- What is AJ Bell?

- AJ Bell Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

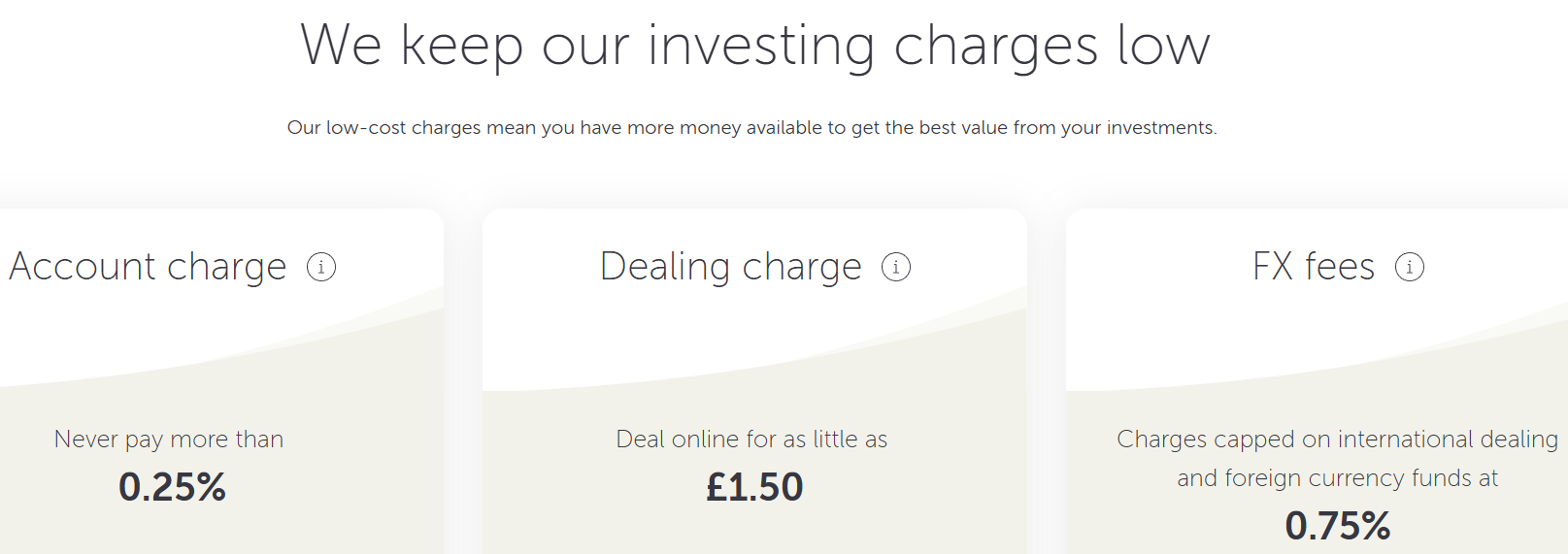

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

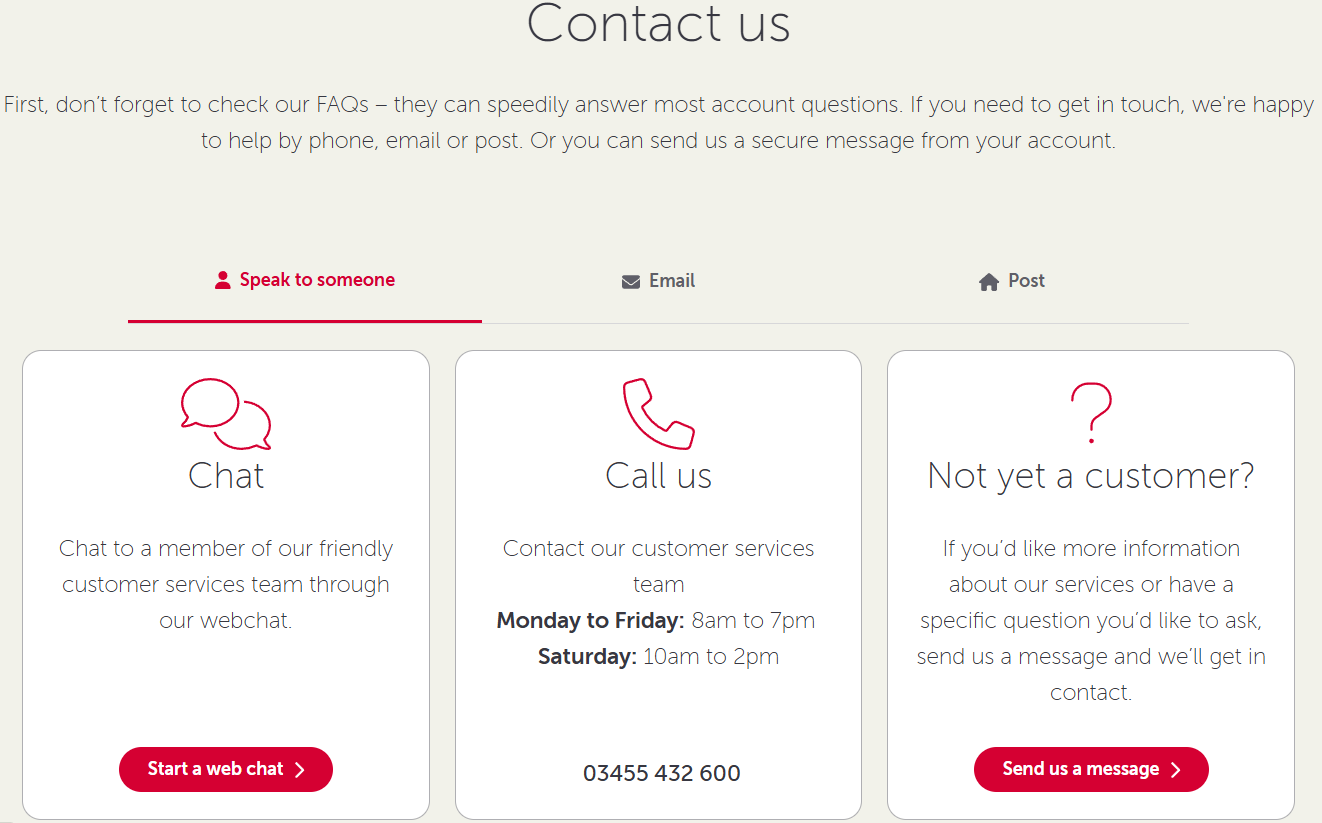

- Customer Support and Responsiveness

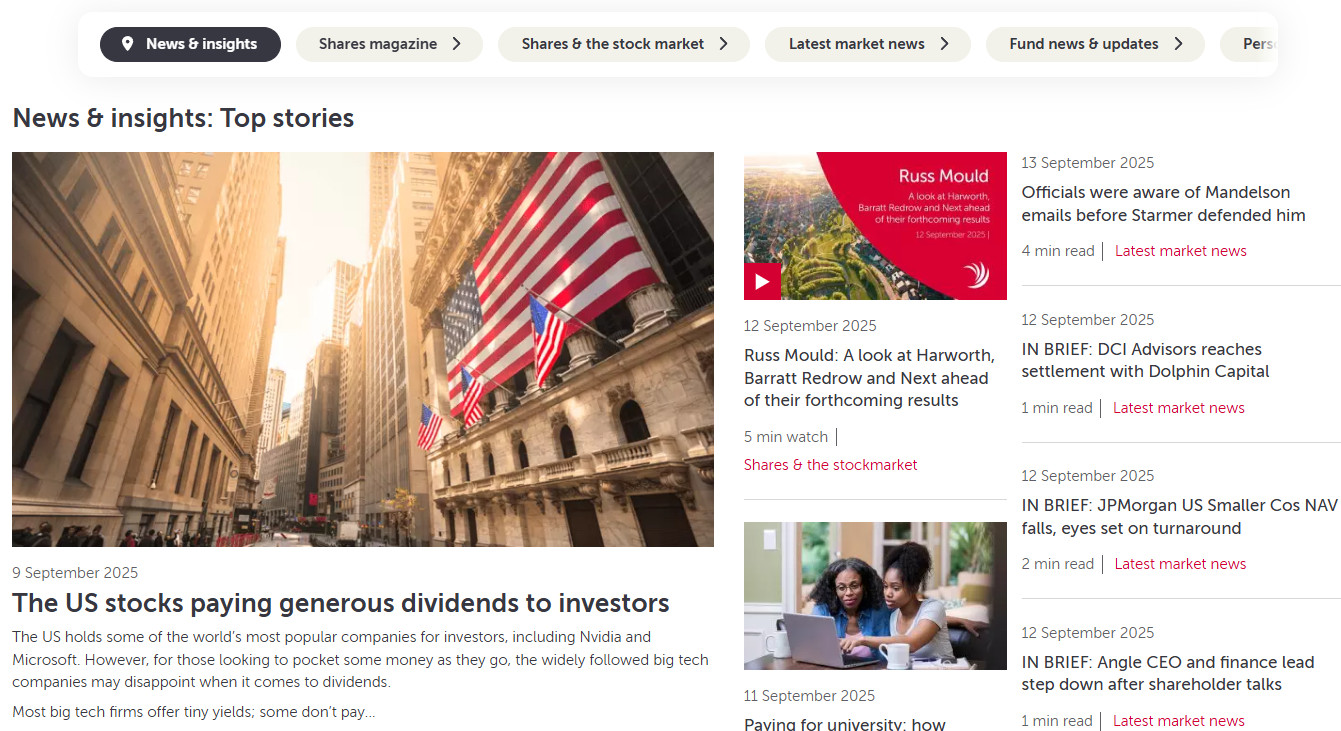

- Research and Education

- Portfolio and Investment Opportunities

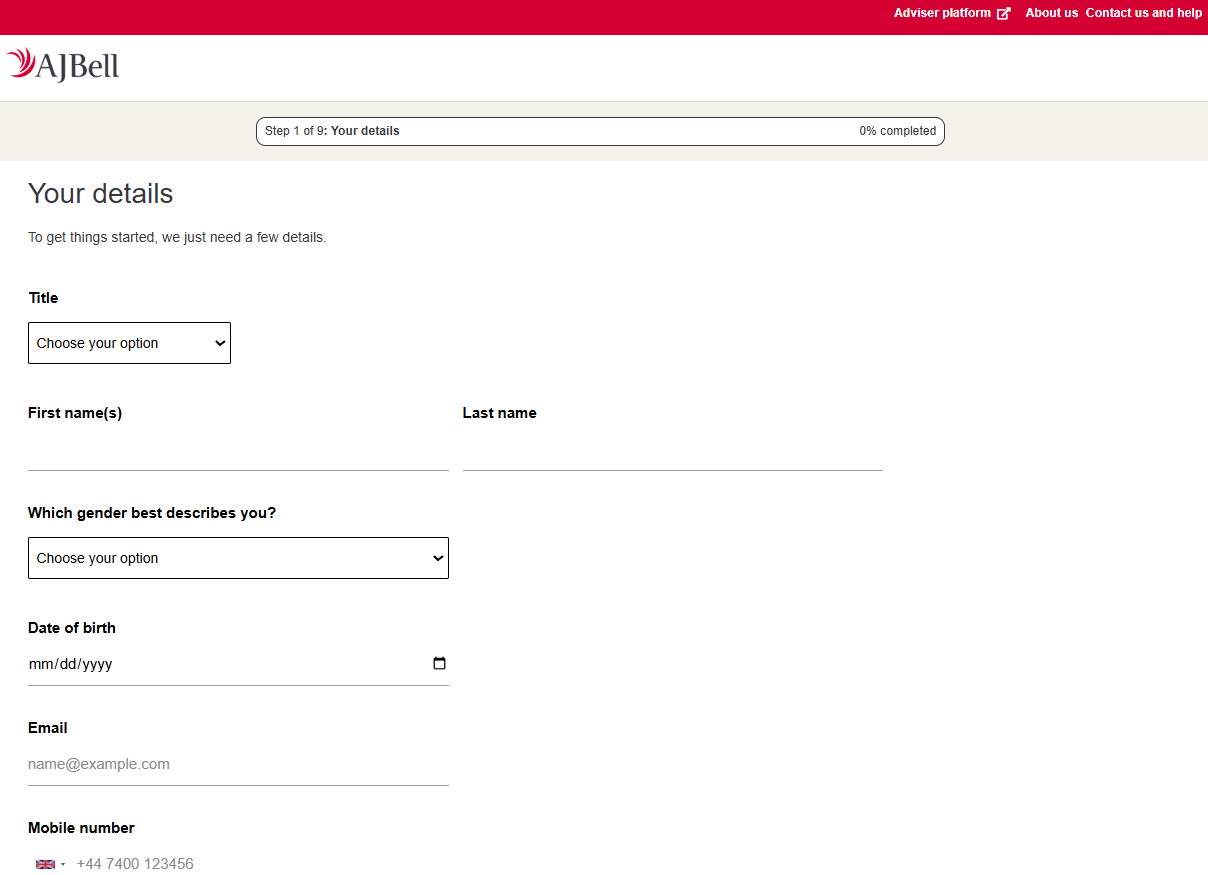

- Account Opening

- Additional Tools And Features

- AJ Bell Compared to Other Brokers

- Full Review of Broker AJ Bell

Overall Rating 4.6

| Regulation and Security | 4.6 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.6 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.6 / 5 |

| Deposit and Withdrawal Options | 4.5 / 5 |

| Customer Support and Responsiveness | 4.6 / 5 |

| Research and Education | 4.5 / 5 |

| Portfolio and Investment Opportunities | 4.6 / 5 |

| Account Opening | 4.4 / 5 |

| Additional Tools and Features | 4.3 / 5 |

What is AJ Bell?

AJ Bell is a Stock trading and Investment company based in the United Kingdom. The firm provides an online investment platform that allows individuals to manage and trade a variety of financial instruments, including stocks, ETFs, bonds, funds, and other financial products.

AJ Bell operates under the regulatory oversight of the Top-Tier Financial Conduct Authority (FCA) in the UK, ensuring strict adherence to regulation.

Overall, the company caters to both individual investors and financial advisors, providing them with tools and resources to manage their portfolios effectively.

Is AJ Bell Stock Broker?

Yes, AJ Bell is a Stock Broker and a financial services company. In addition to stockbroking services, the firm offers a range of investment solutions, including pension management and Individual Savings Accounts (ISAs).

AJ Bell Pros and Cons

The company offers several benefits and drawbacks for potential investors. On the positive side, the firm offers a user-friendly online platform, providing individuals with easy access to popular investment options.

AJ Bell is known for its competitive fee structure and transparent pricing, making it appealing to cost-conscious investors. Additionally, the platform provides tools for portfolio management, learning materials, and research. Moreover, the top-tier regulatory oversight from FCA enhances the overall security of the investment experience.

For the cons, the platform’s potential lack of advanced features could be a limitation for more experienced or active traders seeking specific functionalities. Additionally, the range of available markets and assets is not as extensive as that of some other global brokerage platforms, which could limit investment options for certain individuals.

| Advantages | Disadvantages |

|---|

| FCA regulation and oversee | No 24/7 customer support |

| Secure investing environment | No paper trading or demo account |

| $0 minimum deposit | Limited investment products |

| Account types | |

| UK traders | |

| User-friendly interface | |

| Cost-effective | |

| Learning materials | |

AJ Bell Features

AJ Bell is known for its good reputation, extensive range of investment solutions, and commitment to low-cost investing. A summary of its standout features is as follows:

AJ Bell Features in 10 Points

| 🏢 Regulation | FCA |

| 🗺️ Account Types | Individual Savings Accounts (ISAs), Self-Invested Personal Pensions (SIPPs), Dealing Account |

| 🖥 Trading Platforms | AJ Bell Trading Platform |

| 📉 Trading Instruments | Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, Warrants |

| 💳 Minimum Deposit | £/$0 |

| 💰 Average Stock Commission | From £3,50 |

| 🎮 Demo Account | Not Available |

| 💰 Account Base Currencies | GBP |

| 📚 Trading Education | Webinars, Guides, Videos, Learn Hub, Investing Essentials |

| ☎ Customer Support | 24/5 |

Who is AJ Bell For?

AJ Bell is designed for investors who prefer a straightforward and cost-effective way to manage their portfolios. Based on our findings and Financial Expert Opinions, AJ Bell is Good for:

- UK traders

- Investing

- Stock trading

- Competitive conditions

- Low fees

- Commission-based trading

- Professional trading

- Advanced traders

- Good learning materials and tools

AJ Bell Summary

In conclusion, AJ Bell is a reputable Stock Trading firm offering a user-friendly investment platform with a range of investment options. Known for its competitive fee structure, the platform caters to both novice and experienced investors.

While the platform’s focus on simplicity may lack certain advanced features, it provides a comprehensive solution for those seeking straightforward investment tools.

Overall, we found that AJ Bell provides a reliable environment for investment. However, we advise conducting your research and evaluating whether the firm’s offerings suit your specific trading requirements.

55Brokers Professional Insights

AJ Bell stands out as one of the UK’s most established investment platforms, trusted for its transparency, user-friendly design, and focus on long-term wealth building.

What makes it unique is its investment offering, which includes thousands of shares, funds, ETFs, and bonds, giving investors the flexibility to build highly diversified portfolios.

The platform is also well-regarded for its clear and competitive fee structure, making it easy for clients to understand exactly what they’re paying for.

Another strength is AJ Bell’s commitment to investor education, offering guides, market insights, and resources to support smarter decision-making. Combined with strong regulatory oversight and a reputation for reliability, AJ Bell positions itself as a professional yet approachable platform that balances accessibility with a wide array of investment opportunities.

Consider Trading with AJ Bell If:

| AJ Bell is an excellent Broker for: | - Need a well-regulated broker.

- Secure trading environment.

- Offering popular financial products.

- Stock Trading and Investment.

- Investors who prefer robust learning resources.

- Long-term investing.

- UK investors.

- Looking for broker with a Top-Tier license.

- Competitive trading conditions.

- Looking for broker with a long history of operation and strong establishment.

- Professional trading.

- Providing diverse account types. |

Avoid Trading with AJ Bell If:

| AJ Bell might not be the best for: | - Looking for broker with 24/7 customer support.

- International investors outside the UK.

- Real futures traders. |

Regulation and Security Measures

Score – 4.6/5

AJ Bell Regulatory Overview

AJ Bell is a reliable Stock broker that follows the strict rules and guidelines established by the FCA. This top-tier regulation safeguards client assets and provides low-risk Stock trading.

How Safe is Trading with AJ Bell?

AJ Bell is a legitimate and regulated investing platform. It is regulated by a respected UK financial authority and has a good reputation and integrity in the financial industry.

The firm prioritizes the security and protection of its customers’ trading activities. This includes measures such as encryption for secure online transactions, account authentication protocols, and adherence to regulatory standards to safeguard clients’ funds.

Additionally, in case your bank faces insolvency, resulting in the loss of your funds, the Financial Services Compensation Scheme (FSCS) provides reimbursement within seven working days. The FSCS offers coverage of up to £85,000 per person for each banking license.

Consistency and Clarity

AJ Bell has built a strong reputation in the UK investment industry, consistently recognized for its reliability, transparency, and customer-focused services.

Established in 1995, the broker has grown into one of the largest and most trusted platforms, earning high scores in independent reviews for its ease of use, cost-effectiveness, and range of investment options.

Trader feedback often highlights the platform’s simplicity and competitive fees as major advantages, while some users note that it is better suited for long-term investors rather than active traders due to the lack of margin or advanced tools.

AJ Bell has also received multiple industry awards over the years, reflecting its strong market standing and commitment to quality service. Beyond financial services, the company actively engages with the community through sponsorships, such as partnerships in sports and local events, which further strengthen its presence and reputation in society as a trustworthy and responsible broker.

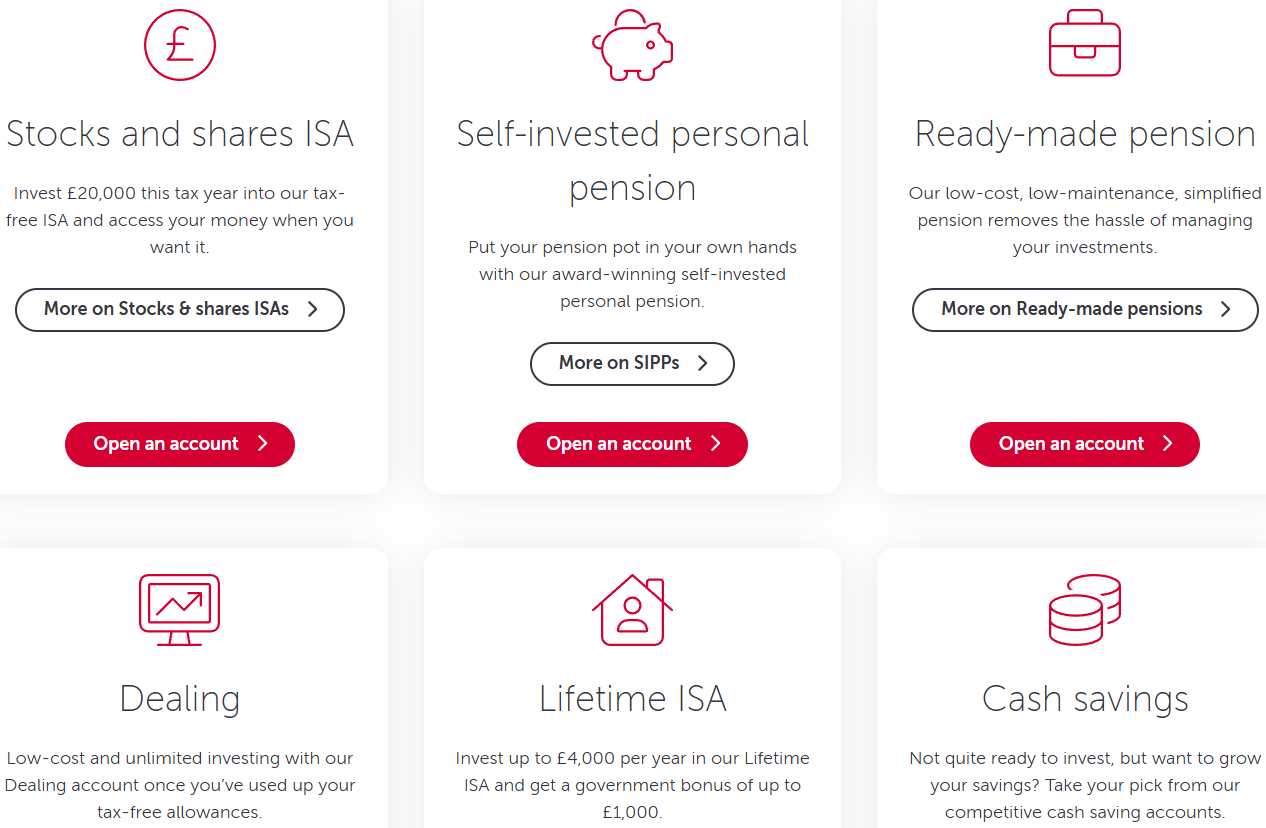

Account Types and Benefits

Score – 4.5/5

Which Account Types Are Available with AJ Bell?

The firm offers a variety of account types catering to different investment needs. Among its offerings are Individual Savings Accounts (ISAs), providing tax-efficient ways to invest, and Self-Invested Personal Pensions (SIPPs), offering individuals control and flexibility over their pension investments.

Additionally, AJ Bell provides a Dealing Account with low-cost and unlimited investing. These account types are designed to accommodate diverse investor preferences and financial goals.

However, the broker does not provide a demo account, meaning investors cannot practice trading with virtual funds before committing real money.

ISA Account

The AJ Bell ISA account is a tax-efficient way for UK investors to grow their savings by investing in a wide range of shares, funds, ETFs, and bonds, with all gains and income sheltered from UK tax.

Investors can open an account without a fixed starting balance and choose to add funds whenever they are ready, making it highly flexible and accessible for all levels of investors.

Regions Where AJ Bell is Restricted

AJ Bell restricts accounts for non-UK residents, particularly excluding countries such as:

- USA

- Canada

- Japan

- Iran

- Iraq

- Syria

- South Korea

- Brazil

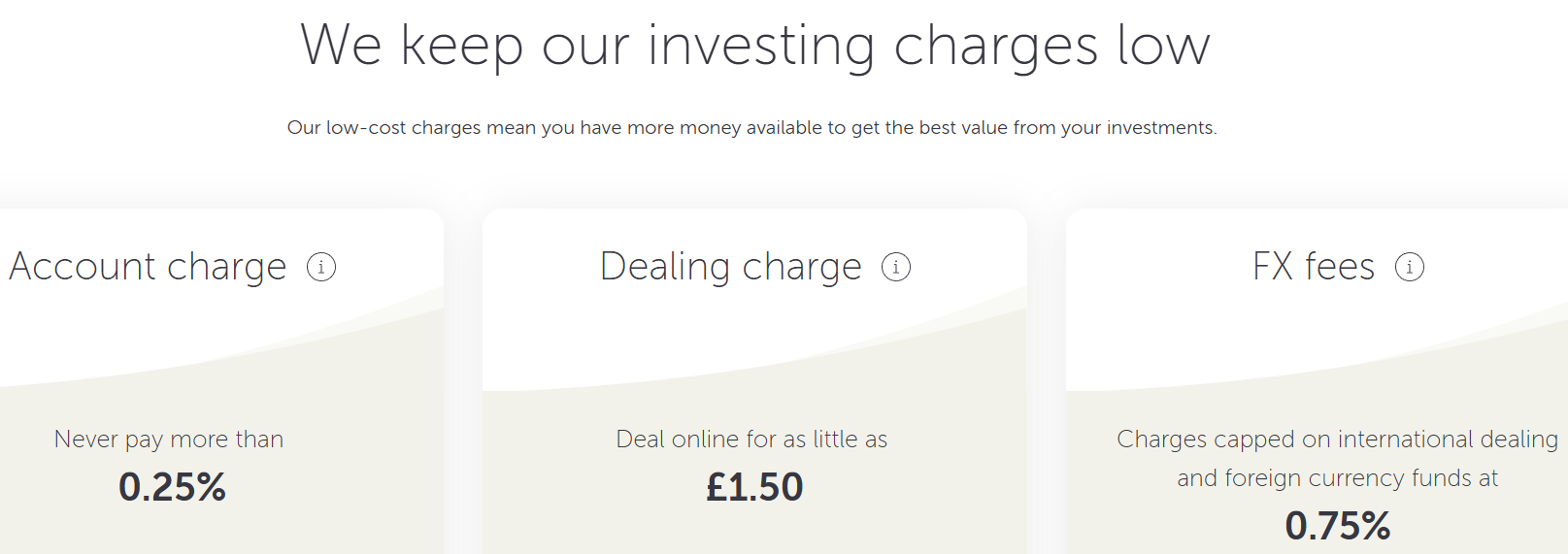

Cost Structure and Fees

Score – 4.6/5

AJ Bell Brokerage Fees

The firm’s fee structure is transparent and competitive, making it attractive to cost-conscious investors. The platform typically charges a variety of fees, including commissions, account management fees, AJ Bell share price, and fund charges.

However, investors should regularly check AJ Bell’s official website or contact their customer support for the latest and most accurate information on fees, ensuring informed decision-making regarding their investment transactions.

AJ Bell’s commission rates vary based on the type of investment product and the size of the trade. The broker is known for its competitive and transparent fee structure; however, investors should review the platform’s fee details for a comprehensive understanding of the costs associated with their investments.

AJ Bell charges exchange and regulatory fees that apply when trading on international markets, covering the costs imposed by overseas exchanges and regulators.

These charges are added to standard dealing fees and vary depending on the market being accessed, ensuring compliance with local regulations while providing investors with transparent and fair pricing on global trades.

AJ Bell does not offer leveraged trading or margin accounts, so traditional rollover or swap fees associated with overnight positions in CFDs or Forex do not apply.

Investors trade on a straightforward buy-and-hold basis, meaning there are no overnight financing costs, making it more suitable for long-term investing rather than short-term or leveraged trading strategies.

How Competitive Are AJ Bell Fees?

AJ Bell is widely regarded as a cost-effective platform, particularly for long-term investors. Its fee structure is transparent and simple, with low annual account charges and competitive dealing fees that make it easy for clients to plan their investments without unexpected costs.

Additionally, the firm offers tiered pricing and discounts for higher-volume investors, allowing more active users to benefit from reduced costs.

| Asset/ Pair | AJ Bell Commission | Questrade Commission | Moomoo Commission |

|---|

| Stocks Fees | From £3,50 | From $0 | From $0 |

| Fractional Shares | No | No | No |

| Options Fees | - | From $0.99 | From $0 |

| ETFs Fees | From £5 | From $0 | From $0 |

| Free Stocks | No | Yes | Yes |

AJ Bell Additional Fees

In addition to standard dealing and account fees, AJ Bell charges extra fees for specific services or transactions. These include charges for transferring assets out of the platform, receiving paper statements, dealing in certain international markets, or using corporate actions services.

While these fees are generally transparent and clearly outlined on AJ Bell’s website, investors should review them carefully to understand any potential additional costs beyond regular trading and account management.

Trading Platforms and Tools

Score – 4.5/5

AJ Bell provides a user-friendly proprietary platform, accessible on web, mobile, and tablet devices. This platform is tailored to meet the diverse needs of investors, offering simplicity and accessibility for users at various experience levels.

Alongside its intuitive design, the platform also features tools for portfolio management, research, and analysis, providing a comprehensive solution for users to make informed investment decisions.

Trading Platform Comparison to Other Brokers:

| Platforms | AJ Bell Platforms | E-Trade Platforms | TradeStation Platforms |

|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

AJ Bell Web Platform

The AJ Bell web platform offers a user-friendly and accessible interface for investors to manage their portfolios online. It is compatible with both PC and Mac browsers, allowing users to execute trades, monitor market movements, and review account performance seamlessly.

The platform provides essential tools such as market and limit orders, portfolio tracking, and detailed fee reporting, making it suitable for all levels of investors.

Main Insights from Testing

Testing the AJ Bell web platform reveals a smooth and intuitive user experience, with fast loading times and clear navigation across different sections.

Investors benefit from well-organized dashboards, easy access to transaction history, and helpful investment summaries that simplify portfolio monitoring.

AJ Bell Desktop MetaTrader 4 Platform

The firm does not offer the MetaTrader 4 platform. As a traditional investment firm, it does not support Forex or CFD trading, which is typically associated with MT4.

AJ Bell Desktop MetaTrader 5 Platform

AJ Bell does not support MetaTrader 5 either. The broker does not provide access to advanced platforms like MT5, maintaining its focus on its own platform.

AJ Bell MobileTrader App

The platform offers a dedicated mobile app designed to provide users with a convenient and accessible way to manage their investments on the go. The app is available for both mobile and tablet devices, allowing investors to trade various financial instruments, monitor their portfolios, and stay informed about market developments in real time.

With user-friendly features and tools, the AJ Bell app caters to the needs of both novice and experienced investors, offering a seamless and intuitive mobile trading experience.

Users can download the app from the respective app stores for iOS and Android devices, providing flexibility and convenience in managing their investment portfolios.

AI Trading

AJ Bell does not currently offer AI-powered features or automated trading tools. The platform focuses on traditional, long-term investing, giving users full control over their investment decisions without algorithm-driven strategies.

While investors can benefit from research, market insights, and educational resources, all trades and portfolio management are manually executed.

Trading Instruments

Score – 4.6/5

What Can You Trade on AJ Bell’s Platform?

AJ Bell offers a range of products to suit investors’ preferences, including Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, and Warrants.

The platform allows access to both domestic and international markets, enabling users to create well-diversified portfolios.

Main Insights from Exploring AJ Bell’s Tradable Assets

Exploring AJ Bell’s tradable assets highlights the platform’s strength in providing a diverse and flexible investment environment. The interface makes it easy to research, compare, and manage different holdings, while detailed performance data and market insights help investors make informed decisions.

Margin Trading at AJ Bell

We found that AJ Bell does not offer margin trading. It is focused on providing a straightforward investment experience without incorporating advanced features like margin trading.

However, for the most accurate and current information about the firm’s offerings, including the multiplier or margin trading, we recommend checking the official website or contacting its customer support directly.

Deposit and Withdrawal Options

Score – 4.5/5

Deposit Options at AJ Bell

The firm provides multiple funding methods for its investment accounts. These methods include bank transfers, debit card payments, and other electronic payment options.

Investors can fund their accounts securely using the preferred method within the platform.

AJ Bell Minimum Deposit

The broker does not have a specific minimum deposit requirement for opening an account. Investors can start trading with any amount they are comfortable with, making the platform accessible to a wide range of investors, including those who prefer to begin with smaller initial investments.

Withdrawal Options at AJ Bell

The platform allows users to make withdrawals from their accounts through various methods, including bank transfers. Withdrawal processing times usually range from 1-3 business days, and these durations may differ based on factors like the selected withdrawal method and any additional verification requirements that might be applicable.

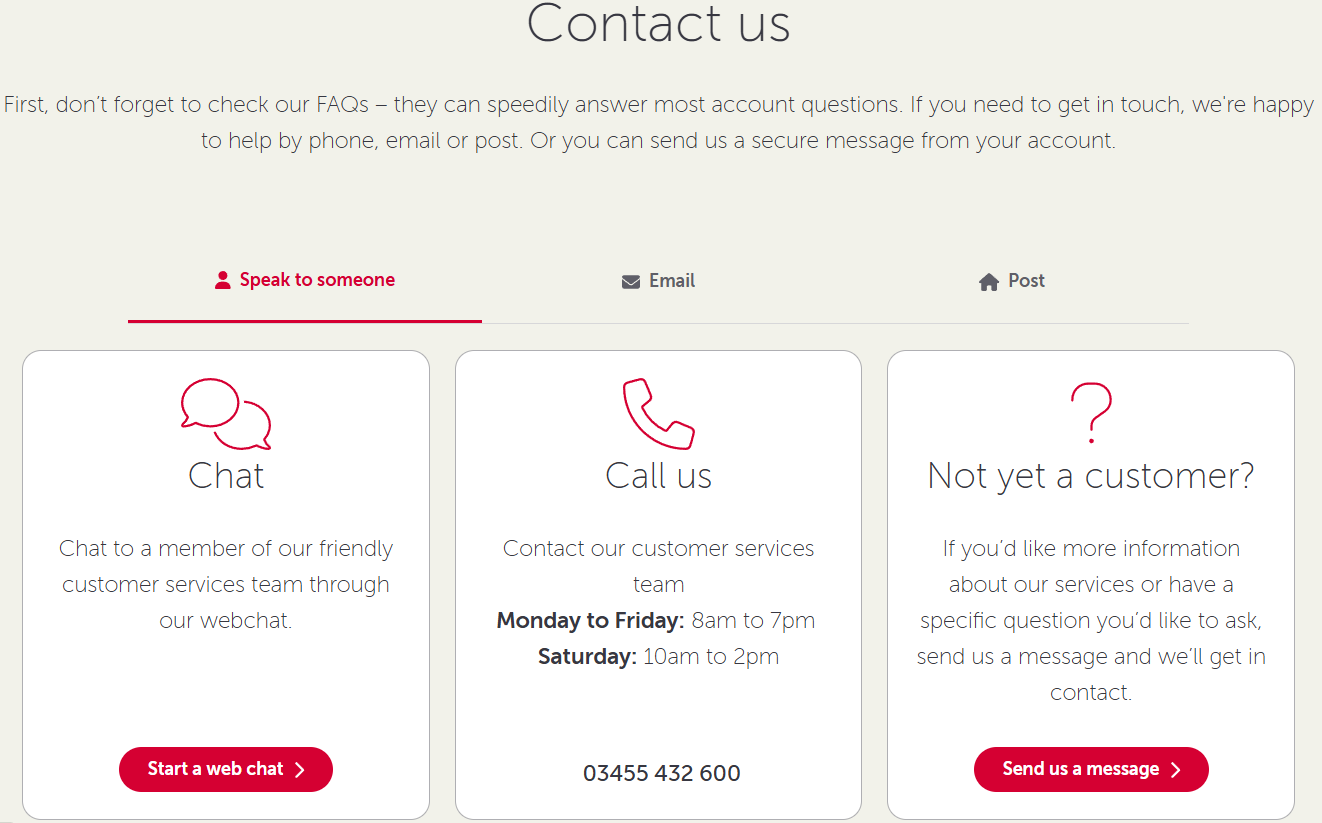

Customer Support and Responsiveness

Score – 4.6/5

Testing AJ Bell’s Customer Support

The firm’s customer support is available 24/5 through live chat, email, and phone. The platform aims to offer responsive assistance to address user concerns, ensuring a positive and supportive experience for its investors.

Contacts AJ Bell

Investors can contact AJ Bell for support or inquiries via phone or email. The main customer service number is 03455 432 600, and they can also be reached by email at help@ajbell.co.uk. Support is available for questions related to accounts, trading, and general platform assistance.

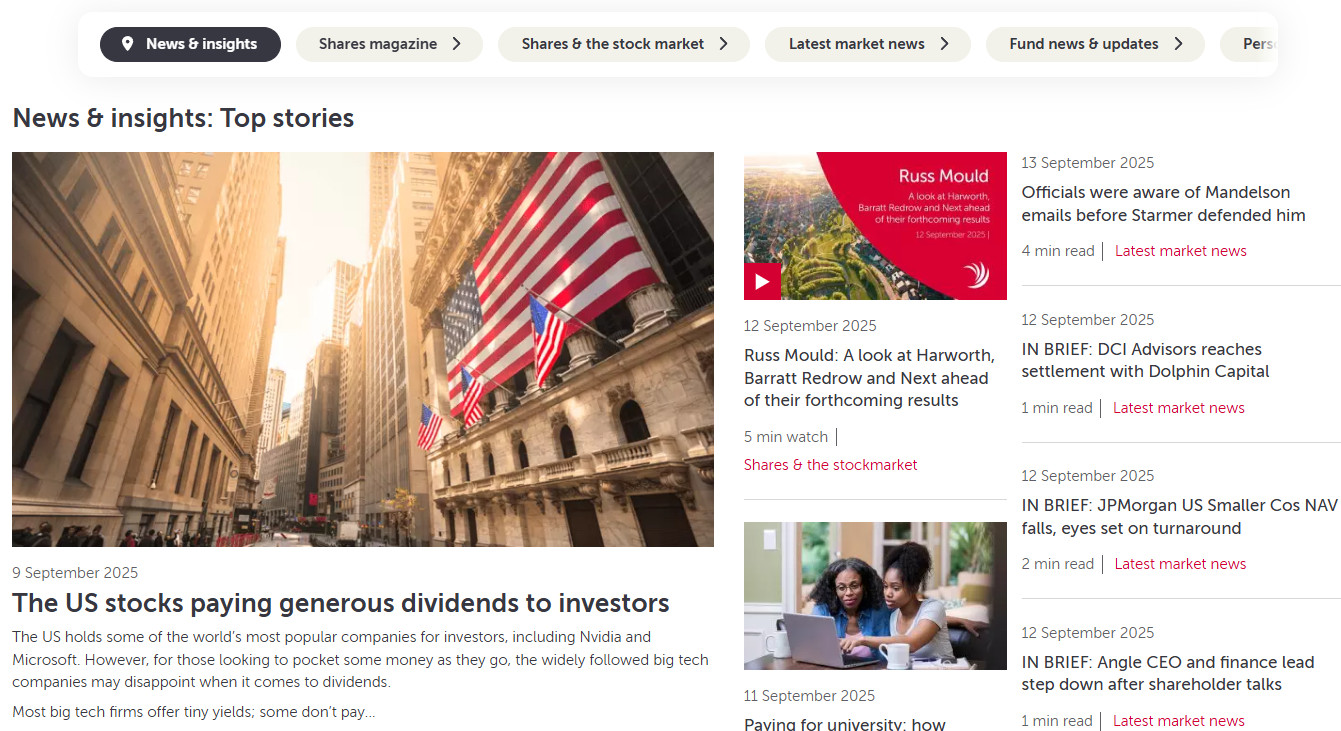

Research and Education

Score – 4.5/5

Research Tools AJ Bell

AJ Bell provides a range of research tools to help investors make informed decisions.

- On both the web platform and mobile app, users can access detailed market data, performance charts, and company information.

- The platform also offers investment screeners, news updates, and fund research, enabling comparisons across different assets. Additionally, market insights are available to guide portfolio planning, making it easier for investors to analyze opportunities and monitor their holdings effectively.

Education

The platform provides robust educational resources to help investors make informed decisions. These resources include investing guides, podcasts, webinars, videos, and articles covering various aspects of investing, financial markets, and investment strategies.

Portfolio and Investment Opportunities

Score – 4.6/5

Investment Options AJ Bell

AJ Bell offers a broad range of investment solutions. These include tax-efficient accounts such as ISAs and SIPPs, as well as general investment accounts for long-term wealth building.

Through these accounts, investors can access a variety of investment vehicles, allowing them to diversify their portfolios and pursue strategies aligned with their financial goals. The platform focuses on straightforward, buy-and-hold investing rather than leveraged or short-term trading approaches.

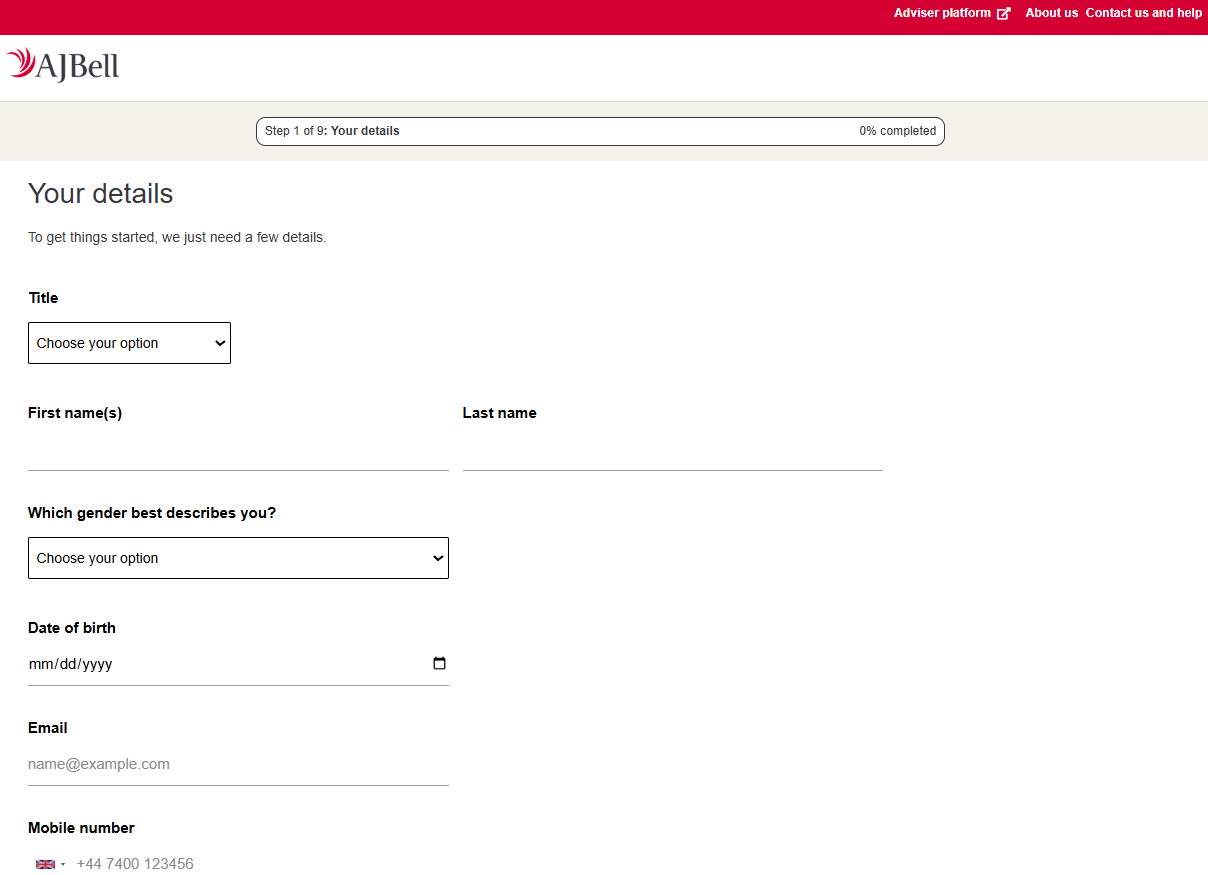

Account Opening

Score – 4.4/5

How to Open AJ Bell Demo Account?

The platform does not offer a demo account, so investors cannot practice trading with virtual funds before committing real money. All account activity is conducted with actual investments, better suited for those ready to engage in long-term investing.

How to Open AJ Bell Live Account?

Opening an account with a broker is considered quite an easy process, as you can log in and register within minutes. Just follow the opening account or AJ Bell login page and proceed with the guided steps:

- Select and click on the “Open an Account” page.

- Enter the required personal data (Name, email, phone number, etc.).

- Verify your data by uploading documentation (residential proof, ID, etc.).

- Complete the electronic quiz confirming your trading experience.

- Once your account is activated and proven, follow with the money deposit.

Additional Tools and Features

Score – 4.3/5

In addition to research tools, AJ Bell offers several supplementary features to enhance the investment experience.

- These include alerts and notifications for account activity, dividend tracking, corporate action updates, and customizable watchlists to monitor preferred investments.

- The platform also provides easy-to-access tax reports and portfolio summaries, helping investors stay organized and informed while managing their accounts efficiently.

AJ Bell Compared to Other Brokers

AJ Bell positions itself as a reliable and well-regulated UK broker, primarily catering to long-term investors with a strong focus on transparency, accessibility, and a wide range of investment options.

Compared to its competitors, it offers a straightforward platform and solid educational resources, particularly suitable for hands-on investors. While it lacks advanced tools, leveraged products, or 24/7 support that some international brokers provide, its strength lies in simplicity and tax-efficient account offerings.

Overall, AJ Bell competes well with other brokers in terms of reliability and long-term investing suitability, even if it does not target highly active or professional traders seeking complex instruments or high-frequency trading features.

| Parameter |

AJ Bell |

Trade Republic |

Interactive Brokers |

TD Ameritrade |

Freetrade |

Questrade |

Webull |

| Broker Fee – Futures E-mini and Standard Contract |

Futures contracts not available / Stock Commission from £3,50 |

Futures contracts not available / Stock Commission from €1 |

$0.85 |

$1.50 |

Futures contracts not available / Stock Commission from $0 |

$Futures contracts not available / Stock Commission from $0 |

$0.70 |

| Plus Exchange Fee – (NFA Fees) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| Fees Ranking |

Low/Average |

Low |

Low |

Average |

Low |

Low/Average |

Low |

| Trading Platforms |

AJ Bell Trading Platform |

Trade Republic Mobile App |

TWS, IBKR WebTrader, Mobile |

Thinkorswim, TD Ameritrade Web, Web, Desktop, and Mobile |

Freetrade Platform |

Questrade Web, QuestMobile, Questrade Edge Mobile, Questrade Edge, Questrade Global |

Webull Trading Platform, TradingView |

| Asset Variety |

Stocks, Shares, Funds, ETFs, Bonds, Gilts, Investment Trusts, ETCs, Warrants |

Stocks, Shares, ETFs, Bonds, Derivatives, Crypto |

Stocks, Options (Incl. Futures Options), Futures, Forex, CFDs, Warrants, Combinations, Bonds, Mutual Funds, Structured Products, Physical Metals, Inter-Commodity Spreads |

Stocks, Options, ETFs, Mutual Funds, Forex, Futures, Crypto, Bonds, CDs |

Stocks, ETFs, Fractional Shares, Bonds, Equities |

Stocks, ETFs, Options, IPOs, CFDs, Mutual Funds, Bonds, GICs, International Equities, FX, Precious Metals |

Real Stocks, Options, Index Options, ETFs, OTC, ADRs, Crypto, Futures, Shares |

| Regulation |

FCA |

BaFin, Bundesbank |

US SEC & CFTC, ASIC, FCA, IIROC, SFC, NSE, BSE, FSA |

SEC, FINRA, SIPC, MAS |

FCA |

CIRO, CIPF, SEC, FINRA |

SEC, FINRA, CFTC, NFA, ASIC, SFC, MAS |

| Customer Support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

| Educational Resources |

Excellent |

Limited |

Excellent |

Good |

Limited |

Excellent |

Good |

| Minimum Deposit |

$0 |

€0 |

$100 |

$0 |

$0 |

$1,000 |

$0 |

Full Review of Broker AJ Bell

AJ Bell is a well-established UK broker known for its reliable and user-friendly platform, ideal for long-term investors. It offers a wide range of investment options through tax-efficient accounts such as ISAs and SIPPs, backed by transparent pricing and strong regulatory oversight.

The platform emphasizes accessibility, providing both web and mobile solutions, along with educational resources and market insights to support informed decision-making.

While it does not offer margin trading, demo accounts, or advanced tools, AJ Bell stands out for its clarity, consistency, and focus on helping investors build diversified portfolios over time.

Share this article [addtoany url="https://55brokers.com/aj-bell-review/" title="AJ Bell"]