- What is HKEX?

- HKEX Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

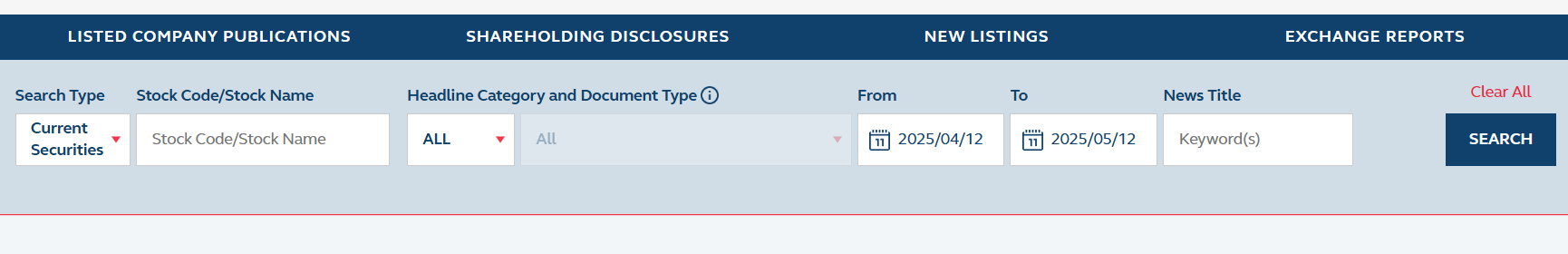

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- HKEX Compared to Other Brokers

- Full Review of Broker HKEX

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.8 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

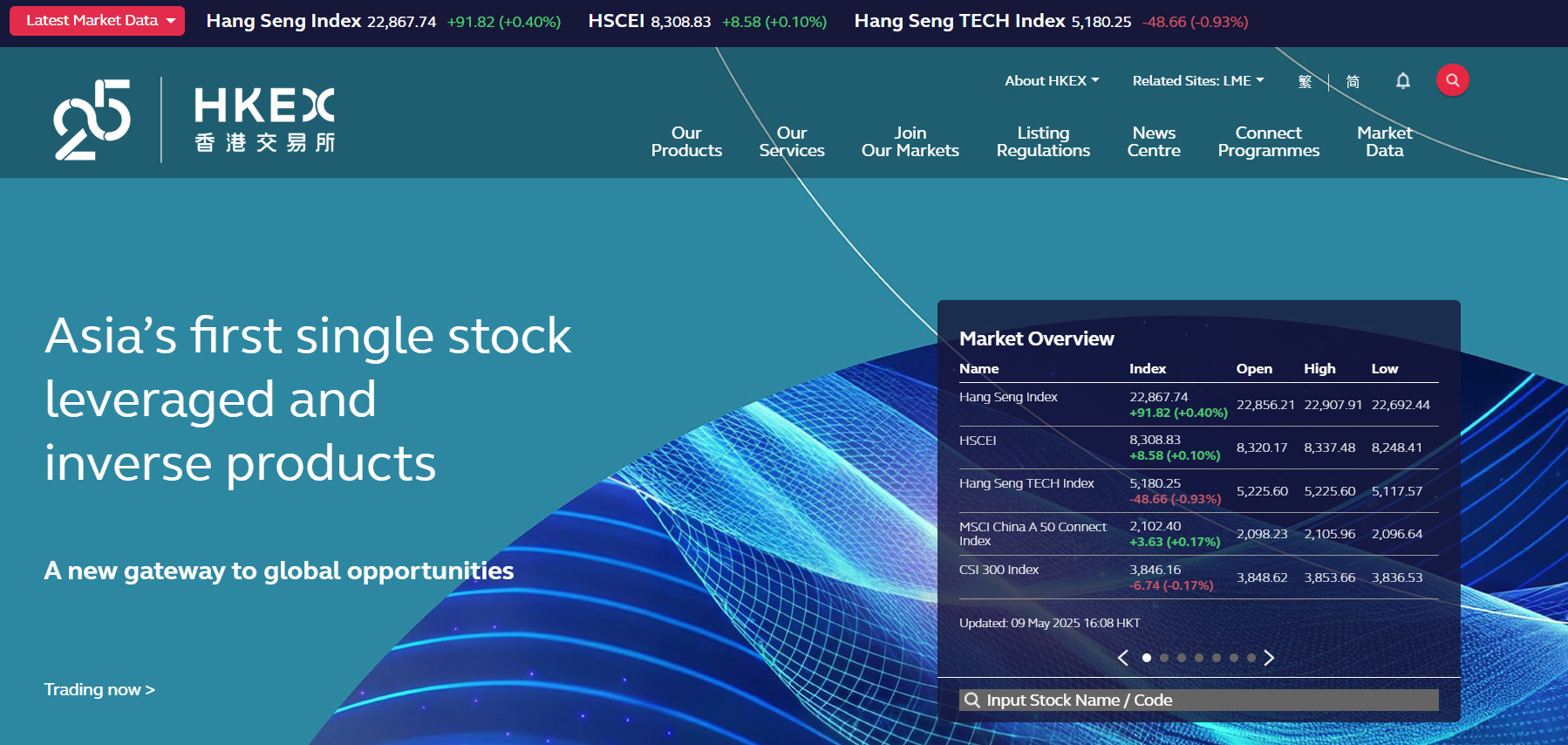

What is HKEX?

Hong Kong Exchanges and Clearing Limited, or HKEX, is a Hong Kong-based financial exchange that provides a diverse range of trading products to its clients, including equities, derivatives, FX, stocks, commodities, metals, ETPs, and more.

In 1986, HKEX introduced a computer-assisted trading system and later replaced it with the “Automatic Order Matching and Execution System,” which was upgraded to a third-generation system in 2000.

The company is regulated by the Hong Kong Securities and Futures Commission (SFC), which oversees and regulates the securities and futures markets in Hong Kong.

HKEX Pros and Cons

HKEX is a well-established and regulated financial exchange that provides access to a wide range of trading products. The company also provides advanced trading technologies and platforms to investors and professional traders from around the world. HKEX offers traders a favorable trading environment with competitive fees and trading conditions, as well as the convenience of not requiring a minimum deposit.

For the cons, the fees charged by HKEX can vary depending on the specific product being traded and the trading platform being used, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Competitive trading conditions | Comparatively high fees |

| SFC overseeing | No 24/7 customer support |

| Access to Asian markets | |

| Professional trading | |

| No minimum deposit amount | |

| Popular trading products | |

| Advanced trading technology | |

HKEX Features

HKEX is a regulated and reputable exchange that provides competitive trading conditions and a range of trading products. Clients can take advantage of advanced trading tools and great technology offered by HKEX. Below is a comprehensive list of its key features:

HKEX Features in 10 Points

| 🏢 Regulation | SFC |

| 🗺️ Account Types | Individual Investor, Joint Investor, Corporate Investor Accounts |

| 🖥 Trading Platforms | OTP-C Trading Platform, Stock Connect |

| 📉 Trading Instruments | Equities, derivatives, FX, stocks, commodities, metals, ETPs |

| 💳 Minimum Deposit | HK$0 |

| 💰 Average Derivatives Commission | HK$0.54 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | HKD, EUR, USD, GBP |

| 📚 Trading Education | Educational Resources, e-Learning Platform, ESG Academy, Graduate Programme, Webinars |

| ☎ Customer Support | 24/5 |

| 📚 Education | Provided |

Who is HKEX For?

HKEX is designed for a wide range of users, including institutional investors, financial institutions, trading firms, and listed companies seeking access to capital and international markets. Based on our findings and Financial Expert Opinions, HKEX is Good for:

- Traders from Asia

- International traders

- Currency trading

- Beginners

- Advanced traders

- Investors

- Professional traders

- Partnerships

- Comprehensive learning materials

- Good trading tools

- Supportive customer support

HKEX Summary

Overall, HKEX is a well-established exchange that offers a wide range of financial instruments for traders to invest in. Its trading platforms are user-friendly and provide access to a variety of trading tools and market data, making it a suitable choice for both novice and experienced traders.

HKEX fees are reasonable, although some traders may find them for certain assets to be higher compared to other brokers. However, the lack of negative balance protection may be a concern for some traders.

The company offers reliable and responsive customer support as well as a comprehensive range of educational materials for traders to improve their knowledge and skills. However, we suggest that you conduct your research before deciding to register with HKEX to make sure it meets your needs and preferences.

55Brokers Professional Insights

HKEX is a global financial marketplace due to its strategic position as a gateway between Mainland China and international capital, making it a suitable choice for large scale investors and high capitalized traders, from both China, Asia and Internationally alike. It offers a robust regulatory framework and deep liquidity across a wide range of asset classes, including equities, commodities, fixed income, and currency products, so its portfolio might suit various trading or investing preferences.

The company is also renowned for cross-border trading programs, which enable seamless access to China‘s markets while maintaining international standards of transparency and investor protection. Its ongoing innovations in fintech, sustainable finance, and market infrastructure further strengthen HKEX’s position as a trusted, future-focused exchange for global investors. While the trading software and execution as we testedm, shows great stability and high performance with good costs, mainy on commission basis, which we find overall very balanced and quality proposal to consider.

Consider Trading with HKEX If:

| HKEX is an excellent Broker for: | - Looking for reputable firm.

- Need a well-regulated broker.

- Suitable for professional traders and investors.

- Looking for a firm with a long history of operation and strong establishment.

- Stock Trading and investment.

- Offering popular financial products.

- Providing diverse trading tools, and trading strategies.

- Professional derivatives and FX traders.

- ESG-conscious investors. |

Avoid Trading with HKEX If:

| HKEX might not be the best for: | - Beginner retail traders.

- Clients seeking low-cost.

- Traders seeking high leverage options.

- Looking for 24/7 crypto or highly speculative assets. |

Regulation and Security Measures

Score – 4.5/5

HKEX Regulatory Overview

HKEX operates under the regulation of the SFC in Hong Kong, which is responsible for supervising and regulating securities and futures markets in Hong Kong.

How Safe is Trading with HKEX?

HKEX is a reputable financial exchange regulated by the Hong Kong Securities and Futures Commission, which imposes strict rules and guidelines on its operations.

The company has been in operation for many years, and its reputation as a reliable exchange has been well-established. While there are some risks associated with trading, HKEX takes measures to ensure the safety and security of its clients, such as implementing risk management policies and safeguarding client funds.

Additionally, clients’ funds are kept in segregated accounts at HKEX, ensuring that they cannot be used for any other purpose.

Consistency and Clarity

HKEX, as a publicly listed company with decades of operational history, maintains high standards of governance, regulatory compliance, and market integrity. While not a traditional retail broker, it earns positive recognition from institutional traders for its robust infrastructure and access to both local and international markets.

Trader reviews highlight HKEX’s strengths in market depth, product diversity, and innovation, though some note limited accessibility for retail clients and the absence of hands-on support typical of retail brokers.

Also, HKEX takes part in community projects, supports environmental efforts, and sponsors various events, which helps build its reputation as a trustworthy and future-oriented organization.

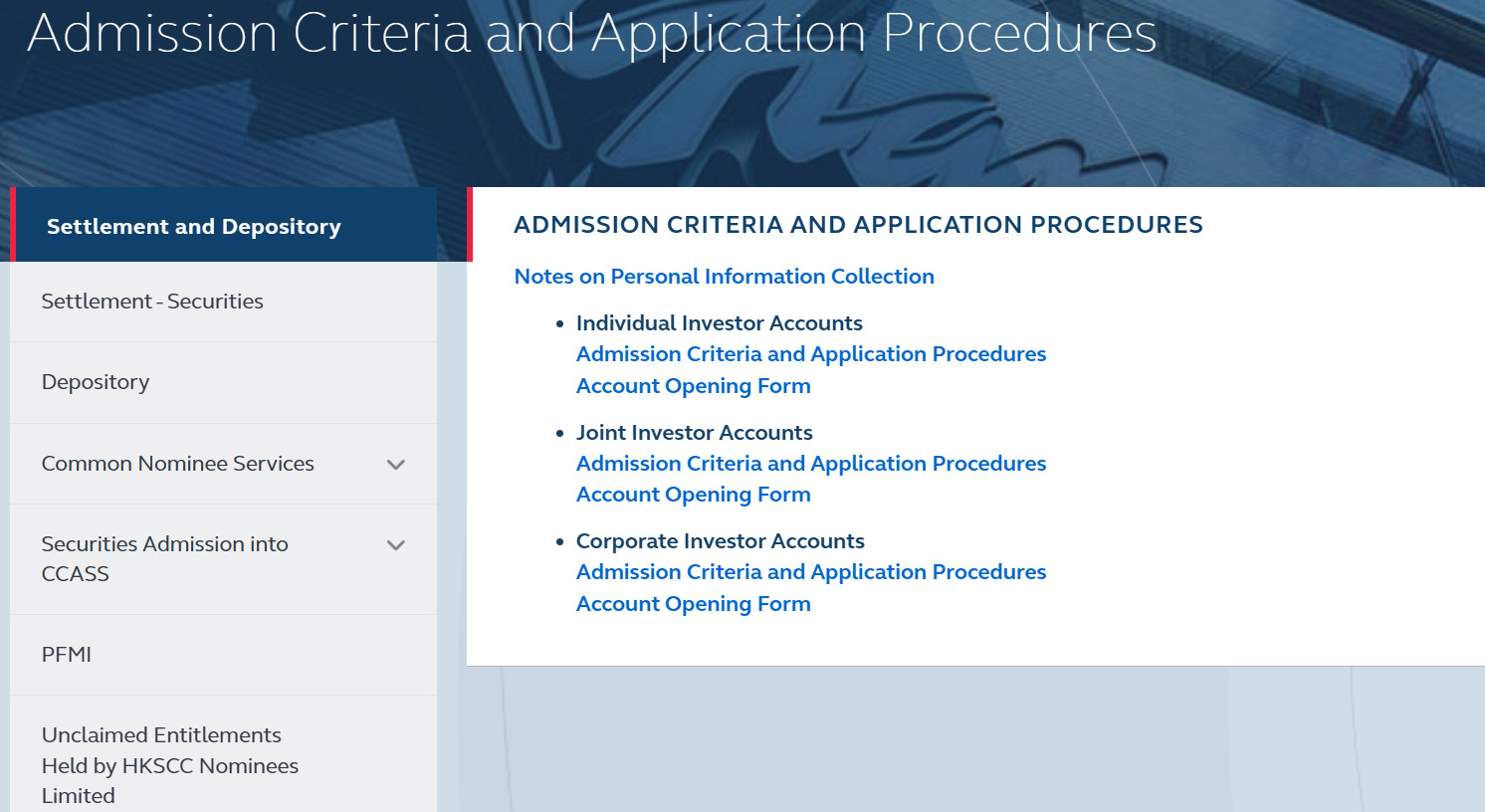

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with HKEX?

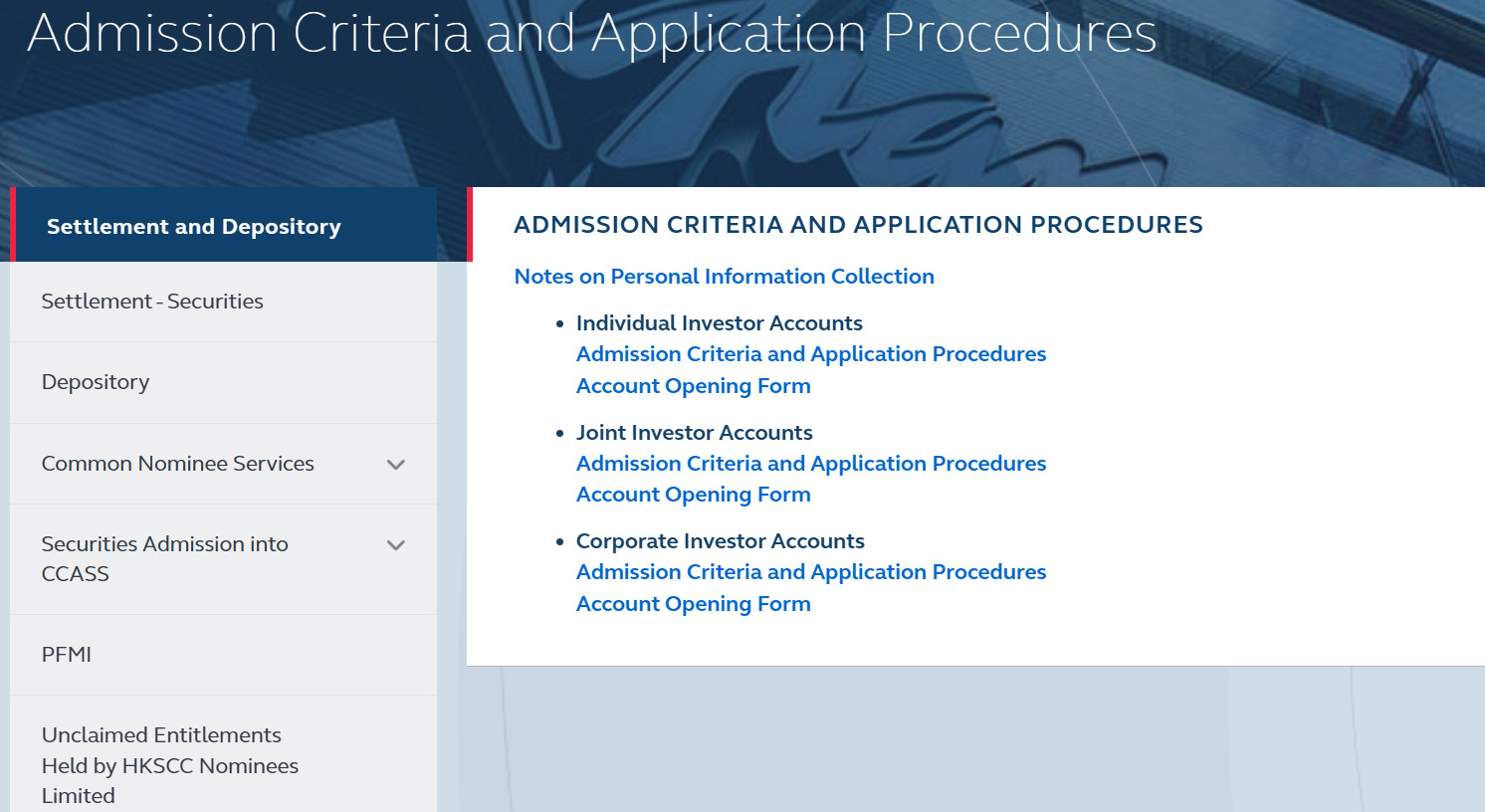

At HKEX, clients can open several account types to meet the needs of different market participants, including Individual Investor, Joint Investor, and Corporate Investor accounts. The accounts support trading in various currencies, including HKD, EUR, USD, and more.

Individual Account

An Individual Account is designed for single investors who want to trade Hong Kong-listed securities. While HKEX itself does not directly offer trading accounts, investors can open an Individual Account through a licensed broker that provides access to HKEX markets.

HKEX does not require a minimum deposit to open an Individual Investor Account. However, brokers that provide access to HKEX may ask for an initial deposit, usually starting at around HK$10,000.

Regions Where HKEX is Restricted

HKEX is a globally recognized exchange, however, access to its markets may be limited in certain regions due to regulatory and compliance factors, including:

- USA

- Canada

- India

- European Union

- Iran, etc.

Cost Structure and Fees

Score – 4.5/5

HKEX Brokerage Fees

The fees charged by HKEX vary depending on the product being traded and the trade volume, and are typically calculated based on commissions.

For equities and funds, the trading fees at HKEX range from 0.003% to 0.005% of the transaction value. The minimum fee is HKD 0.50, and the maximum fee is HKD 100. For derivatives, the fees range from HKD 1.5 to HKD 3.0 per contract.

Clearing fees for equities and funds are charged at 0.002% of the transaction value, with a minimum fee of HKD 2.0 and a maximum fee of HKD 100. For derivatives, clearing fees range from HKD 0.5 to HKD 1.5 per contract.

In contrast to spread-based trading, HKEX’s trading fees are not based on spreads but rather on commissions, where trading fees are charged as commissions on each opened position.

As a result, traders should research and compare fees across different brokers before choosing to trade with HKEX.

At HKEX, the commission rates vary depending on factors such as the type of asset being traded and market conditions. For derivatives, the average commission is HK$0.54 per side.

In addition to the base commission, other transaction costs may apply, such as transaction levies and clearing fees. Investors should also consider these additional fees when calculating the total cost of their trades.

HKEX does not apply swap fees in the same way as retail Forex brokers. Instead, for derivatives products such as futures and options, positions are typically settled daily through a process known as mark-to-market. This means that any gains or losses are realized daily, and there are no additional overnight financing charges.

In addition to standard trading commissions, investors trading on HKEX should be aware of several additional fees that affect the overall cost of transactions. A stamp duty of 0.1% is imposed on the transaction value, payable by both the buyer and the seller.

Additionally, investors who require real-time market data or use automated trading applications may incur extra charges. For example, Automated Trading Applications are subject to a fee of HK$20,000 per firm per month.

How Competitive Are HKEX Fees?

HKEX fees are generally considered competitive within the global exchange market, especially for institutional and high-volume traders. The exchange maintains a transparent fee structure, with clearly outlined charges for different asset classes and services.

While costs may be higher than some retail trading platforms, HKEX offers strong value through its deep liquidity and robust regulatory framework.

| Asset/ Pair | HKEX Spread | Fusion Markets Spread | MarketsVox Spread |

|---|

| EUR USD Spread | - | 0.92 pips | 0.1 pips |

| Crude Oil WTI Spread | - | 1.92 | 3.6 |

| Gold Spread | 0.01 | 0.99 | 23 |

Trading Platforms and Tools

Score – 4.4/5

HKEX offers a variety of trading platforms to suit the needs of different types of traders. The primary platform is the HKEX Orion or OTP-C Trading Platform, which provides a fast and reliable trading experience. It offers advanced order types, real-time market data, and integrated risk management tools.

In addition to the Orion Trading Platform, HKEX also offers Stock Connect, which is a trading link that connects the Hong Kong stock market with the stock markets in Mainland China, allowing investors to trade securities listed on both markets.

Trading Platform Comparison to Other Brokers:

| Platforms | HKEX Platforms | Fusion Markets Platforms | MarketsVox Platforms |

|---|

| MT4 | No | Yes | No |

| MT5 | No | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

HKEX Orion Platform

The Orion Platform is a comprehensive suite of trading and market data systems developed by HKEX to enhance the efficiency, reliability, and scalability of its markets.

The platform includes the Securities Market (OTP-C), which supports cash equity trading, and the Orion Market Data Platform (OMD), delivering low-latency market data for both securities and derivatives markets.

Additionally, HKEX is developing the Orion Derivatives Platform (ODP), an in-house system aimed at providing advanced trading, clearing, and risk management capabilities for derivatives markets.

Main Insights from Testing

Testing of the Orion platform has shown that it works smoothly, handles high trading volumes well, and responds quickly. Users noticed faster performance and better stability, which is important for keeping markets running efficiently.

Overall, the testing highlighted that OTP-C Trading Platform is a strong and reliable system designed to support modern trading needs.

HKEX Desktop MetaTrader 4 Platform

HKEX does not support the MetaTrader 4 platform. HKEX operates its trading infrastructure and does not offer access through third-party platforms like MT4.

HKEX Desktop MetaTrader 5 Platform

Similarly, HKEX does not provide trading access via MT5. Investors trade through brokers or institutional platforms connected to HKEX’s proprietary systems rather than using MT5.

HKEX MobileTrader App

HKEX offers its mobile application called the Futures & Options Mobile App, designed to provide investors with real-time access to stock options, index options, and selected futures prices.

The app includes features such as “My Portfolio” for tracking personalized investment portfolios, a market snapshot, quotes, search functions, an options calculator, and more. It is available on both iOS and Android platforms, catering to investors who wish to monitor and analyze HKEX-listed derivatives on the go.

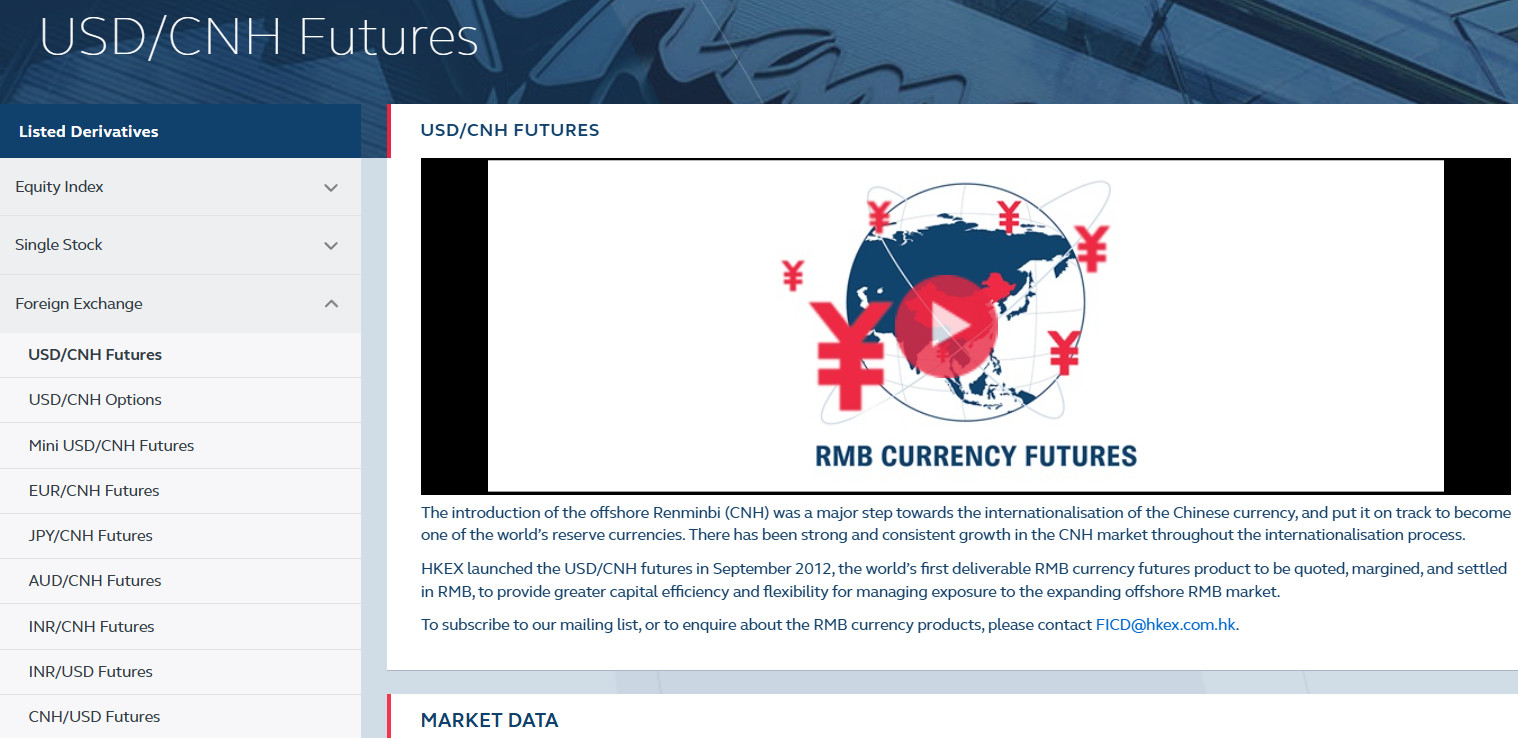

Trading Instruments

Score – 4.6/5

What Can You Trade on HKEX’s Platform?

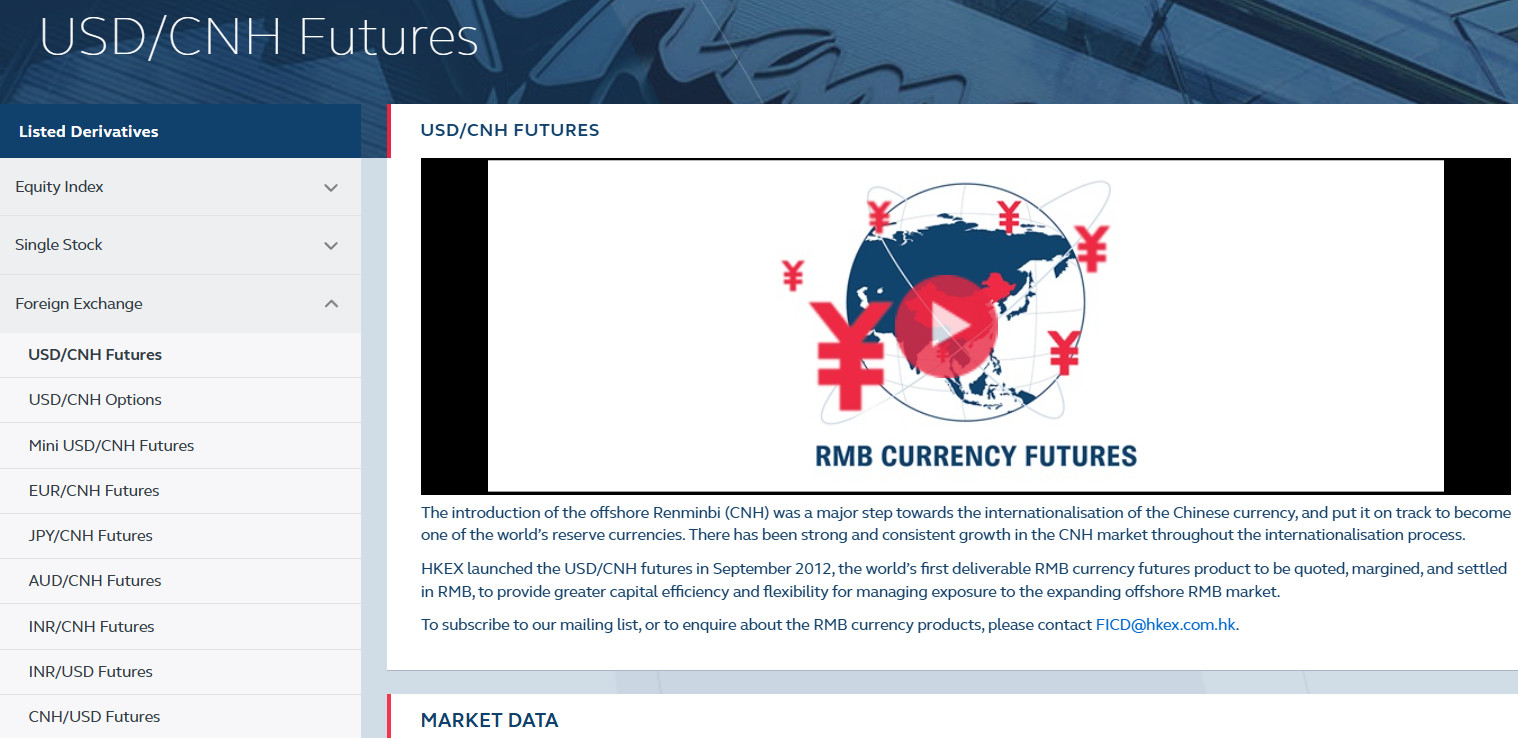

HKEX provides access to over 14,000 trading products, including equities, derivatives, FX, stocks, commodities, metals, futures, and more.

The derivatives products offered by HKEX include options and futures on indices, currencies, commodities, and interest rates, providing clients with a range of investment options to suit their risk profile and investment objectives.

Main Insights from Exploring HKEX’s Tradable Assets

Exploring HKEX’s tradable assets reveals a broad and diverse offering that caters to various traders’ needs, from equities and ETFs to derivatives like futures and options.

With a well-rounded selection of financial products, HKEX offers opportunities for both retail and institutional investors looking for exposure to global markets.

Leverage Options at HKEX

HKEX does not offer leverage in the traditional sense, as it is a stock exchange that primarily facilitates the trading of equities and other securities.

The multiplier requirements for trading on the exchange depend on the specific product being traded. For example, the margin requirement for trading Hong Kong-listed equities is typically 10% of the trade value.

However, some brokers who offer access to HKEX may provide leverage for trading other products, such as derivatives.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at HKEX

In terms of funding methods, HKEX currently accepts only Bank Transfer, and mentions that additional payment options will be available in 2025.

HKEX Minimum Deposit

There is no requirement for a minimum deposit with HKEX. However, our research indicates that many traders prefer starting with an initial amount of HK$10,000.

Withdrawal Options at HKEX

HKEX allows clients to withdraw funds from their trading accounts via bank transfer. The processing time for withdrawals may vary depending on the client’s bank and country of residence, but it typically takes 1-3 business days for the funds to reach the client’s bank account. Clients may be required to provide additional documentation to complete the withdrawal process.

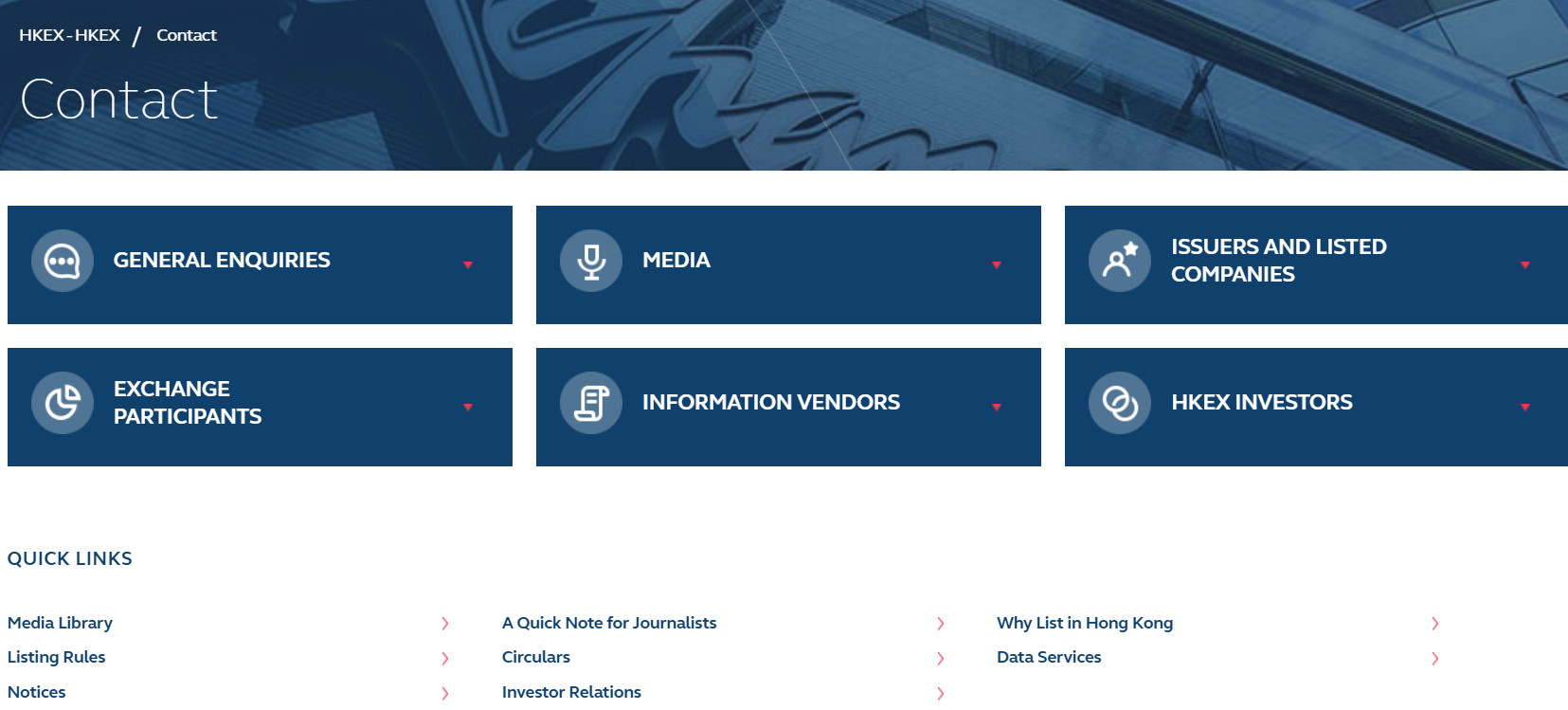

Customer Support and Responsiveness

Score – 4.4/5

Testing HKEX’s Customer Support

HKEX offers 24/5 supportive customer support through Phone lines and Email. The exchange’s support team consists of trading professionals who can help traders with various concerns, including technical support, analysis recommendations, general questions, and operational problems.

Contacts HKEX

For any inquiries related to HKEX, you can contact their general support at (852) 2522 1122 or via email at info@hkex.com.hk. HKEX also offers a dedicated hotline for investor-related questions at (852) 2840 3330. These contact options provide direct access to support and assistance regarding the firm’s services and operations.

Research and Education

Score – 4.7/5

Research Tools HKEX

HKEX provides a variety of research tools to support investors, analysts, and market participants in making informed decisions.

- The HKEX Data Marketplace offers direct access to extensive historical and reference data, including CCASS shareholding data, tick-by-tick trading records, and securities attributes, with flexible delivery options such as cloud-to-cloud transfers and direct downloads.

- For risk management, the VaR Platform enables post-trade clients to perform margin calculations and stress testing, enhancing transparency and cost-efficiency across market participants.

- Additionally, the IR Connect portal serves as a digital investor relations platform, allowing listed companies to manage their investor engagement and access shareholder analysis and market data.

Education

HKEX offers a comprehensive range of educational resources designed to support investors and finance professionals. The e-Learning platform provides webcasts and training materials on topics such as ESG governance, corporate disclosure obligations, and listing rules, helping directors stay informed about regulatory requirements.

For those interested in sustainable finance, the ESG Academy offers webinars, guides, and case studies to assist companies in implementing climate-related disclosures and understanding new ESG requirements.

HKEX also invests in talent development through its 24-month Graduate Programme, providing hands-on experience and exposure to senior management.

Portfolio and Investment Opportunities

Score – 4.8/5

Investment Options HKEX

HKEX offers a wide range of investment options, including equities, derivatives, stocks, ETFs, fixed income products, and more.

Additionally, the exchange provides access to Mainland China’s markets through programs like Stock Connect and Bond Connect, broadening the investment market. With its diverse product range and international links, HKEX serves as a dynamic platform for global investors looking for opportunities in Asia’s most active financial environment.

Account Opening

Score – 4.4/5

How to Open HKEX Demo Account?

HKEX does not offer a traditional demo trading account for retail investors. However, it provides various testing and simulation platforms primarily designed for institutional traders and market professionals.

How to Open HKEX Live Account?

HKEX offers the Individual Investor Account through the Hong Kong Securities Clearing Company Limited, allowing investors to hold securities directly in the Central Clearing and Settlement System.

- Fill out the Individual Investor Account Opening Form.

- Provide the required documents.

- Designate a bank account.

- Mail the completed forms and documents to HKSCC.

- The account opening process typically takes two to three weeks, including the time required to set up the electronic money settlement arrangement with your designated bank.

- Once your account is active, you can access it via the CCASS Internet System to view statements, manage holdings, and participate in corporate actions.

Additional Tools and Features

Score – 4.3/5

In addition to its core trading tools, HKEX provides a variety of additional features that enhance the trading and investing experience.

- These include the HKEX Calendar for tracking key market dates and corporate actions, the Listed Company Search for accessing detailed issuer profiles, and the Market Data Feed Services offering real-time and historical trading data.

- The exchange also provides tools like the Derivatives Analytics Platform and the Depository Services Portal, which support more advanced portfolio management and trade tracking.

These resources cater to both institutional and retail investors seeking in-depth market transparency and operational efficiency.

HKEX Compared to Other Brokers

Compared to other well-known brokers, HKEX stands out for its solid regulatory framework under the SFC and its focus on institutional-grade market infrastructure.

While many competitor brokers offer user-friendly platforms like MT4/MT5 and a wider variety of assets for retail traders, HKEX primarily caters to more experienced or institutional investors, providing access to a broad range of listed instruments and futures contracts.

Unlike many providers that operate on tight spreads with commission-based or hybrid pricing models, HKEX uses a commission-based fee structure that may not appeal to typical retail Forex traders looking for ultra-low spreads.

However, HKEX excels in educational resources and market transparency, and its stability makes it an appealing choice for experienced investors seeking access to the Asian financial markets.

| Parameter |

HKEX |

ADS Securities |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

X Open Hub |

| Spread Based Account |

For USD/CNH futures contracts, the quote spread is 20 pips |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

Average Derivatives Commission is HK$0.54 per side |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average/ High |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

OTP-C Trading Platform, Stock Connect |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

14,000+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

SFC |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$100 |

$0 |

$0 |

$100 |

$0 |

$0 |

Full Review of Broker HKEX

HKEX is a well-established exchange offering a range of investment opportunities, primarily focused on futures and derivatives trading. It is highly regarded for its robust regulatory environment, ensuring a secure and reliable trading experience.

The exchange provides access to a diverse range of investment products, particularly in the Asian markets, making it an attractive option for institutional and professional traders.

The platform offers advanced trading tools and resources, including educational programs, which help investors stay informed. While HKEX may not cater to casual retail traders, its commitment to market innovation and sustainability makes it a trusted firm for investors looking for comprehensive trading solutions.

Share this article [addtoany url="https://55brokers.com/hkex-review/" title="HKEX"]

Is HKEXCHAN part of your group? I have tried to withdraw funds and they are wanting taxes paid to do so. I want to verify the legitimacy of this account. I received an email from HKEX Global Cryptocurrency Exchange U.S. The legal name is Hong Kong Exchange and Clearing Limited.