- What is AIMS?

- AIMS Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

- Account Opening

- Additional Tools And Features

- AIMS Compared to Other Brokers

- Full Review of Broker AIMS

Overall Rating 4.3

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.3 / 5 |

| Cost Structure and Fees | 4.3 / 5 |

| Trading Platforms and Tools | 4.2 / 5 |

| Trading Instruments | 4.4 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.1 / 5 |

| Portfolio and Investment Opportunities | 4.4 / 5 |

| Account opening | 4.6 / 5 |

| Additional Tools and Features | 3.3 / 5 |

What is AIMS?

AIMS is an international Forex trading broker that specializes in trading various financial instruments such as Forex, CFDs, Cryptos, Shares, Stocks, Indices, Commodities, Metals, and Future CFDs. The company is headquartered in Sydney, Australia, and holds regulation and authorization from the reputable ASIC in Australia. Additionally, AIMS is licensed by LFSA in Labuan.

According to our research, the broker offers trading services to both retail and institutional clients across 17 countries. It also has representative offices in several locations, including Australia, Dubai, Malaysia, Vietnam, Cambodia, Japan, Korea, Indonesia, Hong Kong, China, India, Thailand, Africa, and European countries.

Overall, AIMS has gained a reputation as a reliable Forex and CFD trading broker. The broker provides competitive trading conditions and offers a wide range of trading products through the popular MetaTrader platforms.

AIMS Pros and Cons

When selecting AIMS as your trading broker, you should consider its benefits and drawbacks. One advantage is that the broker offers a variety of popular trading instruments and competitive trading fees. Additionally, traders have access to the advanced MetaTrader 4 and 5 trading platforms, which are known for their features and functionality. Another positive aspect is that AIMS holds licenses from multiple authorities, including the top-tier ASIC license, instilling a sense of trust and security. The broker also offers a range of funding methods for convenient deposits and withdrawals.

The cons include the limited availability of research and educational resources at AIMS, which could impact traders seeking in-depth market analysis or learning materials. Additionally, the broker lacks 24/7 customer support, which means that assistance may not always be available.

| Advantages | Disadvantages |

|---|

| ASIC license and oversight | Limited education and research |

| Top-tier license | No 24/7 customer support |

| MT4 trading platform | |

| Funding methods | |

| Competitive pricing | |

| Low minimum deposit | |

| Trading instruments | |

AIMS Features

Being in the market for 10 years, AIMS has managed to gain exposure in 17 countries and get a huge client base, offering high-quality services, functionality, and diversity. While researching the broker’s services, we have formed a list of the main aspects of trading with AIMS:

AIMS Features in 10 Points

| 🗺️ Regulation | ASIC, LFSA |

| 🗺️ Account Types | Standard, MAM |

| 🖥 Trading Platforms | MT4, MT5 |

| 📉 Trading Instruments | 70 Forex currency pairs, Global Shares, Fractional Shares, Indices, Commodities, Metals |

| 💳 Minimum deposit | $50 |

| 💰 Average EUR/USD Spread | 1.5 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base currencies | EUR, USD, GBP, AUD, JPY |

| 📚 Trading Education | Limited |

| ☎ Customer Support | 24/5 |

Who is AIMS For?

Based on Our findings and Financial Expert Opinions AIMS is Good for its different aspects of trading, especially standing out for the following:

- Traders from Australia

- International traders

- Traders from Malaysia, India, and Asia Region

- Traders who prefer the MT4/MT5 trading platforms

- CFD and currency trading

- Advanced traders

- Islamic traders

- Beginners

- STP/NDD execution

- Swap-free trading

- Competitive Pricing

- Good trading tools

- EA/Auto trading

AIMS Summary

AIMS is a reputable Forex and CFD trading broker that offers a diverse range of trading instruments and competitive pricing. Traders also have access to the popular MT4 and MT5 platforms, which provide advanced trading features and capabilities. However, the broker has limited educational resources and research materials, which may not be ideal for beginner traders. Moreover, the absence of 24/7 customer support is another drawback to consider.

Overall, we found that AIMS provides a competitive trading environment, however, we advise conducting your research and evaluating whether the broker’s offerings suit your specific trading requirements.

55Brokers Professional Insights

AIMS is a good choice for traders from Australia and those traders looking for reliable execution and trading performance based on MetaTrader platforms. The broker provides a trustworthy trading environment with overall good spreads and fees, making it an attractive option for most of the traders or suitable for various trading styles. The broker is available for residents of 17 countries and during the ten years of its operation, it has obtained over 88 thousand clients worldwide, which proves good status and shows popularity among traders.

Yet, what is most important, the broker’s top-tier ASIC license ensures reliability and security for clients, providing great trading conditions in a safe and protected environment. However, AIMS operates also under offshore jurisdiction, and it is up to clients to pay attention to under what entity they are registered and verify the conditions, as they might be very different. Lastly, as we tested some of the spreads might be slightly higher than competitors provide, yet it might be not that big con if to consider the quality you get along with good tools provided.

Consider Trading with AIMS If:

| AIMS is an excellent Broker for: | - CFD and currency trading

- Beginner traders

- International traders

- Those who are looking for competitive trading conditions

- EA trading

- Traders who prefer the MT4/MT5 platforms

- Swap-free trading

- Australian traders

- Professional traders |

Avoid Trading with AIMS If:

| AIMS is not the best for: | - High frequency traders

- Traders who are looking for extensive research and educational resources

- Residents from certain countries

- Traders who prefer platforms other than MT4/MT5 |

Regulation and Security Measures

Score – 4.4/5

AIMS Regulatory Overview

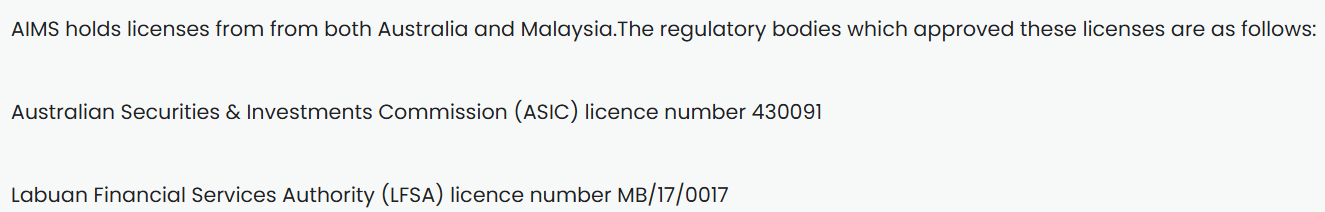

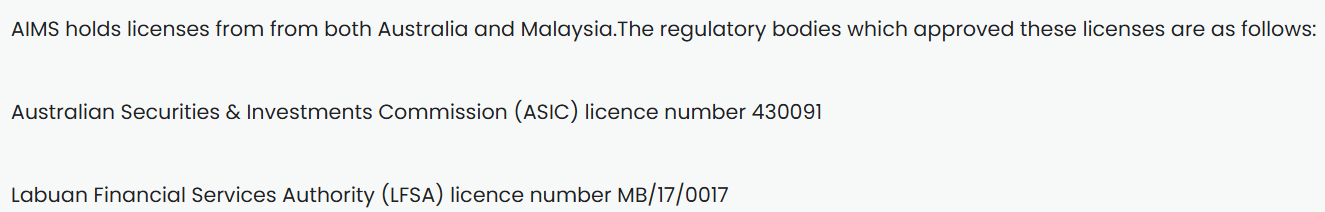

AIMS is a legit and regulated brokerage firm that holds the necessary licenses and follows regulations for offering Forex trading services. The broker’s legitimacy is enhanced by its regulation by a top-tier Australian authority, ASIC, which ensures compliance with established financial regulations and industry standards. The authority is known for implementing strict rules and guidelines to uphold high standards in the financial industry.

- Yet, AIMS also holds an offshore license. Therefore, you should conduct thorough research, including reading user reviews and considering other factors, to assess the broker’s reputation and legitimacy. Engaging in trading activities should always be done after careful consideration and understanding of differences while trading in different jurisdictions even while using the same Broker.

How Safe is Trading with AIMS?

Based on our analysis, AIMS demonstrates adherence to industry standards and compliance requirements. These include measures to protect client funds, such as segregation from company funds and coverage of up to $2,000,000. The broker also provides additional safeguards like negative balance protection to prevent clients from incurring losses exceeding their account balance. As an STP and NDD broker, AIMS aims to create a secure trading environment by directing all trades to global clearing banks, ensuring real-time execution at market prices.

- However, thoroughly review AIMS’ documentation, legal agreements, and policies to gain a comprehensive understanding of the specific trading protections they offer. This will help you make an informed decision before engaging in any trading activities.

Consistency and Clarity

As we found AIMS is a tightly regulated broker that offers its services in 17 countries, and constantly expands its global exposure. The broker has also gained a stable client base due to the provided secure trading environment and consistency in services. We have noticed, that AIMS constantly enhances its offerings, which speaks about the broker’s development. Another proof of its consistency and good standing in the market is the numerous awards and recognition from well-known organizations in the industry.

When we researched AIMS’s customer feedback, we found that there are a good number of positive reviews pointing out the broker’s intuitive trading platforms, diverse range of tradable assets, and secure environment. Among negative feedback are complaints from the withdrawal process, customer support, and aspects of trading. However, the broker has still more positive feedback and regard in the market, and due to its regulatory oversight is considered a safe and consistent broker, that provides clarity and transparency in its offerings.

Account Types and Benefits

Score – 4.3/5

Which Account Types Are Available with AIMS?

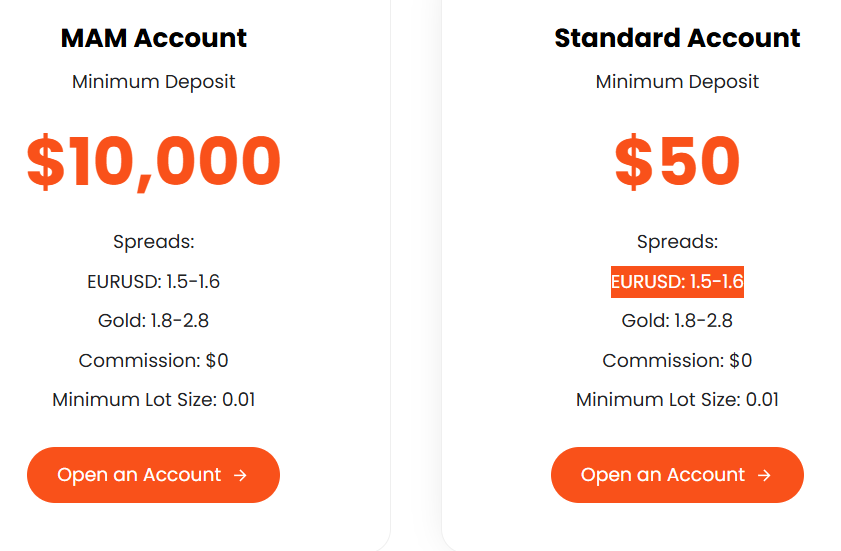

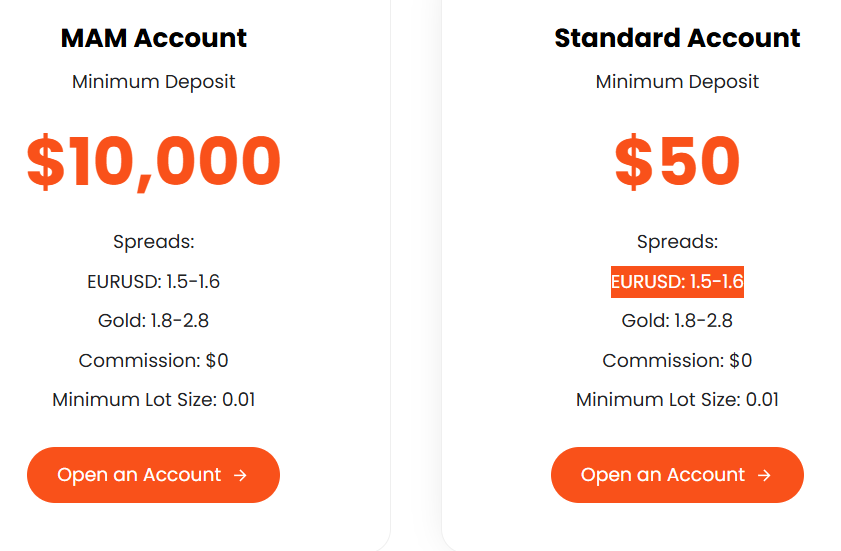

Per our research, the broker offers traders a choice between two types of accounts: Standard and MAM accounts. The accounts allow clients direct access to deep liquidity and interbank pricing that top-tier liquidity providers provide with no commissions.

- For the Standard account, the minimum deposit is $50. Spreads for both Standard and MAM accounts for EUR/USD start from 1.5, with no commissions added. The initial deposit for the MAM accounts is much higher and starts from $10.000.

Swap-Free Accounts

Additionally, AIMS provides the option of 10-day swap-free accounts, where no swap or rollover fees are charged on overnight positions.

Regions Where AIMS is Restricted

Due to regulatory differences from country to country, AIMS does not provide its services to a number of countries. Clients should be careful and check if the broker is available in their particular region.

AIMS services are not available to residents of the following countries:

- USA

- Iran

- Cuba

- Sudan

- Syria

- North Korea

- Russia

Cost Structure and Fees

Score – 4.3/5

AIMS Brokerage Fees

According to our findings and opinion, the broker offers competitive pricing for most of its trading services. The fees are also transparent, providing clarity to clients. There are no transaction fees, and all the trading costs are integrated into spreads.

Based on our test trade, AIMS offers competitive and tight spreads. The average spread for the EUR/USD currency pair in the Forex market is 1.5 pips, while for gold, it ranges from 1.8 to 2.8 pips. However, spreads may vary depending on factors such as market conditions, volatility, and liquidity. For accurate and detailed information on spreads, we recommend visiting the broker’s website or contacting its customer support.

Our research showed that AIMS offers only a spread-based structure without commission fees. This means that all the fees are already integrated into spreads, and clients will not have to pay additional transaction fees per trade.

How Competitive Are AIMS Fees?

All in all, the broker offers competitive pricing for a majority of its trading services. The spreads offered by the broker are in line with the market average. There are no additional trading fees, and the structure is quite transparent and clear for clients. The no-commission requirement can be beneficial for beginner traders, while more professional traders might still prefer fixed commissions for each trade with low spreads. However, AIMS’s spreads are considered average when compared to other brokers in the market, and the overall offering is favorable for traders of different levels.

Yet, as the broker operates under different entities, we advise clients to check all the applicable costs for the specific entity, before opening an account with AIMS.

| Asset/ Pair | AIMS Spread | Trade245 Spread | ThinkMarkets Spread |

|---|

| EUR USD Spread | 1.5 pips | 1 pip | 1.1 pips |

| Crude Oil WTI Spread | 1.8 pips | 3 | 0.03 |

| Gold Spread | 1.8 pips | 1 | 19 cents |

AIMS Additional Fees

As we have found, the service charges for deposit via wire transfer range from $30-60 per order by the bank. We also found that there are no Inactivity fees charged. Instead, any account that is inactive for more than 90 days will be disabled. For more information on non-trading fees, we recommend contacting the broker to gain a comprehensive understanding of the charges and their potential impact on your trading activities.

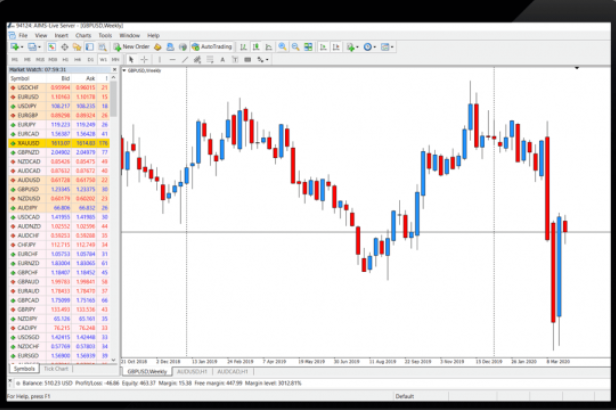

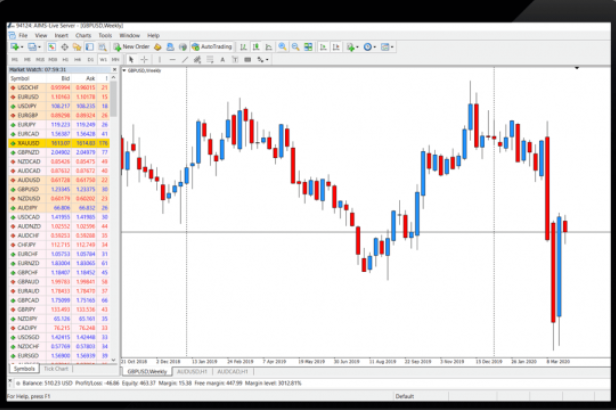

Score – 4.2/5

AIMS enables its clients to conduct their trades on the widely recognized platforms in the market – MT4 and MT5. The platforms are available in both desktop and mobile versions and are recognized for their robust features, user-friendly interface, advanced charting tools, and comprehensive trading capabilities.

| Platforms | AIMS Platforms | FXTM Platforms | Deriv Platforms |

|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | Yes |

| cTrader | No | No | Yes |

| Own Platforms | No | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

AIMS Desktop MetaTrader 4 Platform

MT4 offers a wide range of advanced charting tools, multiple timeframes, trading signals, 30 built-in indicators, and over 80 trading products, making the trading process highly beneficial for its clients. Additionally, the platform provides automated trading capabilities, enabling traders to identify market movements and enhance their market entry and stop-loss strategies. Also, traders are allowed to develop expert advisors, custom indicators, and scripts using the MQL4 programming language.

AIMS Desktop MetaTrader 5 Platform

The AIMS’s MT5 platform is an enhanced and more versatile version of the MT4 platform. It provides advanced analytical tools and automation capabilities, ensuring flexibility for various trading strategies. With over 80 technical indicators, real-time news, an economic calendar, and a testing strategy, AIMS MT5 enables traders to explore the market professionally and trade with precision. Another good point is that traders can develop and implement custom Expert Advisors (EAs) for algorithmic trading. Via the MT5 platform clients can also access copy trading and mirror trades of more successful traders.

Main Insights from Testing

Testing both the MT4 and MT5 platforms of the broker, we concluded that AIMS gives access to functional and well-equipped platforms, that will meet different trading needs. Both the MT4 and MT5 platforms provide robust analytical tools that enable traders in-depth research and informed decisions.

AIMS MobileTrader App

We found that both the MT4 and MT5 platforms have mobile versions, which enables traders flexibility and access to the market from anywhere in the world. Access is available for both iOS and Android devices. The good point is that mobile apps maintain the main features and capabilities, providing unrestrained and diverse trading opportunities.

Trading Instruments

Score – 4.4/5

What Can You Trade on the AIMS Platform?

AIMS offers a variety of trading options, including over 70 Forex currency pairs, CFDs, Global Shares, Fractional Shares, Indices, Commodities, Metals, and other instruments. With its good selection, the broker enables traders to diversify their portfolios and participate in various markets according to their individual preferences and trading strategies.

- AIMS also gives an innovative approach to real investment and offers fractional shares through its MT5 platform. It offers over 1,700 shares from leading stock markets across the US, Europe, Asia, and other regions, allowing retail investors to buy only portions of stocks. This makes traditional investment more accessible for traders, supporting long-term investment.

Main Insights from Exploring AIMS Tradable Assets

Based on our research, AIMS offers a good variety of tradable products, diversifying the chances for traders. Its offering of 70 currency pairs is quite impressive and is much more than what most brokers offer. Besides, due to its Fractional shares availability, traditional investment and long-term engagement in the market become more available. However, through its MT5 platform, the broker gives access to more instruments. Its MT4 platform offers over 80 tradable products, which is limited when compared to the MT5 platform’s instrument availability.

Another important reminder is to check the accessibility of certain instruments based on the entity, as there can be differences between the offerings.

Leverage Options at AIMS

Before participating in leveraged trading, traders should have a solid understanding of the concept and the risks involved. Leverage can be advantageous as it allows traders to enter the market with a smaller initial investment. However, it is essential to be aware of the potential risks associated with leverage.

AIMS leverage is offered according to the ASIC, and LFSA regulations:

- The Australian clients under ASIC regulation are entitled to up to 1:30 leverage.

- International traders may use higher leverage up to 1:400.

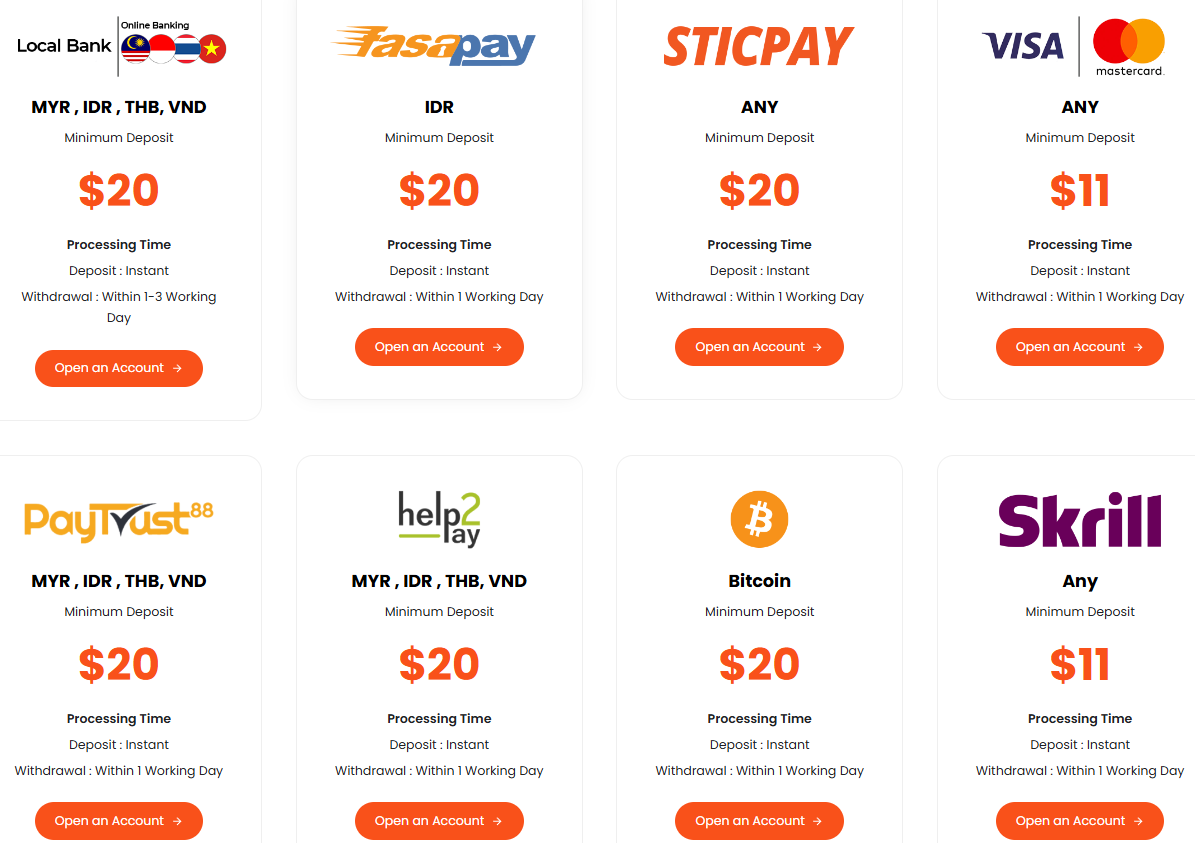

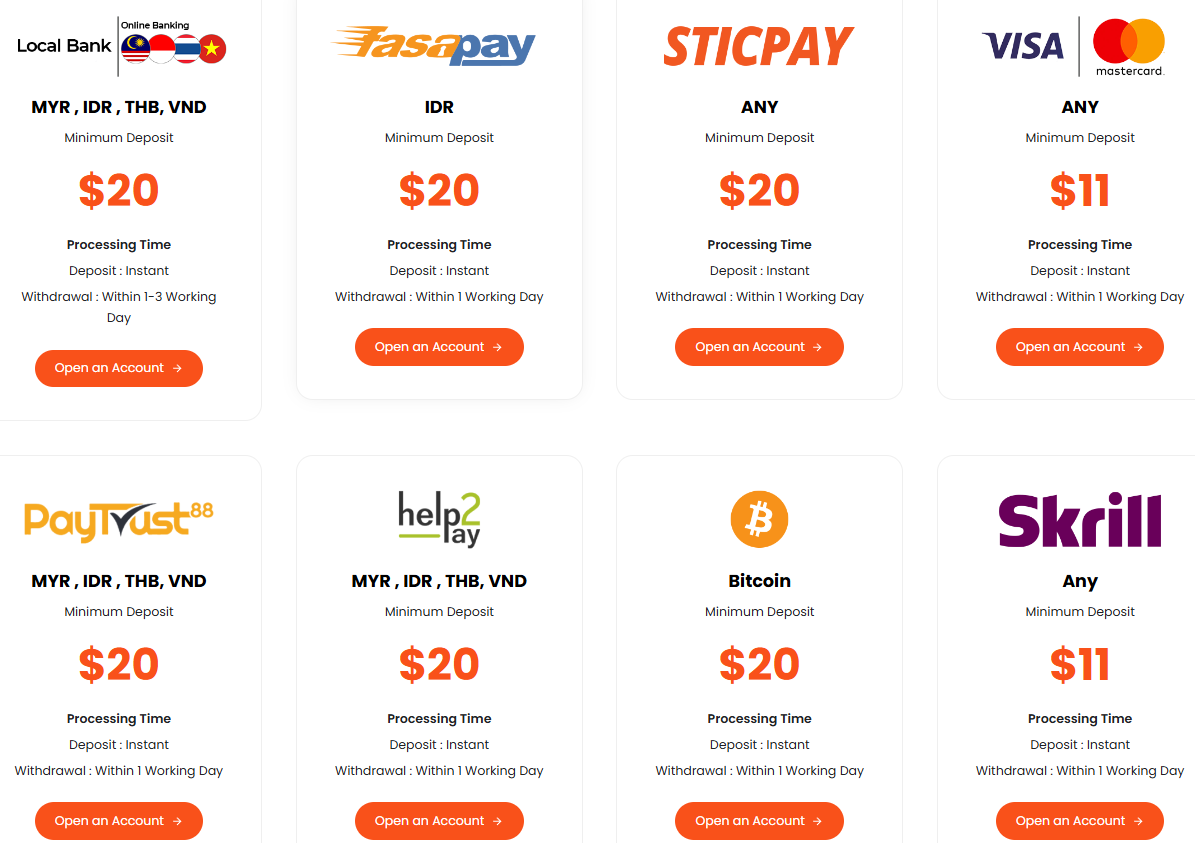

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at AIMS

The broker offers its clients a really good range of deposit methods to fund their trading accounts. These include Bank Wire, Credit/Debit cards, e-wallets, and more. However, certain payment methods may have specific requirements depending on the client’s bank or other financial institutions involved in the transaction.

Here is a full list of the available funding methods:

- Bank Wire

- Credit/Debit Cards

- China Online Banking

- Skrill

- fasapay

- Sticpay

- WeChat Pay

- advcash

Minimum Deposit

To open a live trading account with the broker, clients need to deposit $50 as an initial amount for Standard Accounts, which is considered rather a good offering. For MAM Accounts, the minimum deposit amount starts from $10,000. However, the minimum deposit also depends on the funding method. Thus, we recommend traders research on their own how much is the deposit for their preferred deposit methods.

Withdrawal Options at AIMS

As we found, the broker does not impose fees for deposits and withdrawals. However, there may be fees associated with transferring funds to and from your trading account.

- Any withdrawal request made will be in the base currency of the trading account.

- The withdrawals are mostly processed within 1-3 working days.

Customer Support and Responsiveness

Score – 4.5/5

Testing AIMS Customer Support

Broker’s customer support is available 24/5 through Email, Live chat, and Social Media. The support team also includes trading specialists who can assist with technical support, provide analysis recommendations, address general inquiries, and help resolve operational issues.

- The FAQ section is also very useful. It provides answers to many questions that can arise while trading with the broker, from account opening to funding and withdrawals, platform-related questions, and more.

Contacts AIMS

We found AIMS customer support very responsive and adequate. Traders can direct their questions through the following mediums:

- Live chat is available 24/5 and is really great, providing almost instant and detailed answers. Any trading-related questions will find answers within minutes.

- Clients can also contact the support team via email by using the cs@aimsfx.com address.

- The broker is also social and available through multiple platforms, including Facebook, Instagram, TikTok, and YouTube. Here, traders can find the latest updates on the broker and its services.

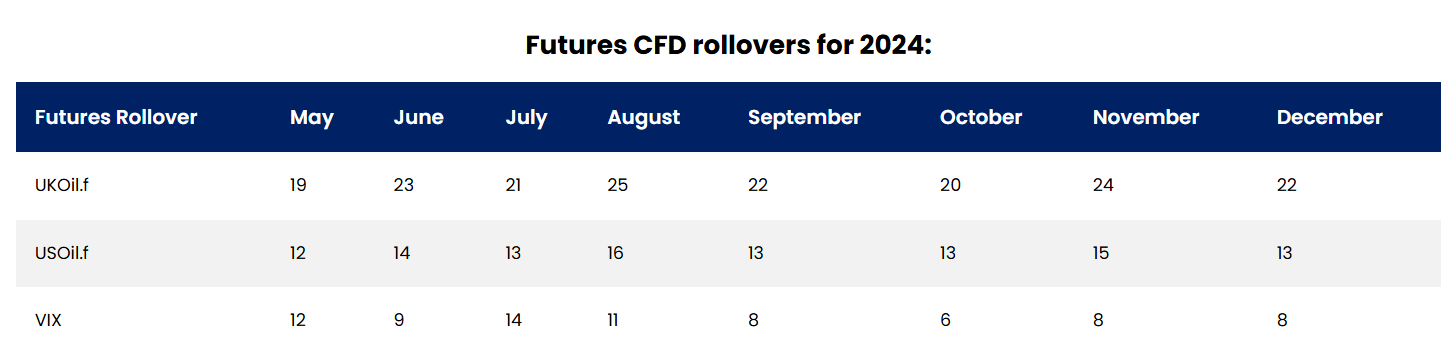

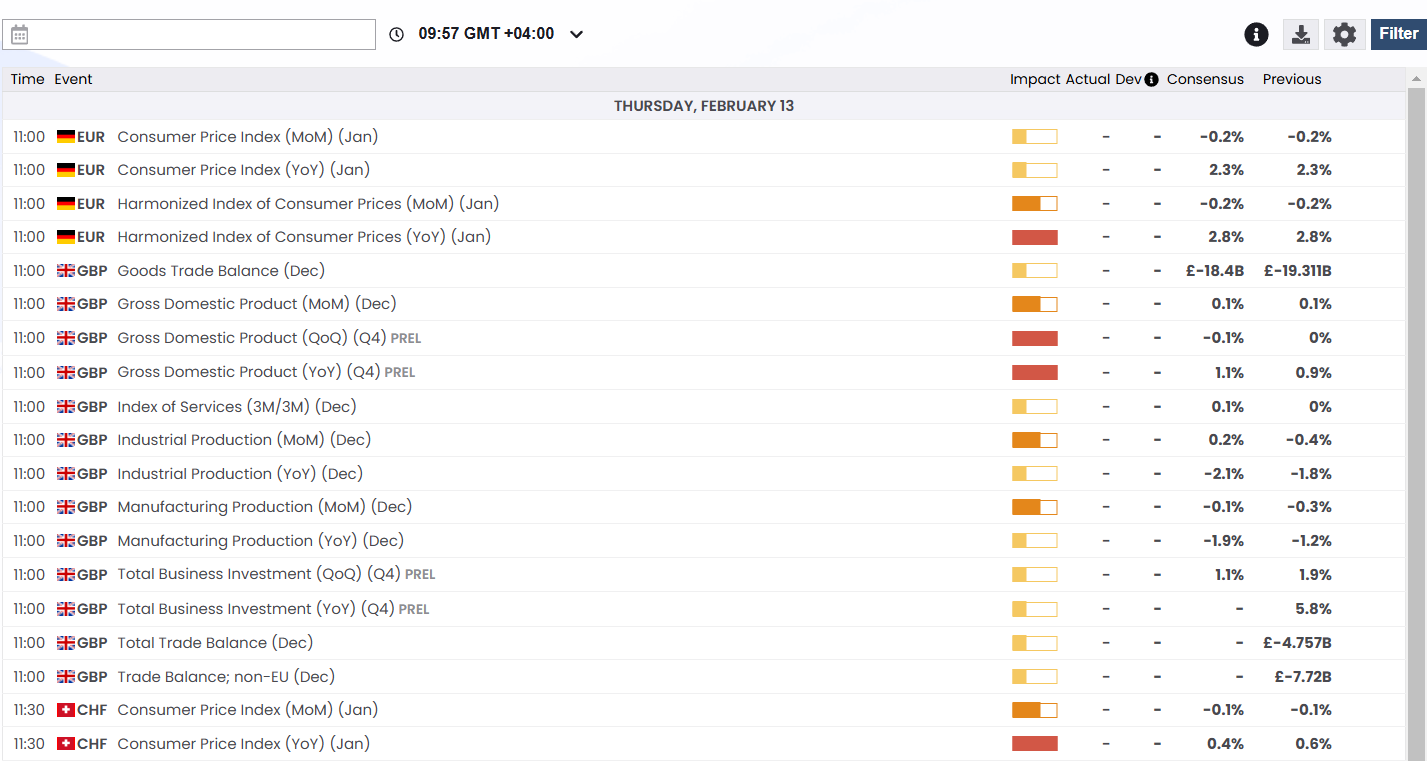

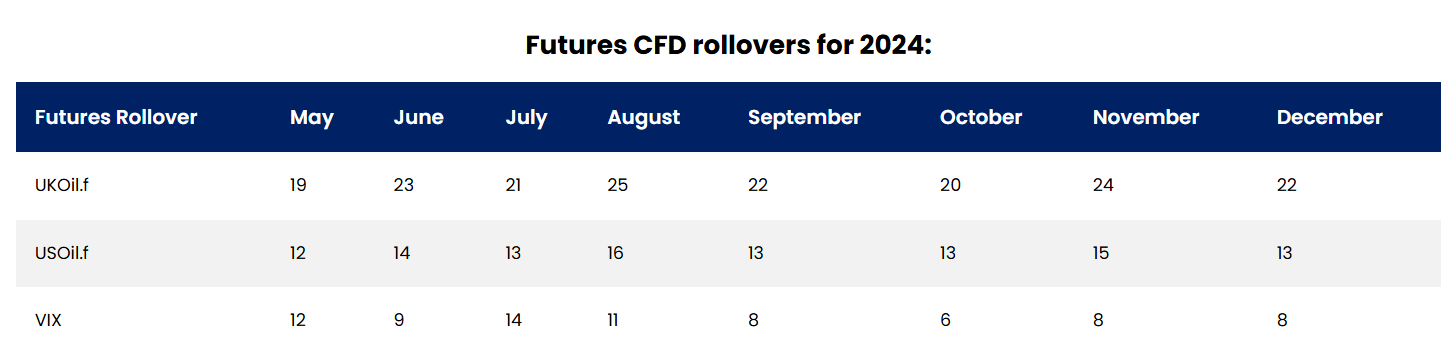

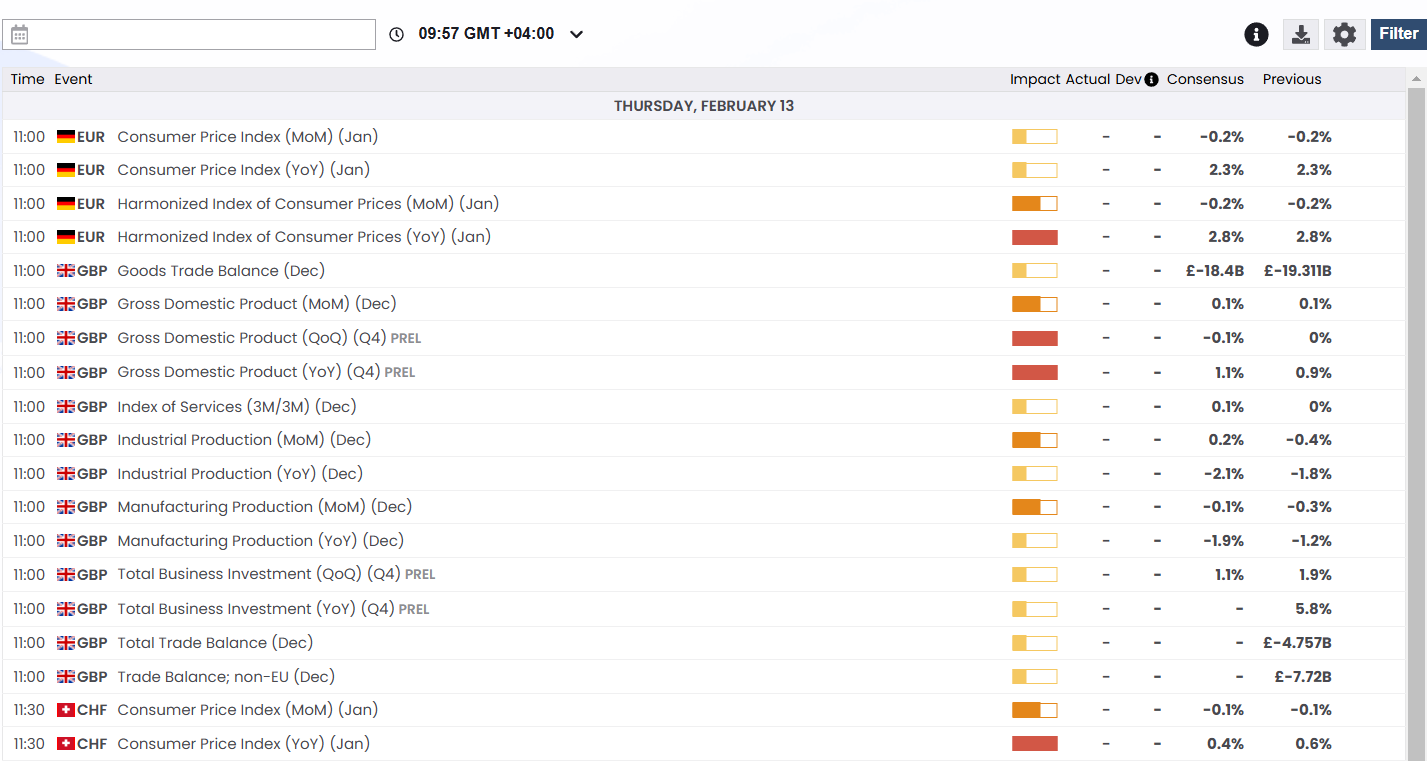

Research and Education

Score – 4.1/5

Research Tools AIMS

We found that the research tools and features are already included in the broker’s platforms. Thus there are not many additional tools clients can use to enhance and explore the market through them. Here is what AIMS provides on its website:

- Economic Calendar is a useful tool to help in planning for trades and futures orders and keeping track of the essential global events that have the power to impact the financial markets.

- The Futures Rollover Section supplies the dates of when Futures mature. AIMS swaps a matured contract price with a new one before the old contract expires and adjusts the difference in price between the 2 underlying contracts, making it easier for clients to keep track.

Education

We have researched AIMS’s offerings and educational resources available to find that the broker lacks extensive research materials, seminars, or webinars, offering only Market Insights and an Economic Calendar. This limited availability of educational resources can be considered a drawback, as traders rely on such materials to enhance their skills and knowledge in the financial markets.

- This means, that clients, especially beginners who need guidance and assistance through different educational materials, will find AIMS not favorable for their special needs and expectations.

Is AIMS a Good Broker for Beginners?

As we have already reviewed the broker from different aspects, we can say that AIMS is a good broker with competitive fees, reliable and flexible trading platforms, and a low minimum requirement of funding. However, beginner traders also need extensive educational resources to boost their trading knowledge and skills. In this respect, novice traders either need to find education materials elsewhere, or choose another broker with better education and research sections.

Portfolio and Investment Opportunities

Score – 4.4 /5

Investment Options AIMS

All in all, AIMS offers a good selection of tradable products, enabling traders to explore the market further, with unique opportunities. We found that AIMS enables real investment through its fractional shares giving access to +1,700 shares from leading stock markets all over the world, making long-term investment more available.

- Besides, through its MT5 platform traders have access to Copy trading, and can easily copy trades from experienced professionals, making the trading process easier and more profitable.

- Another option to expand the portfolio and make investments is provided by the broker’s MAM account.

Thus, AIMS investment options are many, giving traders a chance to expand their trading and engage in long-term investment plans.

Account Opening

Score – 4.6/5

How to Open an AIMS Demo Account?

Demo accounts are a great option for new traders to familiarize themselves with the AIMS trading platform and trade without real consequences. For beginner traders, this is a recommended way to begin a trading journey, yet professionals can also benefit by practicing new techniques and strategies.

Here are the steps to open a Demo account with AIMS:

- Open AIMS Metatrader software

- Click on “Open an Account”

- Select “New Demo Account”

- Fill out the form with the information required

- You will be provided with a Login and Password

- Find your Demo Account Number on the top left corner of the AIMS platform

How to Open an AIMS Live Account?

With AIMS registration or opening an account is considered quite an easy process, as you can log in to the AIMS Portal and register an account within minutes. Just follow the opening account or sign-in page and proceed with the guided steps:

- Select and Click on the “Open an Account” page

- Enter the required personal data (Name, email, phone number, etc.)

- Verify your personal data by uploading documentation (residential proof, ID, etc.)

- Complete the electronic quiz confirming your trading experience

- Once your account is activated and proven, follow with the money deposit.

Score – 3.3/5

In terms of additional tools and features, AIMS does not really stand out. All its features are already included in its MT4 and MT5 platforms. Thus, those traders who are looking for more versatility and innovative options should look elsewhere.

- The only additional tool we were able to find on the broker’s platform is its Economic Calendar we have already discussed in the research section.

AIMS Compared to Other Brokers

It is helpful to compare brokers with one another, to see how competitive are the offerings, and what are the strong points for each broker. Thus, we have compared AIMS to other reputable brokers in the market to see where it stands.

In terms of regulations, AIMS is tightly regulated by ASIC and also holds an offshore license. FP Markets, IC Markets, and Pepperstone similarly are licensed by ASIC and have the same level of reliability. However, the mentioned brokers hold licenses from top-tier authorities as well, such as FCA and CySEC, which further enhances their security.

As to the broker’s fee structure, AIMS offers only spread-based accounts with no commissions and average spreads of 1.5 pips. This offering is in line with the market. As we have found, FXTM and HFM offer similar spreads from 1 to 1.5 pips and a $3-3.5 commission fee. This makes AIMS offering more cost-effective.

AIMS also provides the industry-popular MT4 and MT5 platforms for trading. We found that FXTM has a similar offering, while brokers like Pepperstone, Deriv, and FP Markets enable a better variety of platforms.

At last, the weakest point of AIMS is its lack of comprehensive educational and research materials. FP Markets and Pepperstone excel in this respect, offering their clients extensive educational materials and research tools.

| Parameter |

AIMS |

Deriv |

FXTM |

HFM |

FP Markets |

IC Markets |

Pepperstone |

| Spread Based Account |

Average 1.5 pips |

Average 0.5 pips |

Average 1.5 pips |

Average 1 pip |

From 1 pip |

From 1 pip |

Average 0.7 |

| Commission Based Account |

No commissions |

0.0 pips + $0.05 |

0.0 pips + $3.5 |

0.0 pips + $3 |

0.0 pips + $3 |

0.0 pips + $3.50 |

0.0 pips + $3.50 |

| Fees Ranking |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

Low/ Average |

Low |

| Trading Platforms |

MT4, MT5 |

Deriv MT5, Deriv cTrader, Deriv X, Deriv Trader, Deriv Bot, Deriv GO, SmartTrader |

MT4, MT5 |

MT4, MT5, HFM App |

MT4, MT5, cTrader, IRESS, Proprietary Platform |

MT4, MT5, cTrader |

MT4, MT5, cTrader, TradingView |

| Asset Variety |

2000+ instruments |

200+ instruments |

1,000+ Instruments |

500+ instruments |

10,000+ instruments |

1,000+ instruments |

1,200+ instruments |

| Regulation |

ASIC, LFSA |

MFSA, Labuan FSA, BVI FSC, VFSC |

FCA, FSC, CMA |

CySEC, FCA, DFSA, FSCA, FSA, CMA, FSC |

ASIC, CySEC, FSCA, CMA |

ASIC, CySEC |

ASIC, FCA, DFSA, SCB, CMA, CySEC, BaFIN |

| Customer Support |

24/5 support |

24/7 support |

24/5 support |

24/5 support |

24/7 support |

24/7 support |

24/7 support |

| Educational Resources |

Basic |

Good |

Good |

Good |

Excellent |

Good |

Excellent |

| Minimum Deposit |

$50 |

$5 |

$200 |

$0 |

$100 |

$200 |

$0 |

Full Review of Broker AIMS

AIMS is a well-established Forex and CFD trading broker with years of experience, offering a large range of trading instruments, competitive prices, and access to the popular MT4 and MT5 platforms. Licensed by ASIC, AIMS provides a safe and secure trading environment for clients. The broker has become a respected name in the industry over the years, having won numerous industry awards and being present in 17 countries across the globe.

While AIMS has earned positive feedback for its easy-to-use trading platform, diverse asset options, and secure trading environment, it also has received some criticisms on withdrawal processes, and for the lack of educational resources. Also, traders need to be aware that AIMS operates under offshore jurisdictions besides its ASIC-regulated entity, thus the trading environment would vary depending on the regulatory framework under which it is licensed.

In general, AIMS is a competitive broker, well-suited for traders who appreciate low spreads, advanced trading tools, and the MetaTrader platforms. Nevertheless, clients should first carefully evaluate their own trading requirements and be sure they understand the broker’s regulatory environment and trading conditions before proceeding and opening an account.

Share this article [addtoany url="https://55brokers.com/aims-review/" title="AIMS"]