charges competitive brokerage fees depending on the type of account and trading activity. For the Standard Account, traders typically pay for trades through the spread, which starts from around 0.8 pips for major Currency pairs. The ECN Account, on the other hand, operates on a commission-based structure, charging $30 per million traded, up to a volume of $100 million, with spreads starting from 0.0 pips.

Additional fees may apply for withdrawal requests and inactivity, so traders should review the full fee schedule before opening an account.

LCG offers different spread conditions that vary depending on the traded instrument, with the average spread for EUR/USD of 0.8 pips. However, spreads may vary slightly between the two platforms that LCG uses.

ECN spreads start from 0 pips with no requotes for those who maintain a $10,000 balance along with a commission of $30 per $1,000,000 traded.

LCG operates on a commission-based structure for its ECN Account. Traders using this account type are charged a commission of $30 per million traded, up to a volume of $100 million. This commission structure allows traders to access tighter spreads, starting from 0.0 pips, while maintaining transparency in costs.

LCG offers swap-free accounts for traders who require Islamic-compliant conditions, meaning they can trade without incurring overnight financing charges. For traders who choose standard accounts, LCG applies rollover fees on positions held overnight, which vary depending on the instrument being traded, market conditions, and interest rate differentials. These fees are automatically calculated and can be either positive or negative, depending on the direction of the trade and the currency pair.

In addition to commissions and spreads, LCG also charges additional fees depending on the services provided. These include withdrawal fees, which apply when transferring funds from your account, and an inactivity fee of £15 per month on live accounts that have had no trading activity for 180 days (6 months). Being aware of these potential costs helps traders better manage their overall expenses.

How Competitive Are LCG Fees?

LCG’s fees are generally considered competitive, especially for traders who prioritize tight spreads and direct market access. The broker offers both Standard Accounts with no commission and ECN Accounts that provide tighter spreads starting from 0.0 pips, and operate on a commission-based structure.

While the Standard Account is more suited for those looking for simplicity and low cost, the ECN Account caters to active traders who require more advanced conditions, with slightly higher costs. Overall, LCG allows traders to choose the most suitable one based on their style and preferences.

| Asset/ Pair | LCG Spread | MEX Exchange Spread | MultiBank Spread |

|---|

| EUR USD Spread | 0.8 pips | 1.5 pips | 1.5 pips |

| Crude Oil WTI Spread | 3 pips | 0.03 | 0.03 |

| Gold Spread | 3 | 0.25 | 0.25 |

| BTC USD Spread | - | 58 | 58 |

Trading Platforms and Tools

Score – 4.5/5

LCG offers traders MetaTrader4, available for desktop, mobile, and tablet, and its proprietary platform LCG Trader, available for mobile and browser trading.

Trading Platform Comparison to Other Brokers:

| Platforms | LCG Platforms | MEX Exchange Platforms | MultiBank Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

LCG Web Platform

LCG Trader is a proprietary web-based platform designed for a seamless and intuitive experience. It features advanced charting tools, real-time market data, and a user-friendly interface.

The platform supports one-click trading, customizable layouts, and multiple asset classes, allowing users to execute trades efficiently. With a responsive design, LCG Trader is accessible from any web browser without requiring downloads, ensuring flexibility for traders who prefer a modern, web-based solution. Additionally, it integrates risk management tools and real-time analytics to help traders make informed decisions.

LCG Desktop MetaTrader 4 Platform

The MT4 platform offers a widely recognized experience with its advanced charting capabilities, a vast selection of technical indicators, and support for automated trading through Expert Advisors (EAs).

The platform enables fast execution speeds, multiple order types, and customizable strategies, making it ideal for traders who rely on technical analysis and algorithmic trading. Additionally, MT4’s user-friendly interface ensures a seamless experience, while its desktop application delivers enhanced stability and performance, allowing traders to manage their positions with precision.

Main Insights from Testing

Testing the MT4 platform revealed its reputation for reliable performance and fast execution speeds. The platform provides advanced tools, and the ability to easily customize strategies. Its intuitive interface makes it accessible for both new and experienced traders, while its support for automated trading through EAs offers significant advantages for those looking to automate their strategies.

However, the platform could benefit from enhanced mobile functionality for smoother operation on mobile devices. Overall, MT4 remains a solid choice for traders who value precision and customization.

LCG Desktop MetaTrader 5 Platform

LCG does not offer the MT5 platform, as it primarily provides the MetaTrader 4 for desktop users. Traders looking for the functionality of MT5 will need to consider alternative brokers that support the platform, as LCG’s offerings are limited to MT4 and its proprietary LCG Trader platform.

LCG MobileTrader App

The broker allows traders to access both LCG Trader and MT4 on their mobile devices, providing a seamless experience on the go. With the app, users can execute trades, monitor their positions, and access real-time market data from anywhere.

The LCG Trader mobile app offers the same intuitive interface and advanced charting tools available on the web platform, while MT4 on mobile provides traders with a robust set of technical indicators and the ability to trade using automated strategies. Both apps are optimized for mobile devices, ensuring smooth performance and flexibility for traders who need to stay connected to the markets at all times.

Trading Instruments

Score – 4.6/5

What Can You Trade on LCG’s Platform?

LCG offers over 7000 markets, including Forex, CFDs, Spread Betting (for UK residents only), ETFs, Shares, Bonds and Interest Rates, Indices, Commodities, Spot Metals, and Vanilla Options.

With a diverse selection of instruments, LCG caters to different strategies, from short-term speculative trades to longer-term investments.

Main Insights from Exploring LCG’s Tradable Assets

Exploring LCG’s tradable assets reveals a broad and diverse offering, catering to a variety of preferences. The broker provides access to global Forex markets, along with popular commodities, equities, and indices. The availability of CFDs on these assets allows traders to speculate on price movements without needing to own the underlying instruments.

While the range is extensive, some traders may find that certain niche markets or asset classes are less represented. Overall, LCG’s selection supports a wide range of trading strategies and risk profiles.

Leverage Options at LCG

Being a UK-regulated broker LCG follows strict guidelines set by the regulatory authorities. The multiplier levels fall under a particular set of rules like UK regulators set a limitation towards maximum offered leverage levels

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs, 1:20 for minor ones, and 1:10 for Commodities, etc.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at LCG

In terms of funding methods, LCG offers a few payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller

LCG Minimum Deposit

The minimum deposit required to open an account with LCG depends on the account type, with the Standard account requiring a deposit of $100. For those opting for an ECN account, the minimum deposit is $1,000, which grants access to tighter spreads and more advanced conditions.

Withdrawal Options at LCG

LCG withdrawals are smooth offering Bank Transfers and Card Payments. The clients under FCA may use bank transfers and cards as well, with additional options of Skrill and Neteller.

However, the clients should also be aware of any potential withdrawal fees and verify specific conditions with LCG’s customer support or account terms.

Customer Support and Responsiveness

Score – 4.4/5

Testing LCG’s Customer Support

Testing LCG’s customer support reveals that the broker offers 24/5 support to its clients, ensuring assistance is available during market hours. Phone lines and email support features are available for quick and efficient communication. The support team is responsive and knowledgeable, addressing queries and concerns promptly.

Additionally, LCG provides a comprehensive FAQ section to help traders troubleshoot common issues independently.

Contacts LCG

To get in touch with LCG, you can reach the customer support team through multiple channels. For inquiries related to sales, you can call 02074567575 or email sales@LCG.com. For customer service assistance, LCG offers the phone number +1 (0) 242 601 6866 and the email address customerservices.bhs@lcg-int.com. These contact options ensure that clients can easily get support for any questions or issues they may encounter.

Research and Education

Score – 4.3/5

Research Tools LCG

Both MT4 and LCG Trader offer a range of research tools designed to enhance the experience.

- Traders can access advanced charting tools with multiple chart types and timeframes, as well as a wide selection of technical indicators.

- Both platforms support one-click trading for fast execution, along with real-time market data to keep traders informed of the latest price movements.

- The platforms also offer customizable layouts and support various order types such as market, limit, and stop orders, providing traders with flexibility and control over their strategies.

Education

LCG’s educational resources are currently somewhat limited, with the main offering being video materials available on its YouTube channel. These videos cover a variety of topics, providing traders with insights into different strategies and market analysis techniques.

While the content is helpful, it may not be as extensive as some other brokers, who offer comprehensive educational programs including webinars, articles, and courses.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options LCG

LCG primarily focuses on Forex and CFDs; however, it also provides MAM/PAMM trading options, which are considered investment tools for those looking to invest in managed portfolios.

These services allow clients to allocate funds to professional traders who manage the investments on their behalf, making it a suitable choice for those who prefer a more hands-off approach to trading.

Account Opening

Score – 4.4/5

How to Open LCG Demo Account?

To open an LCG demo account, visit the broker’s website and navigate to the account registration section. From there, select the Demo Account option, where you will be asked to provide basic personal details such as your name, email address, and phone number.

After completing the registration, you will receive login credentials to access the demo account, which will allow you to trade with virtual funds on both the LCG Trader and MT4 platforms. The demo account is a great way to familiarize yourself with the platform, test different strategies, and gain hands-on experience without risking real money.

How to Open LCG Live Account?

Opening an account with LCG is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4/5

LCG offers a few other tools and functionalities to enhance the trading experience.

- The LCG Trader platform provides Client Sentiment indicators and a Depth of Market feature, offering valuable insights into market dynamics.

- Traders can also benefit from a customizable charting package, allowing them to tailor their environment to individual preferences.

LCG Compared to Other Brokers

When comparing LCG with its competitors, it stands out for its spread-based account offering with competitive conditions. While it offers a solid range of instruments and advanced platforms like LCG Trader and MT4, it may not have the same extensive asset variety as brokers like MEX Exchange or Saxo Bank, who provide access to tens of thousands of instruments.

In terms of regulation, LCG is regulated by the Top-Tier FCA, making it a trustworthy option, although brokers like Saxo Bank and Swissquote boast a wider range of global regulatory licenses.

Educational resources at LCG are somewhat limited, which is a drawback when compared to brokers like Saxo Bank and City Index, who offer a comprehensive suite of learning materials.

Overall, LCG provides a solid trading experience with competitive fees and a user-friendly platform, though it might not offer the same depth of features or asset variety as some of the larger, more established brokers in the industry.

| Parameter |

LCG |

MEX Exchange |

Saxo Bank |

City Index |

Swissquote |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.8 pips |

Average 1.5 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $30 per $1,000,000 traded |

0.0 pips + $7 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + €2.50 |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

LCG Trader, MT4 |

MT4, MT5 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT4, MT5, Swiss DOTS, TradingView |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

7,000+ instruments |

20,000+

instruments |

71,000+ instruments |

13,500+ instruments |

400+ Forex and CFDs instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FCA, SCB |

ASIC, CySEC, MAS |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FINMA, FCA, CySEC, MFSA, DFSA, SFC |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Excellent |

Good |

Good |

| Minimum Deposit |

$100 |

$50 |

$0 |

$0 |

$1,000 |

$0 |

$0 |

Full Review of Broker LCG

LCG is a well-established online broker, offering a good experience with a focus on Currency and CFD markets. Regulated by the FCA the broker provides a secure environment for both retail and institutional traders. It offers two main platforms, catering to different styles with advanced charting tools, order execution capabilities, and ease of use.

LCG’s account offerings include Standard and ECN accounts, with competitive spreads and commissions, providing flexibility for traders based on their preferences. The broker also offers MAM/PAMM trading, enabling professional traders to manage multiple clients’ funds.

With its regulatory standing, competitive fees, and user-friendly platforms, LCG remains a good choice for traders looking for a seamless trading experience in the Forex and CFD markets.

Share this article [addtoany url="https://55brokers.com/lcg-london-capital-group-review/" title="LCG"]

It’s nice

Really ?

Is https://www.lcg.fit/ genuine website ?

LCG Broker & Forex went factual broke 2018. It has been taken down from the stock exchange.

A complex restructuring has been established, The LCG broker has been taken away by Henri Charles Sabet for his own interest. He stepped down from the LCG Group, which is seeking capital ventures in new projects under its new structure.

Interesting to know that Sabet must have lost about 30 million Pounds since 2014, when he tookover LCG and tried to reestablisch the broker. He failed.

LCG is a forex and CFD agent without any capital or assets. So be carefull.

Follow up to my message.

I have just find this https://www.financemagnates.com/institutional-forex/regulation/frp-advisory-trading-limited-appointed-as-liquidator-of-lcg-holdings/

which confirms what I wrote last year. Now the previous ‘mother company’ and after the separation with LCG Broker & Forex, the new project, has now been taken out of business bu the London Courts. At the time of separation the LCG Broker & Forex

was responsable for a majority of debts, though Mr Sabet, bought it back in a swap deal (I guess against his shares in the holding through his vehicle GIO, or debts elimination) So that makes that LCG Broker & CFD is basically reverted to a Cyprus company (where Mr Sabet lives ?), without any stock exchange quotation. When I last asked for their annual return, I was answered, that such is no longer available; this makes sense, as smaller entities, not quoted, can be exempt of publishing their accounts. Basically a CFD & Forex broker provider, cannot or should never go broke, unless they pay their staff too much and make too many promotional cost.

Thanks for the info. Was never attractive with such high spreads, now its a on the avoid list for sure..

I want to open a account with you guys

How much spread?