- FinecoBank Pros and Cons

- Is FinecoBank Safe or a Scam?

- Margin Trading

- Fees

- Commission

- Deposits and Withdrawals

- Trading Platform

- Conclusion

Our Review Method

- 55Brokers Financial Experts with over 10 years of experience in Stock and Forex Trading check all trading offerings, fees, and platforms, verified regulations, contacted customer service, and placed traders to see trading conditions and give expert opinions about FinecoBank.

What is FinecoBank?

FinecoBank is a leading real stock trading company with good trading solutions and a technology base. While FinecoBank is one of the leading FinTech banks in Europe. Listed on the FTSE MIB, the company offers a unique business model in Europe, which combines the best platforms with a large network of financial advisors.

It offers banking, credit, trading, and investment services from a single account through transactional and advisory platforms developed with proprietary technologies.

- The brokerage company brings access to online trading since 2004 and is an Italian market leader with over 1,47 million customers.

Is FinecoBank Stock Broker?

Yes, FinecoBank is a Stock Broker that offers a range of brokerage services, including investment opportunities in Forex, CFDs, stocks, bonds, options, and other financial instruments, to its customers. The broker is known for its online trading platforms and is a reputable option for individuals looking to invest in the financial markets.

FinecoBank Pros and Cons

FinecoBank is a highly reliable company since operates with a European Banking license with high trust and reliability. Trading conditions and proposal is good, and there is an extensive range of trading instruments including Stocks, Indices, ETFs, and thousands of other financial instruments. The platform is also well-developed with good research.

For the Cons, there is no proper market research, and a popular MT4 trading platform is not offered.

| Advantages | Disadvantages |

|---|

| European-regulated broker with a strong establishment | No 24/7 customer support |

| Globally recognized and awarded | No proper educational materials |

| Competitive trading costs and spreads | |

| Stocks and Options trading, investing | |

| Wide range of instruments available including Stock Shares, Forex and CFDs | |

| Quality customer support | |

FinecoBank Review Summary in 10 Points

| 🏢 Headquarters | Italy |

| 🗺️ Regulation | Bank of Italy, CONSOB, ECB |

| 🖥 Platforms | PowerDesk, Stock Screener, Fineco app |

| 📉 Trading Products | Forex, CFDs, Indices, Stock Shares, Futures, Options, Cryptocurrencies, and more |

| 💰 Stock Commission | $3.95 |

| 🎮 Paper Trading/ Demo Account | Provided |

| 💳 Minimum deposit | $0 |

| 💰 Base currencies | Several currencies offered |

| 📚 Education | Seminars, Webinars, Video Library |

| ☎ Customer Support | 24/5 |

Overall FinecoBank Ranking

FinecoBank holds a strong establishment and good reputation offering safe and very favorable trading conditions. The company provides a range of online trading services, as well as user-friendly platforms with automatically updated markets and news. In addition, FinecoBank is available in many countries, so traders can sign in also with the lowest spreads.

- FinecoBank Overall Ranking is 9 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | FinecoBank | Capital Index | Tickmill |

|---|

| Our Ranking | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Instruments | Trading Conditions | Trading Platforms |

FinecoBank Alternative Brokers

FinecoBank offers good trading conditions, also low trading spreads, and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to FinecoBank:

Awards

FinecoBank Italy is an award-winning Stock trading company with competitive trading conditions. The bank has also garnered collective recognition from industry leaders many times, such as “Most Honoured Company”, “No. 1 Bank in Italy”, “Best Practice Leader”, and more in 2022.

Is FinecoBank Safe or Scam?

No, FinecoBank is not a scam. It is a reliable broker with a Banking license and low-risk Fineco Stocks Trading. The company is regulated and follows European strict laws.

Is FinecoBank Legit?

Yes, FinecoBank is a legit and regulated brokerage company. FinecoBank S.p.A. is a part of the UniCredit Banking Group enrolled in the Register of Banking Groups, with headquarters in Milan, Italy. Actually, UniCredit Bank is one of the largest groups worldwide, which is also a Member of the National Compensation Fund and the National Interbank Deposit Guarantee Fund. Therefore, FinecoBank is regulated not only as a brokerage or trading firm but as a banking institution, which follows much more sharp authorization for its service delivery by the European Central Bank, Bank of Italy, and cross-regulation within Europe and the UK.

In addition, the company is subject to regulation by FCA (UK) and limited regulation by the Prudential Regulation Authority.

See our conclusion on FinecoBank Reliability:

- Our Ranked FinecoBank Trust Score is 8.9 out of 10 for good reputation and service over the years, and also for a reliable license.

| FinecoBank Strong Points | FinecoBank Weak Points |

|---|

| Regulated broker with a strong establishment | None |

| CONSOB license and overseeing | |

| Financial Services Compensation Scheme is available | |

| Global offering coverage | |

How Are You Protected?

FinecoBank follows and operates under safety measures, which means you can trade with a trust, knowing the bank is constantly overseen and definitely not a scam. To protect its clients, the company uses multiple levels of security, starting from data encryption and ending with numerous security rules in regard to personal data, funds transactions, and storage, as well as execution policies.

All clients’ funds, of course, are kept in segregated accounts, which are supervised internally and externally, which ensures maximum protection of account holders.

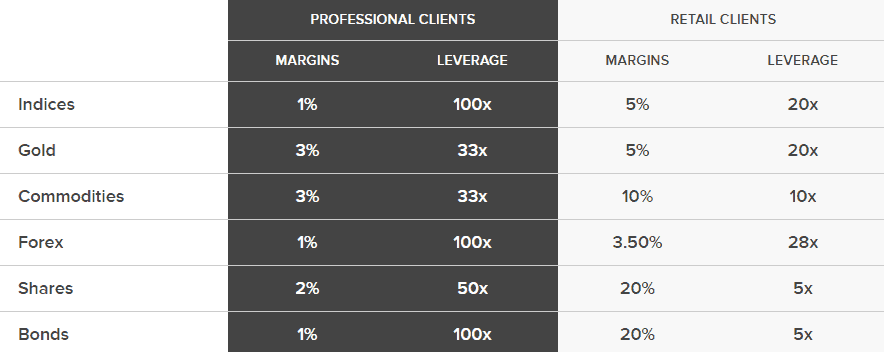

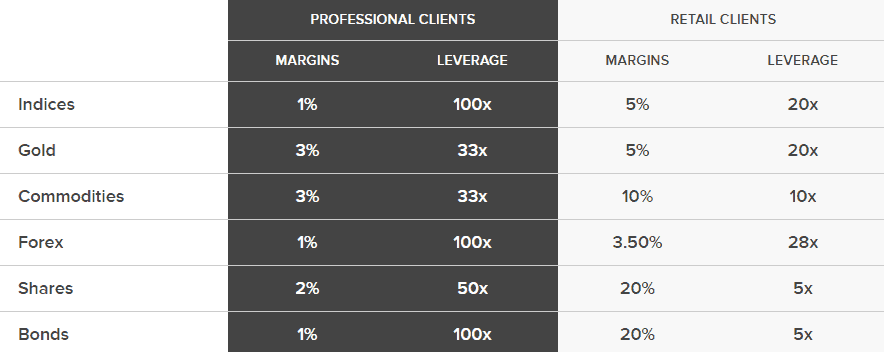

Margin Trading

Being a European Bank and broker, FinecoBank falls under the ESMA regulatory requirements and regulations. Therefore, FinecoBank leverage is the following:

- Retail traders may use a maximum leverage of 1:30 for Forex instruments,

- 1:20 for minor currencies, and even 1:100 for commodities.

However, the professional trader may apply for higher leverage levels once confirm their status.

Account Types

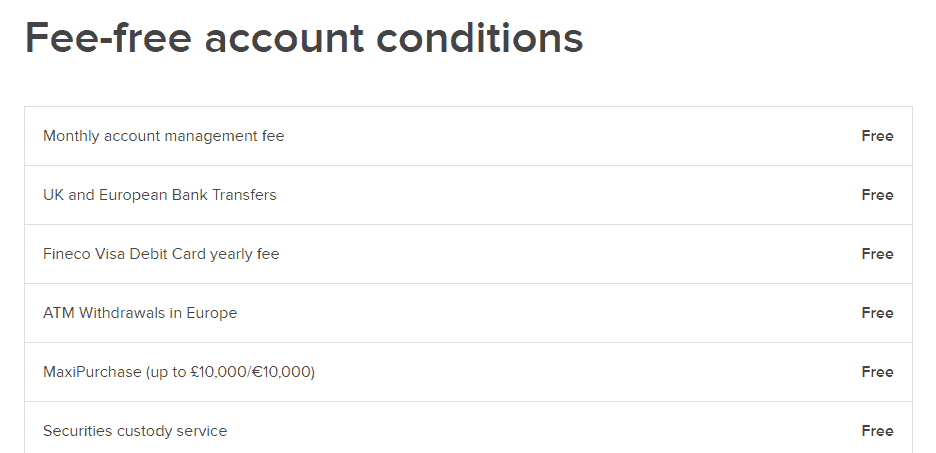

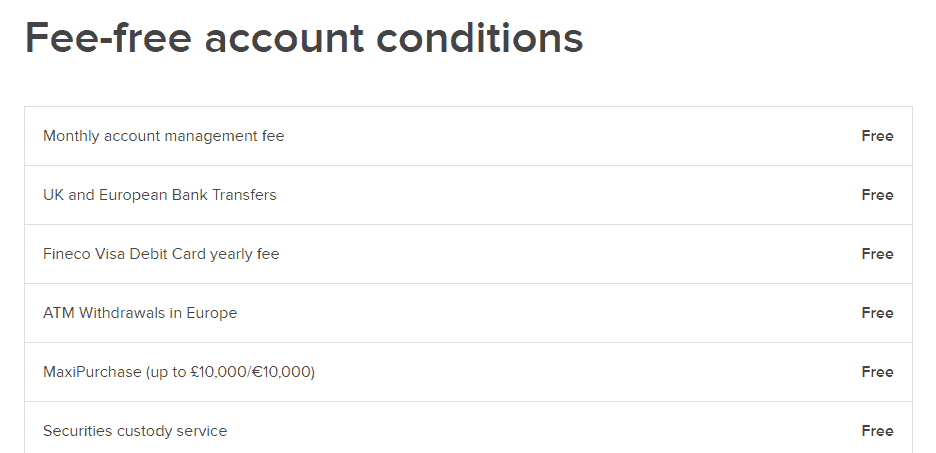

FinecoBank offers a single current account that you can access wherever and whenever you want to make transfers and payments. The Fineco account also offers immediate access to the world’s main stock exchanges and all the necessary trading tools.

Apart from the trading capabilities, the multicurrency account offers banking, brokerage, and investment services to all retail clients that maximized your capabilities.

In addition, reaching a total of 500,000 euros or more client obtains the status of Private which brings more advanced conditions of exclusive account, dedicated rates for Credit Lombard and Mortgages, Advisory services, reduced pricing on securities trading, and credit card reserved for Private customers.

| Pros | Cons |

|---|

| Fast account opening | None |

| Low minimum deposit | |

| Demo account is available | |

| Multi-currency banking account | |

How to Open FinecoBank Live Account?

Opening an account with FinecoBank is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by upload of documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Trading Products

FinecoBank offers a wide range of trading products accessible from a single multi-currency account, website, app, and PowerDesk. The trading instruments include CFDs, Forex CFDs, Indices, Stocks, Futures, Options, Bonds, ETFs and ETCs, Cryptocurrency CFDs, and more.

- FinecoBank Markets Range Score is 9.2 out of 10 for wide trading instrument selection among Forex, Stocks, Indicies, and more.

FinecoBank Fees

FinecoBank offers straightforward and competitive fees across all asset classes, mainly built into commission charges. We found that traders will pay less than €10 per order or even just €2.95 while making 1o order per month. Therefore, there is a great opportunity for both beginning and advanced traders while all tools are developed for professional trading in addition to long and short intraday and multiday margin settings.

Based on our findings, options and futures are offered at €1.95 per batch, and CFDs, FX CFDs, and Super CFDs with zero commissions but only with a spread.

For UK traders, trading meets one of the most convenient Fineco pricing on the market. Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only, and no additional markup.

- FinecoBank Fees are ranked low or average with an overall rating of 8.5 out of 10 based on our testing and compared to over 500 other brokers.

| Fees | FinecoBank Fees | Capital Index Fees | Tickmill Fees |

|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | No | Yes | No |

| Investment plans | Yes | No | Yes |

| Fee ranking | Low | Low, Average | Low |

Trading Commission

FinecoBank offers low commission-free tight spreads, from as low as 0.8 points on EUR/USD for Uk traders. Based on our Expert research, for Italian and European traders the average CFD Forex spread is 1 pip.

- FinecoBank Commission is ranked good with an overall rating of 8.5 out of 10 based on our testing comparison to other brokers. We found fees are rather attractive since built into the commission charge, offering some good costs.

| Asset/ Pair | FinecoBank Commission | PhillipCapital Commission | Robinhood Commission |

|---|

| Stocks Fees | $3.95 | $3.88 | $0 |

| Fractional Shares | No | No | $0 |

| Options Fees | $3.95 | $3.88 | $0 |

| ETFs Fees | $3.95 | $3.88 | From $1 |

| Free Stocks | No | No | Yes |

FinecoBank Trading Hours

The broker’s trading hours typically follow the standard trading hours of the financial markets it provides access to. This includes stock exchanges, Forex, and other markets. Generally, stock exchanges have specific trading hours that vary by location, and Forex markets operate 24 hours a day during the business week.

Deposits and Withdrawals

FinecoBank offers one of the most convenient and good options to transfer money with ease, as the bank allows automatic deposits available through UniCredit or Fineco Bank ATMs. Smart withdrawal is a free service available via the Fineco app for smartphones that allows withdrawing cash without a payment card.

- FinecoBank Funding Methods we ranked good with an overall rating of 8.5 out of 10. Fees are either none or very small also allowing to benefit from various account-based currencies.

Here are some good and negative points for FinecoBank funding methods found:

| FinecoBank Advantage | FinecoBank Disadvantage |

|---|

| $0 is a first deposit amount | None |

| No internal fees for deposits and withdrawals | |

| Fast digital deposits, including Google Pay, Apple Pay | |

| Multiple account base currencies | |

Deposit Options

In terms of funding methods, FinecoBank offers the following payment methods:

- Apple/Google Pay

- Fitbit Pay

- Garmin Pay

FinecoBank Minimum Deposit

There is no minimum deposit requirement for Fineco thus you can transfer any amount suitable for your needs, just check desired instrument trading conditions in order to be able to cover all necessary margins.

FinecoBank minimum deposit vs other brokers

|

FinecoBank |

Most Other Brokers |

| Minimum Deposit |

$0 |

$500 |

FinecoBank Withdrawals

Though deposits and withdrawals are free of charge in the UK, Italy, and European Banks transfer along with Fineco Visa Debit Cards is also free of charge, other regions and jurisdictions may apply international transfer fees, which you should check with customer service.

How Withdraw Money from FinecoBank Step by Step:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with necessary requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

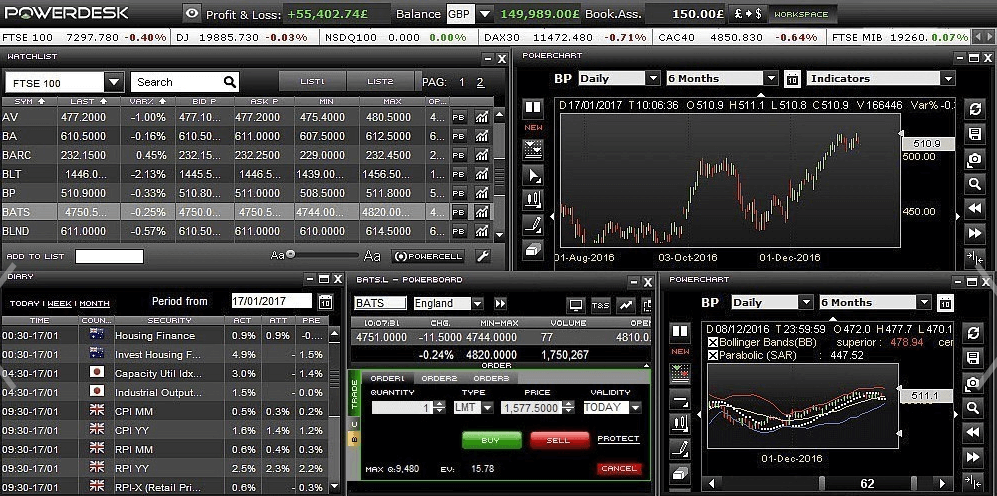

Trading Platforms

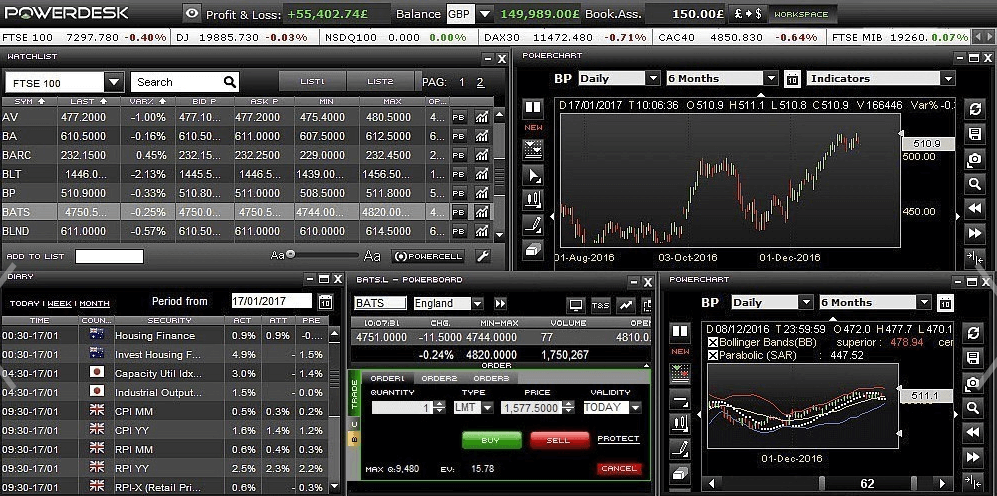

Fineco is one of Europe’s most popular online trading platforms, we found it only takes a click to access the account and start trading, as the broker’s service offers advanced technical solutions for trading based on its own technology via PowerDesk platform and a unique intuitive tool to explore markets Stock Screener, as well as mobile applications.

All in all it offers good technical solution which is an outcome of robust order execution with tight spreads and direct access to liquidity and quite great innovation Fineco applies.

- FinecoBank Platform is ranked good with an overall rating of 8.5 out of 10 compared to over 500 other brokers. We mark it as good since it offers professional trading platforms.

Trading Platform Comparison to Other Brokers:

| Platforms | FinecoBank Platforms | Capital Index Platforms | Tickmill Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

Web and Desktop Trading Platforms

Powerdesk is actually the revolutionary software for trading, with its easy interface to push markets, margin setting, CFD Fineco, and automatic orders that features advanced charts, spread views, news, and more. Its total personalization configures listings and tools while enabling friendly access that does not require installation, see our platform snapshot below.

- With the Stock Screener you’ll be able to invest in bonds through filters divided into 5 main categories and search ideas that allow exploring of the market from predefined searches. Thus you’ll immediately identify the securities of interest, and select technical, fundamental, performance, or sectorial data to run a trade.

- The last is a Fineco App that keeps necessary tools reachable at any time with availability to transfer, top-up, stock market orders, and more while available in real-time with no extra costs.

Customer Support

FinecoBank customer service brings 24/5 highly qualified support with a portfolio of over 96% satisfied customers and more than 200 operators at the disposal of the additional 2,600 personal financial advisors that are able to analyze and fulfill investment expectations. The bank also supports Live chat, Phone lines, and Email.

- Customer Support in FinecoBank is ranked good with an overall rating of 8.9 out of 10 based on our testing. We got fast and knowledgeable responses, also quite easy to reach during the working days.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of live chat, phone lines, and email | |

FinecoBank Education

FinecoBank offers live seminars, online webinars, classroom courses, video library about accounts, markets, trading, and investments clearly explained by professionals. The bank also provides market and economic news and analysis.

- FinecoBank Education ranked with an overall rating of 8.9 out of 10 based on our research. The broker provides good quality educational materials and research and also cooperates with market-leading providers of data.

FinecoBank Review Conclusion

The final thought upon FinecoBank is that it is the top-ranked Italian bank bringing trustable trading and financial solutions without any doubts about its sharp regulatory obligations. The increasingly functional platform brings tons of solutions and offers to trade more effectively.

However, PowerDesk will require a monthly fee if the client does not reach the necessary trading volume therefore may be a better option for active and professional traders along with competitive pricing and commission-free offers. Also, FinecoBank offers trustworthy trading proposals along with banking services that are worth consideration.

Based on Our findings and Financial Expert Opinions FinecoBank is Good for:

- Advanced traders

- Investing

- Italian and European traders

- Professional Trading

- Currency and CFD trading

- ETF and Stock Trading

- Commission based trading

- Competitive trading fees

- Tight spreads

- Variety of trading strategies

- Supportive customer support

- Good learning center and market analysis

Share this article [addtoany url="https://55brokers.com/fineco-bank-review/" title="FinecoBank"]

Hi All,

There is a slight issue that is getting overlooked in most Fineco reviews. When I as a British citizen buy shares on the London Stock Exchange through Fineco, the dividends I get will be subjected to 20% withholding tax. Something I will never recover unless I exceed the dividend tax threshold. With British investment platforms no withholding tax gets deducted. This is a difference of up to GBP400 a year…

And Customer Service gives you a rather military style answer to the above remark:

“we inform you that nationally sourced dividends will be taxed

regardless of the tax residence of the recipient.

Thank you for your collaboration.”

Who could wish for more care and understanding?

I gave up jumping through their innumerable obstacles to setting up an account. Much too complex

fineco bank is a scam!

Read http://www.fineco-bank.com

Of course search engines have banned that website… everybody bows to bankers’ power!

After looking at the devastating reviews left by other users I wonder if there is any point, Fineco is a unprofessional, incompetent outfit, they do not care about their customer, in my experience the so called advisor, are badly trained and ignorant, both professionally and in interpersonal skill. So goodbye fineco.

Hi do you allow South African residence to open an account with the bank?