- What is GoldWell?

- GoldWell Pros and Cons

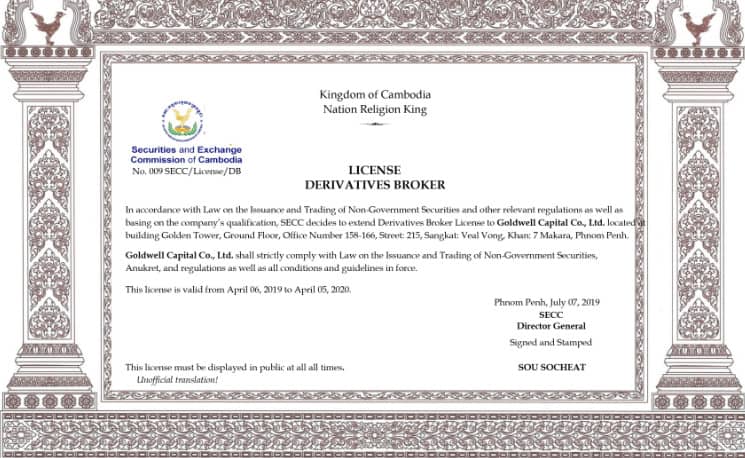

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

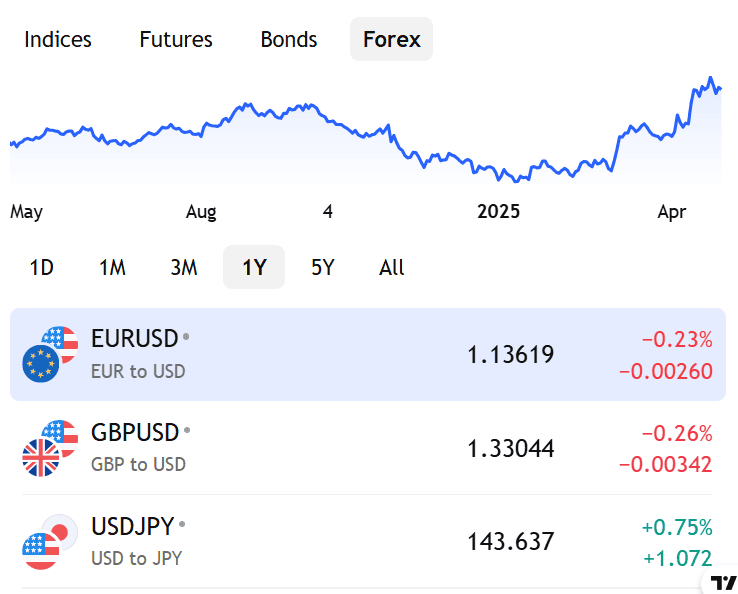

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- GoldWell Compared to Other Brokers

- Full Review of Broker GoldWell

Overall Rating 4.2

| Regulation and Security | 4 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.2 / 5 |

| Research and Education | 4 / 5 |

| Portfolio and Investment Opportunities | 4.2 / 5 |

| Account Opening | 4.3 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is GoldWell?

Goldwell Capital is a Cambodian brokerage firm that provides various derivatives trading services, such as Forex, Commodities, Precious Metals, and CFD trading.

Based on our findings, the company has been operating since 2018 and is registered and regulated by the Securities and Exchange Regulator of Cambodia (SECC).

GoldWell takes necessary steps towards a stable and reliable commitment to provide clients with trustworthy conditions, together with the Cambodian government. The broker follows an NDD execution model, obtaining quotes from international banks and financial institutions and executing trades automatically.

GoldWell Pros and Cons

GoldWell has both advantages and disadvantages to consider when choosing it as your Currency trading broker. On the positive side, the broker offers competitive conditions, easy account opening procedures, and access to popular financial instruments through the advanced MT5 platform.

For the cons, the website lacks proper educational and research materials, and the range of financial instruments the broker offers may not be extensive. Additionally, there is no 24/7 customer support, which could be a concern for some traders seeking immediate assistance.

Another significant point is that the brokerage firm lacks a top-tier or reputable regulatory license, which may raise regulatory oversight concerns for potential traders. Therefore, you should carefully evaluate and conduct thorough research before deciding whether the broker aligns with your specific needs and preferences.

| Advantages | Disadvantages |

|---|

| MT5 trading platform | No top-tier license |

| Competitive pricing | Limited education and research |

| NDD execution | No 24/7 customer support |

| Popular trading instruments | |

| Low minimum deposit | |

GoldWell Features

GoldWell offers competitive conditions catering to both local traders and those from Southeast Asia. Moreover, the broker provides access to popular financial instruments and advanced platforms that allow users to trade effectively. Below is a comprehensive list of its key features:

GoldWell Features in 10 Points

| 🏢 Regulation | SERC |

| 🗺️ Account Types | Standard, Professional, Zero Spread, S Accounts |

| 🖥 Trading Platforms | MT5 |

| 📉 Trading Instruments | Forex, Commodity, Precious Metals and CFD trading |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 1.8 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, GBP, EUR |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is GoldWell For?

With user-friendly tools and competitive brokerage fees, GoldWell caters to traders of all levels. Based on our research, the broker is suitable for:

- Cambodian traders

- Traders who prefer the MT5 platform

- Currency trading

- Beginners

- Advanced traders

- Traders from Southeast Asia

- NDD execution

- Competitive pricing

- Good tools

- EA/Auto trading

GoldWell Summary

In summary, GoldWell is a regulated brokerage firm that provides competitive conditions within its jurisdiction. The broker offers access to popular instruments through the advanced platforms, which are favored by both beginners and professionals.

Although the company has gained some trust within the local community, there are concerns about its regulatory status. Therefore, you should conduct thorough research and evaluate your needs and preferences before deciding whether the broker is the right match for you.

55Brokers Professional Insights

GoldWell stands out as a reliable brokerage firm offering access to global financial markets through the widely recognized MetaTrader 5 platform. These industry-leading platforms provide powerful charting tools, real-time market data, and fast execution, catering to both new and experienced traders.

Regulated by the Securities and Exchange Regulator of Cambodia (SERC), GoldWell ensures a secure environment. With competitive spreads and flexible leverage, the broker delivers a streamlined and efficient experience for clients worldwide.

Consider Trading with GoldWell If:

| GoldWell is an excellent Broker for: | - Competitive conditions.

- Access to robust platform.

- Providing diverse tools, and strategies.

- Suitable for beginners and professional traders.

- Offering popular instruments.

- Traders from Southeast Asia

- Providing Copy Trading.

- Access to unlimited leverage. |

Avoid Trading with GoldWell If:

| GoldWell might not be the best for: | - Look for broker with 24/7 customer support.

- Prefer MAM/PAMM trading.

- Need a broker with top-tier license. |

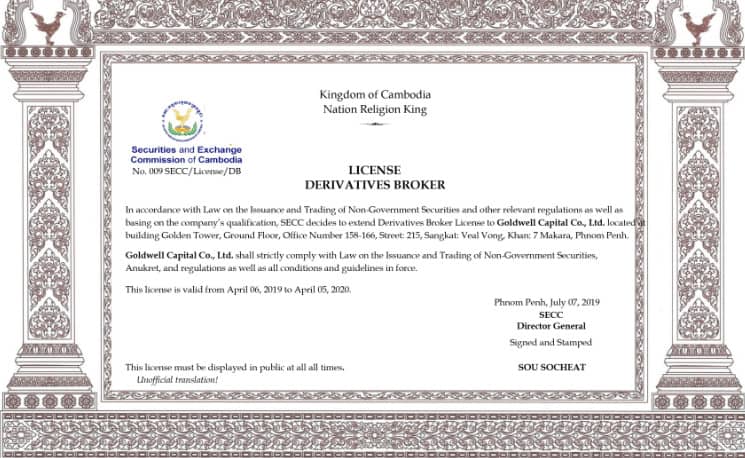

Regulation and Security Measures

Score – 4/5

GoldWell Regulatory Overview

As a Cambodian Forex broker, GoldWell is regulated by the Cambodian government within the framework of a financial regulatory system through the established regulator SERC.

SERC authority was specifically created with the purpose of regulating financial industry participants and protecting investors under necessary rules. This set of obligations covers an essential part of the security of client capital and follows strict policies towards monitoring of actions, as well as protection at every level.

How Safe is Trading with GoldWell?

SERC puts significant efforts into expanding its influence and effectively regulating the Forex industry within the country’s legal framework, with a focus on client protection and the financial system.

To safeguard client funds, GoldWell enforces strict policies specifically designed to ensure the security of clients’ capital. However, we should mention that Cambodia is not a reputable jurisdiction if compared with other industry-known and leading financial participants globally.

Consistency and Clarity

GoldWell has built a reputation for consistency and reliability within the trading community, backed by its regulatory status under the Securities and Exchange Regulator of Cambodia (SERC). Trader reviews often highlight the broker’s solid execution, stable environment, and user-friendly MT5 platform.

While many clients appreciate its competitive spreads and responsive support, some have pointed out the need for broader educational resources and additional tools. Despite this, GoldWell maintains positive ratings across multiple review platforms and continues to grow its presence globally.

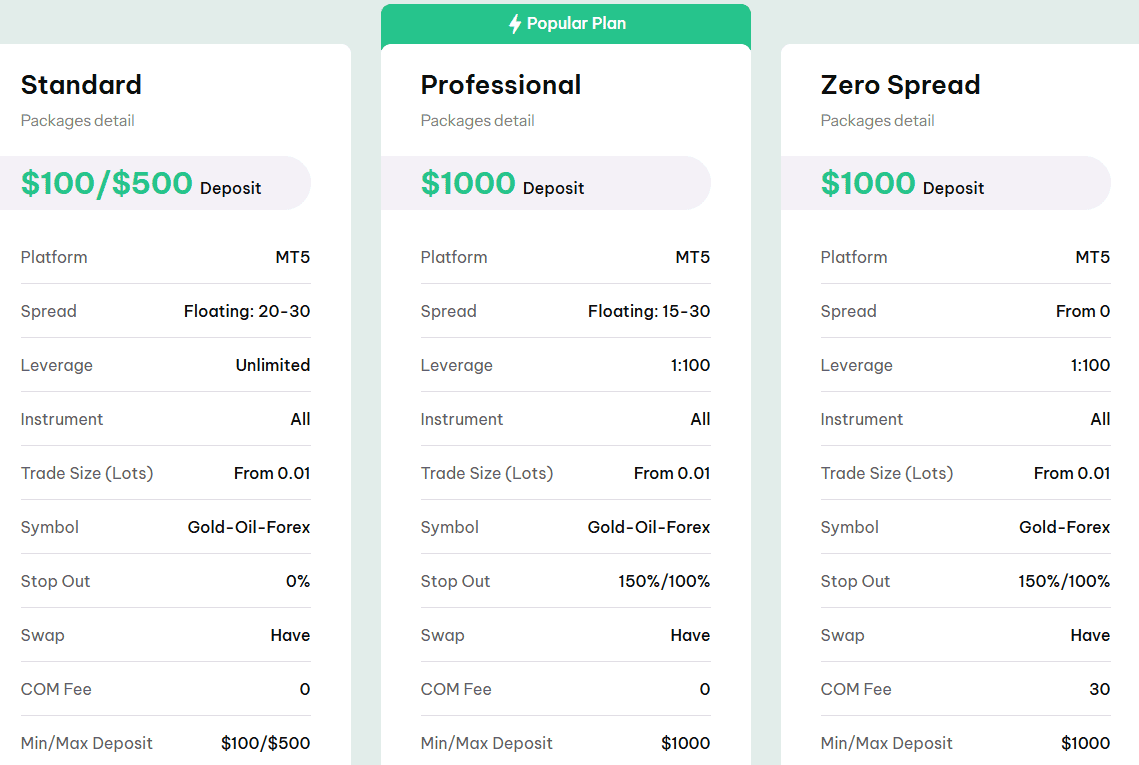

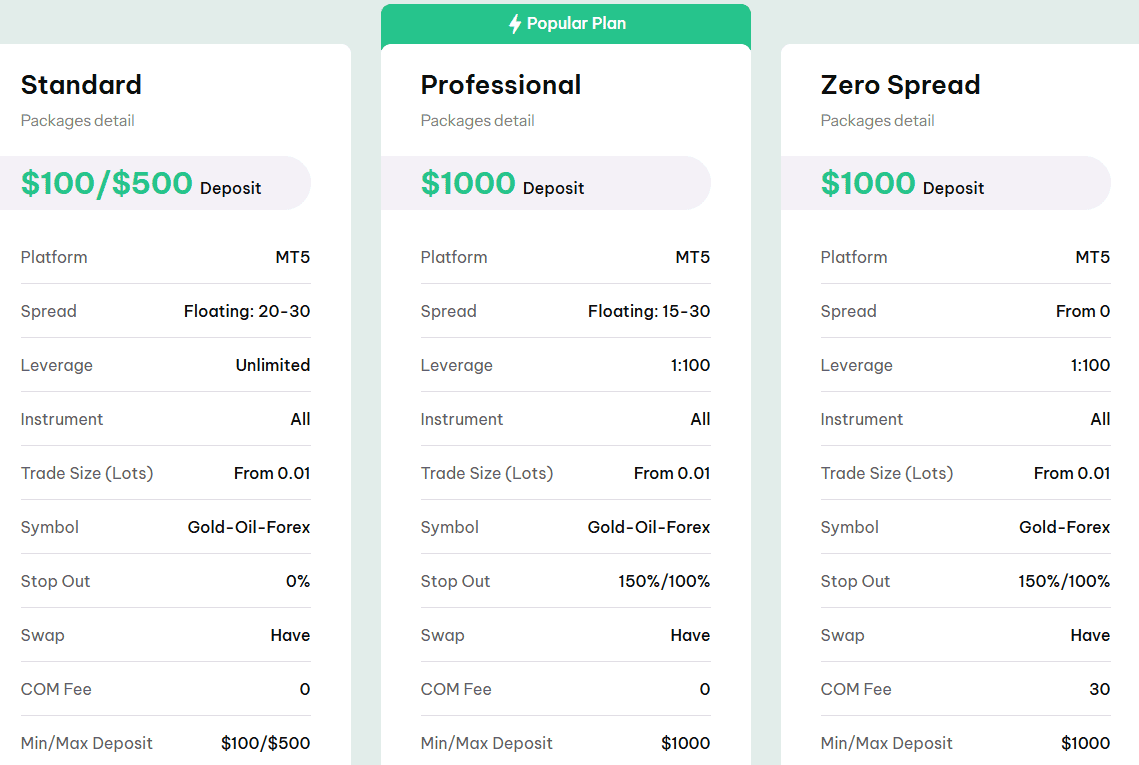

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with GoldWell?

GoldWell offers a range of account types designed to suit different styles and experience levels. Traders can choose from the Standard, Professional, Zero Spread, and Special Accounts, each offering distinct conditions to match their needs.

Additionally, the broker offers a Demo Account, allowing new users to practice in a risk-free environment before trading live.

Standard Account

The Standard Account is designed for traders who prefer simplicity and flexibility. It offers competitive spreads starting from 1.8 pips, unlimited leverage, and access to a range of instruments through the MetaTrader 5 platform.

This account type is ideal for beginner to intermediate traders seeking a straightforward experience with a low minimum deposit requirement.

Professional Account

The Professional Account is tailored for experienced traders who demand more from their trading conditions. It provides tighter spreads, leverage up to 1:100, and enhanced execution speeds to support advanced strategies.

This account type suits active traders who require greater flexibility and access to premium features.

Regions Where GoldWell is Restricted

GoldWell does not accept clients from certain restricted regions due to regulatory and legal limitations, including:

- Canada

- Canada

- Japan, etc.

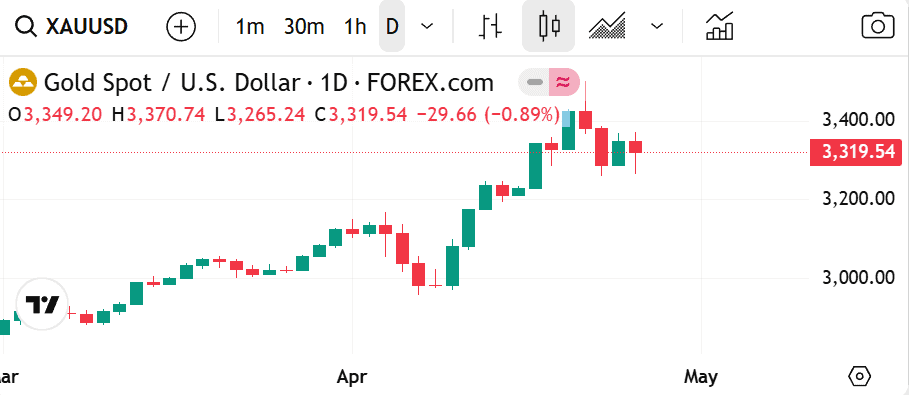

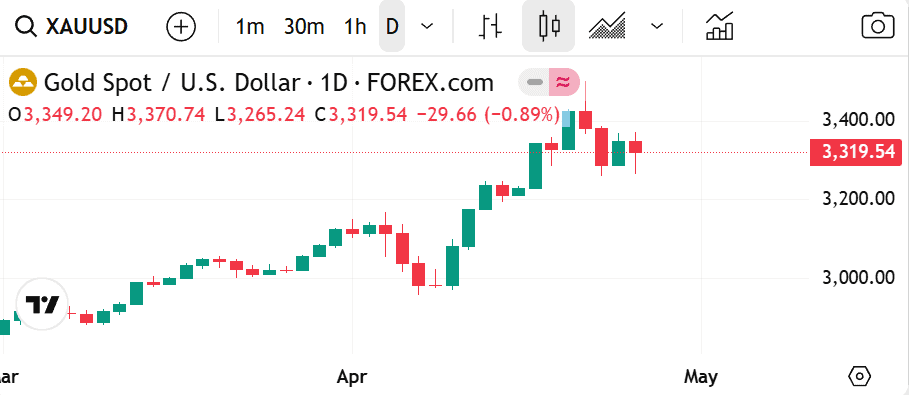

Cost Structure and Fees

Score – 4.3/5

GoldWell Brokerage Fees

GoldWell offers flexible fees, allowing traders to select contract sizes starting from 0.01 lots, which corresponds to a micro account. This feature empowers traders to manage their positions according to their specific strategies effectively.

Additionally, always consider rollover or overnight fees as a cost, which is defined as a fee or refund depending on the long or short positions you held longer than a day.

GoldWell offers competitive spreads with an average spread of 1.8 pips for the EUR/USD currency pair in the Forex market. The spread for Gold is 0.5 pips, and for Silver, it is 0.04 pips.

GoldWell offers commission-free trading on most of its account types. However, the Zero Spread Account incurs a commission fee of $30 per lot. This commission structure is designed to cater to traders who prioritize lower spreads and are comfortable with a per-trade commission model.

- GoldWell Rollover / Swaps

GoldWell applies rollover, or swap fees, to positions held overnight, in line with standard industry practices. These fees can either be charged or credited, depending on the instrument being traded and the direction of the trade.

Swap rates are influenced by the interest rate differentials between currencies and may vary daily.

How Competitive Are GoldWell Fees?

GoldWell’s fees are generally competitive, offering tight spreads and straightforward cost structures. While the Standard, Professional, and Special accounts provide commission-free trading with reasonable spreads, the Zero Spread account caters to traders seeking minimal spreads at the cost of a fixed commission.

Overall, GoldWell balances affordability with quality conditions, making it a solid choice for both casual and active traders.

| Asset/ Pair | GoldWell Spread | Sucden Financial Spread | CPT Markets UK Spread |

|---|

| EUR USD Spread | 1.8 pips | 1 pip | 1.8 pips |

| Crude Oil WTI Spread | 4 | 3 | 7.8 |

| Gold Spread | 50 cents | 1 | 2.8 |

| BTC USD Spread | - | - | 6 |

GoldWell Additional Fees

GoldWell maintains a transparent fee structure with no hidden charges. However, traders should be aware of potential additional costs, such as inactivity fees if an account remains dormant for an extended period.

There may also be standard fees related to deposits and withdrawals, depending on the chosen payment method. Traders should review the broker’s full terms to understand all possible charges before opening an account.

Trading Platforms and Tools

Score – 4.4/5

GoldWell provides traders with access to the popular MetaTrader 5 platform, known for its advanced tools, flexible charting options, and fast execution.

MT5 supports a wide range of order types, technical indicators, and automated trading through EAs, making it suitable for both beginners and experienced traders. The platform is available on desktop, web, and mobile devices, allowing clients to manage their trading activities conveniently from anywhere.

Trading Platform Comparison to Other Brokers:

| Platforms | GoldWell Platforms | Sucden Financial Platforms | CPT Markets UK Platforms |

|---|

| MT4 | No | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| Own Platforms | No | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

GoldWell Web Platform

GoldWell offers the MT5 web platform, allowing traders to access their accounts directly through a web browser without the need to download any software.

The MT5 Web version provides a full set of tools, real-time price quotes, advanced charting features, and fast execution speeds. It is compatible with all major browsers and ensures that traders can manage their positions easily and securely from anywhere with an internet connection.

GoldWell Desktop MetaTrader 4 Platform

The broker currently does not offer the MetaTrader 4 platform to its clients. Instead, the broker focuses on providing trading services exclusively through the more advanced MetaTrader 5 platform.

GoldWell Desktop MetaTrader 5 Platform

GoldWell offers the MT5 desktop platform, providing traders with a powerful and versatile environment. MT5 features advanced charting tools, multiple order types, a wide range of technical indicators, and support for automated trading through Expert Advisors.

The desktop version ensures fast execution and full access to all functions, making it a strong choice for traders who prefer a comprehensive and professional setup.

Main Insights from Testing

During testing, GoldWell’s MT5 platform proved to be stable, user-friendly, and responsive, offering smooth trade execution and a customizable interface.

The platform handled multiple chart setups and technical analysis tools efficiently, making it suitable for both manual and automated trading strategies. Overall, MT5 provided a reliable and professional experience, meeting the needs of a wide range of traders.

GoldWell MobileTrader App

GoldWell offers access to the MT5 mobile app, allowing clients to trade conveniently from their smartphones or tablets. The MT5 mobile version provides a full range of features, including real-time price quotes, interactive charts, technical indicators, and fast order execution.

Available for both iOS and Android devices, the app ensures that traders can monitor the markets and manage their trades on the go with ease and flexibility.

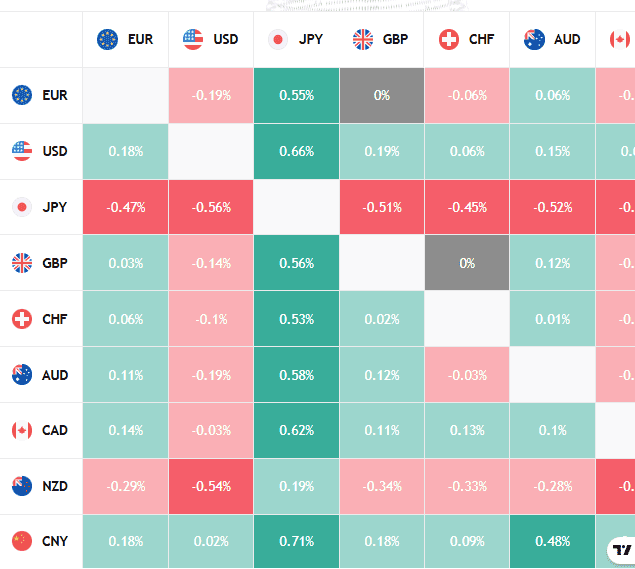

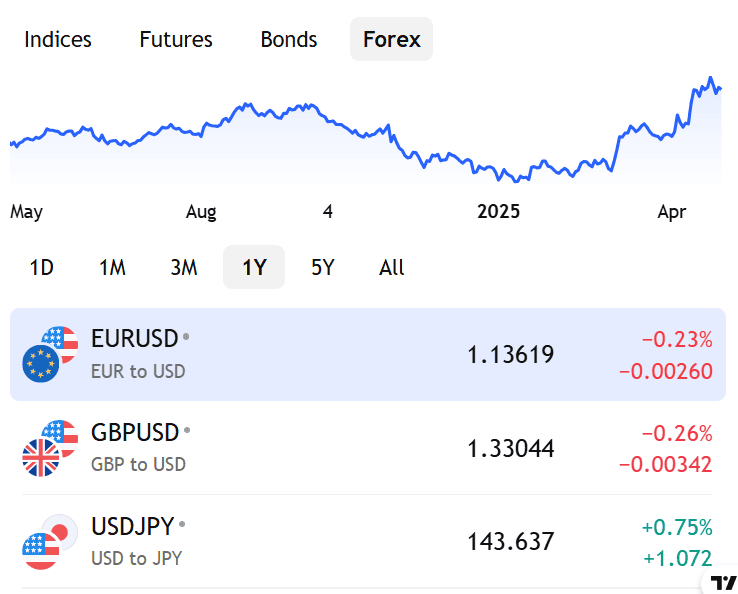

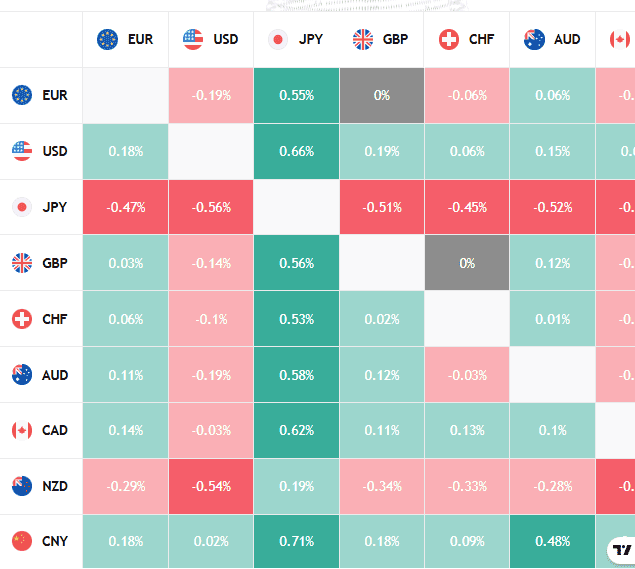

Trading Instruments

Score – 4.2/5

What Can You Trade on GoldWell’s Platform?

GoldWell offers 40 instruments across major asset classes, including Forex, Commodity, Precious Metals, and CFD trading, and more. Moreover, the broker provides traders with the flexibility to participate in various markets according to their unique preferences and approaches.

Main Insights from Exploring GoldWell’s Tradable Assets

The broker focuses on offering a carefully selected range of popular markets. While the available instrument selection is more limited compared to larger, multi-asset brokers, the streamlined offering may appeal to traders who prefer simplicity and focus on the most widely traded assets.

Leverage Options at GoldWell

Leveraged trading provides the possibility of bigger profits, yet increases risks as well, so you should always learn deeply how to use tools smartly. GoldWell multiplier is offered according to the SERC regulation:

- As a Cambodia broker, GoldWell offers high leverage ratios up to 1:100 available for retail traders, and unlimited leverage for Standard accounts.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at GoldWell

We found that to deposit money into your GoldWell account, you may use only Bank Wire transfer as a deposit method.

GoldWell Minimum Deposit

The broker’s minimum deposit amount for the Standard account is $100/$500, which is considered a good offering overall. The Professional and Zero Spread accounts require a $1000 minimum deposit to open an account. The minimum deposit requirement for the Special account is $10.

Withdrawal Options at GoldWell

The broker does not impose any fees for deposits and withdrawals. However, since the only available option for transfers is Bank Wire, you should verify with your payment provider or bank institution to understand if they apply any fees for such transactions.

Different countries may have varying international policies and fee structures that could affect clients.

Customer Support and Responsiveness

Score – 4.2/5

Testing GoldWell’s Customer Support

Broker’s customer support is available 24/5 through Email and Phone. The support team is generally responsive, handling questions related to accounts, platforms, and services.

Contacts GoldWell

Clients can reach out via phone at +855 23 888 778 or email at enquiry@goldwellcap.com.kh. The office is located at #158, Street 215, Sangkat Vealvong, Khan 7Makara, Phnom Penh, Cambodia. Support is available during standard business hours, Monday through Friday.

Research and Education

Score – 4/5

Research Tools GoldWell

GoldWell equips traders with a comprehensive suite of research tools through the MetaTrader 5 platform.

- The platform offers 38 built-in technical indicators and 44 analytical objects, enabling in-depth market analysis across 21 timeframes.

- For fundamental analysis, the platform provides an integrated economic calendar and real-time financial news updates, assisting traders in making informed decisions.

- Additionally, MT5 supports automated trading via Expert Advisors and includes a strategy tester for backtesting strategies.

Education

The broker offers a limited range of learning and research materials for traders. However, we found that the broker offers resources such as market updates and news, and an economic calendar.

Portfolio and Investment Opportunities

Score – 4.2/5

Investment Options GoldWell

GoldWell primarily focuses on offering Currency and CFD trading, providing access to a range of currency pairs, commodities, and indices.

While the broker does not offer traditional investment products like stocks or bonds, it supports copy trading, an investment tool that allows clients to follow and automatically replicate the trades of experienced traders. This feature makes the broker appealing not only to active traders but also to those who prefer a more hands-off investment approach.

Account Opening

Score – 4.3/5

How to Open GoldWell Demo Account?

To open a demo account with GoldWell, visit the broker’s official website and navigate to the “Demo Account” section. There, you will find a registration form where you can enter your details, such as name, email address, and phone number.

After submitting the form, you will receive login credentials to access the MT5 platform, allowing you to practice trading in a risk-free environment. This demo account is an excellent way to familiarize yourself with the platform’s features and test your strategies before committing real funds.

How to Open GoldWell Live Account?

Opening an account with a broker is an easy process, as you can log in and register with GoldWell within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Signup or Login” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.2/5

In addition to the standard research tools available on MT5, GoldWell offers features like one-click trading, alerts, and a built-in community for signals.

Traders can subscribe to signal providers directly through the platform, enhancing their strategies with real-time ideas from experienced traders. These additional tools help improve trading efficiency and offer more flexibility in managing trades.

GoldWell Compared to Other Brokers

Compared to its competitors, GoldWell offers a relatively basic environment, focusing mainly on Currency and CFDs through the MT5 platform. While it provides accessible conditions with a low minimum deposit, its spread and commission structure are generally higher than those of other brokers that offer more competitive pricing.

In terms of asset variety, GoldWell’s range is limited, especially when compared to large brokers that offer thousands of instruments across multiple markets. The broker’s regulation is decent but not as extensive or globally recognized as some leading names.

Additionally, Goldwell’s educational resources are quite limited, which may be a drawback for beginner traders seeking comprehensive learning materials. Overall, GoldWell can suit traders looking for straightforward Forex and CFD access but may fall short for those seeking broader markets, lower costs, and extensive educational support.

| Parameter |

GoldWell |

ADS Securities |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 1.8 pips |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + commission fee of $15 per side |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT5 |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

40+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

SERC |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$100 |

$100 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker GoldWell

GoldWell is a Currency trading broker offering trading services primarily through the popular MetaTrader 5 platform. The broker provides several account types, along with a demo account for practice.

GoldWell features competitive conditions but charges a relatively high commission on its Zero Spread account. The available range of instruments is modest, covering major asset classes. The broker offers essential tools, including technical indicators, an economic calendar, and copy trading features.

While educational resources are minimal, GoldWell maintains a presence through responsible operation and growing community activities. Overall, it offers a competitive experience suitable for traders seeking basic access to global markets.

Share this article [addtoany url="https://55brokers.com/goldwell-capital-review/" title="GoldWell"]

Can I trade from Nigeria starting with $10