- What is IFX Brokers?

- IFX Brokers Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- IFX Brokers Compared to Other Brokers

- Full Review of Broker IFX Brokers

Overall Rating 4.4

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.3 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 3.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is IFX Brokers?

IFX Brokers is a South African online Forex and CFD broker that provides access to global financial markets, including currencies, commodities, indices, shares, and cryptocurrencies.

Regulated by the Financial Sector Conduct Authority, the company offers a secure and transparent trading environment. IFX Brokers operates on the MetaTrader 4 and the MetaTrader 5 platforms and provides various account types to support different experience levels of traders.

The broker also provides competitive spreads, fast execution, and local client support, primarily serving traders within South Africa, the African continent, and some international markets.

IFX Brokers Pros and Cons

IFX Brokers stands out as a well-regulated broker that offers a reliable environment for South African traders. The firm provides access to both the well-known MT4 and MT5 platforms, along with competitive spreads and a range of account types to suit different trading needs.

For the cons, while regulated by the FSCA, IFX Brokers does not hold top-tier licenses such as those from the FCA or ASIC, which may be a concern for traders. Additionally, the broker offers limited educational resources, which may be a drawback for beginners who need in-depth learning support.

| Advantages | Disadvantages |

|---|

| FSCA regulation and oversee | Limited educational materials |

| Competitive trading conditions | No 24/7 customer support |

| Industry-known trading platforms | Not available for international trading |

| Client protection | |

| African traders | |

| Low spreads and fees | |

| Suitable for beginners and professionals | |

| Variety of funding methods | |

IFX Brokers Features

IFX Brokers offers a wide range of features to support traders at all levels. The firm provides access to global markets through the popular MetaTrader 4 and MetaTrader 5 platforms. Below is a comprehensive list of its key features:

IFX Brokers Features in 10 Points

| 🏢 Regulation | FSCA |

| 🗺️ Account Types | iFX Premium, iFX Standard, iFX Vip, iFX Islamic, iFX Cent, iFX Raw Accounts |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | CFDs on Forex, commodities, indices, shares, cryptocurrencies |

| 💳 Minimum Deposit | $250 |

| 💰 Average EUR/USD Spread | 1.3 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | ZAR, USD, GBP, EUR |

| 📚 Trading Education | Financial Information, Blog |

| ☎ Customer Support | 24/5 |

Who is IFX Brokers For?

IFX Brokers is ideal for traders in South Africa or African regions who value a regulated and transparent trading environment under FSCA oversight. According to our findings, the broker is Good for:

- Beginners

- Professional traders

- South African traders

- Traders who prefer the MT4 or MT5

- Currency trading

- Algorithmic/EA trading

- Swap-free trading

- Competitive spreads and commissions

- Good trading strategies

IFX Brokers Summary

In summary, IFX Brokers is a South African CFD broker regulated by the FSCA. It offers access to global financial markets through both MetaTrader 4 and MetaTrader 5 platforms, catering to traders of all experience levels.

The broker provides flexible account options, competitive spreads, and leverage of up to 1:500. With features like a free demo account and negative balance protection, IFX Brokers provides a secure and user-friendly trading experience.

While it is a strong choice for local traders, the lack of top-tier or international licenses may be a consideration for those outside South Africa.

55Brokers Professional Insights

IFX Brokers stands out as a competitive currency trading firm by combining local regulatory reliability with globally recognized tools. As an FSCA-regulated broker, it provides good conditions for South African or traders from Africa region alike, with a sense of security and compliance due to local legal framework.

As for the trade performance, you can choose between MetaTrader 4 and MetaTrader 5 platforms, benefit from multiple account types tailored to different strategies or experience levels, also start trading with a comparatively low minimum deposit. Making it one of optimal conditions to get started and going along. The broker also offers leverage of up to 1:500 and tight spreads, so is an additional plus for traders with small trading size or accounts.

These features, combined with fast execution speeds and negative balance protection, make IFX Brokers a standout option, particularly for traders in South Africa who need a balance between professional conditions and user accessibility, which is not offered by most of the SA Brokers.

Consider Trading with IFX Brokers If:

| IFX Brokers is an excellent Broker for: | - Need a well-regulated broker.

- Get access to MT4, and MT5 trading platforms.

- Looking for reputable firm.

- Providing competitive trading conditions.

- Need broker with fast execution.

- Offering a variety of account types.

- Who prefer higher leverage up to 1:500.

- Need a broker with good research tools.

- Secure trading environment.

- The African Region traders.

- Various strategies allowed.

|

Avoid Trading with IFX Brokers If:

| IFX Brokers might not be the best for: | - Need a broker with a Top-Tier license.

- Who prefer 24/7 customer service.

- Looking for cTrader platform.

- Need comprehensive educational materials. |

Regulation and Security Measures

Score – 4.4/5

IFX Brokers Regulatory Overview

IFX Brokers operates as a regulated brokerage company under the oversight of the South African FSCA. This regulatory authorization suggests that the company operates within the legal framework and is subject to certain industry standards.

How Safe is Trading with IFX Brokers?

The FSCA plays a crucial role in ensuring regulatory compliance within the financial services industry. As part of its oversight, the regulatory body requires brokers to keep client funds separate from their accounts, protecting clients, as their funds cannot be used for the broker’s operational purposes.

Additionally, iFX Brokers offers negative balance protection, ensuring that clients do not incur losses exceeding their account balance.

Though the firm is not authorized by a top-tier regulatory body, it is still considered a safe option for traders in South Africa.

Consistency and Clarity

IFX Brokers has built a solid reputation among South African traders for its reliable execution, fast deposits and withdrawals, and support for both MT4 and MT5 platforms.

User reviews are generally positive, highlighting ease of use and accessible account options, though some mention issues with customer service and limited educational resources.

While the broker lacks top-tier international licenses, it has earned regional recognition, including awards like “Best MT5 Trading Platform Africa 2023.” IFX Brokers also engages in local sponsorships and social activities, helping to strengthen its presence and credibility within the trading community.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with IFX Brokers?

IFX Brokers offers a variety of account types to meet the needs of different trading styles and experience levels. These include the iFX Standard account, ideal for beginners, and the iFX Premium and iFX VIP accounts, which offer tighter spreads and additional benefits for more active or high-volume traders.

The iFX Raw account caters to those seeking ultra-low spreads with a commission-based structure, while the iFX Islamic account provides a swap-free option for traders following Shariah principles.

For those new to financial markets or looking to test strategies, the iFX Cent account offers smaller position sizes, and a Demo Account is also available, allowing users to practice trading in a risk-free environment using virtual funds.

iFX Standard Account

The iFX Standard Account caters to both beginner and intermediate traders with a minimum deposit amount of $250. It supports both MetaTrader 4 and MetaTrader 5 platforms, providing users with full access to all markets and tools.

The account offers floating spreads starting from around 1.3 pips and no commission charges. Traders can use leverage of up to 1:500 and choose mini trade sizes from 0.01 lots.

Regions Where IFX Brokers is Restricted

IFX Brokers does not provide services to residents of multiple jurisdictions due to regulatory restrictions. Excluded countries include:

- Afghanistan

- Canada

- Democratic People’s Republic of Korea

- EU Member States

- Ghana

- Iceland

- Indonesia

- Iran

- Iraq

- Liechtenstein

- Libya

- Norway

- Mongolia

- Myanmar

- Nicaragua

- Panama

- Somalia

- Syria

- UAE

- Uganda

- UK

- USA

- United States Minor Outlying Islands

- Yemen

- Zimbabwe

Cost Structure and Fees

Score – 4.5/5

IFX Brokers Brokerage Fees

IFX Brokers offers competitive and transparent brokerage fees, primarily based on spreads and, in some cases, small trade commissions.

There are no deposit fees, and withdrawal costs are generally low or waived entirely, depending on the method. Inactivity fees are also not charged, making it a cost-efficient option for active and occasional traders.

IFX Brokers offers competitive spreads across its range of accounts. On the iFX Standard Account, the average spread for the EUR/USD pair is 1.3 pips.

Spreads may vary depending on market conditions and account type; however, the broker aims to maintain tight pricing to support cost-effective trading.

IFX Brokers charges commissions on its iFX VIP and iFX Raw accounts, where traders pay a flat fee of $6 per standard lot per round turn. All other account types are commission-free, with no additional charges applied to trades beyond the spread.

- IFX Brokers Rollover / Swaps

IFX Brokers applies overnight rollover fees on positions held open past the trading day. These charges vary depending on the instrument and market conditions and can be either positive or negative. Traders can view the specific swap rates directly on the platforms, helping them factor in potential costs when holding positions long-term.

- IFX Brokers Additional Fees

IFX Brokers imposes a 2.5% deposit fee on bank wire transfers, with processing typically taking 24-48 business hours. The broker may also charge conversion fees if trading in a currency different from your account base currency.

Withdrawal fees may apply depending on the payment method used.

How Competitive Are IFX Brokers Fees?

IFX Brokers generally offers a competitive fee structure within the South African financial market. The combination of reasonable spreads, commission options on select accounts, and straightforward additional fees positions the broker as an attractive choice for traders seeking cost-effective access to global markets.

| Asset/ Pair | IFX Brokers Spread | Earn Spread | M4Markets Spread |

|---|

| EUR USD Spread | 1.3 pips | 0.1 pips | 1.1 pips |

| Crude Oil WTI Spread | 0.03 | 0.027 | 4.8 |

| Gold Spread | 1 | 0.150 | 2.8 |

| BTC USD Spread | 2.7 | 13.13 | 14.1 |

Trading Platforms and Tools

Score – 4.6/5

IFX Brokers provides access to industry-leading MT4 and MT5 platforms, known for their powerful charting tools, automated trading, and broad market coverage.

Trading Platform Comparison to Other Brokers:

| Platforms | IFX Brokers Platforms | Earn Platforms | M4Markets Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yse | Yes |

IFX Brokers Web Platform

IFX Brokers offers web platforms of both MetaTrader 4 and MetaTrader 5, allowing traders to access their accounts directly from any web browser without downloading software.

These web platforms maintain the main functionalities of the desktop versions, including real-time quotes, advanced charting tools, and 2.5 milliseconds trade execution speed, providing a convenient and flexible trading experience across devices.

IFX Brokers Desktop MetaTrader 4 Platform

The MT4 platform offers a robust and user-friendly environment for users. Known for its reliability and extensive range of tools, the platform provides advanced charting capabilities, 30 built-in indicators, over 2000 free custom indicators, 700+ paid indicators, and support for automated trading through EAs.

The platform supports multiple order types, real-time price quotes, and comprehensive risk management features, making it well-suited for CFD trading.

IFX Brokers Desktop MetaTrader 5 Platform

The desktop MetaTrader 5 platform is an advanced trading solution for both beginners and professionals. Building on the success of MT4, MT5 offers enhanced features such as more timeframes, improved charting tools, an economic calendar, and support for a wider range of asset classes.

The platform also supports advanced order types and allows for algorithmic trading through expert advisors and custom indicators. With its powerful analytical tools and user-friendly interface, the platform provides a comprehensive environment for effective market analysis and efficient trade execution.

Main Insights from Testing

From testing the MT5 platform, we found that its speed, stability, and customizable interface are major strengths. The platform handles high trade volumes smoothly, and its intuitive layout allows for easy navigation and personalization.

The platform also stands out for its faster processing times compared to MT4, making it a solid choice for active traders who rely on efficiency and responsiveness.

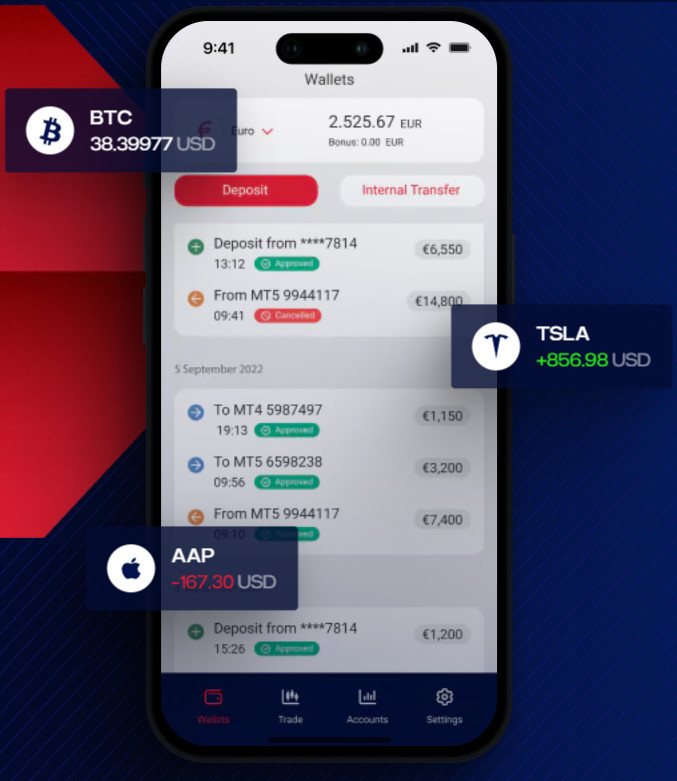

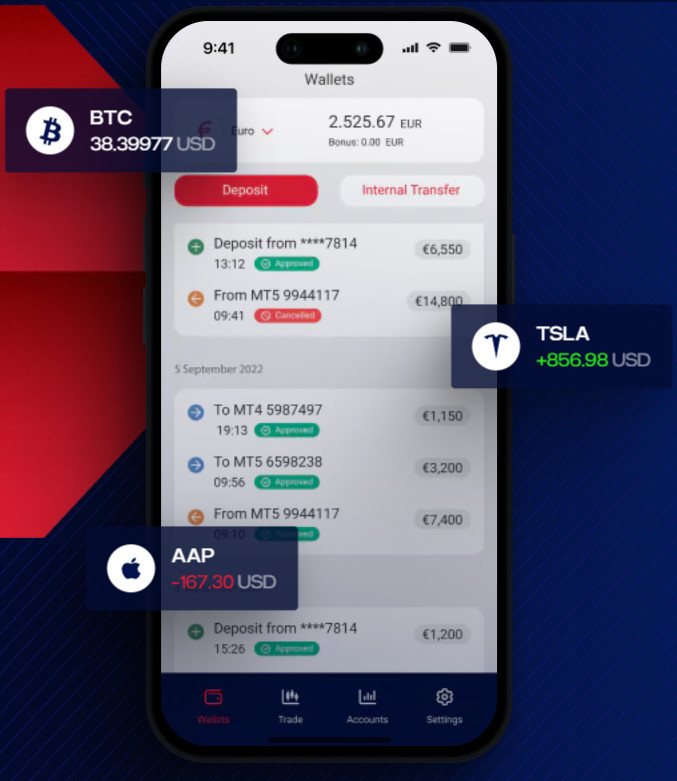

IFX Brokers MobileTrader App

The broker’s Mobile App, available for both Android and iOS devices, offers traders a comprehensive and user-friendly platform to manage their trading activities on the go.

Designed with a clean and intuitive interface, the app provides access to a wide range of financial instruments, including Forex, indices, commodities, and cryptocurrencies. Key features include real-time market data, advanced charting tools, one-click trading, and a unified wallet for managing multiple accounts seamlessly.

AI Trading

IFX Brokers does not currently offer proprietary AI tools or automated trading bots. However, the broker provides access to MT4 and MT5, both of which support algorithmic trading via Expert Advisors.

These EAs can be developed or sourced independently and integrated into the platforms to automate strategies.

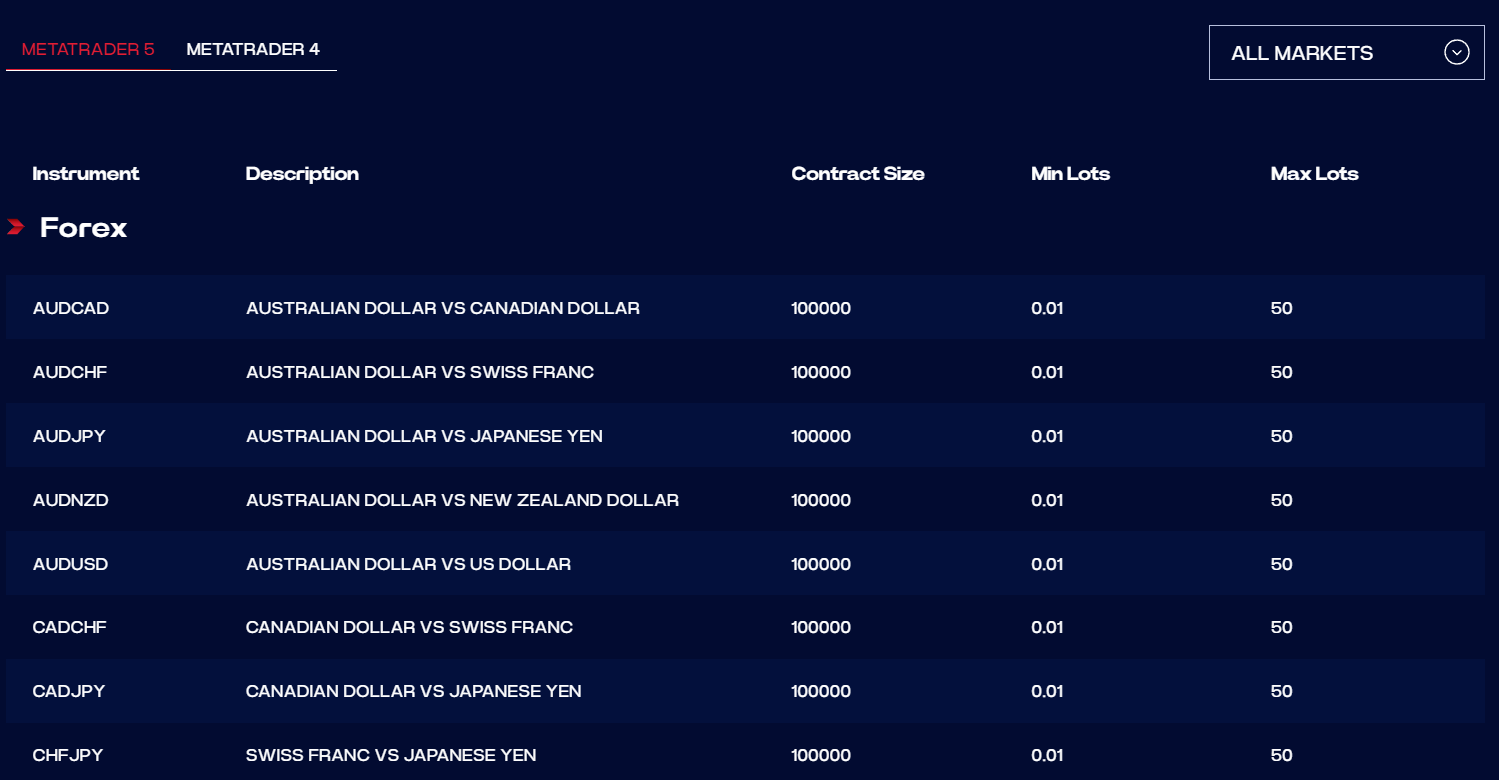

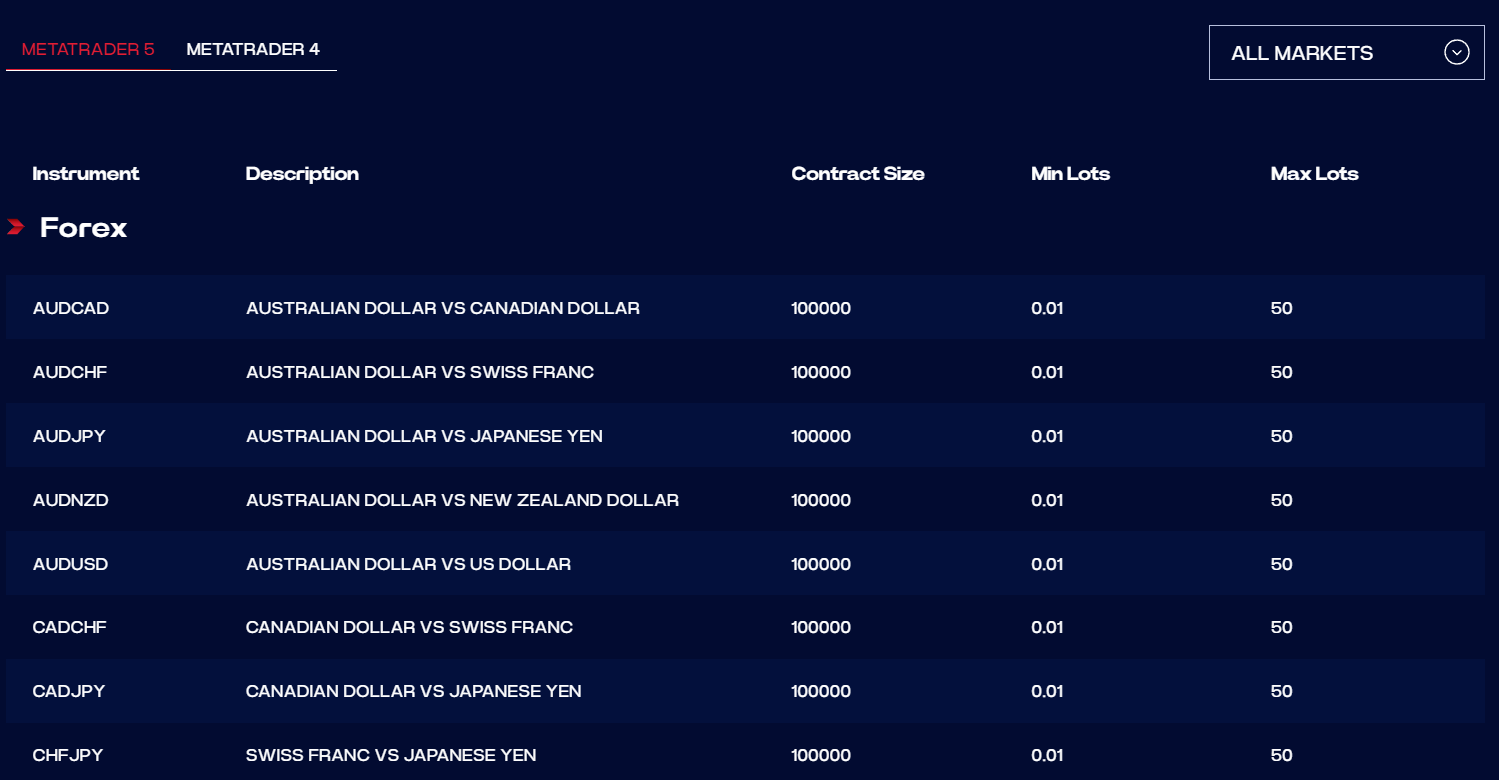

Trading Instruments

Score – 4.4/5

What Can You Trade on IFX Brokers’s Platform?

On IFX Brokers’ platform, traders have access to over 200 CFD instruments, including Forex, commodities, indices, shares, and cryptocurrencies.

This variety allows traders to diversify their portfolios and explore different markets, though the selection is moderate compared to some larger global brokers.

Main Insights from Exploring IFX Brokers’s Tradable Assets

Exploring IFX Brokers’s tradable assets reveals a focus on key global markets, catering to traders interested in popular instruments like currencies, commodities, indices, and cryptos.

The platform is structured to support both short-term and long-term strategies, offering a user-friendly environment for navigating different asset classes.

Leverage Options at IFX Brokers

Trading with leverage can be advantageous as it allows traders to access the market with a smaller initial investment. However, you should have a thorough understanding of how the multiplier works and the potential risks involved before engaging in leveraged trading.

- Trades from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- However, the website states the maximum leverage is 1:500.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at IFX Brokers

There are a variety of funding methods available for traders, allowing them to deposit funds into trading accounts, which is a benefit. These include:

- Credit/Debit cards

- Bank Wire

- Skrill

- Neteller

- PayFast

- Ozow

IFX Brokers Minimum Deposit

IFX Brokers’ Standard account requires a minimum deposit of $250, offering traders access to the full range of markets and platforms with competitive trading conditions.

Withdrawal Options at IFX Brokers

IFX Brokers provides a variety of withdrawal options to accommodate its clients. Traders can initiate withdrawals through the secure client portal, using methods such as wire transfers, Skrill, Neteller, and digital currencies like Bitcoin and Ethereum.

Withdrawals are typically processed within 24 hours during business hours, with funds reaching bank accounts within 2 to 5 working days, depending on the payment method.

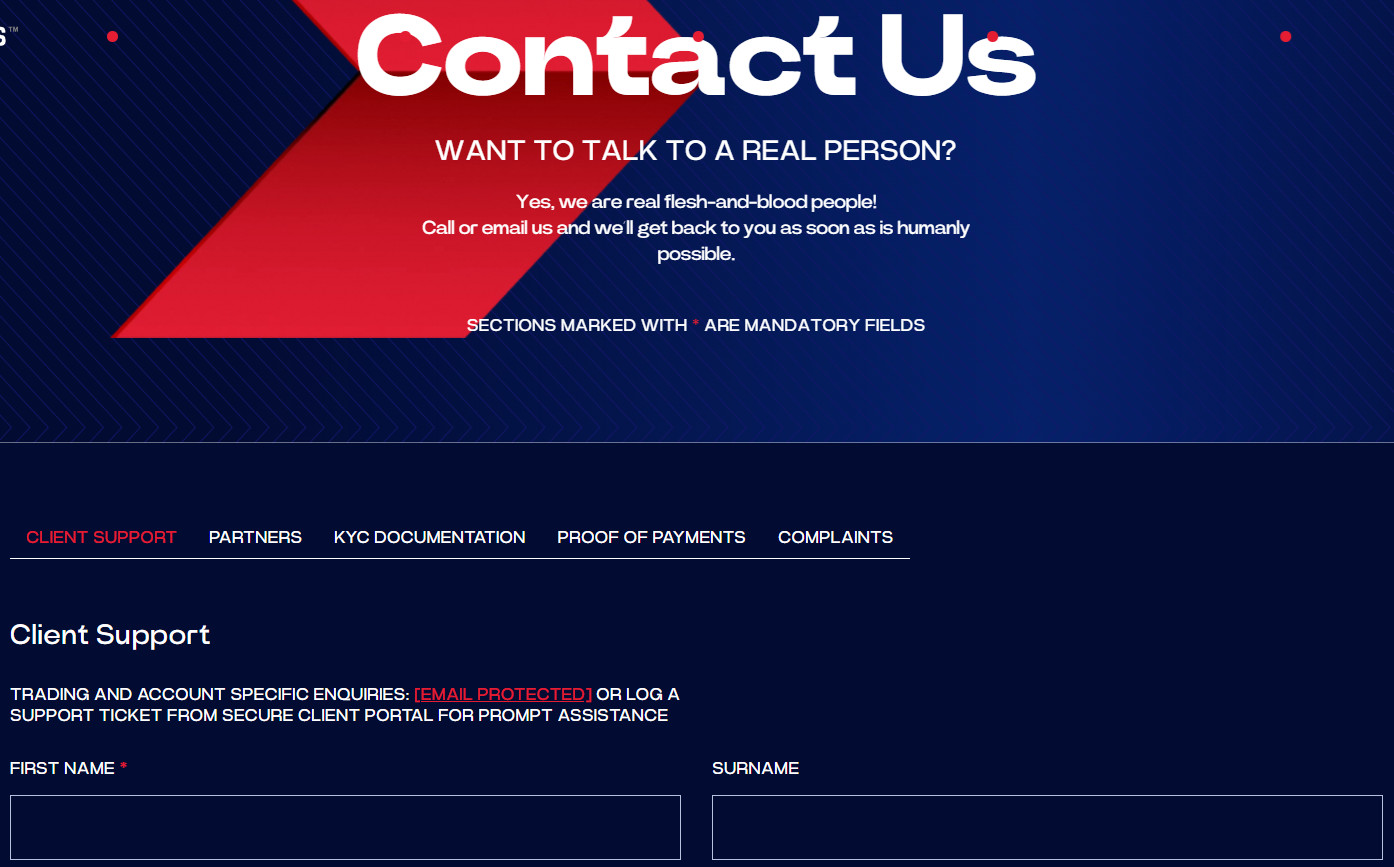

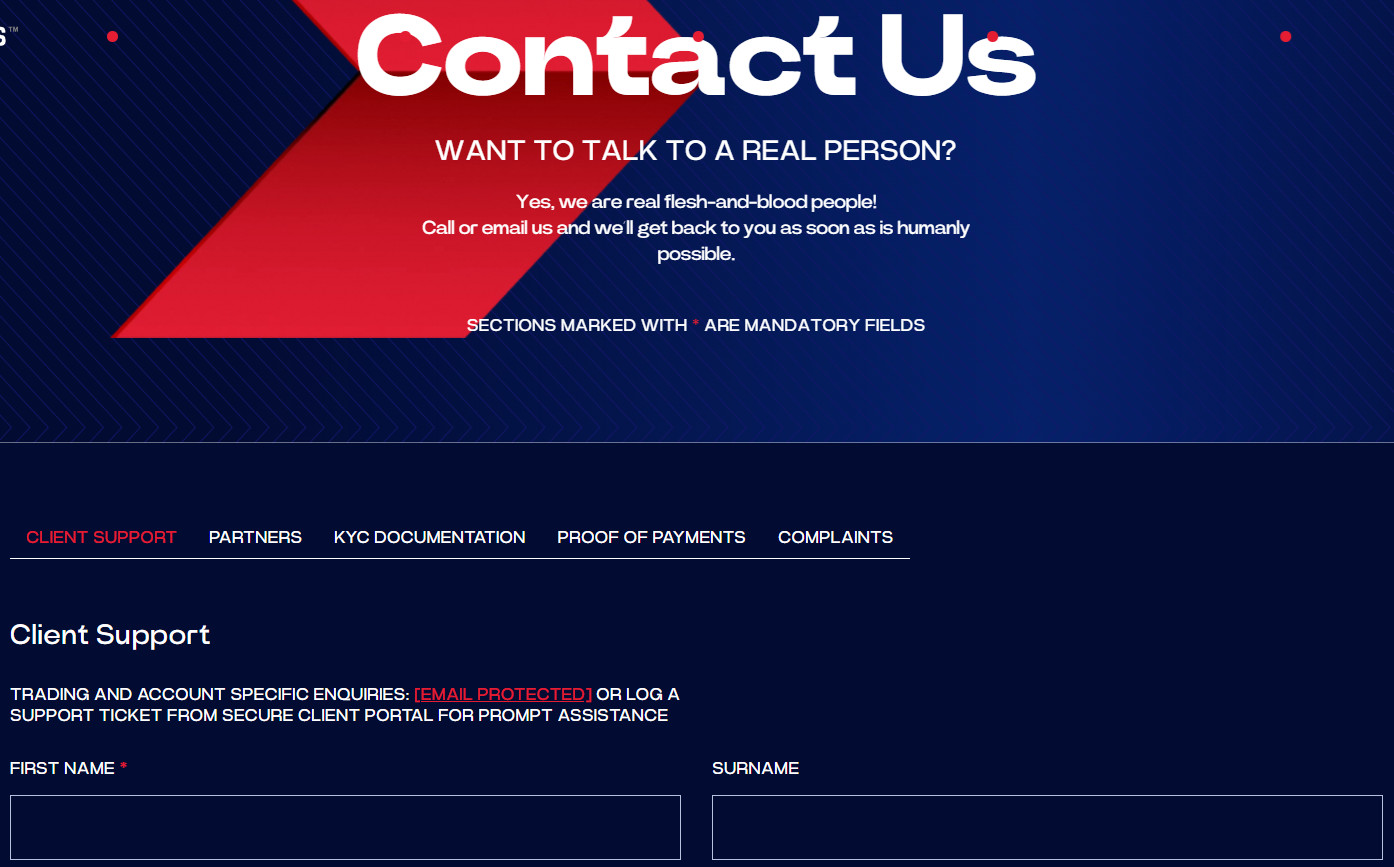

Customer Support and Responsiveness

Score – 4.3/5

Testing IFX Brokers’s Customer Support

The broker offers 24/5 customer support via a phone line, help center, and email, ensuring assistance is available on weekdays. The support team is capable of helping with technical inquiries, analysis recommendations, general questions, and operational matters.

Contacts IFX Brokers

You can contact IFX Brokers via phone at +27 87 944 7273. For email inquiries, reach out to support@ifxbrokers.com for general support and complaints@iFXbrokers.com for complaints.

Research and Education

Score – 4.4/5

Research Tools IFX Brokers

IFX Brokers offers a range of research tools accessible on MetaTrader platforms.

- Within the platforms, IFX Brokers provides advanced charting tools, real-time market data, and a variety of technical indicators to assist in market analysis.

- Additionally, the platforms support algorithmic trading, allowing traders to implement automated strategies. These features enable traders to conduct thorough technical analysis and execute trades efficiently.

Education

IFX Brokers provides a selection of educational resources aimed at enhancing traders’ knowledge and skills. The broker’s website features a Blog that covers various topics, including risk management, trading strategies, and market insights.

Additionally, the platform offers guides, which provide practical advice for traders seeking to refine their strategies. While these resources are valuable, they are somewhat limited in scope and may not be as extensive as those offered by larger brokers.

Portfolio and Investment Opportunities

Score – 3.5/5

Investment Options IFX Brokers

IFX Brokers primarily focuses on currency trading and CFDs across various asset classes. The broker does not offer traditional investment solutions like managed portfolios or long-term wealth management services. Instead, it caters mainly to traders interested in short-term market opportunities and active trading strategies.

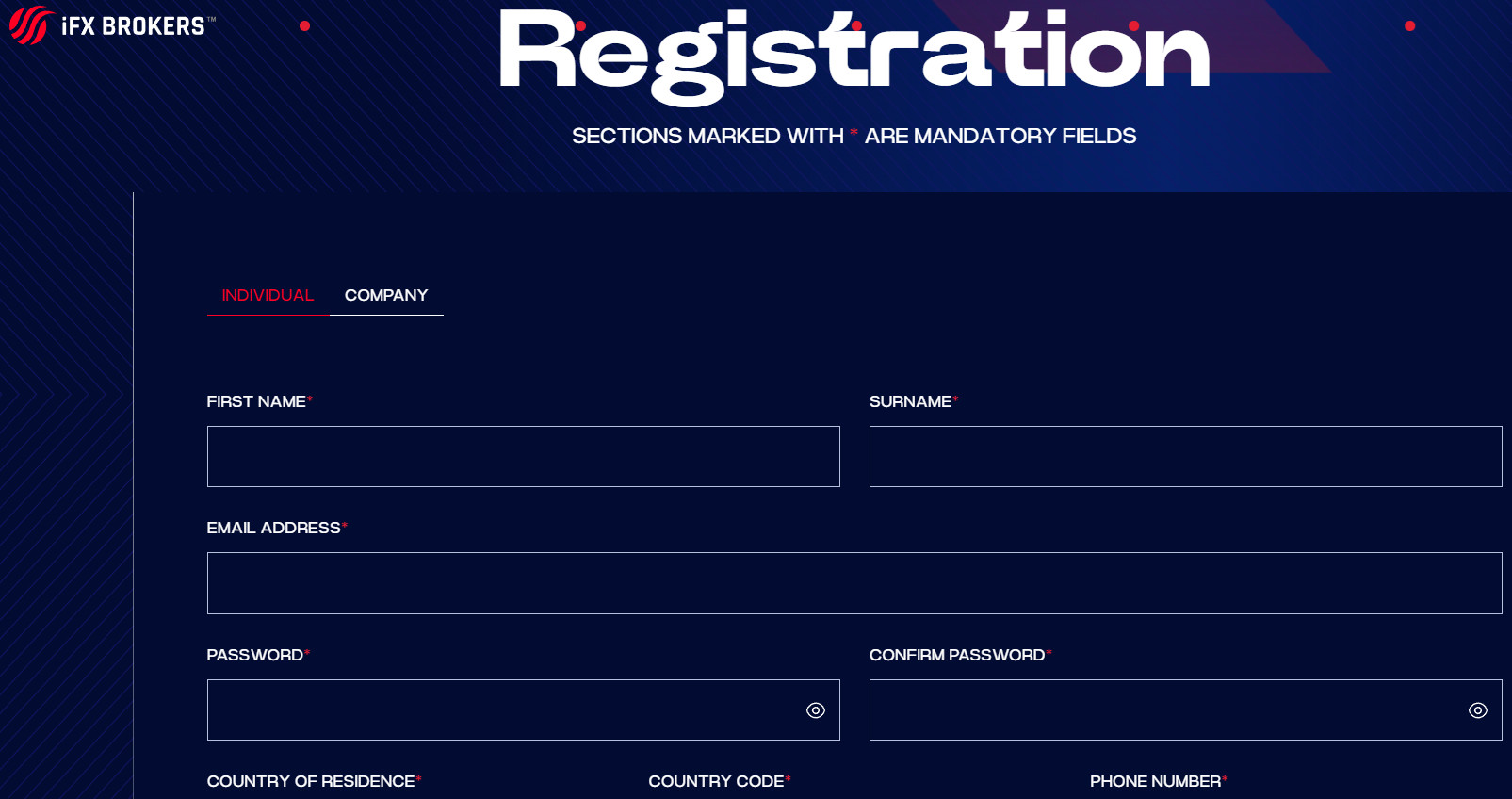

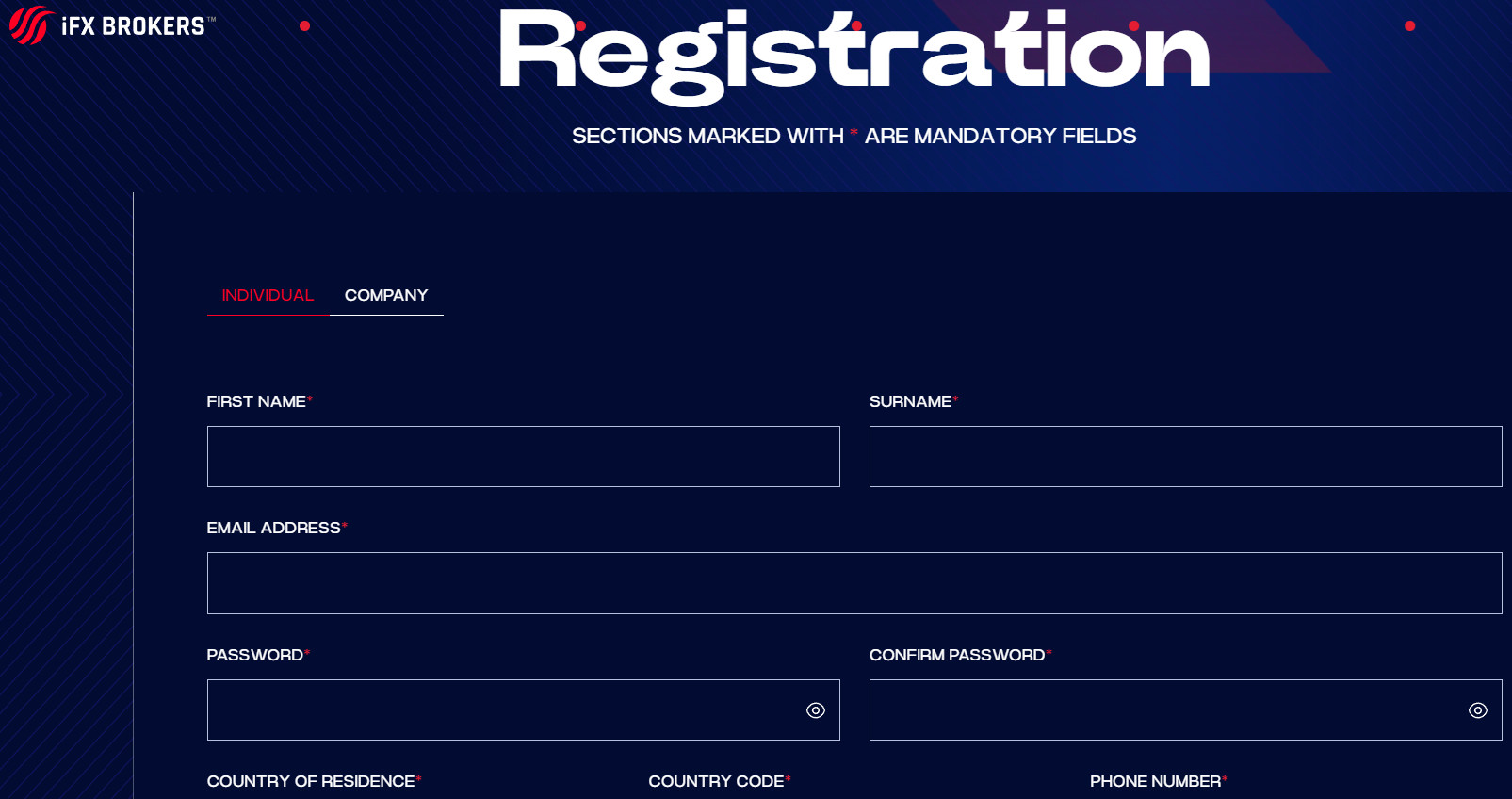

Account Opening

Score – 4.4/5

How to Open IFX Brokers Demo Account?

To start trading risk-free and get familiar with the platform, opening a demo account with IFX Brokers is a great first step. Simply visit their official website and register by providing basic personal details like your name, email, and phone number.

After submitting the registration, you will receive an email with your login credentials and a link to download the platform. Once installed, you can log in and practice trading with virtual funds in a simulated environment.

Demo accounts typically expire after 30 days, but if you open a live account, you can request an extension or a non-expiring demo.

How to Open IFX Brokers Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register with IFX Brokers within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Start Trading” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

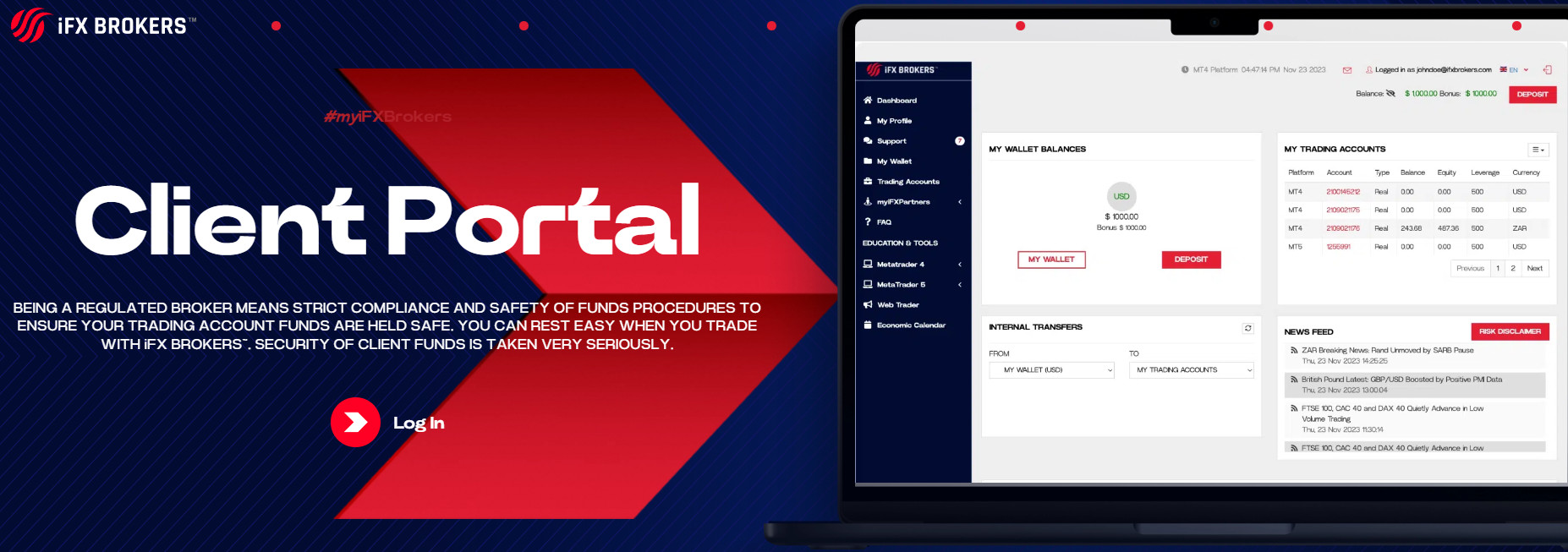

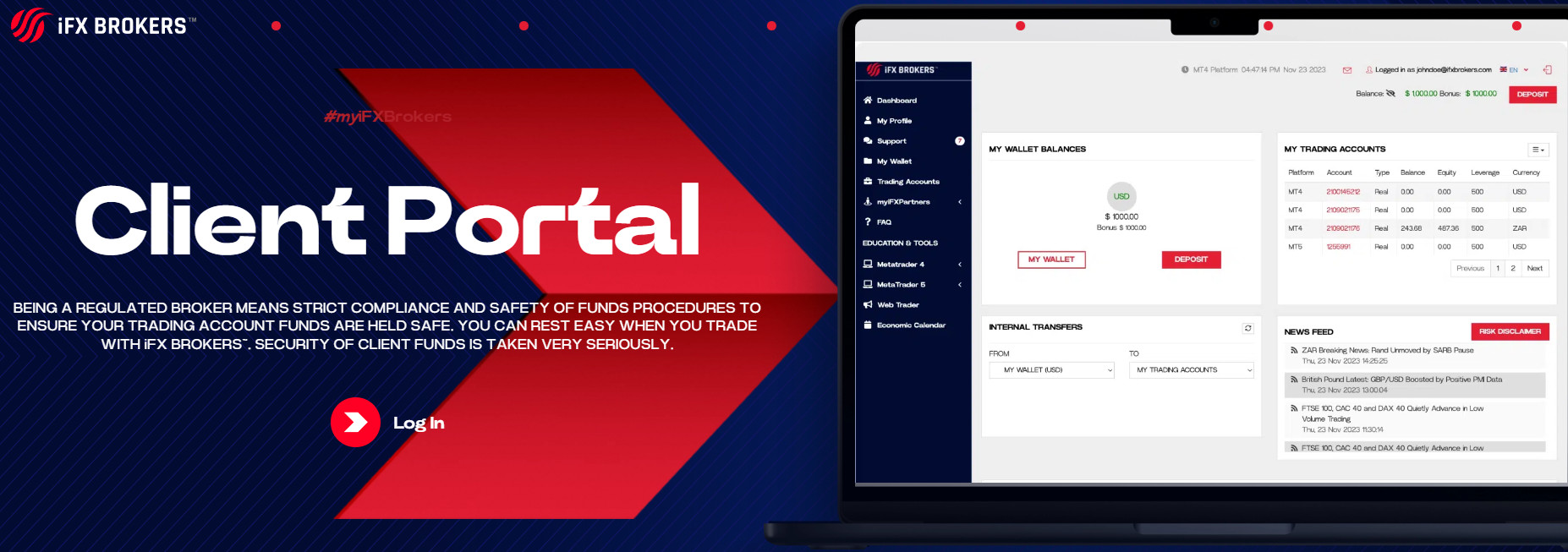

Additional Tools and Features

Score – 4.3/5

In addition to its main research tools, IFX Brokers offers several other features to enhance the trading experience.

- These include a unified wallet system for easy account funding and management, a secure client portal for seamless deposit and withdrawal processes, and a comprehensive FAQ section to assist with common questions.

IFX Brokers Compared to Other Brokers

IFX Brokers offers competitive trading conditions with a range of financial instruments and support for popular platforms like MT4 and MT5. Compared to competitors, the broker provides relatively low to average fees and spreads, regulated primarily by the FSCA, which gives it a strong presence in the South African market.

While some competitors offer a broader asset variety and access to additional platforms or more extensive educational resources, IFX Brokers focuses on delivering core features with simplicity and efficiency.

Its customer support and trading tools are consistent with industry standards, though traders looking for advanced educational content or wider global regulation might consider other options.

Overall, IFX Brokers presents a balanced offering, appealing to those prioritizing a regulated, user-friendly environment with essential market access.

| Parameter |

IFX Brokers |

M4Markets |

Earn |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 1.3 pips |

Average 1.1 pips |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + $3 per side |

0.0 pips + $3.5 per side |

0.0 pips + 0.007% per side |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Low/Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5, cTrader |

MT4, MT5, Earn.Broker |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

200+ instruments |

120+ instruments |

950+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FSCA |

CySEC, DFSA, FSA |

CySEC |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Limited |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$250 |

$5 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker IFX Brokers

IFX Brokers is a South African online CFD broker regulated by the FSCA, offering access to a range of financial markets including Forex, commodities, indices, and cryptocurrencies.

The broker supports both MetaTrader 4 and MetaTrader 5 platforms, providing traders with familiar and robust tools for analysis and execution. IFX Brokers offers both spread-based and commission-based account types, catering to different preferences.

While the broker maintains a user-friendly environment and competitive trading conditions, its educational resources are relatively limited. Traders can benefit from flexible leverage, negative balance protection, and localized customer support.

Overall, IFX Brokers is a competitive choice for traders seeking essential tools and market access without complexity.

Share this article [addtoany url="https://55brokers.com/ifx-brokers-review/" title="IFX Brokers"]