- What is KVB Global?

- KVB Global Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- KVB Global Compared to Other Brokers

- Full Review of Broker KVB Global

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.2 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.6 / 5 |

| Additional Tools and Features | 4.1 / 5 |

What is KVB Global?

Based on our findings, KVB Global provides a range of financial services including global foreign exchange and securities brokering, systems and liquidity providing, corporate treasury management platforms and hedge, wealth management, financial IT solutions, and many more. It also offers a variety of financial instruments such as Forex, derivatives, precious metals, and bulk commodities trading.

The brokerage company allows traders to access a variety of services like risk monitoring, transaction monitoring, price engines, and reporting tools.

Incorporated companies or representative offices are established in various global jurisdictions, including Sydney and Melbourne in Australia, Auckland in New Zealand, Toronto in Canada, Beijing, Hong Kong, Taipei in China, and many other international cities.

KVB Pros and Cons

According to our research, the company has a good reputation and strong establishment with exceptional trading conditions. The account opening is fast, and there is a good choice between trading platforms and financial markets. The broker primarily specializes in providing Treasury, Liquidity Management, FX, and Payment solutions to Corporations and individuals.

For the cons, the trading proposal depends on the entity, and the instruments might be limited to more professional traders rather than beginners and regular traders. As well as there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Top-tier ASIC license and oversight | Limited number of trading instruments |

| Competitive transparent trading fees and spreads | No 24/7 customer support |

| Fast execution | Conditions might vary based on the entity |

| Access to MT4 bridging | |

| Available for international trading | |

KVB Global Features

As a multiple-regulated broker with many years of experience, the company provides customized wealth management and planning programs to meet the respective financial needs of enterprises and individual clients at different stages. For more insight into the broker’s proposal, view different aspects of trading with KVB Global compiled for a quick view:

KVB Global Features in 10 Points

| 🗺️ Regulation | ASIC, FSP, MSB |

| 🗺️ Account Types | Various Account Types based on the entity |

| 🖥 Trading Platforms | MT4, KVB EFX Platform, GCFX mobile app |

| 📉 Trading Instruments | Forex, derivatives, precious metals, bulk commodities, etc. |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 1.2 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | EUR, USD, GBP, AUD, CAD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is KVB Global For?

KVB Global offers unique services that are mostly suitable for professional or institutional clients. Based on our expert opinion, the broker’s proposal might not meet everyone’s needs, and is a better match for the following:

- Traders from Australia

- International traders

- Currency trading

- Advanced traders

- Professional trading

- Scalping/Hedging strategies

- STP/NDD execution

- Range of trading instruments

- Traders who prefer the MT4 trading platform

- Clients who prioritize more advanced platforms

- Competitive fees and spreads

- EA/Auto trading

KVB Global Summary

KVB is a reputable brokerage firm that offers a range of trading services and financial instruments, including Forex and derivatives, precious metals, and bulk commodities trading. The company also provides various account types tailored to different investment needs, such as Forex trading accounts, global settlement accounts, virtual accounts, and stock trading accounts.

Our review shows a company with a global presence and strong position within the financial industry due to its advanced proposals in terms of solutions and investment services. The company provides not only competitive brokerage services but a vast range of financial technologies to choose from.

55Brokers Professional Insights

KVB Global is a tightly regulated broker with a long history of operations. The broker provides well-defined services to corporations and individuals, with a focus on more professional services. Among the available services are global settlement and payment, corporate FX management, securities investment, wealth management, FinTech system, and platform integration.

The broker holds multiple licenses from respected authorities in Australia, New Zealand, Canada, Hong Kong, China, and Singapore. Based on our research, the broker’s proposal varies based on the jurisdiction. Under different entities, clients have access to different account types, with varying conditions, and trading platforms. Among the available platforms are KVB Global’s advanced proprietary platforms, GCFX and eFX 2.0. The platforms allow traders to enjoy seamless functionality, real-time execution, advanced capabilities, and transparent transactions.

KVB Global prioritizes innovative and advanced technology, risk monitoring, and account customization. Traders can also reach the broker 24/5 through multiple methods of communication and find dedicated and helpful guidance.

Also, we found that there are no extensive educational materials, as the broker’s services are mainly directed at professional clients.

Consider Trading with KVB Global If:

| KVB Global is an excellent Broker for: | - Advanced traders

- Corporate clients

- Australian traders

- Traders favoring multi-platform access

- Traders looking for multi-language platforms

- Clients looking for competitive conditions

- Traders who prioritize top-tier regulation and stringent oversight |

Avoid Trading with KVB Global If:

| KVB Global is not the best for: | - Beginner traders

- Retail traders

- Investors looking for copy trading

- Traders looking for MAM and PAMM accounts |

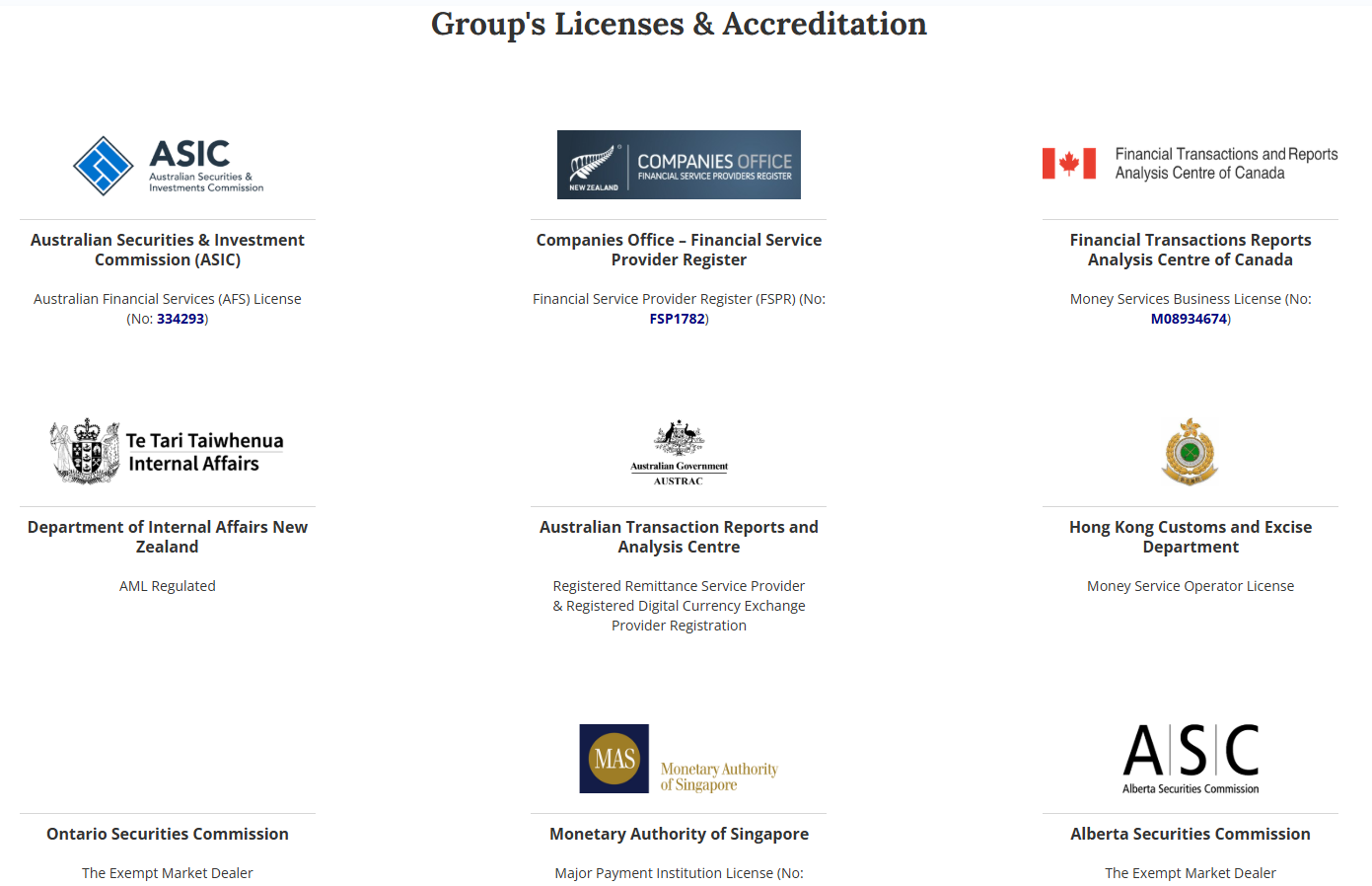

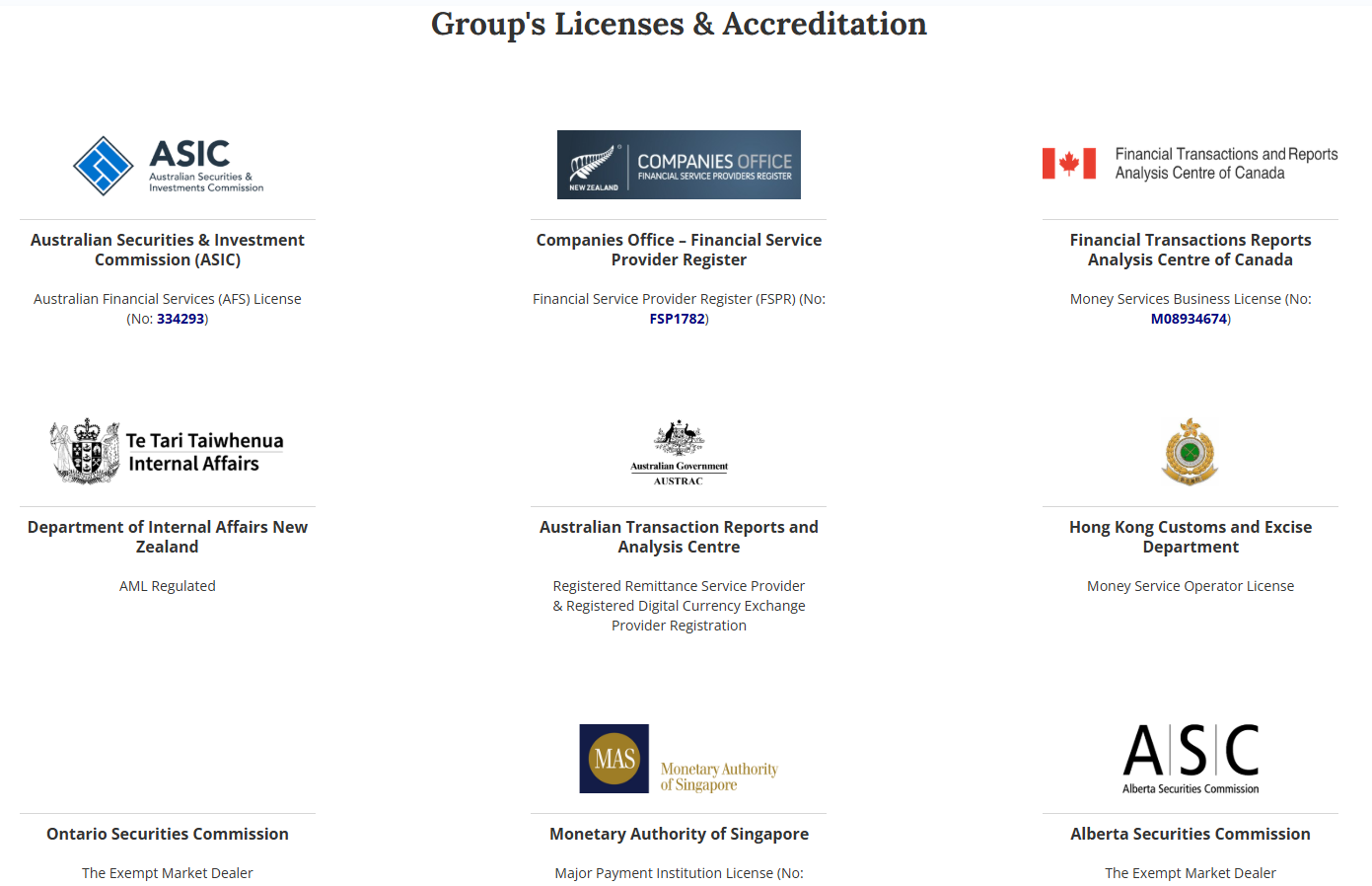

Regulation and Security Measures

Score – 4.5/5

KVB Global Regulatory Overview

KVB Global is a legit and regulated company with many subsidiaries that are respectively licensed and supervised by the local governmental authorities regarding financial services.

- KVB Global is regulated in multiple regions and authorised in Australia, New Zealand, Canada, Hong Kong, Singapore, Indonesia, and more.

- The mentioned entities are a part of the company’s network that hold respective licenses locally, ensuring strong compliance with laws and rules in each region.

How Safe is Trading with KVB Global?

According to its heavy regulation by many entities, the registration provides a clear state of operation, along with fund security and customer protection. The procedures involve proper control systems, adequate accounting, and capital maintenance, as well as the transparency of offered services.

Consistency and Clarity

We have reviewed the broker from the viewpoint of consistency and transparency. As we found, the broker was founded in 2001 and has been consistent in its development and expansion of services. The broker has also obtained multiple licenses in various regions to provide its services, aligning with local requirements.

In addition, the company’s professionalism was recognized and confirmed by numerous awards that confirm its credibility.

We have also reviewed real feedback from traders, which, in our opinion, is essential. In general, traders have provided positive feedback on KVB Global’s trading conditions and services. However, there are also negative reviews and concerns. Thus, traders should conduct their research before deciding to sign up with KVB Global.

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with KVB Global?

Based on our findings, the company offers a range of account types. The account types depend on multiple conditions, including the type of investment and the entity under which the account is opened. The broker offers a separate account for Forex trading, which enables customers to trade foreign currency pairs, precious metals, China, global stock indexes, and commodities.

Another account is for Global Settlement and corporate Forex management, which provides enterprise-grade solutions for foreign exchange management and includes multi-currency virtual accounts.

The company also provides an account for stock trading in Hong Kong and several international stock markets.

- Under its Indonesian entity, the broker offers Cent, Classic and Plus account types. The Cent account enables traders to start with small deposits, starting from $10, giving access to Forex, commodities, and indices. The Classic account requires a $200 initial deposit and provides fixed spreads, starting from 1.2 pips, and fixed $1 commissions. The Plus account, on the contrary, has a higher minimum deposit requirement ($5,000) and offers floating spreads from 0.0 pips, combined with $7 commissions.

Regions Where KVB Global is Restricted

Based on our research, KVB Global is available internationally, and it continuously expands its reach worldwide. The broker is strictly licensed in multiple regions, ensuring its accessibility and credibility. However, due to regulatory reasons, the broker’s services are not provided in certain regions.

- The United States of America

- Canada

- Israel

- Iran

- North Korea

Cost Structure and Fees

Score – 4.4/5

KVB Global Brokerage Fees

Our research revealed transparent and competitive fees, providing clarity and predictability of the applicable charges. The fee structure of the company varies depending on the type of account and trading instrument being used, as well as the entity under which the account is opened. For Forex trading accounts, the company charges a spread fee which can range from as low as 0.1 pips to as high as 10 pips, depending on the currency pair being traded.

It is important to note that the broker may also charge additional fees, which comprise the overall charges for each trade.

The broker offers low spreads, typically 1.2 for EUR/USD, combined with high rebates and no commissions, ensuring cost-efficiency for traders. The quotes are provided by international banks with precise 5-digit quotes, available through customizable window layouts, ensuring powerful capability for any strategy.

Based on our findings, KVB Global integrates trading fees into spreads and does not charge transaction fees. This fee structure is favorable for beginner or intermediate traders, whereas more professional clients would likely prefer fixed commissions for each trade, providing more predictability.

How Competitive Are KVB Global Fees?

We have carefully reviewed the broker’s fee structure and the applicable charges to see how KVB Global aligns with the market standards and average fees. As we have found, the broker provides tight spreads and does not charge any commissions. The proposal is particularly appealing to Forex traders and those looking for cost-effective solutions with minimum additional charges.

From the viewpoint of its trading costs, the broker can be appealing to both retail traders and professional clients. However, the broker’s fees depend on various factors, such as the jurisdiction, the account type, the instrument traded, and others.

| Asset/ Pair | KVB Global Spread | EC Markets Spread | BP Prime Spread |

|---|

| EUR USD Spread | 1.2 pips | 1.1 pips | 0.3 pips |

| Crude Oil WTI Spread | 0.029 pips | 0.45 | 0.01 |

| Gold Spread | 0.62 pips | 2.8 | 0.01 |

KVB Global Additional Fees

In addition to the mentioned charges, KVB Global includes a few extra fees, such as swaps for overnight positions and deposit fees, depending on the funding method.

- The overnight charges are based on the instrument traded and account types. We recommend that traders check long and short swaps for each instrument.

- We also found that for international transfers, there is a $25 funding fee.

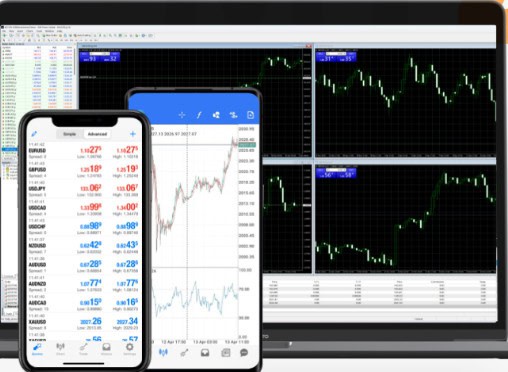

Score – 4.4/5

There are a few options for the trading platform offered by the broker, which also depends on the kind of investment or trading clients do with the broker. The proprietary platform ForexStar includes PC and mobile versions, enabling access to trading anywhere in the world through the developed platform based on MT4 technology.

| Patforms | KVB Global Platforms | Hirose Financial Platforms | EC Markets Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

KVB Global Web Platform

KVB Global offers a functional and sophisticated web platform for those who prefer to trade without prior installations. The web platform includes great charting tools, technical indicators, one-click trading, different order types, real-time quotes, a personalized interface, and fast execution. The platform also allows access to a good range of tradable products.

All in all, the web platform integrates ease of use, advanced features, and trading capabilities.

KVB Global Desktop MetaTrader 4 Platform

KVB Global offers the widely used MT4 platform, providing its clients with extensive charting capabilities, automated trading support, multiple order types, nine timeframes, and push notifications. In addition, the platform is enhanced with risk management functions that include pending orders, regular records, and capabilities to monitor market conditions.

The platform is available through different operating systems, including macOS, Windows, iOS, Android, and Google Play.

KVB Global eFX 2.0 Platform

The broker also offers an online electronic FX Trading Platform, eFX 2.0, which combines real-time trading with flow management capacity. The platform enables placing orders with real-time technical analysis, chart features, and expert reviews with immediate confirmation. The eFX platform is excellent for retail and professional traders, offering a functional and easy-to-use bilingual interface.

KVB Global GCFX MobileTrader App

The broker also offers the GCFX currency trading mobile platform, allowing traders access to the foreign exchange market, with access to over 129 currency pairs. The platform ensures powerful tools, automatic synchronization with bank feeds, competitive exchange rates, XERO integration, access to a Virtual account, and other advanced features. Traders can open a GCFX platform and enjoy secure and effective trading, with seamless execution, online payment capabilities, and competitive rates. The app successfully combines advanced and extensive features with functionality and flexibility.

Main Insights from Testing

Based on our research, KVB Global offers a range of retail and professional platforms, enabling traders great efficiency and flexibility through advanced and innovative features. The platforms are available in web, desktop, and mobile versions. The broker’s MT4 platform includes extensive analytical tools and features with an easy-to-use interface. Other exclusive offerings are the broker’s eFX 2.0 platform and the GCFX mobile app.

AI Trading

Based on our research, the broker does not allow AI trading. Although AI solutions are added to the offerings of many brokers, KVB Global has yet to adopt AI tools and features. For now, traders are open to using Copy trading offered by the broker and automation tools.

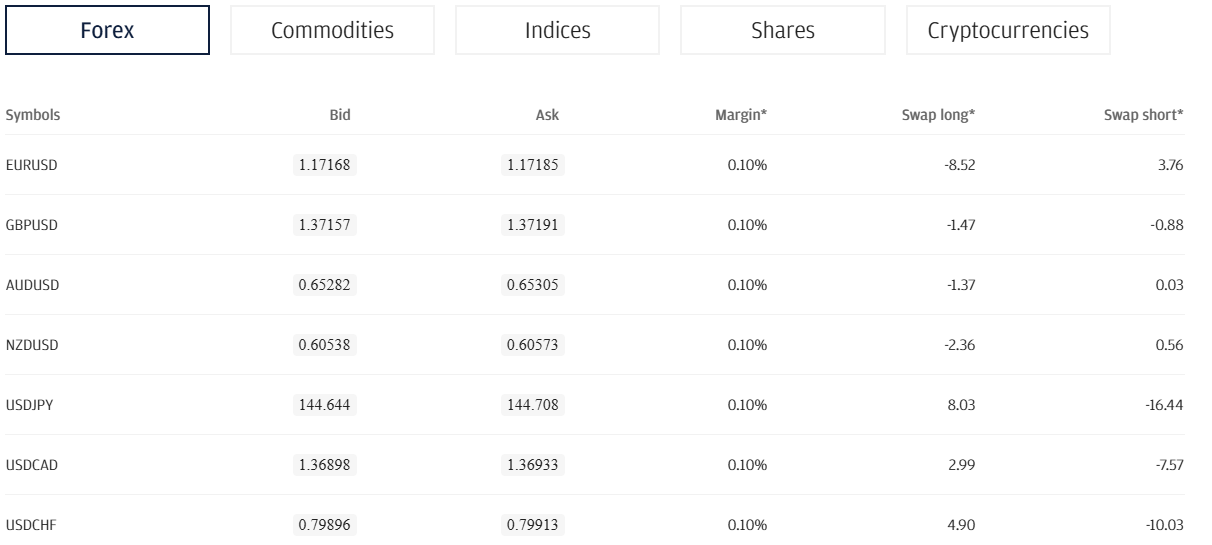

Trading Instruments

Score – 4.3/5

What Can You Trade on the KVB Global Platform?

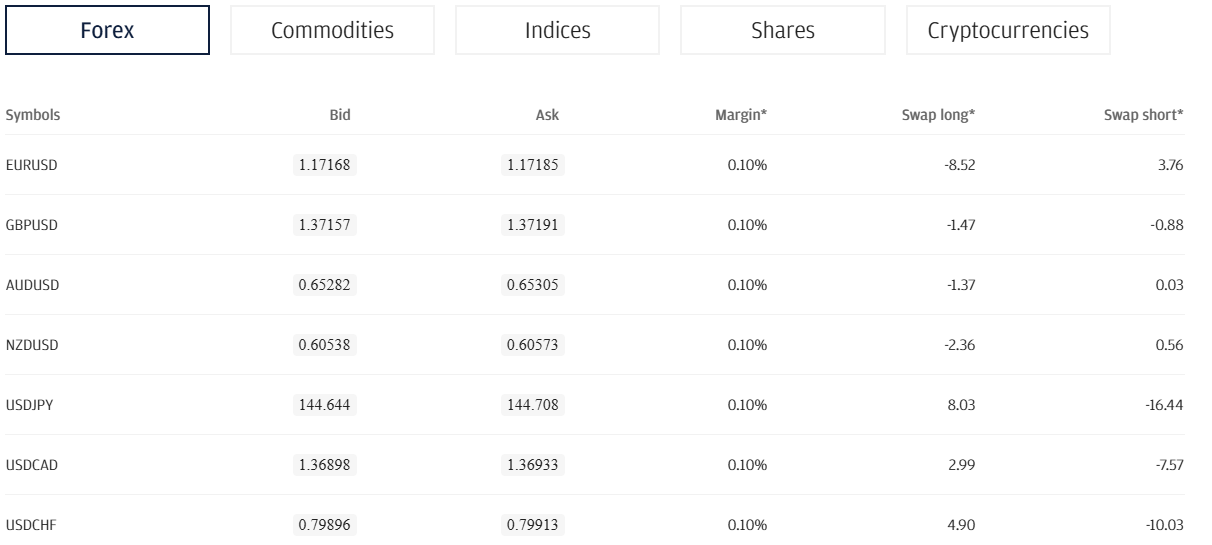

KVB Global is a tightly regulated non-banking company that specializes in retail and corporate trading, treasury, liquidity management, FX, and global payments. The broker’s proposal depends on the entity, including the availability of instruments.

According to our test trade, the broker provides a variety of financial investment products that are designed to meet individual needs and requirements, along with investment and fund management. The broker offers over 40 currency pairs, 7 major global indices, major commodities like gold, silver, and oil, and multiple Stock CFDs.

Main Insights from Exploring KVB Global Tradable Assets

Based on our research and insight into the broker’s available tradable products, KVB Global offers over 60 trading instruments across Forex, commodities, indices, futures, shares, and cryptocurrency under certain entities.

Traders can access about 40 major, minor, and exotic currency pairs with low spreads and competitive trading conditions. Clients can also trade major commodities, shares on CFDs, and popular indices, such as the FTSE 100, Dow, SPX 500, and more. Depending on the entity, the broker also offers cryptocurrency trading, including Bitcoin, Litecoin, Ethereum, Solana, etc.

All in all, the availability of tradable products depends on the entity, and as the broker operates under multiple jurisdictions, the conditions may be very different. We recommend checking conditions and making sure they align with your expectations before opening an account under any entity of KVB Global.

Leverage Options at KVB Global

The use of leverage in trading can lead to significant gains or losses, depending on how it is used. It is essential to understand how the leverage works and the risks its use includes.

KVB leverage is offered according to the ASIC, FSP, and MSB regulations:

- The maximum leverage level for Australian clients is 1:30.

- International traders may use a high leverage of up to 1:1000.

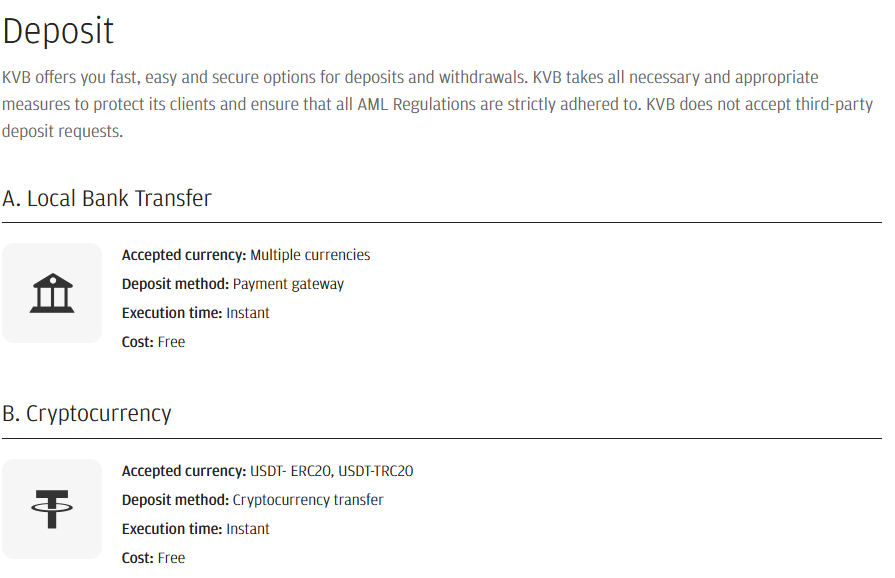

Deposit and Withdrawal Options

Score – 4.4/5

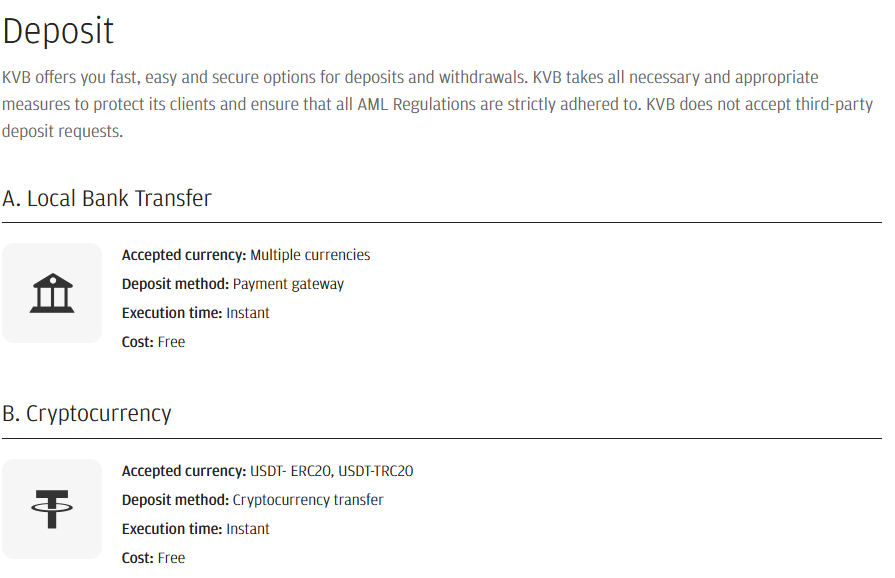

Deposit Options at KVB Global

Clients can use a modest range of payment options, including card payments, local bank transfers, and Cryptocurrency transfers.

The deposits with KVB Global are instant, ensuring safe and quick transactions with no additional fees. However, whereas the broker does not charge deposit fees for bank transfers, there might be certain transaction fees.

Minimum Deposit

The broker offers different funding opportunities that vary based on the account type and the entity. However, the minimum deposit for the broker’s Cent account is as low as $10.

Withdrawal Options at KVB Global

Withdrawals at KVB Global are made through the Client area. Traders can withdraw their funds via the same method they used for deposits. Generally, withdrawals are processed in an average of 2 hours. All the payments undergo a strict security check, and sometimes the broker might request additional documents for the sake of security.

Customer Support and Responsiveness

Score – 4.5/5

Testing KVB Global Customer Support

With KVB Global, traders can take advantage of 24/5 customer support through Live chat, Phone lines, and email. The support team includes trading experts who assist with technical support, analysis recommendations, general inquiries, and operational issues.

- Traders can also access the FAQ section, where they can find information on the most common trading-related questions. Many concerns and issues can easily be solved if traders follow the section’s guidelines.

Contact KVB Global

Based on our research and experience with the broker, the support team is dedicated and helpful, providing quick answers through various channels:

- The Live chat is the most flexible and functional way for traders to direct their questions and receive answers within minutes.

- The broker also provides email addresses for its different entities. Clients should check the information on the broker’s Contact Us section and find the email for each entity. Here we mention the email address that the clients can use under the Australian entity: melcs@kvbgc.com.

- Those who prefer talking directly to the support team can use either of the provided phone numbers for each entity. The phone number we mention here is for the clients under the ASIC jurisdiction: 1300 668 120.

- Besides, clients can find useful information on the broker’s social media pages, including LinkedIn, Facebook, and WeChat.

Research and Education

Score – 4.2/5

Research Tools KVB Global

KVB Global includes comprehensive research tools that allow clients to conduct in-depth analyses and make informed decisions based on them. The research tools the platforms offer are advanced and innovative. In addition, traders can access the following tools through the broker’s website:

- The Newsflash section includes daily news snapshots to help traders keep track of the events in the market.

- The economic calendar informs traders about the potential economic events that can impact the market.

- At last, the Market Analysis section provides clients with essential analysis of the market, various assets and instruments, and the latest developments to let them make decisions based on substantial analysis.

Education

We researched the broker to find what educational materials it offers. However, there is no evidence that KVB Global provides any learning materials, such as trading manuals, articles, videos, e-books, or webinars. This is perhaps because the broker’s services are directed at professionals rather than beginners.

Is KVB Global a Good Broker for Beginners?

KVB Global is a well-established broker with a reliable trading environment and competitive trading conditions. The broker’s offerings are diverse and may meet different needs. KVB also provides various account types with low initial deposit requirements. Thus, this can be a favorable choice for cost-conscious traders. However, the broker’s services are also tailored for professional and corporate clients with a strong emphasis on this. This is why the broker does not include an educational section, which can make it an unfavorable choice for novice traders.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options KVB Global

We have carefully reviewed the broker’s proposal of trading instruments and investment opportunities. Based on our findings, KVB Global offers a limited range of instruments based on CFDs, which eliminates the chances of traditional investments.

However, the broker offers copy trading, which enables traders to make alternative investments. Copy trading allows traders to copy the trades of professionals and gain profits.

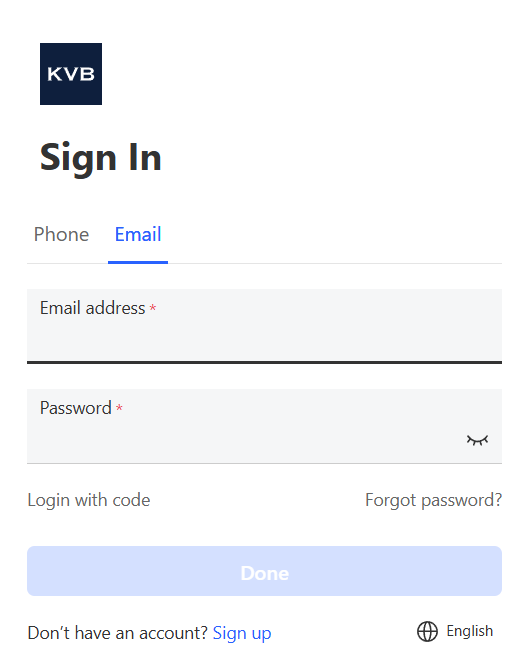

Account Opening

Score – 4.6/5

How to Open a KVB Global Demo Account?

The availability of a demo account is essential for any trader to gain skills and practice new strategies. Opening a demo account with KVB Global is simple. Clients need to go to the broker’s website, create a live account, and choose the MT4 platform. After creating a live account, they just need to select the demo version right on the platform and practice in demo mode until they feel confident enough to switch to a live account.

How to Open a KVB Global Live Account?

Opening an account with KVB Global is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Start Trading” button.

- Enter the required personal data (name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow up with the money deposit.

Score – 4.1/5

We have reviewed KVB Global’s proposal based on different jurisdictions to see what trading conditions, opportunities, and features each entity offers. Not all the features and tools are available for all of the broker’s websites; however, here are what additional opportunities we have found:

- The Cashback Bonus, available for KVB Prime, enables traders to receive a bonus for their deposits. For instance, for making a $500 deposit, traders get 20% of their deposit ($100). To claim the bonus, there are predefined terms to satisfy. If the terms are not met within 90 days, the bonus expires.

- The broker also organizes competitions for its clients. There are competitions for demo accounts and live accounts. At the end of the competition, the winners receive rewards.

KVB Global Compared to Other Brokers

It is essential to compare the broker’s offerings to other good-standing brokers and see how they align with the market expectations and how they stand out from others.

One of the strongest points of KVB Global is its multiple licenses from well-respected authorities, including ASIC, FSP, MSB, and many others. Two other brokers, Saxo Bank, and CMC Markets, are also tightly regulated by ASIC, DFSA, FCA, MAS, CBUAE, FCA, BaFin, IIROC, FMA, and MAS, ensuring an additional layer of protection and security.

Based on our comparison of the brokers’ fees, KVB Global offers average spreads that include all the trading costs. Most other brokers offer similar spreads, or a little lower, like CMC Markets with 0.5 pips, and commissions for the commission-based accounts, combined with very low spreads. On the other hand, KVB Global does not apply commissions.

As to the trading platforms, KVB Global offers a range of platforms, from the market-popular MT4 to more professional solutions. Saxo Bank offers its proprietary platforms only, while Fusion Markets stands out for its extensive platform selection.

The aspect KVB Global lacks in comparison to the other reviewed brokers is the availability of instruments. While the broker offers only 60 tradable products, traders can access 13,500 products with the City Index, gaining an exclusive chance to diversify their trades and portfolios.

| Parameter |

KVB Global |

Fusion Markets |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

Accuindex |

| Spread-Based Account |

Average 1.2 pips |

Average 0.92 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 1.5 pips |

| Commission-Based Account |

No commissions |

0.0 pips + $2.25 per side |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

0.0 pips + $2.5 per side |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, KVB EFX Platform, GCFX mobile app |

MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT5, WebTrader |

| Asset Variety |

60+ instruments |

250+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

300+ instruments |

| Regulation |

ASIC, FSP, MSB |

ASIC, VFSC, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

ASIC, VFSC, FSA |

| Customer Support |

24/5 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/7 |

| Educational Resources |

Not Provided |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$10 |

$0 |

$0 |

$0 |

$100 |

$0 |

$100 |

Full Review of Broker KVB Global

After carefully reviewing all the aspects of trading with KVB Global, we conclude that the broker is a reliable choice for many. Its services are well-defined and directed to not only retail traders but also corporations and individuals, with a focus on more professional services. The broker offers services in global settlement and payment, corporate FX management, securities investment, wealth management, and more.

KVB Global offers the market-popular MT4 platform and additional advanced and innovative professional platforms for more advanced and corporate traders. Clients can also access automated trading and copy trading, ensuring more opportunities for traders.

However, the range of instruments is limited. The broker offers over 40 major, minor, and exotic Forex pairs, popular commodities, and global indices. Under certain entities, traders can also access cryptocurrencies. However, the overall 60 tradable products available are considered a limited proposal and will not be the best choice for traders who want to diversify their portfolios. The minimum deposit requirement is $10, a favorable offering for clients who want to start small.

KVB Global does not include educational materials. Yet, the research section includes an Economic Calendar, Market Analysis, and Newsflash. Also, clients have access to various campaigns and bonuses to enhance their trading experience.

Share this article [addtoany url="https://55brokers.com/kvb-kunlun-review/" title="KVB Global"]