- What is Colmex Pro?

- Colmex Pro Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Colmex Pro Compared to Other Brokers

- Full Review of Broker Colmex Pro

Overall Rating 4.4

| Regulation and Security | 4.5 / 5 |

| Account Types and Benefits | 4.6 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.7 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is Colmex Pro?

Colmes Pro is a Cyprus-based Forex and CFDs trading firm that has been operating since 2010. The broker offers various trading instruments, including Forex, over 4,000 CFDs on commodities, indices, 3,000 US stocks, and more.

The company is regulated by the Cyprus CySEC, ensuring compliance with European financial regulations, client fund safety through segregated accounts, and participation in investor compensation schemes.

Additionally, Colmex Pro holds a license from the FSCA in South Africa, making its services available across the African continent.

Colmex Pro Pros and Cons

Colmex Pro is a well-regulated broker with access to a wide range of financial instruments and a good platform choice, like proprietary Colmex Pro 2.0 and MT4.

The broker provides diverse account types for traders of different experience levels, along with advanced trading tools such as real-time market data and technical analysis, algorithmic trading, and Expert Advisors.

For the cons, the proposals vary depending on the regulatory entity, and the educational resources are limited. Also, the minimum deposit requirements for certain account types are relatively high, and the broker charges an inactivity fee.

Additionally, Colmex Pro lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials. However, trading under CySEC and FSCA is considered safe enough.

| Advantages | Disadvantages |

|---|

| CySEC regulation and oversee | No top-tier license |

| Competitive trading conditions | Limited educational materials |

| Professional trading | Conditions vary based on the entity |

| Popular trading Instruments | |

| MT4 trading platform | |

| European and African traders | |

| Client protection | |

| Good technical solutions and tools | |

Colmex Pro Features

Colmex Pro offers a comprehensive range of features to traders of all experience levels, ensuring a secure and efficient trading environment. The key features are summarized in 10 points, covering aspects like Trading Platforms, Account Types, available Trading Instruments, and more.

Colmex Pro Features in 10 Points

| 🏢 Regulation | CySEC, FSCA |

| 🗺️ Account Types | Bronze, Silver, Gold, Platinum, Diamond Accounts |

| 🖥 Trading Platforms | Colmex Pro 2.0, MT4 |

| 📉 Trading Instruments | Forex, CFDs on indices, stocks, commodities, cryptocurrencies, ETFs, ETNs, equities |

| 💳 Minimum Deposit | $500 |

| 💰 Average EUR/USD Spread | 4 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | USD, EUR |

| 📚 Trading Education | Blog, Market News |

| ☎ Customer Support | 24/5 |

Who is Colmex Pro For?

Colmex Pro is for traders who look for multiple account types and advanced trading tools. Its user-friendly platforms and regulatory compliance make it a reliable choice for those seeking access to global markets. The broker is Good for:

- Beginners

- Professional traders

- European traders

- Traders from Africa

- International trading

- Traders who prefer the MT4 trading platform

- Copy trading

- Currency trading

- Equity traders

- Algorithmic/EA trading

- Good trading strategies

Colmex Pro Summary

In summary, Colmex Pro is a safe broker to trade with reliable trading conditions. The broker provides popular trading products through industry-known MetaTrader 4, and proprietary Colmex Pro 2.0.

With multiple account types tailored to different experience levels, Colmex Pro caters to retail, professional, and institutional clients. While it offers a competitive trading environment, its relatively high minimum deposits, inactivity fees, and limited educational resources may be a drawback for some traders.

55Brokers Professional Insights

Colmex Pro provides a strong regulatory framework, offering clients fund protection via segregated accounts and investor compensation schemes. The broker also offers user-friendly trading platforms like MT4 and its own Colmex Pro 2.0, equipped with real-time market data, customizable charting tools, and high-speed execution features essential for professional traders.

Another notable feature is providing direct market access to US equities, a feature typically favored by advanced or institutional traders.

Additionally, its transparent pricing structure and a variety of account types make Colmex Pro appealing to those who look for depth and reliability in their trading experience.

Although educational resources are limited, the broker offers dedicated customer support with multilingual capabilities for clients requiring assistance, further reinforcing its global reach.

Consider Trading with Colmex Pro If:

| Colmex Pro is an excellent Broker for: | - Need a well-regulated broker.

- Get access to MT4 trading platform.

- Broker with a variety of trading strategies.

- Beginners and professional traders.

- Who prefer higher leverage up to 1:200.

- Looking for wide range of funding options.

- Offering popular trading instruments.

- Providing Copy Trading.

- Need broker with fast execution.

- Offering a variety of account types.

- Secure trading environment.

- Providing floating spreads.

- Currency trading.

- Direct market access to US equities.

- Providing competitive trading conditions.

- European and African traders. |

Avoid Trading with Colmex Pro If:

| Colmex Pro might not be the best for: | - Looking for broker with 24/7 customer support.

- Who prefer to trade with MT5 or cTrader.

- Need broker with access to VPS Hosting.

- Prefer MAM/PAMM trading.

- Need a broker with a Top-Tier license. |

Regulation and Security Measures

Score – 4.5/5

Colmex Pro Regulatory Overview

Colmex Pro is regulated by the well-regarded Cyprus Securities and Exchange Commission (CySEC), which follows strict financial standards, requires regular audits, and the segregation of client funds from company assets.

Additionally, the broker is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa, expanding its regulatory reach to the African continent. These regulatory authorities impose strict rules and regulations to ensure high standards in the financial industry.

How Safe is Trading with Colmex Pro?

Trading with Colmex Pro is generally safe, as the broker operates under a strong regulatory framework, ensuring a high level of client protection and transparency. Client funds are kept in segregated accounts, and eligible clients are protected by the Investor Compensation Fund (ICF).

These regulatory credentials highlight the broker’s commitment to maintaining a secure and compliant trading environment for retail and professional clients.

Consistency and Clarity

Colmex Pro maintains a respectable reputation within the trading community since its establishment in 2010.

Trader reviews reflect a generally positive experience, praising the platforms’ stability and access to a range of instruments while also noting drawbacks such as limited educational resources and inactivity fees.

Though not recognized with industry awards, the broker demonstrates transparency and ongoing service improvement. While its social presence and sponsorship activities are not prominently visible compared to larger competitors, the broker’s long-standing service contributes to a stable profile in the Forex trading market.

Account Types and Benefits

Score – 4.6/5

Which Account Types Are Available with Colmex Pro?

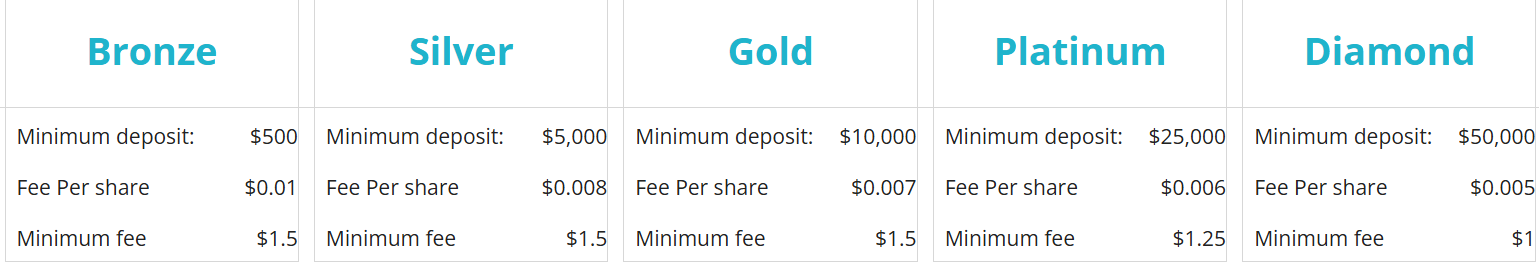

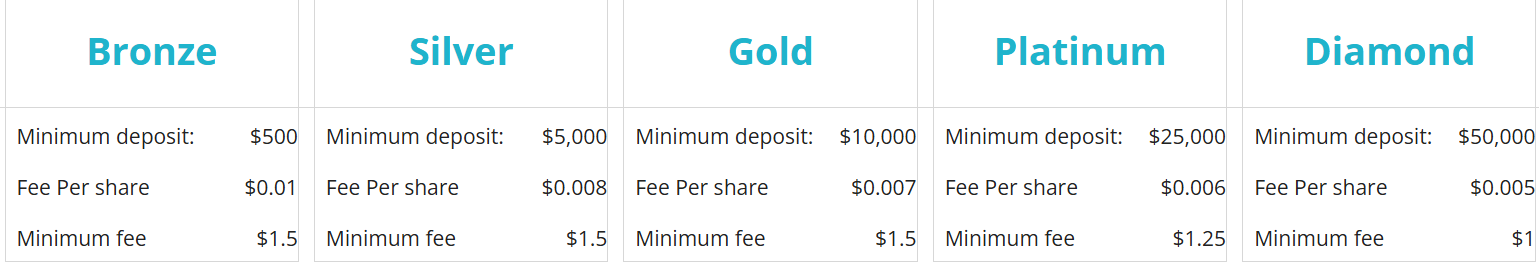

Colmex Pro offers a range of CFD accounts, including Bronze, Silver, Gold, Platinum, and Diamond, designed to suit traders of different experience levels and trading volumes, with minimum deposits starting from $500.

These accounts come with floating spreads, commission structures, and platform access, allowing traders to choose the level that best fits their strategy and budget.

In addition to CFD accounts, the broker provides equities and options accounts with tiered pricing models. A free demo account is also available for beginners to practice and explore the platform risk-free. Also, Colmex Pro offers Islamic or swap-free accounts upon request.

CFDs Accounts

Colmex Pro offers five CFD account types to accommodate traders with varying experience levels and capital. The Bronze account, with a minimum deposit of $500, is suitable for beginner traders, offering standard access to the trading platforms with basic features.

The Silver account requires a minimum deposit of $5,000, providing slightly improved trading conditions and lower commissions compared to the entry-level tier.

For more active traders, the Gold account starts at $10,000, offering enhanced execution conditions, reduced per-share commissions, and broader support.

The Platinum account, with a $25,000 minimum deposit, is tailored for serious traders, featuring cost reductions and advanced tools. At the top tier, the Diamond account requires a $50,000 deposit and is made for high-volume or professional traders, offering the most competitive rates and customized solutions.

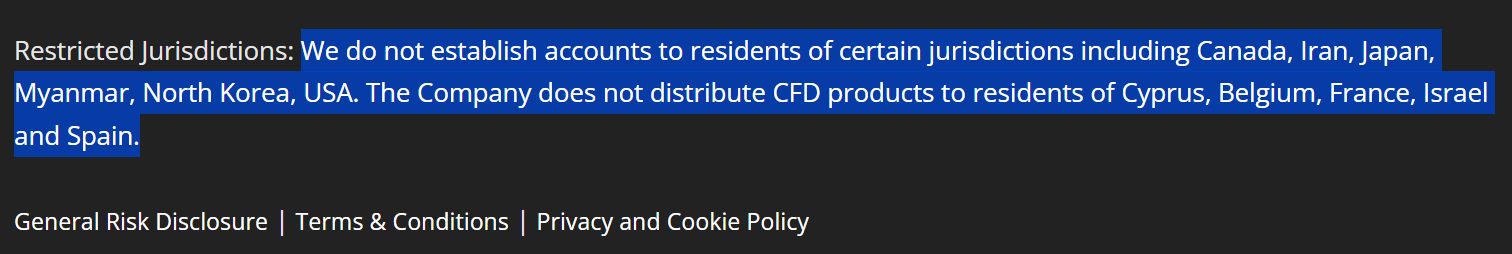

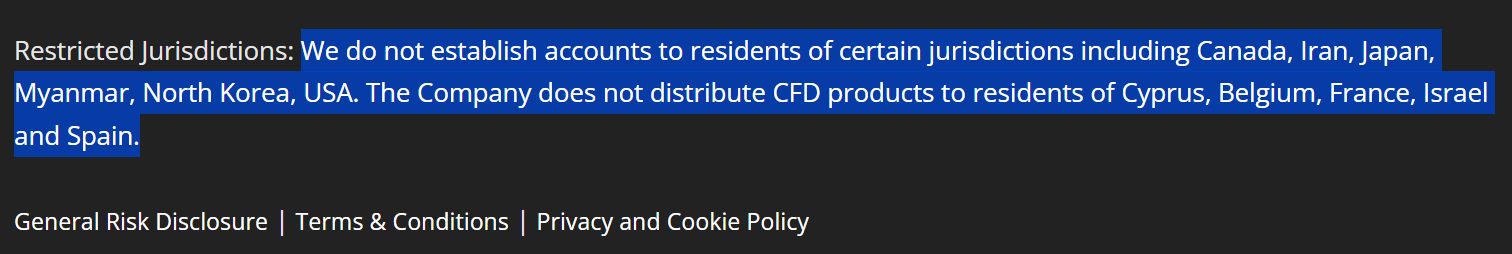

Regions Where Colmex Pro is Restricted

Colmex Pro imposes restrictions on account openings and product offerings in certain jurisdictions due to regulatory and legal considerations. The broker does not provide trading services in countries including:

- USA

- Canada

- Belgium

- France

- Spain

- Japan

- Iran

- Myanmar

- North Korea

- Israel

Cost Structure and Fees

Score – 4.3/5

Colmex Pro Brokerage Fees

Colmex Pro’s trading fees are based on account type and trading volume. For CFD trading, commissions start from $0.01 per share with minimum charges per order.

Forex spreads begin from 0.8 pips, with additional commission fees. The broker charges inactivity fees, swap fees, and withdrawal fees after the first monthly transaction.

While the broker’s fees are more competitive for higher-tier accounts, traders should review the full pricing details based on their trading activity.

Colmex Pro offers floating spreads based on the account type and trading platform. The average spread for the EUR/USD Forex currency pair in the Bronze account is 4 pips, which is relatively wide compared to industry standards.

Higher-tier accounts, such as the Platinum account, offer tighter spreads, with an average EUR/USD spread of 0.8 pips.

Colmex Pro charges commissions based on account type and trading instruments. For stock CFDs, commissions start at $0.01 per share with a minimum fee of $1.5 per order at the Bronze account, with lower rates for higher-tier accounts.

Equity accounts offer tiered commissions starting at $0.0035 per share or fixed fees from $6.95 for up to 1,000 shares.

- Colmex Pro Rollover / Swaps

Colmex Pro applies overnight fees, commonly known as swap or rollover charges. These fees vary depending on the instrument and position type.

Swap fees are calculated daily and are tripled on Wednesdays to account for weekend holding. The specific swap rates and calculations can be found directly within the trading platform.

- Colmex Pro Additional Fees

Colmex Pro imposes several additional fees that traders should be aware of. An inactivity fee applies if there is no trading activity for 30 consecutive days, for $30 per month for CFD accounts and $55 per month for equity accounts.

Withdrawal fees are structured such that the first transaction of the month under or equal to $500 is free, subsequent withdrawals incur a $40 fee.

Traders should also consider potential currency conversion fees from their financial institutions when transferring funds.

How Competitive Are Colmex Pro Fees?

Colmex Pro’s fee structure is comparatively competitive. While its spreads and commission rates may not be the lowest in the Forex market, the broker offers tiered account options that can reduce costs for active or high-volume traders.

However, compared to some discount brokers, Colmex Pro is less cost-effective for casual or low-frequency traders, especially when considering the additional charges and higher minimum deposits for advanced accounts.

| Asset/ Pair | Colmex Pro Spread | TastyFX Spread | Weltrade Spread |

|---|

| EUR USD Spread | 4 pips | 0.8 pips | 1.5 pips |

| Crude Oil WTI Spread | 0.10 | - | 12.4 |

| Gold Spread | 0.68 | - | 31 |

| BTC USD Spread | $195.45 | - | 43 |

Trading Platforms and Tools

Score – 4.5/5

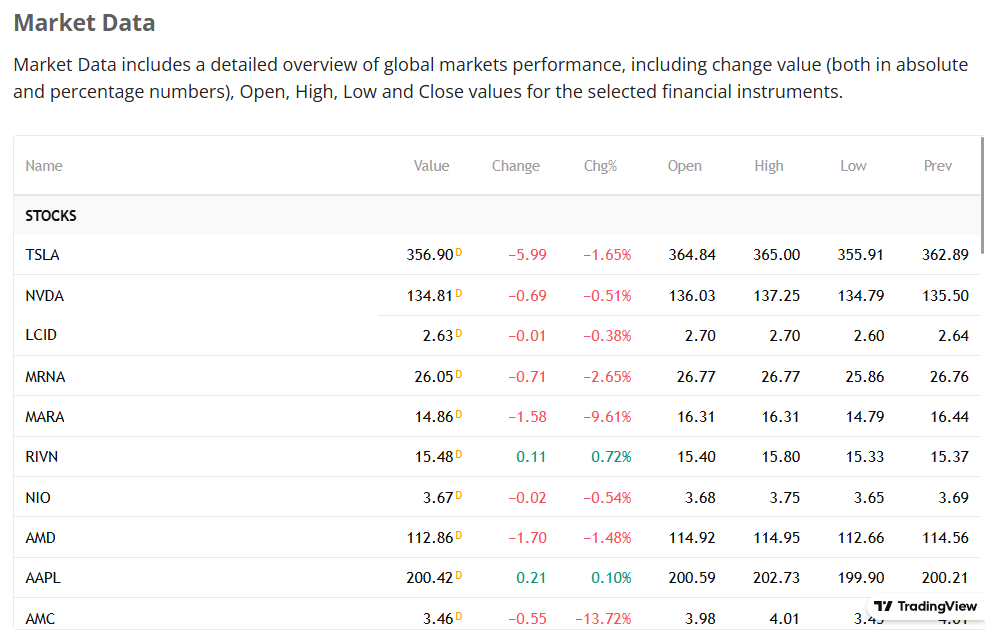

Colmex Pro offers the Colmex Pro 2.0 proprietary trading platform, which is available on the web, desktop, and mobile devices. It features two distinct modes, Pro View for advanced order execution and market depth data, and Lite View for swift market reactions. The platform supports Level II data, advanced charting tools, and real-time stock screeners, enhancing analytical capabilities.

For traders who prefer a more traditional trading experience, MT4 is available, offering robust technical analysis tools, automated trading through Expert Advisors, and a user-friendly interface.

Additionally, Colmex Pro has integrated with TradingView, allowing clients to access real-time market data and execute trades directly through the popular charting platform.

Trading Platform Comparison to Other Brokers:

| Platforms | Colmex Pro Platforms | TastyFX Platforms | Weltrade Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Colmex Pro Web Platform

Colmex Pro 2.0 Web Trader is a browser-based platform for traders of all experience levels, with an order execution time of 31 milliseconds. The platform supports Level II data, advanced charting tools, and real-time stock screeners, enhancing analytical capabilities.

Users can customize their workspace with detachable panels and synchronize stock symbols across multiple panels for efficient monitoring. Additionally, the platform’s integration with TradingView allows clients to access real-time market data and execute trades directly through the popular charting platform.

Colmex Pro Desktop MetaTrader 4 Platform

The Colmex Pro MT4 platform provides a powerful trading experience for its users. It offers online quotes and interactive charts with 9 timeframes, allowing traders to analyze market movements in detail and react quickly to price changes.

With 23 analytical objects and 30 built-in technical indicators, traders can easily perform in-depth technical analysis. MT4 also supports automated trading through EAs, one-click trading, and extensive customization options, making it a reliable choice for various trading strategies.

Main Insights from Testing

Testing the MT4 platform revealed a stable and responsive trading environment, ideal for executing trades efficiently even during volatile market conditions. The interface is intuitive, with smooth order execution.

Additionally, the platform’s compatibility with third-party tools and its reliable performance during backtesting make it a strong choice for traders who prioritize precision and speed.

Colmex Pro Desktop MetaTrader 5 Platform

Colmes Pro does not support the MetaTrader 5 platform, focusing instead on MT4 and its proprietary trading solutions.

Colmex Pro MobileTrader App

Colmex Pro offers mobile trading through the Colmex Pro 2.0 and MetaTrader 4 mobile apps, available on iOS and Android.

The Colmex Pro 2.0 app provides access to thousands of US stocks and CFDs, real-time quotes, advanced charting, and customizable views. Meanwhile, the MT4 app offers a familiar interface with full trading functionality, including technical indicators, multiple timeframes, and one-tap execution.

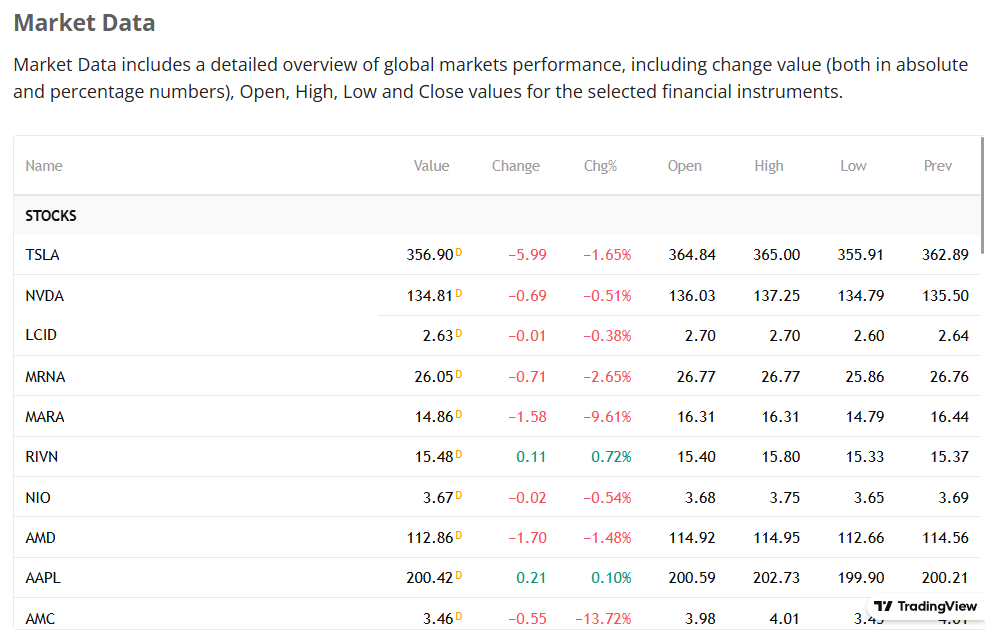

Trading Instruments

Score – 4.7/5

What Can You Trade on Colmex Pro’s Platform?

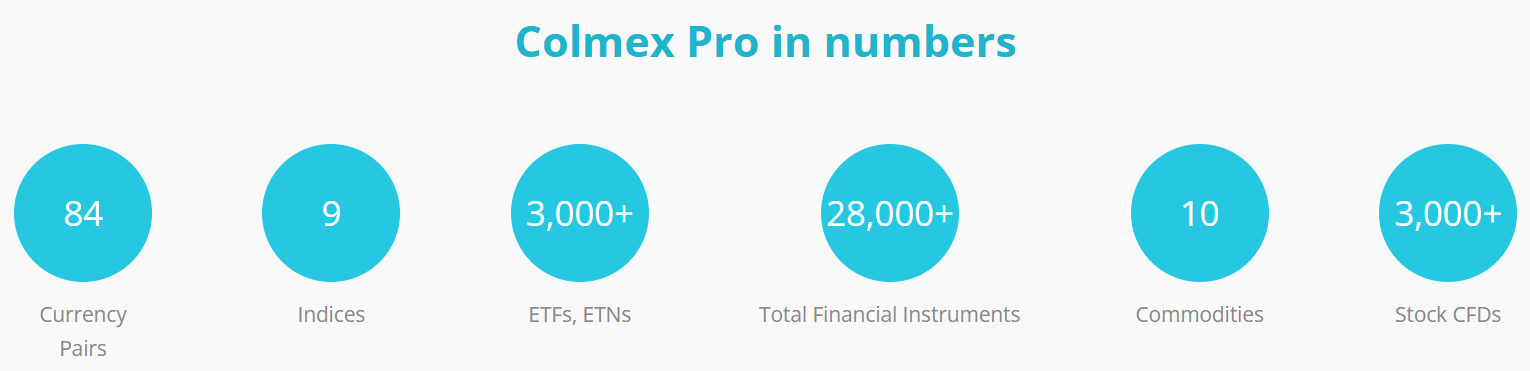

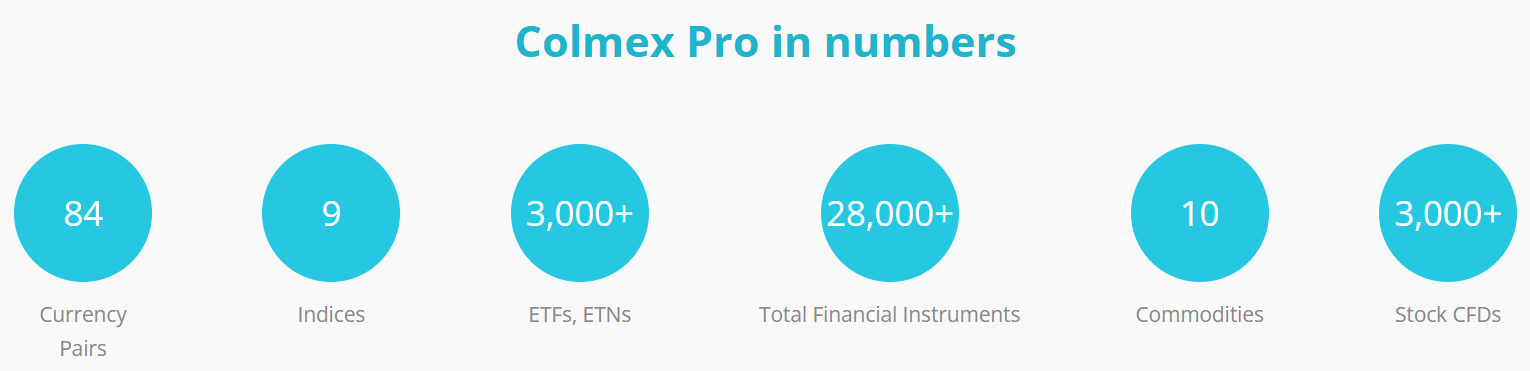

Colmex Pro’s platform offers access to over 28,000 financial instruments, including 84 currency pairs, more than 4,000 CFDs on indices, commodities, cryptocurrencies, over 3,000 stock CFDs, and more than 3,000 ETFs and ETNs.

This comprehensive selection allows traders to diversify their portfolios and explore multiple markets from a single account.

Main Insights from Exploring Colmex Pro’s Tradable Assets

Exploring Colmex Pro’s tradable assets reveals a strong emphasis on market diversity and flexibility. The broker supports trading across a wide range of asset classes, enabling users to build well-rounded portfolios for different strategies and risk profiles.

With a focus on US markets and global instruments, the broker appeals to both active traders and long-term investors looking for comprehensive market access.

Leverage Options at Colmex Pro

Colmex Pro’s leverage depends on the regulation and jurisdiction governing the trading account. Each jurisdiction operates under specific rules and laws, meaning that the multiplier levels and trading conditions vary based on the trader’s country of residence.

- European traders are eligible to use up to 1:30 for major currency pairs.

- Trades from South Africa are eligible to use low leverage up to 1:30 for major currency pairs.

- For professional traders, the website states the potential for higher leverage of up to 1:200.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at Colmex Pro

As for the deposit options, Colmex Pro offers a few options. However, we advise checking funding methods as they might vary based on the client’s country of residence.

- Credit/Debit cards

- Wire transfer

- Skrill

- PayPal, etc.

Colmex Pro Minimum Deposit

Colmex Pro offers various account types with minimum deposits starting from $500 for the Bronze Account, while higher-tier accounts like the Silver, Gold, Platinum, and Diamond require $5,000, $10,000, $25,000, and $50,000, respectively.

Withdrawal Options at Colmex Pro

Colmex Pro offers the same funding methods for withdrawals as for deposits. Withdrawals are typically processed within a few hours, however, the exact time for the funds to appear in your account depends on the selected method.

The first withdrawal of the month up to $500 is free, while additional withdrawals incur a fee of $40.

Customer Support and Responsiveness

Score – 4.5/5

Testing Colmex Pro’s Customer Support

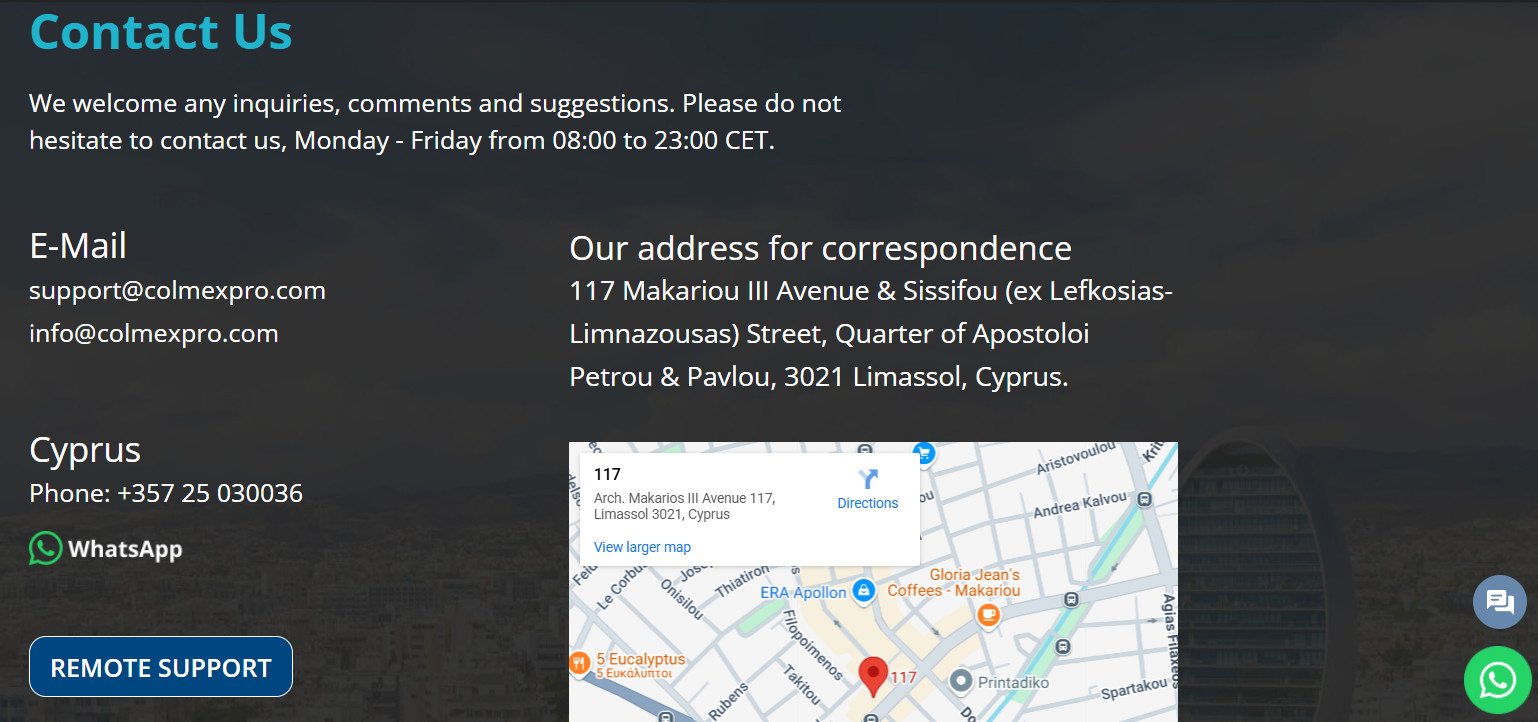

Colmex Pro provides 24/5 multilingual customer support via email, live chat, phone, and WhatsApp, ensuring accessibility for traders across different regions. Additionally, the support team provides remote assistance using the TeamViewer tool to resolve technical issues effectively.

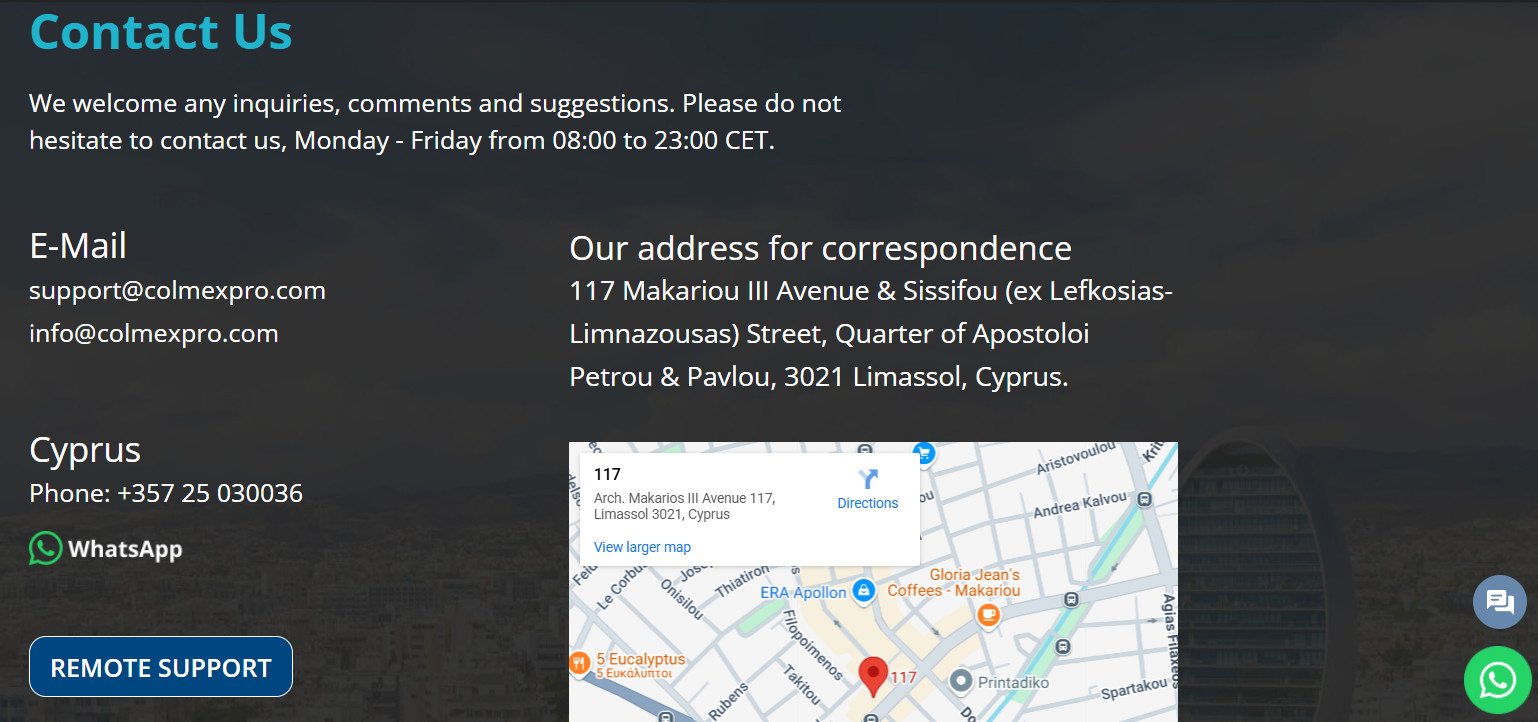

Contacts Colmex Pro

Colmex Pro provides multiple contact options for clients seeking assistance. Traders can reach the support team via email at support@colmexpro.com or info@colmexpro.com. For direct communication, clients can contact the broker’s Cyprus office at +357 25 030036.

Research and Education

Score – 4.4/5

Research Tools Colmex Pro

Colmex Pro offers a range of research tools across its platforms to support users in making informed decisions.

- Colmex Pro 2.0 desktop platform offers advanced charting capabilities, including 14 chart styles such as Heiken Ashi and Cluster charts, and access to 47 technical indicators, with options to import custom indicators.

- Additionally, the platform features real-time stock screeners, such as Gainers/Losers and High/Low panels, to identify market opportunities.

- Also, TradingView integration enhances the traders’ research experience with its real-time market data and charting tools.

- MetaTrader 4 platform, in its turn, provides analytical objects, built-in technical indicators, facilitating detailed market analysis.

Education

Colmex Pro’s educational resources are limited compared to other industry-known brokers. The website primarily offers a blog and market news updates to keep traders informed about market trends and developments.

However, the broker does not provide comprehensive educational materials, webinars, seminars, or in-depth tutorials, which are beneficial for beginners seeking to enhance their knowledge and skills.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options Colmex Pro

Colmex Pro primarily operates as a Forex and CFD broker. While its core focus remains on leveraged trading, the broker also provides investment opportunities such as access to IPOs, enabling retail and institutional traders to invest in new stock issues from the outset. It also offers direct market access to US equities, allowing clients to trade real stocks on the exchanges.

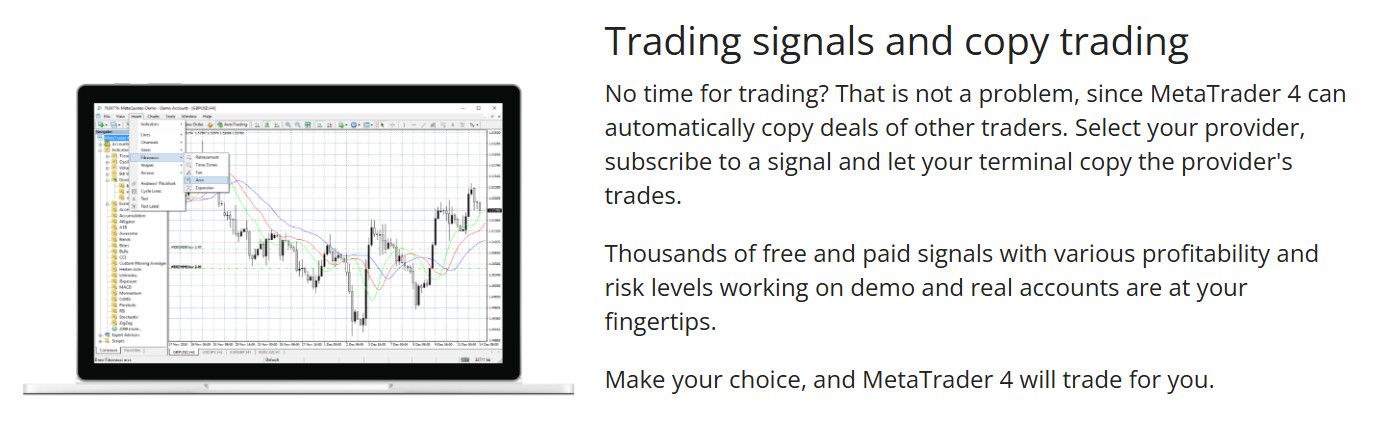

Additionally, Colmex Pro provides copy trading through MetaTrader 4, allowing clients to automatically replicate the trades of other traders by subscribing to their signals. This feature caters to those looking for passive investment strategies.

Account Opening

Score – 4.4/5

How to Open Colmex Pro Demo Account?

Opening a demo account with Colmex Pro is a simple way to practice trading without risking real money. The demo account gives you access to the platform’s features and allows you to test strategies using virtual funds. Follow these steps to get started:

- Visit the official Colmex Pro website.

- Navigate to the “Get Your Free Demo” section.

- Fill out the registration form with your details such as name, email, country of residence, and phone number.

- Submit the form to create your demo account.

- Log in using the demo account credentials provided.

- Start practicing trading with virtual funds in a risk-free environment.

How to Open Colmex Pro Live Account?

To open a live account with Colmex Pro, start by visiting the broker’s official website and then the account registration section. You will need to fill out an application form with your personal information, beginning by providing your email to sign up.

After submitting the form, the broker will require you to verify your identity by uploading necessary documents such as a government-issued ID and proof of address.

Once your account is approved, you can fund it using one of the available deposit methods. After funding your account, you will receive your login credentials to access the trading platform and begin live trading.

Additional Tools and Features

Score – 4.3/5

In addition to its main research tools, Colmex Pro offers additional tools and features to enhance the trading experience.

- These include trading signals that help users identify potential market opportunities, as well as advanced order types to better manage trades.

- The broker also provides customizable alerts and economic calendars to keep traders informed.

- Moreover, MT4 allows access to automated trading through Expert Advisors, giving traders flexibility and efficiency in executing their strategies.

Colmex Pro Compared to Other Brokers

Compared to its competitors, Colmex Pro stands out as a Forex trading broker offering an extensive range of tradable instruments and robust trading platform support through Colmex Pro 2.0 and MetaTrader 4.

While it provides over 28,000 tradable assets, its spreads and commission structure are generally less competitive compared to brokers focused on low-cost trading. The broker also provides solid regulatory backing and competitive trading features, but lacks in areas like educational resources, where some competitors offer more comprehensive learning materials.

What regard to customer support and platform availability, Colmex Pro aligns well with industry standards, providing consistent service and access to popular tools and trading strategies.

| Parameter |

Colmex Pro |

TastyFX |

Tickmill |

OANDA |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 4 pips |

Average 0.8 pips |

Average 0.1 pips |

Average 1 pip |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

None |

0.0 pips + $3 |

0.1 pips + $5 commission per 100,000 traded |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Colmex Pro 2.0, MT4 |

tastyfx, MT4, TradingView, ProRealTime |

MT4, MT5, Tickmill Trader |

OANDA Web Platform, MT4, MT5, TradingView, fxTrade |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

28,000+ instruments |

80+ currency pairs |

180+ instruments |

100+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

CySEC, FSCA |

CFTC, NFA |

FCA, CySEC, FSCA, FSA |

CFTC, NFA, FCA, ASIC, IIROC, MFSA, MAS, FFAJ, BVI FSC |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Limited |

Limited |

Excellent |

Good |

Good |

Good |

Good |

| Minimum Deposit |

$500 |

$100 |

$100 |

$0 |

$50 |

$0 |

$0 |

Full Review of Broker Colmex Pro

Colmex Pro is a well-regulated online trading provider offering a wide selection of financial instruments, including Forex, CFDs on stocks, indices, commodities, ETFs, and more.

The broker provides proprietary Colmex Pro 2.0 platform and the popular MetaTrader 4, available on the web, desktop, and mobile. Diverse account types cater to all experience levels, with commission-based and spread-based options, along with access to demo and swap-free accounts.

Colmex Pro provides additional tools like trading signals and market data from TradingView. While its educational resources are limited, features like copy trading, algorithmic trading, and the use of EAs appeal to both active traders and investors seeking diverse trading strategies.

Share this article [addtoany url="https://55brokers.com/colmex-pro-review/" title="Colmex Pro"]