- What is Angel One?

- Angel One Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

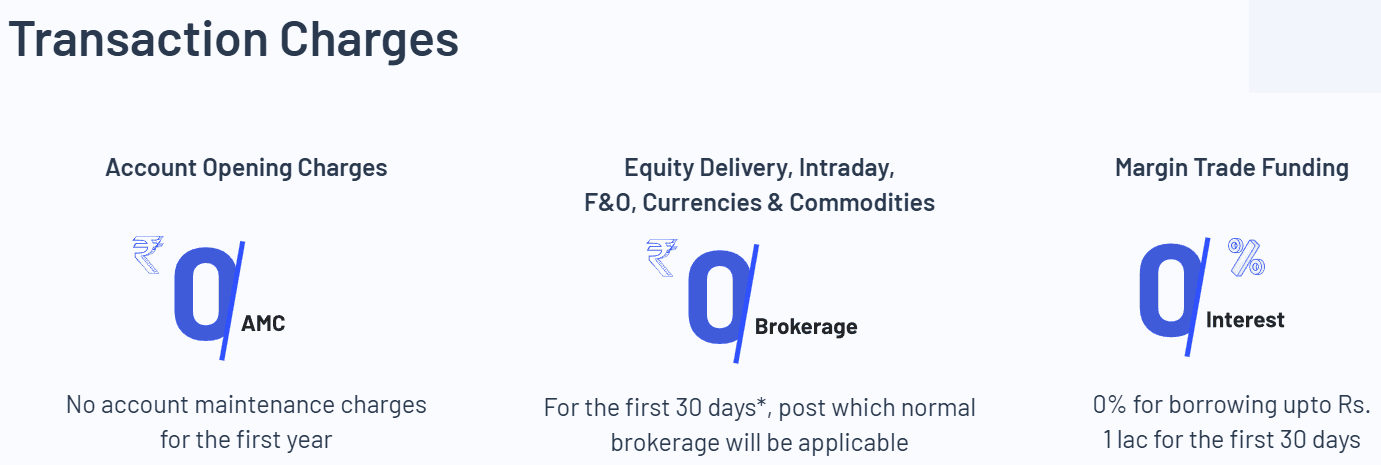

- Cost Structure and Fees

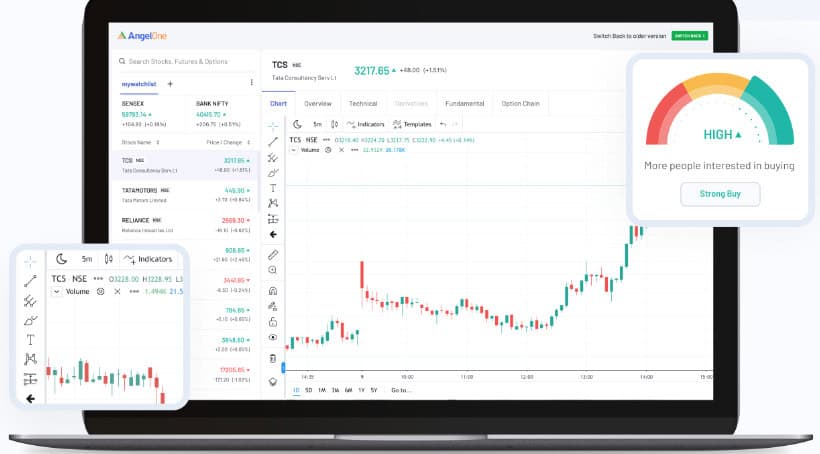

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

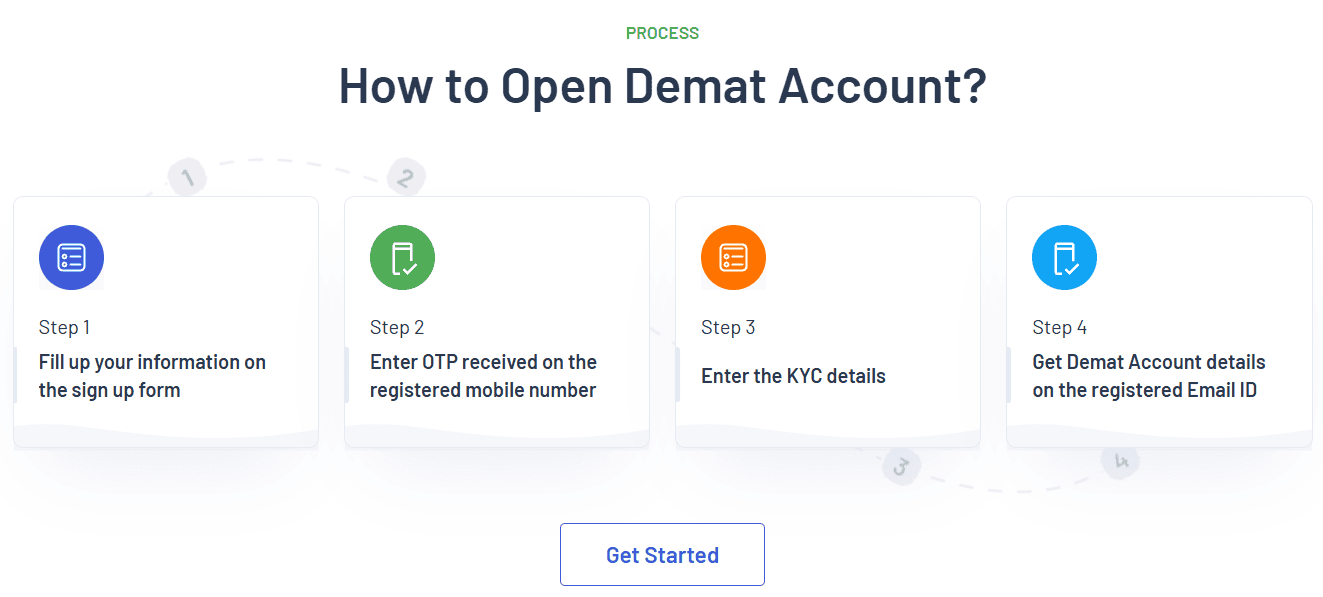

- Account Opening

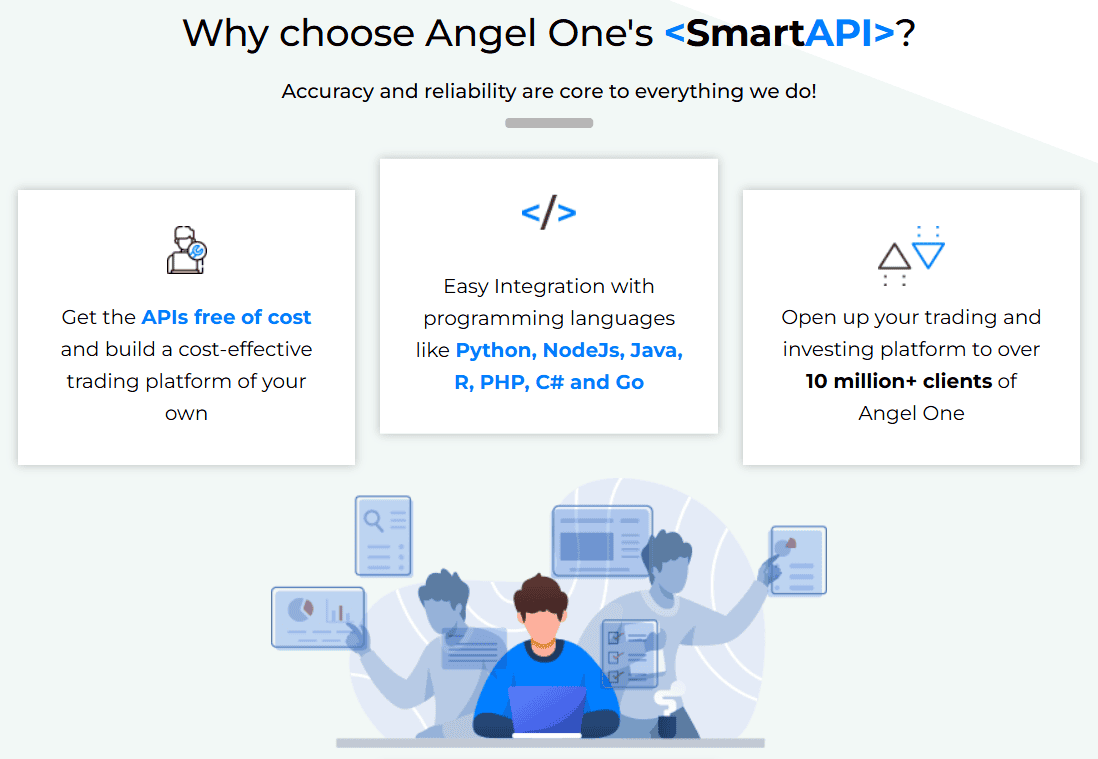

- Additional Tools And Features

- Angel One Compared to Other Brokers

- Full Review of Broker Angel One

Overall Rating 4.5

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.7 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.5 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.5 / 5 |

What is Angel One Brokerage?

Angel One is a Stock broker in India that offers a range of financial products, including Stocks, U.S. Stocks, Mutual Funds, Commodities, Indices, Futures, Options, IPOs, and more.

The brokerage is regulated by the Securities and Exchange Board of India (SEBI), which oversees various aspects of stock trading and brokerage operations to ensure transparency and protect traders’ interests.

Overall, the firm provides competitive conditions and an intuitive interface for clients to manage their investment portfolios, access market research, and execute trades.

Is Angel One Stock Broker?

Yes, Angel One is a Stock brokerage firm based in India. It was formerly known as Angel Broking Limited and rebranded as Angel One Limited. The company provides various financial services, including equity and commodity trading, mutual funds, IPO investments, research, and advisory services.

Angel One Pros and Cons

The broker comes with its set of advantages and disadvantages. On the positive side, the firm offers a diverse range of financial products for investors, user-friendly online platforms, and mobile apps, making it convenient for clients to execute trades and manage their portfolios. Additionally, Angel One offers extensive research and educational resources to empower investors in making informed decisions.

For the cons, the brokerage charges associated with certain services, such as demat and trading account maintenance fees, could be relatively higher compared to some discount brokers. Additionally, the firm lacks a top-tier license, which could be a concern for traders who prioritize brokers with higher regulatory credentials.

| Advantages | Disadvantages |

|---|

| $0 minimum deposit | No top-tier license |

| Competitive trading conditions | No 24/7 customer support |

| User-friendly interface | |

| Trading products | |

| Educational resources | |

| Transparent fee structure | |

| Direct Market Access | |

| Secure investing environment | |

Angel One Features

Angel One is a prominent discount brokerage firm in India, offering online trading services with competitive pricing. A summary of its key features is as follows:

Angel One Features in 10 Points

| 🏢 Regulation | SEBI |

| 🗺️ Account Types | Trading, Demat, Commodity Accounts |

| 🖥 Trading Platforms | AngelOne Trade, Mobile App, Angel NXT |

| 📉 Trading Instruments | Stocks, US Stocks, Mutual Funds, Commodities, Indices, Futures, Options, Currencies, ETFs, IPOs |

| 💳 Minimum Deposit | $0 |

| 💰 Average Stock Commission | From ₹20 |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | INR, USD, EUR, GBP, JPY |

| 📚 Trading Education | Live Blog, Knowledge Center, Webinars, Smart Money, Finance Wiki |

| ☎ Customer Support | 24/5 |

Who is Angel One For?

Angel One is designed for a wide range of investors and traders looking for advanced tools. With its user-friendly mobile app, research insights, and a variety of account types, it caters to individuals who want a simple yet powerful platform for investing in equities, derivatives, mutual funds, IPOs, and more. Based on our findings and Financial Expert Opinions, Angel One is Good for:

- Indian traders

- Stocks and Options trading

- Currency trading

- Investing

- Professional trading

- Advanced traders

- Commission-based trading

- Direct Market Access

- Competitive trading environment

- Good educational and trading tools

Angel One Summary

In conclusion, Angel One is a reputable Stock trading firm in India that offers a comprehensive suite of financial services and products. The broker is known for providing user-friendly online platforms, along with research and advisory services to assist clients in making informed investment decisions.

While the specific features, fees, and services may vary, the firm is recognized for its competitive offerings and commitment to customer support. However, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

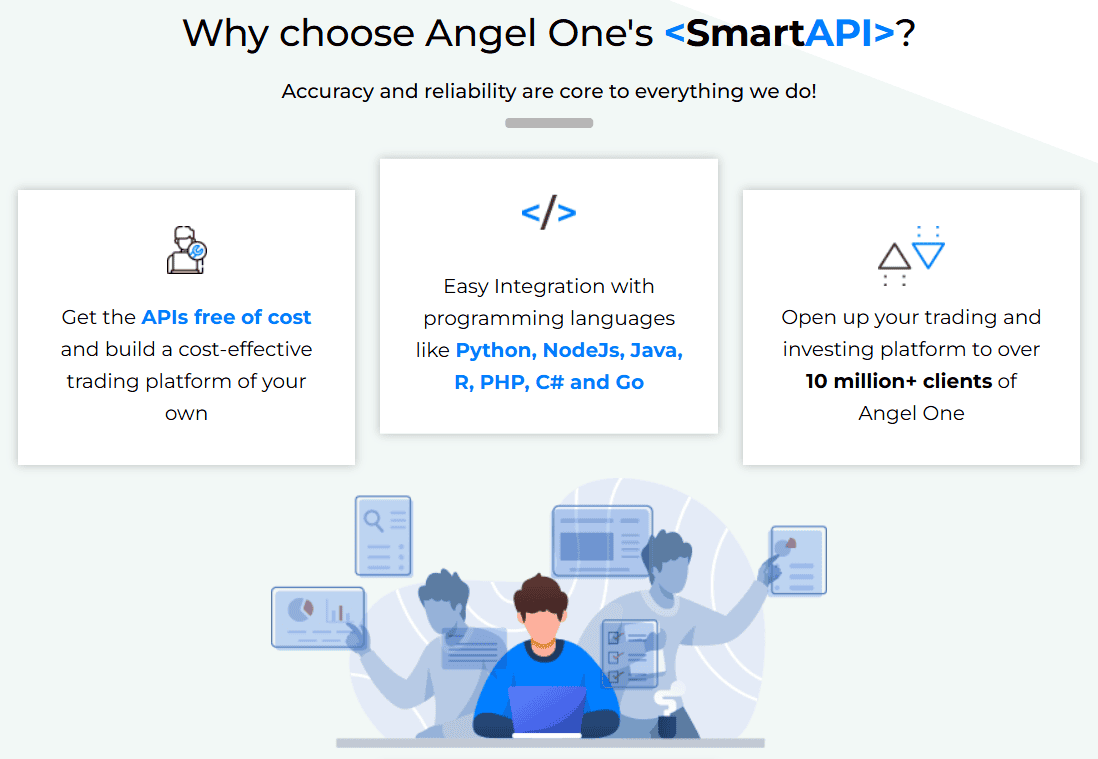

Angel One stands out in the Indian financial market due to its strong blend of technology, research, and accessibility. As a full-service broker with a discount pricing model, it provides investors with the advantage of flat, low-cost brokerage fees while still offering value-added services such as in-depth research reports, market insights, and investment advisory.

The Angel One Super App integrates multiple investment avenues: equities, F&O, commodities, mutual funds, IPOs, and insurance into a single, seamless platform, making it convenient for clients to manage all aspects of their portfolio.

Its SmartAPI and Algo-trading support appeal to tech-savvy traders, while tools like ARQ Prime deliver AI-driven recommendations for smarter decision-making.

With a large physical presence across India alongside robust digital platforms, Angel One combines accessibility with innovation, making it a standout choice for both retail investors and active traders seeking cost efficiency and professional-grade insights.

Consider Trading with Angel One If:

| Angel One is an excellent Broker for: | - Need a well-regulated broker.

- Secure trading environment.

- Competitive trading conditions.

- Offering popular financial products.

- Indian traders.

- Investors who prefer robust learning resources.

- Looking for broker with a long history of operation and strong establishment.

- Stock Trading and Investment.

- Traders who need advanced trading tools.

- All levels of investors.

- Professional trading. |

Avoid Trading with Angel One If:

| Angel One might not be the best for: | - High-frequency traders.

- Need a broker with trading services worldwide.

- Looking for broker with 24/7 customer support.

- Investors who need broker with a comprehensive wealth management offerings. |

Regulation and Security Measures

Score – 4.4/5

Angel One Regulatory Overview

Angel One is a trustworthy Stock trading firm that adheres to the rules and guidelines established by SEBI (India). The authority oversees the brokerage operations to ensure transparency and protect traders’ interests.

How Safe is Trading with Angel One?

Angel One is a legitimate and regulated investing firm. It is regulated and authorized by SEBI (India), which has a good reputation in the financial market.

However, the broker lacks a top-tier license and operates under a single regulatory body, which could be a drawback for some traders seeking accounts with multiple regulatory authorities.

Angel One Invest follows the regulations set by SEBI and employs secure and encrypted technologies to protect user data and financial transactions, enhancing the overall security of the trading experience.

However, investors should also be proactive in implementing security features such as two-factor authentication and staying informed about best practices to further enhance their trading protection.

Consistency and Clarity

Angel One provides margin trading options, allowing investors to borrow funds against their existing securities to potentially amplify their trading positions.

While margin can enhance returns, it also involves increased risk, and traders should carefully consider their risk tolerance and market conditions before engaging in multiplier trading on the broker’s platform.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at Angel One

The broker offers multiple funding methods to facilitate deposits into trading accounts. Common funding methods include online bank transfers, net banking, and Unified Payments Interface (UPI) transactions.

Clients can link their bank accounts with their Angel One accounts and transfer funds seamlessly using these online methods. Additionally, Angel One may support payments through various payment gateways.

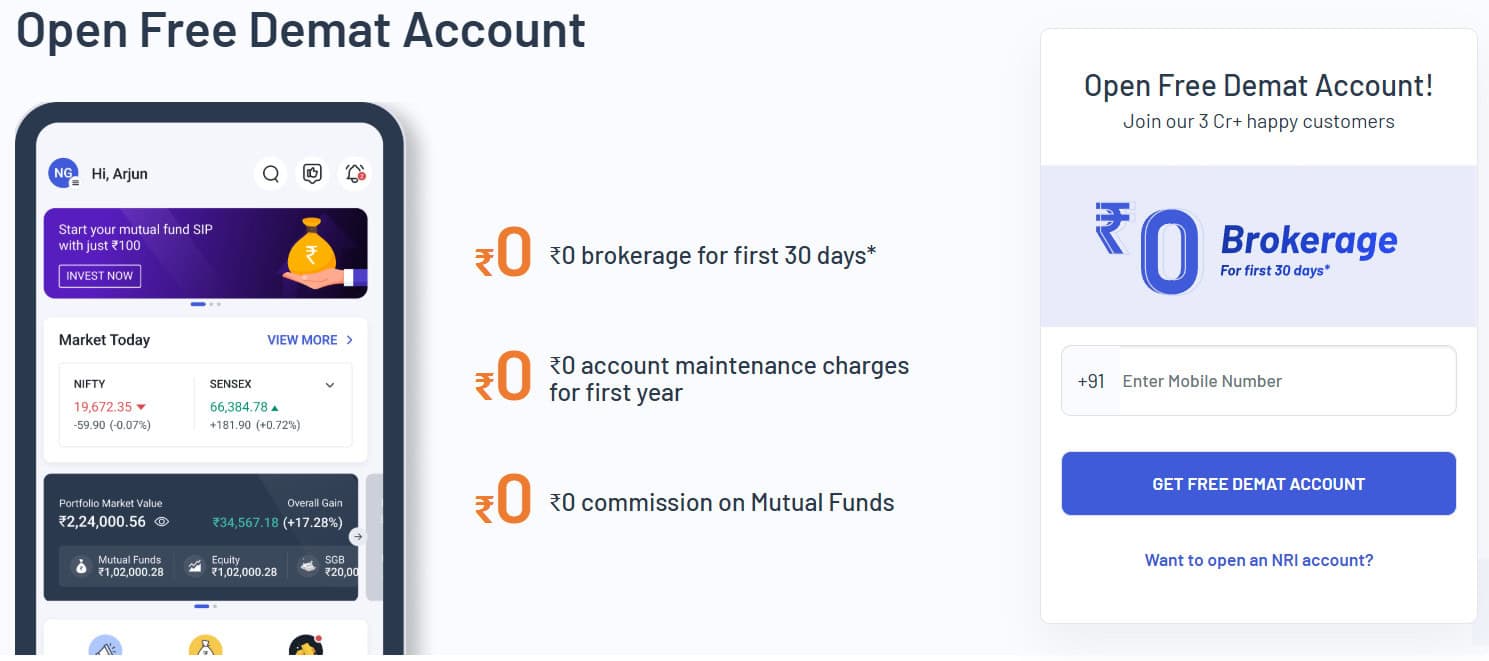

Angel One Minimum Deposit

The broker does not have a mandatory minimum deposit requirement for opening a trading account. Users can start investing with any amount they are comfortable with.

Withdrawal Options at Angel One

The broker allows clients to make withdrawals from their accounts using various methods. Investors can initiate withdrawal requests through the online portal by specifying the desired amount and preferred withdrawal mode.

Common withdrawal methods include online fund transfers to the linked bank account, and the processing time for withdrawals can vary based on the chosen method.

Customer Support and Responsiveness

Score – 4.6/5

Testing Angel One’s Customer Support

The broker offers 24/5 client support through various channels, including FAQs, phone, email, and live chat. The firm provides timely and helpful assistance to address account-related issues, technical queries, or general inquiries about its services.

Contacts Angel One

You can contact Angel One for support or inquiries via multiple channels. The customer care phone number is 022-4003600, and the toll-free number is 1800 1020, both available during business hours for assistance.

For written communication, you can reach them via email at support@angelone.in, where their team responds to queries related to trading, account management, or technical support.

Research and Education

Score – 4.7/5

Research Tools Angel One

Angel One provides a comprehensive set of research tools available on both its website and platforms, designed to support informed decision-making.

- Traders can access market analysis reports, stock screeners, and AI-driven insights, along with advanced charting powered by TradingView integration.

- Additionally, the broker’s SmartAPI and algo-trading support enable users to customize and automate strategies, making research and execution more seamless within a single ecosystem.

Education

The broker offers educational resources to assist clients in enhancing their financial knowledge and skills. These educational materials include tutorials, webinars, articles, and other learning resources covering various topics related to stock market investing, trading strategies, technical and fundamental analysis, and more.

Portfolio and Investment Opportunities

Score – 4.5/5

Investment Options Angel One

Angel One offers a wide range of investment solutions designed to meet the needs of investors. From long-term wealth-building opportunities to diversified portfolio strategies, the broker provides easy access to investment products and advisory services that help clients align their financial goals with suitable market opportunities.

Account Opening

Score – 4.4/5

How to Open Angel One Demo Account?

Opening a demo account with Angel One is a simple process designed to help traders practice without financial risk. Traders need to visit the broker’s official website or download the mobile app, then register by entering basic details such as their name, email, and phone number.

Once registered, they can log in to the demo platform, which replicates real market conditions. From there, traders will receive virtual funds to practice trading, explore features like TradingView charts and SmartAPI, and test different strategies.

How to Open Angel One Live Account?

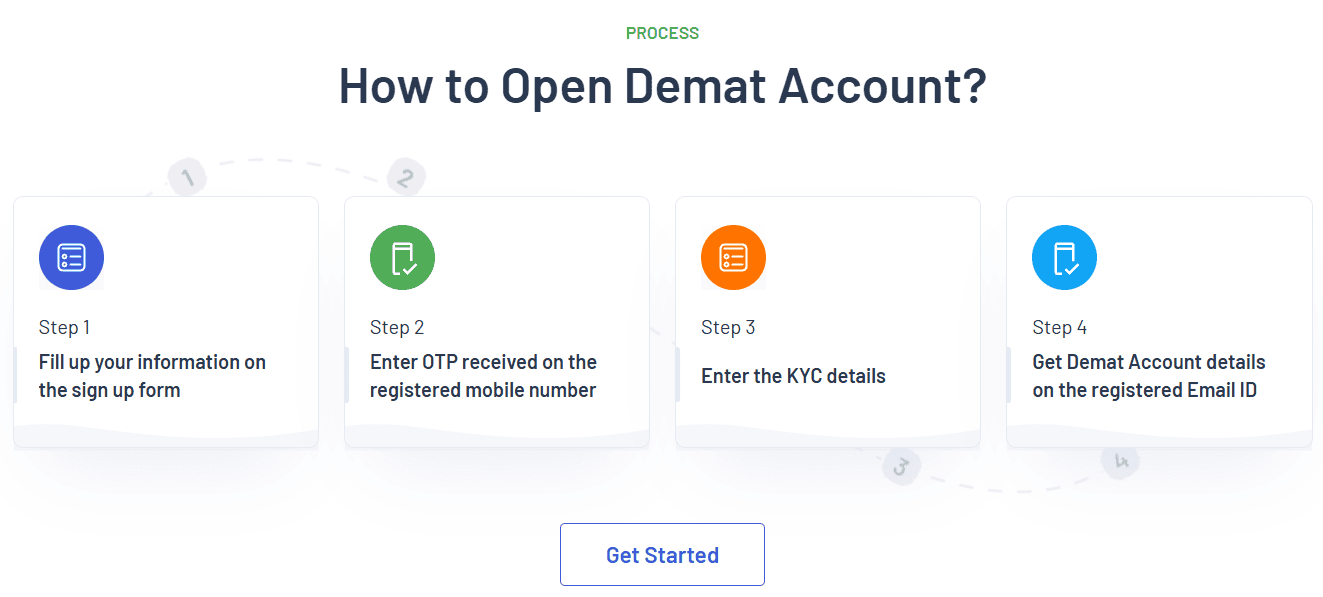

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or Angel One login page and proceed with the guided steps:

- Select and click on the “Open Demat Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

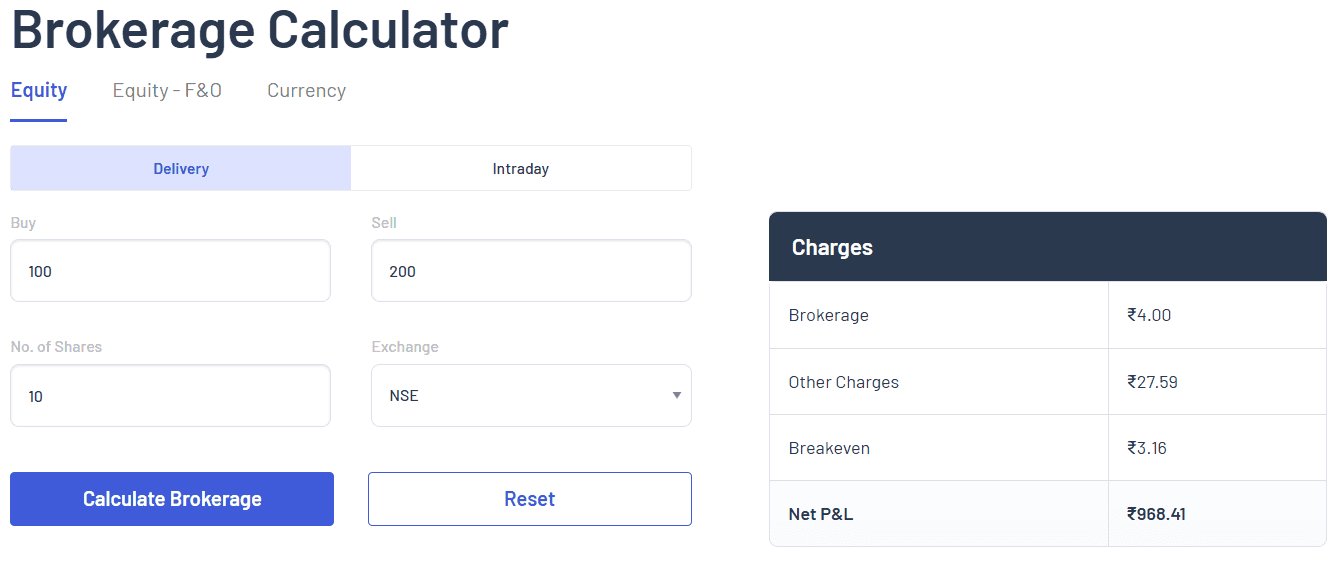

Score – 4.5/5

Apart from its research and charting solutions, Angel One also offers additional tools and features designed to enhance the trading experience.

- These include portfolio tracking, real-time price alerts, watchlists, and seamless fund transfers for easier account management.

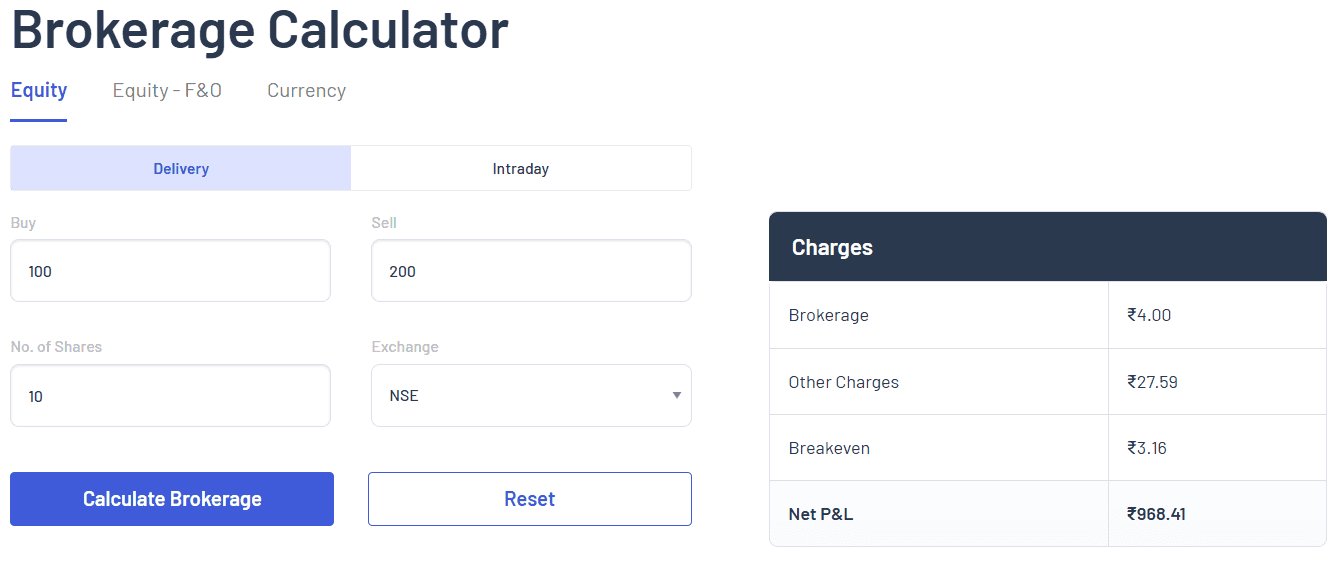

- Traders can also benefit from options calculators, margin calculators, and access to advanced order types, making the platform more efficient and user-friendly.

Angel One Compared to Other Brokers

When compared with its competitors, Angel One stands out as a strong choice for Indian investors, particularly those seeking simplicity, affordability, and a wide range of investment options.

Unlike global brokers such as Interactive Brokers or Webull, which cater more to advanced and international markets, Angel One focuses on providing localized solutions tailored to Indian regulatory standards and investor needs.

It offers robust trading platforms, AI-powered tools, and accessible investment products, making it appealing to both beginners and experienced traders. While international brokers may provide broader global asset coverage and 24/7 support, Angel One maintains its strength through user-friendly platforms, competitive pricing within the Indian market, and reliable research and educational resources.

| Parameter |

Angel One |

Upstox |

Interactive Brokers |

Zerodha |

Freetrade |

E-Trade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures E-mini contracts not available / Stock Commission from ₹20 |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

$0.85 |

Futures E-mini contracts not available / Stock Commission from ₹20/$0,24 |

Futures contracts not available / Stock Commission from $0 |

$1.50 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low/Average |

Low |

Low/Average |

Low |

Average |

Low |

| Trading Platforms |

AngelOne Trade, Mobile App, Angel NXT |

Upstox Pro Web, Mobile, NEST Desktop, Upstox Developer Trading Platforms, TradingView |

TWS, IBKR WebTrader, Mobile |

Kite |

Freetrade Platform |

Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, US Stocks, Mutual Funds, Commodities, Indices, Futures, Options, Currencies, ETFs, IPOs |

Stocks, Mutual Funds, Bonds, Commodities, Futures, Options, ETFs, Currencies |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Direct Mutual Funds, Futures, Options, ETFs, IPO (Initial Public Offering), Securities, Bonds, Commodities |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, Options, Mutual Funds, ETFs, Futures, Bonds, and CDs |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

SEBI |

SEBI |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEBI |

FCA |

SEC, FINRA, CFTC, SIPC, NFA, FDIC |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Excellent |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$0 |

$0 |

$100 |

$0 |

$0 |

$0 |

$0 |

Full Review of Broker Angel One

Angel One is a leading Indian Stock brokerage offering a wide range of investment services across equities, commodities, currencies, derivatives, mutual funds, IPOs, and more.

The broker is well-regarded for its user-friendly platforms, competitive pricing with zero brokerage on equity delivery, and advanced tools like SmartAPI integration and TradingView charts.

Investors benefit from strong research support, educational resources, and additional features such as portfolio trackers, margin trading facilities, and advisory services.

With its seamless account opening process, innovative technology, and comprehensive investment solutions, Angel One provides a reliable option for both beginner and experienced traders in the Indian market.

Share this article [addtoany url="https://55brokers.com/angel-one-review/" title="Angel One"]