ADS Securities Review

Leverage: 1:30 | 1:500

Regulation: SCA, FCA, SFC

Min. Deposit: $100

HQ: Abu Dhabi

Platforms: OREX, MT4

Found in: 2011

Leverage: 1:30 | 1:500

Regulation: SCA, FCA, SFC

Min. Deposit: $100

HQ: Abu Dhabi

Platforms: OREX, MT4

Found in: 2011

ADS Securities is a CFD and Forex broker offering CFDs across 60+ FX pairs, on equities, global indices such as the FTSE and Nasdaq, commodities including gold and oil, or single stocks such as Apple or Tesla, and cryptocurrencies.

In fact, the Holding is one of a small number of investment firms that received a license from Abu Dhabi Central Bank, while affiliated offices are authorized by the appropriate jurisdiction like FCA in UK and SFC in Hong Kong.

Currently, ADS Securities is the biggest Forex trader in the UAE and serves central banks, asset managers, brokerage firms, and hedge funds. ADSS’s focus is on building strong, long-term relationships with institutional or corporate clients, to provide a range of high-quality services and solutions

ADS is a regarded broker with a large expansion in the MENA region, the trading conditions are rather competitive with easy digital account opening, various tools, and an education section. Spreads and commission are on average with a good range of instruments offered.

For the Cons, trading fees for Stock CFDs are higher, and there is no 24/7 support.

| Advantages | Disadvantages |

|---|---|

| FCA licensed broker with a strong establishment | Conditions may vary according to regulation and entity |

| Globally recognized and awarded | No 24/7 customer support |

| Competitive trading costs and spreads | |

| Wide range of trading instruments including Forex and CFDs | |

| MT4 trading platform |

| 🏢 Headquarters | Abu Dhabi |

| 🗺️ Regulation | SCA, FCA, SFC |

| 📉 Instruments | 60+ currency pairs, over 1000 CFDs, indices, commodities, treasuries, and single stocks, cryptos, and more |

| 🖥 Platforms | OREX, MT4 |

| 💰 EUR/USD Spread | 1 pip |

| 🎮 Demo Account | Provided |

| 💳 Minimum deposit | $100 |

| 💰 Base currencies | EUR, USD, GBP |

| 📚 Education | Daily market briefings, news and analysis, economic calendar, webinars, video tutorials, and trading signals |

| ☎ Customer Support | 24/5 |

ADS Securities is considered a good broker with safe and favorable trading conditions with transparency. The broker offers a range of trading services with competitive trading costs. As one of the good advantages, ADS Securities is available in many countries, so traders can sign in also with the lowest spreads.

| Ranking | ADS Securities | Capital Index | Tickmill |

|---|---|---|---|

| Our Ranking | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Advantages | Trading Instruments | Trading Conditions | Trading Platforms |

ADS Securities offers good trading conditions, also low trading spreads, and fees. However, there are a number of other brokers that offer similar services. Here are some of the best alternatives to ADS Securities:

Among the company’s wide influence, there are numerous awards from international publications, as well as, ADSS is a proud sponsor of many organizations in the UAE and the world.

No, ADS Securities is not a scam. It is a regulated broker with low-risk Forex and CFDs.

ADSS covers both institutional and private investment activities from the affiliated centers, and each of the jurisdictions has authorized the ADSS company regulation accordingly.

Yes, ADS Securities is a legit and regulated broker in various jurisdictions.

ADS Securities LLC is a limited liability company incorporated under UAE law, while the firm is registered with the Department of Economic Development of Abu Dhabi and is authorized and regulated by the Securities and Commodities Authority.

Additional licenses from the reputable UK FCA and Hong Kong SFC are respectively adding necessary guidelines on how the broker operates, therefore traders from different regions and jurisdictions may enjoy trading leveraged FX, securities, and futures contracts.

See our conclusion on ADS Securities Reliability:

| ADS Securities Strong Points | ADS Securities Weak Points |

|---|---|

| Regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity |

| FCA license and overseeing | |

| Negative balance protection | |

| Compensation scheme | |

| Global coverage |

ADSS delivers its trading service transparently according to international laws and procedures to handle traders’ funds. These steps perform committed to the compliance processes segregation of the client funds, financial services compensation shame, and overall fair conditions. Furthermore, the broker implements negative balance protection.

ADSS offers leverage of up to 1:500 on many FX pairs and up to 1:333 on indices which are still possible if you hold an account with Hong Kong or UAE entity. It is a fact, that various jurisdictions and their respective authorities applied various allowed levels of leverage.

In addition, since ADSS offers flexible leverage the amount of available leverage depends on the type of account you are trading.

ADS Securities offer two account types: Classic Account with a minimum deposit of $100 and easy to trade and manage account, and Elite Account, designed for VIP clients with deposits over $100,000 for an Elite account and $250,000 for Elite+.

Along with standard features, ADSS supports a specific account for asset/fund managers to trade and monitor their clients: MAM or PAMM. Yet, again make sure to check which offering is applicable to your jurisdiction and residency.

Since the ADSS is a leading MENA broker, it has a Swap Free Account offering too. The account without swap or rollover interest on overnight positions offers all benefits of Classic and Elite accounts tailored to traders following Sharia rules.

Of course, in the beginning, any trader can open a risk-free demo account with ADS Securities.

| Pros | Cons |

|---|---|

| Fast account opening | Account types and proposals may vary according to jurisdiction |

| Low minimum deposit | |

| Hedging and scalping allowed | |

| Demo account is available | |

| Account base currencies EUR, USD, GBP |

Opening an account with ADS Securities is quite easy. You should follow the opening account or sign-in page and proceed with the guided steps:

ADS Securities offers over 10,000 trading instruments including CFDs across 60+ Forex pairs, indices, commodities, treasuries, single stocks, cryptos, and more.

ADS Securities fees are mainly built into a spread defined by the instruments, and also may be different according to the entity you are trading with.

Also, consider overnight fee or swap as a trading cost, as in case you hold an open position longer than a day various fees are applicable. In addition to funding fees and other fees that may arise.

| Fees | ADS Securities Fees | Capital Index Fees | Tickmill Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | No |

| Fee ranking | Average | Low, Average | Low |

ADS Securities spreads are different depending on the account type you choose. Based on our finds the average spread for EUR USD is 1 pip, which is considered slightly lower than the industry average.

To get a better understanding of ADS securities costs, see below the typical spread for popular instruments charged by ADSS which we rank on average levels.

| Asset | ADS Securities Spread | Capital Index Spread | Tickmill Spread |

|---|---|---|---|

| EUR USD Spread | 1 pips | 1.1 pips | 0.3 pips |

| Crude Oil WTI Spread | 4 pips | 7 | 4 |

| Gold Spread | 5 pips | 0.5 | 20 |

| BTC USD Spread | 17276 | - | 12 |

There are different ways to fund ADSS trading accounts. The broker accepts credit or debit card payments and bank transfers in 13 different funding currencies available: AED, GBP, EUR, USD, JPY, and more. As well as you may use popular e-wallets, nevertheless check restrictions according to your residence, as some differences may occur.

Here are some good and negative points for ADS Securities funding methods found:

| ADS Securities Advantage | ADS Securities Disadvantage |

|---|---|

| $100 is a first deposit amount | Methods and fees vary in each entity |

| No internal fees for deposits and withdrawals | |

| Fast digital deposits, including Credit/Debit Cards | |

| Multiple account base currencies |

In terms of funding methods, ADS Securities offers many payment methods which are a very good plus, yet check according to its regulation whether the method is available or not.

The minimum deposit amount is $100, which allows even beginning traders to open an account and engage in the world of trading easily.

ADSS minimum deposit vs other brokers

| ADS Securities | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

As for the deposit and withdrawal fees, according to the company policy, the customer is responsible for conversion fees applied by the bank or any other fees charged by the bank, while the broker himself does not charge additional fees for transfers.

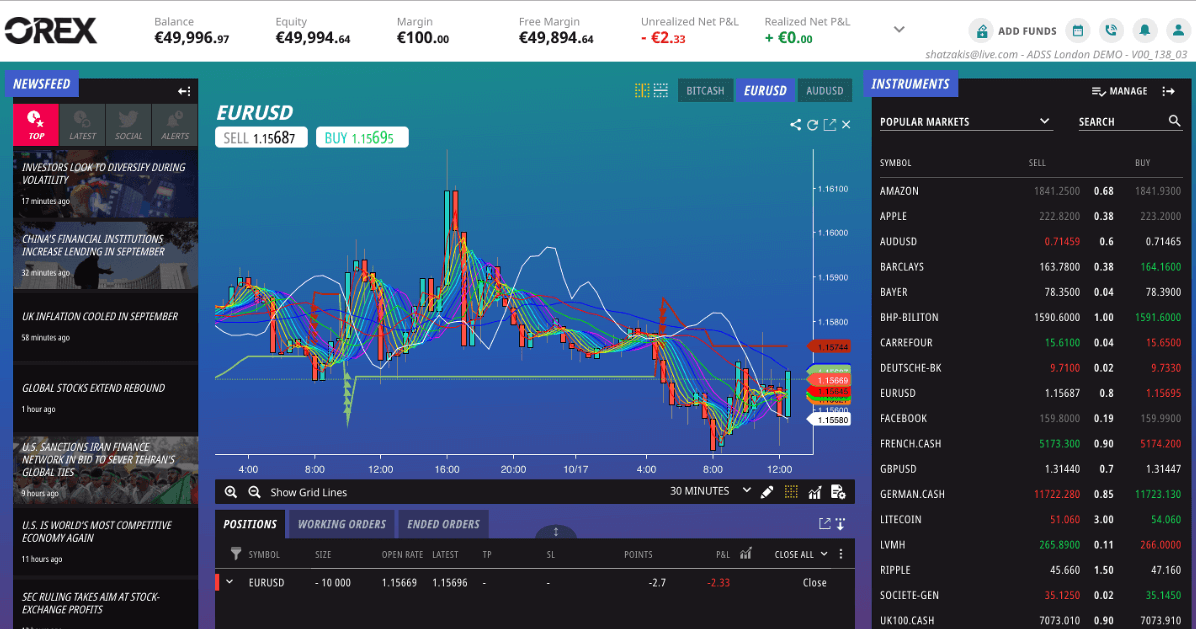

ADS Securities has developed truly multi-asset trading solutions and you may choose between two main trading platforms that are best suited to each trading need: OREX, a proprietary multi-asset platform with low latency, or MT4 which gives the familiarity of the most popular platform.

| Platforms | ADS Securities Platforms | Capital Index Platforms | Tickmill Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | No |

| Own Platform | Yes | No | No |

| Mobile Apps | Yes | Yes | Yes |

OREX is an innovative platform developed by ADS Securities offering exceptional latency and order processing. The platform is available for both desktop and mobile devices and delivers intuitive navigation, position, and risk management. Besides being available OREX market depth feature, the real-time volume displayed by five levels of the market makes it an advanced feature for professionals.

Nevertheless, ADSS MT4 has been developed also together with MetaQuotes that enriched trading solutions by liquidity, pricing, and support from the ADSS, as well community-sourced indicators and EAs. Likewise, the MT4 platform can be accessed from iOS or Android devices.

ADS Securities provides 24/5 customer support to its clients. Phone lines, Live chat, and Email are also available here.

See our find and ranking on Customer Service Quality:

| Pros | Cons |

|---|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | |

| Availability of Live chat, phone lines, and email |

ADS Securities provides daily market news and analysis along with learning materials and data, webinars, video tutorials, an economic calendar, and trading signals.

The final thought upon ADS Securities review is that the broker from many perspectives is a great offer in technology, reliability, learning, and pricing. Broker’s technical optimization and servers are on top of technology, which all bring a truly powerful combination to trade for both beginning or even very advanced traders with various trading styles, which is a great option to consider.

The proposal scope is done in a smart way to satisfy each client’s need, regardless of location or “business mentality”. However, you have to be aware that the broker operates according to the clients’ resident registration, hence there are some differences between the applicable regulations and offers which should be checked before opening an account.

Based on Our findings and Financial Expert Opinions ADS Securities is Good for:

Beginner here. Used the demo account for a month, and I got the hang of the platform quickly. It was also easy to move onto the live account, the process was very seamless.

ADSS provides plenty of educational resources on their website, so I can quickly grasp complicated trading concepts. So far, it's been great trading with them!

It's good to see frequent updates that improve the platform. So far, I've been very impressed with ADSS, especially with their smart charting that lets me keep track of my instruments.

ADSS has good educational resources on their site for improving my skills. Good and convenient for becoming a better trader.

Their trading platform's interface is clear and very easy to navigate. I know exactly where tools are, and what they do. This makes it easy for me to keep track of trades, and so far I'm happy with everything!

The best part about trading with a MENA-focused broker is that articles are not just in English. Arabic is my first language. Not English. And I prefer to trade in Arabic, so the market updates have been very useful!

I have been trading with ADSS for half a year now, and I am impressed that it has such a low learning curve compared to other brokers I have used. I spend less time and energy learning how to use their platform, and more time actually trading in the markets.

I have been trading with ADSS for a few months. The best part is there are no commissions charged on any trades. Very great feature for those who trade frequently, like me!

I have been trading with ADSS for about 3 months, which is not a long time, but it's been a good experience so far. I use the MT4 platform and there have been no problems with trading. The interface is clear and not overwhelming, and I have been learning more about how to use the platform with the guides on the broker website, which help a lot.

As a novice trader, I was hesitant to try out ADSS at first, but I am glad I did. Their platform is intuitive and easy to use, and their educational resources have helped me to improve my trading skills.

Nice range of markets. I generally stick to CFD trading, which is perfect for me. Easy for portfolio diversification, deep liquidity, and low spreads. I will keep trading with this broker, because everything's been going well.

I am satisfied with this broker. Good fees and wide range of instruments on MT4. Plus, no commissions charged on trades - this is my favourite - because I trade really frequently and commissions would really eat into my profits.

ADSS is a reliable broker with competitive spreads. Been trading with them for a long time now and their customer support team is always very responsive and helpful.

I have been trading with ADSS for over a year now, and I am impressed with their low spreads and fast execution speeds. Their platform is also user-friendly, making it easy for me to navigate and place trades.

No news available.

This is not true as they are non-professional company and they don’t care about the client, withdrawal a local transfer 3 days standard, horrible…

Really i was going to deposit please just you inform me which other problems

Can I trade directly without any other parties ie Account Manager

Seriously.

I was researching into ADSS. Why do u say so?

This is not true as they are non professional company and they don’t care about client at all and they change leverage whenever they want and without prior notice