- What is Amana Capital?

- Amana Capital Pros and Cons

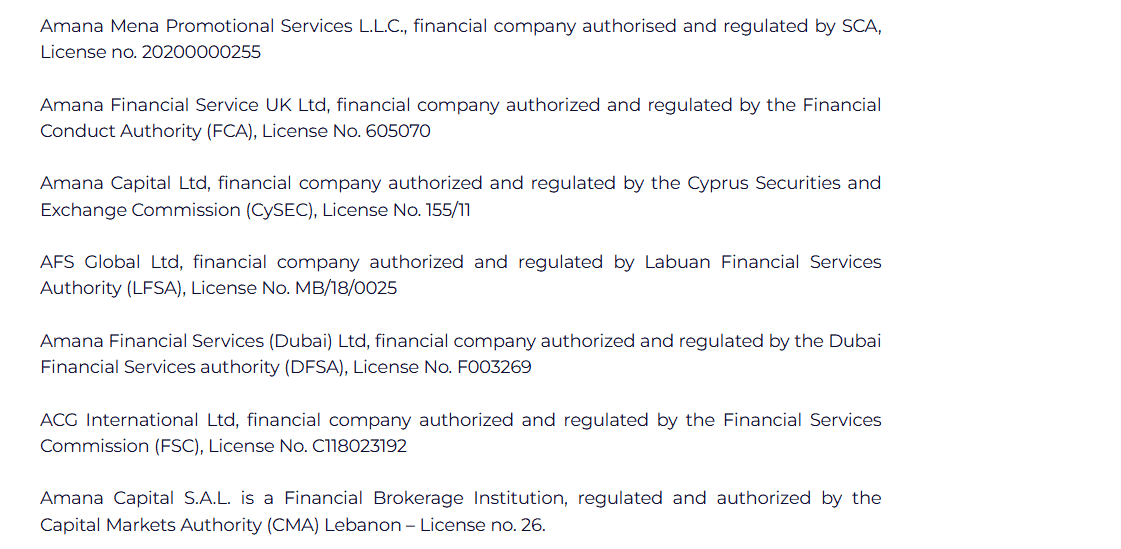

- Regulation and Security Measures

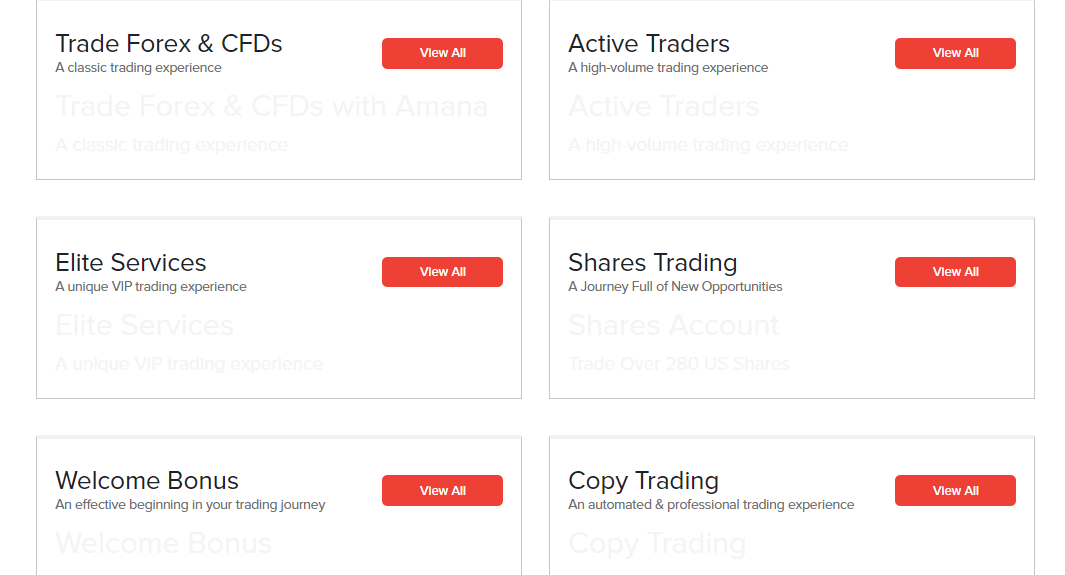

- Account Types and Benefits

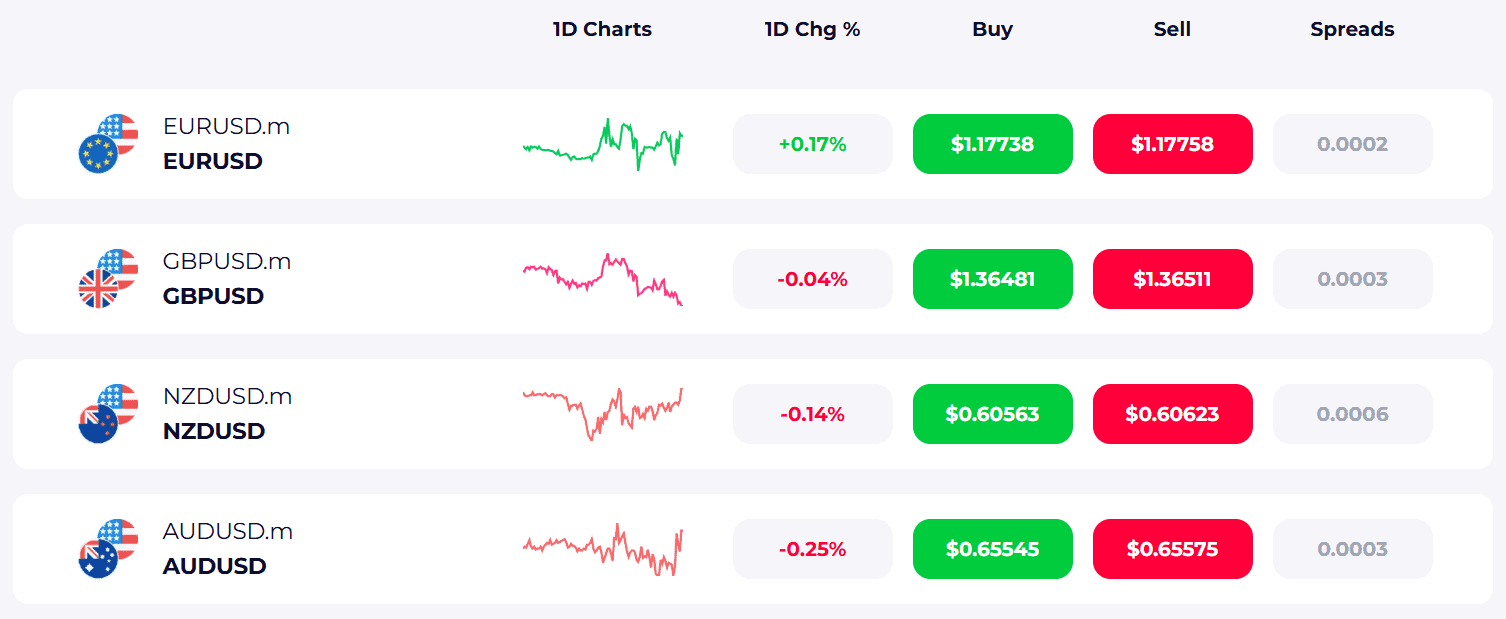

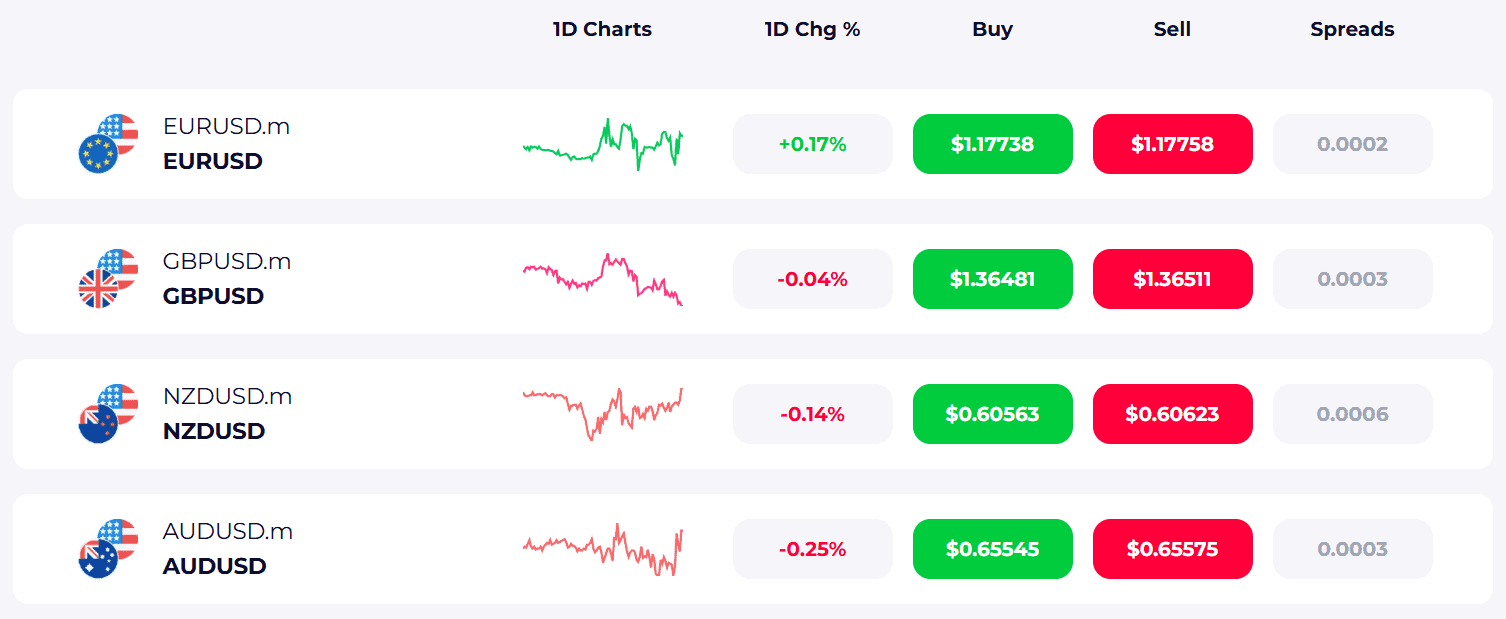

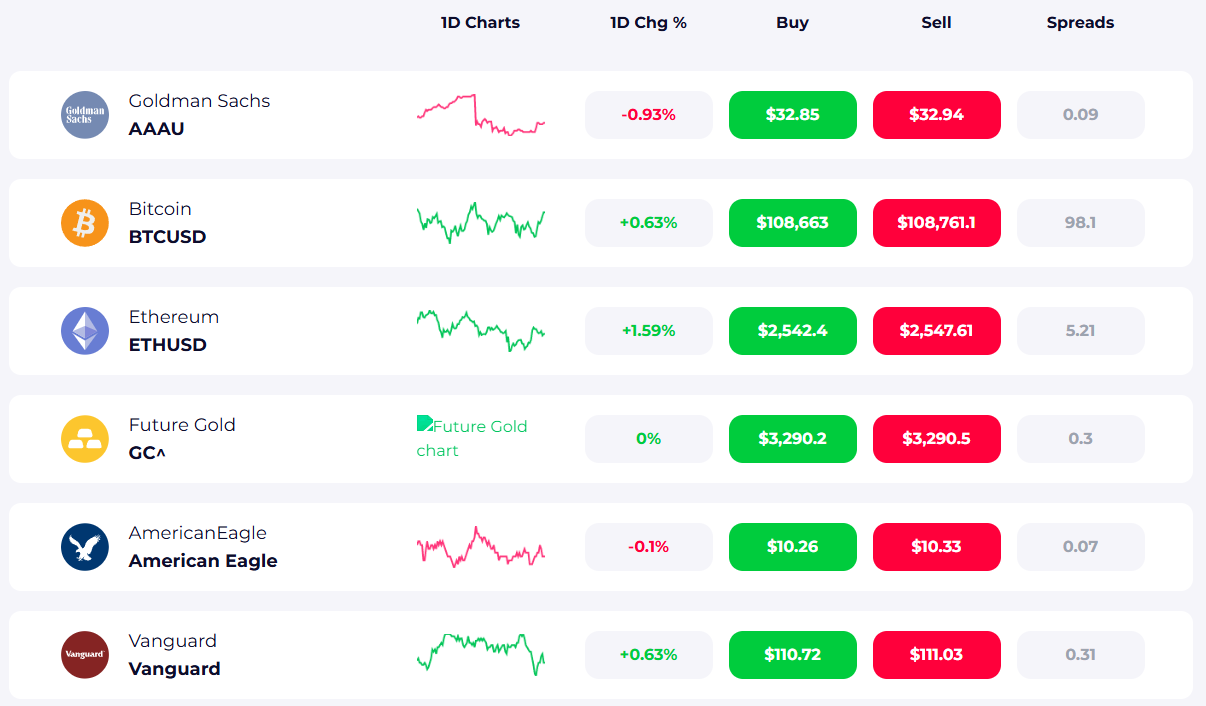

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- Amana Capital Compared to Other Brokers

- Full Review of Broker Amana Capital

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.7 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.7 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.6 / 5 |

What is Amana Capital?

Amana Capital is a financial services group operating in various international markets through its offices located in the UK, Cyprus, the UAE, Lebanon, Malaysia, and Mauritius. It offers brokerage services for a wide range of financial instruments such as Forex, Stocks, ETFs, Commodities, Indices, Cryptocurrencies, and more.

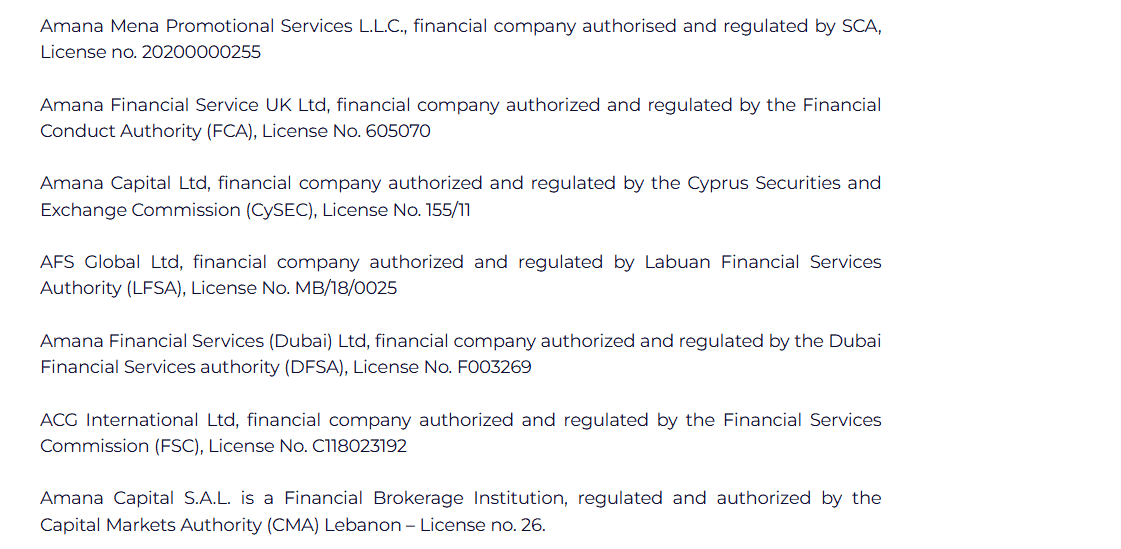

The company consists of 6 main entities, namely Amana Financial Service UK Ltd, Amana Capital Ltd (Cyprus), Amana Financial Services (Dubai) Ltd, AFS Global Ltd (Malaysia), ACG International Ltd (Mauritius), and Amana Capital S.A.L. in Lebanon.

As we found, Amana Capital offices have helped the group to expand its services and offer direct access to global markets through innovative technology, meeting the requirements of both individual and institutional investors.

Amana Capital Pros and Cons

Based on our research, Amana Capital is a reputable broker that adheres to multiple regulations, providing a safer environment for its clients. The costs are affordable and competitive, and the education and research provided are of high quality.

For the cons, account conditions, and fees may vary according to regulation so might be higher for some entities, and there is no 24/7 customer support.

| Advantages | Disadvantages |

|---|

| Regulated broker with FCA license | Conditions might vary based on the entity |

| Additional licenses from CySEC, DFSA, LFSA, and more | No 24/7 customer support |

| Competitive trading fees | |

| MT4 and MT5 | |

| Popular trading Instruments | |

| Safe and secure funds | |

| Negative balance protection | |

| Global expand | |

Amana Features

Amana provides advanced solutions with competitive prices, as well as a secure environment for individuals and enterprises at different stages of financial development. Below you can find the main points to consider while choosing Amana as your broker, including Instruments Range, Platforms, Regulations, and more.

Amana Capital Features in 10 Points

| 🏢 Regulation | FCA, CySEC, DFSA, LFSA, FSC, CMA |

| 🗺️ Account Types | Classic, Active, Elite Accounts |

| 🖥 Trading Platforms | Amana App, Amana Web, MT4, MT5 |

| 📉 Trading Instruments | Forex, Stocks, ETFs, Commodities, Indices, Futures, Derivatives, Crypto |

| 💳 Minimum Deposit | $50 |

| 💰 Average EUR/USD Spread | 0.6 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | GBP, EUR, USD |

| 📚 Trading Education | Tutorials, Videos, Learning Center |

| ☎ Customer Support | 24/6 |

Who is Amana For?

Amana Capital is ideal for traders looking for flexible account options, competitive spreads, and access to global financial markets. With strong regulatory oversight, it appeals to both retail and institutional clients across the UK, Europe, the MENA region, and Asia. Based on our findings, Amana is Good for:

- Traders from the UK

- Traders from Europe

- International traders

- CFD and currency trading

- Beginners

- Advanced traders

- NDD/STP execution

- Competitive spreads and fees

- Good educational materials and tools

- Supportive customer support

- Copy trading

- EA/Auto trading

Amana Summary

In conclusion, Amana Capital is a well-regulated broker that offers a wide range of instruments and platforms to meet the needs of traders of all levels. The broker’s commitment to providing a safe and reliable environment is reflected in its numerous regulations and protective measures, such as negative balance protection and investor compensation fund protection.

Traders also benefit from competitive spreads, flexible leverage, and the availability of mini and macro lots. Additionally, Amana provides traders with access to a variety of tools, educational resources, and reliable customer support, making it an attractive option for those looking to enter the world of online trading.

In general, traders have provided positive feedback on Amana’s conditions and services. However, we recommend that you do your research before choosing to sign up with the broker to ensure it is the right fit for you.

55Brokers Professional Insights

Amana Capital is a multi-regulated broker that combines global trust with a strong regional focus, particularly in the MENA region. It offers a broad range of instruments, including Forex, commodities, indices, shares, and cryptocurrencies, available on industry-leading platforms like MT4 and MT5.

One of Amana’s key strengths is the flexibility of its account types, from low-deposit Classic accounts ideal for beginners to Active and Elite accounts with raw spreads for high-volume and institutional traders.

The broker also supports Islamic accounts, accessible to traders following Sharia law. Professional traders benefit from tight spreads, dedicated account managers, and advanced market insights. With regulatory licenses from top authorities such as the FCA and CySEC, Amana ensures a secure and transparent environment.

Consider Trading with Amana Capital If:

| Amana is an excellent Broker for: | - UK registered broker.

- Looking for broker with low minimum deposit requirement.

- Providing competitive fees and spreads.

- European and international traders.

- Get access to MT4 and MT5.

- Beginners and professional traders.

- Access to VPS hosting.

- Looking for broker with copy trading features.

- Secure environment.

- Looking for multi-regulated broker.

- Providing floating spreads.

- Currency trading. |

Avoid Trading with Amana Capital If:

| Amana might not be the best for: | - Who prefer 24/7 customer service.

- Looking for cTrader platform.

- Prefer MAM/PAMM trading.

|

Regulation and Security Measures

Score – 4.6/5

Amana Regulatory Overview

Amana is regulated by the respected local authorities, which are mandatory for every jurisdiction in which the broker operates. As a result, the firm has ensured that its services comply with the regulatory standards set by the world’s top authorities, including the FCA and CySEC.

How Safe is Trading with Amana?

Amana Capital is regulated by the top-tier FCA in the UK and is considered a safe and low-risk Currency broker.

According to its numerous regulations, the broker enables safe conditions for clients. As per requirements and international standards measures each set its guidelines, which typically include investor protection, operational standards, and risk management systems governed by the respective legislations.

Moreover, the broker also offers negative balance protection during times of market volatility or unforeseen events.

However, trading through its offshore entities carries higher risk due to weaker regulatory oversight. Therefore, traders should choose the regulatory jurisdiction carefully when trading outside the UK and Europe.

Consistency and Clarity

Amana has built a reputation for reliability, backed by years of operation since its establishment in 2010 and regulation by top-tier authorities such as the FCA and CySEC.

The broker generally receives positive feedback from traders for its transparent pricing, multilingual support, and user-friendly platforms. Reviews often highlight the ease of account setup, helpful customer service, and competitive conditions. However, some traders mention platform execution delays during high-volatility periods.

Additionally, Amana frequently engages in community outreach and educational initiatives, although it is less prominent in large-scale sponsorships or global marketing campaigns. Overall, Amana Capital is a stable, client-focused broker with a solid foundation and clear commitment to transparency and regulated trading.

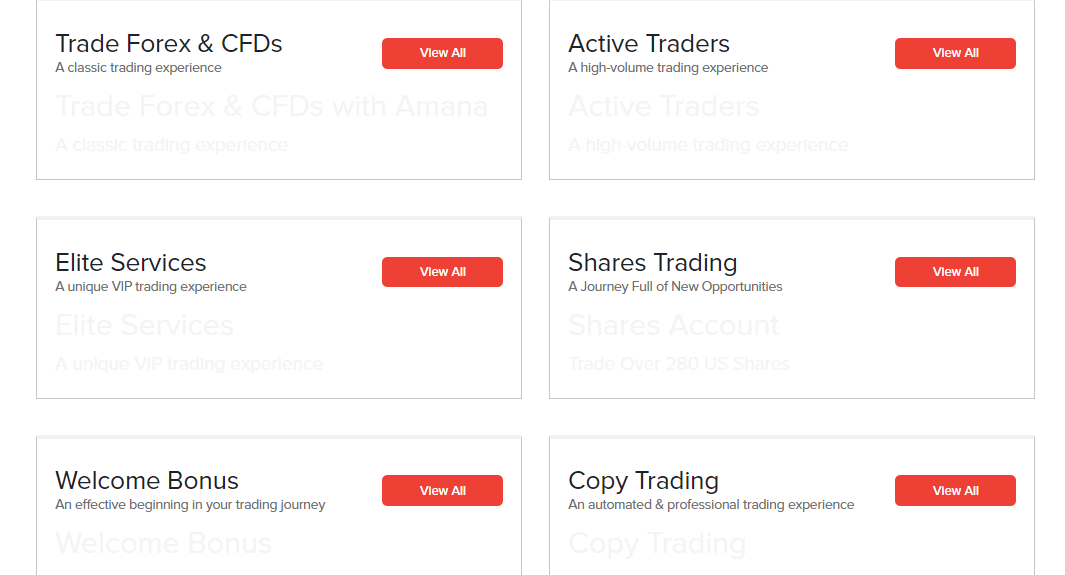

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with Amana?

Amana Capital offers a variety of account types for traders at every experience level. The Classic Account is ideal for beginners, requiring a low minimum deposit with no commissions.

For more experienced traders, the Active Account provides lower spreads and tailored conditions for higher volumes, while the Elite Account is designed for professional traders with raw spreads, personalized pricing, and premium support.

Additionally, the broker offers a Demo Account for risk-free practice using virtual funds, and Swap-Free Accounts that comply with Sharia law, available upon request across account types.

All accounts come with competitive spreads, flexible leverage up to 1:100, mini and macro lots availability, market execution with positive slippage, and no re-quotes.

Classic Account

The Amana Classic Account is ideal for beginner and intermediate traders who require an accessible way to start trading. With a low minimum deposit of $50, the account type offers commission-free trading on Forex and most CFDs.

Traders can access a wide range of instruments through the popular MT4 and MT5 platforms, with leverage of up to 1:100 available depending on regulatory jurisdiction.

The Classic Account also supports swap-free options upon request and charges no inactivity fees, though some transaction and withdrawal fees may apply.

Regions Where Amana is Restricted

Amana Capital does not accept clients from certain countries due to regional regulations and internal policies. The main restricted regions include:

- USA

- Canada

- North Korea

- Australia

- Belgium

- Japan

Cost Structure and Fees

Score – 4.6/5

Amana Brokerage Fees

Amana fees are defined by the account type you would use, which is also tailored to the instrument or asset you will trade. Whether the trader is a beginner or a professional trader, the broker has the right solution with account types or technology offerings, while all orders are performed with Market execution and vary according to the trading size and choice of platform.

In addition, you should also consider an overnight policy that applies in case the trading order is held longer than a day. In this case, a rollover fee, swap, or overnight fee will apply to the position.

Clients at Amana are offered competitive and floating spreads for certain account types and instruments, with an average spread of 0.6 pips available for the popular EUR/USD.

Amana Capital operates on a commission-free model for most asset classes, integrating costs directly into spreads on Currency pairs or cash CFDs.

However, certain instruments carry commission charges: Futures CFDs incur a standard $10 per lot, and share CFDs trigger a fee of approximately $0.02 per share. On higher-tier accounts like Active, it charges a commission of $3 per standard lot, in exchange for tighter raw spreads starting around 0.1 pips.

Amana Capital charges swap fees for positions held overnight, based on the interest rate differential of the traded currencies. For traders seeking Sharia-compliant options, swap-free Islamic accounts are available, though extended holding fees may apply on certain instruments after 10 days.

How Competitive Are Amana Fees?

Amana Capital offers generally competitive fees, particularly for experienced traders using its professional accounts. The broker’s pricing structure is transparent, with tight spreads and no hidden markups.

Overall, its fee model is well-suited to a wide range of traders, offering a good balance between affordability and service quality.

| Asset/ Pair | Amana Capital Spread | LMAX Exchange Spread | Taurex Spread |

|---|

| EUR USD Spread | 0.6 pips | 0.4 pips | 1.7 pips |

| Crude Oil WTI Spread | 0.03 | 4 | 0.054 |

| Gold Spread | 0.29 | 14 | 0.34 |

| BTC USD Spread | 57 | 20 | 41.92 |

Amana Additional Fees

Amana Capital does not charge any inactivity fees, but there are some transaction costs to be aware of. Deposit fees vary by method, typically 1.5% for cards and 2-6.5% for e‑wallets like Skrill and Neteller.

Withdrawal fees also depend on the transaction type, often ranging from 1-2%, or are covered by Amana for card transfers.

Trading Platforms and Tools

Score – 4.5/5

Amana Capital offers the widely used MetaTrader 4 and MetaTrader 5, providing advanced charting tools, automated capabilities, and access to a wide variety of instruments.

Additionally, Amana Capital provides its clients with proprietary platforms that cater to different needs and preferences. The Amana Trade platform is a user-friendly web-based platform that allows for easy access to the global markets. Amana Mobile app provides on-the-go capabilities for both iOS and Android devices.

Overall, the trading platforms are designed with the latest technology and provide advanced tools and features to enhance the experience.

Trading Platform Comparison to Other Brokers:

| Platforms | Amana Capital Platforms | LMAX Exchange Platforms | Taurex Platforms |

|---|

| MT4 | Yes | Yes | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

Amana Web Platform

The Amana Web platform provides an intuitive web-based interface that enables traders to access global markets directly from any browser. It offers core features like real-time quotes, easy order entry, and responsive charting tools with technical indicators.

The platform also integrates account management functions, viewing balances, and trade history, all in one place. Additionally, features like one-click trading, customizable watchlists, and integrated educational tools enhance the overall experience.

Amana Desktop MetaTrader 4 Platform

The MT4 is a versatile platform tailored for both beginner and experienced traders. With its intuitive layout, the broker offers a range of built-in indicators, support for timeframes, and advanced charting tools, making it ideal for technical analysis.

Traders can also use automated strategies through Expert Advisors and run scripts for algorithmic execution. MT4 ensures secure trading and real-time live and demo account access.

Amana Desktop MetaTrader 5 Platform

The MetaTrader 5 platform provides more advanced tools and market capabilities, making it ideal for professional traders. It delivers a range of pre-installed technical indicators, graphical objects, and timeframes, as well as an integrated economic calendar and depth of market views.

MT5 also enables enhanced order management with additional pending order types, trailing stops, and powerful algorithmic trading through its MQL5 development environment.

Amana MobileTrader App

Amana Mobile App is a user-friendly platform that gives access to over 5,500 assets, including Forex, stocks, crypto, and commodities. Designed for both beginners and active traders, it offers real-time pricing, advanced charting tools, instant deposits, and one-tap trading.

The app ensures strong security and negative balance protection, making it a secure and convenient option for trading on the go.

Main Insights from Testing

Testing the Amana Mobile App reveals a smooth and intuitive user experience, with fast execution speeds and a clean interface.

The app performs reliably across different devices, with minimal lag during high-volatility periods. Features like real-time notifications, customizable watchlists, and easy account management make it practical for trading. Overall, the app delivers stable performance that meets the expectations of all levels of traders.

AI Trading

Amana Capital offers a range of algorithmic tools and automated features often associated with AI Trading. While it does not provide a proprietary AI trading system, it supports advanced solutions like AutoChartist, which uses algorithmic technology to scan markets for real-time patterns, key levels, and opportunities.

Traders also benefit from signals and market insights, helping them make more informed decisions.

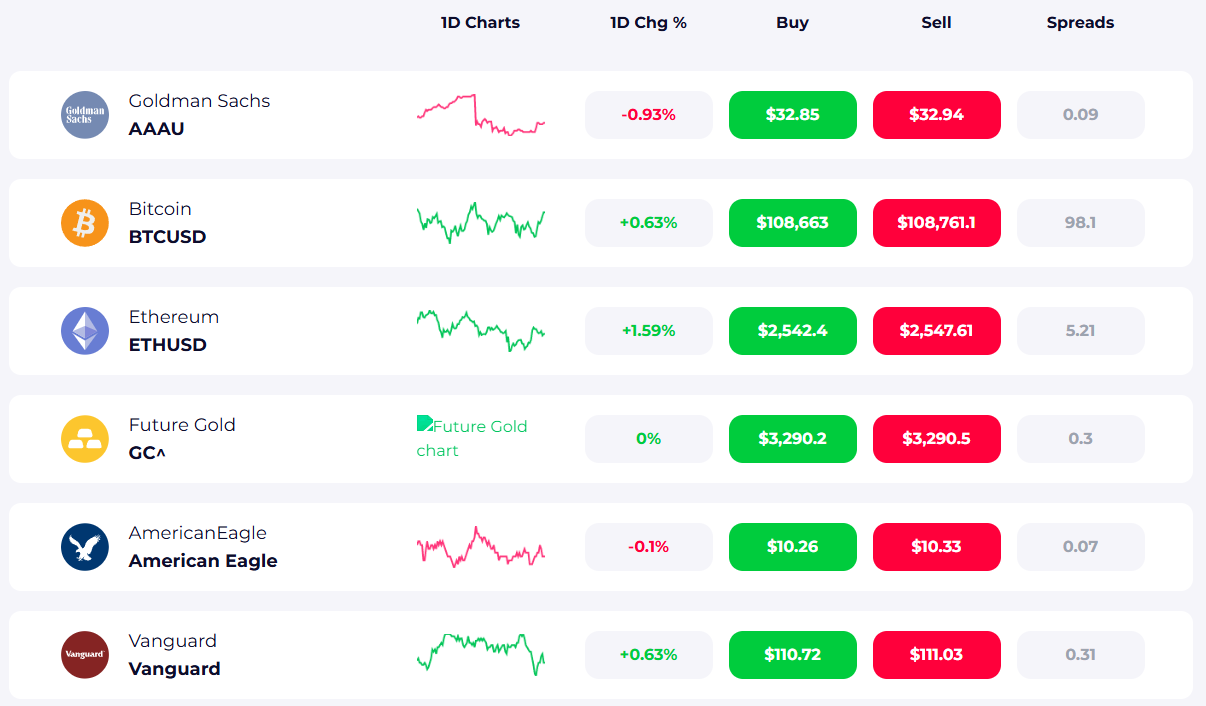

Trading Instruments

Score – 4.6/5

What Can You Trade on Amana’s Platform?

While signing an account broker will provide you with access to over 5,500 financial instruments, such as Forex, CFDs, Stocks, ETFs, Commodities, Indices, Futures, Derivatives, and Cryptocurrencies, that can be tailored to meet your specific needs and requirements.

Main Insights from Exploring Amana’s Tradable Assets

Exploring Amana Capital’s tradable products reveals a well-rounded and globally focused offering that caters to a wide range of strategies.

The broker provides access to both leveraged CFDs and physical investments, giving traders the flexibility to choose between short-term speculation and long-term portfolio building.

Leverage Options at Amana

Leverage can be a helpful tool for traders as it allows them to enter the market with less capital. However, it also has the potential to result in significant gains or losses, depending on how it is used. Therefore, it is crucial to have a clear understanding of how the multiplier works and its associated risks before engaging in leveraged trading activities.

Amana Capital’s leverage is offered according to its regulations:

- UK traders are eligible to use low leverage up to 1:30 for major currency pairs and 1:10 for Commodities.

- European traders are eligible to use a maximum of up to 1:30 for major currency pairs.

- International entity clients can use leverage up to 1:100 for professional trading.

Deposit and Withdrawal Options

Score – 4.7/5

Deposit Options at Amana

In terms of funding methods, Amana Capital offers the following payment methods:

- Bank Wire

- Credit/Debit cards

- Skrill

- Neteller

- WebMoney, etc.

Moreover, Amana offers another great option, the Amana Prepaid Cards, which you can use right the same way as your banking card.

Amana Minimum Deposit

Amana offers a low minimum deposit starting from just $50 for its Classic Account, making it accessible to beginner traders.

Withdrawal Options at Amana

Similarly to deposits, withdrawals can also be processed through the client’s online account area. Amana processes transactions quickly, usually within 1-2 business days. However, there are fees associated with using the prepaid card for withdrawals, while other methods may have additional fees depending on the jurisdiction.

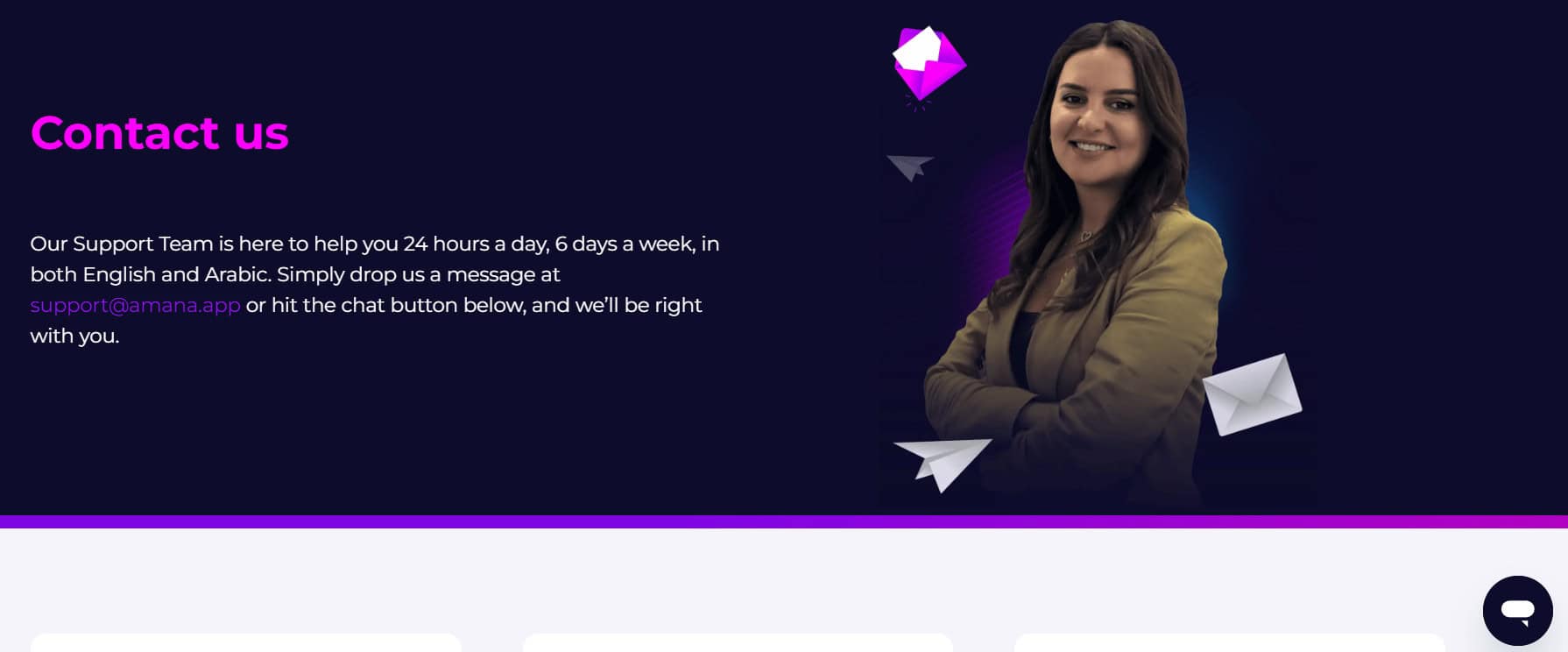

Customer Support and Responsiveness

Score – 4.5/5

Testing Amana’s Customer Support

You can have access to 24/6 customer support through the Phone line, Live chat, Email, and also via social media like Facebook, Twitter, Telegram, WhatsApp, etc. at Amana.

The customer support team comprises experts who are available to assist clients with technical issues, general inquiries, and operational issues and provide recommendations.

Contacts Amana

For general assistance, traders can contact support@amana.app. The broker offers regional phone support across several countries, including the United Kingdom +44 207 248 6494, the United Arab Emirates +971 4 276 9525, and Cyprus +357 25 25 79 80.

Research and Education

Score – 4.7/5

Research Tools Amana

Clients have access to a range of tools at Amana that can enhance their experience and improve their results.

- On the website, traders can benefit from resources such as an economic calendar, daily market analysis, signals, and market news updates, which help them stay informed about key events and trends.

- On the platforms and the Amana App, users can access a wide selection of technical analysis tools, including advanced charts, indicators, and drawing tools for identifying patterns and forecasting price movements.

- Additionally, the platforms support Expert Advisors, which are automated algorithms that can execute trades based on custom strategies. Together, these tools empower traders to make more informed and strategic decisions.

Education

The broker provides traders with a variety of educational resources to support their trading journey. These resources include videos, investment courses, blogs, an economic calendar, news, and more.

In addition, traders can access live webinars and seminars to learn from market experts and improve their skills. The educational materials cover various topics, including market analysis, strategies, risk management, and more.

Portfolio and Investment Opportunities

Score – 4.4/5

Investment Options Amana

Amana offers a range of investment tools that extend beyond traditional CFD trading, providing clients with greater flexibility in managing and growing their capital.

The broker provides access to stock investments and fractional shares alongside leveraged products, enabling longer-term investment strategies. Additionally, Amana Invest is an automated wealth-building program that creates and manages diversified portfolios based on each client’s risk profile and financial goals. This tool is fully integrated into the Amana App, providing a seamless approach to long-term investing.

Account Opening

Score – 4.5/5

How to Open Amana Demo Account?

Opening a demo account with Amana Capital is a quick and easy way to explore platforms and test strategies in a risk-free environment.

- Visit the Amana Capital website and click on the “Try Demo Account” banner or button.

- You will be prompted to choose among platforms.

- Fill out a short form with your name, email, phone number, agree to the privacy policy, and optionally opt in for broker contact.

- After submitting, you will receive an email containing your demo credentials, along with a link to activate your personal trading area.

- Download your chosen platform, then log in using the provided demo details.

How to Open Amana Live Account?

Opening a live account with Amana is a quick process. To begin, users simply complete an online registration form with basic personal and financial information, followed by the submission of identity and address verification documents.

As part of regulatory compliance, traders are also asked to complete a short questionnaire to assess their knowledge. Once verified, clients can choose their preferred account type and platform, fund their accounts, and start trading.

Additional Tools and Features

Score – 4.6/5

In addition to its core features, Amana Capital provides a range of advanced tools to support smarter and more informed decision-making.

- Traders have access to some of the world’s most trusted technical analysis resources, including Trading Central, Autochartist, and TradeCaptain. These tools offer automated chart pattern recognition, signals, market sentiment analysis, and expert insights.

- For those using algorithmic trading or Expert Advisors, Amana also offers VPS hosting to ensure uninterrupted, low-latency execution.

Amana Compared to Other Brokers

Compared to its competitors, Amana Capital offers a well-balanced environment with strong regulatory coverage and a wide selection of tools.

While some brokers cater primarily to institutional or professional clients, Amana stands out by offering low entry requirements suitable for both beginners and professionals. Its platform range, including MT4, MT5, and proprietary web and mobile apps, ensures flexibility across devices.

In terms of research and education, Amana excels with advanced tools like Autochartist, Trading Central, and TradeCaptain, while others may offer limited analytical resources. Overall, Amana’s combination of client support, education, comprehensive asset range, and fee structure makes it a competitive and user-friendly choice in the financial market.

| Parameter |

Amana Capital |

LMAX Exchange |

Tickmill |

Colmex Pro |

OneRoyal |

CMC Markets |

ActivTrades |

| Spread Based Account |

Average 0.6 pips |

Average 0.4 pips |

Average 0.1 pips |

Average 4 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.5 pips |

| Commission Based Account |

0.1 pips + $3 per side |

$25 per million traded for spot FX |

0.0 pips + $3 |

For stock CFDs, $0.01 per share + a minimum of $1.5 per side |

0.0 pips + $3.50 |

0.0 pips + $2.50 |

For Share CFDs Only (0.02 USD per share and a minimum of $1 per trade) |

| Fees Ranking |

Low/Average |

Low/ Average |

Low/ Average |

Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

Amana App, Amana Web, MT4, MT5 |

LMAX Exchange Proprietary Platform, MT4/MT5 bridges |

MT4, MT5, Tickmill Trader |

Colmex Pro 2.0, MT4 |

MT4, MT5 |

CMC Markets Next Generation Web Platform, MT4 |

ActivTrader, MT4, MT5, TradingView |

| Asset Variety |

5,500+ instruments |

100+ instruments |

180+ instruments |

28,000+ instruments |

2,000+ instruments |

12,000+ instruments |

1,000+ instruments |

| Regulation |

FCA, CySEC, DFSA, LFSA, FSC, CMA |

FCA, CySEC, FSP, MAS, FSC |

FCA, CySEC, FSCA, FSA |

CySEC, FSCA |

ASIC, CySEC, VFSC, FSA, CMA |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CMVM, FSC, SCB |

| Customer Support |

24/6 |

24/7 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Excellent |

Limited |

Excellent |

Limited |

Good |

Good |

Good |

| Minimum Deposit |

$50 |

$10,000 |

$100 |

$500 |

$50 |

$0 |

$0 |

Full Review of Broker Amana

Amana Capital is a multi-regulated Forex broker offering access to a wide range of financial markets through platforms like MetaTrader 4, MetaTrader 5, and its proprietary Amana App and Web.

With account types suited for both beginners and professionals, Amana provides flexible conditions, including tight spreads, low minimum deposits, and optional swap-free accounts.

Traders benefit from advanced tools like Autochartist, Trading Central, VPS hosting, and copy trading, along with great customer support and educational resources. Regulated by authorities including the FCA and CySEC, Amana provides a secure environment that supports both active trading and long-term investment strategies.

Share this article [addtoany url="https://55brokers.com/amana-capital-review/" title="Amana Capital"]

Nothing is real about this company please don’t lose your money.

What about Commission

What percentage will benefit me every day