Goldwell Capital Review

Leverage: 1:200

Regulation: SECC

Min. Deposit: $200

HQ: Cambodia

Platforms: MT4

Found in: 2018

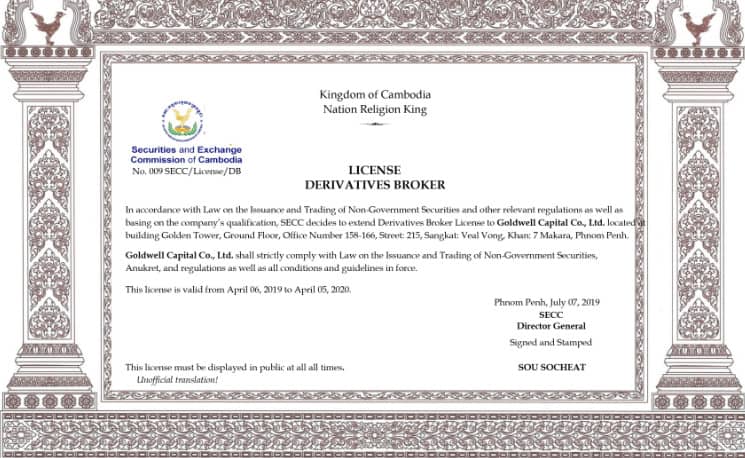

Goldwell Capital Licenses:

- Goldwell Capital Co., Ltd. - authorized by SECC (Cambodia) registration no 00029659

Leverage: 1:200

Regulation: SECC

Min. Deposit: $200

HQ: Cambodia

Platforms: MT4

Found in: 2018

Goldwell Capital is a Cambodian brokerage firm that provides various derivatives trading services, such as Forex, Commodities, Precious Metals, and CFD trading.

Based on our findings, the company has been operating since 2018 and is registered and regulated by the Securities and Exchange Commission of Cambodia (SECC).

In general, Goldwell Capital takes necessary steps towards a stable and reliable commitment to provide clients with trustworthy trading conditions together with the Cambodian government. The broker follows an NDD execution model, obtaining quotes from international banks and financial institutions and executing trades automatically.

Goldwell Capital has both advantages and disadvantages to consider when choosing it as your Forex trading broker. On the positive side, the broker offers competitive trading conditions, easy account opening procedures, and access to popular financial instruments through the advanced MT4 trading platform.

For the cons, the website lacks proper educational and research materials, and the range of financial instruments the broker offers may not be extensive. Additionally, there is no 24/7 customer support, which could be a concern for some traders seeking immediate assistance. Another significant point is that the brokerage firm lacks a top-tier or reputable regulatory license, which may raise regulatory oversight concerns for potential traders. Therefore, you should carefully evaluate and conduct thorough research before deciding whether the broker aligns with your specific trading needs and preferences.

| Advantages | Disadvantages |

|---|---|

| MT4 trading platform | No top-tier license |

| Competitive pricing | Limited education and research |

| NDD execution | No 24/7 customer support |

| Popular trading instruments | |

| Low minimum deposit |

| 🏢 Headquarters | Cambodia |

| 🗺️ Regulation | SECC |

| 📉 Instruments | Forex, Commodity, Precious Metals and CFD trading |

| 🖥 Platforms | MT4 |

| 💰 EUR/USD Spread | 1.8 pips |

| 💳 Minimum deposit | $200 |

| 💰 Base currencies | USD, GBP, EUR |

| 🎮 Demo Account | Available |

| 📚 Education | Market updates and news, economic calendar |

| ☎ Customer Support | 24/5 |

According to our analysis, the broker offers competitive trading conditions catering to both local traders and those from Southeast Asia. Moreover, Goldwell Capital provides access to popular financial instruments and an advanced trading platform that allows users to trade effectively.

| Ranking | Goldwell Capital | Scandinavian Capital Markets | Invast Global |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Advantages | Trading Conditions | Trading Platforms | Prime Brokerage Services |

We have conducted a comprehensive analysis and compiled a list of possible broker alternatives to Goldwell Capital. This list considers various factors, including trading features, regulatory compliance, fees, market availability, customer support, and user feedback.

No, Goldwell Capital is not a scam but a regulated broker with lower-risk Forex trading. As a Cambodian Forex broker, it is regulated by the Cambodian government within the framework of a financial regulatory system through the established regulator SECC.

Yes, Goldwell Capital is a legit and regulated broker.

SECC authority was specifically created with the purpose to regulate financial industry participants and protect investors under necessary rules. This set of obligations covers an essential part of the security of client capital and follows strict policies towards monitoring of actions, as well as protection at every level.

However, we should mention that Cambodia is not a reputable jurisdiction if compared with other industry-known and leading financial participants globally.

See our conclusion on Goldwell Capital Reliability:

| Goldwell Capital Strong Points | Goldwell Capital Weak Points |

|---|---|

| Professional trading | No top-tier license |

| NDD execution | |

| Client capital protection |

The regulatory body puts significant efforts into expanding its influence and effectively regulating the Forex industry within the country’s legal framework, with a focus on client protection and the financial system. To safeguard client funds, Goldwell Capital enforces strict policies specifically designed to ensure the security of clients’ capital.

Leveraged trading provides the possibility of bigger profit, yet increases risks as well so you should always learn deeply how to use tools smartly. Eventually, Goldwell Capital offers flexible leverage so you may choose the most suitable level for the instrument or another.

Goldwell Capital leverage is offered according to SECC regulation:

Based on our research, traders may choose either a Demo account for their practice purposes or sign up for a Live one. For comprehensive details regarding the account types, we advise consulting the broker’s official website or getting in touch with their customer support.

| Pros | Cons |

|---|---|

| Fast and easy account opening | None |

| Demo account | |

| Low minimum deposit amount |

Opening an account with a broker is an easy process, as you can log in and register with Goldwell Capital within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

The broker offers a variety of popular financial markets to engage in, including Forex, Commodity, Precious Metals and CFD trading, and more. Moreover, Goldwell Capital provides traders with the flexibility to participate in various markets according to their unique preferences and trading approaches.

Reviewing the broker’s fee structure we found that the broker offers flexible trading conditions, allowing traders to select contract sizes starting from 0.01 lots, which corresponds to a micro account. This feature empowers traders to manage their positions according to their specific strategies effectively.

Additionally, always consider rollover or overnight fee as a cost, which is defined as a fee or refund depending on long or short positions you held longer than a day.

| Fees | Goldwell Capital Fees | Scandinavian Capital Markets Fees | Invast Global Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | Yes | No |

| Inactivity fee | Yes | Yes | No |

| Fee ranking | Average | Low/Average | Low/Average |

Per our test trade, Goldwell Capital offers competitive spreads with an average spread of 1.8 pips for the EUR/USD currency pair in the Forex market. The spread for Gold is 0.5 pips, and for Silver, it is 0.04 pips.

| Asset/ Pair | Goldwell Capital Spread | Scandinavian Capital Markets Spread | Invast Global Spread |

|---|---|---|---|

| EUR USD Spread | 1.8 pips | 0.0 pips | 0.2 pips |

| Crude Oil WTI Spread | 4 | 4 | 3 |

| Gold Spread | 50 cents | 50 cents | 1 |

We found that in order to deposit money into your Goldwell Capital trading account, you may use only Bank Wire transfer as a deposit method.

Here are some good and negative points for Goldwell Capital funding methods found:

| Advantage | Disadvantage |

|---|---|

| Multiple account base currencies | Limited funding methods |

| Fast digital deposits | |

| No fees for deposits and withdrawals |

The broker’s minimum deposit amount is $200, which is considered a good offering overall. Yet you should always check the margin requirement for the instrument you will trade. Also, better to verify with customer service as different conditions may apply.

Goldwell Capital minimum deposit vs other brokers

| Goldwell Capital | Most Other Brokers | |

| Minimum Deposit | $200 | $500 |

The broker does not impose any fees for deposits and withdrawals. However, since the only available option for transfers is Bank Wire, you should verify with your payment provider or bank institution to understand if they apply any fees for such transactions. Different countries may have varying international policies and fee structures that could affect clients.

To initiate a withdrawal fund from your trading account, the brokerage firm provides a set of typical steps that can be followed:

Goldwell Capital traders have access to the market leader MetaTrader4. The platform is not only known for its powerful chart features and general capabilities to suit any trading style, but it also offers some of the best trading models with powerful tools and add-ons. You may access the platform via any device including PC, iOS, or Mobiles, so you will stay connected and updated under any conditions or circumstances.

| Platforms | Goldwell Capital Platforms | Scandinavian Capital Markets Platforms | Invast Global Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | No |

| MT5 | No | No | No |

| cTrader | No | Yes | No |

| Own Platform | No | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

MT4 is widely accepted by both beginners and experienced traders for its user-friendly interface, the capacity to integrate custom-designed algorithms, and take full advantage of its comprehensive features. Moreover, the platform allows for connectivity through Expert Advisors, popular MT4 robots that execute orders based on predefined algorithms. These algorithms can be customized to suit individual preferences or selected from a range of available options.

Broker’s customer support is available 24/5 through Email, Phone, and Live Chat. Additionally, the support team is proficient in addressing various needs, including technical inquiries, providing analysis recommendations, and answering general questions.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Phone support, email, live chat | No 24/7 customer support |

| Quick responses | |

| Relevant answers |

In the end, the broker offers a limited range of learning and research materials for traders. However, we found that the website offers resources such as market updates and news, financial articles, and economic calendar.

In summary, Goldwell Capital is a regulated brokerage firm that provides competitive trading conditions within its jurisdiction. The broker offers access to popular trading instruments through the advanced MT4 platform, which is favored by both beginners and professionals.

Although the company has gained some trust within the local community, there are concerns about its regulatory status. Therefore, you should conduct thorough research and evaluate your trading needs and preferences before deciding whether the broker is the right match for you.

Based on Our findings and Financial Expert Opinions Goldwell Capital is Good for:

No review found...

No news available.

Can I trade from Nigeria starting with $10