- What is E-Trade?

- E-Trade Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

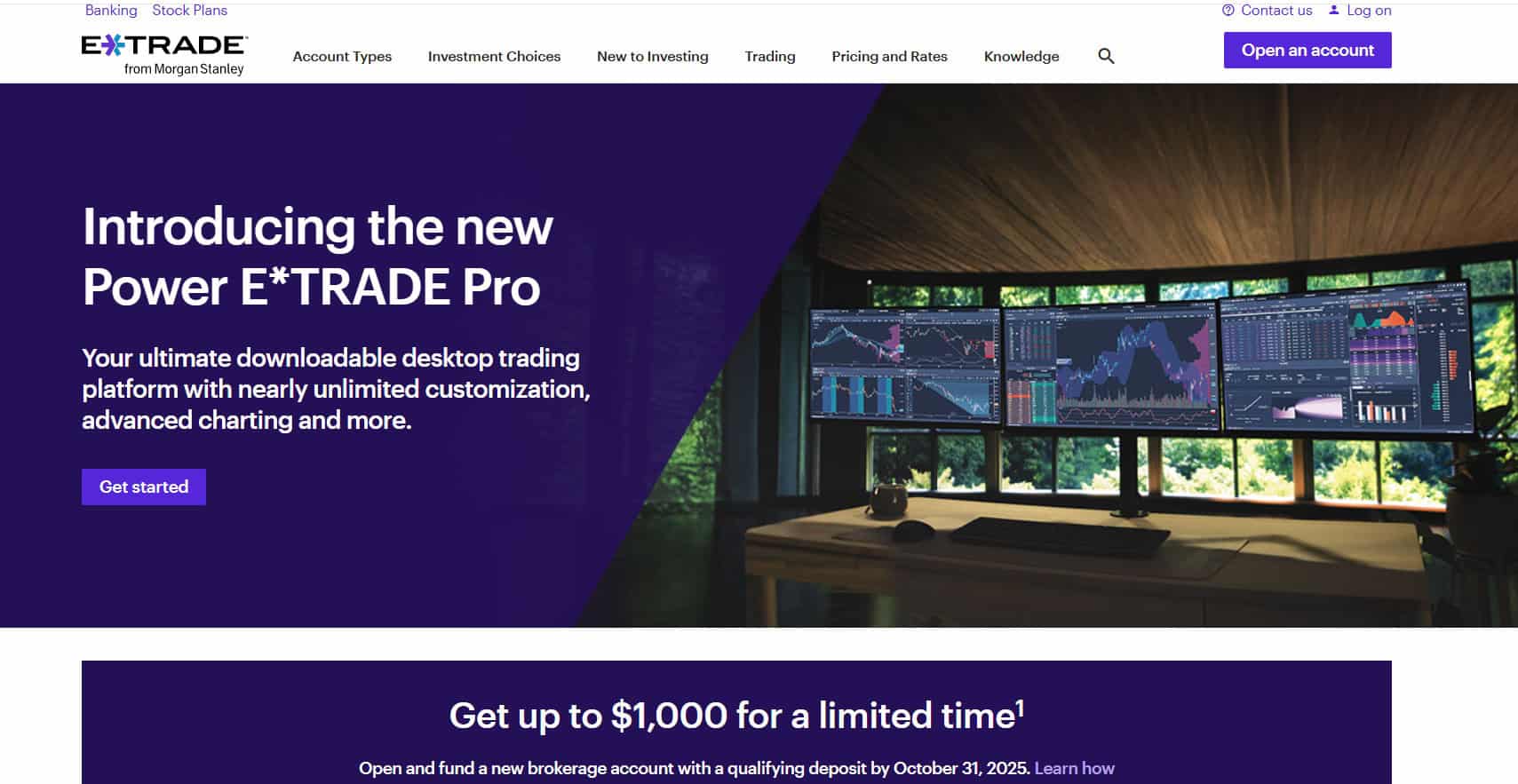

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

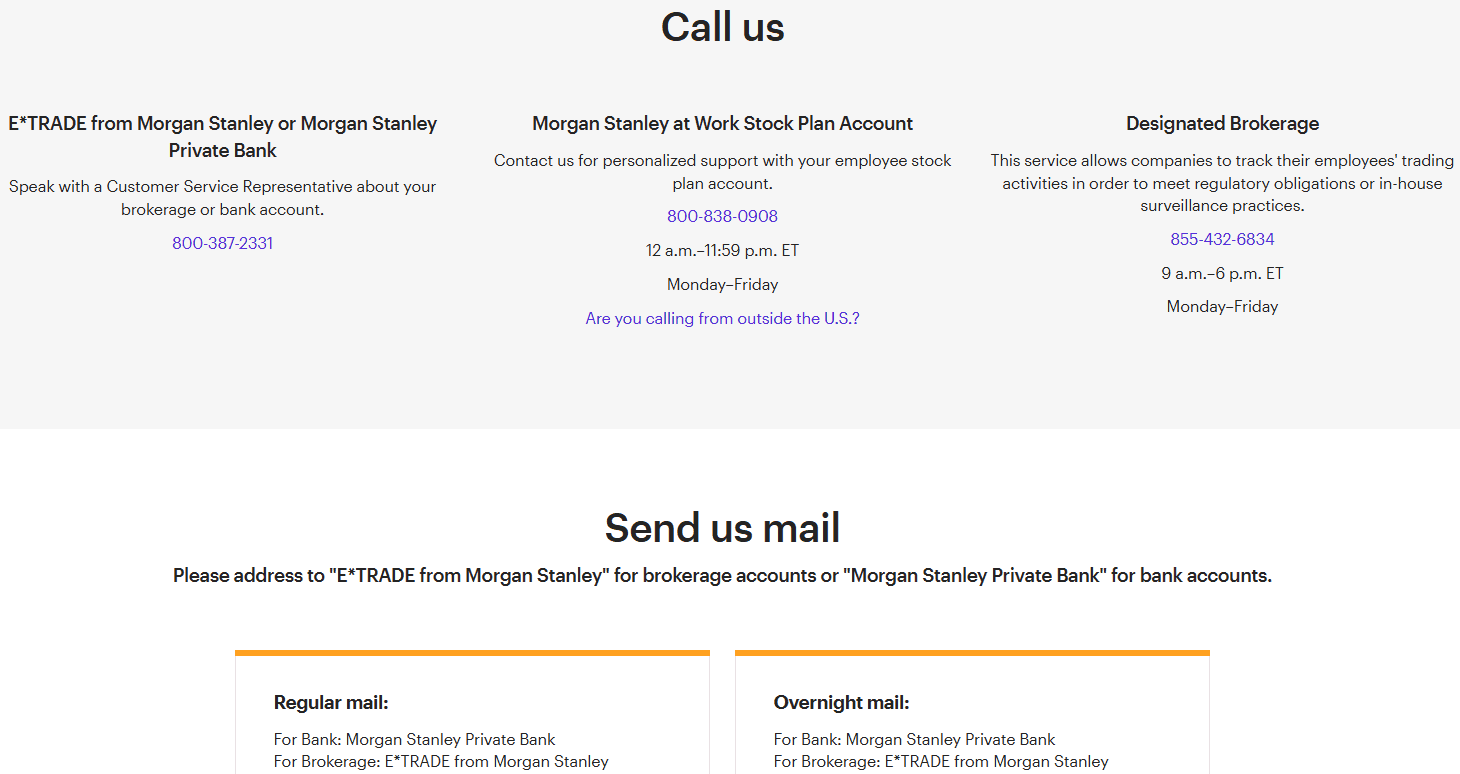

- Customer Support and Responsiveness

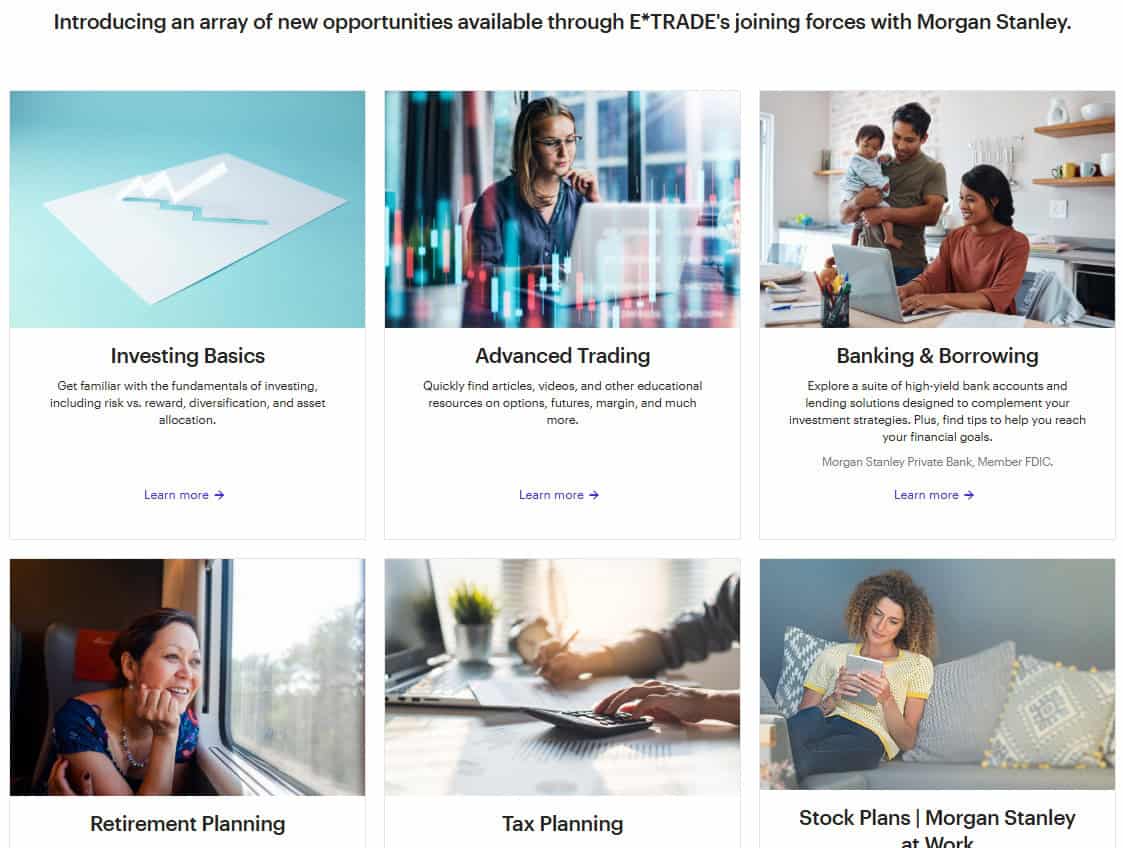

- Research and Education

- Portfolio and Investment Opportunities

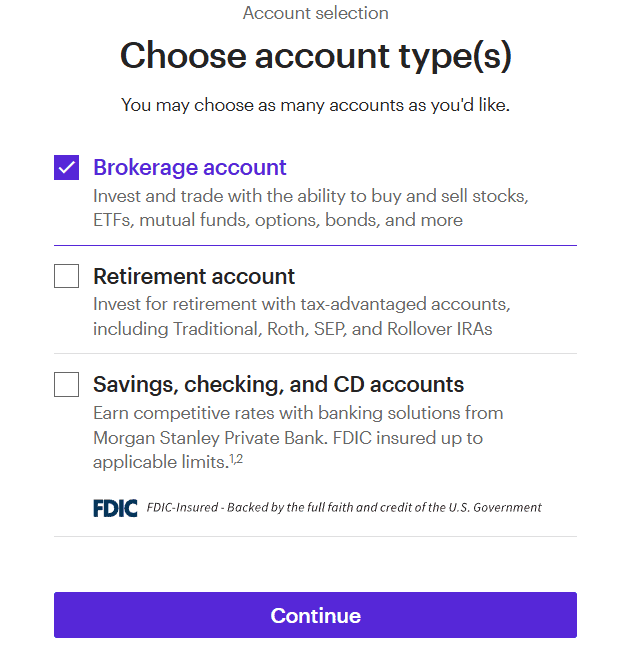

- Account Opening

- Additional Tools And Features

- E-Trade Compared to Other Brokers

- Full Review of Broker E-Trade

Overall Rating 4.6

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.5 / 5 |

| Trading Platforms and Tools | 4.6 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.6 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.4 / 5 |

What is E-Trade?

E-Trade, a subsidiary of Morgan Stanley, operates as a Stock trading company, allowing individual investors and traders to buy and sell various financial products, including Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, and CDs.

The firm adheres to strict regulatory oversight by the US SEC, FINRA, and CFTC. Also, it is a member of the National Futures Association (NFA), the Securities Investor Protection Corporation (SIPC), and the Federal Deposit Insurance Corporation (FDIC).

Overall, the brokerage offers favorable conditions and an intuitive interface for clients to manage their investment portfolios, access market research, and execute trades.

Is E-Trade Stock Broker?

Yes, E-Trade is a Stock brokerage firm. The company became part of the global financial institution Morgan Stanley in 2020, integrating its online brokerage services into the broader suite of financial services offered by Morgan Stanley.

E-Trade Pros and Cons

The broker comes with its set of advantages and drawbacks. On the positive side, it offers a user-friendly interface, competitive trading conditions, and a diverse range of financial products for investors. The platform’s integration with Morgan Stanley adds financial stability and access to a broader suite of services. Additionally, E-Trade offers extensive research and educational resources to empower investors in making informed decisions.

For the cons, the fees and commissions might be comparatively higher, and despite its user-friendly interface, beginners may still find the platform somewhat complex, especially if they are new to investing and trading.

| Advantages | Disadvantages |

|---|

| SEC, FINRA, and CFTC regulation and oversee | No 24/7 customer support |

| $0 minimum deposit | Not suitable for beginners |

| Good education and research | |

| US traders and investors | |

| Competitive trading conditions | |

| Paper trading | |

| Advanced trading platforms | |

| Secure investing environment | |

E-Trade Features

The broker provides competitive investment solutions, a broad range of financial products, and the backing of Morgan Stanley for enhanced financial stability. A summary of its standout features is as follows:

E-Trade Features in 10 Points

| 🏢 Regulation | SEC, FINRA, CFTC, SIPC, NFA, FDIC |

| 🗺️ Account Types | Brokerage, Core Portfolios, Retirement Accounts |

| 🖥 Trading Platforms | Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

| 📉 Trading Instruments | Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $1.50 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD |

| 📚 Trading Education | Investing Basics, Market News, Events |

| ☎ Customer Support | 24/5 |

Who is E-Trade For?

E-Trade is designed for a wide range of investors seeking powerful tools and flexible investment options. It caters to individuals who want a user-friendly platform with access to stocks, ETFs, mutual funds, options, and futures, while also offering educational resources and research to support confident decision-making. Based on our findings and Financial Expert Opinions, E-Trade is Good for:

- Traders from the US

- Investing

- Stocks and Options trading

- Advanced traders

- Professional trading

- Commission-based trading

- Paper trading

- Competitive investment environment

- Good educational materials and research

E-Trade Summary

In conclusion, E-Trade stands as a reputable online brokerage platform offering a user-friendly experience, competitive trading conditions, and a diverse range of products. Additionally, the broker provides comprehensive educational resources, equipping users with the knowledge and tools necessary to make informed investment decisions.

Overall, E-Trade provides a robust suite of tools and features for investors looking to actively engage in the financial markets. However, we advise conducting your research and evaluating whether the broker’s offerings suit your specific requirements.

55Brokers Professional Insights

E Trade stands out by combining strong balance of accessibility, advanced tools, and investor support. There are intuitive, easy-to-navigate platforms suitable for beginners, with accessible start with no deposit requirement, yet platforms delivering professional-grade tools like advanced charting, customizable dashboards, and extensive market research for seasoned traders. So the combination of offerings is a good choice for traders of any level and experience, those who look for Futures trading and Mini Futures Contracts trading.

E-Trade’s standout features include a comprehensive range of investment products, from traditional stocks and ETFs to options and futures, alongside robust educational resources that empower investors at every level. Its Power E*TRADE platform is especially recognized for offering a streamlined yet sophisticated experience with cutting-edge analysis tools.

Backed by the financial strength and credibility of its parent company, Morgan Stanley, E-Trade also offers investors an added sense of security and reliability, making it a trusted choice for both casual investors and active traders looking for depth, versatility, and professional insights.

Consider Trading with E-Trade If:

| E-Trade is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Professional trading.

- Secure trading environment.

- Stock Trading and Investment.

- Offering popular financial products.

- Looking for broker with Top-Tier licenses.

- Competitive trading conditions.

- Looking for broker with a long history of operation and strong establishment.

- Providing diverse trading strategies.

- Futures and options traders.

- US investors.

- Investors who prefer robust educational resources.

- Long-term investing.

|

Avoid Trading with E-Trade If:

| E-Trade might not be the best for: | - Need a broker with trading services worldwide.

- Looking for broker with 24/7 customer support.

- Beginner investors. |

Regulation and Security Measures

Score – 4.8/5

E-Trade Regulatory Overview

E-Trade is a reliable Stock broker that follows the strict rules and guidelines established by the SEC, FINRA, and CFTC. These Top-Tier regulations safeguard client assets and provide low-risk trading.

How Safe is Trading with E-Trade?

E-Trade is a legitimate and regulated investing firm. It is authorized by reliable US financial authorities and has a good reputation in the financial market.

The broker places a high emphasis on safeguarding clients’ investments by following regulatory standards and industry best practices. This commitment includes implementing measures to prevent fraud, unauthorized account access, and stringent identity verification processes.

Additionally, being a member of SIPC, the company protects customer accounts up to $500,000 (including $250,000 for cash only), providing an extra level of security. However, traders should remain cautious, regularly monitor their investments, and practice safe online habits to enhance their trading protection further.

Consistency and Clarity

E-Trade has built a solid reputation over decades of operation, having been established in 1982 and consistently ranking as one of the most recognizable names in online trading.

Its long-standing presence in the market, coupled with its integration under Morgan Stanley, gives it both financial credibility and trust among traders. Industry ratings and professional reviews often highlight E-Trade’s strong trading platforms, extensive product offerings, and reliable customer support, while user feedback from traders generally praises its ease of use and educational content, though some note that commission-free competitors may offer lower costs for certain trades.

Beyond trading, E Trade has actively contributed to the financial community through sponsorships, educational initiatives, and recognition by industry awards for platform innovation and investor services.

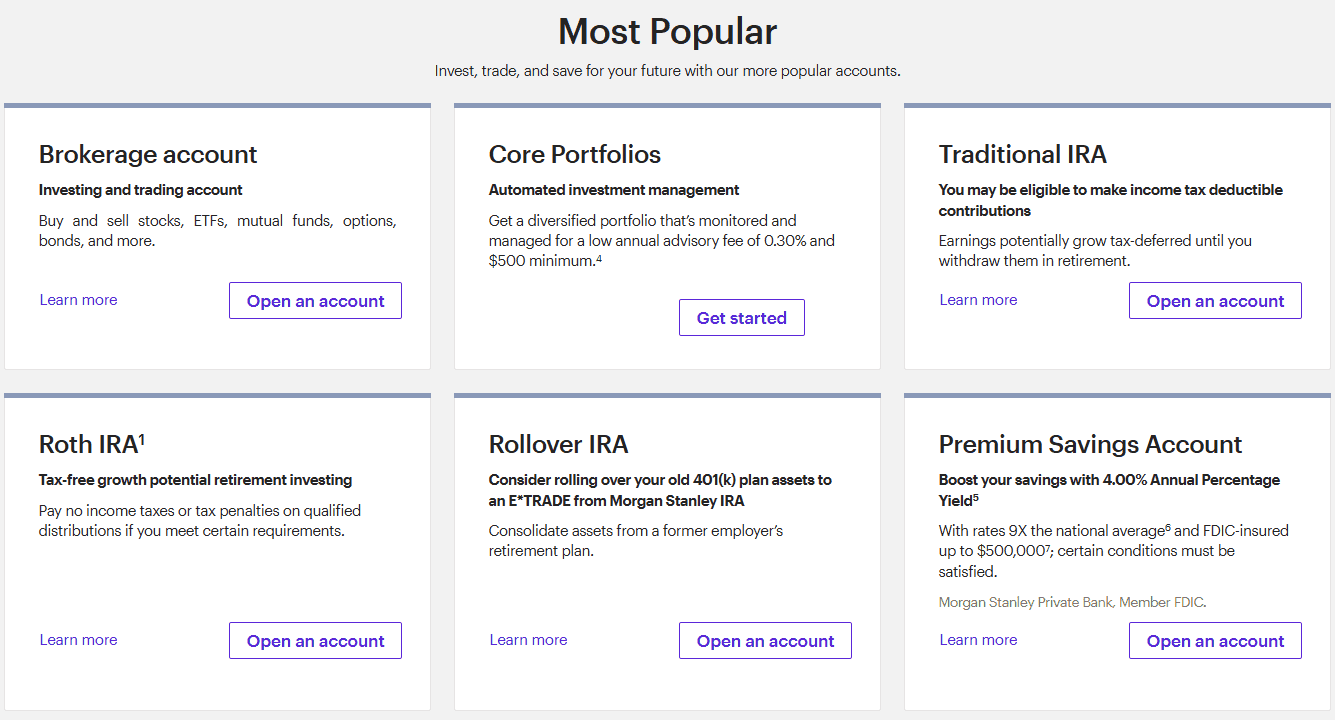

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with E-Trade?

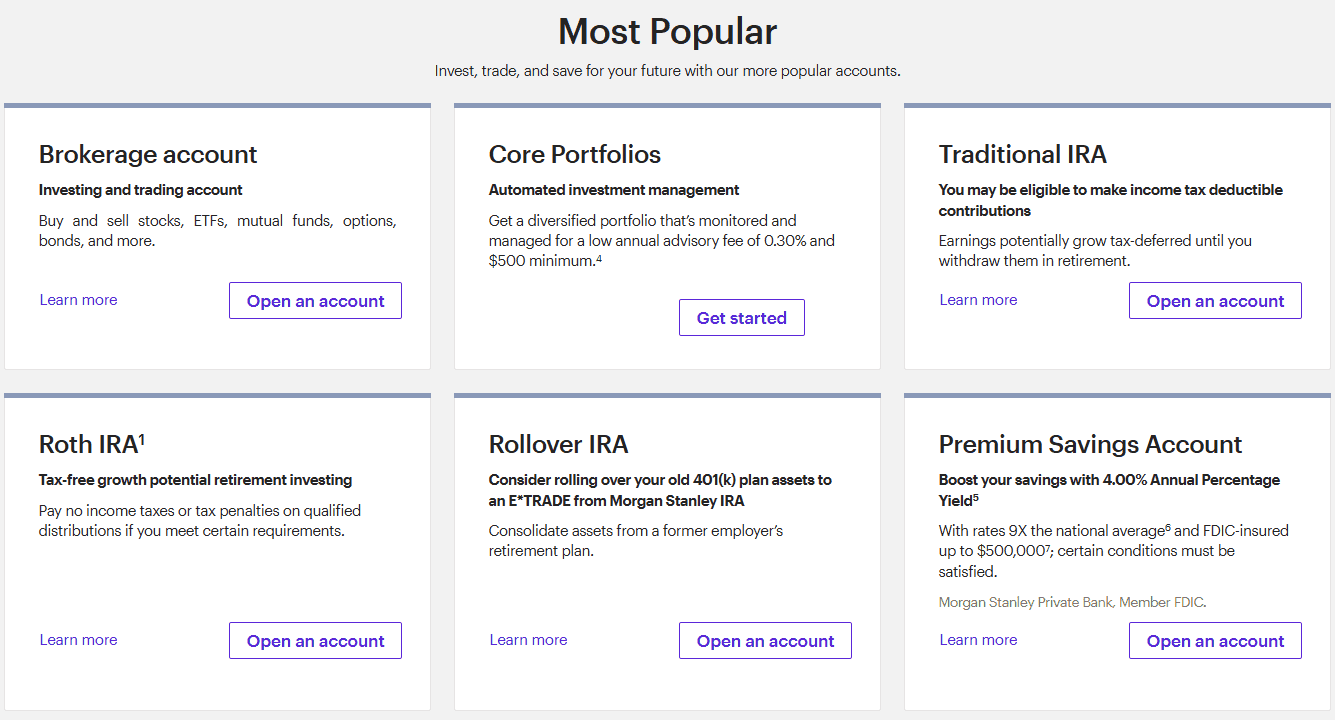

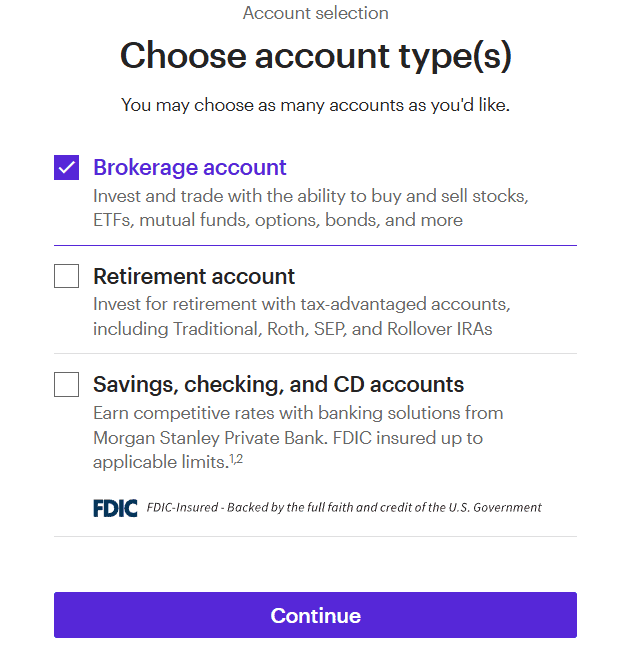

The broker offers a variety of account types tailored to meet diverse investor needs, including Individual Brokerage, Core Portfolios, Retirement Accounts, and more. This range allows investors to choose accounts that offer E-Trade bonuses and align with their financial goals and preferences, providing flexibility in managing their investments on the platform.

E-Trade also offers paper trading, which helps users to test strategies, explore the platform’s features, and practice trading without risking real money.

Brokerage Account

E-Trade brokerage account provides access to a wide range of investment products such as stocks, ETFs, mutual funds, options, and futures, along with powerful platforms and research tools.

Opening an account is straightforward, with no minimum deposit required to get started, making E-Trade accessible to beginners while still offering the depth and flexibility that experienced investors expect.

Regions Where E-Trade is Restricted

E-Trade primarily serves U.S. residents, requiring a U.S. address and Social Security or Tax ID to open an account. The broker has withdrawn from most international markets, making it unavailable in regions like Europe, the UK, and Canada, as well as many parts of Asia and Latin America.

While some countries may allow limited access through complex paper-based processes, the broker is essentially restricted outside the United States.

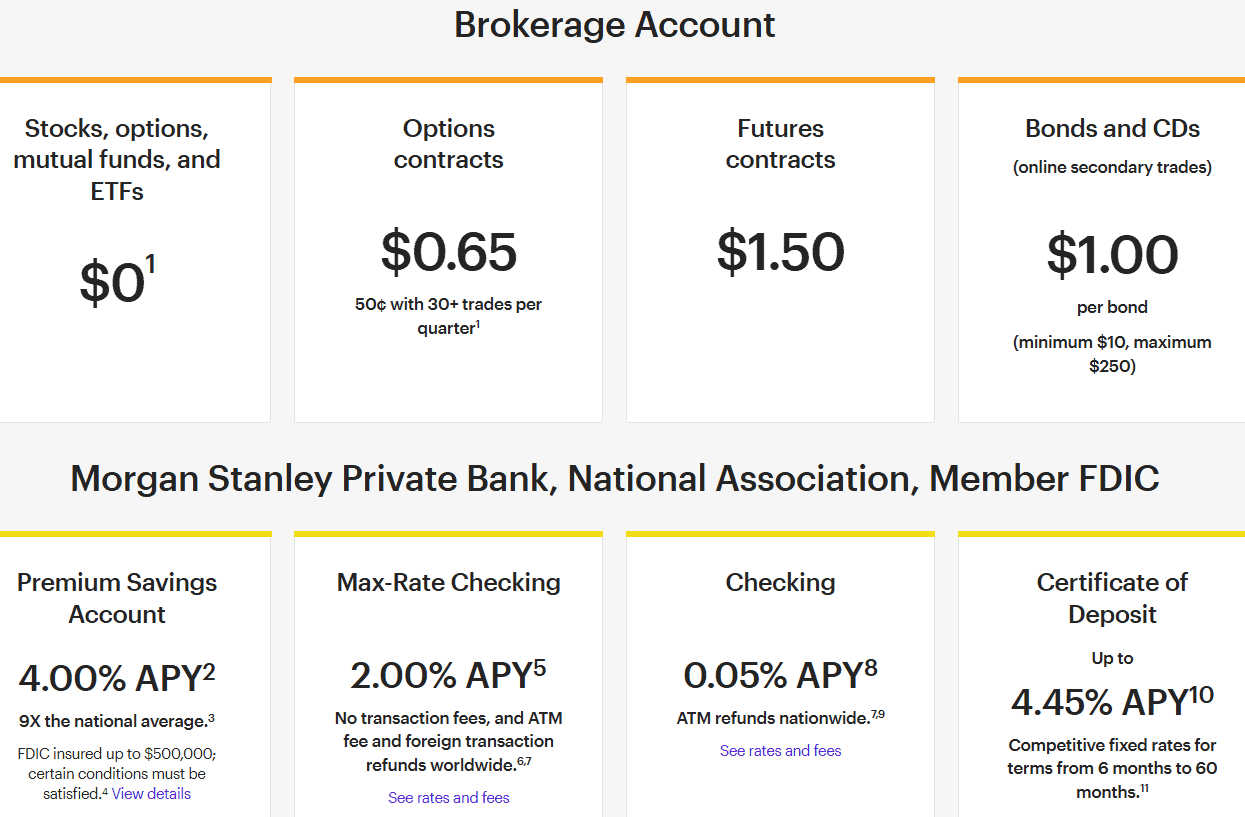

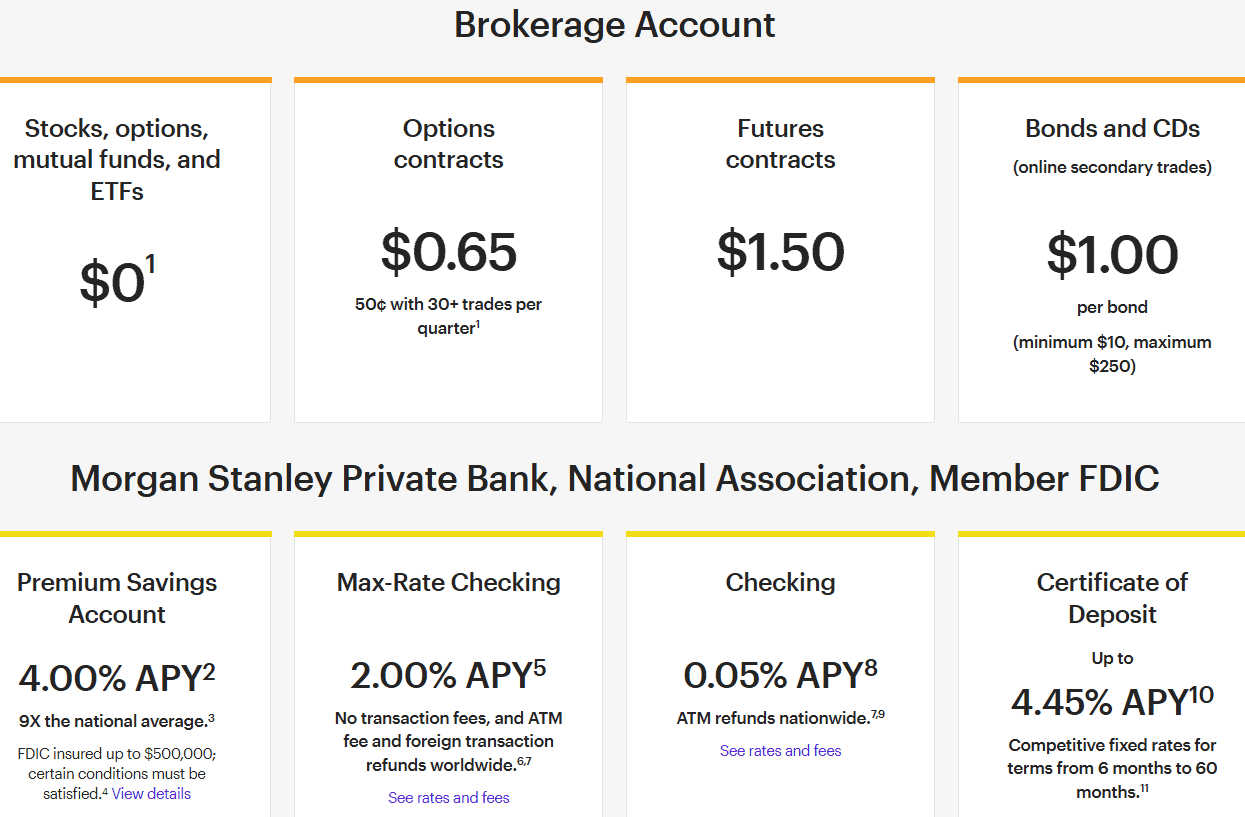

Cost Structure and Fees

Score – 4.5/5

E-Trade Brokerage Fees

The company employs a commission-based fee model for its trading services. While the platform provides competitive pricing, investors should be aware of potential charges like transaction fees and margin interest rates, which can differ depending on the account type and trading activity.

E-Trade offers competitive pricing across its products. For futures, including E-mini and Standard contracts, the fee is $1.50 per contract, per side, with Micro futures priced at $0.50 per contract, per side. This clear and transparent fee structure allows traders to manage costs effectively while accessing a wide range of markets.

In addition to its commissions, E-Trade passes on standard exchange and regulatory fees that apply to certain transactions. These include fees from U.S. stock exchanges, as well as charges mandated by regulatory bodies such as the SEC and FINRA.

E-Trade applies rollover, or swap, charges on positions held overnight in leveraged products such as futures. These fees represent the cost of carrying a position beyond the trading day and are influenced by factors like contract specifications, interest rate differentials, and market conditions.

Beyond commissions, E-Trade charges additional fees depending on account activity and services used. These include charges for broker-assisted trades, paper statements, wire transfers, or account transfers to another broker.

While many of these fees are avoidable with electronic delivery and self-directed trading, investors should review the full fee schedule to understand potential costs outside of standard trading.

How Competitive Are E-Trade Fees?

E-Trade’s fee structure is competitive within the online brokerage industry, particularly for investors seeking a balance between cost and platform quality.

Its commission-free stock and ETF trades, combined with modest fees for options and futures, make it appealing for both casual and active traders.

| Fees | E-Trade Fees | TradeStation Fees | Degiro Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $1.50 | $1.50 | $0.75 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | No | Yes | No |

| Fee ranking | Low/Average | Low/Average | Low |

Trading Platforms and Tools

Score – 4.6/5

E-Trade provides a comprehensive suite of trading platforms to suit different investor preferences and needs. For advanced users, Power E*TRADE Pro provides professional-grade charting, technical analysis, and customizable dashboards, while Power E*TRADE web offers advanced features with real-time market data and intuitive charting tools for seamless online trading.

Power E*TRADE app extends these capabilities to mobile devices, allowing users to manage portfolios and execute trades on the go.The E*TRADE app and E*TRADE web platforms offer user-friendly interfaces, providing accessibility and convenience for investors of all levels. With a range of options, the broker ensures that traders can engage with the financial markets through platforms that align with their preferences.

Trading Platform Comparison to Other Brokers:

| Platforms | E-Trade Platforms | TradeStation Platforms | Merrill Edge Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

E-Trade Desktop Platform

The Power E*TRADE Pro desktop platform is designed for active traders who require advanced tools and customization. It offers 16 chart types, over 120 technical studies, and more than 30 drawing tools, allowing users to analyze market trends and patterns in detail.

The platform supports sophisticated order types, real-time streaming data, and customizable watchlists and dashboards, making it easier to track multiple markets and execute trades efficiently.

Main Insights from Testing

Testing Power E*TRADE Pro reveals a platform that balances speed, reliability, and usability for active traders. Users benefit from fast order execution, real-time market data, and intuitive navigation, which together enhance trading efficiency.

The platform also integrates extensive research tools, alerts, and customizable layouts, allowing traders to tailor their experience to their strategies.

E-Trade Desktop MetaTrader 4 Platform

E-Trade does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

E-Trade Desktop MetaTrader 5 Platform

The firm does not support MetaTrader 5 either. The broker does not provide access to advanced platforms like MT5, maintaining its focus on its own platforms.

E-Trade MobileTrader App

The E-Trade app is a mobile platform that empowers traders to manage their investment portfolios and execute trades conveniently from their smartphones or tablets.

With a user-friendly interface, the app provides real-time market data, intuitive navigation, and secure access to account information. Investors can stay connected to the financial markets, monitor positions, and take advantage of trading opportunities on the go, making the app a versatile tool for mobile trading.

AI Trading

ETRADE does not currently offer proprietary AI tools directly within its platform. However, it provides integration with third-party AI-driven services that can enhance trading strategies.

For instance, TradersPost allows users to automate strategies from platforms like TradingView or TrendSpider directly within E-Trade.

Trading Instruments

Score – 4.7/5

What Can You Trade on E-Trade’s Platform?

The broker offers a comprehensive range of trading products, including stocks, options, mutual funds, ETFs, bonds, futures, and certificates of deposit (CDs).

This diverse selection enables investors to build well-rounded portfolios and engage in various strategies based on their financial objectives and risk preferences.

Main Insights from Exploring E-Trade’s Tradable Assets

Exploring the broker’s tradable assets reveals a comprehensive and accessible range of investment options suitable for various trading strategies. The platform offers a diverse selection of instruments, each supported by robust tools and resources to facilitate informed decision-making.

Margin Trading at E-Trade

E Trade provides margin trading options, allowing investors to borrow funds against their existing securities to potentially amplify their positions.

While margin trading can enhance returns, it also involves increased risk, and investors should carefully consider their risk tolerance and market conditions before engaging in margin trading on the broker’s platform.

Deposit and Withdrawal Options

Score – 4.6/5

Deposit Options at E-Trade

The broker offers various funding methods to enable users to deposit funds into their accounts conveniently. These methods typically include electronic funds transfers (ACH), wire transfers, mobile check deposits, and account transfers from external financial institutions.

By providing multiple funding options, E Trade accommodates diverse preferences and allows traders to fund their investment activities on the platform efficiently.

E-Trade Minimum Deposit

The broker does not have a strict minimum deposit requirement for opening a brokerage account. However, traders should be aware that certain account types and trading activities may have specific funding or balance requirements.

Withdrawal Options at E-Trade

The broker provides users with flexibility in withdrawing funds from their accounts through various methods. Investors can typically withdraw funds via electronic funds transfer (ACH), wire transfer, or by requesting a check, offering multiple options to accommodate individual preferences and needs.

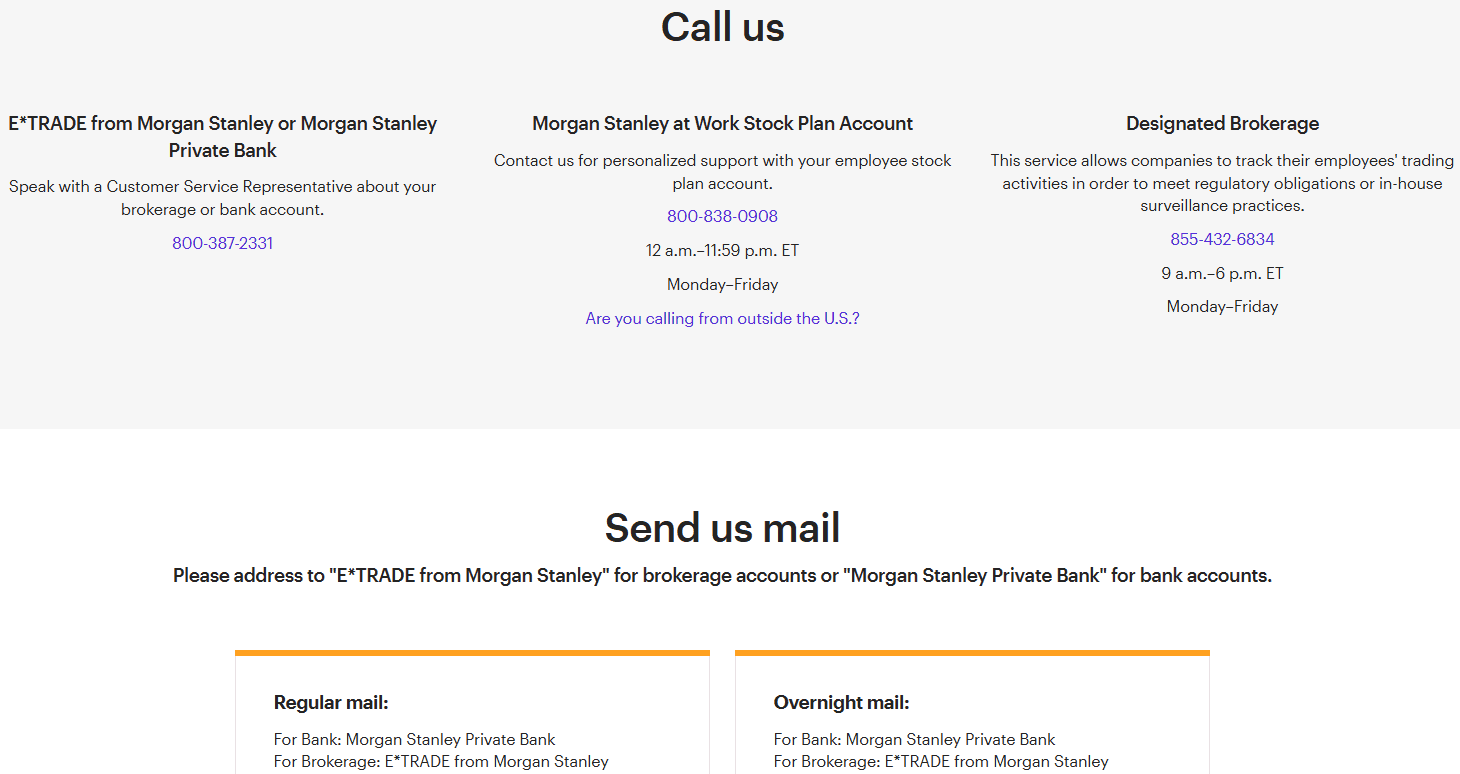

Customer Support and Responsiveness

Score – 4.5/5

Testing E-Trade’s Customer Support

The broker offers 24/5 customer support to assist users with inquiries, technical issues, and account-related concerns. The support channels typically include phone support, email assistance, and social media channels, providing traders with multiple options to seek help and guidance.

Contacts E-Trade

You can contact E Trade’s customer service team to speak with a representative about your brokerage or bank account via 800-387-2331, where trained agents can assist with account inquiries, technical support, and general questions.

Additionally, the broker offers support via email through their secure messaging system within your account, providing a convenient way to get detailed assistance or submit account-related requests.

Research and Education

Score – 4.7/5

Research Tools E-Trade

E-Trade provides a comprehensive suite of research tools across its platforms to support both novice and experienced investors.

- On the Power E*TRADE web platform, users can access real-time streaming quotes, news, and charts, along with daily market commentary. The platform also offers free independent research from providers like TipRanks and Thomson Reuters, as well as stock, mutual fund, bond, and ETF screeners to generate investment ideas based on personalized criteria.

- For more advanced traders, Power E*TRADE Pro delivers a range of advanced tools, including chart types, technical studies, and drawing tools. It also features advanced charting and technical analysis capabilities, such as the Earnings Move Analyzer and Snapshot Analysis, to help traders assess potential price movements and evaluate risk/reward profiles.

- Additionally, the Power E*TRADE app extends these research tools to mobile devices, allowing traders to access interactive charts, technical studies, and preset scans on the go.

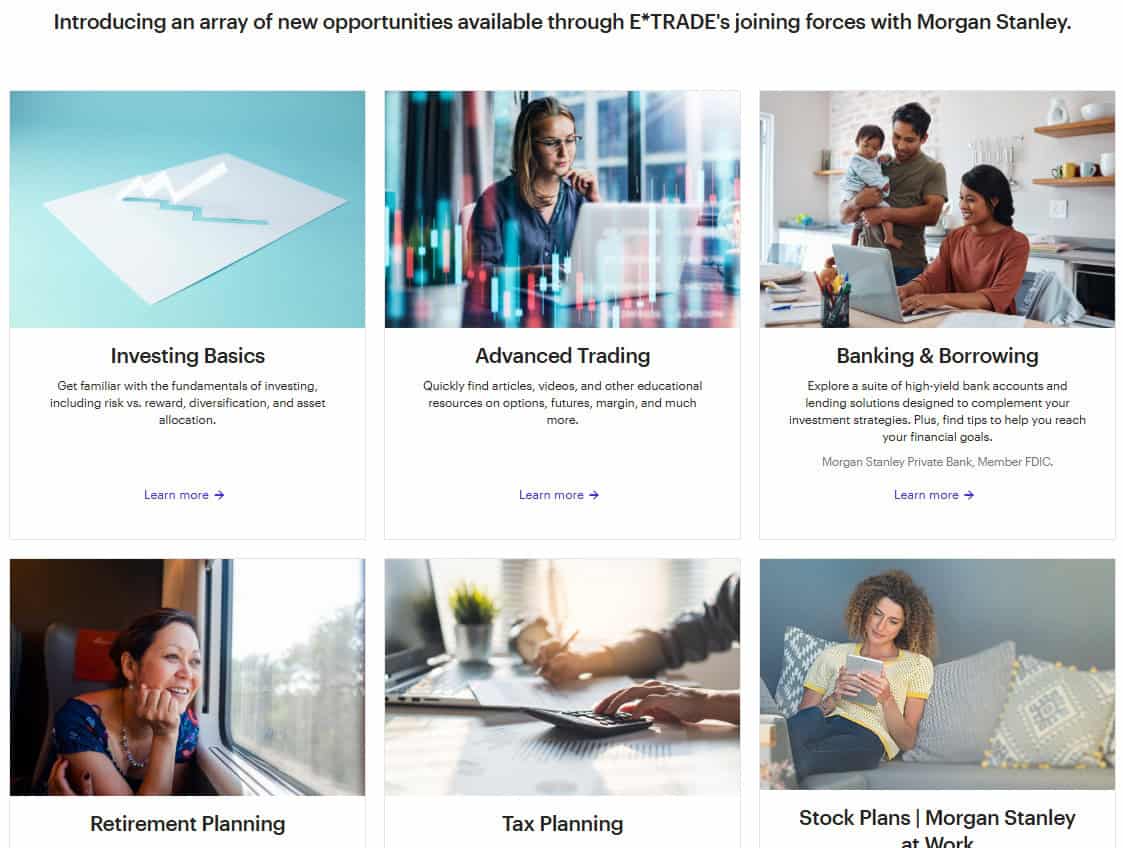

Education

The broker provides a range of educational resources to empower investors with knowledge and insights into financial markets. These resources include articles, videos, events, and interactive tools designed to enhance users’ understanding of trading strategies, market analysis, and investment concepts.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options E-Trade

E Trade provides a wide range of investment options, including stocks, ETFs, mutual funds, bonds, CDs, options, and futures, along with professionally managed portfolios through its Core Portfolios service.

Investors can choose between self-directed trading or automated solutions, making the platform suitable for both hands-on traders and those seeking a more guided investment approach.

Account Opening

Score – 4.5/5

How to Open E-Trade Demo Account?

To open a demo account with E-Trade, you will first need to register for a standard brokerage account, since paper trading is available only through the Power E*TRADE platform.

After your account is set up, you can log in to the platform and switch to paper trading mode, which provides virtual funds to practice trading under real market conditions. This allows you to explore the platform, test strategies, and build confidence without putting actual money at risk.

How to Open E-Trade Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or E-Trade login page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.4/5

Beyond its research capabilities, the broker offers additional tools and features that enhance the overall experience.

- These include advanced risk management calculators, trade alerts, portfolio analysis dashboards, and customizable screeners to help identify opportunities more efficiently.

- The broker also integrates educational resources and retirement planning tools, giving investors a well-rounded set of features to support both short-term trading and long-term financial planning.

E-Trade Compared to Other Brokers

Compared to its competitors, E-Trade stands out as a well-rounded broker that balances cost-effectiveness, platform variety, and investor resources.

While some brokers focus primarily on mobile-first trading or offer a narrower range of assets, the broker provides a broad selection of investment options along with powerful platforms.

Its combination of advanced desktop and web tools, user-friendly mobile apps, and strong educational resources makes it especially appealing to investors seeking both accessibility and depth.

In terms of regulation and reliability, it is on par with other leading global brokers, while its customer support and additional features reinforce its position as a trusted, full-service choice in the industry.

| Parameter |

E-Trade |

Trade Republic |

Interactive Brokers |

TD Ameritrade |

Freetrade |

Questrade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$1.50 |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$Futures contracts not available / Stock Commission from $0 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

Power E*TRADE Pro, Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Trade Republic Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, CDs |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

BaFin, Bundesbank |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$0 |

€0 |

$100 |

$0 |

$0 |

$1,000 |

$0 |

Full Review of Broker E-Trade

E-Trade is a trusted US-based online broker offering a wide range of investment solutions, including stocks, ETFs, mutual funds, options, futures, and fixed income products.

It provides multiple platforms tailored to different trading needs, such as Power E*TRADE Pro for advanced charting and analysis, Power E*TRADE web, and user-friendly mobile apps.

Investors benefit from robust research tools, educational resources, and additional features like retirement planning and portfolio analysis. The broker also supports paper trading for practice and offers reliable customer service via phone and email, making it a comprehensive choice for investors.

Share this article [addtoany url="https://55brokers.com/e-trade-review/" title="E-Trade"]