- What is Cornertrader?

- Cornertrader Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

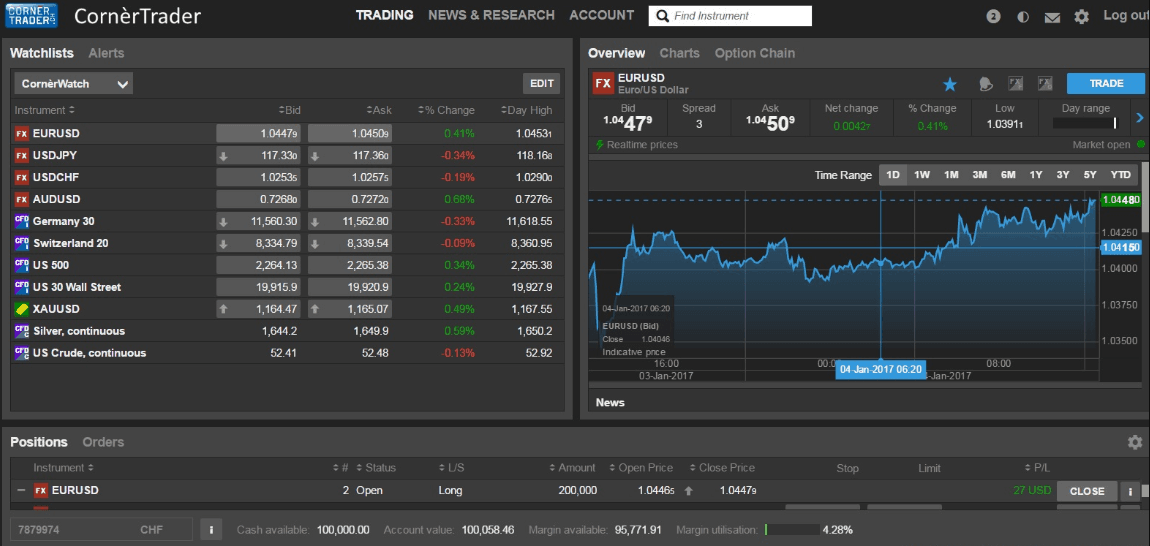

- Trading Platforms and Tools

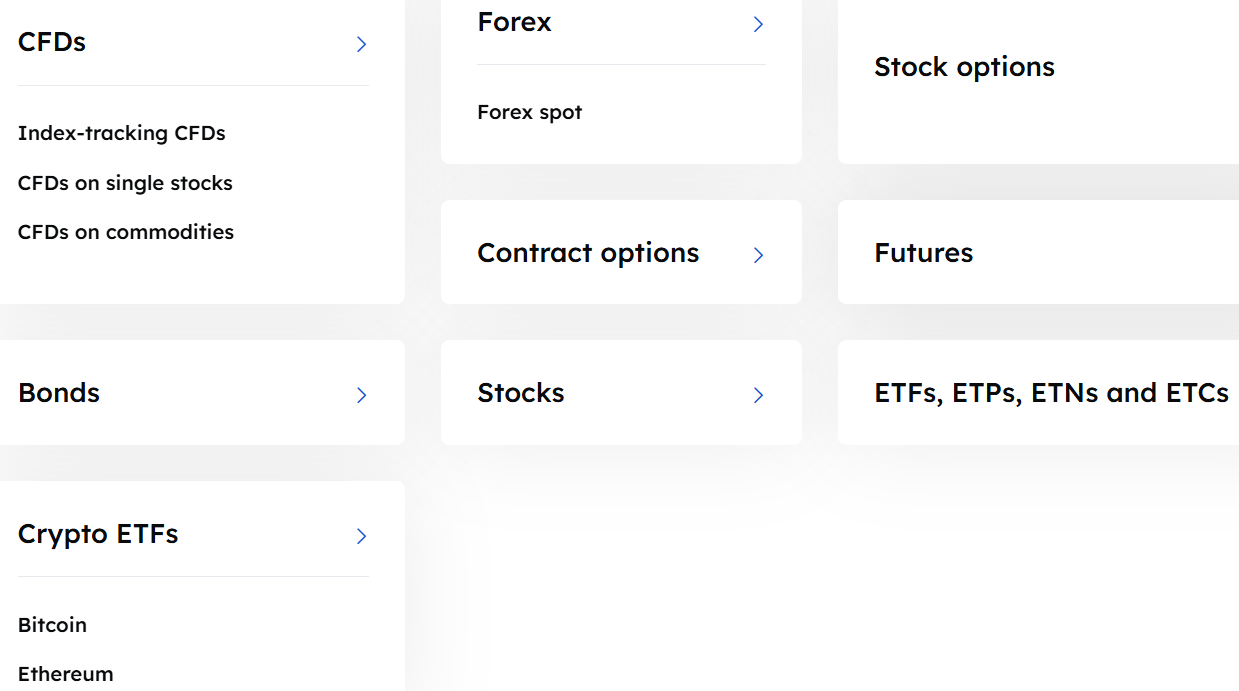

- Trading Instruments

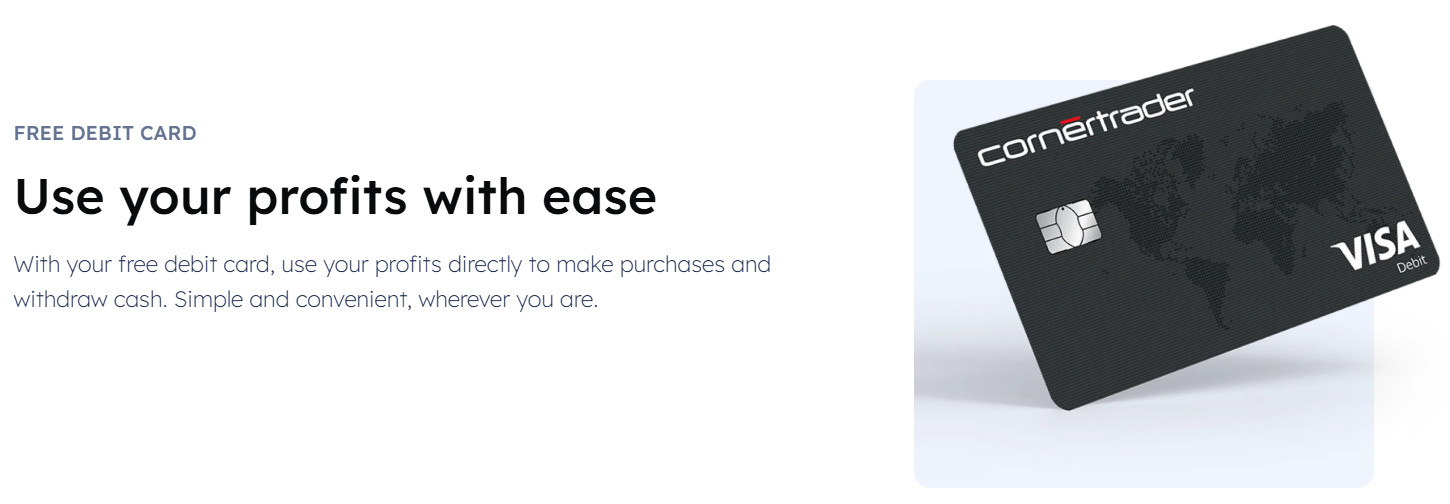

- Deposit and Withdrawal Options

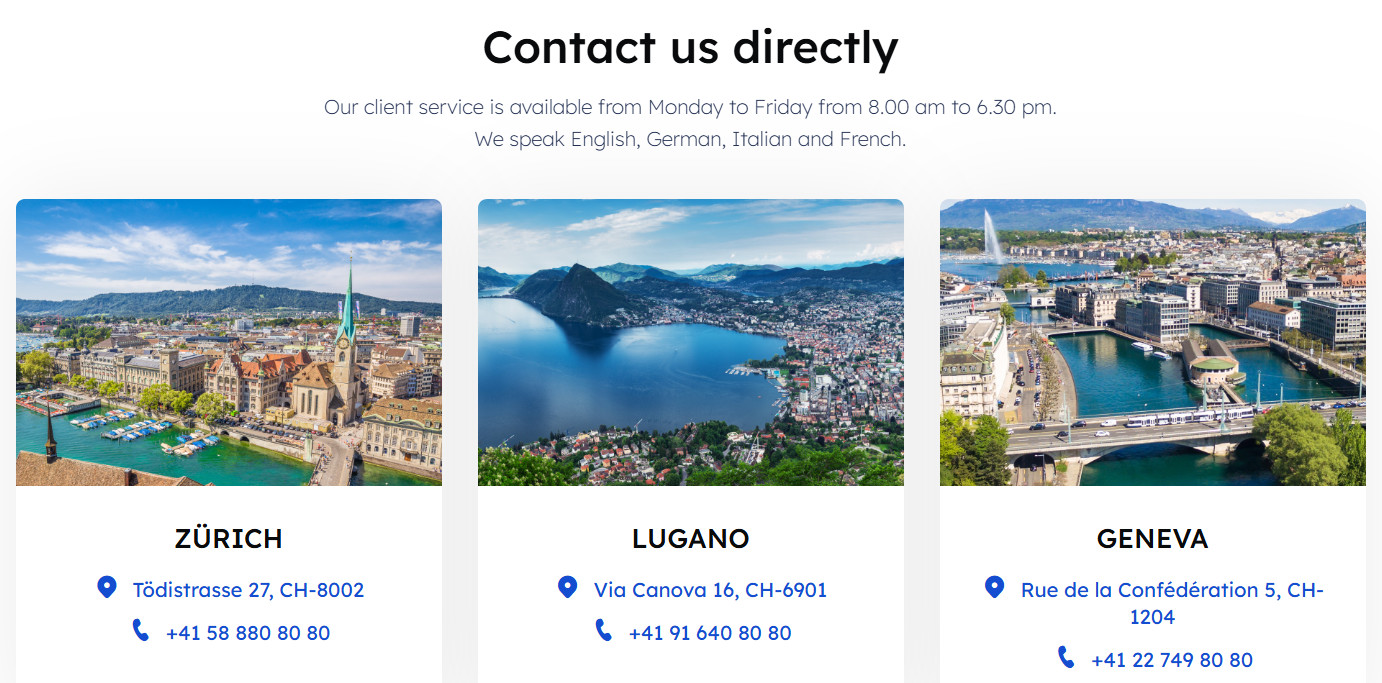

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

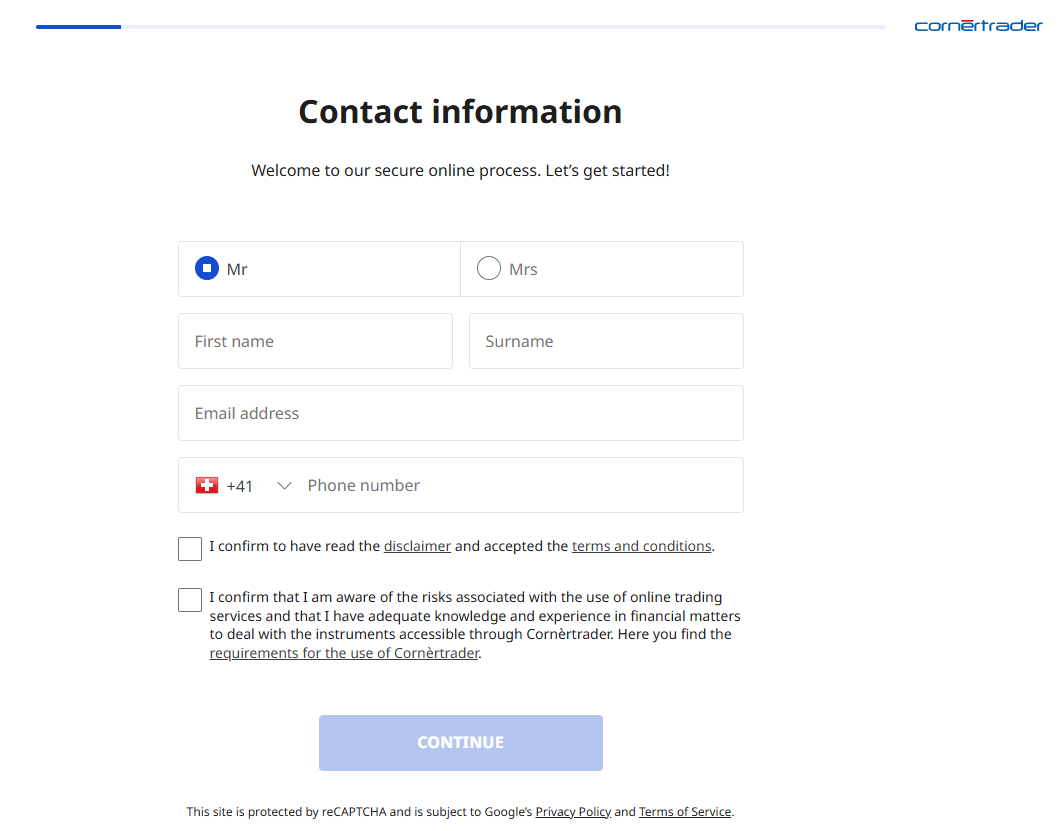

- Account Opening

- Additional Tools And Features

- Cornertrader Compared to Other Brokers

- Full Review of Broker Cornertrader

Overall Rating 4.4

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.3 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Cornertrader?

Cornertrader is a CFD and Forex trading broker offering a wide range of asset classes such as FX options, stocks, bonds, ETFs, mutual funds, and more.

The company is a division of Corner Bank Group. Founded in 1952, Cornèr Bank Ltd is an independent private bank in Switzerland.

With the launch of Cornertrader in 2012, the bank has extended its solutions and services into the growing online financial market.

Cornertrader Pros and Cons

Cornertrader is a regulated brokerage company with transparent and safe conditions established in Switzerland. Spreads and fees are among the average, and there is an easy account opening process suitable for professional traders or regular traders, too. We also mark good technical solutions, a range of offered instruments, and reliable conditions.

For the Cons, there is no MetaTrader platform offered since Broker mainstays on its own technology, also there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Regulated broker with safe trading conditions | No MetaTrader trading platform |

| Competitive trading costs and spreads | No 24/7 customer support |

| Quality customer support | The minimum deposit is high |

| Webinars and seminars | |

| Range of trading instruments | |

Cornertrader Features

Cornertrader is considered a reliable broker with favorable conditions and excellent transparency being highly reputable Broker in Switzerland. The broker offers a range of financial services with competitive spreads and fees. Below is a comprehensive list of its key features:

Cornertrader Features in 10 Points

| 🏢 Regulation | FINMA |

| 🗺️ Account Types | Consistency, Solidity, Opportunity, Energy Accounts |

| 🖥 Trading Platforms | Cornertrader Platform, iCornèr App |

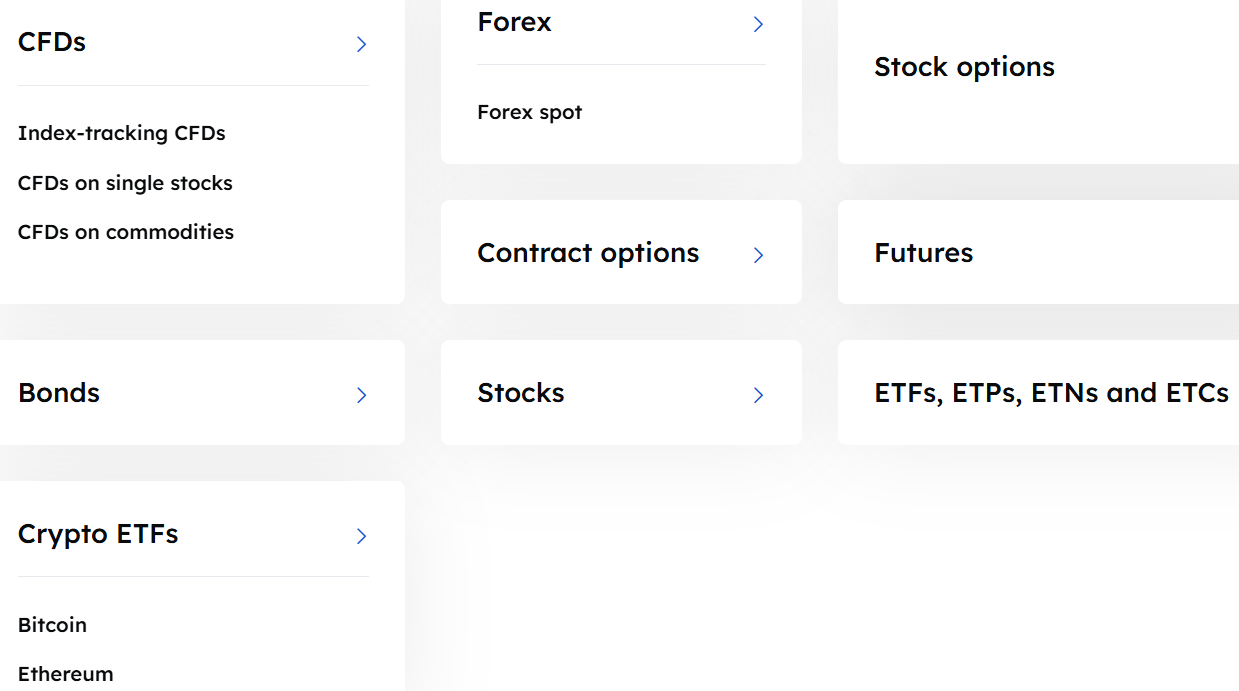

| 📉 Trading Instruments | Forex, FX Options, CFDs, ETFs, Stocks, CFD Options, Futures, Cryptos, and more |

| 💳 Minimum Deposit | $1,000 |

| 💰 Average EUR/USD Spread | 0.2 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | CHF, GBP, EUR, USD |

| 📚 Trading Education | Webinars, Seminars, Guides, Insights |

| ☎ Customer Support | 24/5 |

Who is Cornertrader For?

Cornertrader is tailored for a diverse range of investors, particularly those based in Switzerland, who seek a robust and cost-effective platform. It is especially suitable for individuals aiming to manage substantial portfolios and who prefer the security of a Swiss banking institution. Based on our findings and financial expert opinions, Cornertrader is well-suited for:

- European traders

- Investors

- Professional Trading

- CFD and currency trading

- STP/OTC execution

- Advanced traders

- Institutional trading

- Competitive spreads

- Swiss based Trading

- Higher Leverage access for retail traders

- Good learning and research materials

Cornertrader Summary

To sum up, Cornertrader is a reliable and safe brokerage company along with its competitive services. The trading costs and spreads are also attractive among the market offerings.

The broker provides solutions for retail, institutional, and professional traders, as well as offers investment opportunities through PAMM.

55Brokers Professional Insights

Cornertrader stands out in the competitive online trading space by combining the reliability of Swiss banking with a sophisticated infrastructure. As a platform backed by Cornèr Bank, a well-established Swiss financial institution regulated by FINMA, it offers traders a high level of security and trust.

What makes Cornertrader particularly appealing is its wide range of investment products from stocks, ETFs, and bonds to Forex, options, and futures, available through tiered accounts designed for varying levels of capital and trading experience.

Its professional platforms, competitive commission-based pricing, and personalized service make it especially suitable for active and professional traders who demand both flexibility and performance.

Consider Trading with Cornertrader If:

| Cornertrader is an excellent Broker for: | - Need a well-regulated broker.

- European traders.

- Quality educational and research materials.

- Secure environment.

- Offering popular instruments.

- Providing competitive conditions.

- Professional traders.

- Who prefer higher leverage up to 1:200.

- Providing robust platforms.

- Access to PAMM and MAM systems.

|

Avoid Trading with Cornertrader If:

| Cornertrader might not be the best for: | - Beginner traders.

- Looking for industry-known platform.

- Who prefer 24/7 customer service. |

Regulation and Security Measures

Score – 4.6/5

Cornertrader Regulatory Overview

Cornertrader is a part of Cornèr Bank, which is regulated by one of the sharpest regulators in Switzerland, FINMA. This means that it fully complies with operations according to the requirements and necessary measures.

In fact, to operate as a brokerage firm in Switzerland will require a banking license, which is quite hard to get due to very high requirements and numerous rules that apply to a general model of operation up to ruling directors.

How Safe is Trading with Cornertrader?

Trading with Cornertrader is considered safe due to its strong regulatory framework and robust depositor protection mechanisms. As a division of Cornèr Bank Ltd., Cornertrader benefits from the bank’s regulation by the Swiss Financial Market Supervisory Authority (FINMA), ensuring compliance with stringent Swiss banking standards.

Additionally, Cornèr Bank Ltd. is a member of Esisuisse, the Swiss deposit insurance scheme, which safeguards client deposits up to CHF 100,000 per client in the event of the bank’s insolvency. Esisuisse members collectively guarantee the transfer of required amounts up to CHF 6 billion to cover protected deposits, providing an added layer of security for clients’ funds.

Consistency and Clarity

Cornertrader has built a solid reputation in the Swiss financial landscape, backed by its parent company, Cornèr Bank Ltd., a respected institution regulated by FINMA. The broker is known for its consistent service quality, transparent fee structures, and strong emphasis on client fund safety, earning positive reviews from experienced traders.

Many users appreciate its professional-grade platforms and access to diverse financial instruments, though some beginners may find the platform complex and the minimum deposit relatively high. Cornertrader’s reputation is further enhanced by industry recognition and its active engagement in the financial community through events, sponsorships, and educational initiatives.

This blend of regulatory credibility, user feedback, and societal involvement presents Cornertrader as a trustworthy and established player in the online trading industry.

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Cornertrader?

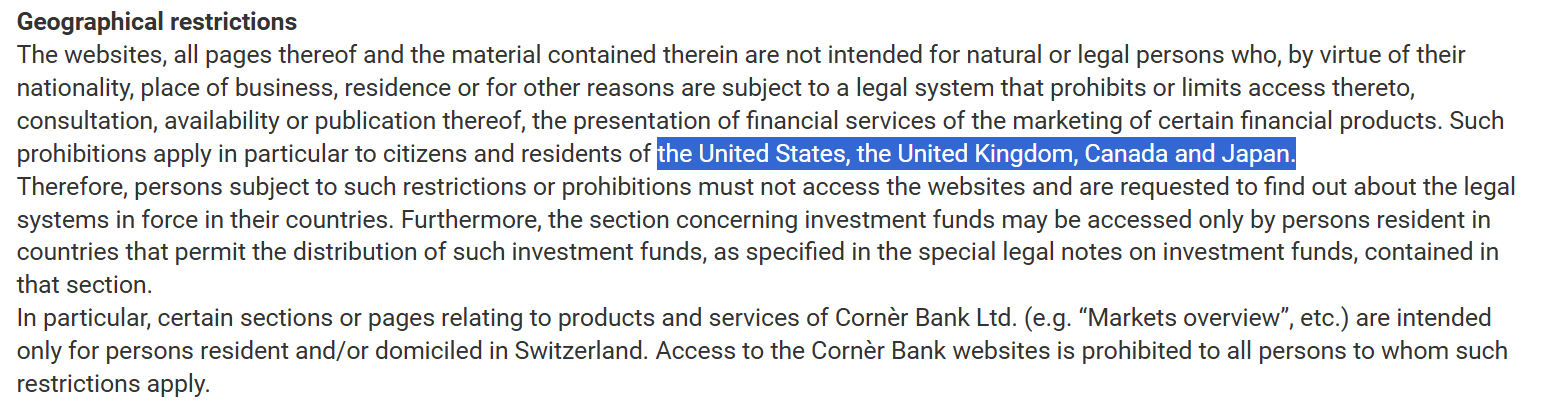

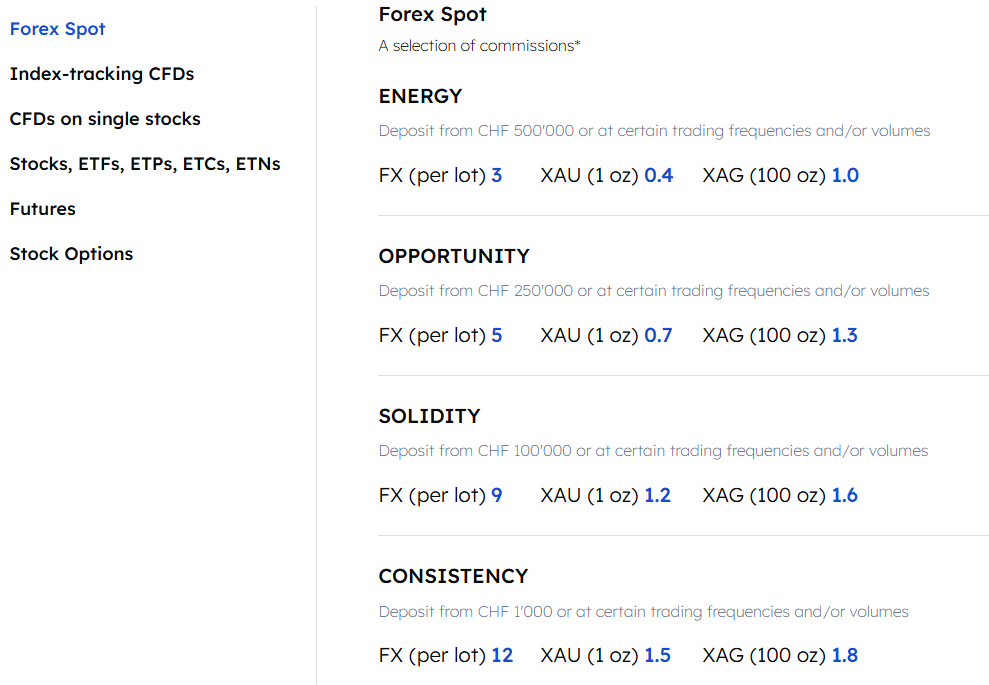

Cornèrtrader offers four distinct account types, Consistency, Solidity, Opportunity, and Energy, each designed to suit different trading volumes and experience levels.

These accounts vary mainly in terms of commission rates and access to advanced features, with the Energy account offering the most competitive pricing for high-volume traders. The tiered structure allows clients to scale their experience as their needs evolve.

In addition to live accounts, Cornertrader provides a free demo account, enabling users to explore the platform and practice strategies in a risk-free environment.

Consistency Account

The Consistency Account is an entry-level option designed for those starting or trading with moderate volume. It requires a minimum deposit of CHF 1,000, making it accessible to many retail traders.

This account charges a commission of CHF 12 per lot traded in the Forex market, which is higher compared to other tiers but offers access to the full suite of Cornertrader’s instruments, including Currency, equities, ETFs, bonds, and more.

Energy Account

The Energy Account is tailored for high-volume and professional traders seeking the most cost-effective conditions. It requires a significantly higher minimum deposit of CHF 500,000, but in return, it offers the lowest commission rate of CHF 3 per lot.

This account type also unlocks premium features and services, potentially including better platform tools or personalized support. The Energy Account is ideal for seasoned traders who value top-tier execution, reduced fees, and the reliability of a Swiss-regulated broker.

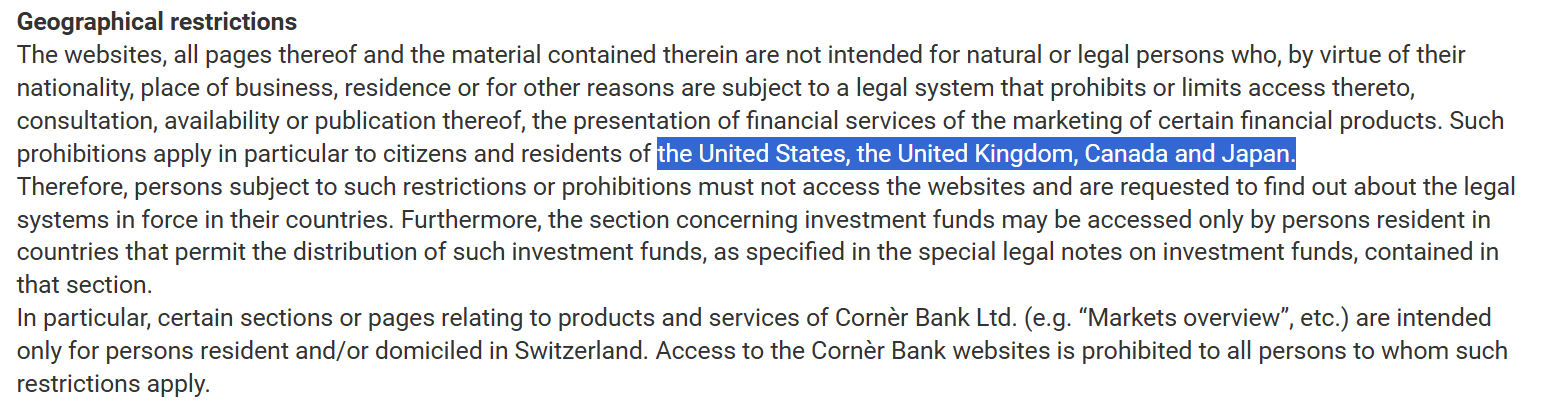

Regions Where Cornertrader is Restricted

Cornertrader primarily caters to clients within Switzerland and certain other jurisdictions. However, its services are not available in all regions. Residents of the following countries are restricted from opening accounts with Cornertrader:

Cost Structure and Fees

Score – 4.4/5

Cornertrader Brokerage Fees

At CornerTrader, fees are based on the account types offered and also according to the instruments. E.g., in trading Cryptocurrencies with Bitcoin and Ethereum, the commission starts from 0.07% for Pro Traders.

CornerTrader spread is also based on the account types the traders choose. Based on our findings, the average EUR/USD spread is 0.2 pips.

Cornèrtrader offers a transparent and competitive commission structure across its various account tiers. Commissions vary by financial product and trading volume, with Energy accounts benefiting from the lowest rates.

For example, trading on the SIX Swiss Stock Exchange incurs a commission of 0.07% for Energy clients, while Consistency clients face a rate of 0.12%. Additionally, Cornertrader does not impose custody fees, which is advantageous for investors holding securities over extended periods.

- Cornertrader Rollover / Swaps

At Cornertrader, rollover rates, also known as swap rates, are applied to positions held overnight to account for the interest rate differentials between the two currencies in a currency pair. These rates can result in either a credit or a debit, depending on the direction of your trade and the prevailing interest rates.

For example, as of the current rates, long positions in Crypto FX are subject to a funding rate of 15% per annum, while short positions incur a 0% rate, adjusted daily based on market conditions. Rollover rates can vary daily and may be influenced by factors such as market volatility and liquidity.

- Cornertrader Additional Fees

Cornertrader maintains a transparent fee structure, aiming to minimize additional costs for its clients. Notably, the broker no longer charges inactivity fees, thereby eliminating penalties for account inactivity.

Clients can also benefit from free incoming security transfers, facilitating the seamless transfer of assets without incurring additional charges. However, certain services charge fees; for instance, phone orders are subject to a fee of CHF 30 for Energy and Opportunity accounts and CHF 50 for Consistency and Solidity accounts.

Additionally, payments and currency conversions may incur fees, with digital channel payments within Switzerland being free, while offline orders incur a CHF 10 fee. Also, custody fees are generally free, except for bonds, which incur a 0.10% annual custody fee.

How Competitive Are Cornertrader Fees?

Cornertrader offers competitive fees that are designed to appeal to both retail and professional traders. The broker’s fee structure is transparent and varies depending on the type of account and the products being traded.

For stock and ETF trades, Cornertrader generally charges a commission based on the trade size, with no hidden fees for deposits or withdrawals within Switzerland. The fees for currency trading are in line with industry standards, ensuring that active traders can benefit from relatively low-cost trading.

While there are no inactivity fees, the commission rates for specific assets or advanced features may vary, so traders need to review the fee schedule based on their individual needs.

| Asset/ Pair | Cornertrader Spread | Trade Nation Spread | ACY Securities Spread |

|---|

| EUR USD Spread | 0.2 pips | 0.6 pips | 1.1 pips |

| Crude Oil WTI Spread | 3 | 0.04 pips | $0.034 |

| Gold Spread | 0.5 | 0.25 pips | 3 |

| BTC USD Spread | 190 pips | 1.5% | 23.7 |

Trading Platforms and Tools

Score – 4.3/5

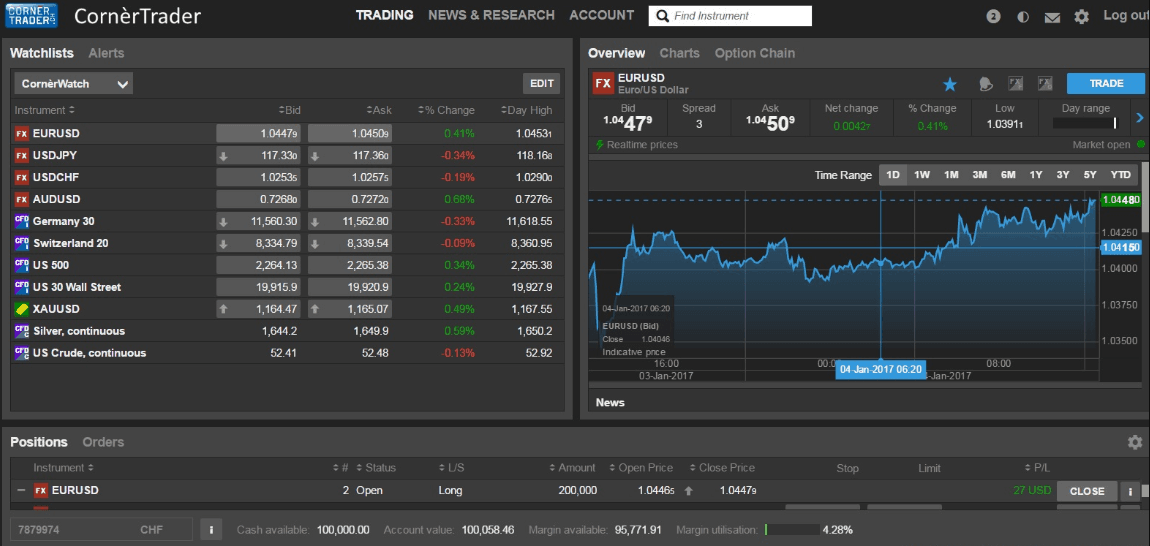

Cornertrader offers its Cornertrader platform as the primary solution for its clients. This platform provides a seamless and user-friendly interface, allowing traders to access a wide range of financial instruments and execute trades efficiently.

It is designed to cater to both beginners and more advanced traders, with features that support various strategies. In addition to the desktop platform, the broker also offers the iCornèr App, a mobile application that allows users to manage their trading activities and investments on the go. The iCornèr App integrates banking and trading functionalities, providing real-time notifications, financial research, and easy access to accounts, making it convenient for users to stay updated and make informed decisions at any time.

Trading Platform Comparison to Other Brokers:

| Platforms | Cornertrader Platforms | Trade Nation Platforms | ACY Securities Platforms |

|---|

| MT4 | No | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Cornertrader Desktop Platform

The Cornertrader platform is a robust and user-friendly interface designed for both novice and experienced traders. It offers a comprehensive range of tools and features that allow users to access global markets, including Forex, stocks, commodities, and more.

The platform is equipped with advanced charting tools, technical indicators, and risk management features, making it suitable for traders with various strategies. It also supports seamless order execution, real-time market data, and personalized account management.

The intuitive design ensures that traders can easily navigate the platform, while its integration with Cornertrader’s banking services enhances the overall experience, offering flexibility and control for users who prefer trading from their desktops.

Main Insights from Testing

Testing the Cornertrader platform reveals that the platform integrates seamlessly with the iCornèr App, allowing for convenient mobile trading. While it provides solid execution speed and essential tools, advanced traders might find some limitations in terms of customization and advanced features. Overall, it is a reliable choice for traders looking for a straightforward and efficient experience.

Cornertrader Desktop MetaTrader 4 Platform

Cornertrader does not offer the MetaTrader 4 platform for desktop users. While MT4 is a popular choice among traders for its simplicity and range of tools, the broker provides its proprietary platform designed to offer a user-friendly experience tailored to various trader needs, along with its iCornèr App for mobile trading.

Cornertrader Desktop MetaTrader 5 Platform

Similarly, Cornertrader does not offer the MT5 platform on desktop. Instead, the broker provides its own Cornertrader platform, which includes key features like advanced charting tools, market access, aiming to provide a seamless and intuitive experience for all users.

Cornertrader MobileTrader App

The iCornèr App is Cornertrader’s mobile solution, designed to offer traders a seamless and flexible way to manage their investments on the go. With this app, users can access their accounts, execute trades, view real-time market data, and stay updated with financial news and notifications.

It also integrates banking and trading functionalities, making it convenient for users to perform various financial tasks, including managing their accounts and executing transactions directly from their mobile devices. Available for both iOS and Android, the iCornèr App ensures that users have full control of their trading activities wherever they are.

Trading Instruments

Score – 4.7/5

What Can You Trade on Cornertrader’s Platform?

Cornertrader offers access to over 20,000 financial instruments, including Forex, FX Options, CFDs, ETFs, Stocks, CFD Options, Futures, Cryptos, and more. This extensive range allows traders to diversify their portfolios and explore various markets worldwide.

Main Insights from Exploring Cornertrader’s Tradable Assets

Exploring Cornertrader’s tradable assets reveals a broad range of opportunities for investors and traders. With a global reach, it provides exposure to a variety of markets, including major and emerging economies.

The wide selection of tradable assets caters to both short-term traders and long-term investors, allowing them to implement diverse strategies. Additionally, Cornertrader’s offering includes the flexibility to trade through different account types, making it suitable for a variety of preferences and risk profiles. Overall, Cornertrader provides a comprehensive and diversified set of assets for clients to trade across international markets.

Leverage Options at Cornertrader

FINMA and various regulatory standards restrict allowed levels of the multiplier to protect clients. So, in most countries, leverage is highly restricted, however, according to FINMA, Swiss-based Brokers still can use a high leverage ratio up to 1:200, yet be sure to verify this for a particular instrument. Thus, the maximum Cornertrader leverage level is the following:

- 1:200 for Forex instruments, professional traders may confirm their status and apply for even higher levels.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Cornertrader

In terms of funding methods, CornerTrader offers TradersCard, which enables traders to pay with:

- Apple Pay

- Google Pay

- Samsung Pay

- Garmin Pay

- Fitbit Pay

Cornertrader Minimum Deposit

Cornertrader minimum deposit is $1,000. However, you should check the account type you choose since some may require minimums to access designed features and cover necessary margins.

Withdrawal Options at Cornertrader

Cornertrader does not charge a commission for money withdrawals while the funds are sent to Cornertrader Card, making the withdrawal an easy process.

Customer Support and Responsiveness

Score – 4.5/5

Testing Cornertrader’s Customer Support

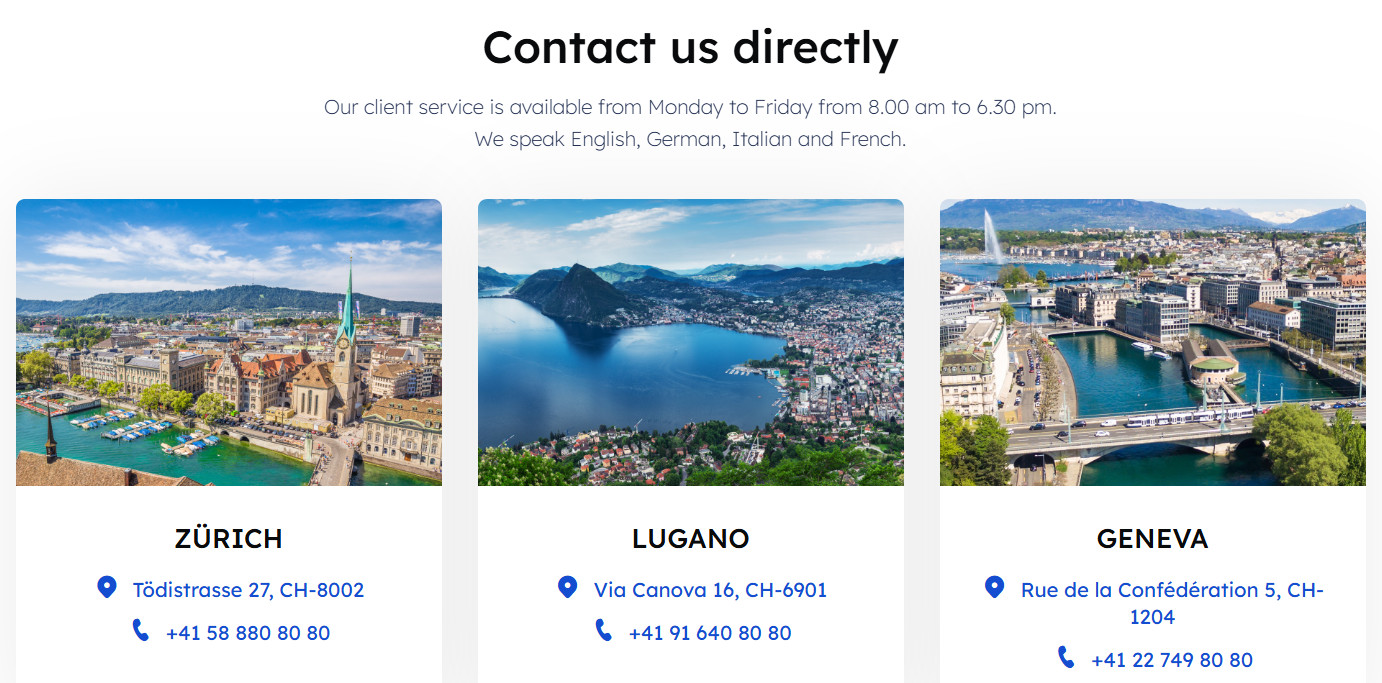

Cornertrader provides 24/5 customer support to its clients. Phone lines and Email are also available here. The support team is available from Monday to Friday, 8:00 am to 6:30 pm.

Contacts Cornertrader

To get in touch with Cornertrader, clients can reach out through several dedicated contact options. For general inquiries and support, the main customer service line is +41 58 880 80 80, with additional regional support available via +41 91 640 80 80 and +41 22 749 80 80. Clients can also send their queries via email to info@cornertrader.ch for prompt assistance.

Research and Education

Score – 4.4/5

Research Tools Cornertrader

Cornertrader provides a suite of research tools designed to support traders in making informed decisions.

- The platform offers free market research and signals, giving users access to fundamental, technical, and momentum analyses. These resources are aimed at enhancing the experience by offering insights into market trends and potential opportunities.

- Additionally, Cornertrader has introduced a simulation tool that allows traders to backtest common strategies, enabling them to evaluate the effectiveness of their approaches before applying them in live markets. These tools collectively provide traders with valuable information to navigate the financial markets more effectively.

Education

Cornertrader is committed to enhancing its clients’ financial knowledge and skills through a variety of educational resources. The broker offers webinars and seminars conducted by experienced professionals, covering topics from market analysis to trading strategies. These interactive sessions provide valuable insights and allow participants to engage directly with experts.

Additionally, the broker provides comprehensive guides and insights that delve into various aspects of trading, catering to both beginners and seasoned traders. These resources are designed to empower clients with the knowledge needed to make informed decisions.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options Cornertrader

While Cornertrader primarily focuses on Currency and CFD trading, it also offers investment opportunities through PAMM accounts. PAMM accounts enable investors to allocate their funds to experienced money managers who trade on their behalf, with profits and losses distributed proportionally among all participants. This approach provides a passive investment strategy for those seeking professional management of their trading capital.

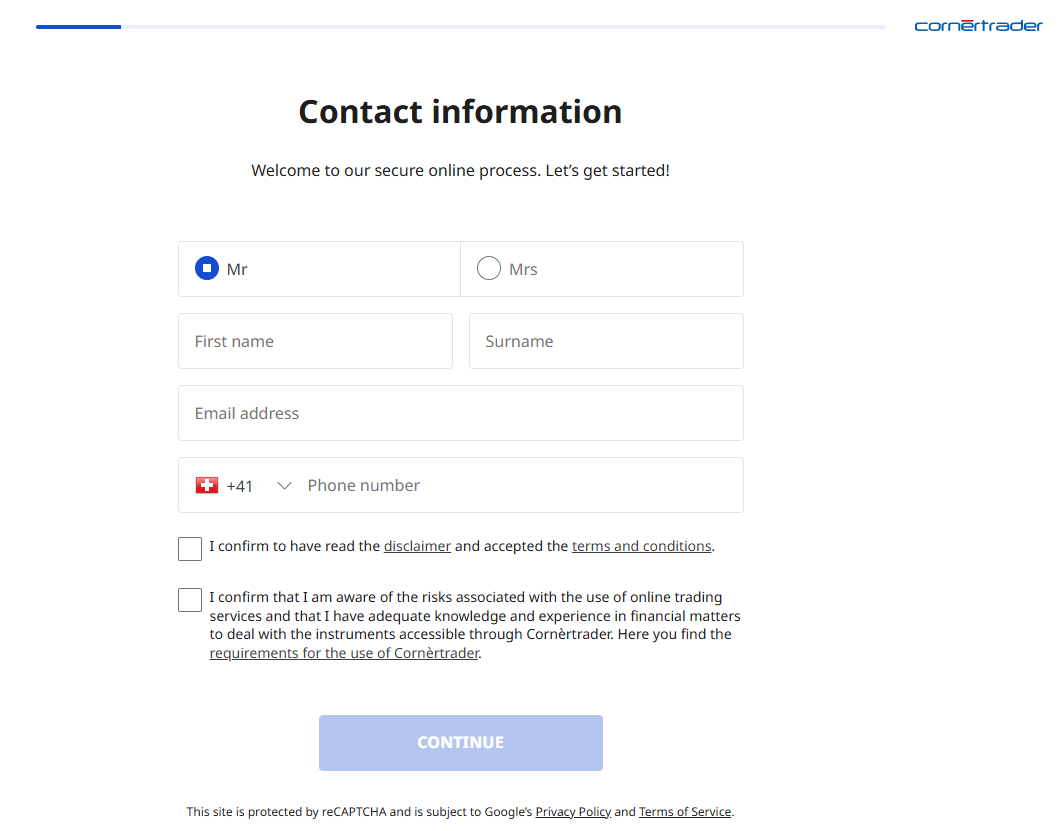

Account Opening

Score – 4.4/5

How to Open Cornertrader Demo Account?

Opening a demo account with Cornertrader allows you to practice trading in a risk-free environment. To get started, visit the broker’s website and navigate to the demo account section.

There, you will find an option to sign up for a free demo account. After completing the registration form with your details, you will receive login credentials via email. Use these credentials to access the demo platform, where you can explore various instruments and features using virtual funds. This setup enables you to familiarize yourself with the platform’s functionalities and develop your strategies without any financial risk.

How to Open Cornertrader Live Account?

Opening an account with Cornertrader is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to its core research offerings, Cornertrader provides several useful tools and features to support a well-rounded experience.

- These include watchlists for tracking preferred assets, real-time news feeds to stay updated on market-moving events, and customizable alerts that notify traders of significant price movements or technical signals.

- The platform also includes portfolio performance tracking and risk management tools, allowing users to monitor their investments and manage exposure effectively.

These additional features complement Cornertrader’s analytical tools and enhance usability, especially for traders who value flexibility and comprehensive control over their trading environment.

Cornertrader Compared to Other Brokers

When comparing Cornertrader with its competitor brokers, it becomes evident that the platform holds a solid position in the market, especially for traders seeking a combination of advanced tools and extensive asset variety.

Unlike some brokers that primarily rely on third-party platforms like MT4 or TradingView, Cornertrader offers its proprietary platform and iCornèr App, ensuring a unique, streamlined user experience. While it requires a higher initial deposit compared to brokers with zero minimums, Cornertrader compensates with access to over 20,000 instruments, providing significantly broader market exposure than many competitors.

The broker is also well-regulated under FINMA, ensuring strong client protection. Although its fees are generally average, the quality of its educational content, customer support, and professional-grade tools position it as a reliable choice for both active and long-term investors who prioritize platform stability and comprehensive market access.

| Parameter |

Cornertrader |

Trade Nation |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.2 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + CHF 3 |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Cornertrader Platform, iCornèr App |

MT4, TN Trader, TradingView, TradeCopier |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

20,000+ instruments |

1000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

FINMA |

FCA, ASIC, FSCA, SCB, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$1,000 |

$0 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker Cornertrader

Cornertrader is a Swiss-based brokerage firm regulated by FINMA, offering a secure and reliable environment. It provides access to over 20,000 financial instruments, including Forex, stocks, ETFs, bonds, options, and more, through its platform and the iCornèr App.

The broker supports several account types, such as Consistency, Energy, Solidity, and Opportunity Accounts, along with a demo account. Spreads are competitive, and commission-based trading is available.

Cornertrader also stands out with strong educational resources like webinars, seminars, and guides. It offers quality customer support and ensures client fund protection up to CHF 100,000 under the Esisuisse scheme. With a strong reputation, robust tools, and a wide asset range, Cornertrader is a reliable option for serious traders and investors.

Share this article [addtoany url="https://55brokers.com/cornertrader-review/" title="Cornertrader"]

I have to add: Since November 2024 Corner has a new platform which is downright terrible, unusuable, a pile of hot g … It took me half an hour to figure out how to buy stocks. And best of all? They erased all the trading history, meaning I don’t know anymore what and how I traded before November 2025.

Customer service is nice, but the platform is cr*p. Stay away from Corner trader.

hi

I am a Jordanian living in Saudi Arabia if I want to open an account with your firm what document do I need to provide? and is it possible to do that as a resident in Saudi Arabia?

Dear Sir or Madam , you have good chance for me may be. I need to open private account in malty currencies in USD and CHF. And currently I need to know about documents from me to open the account. I am from Russia Moscow .

Your Sincerely,

Andrey Donskoy.