Advertising Disclosure

- Our Review

- FunderPro 2025 User Reviews

- FunderPro 2025 News

- What is FunderPro?

- FunderPro Pros Cons

- Is FunderPro Legit?

- FunderPro Challenge

- Funded Account

- Account Conditions

- Payout

- FunderPro Alternative

What is FunderPro Prop Firm?

FunderPro is a proprietary trading firm that aims to empower skilled traders by providing them with the opportunity to manage significant amounts of capital, up to $200,000 initially, with the potential to scale up to $5,000,000. They offer a unique proposition in the prop trading space with their no time limit challenges, which allows traders to operate without the pressure of having to meet objectives within a set timeframe.

FunderPro provides a distinct opportunity to participate in Real Trading with minimal upfront capital requirements. To become a Funded Trader and trade with Company Funds, traders simply need to pass a Test or Challenge to obtain a Funded Account, enabling them to trade as Professional Traders with a Company Account. Learn more about Prop Trading here

| FunderPro Advantages | FunderPro Disadvantages |

|---|---|

| Tailored Trading Conditions | No Strict Overseeing |

| Good Pricing | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Upscaling opportunity | Only MetaTrader Platform |

| MT5 and MT4 with EAs | |

| Refundable Fee once you become Funded Trader | |

| Good range of Challenge Models |

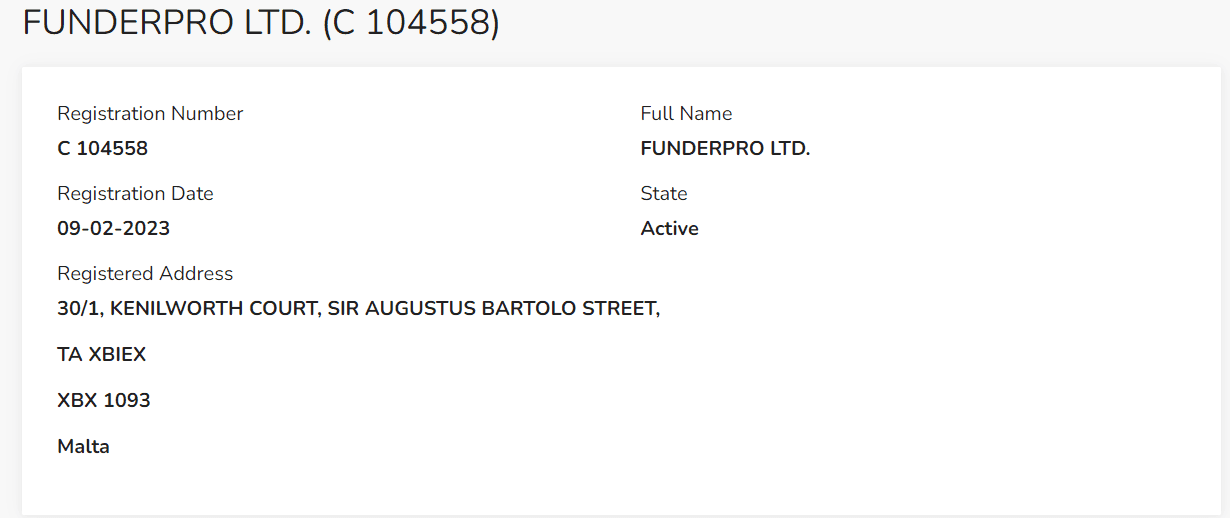

Is FunderPro Legit?

Based on the available information, FunderPro presents itself as a legitimate proprietary trading firm that offers unique opportunities for traders to manage funded accounts without the constraints of time limits on their trading challenges. Their innovative approach, including real capital accounts for funded traders, competitive profit splits up to 90%, and the provision of a technology-driven platform with advanced analytics, positions them as a serious player in the prop trading industry.

- As a general rule, Prop Trading firms typically operate without a Forex Broker license, which means they are subject to less regulation and oversight compared to Forex Brokers. Consequently, they may not offer the highest level of safety, as they are solely responsible for managing the entire operation and providing funds for trading activities. It’s essential to thoroughly understand all the risks involved before engaging with such firms.

Is FunderPro Scam?

We conducted a thorough check of FunderPro’s legitimacy through their official website and found no evidence to suggest it’s a scam. However, given that Prop Trading Firms are typically less regulated by financial authorities, it can be challenging to ascertain the true nature of such firms.

Educate yourself extensively about Prop Trading, understand the associated risks, and select a company with a reputable track record, preferably one that has been operational for many years to ensure greater stability. Additionally, since you’re not investing significant sums into trading but rather paying subscription fees, potential losses are generally lower compared to engaging in Real Trading with your own funds

FunderPro Challenge Evaluation Rules

- To become a Funded Trader with FundedPro, candidates must pass a 2-step evaluation process. Initially, traders work with a demo account during the evaluation phases. Upon successful completion and meeting specific criteria, traders then gain access to a live trading account.

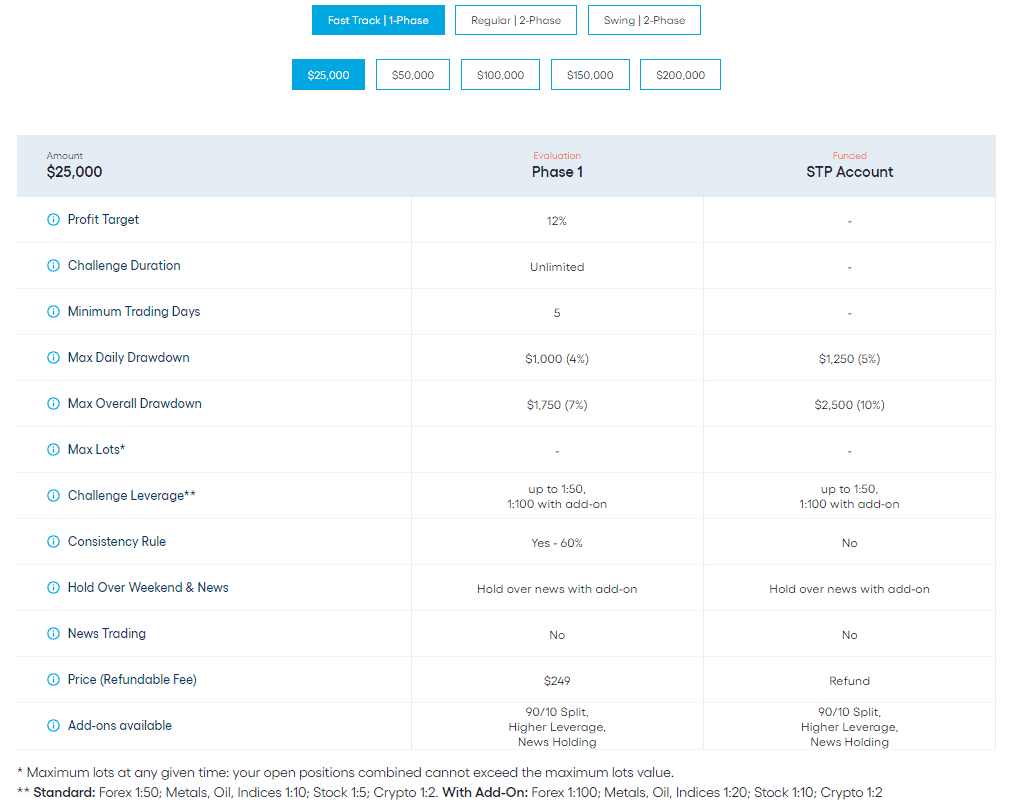

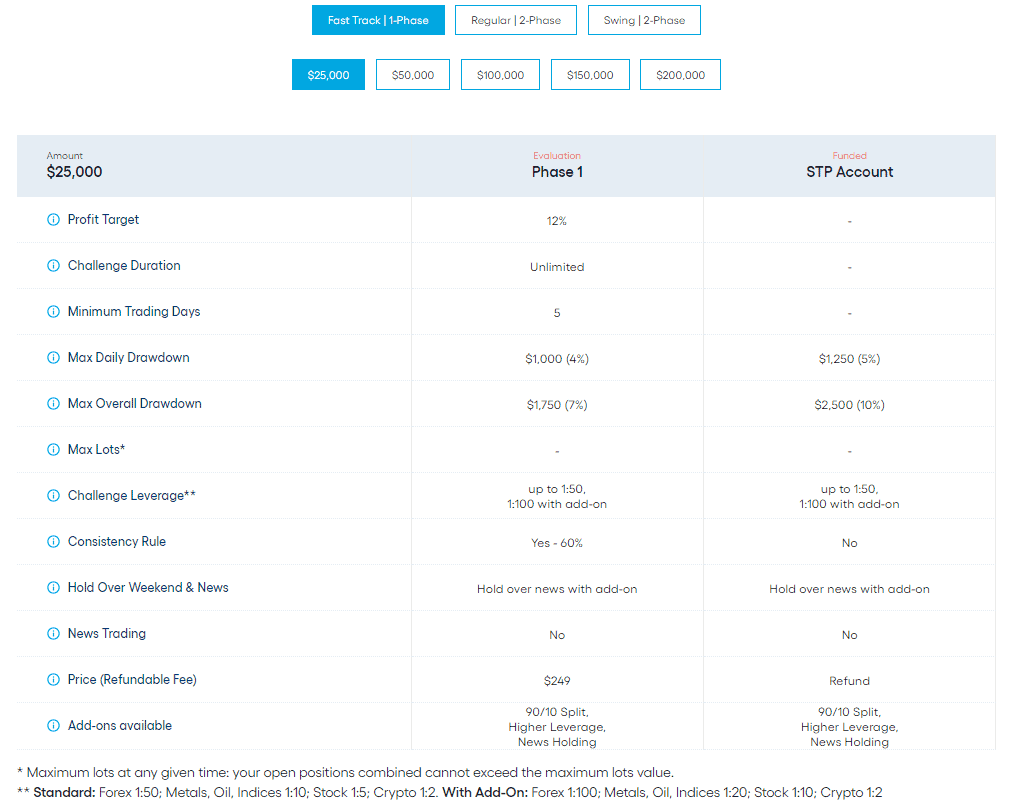

Account Balance and Registration Fee

Prior to initiating the FunderPro login process, you’ll be prompted to choose the Model and Account Balance you wish to qualify for. Depending on the size you select, the terms of the challenge vary slightly. This choice also impacts the registration fee you’ll need to pay to participate in the challenge. However, it’s worth noting that FunderPro provides a refund of this fee upon achieving the status of a Funded Trader. Refer to the Registration Fee comparison table below for further details.

- FunderPro’s challenge and funding model is built to accommodate a wide variety of trading strategies, including the freedom to trade over weekends and during major news events, which is not commonly allowed in many other prop trading firms.

- Traders must navigate through a two-phase evaluation, demonstrating their ability to generate profits while adhering to risk management rules.

- FunderPro offers a variety of account sizes for traders participating in its evaluation challenge, catering to different levels of trading expertise and financial commitment. The account sizes range from $25,000 to $200,000, with corresponding fees for each.

| Fees | FunderPro | FTMO | The Funded Trader |

|---|---|---|---|

| Minimum Account Size | $5,000 | $10,000 | $50,000 |

| Fee | $79 | €155 | $289 |

| Maximum Account Size | $200,000 | $200,000 | $400,000 |

| Fee | $989 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

Based on our finds, FunderPro’s evaluation challenge involves a two-phase process where traders aim for a 10% profit target in the first phase and an 8% target in the second, adhering to strict drawdown limits.

Maximum Loss

In FunderPro’s trading challenge, participants must manage their trades carefully to avoid exceeding maximum loss limits. The challenge specifies two key drawdown restrictions to ensure disciplined risk management: a maximum daily loss limit of 5% and an overall loss limit of 10% from the starting balance.

Minimum Trading Period

See the detailed table with FunderPro Challenge conditions based on Account Size:

Free Trial

FunderPro offers a free challenge trial for users to explore its platform features before committing to a subscription. The trial lasts for 5 days, allowing only one active free trial at a time. After a trial, users can start another after a 5-day waiting period, with no limit on the number of free trials one can start. Each trial requires a 5-day waiting period.

FunderPro Funded Account

Profit Split

Payout and Withdrawals

Withdrawal Method

There are various convenient methods offered by FunderPro Prop Trading Firm once you wish to withdraw funds from you Funded Account. Those Methods include Perfect Money, Crypto Transfers via USDT, USDC, also clasic Bank Transfer, and Wise.

Account Conditions

Trading Instruments

FunderPro Commission

Another point we check is the Commission or Spread on the trades themselves, this conditions are quite favorable at FunderPro as the Broker offers Commission basis of only 3$/Per Lot per round for COmmodities and Currencies, and 0$ for Indices, which is lower than industry average too.

Leverage

FunderPro App Platform

FunderPro supports multiple trading platforms to cater to diverse trader preferences and needs. Among these platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both renowned for their comprehensive features, advanced charting tools, and support for automated trading systems.

Trading Conditions

FunderPro Promotions

FunderPro Alternative Brokers

It’s always wise to evaluate and compare proposals with those of other Prop Trading Firms. While some popular firms may offer similar conditions, others might provide better-suited options for specific traders, such as a broader choice of instruments or platforms other than MetaTrader. Nonetheless, FunderPro boasts several distinct advantages worth considering. For a comprehensive comparison, we’ve compiled a selection of alternatives and a table comparing FunderPro to other companies below.

- FTMO — Great Firm offering Free Trial

- Lux Trading Firm — Good for USA Trading on Funded Accounts

- The Funded Trader — Best for Higher Account Size

No review found...

No news available.

they owe to me 9000 in trading from the time they had real funds,

they owe to me 2000$ in affiliates commissions which is a scam on itself since i generate the clients and those clients purchase the service (aka i brought them business).

btway in my case it is verified even by trust pilot and i was the best trader of 2024, most payouts for the year, most total payouts, most consistent trader 2 months more than the Second best

Join me