- What is Degiro?

- Degiro Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Degiro Compared to Other Brokers

- Full Review of Broker Degiro

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.7 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.6 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Degiro?

DEGIRO is a European online Stock Trading company that allows investors to buy and sell a variety of financial products, including stocks, bonds, options, futures, funds, commodities, and ETFs.

The firm primarily serves clients in various European countries, including the Netherlands, Germany, France, Spain, and others. Moreover, Degiro also provides access to global markets, including those in Australia, Japan, Hong Kong, and various other regions worldwide.

The broker is authorized and supervised by German BaFin, as well as by the Netherlands Authority for the Financial Markets (AFM) and the Dutch Central Bank (DNB). It complies with the regulations set forth by the European Securities and Markets Authority (ESMA) as well. These regulatory bodies help ensure that Degiro operates within legal and financial guidelines, providing a level of security for its users.

Overall, the company is renowned for its cost-effective trading model, providing competitive fees compared to traditional brokerage services and emphasizing a long-term investment approach.

Is Degiro Stock Broker?

Yes, Degiro is a Stock broker that facilitates the buying and selling of various financial products, including stocks, bonds, options, and ETFs. Known for its low-cost approach to trading, the firm has gained popularity among investors seeking competitive fees and a diverse range of investment opportunities.

Flatex Degiro

We found that flatexDEGIRO, the German branch resulting from the merger of Flatex and Degiro, offers online brokerage services catering to the German market. The broker provides diverse financial instruments, including Degiro stock, bonds, options, and ETFs.

Regulated by German financial authorities, the company ensures compliance with strict standards, providing traders with a secure and trustworthy platform for their investment needs within the German financial sphere.

Degiro Pros and Cons

Degiro offers a low-cost approach to Stock invest, offering competitive fees compared to traditional brokerages. The broker is among the most popular brokers and widely regarded companies, making it accessible for investors at various levels of experience. Additionally, the platform provides access to a diverse range of global markets, allowing users to diversify their investment portfolios.

For the cons, the research and educational resources might be limited compared to other platforms, which may pose challenges for trades that rely on in-depth analysis. Also, customer support has been cited as an area of improvement, with concerns about responsiveness and effectiveness.

| Advantages | Disadvantages |

|---|

| European regulation and oversee | No 24/7 customer support |

| Competitive trading conditions | No paper trading or demo account |

| Global market access | Limited research materials |

| $0 minimum deposit | |

| Direct Market Access | |

| Trading products | |

| Secure investing environment | |

| User-friendly interface | |

| No hidden charges | |

Degiro Features

Degiro is known for its low-cost trading and user-friendly interface. The broker offers access to global markets, a wide range of financial instruments, and competitive commission rates. Below is a comprehensive list of its key features:

Degiro Features in 10 Points

| 🏢 Regulation | BaFin, AFM, DNB |

| 🗺️ Account Types | Basic, Active, Trader, Day Trader Accounts |

| 🖥 Trading Platforms | Degiro Proprietary Trading Platform, Mobile App |

| 📉 Trading Instruments | Stocks, bonds, options, futures, funds, commodities, ETFs |

| 💳 Minimum Deposit | $0 |

| 💰 E-mini and Standard Contract | $0.75 |

| 🎮 Demo Account | Not available |

| 💰 Account Base Currencies | EUR, GBP, USD, CHF, DKK |

| 📚 Trading Education | Investor’s Academy, Lessons, Blog |

| ☎ Customer Support | 24/5 |

Who is Degiro For?

Degiro is ideal for cost-conscious investors looking for access to a wide range of global markets without high fees. It caters to those who value low commissions, a user-friendly platform, and a broad selection of products. Based on our findings and Financial Expert Opinions, Degiro is Good for:

- Stocks and Options trading

- European investors

- Investing

- Direct market access

- International traders

- Competitive conditions

- Low fees

- Advanced traders

- Professional trading

- Commission-based investment

Degiro Summary

In conclusion, Degiro stands out for its cost-effective approach to trading, offering competitive fees and a user-friendly platform for investors. The platform provides access to a diverse range of global markets, allowing for portfolio diversification.

While its educational resources may be more limited compared to some competitors, and there are occasional concerns about customer service responsiveness, the firm remains a popular choice for those seeking affordable and accessible online brokerage services.

Overall, Degiro provides a reliable environment for investment. However, we advise conducting your research and evaluating whether the firm’s offerings suit your specific requirements.

55Brokers Professional Insights

Degiro stands out as a professional-grade Stock platform thanks to its competitive fee structure, extensive market access, and regulatory reliability. It is one of the most regarded and large Stock Brokers with numerous key strengths, that are regarded and tested by us too inlcuding low commissions, especially for European and US equities, making it a cost-effective option great for active traders, pro traders and long investors.

The platform is excellent feature too, packed with great tools that we not seen on other brokers also provides access to over 50 exchanges across over 30 countries, covering stocks, ETFs, bonds, options, and futures. With intuitive interface it is easy to navigate, yet is combined with a robust tools, while is comfortable web-based platform and mobile app, that supports efficient order execution and portfolio management.

While it does not offer advanced tools like real-time data or in-depth technical analysis by default, its simplicity, low cost, and global reach make it an appealing choice for investors.

Consider Trading with Degiro If:

| Degiro is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Low fees and commissions.

- Professional trading.

- Secure trading environment.

- Stock Trading and Investment.

- Offering popular financial products.

- Looking for broker with Top-Tier licenses.

- Looking for broker with a long history of operation and strong establishment.

- Providing diverse trading strategies.

- European investors. |

Avoid Trading with Degiro If:

| Degiro might not be the best for: | - Looking for broker with 24/7 customer support.

- Investors who prefer robust educational resources.

- Need a broker with trading services worldwide. |

Regulation and Security Measures

Score – 4.6/5

Degiro Regulatory Overview

Degiro is a reliable Stock broker that follows the strict rules and guidelines established by European BaFin, AFM, and DNB. These respected regulations safeguard client assets and provide low-risk Stocks and Options trading.

How Safe is Trading with Degiro?

Degiro is a legitimate and trustworthy company for traders looking to invest and manage their assets. It is regulated by Top-Tier European authorities and has a good reputation and integrity in the financial market.

The firm adheres to certain industry standards and compliance requirements since it is strictly overseen by European regulators, which include implementing measures to prevent fraud, unauthorized account access, and stringent identity verification processes.

Additionally, Degiro is covered by the German Investor Compensation Scheme, providing compensation for losses arising from non-returned assets at a rate of up to 90%, with a maximum limit of €20,000.

Consistency and Clarity

Degiro has built a strong reputation across Europe as a transparent, low-cost brokerage, consistently earning high scores for its pricing model and ease of use.

Trader reviews often highlight the platform’s affordability, broad market access, and straightforward interface as major strengths, while some drawbacks include limited customer service responsiveness and a lack of advanced tools for professional traders.

The broker is regulated by top-tier financial authorities, including the Dutch AFM, and is under the supervision of the Dutch Central Bank, adding to its credibility. It has won multiple awards, reflecting strong user satisfaction and industry recognition.

Although Degiro does not heavily trade in high-profile sponsorships or social campaigns, it remains focused on delivering accessible investing for retail clients.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Degiro?

Degiro offers four distinct account types tailored to meet varying investor needs. The Basic account is designed for individual investors with standard requirements, providing a straightforward and cost-effective financial experience.

The Active account is geared towards professional traders or those engaging in higher trading volumes, offering advanced features and tools. The Trader account caters to a broad range of trades, striking a balance between the Basic and Active accounts.

Lastly, the Day Trader account is specifically designed for those involved in frequent and intraday trading, providing features suited for this dynamic trading style.

Basic Account

Degiro’s Basic Account is for investors who prefer a simple, fee-efficient platform without margin, derivatives, or short‑selling features. The account has no minimum deposit requirement; you can open it with as little as €0.01 via bank transfer, which is used for identity verification.

This entry-level account provides access to stocks, ETFs, bonds, and investment funds across global exchanges, while keeping fees minimal. As a non‑leveraged account, the account prevents using margin and derivatives, meaning your potential losses are capped at the cash balance you fund, not more.

Regions Where Degiro is Restricted

Degiro operates in many European countries but is not available worldwide. The broker restricts access in certain regions due to regulatory and operational limitations:

- USA

- Canada

- Asia

- Africa, etc.

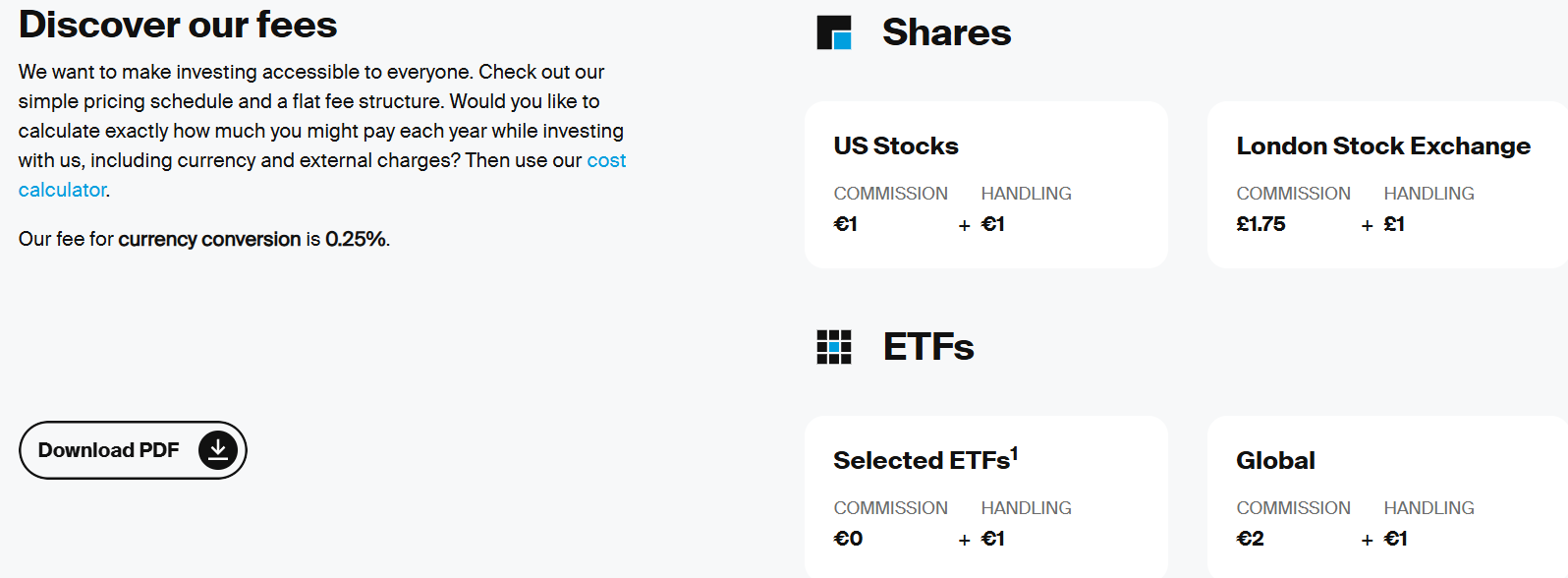

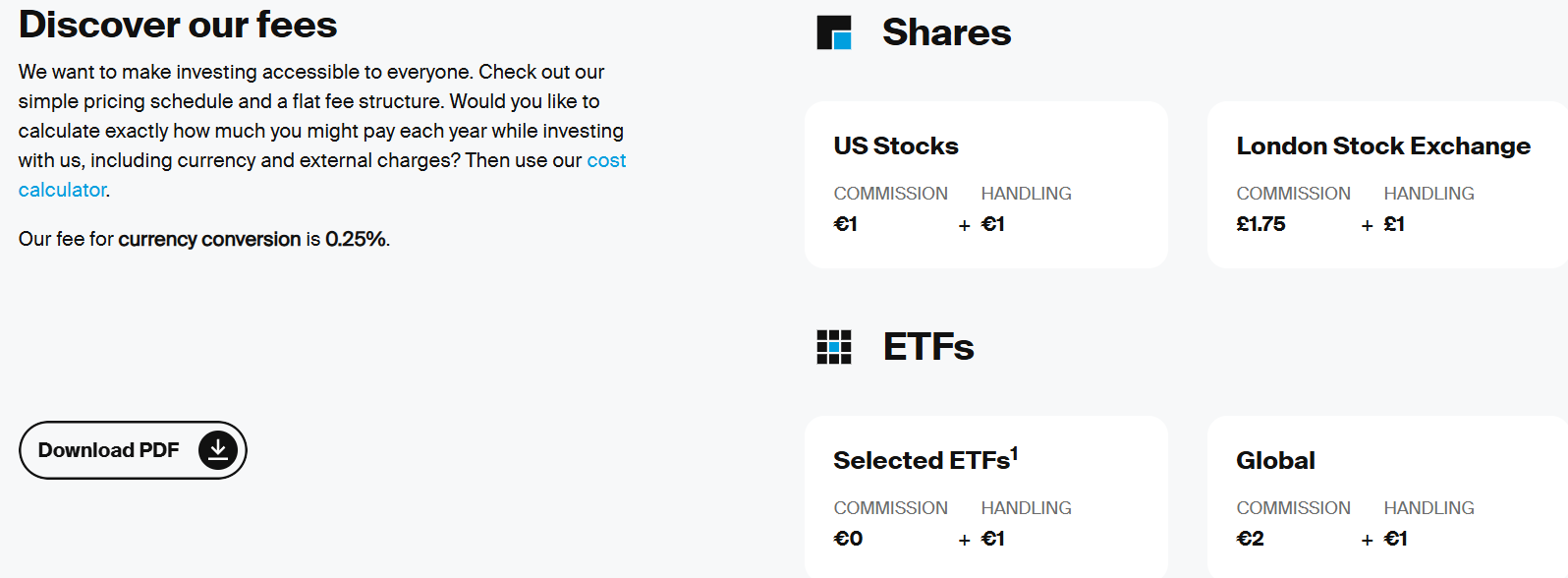

Cost Structure and Fees

Score – 4.7/5

Degiro Brokerage Fees

Degiro offers low costs, making it an attractive choice for cost-conscious investors. However, specific fees can vary depending on the type of account, the products used, and other factors.

Therefore, you should review the broker’s current fee schedule and terms as they can change over time.

DEGIRO offers competitive futures fees, charging €0.75 per contract for standard European futures and $0.75 per contract for US-listed products like E‑mini and Micro E‑mini contracts.

While US futures trading comes with an additional €5 monthly connectivity fee, European markets generally avoid such recurring charges. A small €1 settlement fee applies only when contracts are exercised or settled.

Degiro charges an annual connectivity fee of €2.50 per exchange for using exchanges outside your home market, this covers regulatory and infrastructure access costs.

For US options and futures markets, a €5 per calendar month connectivity fee applies if you trade or hold positions there. Additionally, the broker charges a fixed handling fee of €1 per transaction to cover external costs such as clearing, settlement, regulatory, and execution charges.

The broker applies rollover fees on leveraged positions such as margin trades or derivatives. Rates typically range from 5.25% to 6.9% annually, depending on whether the margin is pre-allocated.

These fees accrue daily and are charged monthly, which is important for traders to factor them into their holding strategies.

Degiro maintains a relatively low-cost structure but applies certain additional fees that traders should be aware of. Notably, there is no inactivity fee, a good choice for occasional investors.

However, users may incur costs such as connectivity fees for certain exchanges, a currency conversion fee of 0.25%, and charges for real-time price feeds or corporate actions like dividend processing.

While these fees are generally low, they can add up depending on the trading activity and asset types involved.

How Competitive Are Degiro Fees?

The broker’s fee structure is widely regarded as competitive, particularly for long-term investors and those trading across European markets.

With low commission rates, no account maintenance fees, and free access to core ETFs under specific conditions, Degiro appeals to cost-conscious traders.

| Fees | Degiro Fees | MEXEM Fees | Webull Fees |

|---|

| Broker Fee - E-mini and Standard Contract | $0.75 | $0.85 | $0.70 |

| Exchange Fee | Defined by Exchange | Defined by Exchange | Defined by Exchange |

| Trading Platform Fee | No | No | No |

| Data Fee | No | No | No |

| Fee ranking | Low | Low/Average | Low |

Trading Platforms and Tools

Score – 4.5/5

The broker provides its user-friendly and intuitive platform designed to meet the diverse needs of investors. The platform offers real-time market data, advanced charting tools, and an efficient order execution system, so you can easily access a wide range of financial products, monitor their portfolios, and execute trades seamlessly.

Additionally, Degiro’s platform is available as a web-based application and a mobile app, providing flexibility for users to manage their investments on various devices.

Trading Platform Comparison to Other Brokers:

| Platforms | Degiro Platforms | MEXEM Platforms | TradeZero Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Degiro Web Platform

Degiro’s WebTrader is an intuitive browser-based platform designed for quick and efficient trading. Accessible on any modern browser and supported across desktop, tablet, and mobile devices, it offers fast order execution, customizable watchlists, and real-time streaming quotes for key European and US markets.

Integrated features such as charting tools, technical indicators, market depth visibility, analyst views, and an economic calendar enable users to manage and monitor portfolios effectively, all without relying on third-party software.

While it lacks features like price alerts, advanced automation, or downloadable desktop clients, its clean interface and responsive design make it well-suited for all levels of investors.

Main Insights from Testing

Testing the broker’s web platform reveals a user-friendly interface tailored for simplicity and speed. The layout is clean and easy to navigate, accessible even for first-time users.

While it lacks more advanced features like backtesting or highly customizable dashboards, it performs reliably, with smooth order placement and clear portfolio overviews.

Degiro Desktop MetaTrader 4 Platform

Degiro does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading typically associated with MT4.

Degiro Desktop MetaTrader 5 Platform

The broker does not support MetaTrader 5 either. Degiro does not provide access to advanced platforms like MT5, maintaining its focus on its proprietary platform.

Degiro MobileTrader App

The broker offers a user-friendly mobile app that empowers investors to manage their portfolios on the go. The app provides real-time market data, enabling users to stay informed about the latest market trends and execute trades seamlessly.

With an intuitive interface, users can easily monitor their investments, access charts, and place orders conveniently from their mobile devices. The Degiro app caters to both novice and experienced individuals, offering a streamlined and efficient mobile trading experience.

AI Trading

Degiro does not offer any AI-driven or algorithmic trading features. Its platform is strictly manual and prohibits the use of trading bots or custom scripts.

Instead, users rely on their decision-making and management, placing and modifying trades manually through the platform. While Degiro presents a range of tools and data designed to assist with investing and portfolio monitoring, there is no native support for AI models that automatically generate or execute trading decisions.

Trading Instruments

Score – 4.7/5

What Can You Trade on Degiro’s Platform?

Degiro provides access to a diverse range of products, allowing to build well-rounded and diversified portfolios. This selection includes stocks, bonds, options, futures, Degiro crypto, funds, commodities, and ETFs.

This comprehensive range enables investors to engage in both short-term and long-term strategies, catering to different risks and goals.

Main Insights from Exploring Degiro’s Tradable Assets

Degiro also offers a wide selection of Exchange-Traded Funds (ETFs) for investors. These funds, traded on stock exchanges, offer a convenient way to access a variety of asset classes, from equities to bonds.

The platform enables users to easily incorporate ETFs into their portfolios, allowing for diversification and flexibility in investment strategies.

Margin Trading at Degiro

Degiro offers margin trading, where investors can borrow funds to trade beyond their cash balance. Interest is charged at 6.90% p.a. if the margin is used without prior allocation, or 5.25% p.a. if you allocate the intended borrowing amount in advance.

Interest accrues only on actual usage and is calculated daily, not for intraday borrowing, and billed monthly. These multiplier facilities are subject to regulatory and account-specific limitations, and new accounts are generally not permitted to enable margin trading.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Degiro

Degiro only supports deposits via bank transfers, allowing users to transfer funds directly from their bank accounts to their Degiro accounts.

Degiro Minimum Deposit

The broker offers no minimum deposit requirement for opening a new account. Investors can open an account and start investing with any amount they are comfortable with.

Withdrawal Options at Degiro

Degiro supports withdrawals exclusively via bank transfer, specifically to your primary registered bank account in your name. Withdrawals to other parties or third-party services are not permitted.

While Degiro does not typically charge for withdrawals, users should be aware of any potential fees associated with bank transactions or currency conversions, depending on their circumstances and the financial institutions involved.

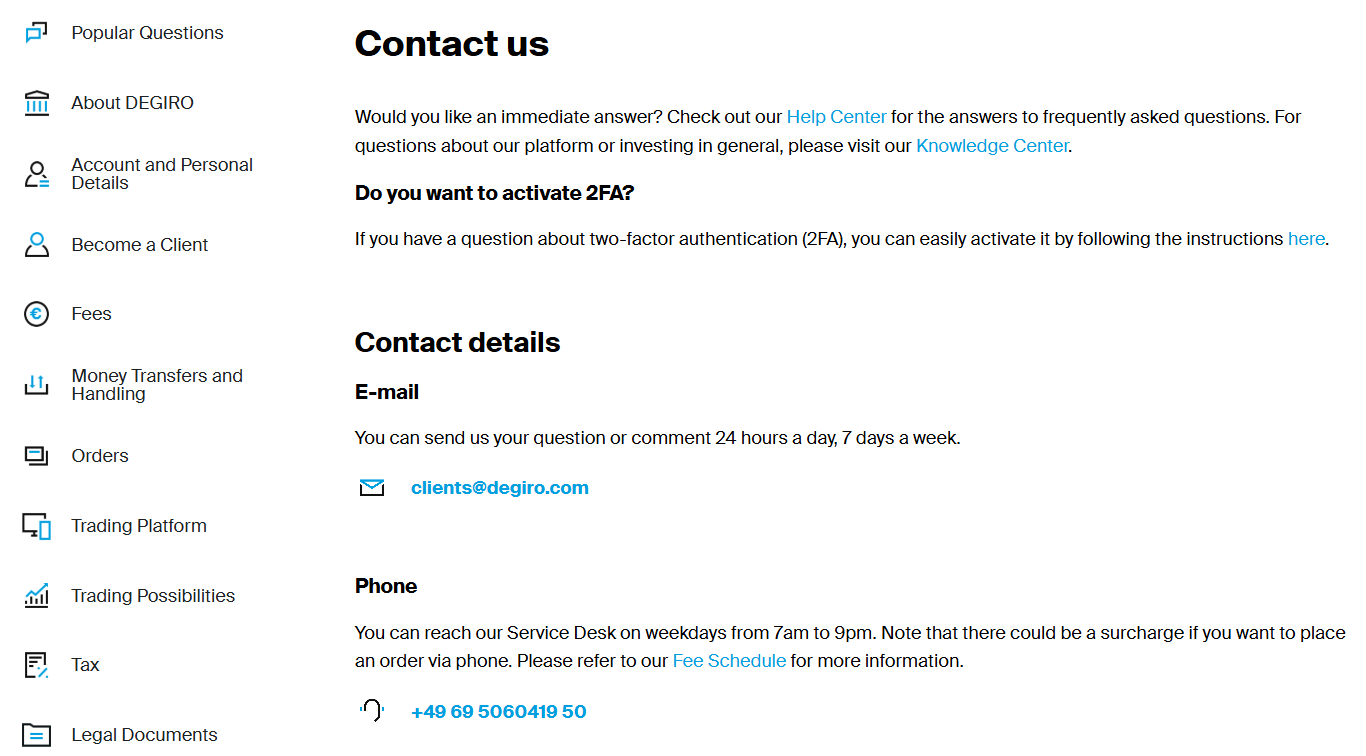

Customer Support and Responsiveness

Score – 4.5/5

Testing Degiro’s Customer Support

The broker’s customer support is available 24/5 through email, phone, Help Center, and social media channels. However, Degiro’s customer service has been a topic of discussion among users, as some of them have raised concerns about the responsiveness and effectiveness of customer support.

Therefore, explore the available support channels, such as email or online help desks, and be aware of the platform’s customer service model when choosing Degiro for your investment needs.

Contacts Degiro

Degiro offers customer support via email at clients@degiro.com and through dedicated phone lines. Clients can contact the Dutch support team at +31 20 535 34 96.

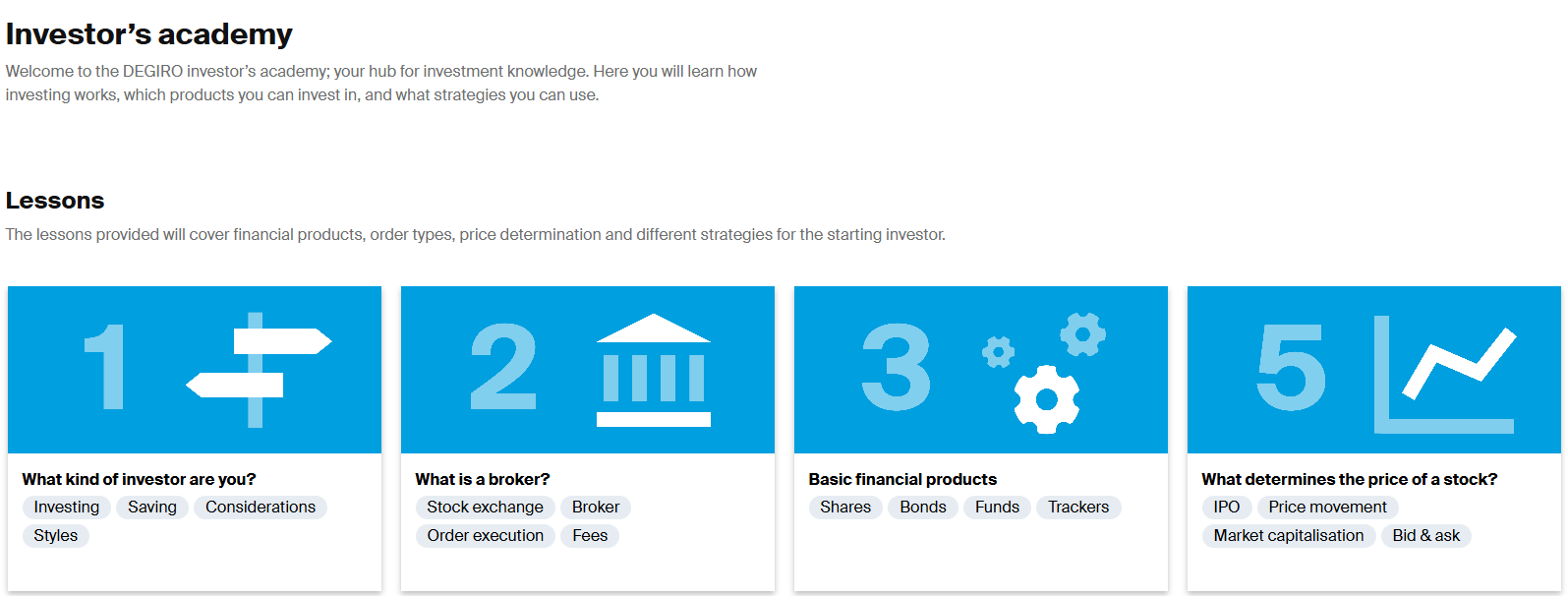

Research and Education

Score – 4.6/5

Research Tools Degiro

Degiro offers a selection of research tools designed to support investors.

- On its web and mobile platforms, users can access fundamental analysis features such as financial statements, company earnings, and valuation ratios, along with basic technical analysis tools like interactive price charts and indicators.

- While the platform does not provide in-depth market screeners or premium research reports, it includes analyst recommendations, real-time news, and market data to help guide investment decisions.

These tools collectively support a straightforward approach to both fundamental and technical strategies.

Education

The firm offers educational resources to help investors enhance their understanding of financial markets and various strategies. Degiro’s educational materials cover a range of topics, catering to both beginners and experienced investors, and providing valuable insights to assist traders in making informed investment decisions.

However, the extent of educational content may not be as comprehensive as some other platforms, so youu may choose to supplement your learning with additional resources if necessary.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options Degiro

The firm provides access to a wide range of investment options, including stocks, ETFs, bonds, mutual funds, options, and futures across major global exchanges.

Investors can diversify their portfolios by trading in over 50 markets worldwide, with low-cost access to both domestic and international instruments. Degiro also supports long-term investing through index funds and themed ETFs, including those focused on sectors like technology, sustainability, and artificial intelligence.

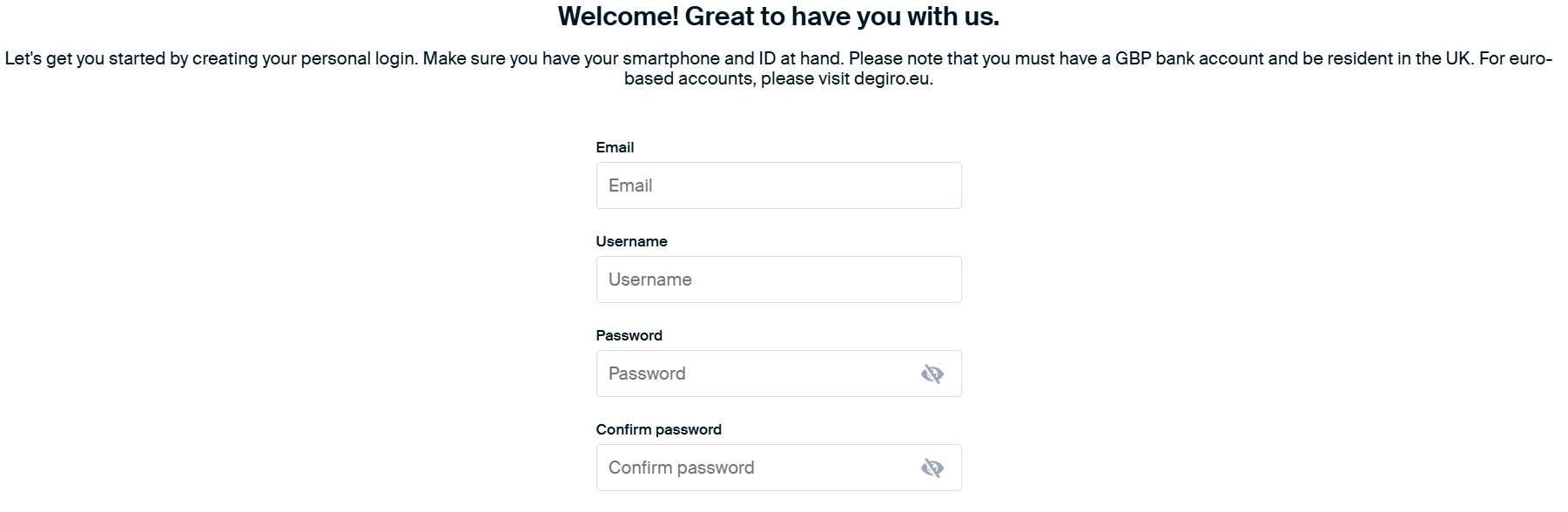

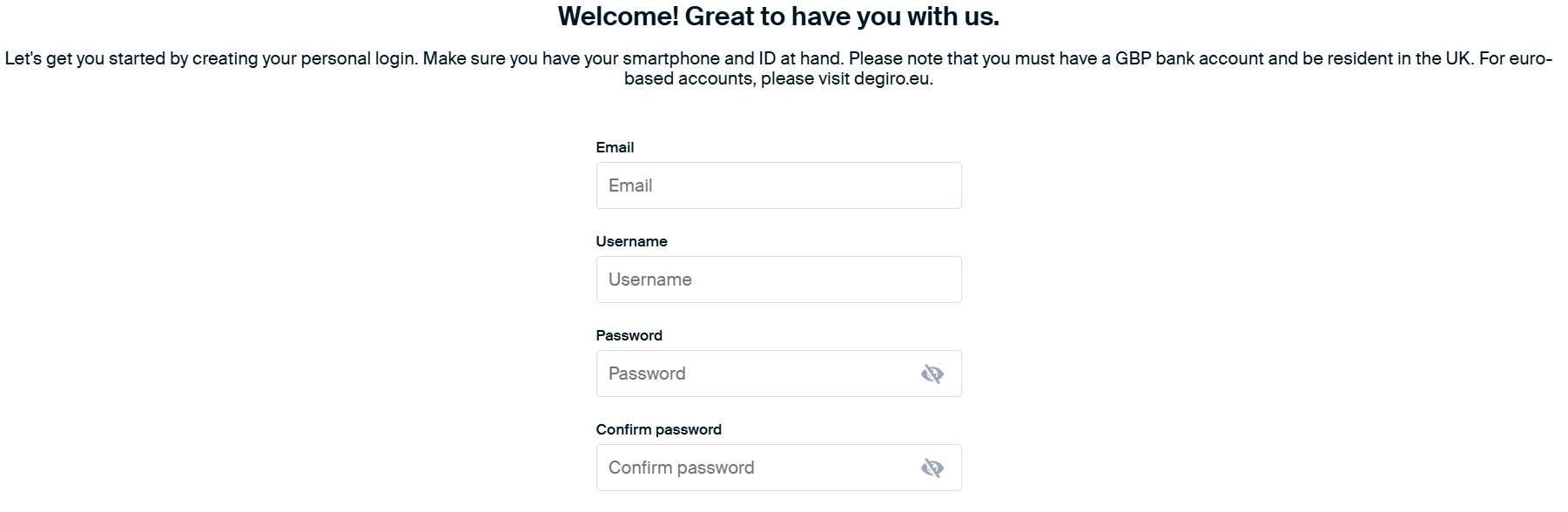

Account Opening

Score – 4.4/5

How to Open Degiro Demo Account?

Degiro does not provide a demo or paper trading account. Investors should open a live account to explore the available tools and features.

How to Open Degiro Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Degiro login page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its research tools, Degiro offers several other useful features for investors, including a comprehensive portfolio overview, price alerts, and customizable watchlists.

The platform also provides access to real-time quotes for select exchanges, downloadable account statements, and secure two-factor authentication for added account protection. These tools help streamline portfolio management and enhance the overall experience.

Degiro Compared to Other Brokers

Compared to its competitors, Degiro stands out for its low-cost structure and straightforward platform designed for investors who need simplicity and direct market access.

While it lacks some advanced tools and asset classes found on platforms like Interactive Brokers or TD Ameritrade, Degiro still offers a solid range of investment products, including stocks, ETFs, bonds, and options.

The broker is a good choice for cost-conscious European clients, though traders seeking more sophisticated tools, 24/7 customer support, or a wider range of markets and educational content might prefer alternatives such as Interactive Brokers or Webull.

| Parameter |

Degiro |

MEXEM |

Interactive Brokers |

TD Ameritrade |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

$0.75 |

$0.85 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low |

Low/Average |

Low |

Average |

Low |

Average |

Low |

| Trading Platforms |

Degiro Proprietary Trading Platform, Mobile App

|

Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, bonds, options, futures, funds, commodities, ETFs |

Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

BaFin, AFM, DNB |

CySEC, FCA, AFM, FSMA |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Good |

Good |

Excellent |

Good |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

€0.1 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Degiro

Degiro is a European, well-regulated Stock Trading firm known for its low costs and user-friendly proprietary platform. It offers a broad selection of investment products, including stocks, ETFs, bonds, options, and futures, suitable for both beginners and experienced investors.

The broker provides access to various research tools such as technical and fundamental analysis, economic calendars, and market news. Clients benefit from the platform’s streamlined interface, responsive mobile app, and additional features like alerts, watchlists, and order types.

Regulated by multiple European authorities, Degiro ensures a secure environment while maintaining transparency through competitive fees and minimal account requirements.

Share this article [addtoany url="https://55brokers.com/degiro-review/" title="Degiro"]