- What is EC Markets?

- EC Markets Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

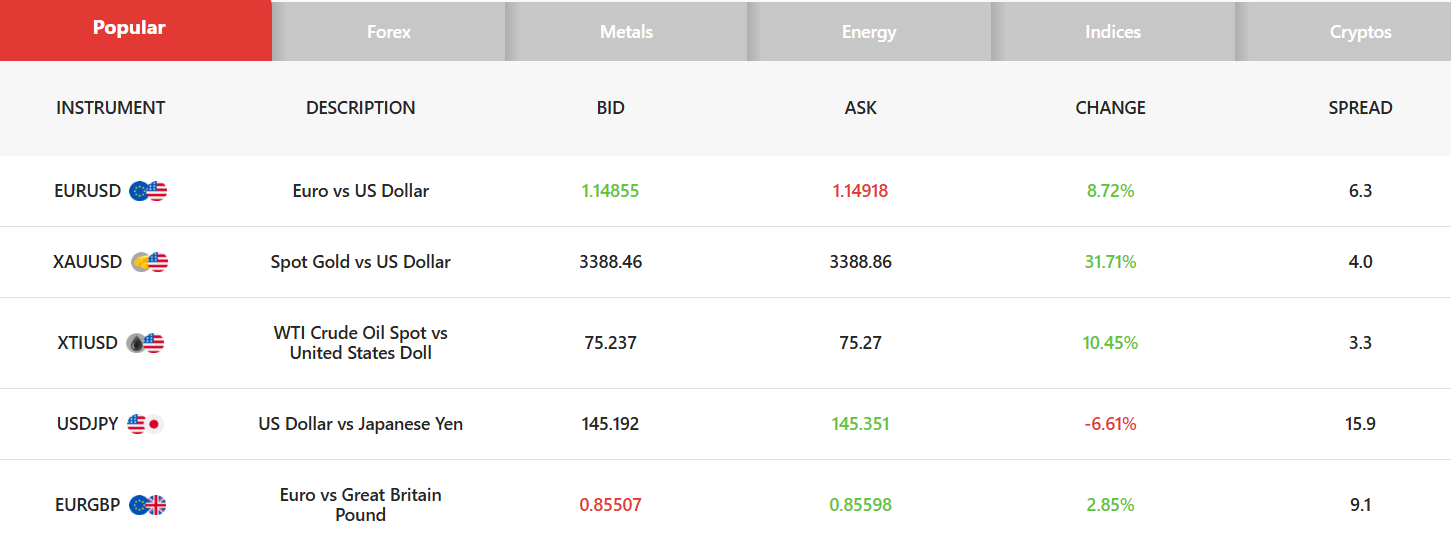

- Trading Instruments

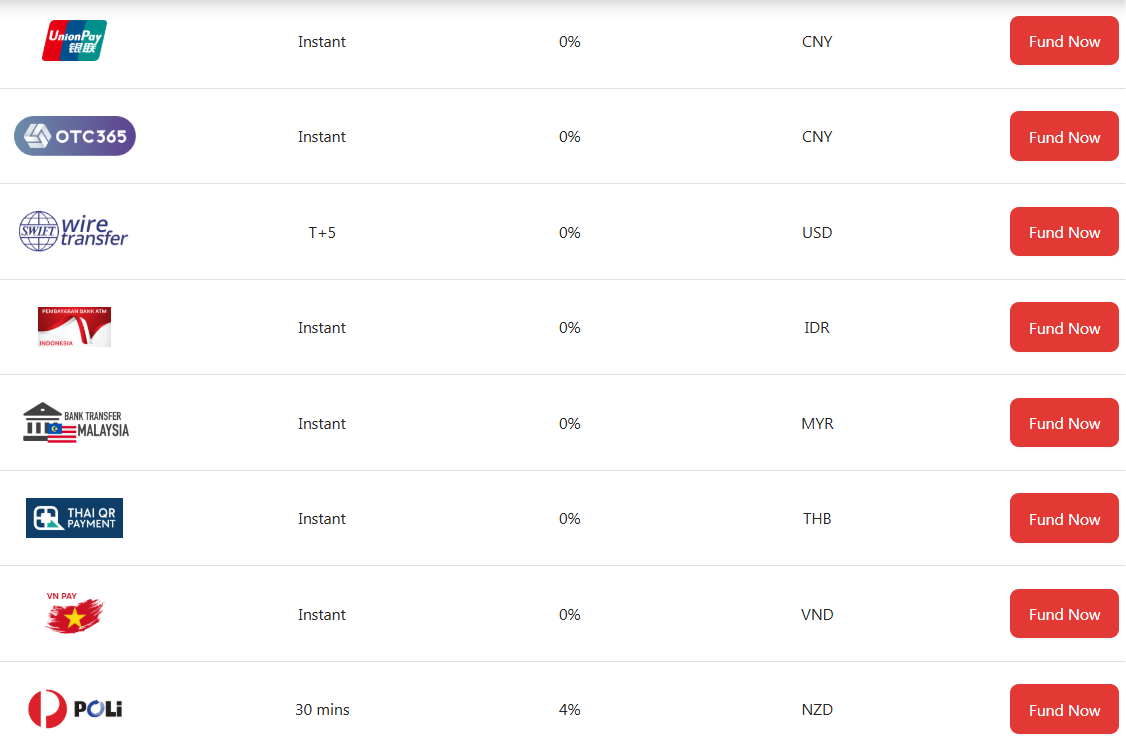

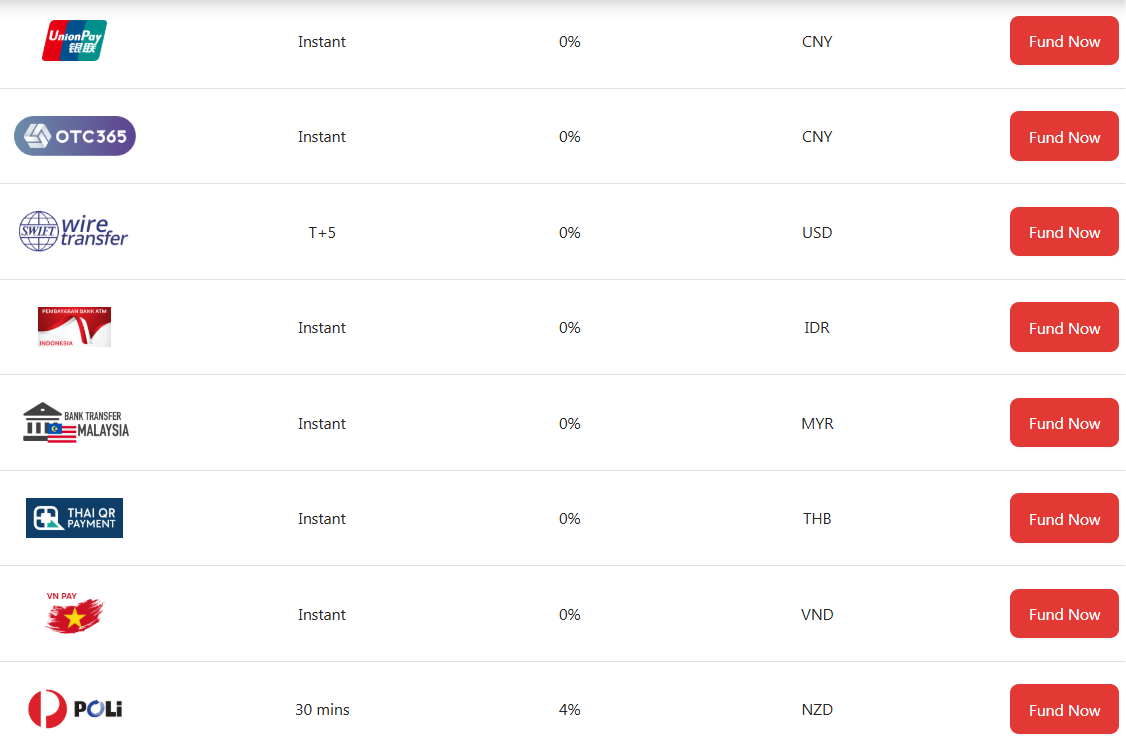

- Deposit and Withdrawal Options

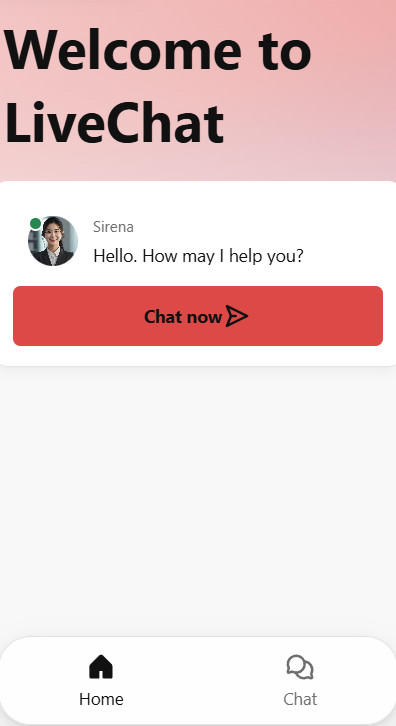

- Customer Support and Responsiveness

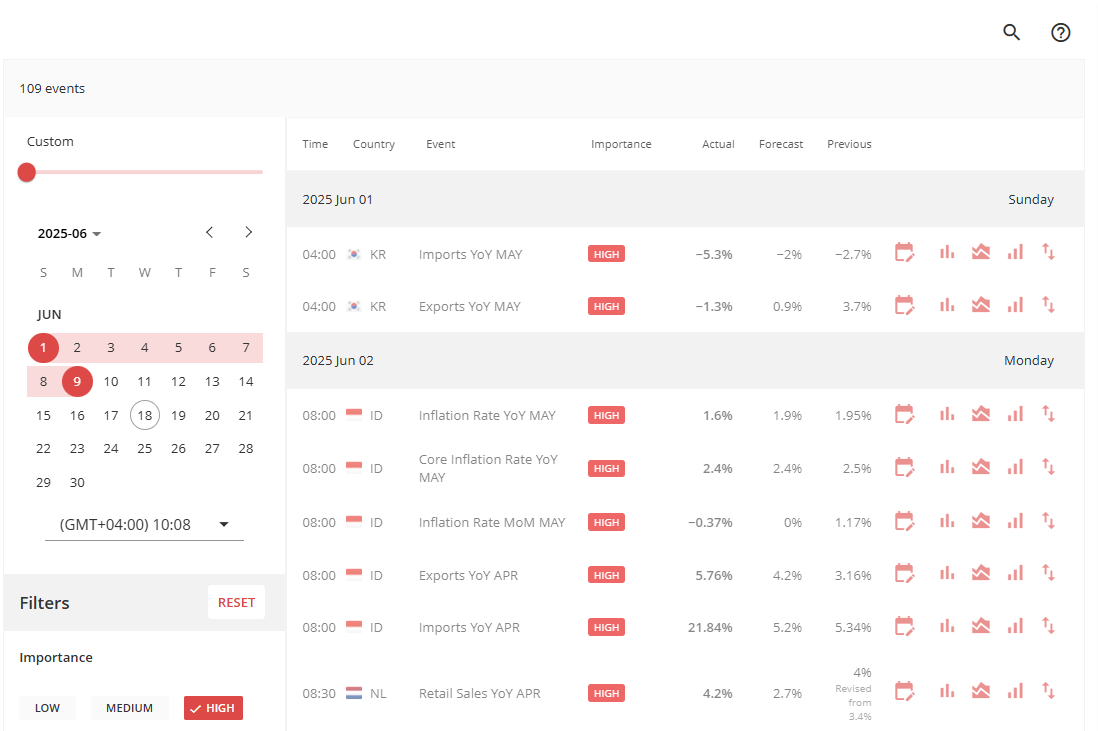

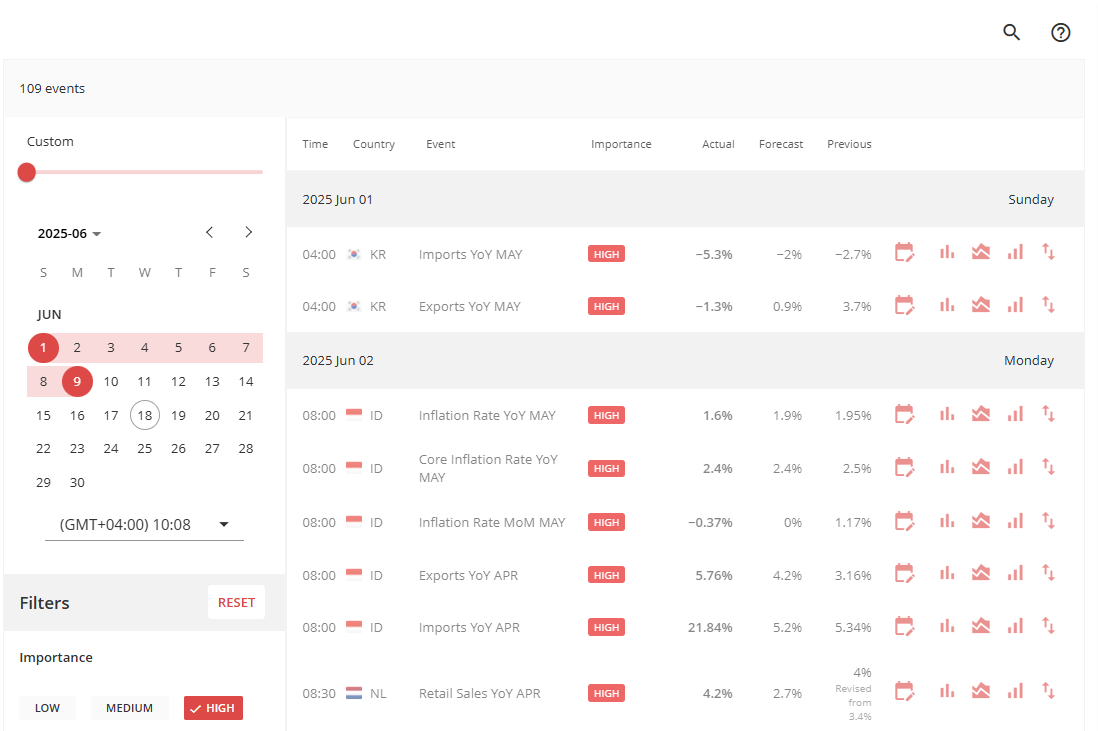

- Research and Education

- Portfolio and Investment Opportunities

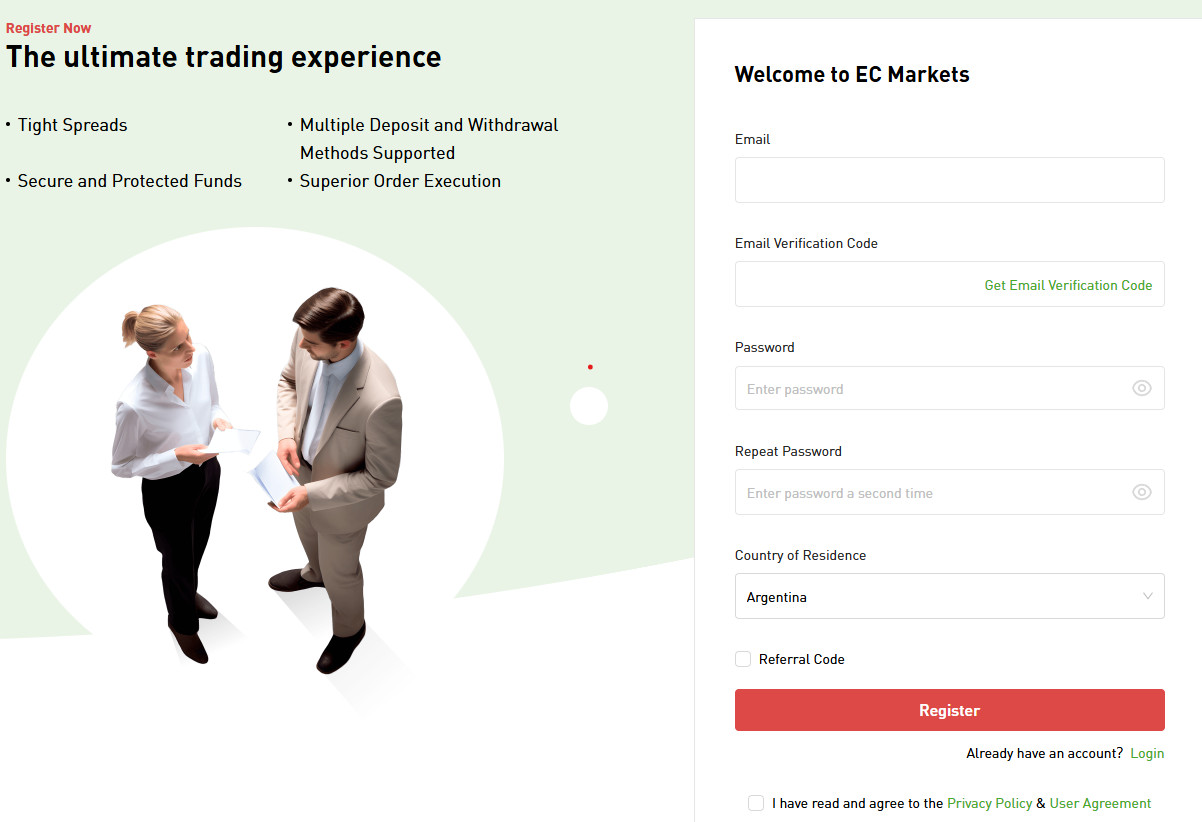

- Account Opening

- Additional Tools And Features

- EC Markets Compared to Other Brokers

- Full Review of Broker EC Markets

Overall Rating 4.4

| Regulation and Security | 4.7 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.4 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4 / 5 |

| Account Opening | 4.6 / 5 |

| Additional Tools and Features | 3.9 / 5 |

What is EC Markets?

EC Markets is a UK-based Forex trading Broker that enables clients to access a wide range of trading instruments, including Forex, Precious Metals, CFD Indices, Crude Oil, and stocks.

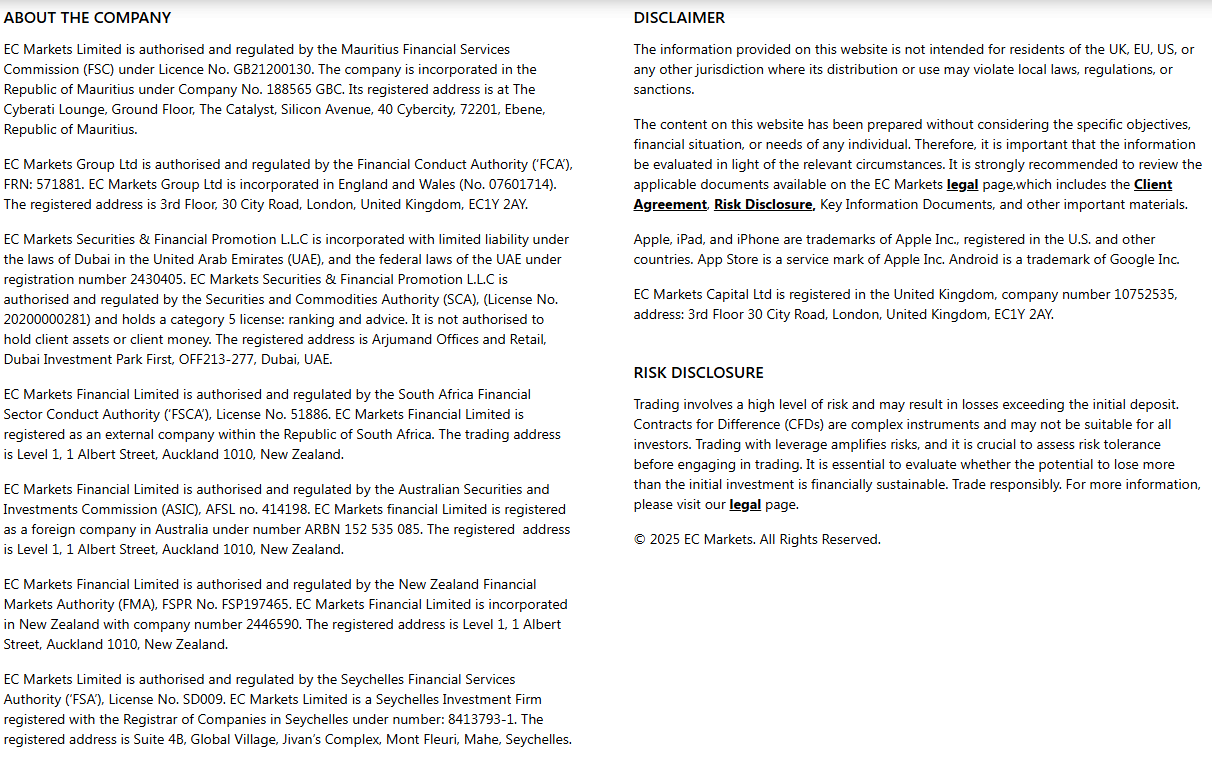

According to our findings, the broker is authorized and regulated by the top-tier Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), ensuring that its operations are secure and reliable. EC Markets also operates internationally, running entities with licenses from the FSA in Seychelles and the FSC in Mauritius. The broker has also recently acquired a license from the FSCA, providing its services to traders from South Africa.

The company provides a smooth trading experience with fast execution through its MetaTrader trading platform. Overall, it is a trustworthy and efficient trading broker that traders can rely on for their trading activities.

EC Markets Pros and Cons

Based on our research, EC Markets has both pros and cons to consider when assessing the company. For the pros, the firm provides reliable trading solutions, advanced technology, and competitive prices for its trading instruments. Also, users can access the widely used MT4 and MT5 trading platforms from desktops and mobile devices. The broker runs competitive tight spreads starting from 0.0 pips. Also, the broker provides 24/5 customer support through Live chat, phone line, and email.

For the cons, the trading conditions may differ based on the entity. Also, traders may find that the broker has a limited selection of trading instruments (150 in total). Additionally, the absence of an education and research section on the UK entity website limits access to educational resources for clients.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversight | Conditions might vary based on the entity |

| Available for UK and international traders | No educational and research materials available |

| MT4/MT5 trading platforms | limited number of market instruments |

| Advanced technology | Cryptocurrency CFDs not available for UK Traders |

| Competitive spreads | |

| Available in the African region | |

| Funds security | |

| White label | |

EC Markets Features

As an FCA-regulated broker based in the United Kingdom, we found that the company provides competitive trading conditions suitable for traders at all levels. Additionally, the availability of a variety of trading services with low pricing and transparency makes it an attractive option for traders of different sizes and experience levels. Find the breakdown of all the aspects of trading with EC Markets below:

EC Markets Features in 10 Points

| 🗺️ Regulation | FCA, ASIC, FSCA, FSA, FSC, FMA |

| 🗺️ Account Types | ECN, STD, and PRO accounts |

| 🖥 Trading Platforms | MT4/MT5 |

| 📉 Trading Instruments | Forex, Precious Metals, CFD Indices, Crude Oil, Stocks, Cryptocurrency CFDs |

| 💳 Minimum deposit | $10 |

| 💰 Average EUR/USD Spread | 1.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | GBP, EUR, USD |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is EC Markets For?

Based on our findings and Financial Expert Opinions, EC Markets is Good for different traders and for various trading expectations. The broker is especially favorable for the following:

- Traders from the UK

- International traders

- Traders who prefer the MT4/MT5 trading platforms

- CFD and currency trading

- Beginners

- Professional traders

- Institutional trading

- OTC/STP execution

- Competitive spreads

- 24/7 customer support

- White Label solution

- EA/Auto trading

- Good trading tools

EC Markets Summary

EC Markets is considered a trustworthy broker with competitive trading services with average prices for its trading instruments. The broker also provides fast order execution and a variety of funding methods, making it a convenient and efficient choice for traders globally. Additionally, you can access two of the most popular trading platforms, MT4 and MT5, available on desktop and mobile devices. The platform offers advanced charting features, automated trading capabilities, and a social trading feature.

The broker provides dedicated customer support available 24/5. However, as we found, the broker does not provide comprehensive educational materials and research, which may be a drawback for beginner traders.

In general, the broker provides a reliable trading environment suitable for traders at different skill levels. However, we recommend traders do their research and evaluate whether the broker’s services and offerings suit their trading requirements.

55Brokers Professional Insights

EC Markets holds multiple licenses, including from the top-tier FCA and ASIC, so is avialable to traders internationally inlcuding Australia nd UK, which is a big plus for reach and availability. The trading conditions and offering itself is a good fit for both beginners and professionals, as there are several account types available covering different trading needs. The applicable trading charges are mostly integrated into spreads and are good for beginners, while for the ECN and Pro accounts are commission-based, so traders may connect to suitbale fee model account.

For the trading software Broker offers popular MT4/MT5 platforms, while its execution been excellent on our tess with ultra-fast speeds, there are also good innovative trading features and tools inlcuded, yet compared to other Brokers not so diverse or provided on free basis, so maybe is good to check more proposals for comparison too.

However, we noticed that education is not available for all the entities; thus, traders need to check the trading conditions and availability of certain tools for each entity, especially beginners who would need trading sources, otherwise better opt to other Broker. Also, although the broker offers a good variety of funding methods, their availability also depends on the jurisdiction which might be limiting for some.

Consider Trading with EC Markets If:

| EC Markets is an excellent Broker for: | - Traders looking for top-tier regulation

- Beginner traders

- Professional clients

- CFD and currency traders

- MT4 and MT5 platform enthusiasts

- Traders who prioritize fast execution of trades

- Cost-conscious traders looking for low costs

- Global traders |

Avoid Trading with EC Markets If:

| EC Markets is not the best for: | - Traditional investors

- Clients looking for an extensive range of instruments

- Beginner traders looking for comprehensive educational materials

- Clients who prioritize 24/7 customer support |

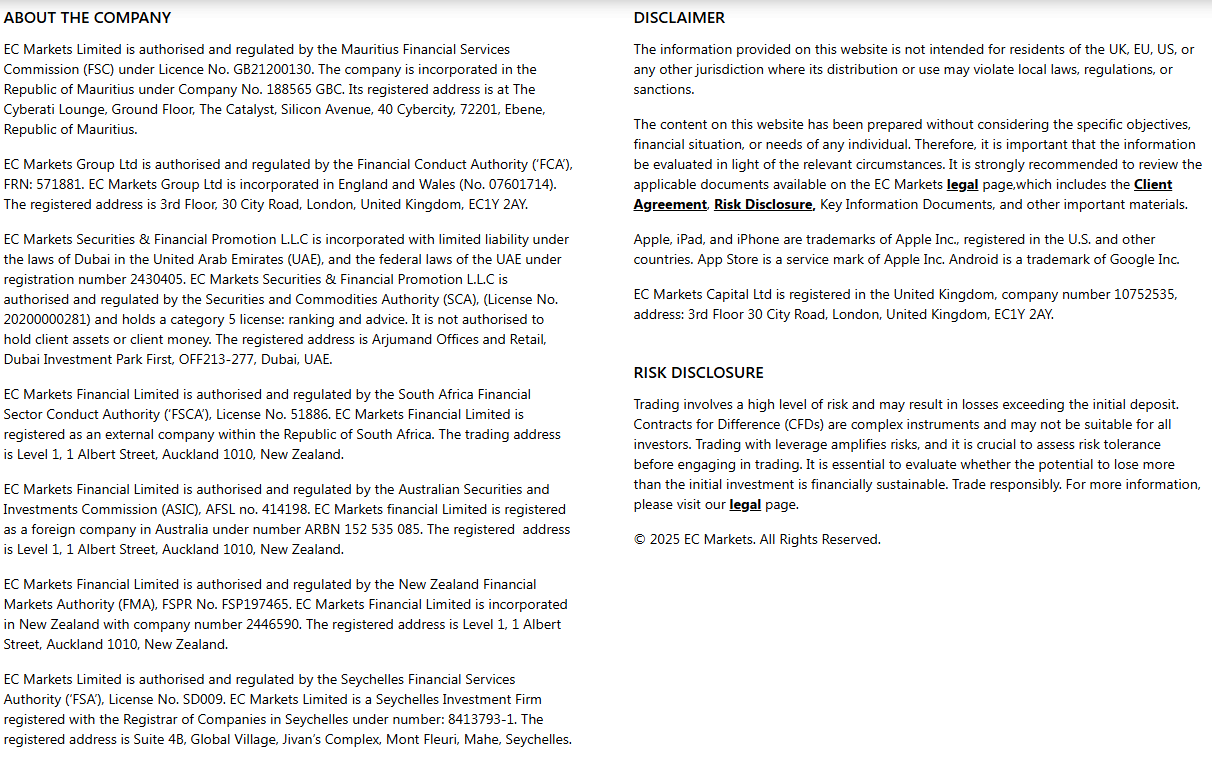

Regulation and Security Measures

Score – 4.7/5

EC Markets Regulatory Overview

EC Markets is considered a trustworthy brokerage firm, regulated by the reputable FCA (UK) and ASIC (Australia), which enforce strict rules and guidelines to ensure the broker operates according to high standards. The broker prioritizes compliance with regulatory requirements and is subject to close monitoring, which ultimately increases traders’ safety and confidence in the company.

- The broker also holds a license from the well-respected FSCA (Financial Sector Conduct Authority, South Africa), making the broker available to clients from the African region.

- The license from the New Zealand Financial Markets Authority (FMA) is another layer of protection for the broker’s already concise regulation and compliance with stringent rules.

- EC Markets additionally holds a license from the Securities and Commodities Authority (SCA), following the federal laws of the UAE.

- At last, EC Markets holds licenses from the FSA in Seychelles and the FSC in Mauritius, ensuring global exposure of the broker.

How Safe is Trading with EC Markets?

The company guarantees the security of clients’ funds, ensured by top-tier FCA regulation, which includes segregation of funds from company accounts and refraining from using them for operational purposes. Additionally, we found the broker offers negative balance protection, which safeguards traders’ accounts from going into negative balance during times of market volatility or unexpected events.

Consistency and Clarity

As we have found, EC Markets was founded in 2011. Since then, the broker has been operating in compliance with strict rules and guidelines. Based on our research, the broker has successfully acquired additional licenses from respected authorities, confirming its reliability by adhering to the standards of the FCA, ASIC, FMA, and FSCA.

Besides, EC Markets shows consistency in its practices and development. The broker strives to provide competitive costs and a good variety of services to please its clients, from beginners to professionals. The customer feedback is mostly positive, pointing out the broker’s advanced platforms, fast execution, dedicated customer support, and other aspects of trading. We also found a few concerns and dissatisfaction with the withdrawal process.

Our recommendation is to carefully consider the broker’s proposal and consider the differences between the entities.

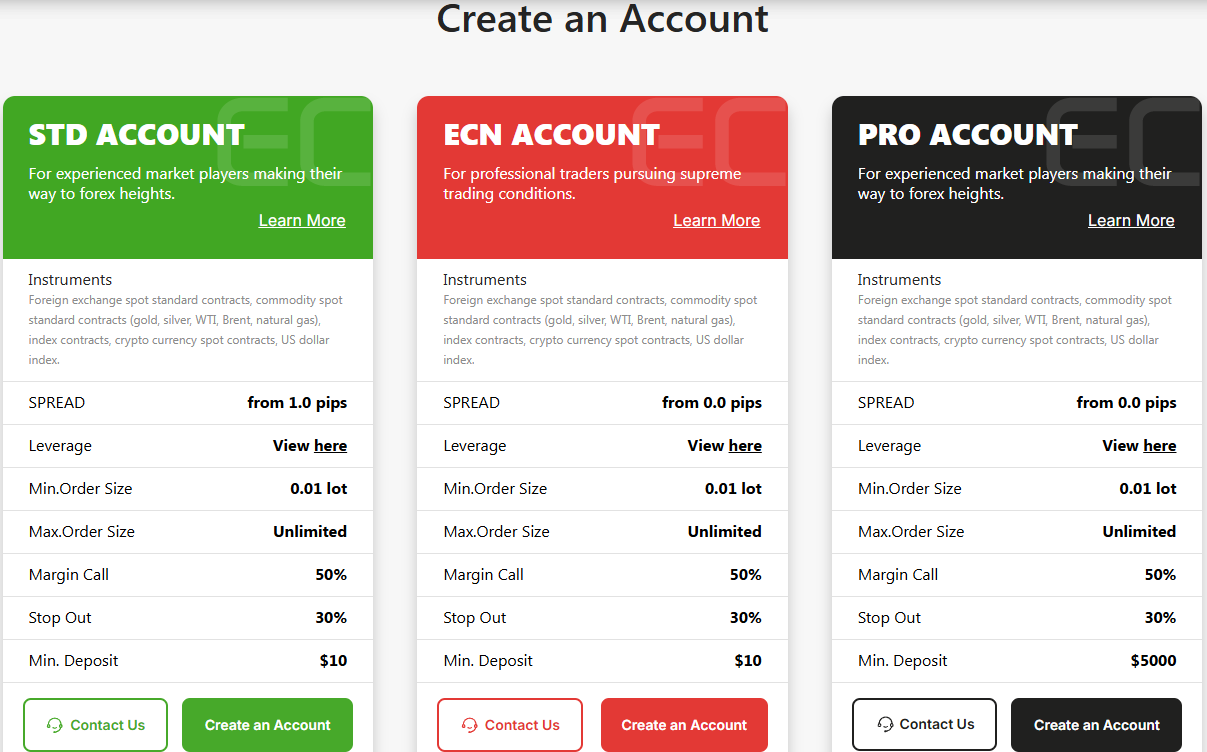

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with EC Markets?

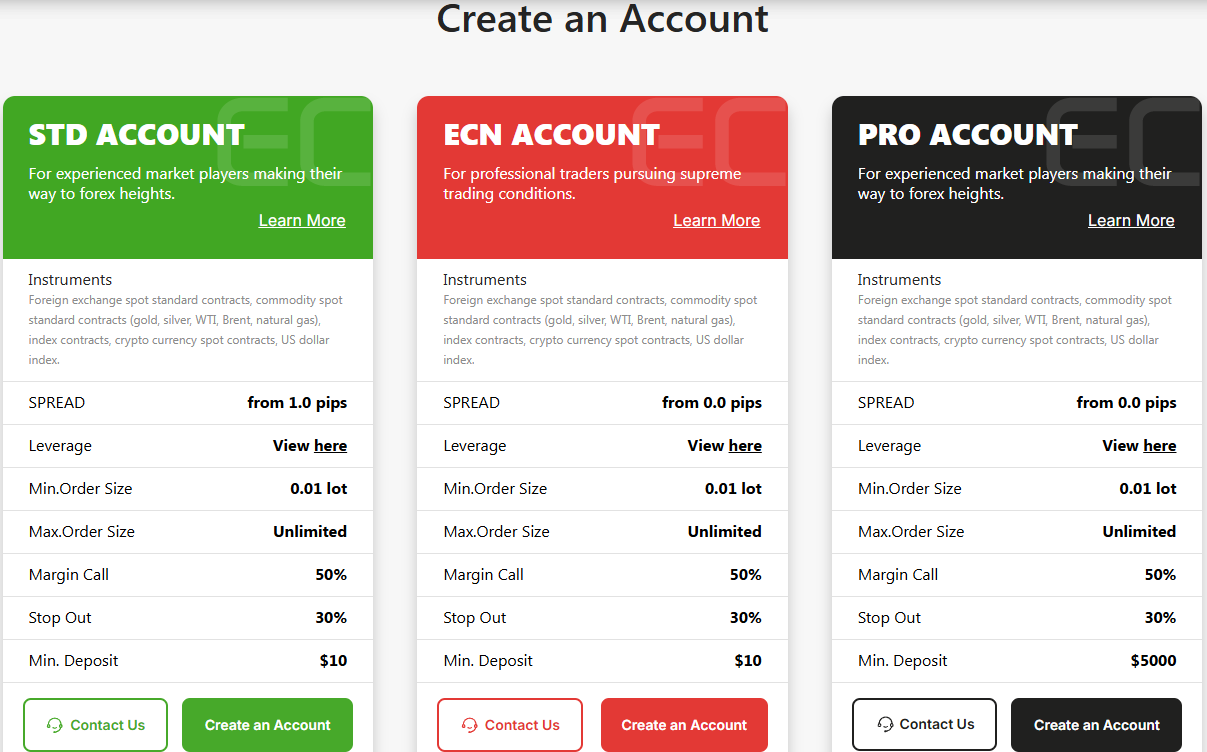

According to our findings, EC Markets offers different types of trading accounts for its clients. UK entity clients can select either Standard or Raw accounts for their trading activities. On the other hand, international entity traders have the option to choose among STD, ECN, and PRO accounts. Additionally, new traders have the opportunity to open a Demo account at no cost, which enables them to practice trading and experiment with strategies by making trial trades.

Based on our analysis of the account types, all the accounts allow leverage up to 1:1000, based on the instrument traded. For the STD and ECN accounts, the deposit requirement is $10. The PRO account requires higher funding, starting from $5.000.

- The STD account is tailored for beginner or intermediate traders, allowing them access to the market with competitive fees with average spreads of 1.1 pips. The account allows fast execution, access to various trading strategies, and availability of over 100 tradable products across multiple markets.

- The ECN accounts offer tighter spreads from as low as 0.0 pips, allowing high leverage based on the instrument trades, unlimited trade size, and a good variety of trading tools and features.

- The PRO account is suitable for advanced traders who are able to start with an initial deposit of $5.000 or higher, accessing exclusive trading features, in-depth market analysis, and various trading strategies. The spreads are tight from 0.0 pips, with no additional transaction fees.

Regions Where EC Markets is Restricted

EC Markets offers its services globally, enabling international traders access to its services. Due to its multiple licenses in different regions, EC Markets is available for traders from Europe, the African region, and other regions. However, due to certain regulatory restrictions, there are regions where the broker’s services are unavailable.

Here is the list of limited countries for EC Markets:

- The USA

- Belgium

- Japan

- Singapore

- Iran

- Iraq

- Syria

- Cuba

- North Korea

Cost Structure and Fees

Score – 4.5/5

EC Markets Brokerage Fees

EC Markets offers competitive fees for trading instruments. The main trading costs are integrated into spreads and depend on the trading account. There are also additional fees, such as swap or rollover fees, that are applied during trading activities.

EC Markets’ spreads depend on the account type and the instrument traded. For the STD account, the average spread for the EUR/USD account is 1.1 pips. For the ECN and PRO accounts, the spreads are tighter, starting from 0.0 pips.

The average spread for Gold is 2.6 pips for the STD account, while for its ECN and PRO accounts, there is an average floating spread of 0.5 pips.

EC Markets offers different fee structures to meet the demand and expectations of every trader. For its STD and PRO accounts, the broker does not apply commissions, and all the costs are calculated in spreads. However, the ECN account imposes spreads on average 0.1 pips, combined with small commissions of $2.5 per side per lot.

EC Markets also incurs swap fees for the overnight open positions. The broker applies both short and long swaps, based on the traded instrument. However, spreads generally depend on the market movements and tend to change. This is the reason why traders should check the swaps with the broker before placing a trade.

How Competitive Are EC Markets’ Fees?

EC Markets offers competitive fees based on different cost structures. The spreads and commissions depend on the account type and, for spreads, on the instrument traded. The broker offers fixed spreads for the STD account, with an average spread of 1.1 pips, which is considered in line with the market average. Besides, the ECN and PRO accounts offer tighter spreads.

All in all, the broker offers transparent fees that are mostly average or on the lower side. Other than commissions and spreads, EC Markets also offers swap fees for the positions held overnight.

However, EC Markets operates under multiple entities, and based on the jurisdiction, the trading conditions, including fees, can differ. It is up to the trader to check the differences between the entities and make sure to be aware of the exact fees before starting to trade.

| Asset/ Pair | EC Markets Spread | Tickmill Spread | ActivTrades Spread |

|---|

| EUR USD Spread | 1.1 pips | 0.1 pips | 0.5 pips |

| Crude Oil WTI Spread | 0.45 | 0.04 | 0.03 |

| Gold Spread | 2.8 | 0.09 | 0.25 |

EC Markets Additional Fees

Our research revealed that EC Markets can apply transaction fees for deposits and withdrawals. It depends on the funding method used. For instance, if traders deposit by using Poli, there is a 4% transaction fee.

The good thing about EC Markets is that it does not apply an inactivity fee, even after 12 months of inactivity. However, this can also differ from entity to entity. Thus, traders should check the information with the broker’s support team.

Score – 4.4/5

The broker provides traders with access to the highly recognized and popular MetaTrader 4 and MetaTrader 5 trading platforms available in web, desktop, and mobile versions. These platforms offer a wide range of features, including technical indicators, trading analysis tools, intuitive interfaces, multiple execution options, and various order types, which are suitable for running various strategies, including swing trading. Note that the MT5 platform is not available for all jurisdictions. For instance, under the UK entity, traders have access to the MT4 platform only.

| Platforms | EC Markets Platforms | Tickmill Platforms | ActivTrades Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

EC Markets Web Platform

Both the MT4 and MT5 platforms offer the web version, enabling traders easy access to the market. The web platform does not require any installations or downloads, ensuring easy access to the market with only internet access. The platforms offer great flexibility, access to over 150 tradable products, extensive trading capabilities, charting tools, over 21 timeframes, fundamental analysis features, technical indicators, and more.

All in all, EC Markets’ web platforms are a suitable option for those who prioritize quick market access and efficient trading.

EC Markets Desktop MetaTrader 4 Platform

EC Markets offers the web, platform, and mobile versions of the well-known MT4 platform. Per our analysis, EC Markets offers a range of trading tools that include advanced charting features with multiple chart types, various timeframes, trading signals, an economic calendar, and technical indicators. Additionally, traders can use EAs to automate their trades, which can assist in identifying market movements and improving market entry and stop-loss strategies.

The MT4 platform supports backtesting and offers over 50 built-in technical analysis tools, customizable profit and loss control, multi-language support, and real-time updates. The execution is fast, allowing traders to conduct efficient trades based on in-depth analysis.

EC Markets Desktop MetaTrader 5 Platform

EC Markets’ MT5 platform is not available under all the entities offered by the broker. The UK entity supports only the MT4 platform; thus, traders should check the platform’s availability before opening an account.

The MT5 platform is a more advanced and sophisticated version of the already efficient MT4 platform. It provides a flexible trading system, allowing traders to employ diverse trading strategies due to multiple execution mode types. The platform offers over 80 technical indicators, charts, and analysis tools. The availability of 21 timeframes enables traders to trace even the slightest market changes. Users can also access fundamental data right from the platform. Besides, traders are free to fully automate their trades by using Expert Advisors. In addition, traders can copy the trades of successful professionals, gaining profits without much effort.

EC Markets MobileTrader App

Traders can download the MT4 and MT5 mobile apps on their Android or iOS devices to trade on the go. The apps include all the essential tools for profitable trading. The platforms offer integrated charting, one-click trading, real-time prices, a wide range of trading indicators, multiple timeframes, market depth, access to the economic calendar, and many other significant features to conduct trades with efficiency and flexibility.

Main Insights from Testing

Our insights about the broker’s available platforms are positive. The broker allows trading through the most popular MT4/MT5 platforms, available through web, desktop, and mobile versions. The platforms offer great analysis tools, enabling efficient trading through advanced capabilities. However, the broker does not allow access to the MT5 platform through all its entities. Under the UK entity, clients can only trade via the MT4 platform. However, the global entity and the entities under the ASIC and FSCA jurisdictions enable access to the MT5 platform.

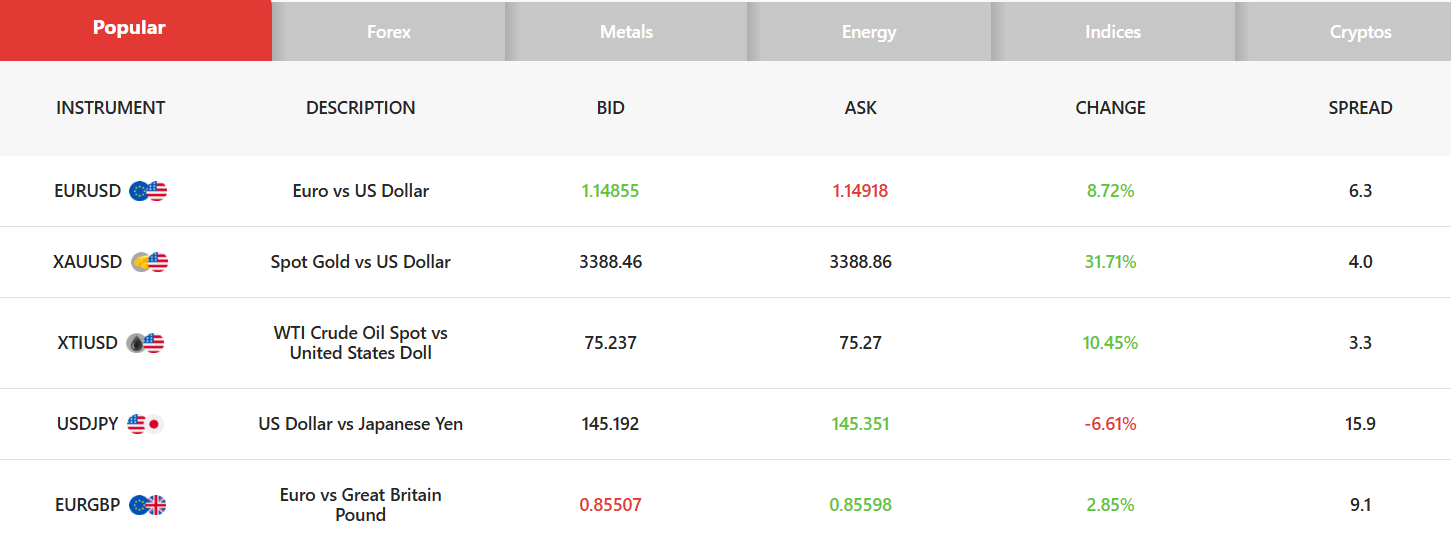

Trading Instruments

Score – 4.4/5

What Can You Trade on the EC Markets Platform?

EC Markets provides traders with a range of popular markets to choose from. These include over 50 currency pairs in the Forex market, as well as metals, CFD indices, crude oil, and cryptocurrency CFDs, which are available only via international entities since the FCA bans the use of cryptos for retail traders. Forex, in particular, is highly regarded for its exceptional liquidity and is widely recognized in the trading industry. However, the availability of specific trading instruments may vary depending on the entity, so we advise conducting thorough research to determine the range of options available.

- In addition, all the products available are based on CFDs, limiting traders’ ability to engage in long-term investments.

Main Insights from Exploring EC Markets Tradable Assets

Based on our research, EC Markets offers a total of 150 tradable products across multiple markets. The broker offers major, minor, and exotic currency pairs, as well as some of the best-known stock indices, precious metals (including gold and silver), and oil. Although the broker does not offer a very large range of instruments, it includes all the popular products with tight spreads and favorable trading conditions.

Additionally, EC Markets offers cryptocurrency CFDs, including Bitcoin, Ethereum, Litecoin, Ripple, and others. However, under the UK entity, traders can only access Forex, precious metals, and crude oil. The number of instruments available under the UK jurisdiction is only 80.

It is essential to consider the differences among the broker’s entities, as there are variations in trading conditions, including instrument availability, prices, and other trading conditions.

Leverage Options at EC Markets

Leverage is a useful tool that enables traders to enter the market with limited capital; its use can lead to substantial profits or losses. As such, traders should have a comprehensive understanding of how leverage works and its possible consequences before engaging in any trading activities that involve leverage.

EC Markets leverage is offered according to the FCA, ASIC, FSCA, FSA, and FSC regulations:

- UK and Australian traders are eligible to use low leverage up to 1:30 for major currency pairs.

- Under the FSCA entity, traders can access leverage of up to 1:500.

- For international traders, the maximum leverage is 1:1000.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at EC Markets

There are a variety of payment methods for the brokers’ clients to deposit funds into trading accounts, which is a benefit. However, some payment methods may have specific requirements or restrictions depending on the client’s bank or other financial institutions involved. Deposit methods can also depend on the jurisdictions, so the availability of the method depends on the entity under which the account is opened.

The available payment methods with the broker are the following:

- Wire transfers

- Credit/debit cards

- Electronic payment methods

- UnionPay

- OTC 365

- Poli

- VN Pay

- Thai QR Payment

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $10 as an initial deposit amount for a Standard account, which is considered a good offering. For the Pro account, the minimum deposit requirement is higher, starting from $5.000. However, the broker operates under several entities, and the minimum deposit requirement may vary from one entity to the other.

Withdrawal Options at EC Markets

Clients of EC Markets can make quick and easy withdrawals. However, conditions vary depending on the payment provider and might take several days to appear in the client’s account. For Bank transfers, the processing time may take up to 5 days. There can also be third-party fees based on the funding method used.

Customer Support and Responsiveness

Score – 4.6/5

Testing EC Markets Customer Support

You can take advantage of 24/5 customer support through Live Chat, Phone lines, Email, and Social Media channels at EC Markets. Also, the support team includes trading experts who can assist with technical support, analysis recommendations, general inquiries, and operational issues.

- The broker’s support is available in multiple languages, including English, Spanish, Portuguese, Thai, French, Chinese, and more.

Contacts EC Markets

EC Markets provides 24/5 dedicated customer support through different channels. Traders can choose one of the following options for communicating with the broker’s support team:

- The live chat enables traders to find prompt and quick answers. Those who are looking for quick solutions will appreciate this support option.

- Clients can also use the provided email address to direct their inquiries, concerns, and suggestions to the broker’s team: support-en@ecmarkets.com.

- Those who prefer direct communication with the support team can use the phone line: +230 54414999.

- Traders can also share their experience and direct questions to the broker through the form available in the broker’s Contact Us section.

- In addition, EC Markets’ presence on social platforms, such as Facebook, X, LinkedIn, YouTube, and Instagram, enables traders to access updated information not only on the broker’s operations but on the market news as well.

Research and Education

Score – 4.1/5

Research Tools EC Markets

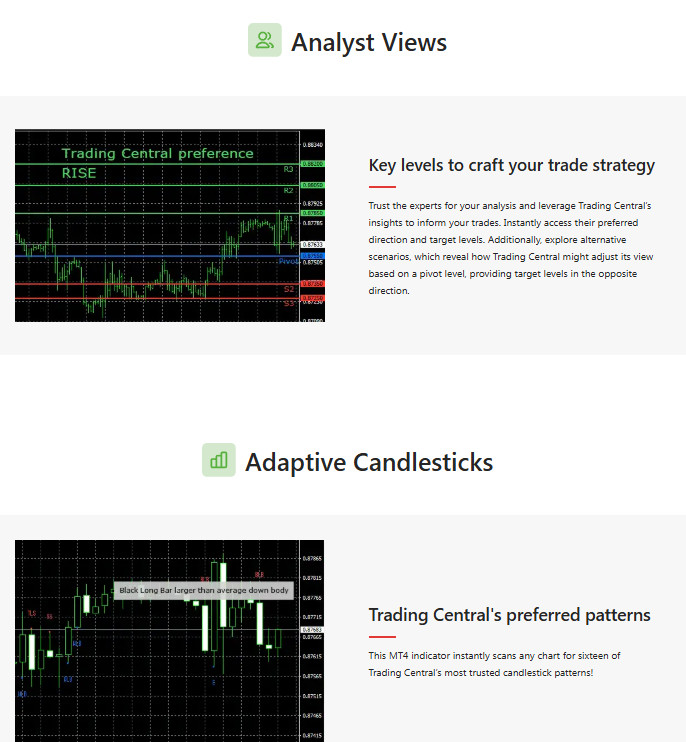

When we were reviewing EC Markets’ research section, we found that the broker offers great research tools and features on its trading platforms. Traders can use multiple charts and technical indicators, as well as access fundamental analysis directly from the platform. It also offers a few additional tools clients can access through the broker’s website.

- The Economic calendar is an excellent way to stay informed about upcoming market changes and essential events, and plan trades based on those important changes.

- The News section provides updated, real-time information on the global market, informing clients about the financial markets, economic updates, and much more.

Education

Finally, the broker lacks a dedicated section on its UK entity website for educational materials, seminars, webinars, or the Trading Academy. It only offers a trading glossary, including explanations of all the essential Forex terms and concepts. This absence can be considered a drawback since educational resources play a crucial role in the development and improvement of traders’ skills.

- However, on the international website of EC Markets, we discovered the presence of educational resources such as a Forex glossary and educational courses dedicated to beginner, intermediate, and advanced clients.

Is EC Markets a Good Broker for Beginners?

EC Markets is a good-standing broker that offers competitive trading conditions and a safe trading environment to explore the financial market. The broker provides three account types tailored for different traders, from beginners to professionals. It also provides a minimum deposit requirement of $10, low spreads, and reasonable commissions.

The broker also offers a demo account with quick registration and access to trading with no risks or funding requirements, enabling beginner traders to gain skills and knowledge before trading live. It also offers a few educational and research tools and materials, but the section is not comprehensive enough for new traders. All in all, the broker can be a favorable choice for many. Clients still need to consider its advantages and drawbacks and see how they can benefit from the broker’s services.

Portfolio and Investment Opportunities

Score – 4 /5

Investment Options EC Markets

Based on our research, EC Markets offers 150 tradable products to its clients and only 80 for its UK-registered clients. Besides, all the products are based on CFDs, allowing traders to speculate on the price movements of underlying assets rather than own them. This means that clients of EC Markets cannot engage in long-term trading or traditional investments and cannot own shares or stocks.

- In addition, we didn’t find any evidence that the broker offers MAM or PAMM accounts, which further restricts the opportunities for alternative investments.

- However, those traders who favor copy trading can copy the trades of professional traders and make profits.

Account Opening

Score – 4.6/5

How to Open an EC Markets Demo Account?

EC Markets offers a Demo account with easy registration and quick access. Traders are free to practice and gain skills in a demo version without risking money and resources.

Here are the steps to follow to set up a demo account:

- Go to the broker’s website and at the top of the page, choose the ‘Demo’ option.

- Fill out the registration form by providing your email, email verification code, country of residence, and password.

- Get the demo credentials via email and complete the registration process.

- Choose the platform (MT4 or MT5).

- Use the credentials to enter the platform and start practicing.

How to Open an EC Markets Live Account?

Opening an account with EC Markets is considered quite easy, as you can log in and register with the broker within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Go to the broker’s website and choose the ‘Register Now’ option at the top of the page.

- Fill out the registration form by providing your email, email verification code, country of residence, and password.

- Verify your personal information by uploading the necessary documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow up with the money deposit.

Score – 3.9/5

The broker’s tools and features are mostly available through one of its available platforms. The MT4 and MT5 platforms are equipped with competitive features to ensure an efficient trading experience. The broker also offers an Economic calendar and news section on its platform, which has already been discussed in the research section.

- For all its jurisdictions, except the FCA-regulated entity, traders can also access the MT4 Indicator Plugin, an indicator from Trading Central, enabling traders to analyse the market and find more trading opportunities.

EC Markets Compared to Other Brokers

It is important to review a broker in comparison to other brokers to determine how it adheres to the market norms and standards. In our comparison of EC Markets, we have reviewed different aspects of trading with the broker and compared them to similar brokers.

First, EC Markets stands out for its extensive regulation, adhering to the rules and guidelines of multiple top-tier and well-respected authorities, such as the FCA, ASIC, FSCA, FSA, FSC, and FMA. The same stringent regulatory oversight is applied to Forex.com and FXCM, offering a substantial layer of security and reliability.

When we compare the brokers’ trading fees to other brokers, such as Axi or FP Markets, we can see that the applicable costs are almost similar, with spreads from 1 to 1.2 pips. However, we noticed that EC Markets offers slightly lower commissions when compared to others.

Trades are conducted on the EC Markets’ MT4 and MT5 platforms, allowing traders access to up to 150 tradable products across multiple financial assets. We noticed that most of the brokers we reviewed offer either the MT4 or MT5 platforms, or both. Yet, FP Markets and Forex.com additionally offer cTrader, TradingView, IRESS, and proprietary platforms.

At last, EC Markets offers educational materials; however, they are not as comprehensive as FXCM’s or FxPro’s educational resources, which include webinars, trading courses, videos, and more.

| Parameter |

EC Markets |

FXTM |

Forex.com |

FP Markets |

Axi |

FXCM |

FxPro |

| Spread Based Account |

Average 1.1 pips |

Average 1.5 pips |

Average 1.3 pips |

From 1 pip |

Average 1.2 pips |

Average 1.3 pips |

Average 1.4 pips |

| Commission Based Account |

0.0 pips +$2.5 |

0.0 pips + $3.5 |

0.0 pips + $5 |

0.0 pips + $3 |

0.0 pips + $7 |

0.2 pips + $0.05 per 1K lot |

0.0 pips + $3.5 |

| Fees Ranking |

Average |

Average |

Average |

Low/ Average |

Average |

Average |

Average |

| Trading Platforms |

MT4, MT5 |

MT4, MT5 |

MT4, MT5, Forex.com Web Trader, TradingView |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, Axi Trading App, Axi Copy Trading App |

MT4, Trading Station, ZuluTrade, TradingView Pro, NinjaTrader, Capitalise AI |

MT4, MT5, cTrader, FxPro WebTrader |

| Asset Variety |

150+ instruments |

1000+ instruments |

6000+ instruments |

10,000+ instruments |

220+ instruments |

200+ instruments |

2,100+ instruments |

| Regulation |

FCA, ASIC, FSCA, FSA, FSC, FMA |

FCA, FSC, CMA |

FCA, NFA, IIROC, ASIC, CySEC, JFSA, MAS, CIMA |

ASIC, CySEC, FSCA, CMA |

ASIC, FCA, CySEC, DFSA, FSA |

FCA, ASIC, CySEC, FSCA, FSA, ISA |

FCA, CySEC, FSCA, SCB, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/7 support |

24/5 |

24/5 |

24/5 support |

| Educational Resources |

Good |

Good |

Excellent |

Excellent |

Good |

Excellent |

Excellent |

| Minimum Deposit |

$10 |

$200 |

$100 |

$100 |

$0 |

$50 |

$100 |

Full Review of Broker EC Markets

We have reviewed all the aspects of trading with EC Markets and summarized its offerings. The broker is a tightly regulated and rigorously overseen company by multiple top-tier and strict authorities.

The broker’s overall trading conditions, combined with safety measures, competitive fees, and great features, make it a favorable choice for various traders and different trading strategies.

The overall tradable products available are 150+ (only 80 for the UK entity). This modest range of instruments restricts the capability to expand portfolios. The broker also does not offer real stock trading or alternative investment options, such as access to MAM or PAMM accounts. Yet, EC Markets offers copy trading.

Trades are conducted on the popular MT4 and MT5 platforms, but the availability of the MT5 platform also depends on the jurisdiction. Traders registered under the UK entity can conduct trades through the MT4 platform. Besides, the account opening process is quick and straightforward, with only a $10 initial deposit requirement. However, the account tailored for professionals requires $5,000 or more. The funding methods available are various, but their availability again depends on the entity.

Finally, although the broker offers a few research and educational materials, it is not a fit for beginner traders who are looking for comprehensive educational resources.

Share this article [addtoany url="https://55brokers.com/ec-markets-review/" title="EC Markets"]

One of the things I appreciate most is how easy the platform is to use. From registration to placing trades, everything felt straightforward and efficient. Execution speed has been solid, and spreads are reasonable compared to other brokers I’ve tried. I also like that I can trade on both desktop and mobile without any issues, which makes monitoring positions convenient. Deposits and withdrawals have worked smoothly so far, which builds confidence. The support team is polite and helpful when needed. Overall, it’s been a positive experience that meets my expectations as a trader.

I’ve been trading with EC Markets for a while now, and the experience has been very smooth. The platform is stable, with fast execution and competitive spreads that make trading more efficient. I also like the variety of instruments available, which allows me to diversify my strategies easily. Deposits were processed quickly, and withdrawals arrived within the expected timeframe without complications. Customer support has been professional and responsive whenever I contacted them. Overall, it feels like a reliable broker that focuses on providing a consistent and user-friendly trading environment.

I’ve tried several brokers, but EC Markets stands out for its smooth operation and professional support. The spreads are reasonable, trades are executed quickly, and the platform is easy to use on both desktop and mobile. I also enjoy the variety of assets available, which helps me diversify without switching platforms. Deposits were quick and withdrawals processed efficiently, giving me confidence in the broker’s reliability. Customer service has been responsive and helpful, answering my questions clearly. Overall, EC Markets provides a dependable trading environment that caters well to both new and experienced traders.

What I appreciate most about EC Markets is the overall user experience. The platform is easy to navigate, and trades execute quickly without delays. I like that there’s a wide range of markets available, allowing me to diversify my portfolio easily. Deposits and withdrawals are processed efficiently, which makes managing funds simple. The support team is friendly and provides clear guidance whenever needed. Execution, spreads, and overall platform stability make it easy to focus on trading strategies. For anyone looking for a reliable and convenient broker, EC Markets is definitely worth considering.

EC Markets is one of the most user-friendly trading platforms I’ve tried. Setting up an account was quick, and I could start trading almost immediately. I love that I can access both desktop and mobile platforms with the same features, making it easy to trade on the go. The spreads are tight, execution is fast, and the variety of instruments is excellent for diversifying my trades. Customer support has always been helpful when I needed guidance. For anyone looking for a straightforward and reliable broker, EC Markets is a solid choice.

I’ve been using EC Markets for a few months, and I’m impressed by how reliable the platform is. Trades execute quickly, and the spreads are very competitive, which makes my trading more efficient. The interface is intuitive, so it’s easy to monitor multiple positions at once. I also appreciate the variety of assets available — from forex to indices and commodities. Deposits and withdrawals have been smooth and fast, with no hidden fees. Whenever I’ve had questions, the support team has been responsive and professional. Overall, EC Markets provides a seamless and trustworthy trading experience.

EC Markets offers a trading environment that feels both professional and easy to use. I appreciate the transparent pricing and the fact that there are no unexpected fees. Orders are processed quickly, and I haven’t faced major technical problems so far. The variety of instruments available makes it easier to diversify my strategies in one place. The mobile platform is responsive and practical for monitoring trades during the day. It’s been a comfortable and reliable broker for my needs.

I’ve been trading with EC Markets for a while now and the experience has been consistently smooth. The execution speed is impressive, and I like how stable the platform feels even when markets are volatile. Spreads are competitive, which helps keep my trading costs under control over time. The interface is clean and not overly complicated, making it easy to focus on trading decisions. It’s also convenient that I can switch between devices without any issues. Overall, a dependable platform for active traders.

My experience with EC Markets has been very comfortable. The platform feels stable, and trades are executed without noticeable delays. I like the variety of account types available, which makes it easier to match different trading strategies. Spreads are reasonable, and the pricing feels transparent with no unpleasant surprises. The mobile app is especially convenient for checking positions during the day. Overall, EC Markets provides a balanced mix of performance, usability, and trading flexibility.

EC Markets has given me a smooth and reliable trading experience so far. Order execution is quick, which really matters when markets move fast. I also appreciate the competitive spreads and clear pricing structure, making it easier to manage overall costs. The platform is user-friendly and works well on both desktop and mobile devices. Having access to multiple instruments in one place helps me diversify my trades efficiently. It’s a practical choice for traders who value speed and stability.

EC Markets has been a great platform for my daily trading. I find the pricing transparent and the execution fast, which gives me confidence entering and exiting positions. The MetaTrader platforms are familiar and powerful, offering the tools I need without overwhelming complexity. I also like that there are no inactivity or deposit fees, so I don’t worry about hidden costs eating into my profits. The customer support team is friendly and helpful when I have questions. Definitely recommend EC Markets to anyone serious about improving their trading.

I’ve been using EC Markets and appreciate its fast and reliable trading experience. The order execution is smooth with competitive spreads and low costs, which really helps keep my trading efficient. I also like that there are multiple account types, including ECN, so I can choose the setup that best suits my strategy. With access to a wide range of instruments like forex, metals, and indices, I can diversify easily. The mobile app is intuitive, letting me manage trades on the go without any hassle. Overall, it’s a solid broker with great pricing.

EC Markets has worked well for my day-to-day trading. The platform feels stable during regular market hours, and orders are filled at the expected prices most of the time. I like that both MT4 and MT5 are available, since I use custom indicators and occasionally automated tools. Funding the account was simple, and withdrawal processing has been smooth in my experience. The range of instruments is also helpful, allowing me to switch between forex and indices depending on market conditions. It’s a straightforward broker that delivers the essentials without making things unnecessarily complicated.

I’ve been trading with EC Markets for several months, and the experience has been consistently reliable. Order execution is fast, and spreads on the major pairs I trade are competitive enough for short-term strategies. The platform runs smoothly on MT5, with charts loading quickly and no noticeable lag. I also appreciate how straightforward the client portal is, making deposits, withdrawals, and account monitoring easy to handle. Support responses have been clear and professional whenever I had a question. Overall, EC Markets provides a stable trading environment that lets me stay focused on strategy rather than technical issues.

My experience with EC Markets has been consistently positive. Orders are executed quickly, and pricing feels transparent during regular market sessions. I mainly trade forex, and the platform provides the tools I need without feeling cluttered. Having both MT4 and MT5 available is a big advantage since I can switch depending on my strategy. Customer support has responded clearly when I reached out with a basic question. Everything from account setup to daily trading feels organized and efficient, which helps me stay focused on my strategy.

EC Markets has been a dependable platform for my trading activities. The execution speed is solid, and I’ve noticed that spreads remain fairly tight on the instruments I trade most. Using MT5 has been smooth, with charts loading quickly and no technical interruptions so far. I also appreciate how simple the account dashboard is, making it easy to check balances and trade history. Funding the account was straightforward, and withdrawals have been processed in a reasonable timeframe. Overall, EC Markets feels like a broker that prioritizes performance and usability over unnecessary extras.

EC Markets has been a practical choice for my trading needs. I appreciate the tight spreads on major currency pairs and how fast orders are filled. It makes a difference when you trade short-term strategies. The platform supports MT4 and MT5, which gives me access to the tools and indicators I’m already comfortable with. Their mobile app is also useful for checking positions when I’m away from my desk. Customer support responded clearly when I had a funding question. So far, everything has felt transparent and easy to manage.

I’ve had a good experience trading with EC Markets so far. The spreads are competitive, and execution speed has been reliable even during busier market hours. I mainly use MT5, and the platform runs smoothly without crashes or lag. Deposits were processed quickly, and withdrawals have been straightforward on my end. I also like that there’s a decent range of instruments available, so I can switch between forex and indices depending on market conditions. Overall, EC Markets feels like a stable broker that focuses on delivering consistent trading performance rather than flashy promotions.

My experience with EC Markets has been good so far. The account opening process was easy, and the platform feels stable during trading hours. Execution speed is solid, and I haven’t noticed unusual slippage. The spreads are competitive enough for my strategy. I like being able to switch between desktop and mobile without any problems. Customer service responded in a professional way when I had a small question. Deposits showed up quickly, and withdrawals were processed within a reasonable time. Overall, EC Markets has been reliable for my day-to-day trading.

EC Markets has given me a positive trading experience overall. The interface is clean and not overloaded with tools, which makes it easier to focus on actual trades. Orders are usually filled quickly, and pricing has been consistent. I mainly trade forex, and spreads have been reasonable compared to other platforms I’ve tried. I haven’t had technical issues, and the platform works well on both desktop and mobile. Support was polite and helpful when I contacted them. So far, everything has been straightforward and dependable.

I’ve been trading on EC Markets for a while and things have gone pretty smoothly. The platform is simple to use, and I didn’t need much time to get familiar with it. Execution speed has been reliable, and spreads seem fair for the markets I follow. I also appreciate that the mobile version runs well when I just want to check my positions. Customer support answered my question clearly the one time I reached out. Deposits and withdrawals have worked without any trouble so far. Overall, it feels like a stable and easy platform for regular trading.

EC Markets has been reliable in my day-to-day trading. The setup was simple, and the interface is clean and easy to navigate. Execution speed is solid, and I haven’t faced any major issues. Deposits and withdrawals have worked without problems.

I’ve had a good experience with EC Markets so far. The platform is easy to use and doesn’t feel complicated. Trades execute quickly and spreads seem fair for what I usually trade. I also like that the system runs smoothly on both desktop and mobile. Support answered my question clearly when I contacted them.

EC Markets has been pretty straightforward for me. Setup was quick, and the platform didn’t take long to get used to. Execution speed is solid and pricing seems reasonable. Support replied fast when I had a small question.

I’ve had a smooth experience with EC Markets so far. The platform is easy to use and trades go through quickly. Spreads feel fair for the pairs I trade. I also like being able to check everything from my phone. No major issues yet.

My overall experience with EC Markets has been fairly average, with a mix of satisfactory features and some limitations. The account opening process was relatively straightforward, and the verification steps were standard compared to other platforms. The interface is simple and functional, making it easy enough to navigate through charts, open positions, and account details, although it doesn’t feel especially modern or advanced.

I’ve had a smooth experience with EC Markets so far. The platform is easy to use and feels well structured. Trades execute quickly, and pricing has been consistent. Customer support was responsive when I needed help. Overall, it’s been reliable and easy to work with.

EC Markets has been smooth and reliable in my experience. Account setup was simple, and the platform didn’t take long to get used to. Execution speed is good, and I haven’t faced technical issues. Deposits and withdrawals have been handled without problems. Overall, a solid trading platform.

I’ve had a positive experience with EC Markets so far. The platform is easy to navigate and feels well organized. Trades execute quickly, and pricing has been consistent. I mainly trade forex, and the spreads have been reasonable. Customer support was responsive when I contacted them. Overall, it feels like a reliable and straightforward platform.

EC Markets has provided a smooth and stress-free trading experience for me. The account opening process was simple, and verification didn’t take long. The interface is intuitive and not cluttered, making it easy to focus on trading without distractions. Execution speed has been consistently fast, even during active market sessions. The spreads are reasonable and pricing feels transparent across the instruments I trade. I also appreciate the variety of markets available, which allows for diversification from one account. Customer service has been helpful and polite when I reached out with questions. Deposits were credited quickly, and withdrawals were processed within a reasonable timeframe. Overall, EC Markets feels dependable and professionally managed, making it a platform I’m comfortable using regularly.

My experience with EC Markets has been very positive overall. From the moment I signed up, the process felt straightforward and well guided. The platform itself is clean and easy to navigate, which makes managing trades much more comfortable. Execution speed has been reliable, with orders filled quickly and minimal slippage. I mainly trade forex and metals, and pricing has been consistent with competitive spreads. The platform works smoothly on both desktop and mobile, which is convenient for monitoring positions throughout the day. Customer support has been responsive and professional whenever I contacted them, providing clear answers instead of generic replies. Deposits were credited promptly, and withdrawals have been processed smoothly so far. Overall, EC Markets feels like a stable, transparent, and user-friendly broker that focuses on providing a reliable trading experience.

One thing I like is the availability of both MT4 and MT5, giving flexibility depending on preference. Customer service has been friendly and easy to reach whenever I needed assistance. Withdrawals have been processed in a reasonable timeframe, which builds trust. Overall, EC Markets provides a reliable and user-friendly environment that makes trading more comfortable and less stressful.

EC Markets has delivered a smooth and consistent experience for me. From account setup to daily use, everything feels well structured and easy to understand. The platform interface is simple and not cluttered, which makes it easier to focus on charts and positions without distractions. I didn’t need much time to get familiar with the tools.

Execution quality has been solid. Trades are filled quickly, and I rarely notice delays. This is important for my trading style, especially during active sessions. The spreads are reasonable and stable, which helps with cost management. I mainly trade forex and gold, and pricing has been competitive compared to other platforms I’ve used.

Customer support has been responsive and professional whenever I reached out with questions. They took the time to explain things clearly instead of giving short answers. Deposits were credited quickly, and withdrawals have been processed smoothly so far. Overall, EC Markets feels reliable, transparent, and well organized, making it a platform I’m comfortable using regularly.

Execution speed has been one of the highlights for me. Orders are placed quickly, and slippage has been minimal, even during more active market periods. The spreads are competitive, especially on the ECN account, which helps keep trading costs reasonable. I also appreciate the wide range of instruments available, including forex, indices, and commodities, as it allows me to diversify my strategies without switching platforms.

My experience with EC Markets has been very positive since I started using the platform. The registration process was simple and well guided, and verification was completed faster than I expected. The platform itself is clean and easy to navigate, which makes managing trades and checking account details straightforward. I mainly use MT5, and it runs smoothly on both desktop and mobile without noticeable lag.

Support has been friendly and helpful whenever I contacted them. My withdrawal requests have been handled without issues, which is always important when choosing a broker. Overall, EC Markets provides a professional and dependable trading experience.

My experience with EC Markets has been smooth and positive. I appreciate how user-friendly the platform is, especially for managing trades and analyzing charts. MT5 runs well, and the mobile version allows me to monitor positions easily while on the go.

After testing several brokers, I decided to stay with EC Markets due to their stable platform and fair trading conditions. The registration and verification process was quick, and funding my account was simple. I mostly use the ECN account, and the low spreads have helped keep my trading costs under control.

Execution speed has been consistently good, even during high-volatility periods. I rarely experience delays or technical issues. The range of instruments is also a plus, allowing me to trade forex, indices, and commodities from one account.

The platform is easy to use, and both MT4 and MT5 run smoothly on desktop and mobile. I like how clear and straightforward everything is, from account management to placing trades. There are no confusing settings or hidden fees.

Customer service has also been a strong point. Whenever I had questions, the support team responded quickly and provided clear answers. Withdrawals have been processed efficiently, which builds trust over time. Overall, EC Markets offers a balanced trading environment that works well for both beginners and more experienced traders.

Customer support has been professional and responsive whenever I reached out. Deposits and withdrawals have been processed smoothly so far, without unnecessary delays. Overall, EC Markets feels reliable and transparent, and I’m comfortable continuing my trading journey with them.

EC Markets has been a reliable broker based on my personal trading experience. I mainly trade forex and gold, and the trading conditions have been stable and consistent. Spreads are reasonable, and execution is fast, which is important for my trading style.

I’ve been trading with EC Markets for several months and my overall experience has been very positive. The account opening process was simple and fast, and I was able to start trading almost immediately after verification. What really stands out to me is the execution speed. Orders are filled quickly with very little slippage, even during active market sessions.

The spreads on the ECN account are competitive, which helps reduce trading costs, especially for frequent trades. I also appreciate the wide range of products available, including forex, metals, indices, and cryptocurrencies. This makes it easy to manage different strategies on one platform.

EC Markets has become one of my preferred brokers due to its reliability and ease of use. I trade frequently, and fast execution with minimal downtime is essential. So far, the platform has delivered consistent performance.

The range of tradable instruments allows me to diversify across different markets, and the mobile app makes managing trades convenient. Funding and withdrawals have been straightforward, and customer support has been responsive when needed. For traders looking for a stable and well-rounded platform, EC Markets is a strong option.

EC Markets delivers on both ease of use and depth of features. The execution speeds are fast, and the pricing feels fair, which I noticed immediately after switching from my old broker. Their multi-platform support means I can do detailed analysis on desktop and execute quickly on my phone. Funding my account was easy with multiple payment options and transparent processes. I also appreciate that the app integrates daily market insights, helping me stay informed. It’s become my go-to platform for global markets.

As someone who trades multiple strategies, I value how flexible EC Markets is. They offer several account types, which helped me find the right fit for my risk tolerance and trading style, and the lack of inactivity or withdrawal fees keeps costs transparent. Their platform is stable across desktop, web, and mobile, so I can jump in and manage trades wherever I am. The ability to trade forex, indices, commodities, and crypto CFDs from one place is really convenient, and the demo account helped me build confidence before going live.

What I enjoy most about EC Markets is how approachable the platform feels while still offering professional-level features. The mobile app is especially handy—real-time price alerts, easy fund transfers, and smooth navigation make it simple to stay on top of the markets even on busy days. I trade forex and metals most often, and the fast executions with tight pricing improve my overall trading experience. I’ve also benefited from the supportive customer service team when I needed help. It’s been a solid all-round broker experience for me

EC Markets has been a great choice for me as a retail trader because it balances powerful tools with simplicity. The platform supports both MT4 and MT5, which I use daily for charting and strategy execution. The spreads are competitive, and the execution speed is impressive, letting me react quickly to market moves. I also like that account opening was fast with a low minimum deposit. Having instant access to real-time market news and alerts gives me confidence when analyzing trades. All in all, EC Markets has helped me improve my trading efficiency significantly.

I’ve been trading with EC Markets for several months now and what stands out most is the smooth execution and extremely user-friendly experience, especially through their mobile app. The clean interface makes it easy to follow markets, place orders, and manage open positions wherever I am. I also appreciate the range of asset classes—from forex and commodities to indices and crypto—so I can trade everything from a single account. Deposits and withdrawals have been straightforward without confusing fees, and support is available when I need it. Overall, the platform feels reliable and well-designed for both beginners and experienced traders.

EC Markets feels like a professional broker focused on performance. I appreciate the fast order execution and competitive spreads. The mobile app works well and keeps me connected to the markets.

EC Markets feels like a professional yet user-friendly broker. I started with their demo account to practice, then moved to live trading because the platform felt so stable. The ability to trade with low spreads and no inactivity fees is a nice bonus.

I appreciate EC Markets’ diverse asset coverage — from forex to indices and cryptocurrencies. Their mobile app makes it easy to trade on the go without missing market moves. The customer support is helpful and responsive whenever I need assistance. Great choice for everyday active traders.

What sets EC Markets apart for me is its fast order execution and low trading costs. I can place trades quickly on forex, commodities, and crypto with minimal slippage. The MT4 and MT5 integration also means I get familiar charting tools and customizable indicators. It’s been a reliable experience overall.

EC Markets offers a clean, intuitive interface that makes trading easy even for beginners. The spreads are competitive, and the high leverage up to 1:1000 gives me more room to scale my strategy. Deposits and withdrawals are handled smoothly too. Definitely a platform I’d recommend to traders who want simplicity with strong execution.

I’ve been using EC Markets for a few months and I genuinely enjoy the fast execution and tight spreads. The platform feels responsive, and I especially like managing my trades through their mobile app. It’s straightforward yet powerful, perfect for both forex and crypto trading. Overall, a solid choice for traders who want flexibility and reliability.

One thing I appreciate about EC Markets is the transparency in pricing and execution statistics. Seeing detailed metrics helps build trust, and the market coverage—from forex to commodities—is broad enough for most trading styles.

EC Markets’ platform feels stable and the trading conditions are competitive. I enjoy the low spreads and the ability to adjust leverage up to 1:1000 if I want to manage risk more flexibly. The mobile app also works well and keeps me connected to markets.

For intermediate traders, EC Markets offers a good mix of assets and tools. The low minimum deposit and multiple deposit options make getting started straightforward. Plus, customer support is available throughout the week if you need help. It’s not perfect, but definitely worth considering.

I like how EC Markets combines competitive pricing with robust platforms. Spreads can be very low and order execution is quick, which helps in fast-moving markets. Having both MT4 and MT5, plus an intuitive mobile app, means I can trade comfortably whether I’m at my desk or out and about.

EC Markets delivers an overall solid trading experience with tight spreads, fast execution and access to MT4/MT5 platforms. Their mobile app makes trading on-the-go effortless and the wide range of markets—from forex to indices and crypto CFDs—ensures plenty of opportunities. It feels like a modern, flexible broker for both new and active traders.

I switch between forex, metals, indices and crypto using ECMarkets.com, and the experience has been positive overall. The breadth of assets is a big plus because it allows me to diversify without juggling multiple accounts. Execution has been tight and fast in my experience, and navigating the MT5 charts for deeper analysis is smooth. Although I always recommend testing with a demo first, I’ve found the live environment to be robust and responsive. Customer service has helped resolve minor questions promptly.

As someone fairly new to trading, ECMarkets feels welcoming. The account setup procedure was straightforward, and I could start trading quickly after verification. The educational resources and market insights embedded in the platform gave me confidence when learning new strategies. I particularly enjoy the intuitive interface and real-time alerts that help me stay aware of key price movements. It’s not perfect — every broker has a learning curve — but overall it feels like a solid platform for both beginners and seasoned traders.

ECMarkets strikes a good balance between simplicity and advanced features. The inclusion of both MT4 and MT5 means I can choose the right platform depending on how deep I want to analyze the markets. The spreads are competitive and don’t feel inflated, which helps reduce overall costs. I also like how the mobile app mirrors much of the desktop functionality, so I never feel like I’m missing out when I’m away from my computer. Support is available when I need it, and their resources on market news are a nice bonus.

I’ve been using ECMarkets.com for a while, and what stands out most is its execution speed. Trades are filled quickly, which is critical during volatile market conditions. The app is particularly user-friendly, making it convenient to manage positions on the go without feeling limited. I also appreciate the range of markets offered — from forex to crypto and commodities — all accessible in one place. While every broker has pros and cons, ECMarkets has consistently delivered reliable service for my day-to-day trading.

ECMarkets offers a robust trading environment with competitive pricing, a wide range of instruments and seamless access through both desktop and mobile platforms. With support for MT4, MT5 and its own app, I find it easy to switch between devices without losing functionality. Execution speeds are fast and the spreads reasonable compared to other brokers I’ve tried. Their customer support is responsive during market hours, and having clear access to market analysis tools directly in the platform helps me stay informed. Overall, the platform feels professional and suitable for traders of various levels.

They allow hedging and scalping, which is great for short-term traders like me. I found the withdrawal process relatively quick in my experience — that gives some peace of mind.

I appreciate that there’s a demo account option — good for practising before using real money. Leverage options at EC Markets are generous — that can be good if you know what you’re doing.

Considering I started with a relatively small deposit, it was nice that EC Markets accepts modest minimums. The availability of both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) makes it easy — I can pick the platform that matches my experience level.

The wide range of instruments (forex, metals, indices, energy …) gives me flexibility — I’m not stuck trading just a few pairs. Tight spreads on major pairs make EC Markets attractive if you care about costs.

EC Markets has impressed me with how fast orders execute — trades feel almost instantaneous.I like that I can choose between ECN, PRO, or Standard accounts based on my trading style and budget.

From a convenience perspective, the combination of desktop, web, and mobile access is one of the strongest parts of EC Markets. I can open positions on my computer and then watch them from the mobile app throughout the day. The syncing is smooth, and I haven’t experienced chart loading delays, which can be really annoying on other platforms.

EC Markets does a good job of making beginner traders feel comfortable. The onboarding felt pretty simple, and the interface doesn’t require a steep learning curve. I also appreciate that deposits don’t require a massive upfront amount, making it easier for new traders to start small and test the waters without too much pressure.

One thing I like is the flexible leverage they provide — it gives traders more room to build different strategies. Of course, leverage comes with risks, but having the option is great if you know how to manage your positions. The platform also seems stable with no big glitches so far, which adds to the confidence factor.

What I appreciate about EC Markets is that it doesn’t overwhelm you, even though it offers a wide product range. You can trade forex, commodities, crypto, and indices all in one dashboard, which makes it easy to diversify. The app also works surprisingly well, so I can monitor open trades on my phone while I’m away from my laptop, which is a huge plus for me.

I’ve been exploring EC Markets for a while, and what stands out to me is how smooth the actual trading experience feels. Order execution is fast, and I barely notice delays even during busy market hours. The platform layout is clean, and switching between assets like forex, metals, and indices is straightforward. It’s definitely convenient for someone who prefers a single place to manage multiple markets.

The educational resources and market updates are a nice touch, especially for traders who want some guidance or just like staying updated. I don’t rely on them exclusively, but having everything in one place — prices, charts, news, and analysis — definitely makes daily trading more efficient.

The user interface feels modern and relatively intuitive, especially compared to older platforms that still look like software from the early 2000s. Charts load fast, and customization options are easy to adjust. It’s not overly complex, which is helpful for traders who care more about execution than unnecessary extras.

For traders concerned about risk, EC Markets advertises negative-balance protection, which is reassuring. It means you shouldn’t end up owing money if the market moves against you extremely fast. This type of feature is something I always look for because it helps reduce the stress of trading volatile assets.

appreciate that EC Markets provides access to a broad mix of global markets instead of limiting you to just forex. This makes it easier to switch strategies depending on current market trends. Some days I mainly trade currencies, while other days I look at oil, indices, or even crypto pairs, and the transition feels seamless.

One thing I’ve noticed is that EC Markets seems to offer pretty stable performance even during high volatility. Price feeds update quickly, and orders don’t lag the way they sometimes do on cheaper or poorly designed platforms. This type of reliability matters a lot when trading fast-moving markets like gold or crypto

I can say that the platform feels optimized for both new and more advanced traders. For example, it supports automated trading strategies, which I find useful when testing EAs on VPS setups. At the same time, the interface isn’t cluttered, so beginners won’t feel lost. It strikes a good balance between usability and functionality.

I like that EC Markets keeps things accessible to traders from different experience levels. Beginners don’t get overwhelmed, yet experienced traders still get high-level tools and low-cost execution.

After using EC Markets for some time, I feel comfortable recommending it to traders who want a reliable, competitive, and steady trading experience. It’s not perfect, but overall it’s one of the better brokers I’ve worked with.

I feel that the platform is particularly friendly toward traders who use strategies that require tighter spreads. Their ECN account has been quite competitive, especially on pairs like EURUSD and GBPUSD. It gives me more room to work with when scalping.

Customer service is something I judge brokers strongly on, and EC Markets did better than I expected. Every time I reached out through live chat, the responses were fast and reasonably helpful, not the generic scripted replies you get from some places.

I like how EC Markets offers different account types tailored for different levels of traders. When I started, the standard account worked well for learning, and later I upgraded to ECN for better pricing. The transition was smooth and hassle-free.

The platform feels like it was designed with both beginners and experienced traders in mind. Everything is clean and organized, but there are also advanced tools and detailed settings for those who want to customize their trading environment.

The wide range of payment methods makes the whole funding process convenient. I used an e-wallet, and deposits appeared instantly, making it easy to jump right back into trading whenever I wanted.

The economic calendar and market insights on their site are handy. They aren’t overly technical, but they give enough detail to understand what’s happening in the market and prepare for potential volatility.

I appreciate that EC Markets offers competitive spreads without forcing users to meet ridiculous deposit requirements. You can start with a manageable amount and still get good trading conditions.My trades have been executed quickly overall. Even when I placed orders during active sessions, I didn’t experience the kind of delay or freeze that can ruin a trading plan. It’s definitely one of the steadier brokers I’ve used.

The broker feels secure enough for everyday trading. Their trading conditions are clear, and spreads don’t jump too much. Customer support isn’t the fastest, but they do respond and solve issues.

I appreciate the competitive spreads on ECMarkets. Even during high-volume sessions, the cost stays acceptable. The interface is simple, and everything loads quickly on both phone and PC.

The platform feels reliable overall. ECMarkets offers several account types, which is nice if you want to change your trading style later. I didn’t have issues with deposits or basic withdrawals so far.

My experience with ECMarkets has been mostly positive. Deposits are quick, and the platform is stable during busy market times. The trading conditions are good, and customer service is helpful when I need updates.

I’ve been using ECMarkets for a while, and overall it feels like a solid broker. The platform is simple, spreads are low, and trades execute fast. I like that they support both MT4 and MT5, so I can switch between devices easily. Regulation from multiple regions also makes me feel safer with my funds. Withdrawals take some time but have been reliable so far. For everyday trading, it’s a steady and cost-effective option.

Please avoid this broker, I was scammed by them they keep asking for more money until I realised myself and refused to pay

Hello, in order to get to know an account system in Ec Markets, I skipped the KYC authentication tab in the first membership process, then I continued the transactions and made a certain amount of profit. When I wanted to withdraw money, they told me that I could not withdraw money because there was no authentication. I immediately recorded my ID photos and information, but no, you are a suspicious account, the money in your account They asked me to deposit a deposit of 30%, at this stage my trust was shaken. Do you think it is right to ask for a deposit for identity verification? Are Ec markets reliable?