- What is Earn?

- Earn Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

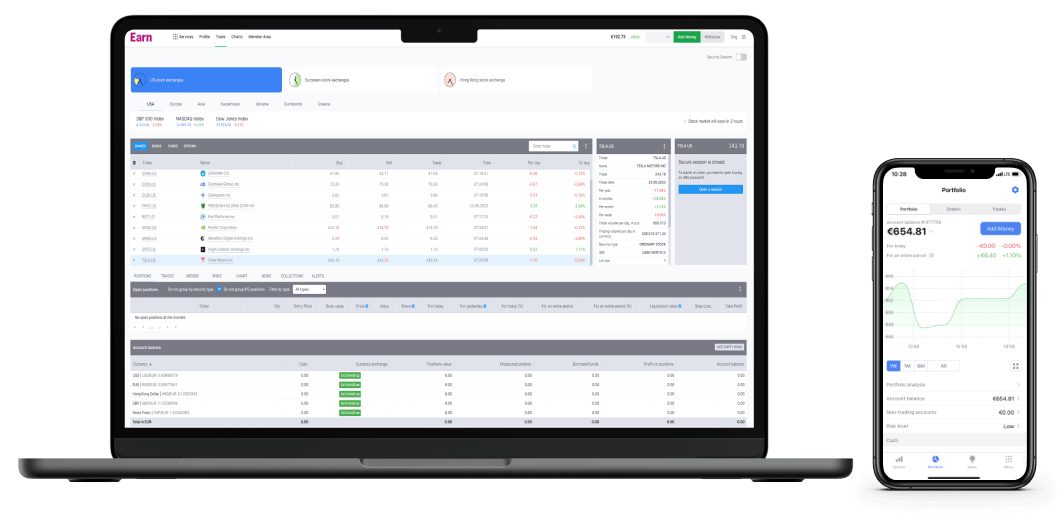

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

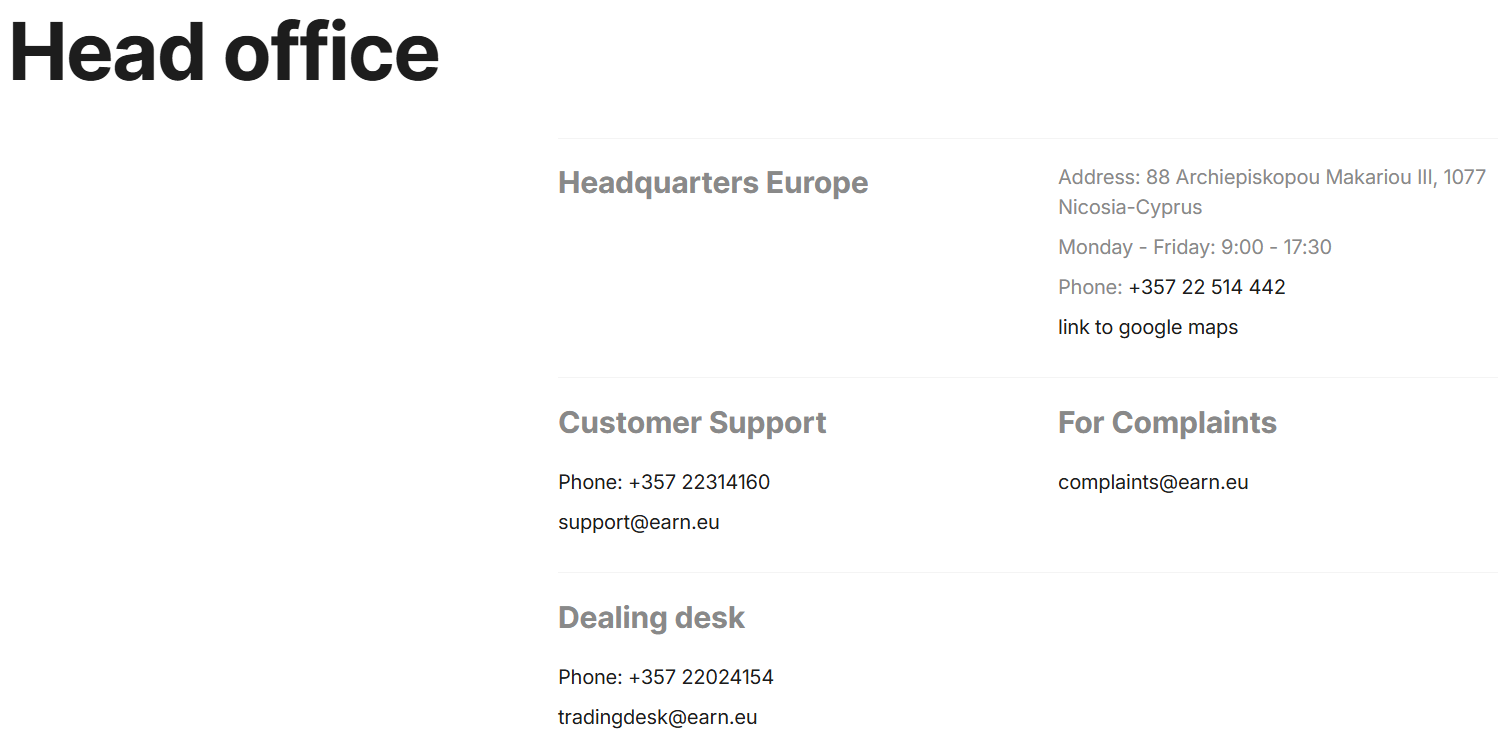

- Customer Support and Responsiveness

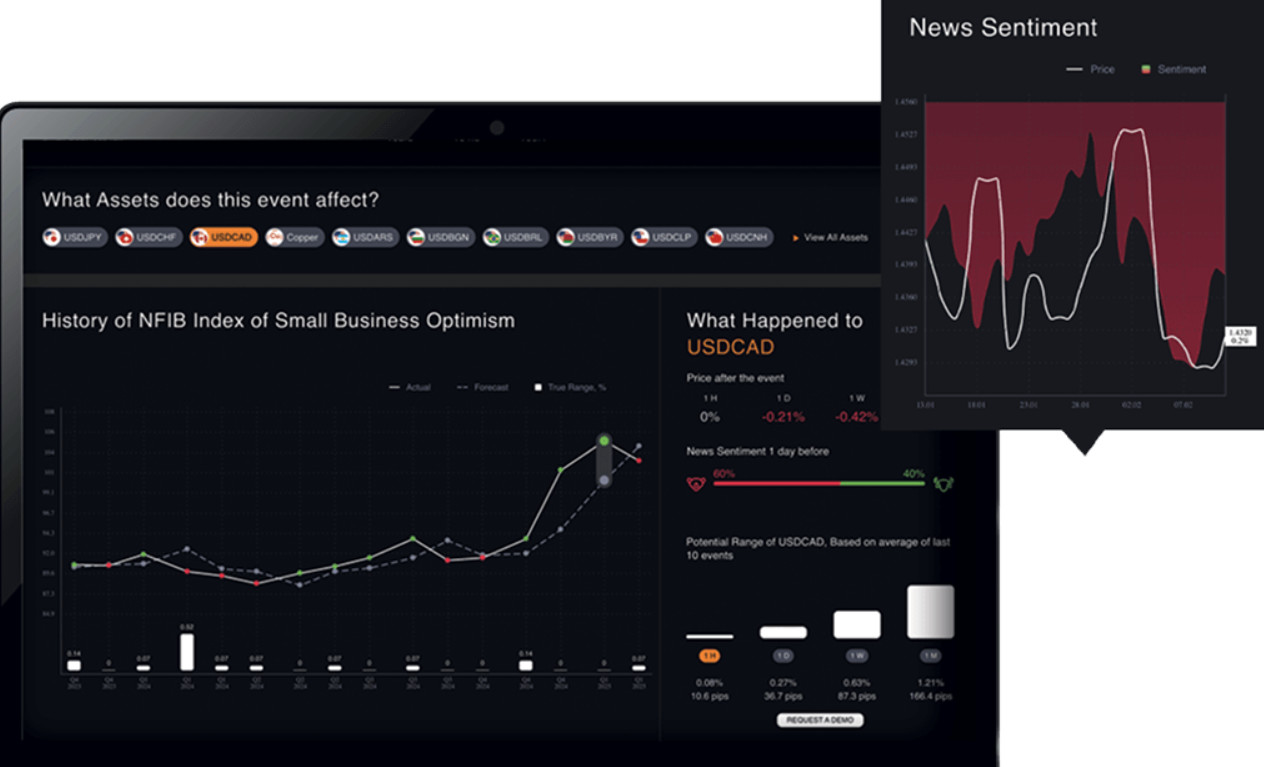

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Earn Compared to Other Brokers

- Full Review of Broker Earn

Overall Rating 4.5

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.5 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Earn?

Earn is a European brokerage firm that offers CFDs on Forex, commodities, indices, stocks, ETFs, and cryptocurrencies via popular MetaTrader 4 and MetaTrader 5 platforms.

Established in 2011, the broker is licensed by the Cyprus Securities and Exchange Commission and operates under strict EU financial regulations, providing secure and transparent conditions.

Earn supports both retail and professional clients, offering a range of account types with competitive commissions and spreads. In addition to CFD trading, the firm also provides direct market access to stocks and ETFs for clients interested in long-term portfolio management.

Earn Pros and Cons

Earn offers several advantages for traders, including regulation under CySEC, access to both MT4 and MT5 platforms, and a choice of account types such as ECN and NDD for competitive spreads and fast market execution.

The broker also provides negative balance protection and a solid range of tradable instruments across Forex, indices, stocks, and commodities.

For the cons, the broker does not currently offer services to clients outside the European Economic Area. Additionally, Earn offers limited educational resources, which may be a drawback for beginners who need in-depth learning support.

| Advantages | Disadvantages |

|---|

| CySEC regulation and oversee | No 24/7 customer support |

| Low spreads and fees | Limited educational materials |

| Competitive trading conditions | Not available for international trading |

| Forex and CFD trading | |

| Suitable for beginners and professionals | |

| Industry-known trading platforms | |

| Client protection | |

| European trading | |

Earn Features

Earn offers a comprehensive trading environment operating under EU financial guidelines. The broker offers access to a diverse range of CFD instruments with competitive fees via popular platforms. Below is a comprehensive list of its key features:

Earn Features in 10 Points

| 🏢 Regulation | CySEC |

| 🗺️ Account Types | MT5 Sharp ECN, MT4 NDD, MT4 Standard Accounts |

| 🖥 Trading Platforms | MT4, MT5, Earn.Broker |

| 📉 Trading Instruments | CFDs on Forex, commodities, indices, stocks, ETFs, cryptocurrencies |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.1 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR |

| 📚 Trading Education | News Room, Analytics |

| ☎ Customer Support | 24/5 |

Who is Earn For?

Earn is suited for users looking to trade a wide range of global markets with transparent pricing, advanced platforms and tools, and secure execution. According to our findings, the broker is Good for:

- Beginners

- Professional traders

- European traders

- Traders who prefer the MT4 or MT5

- Copy trading

- Currency trading

- Investors

- Algorithmic/EA trading

- Competitive spreads and commissions

- Good trading strategies

Earn Summary

In summary, Earn is a European-regulated brokerage firm offering CFD trading across a range of tradable assets. Founded in 2011 and licensed by CySEC, the broker operates under the EU’s strict financial standards, ensuring transparency and security.

Clients benefit from access to industry-leading platforms like MetaTrader 4, MetaTrader 5, and Earn.Broker, as well as investment solutions for long-term traders.

With competitive spreads, fast execution, integrated tools, and a user-friendly interface, the broker provides a competitive and reliable trading experience.

55Brokers Professional Insights

Earn stands out by its regulatory strength, great technology, and diverse market access. Regulated by CySEC, the broker maintains a strong commitment to investor protection and compliance with MiFID standards.

What distinguishes Earn is its offering of both CFD trading and direct market access to real stocks and ETFs, allowing clients to execute trades with transparency and real-time pricing.

The integration of advanced platforms like MetaTrader 4, MetaTrader 5, and the proprietary Earn.Broker platform offers flexibility for various trading styles. Additionally, Earn uses AI-powered tools like Acuity and SignalCentre to provide insights and market sentiment analysis.

Its competitive pricing, fast order execution, and access to comprehensive analytics make Earn a compelling choice for those seeking a reliable financial environment in Europe.

Consider Trading with Earn If:

| Earn is an excellent Broker for: | - Need a well-regulated broker.

- European traders.

- Looking for broker suitable for beginners and professional traders.

- Providing competitive prices.

- Offering a range of popular trading instruments.

- Secure trading environment.

- Looking for broker with MT4 and MT5 trading platforms.

- Providing copy trading.

- Currency trading.

- Providing competitive trading conditions.

- Offering a variety of account types. |

Avoid Trading with Earn If:

| Earn might not be the best for: | - Looking for broker with 24/7 customer support.

- Need a broker with a Top-Tier license.

- Who look for comprehensive educational materials.

- Need broker with access to VPS Hosting. |

Regulation and Security Measures

Score – 4.5/5

Earn Regulatory Overview

Earn operates as a fully regulated brokerage under the supervision of the CySEC, one of the leading financial regulatory bodies within the European Union. Licensed since 2011, the broker complies with MiFID II, ensuring high standards of transparency, investor protection, and operational integrity.

As a CySEC-regulated firm, the firm adheres to strict capital requirements, maintains segregated client funds, and offers negative balance protection. This regulatory framework provides clients with a secure and trustworthy environment aligned with EU financial laws.

How Safe is Trading with Earn?

Trading with Earn is supported by a strong infrastructure that prioritizes security and reliability. The broker uses advanced encryption technologies to protect client data and transactions, while also offering secure fund handling through trusted banking partners.

Additionally, users have access to clear trading conditions, transparent fee structures, and a robust platform environment that minimizes technical risks.

Consistency and Clarity

Overall, Earn has a good reputation in the financial community, combining long-standing operational history with notable industry recognition. Since its establishment, the broker has received multiple awards for trading experience and customer service, highlighting its commitment to quality and innovation.

It has also formed partnerships with respected names like Acuity, Finalto, and Swissquote, reinforcing its technological edge.

However, while many traders appreciate Earn’s broad market access, fast execution, and advanced tools, some users point to areas for improvement, such as website functionality, clarity in communication, and the availability of comprehensive educational resources.

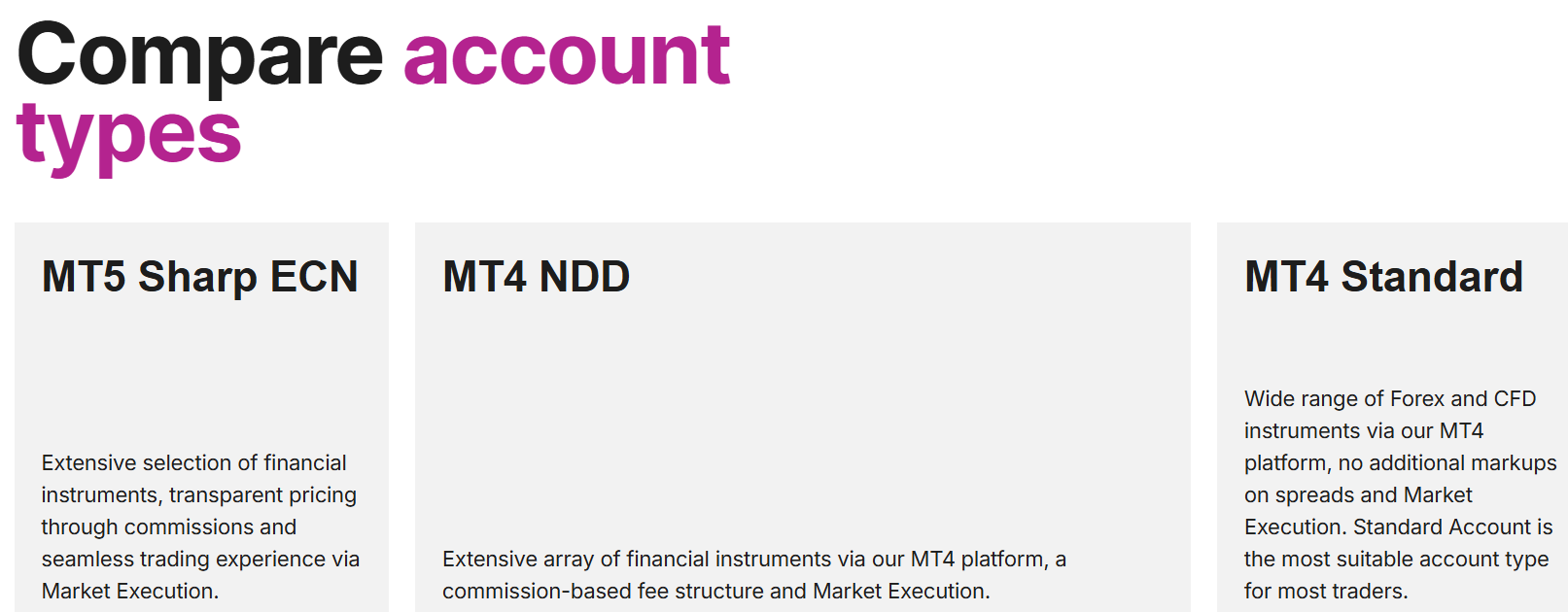

Account Types and Benefits

Score – 4.6/5

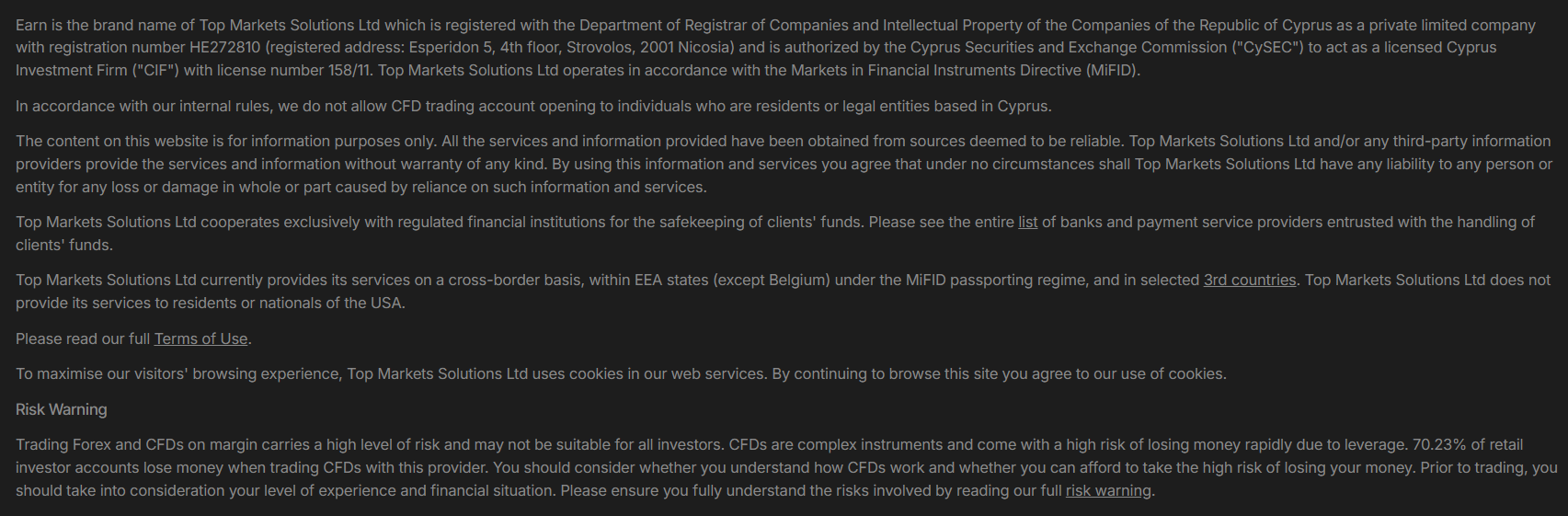

Which Account Types Are Available with Earn?

Earn offers diverse accounts to meet various needs and preferences. The MT5 Sharp ECN account offers raw spreads and low commissions, providing fast execution and enhanced pricing through the MT5 platform.

For traders who prefer MT4, the MT4 NDD account allows for efficient trading with market execution and no broker intervention, a suitable choice for high-frequency strategies like scalping.

The MT4 Standard account provides a more straightforward setup, ideal for those who prefer simplicity in their trading. In addition, the broker offers a demo account, allowing users to practice strategies and explore the platform features in a risk-free environment before committing real funds.

MT4 Standard Account

The MT4 Standard Account is ideal for traders looking for a simple yet effective trading environment. With a minimum deposit of $100, the account provides access to a broad range of CFD instruments through the MetaTrader 4 platform.

It features market execution, competitive floating spreads starting from 0.0 pips, and a per-side commission of 0.007%. The account supports USD and EUR base currencies, allows hedging, and includes negative balance protection.

Regions Where Earn is Restricted

Earn does not offer its services in certain jurisdictions due to regulatory restrictions and international sanctions. Users from the following countries or regions are not supported:

- USA

- Belgium

- Iran

- North Korea, etc.

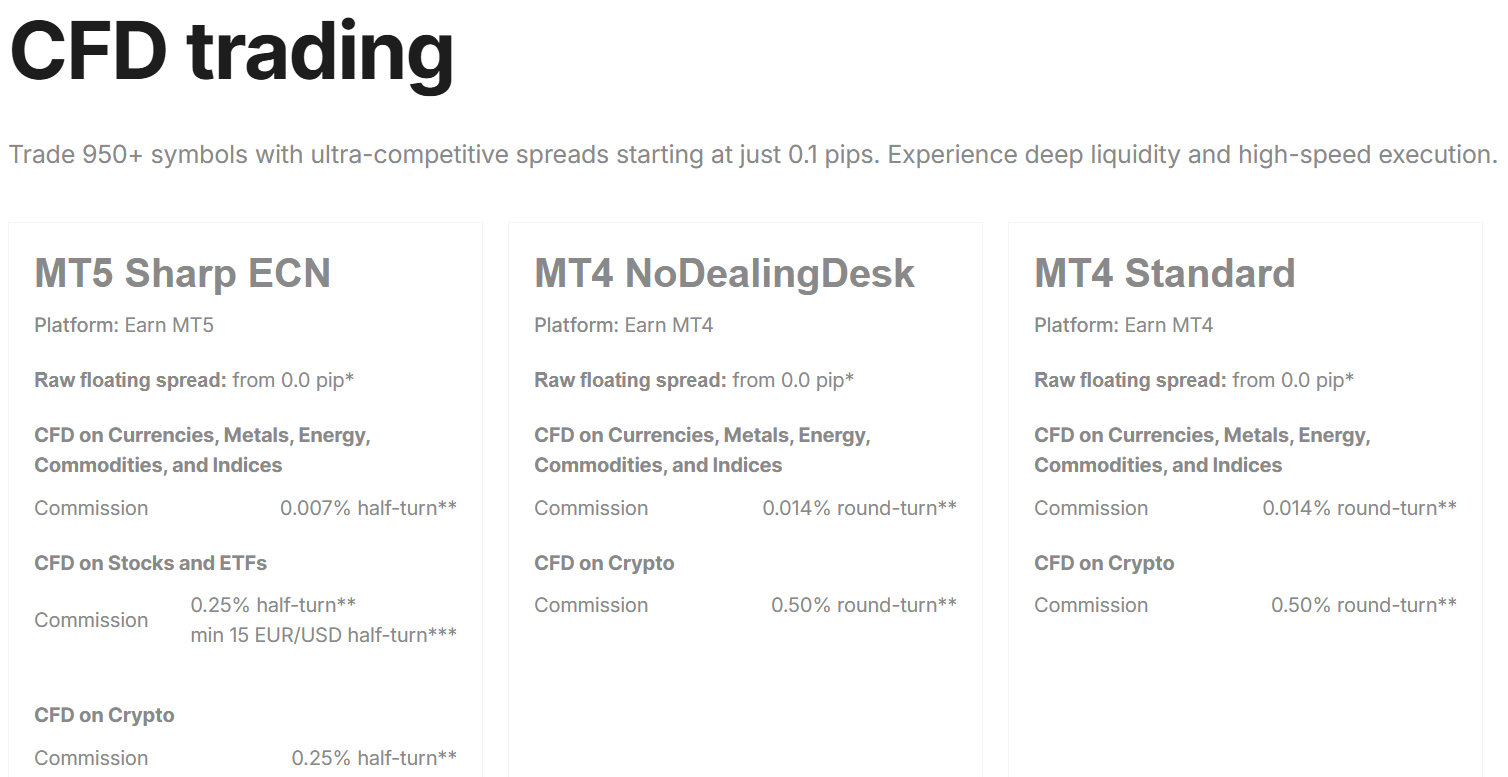

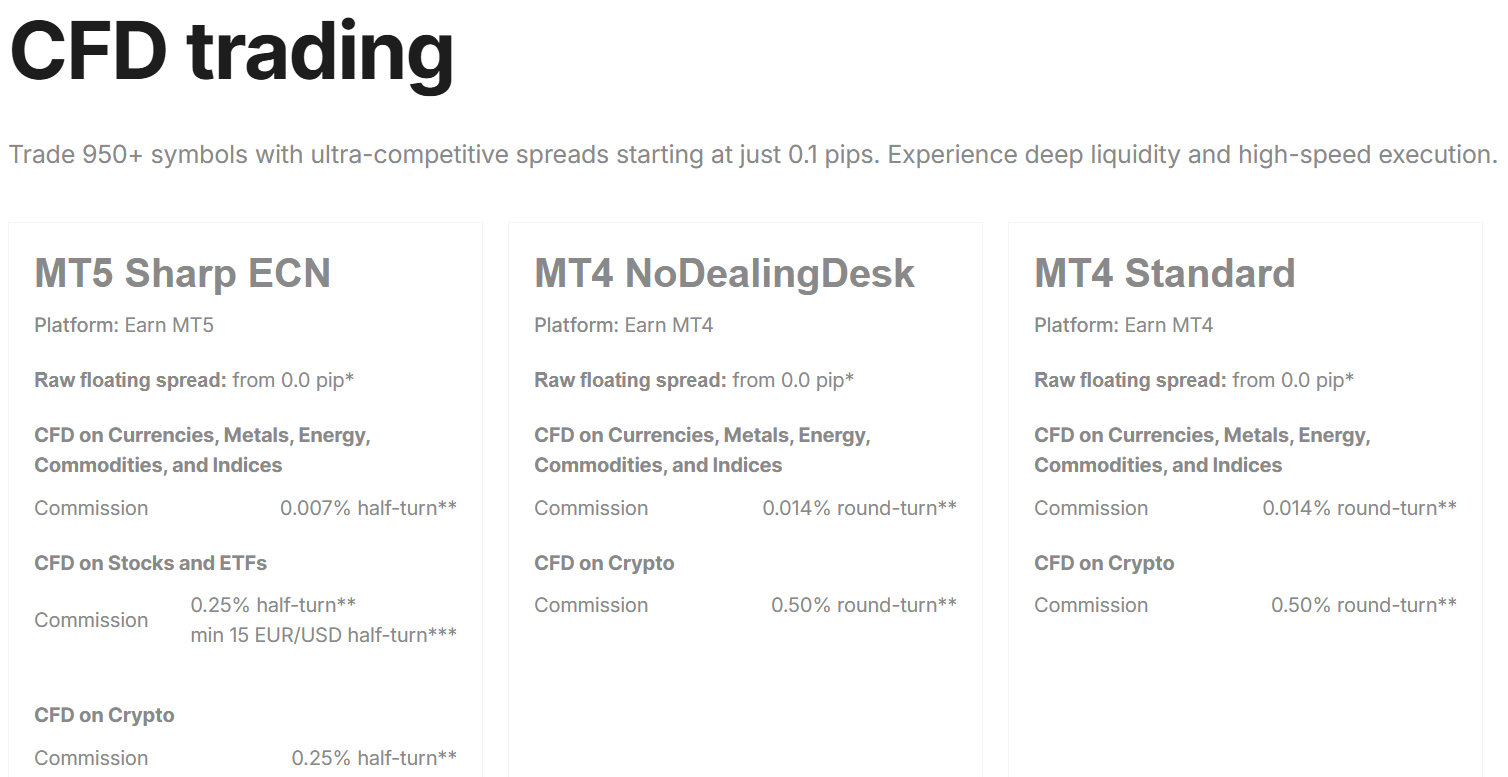

Cost Structure and Fees

Score – 4.5/5

Earn Brokerage Fees

Earn offers a competitive and transparent fee structure tailored to different account types and trading styles. The accounts feature tighter spreads from 0.0 pips with a commission per lot traded.

The broker does not charge deposit fees, and most withdrawal methods are free, though some third-party charges may apply. Additionally, Earn applies overnight swap rates for positions held open beyond market hours.

Overall, the cost structure is clear and competitive within the EU-regulated environment.

Earn offers competitive spreads across all its account types, with spreads starting from 0.0 pips. On the MT4 Standard account, traders can benefit from an average EUR/USD spread of just 0.1 pips, ideal for those seeking ultra-tight pricing.

Earn applies a commission structure across its CFD account types. All the accounts feature a commission of 0.007% per side for CFDs on currencies, metals, energy, commodities, and indices.

Earn applies overnight rollover fees on positions held open past the trading day. These charges vary depending on the instrument and market conditions and can be either positive or negative. Traders can view the specific swap rates directly on the platforms, helping them factor in potential costs when holding positions long-term.

How Competitive Are Earn Fees?

Earn offers a competitive fee structure that appeals to cost-conscious traders, with spreads starting from 0 pips and low commission rates across its account types.

With no hidden charges and efficient execution, the broker stands out as a cost-effective choice for traders seeking value along with a reliable trading environment.

| Asset/ Pair | Earn Spread | M4Markets Spread | Taurex Spread |

|---|

| EUR USD Spread | 0.1 pips | 1.1 pips | 1.7 pips |

| Crude Oil WTI Spread | 0.027 | 4.8 | 0.054 |

| Gold Spread | 0.150 | 2.8 | 0.34 |

| BTC USD Spread | 13.13 | 14.1 | 41.92 |

Earn Additional Fees

Earn maintains an overall transparent fee structure, but traders should be aware of certain additional charges. A monthly fee of €50 is applied to inactive accounts with no trading activity for three consecutive months, for maintenance, administration, and compliance management.

Additionally, a currency conversion cost applies when instruments denominated in a currency different from the account’s base currency. Also, while there are no deposit fees, traders may incur withdrawal fees depending on the payment method used.

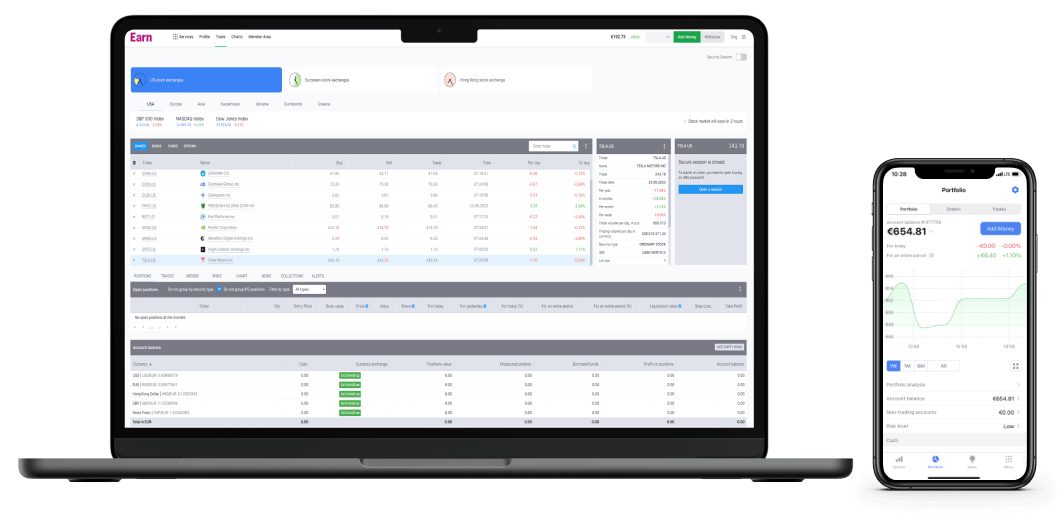

Trading Platforms and Tools

Score – 4.6/5

Earn provides access to the industry-standard MetaTrader 4 and MetaTrader 5, both known for their advanced charting tools, automated capabilities, and customizable interfaces.

In addition, the broker offers its proprietary platform, Earn.Broker, through web and mobile apps. These platforms support efficient trade execution and provide access to analytical tools, technical indicators, and real-time data.

Trading Platform Comparison to Other Brokers:

| Platforms | Earn Platforms | M4Markets Platforms | Taurex Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | Yes | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

Earn Web Platform

The Earn.Broker web platform offers an intuitive experience directly from your browser, no downloads required. Designed for accessibility and speed, it provides real-time market data, advanced charting tools, and one-click features.

The platform supports multiple asset classes and allows traders to manage positions, monitor performance, and execute trades efficiently across devices. With a clean interface and essential tools integrated, this web platform is ideal for traders who value convenience.

Earn Desktop MetaTrader 4 Platform

The MT4 desktop platform offers a reliable and user-friendly environment for Forex and CFDs. Known for its stability and efficiency, the platform includes advanced charting tools, automated trading through Expert Advisors, and customizable indicators.

Traders can manage multiple accounts, set alerts, and analyze market trends with precision.

Main Insights from Testing

Testing the MT4 platform revealed a stable and user-friendly environment suitable for both beginners and experienced traders. The platform offered reliable execution, easy navigation, and access to essential tools like 30 technical indicators, charting features, and automated trading through EAs.

While it may lack some of the advanced capabilities found in newer platforms, MT4 remains a trusted and efficient choice for straightforward trading strategies.

Earn Desktop MetaTrader 5 Platform

The MT5 platform provides an enhanced experience with more advanced features than MT4. It supports 6 pending order types, 38 technical indicators, 21 timeframes, improved charting tools, and faster execution speeds.

The platform is designed for traders who require greater market depth and multi-asset capabilities, ideal for trading Forex, CFDs, commodities, and indices through one comprehensive platform.

Earn MobileTrader App

The broker’s mobile app delivers a full-featured experience on the go. Through the app, users can access real-time global market data, place trades instantly, and manage portfolios across major asset classes.

It offers a clean, intuitive interface with customizable charts, technical indicators, and streamlined navigation. The onboarding process is seamless, allowing users to verify their identity, deposit funds, and start trading quickly.

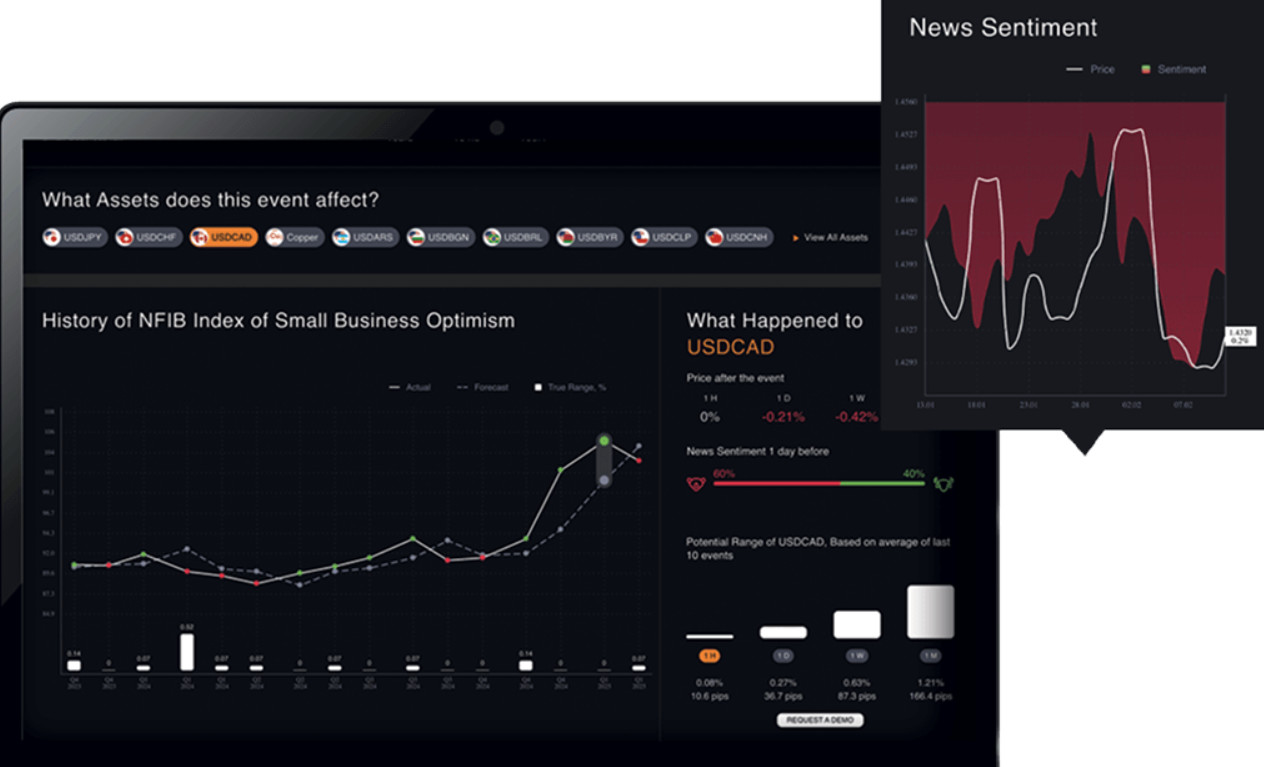

AI Trading

Earn integrates advanced AI-based analytical tools from SignalCentre and Acuity. SignalCentre displays real-time trade signals and sentiment alerts for selected assets, blending expert human analysis with AI-driven insights.

It also offers an AI-powered Economic Calendar developed by Acuity, which converts volatility from global economic events into trading opportunities.

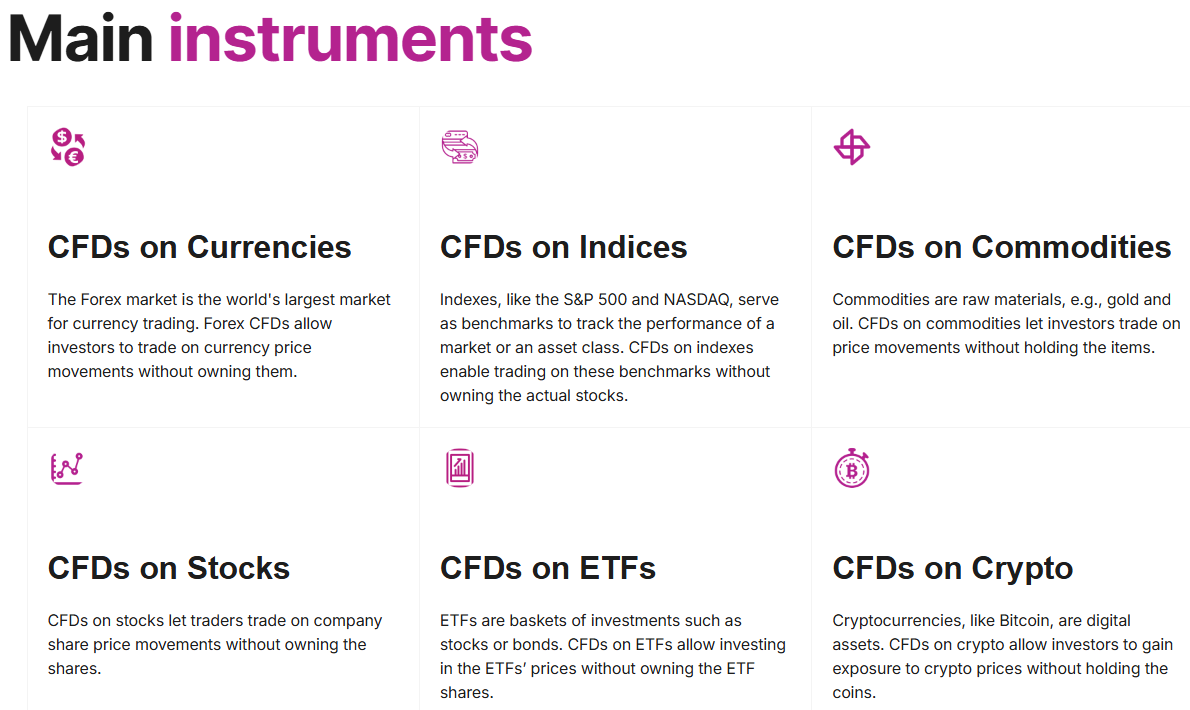

Trading Instruments

Score – 4.5/5

What Can You Trade on Earn’s Platform?

Earn offers access to over 950 instruments across a range of global markets, including CFDs on Forex pairs, commodities like gold and oil, major stock indices, individual stocks, ETFs, and popular cryptocurrencies.

Whether you are interested in traditional financial assets or looking to diversify with digital currencies, the broker provides the flexibility and variety to support multiple trading strategies.

Main Insights from Exploring Earn’s Tradable Assets

Exploring Earn’s tradable assets reveals a well-structured and diversified offering. Markets are updated in real time, and detailed specifications are provided for each asset, helping traders make informed decisions. Overall, the variety and accessibility support a dynamic trading experience.

Leverage Options at Earn

Leverage allows traders to control larger positions with a smaller amount of capital. At Earn, the available leverage depends on the asset class being traded and the applicable regulation.

It is a useful tool that enables traders to enter the market with limited capital; however, its use can lead to both substantial profits and significant losses. Therefore, traders should have a comprehensive understanding of how the multiplier works and its potential consequences before engaging in any trading activities that involve it.

- Clients under the European CySEC license can use a maximum leverage of 1:30.

- However, for professional traders, the maximum leverage is 1:100.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Earn

Earn offers a few payment methods to make funding the accounts quick and convenient, including:

Earn Minimum Deposit

Earn requires a minimum deposit of $/€100 across all account types, making it accessible for both new and experienced traders.

Withdrawal Options at Earn

Earn offers Bank transfers, and card withdrawals as available withdrawal options. Processing times typically range from 2 to 10 business days, depending on the method chosen.

While Earn itself does not usually charge withdrawal fees, third-party providers may apply additional costs.

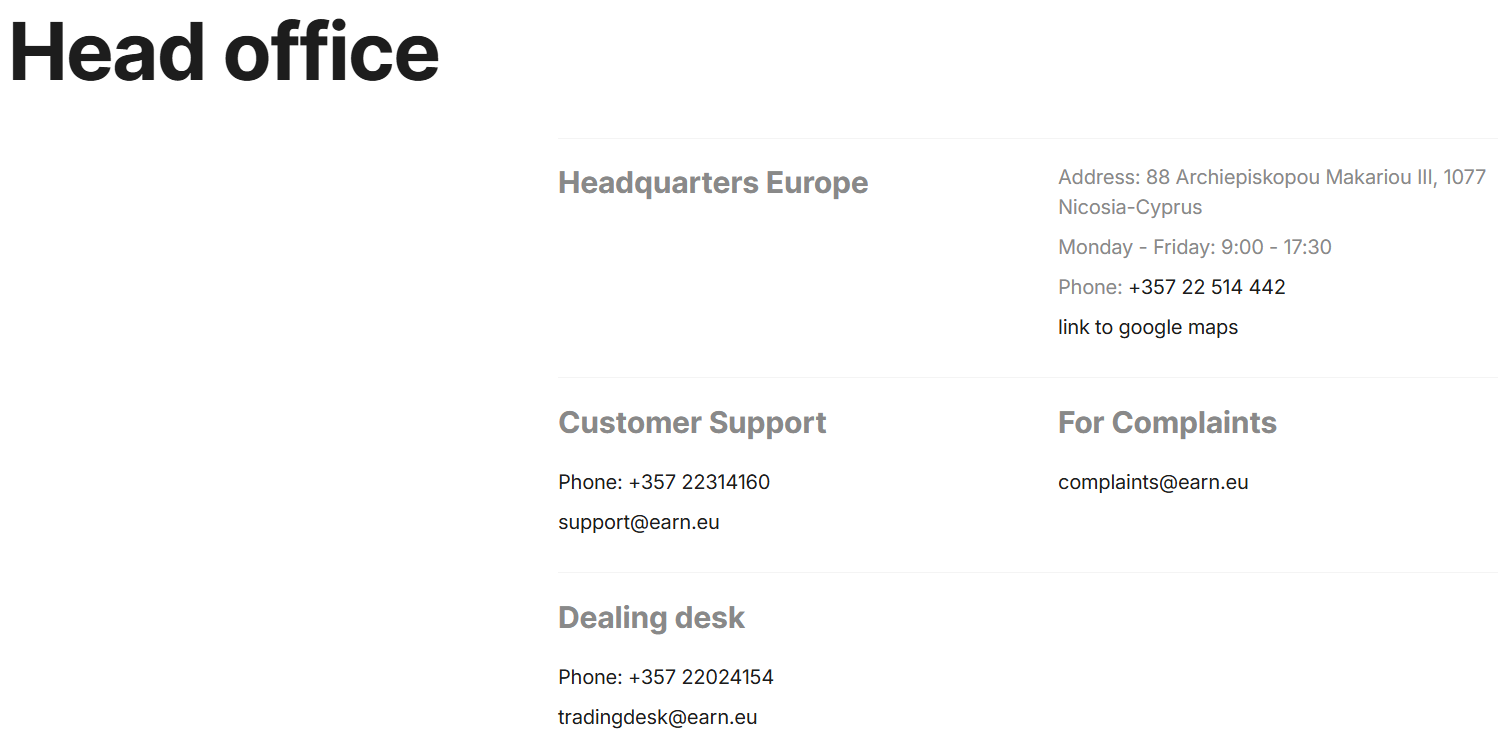

Customer Support and Responsiveness

Score – 4.5/5

Testing Earn’s Customer Support

Earn provides 24/5 responsive support through email and phone, ensuring assistance during active market hours. The support team provides helpful and timely answers, contributing to a smooth trading experience for users.

Contacts Earn

To get in touch with Earn, clients can reach out via phone at +357 22314160 for direct assistance. For general inquiries, support is available at support@earn.eu. For any complaints, clients can contact complaints@earn.eu.

Research and Education

Score – 4.4/5

Research Tools Earn

Earn offers a range of research tools both on its website and within the platforms.

- On the Earn website, clients have access to an economic calendar, calculators for margin, swap, pip, profit, and currency, and in-depth market analysis tools.

- Within the MetaTrader platforms, Earn integrates Acuity and SignalCentre, AI-powered tools that deliver real-time insights, trading signals, and news sentiment data.

Education

Educational resources at Earn are quite limited. The broker does not provide structured learning materials such as courses, video tutorials, or webinars.

Instead, the only available educational content comes from its News Room and Analytics sections, which offer basic market updates and tools. This makes Earn less suitable for beginner traders who need in-depth guidance or educational support.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options Earn

Besides CFD trading, Earn provides Direct Market Access to a wide range of global equities and bonds. Through the Earn.Broker platform, users can invest in thousands of real stocks, ETFs, and fixed-income products across major markets.

This makes the broker a suitable choice for traders who need both short-term opportunities and long-term investment solutions.

Account Opening

Score – 4.4/5

How to Open Earn Demo Account?

Opening a demo account with Earn is a quick and straightforward way to explore the platform, test trading strategies, and get familiar with its tools, without risking real money. Here are the steps to open a demo account:

- Visit the official website and click on “Start Demo.”

- Fill in the short registration form with your name, email, and phone number.

- Choose your preferred platform and set your demo account parameters.

- Submit the form and receive your demo login credentials via email.

- Download the chosen platform and start practicing.

How to Open Earn Live Account?

To open a live account with Earn, simply visit the broker’s website and select “Open an Account.” Users need to complete a short registration form on the official website, verify their identity by uploading the required documents, and select their preferred account type.

Once verification is complete, users can fund their accounts using the available deposit methods and start trading across a range of instruments. The platform ensures a smooth onboarding experience with user-friendly steps and responsive support if needed.

Additional Tools and Features

Score – 4.3/5

In addition to its research tools, Earn also provides several extra features to enhance the trading experience.

- Traders can benefit from copy trading solutions that allow them to follow and replicate the strategies of experienced investors.

- The MetaTrader platforms also support the use of Expert Advisors for automated trading, enabling users to implement algorithmic strategies. These tools offer added flexibility and can help traders optimize their approach in dynamic market conditions.

Earn Compared to Other Brokers

Compared to its competitors, Earn offers a standard trading environment with access to popular platforms like MT4, MT5, and its proprietary Earn.Broker. While its fees are generally competitive, it lacks the depth of educational content found with brokers like Tickmill or Taurex.

In terms of asset variety, the broker provides a good selection, though it falls short of the extensive offerings from brokers such as Colmex Pro or CMC Markets.

Regulation is solid with CySEC oversight, but global traders may prefer firms with broader regulatory coverage. Overall, Earn stands as a balanced option but may not suit those seeking advanced educational tools or an exceptionally wide asset range.

| Parameter |

Earn |

M4Markets |

Tickmill |

Colmex Pro |

Taurex |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.1 pips |

Average 1.1 pips |

Average 0.1 pips |

Average 4 pips |

Average 1.7 pips |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.0 pips + 0.007% per side |

0.0 pips + $3.5 per side |

0.0 pips + $3 |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $2 per side |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Low/Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

MT4, MT5, Earn.Broker

|

MT4, MT5, cTrader |

MT4, MT5, Tickmill Trader |

Colmex Pro 2.0, MT4 |

MT4, MT5, Taurex Trading App |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

950+ instruments |

120+ instruments |

180+ instruments |

28,000+ instruments |

1,500+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC |

CySEC, DFSA, FSA |

FCA, CySEC, FSCA, FSA |

CySEC, FSCA |

FCA, FSA, SCA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Limited |

Excellent |

Good |

Good |

| Minimum Deposit |

$100 |

$5 |

$100 |

$500 |

$10 |

$0 |

$0 |

Full Review of Broker Earn

Earn is a Cyprus-based regulated broker offering access to MT4, MT5, and its own Earn.Broker platform, catering to traders with both spread-based and commission-based account options.

The broker provides over 950 instruments, including CFDs on Forex, indices, commodities, and shares, along with DMA access for more advanced trading.

While the broker provides a good range of research tools, the educational resources are rather limited. Traders can also benefit from additional features such as copy trading and support for expert advisors.

Share this article [addtoany url="https://55brokers.com/earn-review/" title="Earn"]