- What is Errante?

- 55brokers Professional Insights

- Errante Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Errante Compared to Other Brokers

- Full Review of Broker Errante

Overall Rating - 4.3 / 5

| Regulation and Security Measures | 4.3 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.2 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.2 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.2 / 5 |

| Research and education | 4.6 / 5

|

| Portfolio and Investment Opportunities | 4 / 5

|

| Account opening | 4.3 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Errante?

Errante is a Cyprus-based Forex trading company that offers trading services in various financial markets, including Forex, Shares, Metals, Indices, Commodities, Energy, and Cryptos.

Based on our research, the broker is regulated and authorized by the reputable European regulatory body CySEC. Additionally, the firm has a presence in Seychelles and is authorized by the Financial Services Authority (FSA).

Overall, Errante provides a competitive trading environment and a diverse range of financial products through advanced trading platforms. And with our Errante review, you will dive into this broker more deeply.

Errante Pros and Cons

Per our findings, the firm has advantages and disadvantages that are important for traders to consider. For the pros, the broker offers competitive trading solutions, a low minimum deposit requirement, and access to the well-known MetaTrader trading platforms and an advanced cTrader. Moreover, Errante provides comprehensive learning materials and webinars, enabling clients to make informed trading decisions. Another pro is that there is a 24/7 customer support available.

For the cons, the broker lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under CySEC is considered safe enough.

| Advantages | Disadvantages |

|---|

| European license and oversee | No top-tier license |

| Insurance Program - coverage of up to €1,000,000 | |

| MT4, MT5, cTrader trading platforms | |

| Good trading conditions | |

| Trading instruments | |

| Competitive pricing | |

| Professional trading | |

| Education | |

| 24/7 customer support | |

Errante Features

Errante features quality trading proposal suitable for traders from Europe or Internationally too. Here are some salient features of Errante:

Errante Review Summary in 10 Points

| 🏢 Regulation | CySEC, FSA

|

| 🗺️ Account Types | Standard, Premium, VIP, and Tailor Made accounts |

| 🖥 Trading Platforms | MT4, MT5, cTrader |

| 📉 Trading Instruments | Forex, Shares, Metals, Indices, Commodities, Energy, Cryptos |

| 💳 Minimum Deposit | $€50 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD |

| 📚 Trading Education | Provided |

| ☎ Customer Support | 24/7 |

Who is Errante For?

Based on Our findings and Financial Expert Opinions Errante is Good for various traders and especially those from Europe and traders who prefer popular industry software too use. With our opinion Errante is good for:

- European traders

- Traders who prefer the MT4, MT5, cTrader trading platforms

- International traders

- Currency trading

- Beginners

- Advanced traders

- Swap-Free Trading

- STP execution

- Competitive spreads and fees

- EA/Auto trading

- Good trading tools

Errante Summary

In summary, Errante is a reliable Forex trading broker that offers competitive trading conditions, a diverse range of trading products, and low trading fees. The broker provides popular MetaTrader and cTrader trading platforms, which are equipped with advanced features and tools suitable for various levels of traders. Additionally, traders have access to a wide range of educational materials and research resources that support them in expanding their knowledge and staying informed about the market.

Overall, the broker provides a good trading environment, however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55brokers Professional Insights

If you are searching for European or International broker with quality trading environment ECN account on cTrader or MT platforms Errante might be your choice. For traders looking for variation in their portfolios, the broker provides a wide spectrum of accounts suitable for various trading size or preference, also provide great trading academy with quality materials we enjoyed a lot. Yet, the asset classes mainly consistent of most traded and highest trading volume instruments, but covering various asset groups.

For traders who want individualized support, Errante is especially helpful; the broker provides 24-5 customer care and committed account managers. However, for people who need sophisticated trading tools or a lot of educational materials, it could be less appealing since some elements could be extra expenses. For both new and seasoned traders seeking a consistent trading environment, Errante is generally a good option.

Consider Trading with Errante If:

| Errante is a Good Broker for: | – Looking for Well-regulated Firm – Need Low minimum deposit – Look for most traded Assets – High Leverage access – Friendly trading platforms based on MetaTrader or cTrader – Good Range of Tools in platforms – Great Copy Trading range – Need Broker with Trading Academy Education – Quality Trading Conditions |

Avoid Trading with Errante If:

| Errante is not the best for: | – Investment Options are limited – No wide selection of Trading Products – Prefer other than MetaTrader or cTrader Platforms – Traders from certain regions like USA – Require deposits from 0$ – Look for numerous additional tools |

Regulation and Security Measures

Score 4.3/5

Errante Regulatory Overview

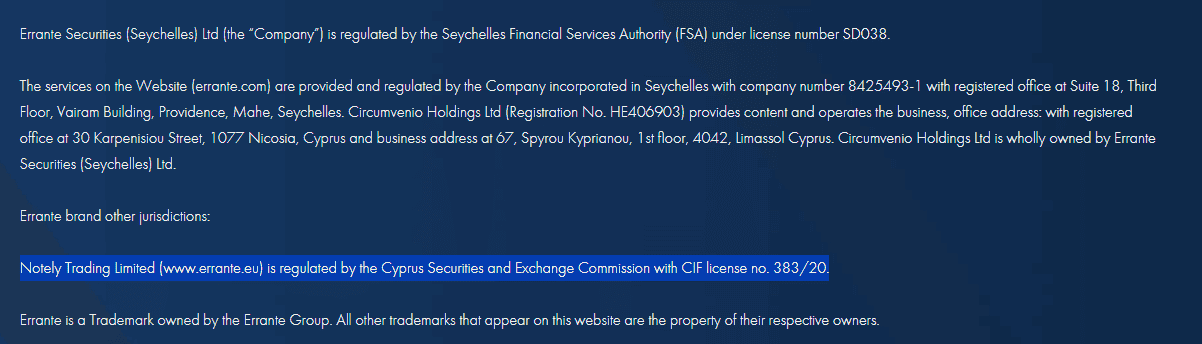

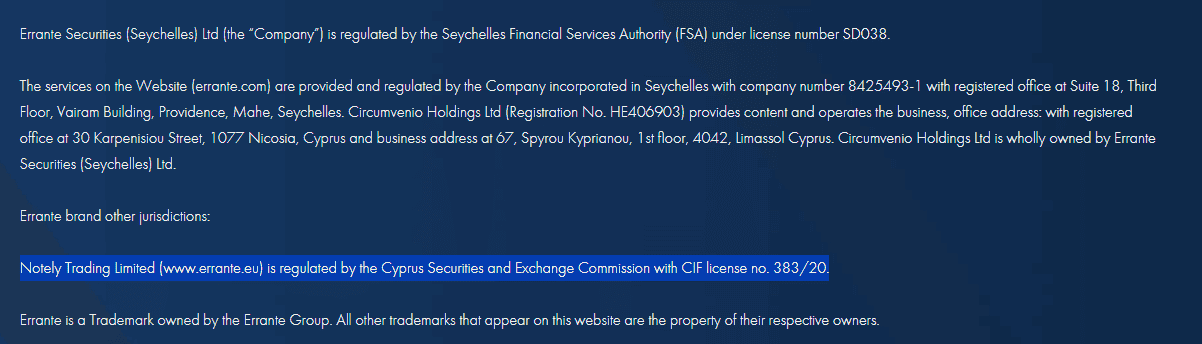

Errante is a legitimate and regulated broker that follows the necessary regulations for offering Forex trading services. The broker’s commitment to compliance with industry standards is evident through its regulation under a respected European trading authority. It is authorized by the well-regarded Cyprus Securities and Exchange Commission (CySEC). The regulatory authority imposes strict rules and regulations to ensure high standards in the financial industry.

However, the broker also holds an offshore license. Therefore, before engaging in trading activities you should carefully consider and understand the differences while trading in different jurisdictions.

How Safe is Trading with Errante?

According to our findings, Errante implements various measures to protect its trading accounts. These typically include regulatory oversight, and ensuring compliance with applicable rules and regulations. The firm also maintains fund protection mechanisms to keep client funds separate from the broker’s operational funds.

To enhance client protection, Errante has implemented an additional layer of security, further safeguarding clients’ funds. Errante’s Insurance Program insulates its liabilities against clients, offering coverage of up to €1,000,000 through reputable insurance brokers in the market, which is definitely additional plus to the offering

However, conduct thorough research and carefully examine the broker’s documentation, legal agreements, and policies. This will provide a comprehensive understanding of the specific trading protections offered by the broker, as trading conditions can vary across jurisdictions.

Consistency and Clarity

Errante Broker is a regulated online trading platform emphasizing financial stability and transparency. Operating since 2019 the Broker constantly provides regulated and reliable services, also there were no breaches or company issues with regulators, which proves good status. Since twin regulatory system of Errante follows rigorous compliance criteria, it offers dealers some degree of protection.

Errante keeps client money in separate accounts at respectable banks to guard against operational risk. Additionally providing an Investor Compensation Fund, the broker further protects client investments up to €20,000 for European clients, which is considered a safer option for investors or traders. Also, the real traders reviewes are mostly positive, marking quality execution and software overall.

Account Types and Benefits

Score 4.4/5

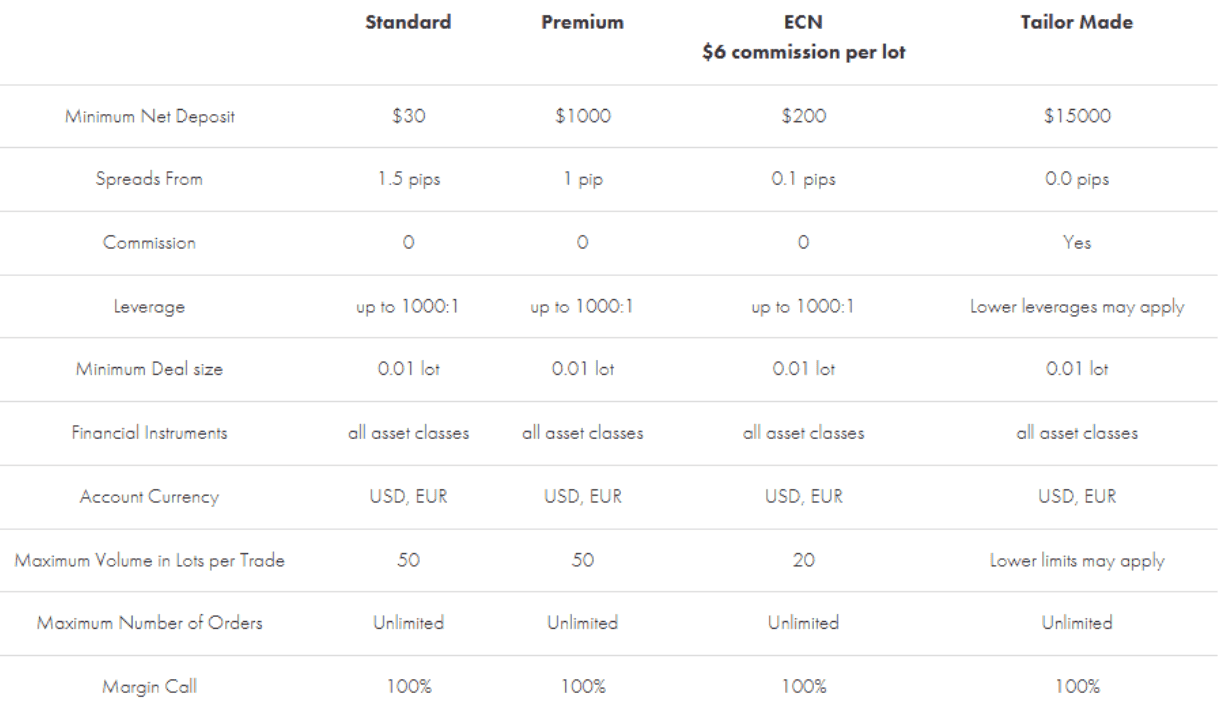

Which Account Types Are Available with Errante?

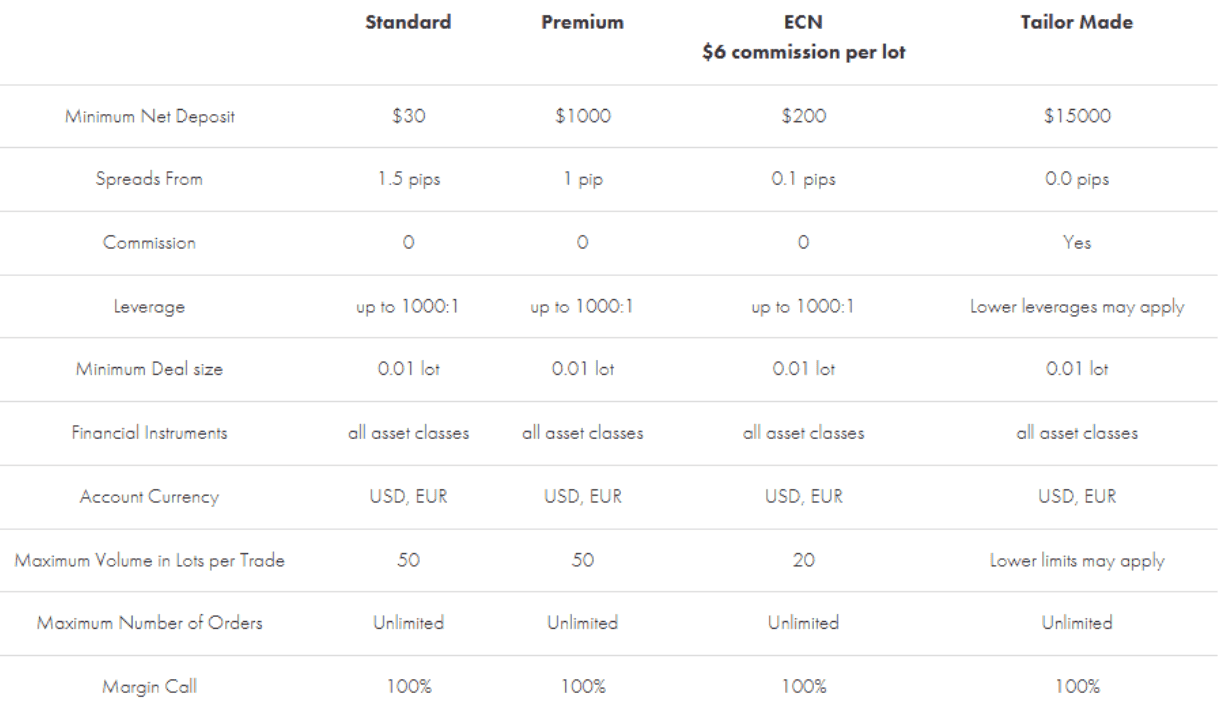

Per our research, the broker offers various account types for all levels of traders: Standard, Premium, ECN, and Tailor Made accounts that might suit the needs of different traders. Additionally, Errante provides Cent Account and Swap-Free accounts for religious purposes. Furthermore, the broker facilitates access to MAM/PAMM and Copy Trading accounts.

- Perfect for beginners, the Standard Account calls for a minimum deposit of $50 and has spreads beginning from 1.5 pips.

- With minimum deposits of $1,000 and $5,000, the Premium and ECN accounts target more seasoned traders and offer tighter spreads. While ECN account is based on commission charges rather than spread fees.

- The Tailor Made account is designed for high-net-worth people and offers customization depending on particular trading techniques.

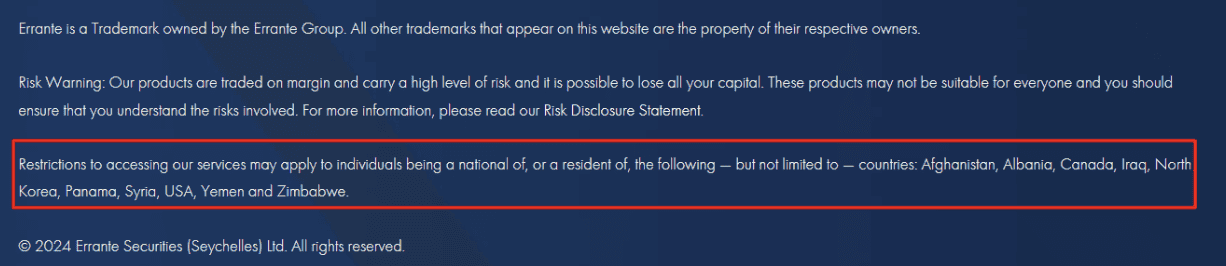

Regions Where Errante is Restricted

Due to regulatory restrictions Errante does not offer its services and products to residents of certain jurisdictions, also conditions are based by the enity rules you trader through. For this reason we advise to verify codnitions before getting started. Traders from some regions can not joing Trading with Errante, such as:

- Afghanistan

- Albania

- Canada

- Iraq

- North Korea

- Panama

- Syria

- USA

- Yemen

- Zimbabwe

Cost Structure and Fees

Score 4.2/5

After examining the broker’s fee offering, we found that fees vary based on the account types, trading services, and the financial instruments involved. Generally, brokerage fees may include spreads, commissions, and rollover charges. Also, additional fees may be incurred during trading activities.

- Errante Fees are ranked low or average with an overall rating of 4.2 out of 5based on our testing and compared to over 500 other brokers.

Errante Brokerage Fees

Whereas the Premium Account offers spreads from 1 pip, the Standard Account usually starts with 1.5 pips which is accessible to most traders. The ECN Account gives high-volume traders option to trade with commission charge instead of spreads. Lastly, the Tailor Made Account allows spreads as low as 0 pip, fees are mainly based on trading volume and alocation affect the commission to this account pays.

For most account types, Errante does not charge trading commissions, so active traders find it economical. However, the ECN account is designed specificcally for traders who prefer commission basis rather than spreads, and commission is 6$ per lot traded, considered low withing the industry, The Tailor Made Account has also a commission per lot traded, which fluctuates based on trading volume and the trader’s country of residency.

For overnight-held positions, Errante pays rollover fees—also referred to as swap rates. The interest rate differences among the currencies engaged in a trade help to decide these fees. Errante does, however, provide swap-free (Islamic) accounts upon demand for traders who so want, which do not suffer any rollover costs. Those following Islamic financial guidelines will especially benefit from this function.

Errante Additional Fees

Errante imposes several non-trading fees that traders should be aware of to manage their costs effectively.

- Errante charges a 1% fee for withdrawals made with e-wallets, including Skrill and Neteller. For traders, however, withdrawals via credit or debit cards and bank transfers are more affordable since these methods incur no costs.

- Errante charges a $10 inactivity fee per month if an account stays dormant for longer than six months. This cost reminds traders to have consistent trading activity to prevent unneeded expenses.

- Errante lets traders fund tradingaccounts free from expenses since it charges no deposit fees. This approach reduces upfront costs, therefore improving the whole trading experience.

- Although Errante does not charge particular currency conversion fees, any amount received in a currency other than the base currency (USD or EUR) may be automatically converted; therefore, depending on the conversion rates used, expenses could result.

How Competitive Are Errante Fees?

Errante Spreads are ranked low/average based on our testing comparison to other brokers. We found Forex spread is slightly higher than the industry average of 1.2 pips common inindustry for Standaard acocunt, while premium account spreads are more competitive. Also, the most favorable fees are on ECN account with commmisison base, as we mark lower than some competitors.

Overall, fees are considered good while commission charges, all additional fees and the spreads for other instruments and products are competitive too.

| Asset/ Pair | Errante Spread | OCBC Securities Spread | FxOro Spread |

|---|

| EUR USD Spread | 1.5 pips | 0.9 pips | 1.2 pips |

| Crude Oil WTI Spread | 1 | 3 | 2 |

| Gold Spread | 1 | 1 | 28 |

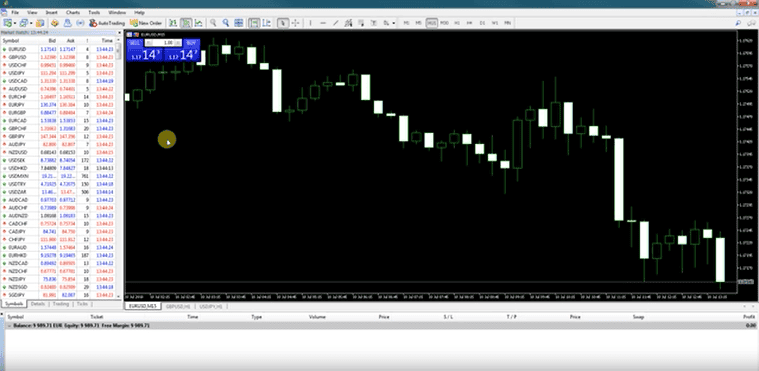

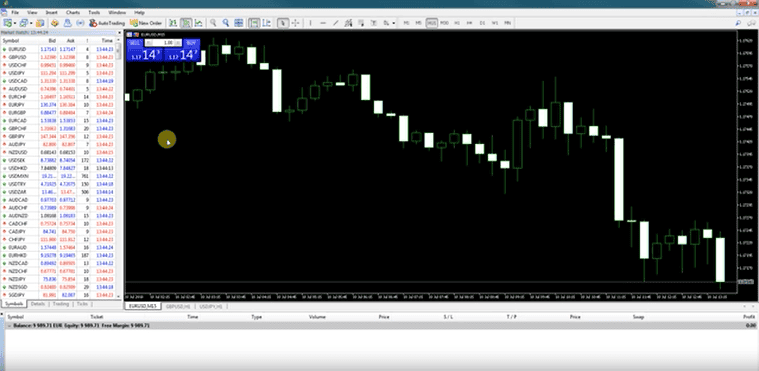

Score 4.5/5

At Errante, you can trade through the advanced MT4, MT5, and cTrader trading platforms. The platforms are known for their strong features, intuitive interface, advanced charting tools, and extensive trading capabilities.

Additionally, they are accessible on desktop, web, and mobile devices, allowing traders to select the option that suits their individual trading preferences and strategies.

Errante Web Platform

Errante presents traders with a complete and easy-to-use web trading platform. Accessible from any online browser, the platform removes the requirement for software installation, therefore saving customers who would rather have flexibility in their trading environment convenience.

The main findings from the test show that the platform’s simple interface lets one easily navigate Forex, commodities, indices, and cryptocurrencies, among other trading instruments. Traders can use sophisticated charting tools to improve their market analysis, including several technical indicators and analytical items.

With no requotes, the platform ensures that trades are carried out at the best possible rates, supporting market performance. Errante’s web platform also fits mobile devices, allowing traders to handle their accounts and run transactions on Android and iOS on-demand.

Although the platform is strong, some customers could find it less beginner-friendly than proprietary systems provided by rival brokers. Errante’s web trading system is appropriate for both new and experienced traders since it offers functionality and accessibility.

Errante Desktop MetaTrader 4 Platform

Errante is fit for both new and experienced traders since it provides the generally utilized MetaTrader 4 (MT4) platform with strong features and adaptability. With 30 technical indicators and 24 analytical objects, the platform includes comprehensive charting capabilities, enabling users to examine market patterns effectively. Using infinite charts and 9 time periods to fit their techniques, traders can personalize their trading environment.

The MT4 platform showed effective order execution with one-click trading during testing; this is crucial for aggressive traders hoping to profit fast from market swings. Using Expert Advisors (EAs), the platform also offers automated trading, enabling users to apply algorithmic techniques easily.

Though MT4 is feature-rich, some users pointed out that it might not be as user-friendly for novices than other broker-provided proprietary systems. Errante’s MT4 platform offers traders looking for a dependable desktop trading solution a complete trading experience and strong analytical tools; thus, it is a good option.

Errante Desktop MetaTrader 5 Platform

Errante offers access to the MetaTrader 5 (MT5) platform, noted for its sophisticated trading features and easy-to-use interface. The platform fits many trading techniques since it offers Forex, commodities, indices, and cryptocurrencies, among other trading tools.

Testing the MT5 platform reveals that it provides 21 time frames and 44 analytical objects, enabling traders to do thorough technical analysis. The improved charting tools and several technical indicators on the platform help customers to customize their trading environment to their particular requirements. Additionally included in MT5 are built-in Economic Calendar and Depth of Market visibility, which give traders useful data to guide decisions.

Although the MT5 platform has many features, some users—especially beginners—may find it less straightforward than simpler systems. Errante provides assistance to users in efficiently navigating the platform through personal account managers.

Errante MobileTrader App

With a mobile trading apps supporting both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), Errante lets traders handle their accounts on-demand. Full functionality of the mobile software helps users monitor market movements, run trades, and instantly examine charts from their tablets or smartphones.

Testing the Errante mobile app reveals significant insights showing a user-friendly interface crucial for effective trading and fast navigation. Forex, commodities, and cryptocurrencies are among the several trading tools users can access to guarantee quick reaction to changes in the market.

Testing revealed certain restrictions, though; several sophisticated capabilities on the desktop version could not be seen on mobile. For instance, compared to the desktop platform, several charting tools and the depth of market perspective are less thorough. Notwithstanding these restrictions, the software lets traders quickly close and change orders and properly measure profit and loss. Errante’s mobile app on Android or iOS is a useful tool overall for traders looking for adaptability in handling their funds.

Trading Instruments

Score 4.2/5

What Can You Trade on Errante’s Platform?

Errante provides access to popular trading instruments, such as Forex, CFDs, Shares, Metals, Indices, Commodities, Energy, and Cryptos. This variety of trading products empowers traders and investors to create well-rounded portfolios that align with their financial objectives and risk preferences.

Forex Trading

Errante trades approximately 50 currency pairs, including exotics, majors, and minors. This wide range lets traders diversify their portfolios and seize possibilities in the very liquid forex market. From high-volatility transactions to more steady investments, traders can use a range of techniques to suit varying risk tolerance and trading approaches.

Share CFDs

Errante lets traders predict on the price swings of shares from top multinational corporations. This covers well-known names such as Apple, Amazon, Microsoft, and Google. Share CFDs let traders possibly profit from both growing and declining prices by exposing to the equity markets without having to hold the underlying shares.

Commodity and Metal Trading

Errante lets traders access a selection of metals and goods. This covers natural gas and crude oil as energy commodities as well as precious metals such gold and silver. Given their reputation as safe havens, commodities and metal trading might especially appeal during times of economic uncertainty or volatility in other markets.

Cryptocurrency Trading

Under its FSA-regulated section, Errante provides crypto trading. This lets dealers engage in the active and quick-paced crypto market, which has witnessed notable expansion lately. The broker gives access to Bitcoin, Ethereum, and Litecoin among other well-known cryptocurrencies.

Main Insights from Exploring Errante’s Tradable Assets

Errante’s asset availability is consistant of popular asset groups and covers most traded instruemtns, yet still far more constrained than that of several bigger brokers, but it still does rather well industry-wise. Forex pairs align with the usual 50+ that most brokers provide, and the commodities and metal offers follow the norm of 5–10 items. Though the index selection is below average, with only 9 compared to 20+ at rivals, the share CFD choice is on the lower end, with 61 compared to hundreds at certain companies.

Errante could broaden its share CFD offering to match the hundreds given by top brokers and raise its index coverage to 20+ to fit industry leaders and improve its asset choices. Access to ETFs, options, and futures could also enable Errante to remain competitive with some of its rivals. However, for now if you look for broader selection of trading products rather than most traded assest then you might opt for other Broker instead.

Leverage Options at Errante

Leverage is a valuable tool that allows traders to enter the market with limited capital. However, you should understand that it can result in substantial gains or losses. Therefore, traders must have a comprehensive understanding of how leverage operates and its potential consequences before engaging in any trading activities involving leverage.

Errante leverage is offered according to CySEC and FSA regulations:

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International traders may use higher leverage up to 1:1000, so understanding the implications and risks associated with leverage is crucial before making decisions about its use in trading.

Deposit and Withdrawal Options

Score 4.4/5

Deposit Options at Errante

Per our research, the broker provides multiple funding methods to accommodate diverse preferences including bank wire transfers, credit/debit card transactions, and e-wallets like Skrill, Neteller, etc. However, some payment options may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved.

Minimum Deposit

We found that the broker’s minimum deposit requirements can differ depending on the type of account. To open a live trading account with the broker, clients need to deposit $€50 as an initial deposit amount for the Standard account type.

Withdrawal Options at Errante

Errante offers a selection of withdrawing options meant to suit different tastes. Bank transfers, credit or debit cards, and e-wallets like Skrill and Neteller enable clients take money out. Additional choices for traders outside the EU are local e-wallets like SticPay and Perfect Money as well as cryptocurrency.

The method used determines the minimum withdrawal limits. Credit and debit cards or e-wallets cost €20 or $20; for bank transfers, the minimum is €100 or $100. With a minimum of $50 for XRP and USDT-TRC20 and $100 for USDT-ERC20, BTC, and ETH, cryptocurrency withdrawals also have particular criteria.

How long does it take to withdraw money from Errante?

Monday through Friday, from 9:00 to 18:00 (GMT+2), withdrawal requests are handled business-hourly. Usually credited to credit cards, e-wallets, and crypto-wallets within one working day, bank transfers may take two to four days. A 5% fee may be charged, nonetheless, should a client want a withdrawal of more than 80% of their invested sum within 48 hours without any notable trading activity.

Based on our analysis, the withdrawal process may take about 2 to 4 working days to get your withdrawal request. However, it may differ depending on your local bank.

Withdraw Money from Errante Step by Step:

To initiate a withdrawal fund from your trading account, the brokerage firm provides a set of typical steps that can be followed:

- Login to your account

- Select Withdraw Funds’ in the menu tab

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the electronic request with the requirements

- Confirm withdrawal information and Submit

- Check the current status of withdrawal through your Dashboard

Customer Support and Responsiveness

Score 4.5/5

Testing Errante’s Customer Support

The broker offers 24/7 customer support via, email, and phone lines. Only support through the live chat is 24/5. Additionally, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

Customer Support in Errante is solid based on our testing. The support team is responsive during working days, ensuring efficient assistance.

Contacts Errante

Errante ensures clients’ direct access to support by offering several contact channels. By email at support@errante.com or info@errante.eu, traders can enable thorough inquiries and help. The live chat tool on the website provides a handy approach to contacting customer support agents for current issues.

Errante’s support staff can also be reached directly for urgent matters by phone at +44 203 519 4600 or +357 25 2533. Operating 24/5, the customer service ensures traders receive prompt help in line with worldwide trading hours.

Errante also advises customers to open tickets using their user accounts, ensuring that all pertinent data is shared efficiently and tracking the development of questions. Errante’s dedication to responsive customer service improves the trading experience generally and helps consumers to overcome any obstacles.

Research and education

Score 4.6/5

Research Tools Errante

We found that the platforms provide a variety of advanced charting tools, analytical technologies, trading signals, technical indicators, and other tools which is an advantage to any trader. Additionally, MetaTrader platforms offer automated trading capabilities, empowering traders to detect market movements and improve their market entry and stop-loss strategies.

Errante provides a range of research tools to help traders analyze markets and make informed trading decisions. These tools include:

Economic Calendar

Errante’s economic calendar informs traders of forthcoming market events, economic releases, and central bank actions that can affect the financial markets. Events can be filtered by country, impact degree, and asset class.

Market News and Analysis

Errante publishes frequent market news and analyses key events and trends spanning many multi-asset classes. The internal staff of analysts and market strategists of the broker writes these reports.

Trading Calculators

Errante offers several trading calculators to help traders manage their positions:

- Profit/Loss Calculator: Estimates potential profits or losses based on trade size, entry price, and target price.

- Margin Calculator: Determines the margin required for a trade based on account leverage and trade size.

- Pip Value Calculator: Calculates the monetary value of a pip for a given trade size and currency pair.

These tools aim to support traders in developing their skills and staying informed about market conditions. However, the depth of research and educational materials is less extensive than some other brokers.

Education

Errante provides instructional materials to equip traders with the information and tools required for profitable trading available via Errante Academy for Traders that is running on separate site and availble for client login and signup. Beginning and advanced training videos covering a range of subjects, including trading strategies, technical and fundamental analysis, and an introduction to Forex trading, abound among the teaching resources. Although the materials are of great quality, advanced videos need a minimum deposit of $300 to access.

Educational Resources

While limited compared to some competitors, Errante provides educational resources including:

- Beginner and advanced trading videos covering topics like technical analysis and risk management

- Webinars on trading basics, strategies, and market analysis

- Glossary of trading terms

Apart from video material, Errante organizes multilingual trading webinars covering fundamental trading principles. All website users can access these webinars; nevertheless, registration is required. Archived past sessions provide on-demand access, enabling traders to learn whenever it is most convenient.

Another part of Errante’s instructional products is market analysis, in which clients get daily market comments created by an in-house team of experts. Other instruments help traders make wise decisions: margin calculators and economic calendars.

Although Errante offers excellent instructional tools, the range of these materials is somewhat small compared to other brokers, reflecting the company’s recent business founding.

Is Errante a good broker for beginners?

For trading beginners wishing to enter the realm of online trading, Errante can be a good broker. The modest minimum deposit needed for the Standard Account—just $50—allows inexperienced traders one of the main benefits. Beginning traders can start with less money because of this low barrier to entrance, lowering the financial risk as they learn and grow in their trade.

- The range of account kinds provided also makes Errante appealing to novices. From the entry-level Standard Account to the more complex Premium and VIP accounts, the broker serves traders with many degrees of experience. Beginning with an account that fits their needs and then progressively advancing as they gain experience, this adaptability helps newcomers.

- Errante also offers instructional materials like videos, seminars, and pieces on fundamental trading subjects, including techniques, market analysis, and ideas. Beginning users can find great value in these materials as they help them to grasp the markets and acquire the fundamentals.

- However, it’s crucial for beginners to weigh possible negatives such as the greater spreads on the Standard Account could affect profitability, especially for beginning traders. Before deciding, beginners should consider their needs closely and compare Errante to other brokers.

Portfolio and Investment Opportunities

Score 4/5

Investment Options Errante

Errante does not offer a variety of investment opportunities for traders looking to grow their capital, since company focuses on trading providing itself, thus differ from classic Investment Firms. Yet, the broker provides access to a wide range of financial instruments and offer some Investment Options like MAM and PAMM accounts, Copy Trading Solutions etc.

Copy Trading

The copy trading system developed by Errante lets traders automatically replicate the moves of successful traders. Beginning traders trying to learn from more seasoned market players may find this function especially helpful. To control their exposure, traders can specify stop-loss levels and own risk tolerance.

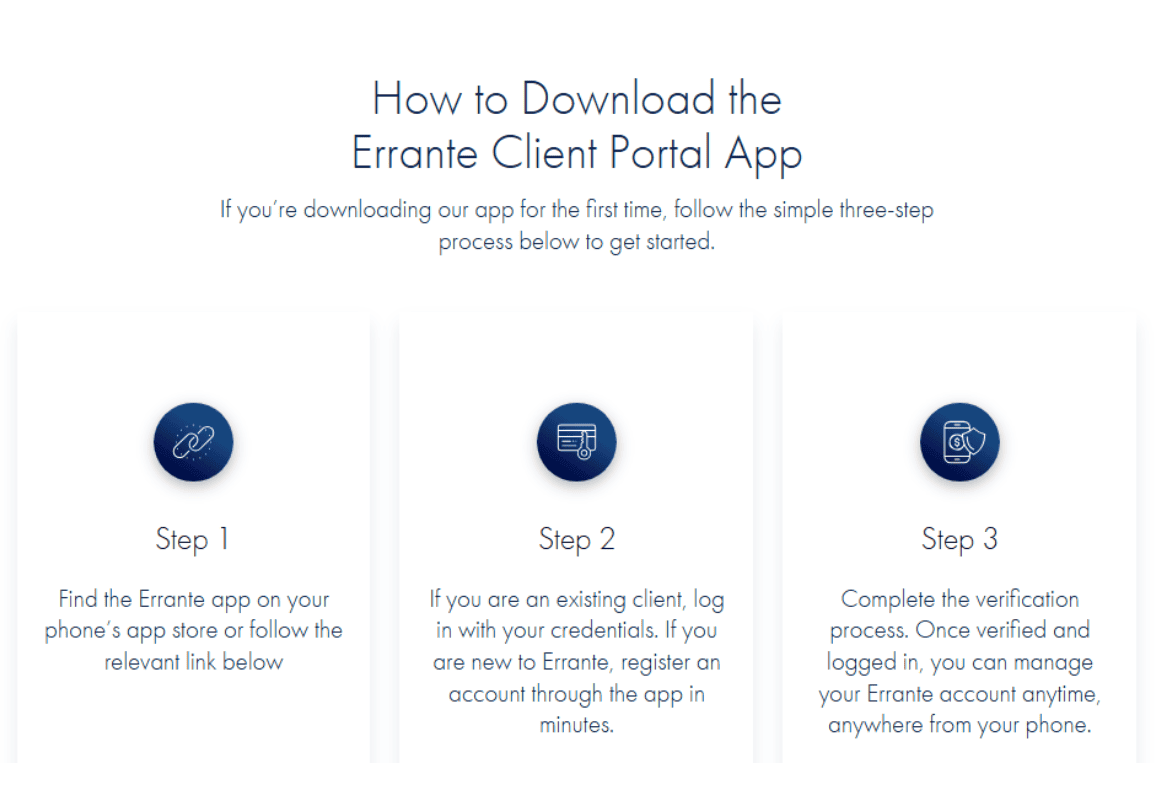

Account opening

Score 4.3/5

How to open Errante Demo Account?

To open a demo account with Errante, follow these straightforward steps:

- Visit the Errante Website: Navigate to the official Errante website and locate the account registration section.

- Click on ‘Open Demo Account’: Find the option to create a demo account, usually prominently displayed on the homepage or within the account section.

- Fill Out the Registration Form: Complete the required registration form by providing your personal details, including your name, email address, phone number, and country of residence. Create a secure password for your account.

- Email Verification: After submitting the form, check your email for a confirmation message from Errante. You may need to enter a PIN code provided in this email to verify your account.

- Access Your Demo Account: Log in to your user account using your credentials once your email is verified. You will then have access to the demo account to practice trading without any financial risk.

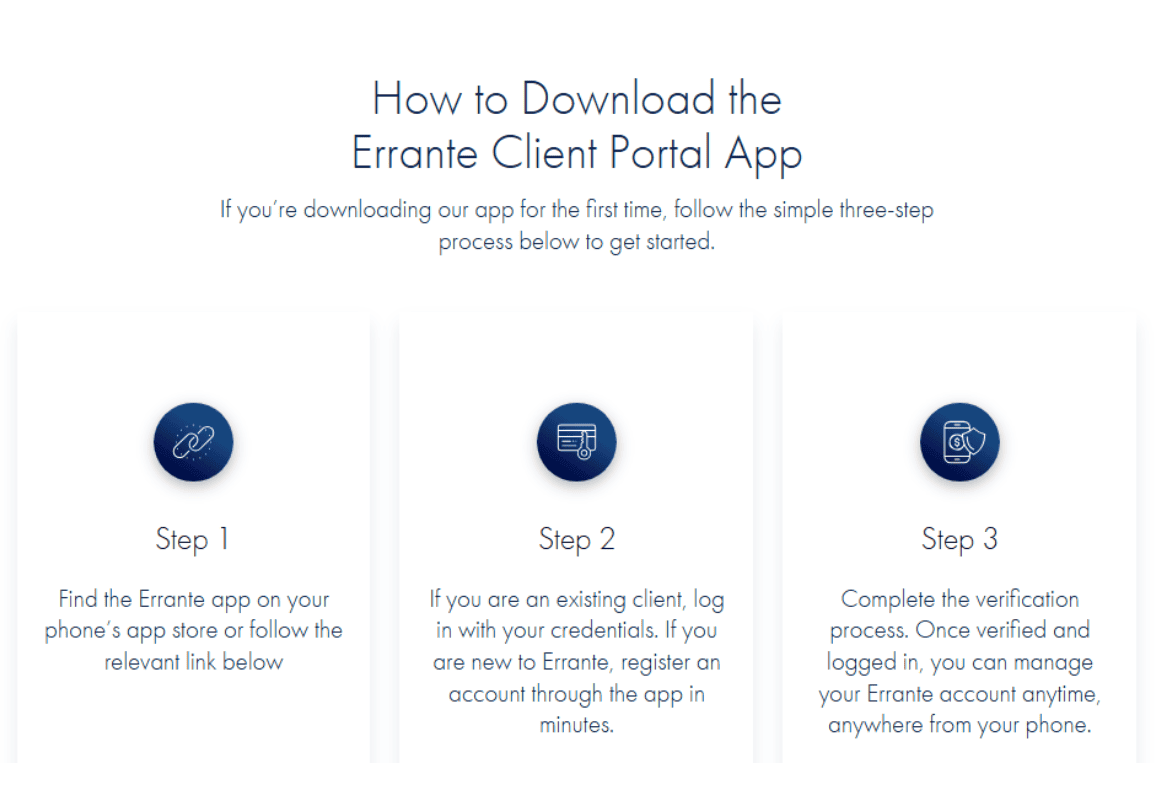

How to open Errante Live account?

Opening an account with a broker is quite an easy process, to follow with Errante Client Portal App Opening you can log in and register with Errante within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Register” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Score 4.3/5

Errante is a flexible broker with a range of tools to improve the trading experience. Majority of tools and avaialble features are provided on the platforms Broker supports, and there are some extra tools that are ncluded in the offering of platforms that includes following:

- Tailored tools and automated trading capabilitiesgiveaccess to sophisticated tools at provided platforms MetaTrader 4, MetaTrader 5, and cTrader. Especially MT5 provides great tools

- Errante also features a CopyTrade tool, which lets users replicate successful traders—perfect for novators.

- Errante addresses traders of all levels by combining strong tools and learning opportunities for improved trading performance using trading calculators for risk management and excellent quality educational resources like webinars and courses va its tools and academy section.

Errante Compared to Other Brokers

Errante considered competitive Broker with good platform selection similar to competitors, and low fees especially on Commission ECN account, Brokers like Exness and FP markets commission is slightly higher, yet their spread account are more competitive. The reputation and overall proposal is also competitive at Errante so is comparable with Fortrade, Pepperstone and EightCap.

Yet, the only gap might be instruments selection is you look for thousands of tradable products Brokers like FP Markets are more considerable then.

| Parameter |

Errante |

Fortrade |

Pepperstone |

Exness |

FP Markets |

Admiral Markets |

Eightcap |

| Spread Based Account |

Average 1.5 pip |

Average 2 pips |

From 1 pip |

From 0.2 pips |

From 1 pip |

From 0.6 pips |

Average 1 pip |

| Commission Based Account |

0.0 pips + $3 |

No commission |

0.0 pips + $3.5 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + from $1.8 to $3.0 |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Low/Average |

Low |

Low/ Average |

Low/ Average |

Average |

| Trading Platforms |

MT4, MT5, cTrader |

Fortrader Platform, MT4 |

MT4, MT5, cTrader, TradingView |

MT4, MT5 |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, Admiral Markets app |

MT4, MT5, TradingView |

| Asset Variety |

120+ instruments |

300+ instruments |

Over 1,200 instruments instruments |

200+ instruments |

10,000+ instruments |

8000+ instruments |

800+ instruments |

| Regulation |

CySEC, FSA |

FCA, ASIC, IIROC, NBRB CySEC, FSC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FCA, FSCA, SFSA, CBCS, FSC BVI, FSC Mauritius |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, FSCA, JSC, CMA, EFSA |

ASIC, SCB, CySEC, FCA |

| Customer Support |

24/7 support |

24/5 support |

24/7 |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

| Educational Resources |

Excellent |

Excellent |

Excellent education and research |

Fair |

Excellent |

Excellent |

Good |

| Minimum Deposit |

$10 |

$100 |

$0 |

$10 |

$100 |

$1 |

$100 |

Full Errante Broker Review

Errante is a multi-regulated online broker fit for both new and experienced traders since it provides a wide spectrum of trading tools and systems. Under control of the Seychelles Financial Services Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC), Errante prioritizes security while serving a worldwide customer base.

The broker offers access to over 100 trading instruments, including key indices, commodities including crude oil and gold, CFDs on well-known companies like Apple and Amazon, more than 50 Forex pairs, and 14 crypto pairs. Known for their sophisticated analytical tools and automated trading capabilities, Errante offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

For novices, the CopyTrade capability—which lets users copy the deals of experienced traders—is quite remarkable. Errante also provides traders with tools for improving their competency, including market analysis and webinars, it’s really crucial details that improve your trading.

Errante offers competitive trading conditions with account kinds needing a minimum deposit of just $50 and leverage choices up to 1:500. Errante is a good option for people wishing to explore several financial marketplaces and gain from strong support and tools.

Share this article [addtoany url="https://55brokers.com/errante-review/" title="Errante"]

Errante is a huge scam. When you try to deposit money into your account, they direct you to make the payment via crypto. After you send the money, they claim that you sent it to the wrong address and that the money never reached them, putting you in a difficult position. Even though the payment address is clearly stated on their website, they still deny receiving the funds.

I have all the email correspondence and proof of the transaction, including screenshots. If anyone wants to review them, I can send them.

If you don’t want to get scammed, stay away from ERRANTE!

They are scammer. I would like to add here all scans. They just scam my money and they say we havent got your money. I have evidance they have nothing