- What is easyMarkets?

- easyMarkets Pros and Cons

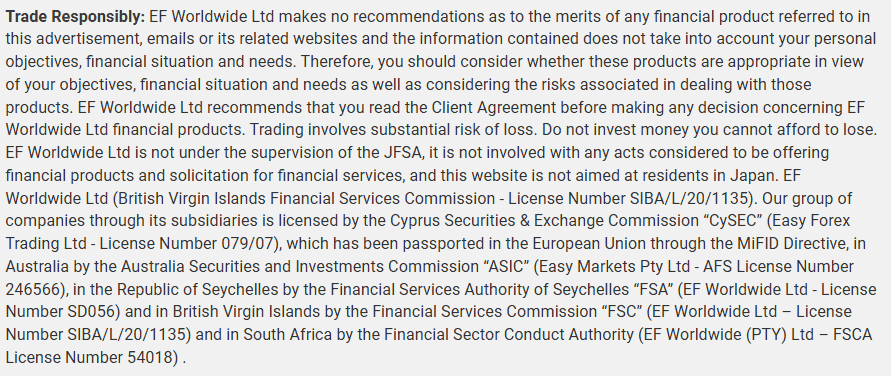

- Regulation and Security Measures

- Account Types and Benefits

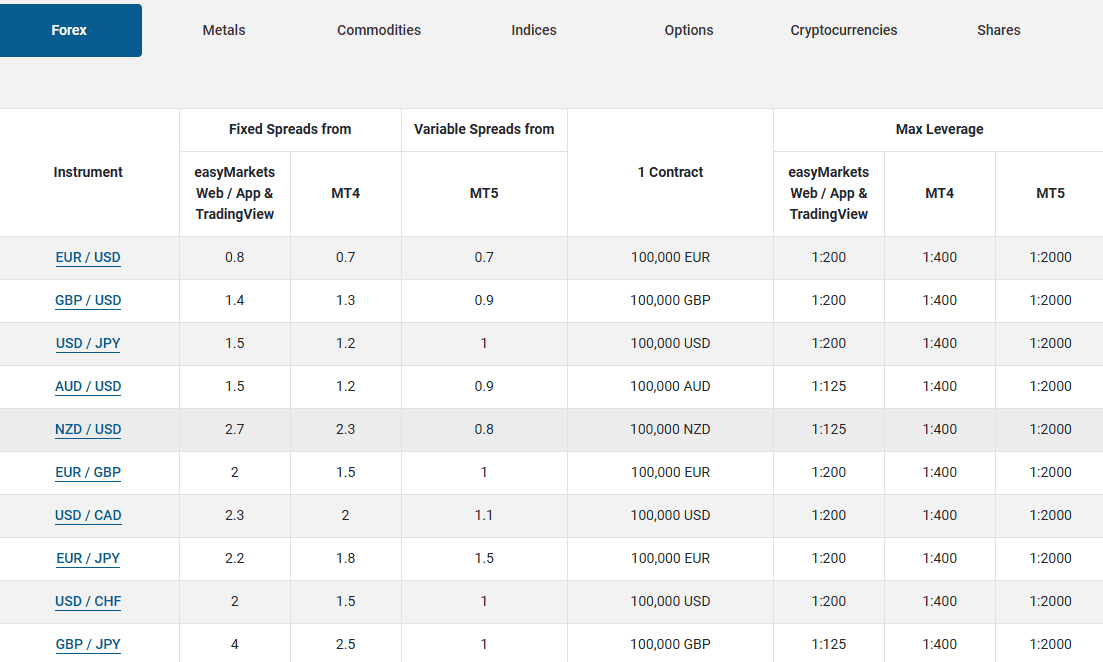

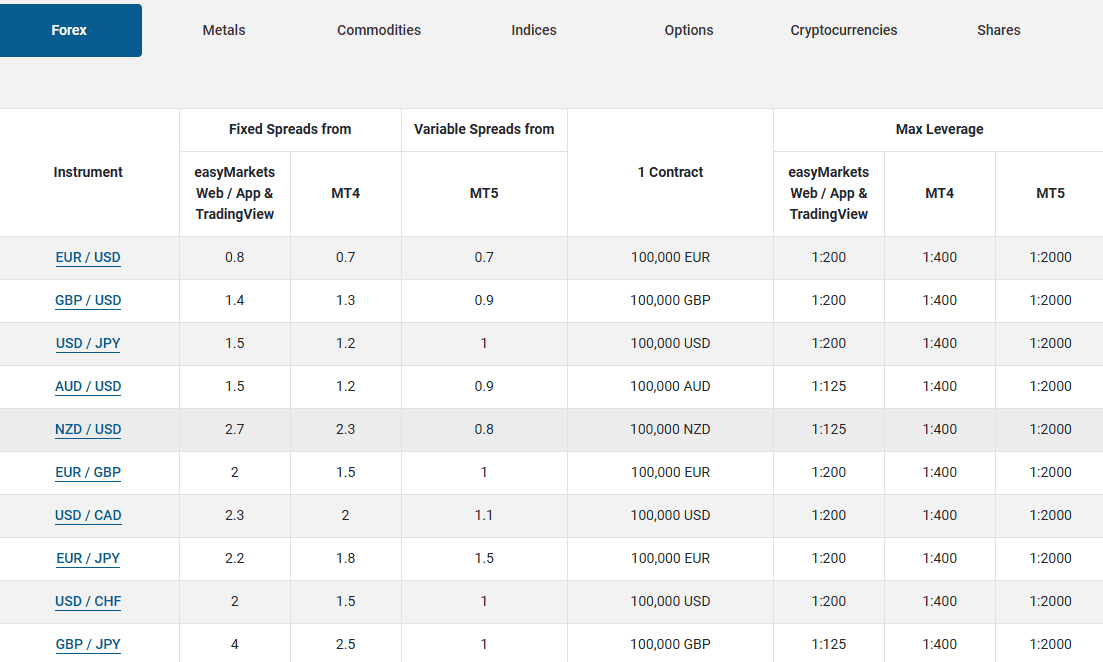

- Cost Structure and Fees

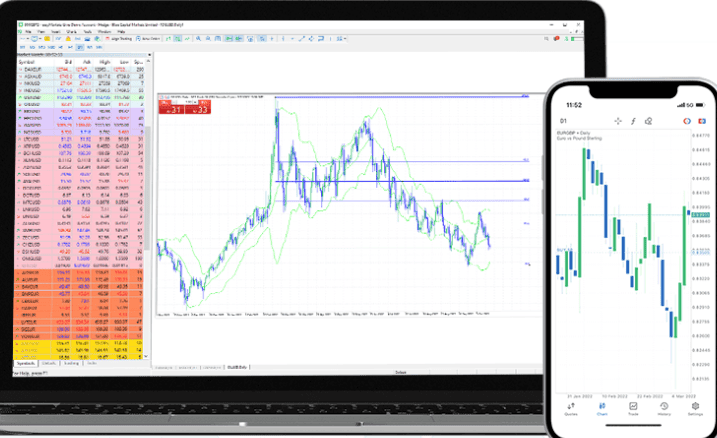

- Trading Platforms and Tools

- Trading Instruments

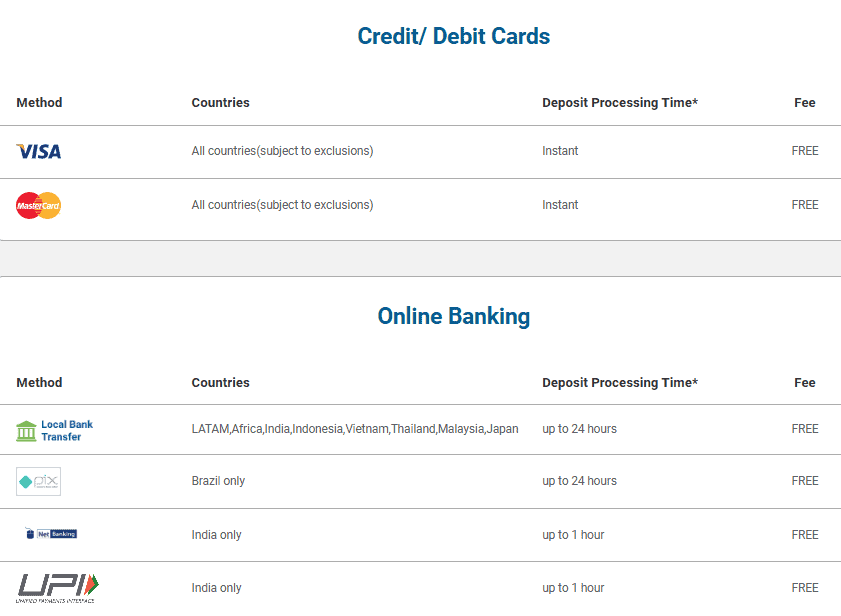

- Deposit and Withdrawal Options

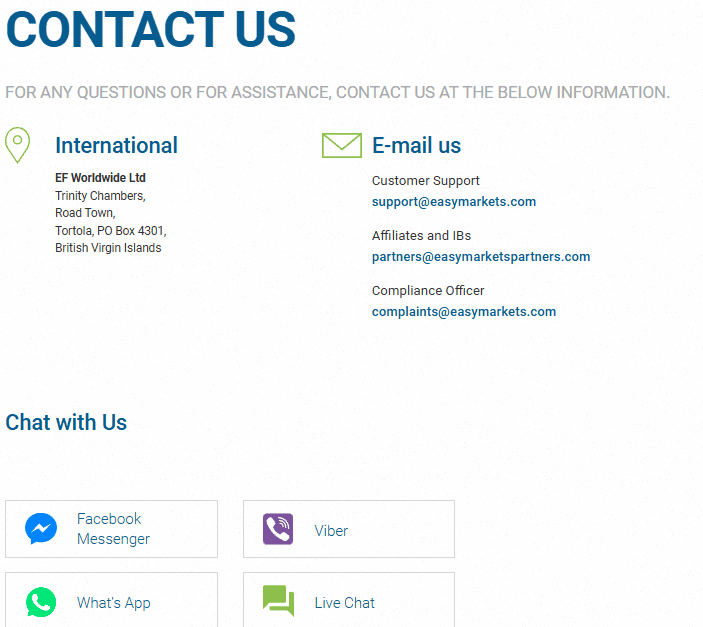

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- easyMarkets Compared to Other Brokers

- Full Review of Broker easyMarkets

Overall Rating 4.5

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.4 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 3.7 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is easyMarkets?

easyMarkets is a Cyprus-based Forex trading firm and Broker that started its operation back in 2001 and was one of the first to offer online trading at their developed user-friendly platform.

easyMarkets offices are located in Shanghai, Sydney, and Limassol (Cyprus), as well as the Marshall Islands, to be able to offer services globally and provide personal customer service.

- The company strives to deliver trustful trading conditions in response to market volatility, with a fixed spread and no slippage. Thus, the traders always know their costs.

Over the years of expansion, easyMarkets’ CFDs offering has expanded to include Forex instruments, global indices, energies, metals, and cryptocurrencies, including Bitcoin, Ripple, and Ethereum.

easyMarkets Pros and Cons

Our experts found that easyMarkets excels in many aspects of the services it provides, including easy account opening, a wide range of instruments, good education and research tools, also, different platform availability. Fees and spreads are mainly in line with the industry average. The minimum deposit offered by the broker is also on the lower side for the industry. Overall, our experience with easyMarket can be considered positive.

For Cons, there aren’t so many in our opinion. The broker has no 24/7 support, also the instrument range is limited to Forex and CFDs. Among other things, the broker’s conditions might vary based on the entity.

| Advantage | Disadvantage |

|---|

| Multiply regulated broker with a strong establishment | Only Forex and CFDs

|

| Great technical solutions, tools, platforms | No 24/7 support

|

| Good Reputation | Conditions vary based on entity

|

| Quality education | |

| Negative balance proteciton | |

| Regulated by ASIC and CySEC | |

| Competitive trading conditions | |

easyMarkets Features

easyMarkets is a broker that has been in operation for many years now, offering constantly improved trading conditions, and providing a secure environment protected by tight rules and guidelines. We have considered all aspects of trading with easyMarkets and have compiled them into ten main points for traders to have a quick look at.

easyMarkets Features in 10 Points

| 🗺️ Regulation | ASIC, CySEC, FSCA, FSC |

| 🗺️ Account Types | easyMarkets Web/App and TradingView, MT4 VIP/Premium/Standard, MT5 |

| 🖥 Trading Platforms | MT4, MT5, TradingView, Mobile App |

| 📉 Trading Instruments | Forex instruments, global indices, energies, shares, metals and cryptocurrencies |

| 💳 Minimum deposit | $25 |

| 💰 Average EUR/USD Spread | 0.8 pips |

| 🎮 Demo Account | Provided |

| 💰 Account Base currencies | Various currencies supported |

| 📚 Trading Education | Education and research included |

| ☎ Customer Support | 24/5 |

Who is easyMarkets For?

Based on Our findings and Financial Expert Opinions, easyMarkets focuses on providing a favorable trading environment, offering a range of conditions and features that will suit the trading expectations of all types of traders. easyMarkets will be a good choice for the following:

- Beginning Traders

- Professional Traders

- Algorithmic or API Traders

- EAs running

- Scalping / Hedging Strategies

- Traders who prefer the MT4 or MT5 platforms

- TradingView Enthusiasts

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

easyMarkets Summary

The easyMarkets review shows a brokerage company with a long operational history and transparent trading conditions. easyMarkets is a market-making broker ensuring stable trading conditions to their client under any market conditions and even extreme volatility. The range of account types and advanced software features are also great benefits available to all easyMarkets clients, which is worth consideration.

As for trading instruments, the broker does seem to provide a limited range, but the great conditions along with tight spreads and low trading costs make it a demanded broker among beginners and advanced traders alike.

55Brokers Professional Insights

easyMarkets has been in operation for over two decades, and is quite known among traders community. The broker expands its services on a constant basis and provides quality trading conditions to clients globally, making them suitable for various size or level of traders.

The trading conditions we mark as good, supporting a variety of trading platforms, also offering a good range of accounts based on platforms, besides offering competitive fees with both fixed and floating spreads so is good for traders who have various preferences so you may choose the best match. However, there are no commission based account, if this is your choice, then look for other broker.

Overall, with a focus on technology and advanced features, easyMarkets becomes a good choice for professional traders, while the availability of extensive educational resources makes the broker a great choice for beginners. Low minimum deposits, no commissions on trades, and protection measures in place add to the appeal of easyMarkets, making it a favorable option for everyone.

Consider Trading with easyMarkets If:

| easyMarkets is an excellent Broker for: | - Beginner traders

- Those who prefer transparent and consistent trading costs

- Professional traders

- Those who prefer the MT4/MT5 platforms

- Forex and CFD traders

- Algorithmic or API Traders |

Avoid Trading with easyMarkets If:

| easyMarkets is not the best for: | - Traders looking for an extensive range of instruments

- Clients who prefer 24/7 customer support

- Those who prefer commission-based fee structure |

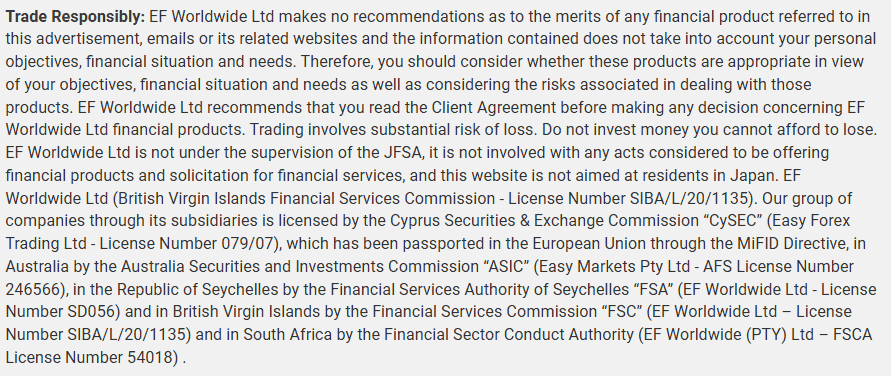

Regulation and Security Measures

Score – 4.6/5

easyMarkets Regulatory Overview

The company’s trading name is Easy Forex Trading Limited, a Cyprus-established financial firm regulated by CySEC in Europe, that complies with the MiFID set of rules. This means its operational standards enable it to provide legal services to clients in the EEA zone and beyond. The broker is also regulated by the well-regarded authority – the Australian Securities and Investments Commission (ASIC) which further solidifies the broker’s reliability.

- The broker also holds a license from the South Africa FSCA, another well-regarded authority in the region, that enables easyMarkets to expand its reach even further.

- Besides, EasyMarkets is located in the Marshall Islands which does not provide strict oversight to financial firms, but since it is regulated by the ASIC and CySEC, the broker is considered trustworthy.

How Safe is Trading with easyMarkets?

easyMarkets strives to provide transparent, trusted, and regulated financial services. The regulatory commitment requires the utmost level of security in various ways and includes clients’ safety of funds to assure integrity and safe performance.

- This is done by the client money segregation, participation in a scheme in case of the company insolvency and strict operational standards constantly audited, which may be slightly diverse according to its obligations.

Consistency and Clarity

Over the years easyMarkets has shown consistency in growing as a broker and developing its services, delivering worldwide. The broker’s incessant operation of over 20 years is another proof of the legibility and trust it has among its clients. We found that the broker is transparent in its services, offering clarity in fees and overall offering.

Since easyMarkets has proved itself as a reputable and favorable broker, it has gained multiple awards and good reviews from both clients and market experts. Each year the broker gains more and more recognition across the globe and various awards for its operation. As to real reviews from clients, we found mixed reviews, with some traders being happy with the experience, emphasizing different positive aspects, such as the customer-oriented approach of broker. Others, still have something to say about withdrawal delays and other experiences they found negative. Yet, both good and negative reviews are an individual experience of traders and should be considered equally before making an informed decision to start with the broker.

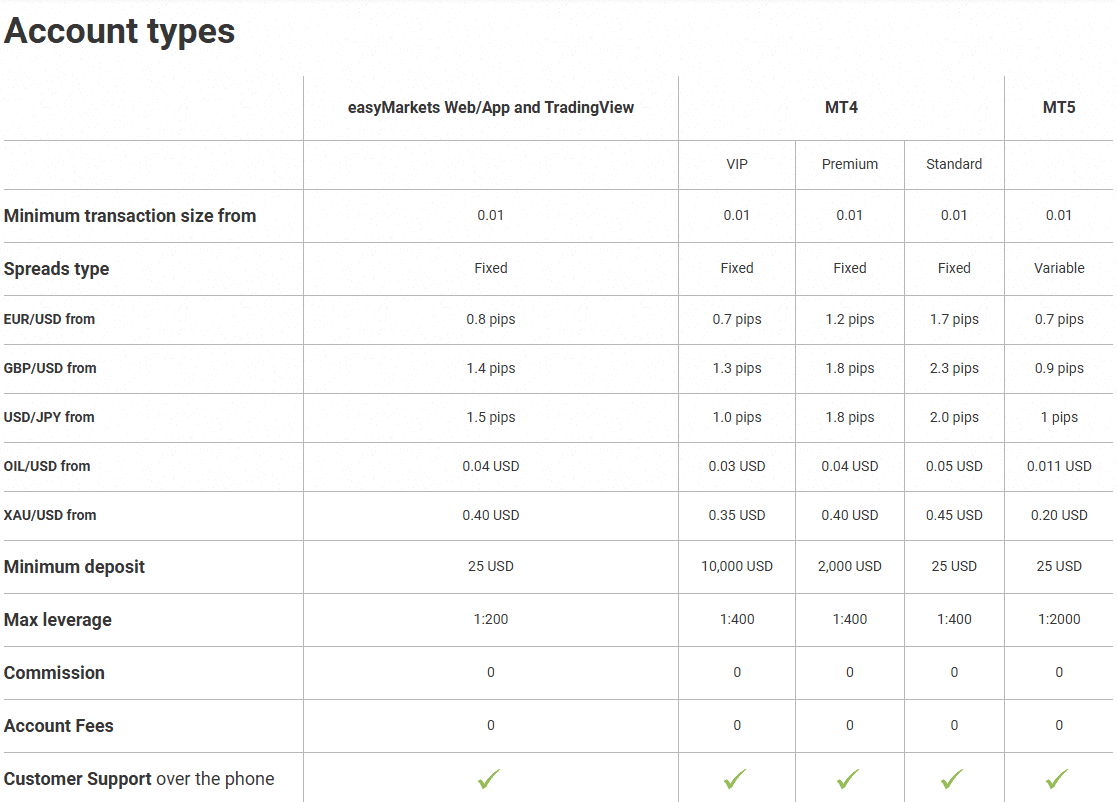

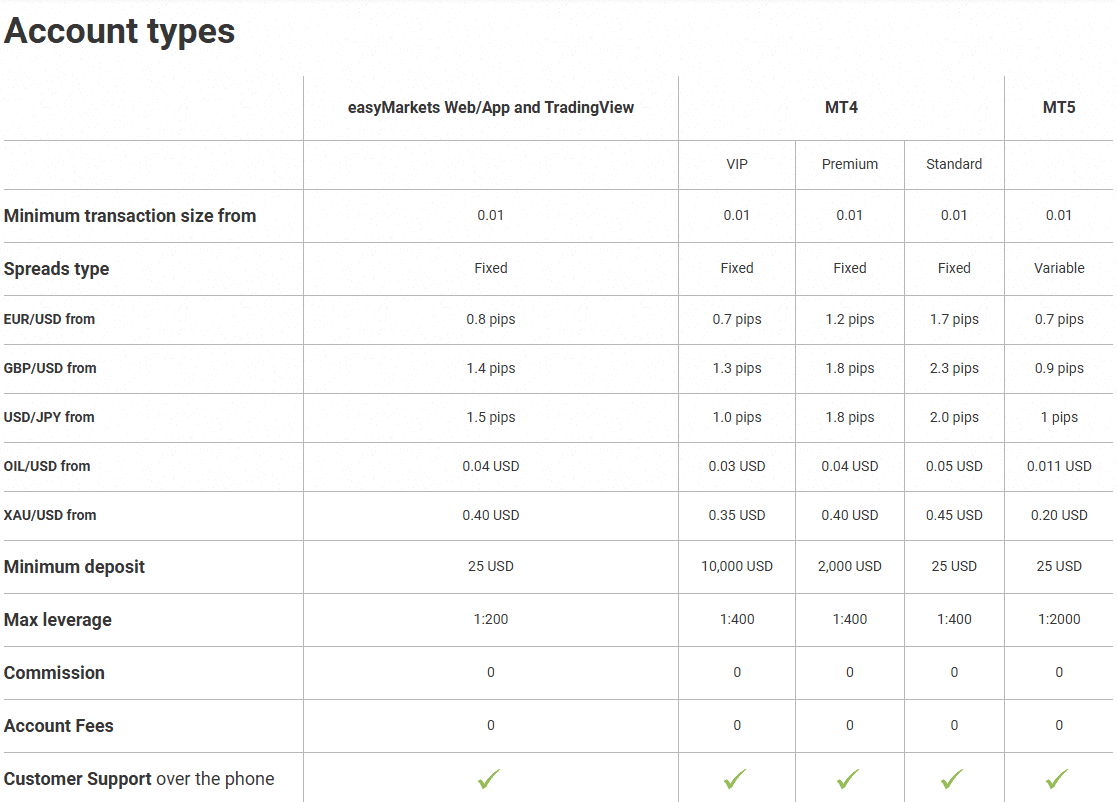

Account Types and Benefits

Score – 4.4/5

Which Account Types Are Available with easyMarkets?

easyMarkets offers several account types, based on the platforms. The accounts are developed to meet the individual needs of clients, giving them access to good trading conditions. For all its accounts easyMarkets offers fixed spreads, except for the MT5 account, which offers floating spreads. Another common feature among the accounts is that they are all spread-based, with fees fully integrated into spreads and no additional transaction fees. All the accounts have access to 24/5 phone and live chat trading.

easyMarkets Web/App and TradingView Account

To open this account type the minimum deposit requirement is $25, which makes the proposal favorable for beginner traders who prefer to start small. With fixed spreads, no commissions, and an average spread of 0.8 pips for the EUR/USD pair, this is a cost-efficient option. The account provides Guaranteed stop-loss and Negative balance protection. In addition, clients have access to fundamental analysis and daily technical analysis for a more enhanced trading experience. The available leverage is up to 1:200.

MT4 Standard Account

The MT4 Standard account offers fixed spreads with an average of 1.7 pips spread. The leverage for this account is up to 1:400. The account supposes a personal account manager, 24/5 support, and Negative balance protection. The minimum deposit for the MT4 Standard account is $25.

MT4 Premium Account

With a minimum deposit of $2.000, available leverage up to 1:400, and fundamental and technical analysis provided, the account is suitable for more experienced traders who want to try new strategies. The spreads are fixed, with an average of 1.2 pips for the EUR/USD pair.

MT4 VIP Account

The MT4 VIP account has a higher deposit requirement of $10,000. The account offers fixed spreads that are on the lower side, with no commissions. The EUR/USD spread for the account is 0.7 pips, which is lower than the market average, especially when there are no other fees applied. With a multiplier of up to 1:400, a Trading Central Indicator, and dedicated customer support, the account will be adequate for professional traders who seek lower prices and more opportunities.

MT5 Account

Opposed to all the other easyMarkets accounts, the MT5 account offers variable spreads, much higher leverage opportunity that reaches up to 1:2000, a low initial deposit of $25, and advanced trading tools and features that are available on the MT5 platform and enables traders to try out new strategies, advantage of automated trading, and in-depth market analysis.

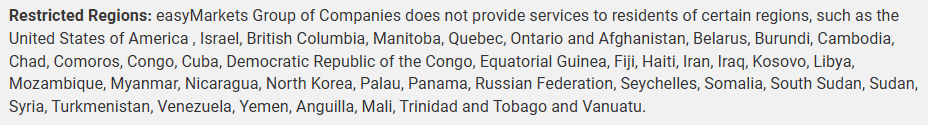

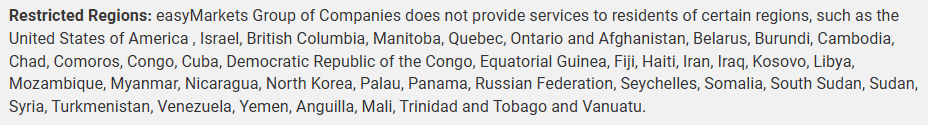

Regions Where easyMarkets is Restricted

Although easyMarkets is an international broker, offering its services worldwide, the broker still imposes some geographical limitations due to regulatory restrictions. Below is the list of the countries the broker does not provide its services to:

- the United States of America

- Israel

- British Columbia

- Manitoba

- Quebec

- Afghanistan

- Belarus

- Burundi

- Cambodia

- Chad

- Comoros

- Congo

- Cuba

- Democratic Republic of the Congo

- Equatorial Guinea

- Fiji

- Haiti

- Iran

- Iraq

- Kosovo

- Libya

- Mozambique

- Myanmar

- Nicaragua

- North Korea

- Palau

- Panama

- Russian Federation

- Seychelles

- Somalia

- South Sudan

- Sudan

- Syria

- Turkmenistan

- Venezuela

- Yemen

- Anguilla

- Trinidad and Tobago

- Vanuatu

Cost Structure and Fees

Score – 4.5/5

easyMarkets Brokerage Fees

easyMarkets offers a competitive fee structure, with costs that are either average or on the lower side if compared to other brokers. The fee structure the broker offers is spread-based, and, depending on the account type, either fixed or floating.

While researching easyMarkets spreads, we discovered that the broker’s accounts are based only on spreads. This means that there are no commissions, and all the costs are already integrated into spreads. Here is what we found in more detail:

Fixed spreads for the easyMarkets Web/App and TradingView account – EUR/USD – 0.8 pips, OIL/USD – $0.04, XAU/USD – $0.40

Fixed spreads for the MT4 Standard account – EUR/USD – 1.7 pips, OIL/USD – $0.05, XAU/USD – 0.45 USD

Fixed spreads for MT4 Premium account – EUR/USD – 1.2 pips, OIL/USD – $0.04, XAU/USD – $0.40

Fixed spreads for MT4 VIP account – EUR/USD – 0.7 pips, OIL/USD – 1.0 pips, OIL/USD – $0.03, XAU/USD – $0.35

Variable spreads for the MT5 account – EUR/USD – 0.7 pips, OIL/USD – $0.011, XAU/USD – $0.20

Based on our research, the broker does not charge commissions or other transaction fees, and all costs are included in spreads. This might be a disadvantage for traders who prefer very low spreads with fixed commissions.

How Competitive Are easyMarkets Fees?

In fact, easyMarkets fees are quite competitive, offering traders a good variety due to the several account types available and consequently the difference in applied costs based on the account type. The broker does not charge any commissions, and all the costs are included in spreads. The spreads easyMarkets offers are fixed or variable, and considerably low for some accounts when compared to the market average, which is good for traders flexibility aand personal preference.

The absence of commission fees might disengage clients who prefer a commission-based structure, where each trade assumes a fixed transaction fee. However, even in this case, the broker gives traders a good range of options and the opportunity to trade with clear and low spreads.

| Asset | easyMarkets Spreead | Capital.com Spread | Fortrade Spread |

|---|

| EUR USD Spread | 0.7 pips | 0.6 pips | 2 pips |

| WTI Crude Oil Spread | 0.04 USD | 0.4 | 0.04$ |

| Gold Spread | 0.40 USD | 0.03 | 0.45$ |

easyMarkets Additional Fees

As for additional fees, easyMarkets charges an inactivity fee of $25 if the account has been dormant for 12 successive months. This fee is charged every six months until there is trading activity or the balance goes to zero. Accounts with a zero balance may not be subject to this inactivity fee, but the broker might impose it at its discretion. Also, we found that easyMarkets doesn’t charge any fees when you fund or withdraw from your account, which is a positive thing.

Score – 4.5/5

The diversity of easyMarkets’ trading platforms is another advantage of the broker. Besides the industry-popular MT4 and MT5 platforms, the broker also gives access to the TradingView platform, and access to mobile apps for a more flexible trading experience.

| Platforms | easyMarkets Platforms | XM Platforms | Pepperstone Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platform | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

easyMarkets Web Platform

As easy access to the platform and own accounts is essential for clients, easyMarkets ensures this with its dedicated web platform, that offers a seamless trading experience. The platform is packed with unique tools such as Free Guaranteed Stop Loss and Take Profit, tools that provide risk management options. Through the broker’s web trader clients can trade on any internet-enabled device, from anywhere with an internet connection. With a simple interface, good analytical tools, and over 275 instruments available, the platform will be a good fit for different trading needs. At last, with zero slippage trades are executed at the quoted price, ensuring additional transparency and reliability.

easyMarkets Desktop MetaTrader 4 Platform

MetaTrader 4 is a preferred platform for many beginner and advanced traders. Due to its simple interface, it can be suitable for beginner traders who will appreciate the ease of navigating the platform, while it will appeal to advanced traders for its versatility and extensive features. The platform offers one-click CFD trading and pre-installed indicators, extensive tools for in-depth analysis, and enhancing traders’ experience. Besides, clients have access to 150+ markets, such as currencies, metals, commodities, indices, cryptocurrencies, and shares. Traders also gain access to historical data, back-test their strategies, and use Expert Advisors for automation of trades. The MT4 platform also enables accessibility and flexibility as it is available on multiple devices, including iPhone, iPad, Android, and PC.

easyMarkets Desktop MetaTrader 5 Platform

The MT5 platform enables flexible trading with fast execution and innovative solutions. The platform is especially favored by experienced traders who appreciate its advanced and customizable tools. The availability of 21 chart timeframes, 38 built-in technical indicators, and Expert Advisors enables traders to conduct deep market research. One of the peculiarities of the EasyMarkets’ MT5 platform is that it supports variable spreads starting from 0.7 pips. In addition, with an availability of over 20 years of historical data and back-testing options, and of course, a very high leverage of up to 1:2000, the platform ensures advanced, innovative, and reliable trading experience.

Main Insights from Testing

Based on our comparison, both platforms are great, offering advanced tools and features, and good market conditions. The main difference between the broker’s MT4 and MT5 platforms is the spread. Whereas the MT4 platform offers solely fixed spreads, the MT5 platform has variable spreads starting at 0.7 pips. Besides, the MT5 platform also offers high leverage that can go up to 1:2000.

easyMarkets TradingView Platform

The easyMarkets TradingView offers a good variety of features, and easy navigation on the platform. It is a good option for clients favoring access to innovative tools. It ensures no slippage fixed spreads, and risk management tools, such as negative balance protection. The platform is effortlessly integrated with the broker’s app and web platform, allowing more flexibility.

easyMarkets MobileTrader App

The easyMarkets mobile app is a flexible solution for traders of every level. The app is a combination of good analysis tools and great trading tools that will serve traders who prefer trading on the go. With easy access to market news, macroeconomic calendars, and trading signals the app supports deep analysis, that enables clients to make use of the same conditions, with little difference from the desktop platform.

Trading Instruments

Score – 4.4/5

What Can You Trade on the easyMarkets Platform?

easyMarkets gives access to over 275 trading instruments across different assets, including Forex pairs, indices, shares, and commodities. The forex pairs are the first instruments the broker started back in 2001 when it was first established. easyMarkets offers minor, exotic, and major currency pairs. Besides, the broker gives access to the World’s most popular shares based on CFDs, enabling traders to speculate on the prices and gain profits. Here is the full list of the instruments easyMarkets offers its clients for trades:

- Forex instruments

- Global indices

- Energies

- Shares

- Metals

- Cryptocurrencies (including Bitcoin, Ripple, and Ethereum)

Main Insights from Exploring easyMarkets Tradable Assets

Although easyMarkets does not offer a wide range of instruments, it still gives access to a good range of assets, enabling diversity of products. We also noticed that different account types and platforms enable different ranges of instruments. The largest amount is available through the easyMarkets’ TradingView.

However, easyMarkets’ instruments are based only on CFDs, which means that the investment opportunities are limited with the broker, disabling them from trading real stocks and holding real shares.

Leverage Options at easyMarkets

EasyMarkets also enables traders to use powerful leverage, which may increase their potential gains by multiplying the initial account balance. Yet, it is essential to learn how to use multipliers smartly, as the incorrect use of high leverage increasess risks.

easyMarkets leverage levels depend on the instrument traded or platform used and are also defined by regulatory restrictions.

- Trading under the Australian ASIC traders can now use only 1:30

- European entity regulated by CySEC demands significantly lower levels due to ESMA restrictions, which offer only 1:30 for Forex instruments and 1:10 for Commodities.

- Opening an account under a global entity, traders can use high leverage of up to 1:2000, also the leverage level depends both on the account type and platform and the instrument traded.

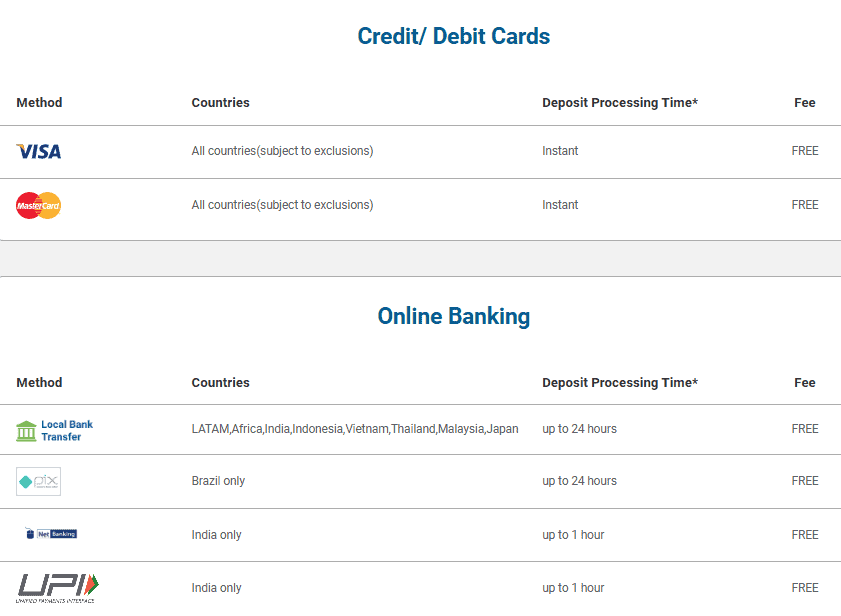

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at easyMarkets

Based on our findings, account funding is easy and straightforward at easyMarkets, and it is available through the client area. The multiple payment options include bank transfer, credit, debit, online cards, and a selection of eWallets: Sofort, Giropay, iDeal, WebMoney, BPAY, Neteller, Skrill, and Fasapay.

Minimum Deposit

easyMarkets minimum deposit requires $25 as a start, while bigger size accounts demand higher balance maintenance, which for VIP accounts is $10,000.

Withdrawal Options at easyMarkets

easyMarkets doesn’t charge any fees to fund or withdraw money from the account. The fees are covered for all easyMarkets payment methods, nevertheless, make sure to check with your payment provider in case fees will be waived from their side.

There is no minimum withdrawal amount for withdrawals through credit/debit cards and eWallets. For withdrawals to bank accounts, a minimum amount of $50 is required. All withdrawal requests are processed within 2 business days, yet depending on third-party processing times, it may take 3 to 10 business days before the funds reach your account.

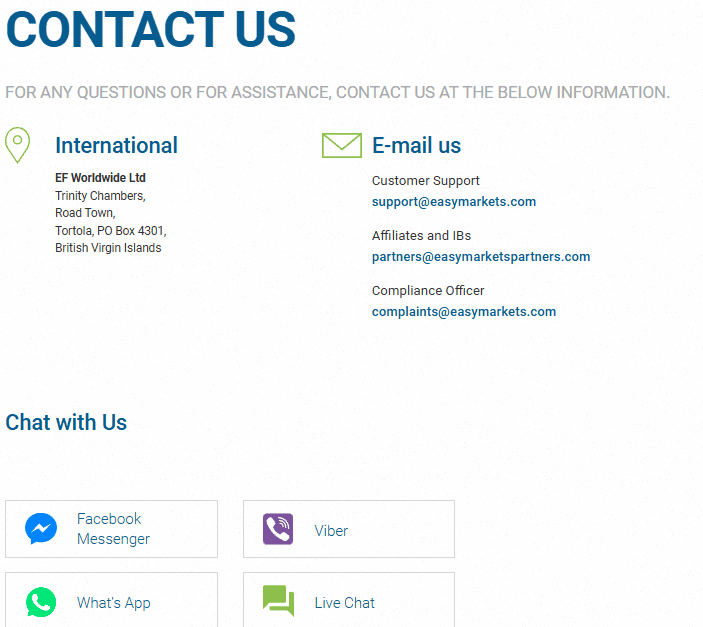

Customer Support and Responsiveness

Score – 4.5/5

Testing easyMarkets Customer Support

Based on our research, easyMarkets customer support is quick and relevant. The broker provides multichannel customer support via Live Chat, email, and phone. The main drawback is that it isn’t operating 24/7. The broker also provides support through Messenger, WhatsApp, and Viber.

- The FAQ section is also good, answering the most common questions that might arise while trading. So, traders can also refer to the section and find relevant answers.

Contacts easyMarkets

easyMarkets has helpful customer support, offering traders multiple methods of communication. In addition to live chat that provides prompt answers 24/5, the broker also offers the following options of support:

- Clients can send their issues and questions to the following email address: support@easymarkets.com

- easyMarkets also has social pages (Linkedin, FB, IG, YouTube) that are constantly updated with the company’s recent news and overall market events.

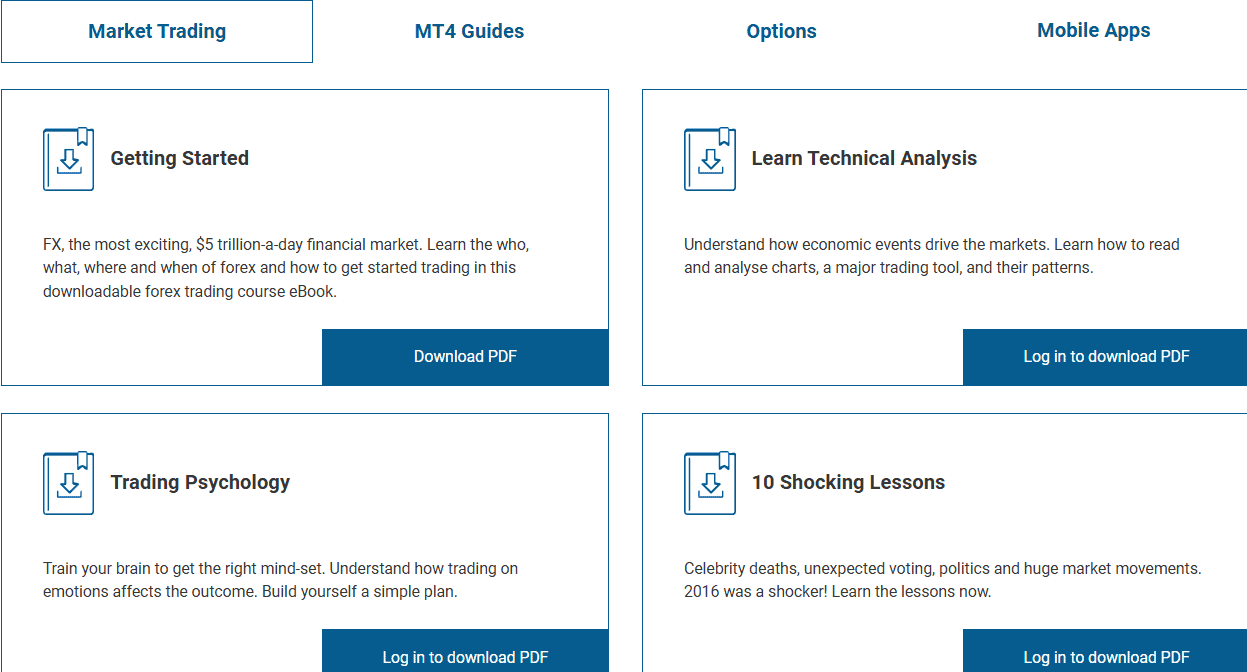

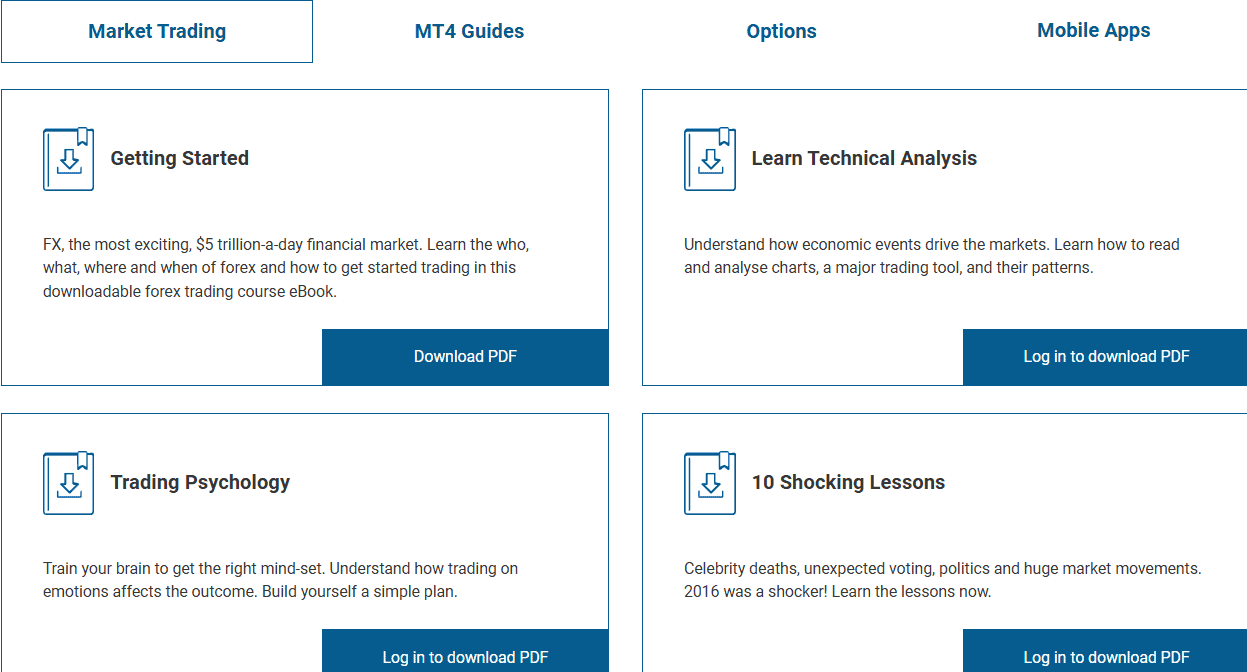

Research and Education

Score – 4.5/5

Research Tools easyMarkets

easyMarkets provides excellent analysis tools and features that are already integrated into its advanced platforms. In addition, there are several other tools traders can access through the brokers’s webpage. Here are a few research tools easyMarkets offers:

- Through its Market News section clients learn about the latest market events that hold significance and can impact the market in a certain way.

- Another powerful research tool is the trading chart, which will assist traders in technical analysis, revealing prices, historical price data, etc.

- Real-time market prices enable traders to better understand when to exit or enter a trade. Being aware of the prices is important to avoid unnecessary risks and plan future trading steps based on this knowledge.

Education

We also checked another important section – education and found that the broker offers a Trading Academy that will assist traders in performing even better in trading. A good range of trading courses, eBooks, Glossary, and other materials will considerably enhance trader’s knowledge and develop more market skills.

- Trading Glossary is an essential offering that is especially useful for beginner traders who surely come across multiple trading terms unknown to them. It makes the trading process easier, providing detailed explanations of every seemingly incomprehensible term.

- Trading courses start with an introduction to trading, moving on to more complicated topics that would be of use both for beginners and professionals. To gain full access to the courses, it is essential to first open a trading account with the broker.

- easyMarkets also offers an excellent selection of eBooks, that will guide traders from the start to more complicated strategies and other aspects of trading, from trading psychology to understanding how market changes impact trading.

Is easyMarkets a Good Broker for Beginners?

Our research of different aspects of trading with easyMarkets shows that the broker will be a good choice for beginner traders for a number of reasons. First of all, easyMarkets requires a very low initial deposit of $25, which is a good offering for just-starting cost-conscious clients. Besides, the availability of different account types gives traders the choice to choose the option that most meets their expectations. With an advanced, but at the same time easy-to-use platform, beginners will not be overwhelmed. In addition, easyMarkets educational resources are aimed at beginner and intermediate traders, offering guidance just from the start of their journey. So, to the question of whether the broker is good for beginners, the answer is a solid yes.

Portfolio and Investment Opportunities

Score – 3.7 /5

Investment Options easyMarkets

Investments are not easyMarkets’s strongest area, as all the instruments the broker offers are mainly CFD-based. This leaves little room for real investments and portfolio diversification.

- What is more, easyMarkets does not offer MAM/PAMM accounts, further restricting investment options. Copy trading is also not available through the broker. This means that traders who are looking for alternative ways to diversify their trades will face serious restrictions while trading with easyMarkets.

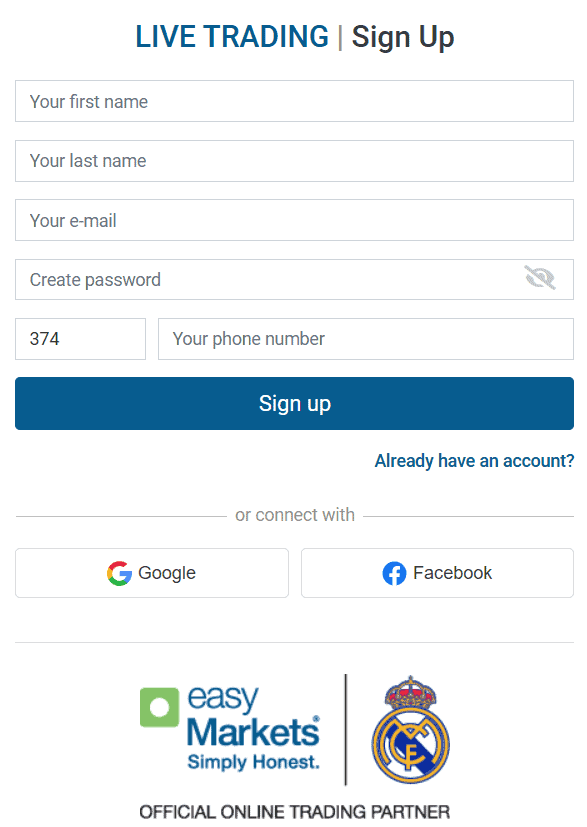

Account Opening

Score – 4.6/5

How to Open a Demo Account?

Opening a demo account with easyMarkets is a great way to get acquainted with the broker’s platform, and learn how to navigate it before switching to live trading. To open a demo account, clients need to follow several simple steps that will take them only a few minutes:

- Go to the broker’s website and choose ‘Try Demo Account’

- Fill out the form supplying the name, email, phone number

- Create a password

- Afterward, they will be redirected to the Demo Account Dashboard and start trading

How to Open an easyMarkets Live Account?

easyMarkets provides an easy, straightforward process of live account opening. Here are the main steps to follow:

- On the broker’s website choose the ‘Start Trading Today’ option

- Fill out the form with your name, email, and phone number, also, create a password

- Then receive an email to verify your email address

- Click on the link received to activate the account

- Provide additional documents to verify your identity

- After the registration is approved choose your account settings (platform, account type, currency, etc.)

- Deposit funds and start trading

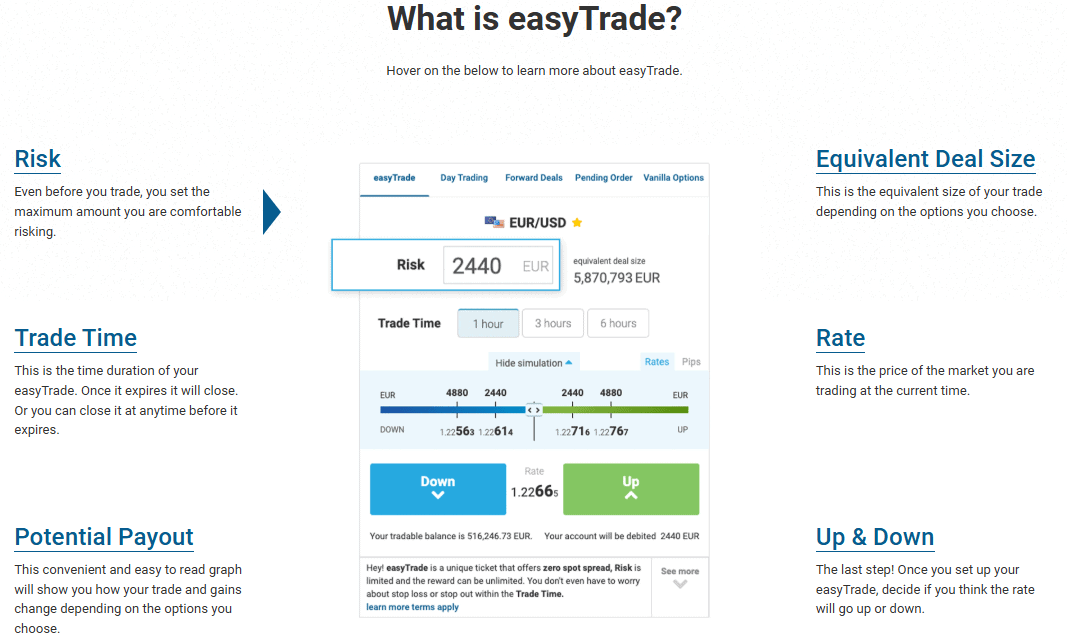

Score – 4.5/5

easyMarkets also offers several unique features that are meant to make trading easier and more flexible, enabling traders to explore the market without pressure and hindrances:

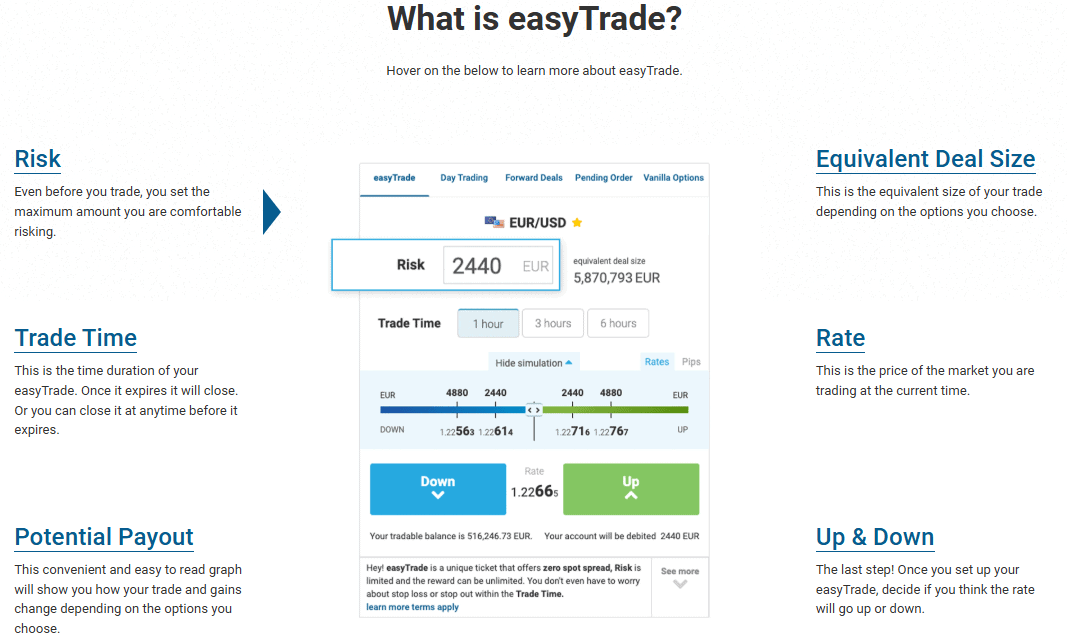

- easyMarkets easyTrade features is a unique proposal, developed to simplify trading and manage risk. With easyTrade, there are no spreads or margins applied to the trade. With easyTrade traders can set a Payout Target, automatically closing their trade when the predefined level has been reached, adding an extra degree of control and convenience.

- dealCancellation is another great tool available at easyMarkets. It gives traders a unique opportunity to cancel a losing trade after it is opened. This feature protects against short-term market turbulence or unexpected market occurrences. When a trade goes against the trader, with dealCancellation it is simply possible to cancel it and get the invested funds back.

- Freeze Rate allows traders to freeze the price for a few seconds to perform the trade. These couple of seconds might be essential for traders when they deal with the volatile Forex or Cryptocurrency markets.

easyMarkets Compared to Other Brokers

At last, we conclude our research by comparing easyMarkets to other well-regarded brokers in the industry. We first compared easyMarkets to Pepperstone, to see which broker offers better regulatory oversight. We found that easyMarkets with licenses from CySEC, ASIC, and FSCA, ensures strong oversight and compliance with international standards. Similarly, Pepperstone is highly regulated, holding licenses from ASIC, FCA, CySEC, and BaFin, with seemingly broader global regulatory coverage. Despite this, both brokers are still reliable with tight regulations and reliable practices.

When researching the fee structure, we found that easyMarkets offers tight fixed spreads with no hidden fees or commissions, which suits traders who prioritize predictability and safety. In contrast, Capital.com features variable spreads with no commissions on most accounts, making the offering beneficial for traders who favor dynamic pricing.

easyMarkets education section includes a range of resources, including a glossary, courses, and eBooks that are suitable mostly for beginners and intermediate traders. In this regard, Eightcap falls behind easyMarkets, with less comprehensive educational materials compared to it.

At last, we compared the instrument availability of different brokers to discover that easyMarkets offers access to over 275 instruments, including forex, commodities, indices, cryptocurrencies, and shares, with fixed spreads. On the other hand, BlackBull Markets is not only ahead of easyMarkets with its extensive range of instruments, but most other brokers as well with its impressive 26,000 tradable instruments.

| Parameter |

easyMarkets |

FP Markets |

Capital.com |

Pepperstone |

BlackBull Markets |

Eightcap |

FXGT.com |

| Spread Based Account |

Average 0.8 pip |

From 1 pip |

Average 0.6 pip |

Average 0.7 |

From 0.8 Pips |

Average 1 pip |

Average 1.2 pip |

| Commission Based Account |

Not available |

0.0 pips + $3 |

Not available |

0.0 pips + $3.50 |

0.1 pips + $3 |

0.0 pips + $3.5 |

0.0 pips + $3 |

| Fees Ranking |

Low |

Low/ Average |

Low |

Average |

Low |

Average |

Average |

| Trading Platforms |

MT4, MT5, TradingView, Mobile App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

Capital.com CFD platform, MT4, TradingView |

MT4, MT5,cTrader, TradingView |

MT4, MT5, cTrader, TradingView |

MT4, MT5, TradingView |

MT4, MT5 |

| Asset Variety |

275+ instruments |

10,000+ instruments |

3000+ instruments |

1,200+ instruments |

26000+ instruments |

800+ instruments |

1000+ instruments |

| Regulation |

ASIC, CySEC, FSC |

ASIC, CySEC, FSCA, CMA |

CySEC, FCA, ASIC, FSA |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

FMA, FSA |

ASIC, SCB, CySEC, FCA |

FSCA, FSA, VFSC, CySEC |

| Customer Support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

24/7 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Excellent |

Good |

Good |

Good |

| Minimum Deposit |

$25 |

$100 |

$20 |

$0 |

$0 |

$100 |

$5 |

Full Review of Broker easyMarkets

With over two decades of operation in the market, easyMarkets has gained a reputation of a reliable broker with rigorous regulatory oversight from well-regarded authorities, such as ASIC, CySEC, and FSCA. easyMarkets provides a secure trading environment offering its services to both beginners and seasoned traders. The broker mostly offers a fixed spread and no-slippage policy, with no additional commissions or transaction fees. The broker offers over 275 trading instruments across a range of trading assets, from forex to indices, metals, cryptocurrencies, and energies, that are mainly CFD-based.

In addition to its cost-efficient fees and tight regulations, easyMarkets appeals to traders for its great trading conditions, advanced and unique features such as easyTrade and dealCancellation, as well as for its support of the popular MT4, MT5, and TradingView platforms. The broker also offers a Trading Academy to its clients, with resources more favorable for beginner or intermediate traders. The broker also offers client-orientated 24/5 customer service through different channels, which we also found quite satisfying.

Share this article [addtoany url="https://55brokers.com/easymarkets-review/" title="easyMarkets"]