- What is Fidelcrest?

- Fidelcrest Pros Cons

- Is Fidelcrest Legit?

- Fidelcrest Challenge

- Funded Account

- Account Conditions

- Payout

- Fidelcrest Alternative

What is Fidelcrest Prop Firm?

Fidelcrest, established in 2018 and headquartered in Cyprus, operates as a global proprietary trading firm. It offers skilled traders who meet certain criteria the opportunity to manage accounts with real funds of up to $1,000,000, providing a significant impact on their financial lives.

- Fidelcrest’s stated goal is to assist retail clients in achieving consistent, long-term financial gains. Boasting over 6,000 active traders worldwide, Fidelcrest is recognized as one of the leading proprietary trading firms and providers of funded trader accounts.

Fidelcrest, as a prop trading firm, offers the unique opportunity to trade with minimal personal funds by becoming a funded trader. This requires passing a test or challenge to access a company-funded account, allowing you to trade like a professional. It’s important to be aware of the risks involved, and we recommend reading more about Prop Trading before starting.

| Fidelcrest Advantages | Fidelcrest Disadvantages |

|---|

| Lower Profit Target | No Strict Overseeing |

| Unlimited evaluation free retries | It is hard to become Funded Trader |

| Great variety of Balances with Low Registration Fees | Limited Instrument Range |

| Profit Share from Challenge | Only MetaTrader Platform |

| MT5 and MT4 with EAs | |

| Refundable Fee once you become Funded Trader | |

| Multilingual Customer support | |

| Free Competitions | |

Is Fidelcrest Legit?

Fidelcrest, headquartered in Cyprus, has maintained a solid reputation since its inception, operating in compliance with the stringent financial regulations set by the EU. Although not licensed by any specific authority, the firm’s adherence to EU financial standards underscores its commitment to upholding industry best practices.

- Typically, unlike Forex Brokers, proprietary trading firms operate without a Forex Broker license, resulting in less regulation and oversight by industry regulators. This means they don’t always offer the highest level of safety, as the company itself manages operations and provides the funds for trading activities. Therefore, it’s crucial to fully understand all the risks involved in such trading environments.

Is Fidelcrest Scam?

After reviewing the official website for Fidelcrest, we found no clear indications that the company is a scam. However, it’s important to note that proprietary trading firms typically operate with minimal regulation from financial authorities. This lack of oversight makes it more challenging to definitively assess the legitimacy or potential risks associated with these firms.

- Our professional advice is to thoroughly educate yourself about proprietary trading and fully understand the associated risks before proceeding. It’s wise to opt for a company with a well-established reputation and a history of stability. Although you’re not investing a large sum of money, but rather paying subscription fees, the potential financial losses in prop trading are generally lower compared to trading with your own funds.

Fidelcrest Trading Challenge Evaluation

The key aspect of our Fidelcrest Review focuses on the evaluation challenge: the process and conditions for enrolling in the trading challenge. This involves understanding the specific tests required to qualify for a Funded Trading Account and become a Proprietary Trader. Additionally, it’s important to consider the costs associated with becoming a trader, which typically involve a registration fee.

- The Fidelcrest Challenge aims to assess your trading skills through a two-phase evaluation. The first phase has stricter rules and focuses on immediate trading ability, while the second phase offers more lenient conditions, mainly to evaluate the long-term sustainability of your trading strategy. Profit targets in both phases are based on the chosen account size.

Account Balance and Registration Fee

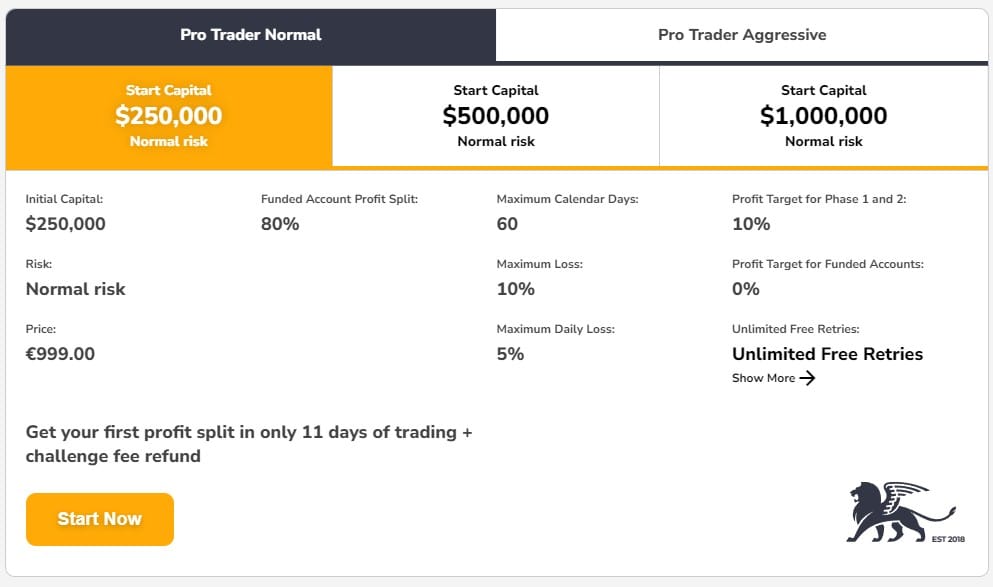

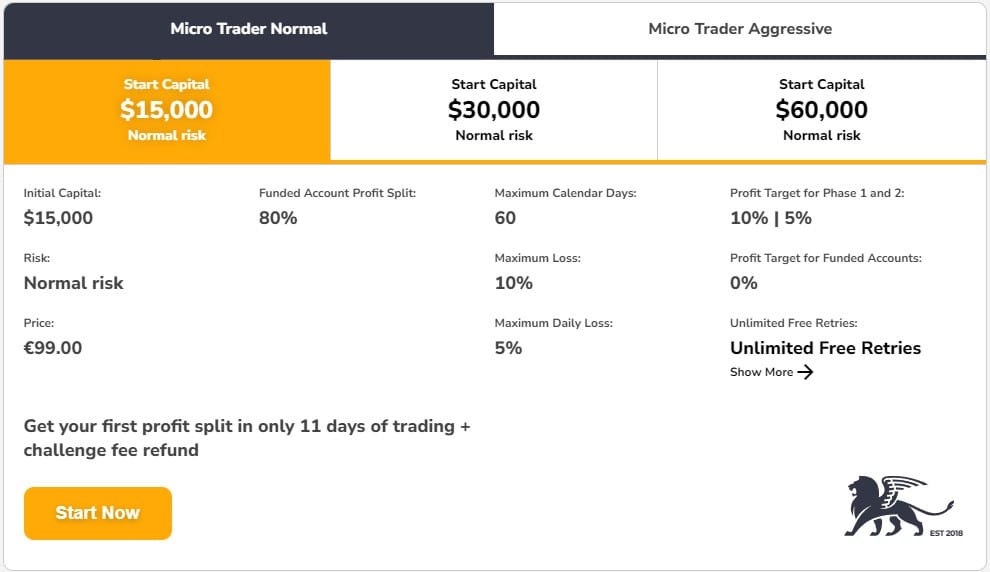

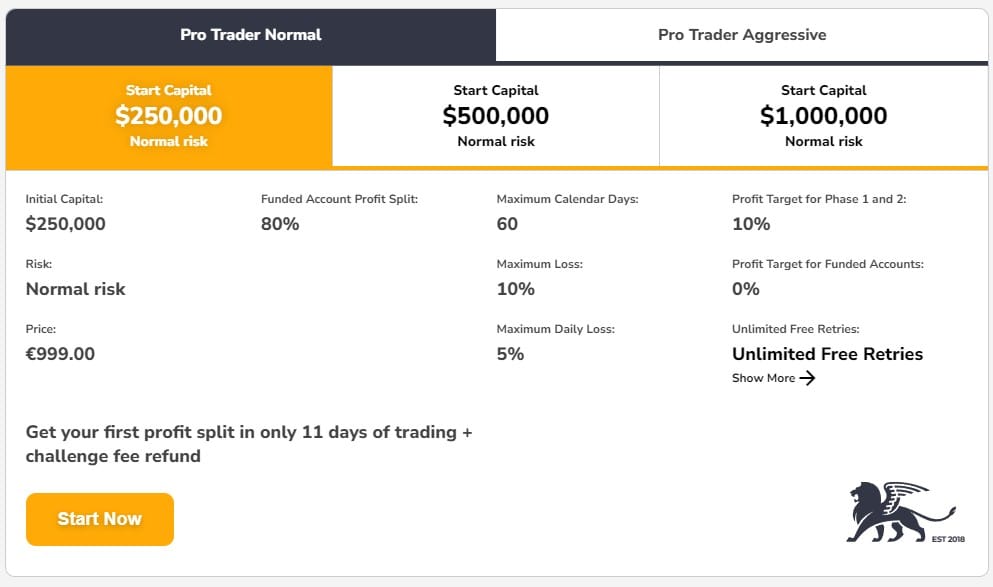

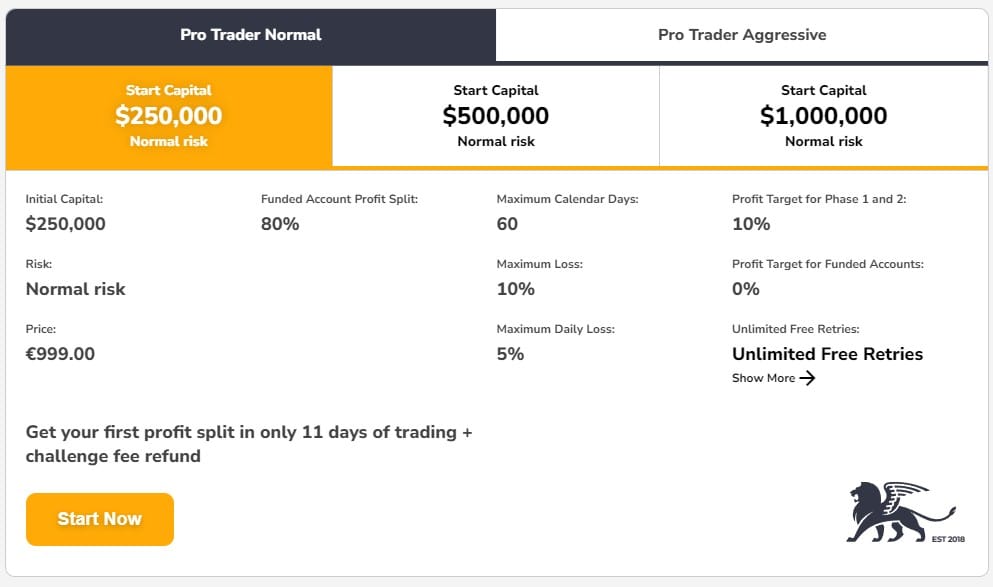

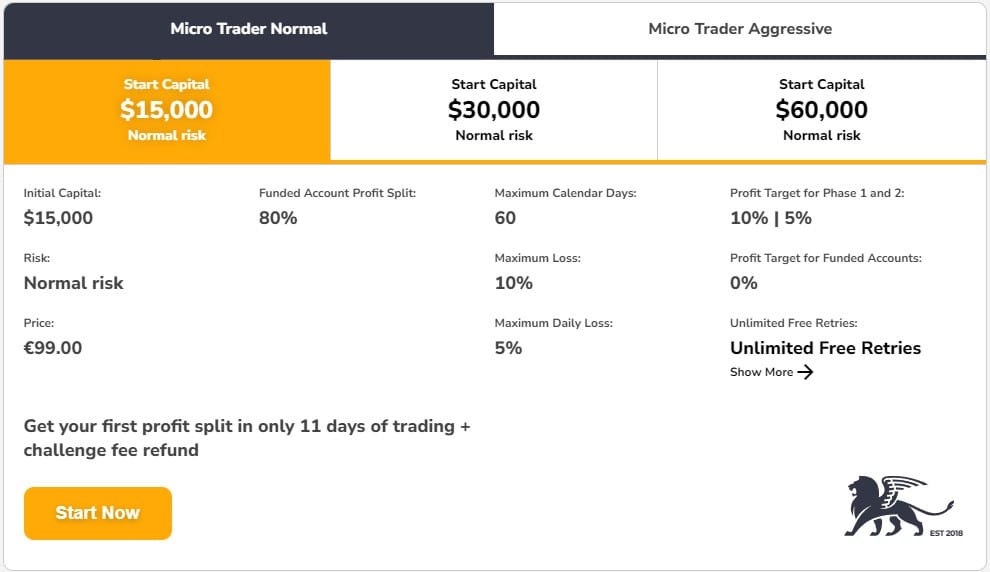

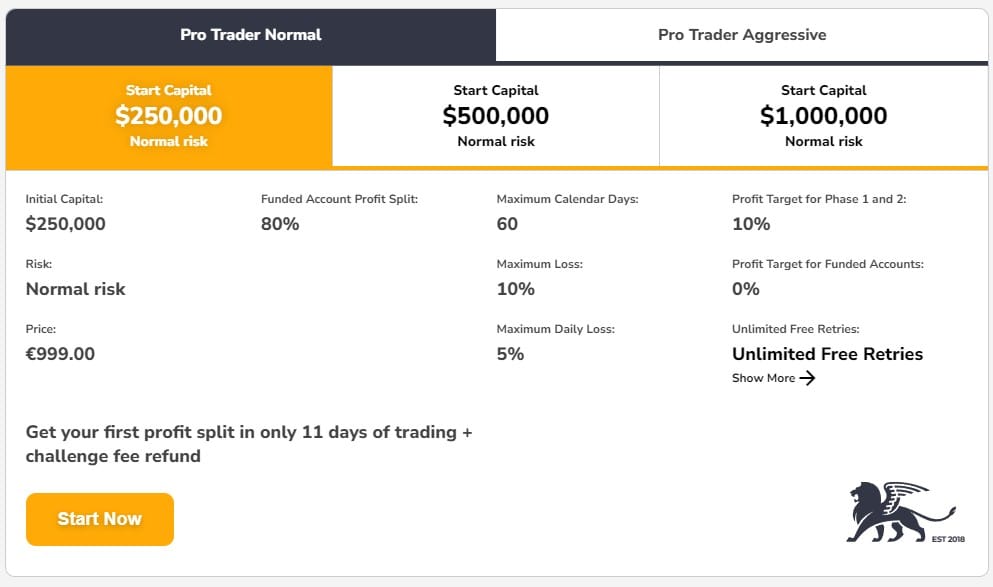

- Fidelcrest offers two primary evaluation programs: Pro Trader and Micro Trader. Each program has two account types – normal and aggressive. These account types differ in terms of conditions like account balance, profit targets, and maximum loss limits.

- Fidelcrest offers a wide array of starting balance options, ranging from $15,000 to $1,000,000. However, the available balance range varies depending on the specific account type chosen.

| Fees | Fidelcrest | FTMO | The Funded Trader |

|---|

| Minimum Account Size | $15,000 | $10,000 | $50,000 |

| Fee | €99 | €155 | $289 |

| Maximum Account Size | $1,000,000 | $200,000 | $400,000 |

| Fee | €999 | €1 080 | $1,869 |

| Reset or Test Retake | Yes | Yes | Yes |

| Is Fee Refundable? | Yes | Yes | Yes |

Profit Target

In Fidelcrest’s evaluation, profit targets vary by account type: 5% for smaller Normal Accounts, 10% for larger accounts, and 20% for aggressive accounts. During the Trading Challenge, these targets must be met within strict loss limits. The subsequent Verification phase tightens these limits further.

Maximum Loss

In Fidelcrest’s trading programs, maximum loss limits vary: 10% for Normal and 20% for Aggressive Accounts in the Trading Challenge, reduced to 5% and 10% respectively in the Verification Phase. Funded Pro Trader Accounts have limits of 10% for Normal and 20% for Aggressive, with corresponding daily loss limits, ensuring strict risk management.

Minimum Trading Period

At Fidelcrest, the minimum trading period varies by program phase. In the initial Fidelcrest Trading Challenge, traders have a 30-day period to meet their profit targets. Following this, in the Verification Phase, the minimum trading period is extended to 60 days. This structure ensures traders have sufficient time to demonstrate their trading skills and risk management strategies under different market conditions.

See detailed table with Fidelcrets Challange conditions based on Account Size:

Fidelcrest Pro Trader Normal

Free Trial

Fidelcrets does not offer a free trial for their programs. Typically, proprietary trading firms require a registration or evaluation fee to participate in their programs, and Funded Trading Plus follows this standard practice.

Fidelcrest Funded Account

After successfully completing the test or challenge, traders receive their Funded Account, which usually takes a few business days to activate. It’s important to remember that the conditions and balance of this account will match those of the test you qualified for. If you wish to upgrade to a higher-grade account, you will need to start over and pass the test for the new, preferred Account Balance you aim to trade with.

Profit Split

Fidelcrest offers a competitive profit split arrangement for its traders, ranging between 80-90% of the profits earned. Traders in the normal-risk program retain 80% of their profits, while those in the aggressive trading challenge can keep up to 90%, rewarding higher risk-taking.

Fidelcrest Micro Trader

The Fidelcrest Micro Trader Program for beginners offers accounts ranging from $10,000 to $50,000. It includes a 30-day Trading Challenge and a 60-day Verification Stage, with profit targets of 5% (Normal) and 15% (Aggressive). Maximum loss limits are set at 10% (Normal) and 20% (Aggressive) in the Challenge, reduced in the Verification Stage. Traders can keep up to 80% of the profits.

Payout and Withdrawals

Fidelcrest efficiently handles trader payouts, ensuring that they are processed and disbursed within a span of 7 business days. This prompt payout system reflects the company’s commitment to providing a smooth and reliable financial transaction experience for its traders.

Withdrawal Method

Fidelcrest offers a versatile range of withdrawal methods, including traditional bank transfers, Visa/MasterCard, and popular e-wallet options like Skrill and Neteller. This diversity in withdrawal options caters to the convenience and preferences of a broad spectrum of traders, ensuring easy and accessible financial transactions.

Account Conditions

In assessing account conditions, we thoroughly review the broker’s account types, available trading platforms, instruments, and costs. It’s also vital to examine leverage levels and trading conditions, as some brokers restrict certain strategies in funded accounts, potentially leading to account loss and the need for requalification. For an in-depth look, see the detailed breakdown below:

Trading Instruments

Fidelcrest offers a wide range of trading instruments including Forex, Stocks, Commodities, Indices, Cryptocurrencies, Energies, Metals, and Bonds. This variety caters to diverse trading strategies and preferences, with traders having the flexibility to choose their preferred broker.

Fidelcrest Commission

Fidelcrest offers very competitive trading conditions, including raw spreads starting from 0 pips and a low commission of $3 per lot. This commission structure is specifically designed for Fidelcrest traders and is part of their trading terminal, which is tailored to their proprietary trading platform.

Leverage

Fidelcrest provides a consistent leverage of up to 1:100 for all trading instruments, whether you’re in the Challenge or as a Funded trader. This leverage allows traders to amplify their positions while managing risks.

Fidelcrest App Platform

Fidelcrest utilizes MetaTrader platforms, including MT5 and MT4, and collaborates with technology providers, which is advantageous. However, it exclusively offers these platforms and does not provide alternatives. If you have a different software preference, you may want to explore alternative proprietary trading companies.

Trading Conditions

Based on our findings, the Fidelcrest broker offers two account conditions eith Swap Accounts suitable for swing trading or swap free accounts available in all challenges available for trader who prefer to avoid overnight charges.

- Fidelcrest allows traders to engage in popular trading styles such as News Trading, Swing Trading, EA Trading, and Weekend Holding. However, it’s important to be aware that certain trading activities like High-Frequency Trading, Latency Trading, and Arbitrage are not permitted on the platform.

- In Fidelcrest or any other trading platform, slippage can occur when there is a gap between the price you requested for a trade and the price at which it is executed due to market conditions changing rapidly.

Fidelcrest Promotions

As observed, the company occasionally runs promotions offering Fidelcrest promo code for discounts. However, it’s important to note that these conditions are typically offered for a limited time, so it’s advisable to confirm their availability when you log in.

Fidelcrest Alternative Brokers

In summary, Fidelcrest is an appealing choice for funded traders due to its competitive costs, various program options with lower fees, and its unique offering of stock prop trading opportunities, which are rare in the industry due to stock market volatility.

Yet, is always good to consider and compare proposal to other Prop Trading Firms, so some of the popular ones may offer similar conditions or might be more suitable for particular traders alike for better choice of instruments and other than MetaTrader platforms. Yet, there are some obvious advantages of Fidelcrest exists too, see our selection of alternatives below also table comparing Fidelcrest to other Companies:

Share this article [addtoany url="https://55brokers.com/fidelcrest-review/" title="Fidelcrest"]

Fidelcrest os now a ghosted propfirm