- What is Glow Node?

- Glow Node Pros Cons

- Is Glow Node Legit?

- Glow Node Challenge

- Funded Account

- Account Conditions

- Payout

- Glow Node Alternative

What is Glow Node Prop Trading Firm?

Glow Node is a proprietary trading firm that was established with the aim of filling a market gap by working closely with traders to help them become profitable. Founded in April 2022, the firm started with a passion for trading and initially released their first Trading View Indicator. They have since expanded to offer a proprietary trading program, providing traders with tools, training, and simulated funding opportunities. This approach allows both the firm and the traders to profit together.

- Initially, Glow Node focused on trading education and the provision of indicators, but it has now grown to offer proprietary firm challenges to responsible traders. This expansion into prop trading allows traders to collaborate with substantial capital, potentially earning significant profits while managing risks effectively.

Glow Node differentiates itself by offering substantial capital provision for traders, allowing them to manage up to $1,000,000 with the potential to retain up to 90% of profits. This makes it a significant player in the prop trading world, enabling traders to achieve substantial financial success and independence. Read more about Prop Trading here

| Glwo Node Advantages | Glow Node Disadvantages |

|---|

| Lower Profit Target | Doesn't have License |

| A variety of trading account sizes | It is hard to become Funded Trader |

| Low entry fees | Limited Instrument Range |

| 50% payout in case of rule breach | Doesn't offer MetaTrader Platform |

| Low Commissions on Forex instruments | Doesn't offer free trial |

| Refundable Fee once you become Funded Trader | Low Leverage |

| Account Merge | |

| No minimum trading days | |

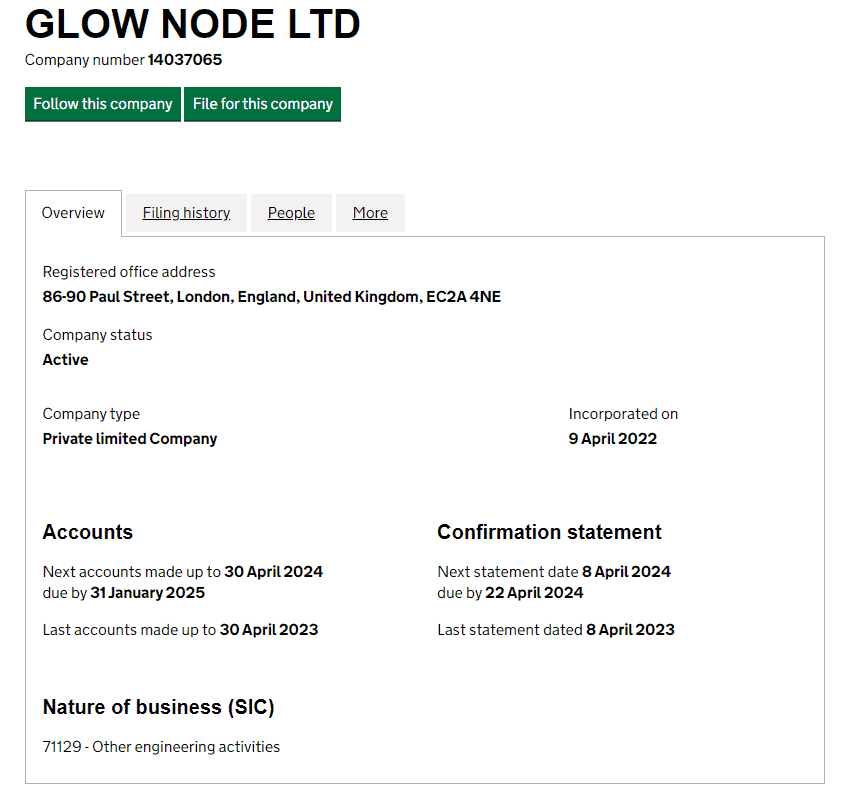

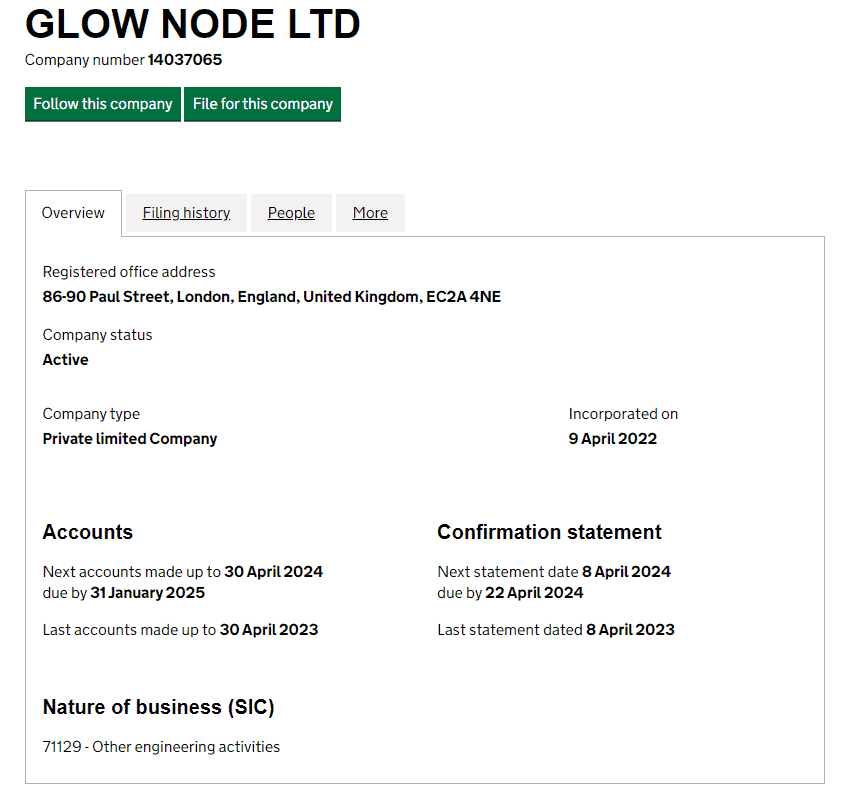

Is Glow Node Legit?

Glow Node is considered a legitimate proprietary trading firm based in the UK, a country known for its strict financial regulation and oversight. Glow Node Trustpilot has garnered many positive reviews, which speaks to its reputation and the satisfaction of its users.

- In general, proprietary trading firms operate differently from forex brokers and usually do not hold a forex broker license. This means they are subject to less regulatory oversight and are not monitored by industry-specific regulators. Consequently, the safety level might not be as high as with regulated forex brokers because the proprietary trading firm itself oversees its operations and provides the capital for trading activities.

Is Glow Node Scam?

We verified the legitimacy of the company by examining the official website and found no evidence suggesting that Glow Node is a scam. However, given that Proprietary Trading Firms typically operate with minimal regulation from financial authorities, it’s challenging to conclusively determine the firm’s nature as either fraudulent or genuine.

Our professional advice is to thoroughly educate yourself about Proprietary Trading, comprehend the associated risks, and opt for a company that not only has a solid reputation but also has been in operation for several years, ensuring stability in its offerings. Although you’re not directly investing substantial amounts of money but rather paying subscription fees, the potential financial losses are relatively lower than those you might face when trading with your own funds in the real trading market.

Glow Node Challenge Evaluation Rules

Our Glow Node Prop Firm Review focuses on examining the structure of the evaluation challenge, including the criteria for enrolling in the trading challenge. This involves understanding the type of assessment required to secure a Funded Trading Account and become a Proprietary Trader, as well as identifying the costs associated with this process, which are typically linked to a Registration Fee.

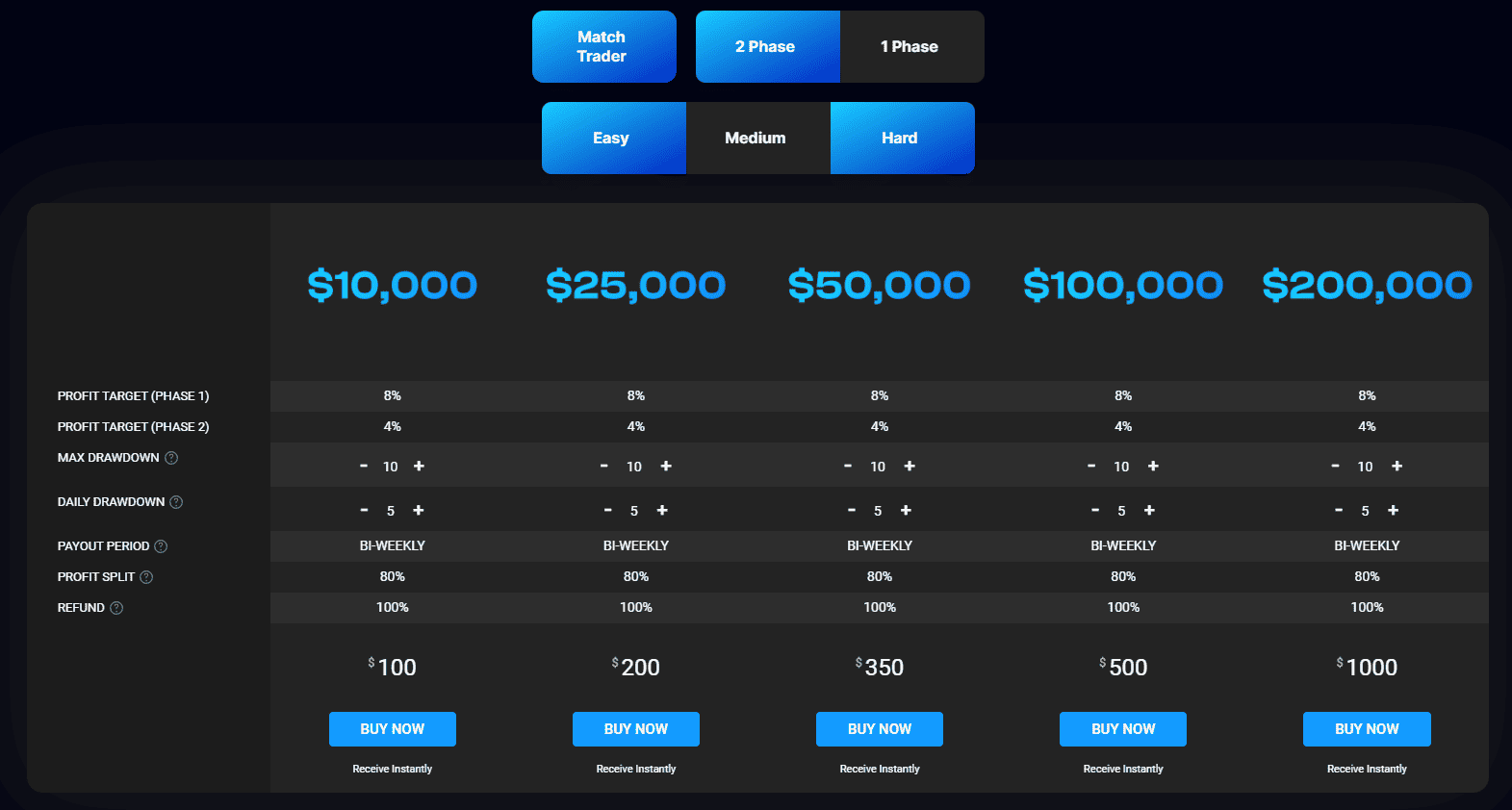

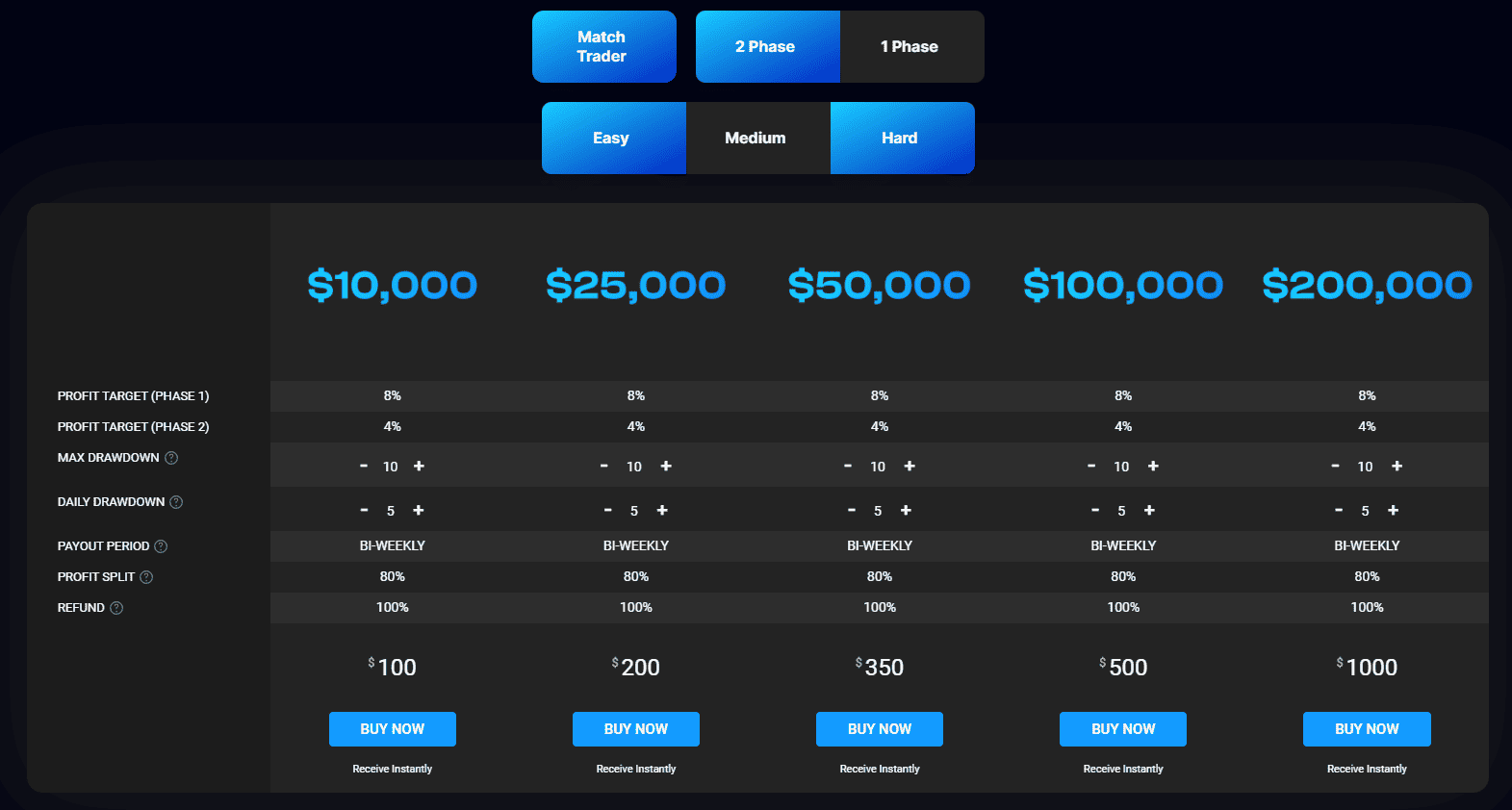

- Glow Node prop trading firm offers several types of evaluation challenges to cater to different trading styles and preferences. These include the 2-Phase and the 1-phase Evaluations — the 2-phase Evaluation is where traders must meet specific profit targets in two distinct phases while adhering to daily and absolute drawdown limits; the 1-Phase Evaluation, a more streamlined option requiring traders to achieve a single profit target with set drawdown restrictions.

Account Balance and Registration Fee

Before starting to trade with the Glow Node, traders must choose the Challenge type and Account Balance that best suits their trading goals, as the challenge conditions vary with each account size. This choice will also determine the registration fee required to enter the challenge. Importantly, Glow Node provides an opportunity for a fee refund once you achieve the status of a Funded Trader. For a detailed comparison of registration fees across different account sizes, please refer to our Registration Fee comparison table below.

- Glow Node offers a tailored approach to trader evaluations with options like the 2-Phase and 1-Phase Evaluations for structured profit target achievements and risk management. Each choice involves specific registration fees, refundable upon reaching funded trader status, catering to various trader preferences and risk profiles.

- Glow Node offers a 2-Phase Evaluation challenge with varying degrees of difficulty, categorized as Easy, Medium, and Hard, each tailored to different trading styles and risk tolerances. These categories likely affect the challenge conditions such as profit targets, maximum drawdown limits, and possibly the evaluation fee.

- Glow Node offers a variety of account sizes from $10,000 to $200,000 across its evaluation, designed to accommodate different levels of trading experience and capital requirements. And the fees for different account sizes are different accordingly.

- In Glow Node, a trader can maintain a maximum of 3 accounts simultaneously, with the combined starting balance of these accounts not exceeding $300,000

| Fees | Glow Node | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $10,000 | $10,000 | $50,000 |

| Fee | $100 | €155 | $289 |

| Maximum Account Size | $200,000 | $200,000 | $400,000 |

| Fee | $1000 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

So to pass evaluation, traders need to meet some requirements one of which is reaching the Profit Traget set by the firm. Glow Node’s profit targets vary depending on the evaluation program chosen. For the 2-Phase Evaluation, the first phase requires an 8% profit target, while the second phase has a 5% profit target. The 1-Phase Evaluation sets a single profit target of 10%. These targets are designed to assess a trader’s ability to generate profits within the set risk management parameters

Maximum Loss

For the 2-Phase Evaluation at Glow Node, the maximum loss parameters are designed to manage risk efficiently. The daily drawdown is capped at 5% relative to the high watermark at the start of the trading day, and the maximum drawdown allowed is 10%, which is a trailing metric. This ensures traders are mindful of their risk exposure while striving to meet their profit targets

- So to meet requirements, all the rules must be met accordingly, otherwise, your account will be canceled and you’ll need to reset it

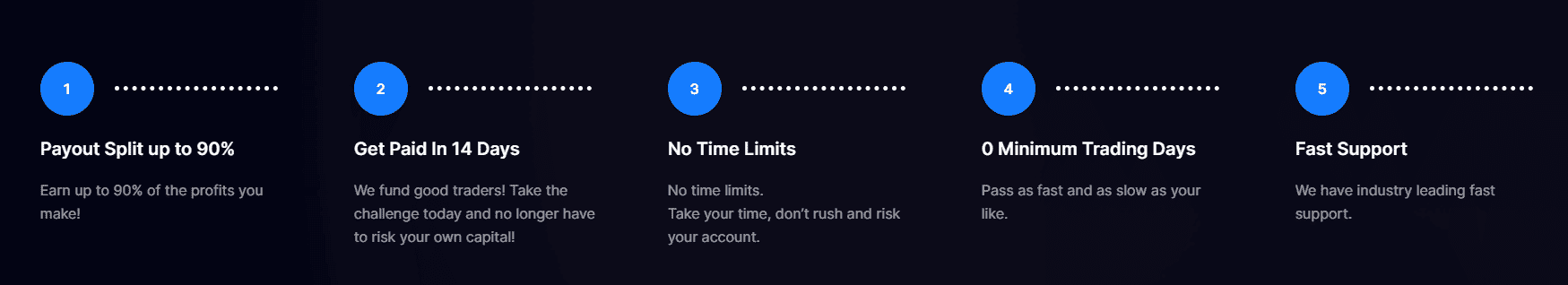

Minimum Trading Period

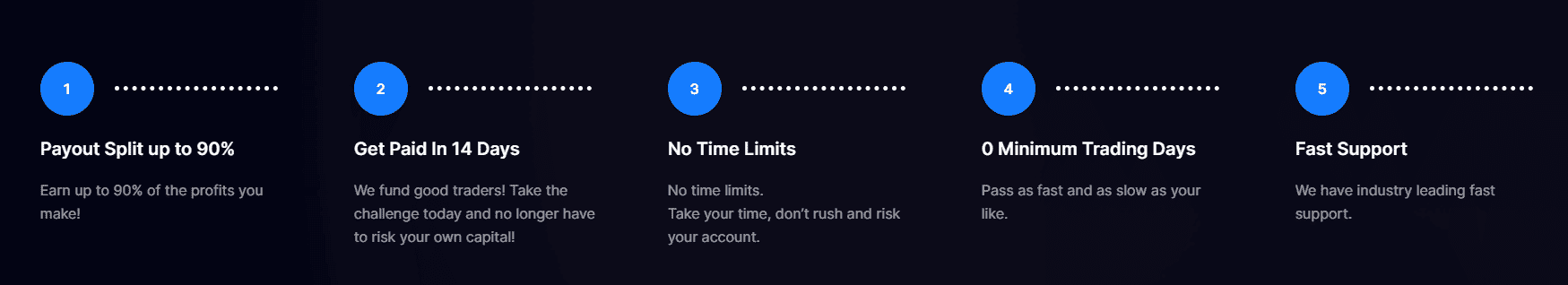

Glow Node does not enforce a minimum trading period for its evaluation challenges. This flexibility allows traders to operate within their timeframes without pressure to trade more frequently than their strategy allows.

See the detailed table with Glow Node Challenge conditions based on Account Size:

Glow Node 2-Step Evaluation Easy Mode

Free Trial

Glow Node does not offer a free trial for its trading challenges. Their programs, including the 2-Phase Evaluation, 1-Phase Evaluation, and Instant Funding options, require participants to pay a registration fee to access the trading evaluations or instant funding accounts.

Glow Node Funding Account

After successfully passing the challenge, the trader will be allocated their Funded Account, which is usually activated within a few business days. The account will mirror the conditions and balance of the level qualified for in the challenge. Should a trader wish to upgrade to a higher account level, they must undergo and pass the challenge again for the desired account balance.

Profit Split

Payout and Withdrawals

Glow Node allows traders to request payouts every 14 days, with the initial withdrawal available after achieving the specified profit targets in their trading challenges. The firm emphasizes a smooth process for withdrawing funds, ensuring traders can access their earnings promptly.

If a trader breaches any of Glow Node’s account rules before the 14-day mark, they might still be eligible for a payout, but it could be adjusted to 50% of the profits remaining in the account.

Withdrawal Method

Glow Node offers multiple methods for withdrawals, including payments through Rise, cryptocurrencies, and bank transfers. This flexibility ensures traders can access their earnings in a manner that suits their preferences and geographical limitations.

Account Conditions

When evaluating account conditions, it’s crucial to assess if the firm offers diverse account options, as well as the available platforms, instruments, and trading costs. Equally important is to review leverage levels and overall trading conditions, noting that some brokers might restrict certain strategies or practices in funded accounts, potentially leading to account loss. In such cases, requalification through testing may be required.

Trading Instruments

Glow Node provides traders with access to a wide range of trading instruments across different markets. These include forex pairs, commodities, indices, and cryptocurrencies, allowing traders to diversify their strategies and explore various financial markets.

Glow Node Commission

Glow Node’s commission on forex pairs trading is set at $2.50 per lot, reflecting their effort to mimic real trading conditions closely. This rate helps traders accurately account for trading costs when planning their strategies.

Leverage

Glow Node App Platform

We found that, unlike many firms that offer MetaTrader platforms, Glow Node offers trading on the Match Trader platform. This platform choice aligns with their goal to provide traders with a reliable and efficient trading environment, suitable for executing various strategies across the wide range of trading instruments Glow Node offers, including forex, indices, and cryptocurrencies.

Trading Conditions

Glow Node offers a carefully designed set of trading conditions to cater to the varied preferences and strategies of traders engaging with their funded accounts. This approach ensures that participants in their programs find the trading environment and rules adaptable to their unique trading styles and goals.

- Glow Node permits a range of trading strategies including swing trading, day trading, and scalping, provided they comply with the firm’s guidelines. Strategies that demonstrate consistent profitability and responsible risk management are encouraged. Specific practices like news trading and holding positions over the weekend are allowed, but with certain conditions to manage risk.

- In case of inactivity, Glow Node challenges have an expiration policy. If a trader does not engage in any trading activity for a specified period, typically 30 days, their challenge or evaluation process may be considered inactive and could expire.

Glow Node Promotions

At the moment of writing this article, Glow Node is promoting two discount codes for their services: a 10% off code “FRESHSTART” and a 30% off code “SPRING”. These discounts offer potential savings on their trading program fees.

Glow Node Alternative Brokers

We conclude that Glow Node stands out in the proprietary trading firm landscape with its flexible trading conditions, diverse account options, and supportive policies for traders. Offering a variety of challenges, alongside competitive profit splits and leverage settings, it caters to a broad spectrum of trading strategies. The firm’s approach to commissions, trading platform selection, and strategy allowances reflects a commitment to facilitating traders’ success.

Glow Node’s offerings come with certain limitations, such as the absence of the popular MetaTrader platform, no option for a free trial to test their system, and a somewhat limited range of markets compared to some competitors. These factors might require traders to adapt their strategies or seek alternative platforms for broader market analysis, such as:

- FTMO — Great Swing Trading Prop Firm

- Fidelcrest — Good for Stock Trading

- Uprofit — Best for Prop Trading Education

Share this article [addtoany url="https://55brokers.com/glow-node-review/" title="Glow Node"]