- What is Fidelity?

- Fidelity Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Fidelity Compared to Other Brokers

- Full Review of Broker Fidelity

Overall Rating 4.8

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.8 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is Fidelity?

Fidelity Investments, founded in 1946, is a Stock Trading and Investing company based in the USA. Its diverse offerings include an extensive selection of mutual funds and ETFs, brokerage services for trading stocks, securities, options, bonds, CDs, precious metals, cryptos, Fidelity retirement planning solutions, global investment research, wealth management, Fidelity online banking, and more.

As a financial institution established and operating in the United States, the firm is subject to strict regulatory oversight by the US SEC and FINRA, ensuring that Fidelity complies with securities laws and provides transparent and accurate information to investors.

Based on our research, the company has a global presence and serves clients in numerous countries around the world. In general, the investment firm is well-known for its dedication to prioritizing the best interests of traders and investors, focusing on low Fidelity fees, competitive trading terms, and a commitment to a long-term investment approach.

Is Fidelity Stock Broker?

Yes, Fidelity is a Stock and Options trading company that includes a brokerage division. It allows individuals and institutions to buy and sell stocks, Fidelity bonds, options, mutual funds, ETFs, and other securities through their brokerage accounts. While Fidelity is known for its mutual funds and investment management services, it also provides a wide range of brokerage-related services, making it a popular choice for investors looking to trade securities on the stock market.

Fidelity Pros and Cons

According to our findings, the firm has a strong reputation and advantages in the investment industry. These include an extensive range of trading products, low costs and commissions, and comprehensive education and research. Additionally, the broker provides good-quality customer service and offers user-friendly digital tools for enhanced accessibility and ease of use.

For the cons, some potential drawbacks may include complex fee structures for certain accounts and high minimum investment requirements for certain funds.

| Advantages | Disadvantages |

|---|

| Strict regulation by SEC, and FINRA | No paper trading or demo account |

| $0 minimum deposit | No futures trading |

| Trading products | |

| Stocks and Options Trading, Investment | |

| Low trading fees and commissions | |

| US traders | |

| Advanced trading platforms | |

| Good education and research | |

| Competitive trading conditions | |

Fidelity Features

Fidelity ranks among the top investment firms due to its extensive range of investment options, commitment to low fees, robust research tools, and good emphasis on investor education. Below is a comprehensive list of its key features:

Fidelity Features in 10 Points

| 🏢 Regulation | SEC, FINRA, IIROC |

| 🗺️ Account Types | Brokerage, Retirement, Education Accounts, etc. |

| 🖥 Trading Platforms | Active Trader Pro, Fidelity Go, Fidelity.com Web |

| 📉 Trading Instruments | Stocks, Mutual Funds, ETFs, Options, Bonds, CDs, Precious Metals, Crypto, etc. |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From $0 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | USD, EUR, GBP, AUD |

| 📚 Trading Education | Learning center, Events, Webinars, etc. |

| ☎ Customer Support | 24/7 |

Who is Fidelity For?

Fidelity provides trading solutions to a wide range of investors, from beginners to high-net-worth individuals and active traders. Its flexibility, strong reputation, and broad offering make it a top choice among investors. Based on our findings and Financial Expert Opinions, Fidelity is Good for:

- Traders from the USA, Canada, Europe, etc.

- Real Stock Trading

- Investing

- Fractional Shares

- Currency trading

- Advanced traders

- Professional trading

- Commission-based trading

- Good education and trading tools

- 24/7 customer support

Fidelity Summary

In conclusion, Fidelity stands out as a reputable and comprehensive Real Stock Trading provider. With a rich history dating back to 1946, the firm offers a diverse range of investment products, competitive trading options, and a commitment to low fees. Its dedication to investor education and robust research tools adds further value to its services.

While specific offerings and fees may evolve, Fidelity’s consistent focus on trustworthiness, innovation, and customer service makes it a trusted choice for investors looking to manage and grow their financial assets.

Overall, we found that Fidelity provides a good trading environment for investment; however, there are some limitations too, like the absence of some popular trading products, etc., so we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

Fidelity stands out as one of the most reputable and comprehensive brokerage firms for Real Stocks in the industry, with offering a blend of low-cost investing, advanced research tools, and supportive customer service. In fact, firm is among the most known and popular among investors in Stocks worldwide, which results in very competitive and professional proposal from various sides.

What truly sets Fidelity apart is its commitment to investor-first practices, such as avoiding payment for order flow on equity trades, providing transparent pricing which we mark as very competitive and low overall. Besides, offering of a wide range of proprietary mutual funds and ETFs with no transaction fees is another plus.

Also, what is definitely big advantage is educational resources that cater to all experience levels so beginning investors are very welcome to Fidelity too. As for the trading software theree are advanced platforms like Active Trader Pro meet the needs of any style traders, and tools inbuilt into the trading platform are on very good quality too. Additionally, Fidelity’s strong emphasis on retirement planning, wealth management, and financial advisory services positions it as a trusted partner for long-term investors and high-net individuals. Overall, Fidelity is a fit and choice almost for any size or type of investor, the maximum point can be something personal you may not like or choose other Broker, but most are definitely are accommodated.

Consider Trading with Fidelity If:

| Fidelity is an excellent Broker for: | - Looking for Reputable Firm.

- Suitable for professional traders and investors.

- Looking for broker with a long history of operation and strong establishment.

- Low fees and commissions.

- Need a well-regulated broker.

- Access to robust proprietary trading platforms.

- Stock Trading and Investment.

- Excellent trading tools and trading technology.

- Offering popular financial products.

- US investors.

- Long-term investing.

- Excellent educational materials, and customer support.

- Looking for broker with Top-Tier licenses.

- Secure trading environment. |

Avoid Trading with Fidelity If:

| Fidelity might not be the best for: | - Looking to trade Futures Contracts.

- Beginners who prefer simpler trading approach.

- International investors outside the US. |

Regulation and Security Measures

Score – 4.8/5

Fidelity Regulatory Overview

Fidelity is a reputable and trustworthy Stock Trading Broker that follows strict rules and guidelines established by the SEC and FINRA, along with Fidelity International licenses that the broker operates.

These are Top-Tier regulations, safeguarding client assets, and providing low-risk Stocks and Options trading.

How Safe is Trading with Fidelity?

Fidelity is a legitimate and reliable company for investors and institutions. The firm has a long history of serving investors and managing assets on their behalf. It is regulated by financial authorities in the countries where it operates and has a strong reputation in the financial industry.

Moreover, an advantage of the company’s legitimacy is that Fidelity does not offer services in offshore zones, emphasizing its commitment to operating within regulated jurisdictions and providing transparency to traders.

As a reputable and well-regulated investment company, it adheres to industry best practices and regulatory standards to ensure the safety and security of client assets. These measures include safeguards against fraud and unauthorized account access, robust online transaction security, and strict identity verification protocols.

In addition, Fidelity is a member of FINRA and SIPC, which provides insurance coverage for client assets held at the firm in case of brokerage failure, adding an extra layer of protection for investors. However, traders should remain cautious about their account security, regularly monitor their investments, and follow safe online practices to further enhance their trading protection.

Consistency and Clarity

Fidelity’s reputation is built on decades of consistent service, operational excellence, and a clear commitment to investor-first principles. As one of the most trusted brokerage firms in the US, the firm has earned high ratings across independent broker reviews, often praised for its transparent pricing, robust research tools, and strong customer support.

Trader feedback highlights the platform’s reliability, low fees, and extensive educational resources, though some active traders note the lack of access to futures, FX, or direct crypto trading as potential drawbacks.

Additionally, Fidelity has been recognized and awarded over time for the excellence of its services and is trusted by thousands of investors who hold accounts with the firm.

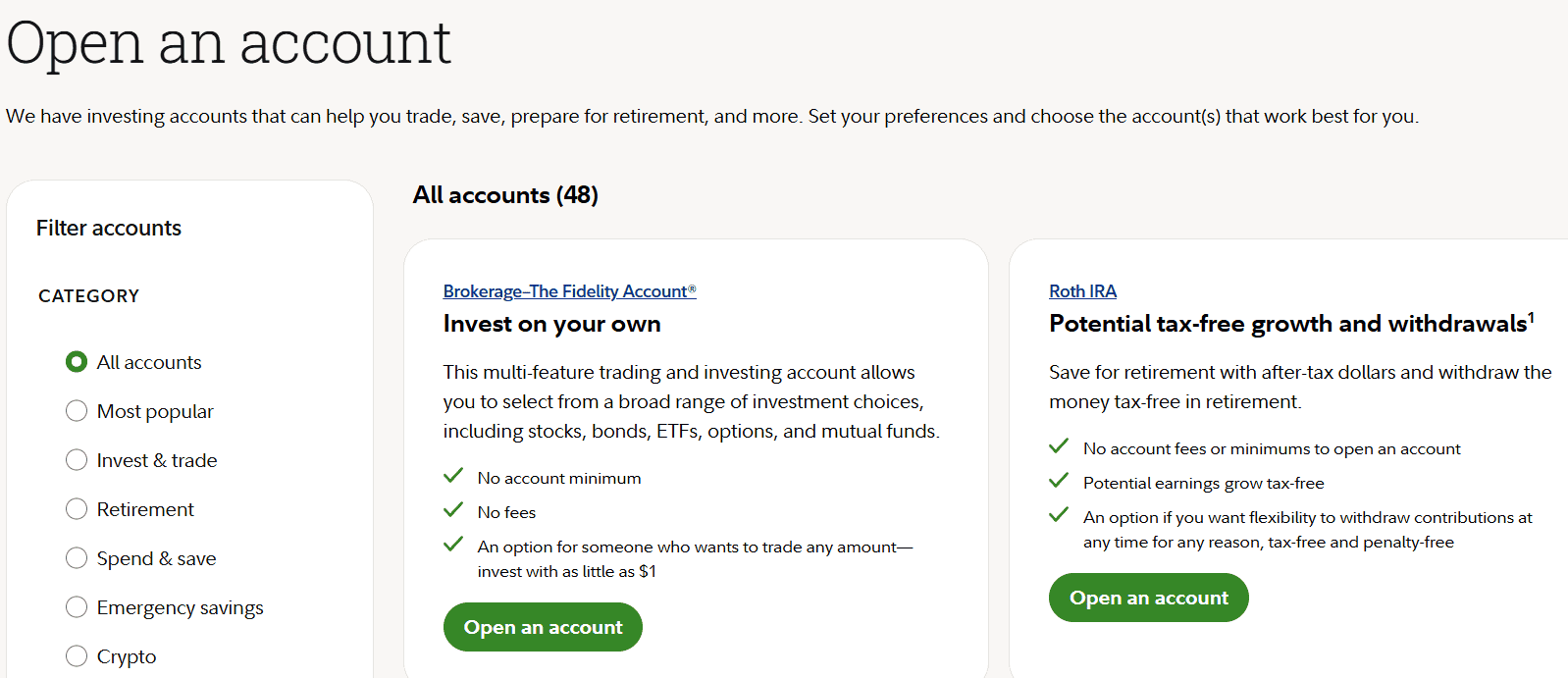

Account Types and Benefits

Score – 4.6/5

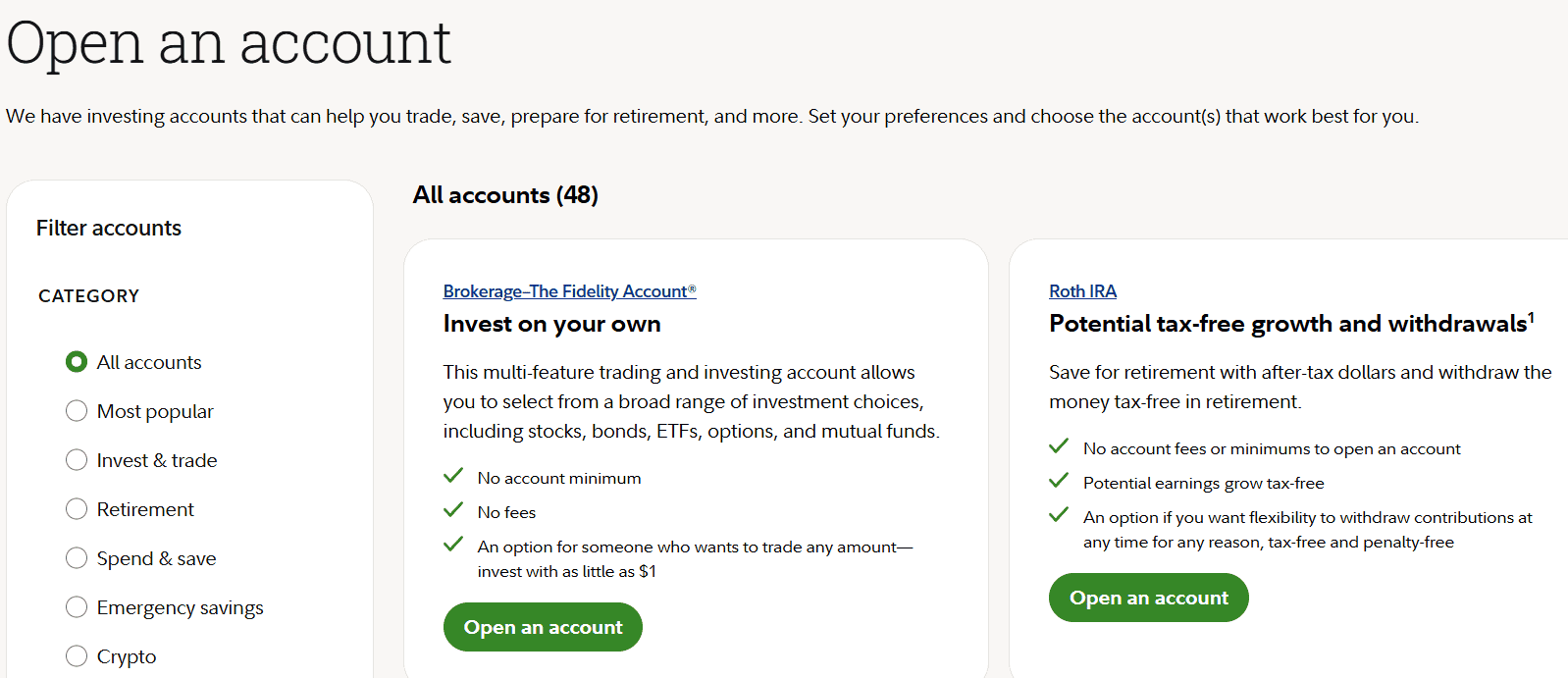

Which Account Types Are Available with Fidelity?

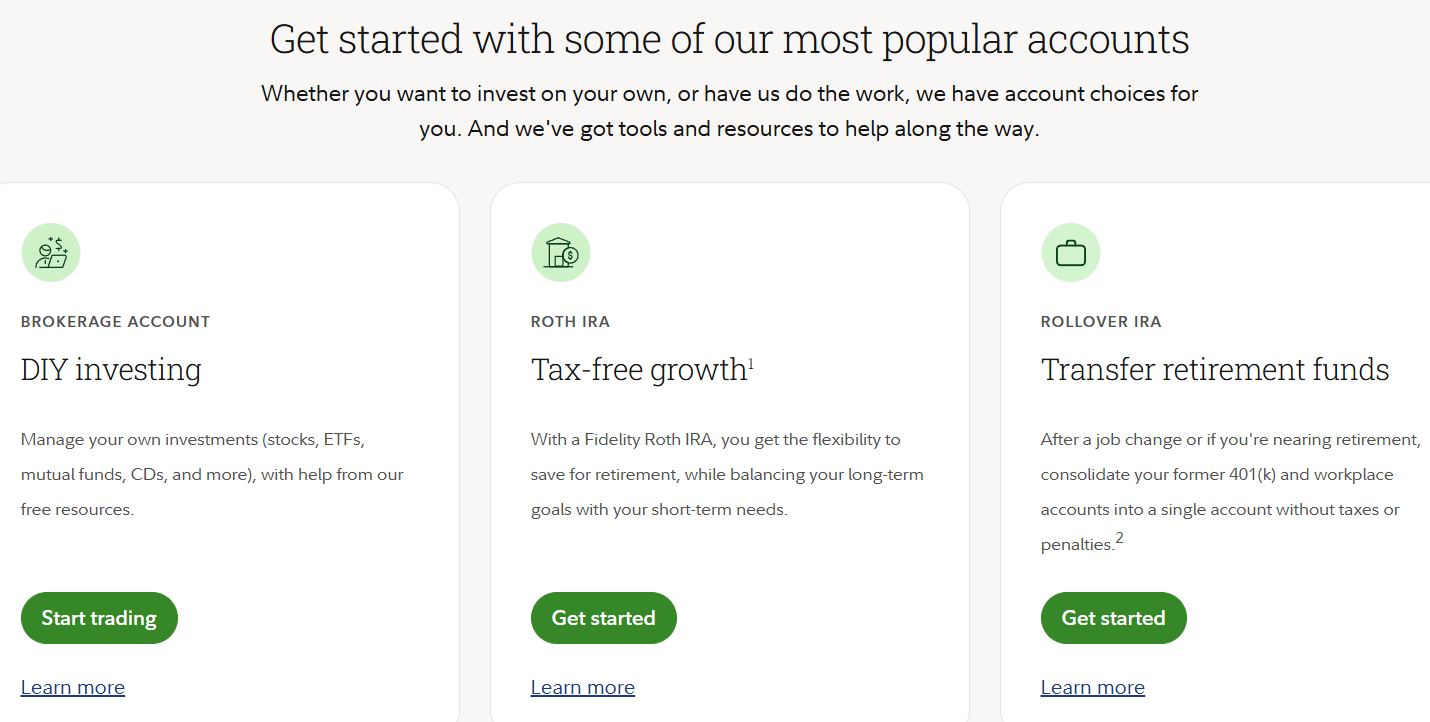

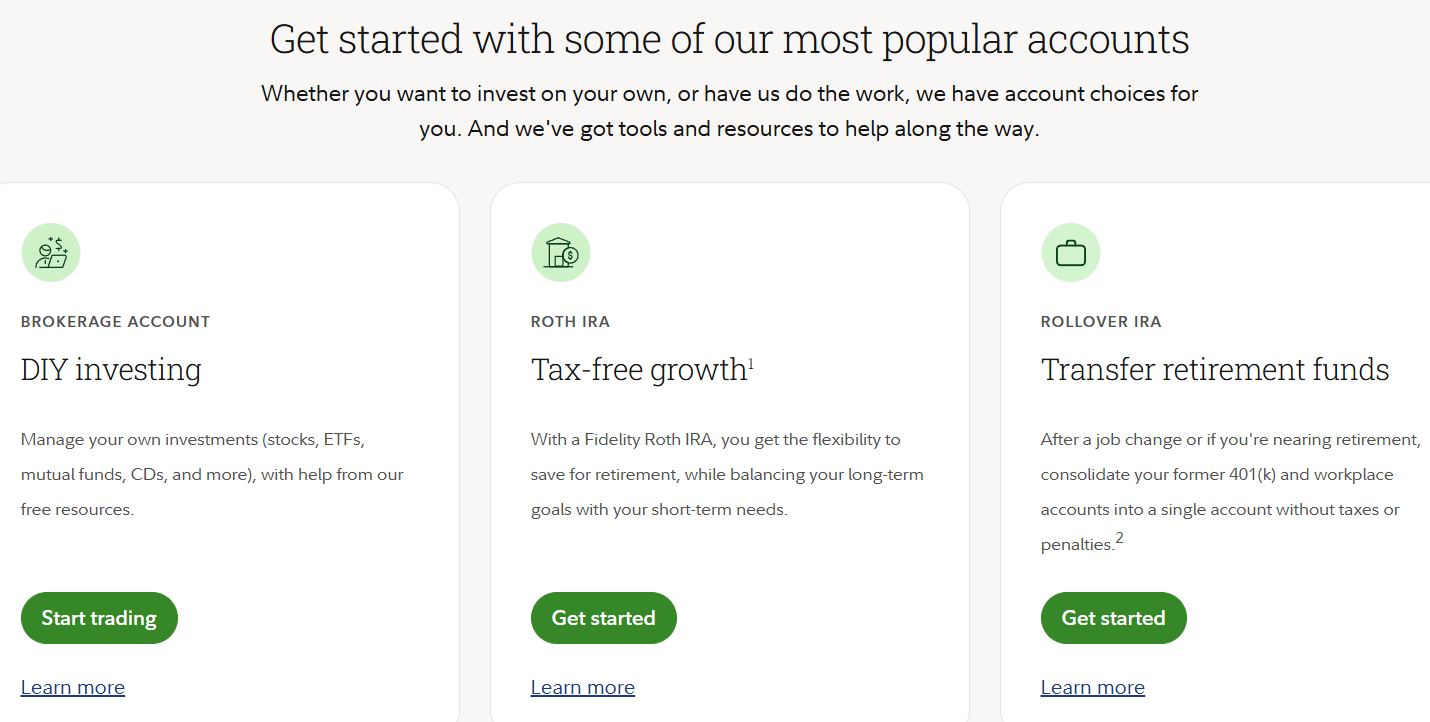

Fidelity offers cash and margin accounts to cater to different financial goals and needs. These include individual brokerage accounts, retirement accounts like IRAs and 401(k)s, custodial accounts for minors, trusts, and various other specialized accounts.

Each account type is designed to provide investors with specific benefits and tax advantages, making it possible for clients to tailor their investments to their unique circumstances and objectives.

Brokerage Account

Fidelity’s Brokerage Account is a flexible, self-directed investment account that allows individuals to buy and sell a wide range of securities, including stocks, ETFs, mutual funds, bonds, and options.

With no account minimums and $0 commissions on US stock and ETF trades, the brokerage accounts offer a cost-effective way to invest. Investors benefit from access to powerful research tools, educational resources, and trading platforms like Active Trader Pro.

Regions Where Fidelity is Restricted

Fidelity’s services are primarily intended for US and Canadian residents. As a result, there are certain regions and countries where the firm either does not open new accounts or restricts the functionality of existing ones.

- Some EU countries

- Iran

- North Korea

- Syria, etc.

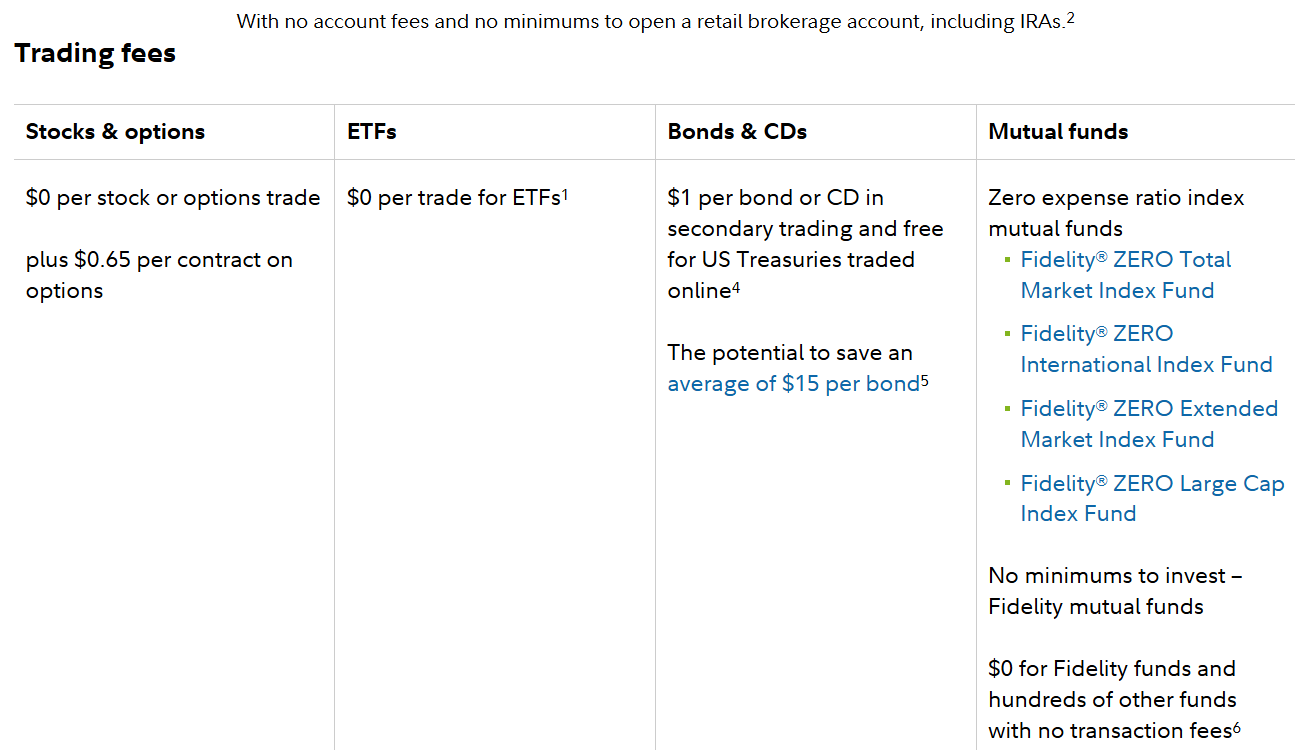

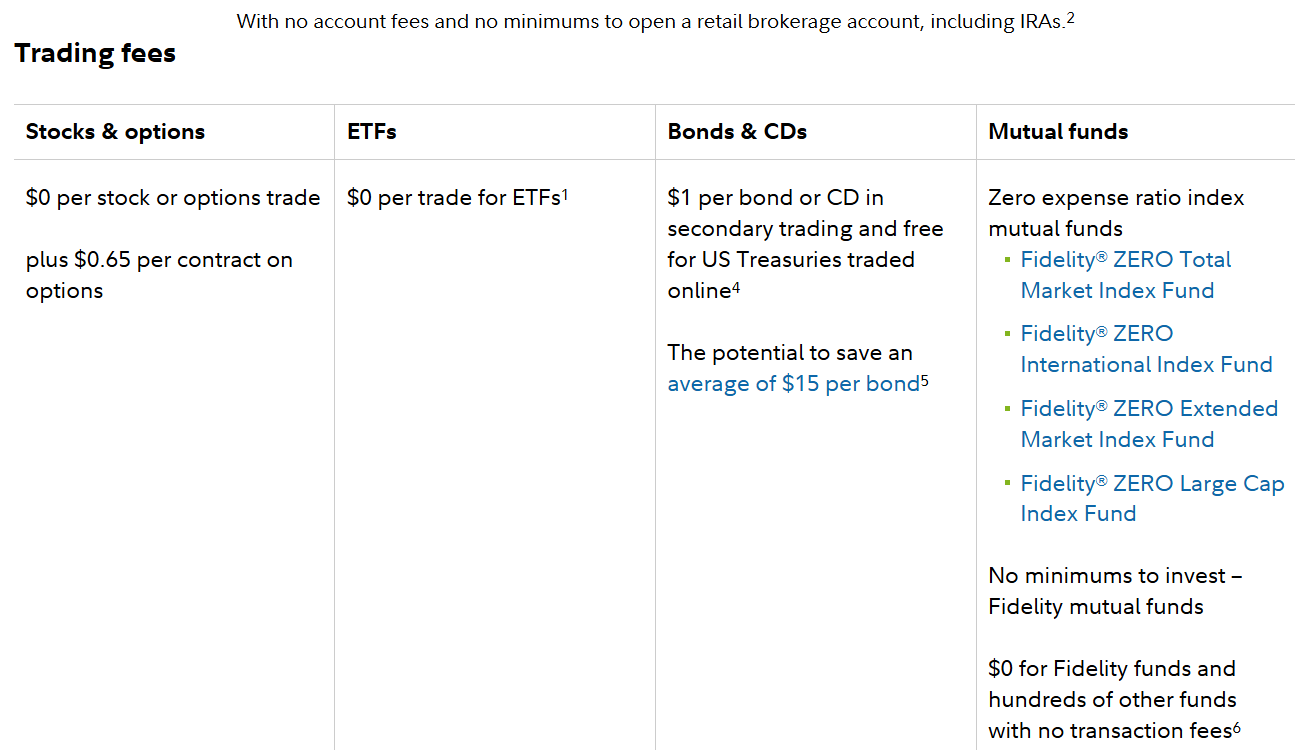

Cost Structure and Fees

Score – 4.7/5

Fidelity Brokerage Fees

In terms of fees, the broker offers low costs, making it an attractive choice for cost-conscious investors. While specific fees can vary depending on the type of account and investment products, Fidelity generally offers competitive fee structures for its mutual funds and ETFs, often with no transaction fees when investing in their own funds.

Additionally, its brokerage services typically come with competitive commission rates for Stock and ETF trades. However, investors should review and understand the fee schedule for their specific accounts and investments, as certain products and services may have associated costs.

As a commission broker, Fidelity does not charge spreads on trades. The firm offers commission-free trading for U.S. stocks, ETFs, and options.

However, the fees and commissions can change over time and may vary based on the type of account, the specific investments, and market conditions. Margin rates are also competitive, starting as low as 8.25%.

Fidelity offers competitive pricing, including $0 commissions for online U.S. stock and ETF trades, and $0.65 per contract for options trades.

Additionally, the broker applies regulatory fees (NFA fee) on options transactions where applicable. As of current rates, the NFA fee is $0.02 per options contract, assessed to help fund regulatory oversight.

- Fidelity Rollover / Swaps

Fidelity does not engage in rollover or swap fees like Forex or CFD brokers do, as it does not offer leveraged overnight trading on those instruments.

However, regarding retirement accounts, the firm provides rollover services that allow clients to move funds from a 401(k) or another plan into a Fidelity IRA.

This is commonly used to consolidate retirement savings and maintain tax advantages. Unlike swap fees in leveraged trading, Fidelity’s rollover process is designed for long-term investors and is typically free.

While Fidelity is well-known for its low-cost structure, there are a few additional fees investors should be aware of. These include a $0.65 per contract fee for options trades, certain wire transfer or overnight delivery fees, and service charges for specific account features.

Additionally, foreign transaction or currency conversion fees may apply when trading international securities. Overall, Fidelity keeps extra costs minimal and transparent, but investors should review the fee schedule for services outside of standard trading activity.

How Competitive Are Fidelity Fees?

Fidelity’s fee structure is widely regarded as highly competitive within the brokerage industry, especially for long-term investors and cost-conscious traders.

The firm consistently ranks among the top brokers for value, offering commission-free trading on U.S. stocks and ETFs. Fidelity also stands out by avoiding payment for order flow on equity trades.

| Asset/ Pair | Fidelity Commission | Freetrade Commission | Vanguard Commission |

|---|

| Stocks Fees | From $0 | From $0 | From $0 |

| Fractional Shares | $1 | £2 | $1 |

| Options Fees | From $0 | - | From $0 |

| ETFs Fees | $0 | From $0 | $0 |

| Free Stocks | Yes | Yes | Yes |

Trading Platforms and Tools

Score – 4.6/5

The broker offers the Fidelity website and mobile app, which are ideal for traders and investors seeking easy access to their accounts and real-time market information from web browsers or mobile devices. Additionally, Fidelity Active Trader Pro is a more advanced desktop trading platform designed for active traders, offering sophisticated charting tools, research capabilities, and customizable layouts.

For those who prefer automated investing, the firm also offers a robo-advisory platform called Fidelity Go, which creates and manages diversified portfolios based on clients’ financial goals and risk tolerance.

Trading Platform Comparison to Other Brokers:

| Platforms | Fidelity Platforms | Freetrade Platforms | Vanguard Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Fidelity Desktop Platform

Fidelity’s desktop platform, Active Trader Pro, is a powerful trading tool suited for active traders seeking speed, customization, and deep market insight.

The platform offers a fully customizable interface with real-time streaming quotes, advanced charting tools, trade analytics, and integrated research. Traders can monitor multiple watchlists, set complex order types, and use features like real-time alerts, profit and loss tracking, and multi-leg options trading.

Active Trader Pro includes advanced technical analysis tools and access to Fidelity’s proprietary market research. While it is ideal for frequent traders, the platform is also available to all Fidelity clients at no additional cost. It is a standout choice for those who want a desktop-based, professional trading experience.

Main Insights from Testing

Testing Fidelity’s Active Trader Pro reveals a platform built with reliability and responsiveness. The software runs smoothly with minimal lag, even when handling high volumes of data or multiple windows.

While the platform may not have the same level of customization as some third-party platforms, its seamless integration with Fidelity accounts and the overall user experience make it a solid choice for active traders who value efficiency.

Fidelity Desktop MetaTrader 4 Platform

Fidelity does not offer MetaTrader 4, the popular third-party trading platform widely used in Forex and CFD markets. Investors looking for MT4 functionality need to consider specialized brokers instead.

Fidelity Desktop MetaTrader 5 Platform

Similarly, Fidelity does not support MT5. As an investment firm focused on long-term wealth management and diversified portfolios, Fidelity does not provide access to this multi-asset trading platform.

Fidelity MobileTrader App

The broker offers a mobile app, which is a powerful tool for investors and traders on the go. It provides convenient access to account information, real-time market data, and a suite of trading tools, all from the convenience of a smartphone or tablet. With the app, users can execute trades, monitor their portfolios, access research and market news, and even manage retirement and investment accounts with ease.

Fidelity’s mobile app is known for its user-friendly interface and robust features, making it a valuable resource for those who want to stay connected to their investments and financial goals wherever they are.

Trading Instruments

Score – 4.7/5

What Can You Trade on Fidelity’s Platform?

Fidelity provides a wide range of trading products to accommodate diverse investment strategies. These products include stocks, bonds, mutual funds, cryptos, metals, exchange-traded funds (ETFs), options, and fixed-income securities. Additionally, the broker offers access to international markets, enabling investors to trade securities from around the world.

However, the availability of specific trading instruments may vary depending on the entity, so we advise conducting good research to determine the range of options available, and also, if conditions vary based on your residence.

Main Insights from Exploring Fidelity’s Tradable Assets

Fidelity offers a well-diversified selection of tradable assets that caters primarily to long-term investors and those focused on building diversified portfolios. Its range of assets highlights a clear focus on traditional investment options, with especially strong representation in U.S. markets.

Overall, Fidelity’s tradable asset range is best suited for investors who prioritize stability, variety, and long-term growth opportunities.

Margin Trading at Fidelity

Fidelity Margin trading allows traders and investors to borrow funds from the Brokerage company to leverage their investments, which is known as Margin Trading and is fully automatic based on the offered levels. The specific multiplier amount provided by the firm can vary depending on factors such as the trader’s account equity and the individual stock being traded.

- The initial margin requirement, known as the Reg T or Fed requirement set by the Federal Reserve Board, is currently 50% of the purchase price for most securities. Additionally, Fidelity requires that customers maintain a minimum account equity of $2,000 to place margin orders.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Fidelity

The broker provides a range of convenient funding methods to accommodate the diverse financial needs of its clients. These methods include:

Additionally, clients can set up automatic deposits for consistent investing or opt for asset transfers when looking to consolidate their investments from other financial institutions.

Fidelity also supports cash or check contributions for retirement accounts and facilitates IRA rollovers, enabling individuals to seamlessly manage their retirement savings.

Fidelity Minimum Deposit

The broker offers great options with no minimum deposit requirement for opening an account.

Withdrawal Options at Fidelity

Fidelity offers various withdrawal options to provide flexibility for clients accessing their funds. Clients can request withdrawals through electronic funds transfers (EFT), wire transfers, or by requesting checks to be sent to their registered addresses.

Additionally, investors can set up recurring withdrawals for regular income needs or make one-time withdrawals as necessary. Withdrawal processes may have specific requirements and processing times, so you should refer to Fidelity’s official website or contact customer service for detailed information on how to make withdrawals and any associated fees or timelines.

Customer Support and Responsiveness

Score – 4.6/5

Testing Fidelity’s Customer Support

The broker’s customer support is available 24/7 through Phone and Virtual Assistant, and 24/5 through Live Chat. Fidelity can also be reached via social media platforms.

The help center is staffed by trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Contacts Fidelity

Fidelity offers 24/7 phone support for general inquiries at 800‑343‑3548, and specialized lines for specific services, like workplace accounts 800‑835‑5095, and international trading 800‑544‑2976.

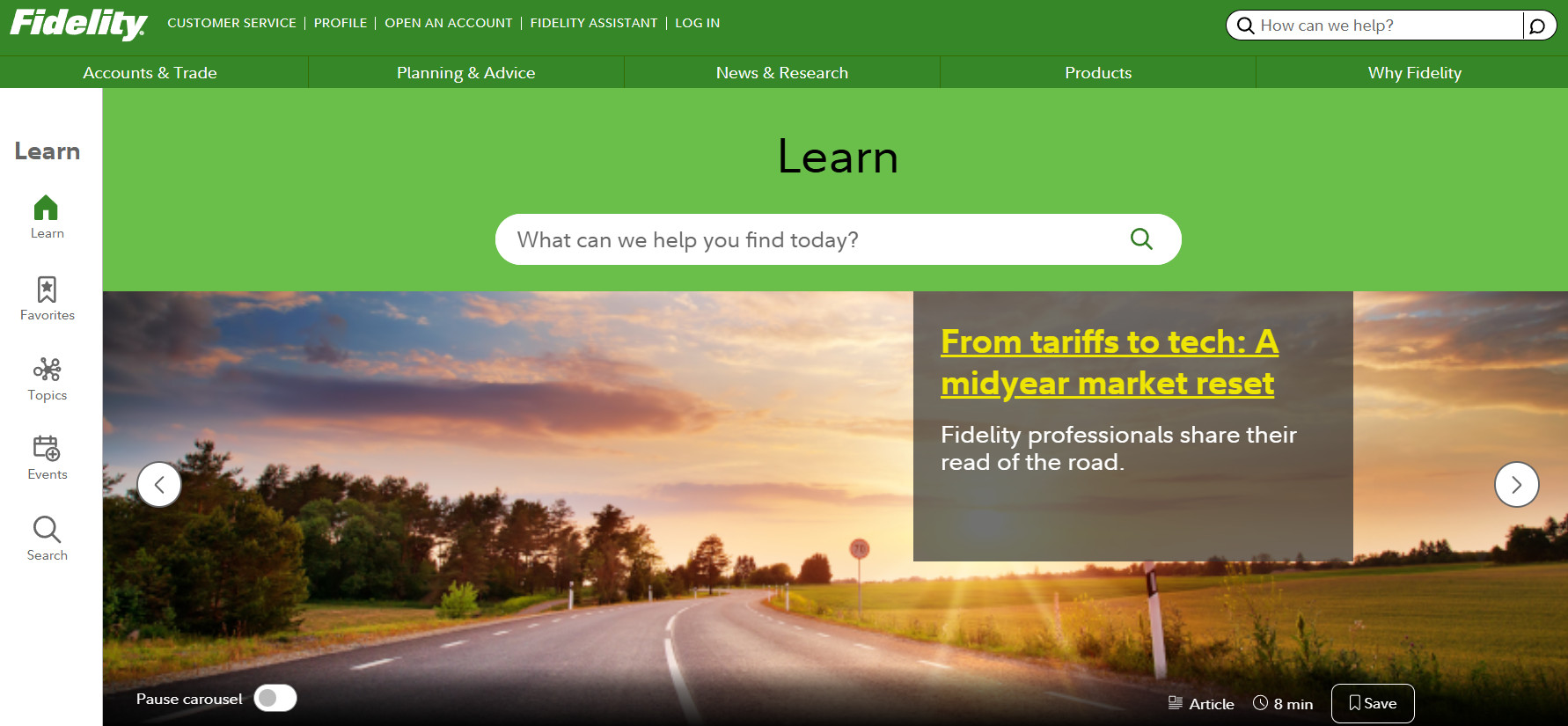

Research and Education

Score – 4.7/5

Research Tools Fidelity

Fidelity offers a comprehensive range of research tools available through its website and trading platforms.

- Investors can access real-time quotes, advanced charting, and screeners for stocks, ETFs, mutual funds, and options.

- Users can set up custom watchlists to track their favorite assets and receive alerts based on price movements, volume, or technical signals.

- The platform also includes tools like Equity Summary Score, which consolidates ratings from multiple providers into a single score, and Stock Research Center, which provides financials, valuations, and news.

- Additionally, clients have access to Wealth Management insights, providing strategic perspectives on long-term investing, market outlooks, and portfolio planning.

- For technical analysis, users can leverage a variety of indicators and drawing tools, while fundamental investors benefit from earnings data, historical performance, and sector analysis.

Education

Fidelity places a strong emphasis on investor education, offering a wealth of educational resources and tools to empower its clients. These resources include webinars, articles, videos, and interactive tools designed to help investors make informed financial decisions.

The educational content covers a wide range of topics, from basic investing principles to advanced trading strategies.

Portfolio and Investment Opportunities

Score – 4.8/5

Investment Options Fidelity

The firm offers a comprehensive range of investment plans and services suitable for the diverse financial needs of individuals and institutions. Additionally, Fidelity offers retirement solutions such as Individual Retirement Accounts (IRAs) and 401k Fidelity plans.

Its brokerage services cater to those looking to trade stocks, bonds, and other securities, while wealth management services are available for high-net-worth clients seeking tailored investment strategies and financial planning.

Moreover, the company supports education savings plans, fixed-income investments, and provides retirement planning tools and advisory services, emphasizing its commitment to helping clients achieve their financial goals.

Account Opening

Score – 4.5/5

How to Open Fidelity Demo Account?

Fidelity does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Fidelity Live Account?

Opening a live account with Fidelity is an easy process that can be completed online in just a few steps. Start by visiting the official Fidelity website and selecting the type of account you wish to open, such as a brokerage account, retirement account (IRA), etc.

You will need to provide personal information, including your Social Security number, employment details, and financial background. Once your application is submitted, you can fund your account via bank transfer, wire, or check.

After funding, your account will be ready for live trading. Fidelity does not require a minimum deposit for most accounts, making it accessible for both new and experienced investors.

Additional Tools and Features

Score – 4.4/5

Beyond its core research capabilities, Fidelity offers a range of additional tools and features that enhance the overall investing experience.

- These include a robust retirement planning calculator, goal tracking tools, and tax planning resources to help investors align their portfolios with long-term financial objectives.

- For more advanced users, Fidelity offers access to market commentary, sector analysis, and IPO tracking. These tools support a more comprehensive approach to wealth management and help investors make strategic and informed decisions.

Fidelity Compared to Other Brokers

Compared to its competitors, Fidelity stands out as a well-rounded and accessible Stock Trading provider, especially for long-term investors and beginners.

While it does not offer futures trading like many other firms, it excels in providing a wide range of traditional assets and commission-free stock trading. Its research tools, educational resources, and customer support are rated among the best in the industry.

Unlike platforms that focus heavily on futures or advanced trading tools, Fidelity focuses more on portfolio building, wealth management, and stability. Overall, Fidelity is a strong choice for those prioritizing reliability, regulatory strength, and low entry barriers.

| Parameter |

Fidelity |

AvaFutures |

Interactive Brokers |

TD Ameritrade |

NinjaTrader |

E-Trade |

WeBull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from $0 |

$0.49 |

$0.85 |

$1.50 |

$1.29 |

$1.50 |

$1.50 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low |

Low |

Average |

Average |

Average |

Average |

| Trading Platforms |

Active Trader Pro, Fidelity Go, Fidelity.com Web |

MT5 |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Proprietary NinjaTrader Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform |

| Asset Variety |

Stocks, Mutual Funds, ETFs, Options, Bonds, CDs, Precious Metals, Crypto |

Futures |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Futures, Forex, Options, Equities, Stocks |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, ETFs, OTC, ADRs, Crypto, Forex, Shares, Futures |

| Regulation |

SEC, FINRA, IIROC |

ASIC, MiFID, Bank of Ireland, JFSA, FSCA, CySEC, BVI FSC, FRSA, ISA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

NFA, CFTC |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, ASIC, SFC, MAS |

| Customer Support |

24/7 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Good |

Good |

Good |

Excellent |

| Minimum Deposit |

$0 |

$100 |

$100 |

$0 |

$400 |

$0 |

$0 |

Full Review of Broker Fidelity

Fidelity is a trusted U.S.-based Stock Trading Broker known for its strong regulatory background, comprehensive range of investment products, and user-friendly platforms.

It offers commission-free trading on U.S. stocks and ETFs, access to mutual funds, bonds, and more, making it suitable for all levels of investors. The broker provides robust research tools, retirement planning features, and wealth management services, all supported by 24/7 customer service.

With no minimum deposit required for most accounts and an emphasis on investor education, Fidelity is well-regarded for its transparency, reliability, and long-term investment focus.

Share this article [addtoany url="https://55brokers.com/fidelity-review/" title="Fidelity"]