- What is ADS Securities?

- ADS Securities Pros and Cons

- Regulation and Security Measures

- Account Types and Benefits

- Cost Structure and Fees

- Trading Platforms and Tools

- Trading Instruments

- Deposit and Withdrawal Options

- Customer Support and Responsiveness

- Research and Education

- Portfolio and Investment Opportunities

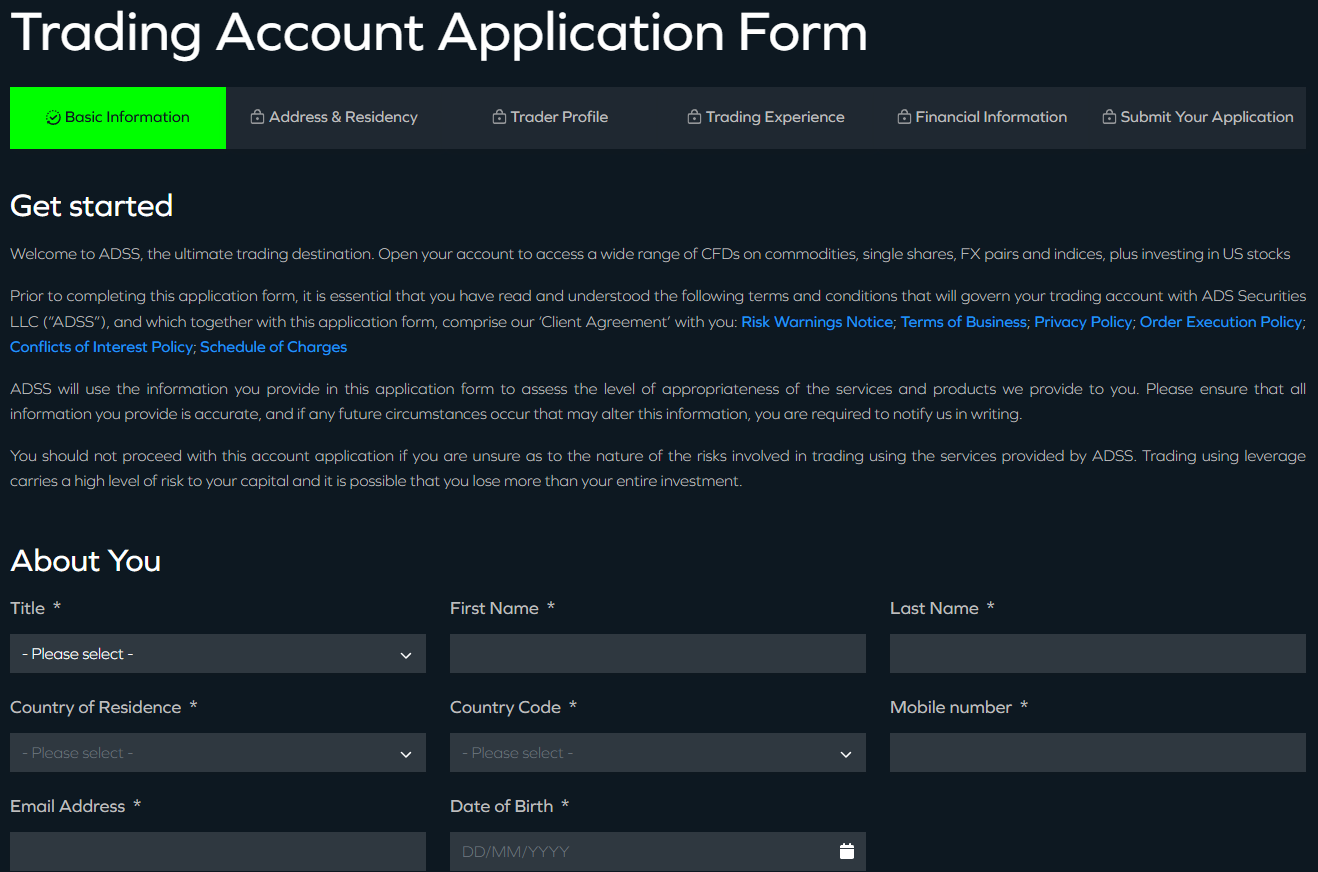

- Account Opening

- Additional Tools And Features

- ADS Securities Compared to Other Brokers

- Full Review of Broker ADS Securities

Overall Rating 4.3

| Regulation and Security | 4.4 / 5 |

| Account Types and Benefits | 4.5 / 5 |

| Cost Structure and Fees | 4.4 / 5 |

| Trading Platforms and Tools | 4.5 / 5 |

| Trading Instruments | 4.3 / 5 |

| Deposit and Withdrawal Options | 4.4 / 5 |

| Customer Support and Responsiveness | 4.5 / 5 |

| Research and Education | 4.4 / 5 |

| Portfolio and Investment Opportunities | 4.3 / 5 |

| Account Opening | 4.5 / 5 |

| Additional Tools and Features | 4.2 / 5 |

What is ADS Securities?

ADS Securities is a CFD and Forex broker offering CFDs across 60+ FX pairs, on equities, global indices such as the FTSE and Nasdaq, commodities including gold and oil, single stocks such as Apple or Tesla, and cryptocurrencies.

Currently, ADS Securities is the biggest Forex trader in the UAE and serves central banks, asset managers, brokerage firms, and hedge funds. ADSS’s focus is on building strong, long-term relationships with institutional or corporate clients to provide a range of high-quality services and solutions

ADS Securities Pros and Cons

ADS is a regarded broker with a large expansion in the MENA region. The conditions are rather competitive, with easy digital account opening, various tools, and an education section. Spreads and commission are on average with a good range of instruments offered.

For the Cons, fees for Stock CFDs are higher, and there is no 24/7 support.

| Advantages | Disadvantages |

|---|

| Reputable broker with a good establishment | No 24/7 customer support |

| Good education and research | No top-tier license |

| Suitable for beginners and professionals | |

| Competitive trading costs and spreads | |

| Wide range of trading instruments including Forex and CFDs | |

| MT4 trading platform | |

ADS Securities Features

ADSS is a recognized Currency and CFD broker headquartered in Abu Dhabi, UAE. Known for its competitive spreads, advanced platforms, and multi-asset offerings, ADSS aims to deliver a premium trading experience backed by robust technology and localized support. Below are the key points to consider when choosing ADSS as your online broker.

ADS Securities Features in 10 Points

| 🏢 Regulation | SCA |

| 🗺️ Account Types | Classic, Elite, Pro |

| 🖥 Trading Platforms | ADSS Platform, MT4 |

| 📉 Trading Instruments | 60+ Currency pairs, over 1000 CFDs, Indices, Commodities, Treasuries, Single Stocks, Cryptos, and more |

| 💳 Minimum Deposit | $100 |

| 💰 Average EUR/USD Spread | 0.7 pips |

| 🎮 Demo Account | Available |

| 💰 Account Base Currencies | EUR, USD, GBP |

| 📚 Trading Education | Tutorials, educational videos, platform guide, glossary |

| ☎ Customer Support | 24/5 |

Who is ADS Securities For?

ADSS is designed for a wide range of clients, from individual traders seeking competitive spreads and user-friendly platforms to institutional investors and wealth managers in need of advanced solutions and deep liquidity. Based on our findings and Financial Expert Opinions, ADS Securities is Good for:

- Beginners

- Advanced traders

- Currency and CFD trading

- STP/NDD execution

- Traders who prefer MT4 platforms

- Competitive fees and spreads

- EA trading

- White label service

- Supportive customer support

- Good educational materials

ADS Securities Summary

The final thought upon ADS Securities review is that the broker, from many perspectives, is a great offer in technology, reliability, learning, and pricing. Broker’s technical optimization and servers are on top of technology, which all bring a truly powerful combination to trade for both beginning or even very advanced traders with various trading styles, which is a great option to consider.

The proposal scope is done in a smart way to satisfy each client’s need, regardless of location or “business mentality”. However, you have to be aware that the broker operates according to the clients’ resident registration, hence, there are some differences between the applicable offers, which should be checked before opening an account.

55Brokers Professional Insights

ADSS stands out through its institutional-grade liquidity and client-focused approach, suitable for traders from MENA region especially day traders and long term holders of trading position too.

What truly sets it apart is its commitment to providing tailored solutions, whether it is through tight spreads, powerful proprietary and MT4 platforms, or customized solutions for institutional clients. The performance is overall good, the Broker also operate for many years which proves its good status. The broker also offers multilingual support and region-specific services, making it particularly appealing to clients in the Middle East and Asia looking for a reliable and responsive partner.

Consider Trading with ADS Securities If:

| ADS Securities is an excellent Broker for: | - Providing competitive fees and spreads.

- Offering popular instruments.

- Access to MT4 platform.

- Broker with a variety of strategies.

- Who prefer higher leverage up to 1:500.

- Secure environment.

- Beginners and professional traders.

- Access to MAM/PAMM tools. |

Avoid Trading with ADS Securities If:

| ADS Securities might not be the best for: | - Looking for broker with 24/7 customer support.

- Need a broker authorized by Top-Tier authorities.

- Providing Copy Trading. |

Regulation and Security Measures

Score – 4.4/5

ADS Securities Regulatory Overview

ADS Securities LLC is a limited liability company incorporated under UAE law. The firm is registered with the Department of Economic Development of Abu Dhabi and is authorized and regulated by the Securities and Commodities Authority.

How Safe is Trading with ADS Securities?

Trading with ADSS is considered relatively safe as the broker is regulated by the SCA of the United Arab Emirates, a recognized financial regulator that enforces strict operational and capital requirements.

ADSS enhances client protection by maintaining segregated accounts, ensuring that traders’ funds are kept separate from company assets. The broker also employs advanced encryption and security protocols to protect user data and transactions.

However, traders should be aware that ADSS does not currently offer negative balance protection, meaning clients could incur losses beyond their initial deposit in highly volatile conditions. As always, effective risk management is essential when trading leveraged products.

Consistency and Clarity

ADS Securities has earned a strong reputation in the financial industry, known for its transparent services and competitive pricing, especially in the Middle East. The broker’s regulatory status under the UAE’s SCA provides traders with a sense of security and reliability. User reviews generally highlight ADSS for its fast execution and quality customer service, but some traders have pointed out areas for improvement, such as the lack of negative balance protection.

ADSS has also been recognized in the industry, earning awards for excellence in trading services and innovation. Beyond its platform, ADSS maintains an active presence in the community through sponsorships and financial events, reinforcing its commitment to client engagement and regional development.

This combination of credibility, community involvement, and tailored solutions positions ADSS as a trusted broker with both institutional depth and retail accessibility.

Account Types and Benefits

Score – 4.5/5

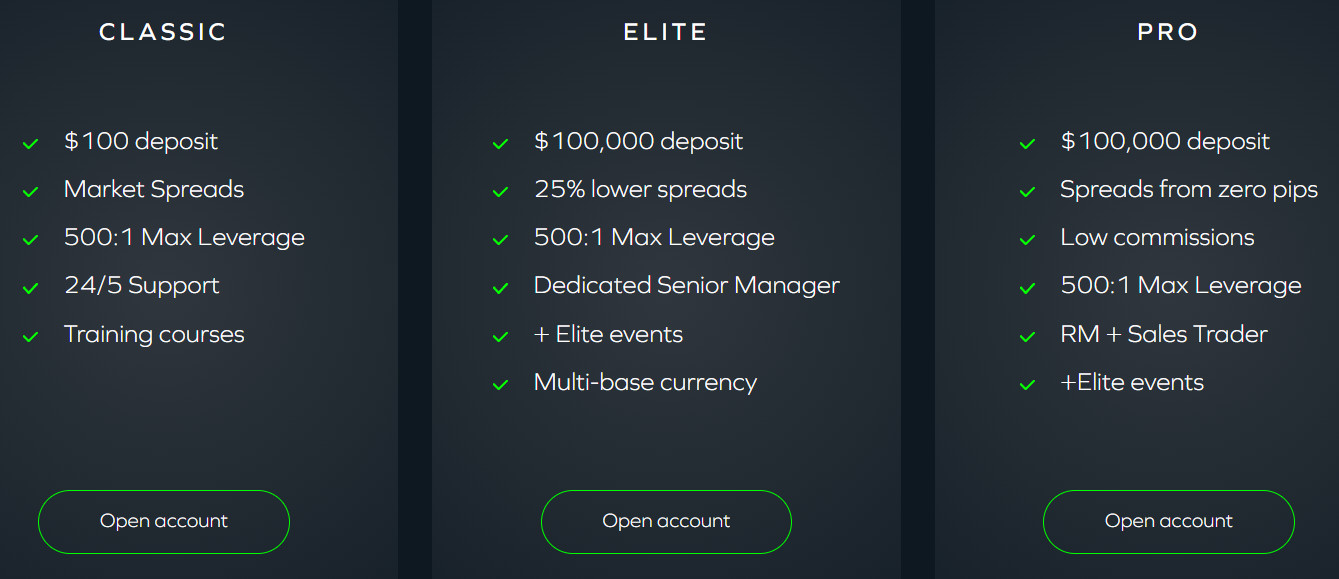

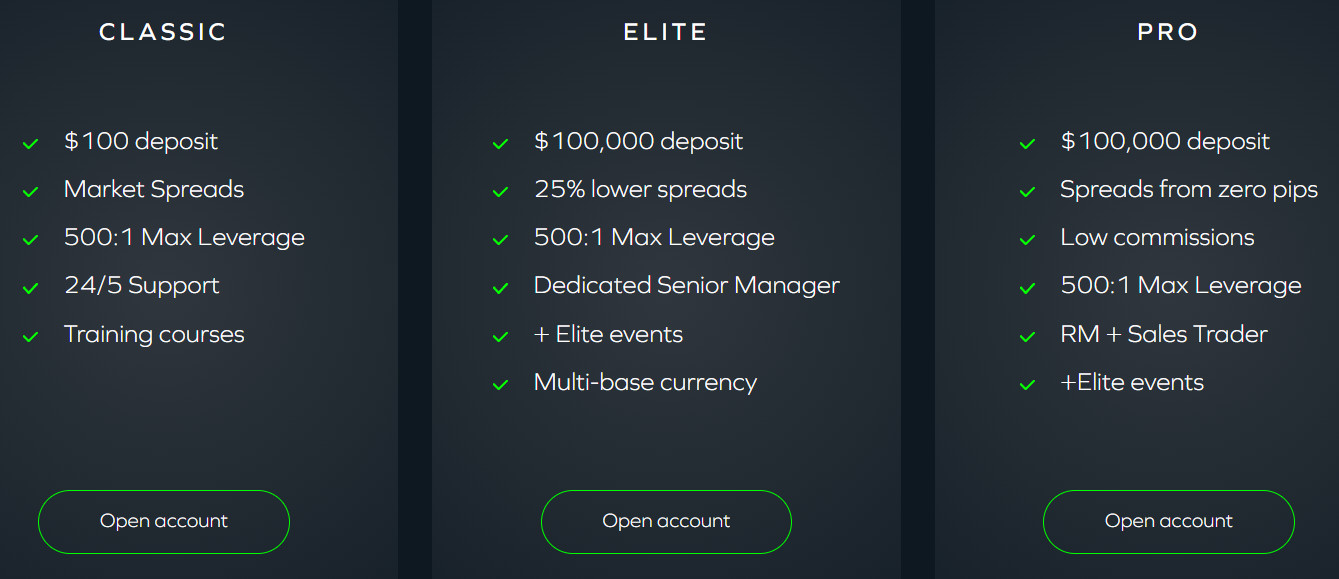

Which Account Types Are Available with ADS Securities?

ADS Securities offers three account types: Classic Account with a minimum deposit of $100, an easy-to-trade and manage account; Elite Account, designed for VIP clients with deposits over $100,000; and Pro Account with a $100,000 deposit amount and low commissions.

Along with standard features, ADSS supports a specific account for asset/fund managers to trade and monitor their clients: MAM or PAMM. Yet, again, make sure to check which offering applies to your jurisdiction and residency.

Since the ADSS is a leading MENA broker, it has a Swap Free Account offering too. Of course, in the beginning, any trader can open a risk-free demo account with ADS Securities.

Classic Account

The Classic Account is designed for traders who are just getting started or those looking for a cost-effective option with a low initial deposit requirement. With a minimum deposit of just $100, this account type offers market spreads and a maximum leverage of 1:500, giving traders the flexibility to manage risk while engaging in the global markets.

The account also comes with 24/5 support, ensuring that help is always available when needed. Additionally, traders have access to various training courses, making it easier for beginners to learn and improve their strategies over time.

Elite Account

The Elite Account is tailored for more experienced traders who are looking for tighter spreads and exclusive services. With a higher minimum deposit of $100,000, this account offers a 25% reduction in spreads compared to the Classic Account, providing traders with a more cost-effective way to execute trades.

It also offers a maximum leverage of 1:500 and includes a dedicated Senior Manager to assist with personalized support. Elite Account holders can enjoy invitations to exclusive events, enhancing their networking opportunities in the trading community. Additionally, the Elite Account offers multi-currency base options, providing greater flexibility for traders dealing in multiple currencies.

Pro Account

For professional traders who require the best possible conditions, the Pro Account at ADS Securities offers top-tier features. With a minimum deposit of $100,000, this account provides spreads from zero pips and low commissions, offering traders the most competitive pricing available.

Along with the 1:500 maximum leverage, Pro Account holders benefit from personalized service, including a dedicated Relationship Manager (RM) and Sales Trader to assist with advanced needs.

Pro Account holders also gain access to exclusive Elite events, providing them with opportunities to network and stay ahead in the fast-paced environment. This account is perfect for experienced traders seeking high liquidity, tight spreads, and exceptional customer support.

Regions Where ADS Securities is Restricted

ADS Securities is committed to complying with international regulations and, as such, has restrictions on its services in certain jurisdictions.

The company states that its offerings are “not directed at residents of any particular country outside the United Arab Emirates and is not intended for distribution to, or use by, any person in any country where the distribution or use is contrary to local law or regulation.”

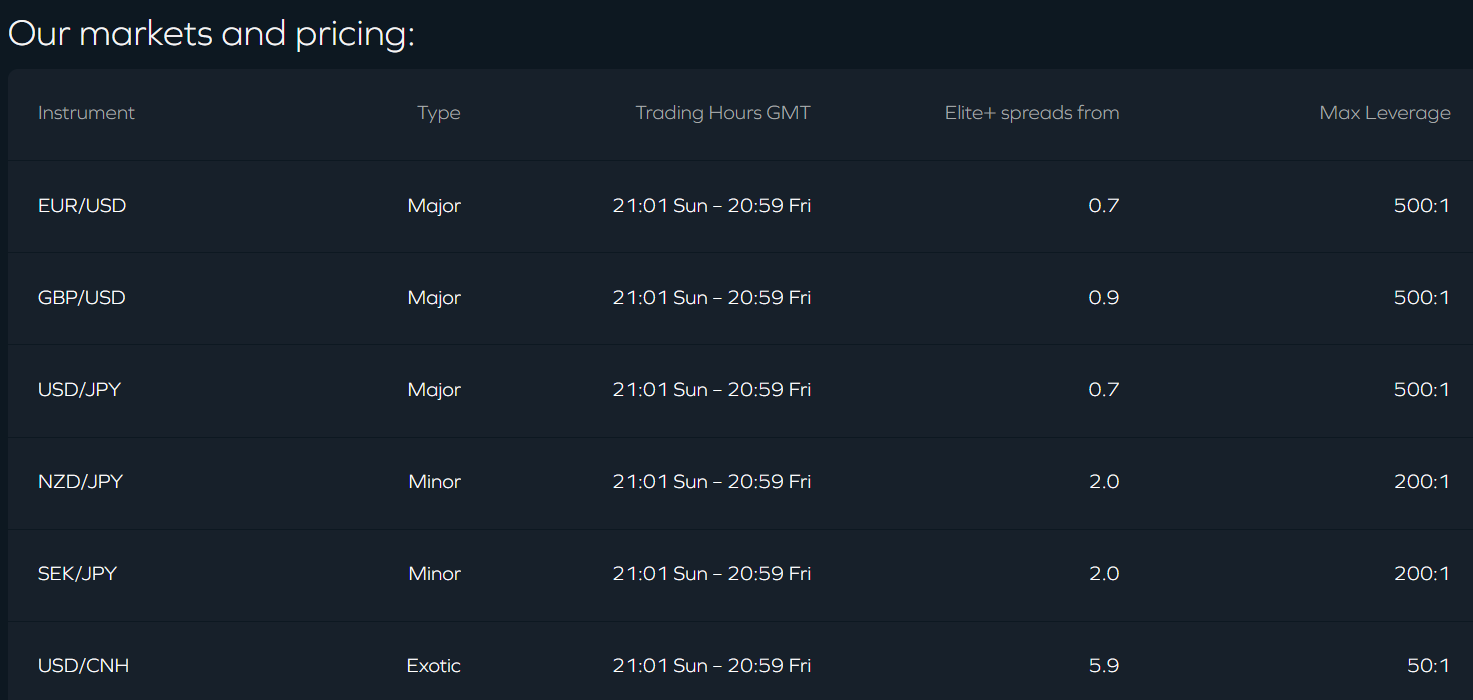

Cost Structure and Fees

Score – 4.4/5

ADS Securities Brokerage Fees

ADS Securities’ fees are primarily built into the spread, which varies depending on the instruments being traded. Additionally, traders should consider overnight fees or swaps as part of the cost, as holding an open position for more than a day may incur various charges. There may also be funding fees and other potential charges that could arise.

ADS Securities spreads are different depending on the account type you choose. Based on our findings, the average spread for EUR/USD is 0.7 pips, which is considered slightly lower than the industry average.

- ADS Securities Commissions

At ADS Securities, commissions are primarily applied to the Pro Account. This account type offers tighter spreads, but in addition to the spread, there is an additional commission of $3.00 per lot traded.

This commission structure is designed to benefit traders who prioritize low spreads and high-volume trading, making it a suitable option for more experienced traders.

- ADS Securities Rollover / Swaps

At ADS Securities, rollover charges apply when positions are held overnight. These charges result from the interest rate differential between the two currencies involved in a currency trade.

The specific swap rate is calculated based on these interest rate differences and is applied daily at 5 p.m. GMT. For precise and up-to-date swap rates for different currency pairs, you can consult ADS Securities’ official resources.

How Competitive Are ADS Securities Fees?

ADS Securities offers a competitive fee structure that is designed to accommodate a wide range of traders, from beginners to professionals. The broker provides flexibility in its pricing, with various account types offering different spreads and additional charges depending on the trading style and volume.

For traders looking for tight spreads, the Pro Account offers the most competitive pricing, albeit with a commission on each lot traded. Meanwhile, the Classic and Elite accounts feature more traditional spread-based pricing without additional commissions.

Overall, the fee structure is competitive within the industry, offering options that cater to both cost-conscious traders and those seeking premium services.

| Asset/ Pair | ADS Securities Spread | Cornertrader Spread | Trade Nation Spread |

|---|

| EUR USD Spread | 0.7 pips | 0.2 pips | 0.6 pips |

| Crude Oil WTI Spread | 6 pips | 3 | 0.04 pips |

| Gold Spread | 5 pips | 0.5 | 0.25 pips |

| BTC USD Spread | $120 | 190 pips | 1.5% |

ADS Securities Additional Fees

In addition to the typical fees, ADSS applies several other charges depending on the type of account and services used. These include overnight financing fees, or swaps, for positions held beyond a trading day, which are based on the interest rate differentials of the currencies involved.

Moreover, while ADS Securities does not impose deposit or withdrawal fees, third-party payment processors may charge their fees for transactions. Traders should also be mindful of any account inactivity fees that may apply if an account is not used for an extended period. Traders need to review the broker’s full fee schedule to understand all potential costs associated with their trading activity.

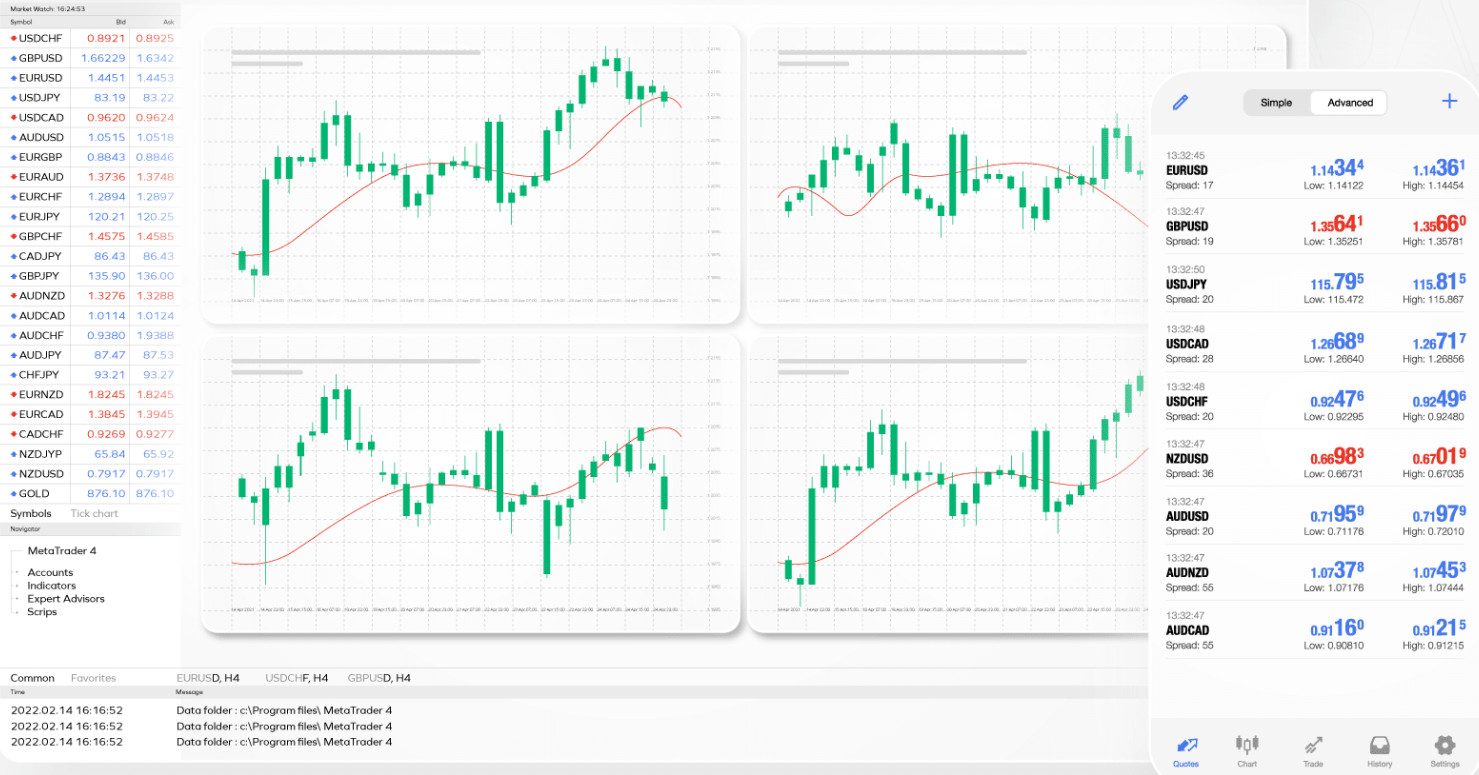

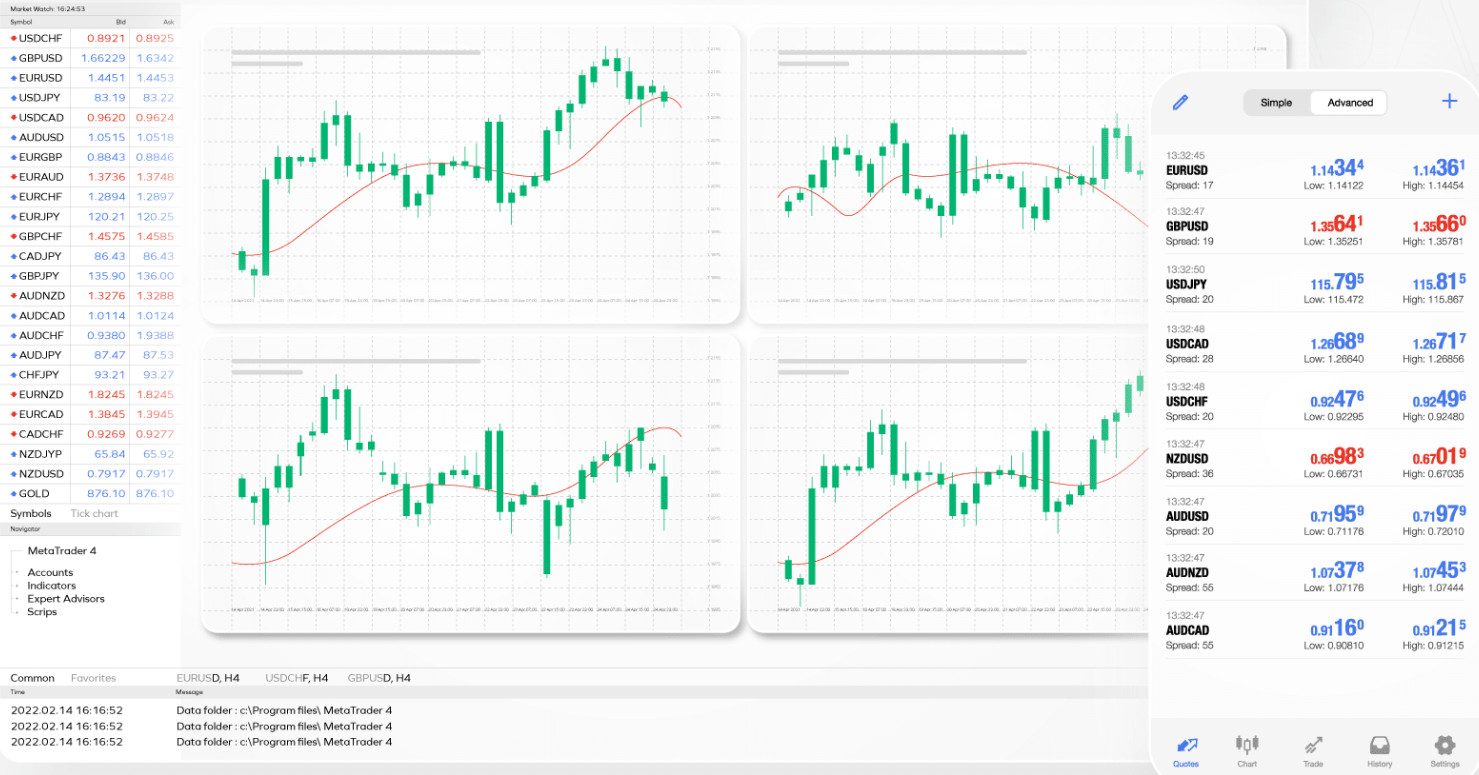

Trading Platforms and Tools

Score – 4.5/5

ADSS provides traders with two primary platforms: its proprietary ADSS Platform and the widely recognized MetaTrader 4. The ADSS Platform offers an intuitive interface, advanced charting tools, and seamless access across mobile and desktop devices, catering to novice and experienced traders.

For those who prefer the MT4 environment, ADSS also supports this platform, delivering competitive pricing, robust liquidity, and comprehensive support. MT4 is renowned for its user-friendly design, extensive charting capabilities, and efficient trade execution, making it a popular choice among traders worldwide.

Trading Platform Comparison to Other Brokers:

| Platforms | ADS Securities Platforms | Cornertrader Platforms | Trade Nation Platforms |

|---|

| MT4 | Yes | No | Yes |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

ADS Securities Desktop Platform

The ADS Securities desktop platform is a comprehensive and customizable solution that balances powerful features with user-friendly design. Its intuitive charting capabilities allow traders to conduct in-depth technical analysis effortlessly. Users can add indicators, switch chart types, and adjust settings with just a click.

Smart features such as asset class filters and personalized watchlists provide quick access to preferred instruments while helping traders explore new market opportunities. Additionally, the platform’s advanced deal ticket system with drop-down menus ensures precise order entry, putting full control in the hands of the trader. Overall, the ADSS platform is built to support both strategic research and swift execution.

ADS Securities Desktop MetaTrader 4 Platform

The MetaTrader 4 desktop platform is a powerful and globally trusted solution, offering advanced and customizable charting tools to suit every strategy. With integrated research and educational resources, traders can sharpen their skills and stay informed.

The platform supports EA plugins for automated trading and offers a web terminal version for added flexibility. Available in 39 languages and compatible with both Android and Apple devices, MT4 through ADS Securities ensures a seamless multi-device experience.

Traders also benefit from competitive spreads and fees, and live newsfeeds to support smart, informed decision-making.

Main Insights from Testing

Testing the MT4 platform with ADS Securities reveals a smooth and reliable experience, particularly praised for its stability during high market volatility.

Order execution is swift, with minimal slippage, and the platform runs efficiently even when multiple charts and indicators are active. Customization options for layout and tools are extensive, allowing traders to tailor the interface to their preferences. Overall, MT4 remains a robust choice for both new and experienced traders seeking consistency and performance.

ADS Securities Desktop MetaTrader 5 Platform

ADSS currently offers the MT4 platform to its clients but does not provide access to MetaTrader 5. Traders seeking the advanced features of MT5, such as enhanced charting tools, additional timeframes, and an integrated economic calendar, may need to consider other brokers that support this platform.

ADS Securities MobileTrader App

ADSS provides a seamless mobile experience through both its proprietary ADSS platform and the popular MetaTrader 4 app. Available on both Android and iOS devices, these mobile platforms allow traders to monitor markets, execute trades, and manage positions on the go.

The ADSS MobileTrader app offers a user-friendly interface with essential tools like real-time charts, watchlists, and one-touch trading. Meanwhile, the MT4 mobile version delivers a familiar layout with advanced charting, technical indicators, and full functionality.

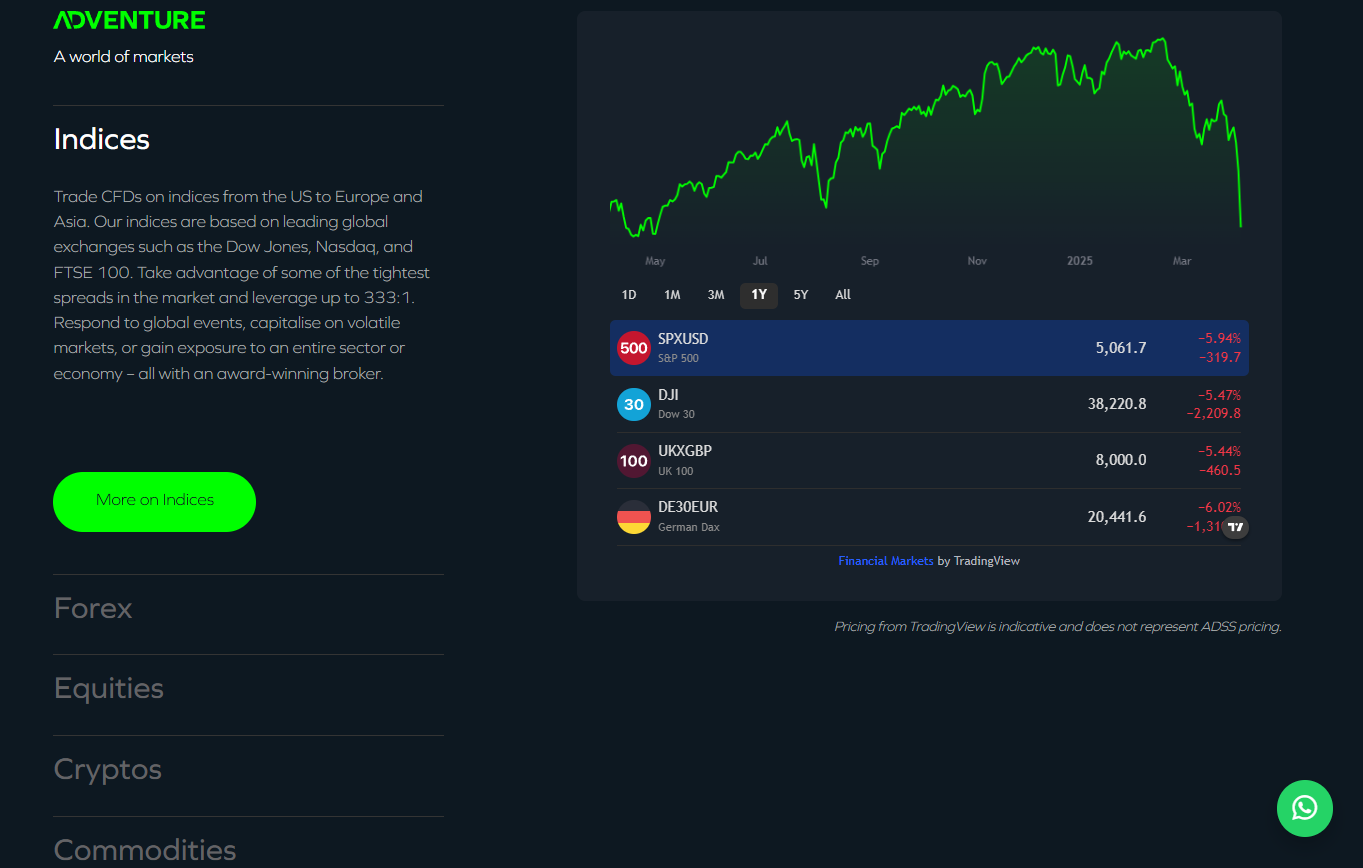

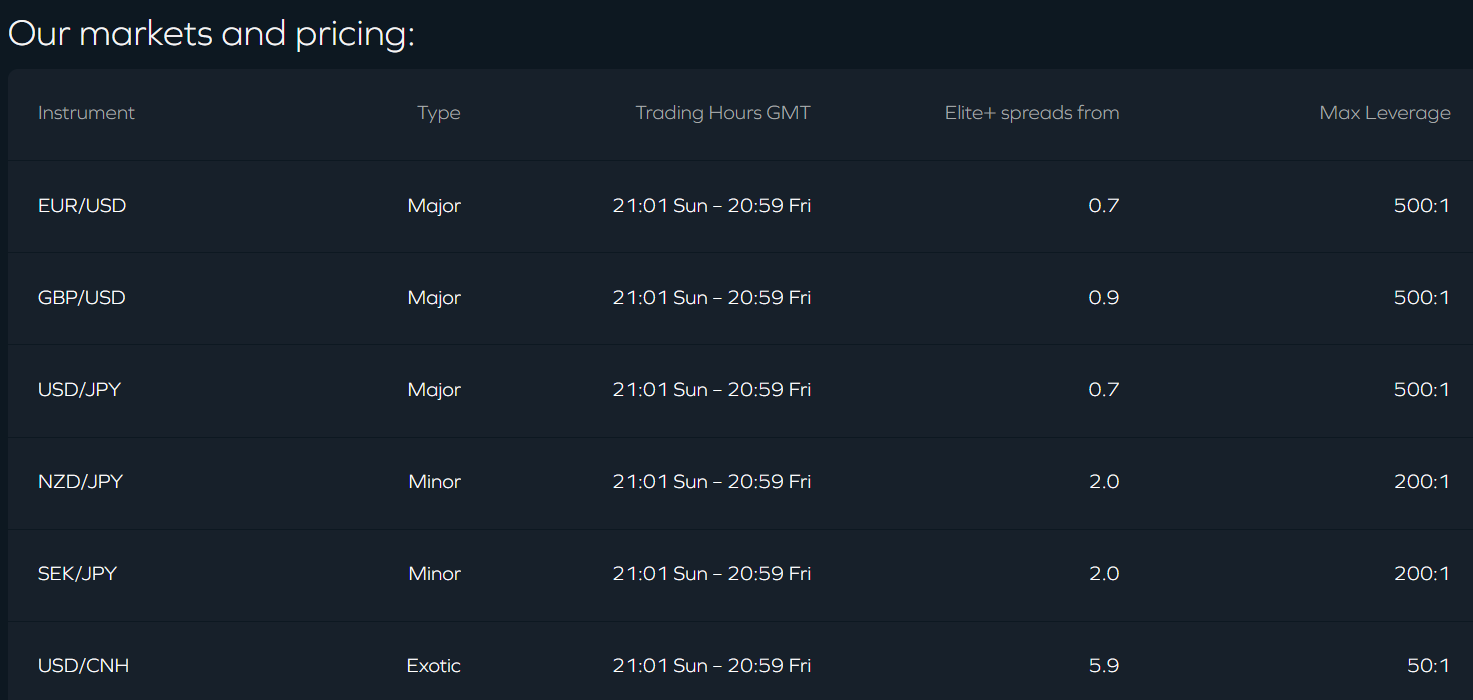

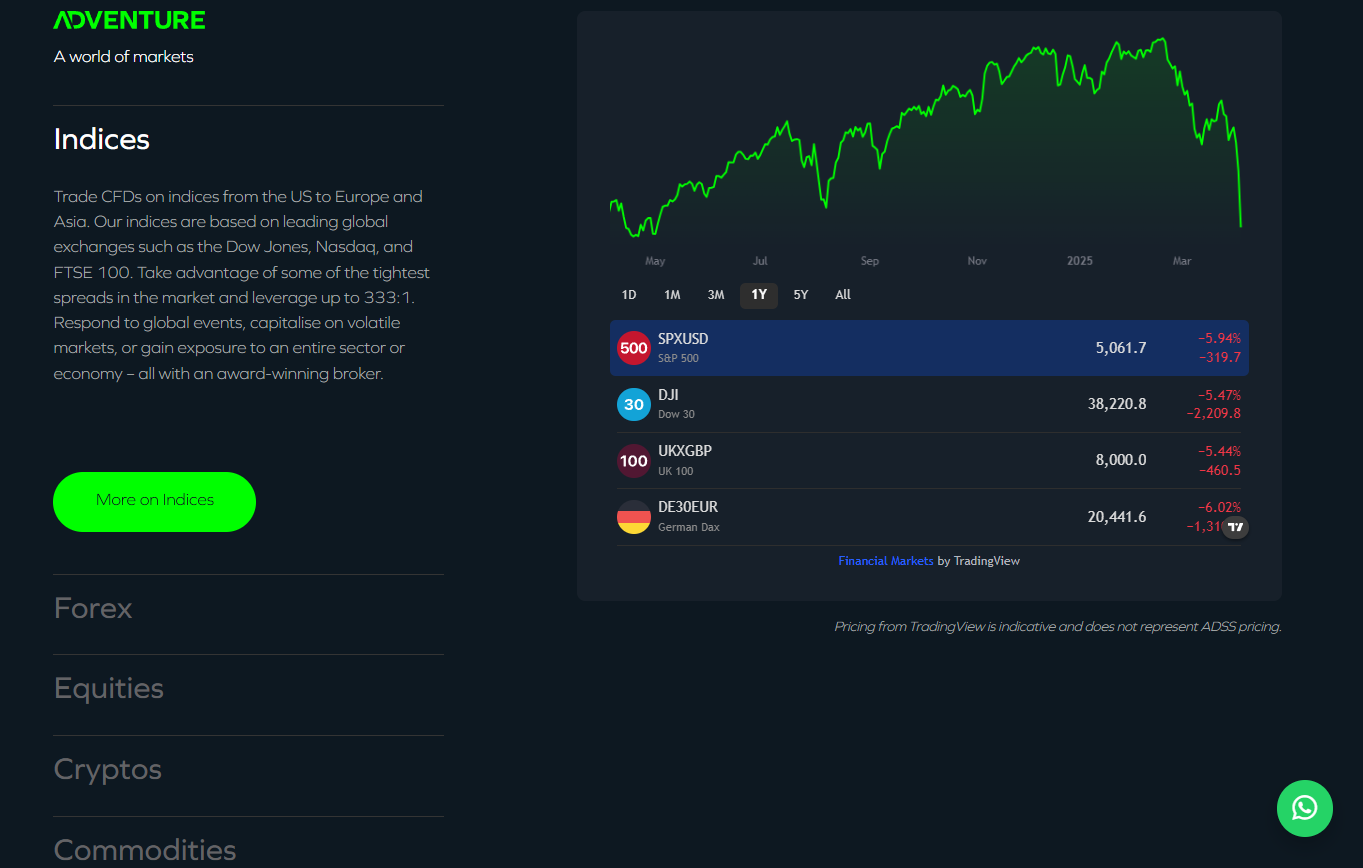

Trading Instruments

Score – 4.3/5

What Can You Trade on ADS Securities’s Platform?

ADS Securities offers a diverse range of instruments to cater to various investor interests. Clients have access to more than 1,000 instruments, including CFDs, over 60 currency pairs, indices, commodities, treasuries, single stocks, cryptocurrencies, and more.

This selection enables traders to diversify their portfolios and explore multiple markets through a single platform.

Main Insights from Exploring ADS Securities’s Tradable Assets

Exploring ADS Securities’ tradable assets reveals a solid but somewhat limited selection compared to some larger global brokers. While it covers key asset classes like Forex, indices, commodities, and stocks, the range may not satisfy traders looking for access to more niche markets or exotic instruments.

Leverage Options at ADS Securities

ADSS offers leverage of up to 1:500 on many FX pairs and up to 1:333 on indices. In addition, since ADSS offers flexible leverage, the amount of available multiplier depends on the type of account you are trading.

Deposit and Withdrawal Options

Score – 4.4/5

Deposit Options at ADS Securities

In terms of funding methods, ADS Securities offers many payment methods, which is a very good plus, yet check according to its regulation whether the method is available or not.

- Credit/Debit cards

- Bank wire

- Skrill

- Neteller, and more

ADS Securities Minimum Deposit

The minimum deposit amount is $100, which allows even beginning traders to open an account and engage in the world of trading easily.

Withdrawal Options at ADS Securities

As for the deposit and withdrawal fees, according to the company policy, the customer is responsible for conversion fees applied by the bank or any other fees charged by the bank, while the broker himself does not charge additional fees for transfers.

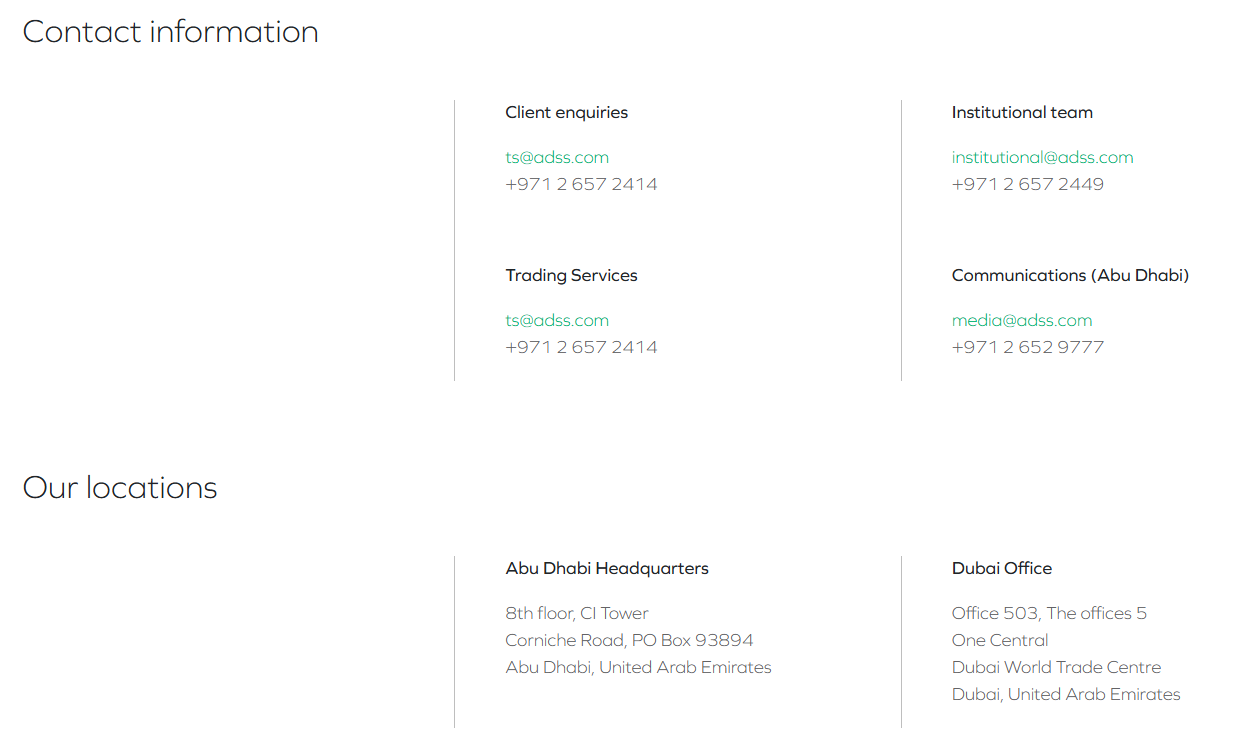

Customer Support and Responsiveness

Score – 4.5/5

Testing ADS Securities’s Customer Support

ADS Securities offers 24/5 customer support through multiple channels, including phone, email, and live chat, ensuring clients can reach assistance during trading hours.

The support team is multilingual, catering to a diverse client base. While the availability of these channels facilitates prompt communication, some users have noted that responses to in-depth inquiries may require follow-up or additional time.

Contacts ADS Securities

For any client inquiries, ADSS can be reached via email at ts@adss.com or by phone at +971 2 657 2414. These contact details are available for general client support as well as specific trading services-related questions.

Whether you need assistance with account issues, technical support, or general inquiries, ADS Securities provides dedicated communication channels to ensure that your concerns are addressed promptly.

Research and Education

Score – 4.4/5

Research Tools ADS Securities

ADS Securities offers a range of research tools on both its website and platforms to assist traders in making informed decisions.

- On the website, clients can access advanced charting capabilities with various drawing tools and numerous pre-defined studies, enhancing technical analysis.

- Additionally, features like asset class filters and watchlists provide personalized market insights. The platform also includes an economic calendar to keep traders informed about major market events.

These tools are designed to cater to both novice and experienced traders, facilitating effective market analysis and strategy development.

Education

ADSS is committed to supporting traders’ educational needs through a variety of resources. The company offers comprehensive tutorials and educational videos on its website, covering topics such as platform usage, strategies, and market analysis.

Additionally, a detailed glossary is available to help users understand key financial terms. These resources are designed to cater to both beginners and experienced traders, enhancing their knowledge and skills.

Portfolio and Investment Opportunities

Score – 4.3/5

Investment Options ADS Securities

ADS Securities primarily focuses on Currency and CFD trading, offering a wide range of currency pairs and contracts for difference across various asset classes.

To enhance investment opportunities, the broker provides MAM and PAMM tools. These investment solutions allow fund managers to handle multiple client accounts efficiently from a single master account, enabling investors to benefit from professional management without the need to directly engage in trading activities themselves.

However, ADSS does not offer traditional investment options such as stocks or bonds directly; instead, it provides access to these markets through CFDs.

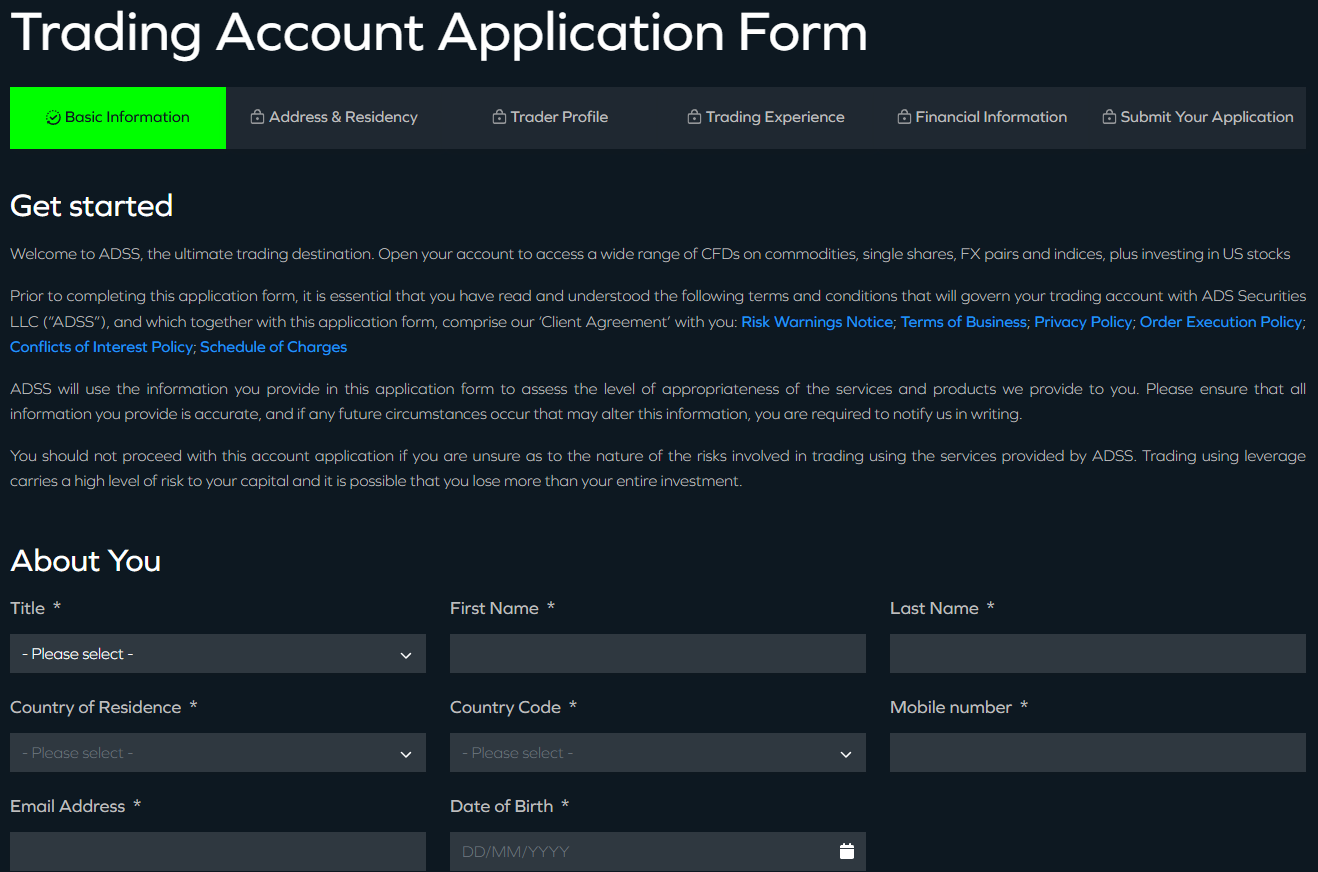

Account Opening

Score – 4.5/5

How to Open ADS Securities Demo Account?

Opening a demo account with ADS Securities allows traders to practice their strategies and familiarize themselves with the platform in a risk-free environment. Here is how you can open one:

- Visit the ADS Securities website.

- Click on the “Open Account” button.

- Select “Demo Account” from the available options.

- Fill in the required personal details, such as name, email, and contact information.

- Choose the desired account settings, including initial virtual deposit and platform preference.

- Submit your registration and wait for confirmation.

- Once approved, you will receive login credentials to access the demo account and start practicing.

How to Open ADS Securities Live Account?

To open a live account with ADSS, you will need to visit the broker’s website and complete the registration process by selecting the type of account that best suits your needs, such as Classic, Elite, or Pro.

After selecting your account, you will be required to fill in personal details, including your contact information and financial background. Additionally, you will need to submit identification documents and proof of address to meet regulatory requirements.

Once your account is approved, you can fund it using various payment methods, and after your deposit is processed, you will be able to start trading on the platform. This process ensures a secure and smooth transition into live trading with ADS Securities.

Additional Tools and Features

Score – 4.2/5

In addition to the core research and tools offered by ADS Securities, the broker also provides several other features to enhance the experience.

- ADSS offers sophisticated charting capabilities with custom indicators and drawing tools to support detailed technical analysis.

- Also, the broker’s platform is equipped with a range of automated options, helping both beginner and experienced traders execute strategies more efficiently.

ADS Securities Compared to Other Brokers

When comparing ADS Securities to its competitors, several factors stand out. ADSS offers a solid experience with competitive spreads and commission options, though its range of tradable instruments is more limited compared to some other brokers.

While it has a good educational resource offering, particularly through tutorials and platform guides, other brokers like Saxo Bank and City Index provide more extensive educational materials. In terms of regulation, ADS Securities is regulated by the SCA, which is less diverse compared to brokers like Saxo Bank or CMC Markets, which are regulated across multiple high-tier jurisdictions.

Customer support is available 24/5, similar to most of its competitors. However, ADS Securities distinguishes itself with its proprietary platform alongside MT4, while others rely more heavily on popular platforms like MT4 and TradingView.

Finally, with a relatively low minimum deposit, it provides easy access for new traders, although some competitors have even lower or no deposit requirements. Overall, ADS Securities stands out for its straightforward offerings and strong customer service but faces tougher competition from brokers offering more diverse regulation, platforms, and educational resources.

| Parameter |

ADS Securities |

Trade Nation |

Saxo Bank |

City Index |

Velocity Trade |

CMC Markets |

X Open Hub |

| Spread Based Account |

Average 0.7 pips |

Average 0.6 pips |

Average 0.9 pips |

Average 0.8 pips |

Average 1 pip |

Average 0.5 pips |

Average 0.14 pips |

| Commission Based Account |

0.0 pips + $3 |

0.0 pips + $3 |

For Stock and ETF (commission of $3 per trade) |

For Share CFDs (Commission of 0.08%, Minimum of £10) |

$3 per side per 100,000 units traded |

0.0 pips + $2.50 |

For Forex (commission of $3.50 per lot per side) |

| Fees Ranking |

Low/ Average |

Low/ Average |

Average |

Low/ Average |

Average |

Low/ Average |

Low/ Average |

| Trading Platforms |

ADSS Platform, MT4 |

MT4, TN Trader, TradingView, TradeCopier |

SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

City Index Web Trader, MT4, TradingView |

V Trader |

CMC Markets Next Generation Web Platform, MT4 |

MT4 White Label, XOH Trader |

| Asset Variety |

1,000+ instruments |

1000+ instruments |

71,000+ instruments |

13,500+ instruments |

250+ instruments |

12,000+ instruments |

5000+ instruments |

| Regulation |

SCA |

FCA, ASIC, FSCA, SCB, FSA |

DFSA, FCA, ASIC, MAS, CBUAE, JFSA, MAS, SFC |

FCA, ASIC, MAS |

FCA, FMA, ASIC, IIROC, AFM, FSCA, MAS |

FCA, ASIC, BaFin, IIROC, FMA, MAS |

FCA, CySEC, KNF, FSCA, DFSA, FSA |

| Customer Support |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

24/5 |

| Educational Resources |

Good |

Limited |

Excellent |

Excellent |

Limited |

Good |

Good |

| Minimum Deposit |

$100 |

$0 |

$0 |

$0 |

$500 |

$0 |

$0 |

Full Review of Broker ADS Securities

ADS Securities is a well-established broker, regulated by the SCA in the UAE, offering a solid range of services. Traders can choose from a variety of accounts with competitive spreads and commission structures.

The broker offers both its proprietary and the widely used MT4 platforms, providing flexibility for traders. In addition to its diverse instruments, ADSS provides advanced charting tools, risk management features, and educational resources to support both novice and experienced traders.

The broker also offers customer support 24/5 via phone, live chat, and email, ensuring assistance is readily available. Overall, ADSS provides a user-friendly and comprehensive environment suitable for a wide range of traders.

Share this article [addtoany url="https://55brokers.com/ads-securities-review/" title="ADS Securities"]

This is not true as they are non-professional company and they don’t care about the client, withdrawal a local transfer 3 days standard, horrible…

Really i was going to deposit please just you inform me which other problems

Can I trade directly without any other parties ie Account Manager

Seriously.

I was researching into ADSS. Why do u say so?

This is not true as they are non professional company and they don’t care about client at all and they change leverage whenever they want and without prior notice