- What is Fusion Markets?

- Fusion Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Fusion Markets Compared to Other Brokers

- Full Review of Broker Fusion Markets

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.8 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Fusion Markets?

Fusion Markets is a Forex and CFD trading broker offering different financial products, including Forex, Metals, Indices, Share CFDs, Stocks, Energy, Commodities, Crypto CFDs, etc.

Founded in 2017 in Melbourne, Australia, the company also has offices in Vanuatu and Seychelles. Fusion Markets offers its trading services globally and cooperates with cutting-edge technology providers in the industry. Based on our findings, the broker offers competitive trading fees and spreads by supporting the NDD/STP execution models.

Fusion Markets offers more than 250 financial products with the lowest spreads from 0.0 and $2.25 commission per side.

Fusion Markets Pros and Cons

Fusion Markets is a reliable and well-known broker headquartered in Australia, available for international traders as well, with an easy account opening, a good trading environment, and competitive spreads and fees.

The broker provides a diverse selection of professional trading platforms, including options like MT4, MT5, and cTrader. Another key advantage is Fusion Markets’s integration with TradingView, allowing traders to execute trades directly from advanced charts, access real-time data, and use powerful technical analysis tools.

For the cons, there are some limitations in education and learning materials, and conditions might vary based on the entity and its applicable regulatory standards.

| Advantages | Disadvantages |

|---|

| Regulated broker with safe trading conditions | Conditions vary based on the entity |

| Competitive trading costs and spreads | International trading offered via offshore entities |

| ASIC license and overseeing | |

| Popular trading instruments | |

| No minimum deposit amount | |

| Suitable for beginners and professionals | |

| Advanced trading platforms | |

| 24/7 customer support | |

Fusion Markets Features

Fusion Markets is a regulated broker with favorable trading conditions and transparency that are suitable for all traders. The broker offers a wide range of trading services with competitive spreads and costs. Below is a comprehensive list of its key features:

Fusion Markets Features in 10 Points

| 🏢 Regulation | ASIC, VFSC, FSA |

| 🗺️ Account Types | Zero, Classic Accounts |

| 🖥 Trading Platforms | MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

| 📉 Trading Instruments | Forex, Share CFDs, Energy, Stocks, Precious Metals, Equity Indices, Commodities, Crypto CFDs |

| 💳 Minimum Deposit | $0 |

| 💰 Average EUR/USD Spread | 0.92 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | AUD, USD, CAD, EUR, GBP |

| 📚 Trading Education | Beginner’s Guide, YouTube Channel |

| ☎ Customer Support | 24/7 |

Who is Fusion Markets For?

Fusion Markets is for all levels of traders looking for low-cost, transparent trading conditions and access to the global financial markets. Based on our findings, the broker is well-suited for:

- Traders from Australia

- International traders

- Professional trading

- CFD and currency trading

- Copy trading

- Scalping/Hedging strategies

- Beginners

- Advanced traders

- Muslim traders

- Traders who prefer MT4 and MT5 trading platforms

- Broker with a variety of trading tools

- NDD/STP execution

- Competitive spreads and costs

- EA/Auto trading

- Good customer support

Fusion Markets Summary

Overall, Fusion Markets is a reliable broker with competitive trading conditions and transparency. The broker supports the NDD/STP execution model, where you can find low trading costs and spreads starting from 0 pips.

The broker overall provides a great selection of platforms and constantly updates its offering, which is a great advantage, as we see Fusion Markets Platform selection is among the best in the industry. Also, tools and available trading resources are on a very good level, too. Besides, there are also various opportunities and solutions for Forex Business also Refer a Friend program, along with Active Trader Programs, which is a good plus.

55Brokers Professional Insights

Fusion Markets is marked by us mainly for offering competitive trading costs among the financial industry, with tight spreads starting from 0.0 pips and a low commission of $2.25 per side. The broker is a good choice for cost-conscious traders, scalpers, and those using algorithmic strategies.

Another good point to admit is integration with TradingView, so the technical part of the trading performance is on a good level, with quality enhancements of the user experience with access to advanced trading tools and direct trade execution from the charts.

As for the overall trust, Broker is regulated by ASIC, so Fusion Markets combines attractive trading conditions, strong regulatory oversight, and modern trading technology, making it a solid choice for traders around the world. Also, a choice for both either beginners or traders with experience.

Consider Trading with Fusion Markets If:

| Fusion Markets is an excellent Broker for: | - Need broker with good reputation and Top-Tier license.

- Selecting broker with popular trading instruments.

- Access to advanced Trading Platforms.

- Looking for broker with no minimum deposit requirement.

- Broker with stable trading environment.

- Providing competitive fees and spreads.

- Broker with a variety of trading strategies and tools.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:500.

- Looking for quality customer support with live chat and fast response.

- Providing Copy Trading.

- Offering multi-account manager (MAM/PAMM) solutions.

- Access to VPS hosting. |

Avoid Trading with Fusion Markets If:

| Fusion Markets might not be the best for: | - Specializing on direct trading of stocks on exchanges.

- Traders from USA due to regulatory restrictions.

- Who look for comprehensive suite of educational resources.

|

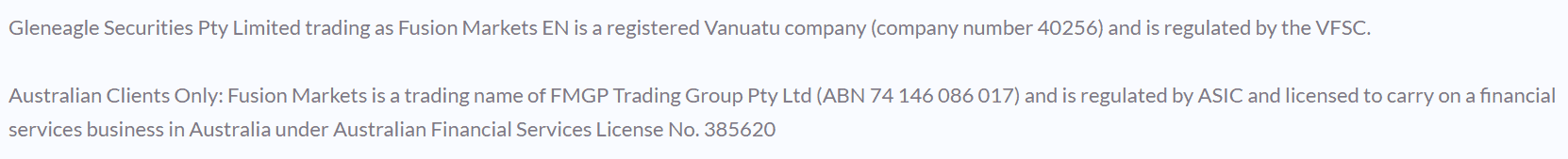

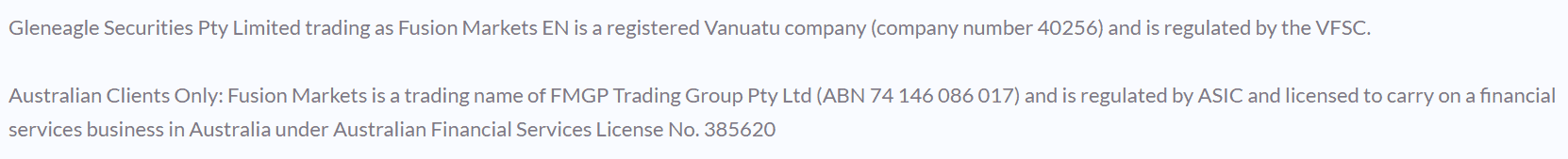

Regulation and Security Measures

Score – 4.5/5

Fusion Markets Regulatory Overview

Fusion Markets operates under a multi-jurisdictional regulatory framework to ensure a safe trading environment for its clients globally. In Australia, Fusion Markets is a trading name of FMGP Trading Group Pty Ltd, regulated by the Top-Tier Australian Securities and Investments Commission (ASIC) under an Australian Financial Services license, providing strong investor protection and compliance with strict financial standards.

For international clients, Gleneagle Securities Pty Limited trading as Fusion Markets EN is a registered company in Vanuatu and is regulated by the Vanuatu Financial Services Commission, and Fusion Markets International Ltd is a company regulated as a Securities Dealer by the Seychelles Financial Services Authority.

How Safe is Trading with Fusion Markets?

Concerning the safety offered by the broker, Fusion Markets keeps all its client funds in segregated Client Trust Accounts.

The broker also offers negative balance protection for its ASIC entity’s clients with leverage of up to 1:30. However, for VFSC and FSA clients, Fusion Markets does not provide negative balance protection.

Consistency and Clarity

Fusion Markets has gained a good reputation in the financial trading for its transparency, reliability, and commitment to low trading costs. With high ratings across well-known review platforms like Trustpilot, the broker is praised by traders for its supportive customer service, low spreads, and fast execution speeds.

While some users note the limited range of non-Forex instruments as a drawback, the overall opinion remains positive. The broker has also earned industry recognition and awards for valuable trading services, also its consistency has been steady along the years with no serious breaches or penalties from the regulators or through operation, which is a good plus to Broker Trading trust score.

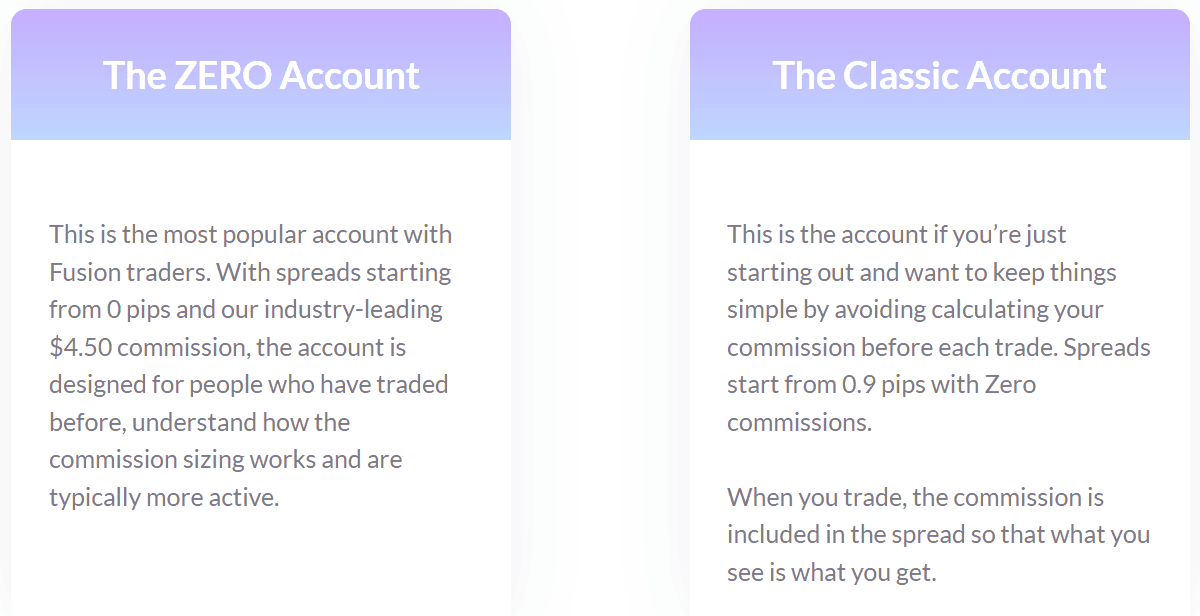

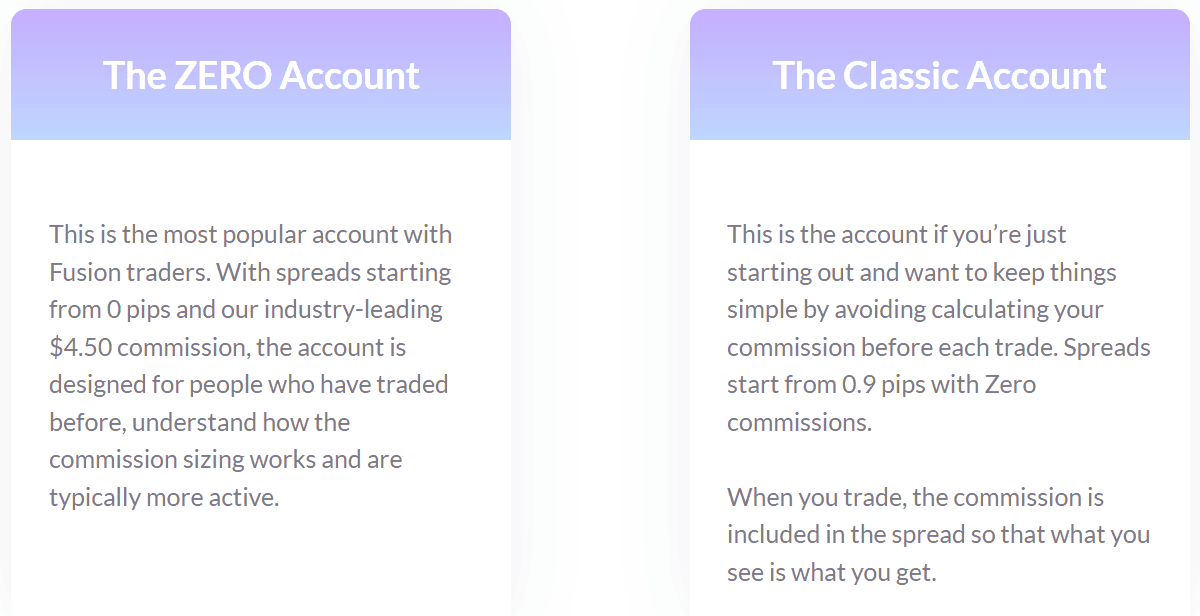

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Fusion Markets?

Account types offered by Fusion Markets are two: Zero and Classic Accounts. For the Zero Accounts, the spread starts from 0 pips, and the commission fee is $2.25 per side. Spreads for the Classic Accounts start from 0.9 pips with zero commissions.

We found out that the broker also provides Swap-Free accounts (Islamic) for its Islamic traders, allowing them to trade most of their popular trading products. Also, new traders can benefit from the trial trades through a free Demo account.

Classic Account

The Classic Account is ideal for beginner traders who prefer a simplified pricing model. With spreads starting from 0.9 pips, zero commissions on trades, and no minimum deposit requirement, the account is accessible to traders of all levels.

It is also available on all supported trading platforms, offering access to robust trading tools, technical indicators, and a user-friendly interface for an efficient trading experience.

Zero Account

For more experienced traders, the Zero Account is a good choice. It provides raw spreads starting from 0.0 pips, with a low commission of $4.50 round turn, making it suitable for scalpers and high-frequency traders.

Like the Classic Account, it requires no minimum deposit and is available on all trading platforms, giving traders access to advanced charting and automation capabilities.

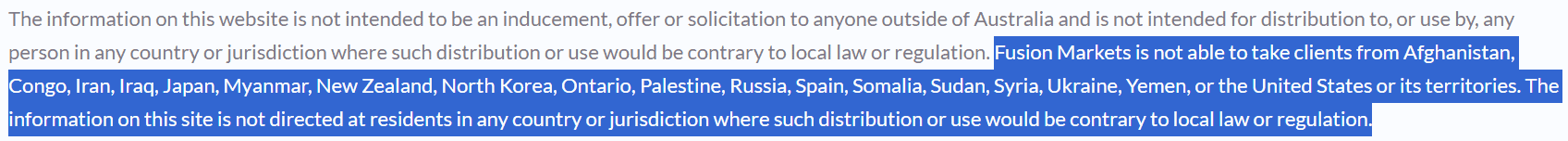

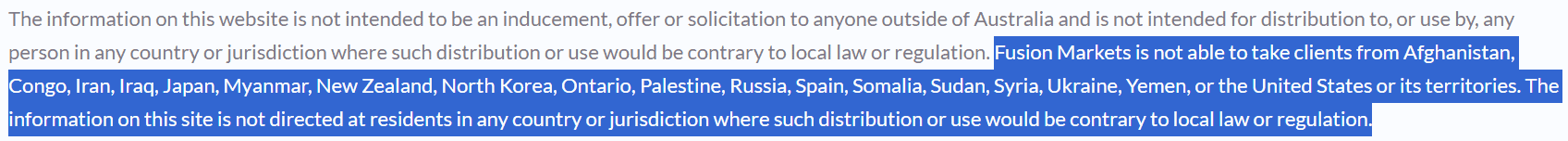

Regions Where Fusion Markets is Restricted

Fusion Markets does not provide services in some countries due to regulatory restrictions. Also, different Fusion Markets entities may offer varying trading conditions or may not be able to open trading accounts due to regulatory restrictions.

The following is a list of regions we found where Fusion Markets is not able to take clients from:

- USA

- Afghanistan

- Congo

- Iran

- Iraq

- Japan

- Myanmar

- New Zealand

- North Korea

- Ontario

- Palestine

- Russia

- Spain

- Somalia

- Sudan

- Syria

- Ukraine

- Yemen

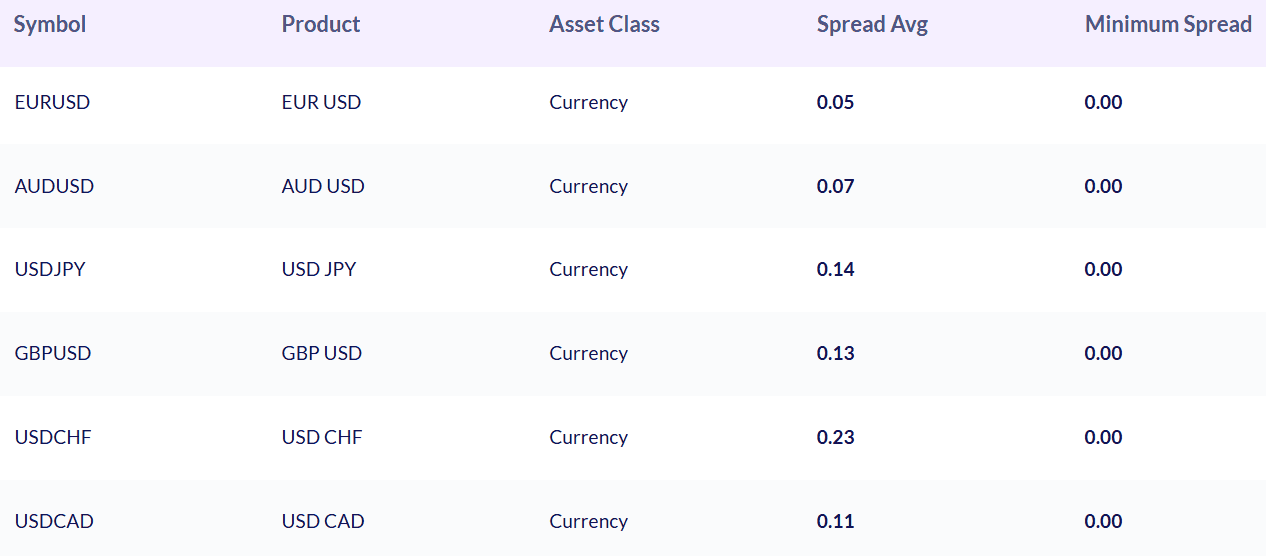

Cost Structure and Fees

Score – 4.5/5

Fusion Markets Brokerage Fees

Fusion Markets’ fees are built into the spread and the account types traders choose. Based on our user review, the broker offers low-commission trading for Australian clients, starting from USD 2.25 per 1 standard lot. In cryptocurrency trading, Fusion Markets does not charge any commissions.

Fusion Markets does not charge an inactivity fee, however, traders need to consider rollover fees, which are charged in case the position is open longer than a day.

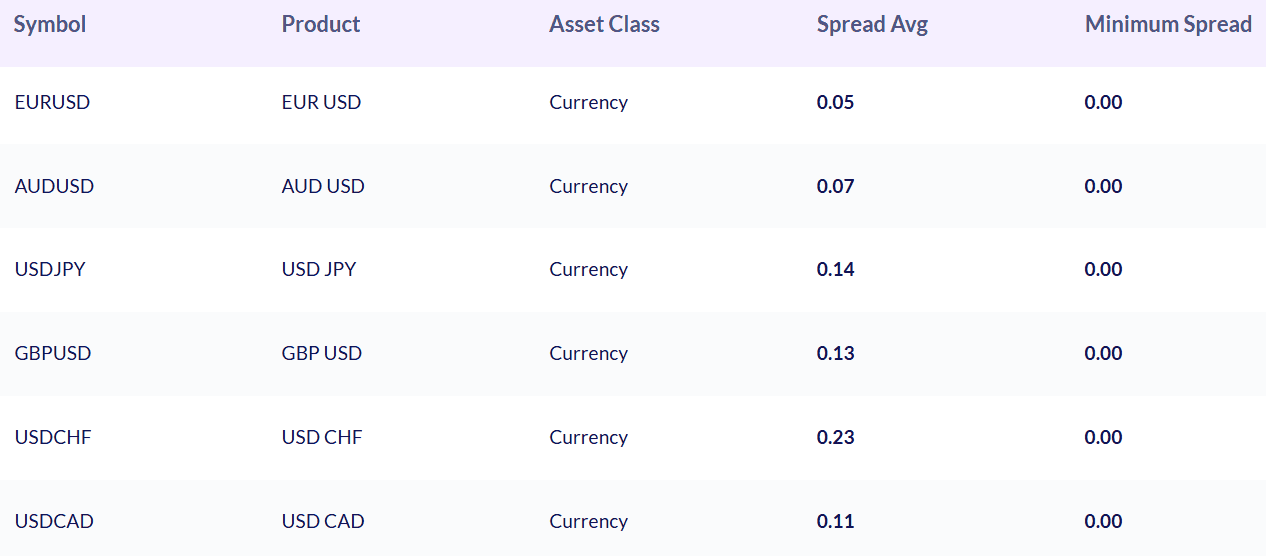

Fusion Markets spreads are floating and depend on the current market price of each currency pair. Based on our findings, the average spread for EUR USD is 0.05 pips for Zero Accounts, and for Classic Accounts, the average EUR USD spread is 0.92, including commissions.

- Fusion Markets Commissions

Fusion Markets offers a competitive commission structure for different trading preferences. The Zero Account features raw spreads starting from 0.0 pips, with a commission of $2.25 per side (or $4.50 round-turn) per standard lot traded. This low commission rate makes it an attractive option for cost-conscious traders.

- Fusion Markets Rollover / Swaps

Fusion Markets applies overnight financing charges, known as swaps or rollover fees, to positions held open past the market close. These charges vary depending on the instrument traded and the direction of the position (long or short).

How Competitive Are Fusion Markets Fees?

Overall, Fusion Markets’s fee structure is competitive, appealing to traders looking for low or industry-average trading fees. The broker offers tight spreads and low commissions. Additionally, Fusion Markets provides commission-free trading on US share CFDs and cryptocurrencies, further enhancing its appeal to cost-conscious traders.

With no minimum deposit requirements and a transparent pricing model, the company stands out as a broker that prioritizes accessibility for traders worldwide.

| Asset/ Pair | Fusion Markets Spread | MarketsVox Spread | GoldWell Spread |

|---|

| EUR USD Spread | 0.92 pips | 0.1 pips | 1.8 pips |

| Crude Oil WTI Spread | 1.92 | 3.6 | 4 |

| Gold Spread | 0.99 | 23 | 50 cents |

| BTC USD Spread | 38.15 | - | - |

Fusion Markets Additional Fees

Fusion Markets maintains a transparent fee structure, minimizing additional charges for traders. There are no fees for deposits or withdrawals made through standard methods like credit/debit cards, PayPal, Skrill, or Neteller. However, international bank wire transfers may incur intermediary bank fees ranging from $15 to $30, which are beyond Fusion Markets’ control.

Additionally, the broker does not impose inactivity fees, allowing traders to maintain dormant accounts without penalty. However, for users of the Fusion+ copy trading service, a monthly fee of $10 applies if trading activity falls below 2.5 lots of FX or metals per month; otherwise, the service is free.

Overall, Fusion Markets’ fee structure is straightforward and competitive, with minimal additional costs.

Trading Platforms and Tools

Score – 4.8/5

Fusion Markets platforms offering include the popular MetaTrader 4 and MetaTrader 5, cTrader, as well as DupliTrade and Fusion+ trading platforms.

MT4 and MT5 are available to trade via Windows, Mac, iOS, and Android. They are considered the most used platforms in the industry for their great functionality and customer-friendly design.

cTrader is another advanced trading platform, available through desktop, mobile, and web versions. Additionally, the integration with TradingView is a significant advantage, especially for professional traders who look for advanced charting tools and market analysis features.

DupliTrade provides traders copy trading platform to duplicate the actions from DupliTrade into their Fusion Markets MT4 Account. Fusion+ is another copy trading platform that enables traders to automatically copy to other clients’ accounts free of charge.

Trading Platform Comparison to Other Brokers:

| Platforms | Fusion Markets Platforms | MarketsVox Platforms | GoldWell Platforms |

|---|

| MT4 | Yes | No | No |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | No | No |

| Own Platforms | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Fusion Markets Web cTrader Platform

The cTrader platform offers traders a powerful and convenient way to access the markets directly from their browser with no downloads or installation requirements.

It provides the full functionality of the desktop version, including advanced market depth, 26 timeframes, and over 70 built-in indicators for in-depth technical analysis.

Designed for speed and performance, this web-based platform ensures a seamless trading experience with a clean interface and professional-grade tools, making it an excellent choice for traders who need flexibility.

Main Insights from Testing

During testing, cTrader stood out for its intuitive interface, fast order execution, and advanced order types that cater well to all skill levels of traders.

The platform’s customization options enhance usability and workflow efficiency. Real-time trade analytics and transparent pricing further contribute to a professional trading experience.

Fusion Markets Desktop MetaTrader 4 Platform

The MT4 desktop platform provides an intuitive trading experience for all types of traders. With customisable charts, over 50 built-in indicators and scripts, the platform makes market analysis and trade execution straightforward.

Key features like one-click trading, real-time quotes, integrated news feeds, and a wide range of analytical tools empower traders to make informed decisions quickly and effectively. Its flexibility and reliability have made it a popular platform for millions of traders worldwide.

Fusion Markets Desktop MetaTrader 5 Platform

The MetaTrader 5 desktop platform offers enhanced performance and functionality, making it ideal for traders looking for more advanced tools and faster execution. With faster processing speeds, 21 timeframes, and over 80 technical analysis objects, the platform offers flexibility for in-depth market analysis.

MT5 also includes advanced pending order types, market depth data, and an integrated Virtual Private Server for uninterrupted trading.

Fusion Markets MobileTrader App

Fusion Markets offers mobile trading solutions across all its supported platforms, including MT4, MT5, cTrader, and TradingView, ensuring traders can manage their accounts and execute trades on the go.

The mobile apps provide a responsive trading experience, with real-time price updates, interactive charts, technical indicators, and full order functionality.

Trading Instruments

Score – 4.4/5

What Can You Trade on Fusion Markets’s Platform?

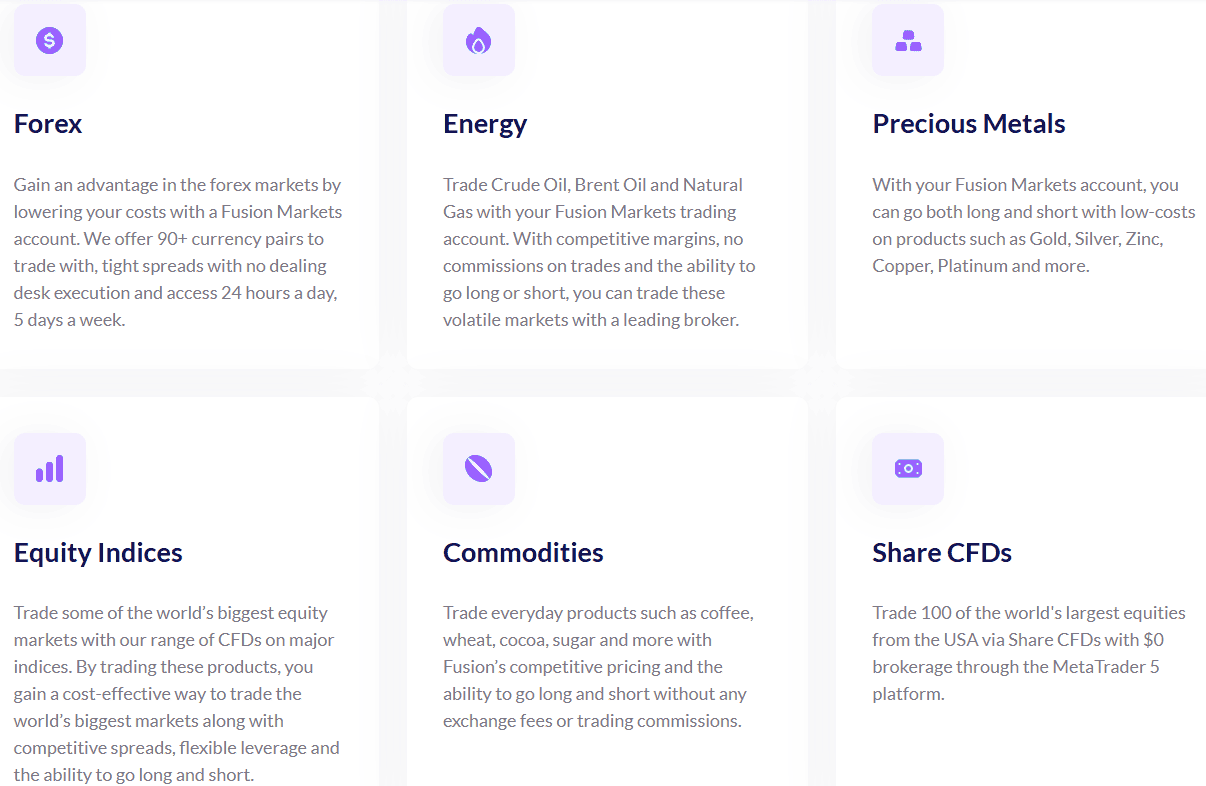

Fusion Markets offers its clients to trade over 250 trading instruments, including Forex, Share CFDs, Energy, Stocks, Precious Metals, Equity Indices, Commodities, and Crypto CFDs. We found Forex trading much more competitive with low costs and spreads, and available to trade with industry-leading trading platforms.

Main Insights from Exploring Fusion Markets’s Tradable Assets

Exploring Fusion Markets’ tradable assets reveals a platform built for flexibility and continuous market access. According to our research, Cryptocurrency trading is available 24/7 and includes Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Stellar, EOS, Polkadot, Chainlink, and more trading products.

On the other hand, many popular asset classes, such as futures, bonds, and options, are not available.

Leverage Options at Fusion Markets

Leverage trading enables traders to trade larger sizes compared to their initial balance, offering to maximize their gains. However, we recommend you carefully learn how to use this tool, since the multiplier may work in reverse as well.

- The Australian clients who hold with ASIC-regulated Fusion Markets accounts are entitled to up to 1:30.

- For FSA and VFSC clients, the maximum leverage for Forex and Metals is 1:500, Index CFDs 1:100, and Cryptocurrencies 1:10.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Fusion Markets

To fund the account and start trading with Fusion Markets, you will have a choice to choose from AUD, USD, CAD, EUR, GBP, and more currencies, and select a few payment methods, including:

- Bank Wire,

- Credit/Debit cards,

- Skrill,

- Neteller,

- PayPal, etc.

Fusion Markets Minimum Deposit

There is no requirement for a minimum deposit with Fusion Markets. However, we found that clients mostly fund with $1500 and above while trading with Fusion Markets.

Withdrawal Options at Fusion Markets

At Fusion Markets, withdrawals are processed via Bank Wire, Credit/Debit Cards, Skrill, and Neteller. Withdrawal requests can last from 1 to 5 business days for Credit/Debit Cards and from 2 to 5 business days for bank wires.

Customer Support and Responsiveness

Score – 4.6/5

Testing Fusion Markets’s Customer Support

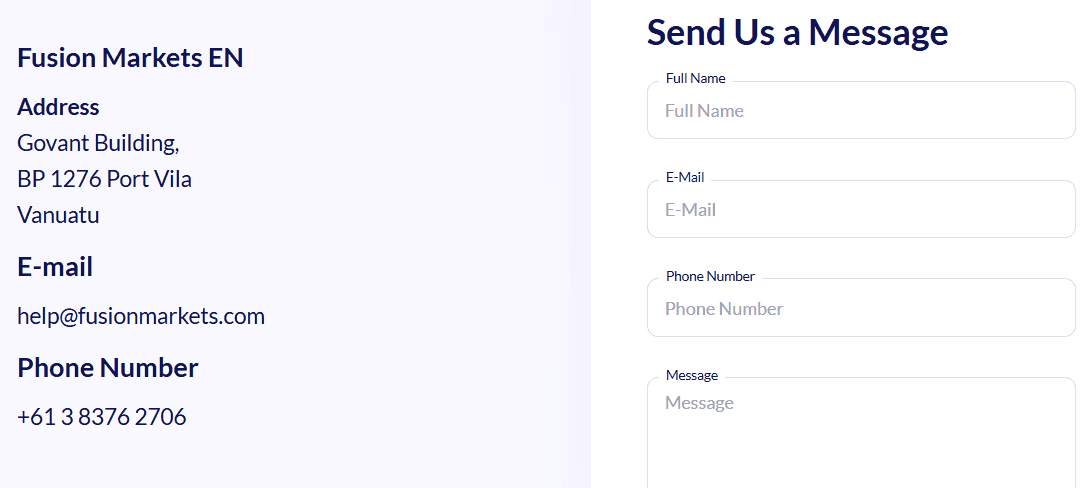

According to our research, Fusion Markets provides 24/7 customer support via Live Chat, Phone lines, and Email. For customer support reasons, besides its headquarters in Melbourne (AU), the broker has other representative offices in Vanuatu and Seychelles.

Contacts Fusion Markets

Fusion Markets offers supportive customer service via multiple channels. You can reach them by phone at +61 3 8376 2706 or by email at help@fusionmarkets.com.

Research and Education

Score – 4.7/5

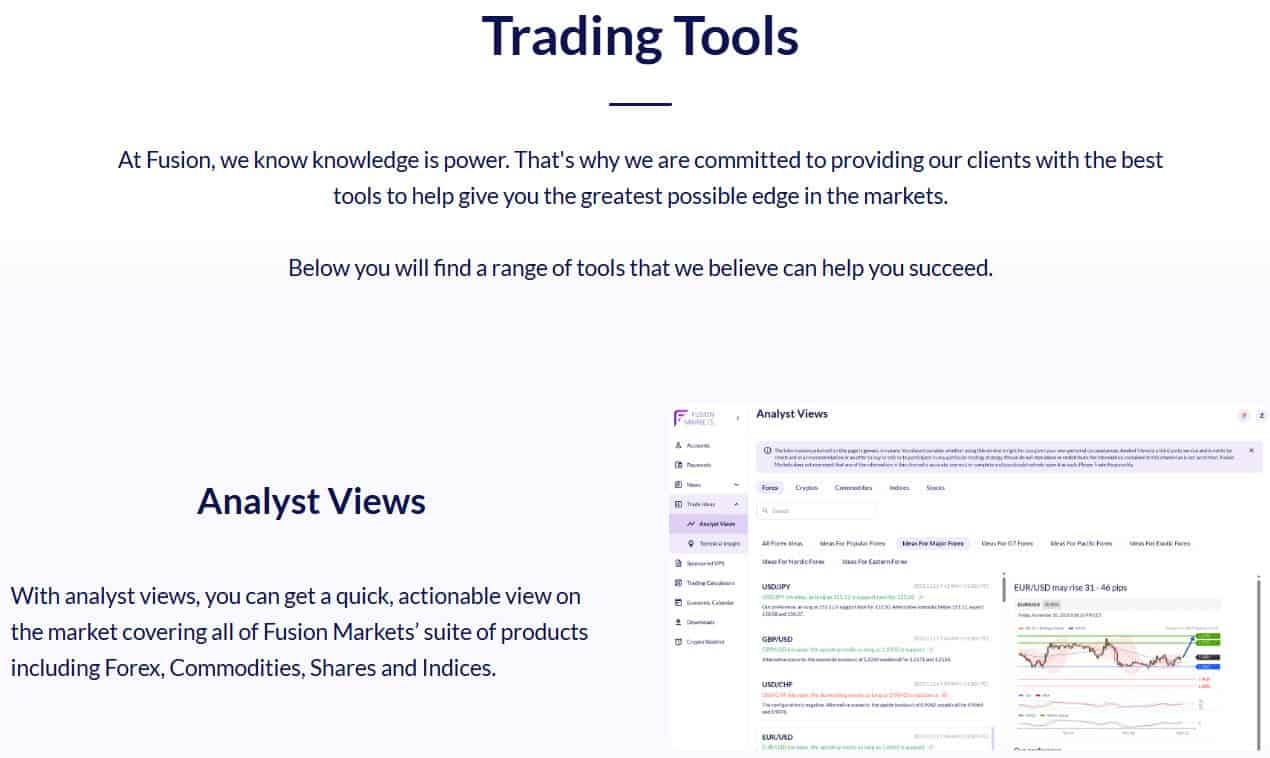

Research Tools Fusion Markets

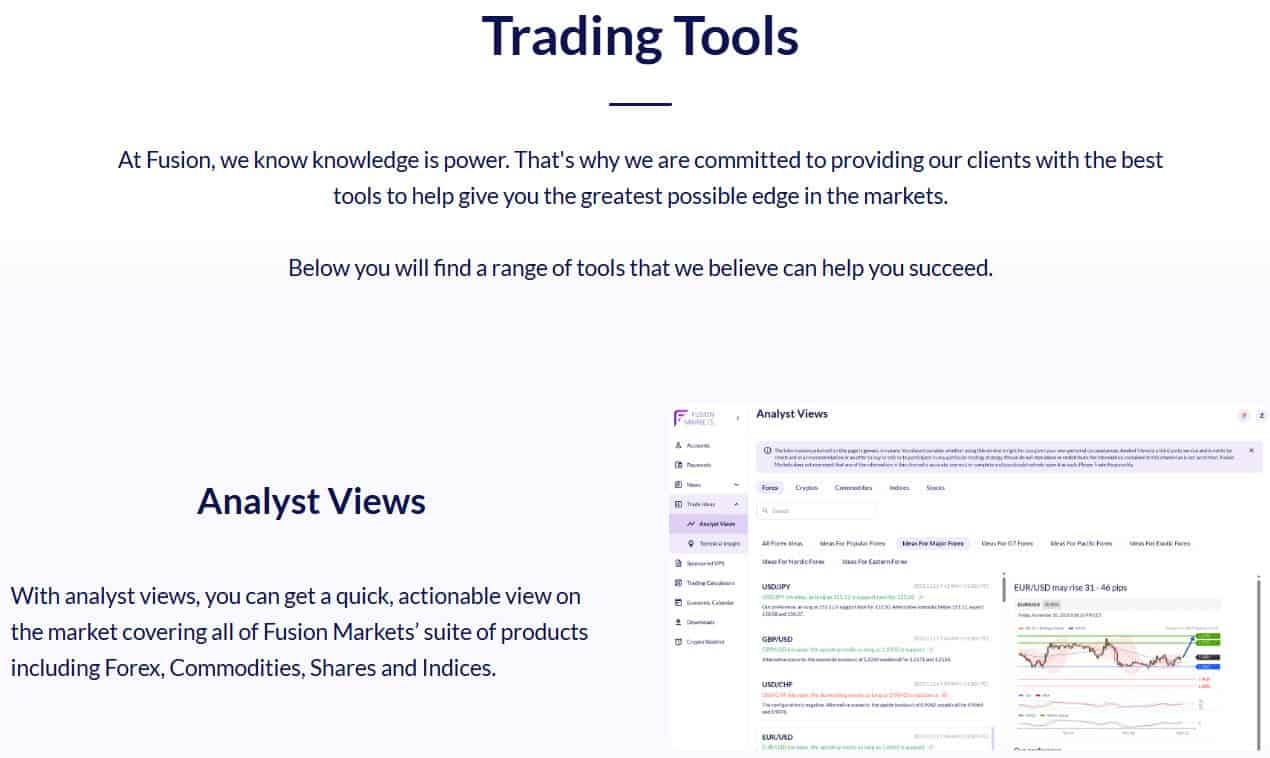

Fusion Markets offers a comprehensive suite of research tools to support traders in making informed decisions.

- Among these tools is Market Buzz by Trading Central, which uses AI to aggregate and analyze news from various sources, providing traders with an overview of market sentiment and trending topics.

- On the website, clients can access an Economic Calendar that not only lists upcoming events but also provides historical impact data, helping traders anticipate market movements.

- Additionally, Analyst Views offers real-time trade setups with key support and resistance levels, alternative scenarios, and expert commentary, available as a custom indicator on MT4 and MT5 platforms.

- For those interested in technical analysis, the Technical Insight tool delivers detailed chart analyses across various timeframes. Also, the Live and Historical Spreads Tool provides transparency by showcasing how spreads have fluctuated over time, aiding in strategic planning.

- MT4 and MT5 trading platforms provide advanced trading features with EAs allowed for all styles of automated traders, with Flexible Charts and Tools, Indicators, Signals, 80+ Technical Analysis objects, and Copy trading. The platforms have the opportunity to customize needs and requirements through MAM or PAMM offerings.

Education

Education provided by Fusion Markets includes a blog with financial-related articles, a beginner’s guide, and a YouTube Channel.

However, the broker does not provide comprehensive educational and learning materials, seminars, or webinars, which are crucial for beginner traders.

Portfolio and Investment Opportunities

Score – 4.4/5

Investment Options Fusion Markets

While Fusion Markets primarily focuses on Forex and CFD trading, it also offers robust investment solutions for individual investors and professional money managers.

Through its Multi Account Manager system, experienced traders can efficiently manage multiple client accounts with flexible allocation methods and full compatibility with Expert Advisors.

Fusion Markets also provides copy trading options for investors interested in automated strategies, catering to a diverse range of investment preferences.

Account Opening

Score – 4.5/5

How to Open Fusion Markets Demo Account?

Opening a demo account with Fusion Markets is a quick process designed to help traders practice in a risk-free environment. To get started, simply visit the Fusion Markets website and click on the “Create a Demo Account.”

You will be asked to fill in basic information such as your name, email address, and preferred platform. Once registered, login credentials will be sent to your email, allowing you to access the platform and begin trading with virtual funds.

This is a great way for beginners to learn and for experienced traders to test strategies without risking real capital.

How to Open Fusion Markets Live Account?

Opening an account with Fusion Markets is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Create an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Create a password for your account.

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Once your account is activated and proven, follow up with the money deposit.

Additional Tools and Features

Score – 4.6/5

Fusion Markets offers a range of additional tools and features for enhancing the clients’ trading experience beyond standard platform capabilities.

- One standout feature is its TradingView integration, allowing clients to trade directly from one of the most advanced charting platforms in the world.

- The broker also provides access to a VPS for traders running automated strategies, ensuring uninterrupted and low-latency performance.

- Moreover, Fusion+, the broker’s proprietary copy trading solution, enables traders to follow and replicate the strategies of experienced traders, making it easier for beginners to confidently participate in the markets.

Fusion Markets Compared to Other Brokers

Fusion Markets holds its place in the competitive financial trading industry by offering a mix of low-cost trading, versatile platform support, and accessibility.

Compared to brokers like Saxo Bank and CMC Markets, which offer a broader range of instruments and institutional platforms, Fusion Markets has a more focused approach on Forex and CFD trading.

While the broker may not match the volume of tradable assets offered by some competitors, it compensates with competitive fees, especially through its commission-based account, and a robust selection of trading platforms, including MT4, MT5, cTrader, and TradingView.

Additionally, the broker stands out for offering 24/7 customer support, no minimum deposit requirements, and a good range of trading and research tools, making it an attractive option for beginner and experienced traders looking for low-cost, efficient trading in a transparent and regulated environment.

| Parameter |

Fusion Markets |

ADS Securities |

Saxo Bank |

City Index |

MarketsVox |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.92 pips |

Average 0.7 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $2.25 per side |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

0.0 pips + $3 per side |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, cTrader, TradingView, DupliTrade, Fusion+ |

ADSS Platform, MT4 |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

250+ instruments |

1,000+ instruments |

71,000+ instruments |

13,500+ instruments |

100+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC, VFSC, FSA |

SCA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FSA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Good |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$100 |

$0 |

$0 |

$100 |

$0 |

$0 |

Full Review of Broker Fusion Markets

Fusion Markets is a reliable Forex trading broker known for its competitive fees, fast execution, and wide platform selection. Regulated by ASIC, the broker offers strong client protection and transparency for Australian clients.

Traders can access a popular range of Forex and CFD instruments with spreads starting from 0.0 pips and flexible account options like Classic and Zero.

Fusion Markets also provides tools like VPS hosting, copy trading via Fusion+, and a user-friendly client portal. With no minimum deposit, supportive customer service, and solid research tools, it appeals to all levels of traders.

Share this article [addtoany url="https://55brokers.com/fusion-markets-review/" title="Fusion Markets"]

Why acct on read only after opening new acct and put a deposit?

Hi Michael I’m Sarah from Fusion Markets. Your account shouldn’t be read only, especially if you passed KYC and could deposit.

Could you please email us at help@fusionmarkets.com

So we can resolve this for you