- What is IUX?

- IUX Pros and Cons

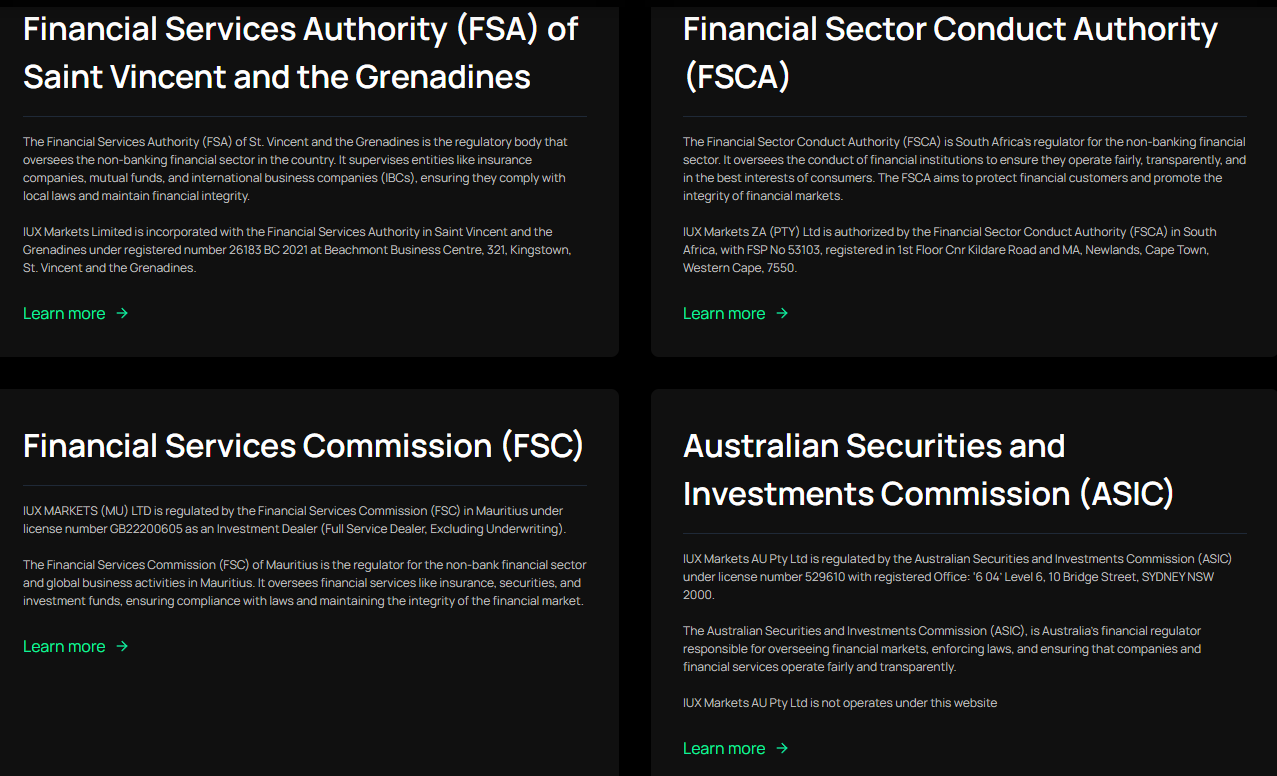

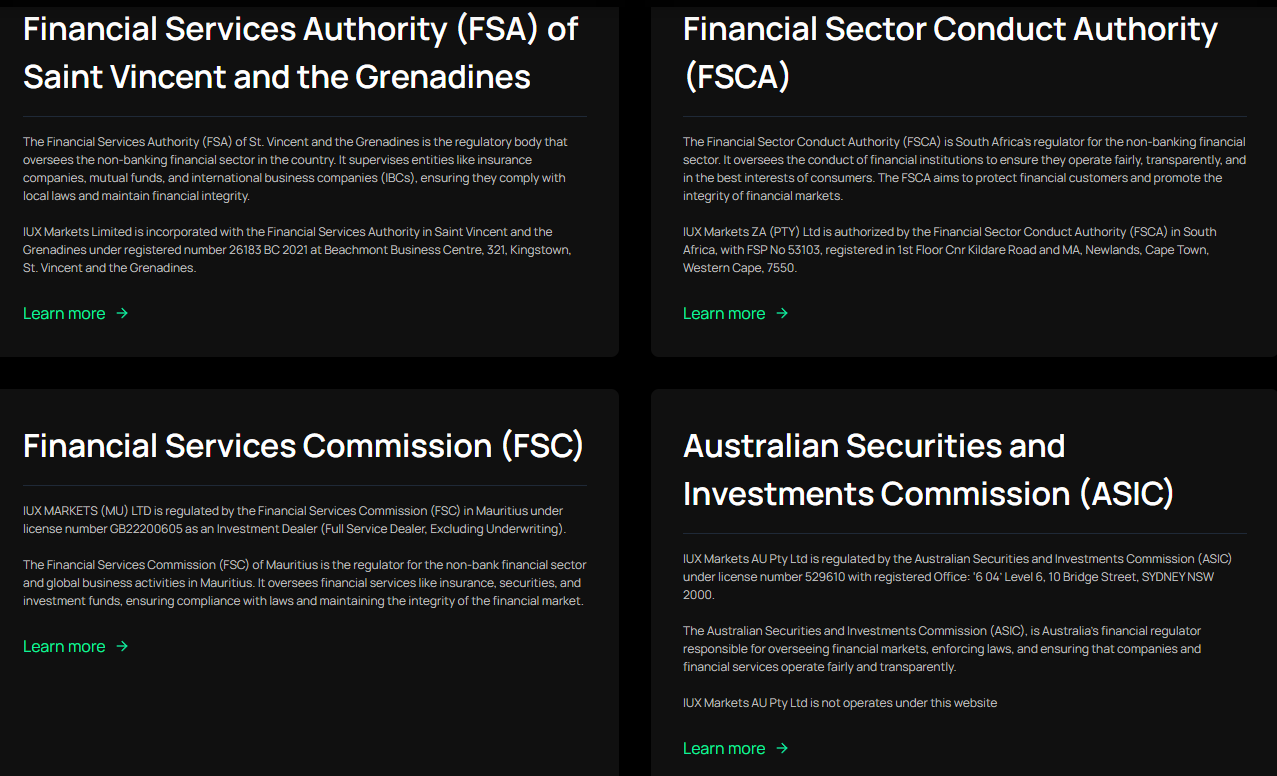

- Regulation and Security Measures

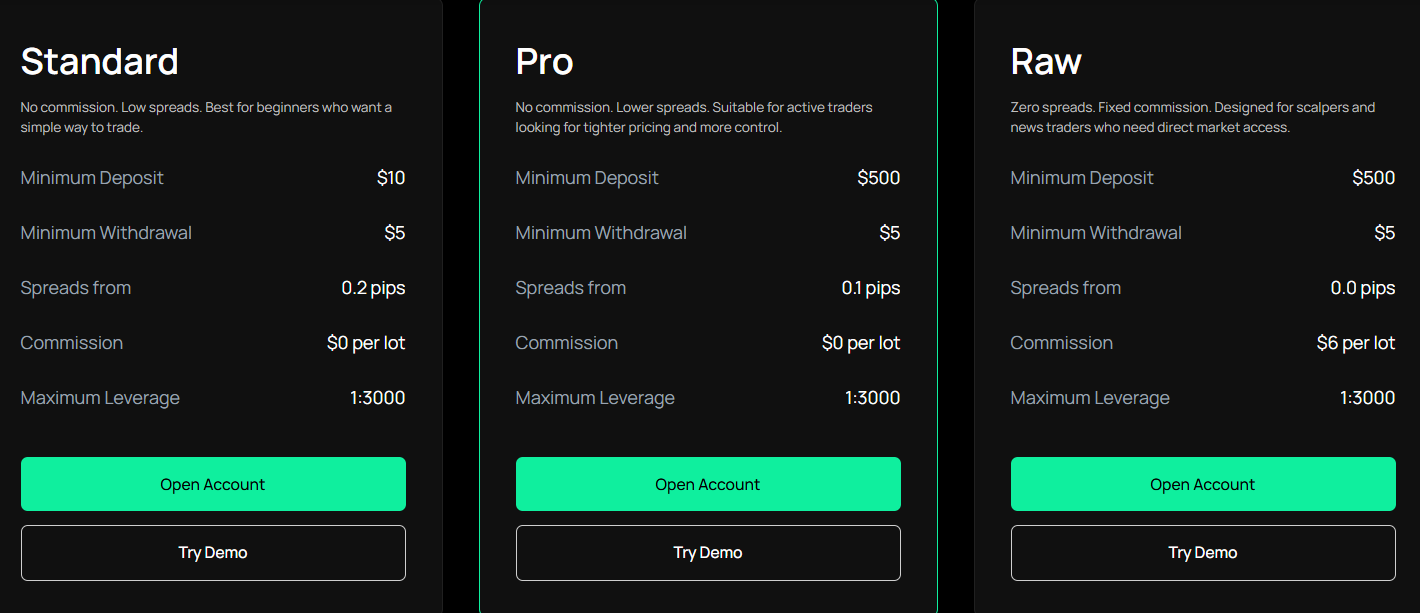

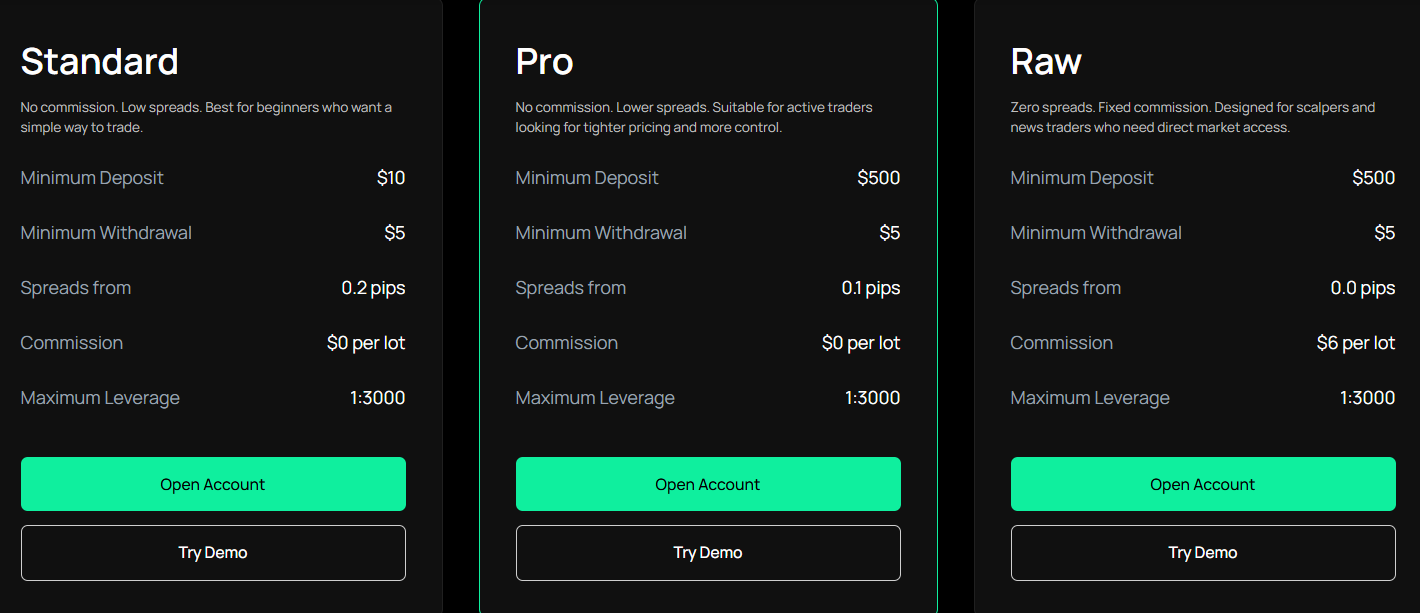

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

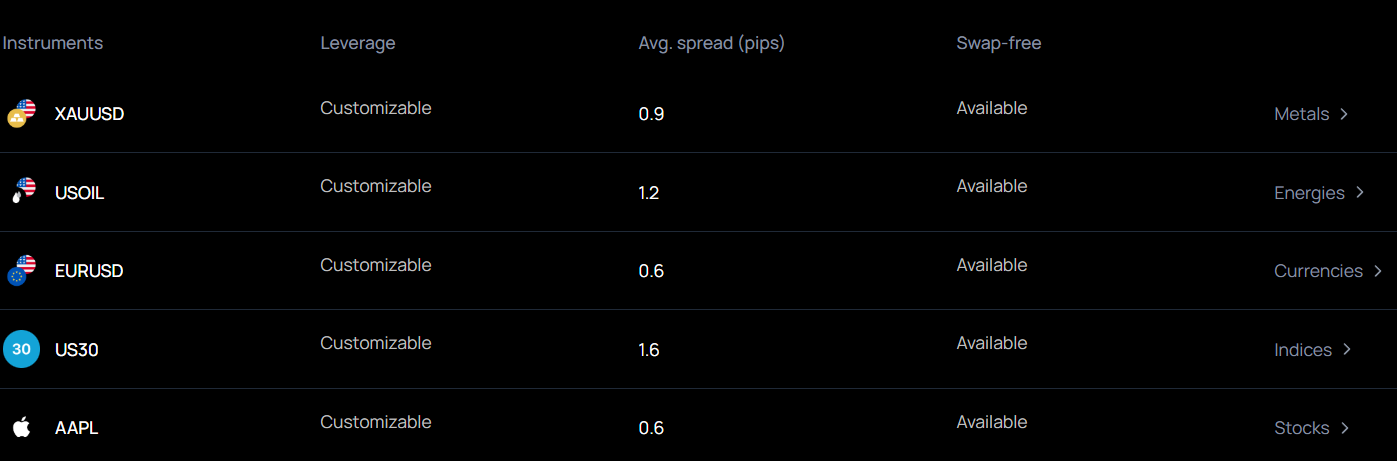

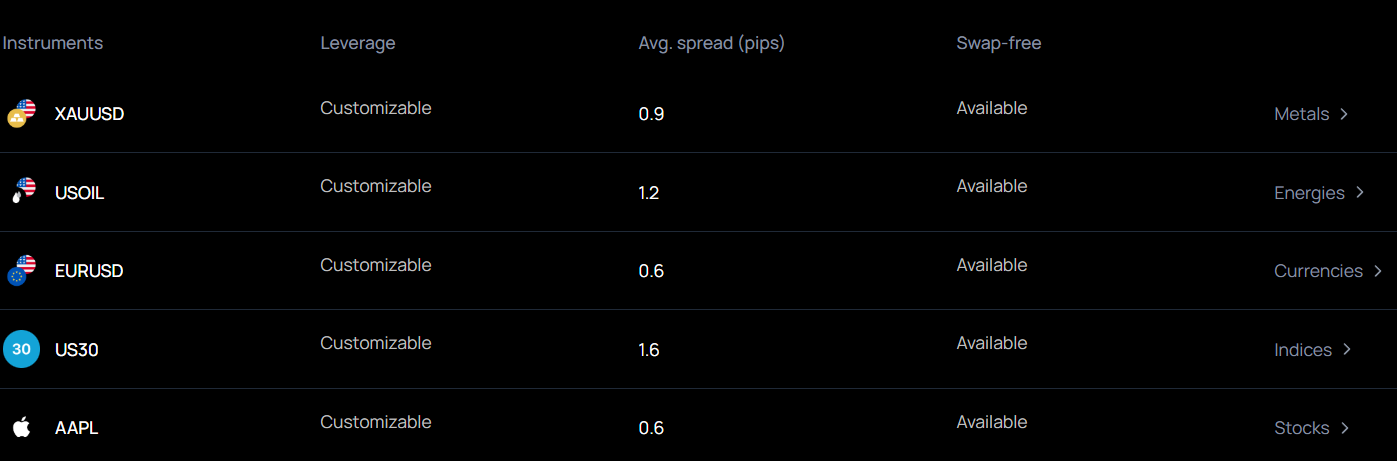

- Trading Instruments

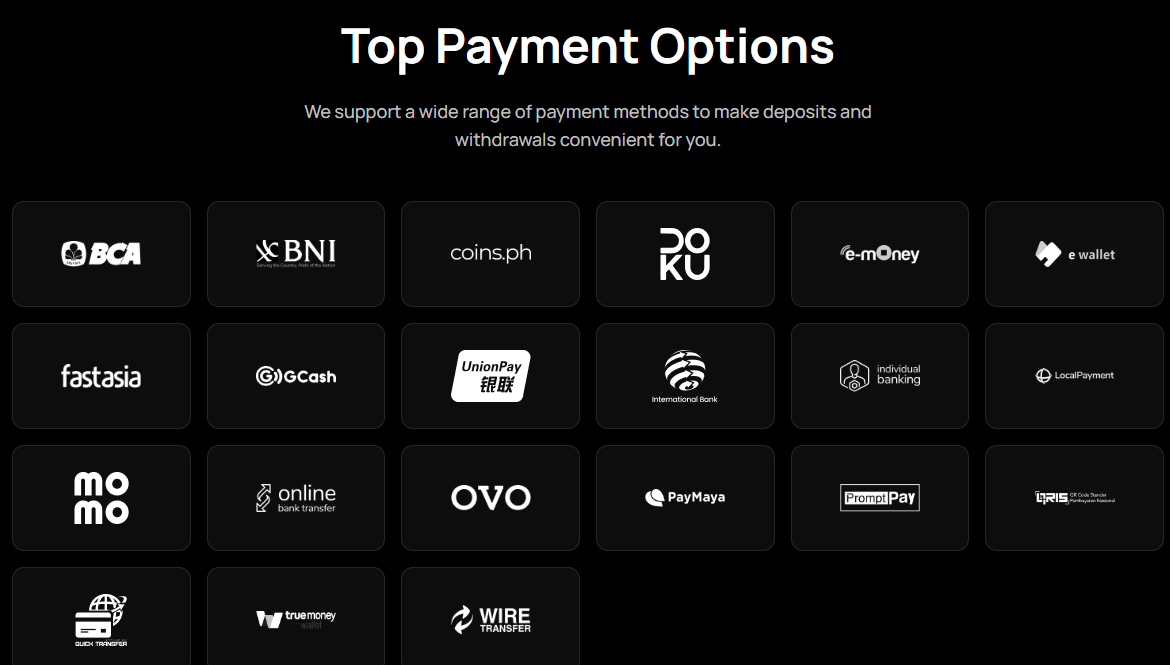

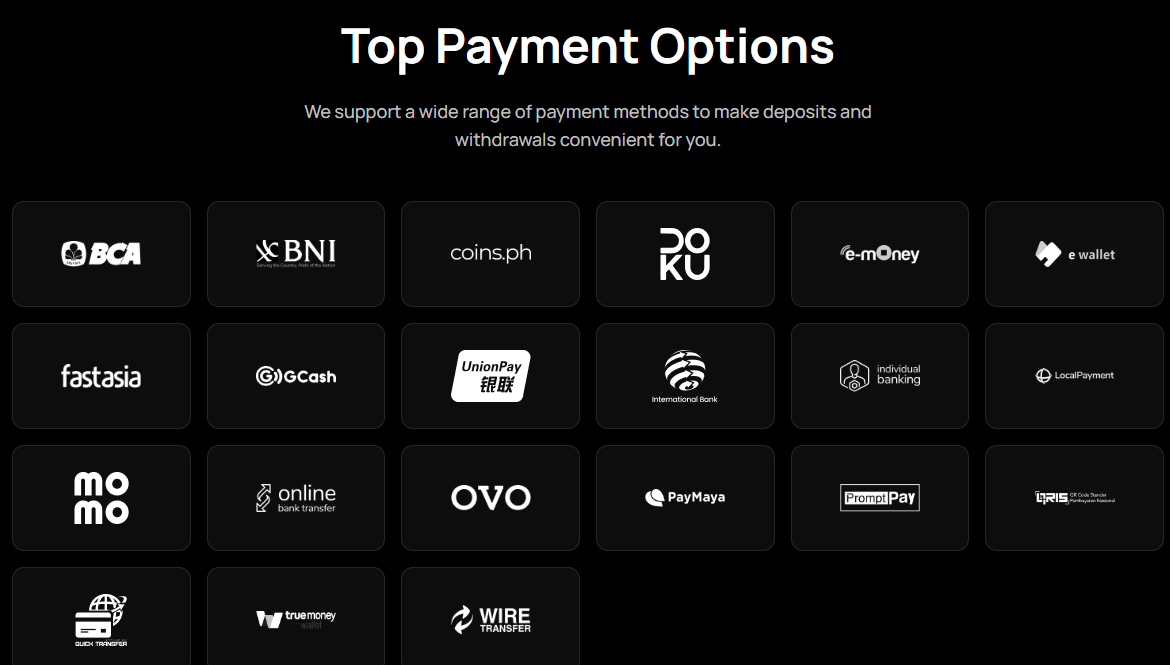

- Deposit and Withdrawal Options

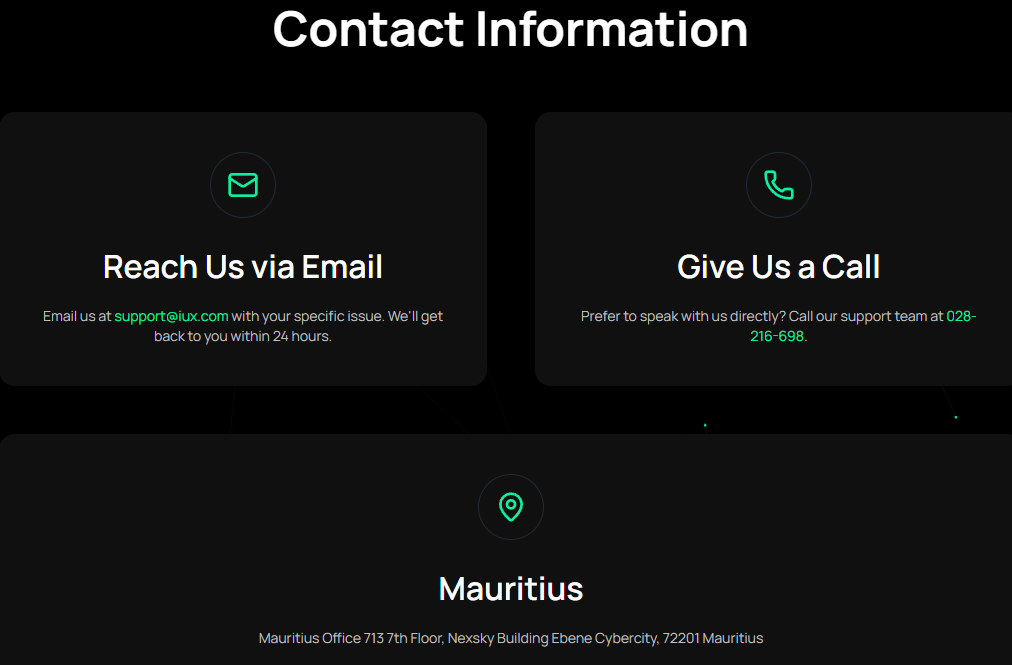

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

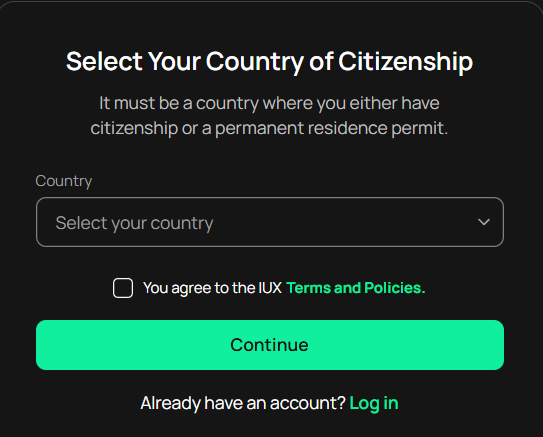

- Account Opening

- Additional Tools And Features

- IUX Compared to Other Brokers

- Full Review of Broker IUX

Overall Rating 4.3

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.3 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.6 / 5 |

| Additional Tools and Features | 4 / 5 |

What is IUX?

IUX is an online CFD Broker and trading provider that operates through several entities. Being a regulated broker with licenses from ASIC and the South African FSCA, it is considered a safe option for different traders. Additional licenses include SVG for International trading.

Although the broker’s initial headquarters is in Cyprus, we could not find any significant licenses under the Cyprus regulators.

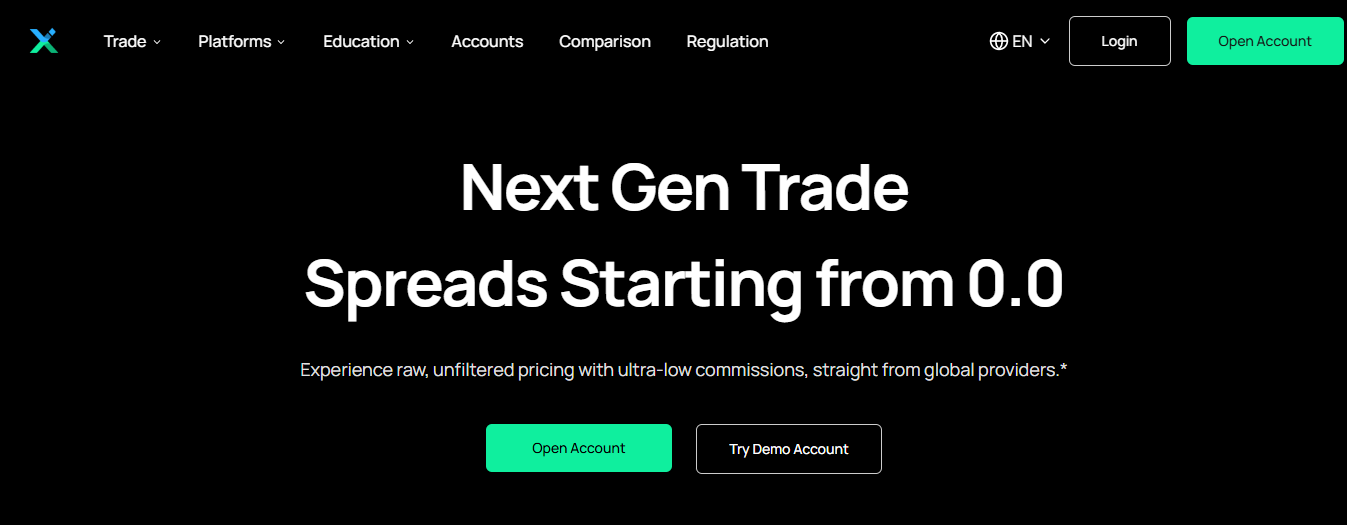

As we found, IUX includes competitive trading conditions with access to a range of markets, including Forex, Precious Metals, Energy CFDs, Indices, Stock, and Crypto CFDs. There are good options between account types and pricing models. In addition to industry-leading software and extensive tools, IUX offers tight spreads, liquidity, and fast trade execution.

IUX Pros and Cons

As our research has found, IUX is a reputable broker with a strong adherence to regulatory standards. Spreads offered by IUX are competitive and kept considerably low, enhancing cost-effectiveness for clients. We also noted a wide range of account types, allowing clients good diversity. The minimum deposit starts from $10, which is very pleasant for all traders.

The available leverage is also very high, exceeding the market average at 1:3000 and providing traders with extra opportunities for potential returns. There is 24/7 support and some support materials provided, which is another advantage.

Yet, IUX is a new broker in the industry, which is not a disadvantage, yet many traders prefer brokers with a solid reputation and background. Also, educational materials are limited, which might restrict beginner traders.

| Advantages | Disadvantages |

|---|

| Regulated by FSCA | Regulatory oversight vary based on entity |

| A license from ASIC | Education is rather basic |

| 1:3000 Leverage | |

| Low spreads and Low Minimum Deposit | |

| Wide range of instruments | |

| 24/7 online support | |

IUX Features

IUX is considered a reliable broker with favorable trading conditions suitable for various traders. It includes a diverse range of instruments and low-cost brokerage fees. A summary of the key aspects is as follows:

IUX Features in 10 Points

| 🗺️ Regulation | FSCA, FSA, ASIC |

| 🗺️ Account Types | Standard, Pro, Raw accounts |

| 🖥 Trading Platforms | MT5, IUX WebTrader |

| 📉 Trading Instruments | Forex, Stocks, Indices, Crypto, Commodities |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | USD |

| 📚 Trading Education | Articles, Basic Courses |

| ☎ Customer Support | 24/7 |

Who is IUX For?

IUX is tailored for diverse clients who seek robust and cost-effective trading solutions. Based on our findings and financial expert opinions, IUX is well-suited for:

- STP Execution Type

- Professionals

- Traders from the African region and international trading

- Currency Trading and CFD Trading

- MT5 platform

- Hedging

- Low spreads

- High leverage

- EA Trading

- Suitable for a Variety of Trading Strategies

- Good customer support

IUX Summary

We found IUX to be a well-established, customer-oriented broker with a secure and regulated trading environment. IUX might be suitable for various types of traders, and its services and trading conditions are attractive, especially with the low costs and spreads across various account types.

Yet, the broker’s education is rather basic. The instrument range includes the popular products and does not offer the widest diversity. Overall, we rank IUX as a good quality broker and an option to consider.

55Brokers Professional Insights

IUX combines safety and reliability with attractive features and a favorable trading experience. It offers a competitive fee structure, with both spread and commission-based account types, so is a suitable option for various strategies either for long term use or day trading. The account availability is diverse and meets different trading expectations. The broker offers low pricing, with an average of 0.2 pips.

IUX also includes advanced platforms with quite good research tools, real-time market data, which attract active traders and is grrat tool for eer trader that we enjoyed too. The broker also offers a few educational resources, including articles and courses tailored for beginner, intermediate, and experienced traders.

One of the most essential aspects is the broker’s tight regulations, so is considered safe choice to trade. Its services align with several requirements and guidelines of authorities, opening doors to Australian and African markets as big advance. However, as the broker operates under several entities, trading conditions and safety measures also differ based on the jurisdiction.

Consider Trading with IUX If:

| IUX is an excellent Broker for: | - Traders looking for a user-friendly and advanced platform

- Clients appreciating low costs

- The MT5 platform enthusiasts

- Clients looking for very high leverage opportunities

- Traders who prioritize quick and smooth deposits and withdrawals

- The South African clients

- International clients |

Avoid Trading with IUX If:

| IUX is not the best for: | - Long-term investors

- Clients looking for platform diversity

- Real stock investors

- Beginner traders searching for extensive educational resources |

Regulation and Security Measures

Score – 4.5/5

IUX Regulatory Overview

IUX is a reliable brokerage company regulated by multiple entities with tight rules and guidelines on the broker’s operations.

UX Markets ZA (PTY) Ltd operates under the authorization and regulation of the Financial Sector Conduct Authority (FSCA) in South Africa, a prominent regulatory body in the African region.

As IUX constantly expands its proposal, it has gained a license from the Australian Securities and Investments Commission (ASIC), a highly-regarded authority, which means that the broker has gained even more reliability.

- Another license the broker holds is under the SVG, an offshore regulation. While the latter does not provide robust protection measures, it ensures international expansion. As the broker already holds well-regarded licenses, it is considered a safe option.

How Safe is Trading with IUX?

IUX provides client protection and proper management of funds to guarantee safety, which includes the separation of client funds from the broker’s operational funds and safeguarding clients’ assets.

- Besides, as a regulated broker, the company is constantly monitored in terms of service delivery and practices. Due to this stringent oversight, there is almost zero risk of market manipulation or misleading, an essential point for traders to understand, especially when trading with solely offshore brokers that do not provide the same safety measures.

Consistency and Clarity

Based on our expert findings, IUX is considered a reliable broker with favorable trading conditions suitable for various traders and good service. In a short period, the broker has managed to gain over 650,000 active traders, with 70+ million withdrawals each month. These numbers speak to the broker’s trustworthiness and the trust it has from its clients.

Besides, the services are constantly enhanced and expanded to more regions, making the broker available worldwide. Despite being a new broker, IUX has managed to get positive feedback from its clients. Traders indicate the broker’s various account types and favorable conditions, the low minimum deposit requirement, easy deposits, and withdrawals. The high leverage availability is also alluring for many clients.

However, we have also encountered negative feedback from clients, with complaints about slow customer service, issues with withdrawals, and more. Thus, clients who consider opening an account with IUX should consider both positive and negative feedback and understand how they can benefit from the broker.

Another essential point is the difference in trading conditions and safety measures between jurisdictions.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with IUX?

IUX provides traders with four account types: Standard, Pro, and Raw. All accounts support the MT5 platform and the broker’s own software. The main differences between accounts are the pricing model, either built into spreads or commissions. This range is quite convenient, so traders can select the account type and platform that best aligns with their trading preferences. All three account types allow very high leverage of 1:3000, although this also depends on the entity and the instrument traded.

However, depending on the country of residence, account specifications, and the products available for trading, they may vary.

- The Standard account is a spread-based account, with average spreads starting at 0.2 pips. The account has a $10 initial deposit requirement, with a minimum withdrawal of $5.

- The Pro account is another spread-based option, with lower spreads that start from just 0.1 pips. To open the Pro account, clients need to make a higher deposit of $500.

- The Raw account is the only commission-based account with a $6 per lot fee, combined with spreads from 0.0 pips. The deposit requirement for this account is $500, which is still considered an average offering.

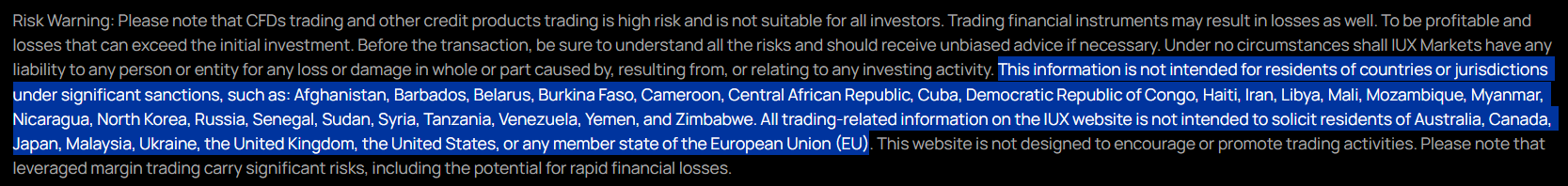

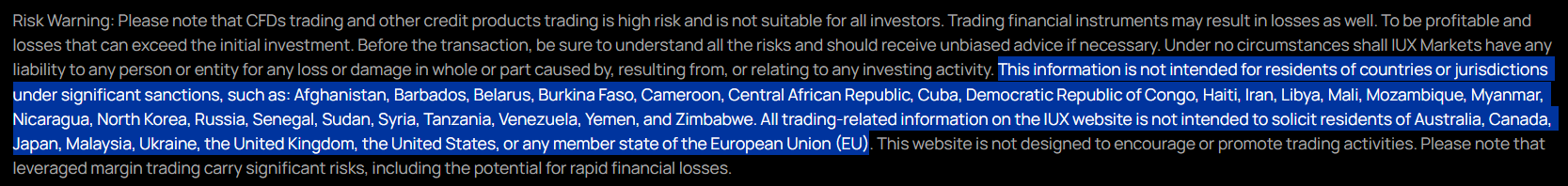

Regions Where IUX is Restricted

The broker holds several licenses, making its services available worldwide. However, due to regulatory reasons, the residents of the following countries are restricted from opening accounts with IUX:

- Afghanistan

- Barbados

- Belarus

- Burkina Faso

- Cameroon

- Central African Republic

- Cuba

- Democratic Republic of Congo

- Haiti

- Iran

- Libya

- Mali

- Mozambique

- Myanmar

- Nicaragua

- North Korea

- Russia

- Senegal

- Sudan

- Syria

- Tanzania

- Venezuela

- Yemen

- Zimbabwe

- Canada

- Japan

- Malaysia

- Ukraine

- the United Kingdom

- United States

Cost Structure and Fees

Score – 4.5/5

IUX Brokerage Fees

While investigating IUX, we discovered that the broker does not impose fees for deposits or withdrawals, which is an advantage for traders.

Regarding commissions, depending on the account type traders choose, the fee structure is either fully built into the spreads or is based on commissions with very low spreads. Overall, the trading fees are lower than the market leverage and will attract cost-conscious traders.

If traders choose the Standard or Pro accounts, fees will be integrated into the spreads. For the Standard account, spreads start from 0.2 pips, while the Pro account offers spreads from 0.1 pips. It is a competitive proposal, as our testing revealed that the broker’s offering is much lower than the industry standards.

IUX offers only one commission-based account, the Raw account. The commissions for this account type are in line with the market average and are $3 per side per lot, combined with spreads from 0.0 pips. This offering is especially beneficial for more seasoned traders who prioritize fixed and predictable fees for each trade.

How Competitive Are IUX Fees?

We find IUX fees highly competitive and the lowest in the industry. The broker offers very low costs for all of its account types. The spread-based accounts have spreads on average of 0.2 pips, some of the lowest we came across in the market. The commission-based account also offers reasonable charges with commissions of $3 per side per lot, which is again an average offering.

Besides, the broker does not have hidden fees, and the offering is overall transparent and clear. There are also no deposit or withdrawal fees, another advantage for clients looking for favorable pricing.

| Asset/ Pair | IUX | ATFX | Deriv |

|---|

| EUR USD Spread | 0.2 pips | 1.8 pips | 0.5 pips |

| Energy CFDs | 3 | 3 pips | 3.6 pips |

| Gold Spread | 1.4 | 3.8 pips | 0.015 |

| BTC USD Spread | 6.4 | - | 50.2 |

IUX Additional Fees

IUX stands out for its competitive fees and transparent practices. The broker does not charge many additional fees. For instance, clients do not pay deposit or withdrawal fees. Also, the broker does not apply an inactivity fee, another advantage for many clients.

- The broker also has a swap-free structure; however, note that there might still be certain conditions when swaps are applied.

Score – 4.3/5

IUX mainstays on the popular MT5 platform, a software regarded by most traders due to its sophisticated yet intuitive environment. Besides, IUX developed its own IUX Web Trade and IUX App Trade for mobile and Web Trading.

| Platforms | IUX Platforms | ATFX Platforms | Deriv Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

IUX Web Platform

We have tested the broker’s proprietary web terminal to see how it aligns with the market standards and trading expectations. The Web platform is an advanced and convenient option to have a desktop experience through the browser. Traders can access charting tools with customizable layouts, one-click order execution, and risk management tools.

The platform is easily accessible from any browser, with no installation required. Traders can easily execute complex orders, track performance with detailed analytics, and access real-time data. All in all, the broker’s web platform ensures functionality and flexibility, ensuring an efficient market experience.

IUX Desktop MetaTrader 4 Platform

We found that IUX does not offer one of the most sought-after platforms in the market, MT4, which is highly preferred by beginner traders. However, clients can benefit from the newer and better-equipped platform version, MetaTrader 5.

IUX Desktop MetaTrader 5 Platform

We tested the broker’s MT5 platform to find that it features great charting capabilities, multiple time frames, and diverse order types. It also allows access to algorithmic trading by expert advisors and numerous custom indicators.

Traders can benefit from real-time market data and news updates, as well as great capabilities for technical analysis, indicators, add-ons, and other great features that the MT5 platform is known for. The MT5 is also available through web and mobile, making the platform more accessible to users.

IUX MobileTrader App

IUX Mobile App is well-designed, packed with essential tools and capabilities. We liked the intuitive features, the spectrum of charts, simple indicators, and drawing tools, along with full control over orders and good monitoring features. The app is available for both Android and iOS devices.

Main Insights from Testing

Our research revealed that IUX does not provide the popular MT4 platform. Yet, the availability of the MT5 platform through desktop, web, and mobile versions ensures the efficiency of trades. The broker also offers its proprietary IUX web and mobile-based platforms. The sophisticated features and capabilities make the available platforms a perfect choice for any trader.

AI Trading

The clients of IUX can benefit from automated trading; however, the broker does not provide fully AI-powered capabilities. Those clients looking for full AI solutions will need to look for another broker with such a proposal.

Trading Instruments

Score – 4.3/5

What Can You Trade on the IUX Platform?

Analyzing IUX, we see a diverse range of products offered, including Forex, Commodities, Indices, Crypto, and Stock CFDs. The range is considered wide enough to explore different markets according to preferences or strategies.

As for the IUX market range itself, there are over 60 currency pairs, 120+ Stocks, 23+ Indices, 15+ cryptocurrencies, and 5 Commodities. Even though the range of tradable products is rather satisfying, many other brokers offer a wider selection across the same asset classes.

Main Insights from Exploring IUX Tradable Assets

Our research of the broker’s tradable products revealed a good range of instruments (over 500). The instrument range largely depends on the jurisdiction. Overall, the available products allow clients a good diversity, with the opportunity to expand their portfolios and explore more markets.

However, all the available products are based on CFDs. It limits the offering for the traditional investors looking for ownership of actual assets. To conclude, short-term and CFD traders will benefit from the proposal.

Leverage Options at IUX

Leverage levels always depend on the jurisdiction in which the Broker operates. In the case of IUX, its main regulated branch is operated by the SA entity; therefore, higher leverage levels are allowed there. As for the International Branch, even very high leverage ratios are available. Nevertheless, we would advise readers to learn about leverage well to avoid unnecessary risks.

See our findings about IUX Leverage:

- The South Africa branch and the International Branch in SVG offer leverage up to 1:3000.

- Traders under the ASIC oversight have access to lower leverage ratios.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at IUX

When it comes to funding, the broker offers various methods to accommodate different needs. It’s important to be aware that processing times differ depending on the payment method and the jurisdiction. Overall, IUX provides deposit and withdrawal availability around the clock.

Here are the available funding methods with IUX:

- Credit cards

- Electronic payment methods

- Wire transfers

- Local bank transfers

- UnionPay

- CryptoPay

Minimum Deposit

The minimum deposit for the IUX Standard account is $10. It is considered a small amount compared to industry standards. Yet, it is essential to check well the margin requirement for each instrument and deposit the amount that will cover fees and risk management. The other account types available have a higher deposit requirement, starting from $500.

Withdrawal Options at IUX

As the broker promises, withdrawals are fast and require only 5-10 minutes within 24 hours. The minimum withdrawal amount is only $5. However, processing time for withdrawals always varies depending on the withdrawal method used.

- Another important note is that withdrawals can only be made to a bank account under the client’s name.

Customer Support and Responsiveness

Score – 4.5/5

Testing IUX’s Customer Support

When selecting a broker for trading, it’s essential to evaluate the quality of their customer support. Effective customer service that supports numerous languages is vital for seamless communication and the resolution of any issues. As we found, the IUX support team is quite knowledgeable. The broker offers various channels for support, including lines for phone calls, live chat, and email.

- The broker also has a Help Center, where it provides essential information and answers to various trading-related questions.

Contacts IUX

IUX offers dedicated customer assistance 24/7, providing its clients with quick responses and support. Clients can choose one from the following support channels, depending on the urgency of the problem.

- The broker provides quick and detailed responses through the Live chat.

- Traders who favor direct contact with the support team can choose the phone line (028-216-698).

- Clients can also email support@iux.com, which is another opportunity to receive quick and detailed solutions.

- IUX is active on social platforms, providing up-to-date information on its operation and the market developments. Clients can find IUX on Facebook, Instagram, X, LinkedIn, and YouTube.

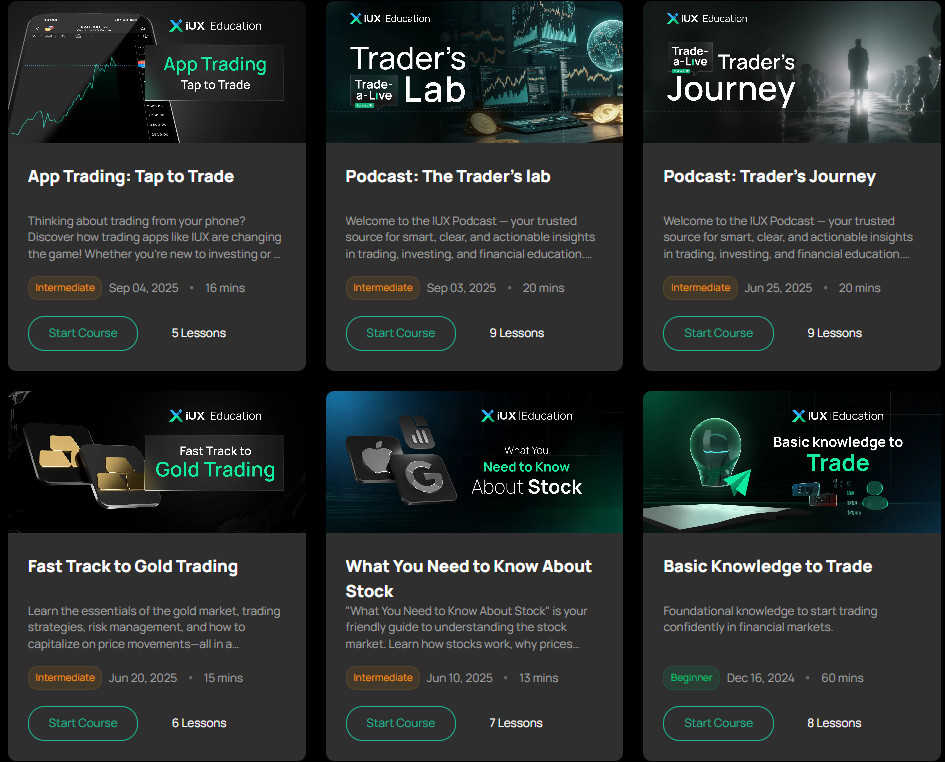

Research and Education

Score – 4.3/5

Research Tools IUX

IUX offers advanced platforms, with an extensive research section, providing its clients with fundamental tools for in-depth research and analysis. It additionally offers the following research tools:

- The technical analysis section includes deep technical analysis, and traders can get insights into the major markets. Analysis is provided in cooperation with TradingView, which is a great plus. However, the available tools are limited in number.

- The economic calendar informs traders about the market’s upcoming changes and developments, impacting their decisions and trading outcomes.

- Traders also have access to trading calculators to support decision-making. Clients can estimate pip value, margin usage, swap fees, and plan their trades with better risk control.

Education

As for education, IUX provides traders with numerous articles and basic knowledge courses on investing. The broker offers educational guidelines, mini-courses, and articles. Yet, the educational materials are rather basic and missing complete trading courses, online videos, webinars, seminars, a trading glossary, and eBooks. Thus, complete beginners might need to look for education resources elsewhere.

Is IUX a Good Broker for Beginners?

IUX is a trustworthy broker that offers attractive services to traders of every level. The account types feature different fee structures, catering to beginners and professionals. The broker includes the popular MT5 platform and its advanced proprietary web and mobile-based platforms. The broker provides a demo account and a few educational and research materials. However, the available learning resources are not comprehensive enough for novice traders. Other advantages for beginner traders are the low minimum deposit requirement and low spreads and commissions.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options IUX

IUX offers a range of trading instruments of over 500 products. The offering concentrates on Forex pairs and CFDs. However, some will find the proposal limiting. Traditional investors and long-term traders cannot engage in stock investment or own real assets.

- We have further researched whether IUX includes alternative investment options, such as copy trading, MAM, and PAMM account features. As a result, we did not find any of the mentioned alternatives.

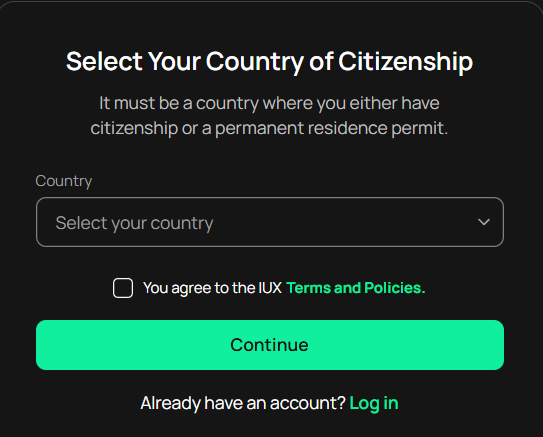

Account Opening

Score – 4.6/5

How to Open an IUX Demo Account?

IUX offers a quick and smooth demo account opening process. The availability of a demo account enables its clients to practice and gain substantial market skills before switching to live trading.

To open a demo account, the following steps are required:

- Go to the broker’s website and select the “Demo account” option.

- Indicate residency and provide a valid email address.

- Choose account specifications, such as the platform, account type, and leverage ratio.

- Create a reliable password.

- Select the virtual amount.

- Submit the form and receive a confirmation email with the account credentials.

- Use the credentials and access the demo account.

How to Open an IUX Live Account?

Opening an IUX live account is a straightforward process. Here are the steps to open an IUX account with ease:

- Fill in personal information.

- Complete the account opening declaration.

- Verify Identity by providing a valid ID and proof of residency.

- Verify Bank Account.

- After the confirmation of the account, start trading.

Score – 4/5

We found that the broker offers a good diversity of trading tools and features, as well as a few research and educational materials, allowing its clients to execute efficient trades. The broker also includes a few TradingView features.

- Also, IUX organizes special campaigns to boost its clients’ trading opportunities and profits.

IUX Compared to Other Brokers

We have drawn a thorough comparison between IUX and its competitors in the market. Regarding regulation, IUX is a reputable broker with licenses from the FSCA, ASIC, and FSA. Other brokers we reviewed are also tightly regulated, such as Forex.com with multiple top-tier and respected licenses, including the oversight from the FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, and CIMA.

IUX offers the well-equipped MT5 platform, and its own web and mobile platforms. eToro, for instance, offers only its proprietary platform, while FP Markets stands out for the extensive range of platforms. FP Markets also includes an attractive range of instruments (over 10.000), which certainly exceeds the IUX’s about 500 tradable products.

However, IUX stands out for its very low trading costs, with spreads starting at 0.2 pips. ATFX, meanwhile, applies higher spreads with an average of 1.8 pips for the EUR/USD pair. IUX also stands out for its low minimum deposit requirement of $10, while most other brokers we reviewed have a minimum deposit of $100.

| Parameter |

IUX |

ATFX |

FP Markets |

IC Markets |

Pepperstone |

eToro |

Forex.com |

| Spread-Based Account |

From 0.2 pips |

From 1.8 pip |

From 1 pip |

From 1 pip |

Average 0.7 |

Average 1 pip |

From 0.8 Pips |

| Commission-Based Account |

0.0 pips + up to $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

Available at US eToro Crypto |

0.0 pips + $5 |

| Fees Ranking |

Low |

Low/ Average |

Low/ Average |

Low/ Average |

Low |

Average |

Average |

| Trading Platforms |

MT5, IUX web and mobile platform |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5,cTrader |

MT4, MT5, cTrader, TradingView |

Proprietary Platform |

MT4, MT5, Forex.com Platform |

| Asset Variety |

|

300+ instruments |

|

1,000+ instruments |

1,200+ instruments |

2,000+ instruments |

500+ instruments |

| Regulation |

FSCA, ASIC, FSA |

FCA, CySEC, ASIC, FSC, FSA |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, CySEC, ASIC, FSAS, NFA for Crypto Exchange |

FCA, NFA, IIROC, ASIC, CFTC, CySEC, JFSA, MAS, CIMA |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

| Educational Resources |

Basic |

Excellent |

Excellent |

Good |

|

Good |

Good |

| Minimum Deposit |

$10 |

$100 |

$100 |

$200 |

$0 |

$200 |

$100 |

Full Review of Broker IUX

While evaluating various aspects of IUX, including trading features, regulatory adherence, trading instruments costs, and overall experience, along with user feedback, we revealed that IUX is a favorable and efficient choice for trading. The broker holds licenses from the respected authorities in the industry, ASIC and FSCA. It also has an international license from the FSA.

IUX provides a good selection of account types, combined with attractive conditions and very low spreads. The broker includes two spread-based accounts and one commission-based account in its proposal. Both spreads and commissions applied are on the lower side, allowing clients cost-efficiency and transparency.

The provided platforms, MT5 available on desktop, web, and mobile versions, enable clients easy accessibility and comprehensive tools and features. The IUX web and mobile platforms are also impressive, offering clients functionality and flexibility of trades.

Another favorable point about the broker is its low minimum deposit of $10. It also offers a demo account, which makes the broker a suitable choice for beginner traders. IUX also includes a few research and educational resources, although we wouldn’t call those offerings comprehensive.

At last, clients can get 24/7 customer support through multiple channels. Through our tests, the support is quick and helpful.

Share this article [addtoany url="https://55brokers.com/iux-review/" title="IUX"]

fantastic and wonderful!

If you like trading gold, I recommend IUX. The spreads are as low as 18 points, and you can hold positions long-term because of the free swap. It’s very suitable for beginners as there are various account types to choose from. You can check out the reviews. Plus, you can receive a $30 bonus without having to make a deposit.

I have been using iux for a while now and I am very impressed with many things, such as stable charts, low spreads, and the support team that is always ready to provide advice and support.

I have been trading iux for 2-3 years and I like the low spreads. Fast deposits and withdrawals No matter how large the amount is, it never takes more than 5 minutes to trade during the news and the graph is dynamic. The support from the broker was always good at helping answer any problems I encountered. Overall, I was very impressed with this broker.

I’ve been trading with IUX for 2 years now, and it’s great. It’s very suitable for beginner traders because it’s easy to use. I regularly deposit into my account, and when I make a profit, I can withdraw it normally and quickly. I checked before trading, and they have legal licenses. I highly recommend it. The spreads are very low, there are no deposit/withdrawal fees, and they offer free swaps, so you can hold orders overnight comfortably.