CornerTrader Review

Leverage: 1:200

Regulation: FINMA

Min. Deposit: $2,000

HQ: Switzerland

Platforms: CornerTrader Platform

Found in: 1952

CornerTrader License

- Cornèr Bank Ltd - authorized by FINMA (Switzerland)

Leverage: 1:200

Regulation: FINMA

Min. Deposit: $2,000

HQ: Switzerland

Platforms: CornerTrader Platform

Found in: 1952

CornerTrader License

Cornet Trader is a CFD and Forex trading broker offering a wide range of asset classes such as FX options, stocks, bonds, ETFs, mutual funds, and more.

The company is a division of Corner Bank Group. Founded in 1952, Cornèr Bank Ltd is an independent Swiss private bank in Switzerland.

With the launch of CornerTrader in 2012, the bank has extended its solutions and services into the growing online trading market.

CornerTrader is a regulated brokerage company with transparent and safe trading conditions established in Switzerland. Spreads and fees are among the average, and there is an easy account opening process suitable for professional traders or regular traders too, we also mark good technical solutions, range of offered instruments and reliable conditions.

For the Cons, there is no MetaTrader trading platform offered since Broker mainstays on its own technology, also there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|---|

| Regulated broker with safe trading conditions | No MetaTrader trading platform |

| Competitive trading costs and spreads | No 24/7 customer support |

| Quality customer support | The minimum deposit is high |

| Range of trading instruments |

| 🏢 Headquarters | Switzerland |

| 🗺️ Regulation | FINMA |

| 🖥 Platforms | CornerTrader Platform |

| 📉 Instruments | Forex, FX Options, CFDs, ETFs, Stocks, CFD Options, Futures, Cryptos, and more |

| 💰 EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Available |

| 💳 Minimum deposit | $2,000 |

| 💰 Base currencies | USD, EUR, GBP |

| 📚 Education | Provided with insights and tutorials |

| ☎ Customer Support | 24/5 |

CornerTrader is considered a reliable broker with favorable trading conditions and great transparency being highly reputable Broker in Switzerland. The broker offers a range of trading services with competitive spreads and fees.

| Ranking | CornerTrader | Core Spreads | Tickmill |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Instruments | Spreads | Trading Platforms |

CornerTrader offers good trading conditions, a range of trading instruments, also competitive trading spreads and fees. However, there are a number of other brokers that may offer similar services. Here are some of the best alternatives to CornerTrader:

CornerTrader is an award-winning broker with competitive trading conditions. The broker has also garnered collective recognition from industry leaders many times.

No, CornerTrader is not a scam. It is a part of Cornèr Bank which is regulated by one of the sharpest regulators in Switzerland, FINMA. This means that it fully complies with operations according to the requirements and necessary measures.

In fact, to operate as a brokerage firm in Switzerland will be required a banking license, which is quite hard to get due to very high requirements and numerous rules that apply to a general model of operation up to ruling directors.

Yes, CornerTrader is a legit and regulated broker.

CornerTrader and Corner Bank is the member of the Esisuisse depositor protection scheme, which ensures that clients’ deposits at Swiss banks are protected.

See our conclusion on CornerTrader Reliability:

| CornerTrader Strong Points | CornerTrader Weak Points |

|---|---|

| Regulated broker with a strong establishment | None |

| All deposits guaranteed up to CHF100,000 | |

| FINMA license and overseeing |

In accordance with the scheme, Esisuisse members ensure the transfer of required amounts of up to CHF 6 billion, in the case of the company insolvency the client receives fund protection of up to CHF 100,000.

FINMA and various regulatory standards restrict allowed levels of leverage in order to protect clients. So in most world countries leverage is highly restricted, however, according to FINMA, Swiss-based Brokers are still can use high leverage ratio up to 1:200, yet be sure to verify this for a particular instrument. Thus, the maximum CornerTrader leverage level is the following:

CornerTrader offers three account types, each of which can be supplemented with a range of additional services and is available in EUR, USD, CHF, and more.

Demo account is also available at the beginning of trading.

| Pros | Cons |

|---|---|

| Fast account opening | The minimum deposit is above average |

| Demo account is available | |

| Account base currencies GBP, EUR, USD, CHF | |

| Hedging and scalping allowed |

Opening an account with CornerTrader is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

A trading offering of CornerTrader presents its proprietary platform with a world of thousands of assets that includes more than 160 Forex classes along with FX Options, thousands of CFDs, ETFs, and Stocks from 22 global exchanges, as well with Contract Options and Futures.

At CornerTrader, fees are based on the account types offered, and also according to the trading instruments. E.g., in trading Cryptocurrencies with Bitcoin and Ethereum, the commission starts from 0.07% for Pro Traders.

There is also an inactivity fee which is charged if there is no purchase of financial instruments for more than 12 months prior to the accounting month.

| Fees | CornerTrader Fees | Core Spreads Fees | Capital Index Fees |

|---|---|---|---|

| Deposit fee | Yes | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | No | Yes |

| Fee ranking | Average | Low | Low, Average |

CornerTrader spread is also based on the account types the traders choose. Based on our findings, the average EUR/USD spread is 0.2 pips, and 0.4 pips for GBP/USD pairs.

| Asset/ Pair | CornerTrader Spread | Core Spreads Spread | Capital Index Spread |

|---|---|---|---|

| EUR USD Spread | 0.2 pips | 0.7 pips | 1.1 pips |

| Crude Oil WTI Spread | - | 3 pips | 7 |

| Gold Spread | - | 4 | 0.5 |

| BTC USD Spread | 190 pips | 0.70% | - |

At CornerTrader, clients are offered Swiss banking services, while the transactions of funds are performed via the Corner Bank IBAN. CornerTrade offers a TradersCard that is linked to the trading account and makes the client option to withdraw money instantly from any ATM counter.

Here are some good and negative points for CornerTrader funding methods found:

| CornerTrader Advantage | CornerTrader Disadvantage |

|---|---|

| No internal fees for withdrawals | No e-wallets payment method |

| Multiple account base currencies | |

| One exclusive prepaid card | |

| Fast digital deposits |

In terms of funding methods, CornerTrader offers TradersCard that enables traders to pay with:

CornerTrader minimum deposit is $2,000. However, you should check the account type you choose since some may require minimums to access designed features and cover necessary margins.

CornerTrader minimum deposit vs other brokers

| CornerTrader | Most Other Brokers | |

| Minimum Deposit | $2,000 | $500 |

CornerTrader does not charge a commission for money withdrawals while the funds are sent to CornerTrader Card making the withdrawal easy process.

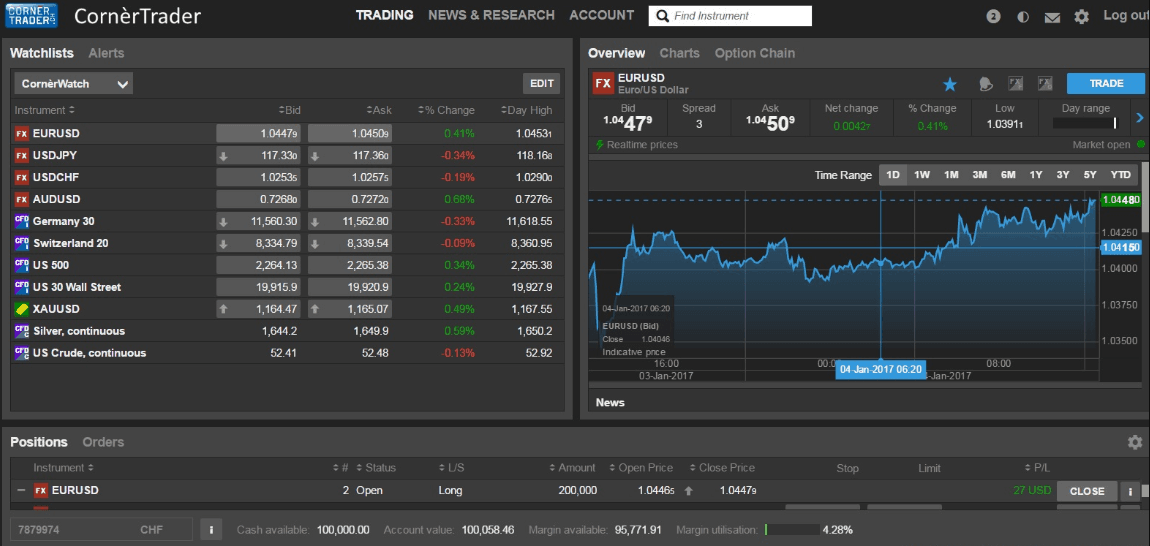

The broker offers its CornerTrader proprietary trading platform which provides access to the world’s markets with an intuitive interface and strategy-building capabilities that are available from any device, desktop, phone, or tablet.

Based on our finds, CornerTrader offers a wide range of fundamentals and analyses of trading instruments, and also the availability of chart trading. Moreover, the platform provides access to market analyses, news, and the financial calendar. We found that CornerTrader trading platform is also equipped with innovative extended options and functions such as risk management tools.

| Platforms | CornerTrader Platforms | Core Spreads Platforms | Capital Index Platforms |

|---|---|---|---|

| MT4 | No | Yes | Yes |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platform | Yes | Yes | No |

| Mobile Apps | Yes | Yes | Yes |

CornerTrader provides 24/5 customer support to its clients. Phone lines and Email are also available here.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Availability of phone lines and email | No live chat |

| Quick responses | |

| Relevant answers |

At CornerTrader all necessary information and learning materials are available through tutorials, trading events, Forex news, charting, and analyses, along with oversights to monitor and control margin requirements, and access to account overview with fees report.

To sum up, CornerTrader is a reliable and safe brokerage company along with its competitive trading services. The trading costs and spreads are also attractive among the market offering. Nevertheless, the company does not require a minimum deposit which can be a good start for new traders or even a solution for active traders.

The broker provides solutions for retail, institutional, and professional traders, as well as offers investment opportunities through PAMM.

Based on Our findings and Financial Expert Opinions CornerTrader is Good for:

No review found...

No news available.

hi

I am a Jordanian living in Saudi Arabia if I want to open an account with your firm what document do I need to provide? and is it possible to do that as a resident in Saudi Arabia?

Dear Sir or Madam , you have good chance for me may be. I need to open private account in malty currencies in USD and CHF. And currently I need to know about documents from me to open the account. I am from Russia Moscow .

Your Sincerely,

Andrey Donskoy.