- What is CommSec?

- CommSec Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

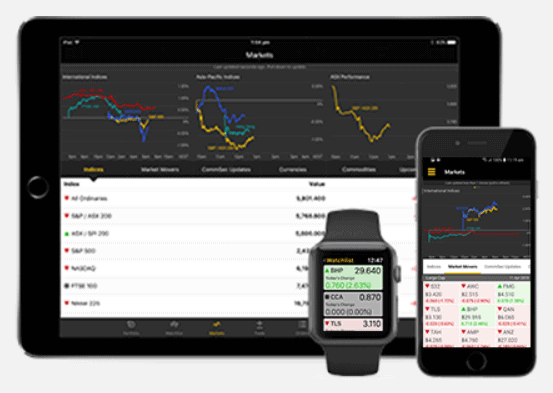

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

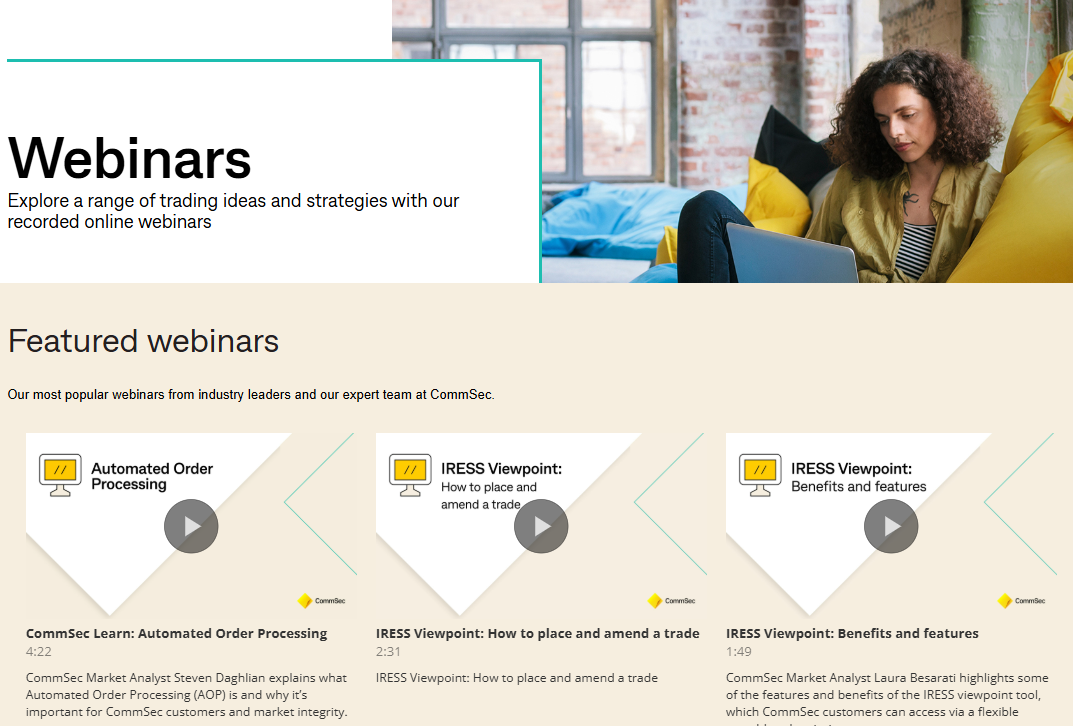

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- CommSec Compared to Other Brokers

- Full Review of Broker CommSec

Overall Rating 4.6

| Regulation and Security | 4.8 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.3 / 5 |

| Customer Support and Responsiveness | 4.4 / 5 |

| Research and Education | 4.8 / 5 |

| Portfolio and Investment Opportunities | 4.7 / 5 |

| Account Opening | 4.3 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is CommSec?

CommSec is an Australian brokerage firm that has operated for 30 years confirming its successful position in the industry and always striving for professionalism in everything they do. Originally, CommSec is an investment firm that offers vast opportunities to either invest through 7 simplified options or trade yourself.

Is CommSec Any Good?

Eventually, CommSec became one of the leading online trading providers within Australia, which actively maintains the financial growth of the industry, educating traders and even supporting regional communities through various programs.

Is CommSec Expensive?

No, we consider CommSec a good value broker also there are options for beginning traders and low deposit requirements at the start.

CommSec Pros and Cons

CommSec is one of the leading online trading providers within Australia with an excellent reputation and is a well-regulated broker. There are Great investment opportunities and unique access to trade Shares and Options on the choice between CommSec, and CommSecIRESS platforms with Quality customer support.

For the Cons, a Broker might be more suitable for professional traders, there is No Forex and CFD trading and No Demo Account.

| Advantages | Disadvantages |

|---|

| Strong establishment and well regulated broker

| Support not available 24/7 |

| Great investment opportunities | Broker might be more suitable for professional traders |

| Unique access to trade Shares and Options | No Forex and CFD trading |

| Ultimate trading technology | No Demo Account |

| Choice between CommSec, CommSecIRESS platforms | |

| Rewards and trading promotions | |

| Quality customer support | |

CommSec Features

CommSec is one of Australia’s leading online trading platforms, offering a wide range of investment options for traders. With access to Australian and international markets, competitive brokerage fees, and innovative tools, the firm provides a seamless trading experience. Below is a comprehensive list of its key features:

CommSec Features in 10 Points

| 🏢 Regulation | ASIC |

| 🗺️ Account Types | Australian Share Trading, CDIA, CommSec Pocket, International Share Trading, Margin Loan, CommSec One Accounts |

| 🖥 Trading Platforms | CommSec, CommSecIRESS |

| 📉 Trading Instruments | Shares, ETFs, Options, Cash, Fixed Income Securities, Equities and International Funds |

| 💳 Minimum Deposit | $500 |

| 💰 Average Stock Commission | $5 for trades up to $1,000 |

| 🎮 Demo Account | Not Avaulable |

| 💰 Account Base Currencies | AUD, USD, EUR, GBP |

| 📚 Trading Education | Professional Education with Webinars and advanced research |

| ☎ Customer Support | 24/5 |

Who is CommSec For?

CommSec trading platform offers a wide range of investment options, including shares, ETFs, and international markets. With user-friendly tools, competitive brokerage fees, and access to in-depth market research, the platform caters to investors of all levels. Based on our research, CommSec broker is suitable for:

- Professional Traders

- Investments

- Share Trading

- Stock Trading

- Option Trading

- Commission-based trading

- Traders from Australia

CommSec Summary

Overall, CommSec is a company with a strong background based on the efficiency and reliability of Commonwealth Bank. The trading environment is also a comprehensive feature mainly suitable for active and professional traders due to its sophisticated technology and access to professional instruments, mainly offering to trade Shares.

However, beginning traders are welcomed also, as the broker provides leading educational materials, as well as offers investment programs suitable for investors of any size or need.

The broker is not suitable for traders preferring CFD and Forex Trading since the broker does not offer one. CommSec conditions are designed for active traders. Any other program for passive investments copy trading, or bonus offers are not provided.

55Brokers Professional Insights

CommSec is widely recognized as one of Australia’s most reputable online trading platforms, offering a robust suite of tools and research resources that cater to investors of all levels. One of its key advantages is its seamless integration with Commonwealth Bank, allowing for easy fund transfers and trade settlements.

The platform provides comprehensive market research, real-time data, and advanced charting tools, making it an attractive choice for active traders. Additionally, features like CommSec Pocket make investing accessible for beginners with small capital. However, higher brokerage fees compared to some discount brokers and the lack of commission-free trading can be a drawback for cost-conscious traders.

Additionally, while CommSec offers access to international markets, its global trading fees are relatively high, and the platform primarily caters to Australian investors. Despite these limitations, its strong reputation, customer support, and range of investment options make it a solid choice for those looking for a reliable and feature-rich brokerage service.

Consider Trading with CommSec If:

| CommSec is an excellent Broker for: | - Looking for Reputable Firm.

- Need a well-regulated broker.

- Looking for broker with a long history of operation and strong establishment.

- Competitive fees and commissions.

- Access to robust proprietary trading platforms.

- Stock Trading and Investment.

- Suitable for professional traders and investors.

- Excellent trading tools and trading technology.

- Australian investors.

- Providing diverse trading tools, and trading strategies.

- Excellent educational materials, and customer support.

- Offering popular investment products. |

Avoid Trading with CommSec If:

| CommSec might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with industry-known MT4/MT5, or cTrader.

- Offering Copy Trading.

- Providing Forex and CFD trading.

|

Regulation and Security Measures

Score – 4.8/5

CommSec Regulatory Overview

CommSec is a trading name used by Commonwealth Securities Limited a wholly-owned subsidiary of Commonwealth Bank of Australia, a market participant of the ASX and Chi-X Australia. As a result, being a subsidiary of a strong established financial company and a bank, its trading service and all settlements are respectively authorized by the Australian Securities and Investment Commission (ASIC) and oblige to necessary laws.

Ever since CommSec has been a regulated broker, also a part of a very reputable Bank within Australia that gives you a better understanding and trustable exposure to the market along with competitive trading conditions.

How Safe is Trading with CommSec?

CommSec is a reputable firm authorized and regulated by the Australian ASIC regulator with low-risk investment due to regulations. Apart from the provided security as per regulation requirements, CommSec also protects client funds, also by its Banking regulated service, and harmonizes experience within and beyond the market.

In addition, treading with a regulated broker you may always count on support in case any misunderstandings or questions appear throughout your cooperation, which is never the case with unregulated firms.

Consistency and Clarity

CommSec has earned a strong reputation as one of Australia’s leading online brokers. Known for its feature-rich platform, CommSec has consistently been recognized in industry awards. The platform is highly regarded by real traders for its reliability, user-friendly interface, and access to comprehensive market research and data.

However, some drawbacks, such as its relatively higher brokerage fees and the occasional reports of overcharging, have raised concerns among users. In 2021, CommSec was fined $20 million for breaching market integrity rules, which affected its reputation. Despite this, the broker continues to maintain a prominent position in the market, not just through its services but also through its active involvement in the community.

CommSec sponsors various initiatives, including charitable programs that benefit Australian communities, highlighting its commitment to social responsibility.

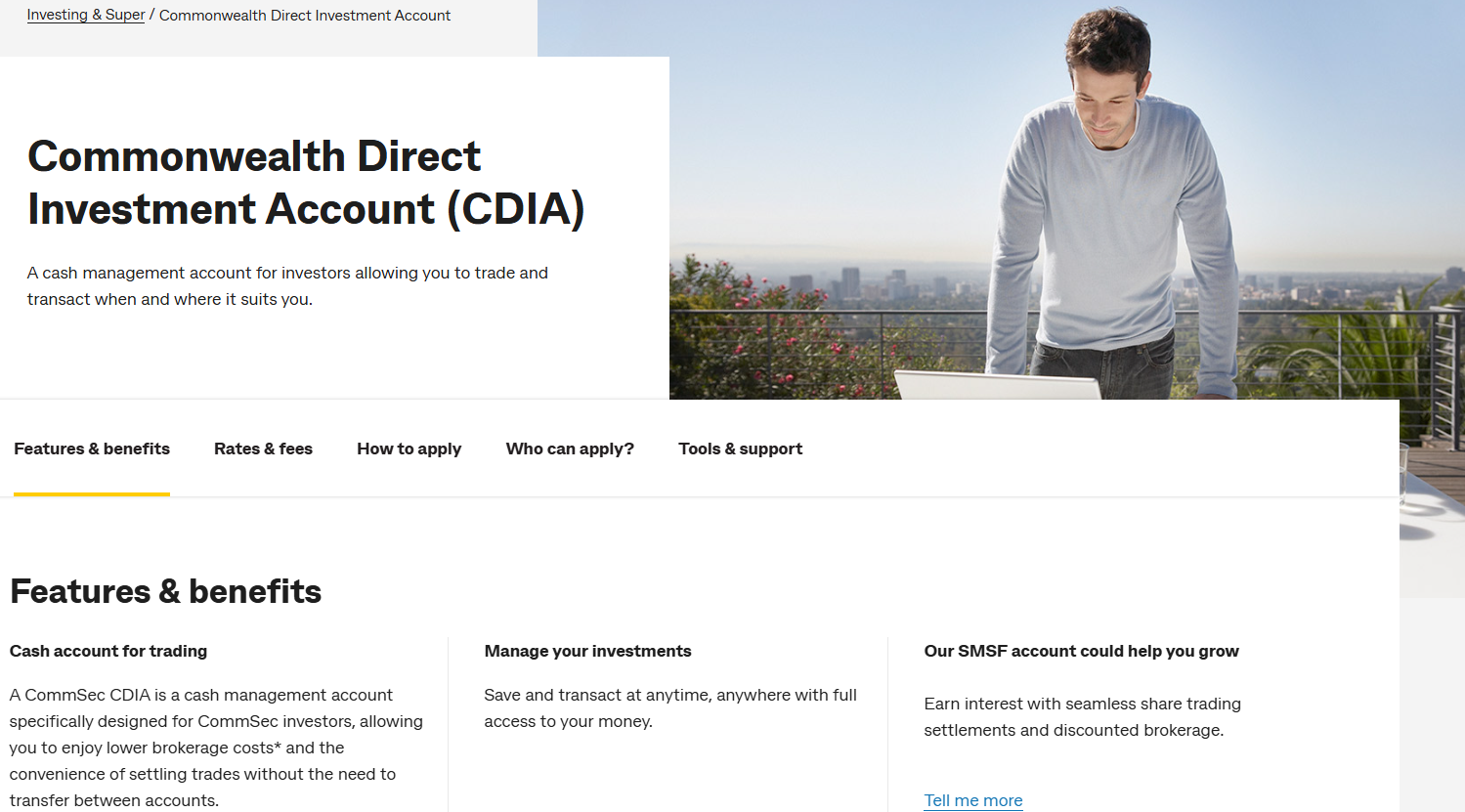

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with CommSec?

CommSec offers a variety of account types to cater to different investment needs. The Australian Share Trading Account allows investors to trade on the Australian Securities Exchange (ASX) with competitive brokerage fees and access to comprehensive research tools.

For those looking to link their trading account with a Commonwealth Direct Investment Account (CDIA), CommSec provides a seamless integration, enabling easy fund transfers and trade settlements. The CommSec Pocket app is designed for micro-investing, allowing users to start with as little as AUD 50 and access a range of ETFs.

For international investors, the International Share Trading Account provides access to global markets with the ability to trade foreign stocks. Those interested in leveraged trading can opt for a Margin Loan Account, which allows for borrowing funds to increase market exposure.

Lastly, the CommSec One Account is a premium service offering dedicated support and exclusive benefits for high-value investors, designed to meet the needs of experienced traders. These diverse account types make CommSec an appealing choice for investors at all stages of their trading journey.

Share Trading Account

CommSec’s Share Trading Account is designed for investors looking to trade on the Australian Securities Exchange (ASX). With this account, you can buy and sell Australian shares, ETFs, and other listed securities.

The minimum deposit to open a standard Share Trading Account is typically AUD 500. Brokerage fees start from AUD $ 5 per trade, depending on the volume and value of your trades, with a sliding scale for higher-value transactions.

For those interested in international markets, the International Share Trading Account allows you to access global stock exchanges, including the NYSE, NASDAQ, and London Stock Exchange. The minimum deposit for the international account is also AUD 500, with a higher commission rate for international trades, typically starting at AUD 19.95 per trade, plus additional currency conversion fees.

CommSec Pocket Account

The CommSec Pocket Account is a micro-investing platform designed for beginners who want to start investing with as little as AUD 50. It allows you to invest in a selection of low-cost, diversified ETFs, making it ideal for those looking to grow their wealth over time without the need for a large initial investment.

Unlike traditional trading accounts, CommSec Pocket focuses on long-term investment strategies, allowing you to invest in fractional units of ETFs, thus minimizing your upfront investment. There are no account maintenance fees, but there is a flat brokerage fee of AUD 2 per trade, regardless of the investment amount, making it a cost-effective way to begin your investment journey.

CommSec One Account

The CommSec One Account is designed for high-net-worth individuals and active traders who require additional features and personalized support. This premium account offers exclusive benefits, including access to a dedicated relationship manager, priority customer support, and advanced trading tools.

The minimum deposit to open a CommSec One Account is typically higher than standard accounts, with a recommended balance of AUD 50,000 or more to take full advantage of its premium services. Commissions for trades vary depending on the value of transactions, with lower brokerage rates available for higher-volume trades. This account is suited for experienced investors who want a tailored service and advanced resources to manage their portfolios more effectively.

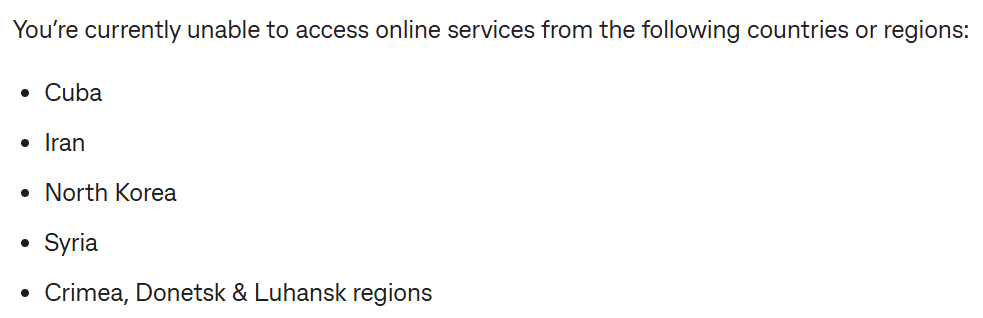

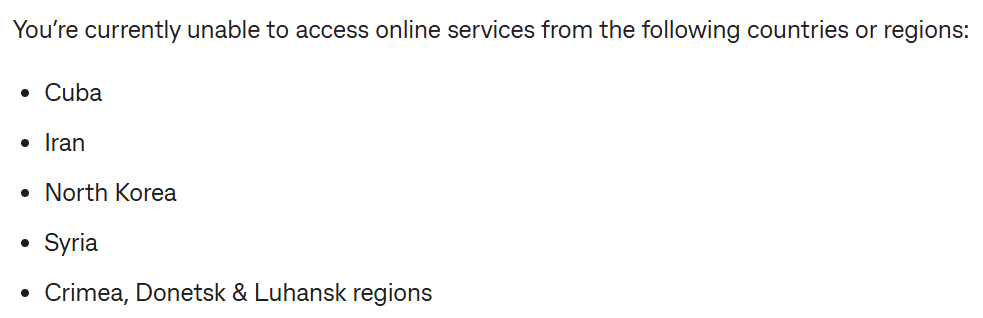

Regions Where CommSec is Restricted

CommSec is primarily available to residents of Australia. However, its services may be restricted in certain regions due to regulatory or legal reasons. Specifically, the firm does not provide services to countries or regions where it is prohibited by local laws or regulations, including:

- Cuba

- Iran

- North Korea

- Syria

- Crimea, Donetsk and Luhansk regions

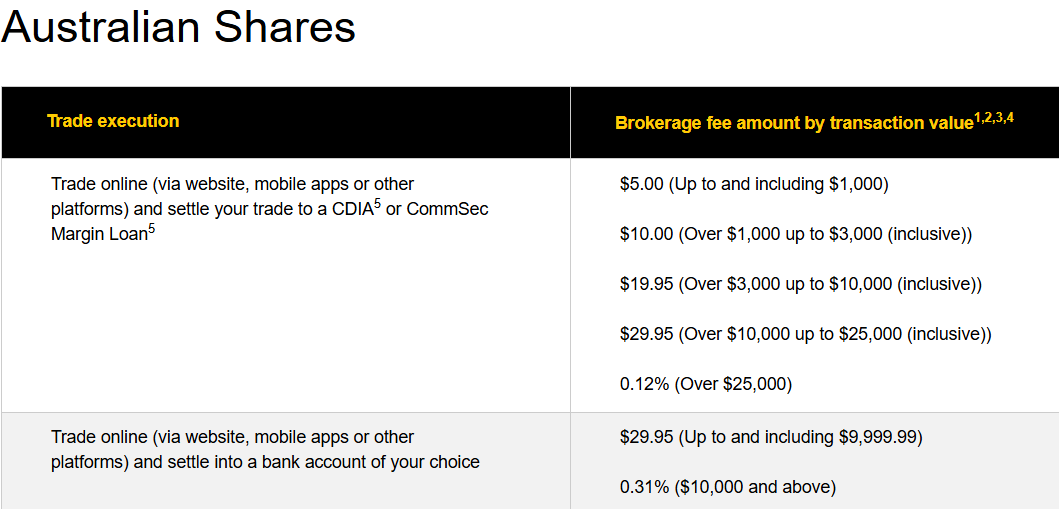

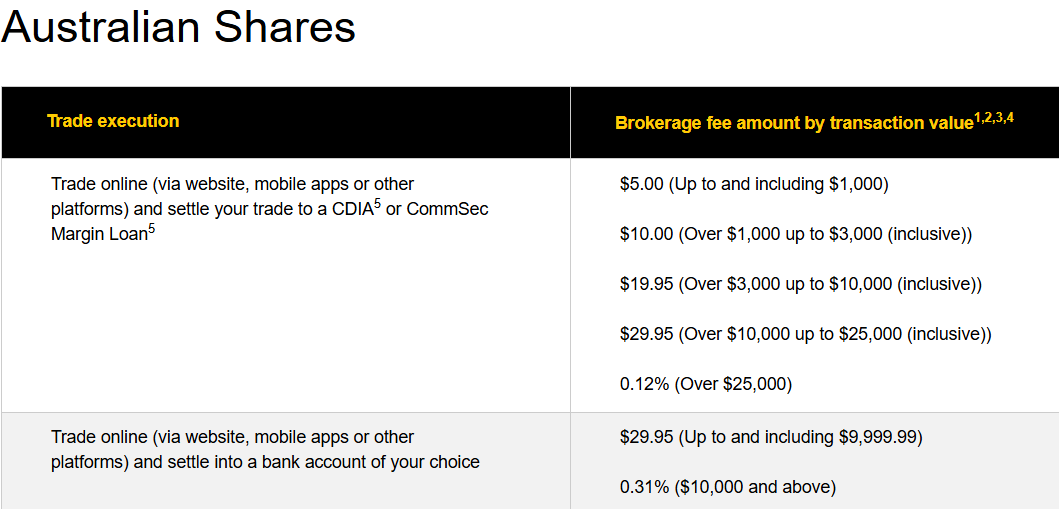

Cost Structure and Fees

Score – 4.4/5

CommSec Brokerage Fees

CommSec offers competitive brokerage fees that cater to a variety of investors. For standard Australian share trades, fees typically start at AUD 5 per trade and can go up to AUD 29.95 for larger transactions. International trades have higher brokerage fees, generally starting around AUD 19.95, along with additional costs for currency conversion.

Overall, while CommSec’s fees are considered reasonable within the industry, investors need to be aware of any additional charges that may apply based on the type of trade or account.

CommSec trading fees are based on a commission basis and do not offer spread-based trading, that depends on the instrument you trade, as well as getting lower as long as your trading size increases.

CommSec developed an interesting pricing strategy considered as low brokerage rates that start from $5 per trade for trades under $1,000 giving you a better value for money.

Also, additional benefits and better conditions are applicable either through the CommSec One program or other tailored conditions according to one’s own investor needs.

CommSec does not typically offer rollover or swap rates for its standard share trading or margin accounts. These types of fees are more commonly associated with Forex or commodities trading, where positions are held overnight and interest or financing charges are applied.

As CommSec primarily focuses on equity, ETF, and international share trading, it does not engage in the same type of swap or rollover processes found in other markets.

How Competitive Are CommSec Fees?

CommSec’s fees are generally competitive within the Australian brokerage market,f especially considering the range of services and features the platform offers.

For investors who are looking for a comprehensive and reliable brokerage with access to extensive research tools, market insights, and seamless integration with Commonwealth Bank accounts, CommSec’s fees are reasonable.

Additionally, for larger traders or those using premium services like CommSec One, the fees become more competitive with the potential for reduced rates based on trade volume. However, for those seeking minimal-cost or discount brokerage options, there may be cheaper alternatives available in the market.

| Asset/ Pair | CommSec Commission | Interactive Brokers Commission | PhillipCapital Commission |

|---|

| Stocks Fees | $5 | $0.0005 | $3,88 |

| Fractional Shares | No | $0.01 | No |

| Options Fees | $34.95 | $0.15 | $3,88 |

| ETFs Fees | $50 | $0.0005 | $3,88 |

| Free Stocks | No | Yes | No |

CommSec Additional Fees

In addition to standard brokerage fees, CommSec may charge other fees depending on the services used. These include currency conversion fees for international trades, margin loan interest for those utilizing leverage, and administration fees for certain account services or features.

Investors should also be aware of potential fees for things like international payments or inactive accounts. They should carefully review CommSec’s fee schedule and terms to understand any additional charges that may apply based on the type of trading or services being used.

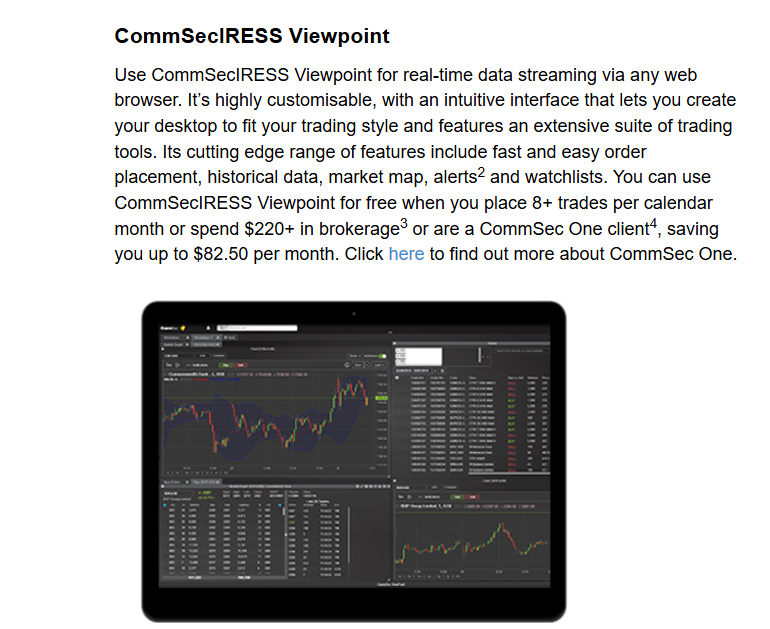

Trading Platforms and Tools

Score – 4.5/5

CommSec trading platform maintains its powerful trading software with the same name, which is aggregated by the front-end technology and powerful features, all packed with the utmost level of security. All Shares trades go directly from the software while charges for trades are taken directly from your bank account and connected card.

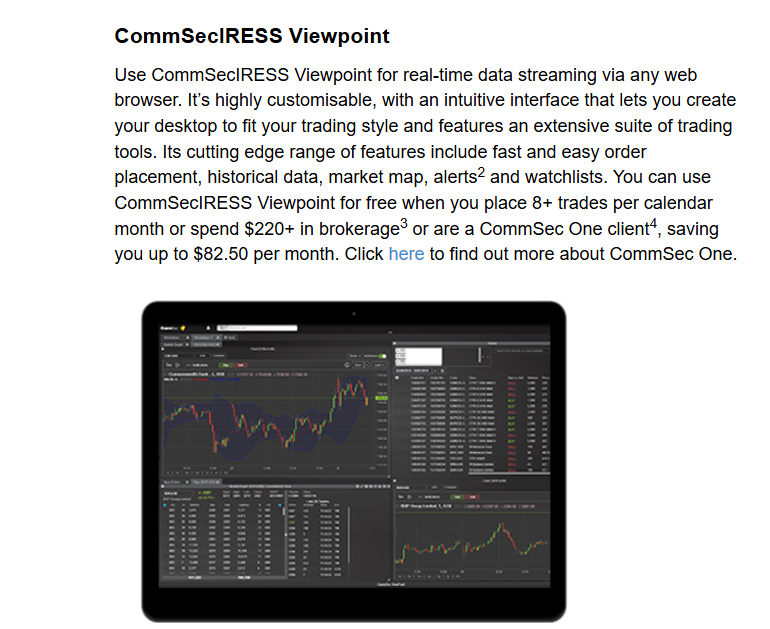

In addition, for live-stream quotes and data CommSecIRESS serves your need as a response instantly to market movements. Even though CommSecIRESS is a paying service, in case you execute 8 or more trades you will get complimentary access to it. IRESS in general is a quite comprehensive platform, a quite well-known software famous for its powerful and sophisticated charting and analysis features.

Trading Platform Comparison to Other Brokers:

| Platforms | CommSec Platforms | KAB Platforms | Rakuten Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | Yes | No |

| cTrader | No | No | No |

| Own Platforms | Yes | No | Yes |

| Mobile Apps | Yes | Yes | Yes |

CommSec Web Platform

The CommSec Web Platform provides a comprehensive and user-friendly interface. Accessible via a web browser, it offers a range of features, including real-time market data, advanced charting tools, and detailed research reports to help users make informed investment decisions.

The platform allows easy access to Australian and international share trading, ETFs, and other securities, with smooth order execution. It also includes educational resources and trading guides for those new to the market. While the platform is intuitive, its advanced tools may require a learning curve for users who are less familiar with online trading. Overall, CommSec’s web platform offers a robust trading experience with plenty of resources to support investors in managing and growing their portfolios.

Main Insights from Testing

Testing of the CommSec Web Platform reveals that it offers a solid and responsive trading experience, with a clean, easy-to-navigate interface. Users appreciate the depth of market data and the availability of powerful charting tools for analyzing stocks and trends.

The platform’s real-time updates and smooth execution of trades are praised, making it suitable for active traders. However, some testers noted that the mobile app experience can occasionally feel more streamlined compared to the web platform, with fewer advanced features. Overall, the web platform is reliable, but there is room for improvement in optimizing user experience and simplifying complex tools for beginners.

CommSec Desktop MetaTrader 4 Platform

CommSec does not offer the MetaTrader 4 platform for its clients. As a broker focused on share and ETF trading, CommSec provides its proprietary trading platform for executing orders on Australian and international markets.

CommSec Desktop MetaTrader 5 Platform

The firm does not provide access to the MT5 platform. While MT5 offers advanced features for multi-asset trading, including Forex and futures, CommSec’s platform is tailored to investors interested in trading shares, ETFs, and other securities. Investors seeking to trade on MT5 will need to explore alternative brokers that cater specifically to those markets.

CommSec MobileTrader App

Also, you may use the CommSec mobile app that also gives you full capacity of control over your orders or an account. In addition, CommSec offers you placement through access via phone or internet so the broker will place the order on your behalf, which may also incur additional charges.

Trading Instruments

Score – 4.6/5

What Can You Trade on CommSec’s Platform?

Apart from numerous trading instruments including Shares with over 2000 companies listed on the Australian Stock Exchange, Options, Cash, Fixed Income Securities, Equities, ETFs, and International Funds, CommSec also allows enhancing your portfolio with unique offerings.

The beginners may be advised to join various investment programs, while active traders may sign for specified conditions. Professionals that met specified criteria over 12 months are also offered the rewarding active traders’ program known as CommSec One which gives numerous trading benefits and dedicated support.

Main Insights from Exploring CommSec’s Tradable Assets

Exploring CommSec’s tradable assets reveals a diverse range of investment opportunities, primarily focused on Australian and international shares, ETFs, and other securities.

Investors can trade stocks listed on the ASX and access a broad selection of international markets, including major exchanges like the NYSE and NASDAQ.

In addition to equities, CommSec offers ETFs, which provide easy diversification for investors. While the platform is well-suited for stock and ETF traders, it does not offer products like Forex, CFDs, or commodities, making it more focused on traditional asset classes. Overall, CommSec offers a robust selection of tradable assets, making it an appealing choice for equity-focused investors.

Leverage Options at CommSec

Trading always walks in parallel with the risk of capital loss, despite the normal winning-losing process of trading risks increasing if you use leverage. The multiplier tool indeed is a powerful feature, which is designed to magnify your potential gains and trade a bigger size, yet you should learn carefully how to use it smartly.

CommSec Leverage Level depends on several factors like jurisdiction, account type as well as traders’ proficiency level defined by each instrument individually so the full details may be always checked through a trading platform.

- Being regulated by ASIC, CommSec does not allow high leverage levels allowing the maximum level up to 1:30.

Deposit and Withdrawal Options

Score – 4.3/5

Deposit Options at CommSec

CommSec offers several convenient deposit options for funding trading accounts, including:

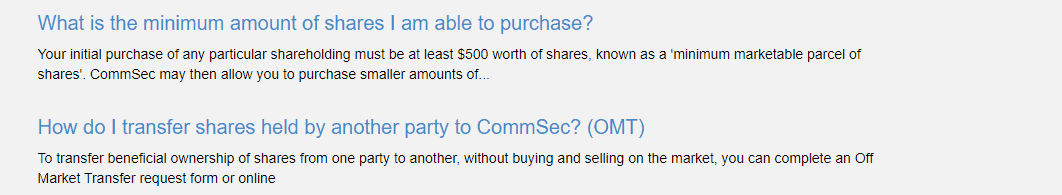

CommSec Minimum Deposit

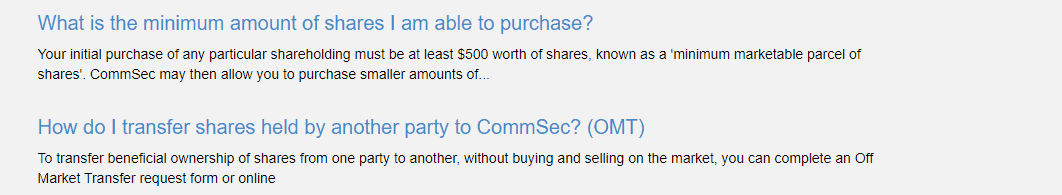

If you sign for beginners CommSec Pocket minimum deposit is $50 for the parcel. Since the CommSec Share Account is connected to the initial bank account, there is no specification on how much money should be there. However, the initial purchase of any particular shareholding must be at least $500 worth of shares, known as a “minimum marketable parcel of shares.”

Withdrawal Options at CommSec

CommSec Withdrawal Options are automatically returned to your connected Bank account, similarly to deposits while trading or investment transactions are directly taken and refunded to your account.

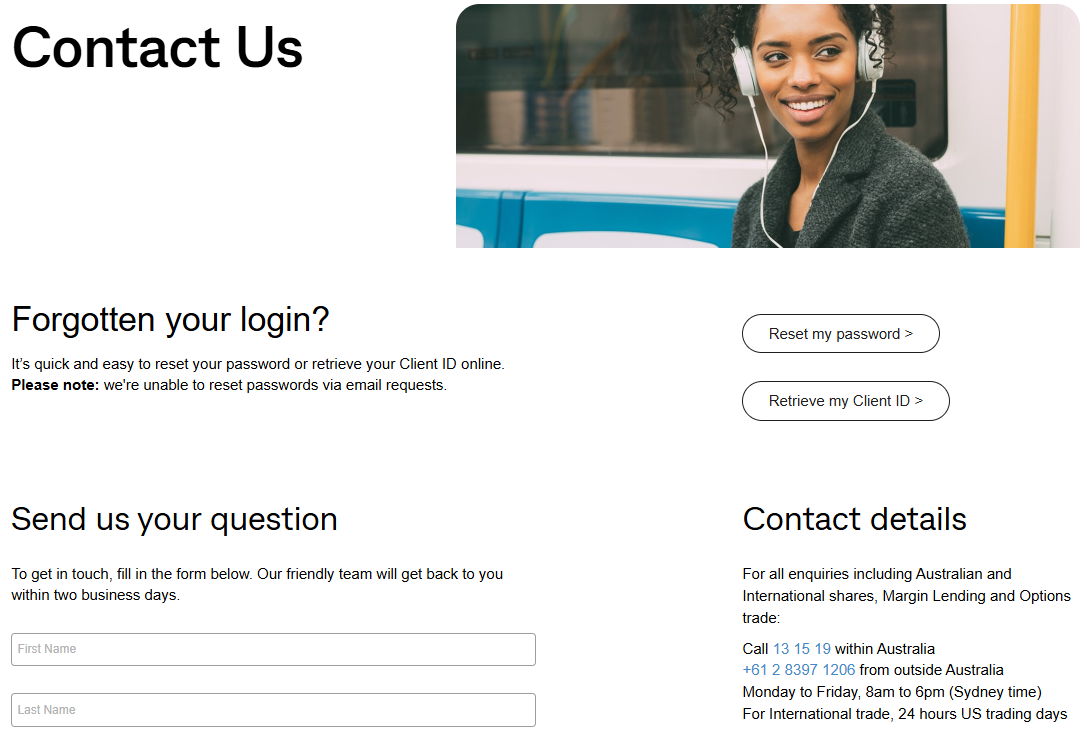

Customer Support and Responsiveness

Score – 4.4/5

Testing CommSec’s Customer Support

One of the other great points we should admit is the Customer Support CommSec provides, being truly a supportive partner for its investors as you can find answers or understanding for all your concerns.

CommSec support is available with the service the trader requires daily, also operating Shared trading via phones, which is also on a very sustainable and professional level. Even though you can access them via Phone, or Email them within working hours 24/5.

Contacts CommSec

For those looking to contact CommSec, customer support is available through multiple channels. Within Australia, you can reach their team by calling 13 15 19 for general inquiries and assistance. For clients located outside Australia, the dedicated international line is +61 2 8397 1206. Whether you need help with account setup, technical support, or general trading questions, CommSec’s support team is available to assist during business hours, ensuring you receive timely and reliable service.

Research and Education

Score – 4.8/5

Research Tools CommSec

CommSec provides a range of comprehensive research tools to support both new and experienced investors.

- On the website, users can access Enhanced Research Tools, offering in-depth analysis, detailed company profiles, and insights into market trends.

- The platform features real-time updates on stock prices and market movements, allowing traders to make informed decisions quickly.

- Additionally, an Economic Calendar is available, providing key economic events that could impact the markets.

- Investors also have access to expert insights and market commentary from CommSec’s analysts, keeping them up to date with the latest market conditions.

- On the CommSec trading platforms, investors can enjoy advanced charting tools, technical indicators, and customizable watchlists, further enhancing their ability to track and analyze the markets in real time.

These tools work seamlessly to provide a robust research experience, ensuring users have the necessary resources to navigate the financial markets with confidence.

Education

CommSec offers a robust education section designed to support investors at all levels. Their professional learning resources include webinars, where experts cover a wide range of topics, from market basics to more advanced strategies, allowing traders to expand their knowledge and improve their skills. These webinars provide valuable insights into current market trends, economic events, and effective trading techniques.

Additionally, CommSec provides guides and tutorials, to help users navigate complex market analysis and make more informed investment decisions. With access to expert knowledge and advanced research, CommSec empowers investors to refine their strategies and enhance their understanding of the markets.

Portfolio and Investment Opportunities

Score – 4.7/5

Investment Options CommSec

CommSec offers a diverse range of investment options to suit different types of investors. Its core offerings include Australian shares, allowing access to the local stock market through the Australian Securities Exchange, as well as international shares, enabling clients to invest in major global markets such as the NYSE and NASDAQ.

Additionally, investors can choose from a variety of exchange-traded funds, providing diversified exposure to various sectors, industries, or regions. CommSec also offers managed funds, where investors can pool their resources to access professional management and diversified portfolios.

For those interested in a more hands-on approach, CommSec Pocket provides a platform for micro-investing in ETFs with as little as $50.

Account Opening

Score – 4.3/5

How to Open CommSec Demo Account?

CommSec does not offer a demo account for potential clients. Unlike some brokers that provide virtual trading accounts to practice strategies without real financial risk, CommSec focuses on live trading accounts from the outset.

How to Open CommSec Live Account?

As for the Trading account itself, CommSec allows the opening of an account based on an existing bank account or opening a Cash account using a CommSec Share Trading account for the seamless settlement of trades.

So the options are:

- Firstly go to CommSec Sign Up page. You may also sign up with an existing account on Facebook or Google.

- Enter your data (name, email, phone number, etc).

- As for the Trading account itself, CommSec allows the opening of an account based on an existing bank account or opening a Cash account using the CommSec Share Trading account.

- Complete questioner about your trading experience and expectations.

- Once your account is activated and approved by customer service you can start trading.

Additional Tools and Features

Score – 4.2/5

In addition to its research tools, CommSec offers several other additional tools and features designed to enhance the trading experience.

- One standout is CommSecIRESS Viewpoint, a premium service providing real-time market data, advanced charting capabilities, and in-depth analysis tools, ideal for active traders seeking detailed market insights.

- Additionally, Portfolio Management tools help investors track their investments and view performance over time. These tools, combined with CommSec’s educational resources, aim to provide a comprehensive trading experience for investors looking to stay informed and make strategic investment decisions.

CommSec Compared to Other Brokers

CommSec stands out in comparison to its competitors primarily due to its focus on stock trading rather than Forex trading, catering to investors looking to trade Australian and international shares.

Unlike brokers such as Rakuten Securities, Saxo Bank, and CMC Markets, which offer extensive Forex and CFD products, CommSec specializes in equity-based trading, offering a robust selection of Australian Stock Exchange (ASX) listed companies. While it does not provide the same range of Forex and derivatives options as these brokers, it compensates with an excellent suite of research and educational resources tailored for stock traders.

Additionally, CommSec’s commission-based structure, in contrast to the spread-based accounts offered by several competitors, appeals to investors with a focus on share trading. Compared to others, CommSec provides a more simplified trading experience without the complexity of margin trading or advanced Forex tools.

However, it may not be the best fit for those interested in global Forex markets or high-frequency trading, as seen with brokers like Saxo Bank or CMC Markets. Despite this, CommSec’s solid reputation in Australia, combined with its user-friendly platform and tailored services, makes it an excellent choice for stock market enthusiasts.

| Parameter |

CommSec |

Rakuten Securities |

Saxo Bank |

City Index |

KAB |

CMC Markets |

X Open Hub |

| Spread Based Account |

Not Available |

Average 0.5 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

$5 for trades up to $1,000 |

For Stock CFDs (Commission of RM1 to a maximum of RM100 in Malaysia) |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

For Share CFDs (Commission of 0.10%) |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

CommSec, CommSecIRESS |

Rakuten FX Webr, MARKETSPEED FX, iSPEED FX |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

MT5 |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

2000+ companies listed on the Australian Stock Exchange |

1000+

instruments |

71,000+ instruments |

13,500+ instruments |

300+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

ASIC |

SFC, SCM |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

KCCI |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$500 |

$0 |

$0 |

$0 |

$100 |

$0 |

$0 |

Full Review of Broker CommSec

CommSec is a leading Australian stockbroker that provides a comprehensive trading platform primarily focused on share trading. It offers access to over 2,000 companies listed on the Australian Stock Exchange and international markets, allowing investors to trade both domestic and global stocks.

The platform is known for its excellent research tools, including real-time market data, detailed company insights, and economic calendars, which help investors make informed decisions. CommSec also provides a range of educational resources, from webinars to in-depth articles, helping traders at all experience levels improve their skills.

With a strong reputation for customer service and support, available 24/5, and its commitment to transparency and reliability, CommSec offers a user-friendly platform that suits investors looking for a robust and trustworthy stock trading experience.

Share this article [addtoany url="https://55brokers.com/commsec-review/" title="CommSec"]

Is this a joke, did they pay you to do this? anyone who thinks commsec is good most be a retarted or sub par S&P returns annually. Cant believe you sold your soul to con people into commsec